Financial Analysis Report: Nine Entertainment Co Holdings (ACCY801)

VerifiedAdded on 2023/06/10

|18

|3662

|122

Report

AI Summary

This report provides a comprehensive financial analysis of Nine Entertainment Co Holdings. It begins with an introduction and a brief overview of the company, detailing its industry sector, primary activities, and recent performance. The report then presents a detailed table outlining the Board of Directors, including their names, ages, education, career history, and remuneration. An assessment of the Board's characteristics, including composition and expertise, is also provided. The report further examines important investment and financing decisions made by the company, along with an outline of the key recommendations of the ASX Corporate Governance Council. It also discusses the external audit function and business ethics, including ethical judgements. The analysis extends to identifying the top five investors and their ownership stakes, followed by an in-depth analysis of the financial statements, covering liquidity, asset management efficiency, capital structure, profitability, and market value ratios. The report concludes with a summary of the findings and includes a list of references.

Running head: ACCOUNTING

Accounting

Name of the Student

Name of the University

Authors Note

Course ID

Accounting

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING

Table of Contents

Introduction:...............................................................................................................................2

Brief Company Overview:.........................................................................................................2

Board of Directors:.....................................................................................................................3

Investment Decision:..................................................................................................................7

Corporate Governance:..............................................................................................................8

Auditors:...................................................................................................................................10

Business Ethics and Ethical Judgements:................................................................................11

Investors and Significant Ownership of Stakes:......................................................................11

Analysis of Financial Statement:.............................................................................................12

Liquidity:..................................................................................................................................12

Asset Management Efficiency:................................................................................................12

Capital Structure:.....................................................................................................................13

Profitability Ratios:..................................................................................................................13

Market Value Ratios:...............................................................................................................13

Cash Management Ratio:.........................................................................................................14

Conclusion:..............................................................................................................................14

References:...............................................................................................................................15

Table of Contents

Introduction:...............................................................................................................................2

Brief Company Overview:.........................................................................................................2

Board of Directors:.....................................................................................................................3

Investment Decision:..................................................................................................................7

Corporate Governance:..............................................................................................................8

Auditors:...................................................................................................................................10

Business Ethics and Ethical Judgements:................................................................................11

Investors and Significant Ownership of Stakes:......................................................................11

Analysis of Financial Statement:.............................................................................................12

Liquidity:..................................................................................................................................12

Asset Management Efficiency:................................................................................................12

Capital Structure:.....................................................................................................................13

Profitability Ratios:..................................................................................................................13

Market Value Ratios:...............................................................................................................13

Cash Management Ratio:.........................................................................................................14

Conclusion:..............................................................................................................................14

References:...............................................................................................................................15

2ACCOUNTING

Introduction:

The current report is based on analysing and discussing operational functions of Nine

Entertainment Co Holdings. The report would outline the industry in which the company

operates, its primary activities and current performance. A detail outline of board of directors

including the name, age, educations, career history and other relevant details would be

provided. An evaluation of the composition of the board and board expertise of Nine

Entertainment Co Holdings would be provided. Emphasis would be paid on the investment

and financial decision made by the NEC Ltd throughout the year. Furthermore, the report

would cover the corporate governance of Nine Entertainment Col Ltd and recommendations

would be provided concerning the ASX Corporate Governance Council.

The study would cover the external audit functions of Nine Entertainment Co

Holdings with key measures taken by the company in making sure that the business

operations are carried on with ethical means. An identification of the top five investors for

NEC would be identified and comment on the ownership stake in the company would be

presented. The analysis of financial statement through relevant ratios would be covered in the

study as well.

Brief Company Overview:

Nine Entertainment Co Holdings Ltd is regarded as the publicly listed Australian

media organization. Initially the company is the 50/50 joint venture with the consolidated

media holdings (Nineentertainmentco.com.au 2018). The strategy of the company is to

establish a great content, to distribute it widely and indulge in audience or advertisers. Since

Australia is the home of the most trusted and loved brands ranging from news, lifestyle,

sports and entertainment. The company takes pride in creating the finest content that is

Introduction:

The current report is based on analysing and discussing operational functions of Nine

Entertainment Co Holdings. The report would outline the industry in which the company

operates, its primary activities and current performance. A detail outline of board of directors

including the name, age, educations, career history and other relevant details would be

provided. An evaluation of the composition of the board and board expertise of Nine

Entertainment Co Holdings would be provided. Emphasis would be paid on the investment

and financial decision made by the NEC Ltd throughout the year. Furthermore, the report

would cover the corporate governance of Nine Entertainment Col Ltd and recommendations

would be provided concerning the ASX Corporate Governance Council.

The study would cover the external audit functions of Nine Entertainment Co

Holdings with key measures taken by the company in making sure that the business

operations are carried on with ethical means. An identification of the top five investors for

NEC would be identified and comment on the ownership stake in the company would be

presented. The analysis of financial statement through relevant ratios would be covered in the

study as well.

Brief Company Overview:

Nine Entertainment Co Holdings Ltd is regarded as the publicly listed Australian

media organization. Initially the company is the 50/50 joint venture with the consolidated

media holdings (Nineentertainmentco.com.au 2018). The strategy of the company is to

establish a great content, to distribute it widely and indulge in audience or advertisers. Since

Australia is the home of the most trusted and loved brands ranging from news, lifestyle,

sports and entertainment. The company takes pride in creating the finest content that is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING

accessed by the consumers when and how they want, while celebrating its ability to provide

the shared experiences among the audience.

The business functions of the company are engaged in the operations of four

divisions, free to air television, digital publishing, on demand video and production of

content. The company has the long standing strategic relations with the Microsoft, for selling

their suite of advertisement products while leveraging their world-leading technology data

insight, innovations together with the data relations with some Australia’s leading technology

providers such as Red Planet and Data Republics (Nineentertainmentco.com.au 2018). The

wide investment includes 50% interest in Stan and interest in Rate City with ASX-Listed

financial service company in Yellow Brick Road.

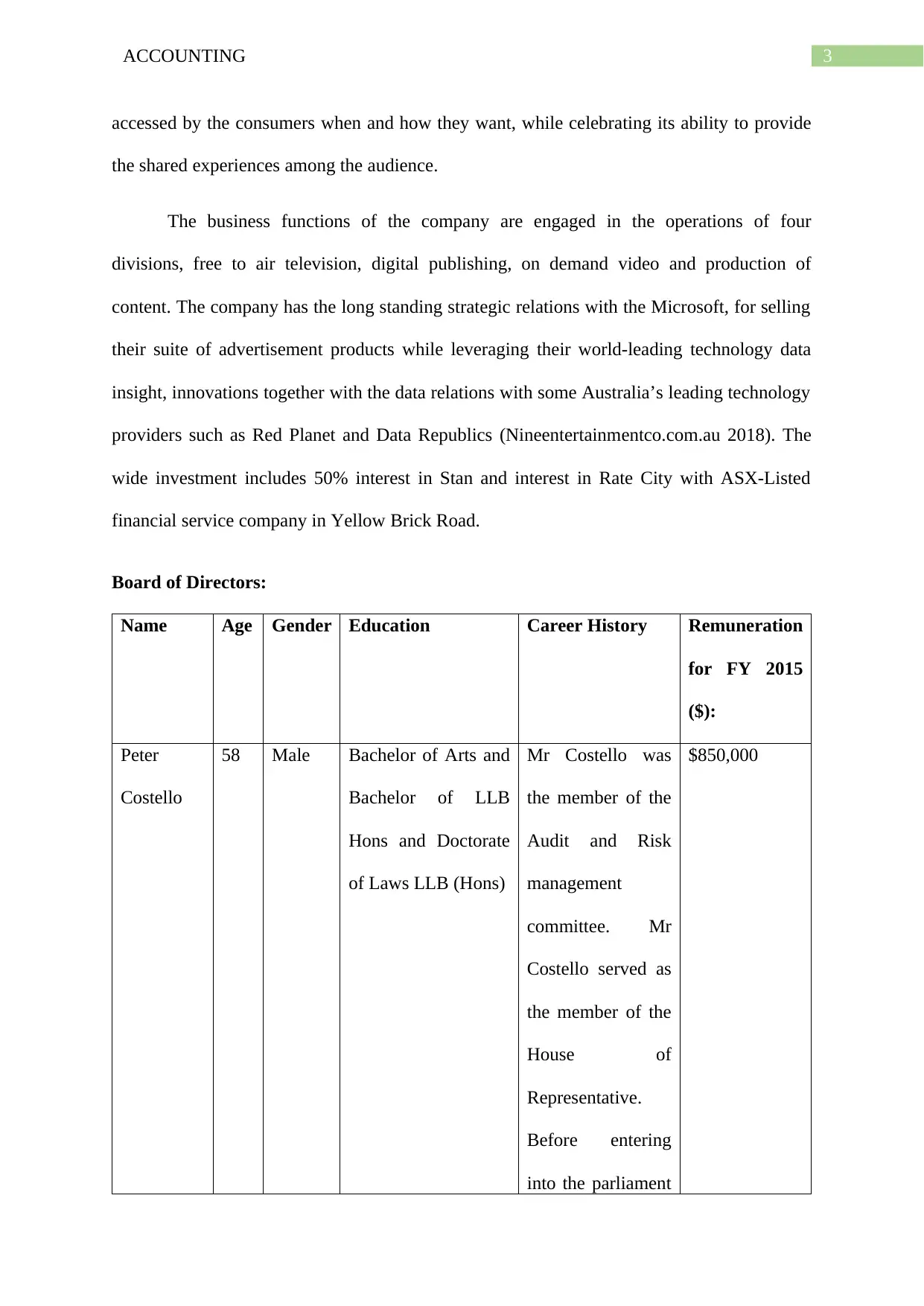

Board of Directors:

Name Age Gender Education Career History Remuneration

for FY 2015

($):

Peter

Costello

58 Male Bachelor of Arts and

Bachelor of LLB

Hons and Doctorate

of Laws LLB (Hons)

Mr Costello was

the member of the

Audit and Risk

management

committee. Mr

Costello served as

the member of the

House of

Representative.

Before entering

into the parliament

$850,000

accessed by the consumers when and how they want, while celebrating its ability to provide

the shared experiences among the audience.

The business functions of the company are engaged in the operations of four

divisions, free to air television, digital publishing, on demand video and production of

content. The company has the long standing strategic relations with the Microsoft, for selling

their suite of advertisement products while leveraging their world-leading technology data

insight, innovations together with the data relations with some Australia’s leading technology

providers such as Red Planet and Data Republics (Nineentertainmentco.com.au 2018). The

wide investment includes 50% interest in Stan and interest in Rate City with ASX-Listed

financial service company in Yellow Brick Road.

Board of Directors:

Name Age Gender Education Career History Remuneration

for FY 2015

($):

Peter

Costello

58 Male Bachelor of Arts and

Bachelor of LLB

Hons and Doctorate

of Laws LLB (Hons)

Mr Costello was

the member of the

Audit and Risk

management

committee. Mr

Costello served as

the member of the

House of

Representative.

Before entering

into the parliament

$850,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

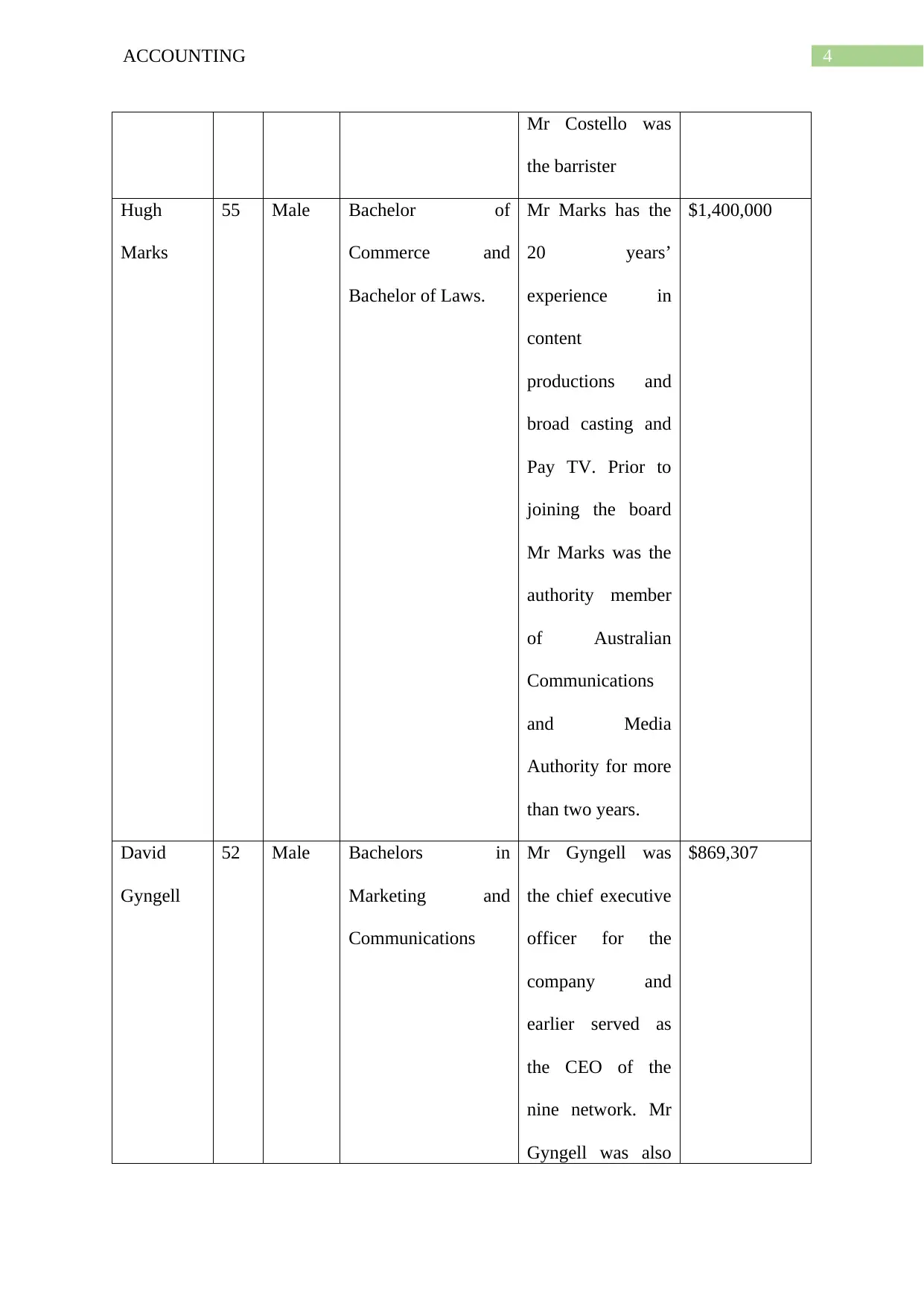

4ACCOUNTING

Mr Costello was

the barrister

Hugh

Marks

55 Male Bachelor of

Commerce and

Bachelor of Laws.

Mr Marks has the

20 years’

experience in

content

productions and

broad casting and

Pay TV. Prior to

joining the board

Mr Marks was the

authority member

of Australian

Communications

and Media

Authority for more

than two years.

$1,400,000

David

Gyngell

52 Male Bachelors in

Marketing and

Communications

Mr Gyngell was

the chief executive

officer for the

company and

earlier served as

the CEO of the

nine network. Mr

Gyngell was also

$869,307

Mr Costello was

the barrister

Hugh

Marks

55 Male Bachelor of

Commerce and

Bachelor of Laws.

Mr Marks has the

20 years’

experience in

content

productions and

broad casting and

Pay TV. Prior to

joining the board

Mr Marks was the

authority member

of Australian

Communications

and Media

Authority for more

than two years.

$1,400,000

David

Gyngell

52 Male Bachelors in

Marketing and

Communications

Mr Gyngell was

the chief executive

officer for the

company and

earlier served as

the CEO of the

nine network. Mr

Gyngell was also

$869,307

5ACCOUNTING

the director of the

International

Management

Group.

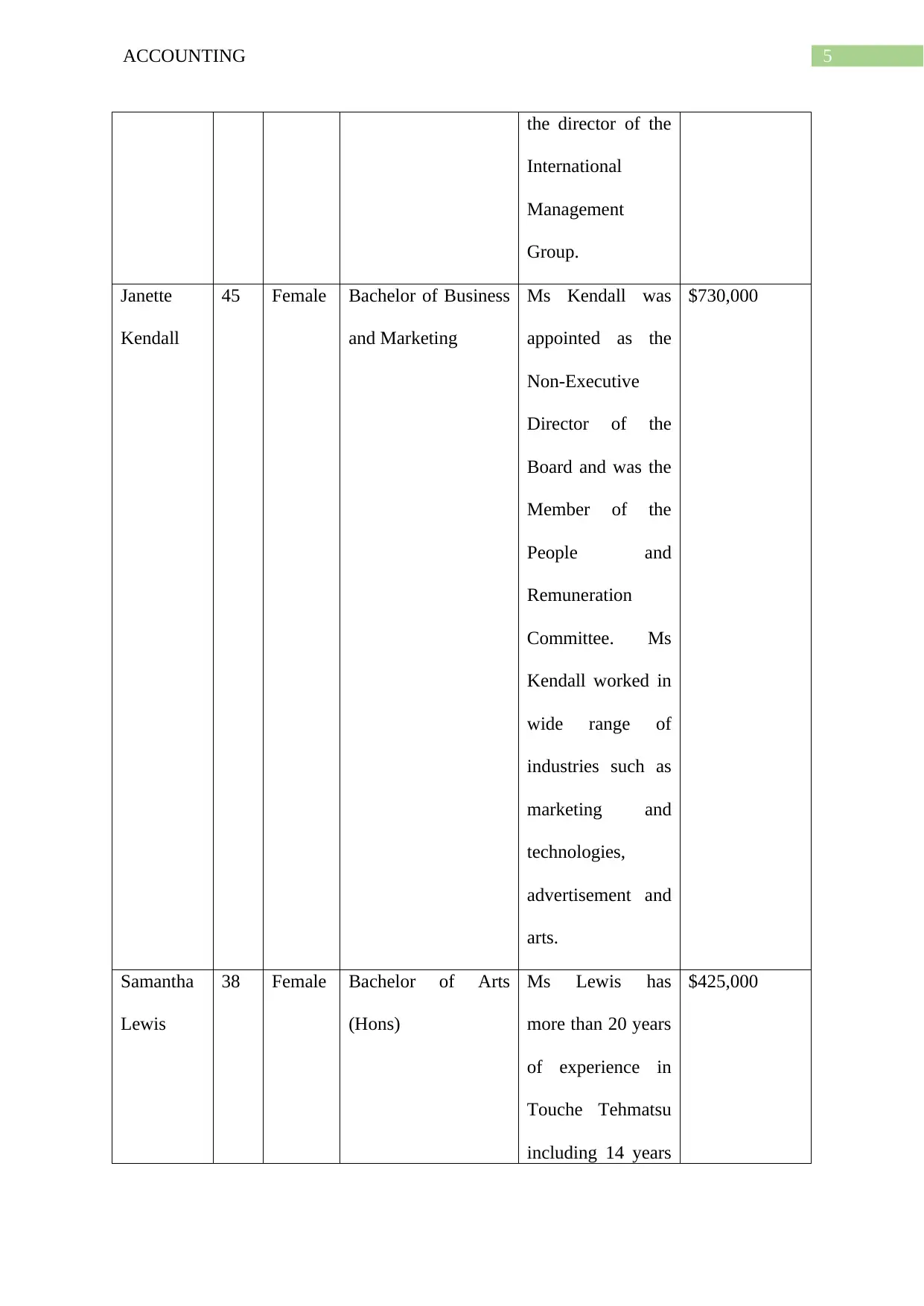

Janette

Kendall

45 Female Bachelor of Business

and Marketing

Ms Kendall was

appointed as the

Non-Executive

Director of the

Board and was the

Member of the

People and

Remuneration

Committee. Ms

Kendall worked in

wide range of

industries such as

marketing and

technologies,

advertisement and

arts.

$730,000

Samantha

Lewis

38 Female Bachelor of Arts

(Hons)

Ms Lewis has

more than 20 years

of experience in

Touche Tehmatsu

including 14 years

$425,000

the director of the

International

Management

Group.

Janette

Kendall

45 Female Bachelor of Business

and Marketing

Ms Kendall was

appointed as the

Non-Executive

Director of the

Board and was the

Member of the

People and

Remuneration

Committee. Ms

Kendall worked in

wide range of

industries such as

marketing and

technologies,

advertisement and

arts.

$730,000

Samantha

Lewis

38 Female Bachelor of Arts

(Hons)

Ms Lewis has

more than 20 years

of experience in

Touche Tehmatsu

including 14 years

$425,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING

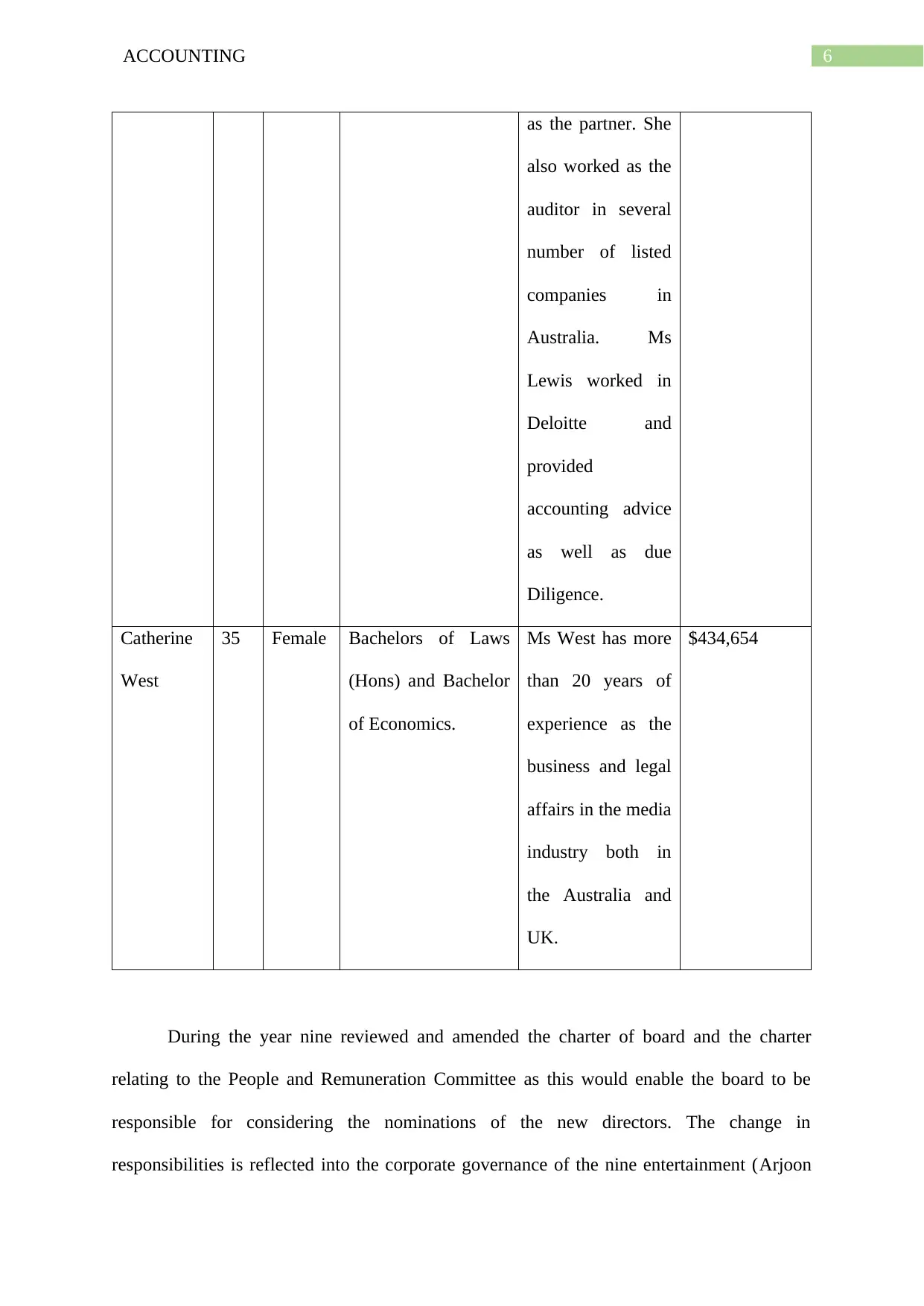

as the partner. She

also worked as the

auditor in several

number of listed

companies in

Australia. Ms

Lewis worked in

Deloitte and

provided

accounting advice

as well as due

Diligence.

Catherine

West

35 Female Bachelors of Laws

(Hons) and Bachelor

of Economics.

Ms West has more

than 20 years of

experience as the

business and legal

affairs in the media

industry both in

the Australia and

UK.

$434,654

During the year nine reviewed and amended the charter of board and the charter

relating to the People and Remuneration Committee as this would enable the board to be

responsible for considering the nominations of the new directors. The change in

responsibilities is reflected into the corporate governance of the nine entertainment (Arjoon

as the partner. She

also worked as the

auditor in several

number of listed

companies in

Australia. Ms

Lewis worked in

Deloitte and

provided

accounting advice

as well as due

Diligence.

Catherine

West

35 Female Bachelors of Laws

(Hons) and Bachelor

of Economics.

Ms West has more

than 20 years of

experience as the

business and legal

affairs in the media

industry both in

the Australia and

UK.

$434,654

During the year nine reviewed and amended the charter of board and the charter

relating to the People and Remuneration Committee as this would enable the board to be

responsible for considering the nominations of the new directors. The change in

responsibilities is reflected into the corporate governance of the nine entertainment (Arjoon

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING

2017). The corporate governance statement of the Nine Entertainment Ltd reflects the degree

to which the company has adhered with the ASX Corporate Governance principles and the

corporate governance best practices. The board of directors of Nine Entertainment Ltd plays

an important part in discharge of their responsibilities.

For instance, committees such as audit, risks management, obedience, nominations,

people policy and sustainability committees. Each and every committee is chaired

independently to carry-out the functions of attaining the overall organizational goals

(Nineentertainmentco.com.au 2018). The board members represent the organizations by

acting as the ambassadors since the charter of the company demands the members to be loyal

and remain committed to the organizational functions (Aguilera et al. 2015). These board of

directors are required to report directly to the shareholders and held accountable for

organization’s growth and development.

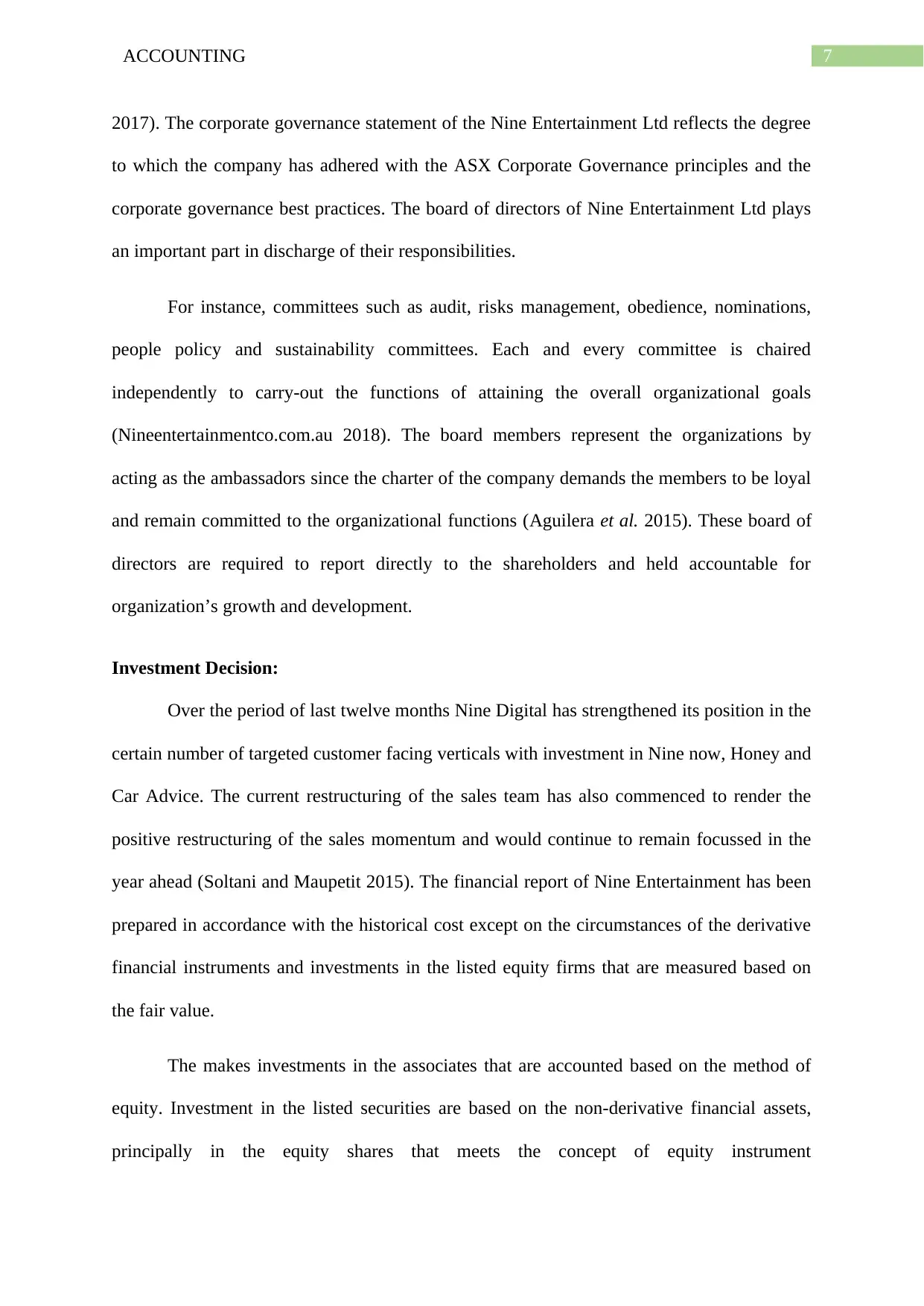

Investment Decision:

Over the period of last twelve months Nine Digital has strengthened its position in the

certain number of targeted customer facing verticals with investment in Nine now, Honey and

Car Advice. The current restructuring of the sales team has also commenced to render the

positive restructuring of the sales momentum and would continue to remain focussed in the

year ahead (Soltani and Maupetit 2015). The financial report of Nine Entertainment has been

prepared in accordance with the historical cost except on the circumstances of the derivative

financial instruments and investments in the listed equity firms that are measured based on

the fair value.

The makes investments in the associates that are accounted based on the method of

equity. Investment in the listed securities are based on the non-derivative financial assets,

principally in the equity shares that meets the concept of equity instrument

2017). The corporate governance statement of the Nine Entertainment Ltd reflects the degree

to which the company has adhered with the ASX Corporate Governance principles and the

corporate governance best practices. The board of directors of Nine Entertainment Ltd plays

an important part in discharge of their responsibilities.

For instance, committees such as audit, risks management, obedience, nominations,

people policy and sustainability committees. Each and every committee is chaired

independently to carry-out the functions of attaining the overall organizational goals

(Nineentertainmentco.com.au 2018). The board members represent the organizations by

acting as the ambassadors since the charter of the company demands the members to be loyal

and remain committed to the organizational functions (Aguilera et al. 2015). These board of

directors are required to report directly to the shareholders and held accountable for

organization’s growth and development.

Investment Decision:

Over the period of last twelve months Nine Digital has strengthened its position in the

certain number of targeted customer facing verticals with investment in Nine now, Honey and

Car Advice. The current restructuring of the sales team has also commenced to render the

positive restructuring of the sales momentum and would continue to remain focussed in the

year ahead (Soltani and Maupetit 2015). The financial report of Nine Entertainment has been

prepared in accordance with the historical cost except on the circumstances of the derivative

financial instruments and investments in the listed equity firms that are measured based on

the fair value.

The makes investments in the associates that are accounted based on the method of

equity. Investment in the listed securities are based on the non-derivative financial assets,

principally in the equity shares that meets the concept of equity instrument

8ACCOUNTING

(Nineentertainmentco.com.au 2018). The company determines the fair value of the

investment that are traded actively in the organized financial markets that are determined by

referring to the quoted market prices upon the closure of the business on the reporting date

(Crane and Matten 2016). The company has made investment in the associates and joint

ventures and are accounted in terms of the equity method of accounting in the consolidated

financial statements.

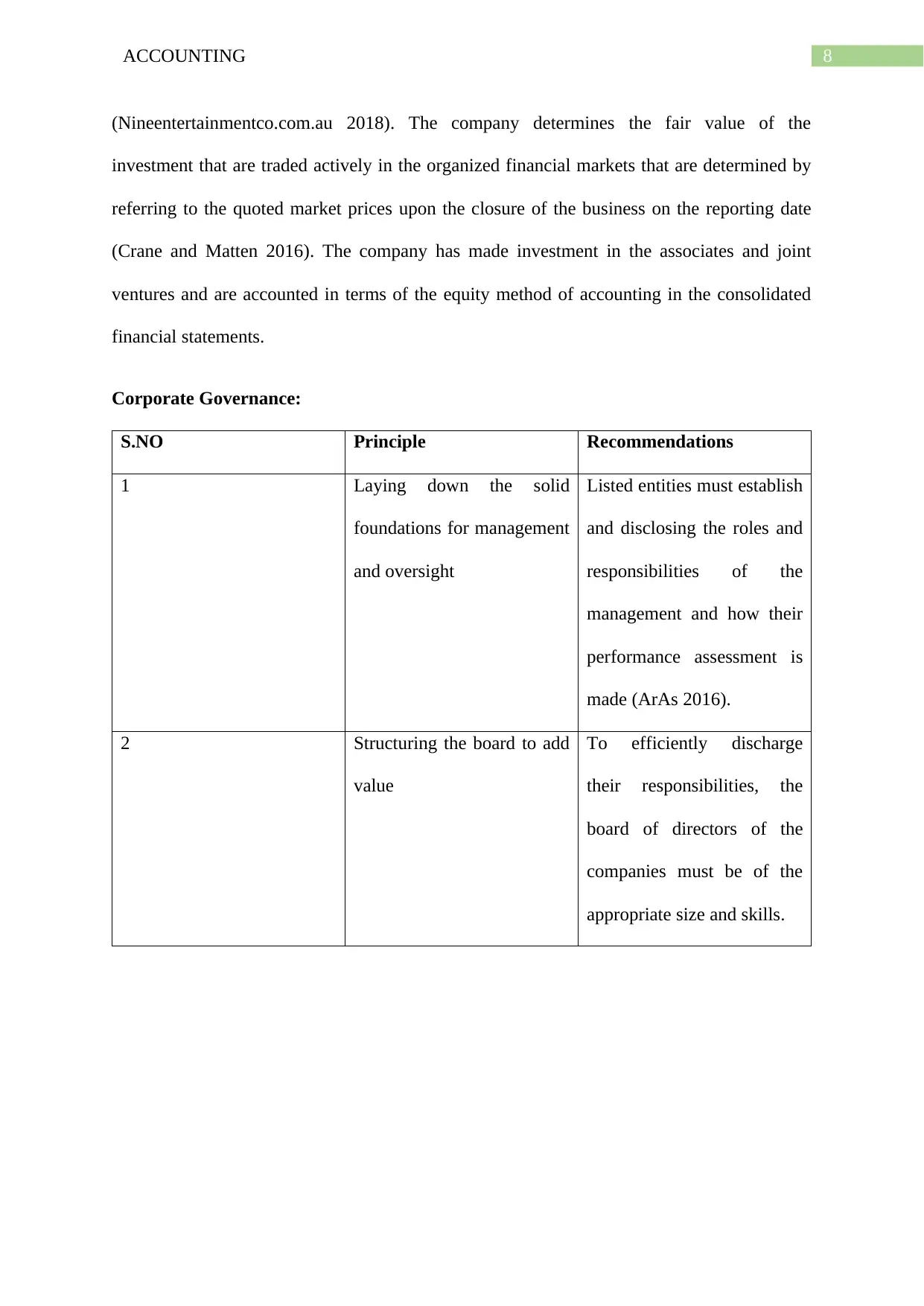

Corporate Governance:

S.NO Principle Recommendations

1 Laying down the solid

foundations for management

and oversight

Listed entities must establish

and disclosing the roles and

responsibilities of the

management and how their

performance assessment is

made (ArAs 2016).

2 Structuring the board to add

value

To efficiently discharge

their responsibilities, the

board of directors of the

companies must be of the

appropriate size and skills.

(Nineentertainmentco.com.au 2018). The company determines the fair value of the

investment that are traded actively in the organized financial markets that are determined by

referring to the quoted market prices upon the closure of the business on the reporting date

(Crane and Matten 2016). The company has made investment in the associates and joint

ventures and are accounted in terms of the equity method of accounting in the consolidated

financial statements.

Corporate Governance:

S.NO Principle Recommendations

1 Laying down the solid

foundations for management

and oversight

Listed entities must establish

and disclosing the roles and

responsibilities of the

management and how their

performance assessment is

made (ArAs 2016).

2 Structuring the board to add

value

To efficiently discharge

their responsibilities, the

board of directors of the

companies must be of the

appropriate size and skills.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING

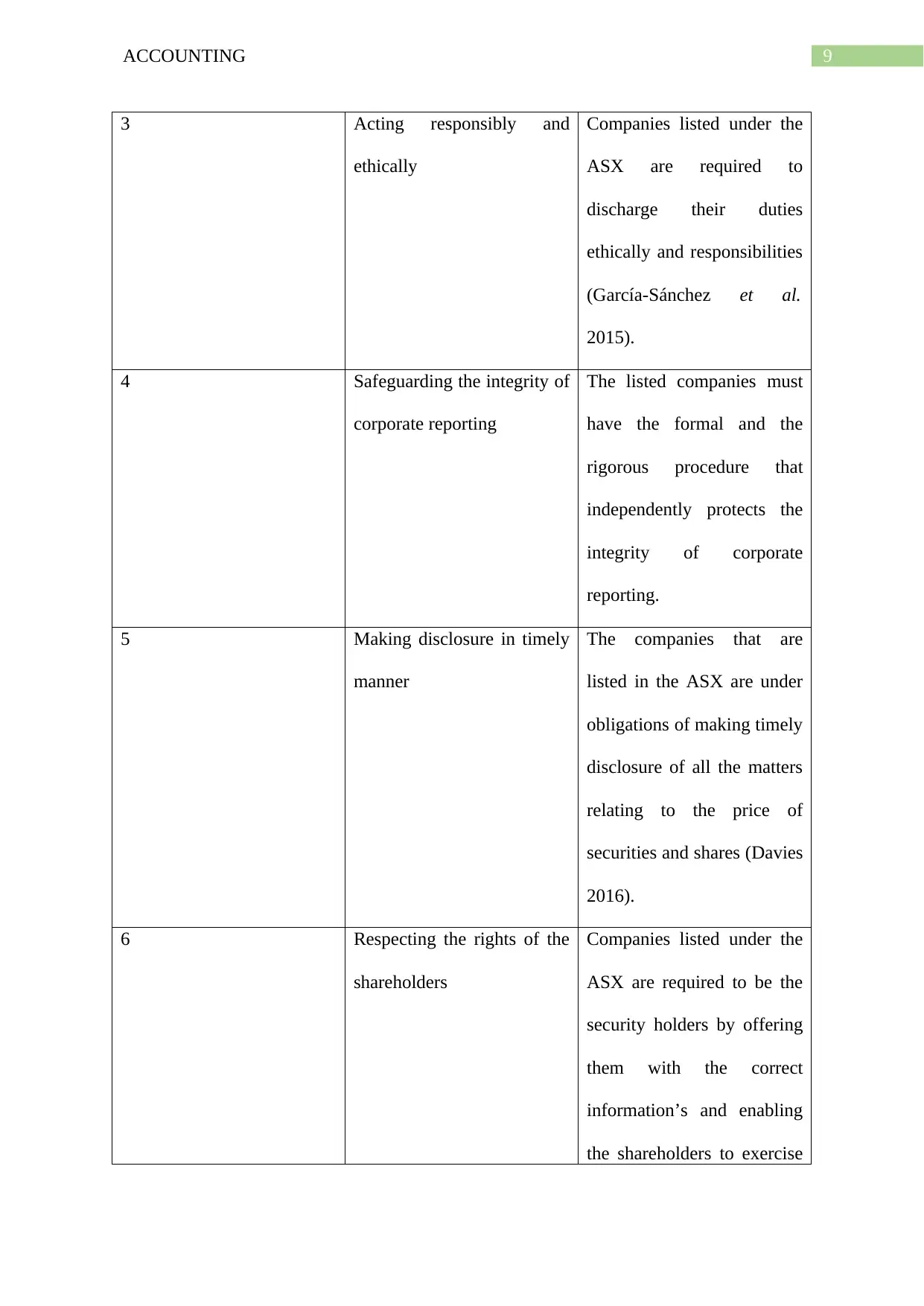

3 Acting responsibly and

ethically

Companies listed under the

ASX are required to

discharge their duties

ethically and responsibilities

(García-Sánchez et al.

2015).

4 Safeguarding the integrity of

corporate reporting

The listed companies must

have the formal and the

rigorous procedure that

independently protects the

integrity of corporate

reporting.

5 Making disclosure in timely

manner

The companies that are

listed in the ASX are under

obligations of making timely

disclosure of all the matters

relating to the price of

securities and shares (Davies

2016).

6 Respecting the rights of the

shareholders

Companies listed under the

ASX are required to be the

security holders by offering

them with the correct

information’s and enabling

the shareholders to exercise

3 Acting responsibly and

ethically

Companies listed under the

ASX are required to

discharge their duties

ethically and responsibilities

(García-Sánchez et al.

2015).

4 Safeguarding the integrity of

corporate reporting

The listed companies must

have the formal and the

rigorous procedure that

independently protects the

integrity of corporate

reporting.

5 Making disclosure in timely

manner

The companies that are

listed in the ASX are under

obligations of making timely

disclosure of all the matters

relating to the price of

securities and shares (Davies

2016).

6 Respecting the rights of the

shareholders

Companies listed under the

ASX are required to be the

security holders by offering

them with the correct

information’s and enabling

the shareholders to exercise

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING

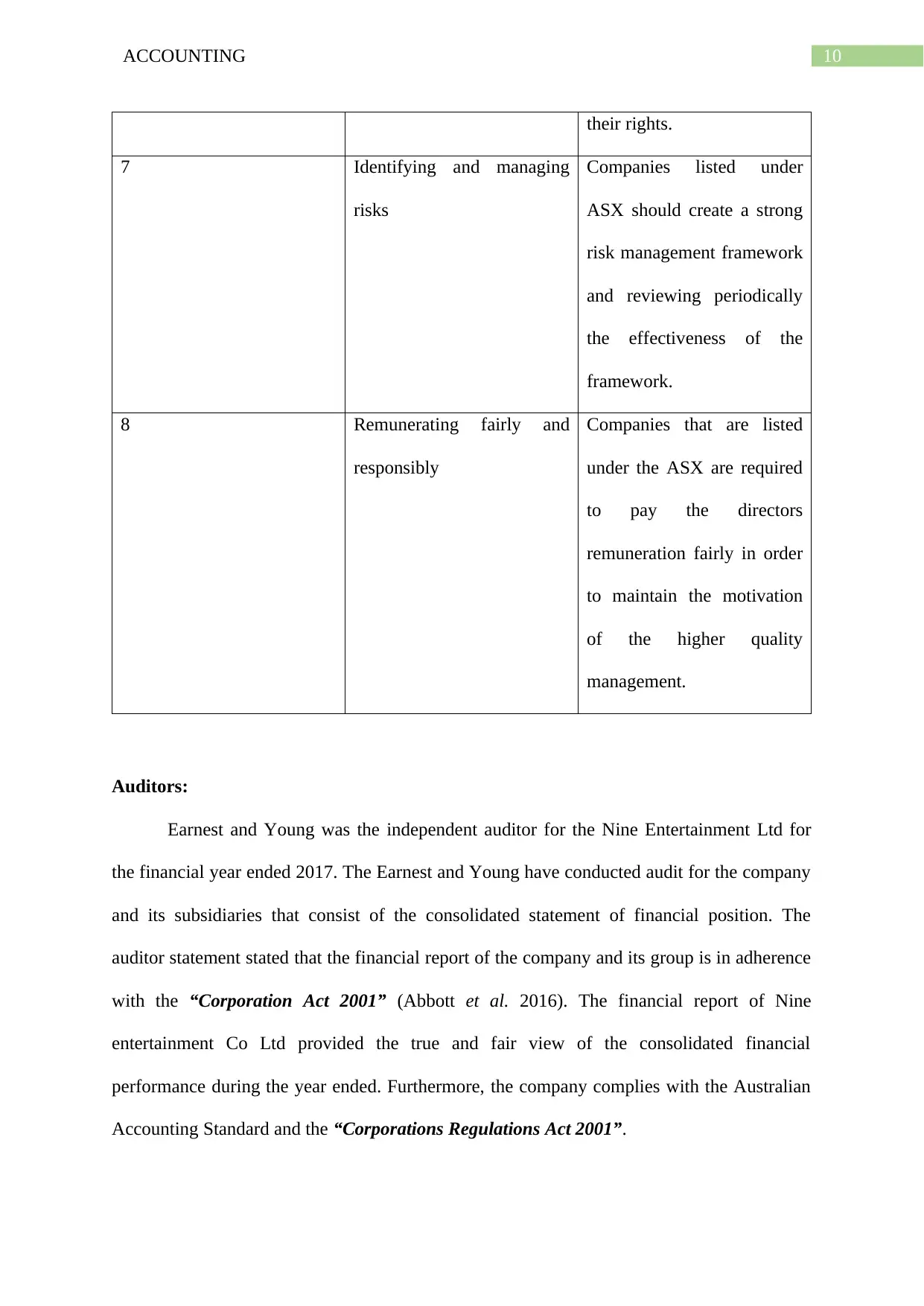

their rights.

7 Identifying and managing

risks

Companies listed under

ASX should create a strong

risk management framework

and reviewing periodically

the effectiveness of the

framework.

8 Remunerating fairly and

responsibly

Companies that are listed

under the ASX are required

to pay the directors

remuneration fairly in order

to maintain the motivation

of the higher quality

management.

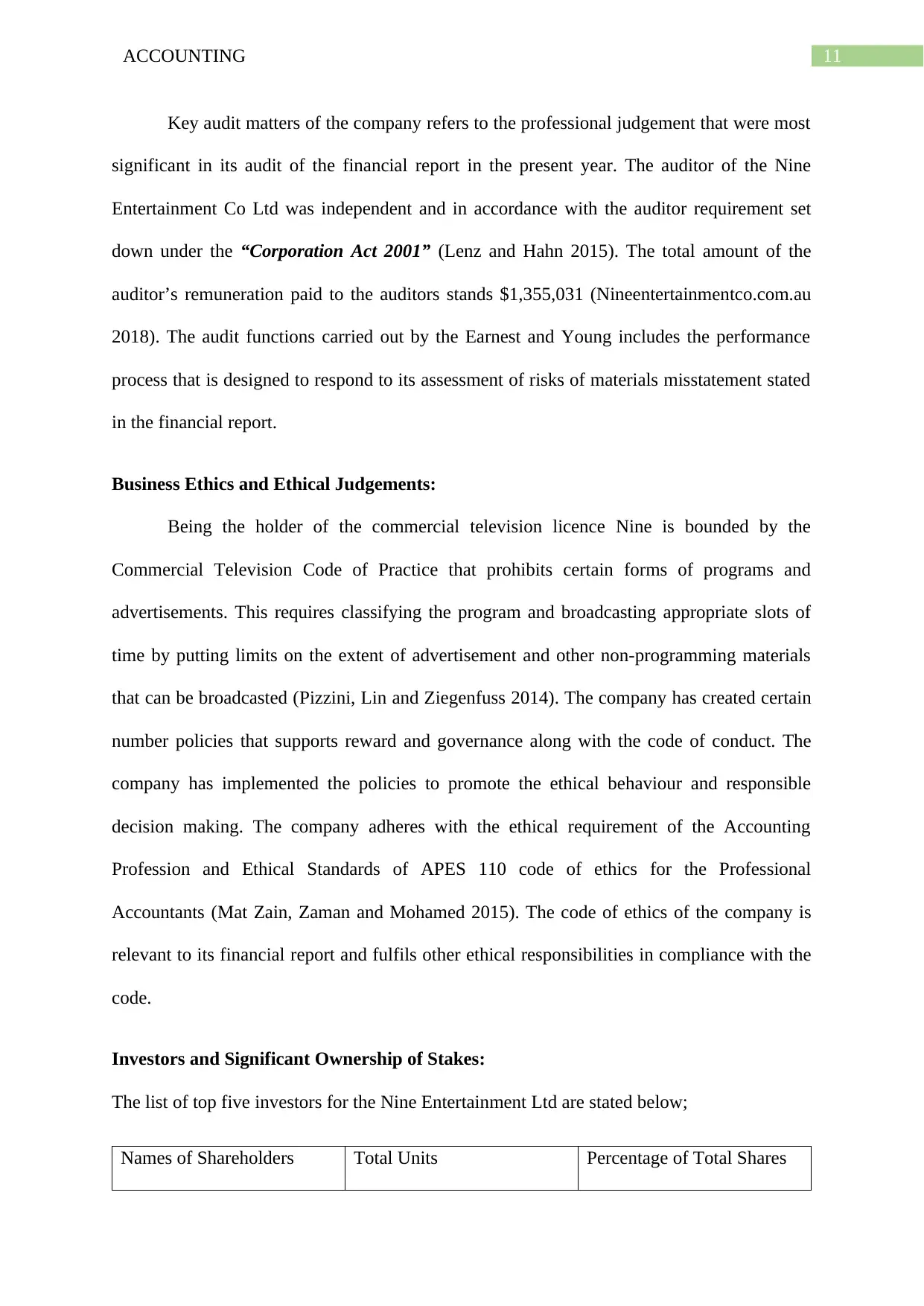

Auditors:

Earnest and Young was the independent auditor for the Nine Entertainment Ltd for

the financial year ended 2017. The Earnest and Young have conducted audit for the company

and its subsidiaries that consist of the consolidated statement of financial position. The

auditor statement stated that the financial report of the company and its group is in adherence

with the “Corporation Act 2001” (Abbott et al. 2016). The financial report of Nine

entertainment Co Ltd provided the true and fair view of the consolidated financial

performance during the year ended. Furthermore, the company complies with the Australian

Accounting Standard and the “Corporations Regulations Act 2001”.

their rights.

7 Identifying and managing

risks

Companies listed under

ASX should create a strong

risk management framework

and reviewing periodically

the effectiveness of the

framework.

8 Remunerating fairly and

responsibly

Companies that are listed

under the ASX are required

to pay the directors

remuneration fairly in order

to maintain the motivation

of the higher quality

management.

Auditors:

Earnest and Young was the independent auditor for the Nine Entertainment Ltd for

the financial year ended 2017. The Earnest and Young have conducted audit for the company

and its subsidiaries that consist of the consolidated statement of financial position. The

auditor statement stated that the financial report of the company and its group is in adherence

with the “Corporation Act 2001” (Abbott et al. 2016). The financial report of Nine

entertainment Co Ltd provided the true and fair view of the consolidated financial

performance during the year ended. Furthermore, the company complies with the Australian

Accounting Standard and the “Corporations Regulations Act 2001”.

11ACCOUNTING

Key audit matters of the company refers to the professional judgement that were most

significant in its audit of the financial report in the present year. The auditor of the Nine

Entertainment Co Ltd was independent and in accordance with the auditor requirement set

down under the “Corporation Act 2001” (Lenz and Hahn 2015). The total amount of the

auditor’s remuneration paid to the auditors stands $1,355,031 (Nineentertainmentco.com.au

2018). The audit functions carried out by the Earnest and Young includes the performance

process that is designed to respond to its assessment of risks of materials misstatement stated

in the financial report.

Business Ethics and Ethical Judgements:

Being the holder of the commercial television licence Nine is bounded by the

Commercial Television Code of Practice that prohibits certain forms of programs and

advertisements. This requires classifying the program and broadcasting appropriate slots of

time by putting limits on the extent of advertisement and other non-programming materials

that can be broadcasted (Pizzini, Lin and Ziegenfuss 2014). The company has created certain

number policies that supports reward and governance along with the code of conduct. The

company has implemented the policies to promote the ethical behaviour and responsible

decision making. The company adheres with the ethical requirement of the Accounting

Profession and Ethical Standards of APES 110 code of ethics for the Professional

Accountants (Mat Zain, Zaman and Mohamed 2015). The code of ethics of the company is

relevant to its financial report and fulfils other ethical responsibilities in compliance with the

code.

Investors and Significant Ownership of Stakes:

The list of top five investors for the Nine Entertainment Ltd are stated below;

Names of Shareholders Total Units Percentage of Total Shares

Key audit matters of the company refers to the professional judgement that were most

significant in its audit of the financial report in the present year. The auditor of the Nine

Entertainment Co Ltd was independent and in accordance with the auditor requirement set

down under the “Corporation Act 2001” (Lenz and Hahn 2015). The total amount of the

auditor’s remuneration paid to the auditors stands $1,355,031 (Nineentertainmentco.com.au

2018). The audit functions carried out by the Earnest and Young includes the performance

process that is designed to respond to its assessment of risks of materials misstatement stated

in the financial report.

Business Ethics and Ethical Judgements:

Being the holder of the commercial television licence Nine is bounded by the

Commercial Television Code of Practice that prohibits certain forms of programs and

advertisements. This requires classifying the program and broadcasting appropriate slots of

time by putting limits on the extent of advertisement and other non-programming materials

that can be broadcasted (Pizzini, Lin and Ziegenfuss 2014). The company has created certain

number policies that supports reward and governance along with the code of conduct. The

company has implemented the policies to promote the ethical behaviour and responsible

decision making. The company adheres with the ethical requirement of the Accounting

Profession and Ethical Standards of APES 110 code of ethics for the Professional

Accountants (Mat Zain, Zaman and Mohamed 2015). The code of ethics of the company is

relevant to its financial report and fulfils other ethical responsibilities in compliance with the

code.

Investors and Significant Ownership of Stakes:

The list of top five investors for the Nine Entertainment Ltd are stated below;

Names of Shareholders Total Units Percentage of Total Shares

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.