Financial Reporting Exam Solution: Alpha Group and Firmino

VerifiedAdded on 2022/12/28

|10

|2152

|2

Homework Assignment

AI Summary

This document presents a detailed solution to a Financial Reporting exam, covering various aspects of financial accounting. Section A includes solutions to questions on group structure, consideration transferred, fair value of net assets, goodwill calculation, and non-controlling interest (NCI) at both acquisition and reporting dates. It also explains the accounting treatment for investment in associates, consolidated retained earnings, and provides a consolidated statement of financial position. Section B analyzes a statement of cash flows for Firmino, addressing negative balances in investing and financing activities and identifying the main drivers of return on capital. Further, the solution provides accounting treatments for contracts, commission calculations, and revenue recognition for performance obligations, along with advice on currency utilization and accounting for various transactions, including building depreciation and patent accounting. The solution is comprehensive and provides a detailed breakdown of each question, making it a useful resource for students studying financial reporting.

Online Exam (Financial

Reporting)

Reporting)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

SECTION A.....................................................................................................................................3

Question 1....................................................................................................................................3

Question 2....................................................................................................................................6

SECTION B.....................................................................................................................................8

Question 4....................................................................................................................................8

Question 5....................................................................................................................................9

SECTION A.....................................................................................................................................3

Question 1....................................................................................................................................3

Question 2....................................................................................................................................6

SECTION B.....................................................................................................................................8

Question 4....................................................................................................................................8

Question 5....................................................................................................................................9

SECTION A

Question 1

a.

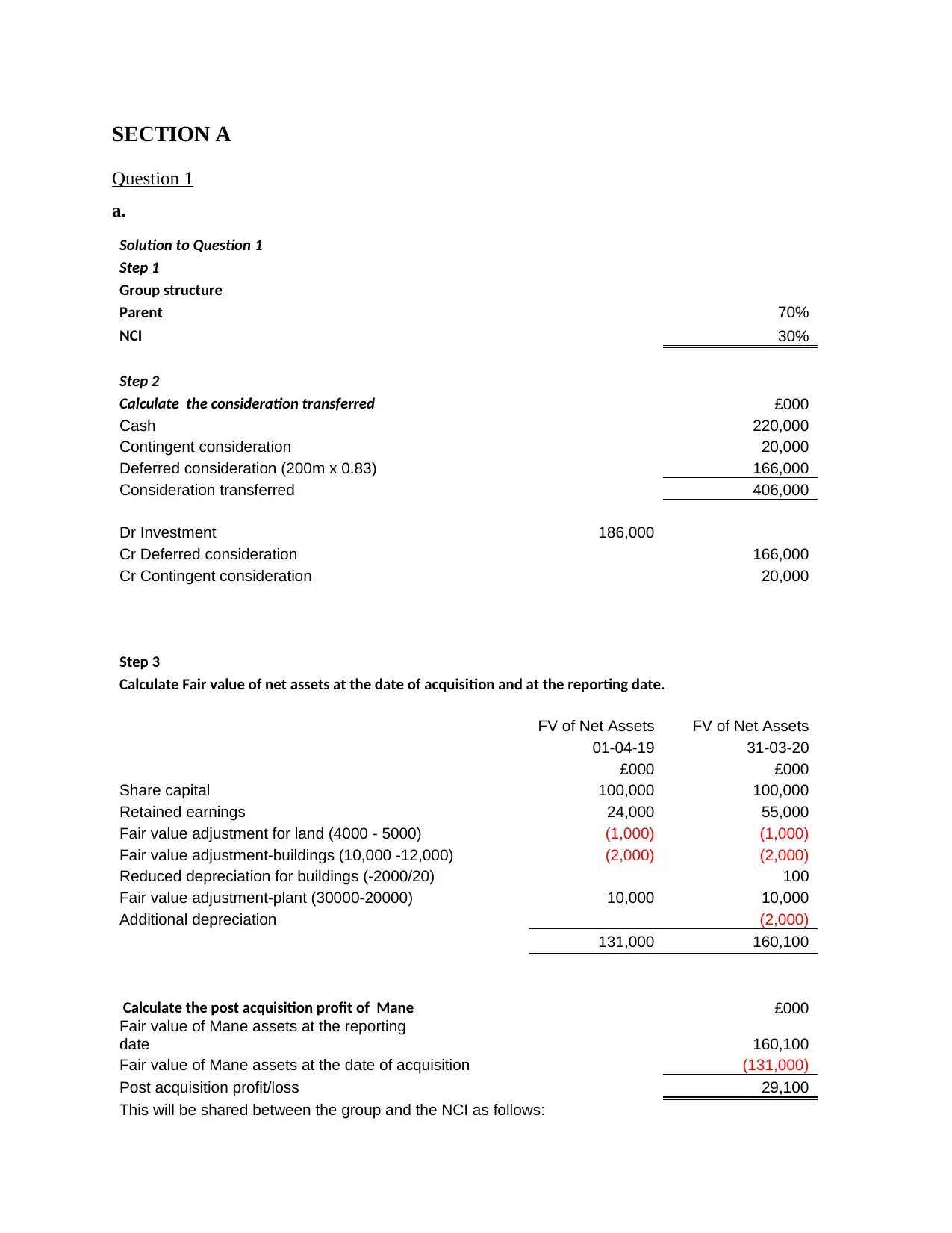

Solution to Question 1

Step 1

Group structure

Parent 70%

NCI 30%

Step 2

Calculate the consideration transferred £000

Cash 220,000

Contingent consideration 20,000

Deferred consideration (200m x 0.83) 166,000

Consideration transferred 406,000

Dr Investment 186,000

Cr Deferred consideration 166,000

Cr Contingent consideration 20,000

Step 3

Calculate Fair value of net assets at the date of acquisition and at the reporting date.

FV of Net Assets FV of Net Assets

01-04-19 31-03-20

£000 £000

Share capital 100,000 100,000

Retained earnings 24,000 55,000

Fair value adjustment for land (4000 - 5000) (1,000) (1,000)

Fair value adjustment-buildings (10,000 -12,000) (2,000) (2,000)

Reduced depreciation for buildings (-2000/20) 100

Fair value adjustment-plant (30000-20000) 10,000 10,000

Additional depreciation (2,000)

131,000 160,100

Calculate the post acquisition profit of Mane £000

Fair value of Mane assets at the reporting

date 160,100

Fair value of Mane assets at the date of acquisition (131,000)

Post acquisition profit/loss 29,100

This will be shared between the group and the NCI as follows:

Question 1

a.

Solution to Question 1

Step 1

Group structure

Parent 70%

NCI 30%

Step 2

Calculate the consideration transferred £000

Cash 220,000

Contingent consideration 20,000

Deferred consideration (200m x 0.83) 166,000

Consideration transferred 406,000

Dr Investment 186,000

Cr Deferred consideration 166,000

Cr Contingent consideration 20,000

Step 3

Calculate Fair value of net assets at the date of acquisition and at the reporting date.

FV of Net Assets FV of Net Assets

01-04-19 31-03-20

£000 £000

Share capital 100,000 100,000

Retained earnings 24,000 55,000

Fair value adjustment for land (4000 - 5000) (1,000) (1,000)

Fair value adjustment-buildings (10,000 -12,000) (2,000) (2,000)

Reduced depreciation for buildings (-2000/20) 100

Fair value adjustment-plant (30000-20000) 10,000 10,000

Additional depreciation (2,000)

131,000 160,100

Calculate the post acquisition profit of Mane £000

Fair value of Mane assets at the reporting

date 160,100

Fair value of Mane assets at the date of acquisition (131,000)

Post acquisition profit/loss 29,100

This will be shared between the group and the NCI as follows:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

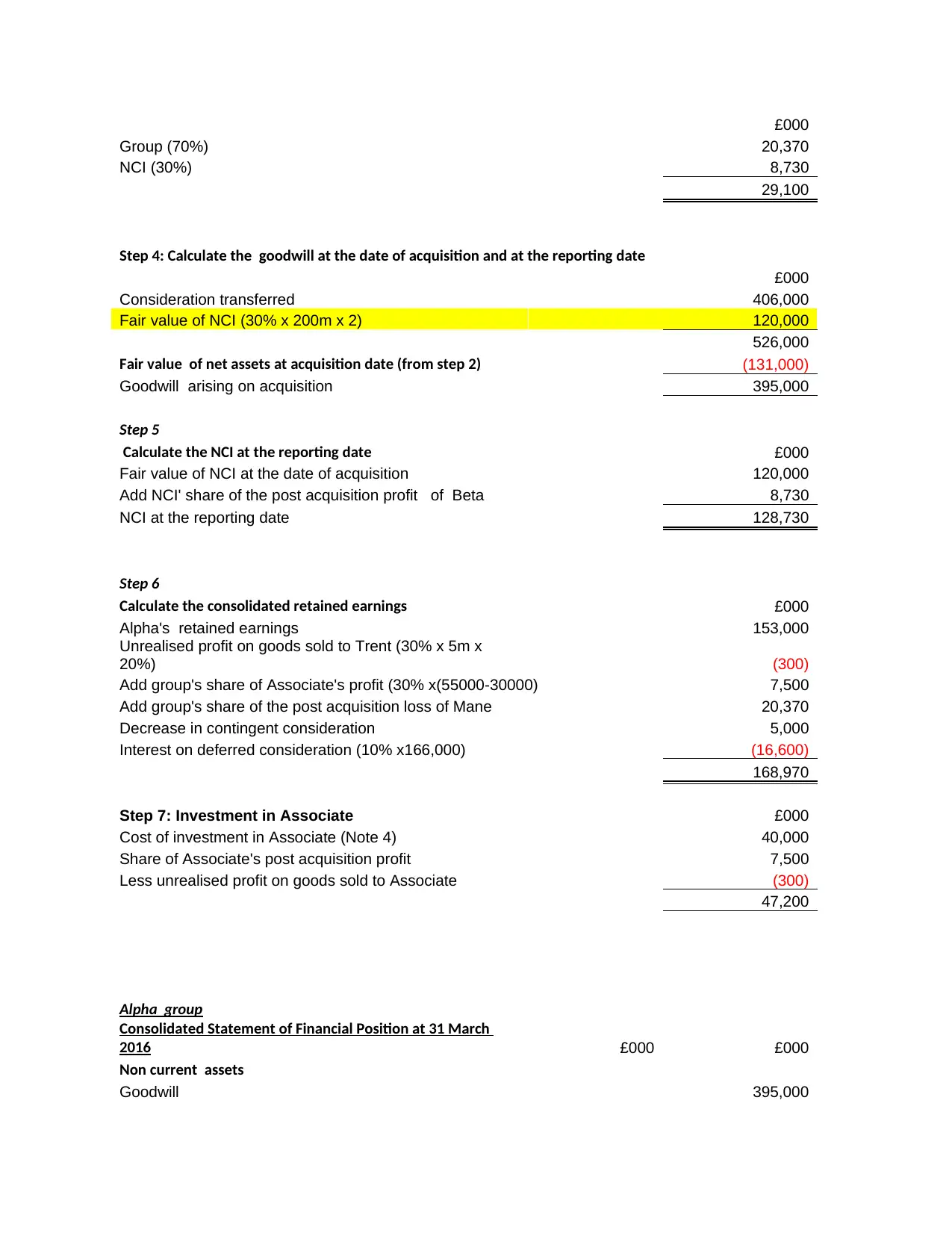

£000

Group (70%) 20,370

NCI (30%) 8,730

29,100

Step 4: Calculate the goodwill at the date of acquisition and at the reporting date

£000

Consideration transferred 406,000

Fair value of NCI (30% x 200m x 2) 120,000

526,000

Fair value of net assets at acquisition date (from step 2) (131,000)

Goodwill arising on acquisition 395,000

Step 5

Calculate the NCI at the reporting date £000

Fair value of NCI at the date of acquisition 120,000

Add NCI' share of the post acquisition profit of Beta 8,730

NCI at the reporting date 128,730

Step 6

Calculate the consolidated retained earnings £000

Alpha's retained earnings 153,000

Unrealised profit on goods sold to Trent (30% x 5m x

20%) (300)

Add group's share of Associate's profit (30% x(55000-30000) 7,500

Add group's share of the post acquisition loss of Mane 20,370

Decrease in contingent consideration 5,000

Interest on deferred consideration (10% x166,000) (16,600)

168,970

Step 7: Investment in Associate £000

Cost of investment in Associate (Note 4) 40,000

Share of Associate's post acquisition profit 7,500

Less unrealised profit on goods sold to Associate (300)

47,200

Alpha group

Consolidated Statement of Financial Position at 31 March

2016 £000 £000

Non current assets

Goodwill 395,000

Group (70%) 20,370

NCI (30%) 8,730

29,100

Step 4: Calculate the goodwill at the date of acquisition and at the reporting date

£000

Consideration transferred 406,000

Fair value of NCI (30% x 200m x 2) 120,000

526,000

Fair value of net assets at acquisition date (from step 2) (131,000)

Goodwill arising on acquisition 395,000

Step 5

Calculate the NCI at the reporting date £000

Fair value of NCI at the date of acquisition 120,000

Add NCI' share of the post acquisition profit of Beta 8,730

NCI at the reporting date 128,730

Step 6

Calculate the consolidated retained earnings £000

Alpha's retained earnings 153,000

Unrealised profit on goods sold to Trent (30% x 5m x

20%) (300)

Add group's share of Associate's profit (30% x(55000-30000) 7,500

Add group's share of the post acquisition loss of Mane 20,370

Decrease in contingent consideration 5,000

Interest on deferred consideration (10% x166,000) (16,600)

168,970

Step 7: Investment in Associate £000

Cost of investment in Associate (Note 4) 40,000

Share of Associate's post acquisition profit 7,500

Less unrealised profit on goods sold to Associate (300)

47,200

Alpha group

Consolidated Statement of Financial Position at 31 March

2016 £000 £000

Non current assets

Goodwill 395,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

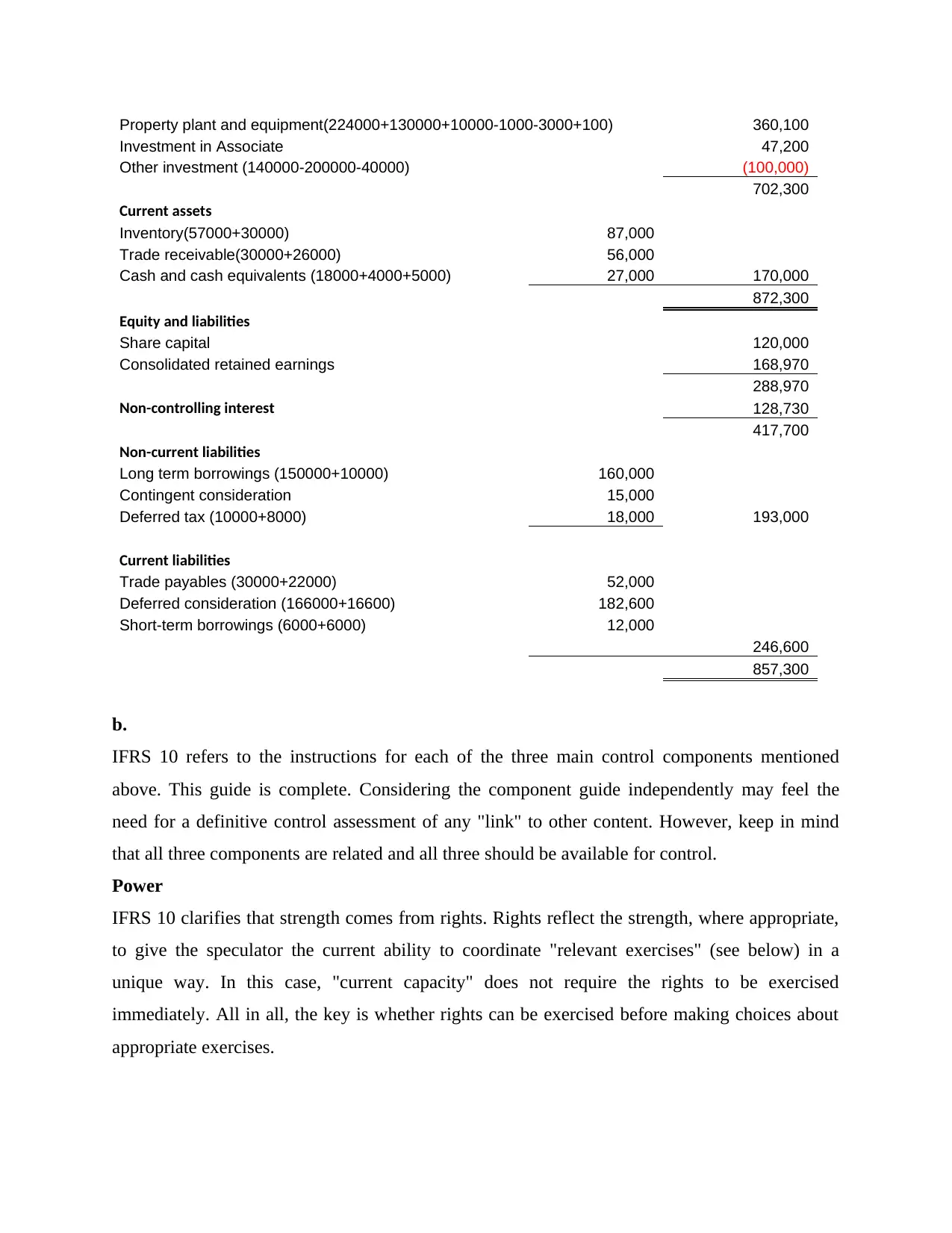

Property plant and equipment(224000+130000+10000-1000-3000+100) 360,100

Investment in Associate 47,200

Other investment (140000-200000-40000) (100,000)

702,300

Current assets

Inventory(57000+30000) 87,000

Trade receivable(30000+26000) 56,000

Cash and cash equivalents (18000+4000+5000) 27,000 170,000

872,300

Equity and liabilities

Share capital 120,000

Consolidated retained earnings 168,970

288,970

Non-controlling interest 128,730

417,700

Non-current liabilities

Long term borrowings (150000+10000) 160,000

Contingent consideration 15,000

Deferred tax (10000+8000) 18,000 193,000

Current liabilities

Trade payables (30000+22000) 52,000

Deferred consideration (166000+16600) 182,600

Short-term borrowings (6000+6000) 12,000

246,600

857,300

b.

IFRS 10 refers to the instructions for each of the three main control components mentioned

above. This guide is complete. Considering the component guide independently may feel the

need for a definitive control assessment of any "link" to other content. However, keep in mind

that all three components are related and all three should be available for control.

Power

IFRS 10 clarifies that strength comes from rights. Rights reflect the strength, where appropriate,

to give the speculator the current ability to coordinate "relevant exercises" (see below) in a

unique way. In this case, "current capacity" does not require the rights to be exercised

immediately. All in all, the key is whether rights can be exercised before making choices about

appropriate exercises.

Investment in Associate 47,200

Other investment (140000-200000-40000) (100,000)

702,300

Current assets

Inventory(57000+30000) 87,000

Trade receivable(30000+26000) 56,000

Cash and cash equivalents (18000+4000+5000) 27,000 170,000

872,300

Equity and liabilities

Share capital 120,000

Consolidated retained earnings 168,970

288,970

Non-controlling interest 128,730

417,700

Non-current liabilities

Long term borrowings (150000+10000) 160,000

Contingent consideration 15,000

Deferred tax (10000+8000) 18,000 193,000

Current liabilities

Trade payables (30000+22000) 52,000

Deferred consideration (166000+16600) 182,600

Short-term borrowings (6000+6000) 12,000

246,600

857,300

b.

IFRS 10 refers to the instructions for each of the three main control components mentioned

above. This guide is complete. Considering the component guide independently may feel the

need for a definitive control assessment of any "link" to other content. However, keep in mind

that all three components are related and all three should be available for control.

Power

IFRS 10 clarifies that strength comes from rights. Rights reflect the strength, where appropriate,

to give the speculator the current ability to coordinate "relevant exercises" (see below) in a

unique way. In this case, "current capacity" does not require the rights to be exercised

immediately. All in all, the key is whether rights can be exercised before making choices about

appropriate exercises.

Exposure, or rights, to variable returns

In order for a financial expert to be in control, he would have to have opening, or variable rights,

in exchange for the owner. Variable returns are then widely identified and extend far beyond the

real estate gains achieved across the value segments.

Ability to use power to affect returns

The third part of scrutiny is that a speculator can use his ability to influence his profits (in some

cases referred to as a "link"). This link depends on the financial expert's ability to coordinate the

appropriate exercises (dynamic rights).

The link between a force and an unlikely return to a normal parent-helper relationship depends

on ownership of a larger portion. Likewise, a subjective study is not required in these cases. In

any case, this third part of the control is important when a speculator retains dynamic rights due

to an administrative contract or a comparative plan, for example the manager of a business or

facility.

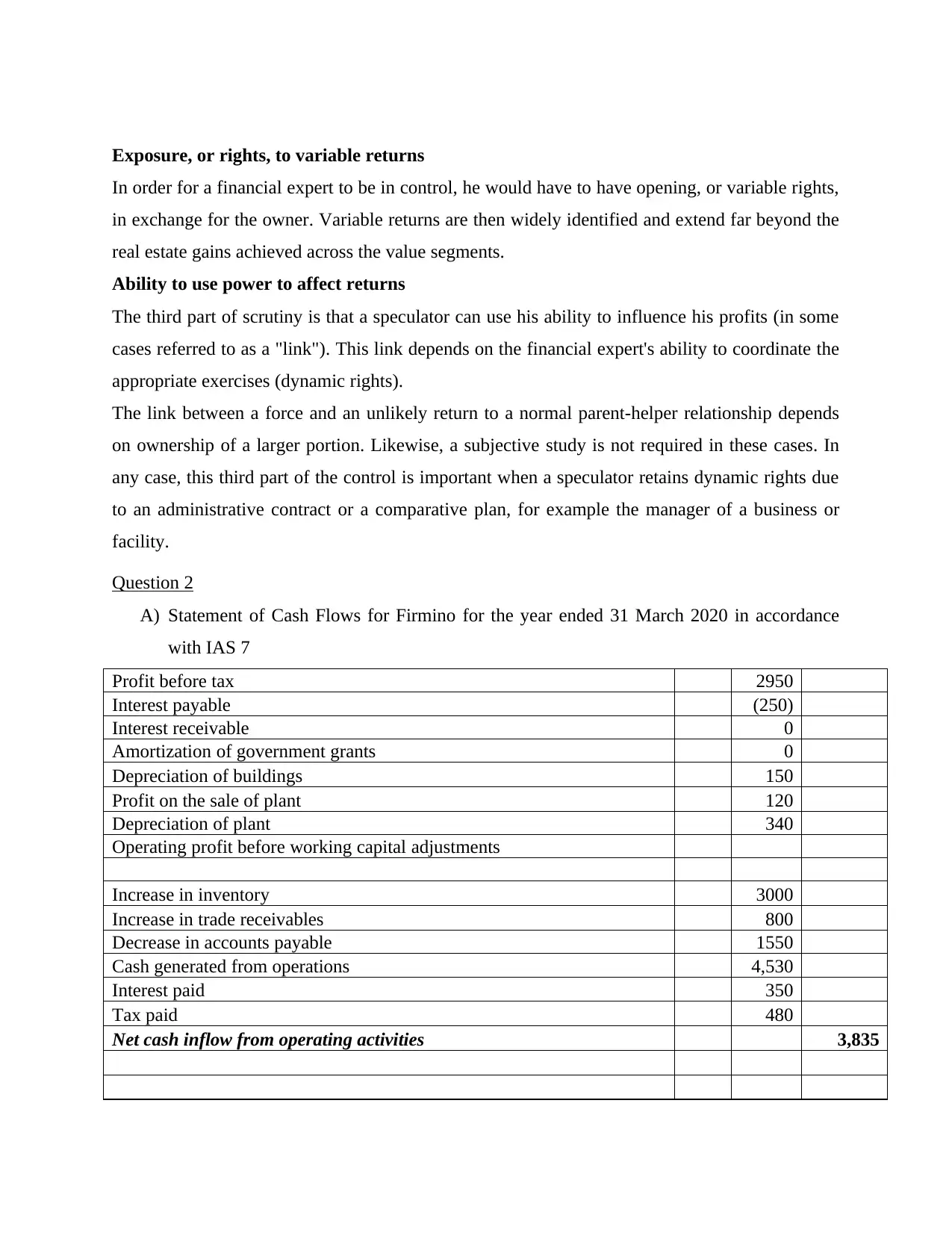

Question 2

A) Statement of Cash Flows for Firmino for the year ended 31 March 2020 in accordance

with IAS 7

Profit before tax 2950

Interest payable (250)

Interest receivable 0

Amortization of government grants 0

Depreciation of buildings 150

Profit on the sale of plant 120

Depreciation of plant 340

Operating profit before working capital adjustments

Increase in inventory 3000

Increase in trade receivables 800

Decrease in accounts payable 1550

Cash generated from operations 4,530

Interest paid 350

Tax paid 480

Net cash inflow from operating activities 3,835

In order for a financial expert to be in control, he would have to have opening, or variable rights,

in exchange for the owner. Variable returns are then widely identified and extend far beyond the

real estate gains achieved across the value segments.

Ability to use power to affect returns

The third part of scrutiny is that a speculator can use his ability to influence his profits (in some

cases referred to as a "link"). This link depends on the financial expert's ability to coordinate the

appropriate exercises (dynamic rights).

The link between a force and an unlikely return to a normal parent-helper relationship depends

on ownership of a larger portion. Likewise, a subjective study is not required in these cases. In

any case, this third part of the control is important when a speculator retains dynamic rights due

to an administrative contract or a comparative plan, for example the manager of a business or

facility.

Question 2

A) Statement of Cash Flows for Firmino for the year ended 31 March 2020 in accordance

with IAS 7

Profit before tax 2950

Interest payable (250)

Interest receivable 0

Amortization of government grants 0

Depreciation of buildings 150

Profit on the sale of plant 120

Depreciation of plant 340

Operating profit before working capital adjustments

Increase in inventory 3000

Increase in trade receivables 800

Decrease in accounts payable 1550

Cash generated from operations 4,530

Interest paid 350

Tax paid 480

Net cash inflow from operating activities 3,835

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

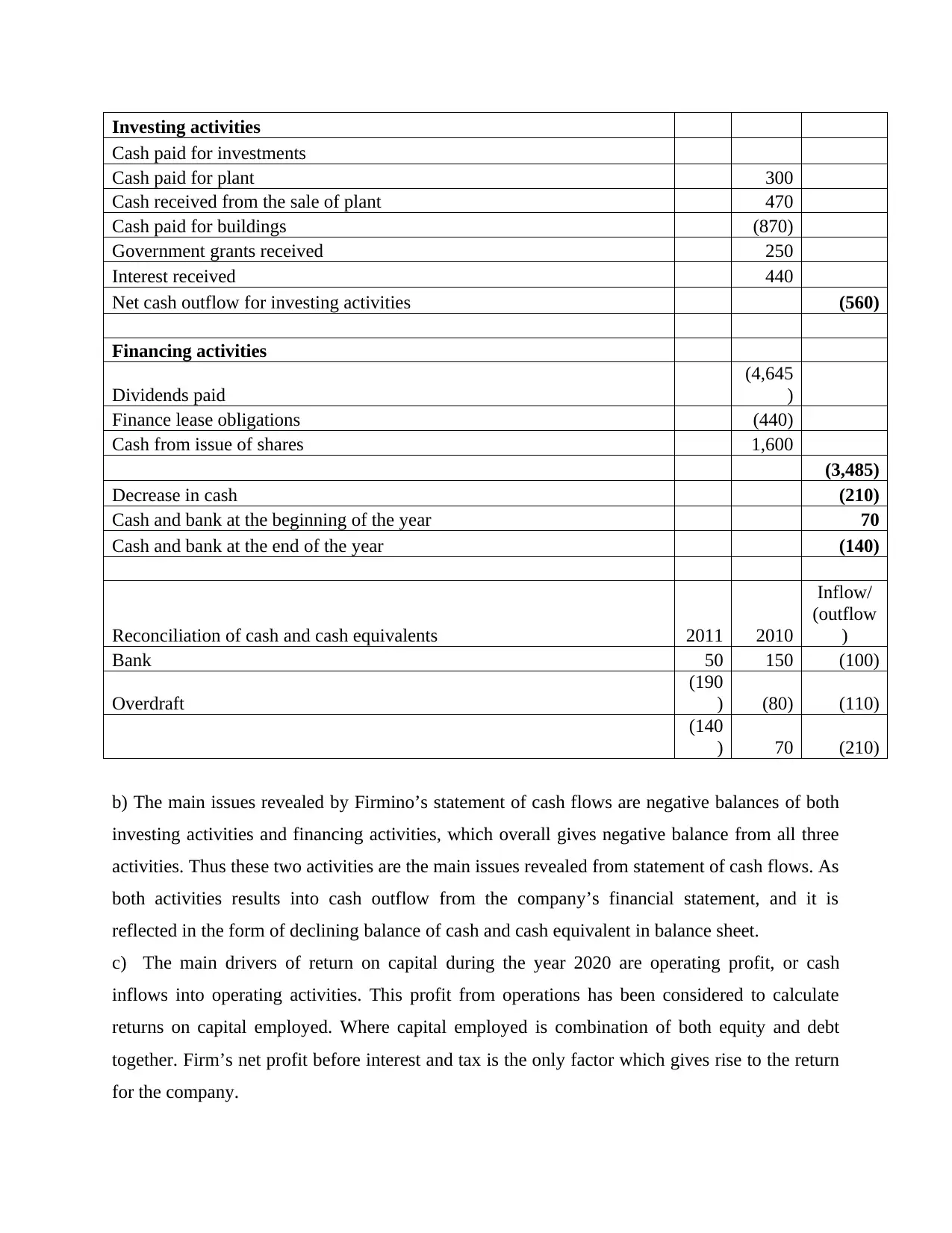

Investing activities

Cash paid for investments

Cash paid for plant 300

Cash received from the sale of plant 470

Cash paid for buildings (870)

Government grants received 250

Interest received 440

Net cash outflow for investing activities (560)

Financing activities

Dividends paid

(4,645

)

Finance lease obligations (440)

Cash from issue of shares 1,600

(3,485)

Decrease in cash (210)

Cash and bank at the beginning of the year 70

Cash and bank at the end of the year (140)

Reconciliation of cash and cash equivalents 2011 2010

Inflow/

(outflow

)

Bank 50 150 (100)

Overdraft

(190

) (80) (110)

(140

) 70 (210)

b) The main issues revealed by Firmino’s statement of cash flows are negative balances of both

investing activities and financing activities, which overall gives negative balance from all three

activities. Thus these two activities are the main issues revealed from statement of cash flows. As

both activities results into cash outflow from the company’s financial statement, and it is

reflected in the form of declining balance of cash and cash equivalent in balance sheet.

c) The main drivers of return on capital during the year 2020 are operating profit, or cash

inflows into operating activities. This profit from operations has been considered to calculate

returns on capital employed. Where capital employed is combination of both equity and debt

together. Firm’s net profit before interest and tax is the only factor which gives rise to the return

for the company.

Cash paid for investments

Cash paid for plant 300

Cash received from the sale of plant 470

Cash paid for buildings (870)

Government grants received 250

Interest received 440

Net cash outflow for investing activities (560)

Financing activities

Dividends paid

(4,645

)

Finance lease obligations (440)

Cash from issue of shares 1,600

(3,485)

Decrease in cash (210)

Cash and bank at the beginning of the year 70

Cash and bank at the end of the year (140)

Reconciliation of cash and cash equivalents 2011 2010

Inflow/

(outflow

)

Bank 50 150 (100)

Overdraft

(190

) (80) (110)

(140

) 70 (210)

b) The main issues revealed by Firmino’s statement of cash flows are negative balances of both

investing activities and financing activities, which overall gives negative balance from all three

activities. Thus these two activities are the main issues revealed from statement of cash flows. As

both activities results into cash outflow from the company’s financial statement, and it is

reflected in the form of declining balance of cash and cash equivalent in balance sheet.

c) The main drivers of return on capital during the year 2020 are operating profit, or cash

inflows into operating activities. This profit from operations has been considered to calculate

returns on capital employed. Where capital employed is combination of both equity and debt

together. Firm’s net profit before interest and tax is the only factor which gives rise to the return

for the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

SECTION B

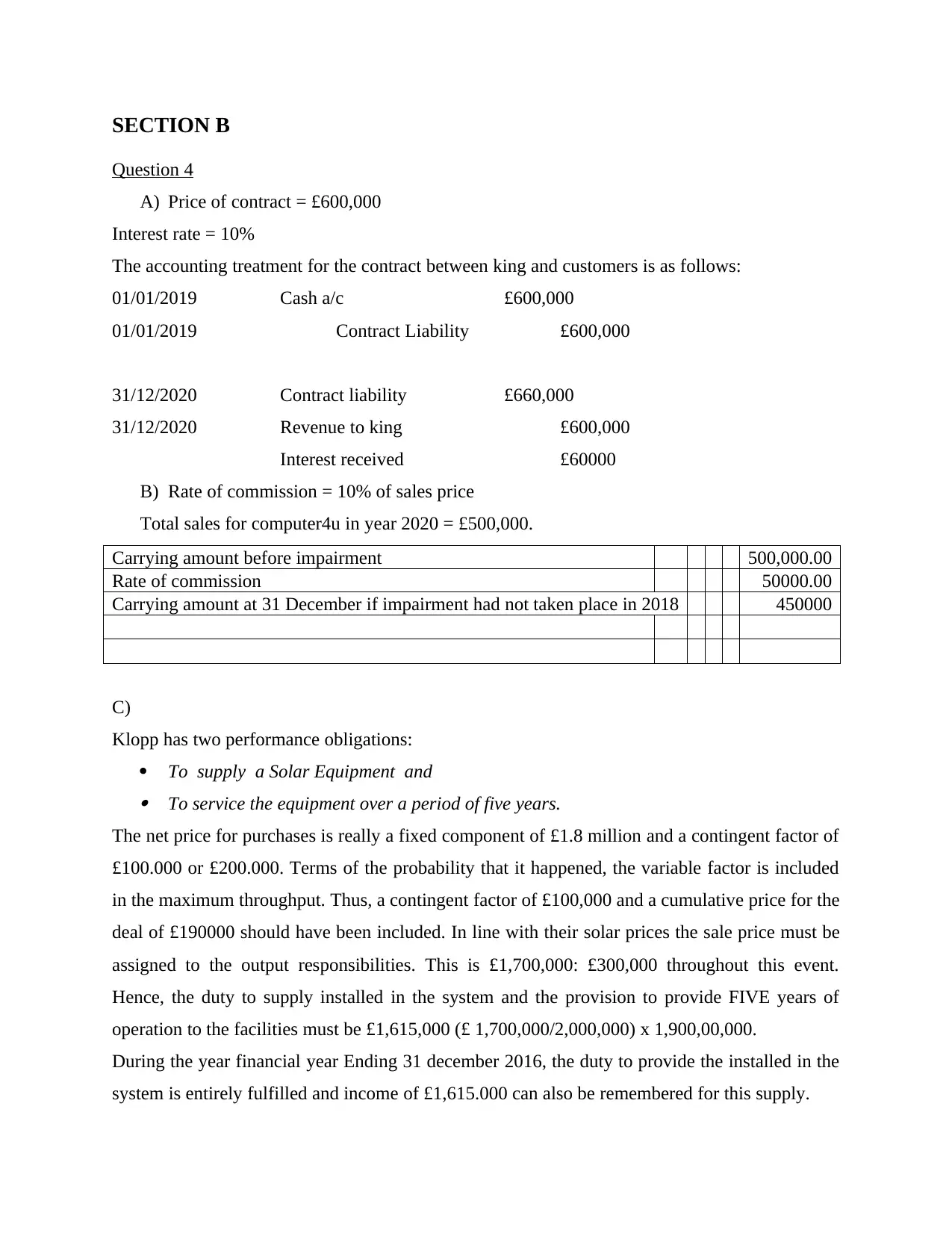

Question 4

A) Price of contract = £600,000

Interest rate = 10%

The accounting treatment for the contract between king and customers is as follows:

01/01/2019 Cash a/c £600,000

01/01/2019 Contract Liability £600,000

31/12/2020 Contract liability £660,000

31/12/2020 Revenue to king £600,000

Interest received £60000

B) Rate of commission = 10% of sales price

Total sales for computer4u in year 2020 = £500,000.

Carrying amount before impairment 500,000.00

Rate of commission 50000.00

Carrying amount at 31 December if impairment had not taken place in 2018 450000

C)

Klopp has two performance obligations:

To supply a Solar Equipment and To service the equipment over a period of five years.

The net price for purchases is really a fixed component of £1.8 million and a contingent factor of

£100.000 or £200.000. Terms of the probability that it happened, the variable factor is included

in the maximum throughput. Thus, a contingent factor of £100,000 and a cumulative price for the

deal of £190000 should have been included. In line with their solar prices the sale price must be

assigned to the output responsibilities. This is £1,700,000: £300,000 throughout this event.

Hence, the duty to supply installed in the system and the provision to provide FIVE years of

operation to the facilities must be £1,615,000 (£ 1,700,000/2,000,000) x 1,900,00,000.

During the year financial year Ending 31 december 2016, the duty to provide the installed in the

system is entirely fulfilled and income of £1,615.000 can also be remembered for this supply.

Question 4

A) Price of contract = £600,000

Interest rate = 10%

The accounting treatment for the contract between king and customers is as follows:

01/01/2019 Cash a/c £600,000

01/01/2019 Contract Liability £600,000

31/12/2020 Contract liability £660,000

31/12/2020 Revenue to king £600,000

Interest received £60000

B) Rate of commission = 10% of sales price

Total sales for computer4u in year 2020 = £500,000.

Carrying amount before impairment 500,000.00

Rate of commission 50000.00

Carrying amount at 31 December if impairment had not taken place in 2018 450000

C)

Klopp has two performance obligations:

To supply a Solar Equipment and To service the equipment over a period of five years.

The net price for purchases is really a fixed component of £1.8 million and a contingent factor of

£100.000 or £200.000. Terms of the probability that it happened, the variable factor is included

in the maximum throughput. Thus, a contingent factor of £100,000 and a cumulative price for the

deal of £190000 should have been included. In line with their solar prices the sale price must be

assigned to the output responsibilities. This is £1,700,000: £300,000 throughout this event.

Hence, the duty to supply installed in the system and the provision to provide FIVE years of

operation to the facilities must be £1,615,000 (£ 1,700,000/2,000,000) x 1,900,00,000.

During the year financial year Ending 31 december 2016, the duty to provide the installed in the

system is entirely fulfilled and income of £1,615.000 can also be remembered for this supply.

Notice and in the year financial year Ending 31 december 2016, indeed 7/60 (1 December to 31

December is seven months) of duty responsibility was fulfilled, and revenues can thus be

accepted as a result of these deliveries of £33,250 (£285,000 x 7/60).

Effective 1 June 2016, Klopp would accept a £1,900,000 payable depending on the appropriate

value of the deal. Klopp's accumulated profits of £251.750 (€1,900,000,000 – £1,615,000 –

33250) is remembered on December 31, 2016. The present debt would be £ 57,000 (£ 251, 750 x

12/53). Non-current obligation is the remaining £194,750 (£251,750-57000).

53= 60 months minus seven months (1 June 2016 to 31 Dexcember 2016 is a period of 7

months).

(b) The rates of transaction include a concentrations of various whether the consumer is entitled

to return items. As this number will be calculated accurately, sales would be estimated and

revenue overall £4,320,000 (90 per cent 800x £6,000) would be calculated. The exchange is

known as receivables for £4,800,000 (800 x £6,000).

The reimbursement duty is £480,000 (£48,000 – £4320000). This is seen to be an existing

obligation. The gross prices was £2,800,000 for the products sold (800 x £3,500). Just

£2,520,000 of the total will be included as an expense for selling (90 percent x 800x £3,500).

The residual £280,000 is seen as a Return Asset Right on existing investments (£2,800,000 -

£2,520,000).

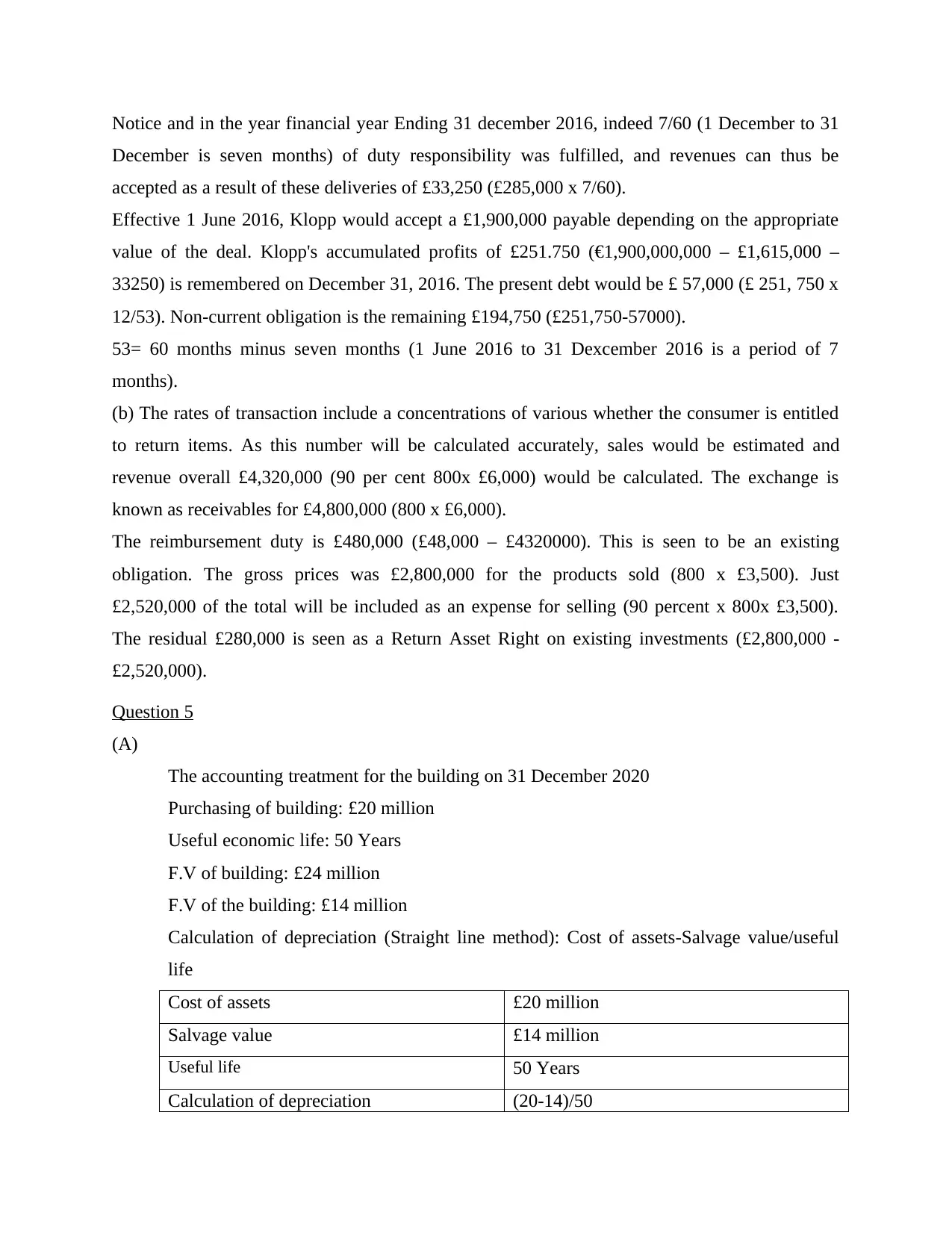

Question 5

(A)

The accounting treatment for the building on 31 December 2020

Purchasing of building: £20 million

Useful economic life: 50 Years

F.V of building: £24 million

F.V of the building: £14 million

Calculation of depreciation (Straight line method): Cost of assets-Salvage value/useful

life

Cost of assets £20 million

Salvage value £14 million

Useful life 50 Years

Calculation of depreciation (20-14)/50

December is seven months) of duty responsibility was fulfilled, and revenues can thus be

accepted as a result of these deliveries of £33,250 (£285,000 x 7/60).

Effective 1 June 2016, Klopp would accept a £1,900,000 payable depending on the appropriate

value of the deal. Klopp's accumulated profits of £251.750 (€1,900,000,000 – £1,615,000 –

33250) is remembered on December 31, 2016. The present debt would be £ 57,000 (£ 251, 750 x

12/53). Non-current obligation is the remaining £194,750 (£251,750-57000).

53= 60 months minus seven months (1 June 2016 to 31 Dexcember 2016 is a period of 7

months).

(b) The rates of transaction include a concentrations of various whether the consumer is entitled

to return items. As this number will be calculated accurately, sales would be estimated and

revenue overall £4,320,000 (90 per cent 800x £6,000) would be calculated. The exchange is

known as receivables for £4,800,000 (800 x £6,000).

The reimbursement duty is £480,000 (£48,000 – £4320000). This is seen to be an existing

obligation. The gross prices was £2,800,000 for the products sold (800 x £3,500). Just

£2,520,000 of the total will be included as an expense for selling (90 percent x 800x £3,500).

The residual £280,000 is seen as a Return Asset Right on existing investments (£2,800,000 -

£2,520,000).

Question 5

(A)

The accounting treatment for the building on 31 December 2020

Purchasing of building: £20 million

Useful economic life: 50 Years

F.V of building: £24 million

F.V of the building: £14 million

Calculation of depreciation (Straight line method): Cost of assets-Salvage value/useful

life

Cost of assets £20 million

Salvage value £14 million

Useful life 50 Years

Calculation of depreciation (20-14)/50

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Depreciation 120000

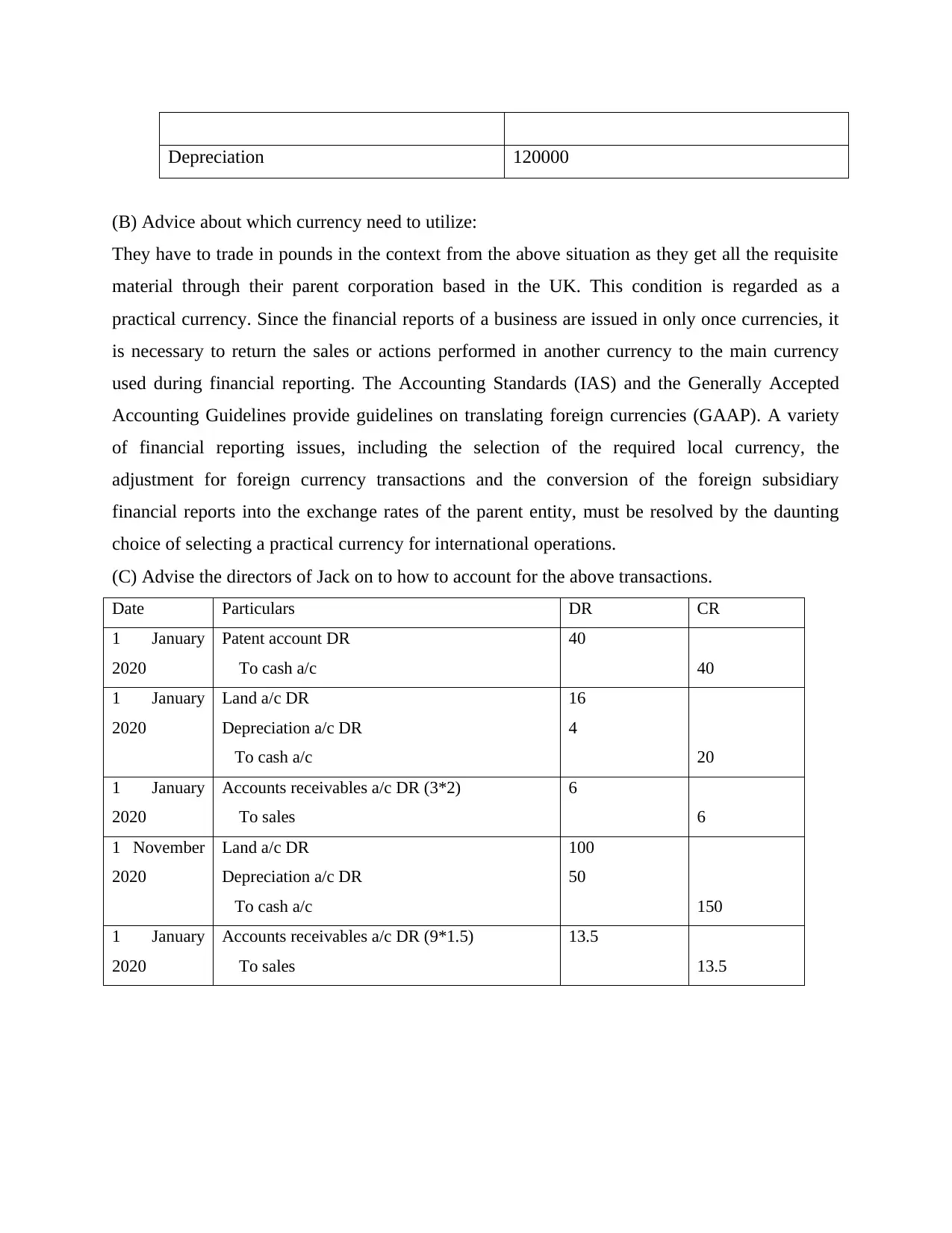

(B) Advice about which currency need to utilize:

They have to trade in pounds in the context from the above situation as they get all the requisite

material through their parent corporation based in the UK. This condition is regarded as a

practical currency. Since the financial reports of a business are issued in only once currencies, it

is necessary to return the sales or actions performed in another currency to the main currency

used during financial reporting. The Accounting Standards (IAS) and the Generally Accepted

Accounting Guidelines provide guidelines on translating foreign currencies (GAAP). A variety

of financial reporting issues, including the selection of the required local currency, the

adjustment for foreign currency transactions and the conversion of the foreign subsidiary

financial reports into the exchange rates of the parent entity, must be resolved by the daunting

choice of selecting a practical currency for international operations.

(C) Advise the directors of Jack on to how to account for the above transactions.

Date Particulars DR CR

1 January

2020

Patent account DR

To cash a/c

40

40

1 January

2020

Land a/c DR

Depreciation a/c DR

To cash a/c

16

4

20

1 January

2020

Accounts receivables a/c DR (3*2)

To sales

6

6

1 November

2020

Land a/c DR

Depreciation a/c DR

To cash a/c

100

50

150

1 January

2020

Accounts receivables a/c DR (9*1.5)

To sales

13.5

13.5

(B) Advice about which currency need to utilize:

They have to trade in pounds in the context from the above situation as they get all the requisite

material through their parent corporation based in the UK. This condition is regarded as a

practical currency. Since the financial reports of a business are issued in only once currencies, it

is necessary to return the sales or actions performed in another currency to the main currency

used during financial reporting. The Accounting Standards (IAS) and the Generally Accepted

Accounting Guidelines provide guidelines on translating foreign currencies (GAAP). A variety

of financial reporting issues, including the selection of the required local currency, the

adjustment for foreign currency transactions and the conversion of the foreign subsidiary

financial reports into the exchange rates of the parent entity, must be resolved by the daunting

choice of selecting a practical currency for international operations.

(C) Advise the directors of Jack on to how to account for the above transactions.

Date Particulars DR CR

1 January

2020

Patent account DR

To cash a/c

40

40

1 January

2020

Land a/c DR

Depreciation a/c DR

To cash a/c

16

4

20

1 January

2020

Accounts receivables a/c DR (3*2)

To sales

6

6

1 November

2020

Land a/c DR

Depreciation a/c DR

To cash a/c

100

50

150

1 January

2020

Accounts receivables a/c DR (9*1.5)

To sales

13.5

13.5

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.