Examining the Effects of Oil Exploration on Saudi Arabia's Economy

VerifiedAdded on 2023/06/11

|20

|2246

|431

Report

AI Summary

This report investigates the impact of oil exploration on key macroeconomic factors in Saudi Arabia, utilizing secondary data and statistical tests such as Granger causality, unit-root tests, co-integration tests, VECM, and VAR models. The analysis covers the period between 2008 and 2019, examining the relationship between oil exports, GDP, unemployment, inflation, and the stock market. Key hypotheses explore the effects of oil exploration on unemployment rates, GDP growth, stock market performance, oil prices, and inflation. The study assumes that oil exports are a major foreign exchange earner and directly influence macroeconomic factors. Distribution statistics for unemployment rate, GDP growth, oil export volume, and average oil prices are presented. The report also includes statistical tests like Vector Auto Regression and Vector Error Correction models to analyze the relationships between variables such as exports, oil industry prices, unemployment, and oil exports. The findings suggest a strong correlation between oil revenues and economic development in Saudi Arabia.

Methodology

In order to answer our statistical questions, we collected a number of data-sets from

secondary sources. We will therefore be able to test our statistical hypothesis

following our data analysis.

For each of the five factors of interest, we will conduct:

i. Causality tests (Granger causality test)

To determine whether oil exploration causes other macroeconomic factors and vice

verse.

During the season, the average annual output of oil is almost 80 million barrels, which

is 18% in the first phase and during the third period, the volume is about 20%

compared to the second phase. However, during the fourth phase it is reduced by 27%

compared to the third period. The slump is due to the fact that economy has been

shown to reduce the imbalance in the economy, which has had a great effect on gross

domestic product, which has focused almost 14 percent in the fourth quarter.

Although gross domestic product has grown from $ 32.94 billion. The average dollar

for almost $ 40.77 billion. The US dollar in most of the three quarters was almost

25% more than the first time.

ii. Stationarity tests (Unit-root tests)

To test the nature of the macroeconomic factors

iii. Co-integration tests

To test for a long-run equilibrium relation between Oil exploration and other

macroeconomic variables such as economy growth, I.e. does Oil mining and export

affect the GDP in the long run, say 20 years?

In order to answer our statistical questions, we collected a number of data-sets from

secondary sources. We will therefore be able to test our statistical hypothesis

following our data analysis.

For each of the five factors of interest, we will conduct:

i. Causality tests (Granger causality test)

To determine whether oil exploration causes other macroeconomic factors and vice

verse.

During the season, the average annual output of oil is almost 80 million barrels, which

is 18% in the first phase and during the third period, the volume is about 20%

compared to the second phase. However, during the fourth phase it is reduced by 27%

compared to the third period. The slump is due to the fact that economy has been

shown to reduce the imbalance in the economy, which has had a great effect on gross

domestic product, which has focused almost 14 percent in the fourth quarter.

Although gross domestic product has grown from $ 32.94 billion. The average dollar

for almost $ 40.77 billion. The US dollar in most of the three quarters was almost

25% more than the first time.

ii. Stationarity tests (Unit-root tests)

To test the nature of the macroeconomic factors

iii. Co-integration tests

To test for a long-run equilibrium relation between Oil exploration and other

macroeconomic variables such as economy growth, I.e. does Oil mining and export

affect the GDP in the long run, say 20 years?

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

iv. Vector Error Correction Model (VECM)

To determine the relationship between Oil exploration and other macroeconomic

variables

v. VAR Model

For macroeconomic data description and performing of causal inference between oil

exploration and other macroeconomic factors.

We will then analyze the test statistics and draw conclusions that will be used to test

our hypotheses.

Data

Based on the above fact, an indication of an oil-dependent economy, said that the

characteristics of choosing a GDP per capita and government revenues would cost the

total value of exports and imports closely linked to changes in oil and oil prices.

Between 2008 and 2019, the average of the relationship between the benchmark

development index of oil prices and economic development outlook was 0.8

Our data includes: Unemployment data from Saudi Arabia, Yearly Oil volume

exports, Saudi Arabian GDP score and growth, internal and external oil price

Economic development depends heavily on the final export value. The cost of

creating the index has identified the relationship between changes in the value of oil

exports on the one hand, and changes in the value of gross domestic product, which is

gross domestic product by government revenues and exports, have reached a gain of

about 0.9,

To determine the relationship between Oil exploration and other macroeconomic

variables

v. VAR Model

For macroeconomic data description and performing of causal inference between oil

exploration and other macroeconomic factors.

We will then analyze the test statistics and draw conclusions that will be used to test

our hypotheses.

Data

Based on the above fact, an indication of an oil-dependent economy, said that the

characteristics of choosing a GDP per capita and government revenues would cost the

total value of exports and imports closely linked to changes in oil and oil prices.

Between 2008 and 2019, the average of the relationship between the benchmark

development index of oil prices and economic development outlook was 0.8

Our data includes: Unemployment data from Saudi Arabia, Yearly Oil volume

exports, Saudi Arabian GDP score and growth, internal and external oil price

Economic development depends heavily on the final export value. The cost of

creating the index has identified the relationship between changes in the value of oil

exports on the one hand, and changes in the value of gross domestic product, which is

gross domestic product by government revenues and exports, have reached a gain of

about 0.9,

Hypotheses:

Unemployment rate against Oil exploration

H0: Oil exploration has no effect on unemployment rates in Saudi Arabia

H1: Oil exploration has a significant effect on unemployment rates in Saudi Arabia

H1 There is an important link between oil exports and economic growth in the

economy.

H2: The economy is heavily dependent on oil exports for most of its revenue. H3:

Any increase in oil prices has always led to a positive growth in the economy.

H4: Global crude oil prices have a direct impact on GDP. H5: Oil investment is

promised in terms of oil revenues.

H6: Oil and gas trade is affected by oil revenues.

H7: Increasing oil exports will lead to increased government budgets. This will lead to

increased spending and spending in many sectors such as the social economy

GDP and Oil exploration

H0: Oil exploration has led to growth of the Saudi Arabian GDP

H1: The Saudi Arabian GDP growth has not been affected by the oil exploration in the

country

Effect of Oil exploration on the Stock Market

H0: Oil exportation from Saudi Arabia has significant effect on the stock market

H1: Oil exportation has no significant effect on the stock market

Oil prices in Saudi Arabia and the Oil production in Saudi Arabia

Unemployment rate against Oil exploration

H0: Oil exploration has no effect on unemployment rates in Saudi Arabia

H1: Oil exploration has a significant effect on unemployment rates in Saudi Arabia

H1 There is an important link between oil exports and economic growth in the

economy.

H2: The economy is heavily dependent on oil exports for most of its revenue. H3:

Any increase in oil prices has always led to a positive growth in the economy.

H4: Global crude oil prices have a direct impact on GDP. H5: Oil investment is

promised in terms of oil revenues.

H6: Oil and gas trade is affected by oil revenues.

H7: Increasing oil exports will lead to increased government budgets. This will lead to

increased spending and spending in many sectors such as the social economy

GDP and Oil exploration

H0: Oil exploration has led to growth of the Saudi Arabian GDP

H1: The Saudi Arabian GDP growth has not been affected by the oil exploration in the

country

Effect of Oil exploration on the Stock Market

H0: Oil exportation from Saudi Arabia has significant effect on the stock market

H1: Oil exportation has no significant effect on the stock market

Oil prices in Saudi Arabia and the Oil production in Saudi Arabia

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

H0: The oil Industry prices have considerable influence on the Saudi Arabian oil

mining and exportation

H1: The oil Industry prices do not have influence over oil exploration and exportation

activities in Saudi Arabia

Oil exploration and Inflation

H0: Oil production and exportation in Saudi Arabia has significant influence on

inflation

H1: Oil production and exportation in Saudi Arabia has no significant effect on

inflation rates in Saudi Arabia

Additionally, we will explore the distribution of the five macroeconomic factors from

the previous years to 2017. Therefore, apart from the aforementioned statistical tests,

we will explore the distribution statistics of the macroeconomic factors in the Saudi

Arabian economy.

Assumptions

During our data analysis, we make several assumptions. Which include:

i. Oil exports from Saudi Arabia are the major foreign exchange earner for the

country

ii. Oil exploration has a direct effect ona number of macro-economic factors such as

employment rate, inflation rates, and the GDP growth of Saudi Arabia.

Additionally we assume that Oil exploration is affected by macro-economic

factors such as the price of Oil in the Oil mining industry

iii. The sample size period is representative of the whole population

mining and exportation

H1: The oil Industry prices do not have influence over oil exploration and exportation

activities in Saudi Arabia

Oil exploration and Inflation

H0: Oil production and exportation in Saudi Arabia has significant influence on

inflation

H1: Oil production and exportation in Saudi Arabia has no significant effect on

inflation rates in Saudi Arabia

Additionally, we will explore the distribution of the five macroeconomic factors from

the previous years to 2017. Therefore, apart from the aforementioned statistical tests,

we will explore the distribution statistics of the macroeconomic factors in the Saudi

Arabian economy.

Assumptions

During our data analysis, we make several assumptions. Which include:

i. Oil exports from Saudi Arabia are the major foreign exchange earner for the

country

ii. Oil exploration has a direct effect ona number of macro-economic factors such as

employment rate, inflation rates, and the GDP growth of Saudi Arabia.

Additionally we assume that Oil exploration is affected by macro-economic

factors such as the price of Oil in the Oil mining industry

iii. The sample size period is representative of the whole population

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

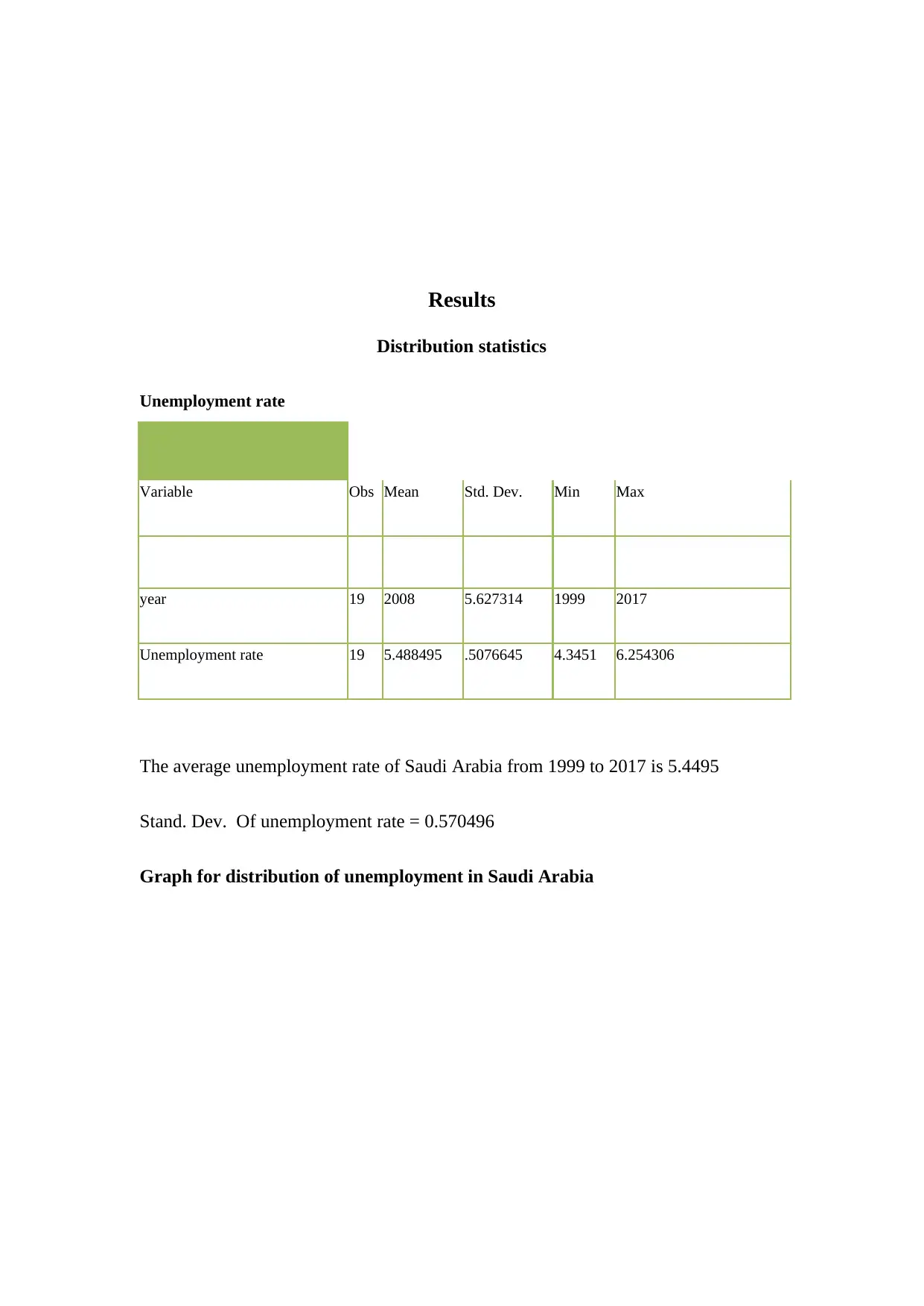

Results

Distribution statistics

Unemployment rate

Variable Obs Mean Std. Dev. Min Max

year 19 2008 5.627314 1999 2017

Unemployment rate 19 5.488495 .5076645 4.3451 6.254306

The average unemployment rate of Saudi Arabia from 1999 to 2017 is 5.4495

Stand. Dev. Of unemployment rate = 0.570496

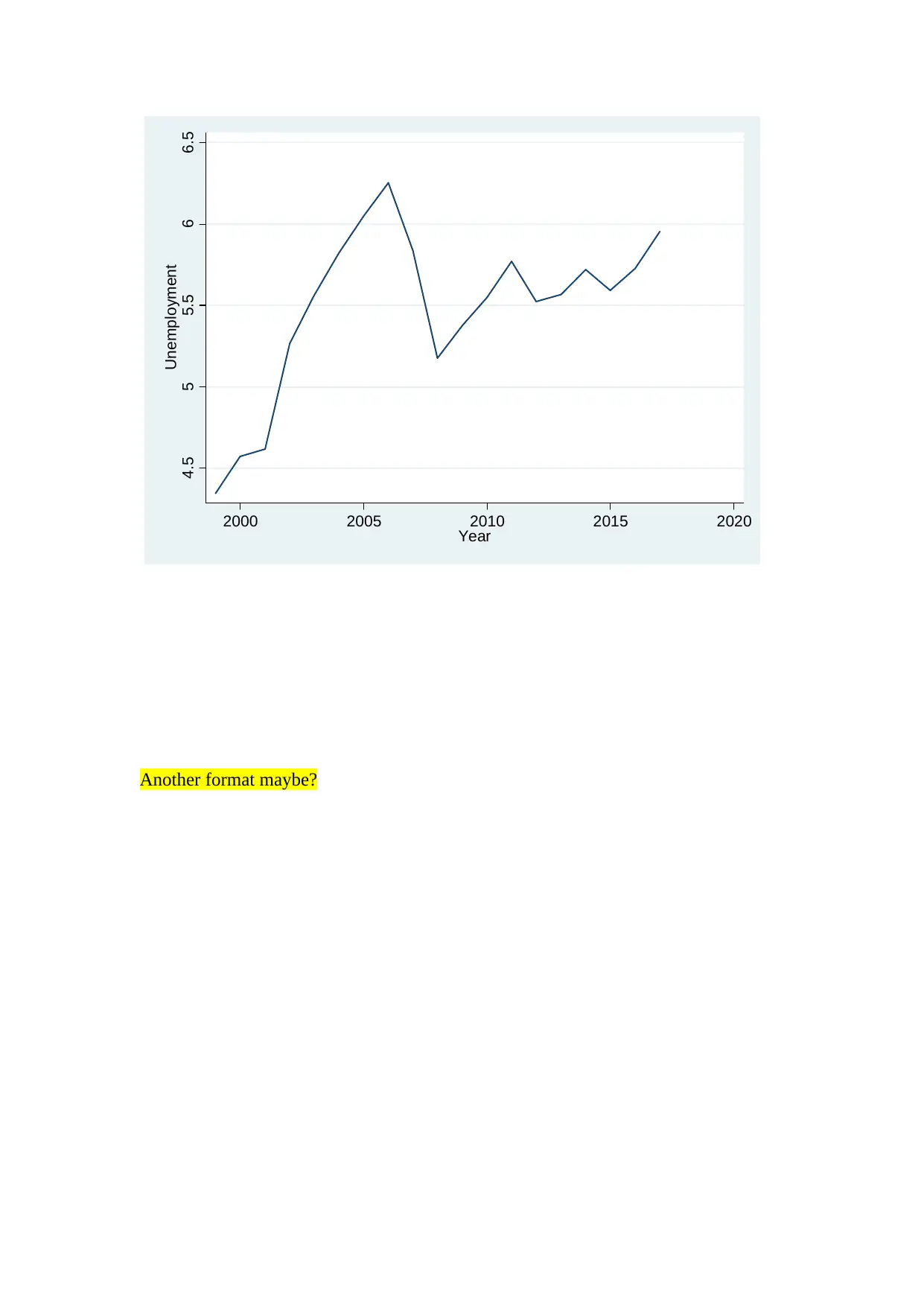

Graph for distribution of unemployment in Saudi Arabia

Distribution statistics

Unemployment rate

Variable Obs Mean Std. Dev. Min Max

year 19 2008 5.627314 1999 2017

Unemployment rate 19 5.488495 .5076645 4.3451 6.254306

The average unemployment rate of Saudi Arabia from 1999 to 2017 is 5.4495

Stand. Dev. Of unemployment rate = 0.570496

Graph for distribution of unemployment in Saudi Arabia

4.5 5 5.5 6 6.5

Unemployment

2000 2005 2010 2015 2020

Year

Another format maybe?

Unemployment

2000 2005 2010 2015 2020

Year

Another format maybe?

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

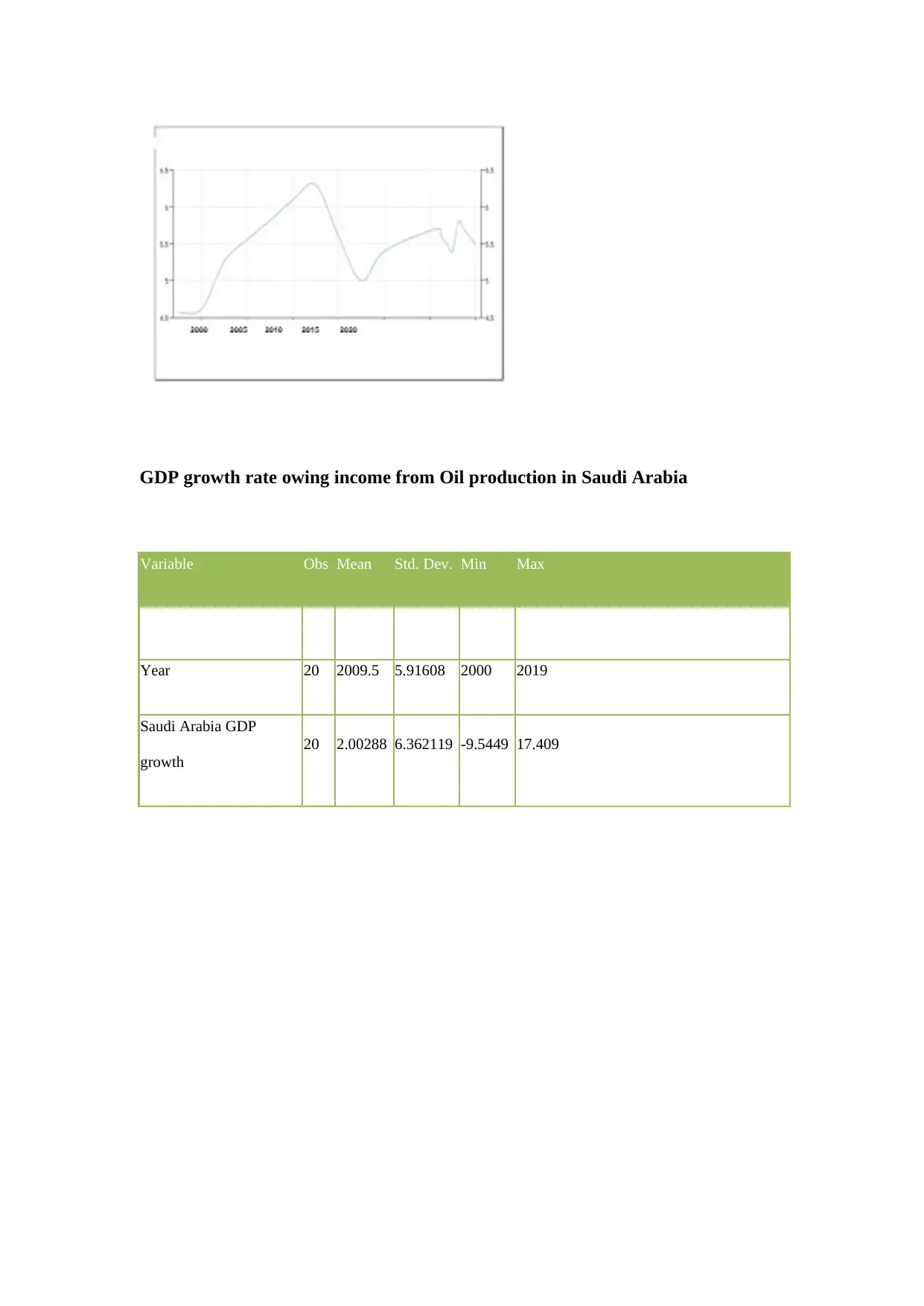

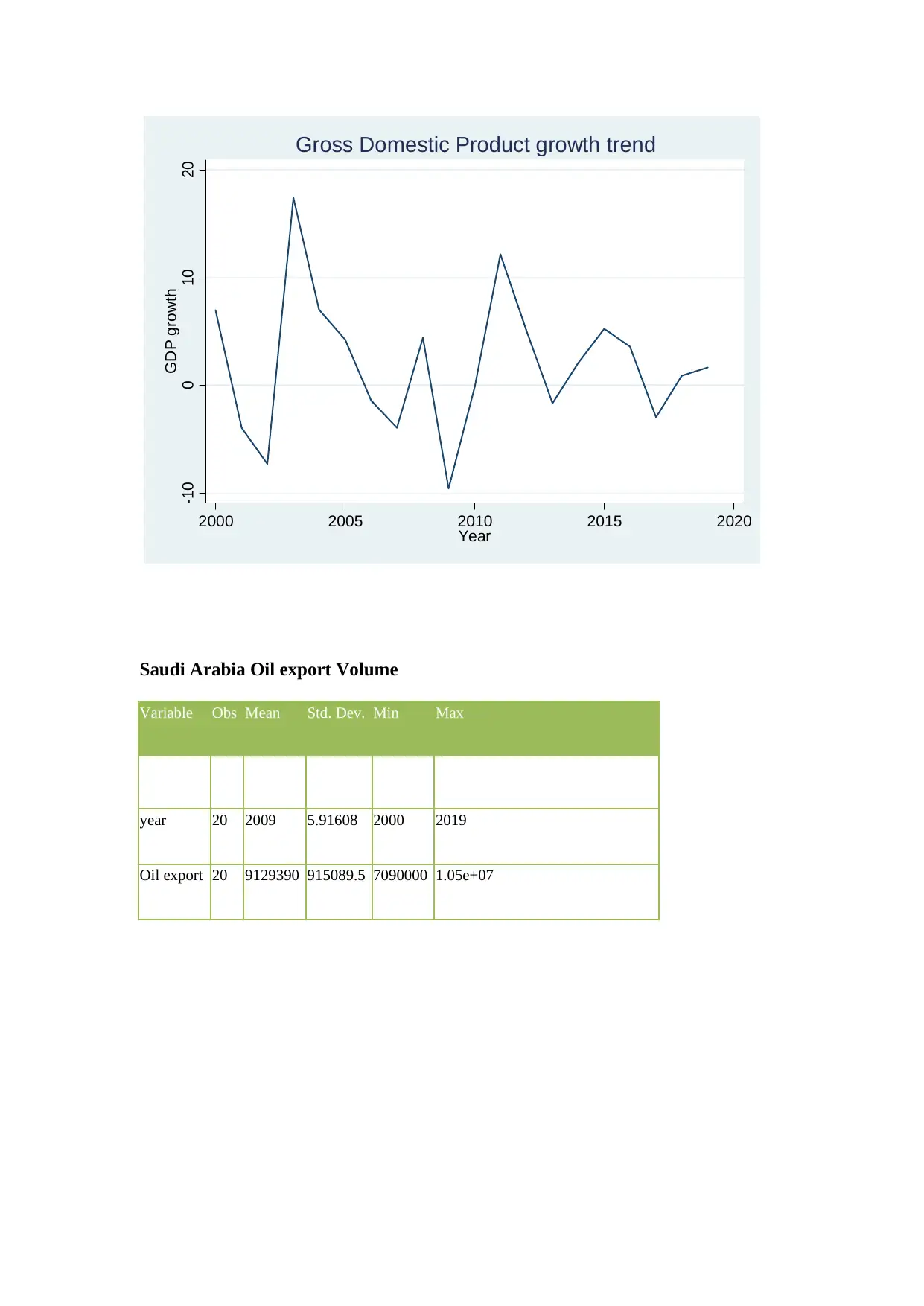

GDP growth rate owing income from Oil production in Saudi Arabia

Variable Obs Mean Std. Dev. Min Max

Year 20 2009.5 5.91608 2000 2019

Saudi Arabia GDP

growth

20 2.00288 6.362119 -9.5449 17.409

Variable Obs Mean Std. Dev. Min Max

Year 20 2009.5 5.91608 2000 2019

Saudi Arabia GDP

growth

20 2.00288 6.362119 -9.5449 17.409

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

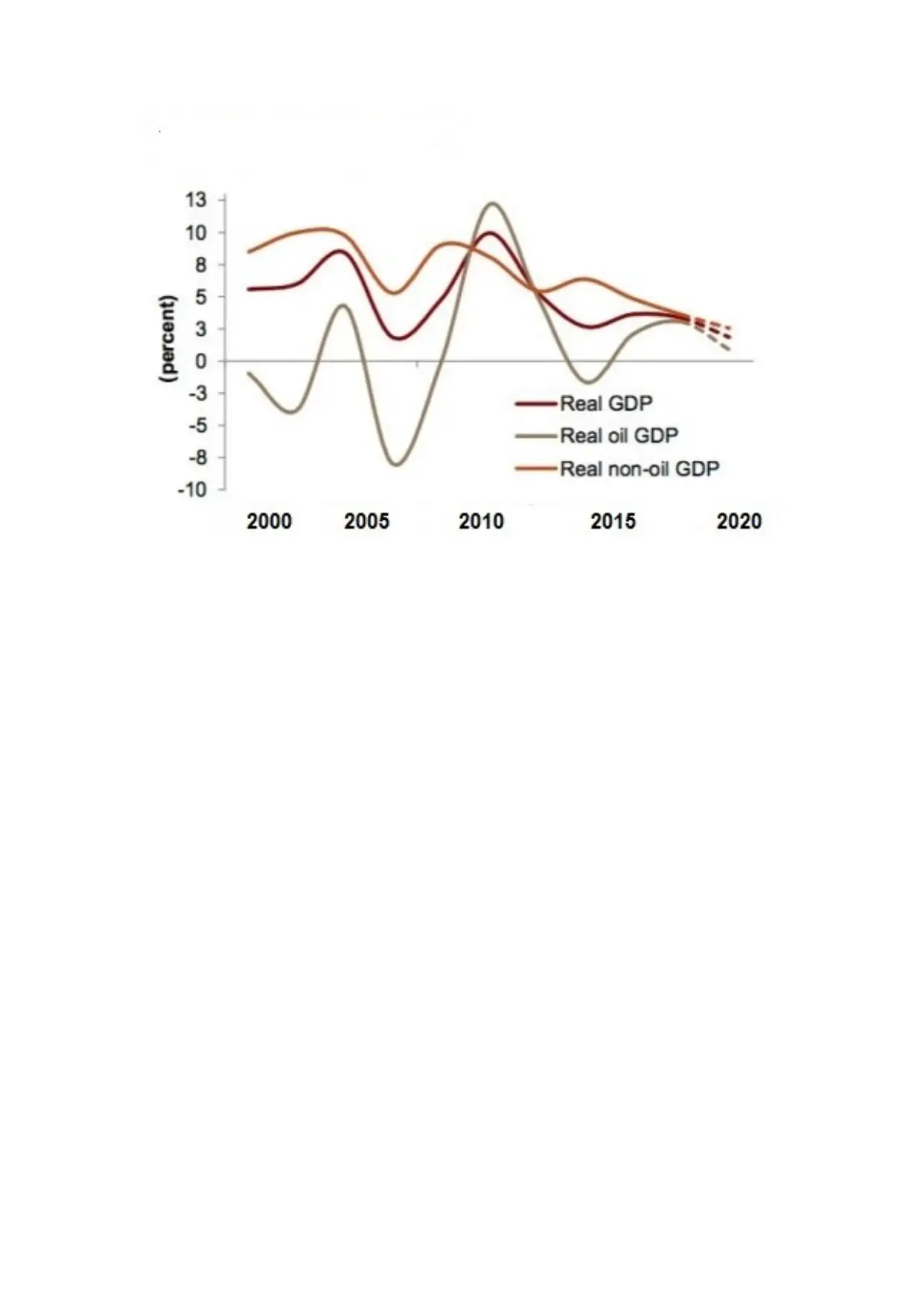

-10 0 10 20

GDP growth

2000 2005 2010 2015 2020

Year

Gross Domestic Product growth trend

Saudi Arabia Oil export Volume

Variable Obs Mean Std. Dev. Min Max

year 20 2009 5.91608 2000 2019

Oil export 20 9129390 915089.5 7090000 1.05e+07

GDP growth

2000 2005 2010 2015 2020

Year

Gross Domestic Product growth trend

Saudi Arabia Oil export Volume

Variable Obs Mean Std. Dev. Min Max

year 20 2009 5.91608 2000 2019

Oil export 20 9129390 915089.5 7090000 1.05e+07

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

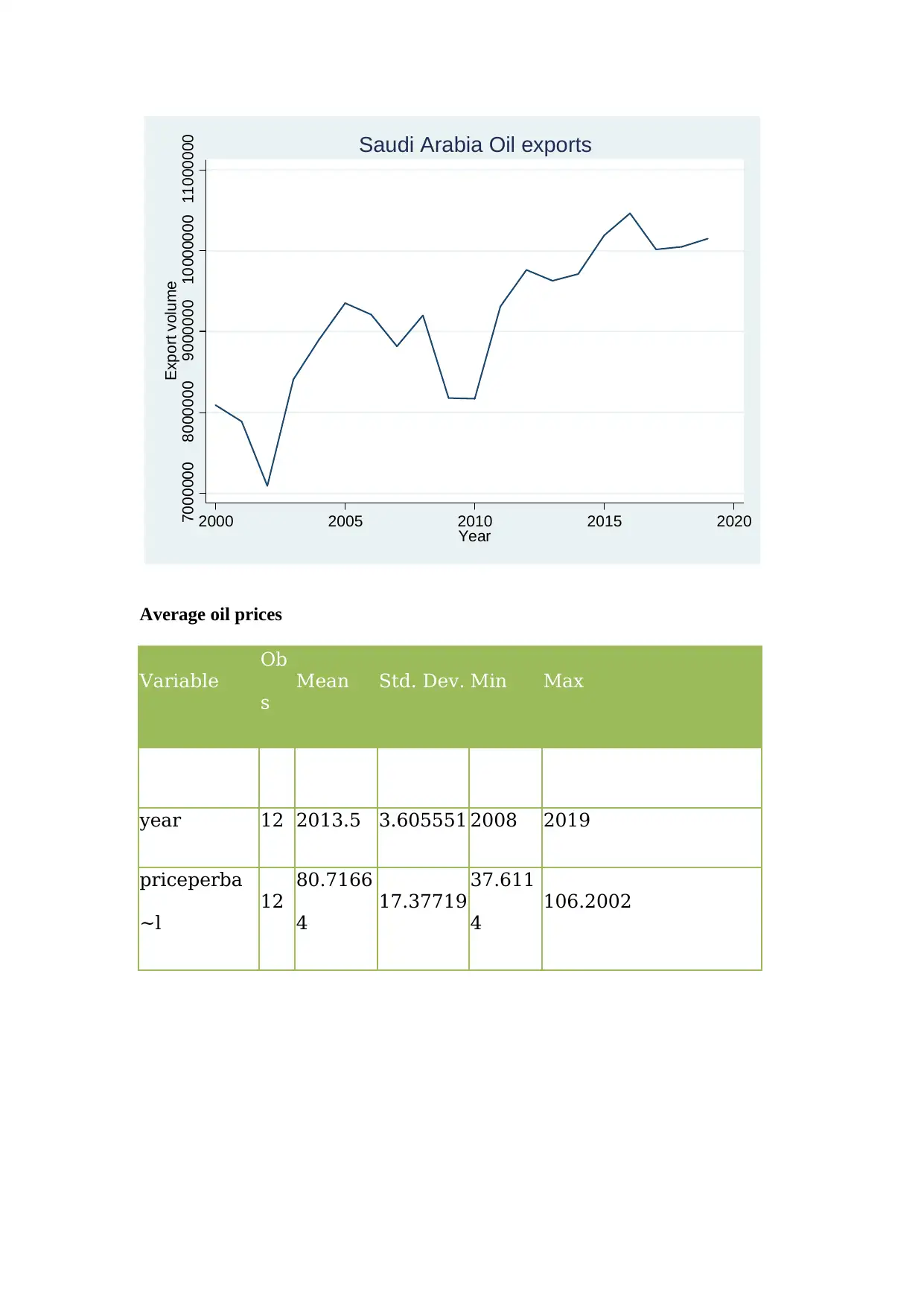

7000000 8000000 9000000 10000000 11000000

Export volume

2000 2005 2010 2015 2020

Year

Saudi Arabia Oil exports

Average oil prices

Variable

Ob

s

Mean Std. Dev. Min Max

year 12 2013.5 3.605551 2008 2019

priceperba

~l

12

80.7166

4

17.37719

37.611

4

106.2002

Export volume

2000 2005 2010 2015 2020

Year

Saudi Arabia Oil exports

Average oil prices

Variable

Ob

s

Mean Std. Dev. Min Max

year 12 2013.5 3.605551 2008 2019

priceperba

~l

12

80.7166

4

17.37719

37.611

4

106.2002

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

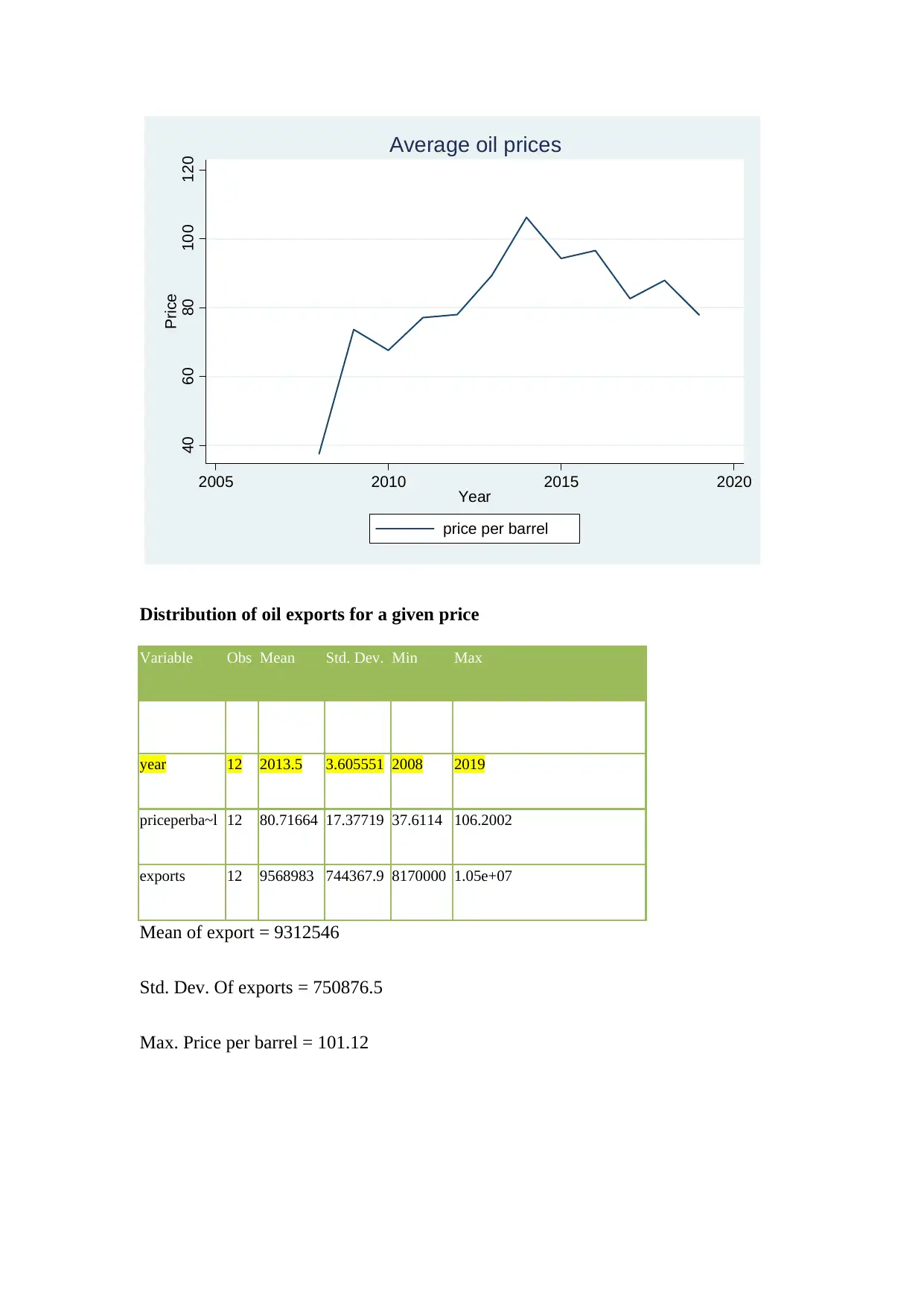

40 60 80 100 120

Price

2005 2010 2015 2020

Year

price per barrel

Average oil prices

Distribution of oil exports for a given price

Variable Obs Mean Std. Dev. Min Max

year 12 2013.5 3.605551 2008 2019

priceperba~l 12 80.71664 17.37719 37.6114 106.2002

exports 12 9568983 744367.9 8170000 1.05e+07

Mean of export = 9312546

Std. Dev. Of exports = 750876.5

Max. Price per barrel = 101.12

Price

2005 2010 2015 2020

Year

price per barrel

Average oil prices

Distribution of oil exports for a given price

Variable Obs Mean Std. Dev. Min Max

year 12 2013.5 3.605551 2008 2019

priceperba~l 12 80.71664 17.37719 37.6114 106.2002

exports 12 9568983 744367.9 8170000 1.05e+07

Mean of export = 9312546

Std. Dev. Of exports = 750876.5

Max. Price per barrel = 101.12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.