Market Analysis of General Motors (GM) in the Automotive Industry

VerifiedAdded on 2023/01/07

|11

|3048

|26

AI Summary

This report provides a market analysis of General Motors (GM) in the automotive industry, including a description of the company, market structure, and financial performance. It also discusses the role of the automotive industry in the business environment.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Economics

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION...........................................................................................................................1

MAIN BODY..................................................................................................................................1

1. Description of selected company.............................................................................................1

2. Market analysis of General Motors (GM)...............................................................................2

3. Market structure of General Motors (GM)..............................................................................5

4. Considering the nature of the industry in which the firm operates..........................................6

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

MAIN BODY..................................................................................................................................1

1. Description of selected company.............................................................................................1

2. Market analysis of General Motors (GM)...............................................................................2

3. Market structure of General Motors (GM)..............................................................................5

4. Considering the nature of the industry in which the firm operates..........................................6

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Management concept applies to one of essential principles concerned primarily with diverse

theories and models, to resolve complex market challenges (An, Zhang and Adom, 2019).

Implementing this concept in corporation attempts to assess the effectiveness and productivity

improvements in the very same way, to successfully lead the business. In this report, a research

on the automotive industry is developed to explain its role in the business surroundings by

selecting General Motors as the operating base. This company is focused because of its greatest

existence in the automotive industry, in which it has enhanced its business worldwide. Towards

this end, in depth analysis is carried out by analyzing the specific company's previous and

contemporary role in a relevant sport. In addition, various aspects of market structure are

analytically analyzed in order to suggest which one will be better for the current business in

order to run corporation highly competitive. In addition, key recommendations are made, when

considering social gains, for either smaller or larger government action on the development of

the automobile sector.

MAIN BODY

1. Description of selected company

General Motors is leading company in the world in production of 20th and early 21st

century automobiles (Canonico and et. al., 2020). It runs both processing and assembly facilities,

with large fulfilment centres throughout the U.S., UK, Canada and in other nations. The

company's main offerings have included a wide variety of cars and industrial parts, equipment

and machinery and are also involved in financial industries. It has its head office in Detroit and

was initiated under William Durant’s leadership in 1908, and originally only operates its

company in the European market. In 1929, this corporation had exceeded one international

company; i.e. Ford Motors Corporation is to become America's largest producer of passenger-

cars. GM also since incorporated its global operations such as UK Vauxhall in 1925, then

German's Adam Opel in 1929, then the Australian Holden in 1931. All these processes made

General Motors the country's greatest motor vehicle Production Company in 1931. By 1941,

GM produced 44% of all U.S. cars and reached the largest business corporations (Delic and

Eyers, 2020). GM Motors presently conducts its operations around 37 countries, including

Chevrolet, Buick, GMC and Cadillac, where the company's core branded vehicles. As well

1

Management concept applies to one of essential principles concerned primarily with diverse

theories and models, to resolve complex market challenges (An, Zhang and Adom, 2019).

Implementing this concept in corporation attempts to assess the effectiveness and productivity

improvements in the very same way, to successfully lead the business. In this report, a research

on the automotive industry is developed to explain its role in the business surroundings by

selecting General Motors as the operating base. This company is focused because of its greatest

existence in the automotive industry, in which it has enhanced its business worldwide. Towards

this end, in depth analysis is carried out by analyzing the specific company's previous and

contemporary role in a relevant sport. In addition, various aspects of market structure are

analytically analyzed in order to suggest which one will be better for the current business in

order to run corporation highly competitive. In addition, key recommendations are made, when

considering social gains, for either smaller or larger government action on the development of

the automobile sector.

MAIN BODY

1. Description of selected company

General Motors is leading company in the world in production of 20th and early 21st

century automobiles (Canonico and et. al., 2020). It runs both processing and assembly facilities,

with large fulfilment centres throughout the U.S., UK, Canada and in other nations. The

company's main offerings have included a wide variety of cars and industrial parts, equipment

and machinery and are also involved in financial industries. It has its head office in Detroit and

was initiated under William Durant’s leadership in 1908, and originally only operates its

company in the European market. In 1929, this corporation had exceeded one international

company; i.e. Ford Motors Corporation is to become America's largest producer of passenger-

cars. GM also since incorporated its global operations such as UK Vauxhall in 1925, then

German's Adam Opel in 1929, then the Australian Holden in 1931. All these processes made

General Motors the country's greatest motor vehicle Production Company in 1931. By 1941,

GM produced 44% of all U.S. cars and reached the largest business corporations (Delic and

Eyers, 2020). GM Motors presently conducts its operations around 37 countries, including

Chevrolet, Buick, GMC and Cadillac, where the company's core branded vehicles. As well

1

as GM’s vehicle sales has been managed to reach in terms of total revenue to its great

achievement to around millions per year.

According to the community for Motor producers and Traders, in the context of the UK

market, this country generates and over 1.5 million vehicles, commercial trucks which include 3

million motors, which accounts for 9 to 11 per cent of the overall export markets. This industry

also produces over £ 55bn in annual revenue, employing around 700,000 people, which provides

the economic system with nearly £ 12bn of net worth. It has enabled UK a major regional

competitor in the automobile industry worldwide, with a large boost from the firms running their

industries across the economy.

2. Market analysis of General Motors (GM)

General Motors produced a wide variety of cars ranging around US$ 10,000 to US$ 100,000

and also satisfy the demands of various market groups globally, from the medium and premium

class customers. Several of General Motors' top markets are GMC, Pontiac Cadillac, Chevrolet,

Hummer, GM Daewoo and Opel models etc. It was common also at turn of the 21st century that

this industry's ecosystem had to be maintained (Eiza, Cao and Xu, 2020). General Motors starts

production automobiles that are more ecologically responsible and innovative its manufacture by

creating vehicles that is bio-fuels, variant and fuel effective. After its founding, GM has grown to

market of trucks, motorcycles, and other vehicles throughout Europe, Asia-Pacific, Latin

America, the Middle East and more in upwards of 140 nations.

In 2008, this company sold more than 8.35 million cars and grew its share of the market in

industrialized as well as undeveloped countries. However as a growth of multinational

companies have functioned their companies in the automotive industry, such as Volkswagen,

BMW, Ferrari and much more, thereby enforcing General Motors to become more concerned

about innovations and offering targeted audiences strong-featured transport services to maintain

its dominant position (Barbier and et.al., 2019). Concentrating on identifying weaknesses, along

with the industries where its competition have beaten their position, this car manufacturers

concentrate is on the premium market in particular. It relates to a certain area in which

competing German car manufacturers have thrived to strengthen the Cadillac product line as well

as enlarge its business operations, particularly with regard to enhancing its operations and

maintenance market. This growth would include its scheduled establishment on huge rear-wheel

2

achievement to around millions per year.

According to the community for Motor producers and Traders, in the context of the UK

market, this country generates and over 1.5 million vehicles, commercial trucks which include 3

million motors, which accounts for 9 to 11 per cent of the overall export markets. This industry

also produces over £ 55bn in annual revenue, employing around 700,000 people, which provides

the economic system with nearly £ 12bn of net worth. It has enabled UK a major regional

competitor in the automobile industry worldwide, with a large boost from the firms running their

industries across the economy.

2. Market analysis of General Motors (GM)

General Motors produced a wide variety of cars ranging around US$ 10,000 to US$ 100,000

and also satisfy the demands of various market groups globally, from the medium and premium

class customers. Several of General Motors' top markets are GMC, Pontiac Cadillac, Chevrolet,

Hummer, GM Daewoo and Opel models etc. It was common also at turn of the 21st century that

this industry's ecosystem had to be maintained (Eiza, Cao and Xu, 2020). General Motors starts

production automobiles that are more ecologically responsible and innovative its manufacture by

creating vehicles that is bio-fuels, variant and fuel effective. After its founding, GM has grown to

market of trucks, motorcycles, and other vehicles throughout Europe, Asia-Pacific, Latin

America, the Middle East and more in upwards of 140 nations.

In 2008, this company sold more than 8.35 million cars and grew its share of the market in

industrialized as well as undeveloped countries. However as a growth of multinational

companies have functioned their companies in the automotive industry, such as Volkswagen,

BMW, Ferrari and much more, thereby enforcing General Motors to become more concerned

about innovations and offering targeted audiences strong-featured transport services to maintain

its dominant position (Barbier and et.al., 2019). Concentrating on identifying weaknesses, along

with the industries where its competition have beaten their position, this car manufacturers

concentrate is on the premium market in particular. It relates to a certain area in which

competing German car manufacturers have thrived to strengthen the Cadillac product line as well

as enlarge its business operations, particularly with regard to enhancing its operations and

maintenance market. This growth would include its scheduled establishment on huge rear-wheel

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

- drive sedans to introduce or remodel new Cadillac models in 2015 taking into consideration

"The sense of danger appears high."

General Motors are suitable to operate in Oligopoly market because it has several

characteristics which help in performing in this market structure (Frey, 2018). Such as few

sellers are available in this market structure, entered in this market is very difficult due to some

barriers, market is interdependence or also preventing advertising. Because of these features,

organizations is able to perform well or achieve high profitability in the market.

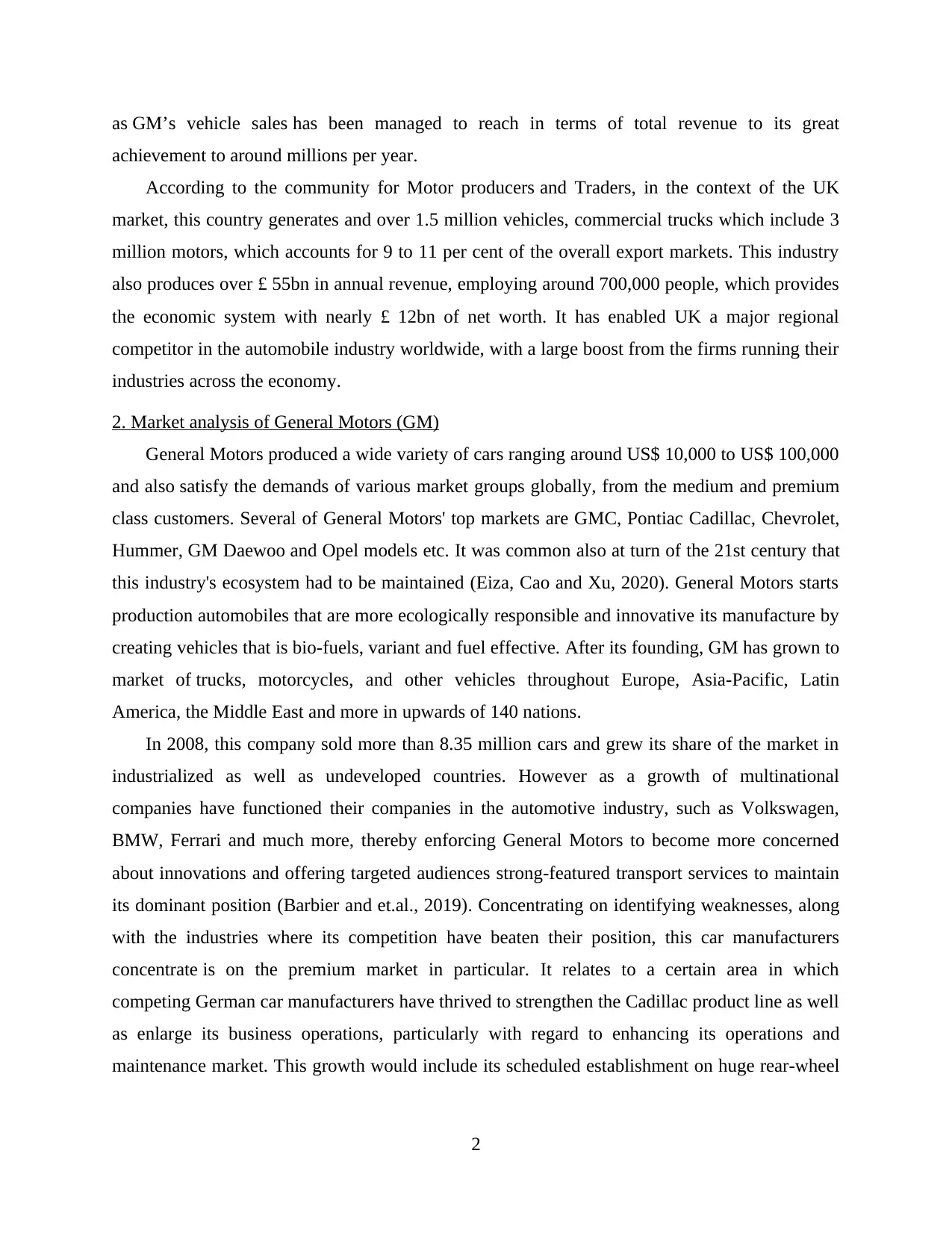

Income statement from the period of 2017 to 2019:

Breakdown 2017 2018 2019 TTM

Total revenue 145588,000 147049,000 137237,000 115786,000

Cost of revenue 125997,000 132954,000 123265,000 107023,000

Gross profit 19591,000 14095,000 13972,000 8763,000

Operating expenses

Selling general and administrative 9575,000 9650,000 8491,000 7570,000

Total operating expenses 9575,000 9650,000 8491,000 7570,000

Operating income or loss 10016,000 4445,000 5481,000 1193,000

Interest expense 575,000 655,000 782,000 902,000

Total other income/expenses net 2132,000 4424,000 2308,000 1703,000

Income before tax 11863,000 8549,000 7436,000 1978,000

Income tax expense 11533,000 474,000 769,000 353,000

Income from continuing operations 330,000 8075,000 6667,000 1625,000

Net income -3864,000 8014,000 6732,000 1693,000

Net income available to common

shareholders -3880,000 7916,000 6581,000 1522,000

Basic EPS -2.65 5.61 4.62 -

Diluted EPS -2.65 5.53 4.57 -

Basic average shares 1465,000 1411,000 1424,000 -

Diluted average shares 1492,000 1431,000 1439,000 -

EBITDA 24699,000 22873,000 22336,000 -

Balance Sheet of General Motors:

3

"The sense of danger appears high."

General Motors are suitable to operate in Oligopoly market because it has several

characteristics which help in performing in this market structure (Frey, 2018). Such as few

sellers are available in this market structure, entered in this market is very difficult due to some

barriers, market is interdependence or also preventing advertising. Because of these features,

organizations is able to perform well or achieve high profitability in the market.

Income statement from the period of 2017 to 2019:

Breakdown 2017 2018 2019 TTM

Total revenue 145588,000 147049,000 137237,000 115786,000

Cost of revenue 125997,000 132954,000 123265,000 107023,000

Gross profit 19591,000 14095,000 13972,000 8763,000

Operating expenses

Selling general and administrative 9575,000 9650,000 8491,000 7570,000

Total operating expenses 9575,000 9650,000 8491,000 7570,000

Operating income or loss 10016,000 4445,000 5481,000 1193,000

Interest expense 575,000 655,000 782,000 902,000

Total other income/expenses net 2132,000 4424,000 2308,000 1703,000

Income before tax 11863,000 8549,000 7436,000 1978,000

Income tax expense 11533,000 474,000 769,000 353,000

Income from continuing operations 330,000 8075,000 6667,000 1625,000

Net income -3864,000 8014,000 6732,000 1693,000

Net income available to common

shareholders -3880,000 7916,000 6581,000 1522,000

Basic EPS -2.65 5.61 4.62 -

Diluted EPS -2.65 5.53 4.57 -

Basic average shares 1465,000 1411,000 1424,000 -

Diluted average shares 1492,000 1431,000 1439,000 -

EBITDA 24699,000 22873,000 22336,000 -

Balance Sheet of General Motors:

3

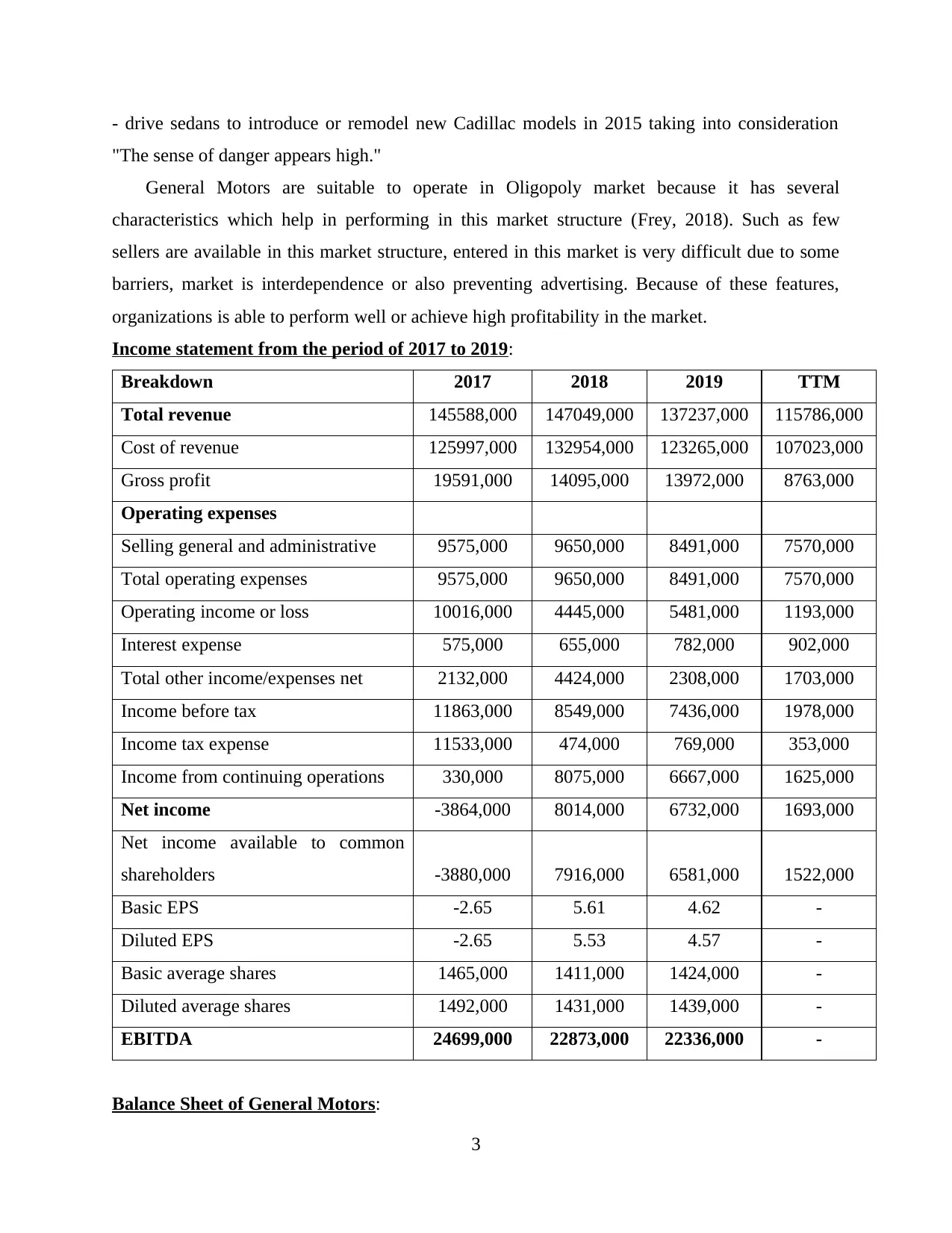

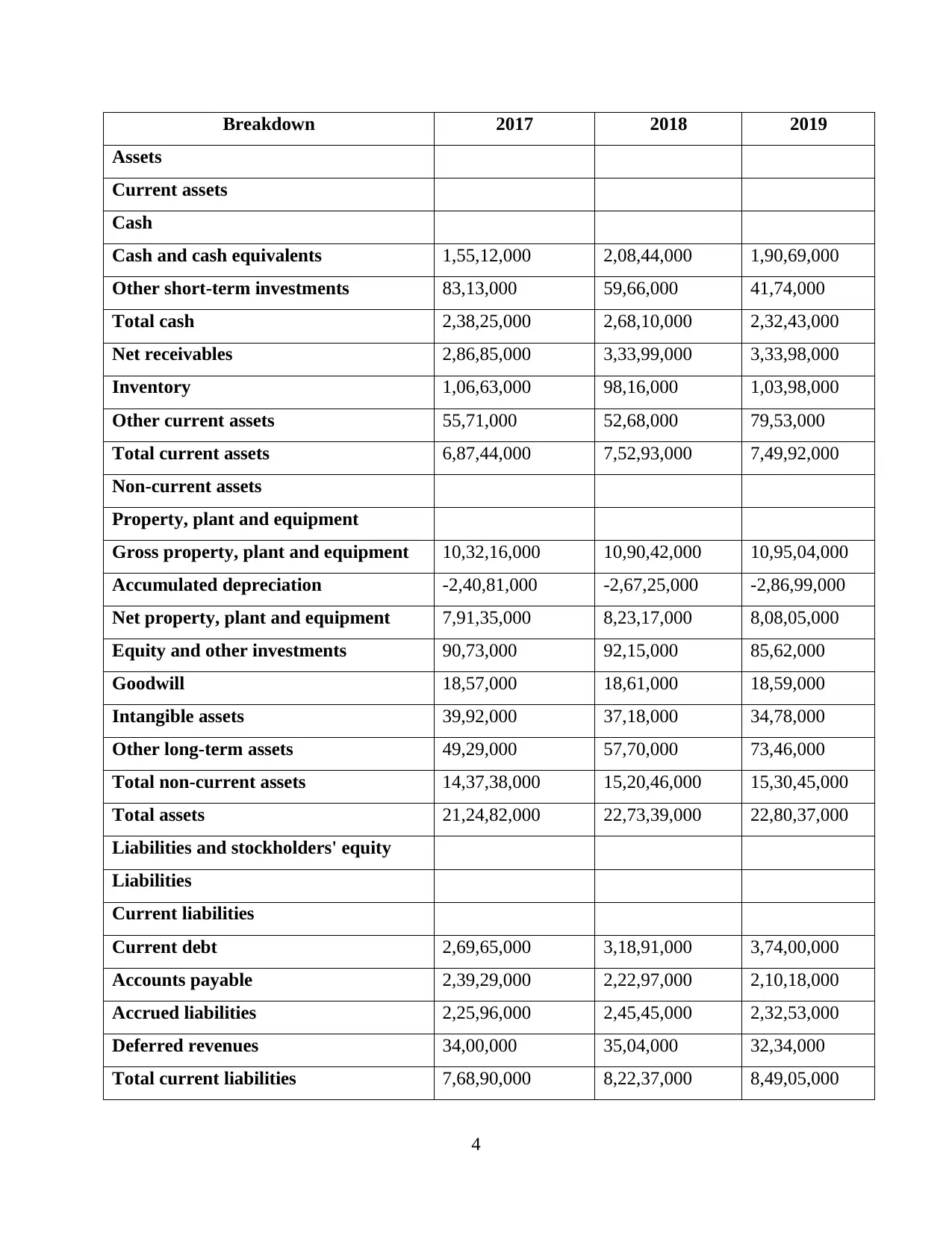

Breakdown 2017 2018 2019

Assets

Current assets

Cash

Cash and cash equivalents 1,55,12,000 2,08,44,000 1,90,69,000

Other short-term investments 83,13,000 59,66,000 41,74,000

Total cash 2,38,25,000 2,68,10,000 2,32,43,000

Net receivables 2,86,85,000 3,33,99,000 3,33,98,000

Inventory 1,06,63,000 98,16,000 1,03,98,000

Other current assets 55,71,000 52,68,000 79,53,000

Total current assets 6,87,44,000 7,52,93,000 7,49,92,000

Non-current assets

Property, plant and equipment

Gross property, plant and equipment 10,32,16,000 10,90,42,000 10,95,04,000

Accumulated depreciation -2,40,81,000 -2,67,25,000 -2,86,99,000

Net property, plant and equipment 7,91,35,000 8,23,17,000 8,08,05,000

Equity and other investments 90,73,000 92,15,000 85,62,000

Goodwill 18,57,000 18,61,000 18,59,000

Intangible assets 39,92,000 37,18,000 34,78,000

Other long-term assets 49,29,000 57,70,000 73,46,000

Total non-current assets 14,37,38,000 15,20,46,000 15,30,45,000

Total assets 21,24,82,000 22,73,39,000 22,80,37,000

Liabilities and stockholders' equity

Liabilities

Current liabilities

Current debt 2,69,65,000 3,18,91,000 3,74,00,000

Accounts payable 2,39,29,000 2,22,97,000 2,10,18,000

Accrued liabilities 2,25,96,000 2,45,45,000 2,32,53,000

Deferred revenues 34,00,000 35,04,000 32,34,000

Total current liabilities 7,68,90,000 8,22,37,000 8,49,05,000

4

Assets

Current assets

Cash

Cash and cash equivalents 1,55,12,000 2,08,44,000 1,90,69,000

Other short-term investments 83,13,000 59,66,000 41,74,000

Total cash 2,38,25,000 2,68,10,000 2,32,43,000

Net receivables 2,86,85,000 3,33,99,000 3,33,98,000

Inventory 1,06,63,000 98,16,000 1,03,98,000

Other current assets 55,71,000 52,68,000 79,53,000

Total current assets 6,87,44,000 7,52,93,000 7,49,92,000

Non-current assets

Property, plant and equipment

Gross property, plant and equipment 10,32,16,000 10,90,42,000 10,95,04,000

Accumulated depreciation -2,40,81,000 -2,67,25,000 -2,86,99,000

Net property, plant and equipment 7,91,35,000 8,23,17,000 8,08,05,000

Equity and other investments 90,73,000 92,15,000 85,62,000

Goodwill 18,57,000 18,61,000 18,59,000

Intangible assets 39,92,000 37,18,000 34,78,000

Other long-term assets 49,29,000 57,70,000 73,46,000

Total non-current assets 14,37,38,000 15,20,46,000 15,30,45,000

Total assets 21,24,82,000 22,73,39,000 22,80,37,000

Liabilities and stockholders' equity

Liabilities

Current liabilities

Current debt 2,69,65,000 3,18,91,000 3,74,00,000

Accounts payable 2,39,29,000 2,22,97,000 2,10,18,000

Accrued liabilities 2,25,96,000 2,45,45,000 2,32,53,000

Deferred revenues 34,00,000 35,04,000 32,34,000

Total current liabilities 7,68,90,000 8,22,37,000 8,49,05,000

4

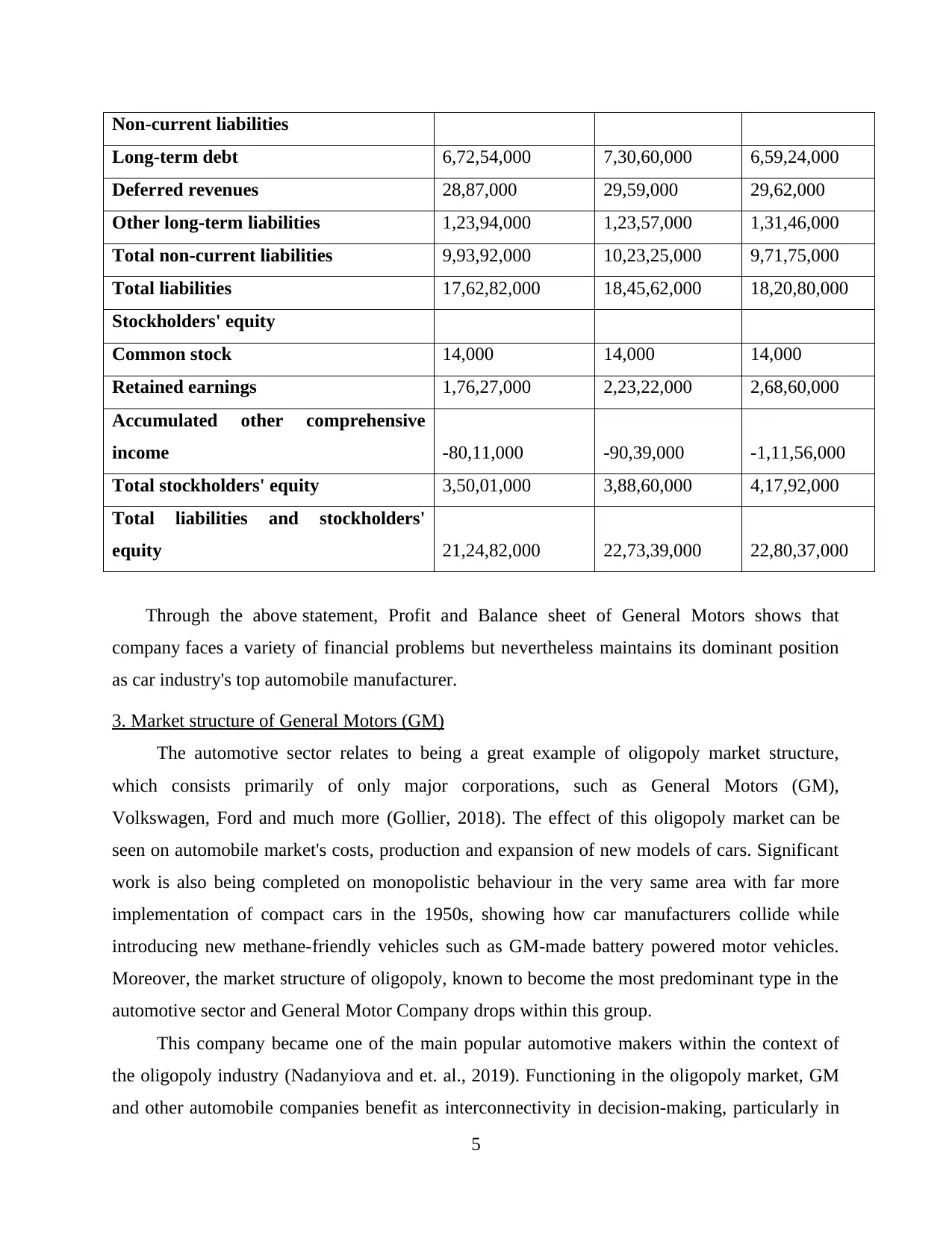

Non-current liabilities

Long-term debt 6,72,54,000 7,30,60,000 6,59,24,000

Deferred revenues 28,87,000 29,59,000 29,62,000

Other long-term liabilities 1,23,94,000 1,23,57,000 1,31,46,000

Total non-current liabilities 9,93,92,000 10,23,25,000 9,71,75,000

Total liabilities 17,62,82,000 18,45,62,000 18,20,80,000

Stockholders' equity

Common stock 14,000 14,000 14,000

Retained earnings 1,76,27,000 2,23,22,000 2,68,60,000

Accumulated other comprehensive

income -80,11,000 -90,39,000 -1,11,56,000

Total stockholders' equity 3,50,01,000 3,88,60,000 4,17,92,000

Total liabilities and stockholders'

equity 21,24,82,000 22,73,39,000 22,80,37,000

Through the above statement, Profit and Balance sheet of General Motors shows that

company faces a variety of financial problems but nevertheless maintains its dominant position

as car industry's top automobile manufacturer.

3. Market structure of General Motors (GM)

The automotive sector relates to being a great example of oligopoly market structure,

which consists primarily of only major corporations, such as General Motors (GM),

Volkswagen, Ford and much more (Gollier, 2018). The effect of this oligopoly market can be

seen on automobile market's costs, production and expansion of new models of cars. Significant

work is also being completed on monopolistic behaviour in the very same area with far more

implementation of compact cars in the 1950s, showing how car manufacturers collide while

introducing new methane-friendly vehicles such as GM-made battery powered motor vehicles.

Moreover, the market structure of oligopoly, known to become the most predominant type in the

automotive sector and General Motor Company drops within this group.

This company became one of the main popular automotive makers within the context of

the oligopoly industry (Nadanyiova and et. al., 2019). Functioning in the oligopoly market, GM

and other automobile companies benefit as interconnectivity in decision-making, particularly in

5

Long-term debt 6,72,54,000 7,30,60,000 6,59,24,000

Deferred revenues 28,87,000 29,59,000 29,62,000

Other long-term liabilities 1,23,94,000 1,23,57,000 1,31,46,000

Total non-current liabilities 9,93,92,000 10,23,25,000 9,71,75,000

Total liabilities 17,62,82,000 18,45,62,000 18,20,80,000

Stockholders' equity

Common stock 14,000 14,000 14,000

Retained earnings 1,76,27,000 2,23,22,000 2,68,60,000

Accumulated other comprehensive

income -80,11,000 -90,39,000 -1,11,56,000

Total stockholders' equity 3,50,01,000 3,88,60,000 4,17,92,000

Total liabilities and stockholders'

equity 21,24,82,000 22,73,39,000 22,80,37,000

Through the above statement, Profit and Balance sheet of General Motors shows that

company faces a variety of financial problems but nevertheless maintains its dominant position

as car industry's top automobile manufacturer.

3. Market structure of General Motors (GM)

The automotive sector relates to being a great example of oligopoly market structure,

which consists primarily of only major corporations, such as General Motors (GM),

Volkswagen, Ford and much more (Gollier, 2018). The effect of this oligopoly market can be

seen on automobile market's costs, production and expansion of new models of cars. Significant

work is also being completed on monopolistic behaviour in the very same area with far more

implementation of compact cars in the 1950s, showing how car manufacturers collide while

introducing new methane-friendly vehicles such as GM-made battery powered motor vehicles.

Moreover, the market structure of oligopoly, known to become the most predominant type in the

automotive sector and General Motor Company drops within this group.

This company became one of the main popular automotive makers within the context of

the oligopoly industry (Nadanyiova and et. al., 2019). Functioning in the oligopoly market, GM

and other automobile companies benefit as interconnectivity in decision-making, particularly in

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

price making strategies, since every small influence on the price of one company's vehicles also

have a significant effect on competitors. Consequently GM adaptive contrast as well as

standardized marketing method to improve significant market share. In addition to this, since

there are few rivals involved in oligopoly market structure of business environment, it also

strengths to GM in maintaining its existing buyers by adding more new technological

technologies of its luxury offerings or new vehicle designs on global market. This has been

discussed at the General Motors because it is serious about manufacturing, designing and

marketing the most advanced and fuel-efficient cars on the planet. This declaration of mission

unites the corresponding company as a collective with a cornerstone of its customer-driven

community every day.

4. Considering the nature of the industry in which the firm operates

(A). Did the organization operates in different market structure:

The structure of the marketplace can be characterized as features of the competitive

climate during which a firm operates its business activities. This distinguishes a company in

terms of market participation, business decision-making interconnectedness, elasticity or

inelasticity of the goods, commodity differentiability etc. Generally, the market structure of the

company can generally be divided into 4 major categories such as oligopoly, monopoly,

monopolistic competition and perfect market structure. Within the monopoly market, a single

company gains overall effect on the price of products or services, thus creating high obstacles to

the entry and exit points of new entries.

Oligopoly, on the other hand, is entirely distinct of the monopoly firm, as an area

dominated by very few but big firms, such as limited competition with distinguishable or

homogenous goods (Pavlínek, 2020) Consequently, huge funding needed to invest in new

companies for entry into this market that also constrains the opportunities for small firms. While

great markets show the existence of multiple companies running small to medium-sized

enterprises, no single company can henceforth achieve advantages when it comes to market

control. Industries have the leverage to achieve high sales in the form of monopolistic markets by

fixing prices for their goods under their own. Yet, owing to the low barrier to entry that enables

emerging entrants to catch the imagination of customers, it cannot work on a long-term strategy.

As General Motors operates in the oligopoly market, this brings benefits of fewer

rivals with large barriers to new entries. Although with changes happening in the GDP rate that

6

have a significant effect on competitors. Consequently GM adaptive contrast as well as

standardized marketing method to improve significant market share. In addition to this, since

there are few rivals involved in oligopoly market structure of business environment, it also

strengths to GM in maintaining its existing buyers by adding more new technological

technologies of its luxury offerings or new vehicle designs on global market. This has been

discussed at the General Motors because it is serious about manufacturing, designing and

marketing the most advanced and fuel-efficient cars on the planet. This declaration of mission

unites the corresponding company as a collective with a cornerstone of its customer-driven

community every day.

4. Considering the nature of the industry in which the firm operates

(A). Did the organization operates in different market structure:

The structure of the marketplace can be characterized as features of the competitive

climate during which a firm operates its business activities. This distinguishes a company in

terms of market participation, business decision-making interconnectedness, elasticity or

inelasticity of the goods, commodity differentiability etc. Generally, the market structure of the

company can generally be divided into 4 major categories such as oligopoly, monopoly,

monopolistic competition and perfect market structure. Within the monopoly market, a single

company gains overall effect on the price of products or services, thus creating high obstacles to

the entry and exit points of new entries.

Oligopoly, on the other hand, is entirely distinct of the monopoly firm, as an area

dominated by very few but big firms, such as limited competition with distinguishable or

homogenous goods (Pavlínek, 2020) Consequently, huge funding needed to invest in new

companies for entry into this market that also constrains the opportunities for small firms. While

great markets show the existence of multiple companies running small to medium-sized

enterprises, no single company can henceforth achieve advantages when it comes to market

control. Industries have the leverage to achieve high sales in the form of monopolistic markets by

fixing prices for their goods under their own. Yet, owing to the low barrier to entry that enables

emerging entrants to catch the imagination of customers, it cannot work on a long-term strategy.

As General Motors operates in the oligopoly market, this brings benefits of fewer

rivals with large barriers to new entries. Although with changes happening in the GDP rate that

6

sometimes lead to problems facing General Motors and other vehicle manufacturers in aspects of

profitability and profits retention. With regard to ideal competitiveness, shifting company in this

marketplace will allow GM the ability to increase its income by selling more volume, so the total

cost of making a product will be equal to the retail price relative to the actual sales itself. It

is fact that, perfect market's efficiency and high competitive factor, because firms are given the

opportunity to charge their product’s price with zero financial profit.

(B). Suggest that greater or lesser government intervention is beneficial for society or not:

As this has been assessed that the automobile industry is among the fastest growing sectors

by development in other countries, through where all the major corporations have set the

progress at international basis (Sears and Lawell, 2019). Therefore, given this sector’s significant

capital to sustainable development, such as the role of providing jobs in the process to both

extremely medium - skilled citizens, state is expected to bring in more interventions. This

involves providing assistance to companies working in this sector for further market growth.

Throughout the background of General Motors, one of the biggest factors to its longevity

though is the-present anxiety for the future of the car market, in which it has long been

understood to reel the selling dominance in a plurality of the sports cars and full size

commercial trucks segment. Despite rising fluctuations in oil markets, along with minor

development and fuel-efficient vehicles, GM has implemented male creativity for renewable

energy launch. In 2017, GM has expected to bring in more than 500,000 cars with

groundbreaking transport infrastructure.

In fact, General Motors is now renovating about 70 percent of the logo to make absolutely

sure it looks more attractive to its customers over its cars, who are also worried with greater

energy costs and environmental concerns (Thampapillai and Ruth, 2019). Therefore, given its

economic commitment to the effect of diesel vehicles on the atmosphere and position of electric

vehicle engineering, it has determined that it would benefit further by receiving more funding

from the UK Government. Additionally, government measures for fuel conservation and

elimination of coal-consuming cars that emit heavy toxic smoke and stop polluting entire

habitats.

This also aims to push GM and its competitors to place greater emphasis on hybrid and fuel-

efficient car production. It will aim to minimize automotive carbon emissions, which would have

been helpful to both economic and social growth. Yet further policy restrictions on operating and

7

profitability and profits retention. With regard to ideal competitiveness, shifting company in this

marketplace will allow GM the ability to increase its income by selling more volume, so the total

cost of making a product will be equal to the retail price relative to the actual sales itself. It

is fact that, perfect market's efficiency and high competitive factor, because firms are given the

opportunity to charge their product’s price with zero financial profit.

(B). Suggest that greater or lesser government intervention is beneficial for society or not:

As this has been assessed that the automobile industry is among the fastest growing sectors

by development in other countries, through where all the major corporations have set the

progress at international basis (Sears and Lawell, 2019). Therefore, given this sector’s significant

capital to sustainable development, such as the role of providing jobs in the process to both

extremely medium - skilled citizens, state is expected to bring in more interventions. This

involves providing assistance to companies working in this sector for further market growth.

Throughout the background of General Motors, one of the biggest factors to its longevity

though is the-present anxiety for the future of the car market, in which it has long been

understood to reel the selling dominance in a plurality of the sports cars and full size

commercial trucks segment. Despite rising fluctuations in oil markets, along with minor

development and fuel-efficient vehicles, GM has implemented male creativity for renewable

energy launch. In 2017, GM has expected to bring in more than 500,000 cars with

groundbreaking transport infrastructure.

In fact, General Motors is now renovating about 70 percent of the logo to make absolutely

sure it looks more attractive to its customers over its cars, who are also worried with greater

energy costs and environmental concerns (Thampapillai and Ruth, 2019). Therefore, given its

economic commitment to the effect of diesel vehicles on the atmosphere and position of electric

vehicle engineering, it has determined that it would benefit further by receiving more funding

from the UK Government. Additionally, government measures for fuel conservation and

elimination of coal-consuming cars that emit heavy toxic smoke and stop polluting entire

habitats.

This also aims to push GM and its competitors to place greater emphasis on hybrid and fuel-

efficient car production. It will aim to minimize automotive carbon emissions, which would have

been helpful to both economic and social growth. Yet further policy restrictions on operating and

7

industrial operations, such as high tariffs on vehicle exports and imports, could limit productivity

and other transportation revenues. Therefore, to resolve a very danger, it is crucial that General

Motors and its rivalries put more worries with appropriate pricing strategies on the growth of

fuel efficient vehicles for customers.

CONCLUSION

On the basis of above discussion it has been concluded that, company lacks its productive

capacity such as ways of improving same could be assessed. In addition to this, awareness and

value of different market structures often allow businesses to push business competitively in

evaluating the field with main strategies. Throughout this study, it's also been outlined that if

they work in oligopoly market, it will make it easier for companies operating with the

automobile sector to gain and maintain longer longevity in company. This also gives them the

advantages of being industry leader by launching more vehicle versions with different

technology.

8

and other transportation revenues. Therefore, to resolve a very danger, it is crucial that General

Motors and its rivalries put more worries with appropriate pricing strategies on the growth of

fuel efficient vehicles for customers.

CONCLUSION

On the basis of above discussion it has been concluded that, company lacks its productive

capacity such as ways of improving same could be assessed. In addition to this, awareness and

value of different market structures often allow businesses to push business competitively in

evaluating the field with main strategies. Throughout this study, it's also been outlined that if

they work in oligopoly market, it will make it easier for companies operating with the

automobile sector to gain and maintain longer longevity in company. This also gives them the

advantages of being industry leader by launching more vehicle versions with different

technology.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books & Journals

An, Y., Zhang, L. and Adom, P. K., 2019. Economics of wastewater management in China's

industry. Environment and Development Economics, 24(5), pp.457-478.

Barbier, E. B. and et.al., 2019. The economics of the tropical timber trade. Routledge

Canonico, P. and et. al., 2020. Knowledge creation in the automotive industry: Analysing obeya-

oriented practices using the SECI model. Journal of Business Research. 112. pp.450-457.

Delic, M. and Eyers, D. R., 2020. The effect of additive manufacturing adoption on supply chain

flexibility and performance: An empirical analysis from the automotive

industry. International Journal of Production Economics. 228. p.107689.

Eiza, M. H., Cao, Y. and Xu, L. eds., 2020. Toward Sustainable and Economic Smart Mobility:

Shaping the Future of Smart Cities. World Scientific.

Frey, B. S., 2018. Happiness and management. In Economics of Happiness (pp. 55-58). Springer,

Cham.

Gollier, C., 2018. The economics of risk and uncertainty. Edward Elgar Publishing Limited.

Nadanyiova, M. and et. al., 2019. The Brand Value and its Impact on Sales in Automotive

Industry. LOGI–Scientific Journal on Transport and Logistics. 10(1). pp.41-49.

Pavlínek, P., 2020. Restructuring and internationalization of the European automotive

industry. Journal of Economic Geography. 20(2). pp.509-541.

Sears, L. and Lawell, C. Y. L., 2019. Water management and economics. The Routledge

Handbook of Agricultural Economics, pp.269-284.

Thampapillai, D. J. and Ruth, M., 2019. Environmental economics: Concepts, methods and

policies. Routledge.

9

Books & Journals

An, Y., Zhang, L. and Adom, P. K., 2019. Economics of wastewater management in China's

industry. Environment and Development Economics, 24(5), pp.457-478.

Barbier, E. B. and et.al., 2019. The economics of the tropical timber trade. Routledge

Canonico, P. and et. al., 2020. Knowledge creation in the automotive industry: Analysing obeya-

oriented practices using the SECI model. Journal of Business Research. 112. pp.450-457.

Delic, M. and Eyers, D. R., 2020. The effect of additive manufacturing adoption on supply chain

flexibility and performance: An empirical analysis from the automotive

industry. International Journal of Production Economics. 228. p.107689.

Eiza, M. H., Cao, Y. and Xu, L. eds., 2020. Toward Sustainable and Economic Smart Mobility:

Shaping the Future of Smart Cities. World Scientific.

Frey, B. S., 2018. Happiness and management. In Economics of Happiness (pp. 55-58). Springer,

Cham.

Gollier, C., 2018. The economics of risk and uncertainty. Edward Elgar Publishing Limited.

Nadanyiova, M. and et. al., 2019. The Brand Value and its Impact on Sales in Automotive

Industry. LOGI–Scientific Journal on Transport and Logistics. 10(1). pp.41-49.

Pavlínek, P., 2020. Restructuring and internationalization of the European automotive

industry. Journal of Economic Geography. 20(2). pp.509-541.

Sears, L. and Lawell, C. Y. L., 2019. Water management and economics. The Routledge

Handbook of Agricultural Economics, pp.269-284.

Thampapillai, D. J. and Ruth, M., 2019. Environmental economics: Concepts, methods and

policies. Routledge.

9

1 out of 11

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)