Accounting & Finance for Managers: Financial Ratio Analysis Report

VerifiedAdded on 2020/02/05

|18

|3708

|35

Report

AI Summary

This report presents a detailed financial ratio analysis comparing the performance of Next Plc and Hennes & Mauritz (H&M). It examines various financial ratios, including current ratio, asset turnover, inventory turnover, days sales in inventory, accounts receivable turnover, gross profit margin, operating margin, free cash flow per share, COGS/Revenue, and revenue per employee. The analysis covers both financial and non-financial ratios, such as staff turnover. The report evaluates the companies' liquidity, asset utilization, profitability, and efficiency, providing insights into their financial health and performance trends. Tables and illustrations are included to support the analysis. The report concludes with recommendations based on the comparative analysis of the two companies and discusses the limitations of using financial ratios for evaluation.

Accounting & Finance

for Managers

for Managers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction................................................................................................................................5

QUESTION 1.............................................................................................................................5

Question 2................................................................................................................................13

Conclusion................................................................................................................................17

references..................................................................................................................................18

Introduction................................................................................................................................5

QUESTION 1.............................................................................................................................5

Question 2................................................................................................................................13

Conclusion................................................................................................................................17

references..................................................................................................................................18

Index of Tables

Table 1: Current ratio of two companies....................................................................................4

Table 2: Asset turnover ratio of two companies.........................................................................5

Table 3: Inventory turnover ratio of two companies..................................................................5

Table 4: Days of inventory of two companies...........................................................................6

Table 5: Receivables turnover ratio of two companies..............................................................6

Table 6: Gross profit margin of two companies.........................................................................6

Table 7: Operating profit margin................................................................................................7

Table 8: Free cash flow..............................................................................................................7

Table 9: COGS as percentage of revenue..................................................................................8

Table 10: Revenue per employee...............................................................................................8

Table 11: Staff turnover ratio of Next Plc..................................................................................8

Table 12: Staff turnover ratio of H&M......................................................................................9

Table 13: Estimated working days of Next Plc..........................................................................9

Table 14: Estimated working days lost of H&M.......................................................................9

Table 15: Liquidity position of Next Plc..................................................................................11

Table 16: Asset Utilization of Next Plc....................................................................................11

Table 17: Depreciation on machines........................................................................................12

Table 18: Depreciation on machines........................................................................................12

Table 19: Payback Period.........................................................................................................12

Table 1: Current ratio of two companies....................................................................................4

Table 2: Asset turnover ratio of two companies.........................................................................5

Table 3: Inventory turnover ratio of two companies..................................................................5

Table 4: Days of inventory of two companies...........................................................................6

Table 5: Receivables turnover ratio of two companies..............................................................6

Table 6: Gross profit margin of two companies.........................................................................6

Table 7: Operating profit margin................................................................................................7

Table 8: Free cash flow..............................................................................................................7

Table 9: COGS as percentage of revenue..................................................................................8

Table 10: Revenue per employee...............................................................................................8

Table 11: Staff turnover ratio of Next Plc..................................................................................8

Table 12: Staff turnover ratio of H&M......................................................................................9

Table 13: Estimated working days of Next Plc..........................................................................9

Table 14: Estimated working days lost of H&M.......................................................................9

Table 15: Liquidity position of Next Plc..................................................................................11

Table 16: Asset Utilization of Next Plc....................................................................................11

Table 17: Depreciation on machines........................................................................................12

Table 18: Depreciation on machines........................................................................................12

Table 19: Payback Period.........................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Illustration Index

Illustration 1: ARR Method......................................................................................................14

Illustration 2: NPV Method......................................................................................................16

Illustration 1: ARR Method......................................................................................................14

Illustration 2: NPV Method......................................................................................................16

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Accounting is a concept that measures and evaluates the performance of

business organisation. Financial accounting analyse and report all business

transactions of the company. It involves preparation of many financial statements of

the organisations. The report provides an understanding of financial ratios of two

chosen companies. Further, it will provide recommendations on the financial

performance of those cite firms and also discuss the limitations of financial ratios.

QUESTION 1

Financial ratio is a magnitude that calculate and compares two values from

financial statements of the company. There are many standard ratios that are being

used to evaluate the financial state of the corporation. As per the provided case,

ratios of two companies namely; Next Plc and Hennes & Mauritz (H & M) are being

selected and justified to analyse the performance of the companies and also to

determine their financial positions. Analysing the financial and non-financial ratios of

two companies is given below:

Financial Ratios:

Current Ratio: This ratio measures the ability of company to discharge or pay

off its short-term liabilities with current assets (Vogel, 2014). It is an important

measure because it determines liquidity of the company. Current ratio is

continuously decreasing in case of Next Plc, which depicts that the company's

liquidity is decreasing and is not efficient enough to clear its debt payments. To the

contrary, current ratio of H & M is increasing from year 2010 to 2014, which is

favourable for it. Thus, H&M has better financial position than the Next Plc.

Table 1: Current ratio of two companies

Next plc Current Ratio 1.82 1.76 1.48 1.54 1.28

H & M Hennes &

Mauritz Current Ratio 2.11 2.25 2.66 2.71 2.96

Asset Turnover Ratio: The aim of this ratio is to measure the ability of the

company to generate sales from its total available assets. It shows the efficiency of

company to effectively use its assets to yield sales revenue. It can be calculated by

Accounting is a concept that measures and evaluates the performance of

business organisation. Financial accounting analyse and report all business

transactions of the company. It involves preparation of many financial statements of

the organisations. The report provides an understanding of financial ratios of two

chosen companies. Further, it will provide recommendations on the financial

performance of those cite firms and also discuss the limitations of financial ratios.

QUESTION 1

Financial ratio is a magnitude that calculate and compares two values from

financial statements of the company. There are many standard ratios that are being

used to evaluate the financial state of the corporation. As per the provided case,

ratios of two companies namely; Next Plc and Hennes & Mauritz (H & M) are being

selected and justified to analyse the performance of the companies and also to

determine their financial positions. Analysing the financial and non-financial ratios of

two companies is given below:

Financial Ratios:

Current Ratio: This ratio measures the ability of company to discharge or pay

off its short-term liabilities with current assets (Vogel, 2014). It is an important

measure because it determines liquidity of the company. Current ratio is

continuously decreasing in case of Next Plc, which depicts that the company's

liquidity is decreasing and is not efficient enough to clear its debt payments. To the

contrary, current ratio of H & M is increasing from year 2010 to 2014, which is

favourable for it. Thus, H&M has better financial position than the Next Plc.

Table 1: Current ratio of two companies

Next plc Current Ratio 1.82 1.76 1.48 1.54 1.28

H & M Hennes &

Mauritz Current Ratio 2.11 2.25 2.66 2.71 2.96

Asset Turnover Ratio: The aim of this ratio is to measure the ability of the

company to generate sales from its total available assets. It shows the efficiency of

company to effectively use its assets to yield sales revenue. It can be calculated by

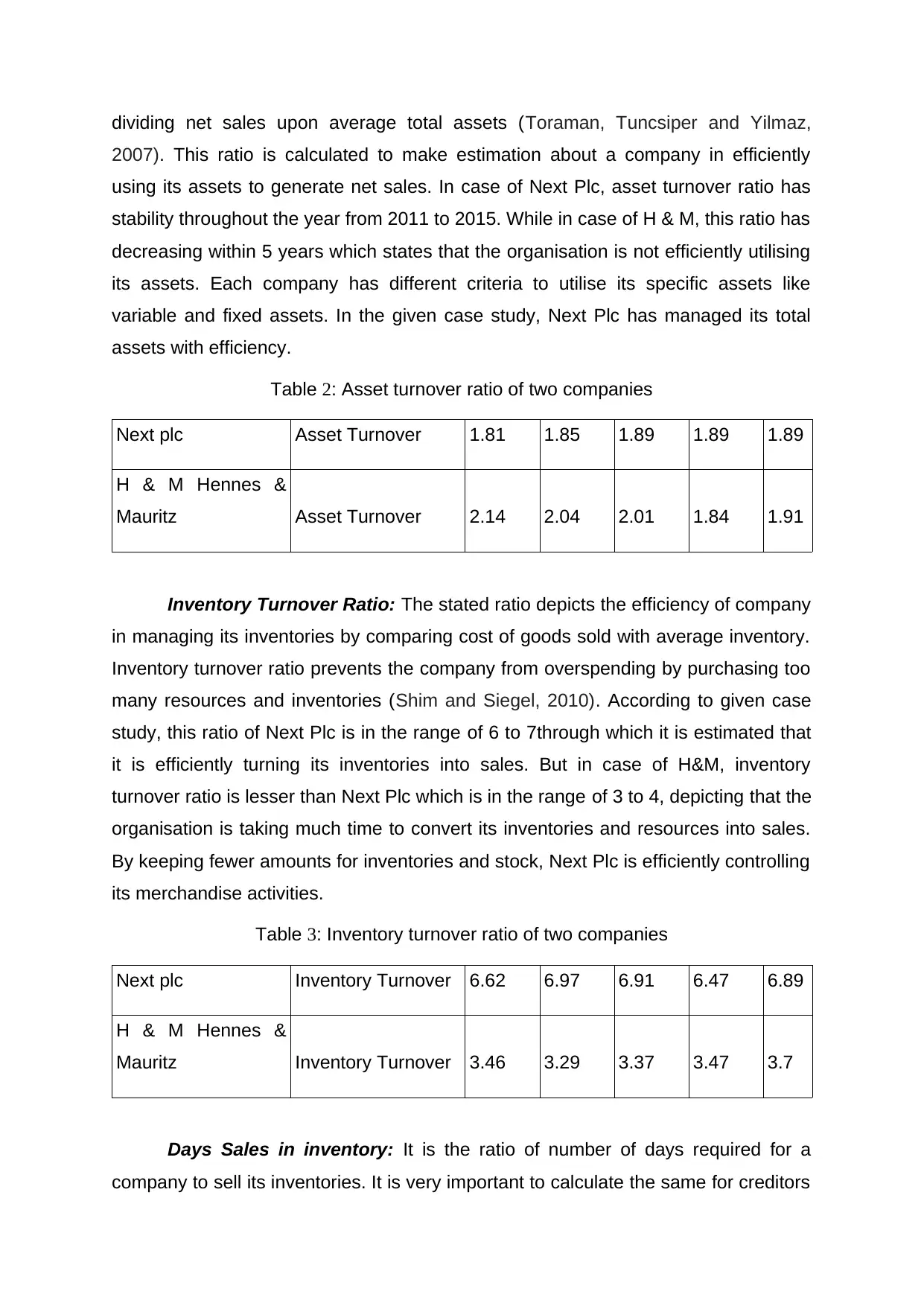

dividing net sales upon average total assets (Toraman, Tuncsiper and Yilmaz,

2007). This ratio is calculated to make estimation about a company in efficiently

using its assets to generate net sales. In case of Next Plc, asset turnover ratio has

stability throughout the year from 2011 to 2015. While in case of H & M, this ratio has

decreasing within 5 years which states that the organisation is not efficiently utilising

its assets. Each company has different criteria to utilise its specific assets like

variable and fixed assets. In the given case study, Next Plc has managed its total

assets with efficiency.

Table 2: Asset turnover ratio of two companies

Next plc Asset Turnover 1.81 1.85 1.89 1.89 1.89

H & M Hennes &

Mauritz Asset Turnover 2.14 2.04 2.01 1.84 1.91

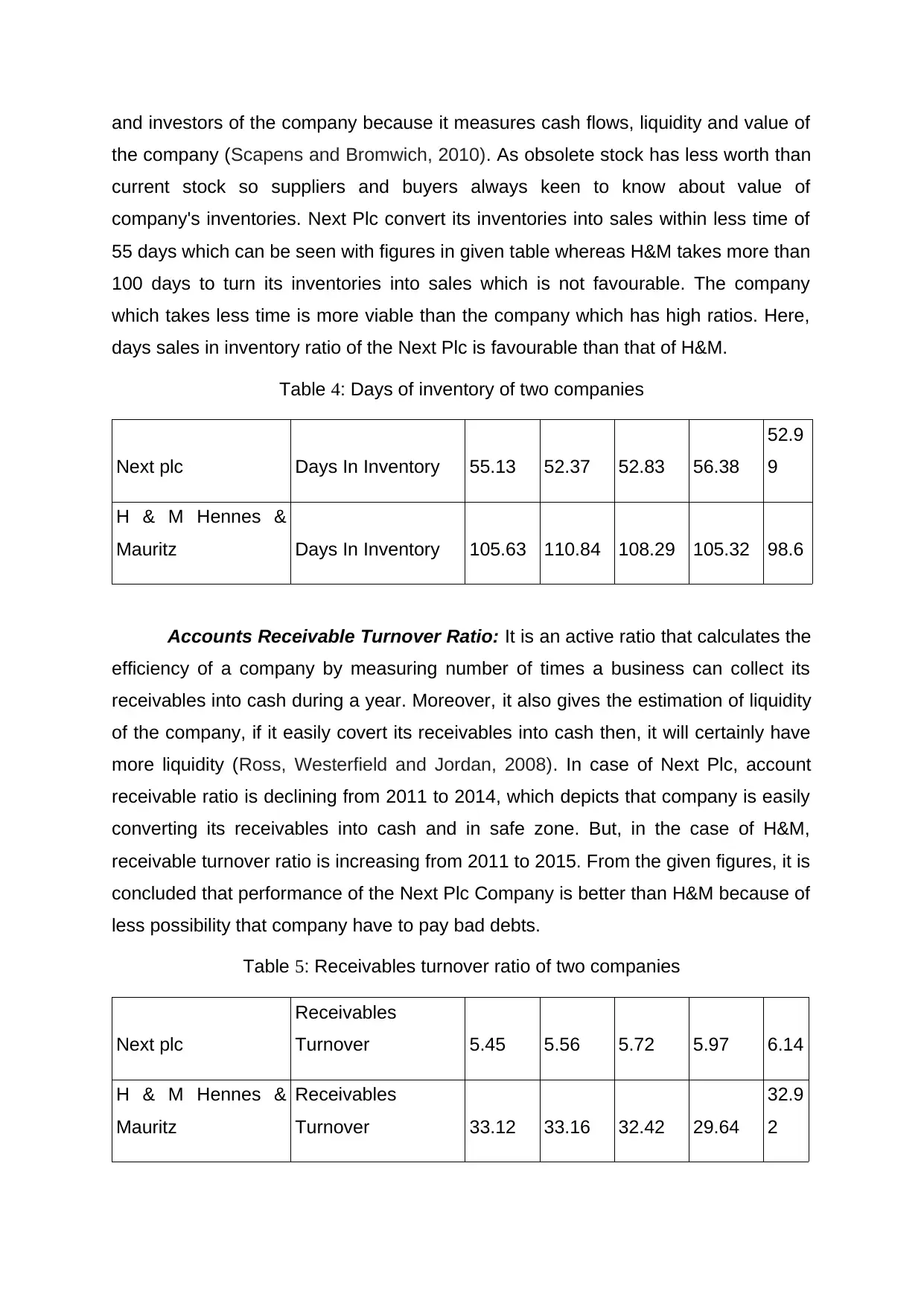

Inventory Turnover Ratio: The stated ratio depicts the efficiency of company

in managing its inventories by comparing cost of goods sold with average inventory.

Inventory turnover ratio prevents the company from overspending by purchasing too

many resources and inventories (Shim and Siegel, 2010). According to given case

study, this ratio of Next Plc is in the range of 6 to 7through which it is estimated that

it is efficiently turning its inventories into sales. But in case of H&M, inventory

turnover ratio is lesser than Next Plc which is in the range of 3 to 4, depicting that the

organisation is taking much time to convert its inventories and resources into sales.

By keeping fewer amounts for inventories and stock, Next Plc is efficiently controlling

its merchandise activities.

Table 3: Inventory turnover ratio of two companies

Next plc Inventory Turnover 6.62 6.97 6.91 6.47 6.89

H & M Hennes &

Mauritz Inventory Turnover 3.46 3.29 3.37 3.47 3.7

Days Sales in inventory: It is the ratio of number of days required for a

company to sell its inventories. It is very important to calculate the same for creditors

2007). This ratio is calculated to make estimation about a company in efficiently

using its assets to generate net sales. In case of Next Plc, asset turnover ratio has

stability throughout the year from 2011 to 2015. While in case of H & M, this ratio has

decreasing within 5 years which states that the organisation is not efficiently utilising

its assets. Each company has different criteria to utilise its specific assets like

variable and fixed assets. In the given case study, Next Plc has managed its total

assets with efficiency.

Table 2: Asset turnover ratio of two companies

Next plc Asset Turnover 1.81 1.85 1.89 1.89 1.89

H & M Hennes &

Mauritz Asset Turnover 2.14 2.04 2.01 1.84 1.91

Inventory Turnover Ratio: The stated ratio depicts the efficiency of company

in managing its inventories by comparing cost of goods sold with average inventory.

Inventory turnover ratio prevents the company from overspending by purchasing too

many resources and inventories (Shim and Siegel, 2010). According to given case

study, this ratio of Next Plc is in the range of 6 to 7through which it is estimated that

it is efficiently turning its inventories into sales. But in case of H&M, inventory

turnover ratio is lesser than Next Plc which is in the range of 3 to 4, depicting that the

organisation is taking much time to convert its inventories and resources into sales.

By keeping fewer amounts for inventories and stock, Next Plc is efficiently controlling

its merchandise activities.

Table 3: Inventory turnover ratio of two companies

Next plc Inventory Turnover 6.62 6.97 6.91 6.47 6.89

H & M Hennes &

Mauritz Inventory Turnover 3.46 3.29 3.37 3.47 3.7

Days Sales in inventory: It is the ratio of number of days required for a

company to sell its inventories. It is very important to calculate the same for creditors

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

and investors of the company because it measures cash flows, liquidity and value of

the company (Scapens and Bromwich, 2010). As obsolete stock has less worth than

current stock so suppliers and buyers always keen to know about value of

company's inventories. Next Plc convert its inventories into sales within less time of

55 days which can be seen with figures in given table whereas H&M takes more than

100 days to turn its inventories into sales which is not favourable. The company

which takes less time is more viable than the company which has high ratios. Here,

days sales in inventory ratio of the Next Plc is favourable than that of H&M.

Table 4: Days of inventory of two companies

Next plc Days In Inventory 55.13 52.37 52.83 56.38

52.9

9

H & M Hennes &

Mauritz Days In Inventory 105.63 110.84 108.29 105.32 98.6

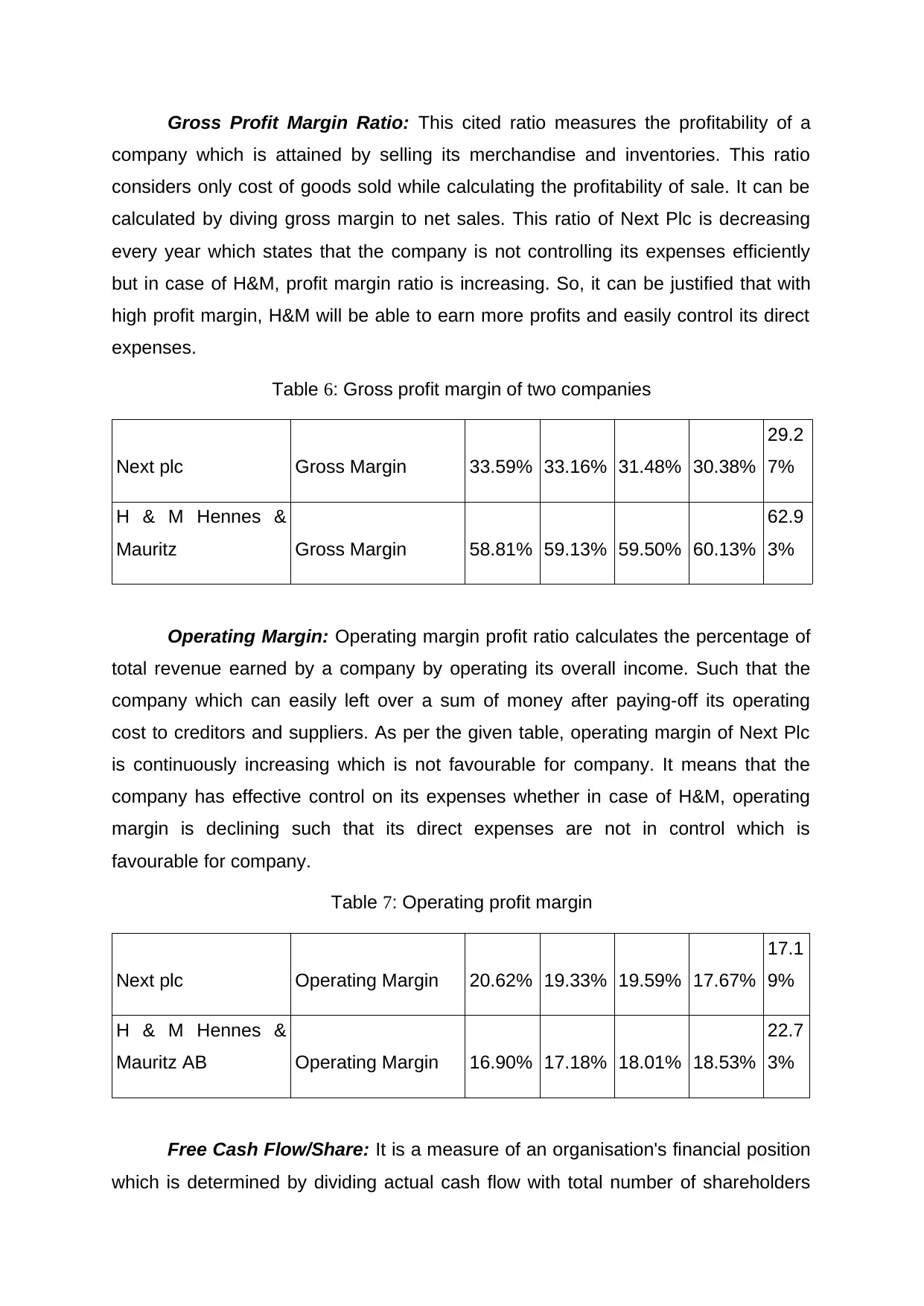

Accounts Receivable Turnover Ratio: It is an active ratio that calculates the

efficiency of a company by measuring number of times a business can collect its

receivables into cash during a year. Moreover, it also gives the estimation of liquidity

of the company, if it easily covert its receivables into cash then, it will certainly have

more liquidity (Ross, Westerfield and Jordan, 2008). In case of Next Plc, account

receivable ratio is declining from 2011 to 2014, which depicts that company is easily

converting its receivables into cash and in safe zone. But, in the case of H&M,

receivable turnover ratio is increasing from 2011 to 2015. From the given figures, it is

concluded that performance of the Next Plc Company is better than H&M because of

less possibility that company have to pay bad debts.

Table 5: Receivables turnover ratio of two companies

Next plc

Receivables

Turnover 5.45 5.56 5.72 5.97 6.14

H & M Hennes &

Mauritz

Receivables

Turnover 33.12 33.16 32.42 29.64

32.9

2

the company (Scapens and Bromwich, 2010). As obsolete stock has less worth than

current stock so suppliers and buyers always keen to know about value of

company's inventories. Next Plc convert its inventories into sales within less time of

55 days which can be seen with figures in given table whereas H&M takes more than

100 days to turn its inventories into sales which is not favourable. The company

which takes less time is more viable than the company which has high ratios. Here,

days sales in inventory ratio of the Next Plc is favourable than that of H&M.

Table 4: Days of inventory of two companies

Next plc Days In Inventory 55.13 52.37 52.83 56.38

52.9

9

H & M Hennes &

Mauritz Days In Inventory 105.63 110.84 108.29 105.32 98.6

Accounts Receivable Turnover Ratio: It is an active ratio that calculates the

efficiency of a company by measuring number of times a business can collect its

receivables into cash during a year. Moreover, it also gives the estimation of liquidity

of the company, if it easily covert its receivables into cash then, it will certainly have

more liquidity (Ross, Westerfield and Jordan, 2008). In case of Next Plc, account

receivable ratio is declining from 2011 to 2014, which depicts that company is easily

converting its receivables into cash and in safe zone. But, in the case of H&M,

receivable turnover ratio is increasing from 2011 to 2015. From the given figures, it is

concluded that performance of the Next Plc Company is better than H&M because of

less possibility that company have to pay bad debts.

Table 5: Receivables turnover ratio of two companies

Next plc

Receivables

Turnover 5.45 5.56 5.72 5.97 6.14

H & M Hennes &

Mauritz

Receivables

Turnover 33.12 33.16 32.42 29.64

32.9

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

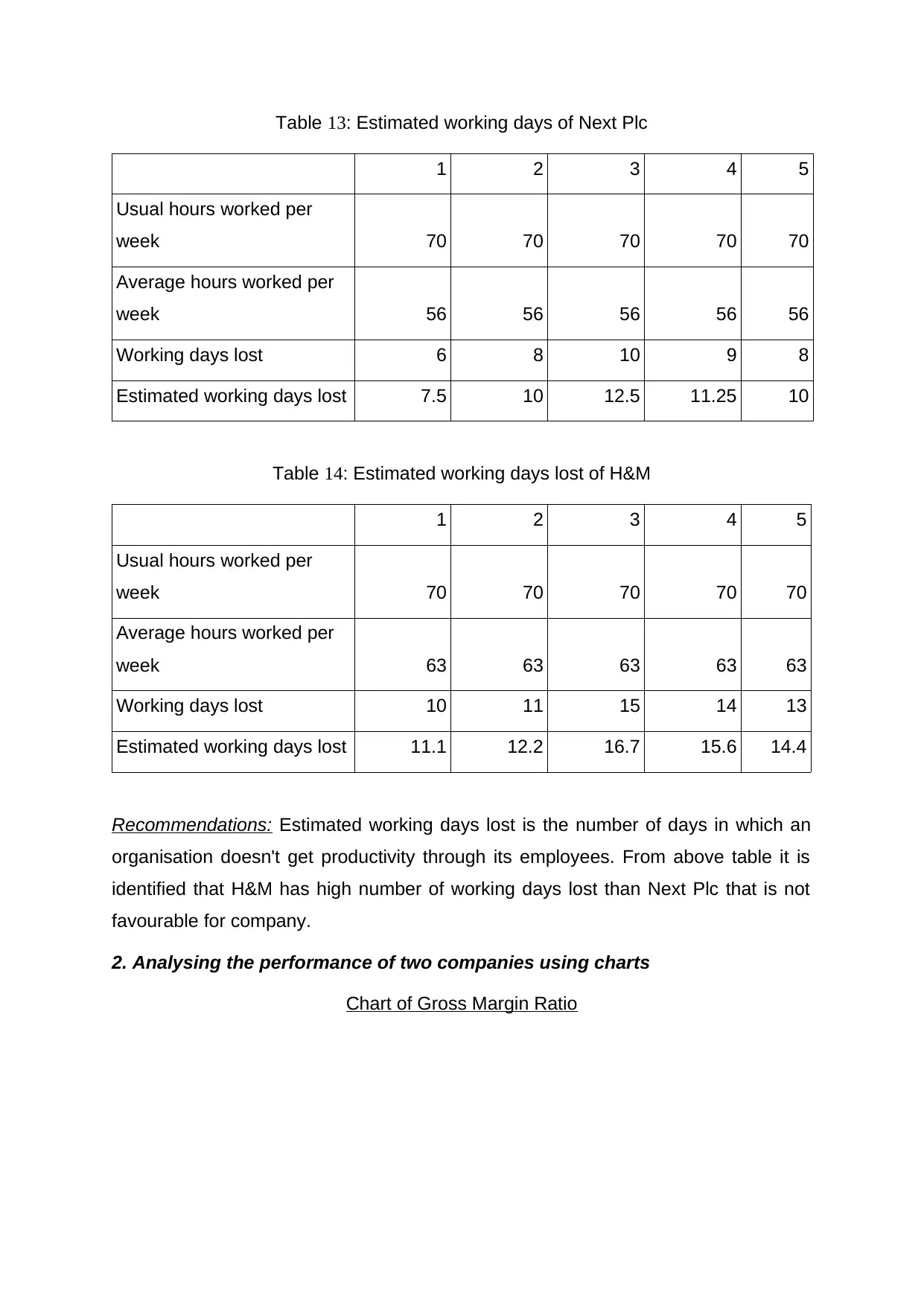

Gross Profit Margin Ratio: This cited ratio measures the profitability of a

company which is attained by selling its merchandise and inventories. This ratio

considers only cost of goods sold while calculating the profitability of sale. It can be

calculated by diving gross margin to net sales. This ratio of Next Plc is decreasing

every year which states that the company is not controlling its expenses efficiently

but in case of H&M, profit margin ratio is increasing. So, it can be justified that with

high profit margin, H&M will be able to earn more profits and easily control its direct

expenses.

Table 6: Gross profit margin of two companies

Next plc Gross Margin 33.59% 33.16% 31.48% 30.38%

29.2

7%

H & M Hennes &

Mauritz Gross Margin 58.81% 59.13% 59.50% 60.13%

62.9

3%

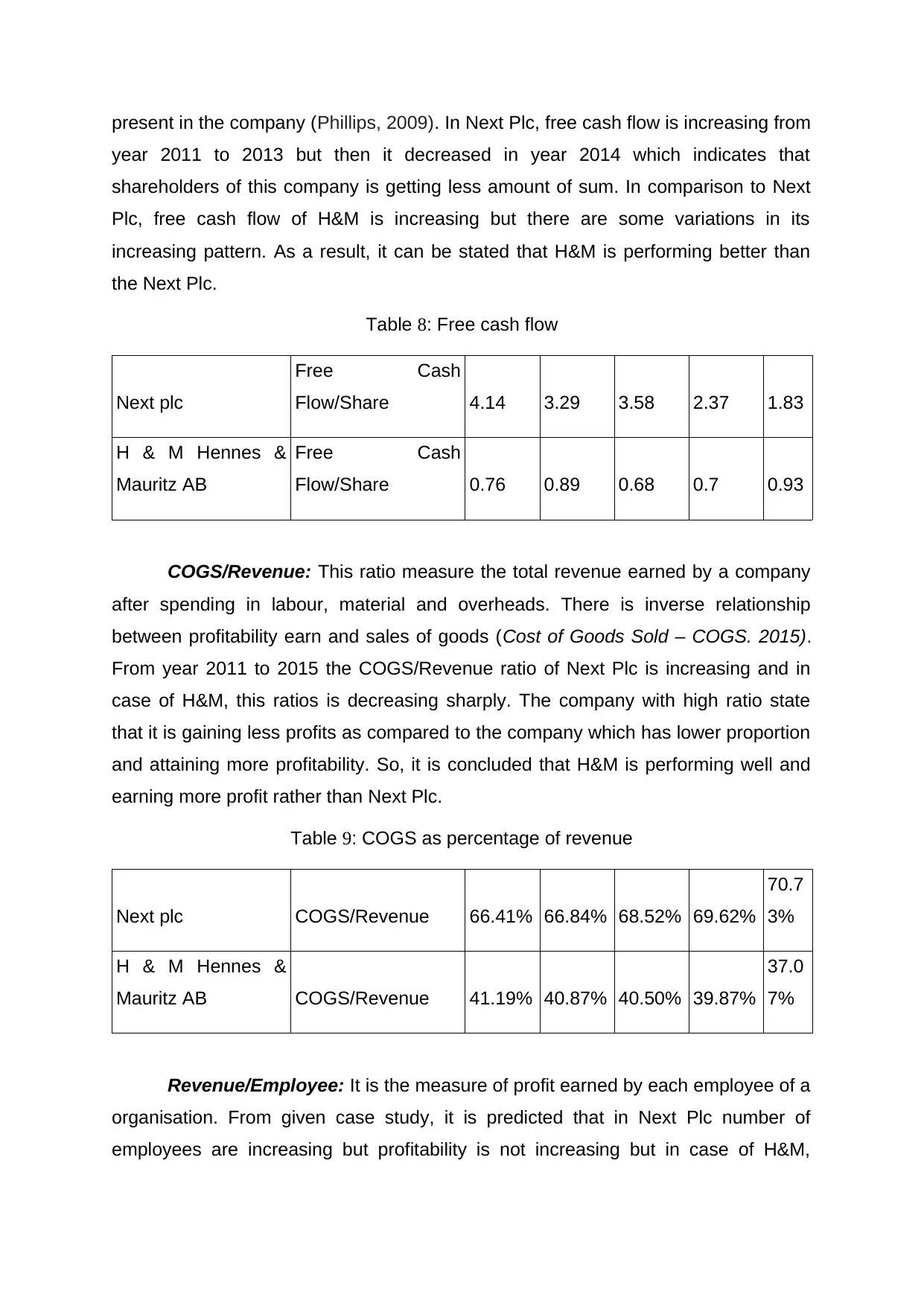

Operating Margin: Operating margin profit ratio calculates the percentage of

total revenue earned by a company by operating its overall income. Such that the

company which can easily left over a sum of money after paying-off its operating

cost to creditors and suppliers. As per the given table, operating margin of Next Plc

is continuously increasing which is not favourable for company. It means that the

company has effective control on its expenses whether in case of H&M, operating

margin is declining such that its direct expenses are not in control which is

favourable for company.

Table 7: Operating profit margin

Next plc Operating Margin 20.62% 19.33% 19.59% 17.67%

17.1

9%

H & M Hennes &

Mauritz AB Operating Margin 16.90% 17.18% 18.01% 18.53%

22.7

3%

Free Cash Flow/Share: It is a measure of an organisation's financial position

which is determined by dividing actual cash flow with total number of shareholders

company which is attained by selling its merchandise and inventories. This ratio

considers only cost of goods sold while calculating the profitability of sale. It can be

calculated by diving gross margin to net sales. This ratio of Next Plc is decreasing

every year which states that the company is not controlling its expenses efficiently

but in case of H&M, profit margin ratio is increasing. So, it can be justified that with

high profit margin, H&M will be able to earn more profits and easily control its direct

expenses.

Table 6: Gross profit margin of two companies

Next plc Gross Margin 33.59% 33.16% 31.48% 30.38%

29.2

7%

H & M Hennes &

Mauritz Gross Margin 58.81% 59.13% 59.50% 60.13%

62.9

3%

Operating Margin: Operating margin profit ratio calculates the percentage of

total revenue earned by a company by operating its overall income. Such that the

company which can easily left over a sum of money after paying-off its operating

cost to creditors and suppliers. As per the given table, operating margin of Next Plc

is continuously increasing which is not favourable for company. It means that the

company has effective control on its expenses whether in case of H&M, operating

margin is declining such that its direct expenses are not in control which is

favourable for company.

Table 7: Operating profit margin

Next plc Operating Margin 20.62% 19.33% 19.59% 17.67%

17.1

9%

H & M Hennes &

Mauritz AB Operating Margin 16.90% 17.18% 18.01% 18.53%

22.7

3%

Free Cash Flow/Share: It is a measure of an organisation's financial position

which is determined by dividing actual cash flow with total number of shareholders

present in the company (Phillips, 2009). In Next Plc, free cash flow is increasing from

year 2011 to 2013 but then it decreased in year 2014 which indicates that

shareholders of this company is getting less amount of sum. In comparison to Next

Plc, free cash flow of H&M is increasing but there are some variations in its

increasing pattern. As a result, it can be stated that H&M is performing better than

the Next Plc.

Table 8: Free cash flow

Next plc

Free Cash

Flow/Share 4.14 3.29 3.58 2.37 1.83

H & M Hennes &

Mauritz AB

Free Cash

Flow/Share 0.76 0.89 0.68 0.7 0.93

COGS/Revenue: This ratio measure the total revenue earned by a company

after spending in labour, material and overheads. There is inverse relationship

between profitability earn and sales of goods (Cost of Goods Sold – COGS. 2015).

From year 2011 to 2015 the COGS/Revenue ratio of Next Plc is increasing and in

case of H&M, this ratios is decreasing sharply. The company with high ratio state

that it is gaining less profits as compared to the company which has lower proportion

and attaining more profitability. So, it is concluded that H&M is performing well and

earning more profit rather than Next Plc.

Table 9: COGS as percentage of revenue

Next plc COGS/Revenue 66.41% 66.84% 68.52% 69.62%

70.7

3%

H & M Hennes &

Mauritz AB COGS/Revenue 41.19% 40.87% 40.50% 39.87%

37.0

7%

Revenue/Employee: It is the measure of profit earned by each employee of a

organisation. From given case study, it is predicted that in Next Plc number of

employees are increasing but profitability is not increasing but in case of H&M,

year 2011 to 2013 but then it decreased in year 2014 which indicates that

shareholders of this company is getting less amount of sum. In comparison to Next

Plc, free cash flow of H&M is increasing but there are some variations in its

increasing pattern. As a result, it can be stated that H&M is performing better than

the Next Plc.

Table 8: Free cash flow

Next plc

Free Cash

Flow/Share 4.14 3.29 3.58 2.37 1.83

H & M Hennes &

Mauritz AB

Free Cash

Flow/Share 0.76 0.89 0.68 0.7 0.93

COGS/Revenue: This ratio measure the total revenue earned by a company

after spending in labour, material and overheads. There is inverse relationship

between profitability earn and sales of goods (Cost of Goods Sold – COGS. 2015).

From year 2011 to 2015 the COGS/Revenue ratio of Next Plc is increasing and in

case of H&M, this ratios is decreasing sharply. The company with high ratio state

that it is gaining less profits as compared to the company which has lower proportion

and attaining more profitability. So, it is concluded that H&M is performing well and

earning more profit rather than Next Plc.

Table 9: COGS as percentage of revenue

Next plc COGS/Revenue 66.41% 66.84% 68.52% 69.62%

70.7

3%

H & M Hennes &

Mauritz AB COGS/Revenue 41.19% 40.87% 40.50% 39.87%

37.0

7%

Revenue/Employee: It is the measure of profit earned by each employee of a

organisation. From given case study, it is predicted that in Next Plc number of

employees are increasing but profitability is not increasing but in case of H&M,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

employee turnover is deceasing which indicates that the company is focused to

increase its profitability. So, the performance of H&M is better.

Table 10: Revenue per employee

Next plc Revenue/Employee 135729 130916 125360 119962

114

727

H & M Hennes &

Mauritz AB Revenue/Employee 138467 147942 156151 159858

166

639

Non Financial Ratio

Table 11: Staff turnover ratio of Next Plc

1 2 3 4 5

Total staff 44287 46133 48055 50057 47562

Absenteeism 7300 9125 8030 8760 9855

Staff turnover ratio 0.16 0.20 0.17 0.18 0.21

Table 12: Staff turnover ratio of H&M

1 2 3 4 5

Total staff 47524 50026 50026 52659 55430

Absenteeism 8030 9855 10950 11680 12045

Staff turnover ratio 0.17 0.20 0.22 0.22 0.22

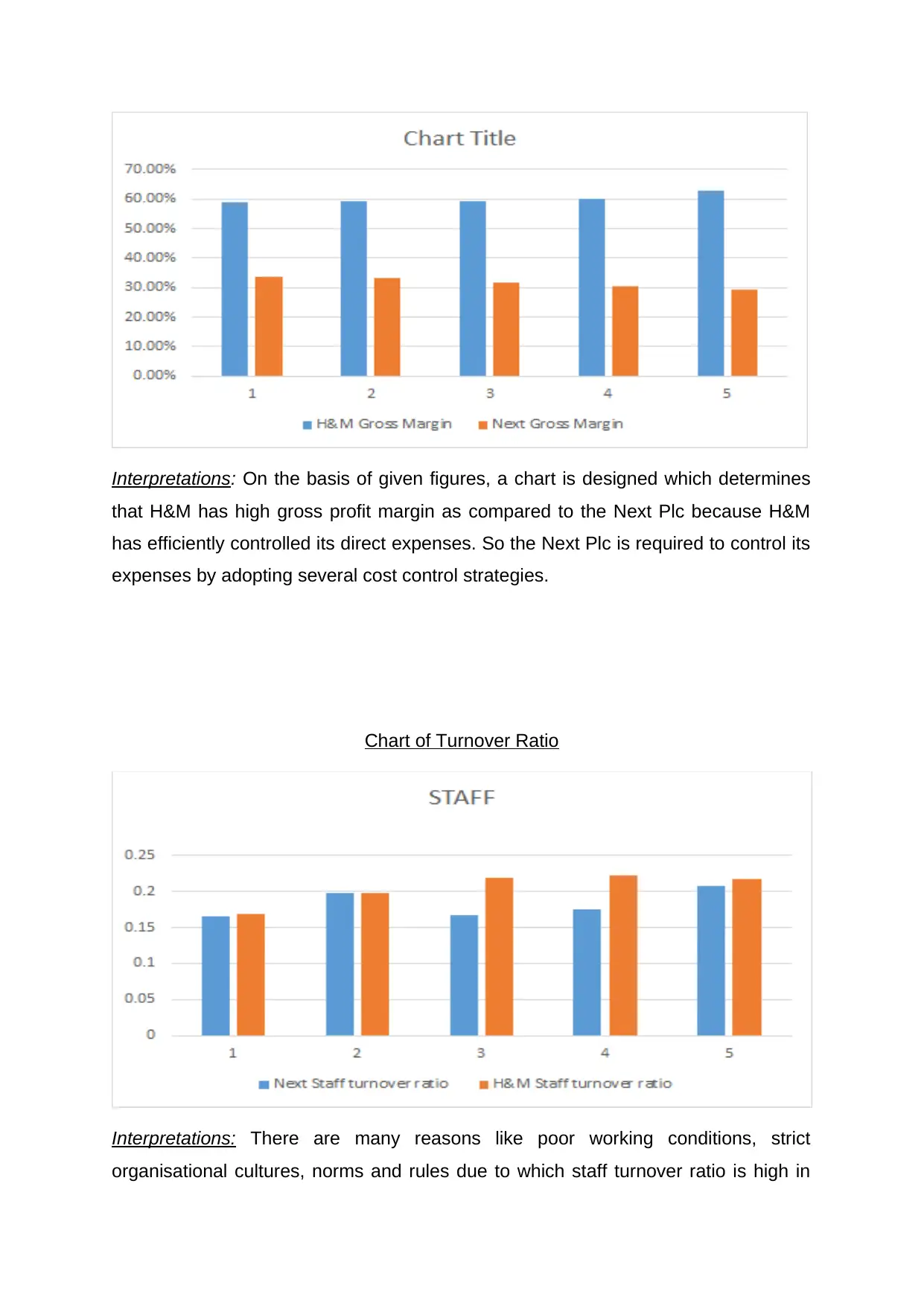

Recommendations: Staff Turnover Ratio measures the optimum utilization of a

company's manpower during a specific period. From above table, it is predicted that

employees turnover is more in H&M as compared to other company whereas in case

of Next Plc, staff turnover ratios is continuously declining within 5 years. So, The

Next Plc has better staff management and policies due to which employee's turnover

ratio is decreasing (Greenaway, Guariglia and Kneller, 2007)

increase its profitability. So, the performance of H&M is better.

Table 10: Revenue per employee

Next plc Revenue/Employee 135729 130916 125360 119962

114

727

H & M Hennes &

Mauritz AB Revenue/Employee 138467 147942 156151 159858

166

639

Non Financial Ratio

Table 11: Staff turnover ratio of Next Plc

1 2 3 4 5

Total staff 44287 46133 48055 50057 47562

Absenteeism 7300 9125 8030 8760 9855

Staff turnover ratio 0.16 0.20 0.17 0.18 0.21

Table 12: Staff turnover ratio of H&M

1 2 3 4 5

Total staff 47524 50026 50026 52659 55430

Absenteeism 8030 9855 10950 11680 12045

Staff turnover ratio 0.17 0.20 0.22 0.22 0.22

Recommendations: Staff Turnover Ratio measures the optimum utilization of a

company's manpower during a specific period. From above table, it is predicted that

employees turnover is more in H&M as compared to other company whereas in case

of Next Plc, staff turnover ratios is continuously declining within 5 years. So, The

Next Plc has better staff management and policies due to which employee's turnover

ratio is decreasing (Greenaway, Guariglia and Kneller, 2007)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table 13: Estimated working days of Next Plc

1 2 3 4 5

Usual hours worked per

week 70 70 70 70 70

Average hours worked per

week 56 56 56 56 56

Working days lost 6 8 10 9 8

Estimated working days lost 7.5 10 12.5 11.25 10

Table 14: Estimated working days lost of H&M

1 2 3 4 5

Usual hours worked per

week 70 70 70 70 70

Average hours worked per

week 63 63 63 63 63

Working days lost 10 11 15 14 13

Estimated working days lost 11.1 12.2 16.7 15.6 14.4

Recommendations: Estimated working days lost is the number of days in which an

organisation doesn't get productivity through its employees. From above table it is

identified that H&M has high number of working days lost than Next Plc that is not

favourable for company.

2. Analysing the performance of two companies using charts

Chart of Gross Margin Ratio

1 2 3 4 5

Usual hours worked per

week 70 70 70 70 70

Average hours worked per

week 56 56 56 56 56

Working days lost 6 8 10 9 8

Estimated working days lost 7.5 10 12.5 11.25 10

Table 14: Estimated working days lost of H&M

1 2 3 4 5

Usual hours worked per

week 70 70 70 70 70

Average hours worked per

week 63 63 63 63 63

Working days lost 10 11 15 14 13

Estimated working days lost 11.1 12.2 16.7 15.6 14.4

Recommendations: Estimated working days lost is the number of days in which an

organisation doesn't get productivity through its employees. From above table it is

identified that H&M has high number of working days lost than Next Plc that is not

favourable for company.

2. Analysing the performance of two companies using charts

Chart of Gross Margin Ratio

Interpretations: On the basis of given figures, a chart is designed which determines

that H&M has high gross profit margin as compared to the Next Plc because H&M

has efficiently controlled its direct expenses. So the Next Plc is required to control its

expenses by adopting several cost control strategies.

Chart of Turnover Ratio

Interpretations: There are many reasons like poor working conditions, strict

organisational cultures, norms and rules due to which staff turnover ratio is high in

that H&M has high gross profit margin as compared to the Next Plc because H&M

has efficiently controlled its direct expenses. So the Next Plc is required to control its

expenses by adopting several cost control strategies.

Chart of Turnover Ratio

Interpretations: There are many reasons like poor working conditions, strict

organisational cultures, norms and rules due to which staff turnover ratio is high in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.