Analysis of Louie Turley's 2017 Individual Tax Return (Finance)

VerifiedAdded on 2020/05/28

|15

|2614

|118

Homework Assignment

AI Summary

This document is an analysis of Louie Turley's 2017 individual tax return. The return details his income sources, including salary, dividends, and business income, and calculates his total income, including losses. It outlines various deductions, such as work-related expenses, interest, dividend deductions, and gifts. The document calculates his taxable income after deductions and applies tax offsets, including a superannuation contribution. The return also includes information on his spouse's income and details about his business activities, including income and expenses. The analysis provides a comprehensive overview of the tax return, including calculations of taxable income, total tax offsets, and relevant financial information.

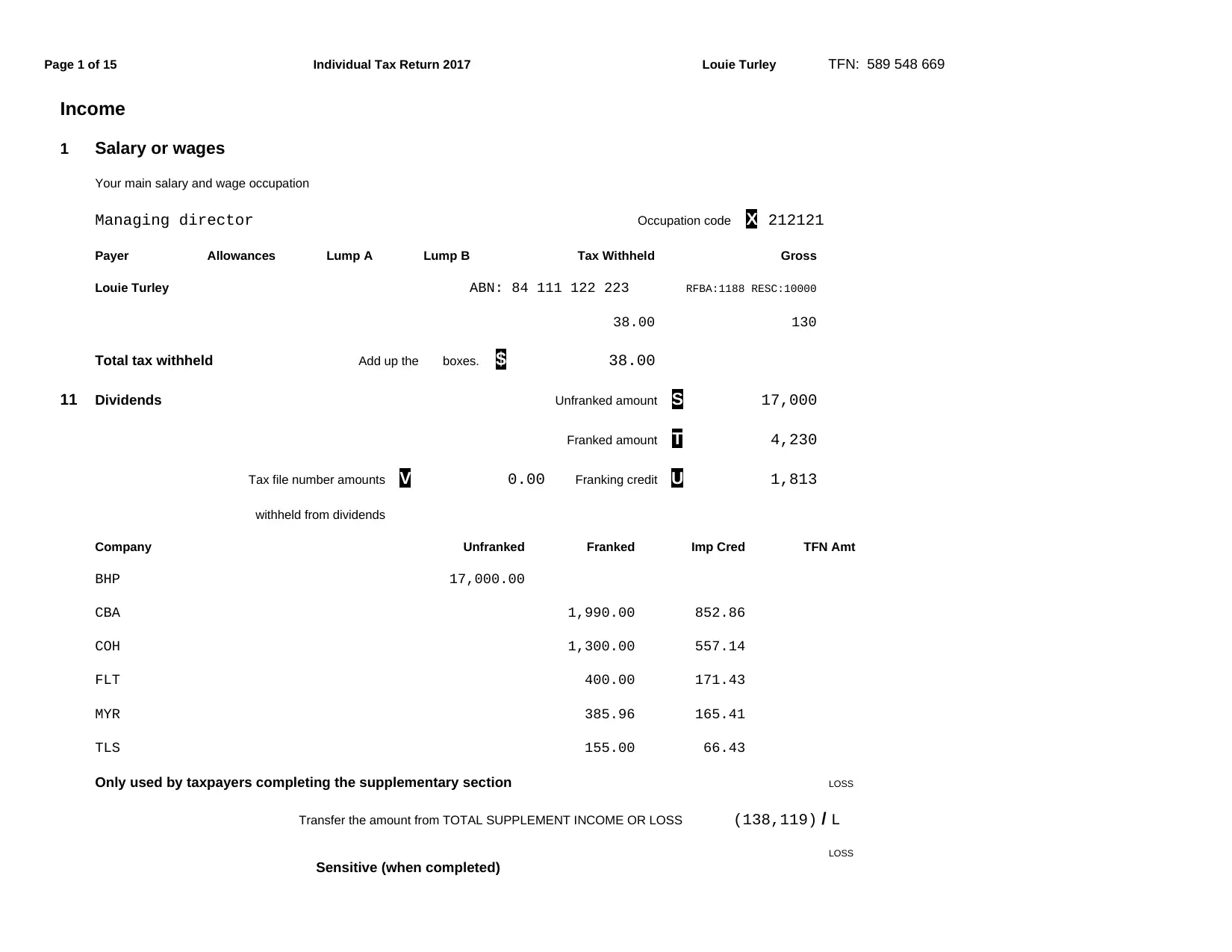

Page 1 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

Income

1 Salary or wages

Your main salary and wage occupation

Managing director Occupation code X 212121

Payer Allowances Lump A Lump B Tax Withheld Gross

Louie Turley ABN: 84 111 122 223 RFBA:1188 RESC:10000

38.00 130

Total tax withheld Add up the boxes. $ 38.00

11 Dividends Unfranked amount S 17,000

Franked amount T 4,230

Tax file number amounts V 0.00 Franking credit U 1,813

withheld from dividends

Company Unfranked Franked Imp Cred TFN Amt

BHP 17,000.00

CBA 1,990.00 852.86

COH 1,300.00 557.14

FLT 400.00 171.43

MYR 385.96 165.41

TLS 155.00 66.43

Only used by taxpayers completing the supplementary section LOSS

Transfer the amount from TOTAL SUPPLEMENT INCOME OR LOSS (138,119) / L

LOSS

Sensitive (when completed)

Income

1 Salary or wages

Your main salary and wage occupation

Managing director Occupation code X 212121

Payer Allowances Lump A Lump B Tax Withheld Gross

Louie Turley ABN: 84 111 122 223 RFBA:1188 RESC:10000

38.00 130

Total tax withheld Add up the boxes. $ 38.00

11 Dividends Unfranked amount S 17,000

Franked amount T 4,230

Tax file number amounts V 0.00 Franking credit U 1,813

withheld from dividends

Company Unfranked Franked Imp Cred TFN Amt

BHP 17,000.00

CBA 1,990.00 852.86

COH 1,300.00 557.14

FLT 400.00 171.43

MYR 385.96 165.41

TLS 155.00 66.43

Only used by taxpayers completing the supplementary section LOSS

Transfer the amount from TOTAL SUPPLEMENT INCOME OR LOSS (138,119) / L

LOSS

Sensitive (when completed)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 2 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

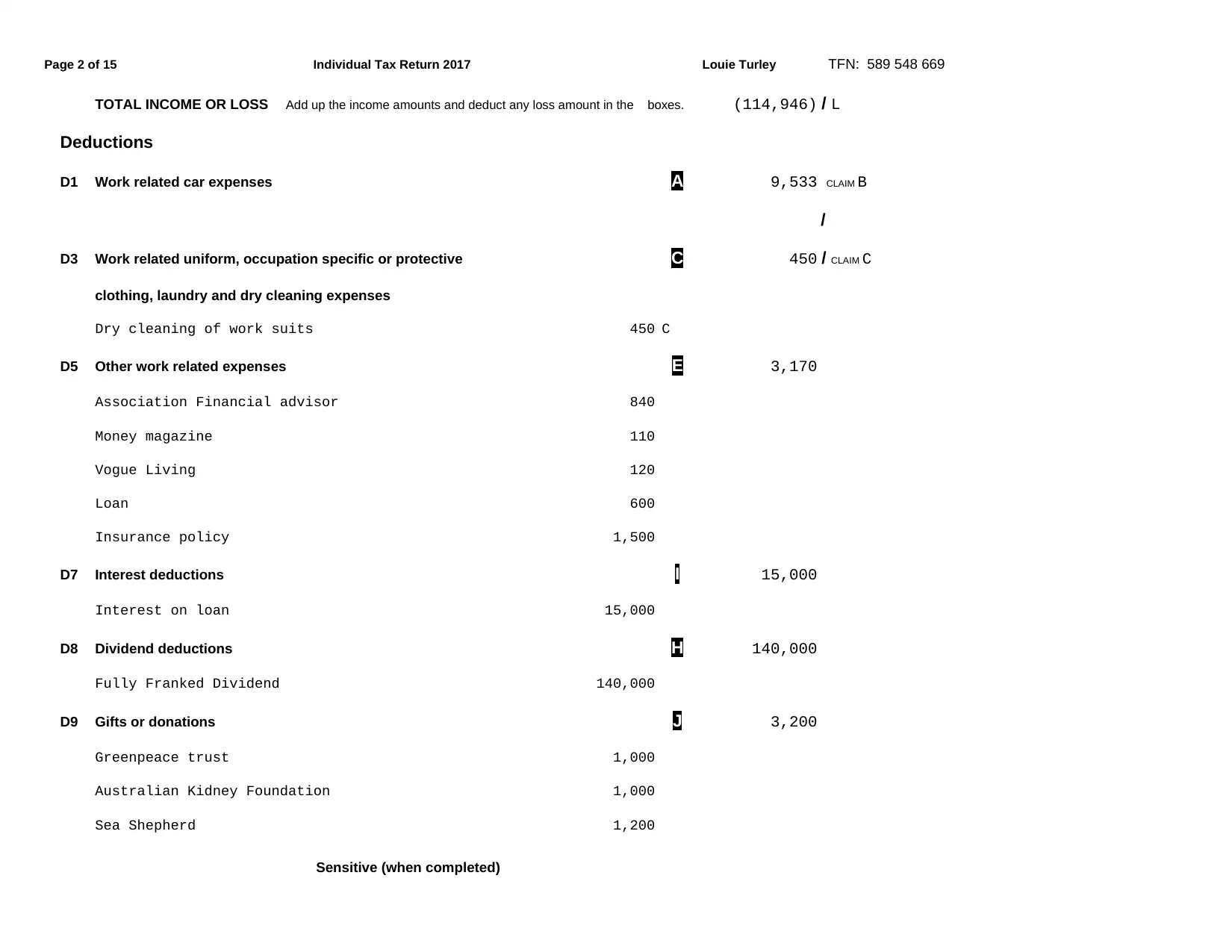

TOTAL INCOME OR LOSS Add up the income amounts and deduct any loss amount in the boxes. (114,946) / L

Deductions

D1 Work related car expenses A 9,533 CLAIM B

/

D3 Work related uniform, occupation specific or protective C 450 / CLAIM C

clothing, laundry and dry cleaning expenses

Dry cleaning of work suits 450 C

D5 Other work related expenses E 3,170

Association Financial advisor 840

Money magazine 110

Vogue Living 120

Loan 600

Insurance policy 1,500

D7 Interest deductions I 15,000

Interest on loan 15,000

D8 Dividend deductions H 140,000

Fully Franked Dividend 140,000

D9 Gifts or donations J 3,200

Greenpeace trust 1,000

Australian Kidney Foundation 1,000

Sea Shepherd 1,200

Sensitive (when completed)

TOTAL INCOME OR LOSS Add up the income amounts and deduct any loss amount in the boxes. (114,946) / L

Deductions

D1 Work related car expenses A 9,533 CLAIM B

/

D3 Work related uniform, occupation specific or protective C 450 / CLAIM C

clothing, laundry and dry cleaning expenses

Dry cleaning of work suits 450 C

D5 Other work related expenses E 3,170

Association Financial advisor 840

Money magazine 110

Vogue Living 120

Loan 600

Insurance policy 1,500

D7 Interest deductions I 15,000

Interest on loan 15,000

D8 Dividend deductions H 140,000

Fully Franked Dividend 140,000

D9 Gifts or donations J 3,200

Greenpeace trust 1,000

Australian Kidney Foundation 1,000

Sea Shepherd 1,200

Sensitive (when completed)

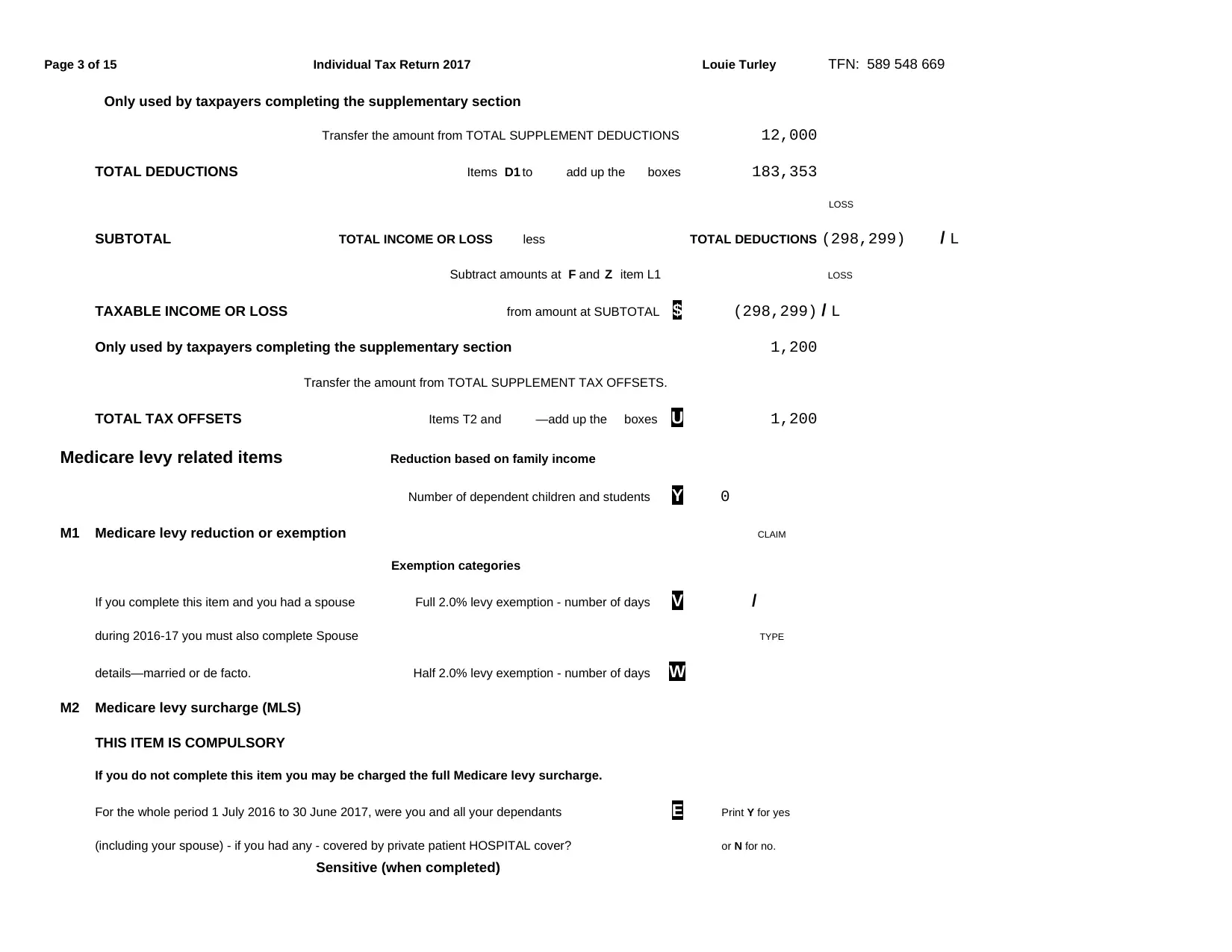

Page 3 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

Only used by taxpayers completing the supplementary section

Transfer the amount from TOTAL SUPPLEMENT DEDUCTIONS 12,000

TOTAL DEDUCTIONS Items D1 to add up the boxes 183,353

LOSS

SUBTOTAL TOTAL INCOME OR LOSS less TOTAL DEDUCTIONS (298,299) / L

Subtract amounts at F and Z item L1 LOSS

TAXABLE INCOME OR LOSS from amount at SUBTOTAL $ (298,299) / L

Only used by taxpayers completing the supplementary section 1,200

Transfer the amount from TOTAL SUPPLEMENT TAX OFFSETS.

TOTAL TAX OFFSETS Items T2 and —add up the boxes U 1,200

Medicare levy related items Reduction based on family income

Number of dependent children and students Y 0

M1 Medicare levy reduction or exemption CLAIM

Exemption categories

If you complete this item and you had a spouse Full 2.0% levy exemption - number of days V /

during 2016-17 you must also complete Spouse TYPE

details—married or de facto. Half 2.0% levy exemption - number of days W

M2 Medicare levy surcharge (MLS)

THIS ITEM IS COMPULSORY

If you do not complete this item you may be charged the full Medicare levy surcharge.

For the whole period 1 July 2016 to 30 June 2017, were you and all your dependants E Print Y for yes

(including your spouse) - if you had any - covered by private patient HOSPITAL cover? or N for no.

Sensitive (when completed)

Only used by taxpayers completing the supplementary section

Transfer the amount from TOTAL SUPPLEMENT DEDUCTIONS 12,000

TOTAL DEDUCTIONS Items D1 to add up the boxes 183,353

LOSS

SUBTOTAL TOTAL INCOME OR LOSS less TOTAL DEDUCTIONS (298,299) / L

Subtract amounts at F and Z item L1 LOSS

TAXABLE INCOME OR LOSS from amount at SUBTOTAL $ (298,299) / L

Only used by taxpayers completing the supplementary section 1,200

Transfer the amount from TOTAL SUPPLEMENT TAX OFFSETS.

TOTAL TAX OFFSETS Items T2 and —add up the boxes U 1,200

Medicare levy related items Reduction based on family income

Number of dependent children and students Y 0

M1 Medicare levy reduction or exemption CLAIM

Exemption categories

If you complete this item and you had a spouse Full 2.0% levy exemption - number of days V /

during 2016-17 you must also complete Spouse TYPE

details—married or de facto. Half 2.0% levy exemption - number of days W

M2 Medicare levy surcharge (MLS)

THIS ITEM IS COMPULSORY

If you do not complete this item you may be charged the full Medicare levy surcharge.

For the whole period 1 July 2016 to 30 June 2017, were you and all your dependants E Print Y for yes

(including your spouse) - if you had any - covered by private patient HOSPITAL cover? or N for no.

Sensitive (when completed)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

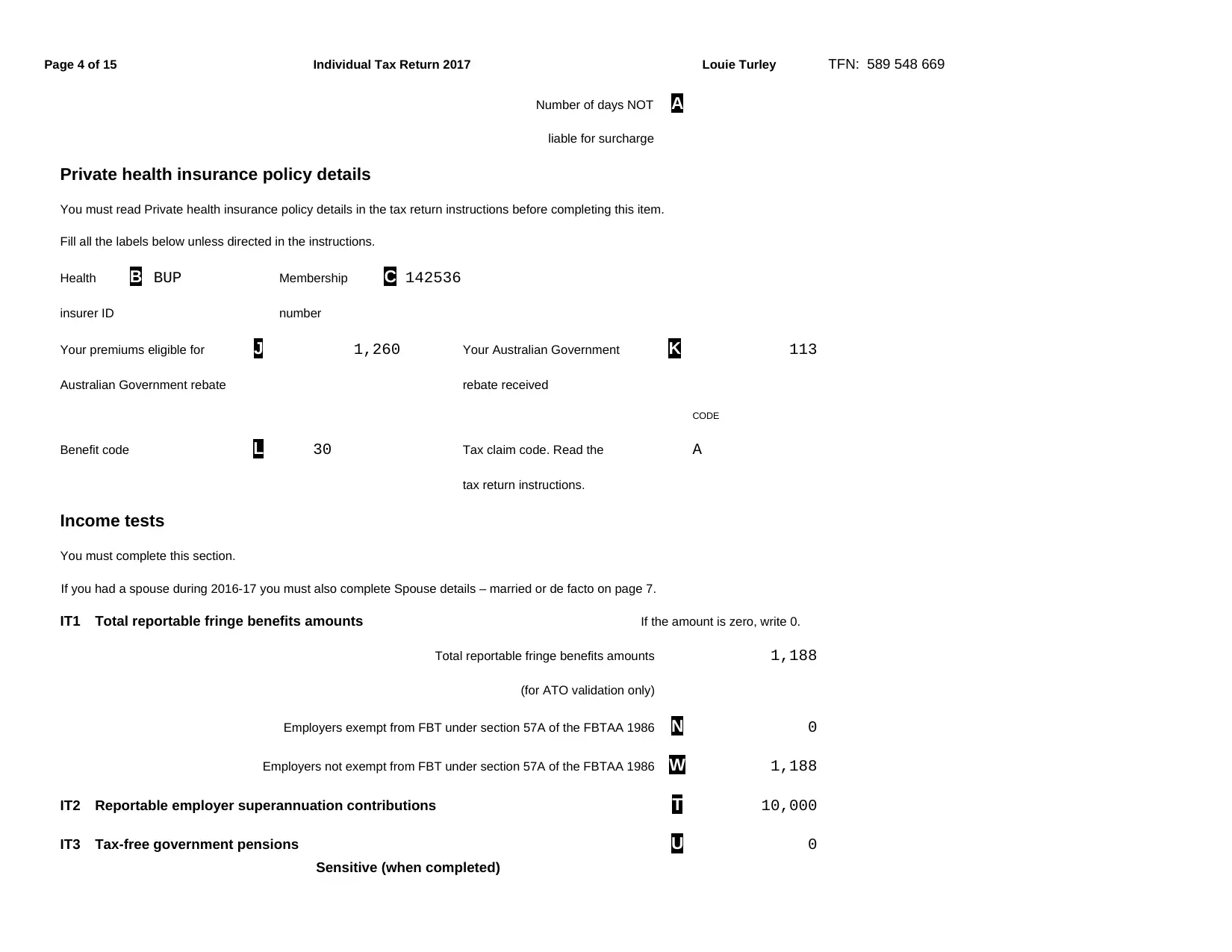

Page 4 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

Number of days NOT A

liable for surcharge

Private health insurance policy details

You must read Private health insurance policy details in the tax return instructions before completing this item.

Fill all the labels below unless directed in the instructions.

Health B BUP Membership C 142536

insurer ID number

Your premiums eligible for J 1,260 Your Australian Government K 113

Australian Government rebate rebate received

CODE

Benefit code L 30 Tax claim code. Read the A

tax return instructions.

Income tests

You must complete this section.

If you had a spouse during 2016-17 you must also complete Spouse details – married or de facto on page 7.

IT1 Total reportable fringe benefits amounts If the amount is zero, write 0.

Total reportable fringe benefits amounts 1,188

(for ATO validation only)

Employers exempt from FBT under section 57A of the FBTAA 1986 N 0

Employers not exempt from FBT under section 57A of the FBTAA 1986 W 1,188

IT2 Reportable employer superannuation contributions T 10,000

IT3 Tax-free government pensions U 0

Sensitive (when completed)

Number of days NOT A

liable for surcharge

Private health insurance policy details

You must read Private health insurance policy details in the tax return instructions before completing this item.

Fill all the labels below unless directed in the instructions.

Health B BUP Membership C 142536

insurer ID number

Your premiums eligible for J 1,260 Your Australian Government K 113

Australian Government rebate rebate received

CODE

Benefit code L 30 Tax claim code. Read the A

tax return instructions.

Income tests

You must complete this section.

If you had a spouse during 2016-17 you must also complete Spouse details – married or de facto on page 7.

IT1 Total reportable fringe benefits amounts If the amount is zero, write 0.

Total reportable fringe benefits amounts 1,188

(for ATO validation only)

Employers exempt from FBT under section 57A of the FBTAA 1986 N 0

Employers not exempt from FBT under section 57A of the FBTAA 1986 W 1,188

IT2 Reportable employer superannuation contributions T 10,000

IT3 Tax-free government pensions U 0

Sensitive (when completed)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

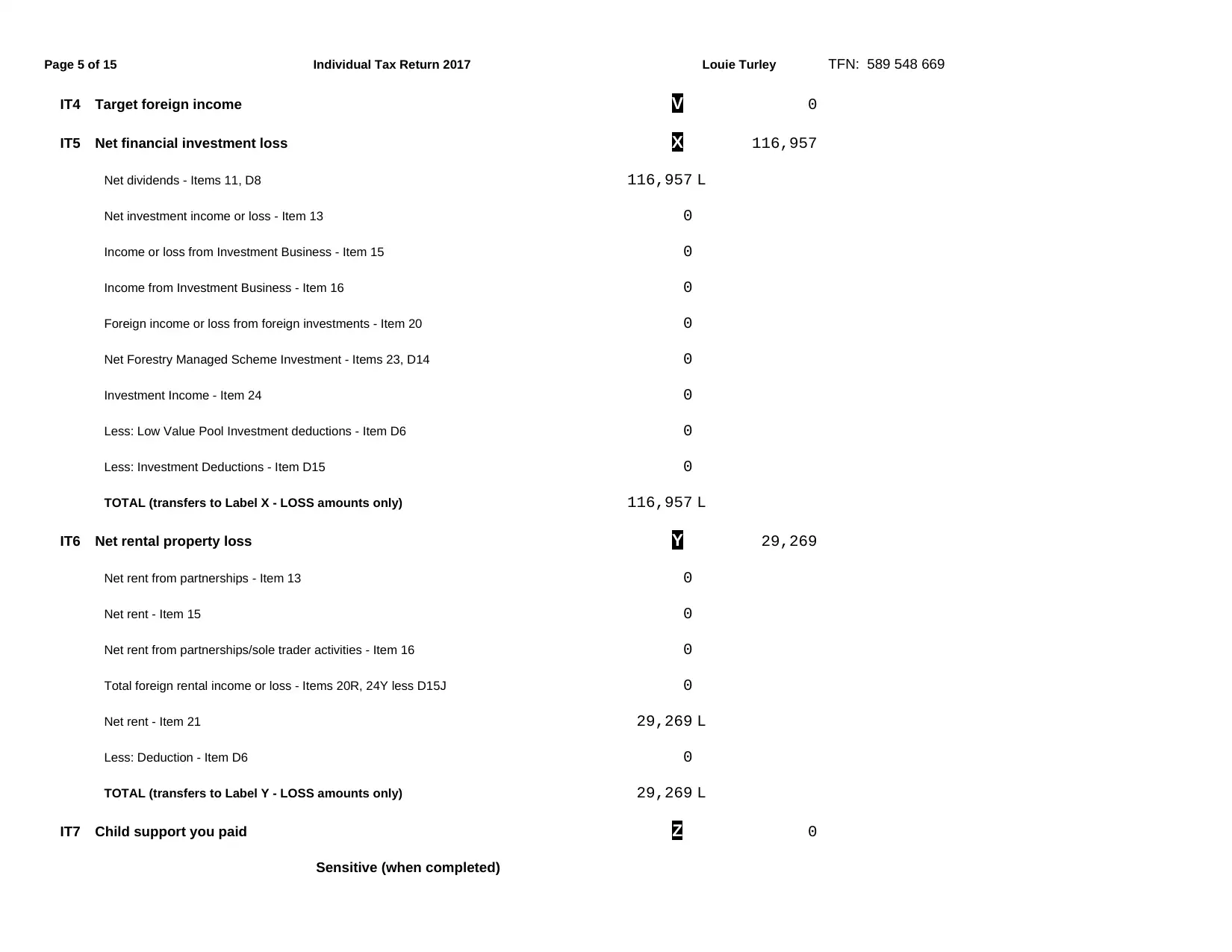

Page 5 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

IT4 Target foreign income V 0

IT5 Net financial investment loss X 116,957

Net dividends - Items 11, D8 116,957 L

Net investment income or loss - Item 13 0

Income or loss from Investment Business - Item 15 0

Income from Investment Business - Item 16 0

Foreign income or loss from foreign investments - Item 20 0

Net Forestry Managed Scheme Investment - Items 23, D14 0

Investment Income - Item 24 0

Less: Low Value Pool Investment deductions - Item D6 0

Less: Investment Deductions - Item D15 0

TOTAL (transfers to Label X - LOSS amounts only) 116,957 L

IT6 Net rental property loss Y 29,269

Net rent from partnerships - Item 13 0

Net rent - Item 15 0

Net rent from partnerships/sole trader activities - Item 16 0

Total foreign rental income or loss - Items 20R, 24Y less D15J 0

Net rent - Item 21 29,269 L

Less: Deduction - Item D6 0

TOTAL (transfers to Label Y - LOSS amounts only) 29,269 L

IT7 Child support you paid Z 0

Sensitive (when completed)

IT4 Target foreign income V 0

IT5 Net financial investment loss X 116,957

Net dividends - Items 11, D8 116,957 L

Net investment income or loss - Item 13 0

Income or loss from Investment Business - Item 15 0

Income from Investment Business - Item 16 0

Foreign income or loss from foreign investments - Item 20 0

Net Forestry Managed Scheme Investment - Items 23, D14 0

Investment Income - Item 24 0

Less: Low Value Pool Investment deductions - Item D6 0

Less: Investment Deductions - Item D15 0

TOTAL (transfers to Label X - LOSS amounts only) 116,957 L

IT6 Net rental property loss Y 29,269

Net rent from partnerships - Item 13 0

Net rent - Item 15 0

Net rent from partnerships/sole trader activities - Item 16 0

Total foreign rental income or loss - Items 20R, 24Y less D15J 0

Net rent - Item 21 29,269 L

Less: Deduction - Item D6 0

TOTAL (transfers to Label Y - LOSS amounts only) 29,269 L

IT7 Child support you paid Z 0

Sensitive (when completed)

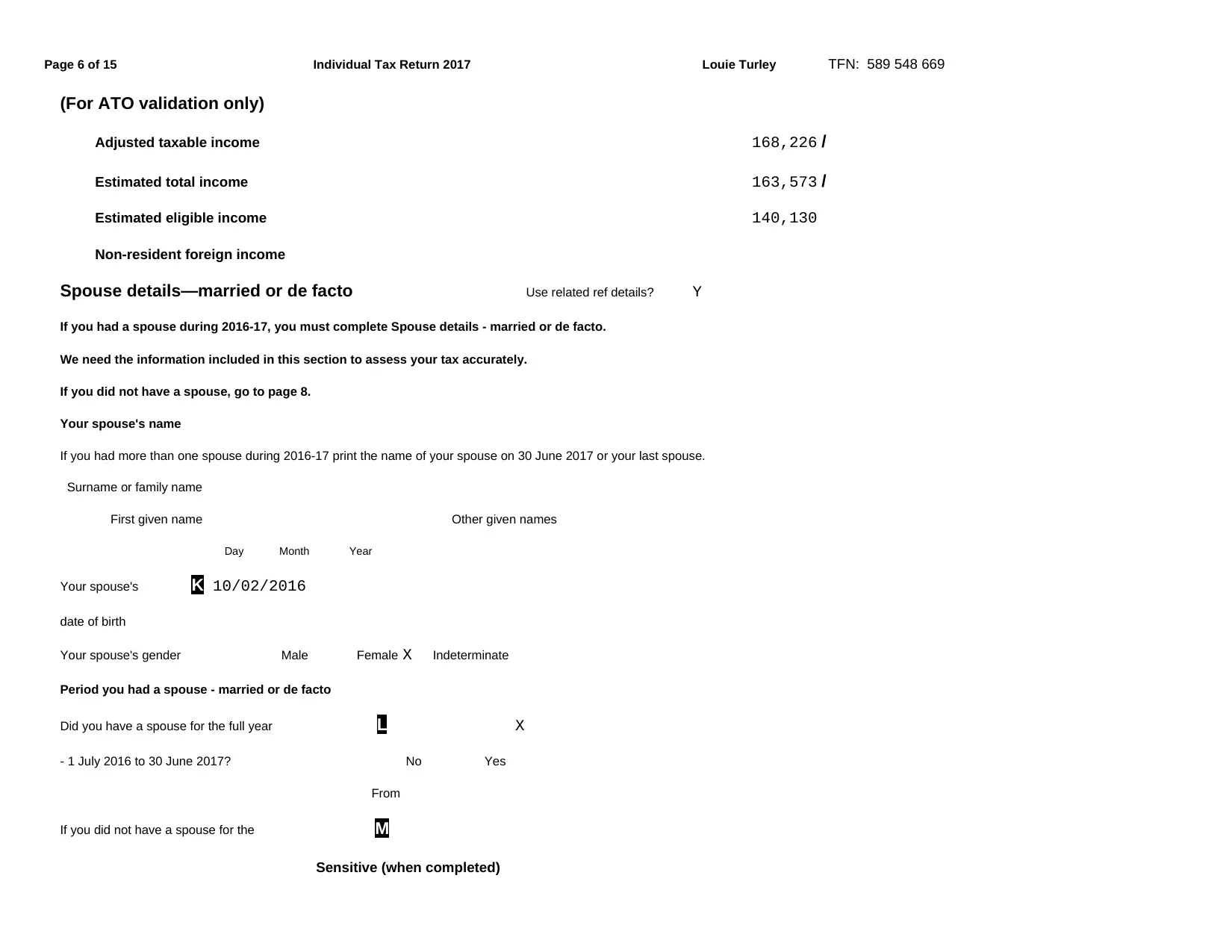

Page 6 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

(For ATO validation only)

Adjusted taxable income 168,226 /

Estimated total income 163,573 /

Estimated eligible income 140,130

Non-resident foreign income

Spouse details—married or de facto Use related ref details? Y

If you had a spouse during 2016-17, you must complete Spouse details - married or de facto.

We need the information included in this section to assess your tax accurately.

If you did not have a spouse, go to page 8.

Your spouse's name

If you had more than one spouse during 2016-17 print the name of your spouse on 30 June 2017 or your last spouse.

Surname or family name

First given name Other given names

Day Month Year

Your spouse's K 10/02/2016

date of birth

Your spouse's gender Male Female X Indeterminate

Period you had a spouse - married or de facto

Did you have a spouse for the full year L X

- 1 July 2016 to 30 June 2017? No Yes

From

If you did not have a spouse for the M

Sensitive (when completed)

(For ATO validation only)

Adjusted taxable income 168,226 /

Estimated total income 163,573 /

Estimated eligible income 140,130

Non-resident foreign income

Spouse details—married or de facto Use related ref details? Y

If you had a spouse during 2016-17, you must complete Spouse details - married or de facto.

We need the information included in this section to assess your tax accurately.

If you did not have a spouse, go to page 8.

Your spouse's name

If you had more than one spouse during 2016-17 print the name of your spouse on 30 June 2017 or your last spouse.

Surname or family name

First given name Other given names

Day Month Year

Your spouse's K 10/02/2016

date of birth

Your spouse's gender Male Female X Indeterminate

Period you had a spouse - married or de facto

Did you have a spouse for the full year L X

- 1 July 2016 to 30 June 2017? No Yes

From

If you did not have a spouse for the M

Sensitive (when completed)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

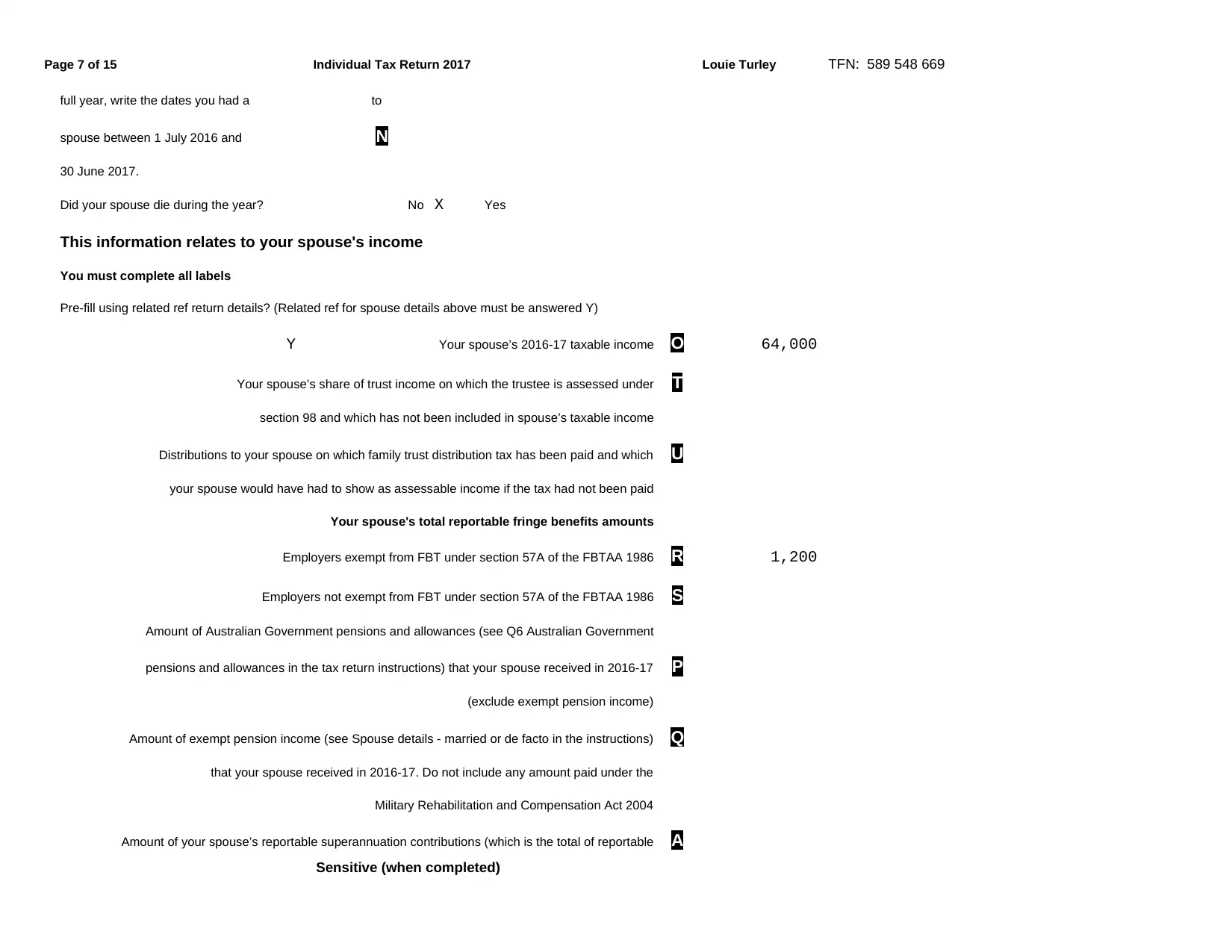

Page 7 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

full year, write the dates you had a to

spouse between 1 July 2016 and N

30 June 2017.

Did your spouse die during the year? No X Yes

This information relates to your spouse's income

You must complete all labels

Pre-fill using related ref return details? (Related ref for spouse details above must be answered Y)

Y Your spouse’s 2016-17 taxable income O 64,000

Your spouse’s share of trust income on which the trustee is assessed under T

section 98 and which has not been included in spouse’s taxable income

Distributions to your spouse on which family trust distribution tax has been paid and which U

your spouse would have had to show as assessable income if the tax had not been paid

Your spouse's total reportable fringe benefits amounts

Employers exempt from FBT under section 57A of the FBTAA 1986 R 1,200

Employers not exempt from FBT under section 57A of the FBTAA 1986 S

Amount of Australian Government pensions and allowances (see Q6 Australian Government

pensions and allowances in the tax return instructions) that your spouse received in 2016-17 P

(exclude exempt pension income)

Amount of exempt pension income (see Spouse details - married or de facto in the instructions) Q

that your spouse received in 2016-17. Do not include any amount paid under the

Military Rehabilitation and Compensation Act 2004

Amount of your spouse’s reportable superannuation contributions (which is the total of reportable A

Sensitive (when completed)

full year, write the dates you had a to

spouse between 1 July 2016 and N

30 June 2017.

Did your spouse die during the year? No X Yes

This information relates to your spouse's income

You must complete all labels

Pre-fill using related ref return details? (Related ref for spouse details above must be answered Y)

Y Your spouse’s 2016-17 taxable income O 64,000

Your spouse’s share of trust income on which the trustee is assessed under T

section 98 and which has not been included in spouse’s taxable income

Distributions to your spouse on which family trust distribution tax has been paid and which U

your spouse would have had to show as assessable income if the tax had not been paid

Your spouse's total reportable fringe benefits amounts

Employers exempt from FBT under section 57A of the FBTAA 1986 R 1,200

Employers not exempt from FBT under section 57A of the FBTAA 1986 S

Amount of Australian Government pensions and allowances (see Q6 Australian Government

pensions and allowances in the tax return instructions) that your spouse received in 2016-17 P

(exclude exempt pension income)

Amount of exempt pension income (see Spouse details - married or de facto in the instructions) Q

that your spouse received in 2016-17. Do not include any amount paid under the

Military Rehabilitation and Compensation Act 2004

Amount of your spouse’s reportable superannuation contributions (which is the total of reportable A

Sensitive (when completed)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

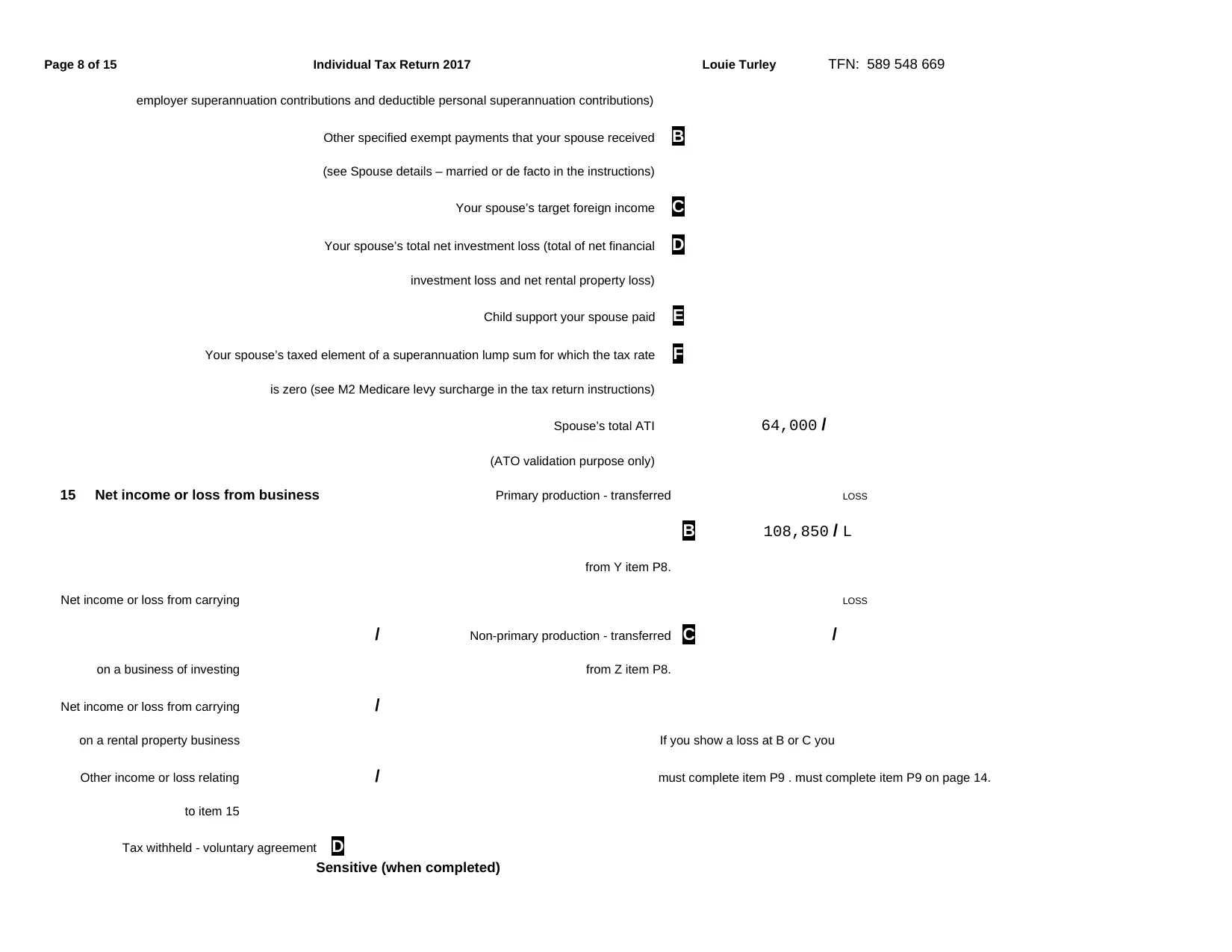

Page 8 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

employer superannuation contributions and deductible personal superannuation contributions)

Other specified exempt payments that your spouse received B

(see Spouse details – married or de facto in the instructions)

Your spouse’s target foreign income C

Your spouse’s total net investment loss (total of net financial D

investment loss and net rental property loss)

Child support your spouse paid E

Your spouse’s taxed element of a superannuation lump sum for which the tax rate F

is zero (see M2 Medicare levy surcharge in the tax return instructions)

Spouse’s total ATI 64,000 /

(ATO validation purpose only)

15 Net income or loss from business Primary production - transferred LOSS

B 108,850 / L

from Y item P8.

Net income or loss from carrying LOSS

/ Non-primary production - transferred C /

on a business of investing from Z item P8.

Net income or loss from carrying /

on a rental property business If you show a loss at B or C you

Other income or loss relating / must complete item P9 . must complete item P9 on page 14.

to item 15

Tax withheld - voluntary agreement D

Sensitive (when completed)

employer superannuation contributions and deductible personal superannuation contributions)

Other specified exempt payments that your spouse received B

(see Spouse details – married or de facto in the instructions)

Your spouse’s target foreign income C

Your spouse’s total net investment loss (total of net financial D

investment loss and net rental property loss)

Child support your spouse paid E

Your spouse’s taxed element of a superannuation lump sum for which the tax rate F

is zero (see M2 Medicare levy surcharge in the tax return instructions)

Spouse’s total ATI 64,000 /

(ATO validation purpose only)

15 Net income or loss from business Primary production - transferred LOSS

B 108,850 / L

from Y item P8.

Net income or loss from carrying LOSS

/ Non-primary production - transferred C /

on a business of investing from Z item P8.

Net income or loss from carrying /

on a rental property business If you show a loss at B or C you

Other income or loss relating / must complete item P9 . must complete item P9 on page 14.

to item 15

Tax withheld - voluntary agreement D

Sensitive (when completed)

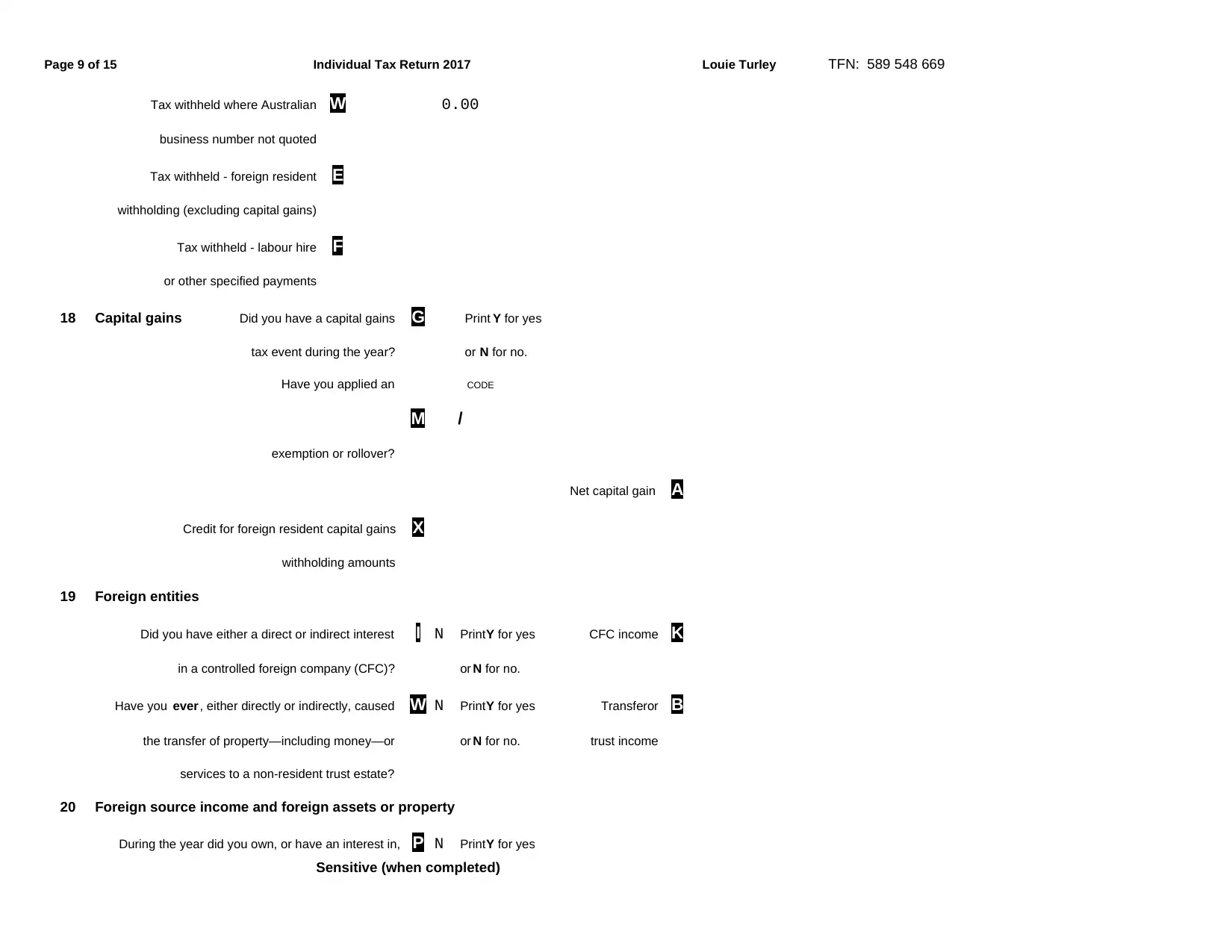

Page 9 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

Tax withheld where Australian W 0.00

business number not quoted

Tax withheld - foreign resident E

withholding (excluding capital gains)

Tax withheld - labour hire F

or other specified payments

18 Capital gains Did you have a capital gains G Print Y for yes

tax event during the year? or N for no.

Have you applied an CODE

M /

exemption or rollover?

Net capital gain A

Credit for foreign resident capital gains X

withholding amounts

19 Foreign entities

Did you have either a direct or indirect interest I N PrintY for yes CFC income K

in a controlled foreign company (CFC)? or N for no.

Have you ever , either directly or indirectly, caused W N PrintY for yes Transferor B

the transfer of property—including money—or or N for no. trust income

services to a non-resident trust estate?

20 Foreign source income and foreign assets or property

During the year did you own, or have an interest in, P N PrintY for yes

Sensitive (when completed)

Tax withheld where Australian W 0.00

business number not quoted

Tax withheld - foreign resident E

withholding (excluding capital gains)

Tax withheld - labour hire F

or other specified payments

18 Capital gains Did you have a capital gains G Print Y for yes

tax event during the year? or N for no.

Have you applied an CODE

M /

exemption or rollover?

Net capital gain A

Credit for foreign resident capital gains X

withholding amounts

19 Foreign entities

Did you have either a direct or indirect interest I N PrintY for yes CFC income K

in a controlled foreign company (CFC)? or N for no.

Have you ever , either directly or indirectly, caused W N PrintY for yes Transferor B

the transfer of property—including money—or or N for no. trust income

services to a non-resident trust estate?

20 Foreign source income and foreign assets or property

During the year did you own, or have an interest in, P N PrintY for yes

Sensitive (when completed)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

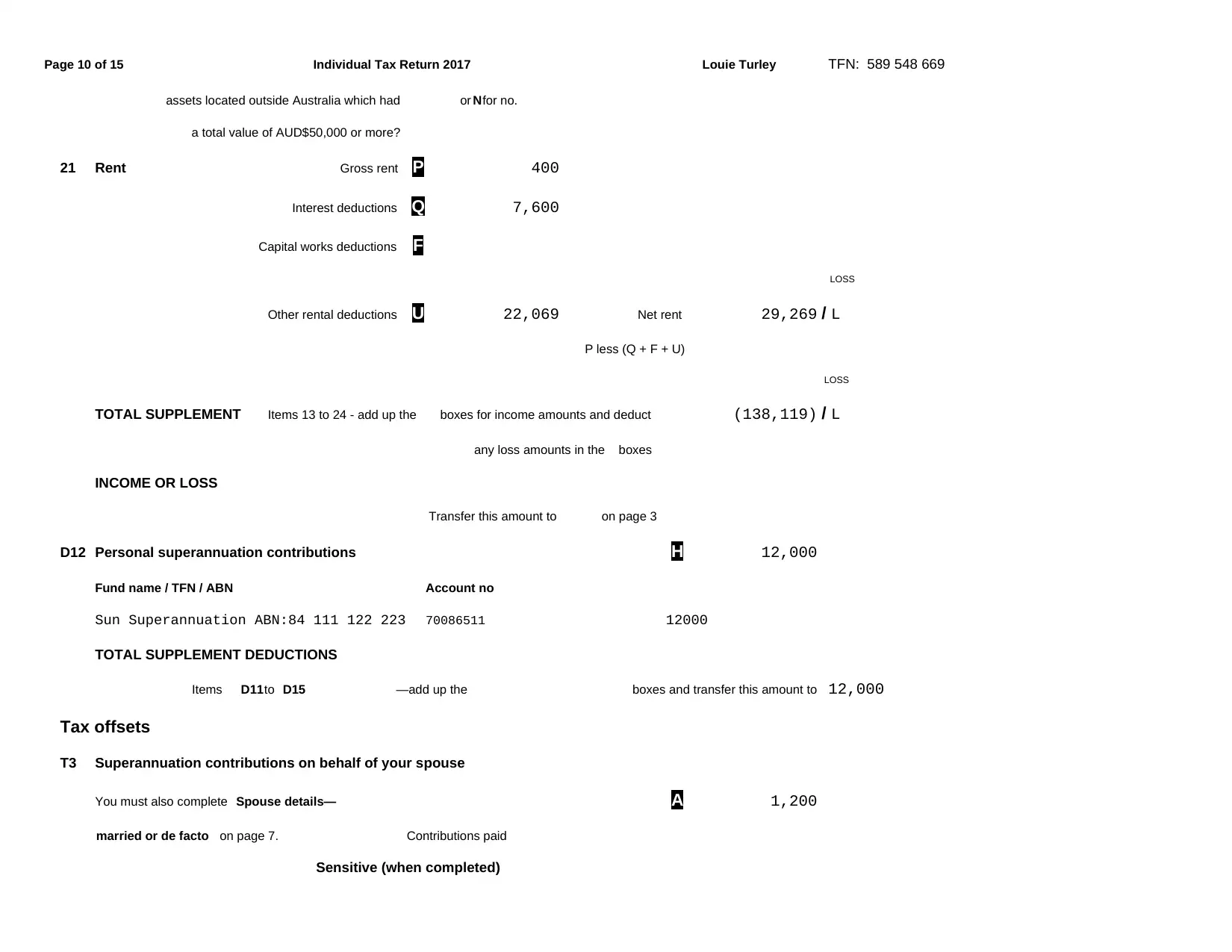

Page 10 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

assets located outside Australia which had or Nfor no.

a total value of AUD$50,000 or more?

21 Rent Gross rent P 400

Interest deductions Q 7,600

Capital works deductions F

LOSS

Other rental deductions U 22,069 Net rent 29,269 / L

P less (Q + F + U)

LOSS

TOTAL SUPPLEMENT Items 13 to 24 - add up the boxes for income amounts and deduct (138,119) / L

any loss amounts in the boxes

INCOME OR LOSS

Transfer this amount to on page 3

D12 Personal superannuation contributions H 12,000

Fund name / TFN / ABN Account no

Sun Superannuation ABN:84 111 122 223 70086511 12000

TOTAL SUPPLEMENT DEDUCTIONS

Items D11to D15 —add up the boxes and transfer this amount to 12,000

Tax offsets

T3 Superannuation contributions on behalf of your spouse

You must also complete Spouse details— A 1,200

married or de facto on page 7. Contributions paid

Sensitive (when completed)

assets located outside Australia which had or Nfor no.

a total value of AUD$50,000 or more?

21 Rent Gross rent P 400

Interest deductions Q 7,600

Capital works deductions F

LOSS

Other rental deductions U 22,069 Net rent 29,269 / L

P less (Q + F + U)

LOSS

TOTAL SUPPLEMENT Items 13 to 24 - add up the boxes for income amounts and deduct (138,119) / L

any loss amounts in the boxes

INCOME OR LOSS

Transfer this amount to on page 3

D12 Personal superannuation contributions H 12,000

Fund name / TFN / ABN Account no

Sun Superannuation ABN:84 111 122 223 70086511 12000

TOTAL SUPPLEMENT DEDUCTIONS

Items D11to D15 —add up the boxes and transfer this amount to 12,000

Tax offsets

T3 Superannuation contributions on behalf of your spouse

You must also complete Spouse details— A 1,200

married or de facto on page 7. Contributions paid

Sensitive (when completed)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

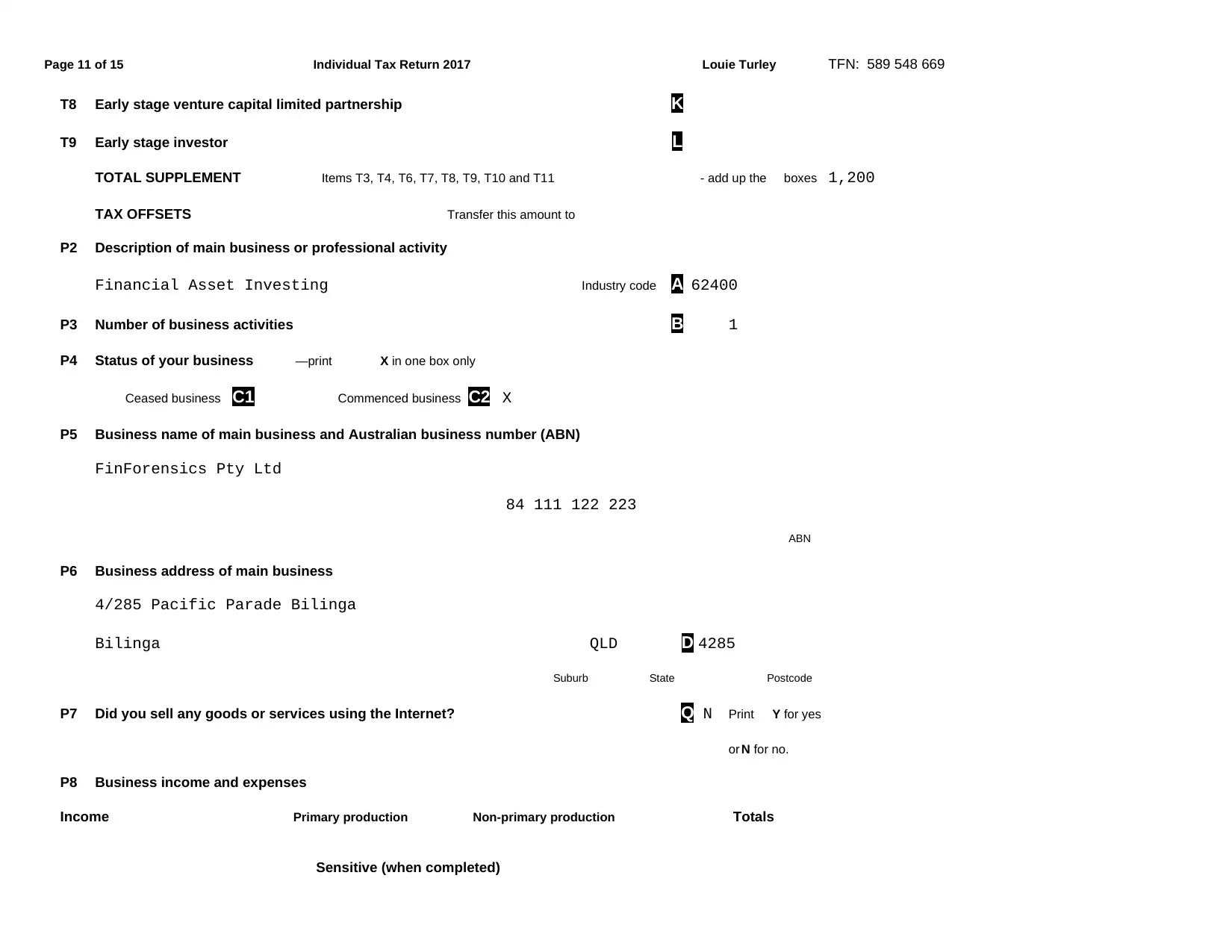

Page 11 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

T8 Early stage venture capital limited partnership K

T9 Early stage investor L

TOTAL SUPPLEMENT Items T3, T4, T6, T7, T8, T9, T10 and T11 - add up the boxes 1,200

TAX OFFSETS Transfer this amount to

P2 Description of main business or professional activity

Financial Asset Investing Industry code A 62400

P3 Number of business activities B 1

P4 Status of your business —print X in one box only

Ceased business C1 Commenced business C2 X

P5 Business name of main business and Australian business number (ABN)

FinForensics Pty Ltd

84 111 122 223

ABN

P6 Business address of main business

4/285 Pacific Parade Bilinga

Bilinga QLD D 4285

Suburb State Postcode

P7 Did you sell any goods or services using the Internet? Q N Print Y for yes

or N for no.

P8 Business income and expenses

Income Primary production Non-primary production Totals

Sensitive (when completed)

T8 Early stage venture capital limited partnership K

T9 Early stage investor L

TOTAL SUPPLEMENT Items T3, T4, T6, T7, T8, T9, T10 and T11 - add up the boxes 1,200

TAX OFFSETS Transfer this amount to

P2 Description of main business or professional activity

Financial Asset Investing Industry code A 62400

P3 Number of business activities B 1

P4 Status of your business —print X in one box only

Ceased business C1 Commenced business C2 X

P5 Business name of main business and Australian business number (ABN)

FinForensics Pty Ltd

84 111 122 223

ABN

P6 Business address of main business

4/285 Pacific Parade Bilinga

Bilinga QLD D 4285

Suburb State Postcode

P7 Did you sell any goods or services using the Internet? Q N Print Y for yes

or N for no.

P8 Business income and expenses

Income Primary production Non-primary production Totals

Sensitive (when completed)

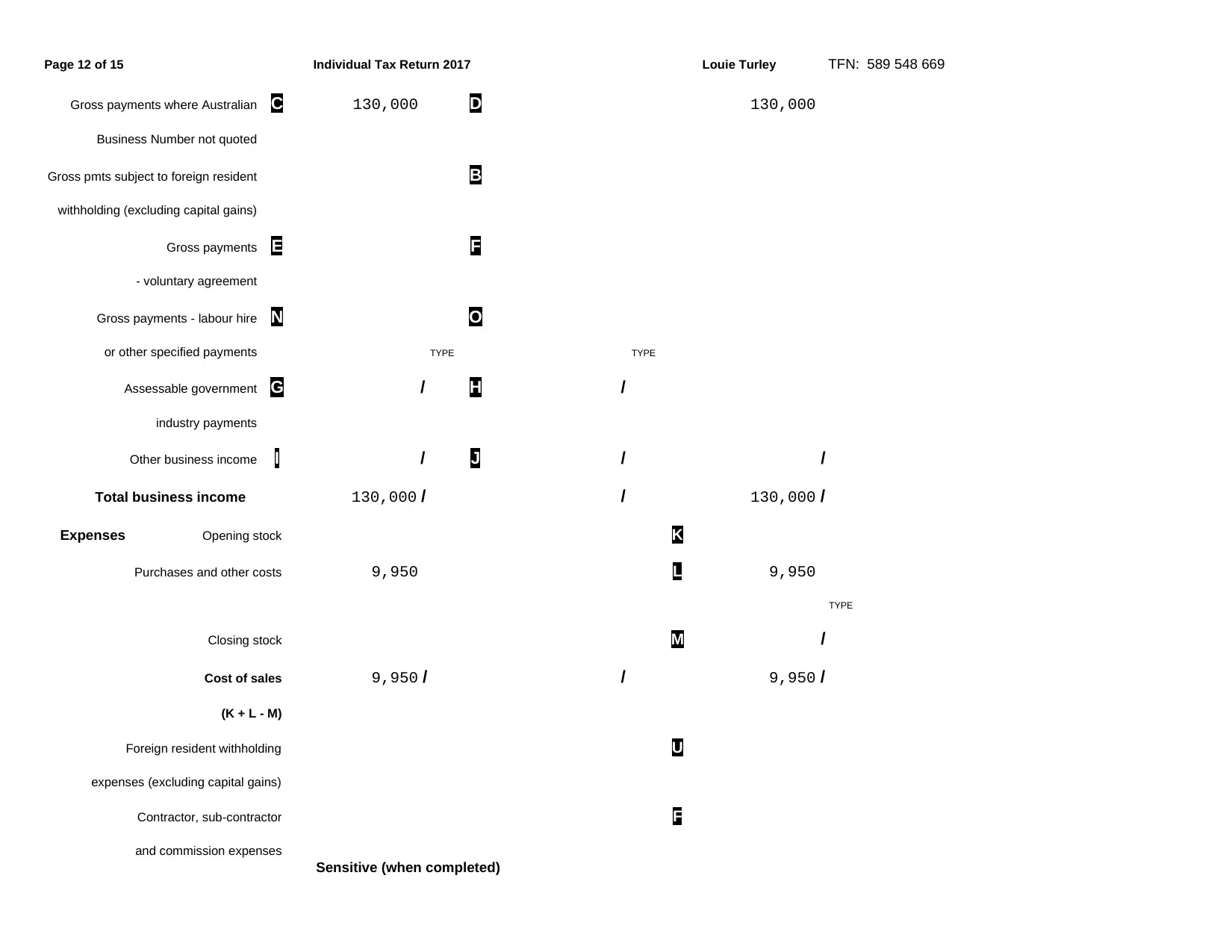

Page 12 of 15 Individual Tax Return 2017 Louie Turley TFN: 589 548 669

Gross payments where Australian C 130,000 D 130,000

Business Number not quoted

Gross pmts subject to foreign resident B

withholding (excluding capital gains)

Gross payments E F

- voluntary agreement

Gross payments - labour hire N O

or other specified payments TYPE TYPE

Assessable government G / H /

industry payments

Other business income I / J / /

Total business income 130,000 / / 130,000 /

Expenses Opening stock K

Purchases and other costs 9,950 L 9,950

TYPE

Closing stock M /

Cost of sales 9,950 / / 9,950 /

(K + L - M)

Foreign resident withholding U

expenses (excluding capital gains)

Contractor, sub-contractor F

and commission expenses

Sensitive (when completed)

Gross payments where Australian C 130,000 D 130,000

Business Number not quoted

Gross pmts subject to foreign resident B

withholding (excluding capital gains)

Gross payments E F

- voluntary agreement

Gross payments - labour hire N O

or other specified payments TYPE TYPE

Assessable government G / H /

industry payments

Other business income I / J / /

Total business income 130,000 / / 130,000 /

Expenses Opening stock K

Purchases and other costs 9,950 L 9,950

TYPE

Closing stock M /

Cost of sales 9,950 / / 9,950 /

(K + L - M)

Foreign resident withholding U

expenses (excluding capital gains)

Contractor, sub-contractor F

and commission expenses

Sensitive (when completed)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.