Online Library for Study Material with Solved Assignments - Desklib

VerifiedAdded on 2023/06/11

|12

|2383

|286

AI Summary

This content provides a brief explanation of different types of business organizations, six main users of accounting information, journal entries in the books of David, general ledger of Kelvin Co, trial balance as at 30 Sep 2021, and income statement in the books of S. Brown as at 30th December 2021.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Resit project A1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

PART 1............................................................................................................................................3

a. Brief Explanation of Different Types of Business Organizations...........................................3

b. Six main users of accounting information...............................................................................4

Part 2................................................................................................................................................5

Journal Entries in the books of David..........................................................................................5

Part 3................................................................................................................................................6

a. General Ledger of Kelvin Co...................................................................................................6

b. Trial Balance as at 30 Sep 2021............................................................................................10

Part 4..............................................................................................................................................10

Income Statement in the books of S. Brown as at 30th December 2021....................................10

REFERENCES................................................................................................................................1

PART 1............................................................................................................................................3

a. Brief Explanation of Different Types of Business Organizations...........................................3

b. Six main users of accounting information...............................................................................4

Part 2................................................................................................................................................5

Journal Entries in the books of David..........................................................................................5

Part 3................................................................................................................................................6

a. General Ledger of Kelvin Co...................................................................................................6

b. Trial Balance as at 30 Sep 2021............................................................................................10

Part 4..............................................................................................................................................10

Income Statement in the books of S. Brown as at 30th December 2021....................................10

REFERENCES................................................................................................................................1

PART 1

a. Brief Explanation of Different Types of Business Organizations

Sole Proprietorship

This is the simplest form of business and easiest to register. The sole proprietor or sole

trader needs to register the business self-run by himself with HMRC. The owner of the sole

proprietorship is entitled to all the profits and liable for payments of tax and national insurance.

This is done by filling up of Self-Assessment tax return (Meiryani, Heykal and Wahyuningtias,

2020). There is no limit regarding the earnings of the sole trader. However, the high amount of

earnings is associated with low tax efficiency due to higher tax brackets. A sole proprietor is

liable for all the liabilities inclusive of all the personal assets along with jointly owned assets.

Partnership

In a partnership form of business two or more individual persons come together to form

an association sharing the profits and losses together. All the risks, costs, pros and

responsibilities that are involved in running of a business are shared together. In a partnership

one partner works for all and results of the carelessness of one partner is suffered by all. There is

an agreed share of each partner in which all the profits and losses are distributed and each partner

pays tax for their share of profit.

Limited Liability Partnership

This kind of business form is similar to the partnership form of business the only

difference is that the liability of partners is limited. Partners are liable to the extent of amount

capital invested by them. A limited liability partnership must be registered with the Companies

house and HMRC. The accounts are also prepared and filed annually. Minimum number of

partners required for the formation of limited liability are two. The LLP agreement states the

responsibilities and profit sharing ratio among all the partners (Safkaur and et.al, 2021). Partners

of a LLP are required to compulsorily submit self-assessment tax every and pay the share of their

income tax on the profits and also national insurance payment to HMRC.

Limited Company

Limited company is a form of business that is privately managed, the shareholders are the

owners and directors are the managers of the business. The company has its own legal rights as

per the constitution and obligations, it is a separate legal entity. For every actions of the company

it is responsible and the finances of the company are different from the personal assets of the

a. Brief Explanation of Different Types of Business Organizations

Sole Proprietorship

This is the simplest form of business and easiest to register. The sole proprietor or sole

trader needs to register the business self-run by himself with HMRC. The owner of the sole

proprietorship is entitled to all the profits and liable for payments of tax and national insurance.

This is done by filling up of Self-Assessment tax return (Meiryani, Heykal and Wahyuningtias,

2020). There is no limit regarding the earnings of the sole trader. However, the high amount of

earnings is associated with low tax efficiency due to higher tax brackets. A sole proprietor is

liable for all the liabilities inclusive of all the personal assets along with jointly owned assets.

Partnership

In a partnership form of business two or more individual persons come together to form

an association sharing the profits and losses together. All the risks, costs, pros and

responsibilities that are involved in running of a business are shared together. In a partnership

one partner works for all and results of the carelessness of one partner is suffered by all. There is

an agreed share of each partner in which all the profits and losses are distributed and each partner

pays tax for their share of profit.

Limited Liability Partnership

This kind of business form is similar to the partnership form of business the only

difference is that the liability of partners is limited. Partners are liable to the extent of amount

capital invested by them. A limited liability partnership must be registered with the Companies

house and HMRC. The accounts are also prepared and filed annually. Minimum number of

partners required for the formation of limited liability are two. The LLP agreement states the

responsibilities and profit sharing ratio among all the partners (Safkaur and et.al, 2021). Partners

of a LLP are required to compulsorily submit self-assessment tax every and pay the share of their

income tax on the profits and also national insurance payment to HMRC.

Limited Company

Limited company is a form of business that is privately managed, the shareholders are the

owners and directors are the managers of the business. The company has its own legal rights as

per the constitution and obligations, it is a separate legal entity. For every actions of the company

it is responsible and the finances of the company are different from the personal assets of the

owners (Voskanyan and et.al., 2021). After the payments of the corporation tax the excess profits

are retained within the organization. Limited by shares or limited by guarantee are the two types

of limited companies. The limited companies are required to make annual reports and also file

them with Companies House and HMRC.

b. Six main users of accounting information

Significant amount of accounting information is provided by the financial reports that are used

by the wide range of individuals for different purposes. The users of financial information can be

both internal or external. The people that are within the organizations and uses the financial

information are known as internal user of accounting information. The users that are outside the

business organization using the accounting information are known as the external users of

accounting information. Below are some of the main internal and external users of accounting

information:

Internal Users

Owners and Stockholders: Accounting information is used by the owners and stockholders of

the organization to assess whether the business entity has earned an income amount that is

satisfactory out of the amount of money that has been invested by them. This forms their

decision regarding whether the money should be invested in the company or not (Dube, Van Eck

and Zuva, 2020). They get to know the answers regarding the existing investment has increased,

decreased or retained within the company at same levels. Important capital investment decisions

require the deep study of financial statements and analyse the potential impact of the capital

investment over the business function.

Directors and Managers: The day to day activities of the business are managed by the managers

of the organization. A variety of managerial functions are performed by the managers. These

functions include planning, forming of strategies, keeping control over the organizational

activities and administering and directing the human resource of the organization. Financial and

economic framework of the are related with these functions. Managers and directors use the

financial statements for getting accounting information that is essential for performance of these

activities. The workings of the organization determine whether the set objectives will be

achieved or not. Directors and managers use accounting information for directing the activities

within the organization towards achieving the objectives.

are retained within the organization. Limited by shares or limited by guarantee are the two types

of limited companies. The limited companies are required to make annual reports and also file

them with Companies House and HMRC.

b. Six main users of accounting information

Significant amount of accounting information is provided by the financial reports that are used

by the wide range of individuals for different purposes. The users of financial information can be

both internal or external. The people that are within the organizations and uses the financial

information are known as internal user of accounting information. The users that are outside the

business organization using the accounting information are known as the external users of

accounting information. Below are some of the main internal and external users of accounting

information:

Internal Users

Owners and Stockholders: Accounting information is used by the owners and stockholders of

the organization to assess whether the business entity has earned an income amount that is

satisfactory out of the amount of money that has been invested by them. This forms their

decision regarding whether the money should be invested in the company or not (Dube, Van Eck

and Zuva, 2020). They get to know the answers regarding the existing investment has increased,

decreased or retained within the company at same levels. Important capital investment decisions

require the deep study of financial statements and analyse the potential impact of the capital

investment over the business function.

Directors and Managers: The day to day activities of the business are managed by the managers

of the organization. A variety of managerial functions are performed by the managers. These

functions include planning, forming of strategies, keeping control over the organizational

activities and administering and directing the human resource of the organization. Financial and

economic framework of the are related with these functions. Managers and directors use the

financial statements for getting accounting information that is essential for performance of these

activities. The workings of the organization determine whether the set objectives will be

achieved or not. Directors and managers use accounting information for directing the activities

within the organization towards achieving the objectives.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

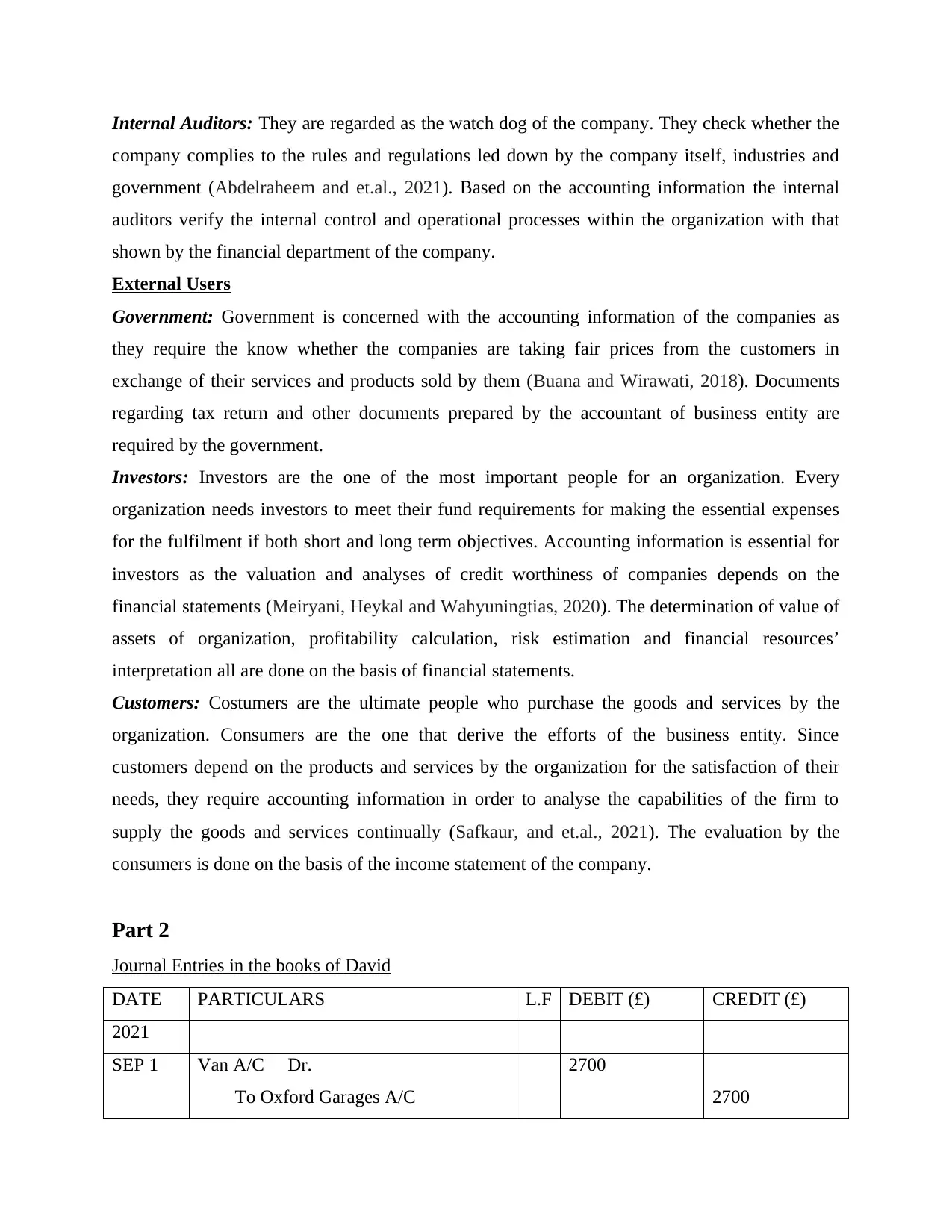

Internal Auditors: They are regarded as the watch dog of the company. They check whether the

company complies to the rules and regulations led down by the company itself, industries and

government (Abdelraheem and et.al., 2021). Based on the accounting information the internal

auditors verify the internal control and operational processes within the organization with that

shown by the financial department of the company.

External Users

Government: Government is concerned with the accounting information of the companies as

they require the know whether the companies are taking fair prices from the customers in

exchange of their services and products sold by them (Buana and Wirawati, 2018). Documents

regarding tax return and other documents prepared by the accountant of business entity are

required by the government.

Investors: Investors are the one of the most important people for an organization. Every

organization needs investors to meet their fund requirements for making the essential expenses

for the fulfilment if both short and long term objectives. Accounting information is essential for

investors as the valuation and analyses of credit worthiness of companies depends on the

financial statements (Meiryani, Heykal and Wahyuningtias, 2020). The determination of value of

assets of organization, profitability calculation, risk estimation and financial resources’

interpretation all are done on the basis of financial statements.

Customers: Costumers are the ultimate people who purchase the goods and services by the

organization. Consumers are the one that derive the efforts of the business entity. Since

customers depend on the products and services by the organization for the satisfaction of their

needs, they require accounting information in order to analyse the capabilities of the firm to

supply the goods and services continually (Safkaur, and et.al., 2021). The evaluation by the

consumers is done on the basis of the income statement of the company.

Part 2

Journal Entries in the books of David

DATE PARTICULARS L.F DEBIT (£) CREDIT (£)

2021

SEP 1 Van A/C Dr.

To Oxford Garages A/C

2700

2700

company complies to the rules and regulations led down by the company itself, industries and

government (Abdelraheem and et.al., 2021). Based on the accounting information the internal

auditors verify the internal control and operational processes within the organization with that

shown by the financial department of the company.

External Users

Government: Government is concerned with the accounting information of the companies as

they require the know whether the companies are taking fair prices from the customers in

exchange of their services and products sold by them (Buana and Wirawati, 2018). Documents

regarding tax return and other documents prepared by the accountant of business entity are

required by the government.

Investors: Investors are the one of the most important people for an organization. Every

organization needs investors to meet their fund requirements for making the essential expenses

for the fulfilment if both short and long term objectives. Accounting information is essential for

investors as the valuation and analyses of credit worthiness of companies depends on the

financial statements (Meiryani, Heykal and Wahyuningtias, 2020). The determination of value of

assets of organization, profitability calculation, risk estimation and financial resources’

interpretation all are done on the basis of financial statements.

Customers: Costumers are the ultimate people who purchase the goods and services by the

organization. Consumers are the one that derive the efforts of the business entity. Since

customers depend on the products and services by the organization for the satisfaction of their

needs, they require accounting information in order to analyse the capabilities of the firm to

supply the goods and services continually (Safkaur, and et.al., 2021). The evaluation by the

consumers is done on the basis of the income statement of the company.

Part 2

Journal Entries in the books of David

DATE PARTICULARS L.F DEBIT (£) CREDIT (£)

2021

SEP 1 Van A/C Dr.

To Oxford Garages A/C

2700

2700

(Being van on credit from Oxford

Garages)

SEP 3 Bad Debts A/C Dr

To K. Green A/C

(Being bad debts written off)

70

70

SEP 8 Cash A/C Dr

To Office Fixtures A/C

(Being previously bought office fixtures

returned for being unsuitable for use)

400

400

SEP 12 Bad debt A/C Dr

Cash A/C Dr

To Q Hanson A/C

(Being part amount owned by Q Hanson

received in full settlement)

60

100

160

SEP 14 Drawings A/C Dr

To Sales A/C

(Being goods taken by the owner)

100

100

SEP 28 Drawings A/C Dr

To Insurance paid A/C

(Being personal house insurance amount

paid by owner)

80

80

SEP 28 Machinery A/C Dr

To Electronics R Us A/C

720

720

4230 4230

Part 3

a. General Ledger of Kelvin Co.

Journal Entries

DATE PARTICULARS L.F DEBIT (£) CREDIT (£)

2021

Garages)

SEP 3 Bad Debts A/C Dr

To K. Green A/C

(Being bad debts written off)

70

70

SEP 8 Cash A/C Dr

To Office Fixtures A/C

(Being previously bought office fixtures

returned for being unsuitable for use)

400

400

SEP 12 Bad debt A/C Dr

Cash A/C Dr

To Q Hanson A/C

(Being part amount owned by Q Hanson

received in full settlement)

60

100

160

SEP 14 Drawings A/C Dr

To Sales A/C

(Being goods taken by the owner)

100

100

SEP 28 Drawings A/C Dr

To Insurance paid A/C

(Being personal house insurance amount

paid by owner)

80

80

SEP 28 Machinery A/C Dr

To Electronics R Us A/C

720

720

4230 4230

Part 3

a. General Ledger of Kelvin Co.

Journal Entries

DATE PARTICULARS L.F DEBIT (£) CREDIT (£)

2021

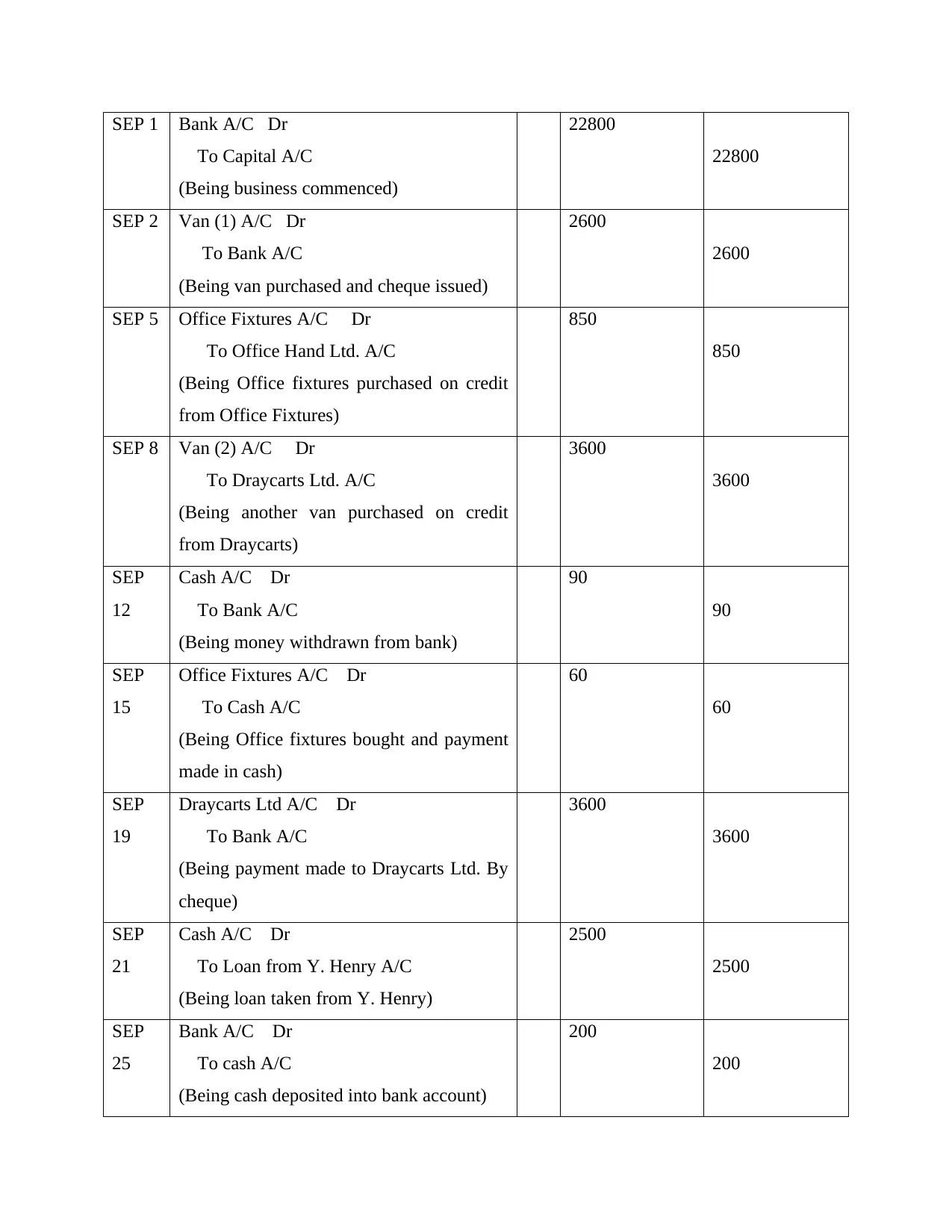

SEP 1 Bank A/C Dr

To Capital A/C

(Being business commenced)

22800

22800

SEP 2 Van (1) A/C Dr

To Bank A/C

(Being van purchased and cheque issued)

2600

2600

SEP 5 Office Fixtures A/C Dr

To Office Hand Ltd. A/C

(Being Office fixtures purchased on credit

from Office Fixtures)

850

850

SEP 8 Van (2) A/C Dr

To Draycarts Ltd. A/C

(Being another van purchased on credit

from Draycarts)

3600

3600

SEP

12

Cash A/C Dr

To Bank A/C

(Being money withdrawn from bank)

90

90

SEP

15

Office Fixtures A/C Dr

To Cash A/C

(Being Office fixtures bought and payment

made in cash)

60

60

SEP

19

Draycarts Ltd A/C Dr

To Bank A/C

(Being payment made to Draycarts Ltd. By

cheque)

3600

3600

SEP

21

Cash A/C Dr

To Loan from Y. Henry A/C

(Being loan taken from Y. Henry)

2500

2500

SEP

25

Bank A/C Dr

To cash A/C

(Being cash deposited into bank account)

200

200

To Capital A/C

(Being business commenced)

22800

22800

SEP 2 Van (1) A/C Dr

To Bank A/C

(Being van purchased and cheque issued)

2600

2600

SEP 5 Office Fixtures A/C Dr

To Office Hand Ltd. A/C

(Being Office fixtures purchased on credit

from Office Fixtures)

850

850

SEP 8 Van (2) A/C Dr

To Draycarts Ltd. A/C

(Being another van purchased on credit

from Draycarts)

3600

3600

SEP

12

Cash A/C Dr

To Bank A/C

(Being money withdrawn from bank)

90

90

SEP

15

Office Fixtures A/C Dr

To Cash A/C

(Being Office fixtures bought and payment

made in cash)

60

60

SEP

19

Draycarts Ltd A/C Dr

To Bank A/C

(Being payment made to Draycarts Ltd. By

cheque)

3600

3600

SEP

21

Cash A/C Dr

To Loan from Y. Henry A/C

(Being loan taken from Y. Henry)

2500

2500

SEP

25

Bank A/C Dr

To cash A/C

(Being cash deposited into bank account)

200

200

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

SEP

30

Office Fixtures A/C Dr

To Bank A/C

(Being office fixtures purchased against

cheque payment)

340

340

36640 36640

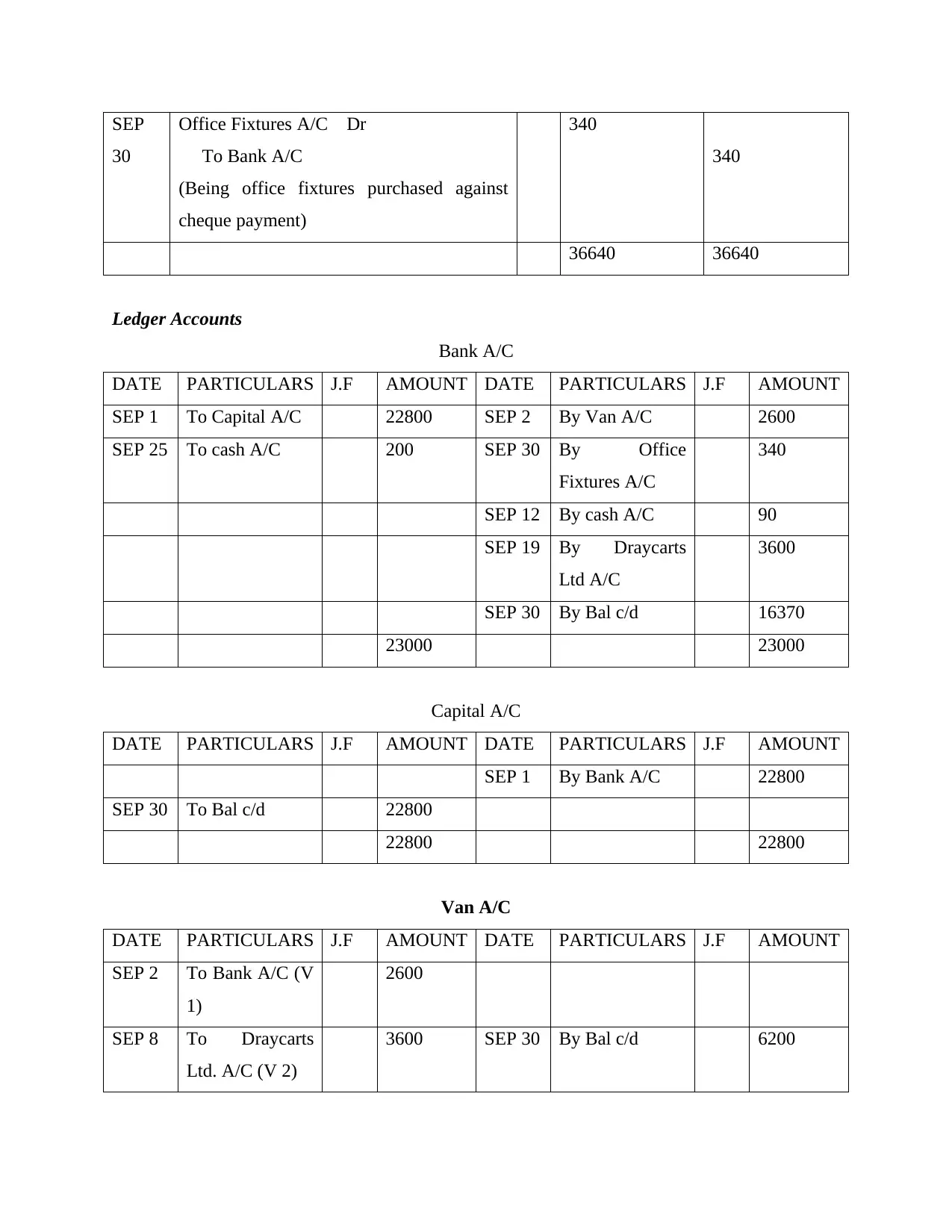

Ledger Accounts

Bank A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 1 To Capital A/C 22800 SEP 2 By Van A/C 2600

SEP 25 To cash A/C 200 SEP 30 By Office

Fixtures A/C

340

SEP 12 By cash A/C 90

SEP 19 By Draycarts

Ltd A/C

3600

SEP 30 By Bal c/d 16370

23000 23000

Capital A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 1 By Bank A/C 22800

SEP 30 To Bal c/d 22800

22800 22800

Van A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 2 To Bank A/C (V

1)

2600

SEP 8 To Draycarts

Ltd. A/C (V 2)

3600 SEP 30 By Bal c/d 6200

30

Office Fixtures A/C Dr

To Bank A/C

(Being office fixtures purchased against

cheque payment)

340

340

36640 36640

Ledger Accounts

Bank A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 1 To Capital A/C 22800 SEP 2 By Van A/C 2600

SEP 25 To cash A/C 200 SEP 30 By Office

Fixtures A/C

340

SEP 12 By cash A/C 90

SEP 19 By Draycarts

Ltd A/C

3600

SEP 30 By Bal c/d 16370

23000 23000

Capital A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 1 By Bank A/C 22800

SEP 30 To Bal c/d 22800

22800 22800

Van A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 2 To Bank A/C (V

1)

2600

SEP 8 To Draycarts

Ltd. A/C (V 2)

3600 SEP 30 By Bal c/d 6200

6200 6200

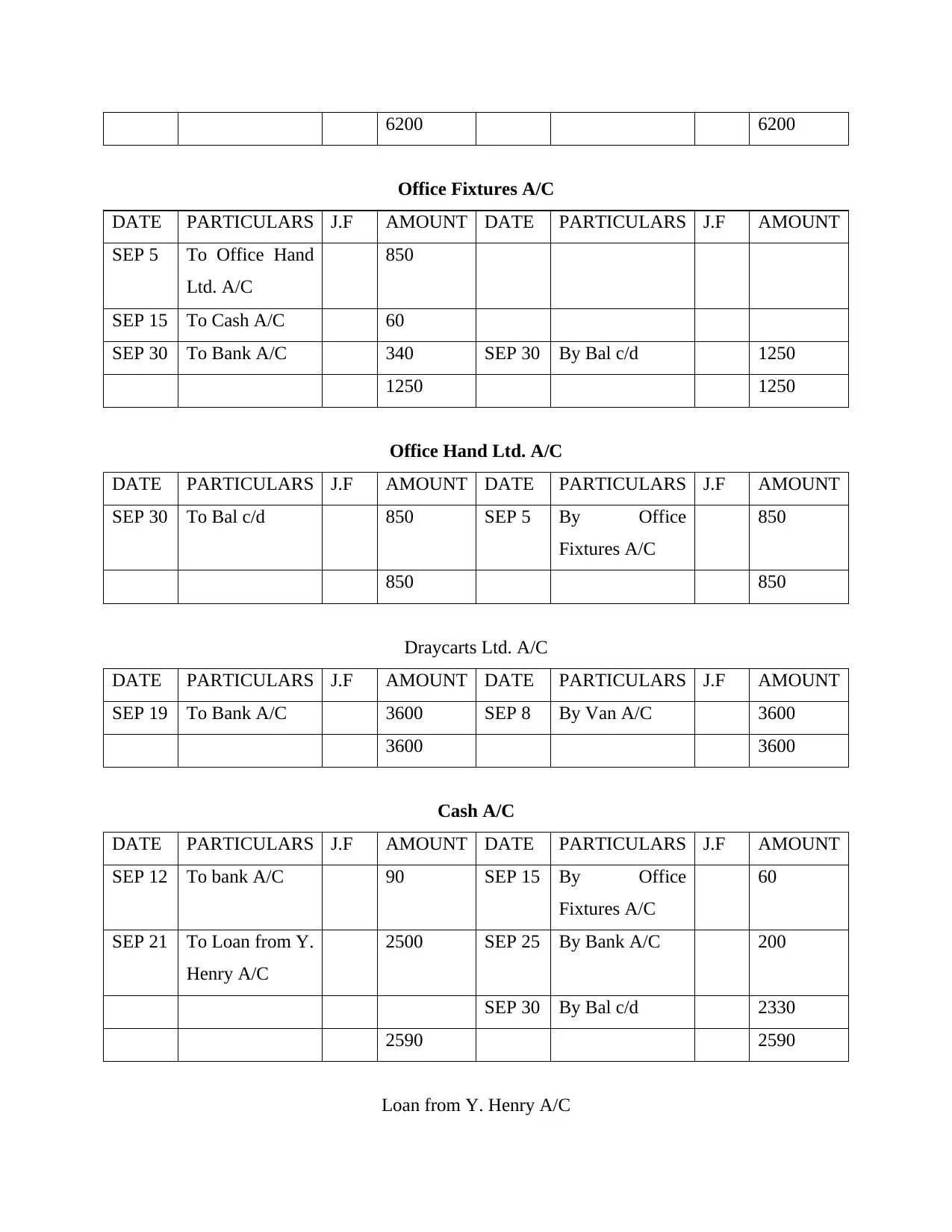

Office Fixtures A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 5 To Office Hand

Ltd. A/C

850

SEP 15 To Cash A/C 60

SEP 30 To Bank A/C 340 SEP 30 By Bal c/d 1250

1250 1250

Office Hand Ltd. A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 30 To Bal c/d 850 SEP 5 By Office

Fixtures A/C

850

850 850

Draycarts Ltd. A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 19 To Bank A/C 3600 SEP 8 By Van A/C 3600

3600 3600

Cash A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 12 To bank A/C 90 SEP 15 By Office

Fixtures A/C

60

SEP 21 To Loan from Y.

Henry A/C

2500 SEP 25 By Bank A/C 200

SEP 30 By Bal c/d 2330

2590 2590

Loan from Y. Henry A/C

Office Fixtures A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 5 To Office Hand

Ltd. A/C

850

SEP 15 To Cash A/C 60

SEP 30 To Bank A/C 340 SEP 30 By Bal c/d 1250

1250 1250

Office Hand Ltd. A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 30 To Bal c/d 850 SEP 5 By Office

Fixtures A/C

850

850 850

Draycarts Ltd. A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 19 To Bank A/C 3600 SEP 8 By Van A/C 3600

3600 3600

Cash A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 12 To bank A/C 90 SEP 15 By Office

Fixtures A/C

60

SEP 21 To Loan from Y.

Henry A/C

2500 SEP 25 By Bank A/C 200

SEP 30 By Bal c/d 2330

2590 2590

Loan from Y. Henry A/C

DATE PARTICULARS J.F AMOUNT DATE PARTICULARS J.F AMOUNT

SEP 30 To Bal c/d 2500 SEP 21 By Cash A/C 2500

2500 2500

b. Trial Balance as at 30 Sep 2021

PARTICULARS DEBIT (£) CREDIT (£)

Bank A/C 16370

Capital A/C 22800

Van A/C 6200

Office Fixtures A/C 1250

Office Hand Ltd. A/C 850

Cash A/C 2330

Loan from Y. Henry A/C 2500

Total 26150 26150

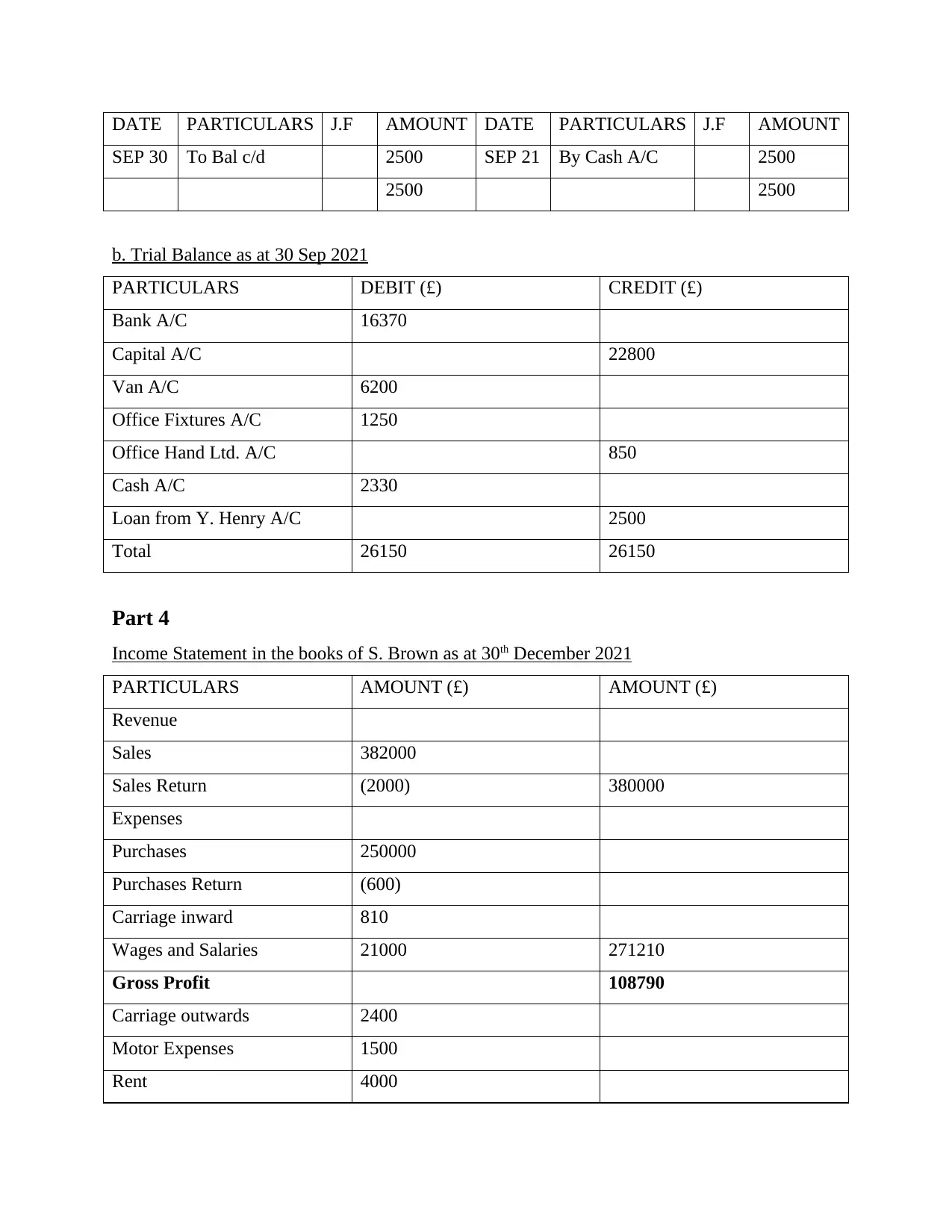

Part 4

Income Statement in the books of S. Brown as at 30th December 2021

PARTICULARS AMOUNT (£) AMOUNT (£)

Revenue

Sales 382000

Sales Return (2000) 380000

Expenses

Purchases 250000

Purchases Return (600)

Carriage inward 810

Wages and Salaries 21000 271210

Gross Profit 108790

Carriage outwards 2400

Motor Expenses 1500

Rent 4000

SEP 30 To Bal c/d 2500 SEP 21 By Cash A/C 2500

2500 2500

b. Trial Balance as at 30 Sep 2021

PARTICULARS DEBIT (£) CREDIT (£)

Bank A/C 16370

Capital A/C 22800

Van A/C 6200

Office Fixtures A/C 1250

Office Hand Ltd. A/C 850

Cash A/C 2330

Loan from Y. Henry A/C 2500

Total 26150 26150

Part 4

Income Statement in the books of S. Brown as at 30th December 2021

PARTICULARS AMOUNT (£) AMOUNT (£)

Revenue

Sales 382000

Sales Return (2000) 380000

Expenses

Purchases 250000

Purchases Return (600)

Carriage inward 810

Wages and Salaries 21000 271210

Gross Profit 108790

Carriage outwards 2400

Motor Expenses 1500

Rent 4000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

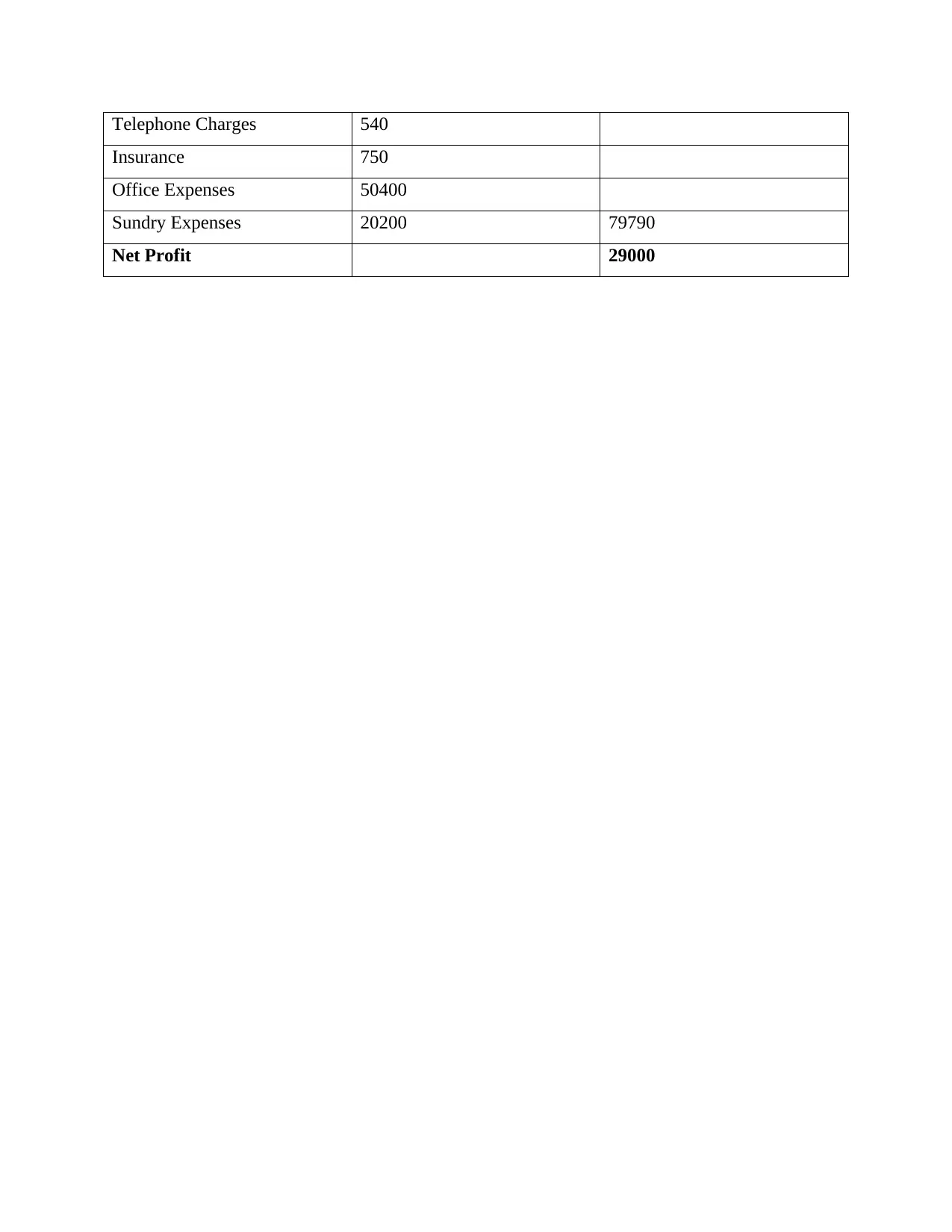

Telephone Charges 540

Insurance 750

Office Expenses 50400

Sundry Expenses 20200 79790

Net Profit 29000

Insurance 750

Office Expenses 50400

Sundry Expenses 20200 79790

Net Profit 29000

REFERENCES

Abdelraheem, A. and et.al., 2021. The effect of information technology on the quality of

accounting information. Accounting. 7(1). pp.191-196.

Buana, I. B. G. M. M. and Wirawati, N. G. P., 2018. Influence Quality of Information System,

Quality of Information, And Perceived Usefulness On User Accounting Information

System Satisfaction. E-Jurnal Akuntansi. 22(1). pp.683-713.

Dube, T., Van Eck, R. and Zuva, T., 2020. Review of technology adoption models and theories

to measure readiness and acceptable use of technology in a business organization. Journal

of Information Technology. 2(04). pp.207-212.

Meiryani, Y. L., Heykal, M. and Wahyuningtias, D., 2020. Usefulness of Accounting

Information Systems for Businesses. Systematic Reviews in Pharmacy. 11(12). pp.2054-

2058.

Negron, A. and Alberto, J. E., 2019. The Four-Legged Bird That Barks and Has a Tail: The"

New" Puerto Rico Inter Vivos Trust, Another Type of Business Organization?. Rev. Jur.

UPR. 88. p.498.

Safkaur, O. and et.al., 2021. The Role of Accounting Information System Afflication In

Reliability Financial Reporting. Ilomata International Journal of Tax and

Accounting. 2(1). pp.97-112.

Voskanyan, Y. and et.al., 2021, June. A Strategic Model of a Medical Organization in the

Context of Cognitive Transformation of the World. In International Conference on

Comprehensible Science (pp. 426-437). Springer, Cham.

Yembergenov, R. and Zharylkasinova, М., 2019. Management accounting in the restaurant

business: organization methodology. Entrepreneurship and Sustainability Issues. 7(2).

pp.1542-1554.

1

Abdelraheem, A. and et.al., 2021. The effect of information technology on the quality of

accounting information. Accounting. 7(1). pp.191-196.

Buana, I. B. G. M. M. and Wirawati, N. G. P., 2018. Influence Quality of Information System,

Quality of Information, And Perceived Usefulness On User Accounting Information

System Satisfaction. E-Jurnal Akuntansi. 22(1). pp.683-713.

Dube, T., Van Eck, R. and Zuva, T., 2020. Review of technology adoption models and theories

to measure readiness and acceptable use of technology in a business organization. Journal

of Information Technology. 2(04). pp.207-212.

Meiryani, Y. L., Heykal, M. and Wahyuningtias, D., 2020. Usefulness of Accounting

Information Systems for Businesses. Systematic Reviews in Pharmacy. 11(12). pp.2054-

2058.

Negron, A. and Alberto, J. E., 2019. The Four-Legged Bird That Barks and Has a Tail: The"

New" Puerto Rico Inter Vivos Trust, Another Type of Business Organization?. Rev. Jur.

UPR. 88. p.498.

Safkaur, O. and et.al., 2021. The Role of Accounting Information System Afflication In

Reliability Financial Reporting. Ilomata International Journal of Tax and

Accounting. 2(1). pp.97-112.

Voskanyan, Y. and et.al., 2021, June. A Strategic Model of a Medical Organization in the

Context of Cognitive Transformation of the World. In International Conference on

Comprehensible Science (pp. 426-437). Springer, Cham.

Yembergenov, R. and Zharylkasinova, М., 2019. Management accounting in the restaurant

business: organization methodology. Entrepreneurship and Sustainability Issues. 7(2).

pp.1542-1554.

1

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.