Online Exam: Breakeven Analysis and Management Accounting Concepts

VerifiedAdded on 2023/01/06

|7

|1098

|77

Homework Assignment

AI Summary

This assignment delves into the core concepts of financial analysis and management accounting. The first part focuses on breakeven analysis, including calculating the breakeven point in units and amount, determining profit made on sales, and projecting new profit figures based on changes in sales price and units. It also discusses the limitations of breakeven analysis, such as difficulties in cost differentiation and valuation issues. The second part explores the significance of management accounting, emphasizing its role in internal decision-making and the preparation of financial statements. It outlines various techniques used in management accounting, including margin analysis, trend analysis, capital budgeting, and inventory valuation. The assignment provides practical examples and calculations to illustrate these concepts, supported by relevant references.

Online Exam

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Question 1.............................................................................................................................................3

Breakeven point.................................................................................................................................3

Profit made on sale............................................................................................................................3

New profit figure...............................................................................................................................4

Limitations of Breakeven Analysis....................................................................................................4

Question 2.............................................................................................................................................5

Significance of management accounting...........................................................................................5

Techniques of Management Accounting...........................................................................................5

REFERENCES......................................................................................................................................7

Question 1.............................................................................................................................................3

Breakeven point.................................................................................................................................3

Profit made on sale............................................................................................................................3

New profit figure...............................................................................................................................4

Limitations of Breakeven Analysis....................................................................................................4

Question 2.............................................................................................................................................5

Significance of management accounting...........................................................................................5

Techniques of Management Accounting...........................................................................................5

REFERENCES......................................................................................................................................7

Question 1.

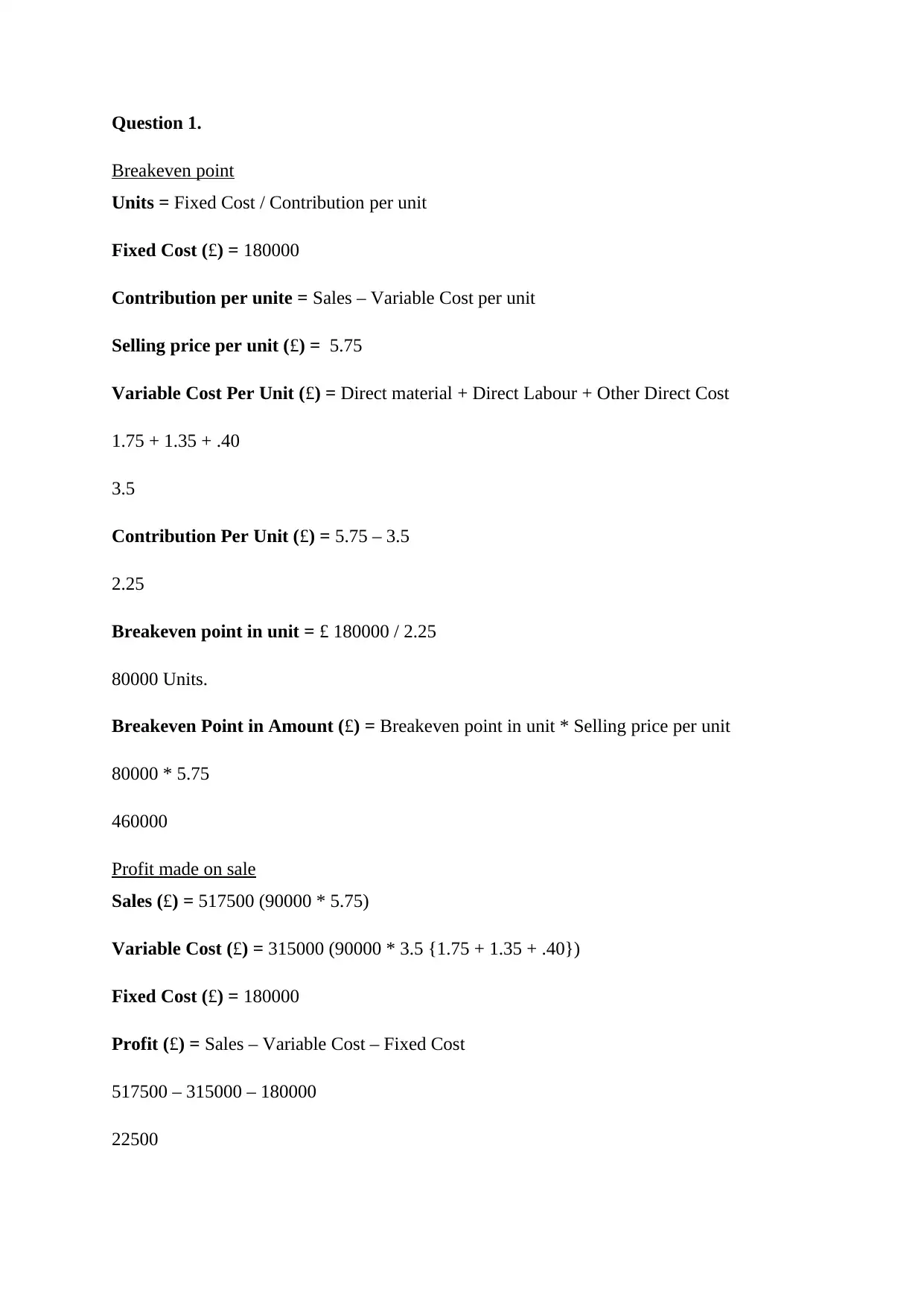

Breakeven point

Units = Fixed Cost / Contribution per unit

Fixed Cost (£) = 180000

Contribution per unite = Sales – Variable Cost per unit

Selling price per unit (£) = 5.75

Variable Cost Per Unit (£) = Direct material + Direct Labour + Other Direct Cost

1.75 + 1.35 + .40

3.5

Contribution Per Unit (£) = 5.75 – 3.5

2.25

Breakeven point in unit = £ 180000 / 2.25

80000 Units.

Breakeven Point in Amount (£) = Breakeven point in unit * Selling price per unit

80000 * 5.75

460000

Profit made on sale

Sales (£) = 517500 (90000 * 5.75)

Variable Cost (£) = 315000 (90000 * 3.5 {1.75 + 1.35 + .40})

Fixed Cost (£) = 180000

Profit (£) = Sales – Variable Cost – Fixed Cost

517500 – 315000 – 180000

22500

Breakeven point

Units = Fixed Cost / Contribution per unit

Fixed Cost (£) = 180000

Contribution per unite = Sales – Variable Cost per unit

Selling price per unit (£) = 5.75

Variable Cost Per Unit (£) = Direct material + Direct Labour + Other Direct Cost

1.75 + 1.35 + .40

3.5

Contribution Per Unit (£) = 5.75 – 3.5

2.25

Breakeven point in unit = £ 180000 / 2.25

80000 Units.

Breakeven Point in Amount (£) = Breakeven point in unit * Selling price per unit

80000 * 5.75

460000

Profit made on sale

Sales (£) = 517500 (90000 * 5.75)

Variable Cost (£) = 315000 (90000 * 3.5 {1.75 + 1.35 + .40})

Fixed Cost (£) = 180000

Profit (£) = Sales – Variable Cost – Fixed Cost

517500 – 315000 – 180000

22500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

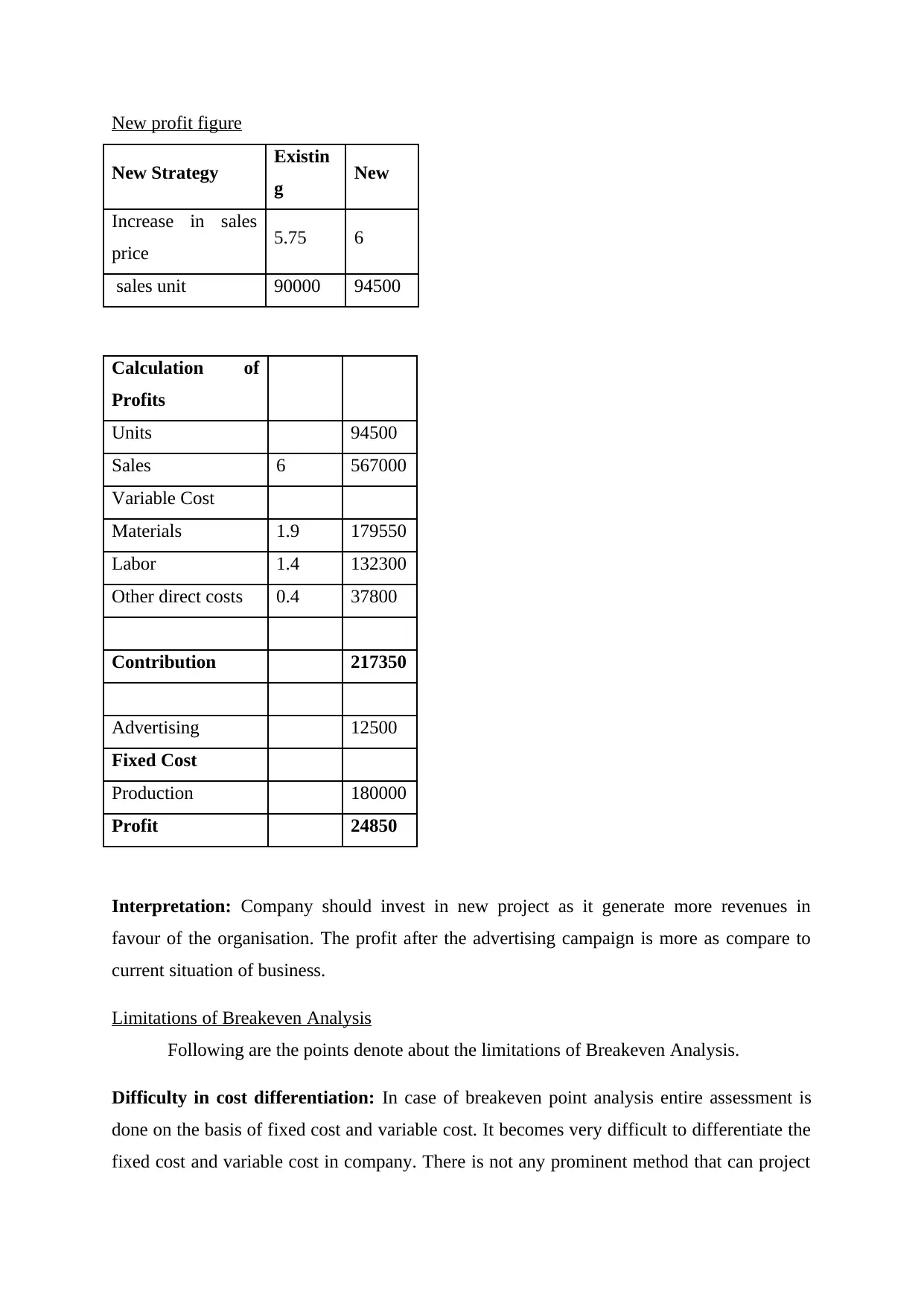

New profit figure

New Strategy Existin

g New

Increase in sales

price 5.75 6

sales unit 90000 94500

Calculation of

Profits

Units 94500

Sales 6 567000

Variable Cost

Materials 1.9 179550

Labor 1.4 132300

Other direct costs 0.4 37800

Contribution 217350

Advertising 12500

Fixed Cost

Production 180000

Profit 24850

Interpretation: Company should invest in new project as it generate more revenues in

favour of the organisation. The profit after the advertising campaign is more as compare to

current situation of business.

Limitations of Breakeven Analysis

Following are the points denote about the limitations of Breakeven Analysis.

Difficulty in cost differentiation: In case of breakeven point analysis entire assessment is

done on the basis of fixed cost and variable cost. It becomes very difficult to differentiate the

fixed cost and variable cost in company. There is not any prominent method that can project

New Strategy Existin

g New

Increase in sales

price 5.75 6

sales unit 90000 94500

Calculation of

Profits

Units 94500

Sales 6 567000

Variable Cost

Materials 1.9 179550

Labor 1.4 132300

Other direct costs 0.4 37800

Contribution 217350

Advertising 12500

Fixed Cost

Production 180000

Profit 24850

Interpretation: Company should invest in new project as it generate more revenues in

favour of the organisation. The profit after the advertising campaign is more as compare to

current situation of business.

Limitations of Breakeven Analysis

Following are the points denote about the limitations of Breakeven Analysis.

Difficulty in cost differentiation: In case of breakeven point analysis entire assessment is

done on the basis of fixed cost and variable cost. It becomes very difficult to differentiate the

fixed cost and variable cost in company. There is not any prominent method that can project

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

that the certain cost company has incurred is fixed in nature and certain cost that company

has entertained is variable in nature. This is the tough task to project a certain cost as fixed or

variable. Many times expenses only look fixed due to same amount every month company

need to bear but in general term they might be variable in nature.

Confusions in semi variable cost: Semi variable cost is such costs that are partially fixed in

nature and partially variable in nature. Semi variable cost always creates huge confusions in

the financial analyst as to weather a certain cost he must report as a fixed cost or a variable

cost. Due to any wrong and minor error the entire breakeven point in respect to company gets

change.

Valuation issue: Many times it becomes difficult to evaluate the values. This is also a

limitation attached with the breakeven analysis point. This is becomes very difficult to value

all variable cost in order to calculate the breakeven point.

The above mentioned limitations are some of the major limitations associated with the

breakeven analysis.

Question 2.

Significance of management accounting

Management accounting is accounting principles and code of conducts that are used

to project the financial statements of company. Management accounting is also denoted as

managerial accounting in professional term. In most of the cases managerial accounting is

only used by the internal team in organisation to make the business decisions in company.

The use of management accounting is only restricts towards making the suitable decision in

business based on the actual financial position of company (Granlund and Lukka, 2017). As

per the guidelines issued by Company Law every company requires to prepare the financial

statements as per the rules and guidelines issues in accounting standards to project the actual

financial position of company. Due to necessity of the preparation in financial statement

many companies do not prepare the use of management accounting as it is not mandatory. All

business decisions can also be taken by board of director on the basis of the regular financial

statement of company.

Techniques of Management Accounting

Following are the techniques used in management accounting.

has entertained is variable in nature. This is the tough task to project a certain cost as fixed or

variable. Many times expenses only look fixed due to same amount every month company

need to bear but in general term they might be variable in nature.

Confusions in semi variable cost: Semi variable cost is such costs that are partially fixed in

nature and partially variable in nature. Semi variable cost always creates huge confusions in

the financial analyst as to weather a certain cost he must report as a fixed cost or a variable

cost. Due to any wrong and minor error the entire breakeven point in respect to company gets

change.

Valuation issue: Many times it becomes difficult to evaluate the values. This is also a

limitation attached with the breakeven analysis point. This is becomes very difficult to value

all variable cost in order to calculate the breakeven point.

The above mentioned limitations are some of the major limitations associated with the

breakeven analysis.

Question 2.

Significance of management accounting

Management accounting is accounting principles and code of conducts that are used

to project the financial statements of company. Management accounting is also denoted as

managerial accounting in professional term. In most of the cases managerial accounting is

only used by the internal team in organisation to make the business decisions in company.

The use of management accounting is only restricts towards making the suitable decision in

business based on the actual financial position of company (Granlund and Lukka, 2017). As

per the guidelines issued by Company Law every company requires to prepare the financial

statements as per the rules and guidelines issues in accounting standards to project the actual

financial position of company. Due to necessity of the preparation in financial statement

many companies do not prepare the use of management accounting as it is not mandatory. All

business decisions can also be taken by board of director on the basis of the regular financial

statement of company.

Techniques of Management Accounting

Following are the techniques used in management accounting.

Margin analysis: Margin analysis is about to assess the incremental benefits company has

entertained from the increased production. This is an important analysis part of management

accounting which denotes the trade profit in respect to increased in production of company

(Johnstone, 2018). Company make the decisions in respect to improve the sales of company

on the basis of the margin analysis part of management accounting.

Trend analysis: Board of director in company analysis the current trend in respect to product

cost and unusual variances from such forecast values. This play a huge role in taking crucial

decision for the production in company’s business. Trend analysis allows company to control

cost of production in order to improve the profitability.

Capital Budgeting: Capital budgeting is a crucial technique part of the management

accounting. In order to take decision related to the capital expenditure company is planning to

entertain this technique of management accounting is used (Mahmoudian and et.al., 2020).

This technique guides company in taking the best investment decision for the future growth

of company.

Inventory valuation: Inventory valuation is all about identifying the actual cost incurred

with the production and inventory left at the end of financial year. This is an important

assessment part of management accounting which allows company to control the inventory

and also the cost control in producing the overall production of company.

The above mentioned techniques are the part of management accounting.

entertained from the increased production. This is an important analysis part of management

accounting which denotes the trade profit in respect to increased in production of company

(Johnstone, 2018). Company make the decisions in respect to improve the sales of company

on the basis of the margin analysis part of management accounting.

Trend analysis: Board of director in company analysis the current trend in respect to product

cost and unusual variances from such forecast values. This play a huge role in taking crucial

decision for the production in company’s business. Trend analysis allows company to control

cost of production in order to improve the profitability.

Capital Budgeting: Capital budgeting is a crucial technique part of the management

accounting. In order to take decision related to the capital expenditure company is planning to

entertain this technique of management accounting is used (Mahmoudian and et.al., 2020).

This technique guides company in taking the best investment decision for the future growth

of company.

Inventory valuation: Inventory valuation is all about identifying the actual cost incurred

with the production and inventory left at the end of financial year. This is an important

assessment part of management accounting which allows company to control the inventory

and also the cost control in producing the overall production of company.

The above mentioned techniques are the part of management accounting.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Granlund, M. and Lukka, K., 2017. Investigating highly established research paradigms:

Reviving contextuality in contingency theory based management accounting

research. Critical Perspectives on Accounting. 45. pp.63-80.

Johnstone, L., 2018. Theorising and modelling social control in environmental management

accounting research. Social and Environmental Accountability Journal. 38(1).

pp.30-48.

Mahmoudian, F. and et.al., 2020. Inter-and intra-organizational stakeholder arrangements in

carbon management accounting. The British Accounting Review, p.100933.

Books and Journals

Granlund, M. and Lukka, K., 2017. Investigating highly established research paradigms:

Reviving contextuality in contingency theory based management accounting

research. Critical Perspectives on Accounting. 45. pp.63-80.

Johnstone, L., 2018. Theorising and modelling social control in environmental management

accounting research. Social and Environmental Accountability Journal. 38(1).

pp.30-48.

Mahmoudian, F. and et.al., 2020. Inter-and intra-organizational stakeholder arrangements in

carbon management accounting. The British Accounting Review, p.100933.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.