Financial Analysis: Break-Even, Profit, and Management Accounting

VerifiedAdded on 2023/01/07

|17

|6073

|52

Homework Assignment

AI Summary

This assignment delves into break-even analysis and management accounting. The first question calculates the break-even point, profit margins, and the impact of changes in costs and selling prices for Solent Ltd's sandals. It also discusses the limitations of break-even analysis. The second question critically examines the necessity of management accounting, especially given the legal requirements of financial accounting. It explores how management accountants can achieve their objectives through various techniques, emphasizing the importance of internal record-keeping for strategic decision-making, coordination, organization, customer satisfaction, planning, efficiency improvements, communication, and motivation within a business context. The assignment provides detailed calculations and critical discussions to illustrate these concepts.

Online Exam

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

QUESTION 1...................................................................................................................................1

1. Calculation of Break Even Point of the Sandals for Solent Ltd..............................................1

2. Calculation of the profit made on sales of 90000 units...........................................................1

3. Calculation of new profit figure for the improved Sandals.....................................................1

4. Discussion of limitations of break-even analysis.....................................................................2

QUESTION 2...................................................................................................................................4

a. Critical discussion of why management is necessary, given that most businesses have to

prepare financial accounting in accordance with the law............................................................4

b. Critical discussion of the techniques by which the management accountants can achieve the

above objectives...........................................................................................................................9

REFERENCES..............................................................................................................................13

QUESTION 1...................................................................................................................................1

1. Calculation of Break Even Point of the Sandals for Solent Ltd..............................................1

2. Calculation of the profit made on sales of 90000 units...........................................................1

3. Calculation of new profit figure for the improved Sandals.....................................................1

4. Discussion of limitations of break-even analysis.....................................................................2

QUESTION 2...................................................................................................................................4

a. Critical discussion of why management is necessary, given that most businesses have to

prepare financial accounting in accordance with the law............................................................4

b. Critical discussion of the techniques by which the management accountants can achieve the

above objectives...........................................................................................................................9

REFERENCES..............................................................................................................................13

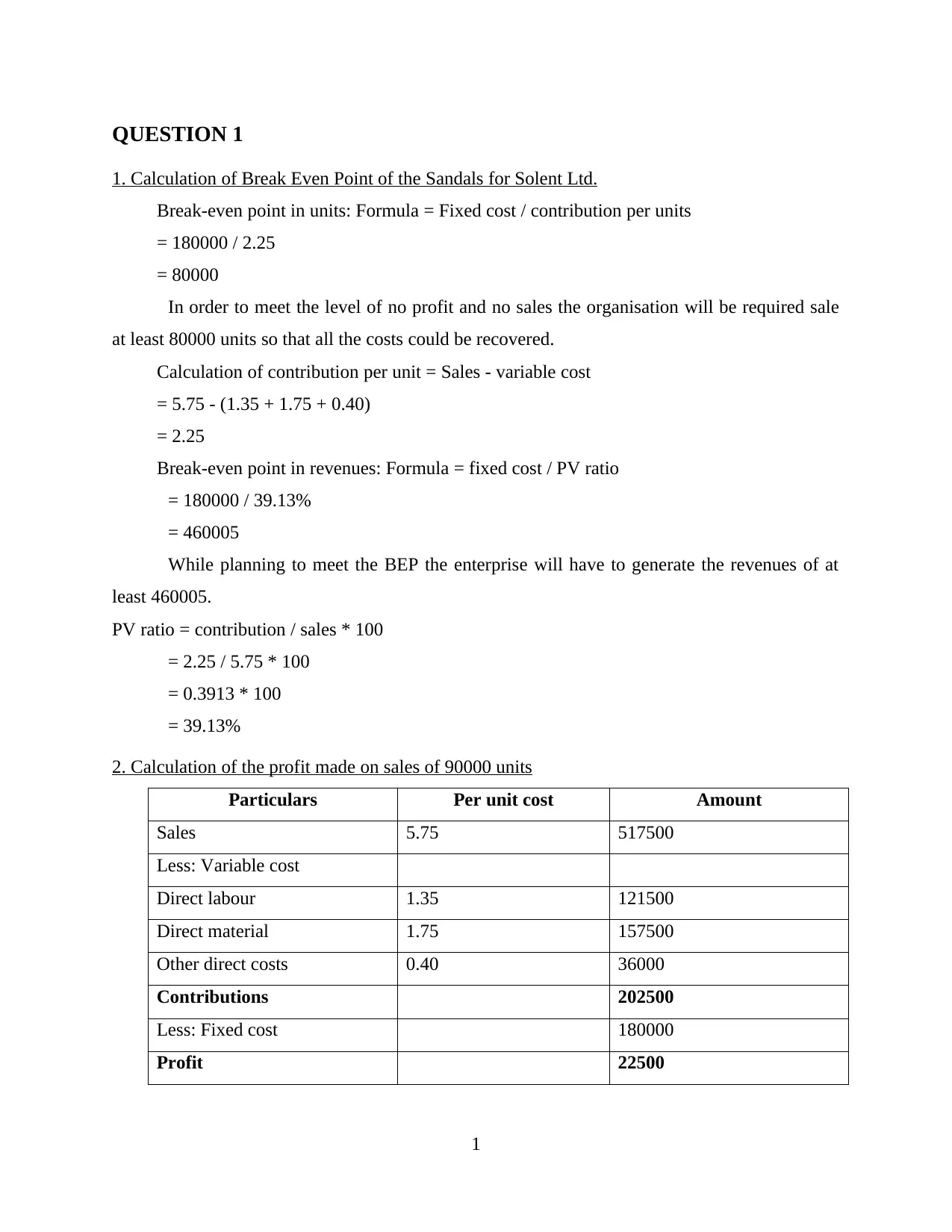

QUESTION 1

1. Calculation of Break Even Point of the Sandals for Solent Ltd.

Break-even point in units: Formula = Fixed cost / contribution per units

= 180000 / 2.25

= 80000

In order to meet the level of no profit and no sales the organisation will be required sale

at least 80000 units so that all the costs could be recovered.

Calculation of contribution per unit = Sales - variable cost

= 5.75 - (1.35 + 1.75 + 0.40)

= 2.25

Break-even point in revenues: Formula = fixed cost / PV ratio

= 180000 / 39.13%

= 460005

While planning to meet the BEP the enterprise will have to generate the revenues of at

least 460005.

PV ratio = contribution / sales * 100

= 2.25 / 5.75 * 100

= 0.3913 * 100

= 39.13%

2. Calculation of the profit made on sales of 90000 units

Particulars Per unit cost Amount

Sales 5.75 517500

Less: Variable cost

Direct labour 1.35 121500

Direct material 1.75 157500

Other direct costs 0.40 36000

Contributions 202500

Less: Fixed cost 180000

Profit 22500

1

1. Calculation of Break Even Point of the Sandals for Solent Ltd.

Break-even point in units: Formula = Fixed cost / contribution per units

= 180000 / 2.25

= 80000

In order to meet the level of no profit and no sales the organisation will be required sale

at least 80000 units so that all the costs could be recovered.

Calculation of contribution per unit = Sales - variable cost

= 5.75 - (1.35 + 1.75 + 0.40)

= 2.25

Break-even point in revenues: Formula = fixed cost / PV ratio

= 180000 / 39.13%

= 460005

While planning to meet the BEP the enterprise will have to generate the revenues of at

least 460005.

PV ratio = contribution / sales * 100

= 2.25 / 5.75 * 100

= 0.3913 * 100

= 39.13%

2. Calculation of the profit made on sales of 90000 units

Particulars Per unit cost Amount

Sales 5.75 517500

Less: Variable cost

Direct labour 1.35 121500

Direct material 1.75 157500

Other direct costs 0.40 36000

Contributions 202500

Less: Fixed cost 180000

Profit 22500

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The amount of profit which will be generated by the organisation by selling 90000 units

will be 22500.

3. Calculation of new profit figure for the improved Sandals

Calculation of increased cost:

Selling price:

Particulars Amount

Current selling price 5.75

Increment in the selling price 0.25

New selling price 6.00

New material costs:

Particulars Amount

Current material cost 1.75

Increment in the material cost 0.15

New material cost 1.90

New labour costs:

Particulars Amount

Current labour cost 1.35

Increment in labour cost 0.05

New labour cost 1.40

New selling units:

Particulars Amount

Current selling units 90000

Increment in selling cost is 5% (90000 *

5%)

4500

New selling units 94500

Calculation of profits for new selling units:

Particulars Per unit cost Amount

Sales (94500) 6.00 567000

Less: Variable cost

Direct labour 1.40 132300

2

will be 22500.

3. Calculation of new profit figure for the improved Sandals

Calculation of increased cost:

Selling price:

Particulars Amount

Current selling price 5.75

Increment in the selling price 0.25

New selling price 6.00

New material costs:

Particulars Amount

Current material cost 1.75

Increment in the material cost 0.15

New material cost 1.90

New labour costs:

Particulars Amount

Current labour cost 1.35

Increment in labour cost 0.05

New labour cost 1.40

New selling units:

Particulars Amount

Current selling units 90000

Increment in selling cost is 5% (90000 *

5%)

4500

New selling units 94500

Calculation of profits for new selling units:

Particulars Per unit cost Amount

Sales (94500) 6.00 567000

Less: Variable cost

Direct labour 1.40 132300

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

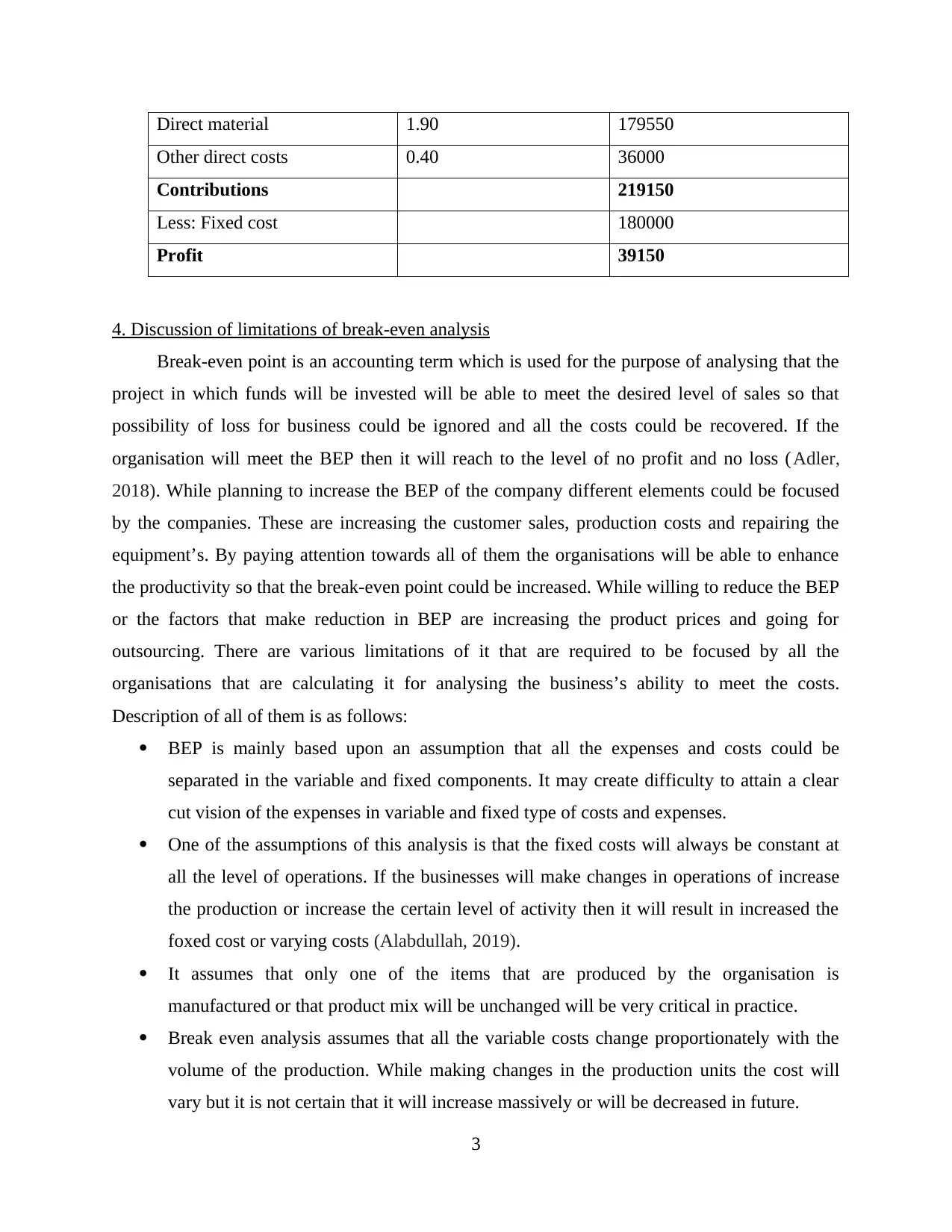

Direct material 1.90 179550

Other direct costs 0.40 36000

Contributions 219150

Less: Fixed cost 180000

Profit 39150

4. Discussion of limitations of break-even analysis

Break-even point is an accounting term which is used for the purpose of analysing that the

project in which funds will be invested will be able to meet the desired level of sales so that

possibility of loss for business could be ignored and all the costs could be recovered. If the

organisation will meet the BEP then it will reach to the level of no profit and no loss (Adler,

2018). While planning to increase the BEP of the company different elements could be focused

by the companies. These are increasing the customer sales, production costs and repairing the

equipment’s. By paying attention towards all of them the organisations will be able to enhance

the productivity so that the break-even point could be increased. While willing to reduce the BEP

or the factors that make reduction in BEP are increasing the product prices and going for

outsourcing. There are various limitations of it that are required to be focused by all the

organisations that are calculating it for analysing the business’s ability to meet the costs.

Description of all of them is as follows:

BEP is mainly based upon an assumption that all the expenses and costs could be

separated in the variable and fixed components. It may create difficulty to attain a clear

cut vision of the expenses in variable and fixed type of costs and expenses.

One of the assumptions of this analysis is that the fixed costs will always be constant at

all the level of operations. If the businesses will make changes in operations of increase

the production or increase the certain level of activity then it will result in increased the

foxed cost or varying costs (Alabdullah, 2019).

It assumes that only one of the items that are produced by the organisation is

manufactured or that product mix will be unchanged will be very critical in practice.

Break even analysis assumes that all the variable costs change proportionately with the

volume of the production. While making changes in the production units the cost will

vary but it is not certain that it will increase massively or will be decreased in future.

3

Other direct costs 0.40 36000

Contributions 219150

Less: Fixed cost 180000

Profit 39150

4. Discussion of limitations of break-even analysis

Break-even point is an accounting term which is used for the purpose of analysing that the

project in which funds will be invested will be able to meet the desired level of sales so that

possibility of loss for business could be ignored and all the costs could be recovered. If the

organisation will meet the BEP then it will reach to the level of no profit and no loss (Adler,

2018). While planning to increase the BEP of the company different elements could be focused

by the companies. These are increasing the customer sales, production costs and repairing the

equipment’s. By paying attention towards all of them the organisations will be able to enhance

the productivity so that the break-even point could be increased. While willing to reduce the BEP

or the factors that make reduction in BEP are increasing the product prices and going for

outsourcing. There are various limitations of it that are required to be focused by all the

organisations that are calculating it for analysing the business’s ability to meet the costs.

Description of all of them is as follows:

BEP is mainly based upon an assumption that all the expenses and costs could be

separated in the variable and fixed components. It may create difficulty to attain a clear

cut vision of the expenses in variable and fixed type of costs and expenses.

One of the assumptions of this analysis is that the fixed costs will always be constant at

all the level of operations. If the businesses will make changes in operations of increase

the production or increase the certain level of activity then it will result in increased the

foxed cost or varying costs (Alabdullah, 2019).

It assumes that only one of the items that are produced by the organisation is

manufactured or that product mix will be unchanged will be very critical in practice.

Break even analysis assumes that all the variable costs change proportionately with the

volume of the production. While making changes in the production units the cost will

vary but it is not certain that it will increase massively or will be decreased in future.

3

While using it businesses assume that the business conditions will not change in future

which may result in inaccurate results.

Its assumption of that the price of sales for the units will remain unchanged give a

straight revenue line which is not true. The selling price of all the items that are sold by

an organisation depends upon different types of factors. These are market demand,

competition, supply etc. so the price in most of the cases remain constant (Alamri, 2019).

Break-even analysis states that the sales and production units will be equal to each other

and will not get changed in upcoming period and apart from this, it also assumes that the

opening and closing balance of stock will be unchanged. Due to this, assumption the

accuracy of the results may get impacted.

All the business entities face three different types of costs which are fixed, variable and

semi variable. While calculation of BEP only variable and fixed expenses are considered

and it ignores semi variable expenses that affects the level of accuracy of the results.

All the variable overheads in this analysis are appropriated on the basis of estimated so it

may result in the issue of lack of ignorance of under or over recovery of the cost.

In this analysis it is not possible to compare and fix price for two costs if there is no fixed

cost.

The time factor is ignored in this analysis as the cost’s changes with time in long run so

the estimation which is made on the basis of it for long run is not possible.

This method of analysis is not suitable for different industries such as ship building. It

may result in problems related to income tax (Amir, Rehman and Khan, 2020).

QUESTION 2

a. Critical discussion of why management is necessary, given that most businesses have to

prepare financial accounting in accordance with the law

Management accounting could be defined as the technique which is used by businesses

for the purpose of formulating internal records so that it could be analysed that the plans that

were formulated by the managers will be able to result positively or negatively. With the help of

it, the internal stakeholders such as managers, employees, shareholders etc. can evaluate actual

performance of business. For all the large as well as small business entities it is very important to

make sure that they are conducting management accounting on yearly basis as it can help to

4

which may result in inaccurate results.

Its assumption of that the price of sales for the units will remain unchanged give a

straight revenue line which is not true. The selling price of all the items that are sold by

an organisation depends upon different types of factors. These are market demand,

competition, supply etc. so the price in most of the cases remain constant (Alamri, 2019).

Break-even analysis states that the sales and production units will be equal to each other

and will not get changed in upcoming period and apart from this, it also assumes that the

opening and closing balance of stock will be unchanged. Due to this, assumption the

accuracy of the results may get impacted.

All the business entities face three different types of costs which are fixed, variable and

semi variable. While calculation of BEP only variable and fixed expenses are considered

and it ignores semi variable expenses that affects the level of accuracy of the results.

All the variable overheads in this analysis are appropriated on the basis of estimated so it

may result in the issue of lack of ignorance of under or over recovery of the cost.

In this analysis it is not possible to compare and fix price for two costs if there is no fixed

cost.

The time factor is ignored in this analysis as the cost’s changes with time in long run so

the estimation which is made on the basis of it for long run is not possible.

This method of analysis is not suitable for different industries such as ship building. It

may result in problems related to income tax (Amir, Rehman and Khan, 2020).

QUESTION 2

a. Critical discussion of why management is necessary, given that most businesses have to

prepare financial accounting in accordance with the law

Management accounting could be defined as the technique which is used by businesses

for the purpose of formulating internal records so that it could be analysed that the plans that

were formulated by the managers will be able to result positively or negatively. With the help of

it, the internal stakeholders such as managers, employees, shareholders etc. can evaluate actual

performance of business. For all the large as well as small business entities it is very important to

make sure that they are conducting management accounting on yearly basis as it can help to

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

execute all the operations in systematic manner. If the businesses will not be able to formulate

the internal records with the help of it, then it will be very difficult to make sure that the steps

that are taken for betterment of business are resulting positively or negatively (Ammar, 2017).

For all the business entities it is very important to make sure that they are paying

attention towards management accounting as it may provide different types of benefits to the

business. Some of the key benefits of it to the organisations are discussed below that suggest that

all the companies should conduct management accounting on yearly basis:

Coordinating: Management accounting help the managers to evaluate that they are able

to coordinate with the predetermined objectives of business. If they will not be able to

coordinate with the goals and objectives then they can make strategies for the same

purpose. If management accounting will not be used by them then it will be very difficult

for them to analyse that they are coordinating with the organisational goals or not. Apart

from this, management accounting will also help the organisation to determine that all the

staff members are performing all their jobs properly or not. With the help of management

reports the managers will be able to guide all the employees to make sure that they

perform all their jobs in systematic manner (Botes and Sharma, 2017).

Organising: Management accounting help to organise all the operational in systematic

manner because all the internal records that are generated with the help of it guide the

managers to make sure that they organise all the activities in systematic manner. If the

progress of business will not be accurate then it will be beneficial to make strategies to

organise all the operations properly. With the help of it, all the predetermined goals and

objectives could be accomplished successfully. Apart from this, if the management teams

will not be performing properly or not able to meet the targets that are provided to them

then management accounting will help them to make sure that they perform properly

(Charifzadeh and Taschner, 2017).

Services to the customers: Management accounting is used by the businesses to make

sure that all the organisational goals such as higher customer satisfaction are met. If the

business will analyse that the organisation is not able to satisfy the customers then with

the help of internal reports and different systems of it, effective strategies could be

formulated. With the help of the management accounting systems the managers can make

5

the internal records with the help of it, then it will be very difficult to make sure that the steps

that are taken for betterment of business are resulting positively or negatively (Ammar, 2017).

For all the business entities it is very important to make sure that they are paying

attention towards management accounting as it may provide different types of benefits to the

business. Some of the key benefits of it to the organisations are discussed below that suggest that

all the companies should conduct management accounting on yearly basis:

Coordinating: Management accounting help the managers to evaluate that they are able

to coordinate with the predetermined objectives of business. If they will not be able to

coordinate with the goals and objectives then they can make strategies for the same

purpose. If management accounting will not be used by them then it will be very difficult

for them to analyse that they are coordinating with the organisational goals or not. Apart

from this, management accounting will also help the organisation to determine that all the

staff members are performing all their jobs properly or not. With the help of management

reports the managers will be able to guide all the employees to make sure that they

perform all their jobs in systematic manner (Botes and Sharma, 2017).

Organising: Management accounting help to organise all the operational in systematic

manner because all the internal records that are generated with the help of it guide the

managers to make sure that they organise all the activities in systematic manner. If the

progress of business will not be accurate then it will be beneficial to make strategies to

organise all the operations properly. With the help of it, all the predetermined goals and

objectives could be accomplished successfully. Apart from this, if the management teams

will not be performing properly or not able to meet the targets that are provided to them

then management accounting will help them to make sure that they perform properly

(Charifzadeh and Taschner, 2017).

Services to the customers: Management accounting is used by the businesses to make

sure that all the organisational goals such as higher customer satisfaction are met. If the

business will analyse that the organisation is not able to satisfy the customers then with

the help of internal reports and different systems of it, effective strategies could be

formulated. With the help of the management accounting systems the managers can make

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

sure that they are able to formulate such strategies which may result in higher level of

customer satisfaction (Dierynck and Labro, 2018).

Planning: In order to reach all the long as well as short-term business goals and

objectives it is very important for all the businesses to make sure that they are focused

with effective planning. Management accounting can help the businesses to formulate

effective plans for future so that the desired level of success could be attained. While

evaluating business performance the managers can analyse the internal records and then

they can formulate effective decisions for business so that success could be attained

Improvement in the efficiency: With the help of management accounting the businesses

can analyse the level of operational efficiency and if the level of it will be low then

strategies could be formulated for the purpose making improvement in efficiency. If the

organisation will not be using the management accounting then it will not be possible to

analyse the higher or lower level of efficiency and make improvements in it. If

management accounting will be used on yearly basis then it will help to evaluate

efficiency and improve it to reach the desired level of success (Eldenburg, Krishnan and

Krishnan, 2017).

Communication: While planning to develop the business and increase profitability it

will be very important for the managers to make sure that they are having detailed

information about business operations and actual status of it. With the help of

management accounting the mangers can evaluate the business and communicate the

actual position with the staff members. If they will communicate it properly then it will

be very easy to attain the desired level of success.

Motivation: For all the organisations are able to motivate the staff members so that they

can perform all the jobs properly. With the help of management accounting reports the

top-level executives can share the information of organisational performance with the

staff members which will help them to evaluate the position of business. Apart from this,

it they will not be sharing the actual information of business with the employees then it

will be very difficult to motivate them to take part in the jobs that are assigned to them.

From the above discussion it has been analysed that management accounting should be

focused by all the business entities as it helps to evaluate actual position of business and then

make improvements in it so that the desired goals and objectives could be accomplished. There

6

customer satisfaction (Dierynck and Labro, 2018).

Planning: In order to reach all the long as well as short-term business goals and

objectives it is very important for all the businesses to make sure that they are focused

with effective planning. Management accounting can help the businesses to formulate

effective plans for future so that the desired level of success could be attained. While

evaluating business performance the managers can analyse the internal records and then

they can formulate effective decisions for business so that success could be attained

Improvement in the efficiency: With the help of management accounting the businesses

can analyse the level of operational efficiency and if the level of it will be low then

strategies could be formulated for the purpose making improvement in efficiency. If the

organisation will not be using the management accounting then it will not be possible to

analyse the higher or lower level of efficiency and make improvements in it. If

management accounting will be used on yearly basis then it will help to evaluate

efficiency and improve it to reach the desired level of success (Eldenburg, Krishnan and

Krishnan, 2017).

Communication: While planning to develop the business and increase profitability it

will be very important for the managers to make sure that they are having detailed

information about business operations and actual status of it. With the help of

management accounting the mangers can evaluate the business and communicate the

actual position with the staff members. If they will communicate it properly then it will

be very easy to attain the desired level of success.

Motivation: For all the organisations are able to motivate the staff members so that they

can perform all the jobs properly. With the help of management accounting reports the

top-level executives can share the information of organisational performance with the

staff members which will help them to evaluate the position of business. Apart from this,

it they will not be sharing the actual information of business with the employees then it

will be very difficult to motivate them to take part in the jobs that are assigned to them.

From the above discussion it has been analysed that management accounting should be

focused by all the business entities as it helps to evaluate actual position of business and then

make improvements in it so that the desired goals and objectives could be accomplished. There

6

are various types of reports and systems of management accounting which are used by

companies for the purpose of formulating effective decisions for future (Ferdous, Adams and

Boyce, 2019). Some of the systems are cost accounting, price optimisation, inventory

management, job order costing etc. Apart from this, some of the key reports of management

accounting are inventory management, performance, budget, account receivable etc.

Cost accounting system is one of the main systems of management accounting which is

used to record cost of all the activities that are performed by the organisation. With the help of it,

funds are assigned to all the departments so that they can perform all the activities in systematic

manner. It can help the managers to analyse the activities that are resulting in very high costs so

that actions for controlling them could be taken. Apart from this, if it will be used by the

companies then it can help to determine all the costs and then the estimation of future expenses

could be made on the basis of the same.

Inventory management system is also used in management accounting by all the

businesses so that they can manage the desired level of inventory for all the operations. If they

will not be able to manage the stock properly then it may result in unmet requirements of

customers. If this system will be used by the companies then they will be able to analyse that

they are having sufficient stock to meet the expectations of customers. There are three different

types of it which are LIFO, FIFO and AVCO (Hiebl and Mayrleitner, 2019). In LIFO all the

recently received goods are used for carrying out operational activities. In FIFO all the early

bought goods are used to perform the operations. In AVCO inventory is used on the basis of

average cost by all the managers so that they can meet the expectation of senior authorities of the

enterprise. While planning to utilise all the resources in systematic manner the businesses can

use FIFO method.

Job order costing system is also a main system of management accounting which is used

by companies for the purpose of keeping track record of all the jobs that are performed on the

basis of specification of clients. With the help of it, all the costs that are resulting in losses and

the jobs that are highly profitable could be identified. While using it the managers can ignore to

perform all the jobs that are not able to provide any type of benefit to the business.

Price optimisation system is used by businesses for the purpose of determining right price

which could be set for the products so that organisational goals as well as requirements of

client’s could be met. If it will be used by the companies while performing management

7

companies for the purpose of formulating effective decisions for future (Ferdous, Adams and

Boyce, 2019). Some of the systems are cost accounting, price optimisation, inventory

management, job order costing etc. Apart from this, some of the key reports of management

accounting are inventory management, performance, budget, account receivable etc.

Cost accounting system is one of the main systems of management accounting which is

used to record cost of all the activities that are performed by the organisation. With the help of it,

funds are assigned to all the departments so that they can perform all the activities in systematic

manner. It can help the managers to analyse the activities that are resulting in very high costs so

that actions for controlling them could be taken. Apart from this, if it will be used by the

companies then it can help to determine all the costs and then the estimation of future expenses

could be made on the basis of the same.

Inventory management system is also used in management accounting by all the

businesses so that they can manage the desired level of inventory for all the operations. If they

will not be able to manage the stock properly then it may result in unmet requirements of

customers. If this system will be used by the companies then they will be able to analyse that

they are having sufficient stock to meet the expectations of customers. There are three different

types of it which are LIFO, FIFO and AVCO (Hiebl and Mayrleitner, 2019). In LIFO all the

recently received goods are used for carrying out operational activities. In FIFO all the early

bought goods are used to perform the operations. In AVCO inventory is used on the basis of

average cost by all the managers so that they can meet the expectation of senior authorities of the

enterprise. While planning to utilise all the resources in systematic manner the businesses can

use FIFO method.

Job order costing system is also a main system of management accounting which is used

by companies for the purpose of keeping track record of all the jobs that are performed on the

basis of specification of clients. With the help of it, all the costs that are resulting in losses and

the jobs that are highly profitable could be identified. While using it the managers can ignore to

perform all the jobs that are not able to provide any type of benefit to the business.

Price optimisation system is used by businesses for the purpose of determining right price

which could be set for the products so that organisational goals as well as requirements of

client’s could be met. If it will be used by the companies while performing management

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

accounting then it can help to set the right price for all the products which will help to satisfy the

customers. It helps to set optimum prices for all the products that results in meeting the client’s

expectations and enhance the profits for business (Kihn and Näsi, 2017).

One of the main reports of management accounting is performance report which is used

to analyse performance of organisation as well as the staff members. With the help of it,

managers can analyse that the employees are performing well or not. Additionally, it also

facilitates the analysis of organisational performance. This report of management accounting

helps to provide bonuses as well as rewards to the employees on the basis of their performance.

If the staff members will not be performing all their jobs properly then the managers can reduce

their compensation on the basis of this report.

Inventory management report is used by the businesses for the purpose of analysing that

the warehouses are having minimum level of inventory of for meeting expectations of all the

customers. While using this inventory management report the managers will be able to analyse

that they are able to keep the stock to fulfil requirements of all the staff members. With the help

of it, the management teams can order the inventory on the basis on demand of products in the

market (Lasyoud and Alsharari, 2017).

Account receivable report is also a management accounting report which is used for the

purpose of analysing the actual owed amount which is required to be recovered from clients. In

large companies some of the clients ask for credit from the companies and if it is provided to

them then a report to record the information of credit is recorded in the reports. With the help of

it, the companies can analyse actual outstanding amount from various debtors and recover them

in specific time duration so that operations could be carried out successfully.

In most of the companies, budget reports are also generated which can help to make sure

that all the activities are performed in the specific budgets that are assigned to different

departments for them. With the help of it, possibility of overspending of budget could be ignored

which can help to perform all the operations in specific budget. It is very important for all the

companies to make sure that they are generating this report because with the help of it all the

planned activities could be performed in systematic manner. If the budget report will not be

generated then it will be very difficult to estimate the future expenses and make arrangement to

meet them (Li, 2018).

8

customers. It helps to set optimum prices for all the products that results in meeting the client’s

expectations and enhance the profits for business (Kihn and Näsi, 2017).

One of the main reports of management accounting is performance report which is used

to analyse performance of organisation as well as the staff members. With the help of it,

managers can analyse that the employees are performing well or not. Additionally, it also

facilitates the analysis of organisational performance. This report of management accounting

helps to provide bonuses as well as rewards to the employees on the basis of their performance.

If the staff members will not be performing all their jobs properly then the managers can reduce

their compensation on the basis of this report.

Inventory management report is used by the businesses for the purpose of analysing that

the warehouses are having minimum level of inventory of for meeting expectations of all the

customers. While using this inventory management report the managers will be able to analyse

that they are able to keep the stock to fulfil requirements of all the staff members. With the help

of it, the management teams can order the inventory on the basis on demand of products in the

market (Lasyoud and Alsharari, 2017).

Account receivable report is also a management accounting report which is used for the

purpose of analysing the actual owed amount which is required to be recovered from clients. In

large companies some of the clients ask for credit from the companies and if it is provided to

them then a report to record the information of credit is recorded in the reports. With the help of

it, the companies can analyse actual outstanding amount from various debtors and recover them

in specific time duration so that operations could be carried out successfully.

In most of the companies, budget reports are also generated which can help to make sure

that all the activities are performed in the specific budgets that are assigned to different

departments for them. With the help of it, possibility of overspending of budget could be ignored

which can help to perform all the operations in specific budget. It is very important for all the

companies to make sure that they are generating this report because with the help of it all the

planned activities could be performed in systematic manner. If the budget report will not be

generated then it will be very difficult to estimate the future expenses and make arrangement to

meet them (Li, 2018).

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The above discussion of management accounting report and systems demonstrates that if

the business entities will be generating all the reports and focusing upon various systems of it

then it can help to analyse the business performance and formulate effective decisions for future.

If the companies will not pay attention towards management accounting then it may leave

negative impact upon the mind set of internal stakeholders as they will not be able to analyse the

position of business. Apart from this, management accounting should be focused by businesses

as it can help to determine that the efforts which are made by the managers for effective

execution of operations are resulting positively or negatively. It is not compulsory to use

management accounting or conduct auditing of all the records of it for business but if it will be

used then it will provide various benefits to the businesses.

According to the law all the companies are required to generate financial records on

yearly basis because these are required for analysing actual position of business. Apart from this,

with the help of them profitability and liquidity of business could be determined. All the final

accounts are provided to the external stakeholders so that they can analyse that the enterprise is

performing well or not. One of the main aspects which is not focused by the financial accounting

is non-financial activities. In order to make sure that all the long-term objectives are achieved

successfully it is very important for all the companies to pay attention towards such activities.

The information of them could be recorded in the management accounting reports which can

help to make sure that all the activities are profitable or not. If it will not be followed by the

businesses then it may leave negative impact upon the decision making. When management

accounting will not be used then the managers and other internal stakeholders will not be able to

analyse the growth and actual position of business on the basis of non-financial activities. Lack

of this analysis will result in ineffective decision making of them which may affect the

sustainability of business. On the basis of these arguments it has been evaluated that

management accounting is needed by all the businesses because with the help of it they can

formulate effective decisions for future and try to meet the predetermined objectives (Nielsen

and Pontoppidan, 2019).

b. Critical discussion of the techniques by which the management accountants can achieve the

above objectives

Management accounting is an effective approach which should be used by all the

business because it can help to reach all the long as well as short term objectives of business.

9

the business entities will be generating all the reports and focusing upon various systems of it

then it can help to analyse the business performance and formulate effective decisions for future.

If the companies will not pay attention towards management accounting then it may leave

negative impact upon the mind set of internal stakeholders as they will not be able to analyse the

position of business. Apart from this, management accounting should be focused by businesses

as it can help to determine that the efforts which are made by the managers for effective

execution of operations are resulting positively or negatively. It is not compulsory to use

management accounting or conduct auditing of all the records of it for business but if it will be

used then it will provide various benefits to the businesses.

According to the law all the companies are required to generate financial records on

yearly basis because these are required for analysing actual position of business. Apart from this,

with the help of them profitability and liquidity of business could be determined. All the final

accounts are provided to the external stakeholders so that they can analyse that the enterprise is

performing well or not. One of the main aspects which is not focused by the financial accounting

is non-financial activities. In order to make sure that all the long-term objectives are achieved

successfully it is very important for all the companies to pay attention towards such activities.

The information of them could be recorded in the management accounting reports which can

help to make sure that all the activities are profitable or not. If it will not be followed by the

businesses then it may leave negative impact upon the decision making. When management

accounting will not be used then the managers and other internal stakeholders will not be able to

analyse the growth and actual position of business on the basis of non-financial activities. Lack

of this analysis will result in ineffective decision making of them which may affect the

sustainability of business. On the basis of these arguments it has been evaluated that

management accounting is needed by all the businesses because with the help of it they can

formulate effective decisions for future and try to meet the predetermined objectives (Nielsen

and Pontoppidan, 2019).

b. Critical discussion of the techniques by which the management accountants can achieve the

above objectives

Management accounting is an effective approach which should be used by all the

business because it can help to reach all the long as well as short term objectives of business.

9

With the help of it, effective decisions for future could be formulated. It assists the managers in

process of planning, control and decision making. For all the business entities to make sure that

they are able to use it properly so that various benefits could be acquired. If they will not be

using it in systematic manner then it will result in failure of all the plans that were formulated

previously. There are various types of management accounting techniques which are used for

attaining the main objective of it (Nitzl, 2016). Discussion of them along with their positive and

negative aspects is as follows:

Marginal analysis: It is used by the businesses which are involved in manufacturing

activities because with the help of cost and each and every additional units which is produced by

the organisations could be determined. It is the most fundamental approach of management

accounting that facilitate the decision making and business planning by evaluating the actual

costs of all the units that are produced by the company within the specific time duration. With

the help of this technique break even of the production could be calculated that can help the

organisation to reach the situation of no profit and no loss. It is the common decision-making

tool which is used by businesses to maximise the potential profits so that the business could be

sustained for long run in future. It is one of the costly techniques which may result in higher cost

for the units as the expenses which will be incurred during application of it will be recovered

from the revenues that will be generated by performing all the operations in systematic manner.

It helps to plan for future activities and make decisions according to the current position of

business so that the desired goals and objectives could be attained. One of the negative aspect of

it is that if the business will start factoring it will be very difficult to revert easily to an internal

credit control system of the organisation.

Capital budgeting: When businesses plan to invest in a project which will result in

higher profits then it is used. With the help of it, different alternatives that are available for

investment purpose are evaluated and then one of them is selected on the basis of results. There

are various types of approaches that are used under this technique so that the businesses can

select one of the best options which will help the business to grow and reach to the goals. Some

of the main approaches of it are net present value, payback period, accounting rate of return,

internal rate of return etc. NPV is used to analyse the actual present value of the investments so

that the possibility of attaining profits from them could be assessed. If it will not be used while

using capital budgeting then it may result in ineffective decisions. While choosing project on the

10

process of planning, control and decision making. For all the business entities to make sure that

they are able to use it properly so that various benefits could be acquired. If they will not be

using it in systematic manner then it will result in failure of all the plans that were formulated

previously. There are various types of management accounting techniques which are used for

attaining the main objective of it (Nitzl, 2016). Discussion of them along with their positive and

negative aspects is as follows:

Marginal analysis: It is used by the businesses which are involved in manufacturing

activities because with the help of cost and each and every additional units which is produced by

the organisations could be determined. It is the most fundamental approach of management

accounting that facilitate the decision making and business planning by evaluating the actual

costs of all the units that are produced by the company within the specific time duration. With

the help of this technique break even of the production could be calculated that can help the

organisation to reach the situation of no profit and no loss. It is the common decision-making

tool which is used by businesses to maximise the potential profits so that the business could be

sustained for long run in future. It is one of the costly techniques which may result in higher cost

for the units as the expenses which will be incurred during application of it will be recovered

from the revenues that will be generated by performing all the operations in systematic manner.

It helps to plan for future activities and make decisions according to the current position of

business so that the desired goals and objectives could be attained. One of the negative aspect of

it is that if the business will start factoring it will be very difficult to revert easily to an internal

credit control system of the organisation.

Capital budgeting: When businesses plan to invest in a project which will result in

higher profits then it is used. With the help of it, different alternatives that are available for

investment purpose are evaluated and then one of them is selected on the basis of results. There

are various types of approaches that are used under this technique so that the businesses can

select one of the best options which will help the business to grow and reach to the goals. Some

of the main approaches of it are net present value, payback period, accounting rate of return,

internal rate of return etc. NPV is used to analyse the actual present value of the investments so

that the possibility of attaining profits from them could be assessed. If it will not be used while

using capital budgeting then it may result in ineffective decisions. While choosing project on the

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.