Accounting Solutions: Income Tax, Journal Entries, Financial Leases

VerifiedAdded on 2023/06/18

|11

|1223

|281

Homework Assignment

AI Summary

This accounting assignment solution provides detailed answers to various accounting problems. It includes calculating income tax, preparing journal entries for intragroup sales, unrealized profits, and deferred tax assets. It also covers the creation of a consolidation worksheet, including eliminations for intragroup transactions. Furthermore, the solution addresses the calculation of capital gains, income tax liabilities, and the accounting treatment for financial leases, including the present value calculation and lease payment schedule. Finally, it discusses the accounting standard for proposed dividends and their treatment as contingent liabilities. Desklib offers this and many other solved assignments for students.

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Question 1...................................................................................................................................3

Question 3...................................................................................................................................3

Question 4...................................................................................................................................8

Question 5...................................................................................................................................9

Question 6.................................................................................................................................10

Question 7.................................................................................................................................10

Question 8.................................................................................................................................11

Question 1...................................................................................................................................3

Question 3...................................................................................................................................3

Question 4...................................................................................................................................8

Question 5...................................................................................................................................9

Question 6.................................................................................................................................10

Question 7.................................................................................................................................10

Question 8.................................................................................................................................11

Question 1

Q1(a).

The main objectives of income tax are to record the amount of income taxes payable or

refundable for the current financial year and to recognize the deferred tax assets and liabilities

for the future tax circumstances of events that had been recorded in the company's financial

statements or tax returns.

Q1(b)

Principle state the fact that every expense belong to the current financial year must be

recorded under the books of accounts of the organisation. The current tax liability should be

recognised as a tax payable which further be paid by the company on due date. The tax liability

must be deducted from the current year profit of the company as this is an existing obligation

require to be paid by the organisation. The principle of reporting the tax liability in books of

accounts meet the objective related to accounting.

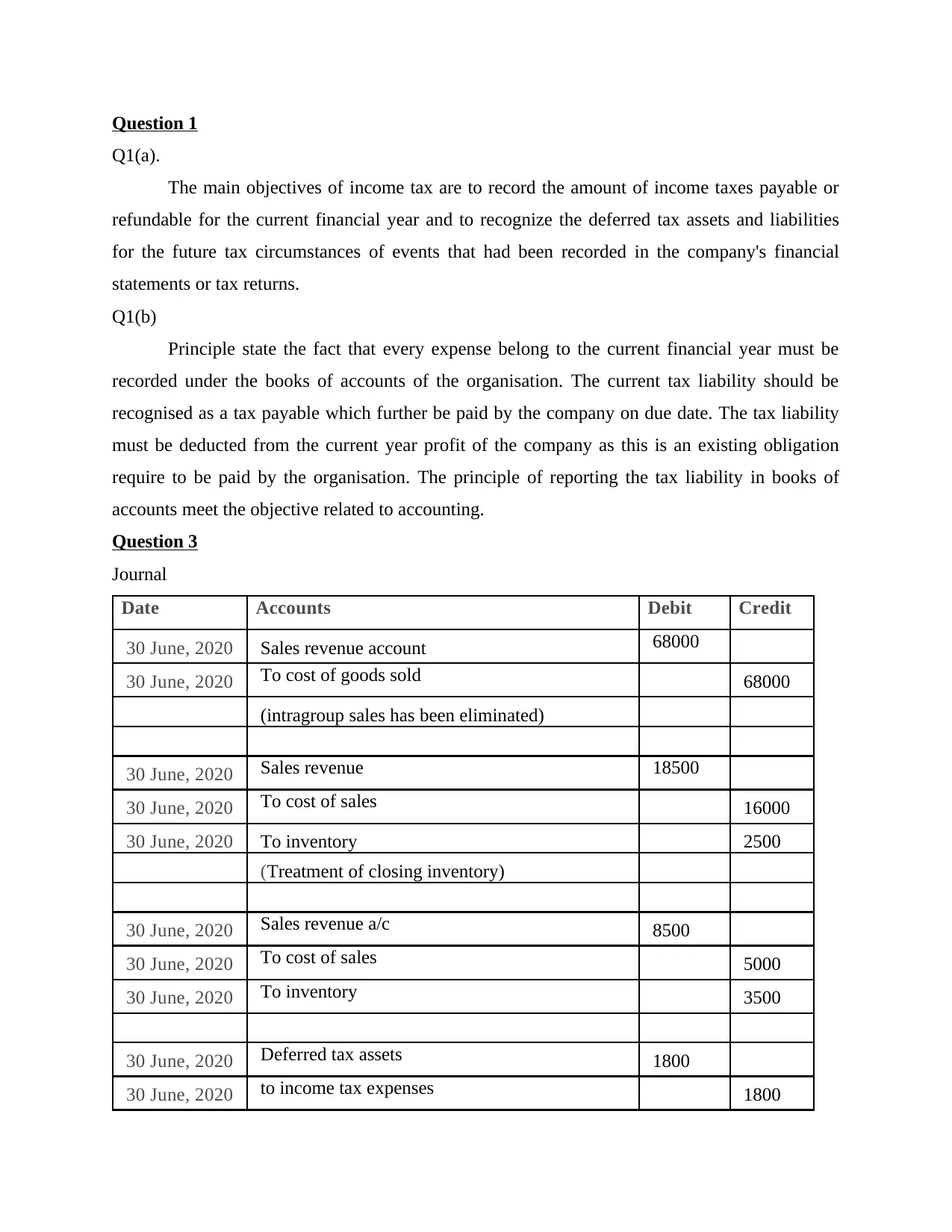

Question 3

Journal

Date Accounts Debit Credit

30 June, 2020 Sales revenue account 68000

30 June, 2020 To cost of goods sold 68000

(intragroup sales has been eliminated)

30 June, 2020 Sales revenue 18500

30 June, 2020 To cost of sales 16000

30 June, 2020 To inventory 2500

(Treatment of closing inventory)

30 June, 2020 Sales revenue a/c 8500

30 June, 2020 To cost of sales 5000

30 June, 2020 To inventory 3500

30 June, 2020 Deferred tax assets 1800

30 June, 2020 to income tax expenses 1800

Q1(a).

The main objectives of income tax are to record the amount of income taxes payable or

refundable for the current financial year and to recognize the deferred tax assets and liabilities

for the future tax circumstances of events that had been recorded in the company's financial

statements or tax returns.

Q1(b)

Principle state the fact that every expense belong to the current financial year must be

recorded under the books of accounts of the organisation. The current tax liability should be

recognised as a tax payable which further be paid by the company on due date. The tax liability

must be deducted from the current year profit of the company as this is an existing obligation

require to be paid by the organisation. The principle of reporting the tax liability in books of

accounts meet the objective related to accounting.

Question 3

Journal

Date Accounts Debit Credit

30 June, 2020 Sales revenue account 68000

30 June, 2020 To cost of goods sold 68000

(intragroup sales has been eliminated)

30 June, 2020 Sales revenue 18500

30 June, 2020 To cost of sales 16000

30 June, 2020 To inventory 2500

(Treatment of closing inventory)

30 June, 2020 Sales revenue a/c 8500

30 June, 2020 To cost of sales 5000

30 June, 2020 To inventory 3500

30 June, 2020 Deferred tax assets 1800

30 June, 2020 to income tax expenses 1800

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

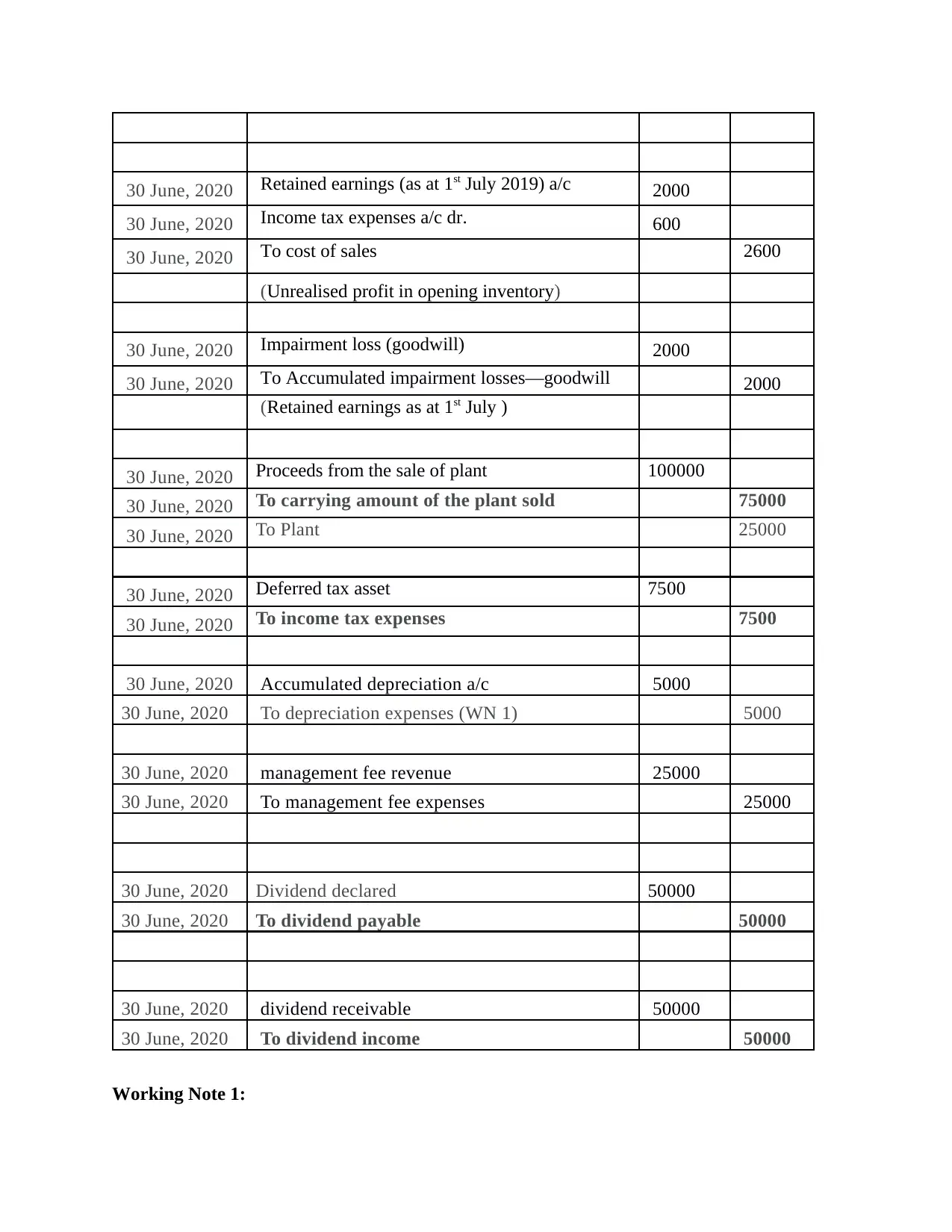

30 June, 2020 Retained earnings (as at 1st July 2019) a/c 2000

30 June, 2020 Income tax expenses a/c dr. 600

30 June, 2020 To cost of sales 2600

(Unrealised profit in opening inventory)

30 June, 2020 Impairment loss (goodwill) 2000

30 June, 2020 To Accumulated impairment losses—goodwill 2000

(Retained earnings as at 1st July )

30 June, 2020 Proceeds from the sale of plant 100000

30 June, 2020 To carrying amount of the plant sold 75000

30 June, 2020 To Plant 25000

30 June, 2020 Deferred tax asset 7500

30 June, 2020 To income tax expenses 7500

30 June, 2020 Accumulated depreciation a/c 5000

30 June, 2020 To depreciation expenses (WN 1) 5000

30 June, 2020 management fee revenue 25000

30 June, 2020 To management fee expenses 25000

30 June, 2020 Dividend declared 50000

30 June, 2020 To dividend payable 50000

30 June, 2020 dividend receivable 50000

30 June, 2020 To dividend income 50000

Working Note 1:

30 June, 2020 Income tax expenses a/c dr. 600

30 June, 2020 To cost of sales 2600

(Unrealised profit in opening inventory)

30 June, 2020 Impairment loss (goodwill) 2000

30 June, 2020 To Accumulated impairment losses—goodwill 2000

(Retained earnings as at 1st July )

30 June, 2020 Proceeds from the sale of plant 100000

30 June, 2020 To carrying amount of the plant sold 75000

30 June, 2020 To Plant 25000

30 June, 2020 Deferred tax asset 7500

30 June, 2020 To income tax expenses 7500

30 June, 2020 Accumulated depreciation a/c 5000

30 June, 2020 To depreciation expenses (WN 1) 5000

30 June, 2020 management fee revenue 25000

30 June, 2020 To management fee expenses 25000

30 June, 2020 Dividend declared 50000

30 June, 2020 To dividend payable 50000

30 June, 2020 dividend receivable 50000

30 June, 2020 To dividend income 50000

Working Note 1:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Adjustment of depreciation

100000 / 5 = 20000

75000 / 5 = 15000

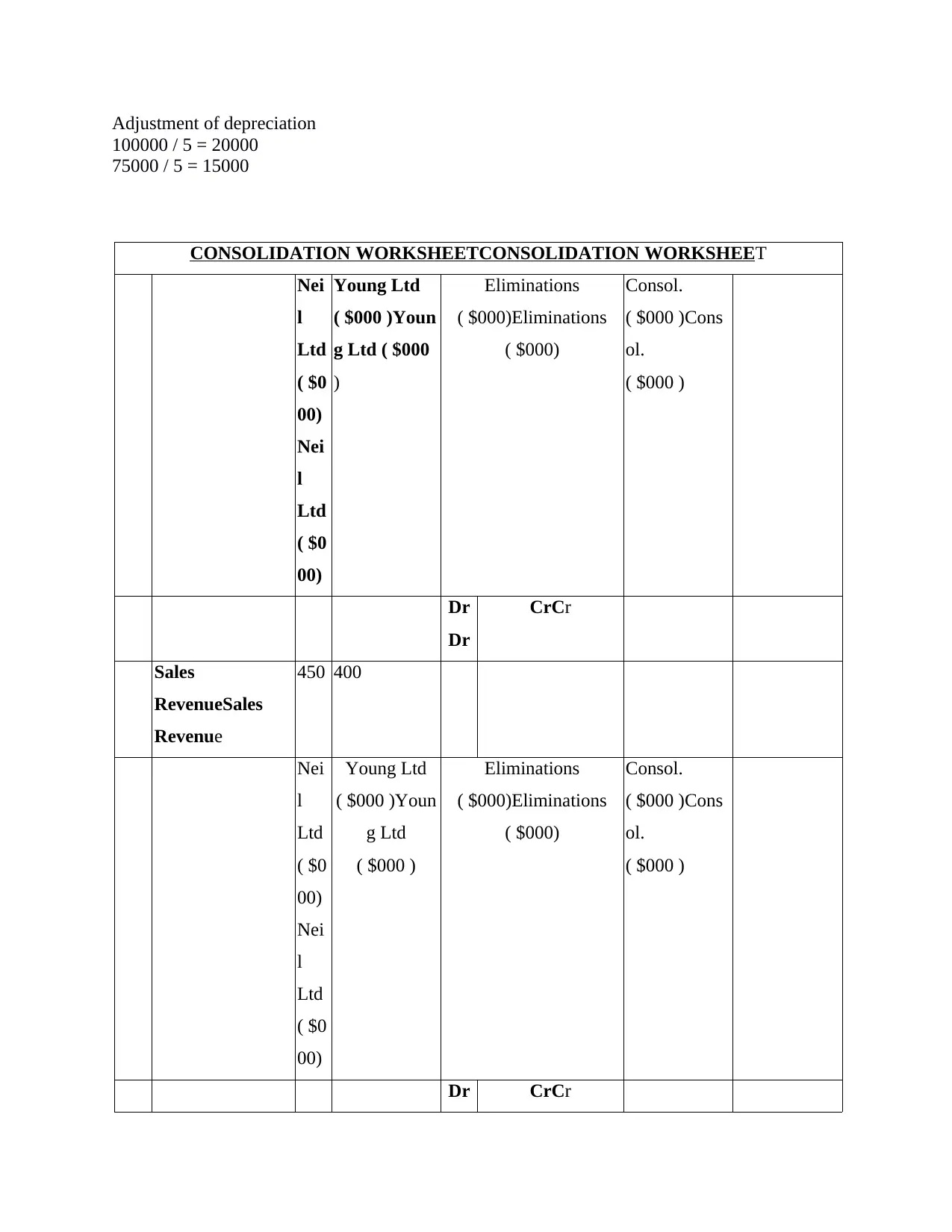

CONSOLIDATION WORKSHEETCONSOLIDATION WORKSHEET

Nei

l

Ltd

( $0

00)

Nei

l

Ltd

( $0

00)

Young Ltd

( $000 )Youn

g Ltd ( $000

)

Eliminations

( $000)Eliminations

( $000)

Consol.

( $000 )Cons

ol.

( $000 )

Dr

Dr

CrCr

Sales

RevenueSales

Revenue

450 400

Nei

l

Ltd

( $0

00)

Nei

l

Ltd

( $0

00)

Young Ltd

( $000 )Youn

g Ltd

( $000 )

Eliminations

( $000)Eliminations

( $000)

Consol.

( $000 )Cons

ol.

( $000 )

Dr CrCr

100000 / 5 = 20000

75000 / 5 = 15000

CONSOLIDATION WORKSHEETCONSOLIDATION WORKSHEET

Nei

l

Ltd

( $0

00)

Nei

l

Ltd

( $0

00)

Young Ltd

( $000 )Youn

g Ltd ( $000

)

Eliminations

( $000)Eliminations

( $000)

Consol.

( $000 )Cons

ol.

( $000 )

Dr

Dr

CrCr

Sales

RevenueSales

Revenue

450 400

Nei

l

Ltd

( $0

00)

Nei

l

Ltd

( $0

00)

Young Ltd

( $000 )Youn

g Ltd

( $000 )

Eliminations

( $000)Eliminations

( $000)

Consol.

( $000 )Cons

ol.

( $000 )

Dr CrCr

Dr

Sales

RevenueSales

Revenue

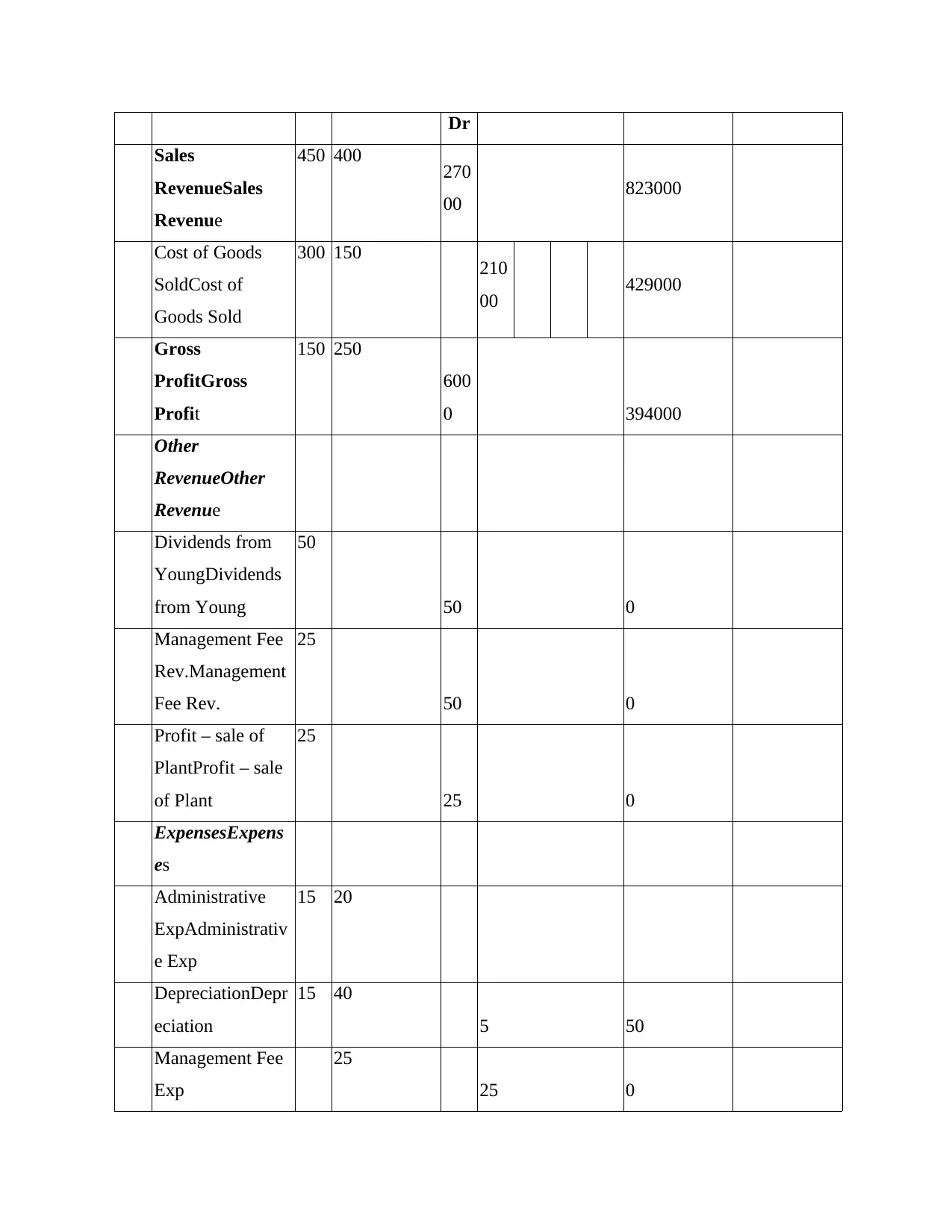

450 400 270

00 823000

Cost of Goods

SoldCost of

Goods Sold

300 150 210

00 429000

Gross

ProfitGross

Profit

150 250

600

0 394000

Other

RevenueOther

Revenue

Dividends from

YoungDividends

from Young

50

50 0

Management Fee

Rev.Management

Fee Rev.

25

50 0

Profit – sale of

PlantProfit – sale

of Plant

25

25 0

ExpensesExpens

es

Administrative

ExpAdministrativ

e Exp

15 20

DepreciationDepr

eciation

15 40

5 50

Management Fee

Exp

25

25 0

Sales

RevenueSales

Revenue

450 400 270

00 823000

Cost of Goods

SoldCost of

Goods Sold

300 150 210

00 429000

Gross

ProfitGross

Profit

150 250

600

0 394000

Other

RevenueOther

Revenue

Dividends from

YoungDividends

from Young

50

50 0

Management Fee

Rev.Management

Fee Rev.

25

50 0

Profit – sale of

PlantProfit – sale

of Plant

25

25 0

ExpensesExpens

es

Administrative

ExpAdministrativ

e Exp

15 20

DepreciationDepr

eciation

15 40

5 50

Management Fee

Exp

25

25 0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

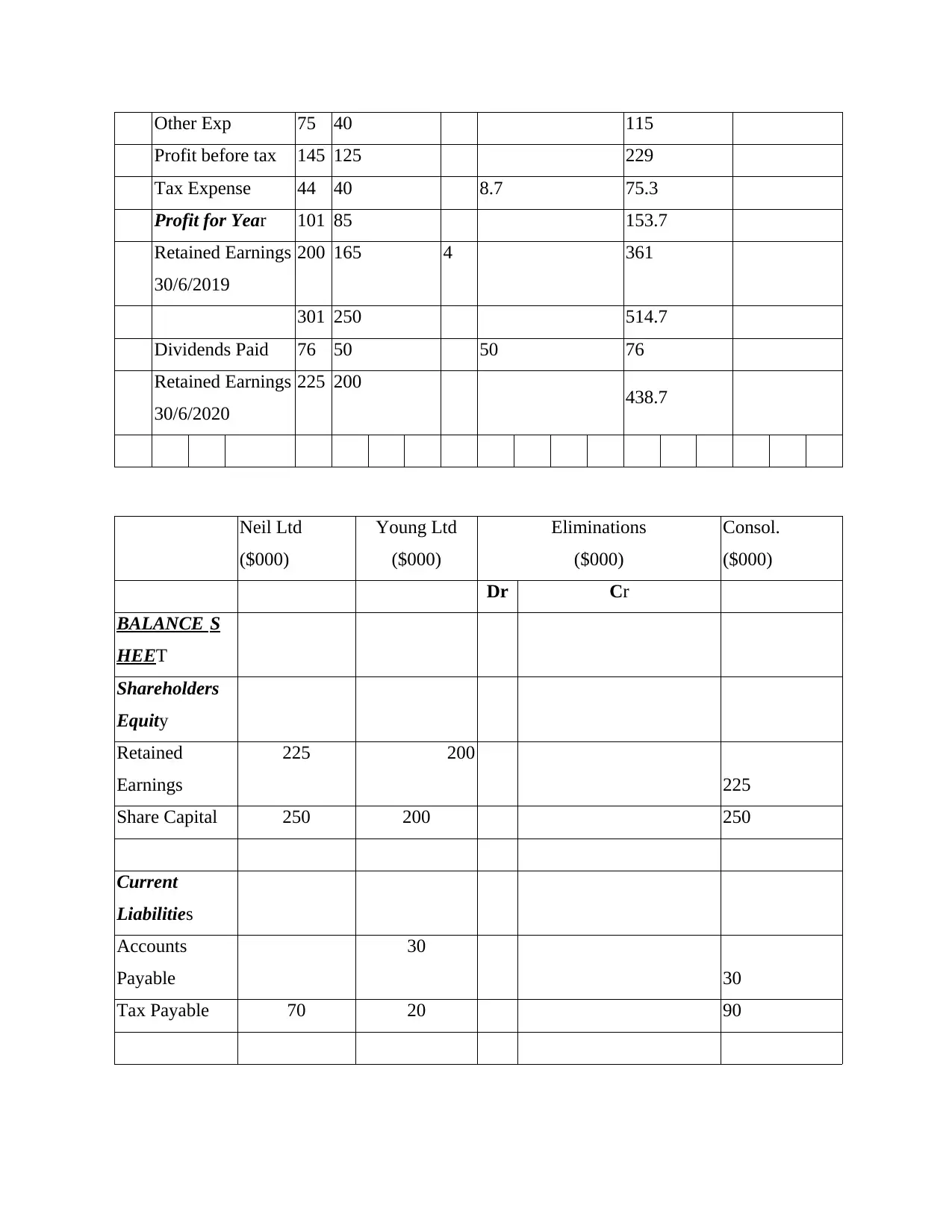

Other Exp 75 40 115

Profit before tax 145 125 229

Tax Expense 44 40 8.7 75.3

Profit for Year 101 85 153.7

Retained Earnings

30/6/2019

200 165 4 361

301 250 514.7

Dividends Paid 76 50 50 76

Retained Earnings

30/6/2020

225 200 438.7

Neil Ltd

($000)

Young Ltd

($000)

Eliminations

($000)

Consol.

($000)

Dr Cr

BALANCE S

HEET

Shareholders

Equity

Retained

Earnings

225 200

225

Share Capital 250 200 250

Current

Liabilities

Accounts

Payable

30

30

Tax Payable 70 20 90

Profit before tax 145 125 229

Tax Expense 44 40 8.7 75.3

Profit for Year 101 85 153.7

Retained Earnings

30/6/2019

200 165 4 361

301 250 514.7

Dividends Paid 76 50 50 76

Retained Earnings

30/6/2020

225 200 438.7

Neil Ltd

($000)

Young Ltd

($000)

Eliminations

($000)

Consol.

($000)

Dr Cr

BALANCE S

HEET

Shareholders

Equity

Retained

Earnings

225 200

225

Share Capital 250 200 250

Current

Liabilities

Accounts

Payable

30

30

Tax Payable 70 20 90

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

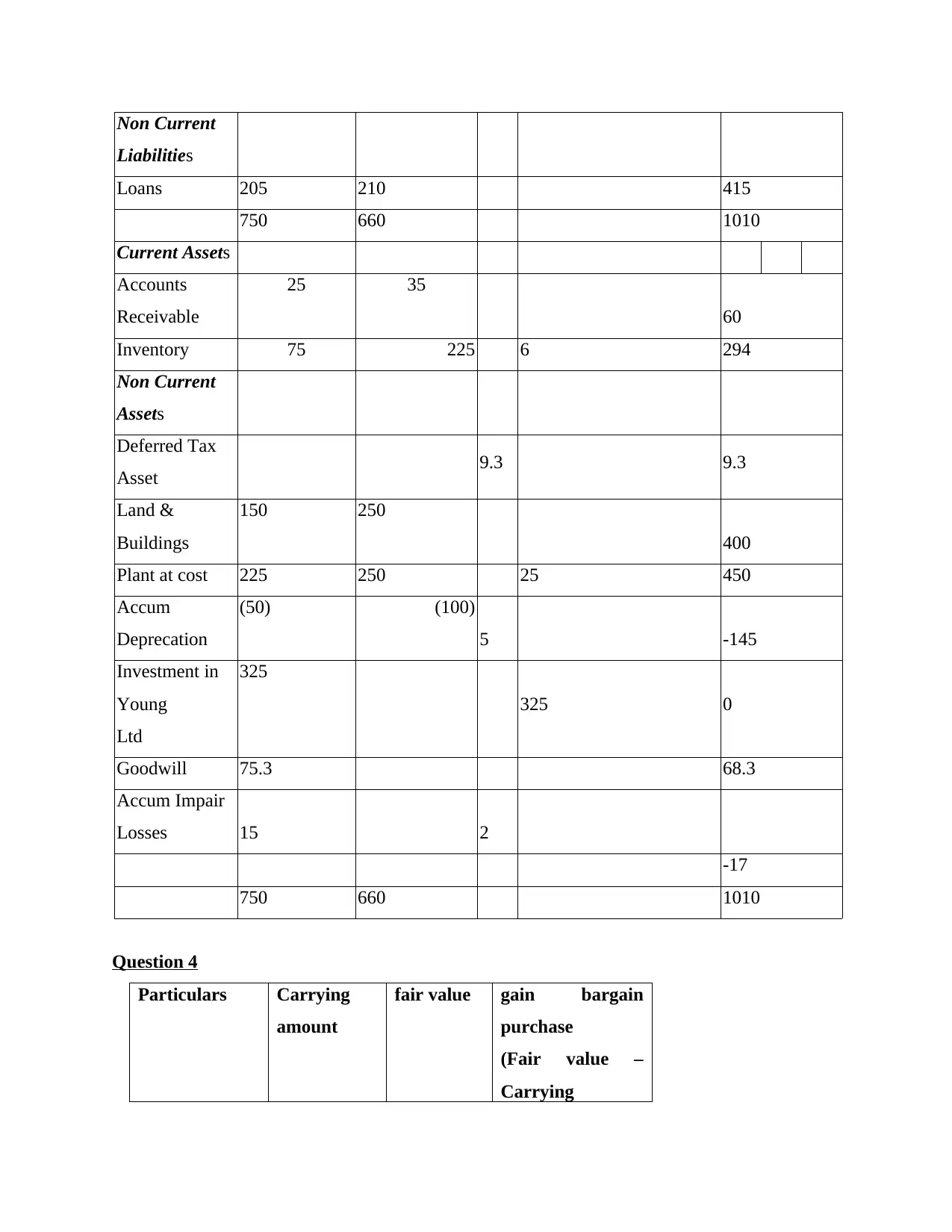

Non Current

Liabilities

Loans 205 210 415

750 660 1010

Current Assets

Accounts

Receivable

25 35

60

Inventory 75 225 6 294

Non Current

Assets

Deferred Tax

Asset 9.3 9.3

Land &

Buildings

150 250

400

Plant at cost 225 250 25 450

Accum

Deprecation

(50) (100)

5 -145

Investment in

Young

Ltd

325

325 0

Goodwill 75.3 68.3

Accum Impair

Losses 15 2

-17

750 660 1010

Question 4

Particulars Carrying

amount

fair value gain bargain

purchase

(Fair value –

Carrying

Liabilities

Loans 205 210 415

750 660 1010

Current Assets

Accounts

Receivable

25 35

60

Inventory 75 225 6 294

Non Current

Assets

Deferred Tax

Asset 9.3 9.3

Land &

Buildings

150 250

400

Plant at cost 225 250 25 450

Accum

Deprecation

(50) (100)

5 -145

Investment in

Young

Ltd

325

325 0

Goodwill 75.3 68.3

Accum Impair

Losses 15 2

-17

750 660 1010

Question 4

Particulars Carrying

amount

fair value gain bargain

purchase

(Fair value –

Carrying

amount)

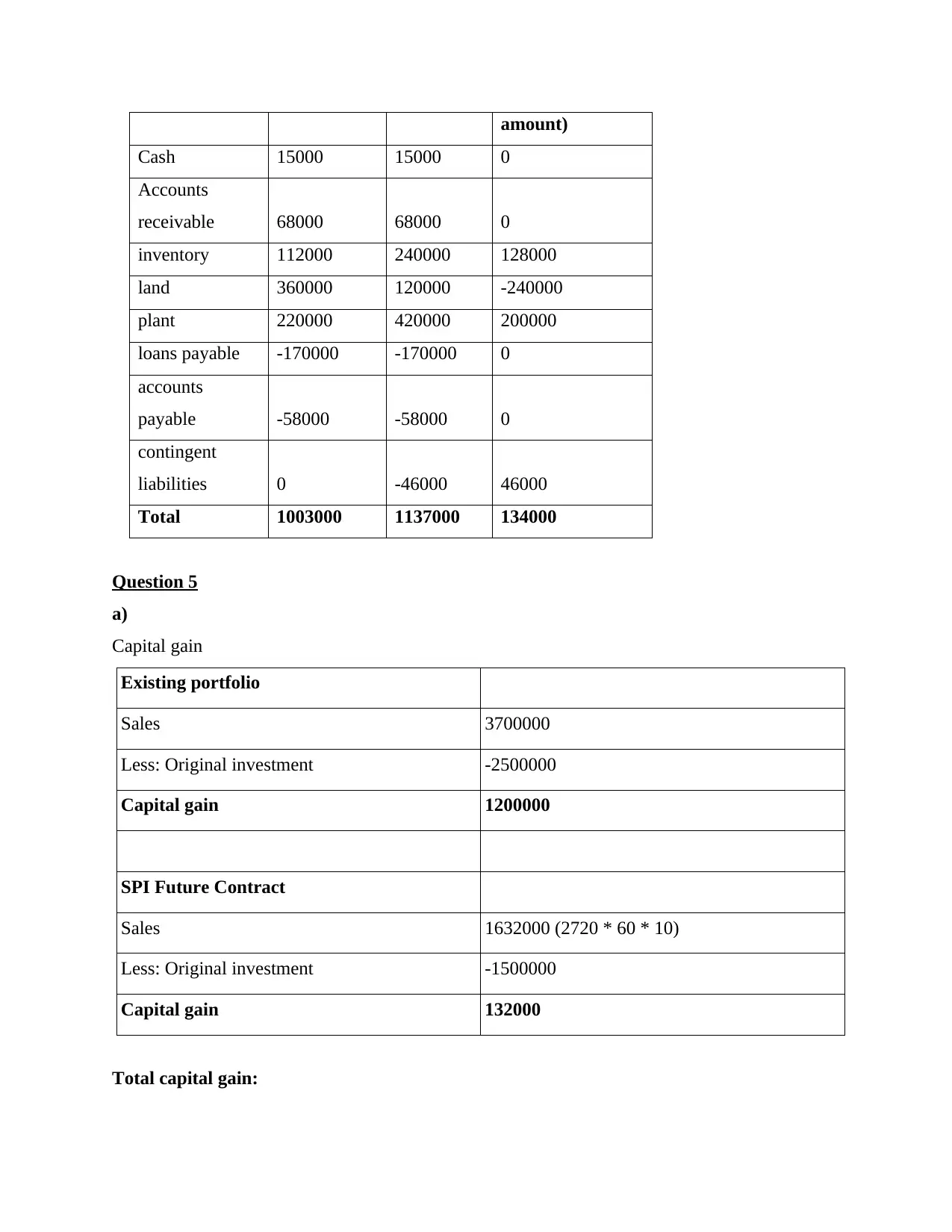

Cash 15000 15000 0

Accounts

receivable 68000 68000 0

inventory 112000 240000 128000

land 360000 120000 -240000

plant 220000 420000 200000

loans payable -170000 -170000 0

accounts

payable -58000 -58000 0

contingent

liabilities 0 -46000 46000

Total 1003000 1137000 134000

Question 5

a)

Capital gain

Existing portfolio

Sales 3700000

Less: Original investment -2500000

Capital gain 1200000

SPI Future Contract

Sales 1632000 (2720 * 60 * 10)

Less: Original investment -1500000

Capital gain 132000

Total capital gain:

Cash 15000 15000 0

Accounts

receivable 68000 68000 0

inventory 112000 240000 128000

land 360000 120000 -240000

plant 220000 420000 200000

loans payable -170000 -170000 0

accounts

payable -58000 -58000 0

contingent

liabilities 0 -46000 46000

Total 1003000 1137000 134000

Question 5

a)

Capital gain

Existing portfolio

Sales 3700000

Less: Original investment -2500000

Capital gain 1200000

SPI Future Contract

Sales 1632000 (2720 * 60 * 10)

Less: Original investment -1500000

Capital gain 132000

Total capital gain:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

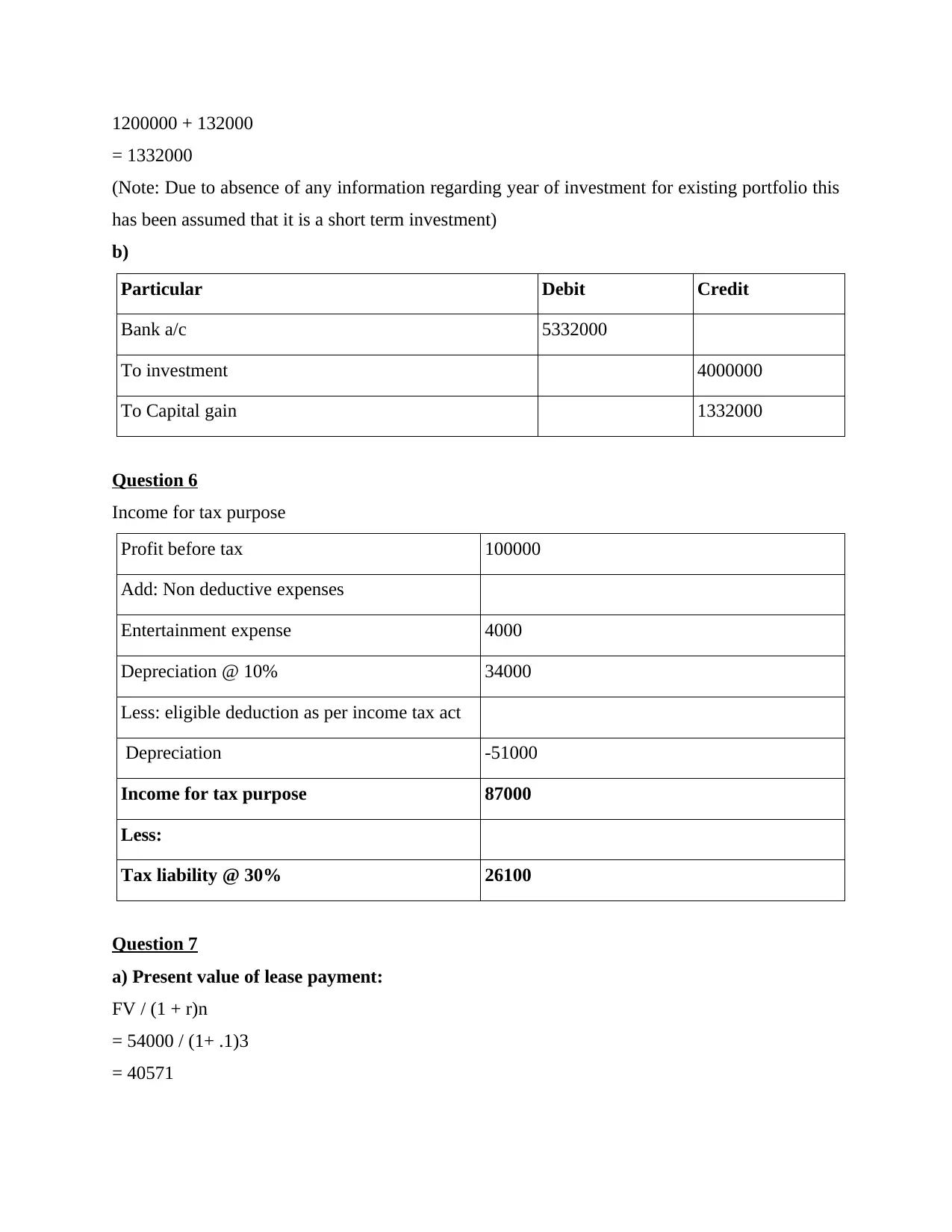

1200000 + 132000

= 1332000

(Note: Due to absence of any information regarding year of investment for existing portfolio this

has been assumed that it is a short term investment)

b)

Particular Debit Credit

Bank a/c 5332000

To investment 4000000

To Capital gain 1332000

Question 6

Income for tax purpose

Profit before tax 100000

Add: Non deductive expenses

Entertainment expense 4000

Depreciation @ 10% 34000

Less: eligible deduction as per income tax act

Depreciation -51000

Income for tax purpose 87000

Less:

Tax liability @ 30% 26100

Question 7

a) Present value of lease payment:

FV / (1 + r)n

= 54000 / (1+ .1)3

= 40571

= 1332000

(Note: Due to absence of any information regarding year of investment for existing portfolio this

has been assumed that it is a short term investment)

b)

Particular Debit Credit

Bank a/c 5332000

To investment 4000000

To Capital gain 1332000

Question 6

Income for tax purpose

Profit before tax 100000

Add: Non deductive expenses

Entertainment expense 4000

Depreciation @ 10% 34000

Less: eligible deduction as per income tax act

Depreciation -51000

Income for tax purpose 87000

Less:

Tax liability @ 30% 26100

Question 7

a) Present value of lease payment:

FV / (1 + r)n

= 54000 / (1+ .1)3

= 40571

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

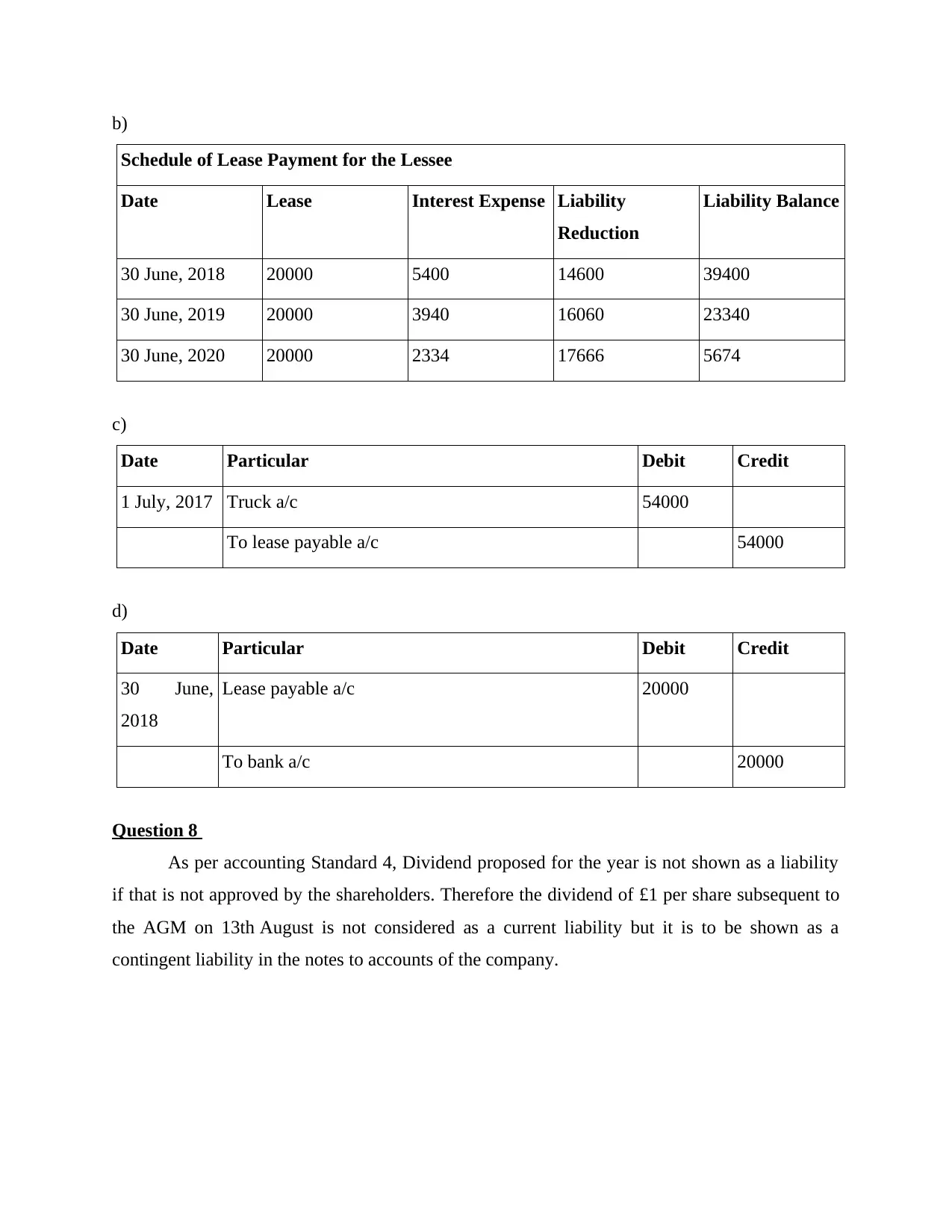

b)

Schedule of Lease Payment for the Lessee

Date Lease Interest Expense Liability

Reduction

Liability Balance

30 June, 2018 20000 5400 14600 39400

30 June, 2019 20000 3940 16060 23340

30 June, 2020 20000 2334 17666 5674

c)

Date Particular Debit Credit

1 July, 2017 Truck a/c 54000

To lease payable a/c 54000

d)

Date Particular Debit Credit

30 June,

2018

Lease payable a/c 20000

To bank a/c 20000

Question 8

As per accounting Standard 4, Dividend proposed for the year is not shown as a liability

if that is not approved by the shareholders. Therefore the dividend of £1 per share subsequent to

the AGM on 13th August is not considered as a current liability but it is to be shown as a

contingent liability in the notes to accounts of the company.

Schedule of Lease Payment for the Lessee

Date Lease Interest Expense Liability

Reduction

Liability Balance

30 June, 2018 20000 5400 14600 39400

30 June, 2019 20000 3940 16060 23340

30 June, 2020 20000 2334 17666 5674

c)

Date Particular Debit Credit

1 July, 2017 Truck a/c 54000

To lease payable a/c 54000

d)

Date Particular Debit Credit

30 June,

2018

Lease payable a/c 20000

To bank a/c 20000

Question 8

As per accounting Standard 4, Dividend proposed for the year is not shown as a liability

if that is not approved by the shareholders. Therefore the dividend of £1 per share subsequent to

the AGM on 13th August is not considered as a current liability but it is to be shown as a

contingent liability in the notes to accounts of the company.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.