Week 4 Assignment: Financial Ratios for Physician Practices, HCA 312

VerifiedAdded on 2023/04/21

|8

|2638

|55

Homework Assignment

AI Summary

This assignment analyzes the financial health of Dr. Smith and Dr. Brown's physician practice using financial and operating ratios. The solution calculates and defines various financial ratios, including liquidity, solvency, and profitability ratios, along with their implications. The assignment also delves into operating ratios, analyzing inventory turnover, current ratio, quick ratio, debt service coverage ratio, operating margin, and return on total assets. Furthermore, it includes time value of money calculations for capital expenditures, such as present value, internal rate of return, and payback period for investments in laboratory equipment, EMR software, e-prescribing software, and integrated billing systems. The assignment concludes with an evaluation of capital budget expenditures, applying financial management principles to make informed decisions regarding capital investments, considering regulatory mandates and the time value of money.

Page 1 of 8

HCA 312 - WEEK 4 ASSIGNMENT

ENTER YOUR NAME IN THE BOX ABOVE

FINANCIAL AND OPERATING RATIOS

INSTRUCTIONS: Review Chapters 11, 12, & 13 before completing the template. You will be utilizing Dr. Smith and Dr. Brown’s Physician

Practice financial statements for completing the financial ratio calculations. In addition, you will utilize the Ratio Benchmark & Median

Table below as well as the textbook appendices 13A, and 13C to complete the operating ratio calculations. Refer to the Week 4 Assignment

directions within the course to understand what is expected in each part of the table below. Thorough explanations and definitions for each section

are required. If you include enough detail for each section, the template document will be at least seven pages in length. Include APA citations

within the Response Column where appropriate. List your references in APA format on the last row of this template. All citations and references

must be in APA style according to the Ashford Writing Center guidelines. Once you complete the template, upload the document to the Week 4

Assignment section of the course.

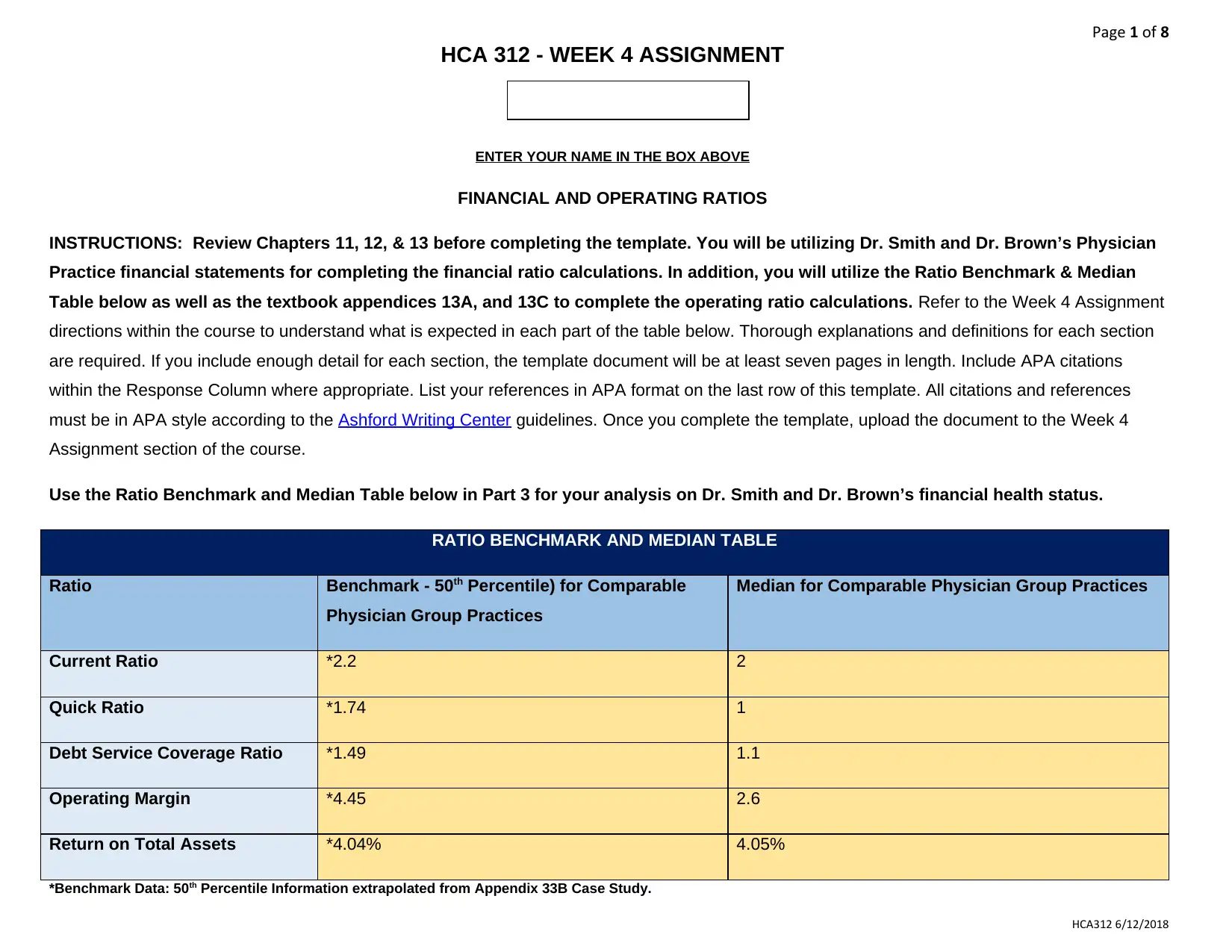

Use the Ratio Benchmark and Median Table below in Part 3 for your analysis on Dr. Smith and Dr. Brown’s financial health status.

RATIO BENCHMARK AND MEDIAN TABLE

Ratio Benchmark - 50th Percentile) for Comparable

Physician Group Practices

Median for Comparable Physician Group Practices

Current Ratio *2.2 2

Quick Ratio *1.74 1

Debt Service Coverage Ratio *1.49 1.1

Operating Margin *4.45 2.6

Return on Total Assets *4.04% 4.05%

*Benchmark Data: 50th Percentile Information extrapolated from Appendix 33B Case Study.

HCA312 6/12/2018

HCA 312 - WEEK 4 ASSIGNMENT

ENTER YOUR NAME IN THE BOX ABOVE

FINANCIAL AND OPERATING RATIOS

INSTRUCTIONS: Review Chapters 11, 12, & 13 before completing the template. You will be utilizing Dr. Smith and Dr. Brown’s Physician

Practice financial statements for completing the financial ratio calculations. In addition, you will utilize the Ratio Benchmark & Median

Table below as well as the textbook appendices 13A, and 13C to complete the operating ratio calculations. Refer to the Week 4 Assignment

directions within the course to understand what is expected in each part of the table below. Thorough explanations and definitions for each section

are required. If you include enough detail for each section, the template document will be at least seven pages in length. Include APA citations

within the Response Column where appropriate. List your references in APA format on the last row of this template. All citations and references

must be in APA style according to the Ashford Writing Center guidelines. Once you complete the template, upload the document to the Week 4

Assignment section of the course.

Use the Ratio Benchmark and Median Table below in Part 3 for your analysis on Dr. Smith and Dr. Brown’s financial health status.

RATIO BENCHMARK AND MEDIAN TABLE

Ratio Benchmark - 50th Percentile) for Comparable

Physician Group Practices

Median for Comparable Physician Group Practices

Current Ratio *2.2 2

Quick Ratio *1.74 1

Debt Service Coverage Ratio *1.49 1.1

Operating Margin *4.45 2.6

Return on Total Assets *4.04% 4.05%

*Benchmark Data: 50th Percentile Information extrapolated from Appendix 33B Case Study.

HCA312 6/12/2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 2 of 8

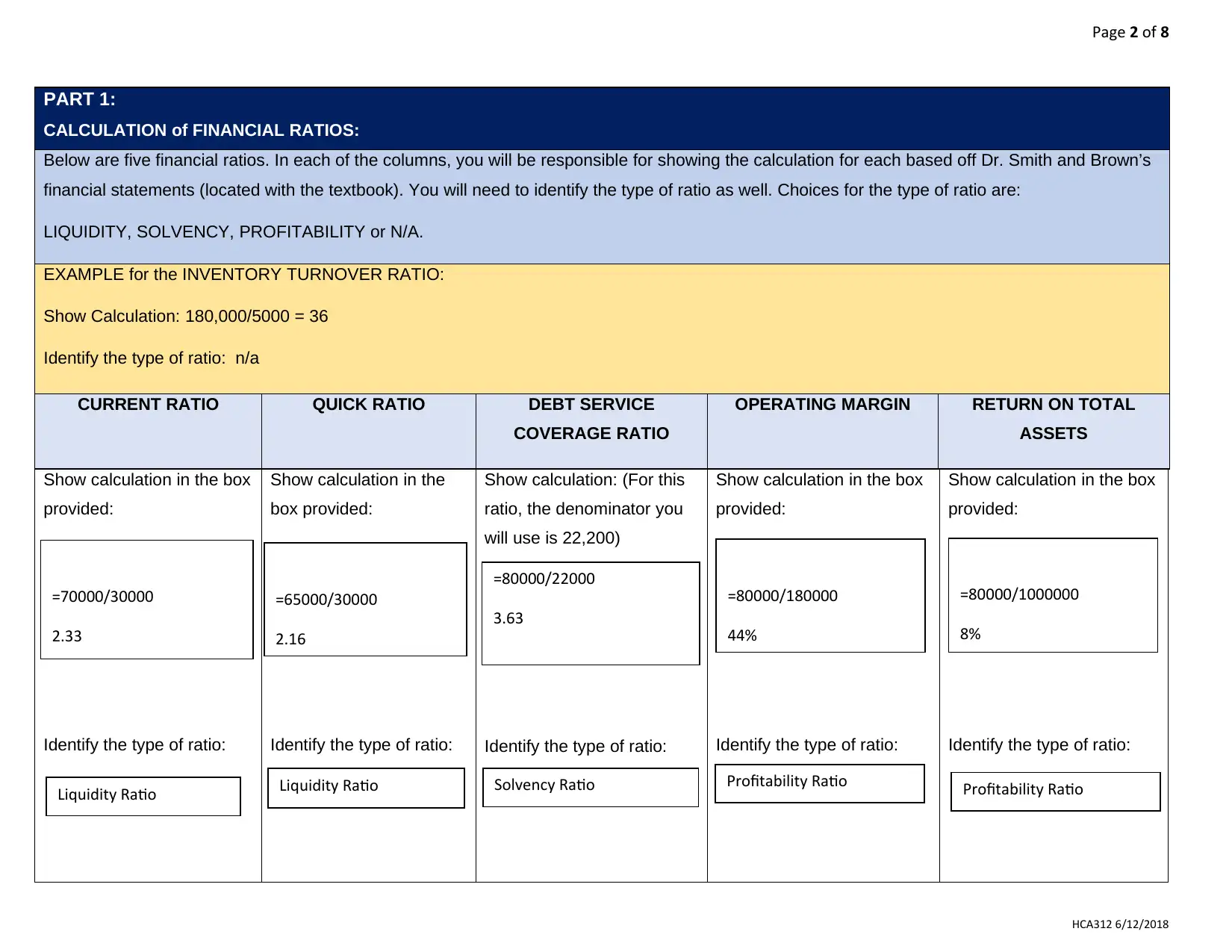

PART 1:

CALCULATION of FINANCIAL RATIOS:

Below are five financial ratios. In each of the columns, you will be responsible for showing the calculation for each based off Dr. Smith and Brown’s

financial statements (located with the textbook). You will need to identify the type of ratio as well. Choices for the type of ratio are:

LIQUIDITY, SOLVENCY, PROFITABILITY or N/A.

EXAMPLE for the INVENTORY TURNOVER RATIO:

Show Calculation: 180,000/5000 = 36

Identify the type of ratio: n/a

CURRENT RATIO QUICK RATIO DEBT SERVICE

COVERAGE RATIO

OPERATING MARGIN RETURN ON TOTAL

ASSETS

Show calculation in the box

provided:

Identify the type of ratio:

Show calculation in the

box provided:

Identify the type of ratio:

Show calculation: (For this

ratio, the denominator you

will use is 22,200)

Identify the type of ratio:

Show calculation in the box

provided:

Identify the type of ratio:

Show calculation in the box

provided:

Identify the type of ratio:

HCA312 6/12/2018

=70000/30000

2.33

Liquidity Ratio

=65000/30000

2.16

Liquidity Ratio Solvency Ratio Profitability Ratio

=80000/180000

44%

=80000/1000000

8%

Profitability Ratio

=80000/22000

3.63

PART 1:

CALCULATION of FINANCIAL RATIOS:

Below are five financial ratios. In each of the columns, you will be responsible for showing the calculation for each based off Dr. Smith and Brown’s

financial statements (located with the textbook). You will need to identify the type of ratio as well. Choices for the type of ratio are:

LIQUIDITY, SOLVENCY, PROFITABILITY or N/A.

EXAMPLE for the INVENTORY TURNOVER RATIO:

Show Calculation: 180,000/5000 = 36

Identify the type of ratio: n/a

CURRENT RATIO QUICK RATIO DEBT SERVICE

COVERAGE RATIO

OPERATING MARGIN RETURN ON TOTAL

ASSETS

Show calculation in the box

provided:

Identify the type of ratio:

Show calculation in the

box provided:

Identify the type of ratio:

Show calculation: (For this

ratio, the denominator you

will use is 22,200)

Identify the type of ratio:

Show calculation in the box

provided:

Identify the type of ratio:

Show calculation in the box

provided:

Identify the type of ratio:

HCA312 6/12/2018

=70000/30000

2.33

Liquidity Ratio

=65000/30000

2.16

Liquidity Ratio Solvency Ratio Profitability Ratio

=80000/180000

44%

=80000/1000000

8%

Profitability Ratio

=80000/22000

3.63

Page 3 of 8

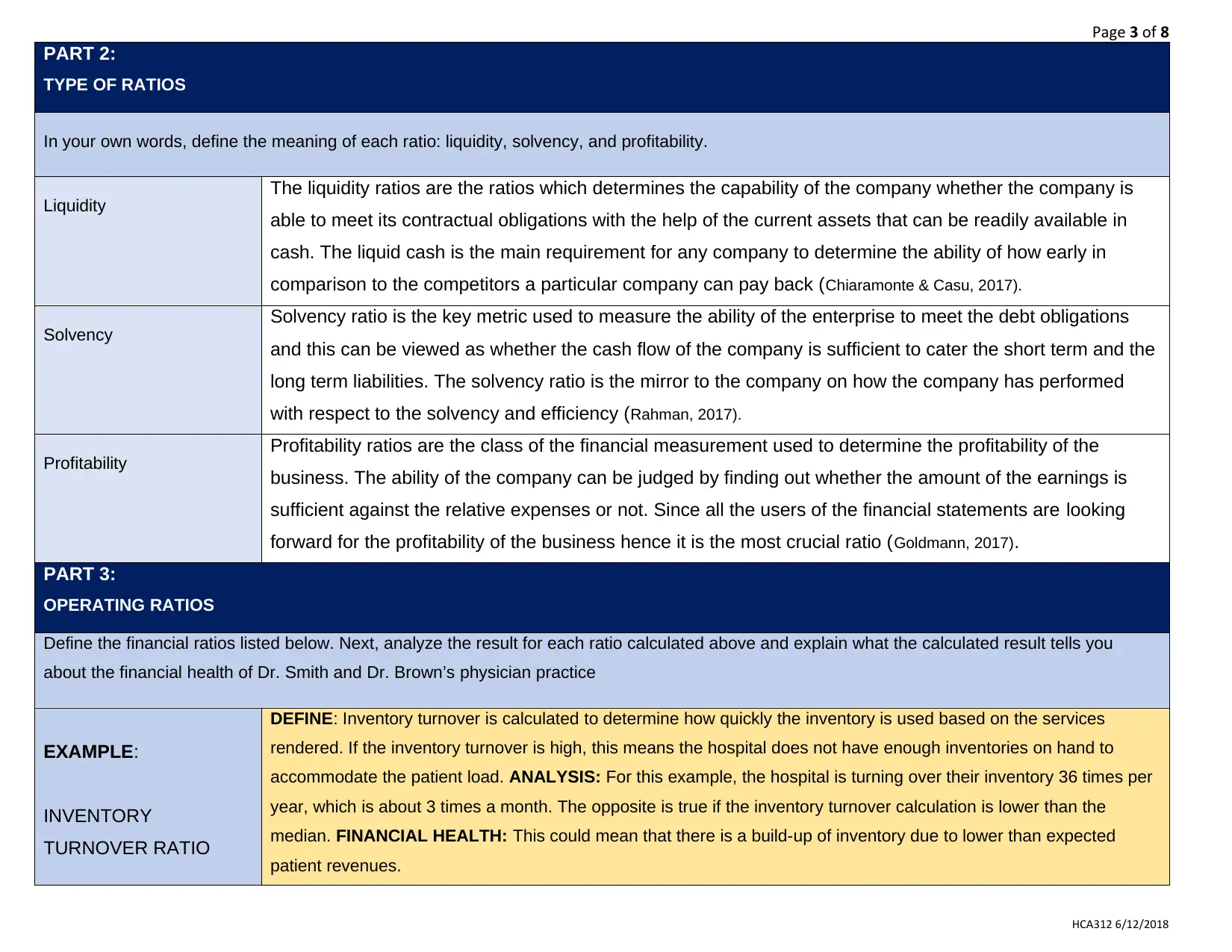

PART 2:

TYPE OF RATIOS

In your own words, define the meaning of each ratio: liquidity, solvency, and profitability.

Liquidity

The liquidity ratios are the ratios which determines the capability of the company whether the company is

able to meet its contractual obligations with the help of the current assets that can be readily available in

cash. The liquid cash is the main requirement for any company to determine the ability of how early in

comparison to the competitors a particular company can pay back (Chiaramonte & Casu, 2017).

Solvency

Solvency ratio is the key metric used to measure the ability of the enterprise to meet the debt obligations

and this can be viewed as whether the cash flow of the company is sufficient to cater the short term and the

long term liabilities. The solvency ratio is the mirror to the company on how the company has performed

with respect to the solvency and efficiency (Rahman, 2017).

Profitability

Profitability ratios are the class of the financial measurement used to determine the profitability of the

business. The ability of the company can be judged by finding out whether the amount of the earnings is

sufficient against the relative expenses or not. Since all the users of the financial statements are looking

forward for the profitability of the business hence it is the most crucial ratio (Goldmann, 2017).

PART 3:

OPERATING RATIOS

Define the financial ratios listed below. Next, analyze the result for each ratio calculated above and explain what the calculated result tells you

about the financial health of Dr. Smith and Dr. Brown’s physician practice

EXAMPLE:

INVENTORY

TURNOVER RATIO

DEFINE: Inventory turnover is calculated to determine how quickly the inventory is used based on the services

rendered. If the inventory turnover is high, this means the hospital does not have enough inventories on hand to

accommodate the patient load. ANALYSIS: For this example, the hospital is turning over their inventory 36 times per

year, which is about 3 times a month. The opposite is true if the inventory turnover calculation is lower than the

median. FINANCIAL HEALTH: This could mean that there is a build-up of inventory due to lower than expected

patient revenues.

HCA312 6/12/2018

PART 2:

TYPE OF RATIOS

In your own words, define the meaning of each ratio: liquidity, solvency, and profitability.

Liquidity

The liquidity ratios are the ratios which determines the capability of the company whether the company is

able to meet its contractual obligations with the help of the current assets that can be readily available in

cash. The liquid cash is the main requirement for any company to determine the ability of how early in

comparison to the competitors a particular company can pay back (Chiaramonte & Casu, 2017).

Solvency

Solvency ratio is the key metric used to measure the ability of the enterprise to meet the debt obligations

and this can be viewed as whether the cash flow of the company is sufficient to cater the short term and the

long term liabilities. The solvency ratio is the mirror to the company on how the company has performed

with respect to the solvency and efficiency (Rahman, 2017).

Profitability

Profitability ratios are the class of the financial measurement used to determine the profitability of the

business. The ability of the company can be judged by finding out whether the amount of the earnings is

sufficient against the relative expenses or not. Since all the users of the financial statements are looking

forward for the profitability of the business hence it is the most crucial ratio (Goldmann, 2017).

PART 3:

OPERATING RATIOS

Define the financial ratios listed below. Next, analyze the result for each ratio calculated above and explain what the calculated result tells you

about the financial health of Dr. Smith and Dr. Brown’s physician practice

EXAMPLE:

INVENTORY

TURNOVER RATIO

DEFINE: Inventory turnover is calculated to determine how quickly the inventory is used based on the services

rendered. If the inventory turnover is high, this means the hospital does not have enough inventories on hand to

accommodate the patient load. ANALYSIS: For this example, the hospital is turning over their inventory 36 times per

year, which is about 3 times a month. The opposite is true if the inventory turnover calculation is lower than the

median. FINANCIAL HEALTH: This could mean that there is a build-up of inventory due to lower than expected

patient revenues.

HCA312 6/12/2018

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

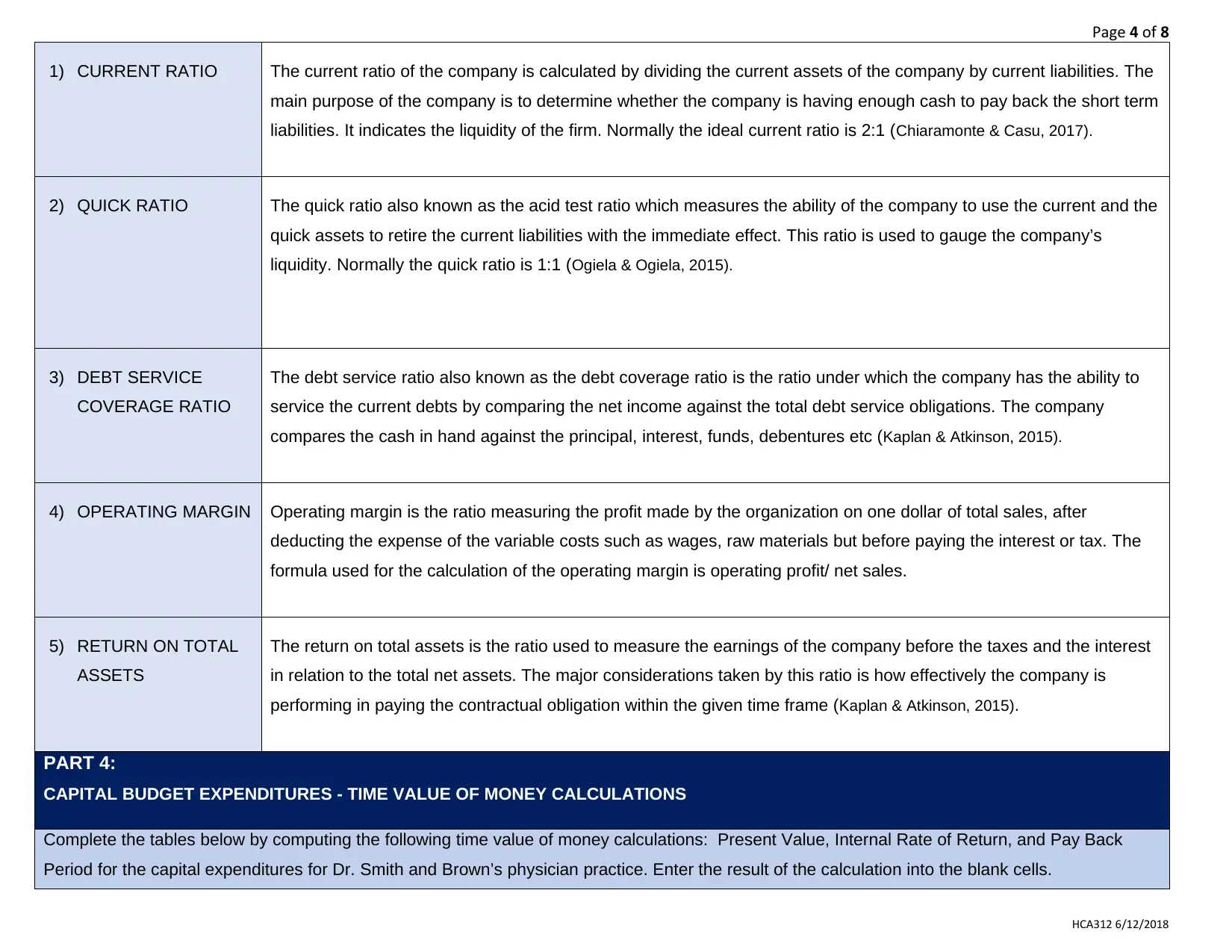

Page 4 of 8

1) CURRENT RATIO The current ratio of the company is calculated by dividing the current assets of the company by current liabilities. The

main purpose of the company is to determine whether the company is having enough cash to pay back the short term

liabilities. It indicates the liquidity of the firm. Normally the ideal current ratio is 2:1 (Chiaramonte & Casu, 2017).

2) QUICK RATIO The quick ratio also known as the acid test ratio which measures the ability of the company to use the current and the

quick assets to retire the current liabilities with the immediate effect. This ratio is used to gauge the company’s

liquidity. Normally the quick ratio is 1:1 (Ogiela & Ogiela, 2015).

3) DEBT SERVICE

COVERAGE RATIO

The debt service ratio also known as the debt coverage ratio is the ratio under which the company has the ability to

service the current debts by comparing the net income against the total debt service obligations. The company

compares the cash in hand against the principal, interest, funds, debentures etc (Kaplan & Atkinson, 2015).

4) OPERATING MARGIN Operating margin is the ratio measuring the profit made by the organization on one dollar of total sales, after

deducting the expense of the variable costs such as wages, raw materials but before paying the interest or tax. The

formula used for the calculation of the operating margin is operating profit/ net sales.

5) RETURN ON TOTAL

ASSETS

The return on total assets is the ratio used to measure the earnings of the company before the taxes and the interest

in relation to the total net assets. The major considerations taken by this ratio is how effectively the company is

performing in paying the contractual obligation within the given time frame (Kaplan & Atkinson, 2015).

PART 4:

CAPITAL BUDGET EXPENDITURES - TIME VALUE OF MONEY CALCULATIONS

Complete the tables below by computing the following time value of money calculations: Present Value, Internal Rate of Return, and Pay Back

Period for the capital expenditures for Dr. Smith and Brown’s physician practice. Enter the result of the calculation into the blank cells.

HCA312 6/12/2018

1) CURRENT RATIO The current ratio of the company is calculated by dividing the current assets of the company by current liabilities. The

main purpose of the company is to determine whether the company is having enough cash to pay back the short term

liabilities. It indicates the liquidity of the firm. Normally the ideal current ratio is 2:1 (Chiaramonte & Casu, 2017).

2) QUICK RATIO The quick ratio also known as the acid test ratio which measures the ability of the company to use the current and the

quick assets to retire the current liabilities with the immediate effect. This ratio is used to gauge the company’s

liquidity. Normally the quick ratio is 1:1 (Ogiela & Ogiela, 2015).

3) DEBT SERVICE

COVERAGE RATIO

The debt service ratio also known as the debt coverage ratio is the ratio under which the company has the ability to

service the current debts by comparing the net income against the total debt service obligations. The company

compares the cash in hand against the principal, interest, funds, debentures etc (Kaplan & Atkinson, 2015).

4) OPERATING MARGIN Operating margin is the ratio measuring the profit made by the organization on one dollar of total sales, after

deducting the expense of the variable costs such as wages, raw materials but before paying the interest or tax. The

formula used for the calculation of the operating margin is operating profit/ net sales.

5) RETURN ON TOTAL

ASSETS

The return on total assets is the ratio used to measure the earnings of the company before the taxes and the interest

in relation to the total net assets. The major considerations taken by this ratio is how effectively the company is

performing in paying the contractual obligation within the given time frame (Kaplan & Atkinson, 2015).

PART 4:

CAPITAL BUDGET EXPENDITURES - TIME VALUE OF MONEY CALCULATIONS

Complete the tables below by computing the following time value of money calculations: Present Value, Internal Rate of Return, and Pay Back

Period for the capital expenditures for Dr. Smith and Brown’s physician practice. Enter the result of the calculation into the blank cells.

HCA312 6/12/2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 5 of 8

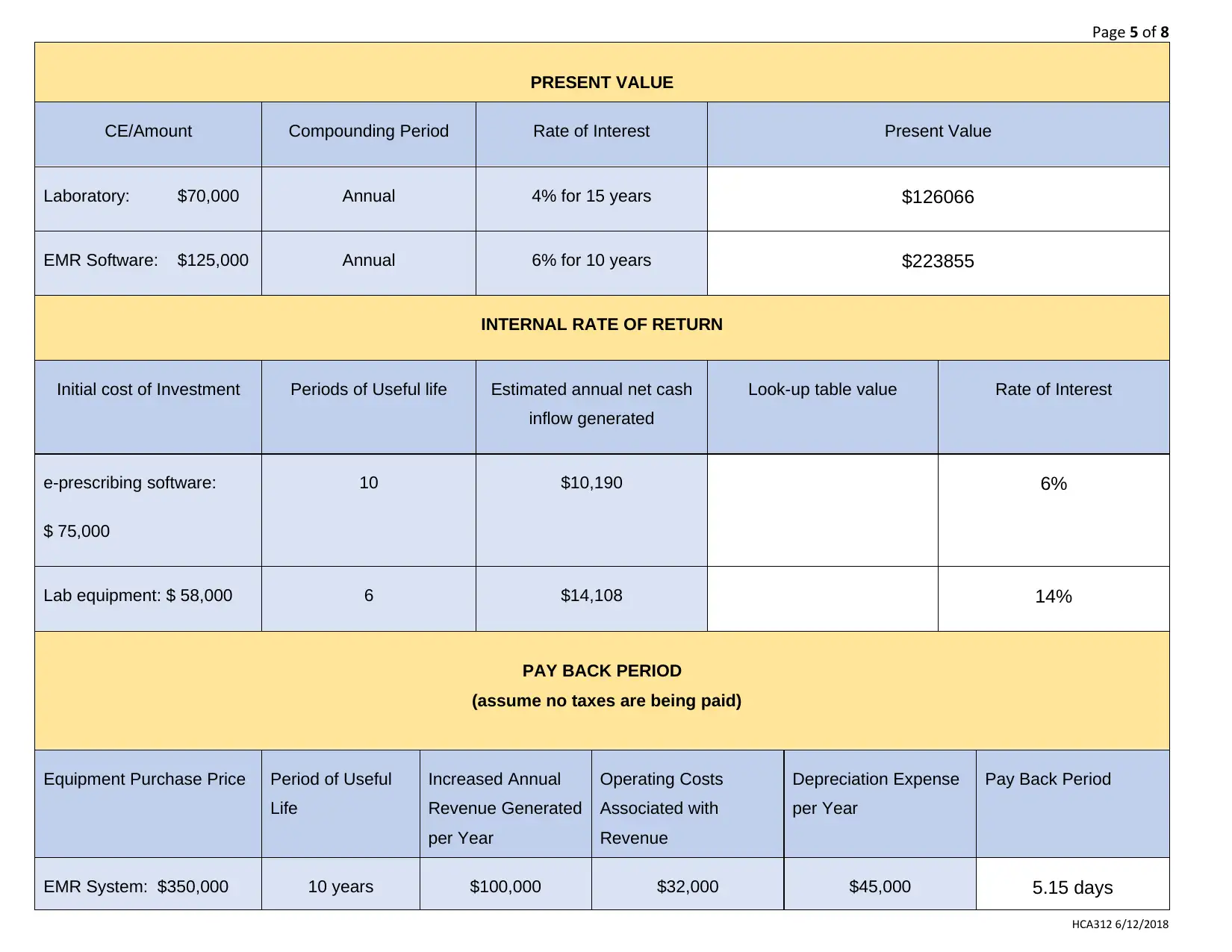

PRESENT VALUE

CE/Amount Compounding Period Rate of Interest Present Value

Laboratory: $70,000 Annual 4% for 15 years $126066

EMR Software: $125,000 Annual 6% for 10 years $223855

INTERNAL RATE OF RETURN

Initial cost of Investment Periods of Useful life Estimated annual net cash

inflow generated

Look-up table value Rate of Interest

e-prescribing software:

$ 75,000

10 $10,190 6%

Lab equipment: $ 58,000 6 $14,108 14%

PAY BACK PERIOD

(assume no taxes are being paid)

Equipment Purchase Price Period of Useful

Life

Increased Annual

Revenue Generated

per Year

Operating Costs

Associated with

Revenue

Depreciation Expense

per Year

Pay Back Period

EMR System: $350,000 10 years $100,000 $32,000 $45,000 5.15 days

HCA312 6/12/2018

PRESENT VALUE

CE/Amount Compounding Period Rate of Interest Present Value

Laboratory: $70,000 Annual 4% for 15 years $126066

EMR Software: $125,000 Annual 6% for 10 years $223855

INTERNAL RATE OF RETURN

Initial cost of Investment Periods of Useful life Estimated annual net cash

inflow generated

Look-up table value Rate of Interest

e-prescribing software:

$ 75,000

10 $10,190 6%

Lab equipment: $ 58,000 6 $14,108 14%

PAY BACK PERIOD

(assume no taxes are being paid)

Equipment Purchase Price Period of Useful

Life

Increased Annual

Revenue Generated

per Year

Operating Costs

Associated with

Revenue

Depreciation Expense

per Year

Pay Back Period

EMR System: $350,000 10 years $100,000 $32,000 $45,000 5.15 days

HCA312 6/12/2018

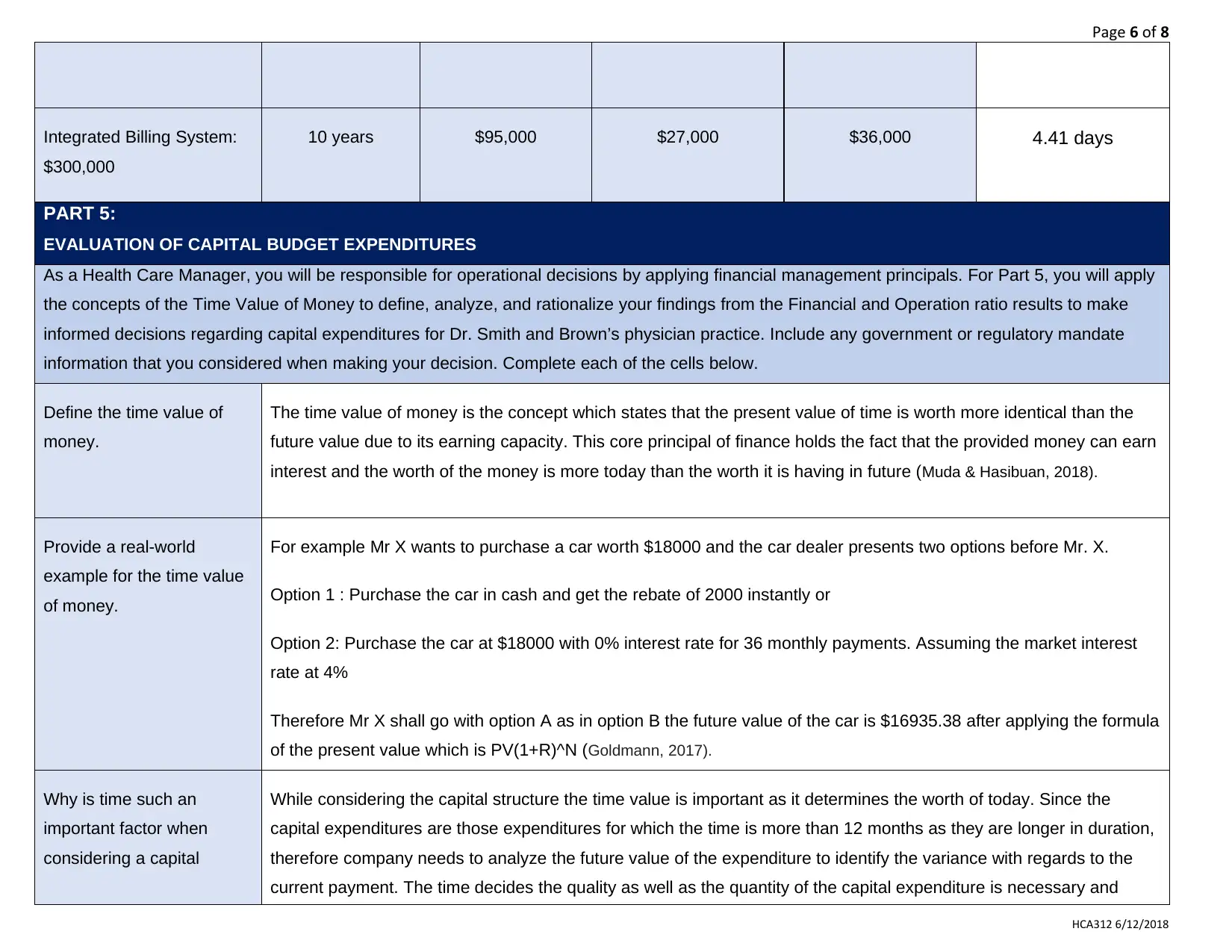

Page 6 of 8

Integrated Billing System:

$300,000

10 years $95,000 $27,000 $36,000 4.41 days

PART 5:

EVALUATION OF CAPITAL BUDGET EXPENDITURES

As a Health Care Manager, you will be responsible for operational decisions by applying financial management principals. For Part 5, you will apply

the concepts of the Time Value of Money to define, analyze, and rationalize your findings from the Financial and Operation ratio results to make

informed decisions regarding capital expenditures for Dr. Smith and Brown’s physician practice. Include any government or regulatory mandate

information that you considered when making your decision. Complete each of the cells below.

Define the time value of

money.

The time value of money is the concept which states that the present value of time is worth more identical than the

future value due to its earning capacity. This core principal of finance holds the fact that the provided money can earn

interest and the worth of the money is more today than the worth it is having in future (Muda & Hasibuan, 2018).

Provide a real-world

example for the time value

of money.

For example Mr X wants to purchase a car worth $18000 and the car dealer presents two options before Mr. X.

Option 1 : Purchase the car in cash and get the rebate of 2000 instantly or

Option 2: Purchase the car at $18000 with 0% interest rate for 36 monthly payments. Assuming the market interest

rate at 4%

Therefore Mr X shall go with option A as in option B the future value of the car is $16935.38 after applying the formula

of the present value which is PV(1+R)^N (Goldmann, 2017).

Why is time such an

important factor when

considering a capital

While considering the capital structure the time value is important as it determines the worth of today. Since the

capital expenditures are those expenditures for which the time is more than 12 months as they are longer in duration,

therefore company needs to analyze the future value of the expenditure to identify the variance with regards to the

current payment. The time decides the quality as well as the quantity of the capital expenditure is necessary and

HCA312 6/12/2018

Integrated Billing System:

$300,000

10 years $95,000 $27,000 $36,000 4.41 days

PART 5:

EVALUATION OF CAPITAL BUDGET EXPENDITURES

As a Health Care Manager, you will be responsible for operational decisions by applying financial management principals. For Part 5, you will apply

the concepts of the Time Value of Money to define, analyze, and rationalize your findings from the Financial and Operation ratio results to make

informed decisions regarding capital expenditures for Dr. Smith and Brown’s physician practice. Include any government or regulatory mandate

information that you considered when making your decision. Complete each of the cells below.

Define the time value of

money.

The time value of money is the concept which states that the present value of time is worth more identical than the

future value due to its earning capacity. This core principal of finance holds the fact that the provided money can earn

interest and the worth of the money is more today than the worth it is having in future (Muda & Hasibuan, 2018).

Provide a real-world

example for the time value

of money.

For example Mr X wants to purchase a car worth $18000 and the car dealer presents two options before Mr. X.

Option 1 : Purchase the car in cash and get the rebate of 2000 instantly or

Option 2: Purchase the car at $18000 with 0% interest rate for 36 monthly payments. Assuming the market interest

rate at 4%

Therefore Mr X shall go with option A as in option B the future value of the car is $16935.38 after applying the formula

of the present value which is PV(1+R)^N (Goldmann, 2017).

Why is time such an

important factor when

considering a capital

While considering the capital structure the time value is important as it determines the worth of today. Since the

capital expenditures are those expenditures for which the time is more than 12 months as they are longer in duration,

therefore company needs to analyze the future value of the expenditure to identify the variance with regards to the

current payment. The time decides the quality as well as the quantity of the capital expenditure is necessary and

HCA312 6/12/2018

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

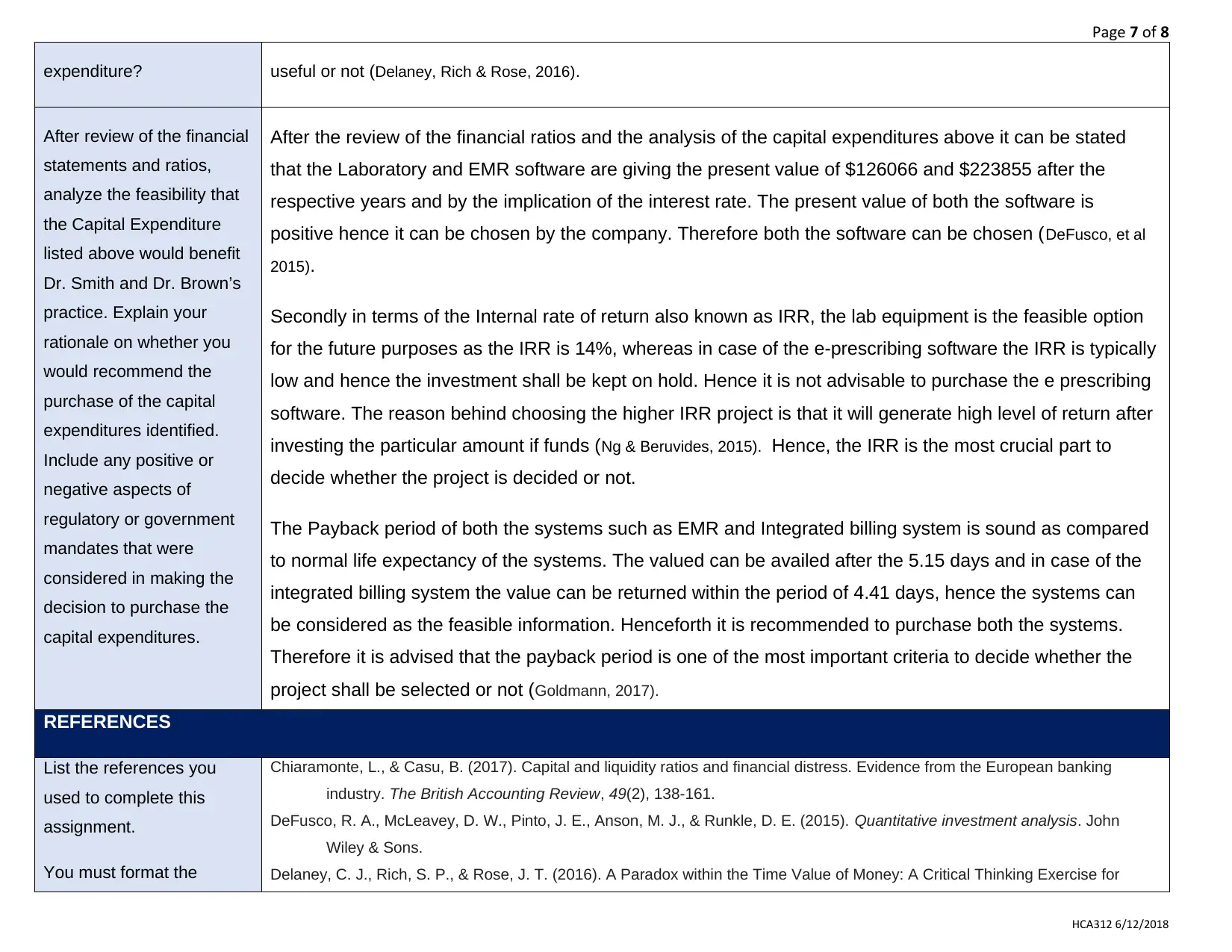

Page 7 of 8

expenditure? useful or not (Delaney, Rich & Rose, 2016).

After review of the financial

statements and ratios,

analyze the feasibility that

the Capital Expenditure

listed above would benefit

Dr. Smith and Dr. Brown’s

practice. Explain your

rationale on whether you

would recommend the

purchase of the capital

expenditures identified.

Include any positive or

negative aspects of

regulatory or government

mandates that were

considered in making the

decision to purchase the

capital expenditures.

After the review of the financial ratios and the analysis of the capital expenditures above it can be stated

that the Laboratory and EMR software are giving the present value of $126066 and $223855 after the

respective years and by the implication of the interest rate. The present value of both the software is

positive hence it can be chosen by the company. Therefore both the software can be chosen (DeFusco, et al

2015).

Secondly in terms of the Internal rate of return also known as IRR, the lab equipment is the feasible option

for the future purposes as the IRR is 14%, whereas in case of the e-prescribing software the IRR is typically

low and hence the investment shall be kept on hold. Hence it is not advisable to purchase the e prescribing

software. The reason behind choosing the higher IRR project is that it will generate high level of return after

investing the particular amount if funds (Ng & Beruvides, 2015). Hence, the IRR is the most crucial part to

decide whether the project is decided or not.

The Payback period of both the systems such as EMR and Integrated billing system is sound as compared

to normal life expectancy of the systems. The valued can be availed after the 5.15 days and in case of the

integrated billing system the value can be returned within the period of 4.41 days, hence the systems can

be considered as the feasible information. Henceforth it is recommended to purchase both the systems.

Therefore it is advised that the payback period is one of the most important criteria to decide whether the

project shall be selected or not (Goldmann, 2017).

REFERENCES

List the references you

used to complete this

assignment.

You must format the

Chiaramonte, L., & Casu, B. (2017). Capital and liquidity ratios and financial distress. Evidence from the European banking

industry. The British Accounting Review, 49(2), 138-161.

DeFusco, R. A., McLeavey, D. W., Pinto, J. E., Anson, M. J., & Runkle, D. E. (2015). Quantitative investment analysis. John

Wiley & Sons.

Delaney, C. J., Rich, S. P., & Rose, J. T. (2016). A Paradox within the Time Value of Money: A Critical Thinking Exercise for

HCA312 6/12/2018

expenditure? useful or not (Delaney, Rich & Rose, 2016).

After review of the financial

statements and ratios,

analyze the feasibility that

the Capital Expenditure

listed above would benefit

Dr. Smith and Dr. Brown’s

practice. Explain your

rationale on whether you

would recommend the

purchase of the capital

expenditures identified.

Include any positive or

negative aspects of

regulatory or government

mandates that were

considered in making the

decision to purchase the

capital expenditures.

After the review of the financial ratios and the analysis of the capital expenditures above it can be stated

that the Laboratory and EMR software are giving the present value of $126066 and $223855 after the

respective years and by the implication of the interest rate. The present value of both the software is

positive hence it can be chosen by the company. Therefore both the software can be chosen (DeFusco, et al

2015).

Secondly in terms of the Internal rate of return also known as IRR, the lab equipment is the feasible option

for the future purposes as the IRR is 14%, whereas in case of the e-prescribing software the IRR is typically

low and hence the investment shall be kept on hold. Hence it is not advisable to purchase the e prescribing

software. The reason behind choosing the higher IRR project is that it will generate high level of return after

investing the particular amount if funds (Ng & Beruvides, 2015). Hence, the IRR is the most crucial part to

decide whether the project is decided or not.

The Payback period of both the systems such as EMR and Integrated billing system is sound as compared

to normal life expectancy of the systems. The valued can be availed after the 5.15 days and in case of the

integrated billing system the value can be returned within the period of 4.41 days, hence the systems can

be considered as the feasible information. Henceforth it is recommended to purchase both the systems.

Therefore it is advised that the payback period is one of the most important criteria to decide whether the

project shall be selected or not (Goldmann, 2017).

REFERENCES

List the references you

used to complete this

assignment.

You must format the

Chiaramonte, L., & Casu, B. (2017). Capital and liquidity ratios and financial distress. Evidence from the European banking

industry. The British Accounting Review, 49(2), 138-161.

DeFusco, R. A., McLeavey, D. W., Pinto, J. E., Anson, M. J., & Runkle, D. E. (2015). Quantitative investment analysis. John

Wiley & Sons.

Delaney, C. J., Rich, S. P., & Rose, J. T. (2016). A Paradox within the Time Value of Money: A Critical Thinking Exercise for

HCA312 6/12/2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 8 of 8

references in APA format

as outlined in 6th edition

guidelines found at the AU

Writing Center.

Finance Students. American Journal of Business Education, 9(2), 83-86.

Goldmann, K. (2017). Financial liquidity and profitability management in practice of polish business. In Financial Environment and

Business Development (pp. 103-112). Springer, Cham.

Kaplan, R. S., & Atkinson, A. A. (2015). Advanced management accounting. PHI Learning.

Muda, I., & Hasibuan, A. N. (2018). Public Discovery of the Concept of Time Value of Money with Economic Value of Time.

In Proceedings of MICoMS 2017 (pp. 251-257). Emerald Publishing Limited.

Ng, E. H., & Beruvides, M. G. (2015). Multiple internal rate of return revisited: Frequency of occurrences. The Engineering

Economist, 60(1), 75-87.

Ogiela, L., & Ogiela, M. R. (2015). Management information systems. In Ubiquitous Computing Application and Wireless

Sensor (pp. 449-456). Springer, Dordrecht.

Rahman, A. (2017). The Relationship between Solvency Ratios and Profitability Ratios: Analytical Study in Food Industrial

Companies listed in Amman Bursa. International Journal of Economics and Financial Issues, 7(2), 86-93.

HCA312 6/12/2018

references in APA format

as outlined in 6th edition

guidelines found at the AU

Writing Center.

Finance Students. American Journal of Business Education, 9(2), 83-86.

Goldmann, K. (2017). Financial liquidity and profitability management in practice of polish business. In Financial Environment and

Business Development (pp. 103-112). Springer, Cham.

Kaplan, R. S., & Atkinson, A. A. (2015). Advanced management accounting. PHI Learning.

Muda, I., & Hasibuan, A. N. (2018). Public Discovery of the Concept of Time Value of Money with Economic Value of Time.

In Proceedings of MICoMS 2017 (pp. 251-257). Emerald Publishing Limited.

Ng, E. H., & Beruvides, M. G. (2015). Multiple internal rate of return revisited: Frequency of occurrences. The Engineering

Economist, 60(1), 75-87.

Ogiela, L., & Ogiela, M. R. (2015). Management information systems. In Ubiquitous Computing Application and Wireless

Sensor (pp. 449-456). Springer, Dordrecht.

Rahman, A. (2017). The Relationship between Solvency Ratios and Profitability Ratios: Analytical Study in Food Industrial

Companies listed in Amman Bursa. International Journal of Economics and Financial Issues, 7(2), 86-93.

HCA312 6/12/2018

1 out of 8