MGT723 Research Project: Organizational Behavior & Carbon Emission

VerifiedAdded on 2023/06/12

|11

|1864

|368

Report

AI Summary

This research paper investigates the impact of organizational behavior related to climate change on carbon emissions, using data collected from 60 firms across India, South Africa, and Brazil. Descriptive statistics reveal a high variation in CO2 emissions among firms, with an average emission of 130927619401 and an average change of 9.5%. Analysis of categorical variables indicates that boards have the highest level of direct responsibility for carbon emission in 90% of the firms, and 80% of firms incentivize managers to reduce carbon emissions. Inferential statistics, including chi-square tests, show no significant difference in emission changes based on the authority responsible for carbon emission. Correlation analysis suggests a negative relationship between the dependent variable and factors like incentives for managers and integration of climate change into business strategy. Regression analysis indicates that the independent variables explain less than 1% of the variation in carbon emissions, with no statistically significant coefficients.

Data collection

The main aim of this research paper is to examine the impact of the organizational behavior

related to climate change on the emission of carbon. To examine the impact the data was

collected from 60 firms from three developing countries, namely India, South Africa, and Brazil.

The focus for the research is on the developing countries as the emission of carbon is increasing

in these countries with the economic growth taking the pace. So, the data from the developing

countries has been extracted from the master data set. The selection of companies from each

countries was based on the random selectiono(Doytch & Uctum, 2011; Millimet & Roy, 2011).

Extracted data was cleaned in excel and the missing values were addressed. Once the data was

ready, it was exported to SPSS for the descriptive and inferential analysis.

Data analysis (descriptive)

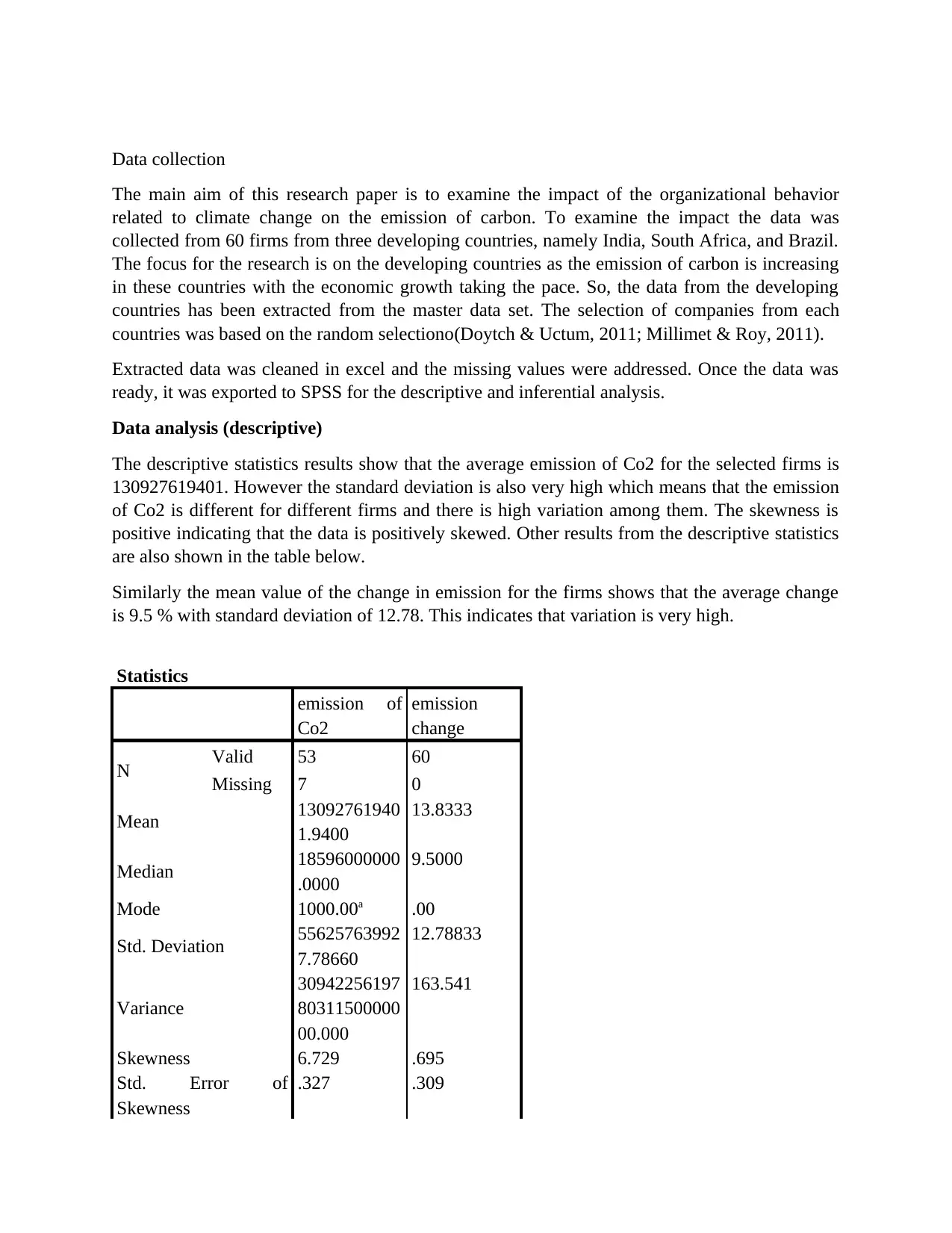

The descriptive statistics results show that the average emission of Co2 for the selected firms is

130927619401. However the standard deviation is also very high which means that the emission

of Co2 is different for different firms and there is high variation among them. The skewness is

positive indicating that the data is positively skewed. Other results from the descriptive statistics

are also shown in the table below.

Similarly the mean value of the change in emission for the firms shows that the average change

is 9.5 % with standard deviation of 12.78. This indicates that variation is very high.

Statistics

emission of

Co2

emission

change

N Valid 53 60

Missing 7 0

Mean 13092761940

1.9400

13.8333

Median 18596000000

.0000

9.5000

Mode 1000.00a .00

Std. Deviation 55625763992

7.78660

12.78833

Variance

30942256197

80311500000

00.000

163.541

Skewness 6.729 .695

Std. Error of

Skewness

.327 .309

The main aim of this research paper is to examine the impact of the organizational behavior

related to climate change on the emission of carbon. To examine the impact the data was

collected from 60 firms from three developing countries, namely India, South Africa, and Brazil.

The focus for the research is on the developing countries as the emission of carbon is increasing

in these countries with the economic growth taking the pace. So, the data from the developing

countries has been extracted from the master data set. The selection of companies from each

countries was based on the random selectiono(Doytch & Uctum, 2011; Millimet & Roy, 2011).

Extracted data was cleaned in excel and the missing values were addressed. Once the data was

ready, it was exported to SPSS for the descriptive and inferential analysis.

Data analysis (descriptive)

The descriptive statistics results show that the average emission of Co2 for the selected firms is

130927619401. However the standard deviation is also very high which means that the emission

of Co2 is different for different firms and there is high variation among them. The skewness is

positive indicating that the data is positively skewed. Other results from the descriptive statistics

are also shown in the table below.

Similarly the mean value of the change in emission for the firms shows that the average change

is 9.5 % with standard deviation of 12.78. This indicates that variation is very high.

Statistics

emission of

Co2

emission

change

N Valid 53 60

Missing 7 0

Mean 13092761940

1.9400

13.8333

Median 18596000000

.0000

9.5000

Mode 1000.00a .00

Std. Deviation 55625763992

7.78660

12.78833

Variance

30942256197

80311500000

00.000

163.541

Skewness 6.729 .695

Std. Error of

Skewness

.327 .309

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Kurtosis 47.166 -.765

Std. Error of Kurtosis .644 .608

Minimum 1000.00 .00

Maximum 39960100000

00.00

44.00

Sum 69391638283

02.82

830.00

Percentiles

25 1466798000.

0000

2.4225

50 18596000000

.0000

9.5000

75 53151950000

.0000

24.4350

Std. Error of Kurtosis .644 .608

Minimum 1000.00 .00

Maximum 39960100000

00.00

44.00

Sum 69391638283

02.82

830.00

Percentiles

25 1466798000.

0000

2.4225

50 18596000000

.0000

9.5000

75 53151950000

.0000

24.4350

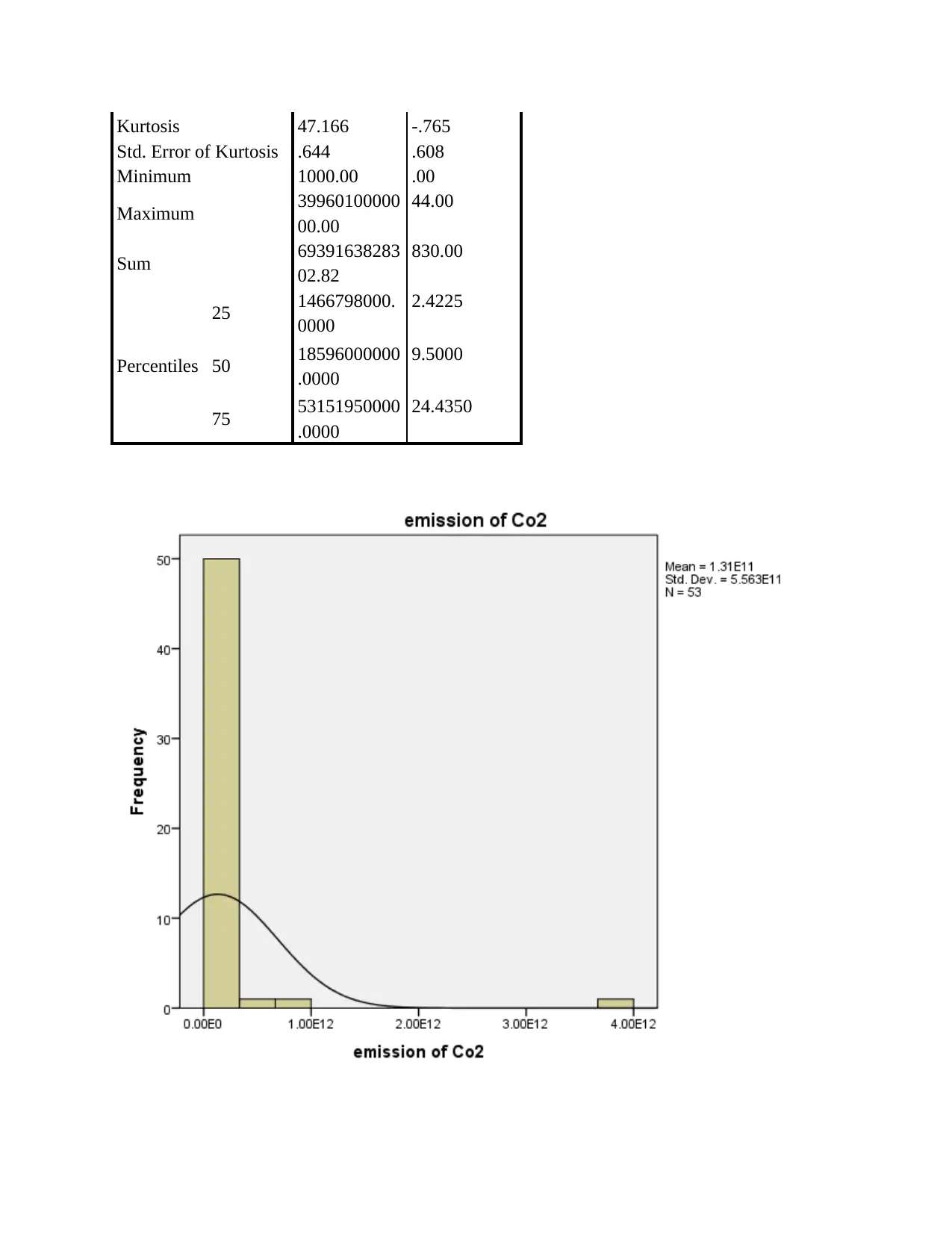

The results from the histograms are shown in below which has been shown in the figures below

and the results shows that the emission of Co2 do not follow the normal distribution. Most of the

firms have low emission whereas some of the firms have very high level of emission. .

Categorical variable

The descriptive results for the categorical variables have been shown through the pie charts

which are easy and effective way to present the categorical variables

and the results shows that the emission of Co2 do not follow the normal distribution. Most of the

firms have low emission whereas some of the firms have very high level of emission. .

Categorical variable

The descriptive results for the categorical variables have been shown through the pie charts

which are easy and effective way to present the categorical variables

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3%7%

90%

Highest level of direct responsibility

other manager

Senior managers

Board

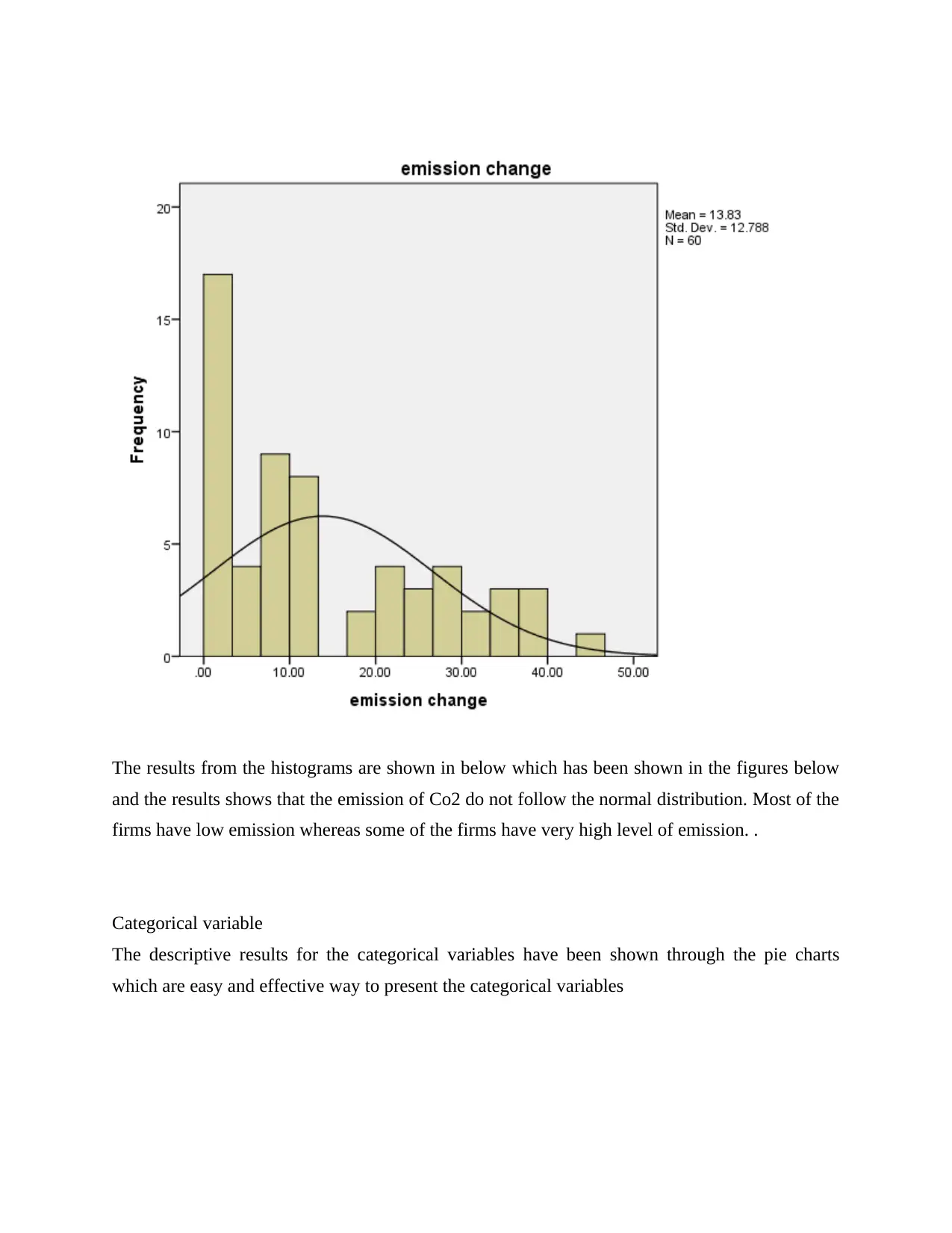

Results shows that for 90 % of the firms the board has the highest level of direct responsibility

for carbon emission, followed by the senior managers which comprises for 7 % of the firms.

80%

20%

Incentive for managers

Yes

No

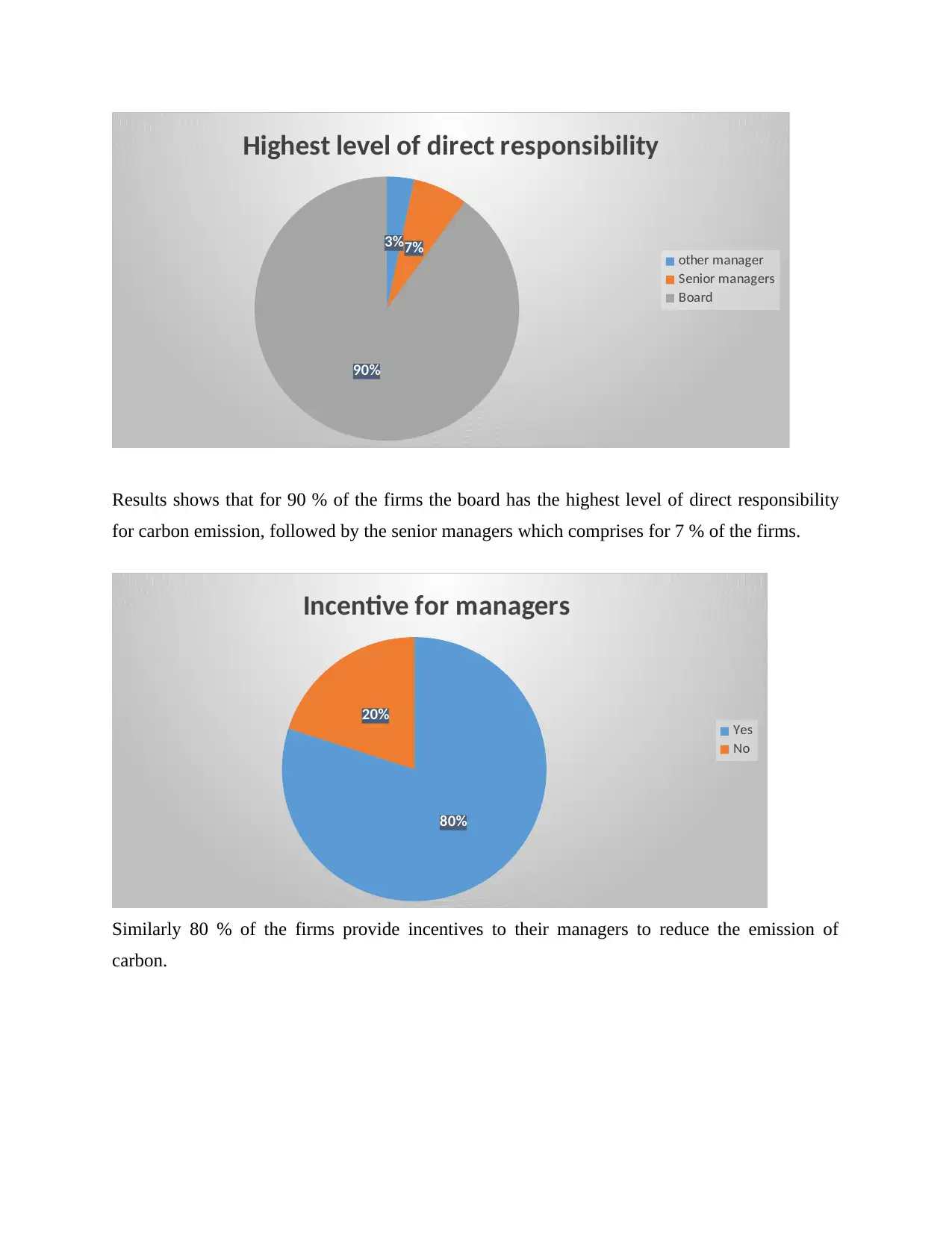

Similarly 80 % of the firms provide incentives to their managers to reduce the emission of

carbon.

90%

Highest level of direct responsibility

other manager

Senior managers

Board

Results shows that for 90 % of the firms the board has the highest level of direct responsibility

for carbon emission, followed by the senior managers which comprises for 7 % of the firms.

80%

20%

Incentive for managers

Yes

No

Similarly 80 % of the firms provide incentives to their managers to reduce the emission of

carbon.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8%

88%

3%

Risk management process

specific risk management system

intetregrated with other

multidiciplinary system

No documented proces

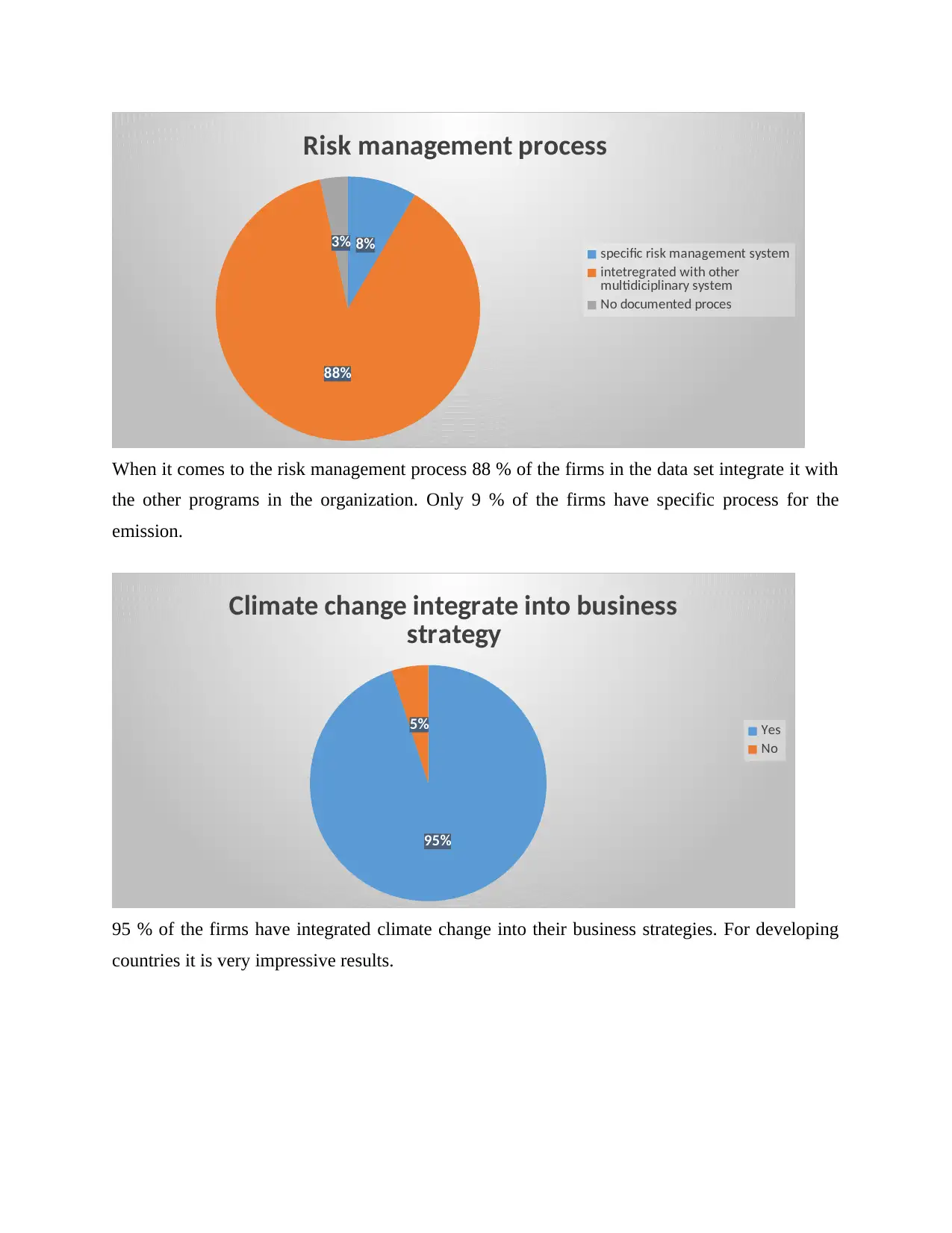

When it comes to the risk management process 88 % of the firms in the data set integrate it with

the other programs in the organization. Only 9 % of the firms have specific process for the

emission.

95%

5%

Climate change integrate into business

strategy

Yes

No

95 % of the firms have integrated climate change into their business strategies. For developing

countries it is very impressive results.

88%

3%

Risk management process

specific risk management system

intetregrated with other

multidiciplinary system

No documented proces

When it comes to the risk management process 88 % of the firms in the data set integrate it with

the other programs in the organization. Only 9 % of the firms have specific process for the

emission.

95%

5%

Climate change integrate into business

strategy

Yes

No

95 % of the firms have integrated climate change into their business strategies. For developing

countries it is very impressive results.

27%

31%

42%

Internal price on carbon

Yes

In process

No

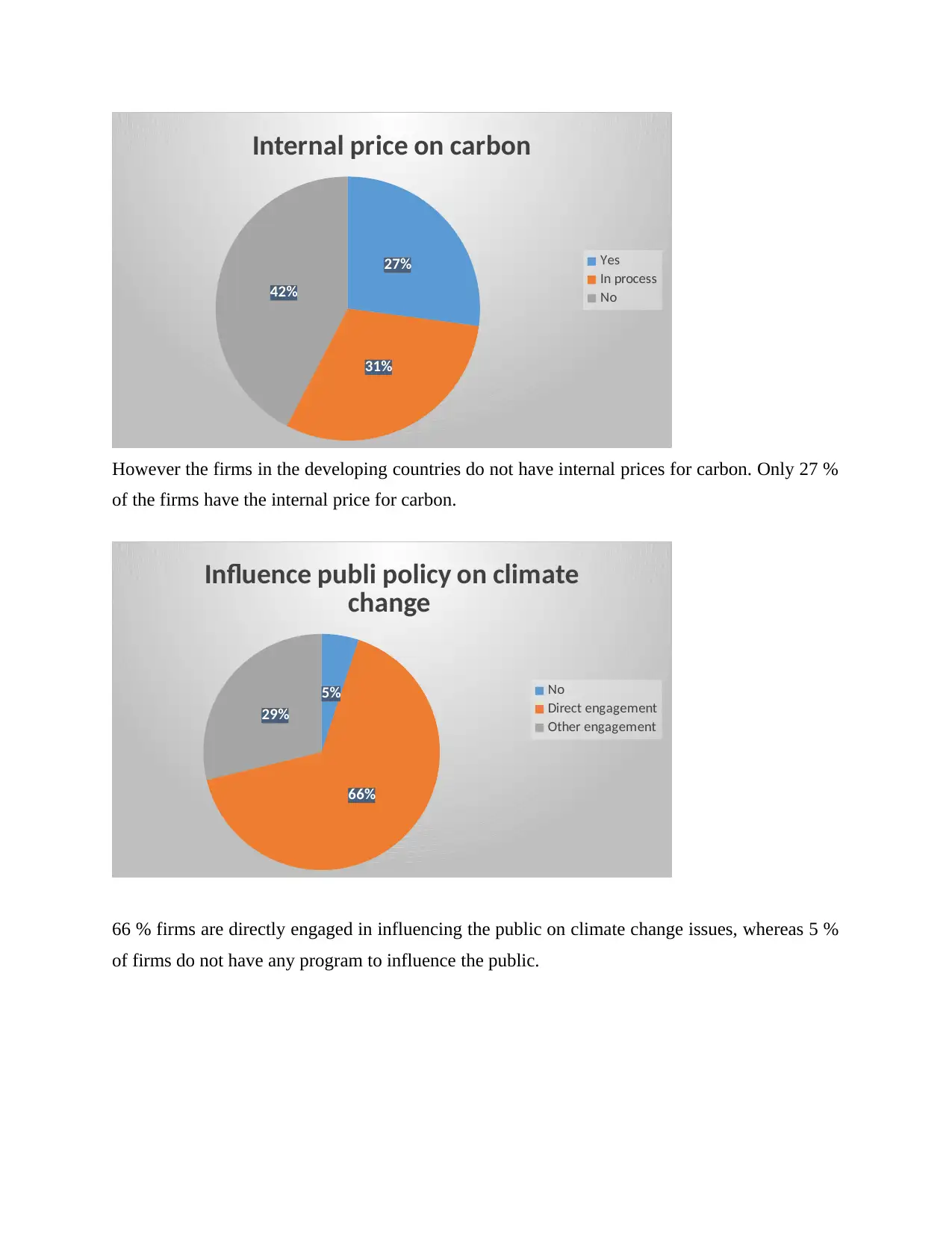

However the firms in the developing countries do not have internal prices for carbon. Only 27 %

of the firms have the internal price for carbon.

5%

66%

29%

Influence publi policy on climate

change

No

Direct engagement

Other engagement

66 % firms are directly engaged in influencing the public on climate change issues, whereas 5 %

of firms do not have any program to influence the public.

31%

42%

Internal price on carbon

Yes

In process

No

However the firms in the developing countries do not have internal prices for carbon. Only 27 %

of the firms have the internal price for carbon.

5%

66%

29%

Influence publi policy on climate

change

No

Direct engagement

Other engagement

66 % firms are directly engaged in influencing the public on climate change issues, whereas 5 %

of firms do not have any program to influence the public.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2%

33%

60%

5%

Frequency of monitoring

Every 2 years

annually

half yearly

not defined

Half yearly is the most used frequency for monitoring the carbon emission, whereas annually

monitoring is done by 33 % of the firms in the data set.

59%

37%

3%

Low carbon price

Yes

No

Don't know

Furthermore 59 % of the firms said that their products are low on carbon whereas 37 % of them

said that their products are not low in terms of carbon emission. Rest of the firms were not sure

about their products.

Data analysis (inferential)

Chi square test

33%

60%

5%

Frequency of monitoring

Every 2 years

annually

half yearly

not defined

Half yearly is the most used frequency for monitoring the carbon emission, whereas annually

monitoring is done by 33 % of the firms in the data set.

59%

37%

3%

Low carbon price

Yes

No

Don't know

Furthermore 59 % of the firms said that their products are low on carbon whereas 37 % of them

said that their products are not low in terms of carbon emission. Rest of the firms were not sure

about their products.

Data analysis (inferential)

Chi square test

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Chi-Square Tests

Value df Asymp. Sig.

(2-sided)

Pearson Chi-Square 106.000a 104 .427

Likelihood Ratio 38.125 104 1.000

Linear-by-Linear

Association

.201 1 .654

N of Valid Cases 53

a. 159 cells (100.0%) have expected count less than 5. The

minimum expected count is .02.

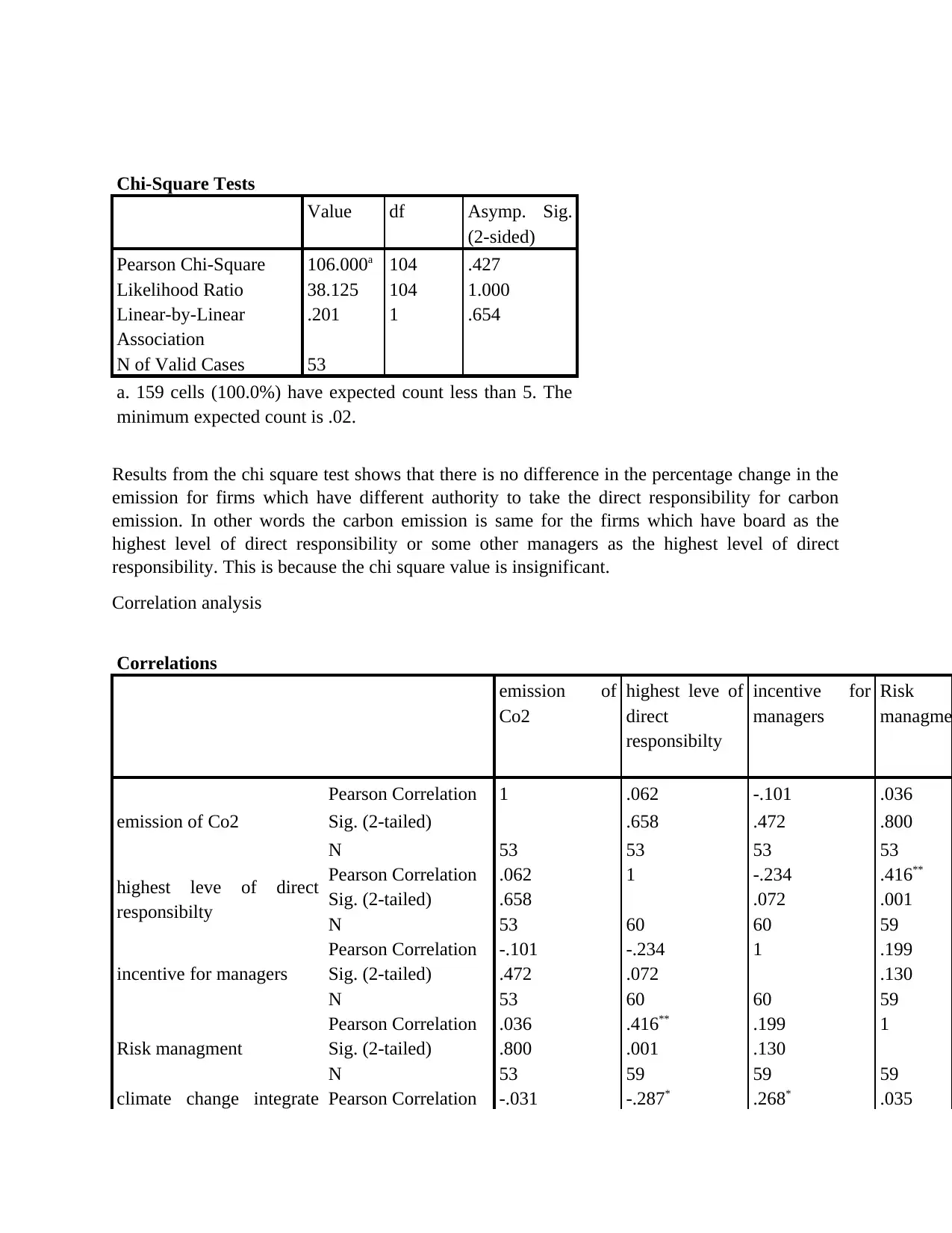

Results from the chi square test shows that there is no difference in the percentage change in the

emission for firms which have different authority to take the direct responsibility for carbon

emission. In other words the carbon emission is same for the firms which have board as the

highest level of direct responsibility or some other managers as the highest level of direct

responsibility. This is because the chi square value is insignificant.

Correlation analysis

Correlations

emission of

Co2

highest leve of

direct

responsibilty

incentive for

managers

Risk

managme

emission of Co2

Pearson Correlation 1 .062 -.101 .036

Sig. (2-tailed) .658 .472 .800

N 53 53 53 53

highest leve of direct

responsibilty

Pearson Correlation .062 1 -.234 .416**

Sig. (2-tailed) .658 .072 .001

N 53 60 60 59

incentive for managers

Pearson Correlation -.101 -.234 1 .199

Sig. (2-tailed) .472 .072 .130

N 53 60 60 59

Risk managment

Pearson Correlation .036 .416** .199 1

Sig. (2-tailed) .800 .001 .130

N 53 59 59 59

climate change integrate Pearson Correlation -.031 -.287* .268* .035

Value df Asymp. Sig.

(2-sided)

Pearson Chi-Square 106.000a 104 .427

Likelihood Ratio 38.125 104 1.000

Linear-by-Linear

Association

.201 1 .654

N of Valid Cases 53

a. 159 cells (100.0%) have expected count less than 5. The

minimum expected count is .02.

Results from the chi square test shows that there is no difference in the percentage change in the

emission for firms which have different authority to take the direct responsibility for carbon

emission. In other words the carbon emission is same for the firms which have board as the

highest level of direct responsibility or some other managers as the highest level of direct

responsibility. This is because the chi square value is insignificant.

Correlation analysis

Correlations

emission of

Co2

highest leve of

direct

responsibilty

incentive for

managers

Risk

managme

emission of Co2

Pearson Correlation 1 .062 -.101 .036

Sig. (2-tailed) .658 .472 .800

N 53 53 53 53

highest leve of direct

responsibilty

Pearson Correlation .062 1 -.234 .416**

Sig. (2-tailed) .658 .072 .001

N 53 60 60 59

incentive for managers

Pearson Correlation -.101 -.234 1 .199

Sig. (2-tailed) .472 .072 .130

N 53 60 60 59

Risk managment

Pearson Correlation .036 .416** .199 1

Sig. (2-tailed) .800 .001 .130

N 53 59 59 59

climate change integrate Pearson Correlation -.031 -.287* .268* .035

into busines strategy Sig. (2-tailed) .826 .026 .039 .795

N 53 60 60 59

internal price on carbon

Pearson Correlation .140 .011 .070 -.033

Sig. (2-tailed) .317 .937 .597 .804

N 53 59 59 59

influence public policy on

climate change

Pearson Correlation -.003 -.008 -.377** -.214

Sig. (2-tailed) .986 .955 .003 .103

N 53 59 59 59

**. Correlation is significant at the 0.01 level (2-tailed).

*. Correlation is significant at the 0.05 level (2-tailed).

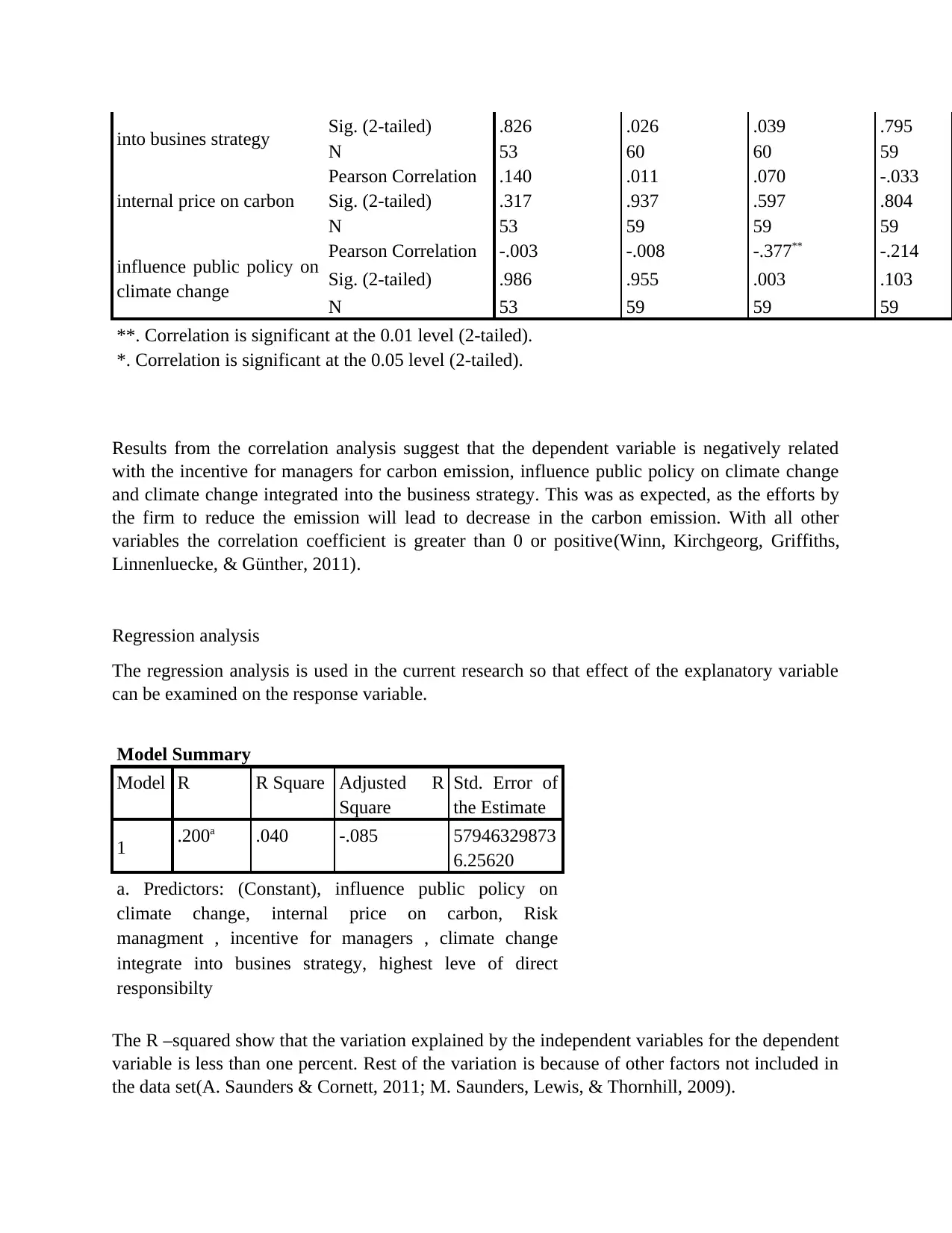

Results from the correlation analysis suggest that the dependent variable is negatively related

with the incentive for managers for carbon emission, influence public policy on climate change

and climate change integrated into the business strategy. This was as expected, as the efforts by

the firm to reduce the emission will lead to decrease in the carbon emission. With all other

variables the correlation coefficient is greater than 0 or positive(Winn, Kirchgeorg, Griffiths,

Linnenluecke, & Günther, 2011).

Regression analysis

The regression analysis is used in the current research so that effect of the explanatory variable

can be examined on the response variable.

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .200a .040 -.085 57946329873

6.25620

a. Predictors: (Constant), influence public policy on

climate change, internal price on carbon, Risk

managment , incentive for managers , climate change

integrate into busines strategy, highest leve of direct

responsibilty

The R –squared show that the variation explained by the independent variables for the dependent

variable is less than one percent. Rest of the variation is because of other factors not included in

the data set(A. Saunders & Cornett, 2011; M. Saunders, Lewis, & Thornhill, 2009).

N 53 60 60 59

internal price on carbon

Pearson Correlation .140 .011 .070 -.033

Sig. (2-tailed) .317 .937 .597 .804

N 53 59 59 59

influence public policy on

climate change

Pearson Correlation -.003 -.008 -.377** -.214

Sig. (2-tailed) .986 .955 .003 .103

N 53 59 59 59

**. Correlation is significant at the 0.01 level (2-tailed).

*. Correlation is significant at the 0.05 level (2-tailed).

Results from the correlation analysis suggest that the dependent variable is negatively related

with the incentive for managers for carbon emission, influence public policy on climate change

and climate change integrated into the business strategy. This was as expected, as the efforts by

the firm to reduce the emission will lead to decrease in the carbon emission. With all other

variables the correlation coefficient is greater than 0 or positive(Winn, Kirchgeorg, Griffiths,

Linnenluecke, & Günther, 2011).

Regression analysis

The regression analysis is used in the current research so that effect of the explanatory variable

can be examined on the response variable.

Model Summary

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

1 .200a .040 -.085 57946329873

6.25620

a. Predictors: (Constant), influence public policy on

climate change, internal price on carbon, Risk

managment , incentive for managers , climate change

integrate into busines strategy, highest leve of direct

responsibilty

The R –squared show that the variation explained by the independent variables for the dependent

variable is less than one percent. Rest of the variation is because of other factors not included in

the data set(A. Saunders & Cornett, 2011; M. Saunders, Lewis, & Thornhill, 2009).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression

64419835207

16540000000

00.000

6 10736639201

19423300000

00.000

.320 .923b

Residual

15445774870

78597000000

0000.000

46 33577771458

23037000000

00.000

Total

16089973222

85762500000

0000.000

52

a. Dependent Variable: emission of Co2

b. Predictors: (Constant), influence public policy on climate change, internal

price on carbon, Risk managment , incentive for managers , climate change

integrate into busines strategy, highest leve of direct responsibilty

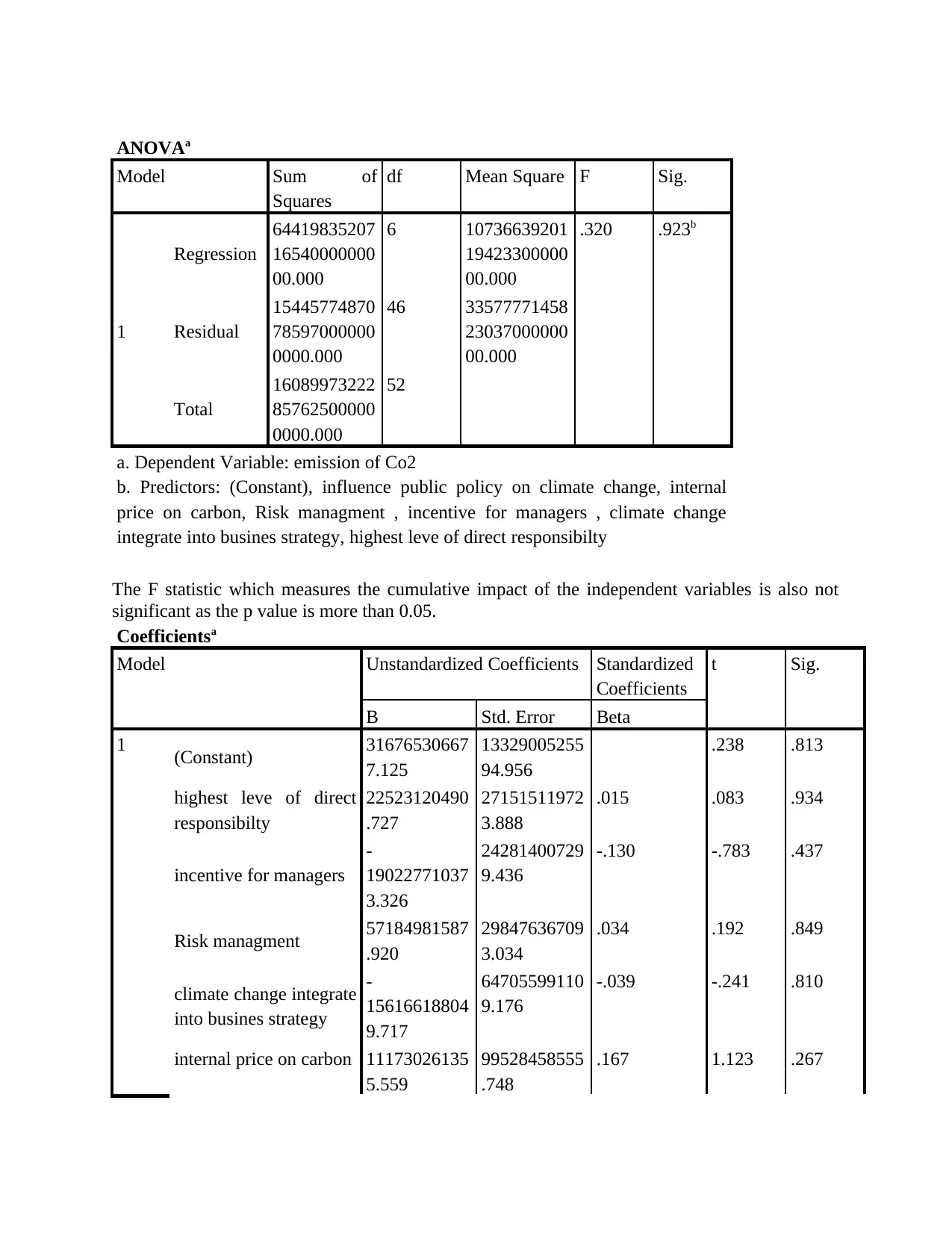

The F statistic which measures the cumulative impact of the independent variables is also not

significant as the p value is more than 0.05.

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 31676530667

7.125

13329005255

94.956

.238 .813

highest leve of direct

responsibilty

22523120490

.727

27151511972

3.888

.015 .083 .934

incentive for managers

-

19022771037

3.326

24281400729

9.436

-.130 -.783 .437

Risk managment 57184981587

.920

29847636709

3.034

.034 .192 .849

climate change integrate

into busines strategy

-

15616618804

9.717

64705599110

9.176

-.039 -.241 .810

internal price on carbon 11173026135

5.559

99528458555

.748

.167 1.123 .267

Model Sum of

Squares

df Mean Square F Sig.

1

Regression

64419835207

16540000000

00.000

6 10736639201

19423300000

00.000

.320 .923b

Residual

15445774870

78597000000

0000.000

46 33577771458

23037000000

00.000

Total

16089973222

85762500000

0000.000

52

a. Dependent Variable: emission of Co2

b. Predictors: (Constant), influence public policy on climate change, internal

price on carbon, Risk managment , incentive for managers , climate change

integrate into busines strategy, highest leve of direct responsibilty

The F statistic which measures the cumulative impact of the independent variables is also not

significant as the p value is more than 0.05.

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 31676530667

7.125

13329005255

94.956

.238 .813

highest leve of direct

responsibilty

22523120490

.727

27151511972

3.888

.015 .083 .934

incentive for managers

-

19022771037

3.326

24281400729

9.436

-.130 -.783 .437

Risk managment 57184981587

.920

29847636709

3.034

.034 .192 .849

climate change integrate

into busines strategy

-

15616618804

9.717

64705599110

9.176

-.039 -.241 .810

internal price on carbon 11173026135

5.559

99528458555

.748

.167 1.123 .267

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

influence public policy

on climate change

-

66628498947

.867

17855639922

5.969

-.063 -.373 .711

a. Dependent Variable: emission of Co2

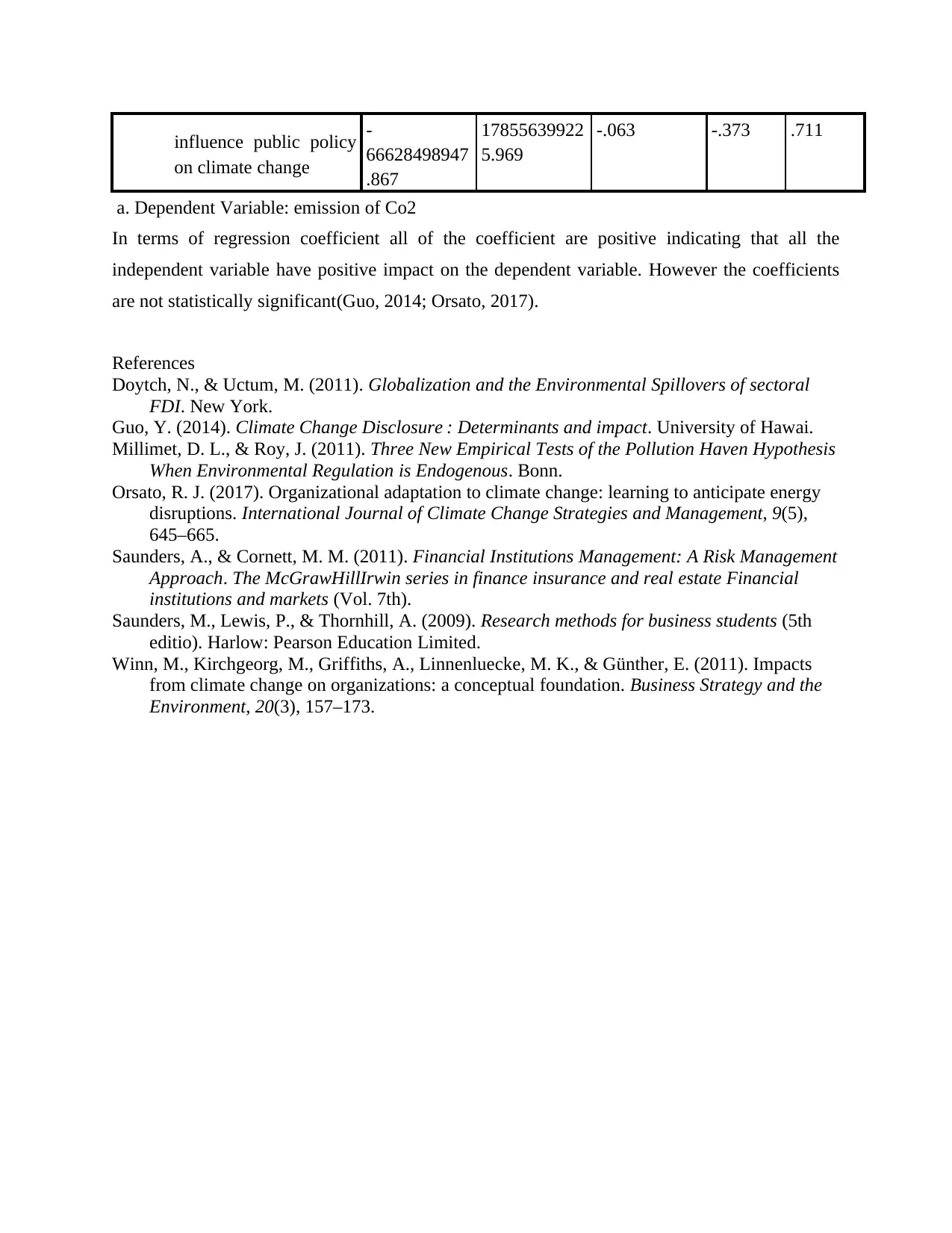

In terms of regression coefficient all of the coefficient are positive indicating that all the

independent variable have positive impact on the dependent variable. However the coefficients

are not statistically significant(Guo, 2014; Orsato, 2017).

References

Doytch, N., & Uctum, M. (2011). Globalization and the Environmental Spillovers of sectoral

FDI. New York.

Guo, Y. (2014). Climate Change Disclosure : Determinants and impact. University of Hawai.

Millimet, D. L., & Roy, J. (2011). Three New Empirical Tests of the Pollution Haven Hypothesis

When Environmental Regulation is Endogenous. Bonn.

Orsato, R. J. (2017). Organizational adaptation to climate change: learning to anticipate energy

disruptions. International Journal of Climate Change Strategies and Management, 9(5),

645–665.

Saunders, A., & Cornett, M. M. (2011). Financial Institutions Management: A Risk Management

Approach. The McGrawHillIrwin series in finance insurance and real estate Financial

institutions and markets (Vol. 7th).

Saunders, M., Lewis, P., & Thornhill, A. (2009). Research methods for business students (5th

editio). Harlow: Pearson Education Limited.

Winn, M., Kirchgeorg, M., Griffiths, A., Linnenluecke, M. K., & Günther, E. (2011). Impacts

from climate change on organizations: a conceptual foundation. Business Strategy and the

Environment, 20(3), 157–173.

on climate change

-

66628498947

.867

17855639922

5.969

-.063 -.373 .711

a. Dependent Variable: emission of Co2

In terms of regression coefficient all of the coefficient are positive indicating that all the

independent variable have positive impact on the dependent variable. However the coefficients

are not statistically significant(Guo, 2014; Orsato, 2017).

References

Doytch, N., & Uctum, M. (2011). Globalization and the Environmental Spillovers of sectoral

FDI. New York.

Guo, Y. (2014). Climate Change Disclosure : Determinants and impact. University of Hawai.

Millimet, D. L., & Roy, J. (2011). Three New Empirical Tests of the Pollution Haven Hypothesis

When Environmental Regulation is Endogenous. Bonn.

Orsato, R. J. (2017). Organizational adaptation to climate change: learning to anticipate energy

disruptions. International Journal of Climate Change Strategies and Management, 9(5),

645–665.

Saunders, A., & Cornett, M. M. (2011). Financial Institutions Management: A Risk Management

Approach. The McGrawHillIrwin series in finance insurance and real estate Financial

institutions and markets (Vol. 7th).

Saunders, M., Lewis, P., & Thornhill, A. (2009). Research methods for business students (5th

editio). Harlow: Pearson Education Limited.

Winn, M., Kirchgeorg, M., Griffiths, A., Linnenluecke, M. K., & Günther, E. (2011). Impacts

from climate change on organizations: a conceptual foundation. Business Strategy and the

Environment, 20(3), 157–173.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.