Debt Financing for Albercan Drilling: Analysis and Recommendations

VerifiedAdded on 2020/02/23

|11

|2782

|76

Report

AI Summary

This report examines the financial situation of Albercan Drilling Supply Company, focusing on the need for debt financing despite the company's profitability. The primary issue is identified as cash flow problems stemming from overstocking and the acquisition of Mr. Kelly's shares. The report explores the advantages and disadvantages of debt and equity financing, analyzing projected financial statements for 2008 and 2009. It highlights the company's growth plans and the potential benefits of borrowing, such as increased product portfolio diversification and expanded marketing efforts. Furthermore, the report evaluates alternative financing options, including selling debentures, seeking strategic investors, and raising capital from family and friends. The analysis includes a detailed examination of the profit and loss statements, and the balance sheets, offering insights into the company's financial health and the associated risks. The report concludes with a recommendation on whether to approve a loan under specific conditions, considering the high-interest rates and repayment terms, and offering a contrasting viewpoint from MacDonald's perspective, evaluating the feasibility of the loan given its restrictive conditions.

Name of student:

Registration number:

Module code:

Name of supervisor:

Subject title:

Date due:

Registration number:

Module code:

Name of supervisor:

Subject title:

Date due:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

Businesses find themselves in need of extra capital even if they are making profits.

There are two major ways through which these businesses can raise additional capital

for their businesses. These methods include equity and debt capital. Equity capital is

where a company divides its ownership into small units called shares (Ahuja,

Narender). These shares are sold to various people at a predetermined fixed share

price in order to raise capital for the business. The shareholders own a percentage of

the company and they have various rights as outlined in the companies act. They

benefit from the companies` dividends when a company makes profits. Another

method of raising capital for businesses is the debt capital financing. This is where a

company or organization borrows funds from a financial institution or an individual

and repays it later at an interest. Debt financing is used by most companies as most of

them do not want to lose control of their ventures by sharing ownership (Mullins,

John).There are various advantages and disadvantages of using either of the methods.

This paper analyzes the reasons why MacDonald needs to borrow to support his

growing business. The problem that MacDonald is facing in this case is mainly due to

overstocking hence leading to cash flow problems for the company. MacDonald has a

variety of other options that he can exploit in order to raise capital. One of them as

stated above is seeking to sell shares or by selling debentures (Bilgin, Mehmet ,

Hakan Danis, Ender Demir, and Ugur Can).Also contained in this paper are projected

financial reports for Albercan drilling and a detailed analysis of the same.

Reasons why McDonald needs to borrow to finance his profitable business

Businesses find themselves in need of extra capital even if they are making profits.

There are two major ways through which these businesses can raise additional capital

for their businesses. These methods include equity and debt capital. Equity capital is

where a company divides its ownership into small units called shares (Ahuja,

Narender). These shares are sold to various people at a predetermined fixed share

price in order to raise capital for the business. The shareholders own a percentage of

the company and they have various rights as outlined in the companies act. They

benefit from the companies` dividends when a company makes profits. Another

method of raising capital for businesses is the debt capital financing. This is where a

company or organization borrows funds from a financial institution or an individual

and repays it later at an interest. Debt financing is used by most companies as most of

them do not want to lose control of their ventures by sharing ownership (Mullins,

John).There are various advantages and disadvantages of using either of the methods.

This paper analyzes the reasons why MacDonald needs to borrow to support his

growing business. The problem that MacDonald is facing in this case is mainly due to

overstocking hence leading to cash flow problems for the company. MacDonald has a

variety of other options that he can exploit in order to raise capital. One of them as

stated above is seeking to sell shares or by selling debentures (Bilgin, Mehmet ,

Hakan Danis, Ender Demir, and Ugur Can).Also contained in this paper are projected

financial reports for Albercan drilling and a detailed analysis of the same.

Reasons why McDonald needs to borrow to finance his profitable business

The major reason why McDonald needs to borrow in order to finance Albercan

drilling despite the company making good profits is so that the company can solve its

cash flow problems. The company has fallen into cash flow problems because of its

decision to increase its inventory by a very large margin. This decision has resulted in

the companies` cash outflows exceeding cash inflows (Kim, Joon Ho). These cash

flow problems for the company were brought about by the decision of McDonald to

buy the share ownership of Mr.Kelly who decided to exit the business. Due to this

reason, it is vital that ADS seeks additional investment so as to be able to run the

operations of the company smoothly.

Another reason why ADC needs to borrow despite making reasonable profits is that

the company has a growth plan and vision. In order to achieve this vision, it is

important that the company borrows money in order to facilitate its growth and

expansion plans. The company has been growing at a consistent rate over the previous

10 years and the profits have been increasing persistently. This growth however is

threatened by the reduction in cash from the business as a result of acquiring the stake

belonging to Mr Kelly. If the company’s growth projections are met, it will be easy

for the company to repay the loans and consequently increase its profits. The

investment from the loan from the bank will generate enough cash to cover the cost of

borrowing. The company can increase its product portfolio and increase its stock to

more diverse and modern drilling equipment.

In addition to this, the borrowing by ADC can help the company to advertise more

and get more customers for its business. The company can now start selling drilling

pipes to larger drilling companies who buy directly from the manufacturer. This will

be possible since the company can enjoy large economies of scale and quantity

drilling despite the company making good profits is so that the company can solve its

cash flow problems. The company has fallen into cash flow problems because of its

decision to increase its inventory by a very large margin. This decision has resulted in

the companies` cash outflows exceeding cash inflows (Kim, Joon Ho). These cash

flow problems for the company were brought about by the decision of McDonald to

buy the share ownership of Mr.Kelly who decided to exit the business. Due to this

reason, it is vital that ADS seeks additional investment so as to be able to run the

operations of the company smoothly.

Another reason why ADC needs to borrow despite making reasonable profits is that

the company has a growth plan and vision. In order to achieve this vision, it is

important that the company borrows money in order to facilitate its growth and

expansion plans. The company has been growing at a consistent rate over the previous

10 years and the profits have been increasing persistently. This growth however is

threatened by the reduction in cash from the business as a result of acquiring the stake

belonging to Mr Kelly. If the company’s growth projections are met, it will be easy

for the company to repay the loans and consequently increase its profits. The

investment from the loan from the bank will generate enough cash to cover the cost of

borrowing. The company can increase its product portfolio and increase its stock to

more diverse and modern drilling equipment.

In addition to this, the borrowing by ADC can help the company to advertise more

and get more customers for its business. The company can now start selling drilling

pipes to larger drilling companies who buy directly from the manufacturer. This will

be possible since the company can enjoy large economies of scale and quantity

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

discounts which will help the company to price its products cheaply so that more

clients can be attracted to buy its products (Panzarino, Helene).

Borrowing money for the company will also help to reduce the personal risk for

McDonald. Instead of McDonald selling his other prized personal assets to fund the

business, it is more prudent for him to borrow a loan since he will not risk the

livelihoods of his family.

McDonald has many other options available to him. Apart from borrowing from

banks and other financial institutions, ADC can sell debentures in order to raise

money to fund the company. A debenture is an unsecured debt that is backed only by

the company and there is no collateral for the debt. The advantage of this form of

funding is that the company does not risk its assets and the cost of the debt may not be

as high as financing a loan from a financial institution. Alternative, McDonald can

decide to seek for a strategic investor who he can sell a portion of his shares to. This

can easily help the company to raise large sums of money to fund growth. The

investor will enjoy ownership rights such as sharing in the companies` profits. The

strategic investor is also referred to as Angel investor. Another alternative available to

McDonald is raising additional capital through family members and friends. Even

thou this is mostly common for small start up business, McDonald can still manage to

raise a significant amount by selling part of his personal possession and assets in order

to invest in the business. This can be boasted by support from close family members

and friends. This method is risky for family members and cannot be relied to raise

large amounts of capital.

clients can be attracted to buy its products (Panzarino, Helene).

Borrowing money for the company will also help to reduce the personal risk for

McDonald. Instead of McDonald selling his other prized personal assets to fund the

business, it is more prudent for him to borrow a loan since he will not risk the

livelihoods of his family.

McDonald has many other options available to him. Apart from borrowing from

banks and other financial institutions, ADC can sell debentures in order to raise

money to fund the company. A debenture is an unsecured debt that is backed only by

the company and there is no collateral for the debt. The advantage of this form of

funding is that the company does not risk its assets and the cost of the debt may not be

as high as financing a loan from a financial institution. Alternative, McDonald can

decide to seek for a strategic investor who he can sell a portion of his shares to. This

can easily help the company to raise large sums of money to fund growth. The

investor will enjoy ownership rights such as sharing in the companies` profits. The

strategic investor is also referred to as Angel investor. Another alternative available to

McDonald is raising additional capital through family members and friends. Even

thou this is mostly common for small start up business, McDonald can still manage to

raise a significant amount by selling part of his personal possession and assets in order

to invest in the business. This can be boasted by support from close family members

and friends. This method is risky for family members and cannot be relied to raise

large amounts of capital.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Projected financial statements

AlberCan Drilling Supply Company - Projected 2008 profit and Loss Statement

(Canadian $ in 000`s)

Sales 4,400

Cost of sales (70%) 3,080

Gross profit 1,320

Operating expenses (21% of sales) 924

Interest (Mortgages+ Notes+ New) 18+4+24 =46

Operating expenses 878

Profit before taxes 442

Taxes due(40%) 177

Living expenses 168

Total Drawings 345

Profit Left in Business 97

Cash 34 notes payable 302

Accounts receivable (52 days) 566 Accounts payable 298

Inventory (98 days) 744 Accrued Expenses 80

LTD Current 8

Current assets 1320 Current Liability 688

Mortgage debt 300

AlberCan Drilling Supply Company - Projected 2008 profit and Loss Statement

(Canadian $ in 000`s)

Sales 4,400

Cost of sales (70%) 3,080

Gross profit 1,320

Operating expenses (21% of sales) 924

Interest (Mortgages+ Notes+ New) 18+4+24 =46

Operating expenses 878

Profit before taxes 442

Taxes due(40%) 177

Living expenses 168

Total Drawings 345

Profit Left in Business 97

Cash 34 notes payable 302

Accounts receivable (52 days) 566 Accounts payable 298

Inventory (98 days) 744 Accrued Expenses 80

LTD Current 8

Current assets 1320 Current Liability 688

Mortgage debt 300

Property 258 Retained Earnings 84

Current Profit 97

Total Liability $ Equity 1,169

Additional Bank Loan 200

Total Assets 1,578 Total Liability & Equity 1,369

AlberCan Drilling Supply Company - Projected 2009 profit and Loss

Statement(Canadian $ in 000`s)

Sales 5,500

Cost of sales (70%) 3,850

Gross profit 1,650

Operating expenses (21% of sales) 1,155

Interest (Mortgages+Notes+New) 18+4+48 =70

Operating expenses 1085

Profit before taxes 565

Taxes due(40%) 226

Living expenses 174

Total Drawings 400

Profit Left in Business 165

Cash 54 notes payable 302

Accounts receivable(52 days) 566 Accounts payable 225

Inventory(98 days) 767 Accrued Expenses 80

LTD Current 8

Current assets 1387 Current Liability 615

Mortgage debt 240

Current Profit 97

Total Liability $ Equity 1,169

Additional Bank Loan 200

Total Assets 1,578 Total Liability & Equity 1,369

AlberCan Drilling Supply Company - Projected 2009 profit and Loss

Statement(Canadian $ in 000`s)

Sales 5,500

Cost of sales (70%) 3,850

Gross profit 1,650

Operating expenses (21% of sales) 1,155

Interest (Mortgages+Notes+New) 18+4+48 =70

Operating expenses 1085

Profit before taxes 565

Taxes due(40%) 226

Living expenses 174

Total Drawings 400

Profit Left in Business 165

Cash 54 notes payable 302

Accounts receivable(52 days) 566 Accounts payable 225

Inventory(98 days) 767 Accrued Expenses 80

LTD Current 8

Current assets 1387 Current Liability 615

Mortgage debt 240

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Property 267 Retained Earnings 84

Current Profit 97

Total Liability $ Equity 1,036

Additional Bank Loan 160

Total Assets 1,654 Total Liability & Equity 1,196

Analysis of the projected financial statements

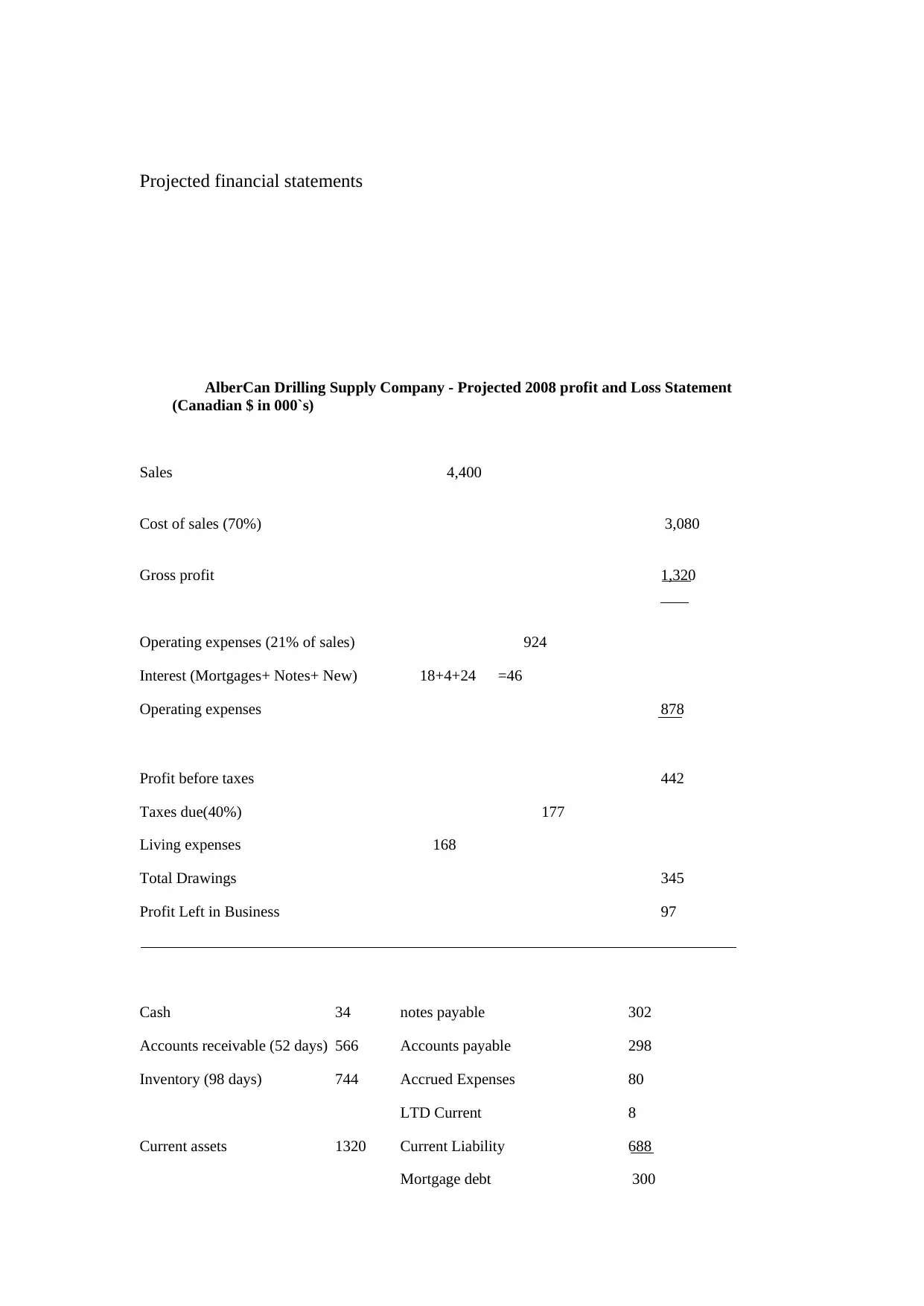

The projected statement of profit and loss for the company provides very crucial

information. This information can be used by various stakeholders in the company

such the owner and the lending institution to make decisions for the company

(Qfinance).In the projected profit and loss statement for the year 2008, the companies

sales are estimated at $4,400,000. The prediction of sales for the year 2008 is based

on previous three years growth in sales volumes for ADS. The projection of sales

volumes is also informed by the growth plan of the company. The company is

planning to diversify to drilling pipes of other sizes and also to increase its customer

base to middle sized companies. With this plan, the company will be able to achieve

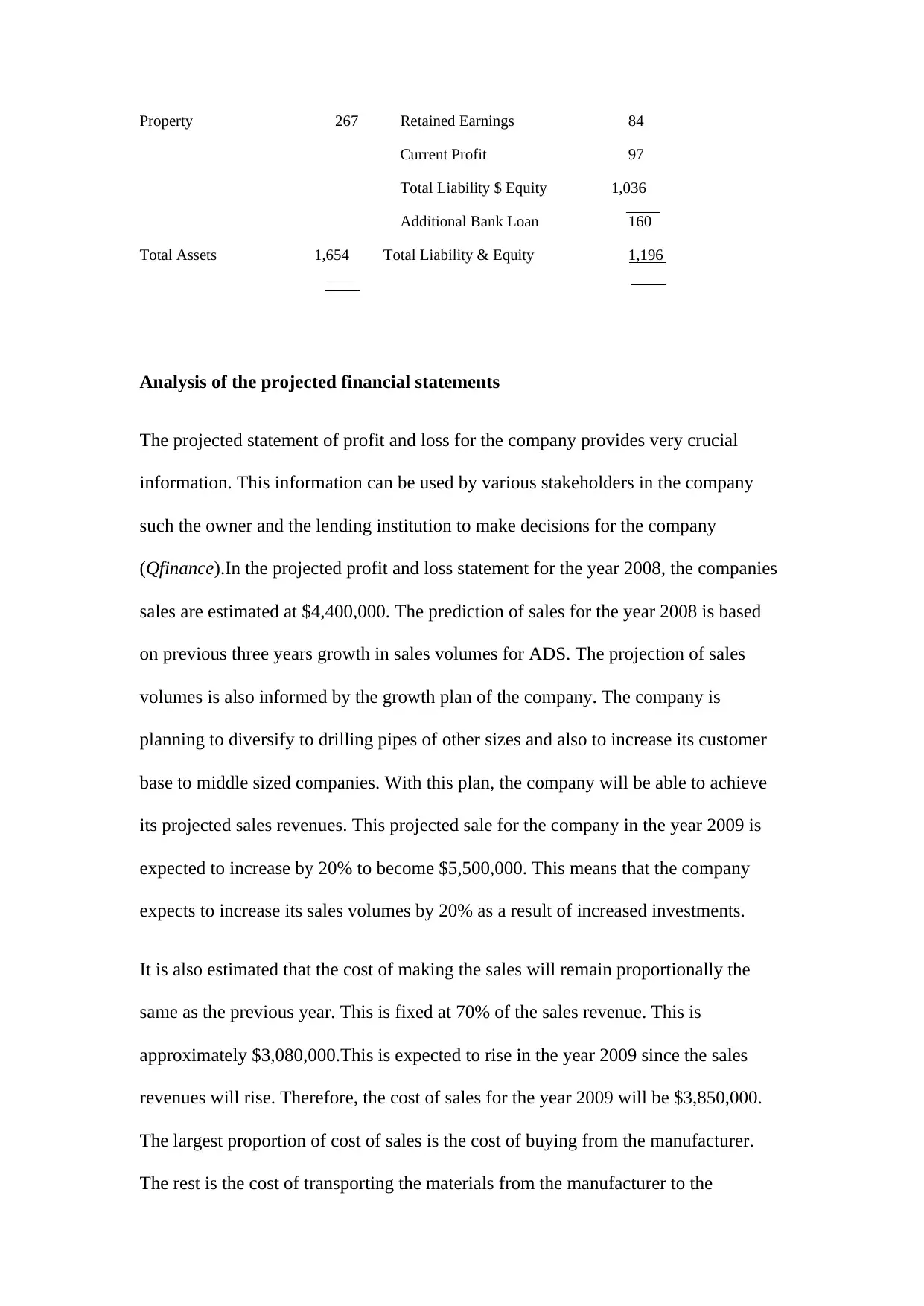

its projected sales revenues. This projected sale for the company in the year 2009 is

expected to increase by 20% to become $5,500,000. This means that the company

expects to increase its sales volumes by 20% as a result of increased investments.

It is also estimated that the cost of making the sales will remain proportionally the

same as the previous year. This is fixed at 70% of the sales revenue. This is

approximately $3,080,000.This is expected to rise in the year 2009 since the sales

revenues will rise. Therefore, the cost of sales for the year 2009 will be $3,850,000.

The largest proportion of cost of sales is the cost of buying from the manufacturer.

The rest is the cost of transporting the materials from the manufacturer to the

Current Profit 97

Total Liability $ Equity 1,036

Additional Bank Loan 160

Total Assets 1,654 Total Liability & Equity 1,196

Analysis of the projected financial statements

The projected statement of profit and loss for the company provides very crucial

information. This information can be used by various stakeholders in the company

such the owner and the lending institution to make decisions for the company

(Qfinance).In the projected profit and loss statement for the year 2008, the companies

sales are estimated at $4,400,000. The prediction of sales for the year 2008 is based

on previous three years growth in sales volumes for ADS. The projection of sales

volumes is also informed by the growth plan of the company. The company is

planning to diversify to drilling pipes of other sizes and also to increase its customer

base to middle sized companies. With this plan, the company will be able to achieve

its projected sales revenues. This projected sale for the company in the year 2009 is

expected to increase by 20% to become $5,500,000. This means that the company

expects to increase its sales volumes by 20% as a result of increased investments.

It is also estimated that the cost of making the sales will remain proportionally the

same as the previous year. This is fixed at 70% of the sales revenue. This is

approximately $3,080,000.This is expected to rise in the year 2009 since the sales

revenues will rise. Therefore, the cost of sales for the year 2009 will be $3,850,000.

The largest proportion of cost of sales is the cost of buying from the manufacturer.

The rest is the cost of transporting the materials from the manufacturer to the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

warehouse. From the calculations, the gross profit for the company for the year 2008

is $1,320,000. This is an increase compared to what was achieved in 2007 sale of

$1,040. The operating expenses for the company are retained at 21% of the total sales.

The projected operating expenses for the year 2008 are therefore expected to be $924.

The interest expense for ADS is a combination of the mortgage interest, the interest

on notes and the interest from the expected new loan of $200,000. The total interest

expense for the year adds up to $46.In the year 2009, the interest expense increases to

$70,000. This huge increase is due to the increased regulations which increases the

mortgage interest rate to 12%.The total operating expense for the company is

$878,000, this is expected to increase for the year 2009 to $1,085. The increase is due

to the increase in cost of marketing the company increasing in order to achieve the

targeted sales. The profit before tax for the year 2008 is $452,000 and it increases to

$565,000 in the following year. Thus is attributed to increase in sales revenues hence

causing a proportional change in the profit before taxes. The tax rate for the company

is fixed at 40% of the profit before tax. The tax rate for the company does not change

and this therefore means that it does not have a huge effect on the loan that McDonald

is applying for (Zhang, Shage).

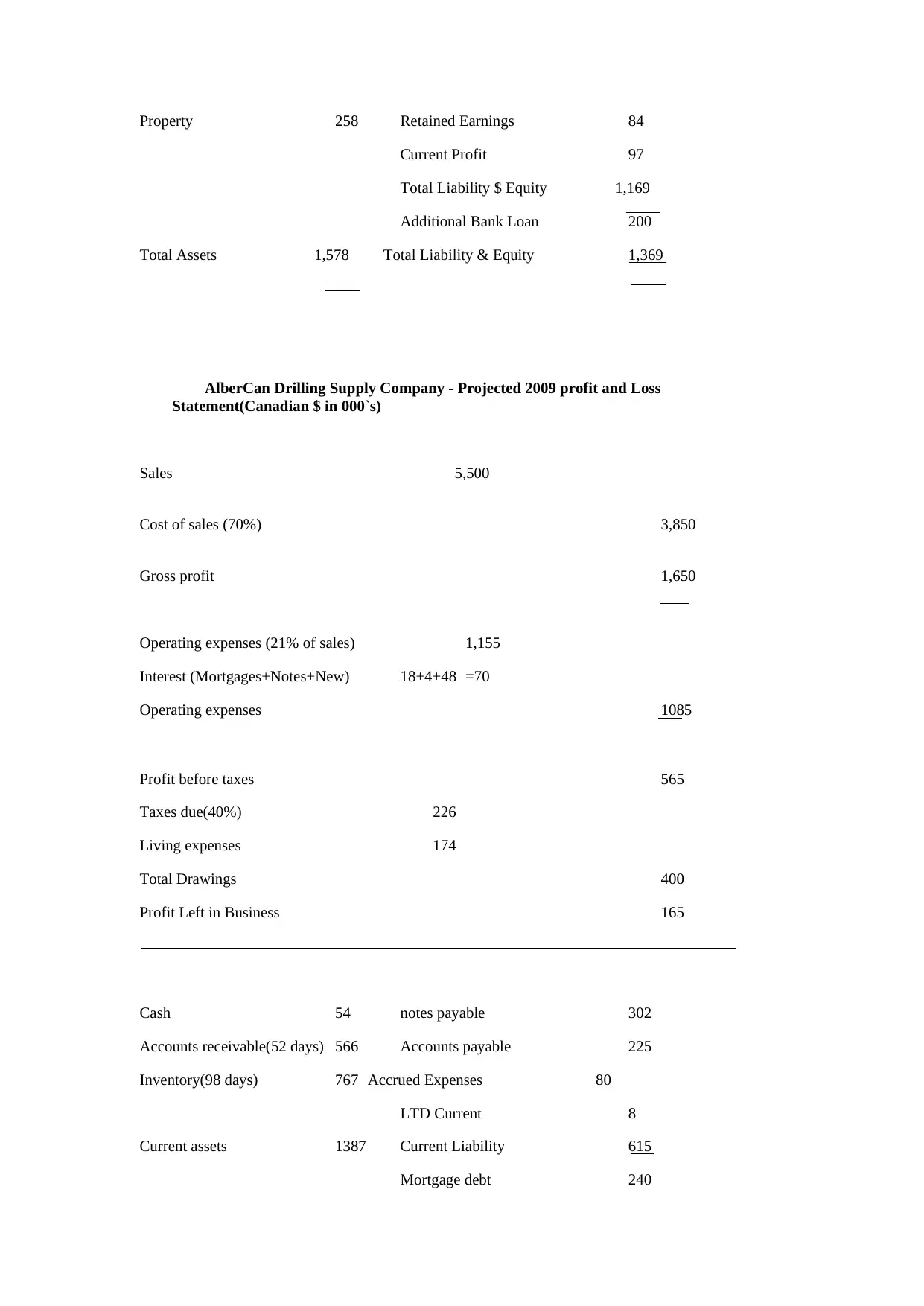

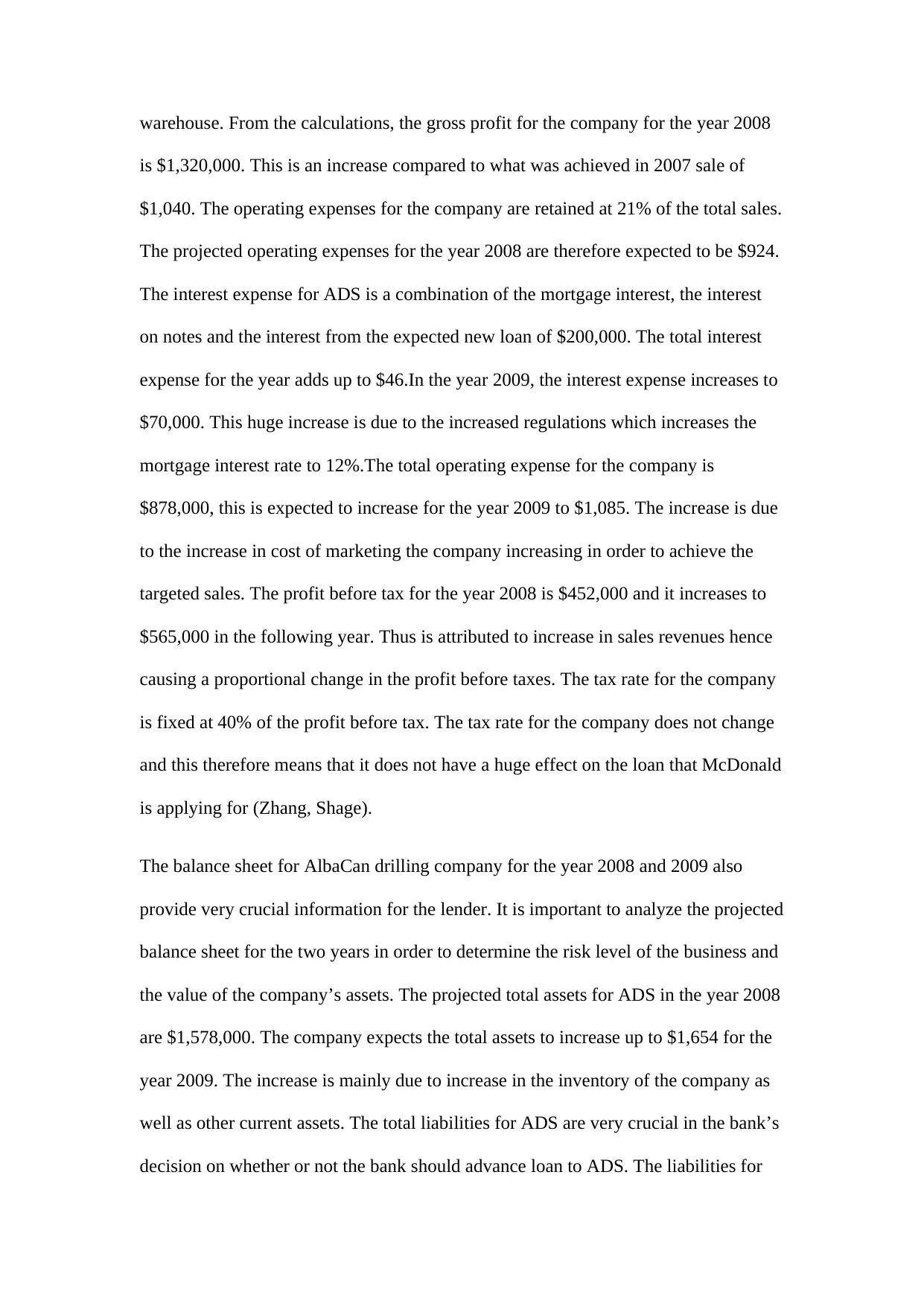

The balance sheet for AlbaCan drilling company for the year 2008 and 2009 also

provide very crucial information for the lender. It is important to analyze the projected

balance sheet for the two years in order to determine the risk level of the business and

the value of the company’s assets. The projected total assets for ADS in the year 2008

are $1,578,000. The company expects the total assets to increase up to $1,654 for the

year 2009. The increase is mainly due to increase in the inventory of the company as

well as other current assets. The total liabilities for ADS are very crucial in the bank’s

decision on whether or not the bank should advance loan to ADS. The liabilities for

is $1,320,000. This is an increase compared to what was achieved in 2007 sale of

$1,040. The operating expenses for the company are retained at 21% of the total sales.

The projected operating expenses for the year 2008 are therefore expected to be $924.

The interest expense for ADS is a combination of the mortgage interest, the interest

on notes and the interest from the expected new loan of $200,000. The total interest

expense for the year adds up to $46.In the year 2009, the interest expense increases to

$70,000. This huge increase is due to the increased regulations which increases the

mortgage interest rate to 12%.The total operating expense for the company is

$878,000, this is expected to increase for the year 2009 to $1,085. The increase is due

to the increase in cost of marketing the company increasing in order to achieve the

targeted sales. The profit before tax for the year 2008 is $452,000 and it increases to

$565,000 in the following year. Thus is attributed to increase in sales revenues hence

causing a proportional change in the profit before taxes. The tax rate for the company

is fixed at 40% of the profit before tax. The tax rate for the company does not change

and this therefore means that it does not have a huge effect on the loan that McDonald

is applying for (Zhang, Shage).

The balance sheet for AlbaCan drilling company for the year 2008 and 2009 also

provide very crucial information for the lender. It is important to analyze the projected

balance sheet for the two years in order to determine the risk level of the business and

the value of the company’s assets. The projected total assets for ADS in the year 2008

are $1,578,000. The company expects the total assets to increase up to $1,654 for the

year 2009. The increase is mainly due to increase in the inventory of the company as

well as other current assets. The total liabilities for ADS are very crucial in the bank’s

decision on whether or not the bank should advance loan to ADS. The liabilities for

the company are huge for the year 2008 and they are expected to increase further in

the year 2009. The mortgage of the company is the main long term liability for the

company and it has experienced problems in repaying the loan. The bank also owes

suppliers to the tune of $225,000. The companies working capital is also not

impressive. From the above analysis,it is clear that the businesses future prospects are

promising even thou the debt capital seems to become a burden for the company in

future. Under the conditions that the bank has given ADS company, I would lend out

the amount if I were in the banks` position. The increase in interest to 12% would be

profitable for the bank and the other conditions would also be crucial in ensuring that

ADS commits itself to repaying the loans.

As MacDonald, I would not take the loan. This is because the conditions offered for

the loan are too stringent. Firstly, the cost of financing the loan is too high. In this

case, its double the normal market rate of offering credit. This therefore means that

the loan will not be able to bring huge returns as expected. The requirement of paying

20% of principal every October means that the company may not be able to

implement its growth agenda as planned. The loan being borrowed is also seen to

affect the previous mortgage loan taken by the company and therefore it would not be

in the interest of the company to interfere with the terms of the previous loan. The

loan condition of not taken any short term loan by the company would also have very

negative effect on the company. This is because the company may in the future find

itself in cash flow problems that may make it necessary to borrow a short term loan.

The company may also find a very good investment opportunity with quick returns

and due to these restrictions it may miss this opportunity. Therefore under these

circumstances, it is unwise for the company to proceed with accepting the terms of the

loan.

the year 2009. The mortgage of the company is the main long term liability for the

company and it has experienced problems in repaying the loan. The bank also owes

suppliers to the tune of $225,000. The companies working capital is also not

impressive. From the above analysis,it is clear that the businesses future prospects are

promising even thou the debt capital seems to become a burden for the company in

future. Under the conditions that the bank has given ADS company, I would lend out

the amount if I were in the banks` position. The increase in interest to 12% would be

profitable for the bank and the other conditions would also be crucial in ensuring that

ADS commits itself to repaying the loans.

As MacDonald, I would not take the loan. This is because the conditions offered for

the loan are too stringent. Firstly, the cost of financing the loan is too high. In this

case, its double the normal market rate of offering credit. This therefore means that

the loan will not be able to bring huge returns as expected. The requirement of paying

20% of principal every October means that the company may not be able to

implement its growth agenda as planned. The loan being borrowed is also seen to

affect the previous mortgage loan taken by the company and therefore it would not be

in the interest of the company to interfere with the terms of the previous loan. The

loan condition of not taken any short term loan by the company would also have very

negative effect on the company. This is because the company may in the future find

itself in cash flow problems that may make it necessary to borrow a short term loan.

The company may also find a very good investment opportunity with quick returns

and due to these restrictions it may miss this opportunity. Therefore under these

circumstances, it is unwise for the company to proceed with accepting the terms of the

loan.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Conclusion

An in depth evaluation of the various sources of capital for various businesses has

done. The major sources of capital for most businesses are debt capital or equity. Debt

capital is the funding of a business from borrowed funds which carry an interest.

Some of the advantages of borrowing to finance a business is that the owners do not

lose control of the company and they do not have to share the profits with a third

party. Equity funding is where a company sells shares in order to raise funds. It has

various advantages and disadvantages which have also been clearly discussed in the

paper. The reasons of seeking additional funding for ADS are also clearly outlined in

the paper. Projected financial statement for the company for two years is then

prepared. The statements are then analyzed in detail to help advice Mr.MacDonald

and his company on whether or not he should take the loan and the conditions

provided by the bank. The banks position in regard to the state of the company’s

projected financial statements and whether or not it would be prudent to extend the

loan to ADS.

References

Ahuja, Narender L. Corporate Finance. Place of publication not identified: Prentice-

Hall Of India, 2016. Print.

Bilgin, Mehmet H, Hakan Danis, Ender Demir, and Ugur Can. Financial Environment

and Business Development: Proceedings of the 16th Eurasia Business and Economics

Society Conference. , 2016. Internet resource.

Kim, Joon Ho. "Debt Financing Frictions And Access To Public Debt."SSRN

Electronic Journal, 2012, Elsevier BV, doi:10.2139/ssrn.2024084.

An in depth evaluation of the various sources of capital for various businesses has

done. The major sources of capital for most businesses are debt capital or equity. Debt

capital is the funding of a business from borrowed funds which carry an interest.

Some of the advantages of borrowing to finance a business is that the owners do not

lose control of the company and they do not have to share the profits with a third

party. Equity funding is where a company sells shares in order to raise funds. It has

various advantages and disadvantages which have also been clearly discussed in the

paper. The reasons of seeking additional funding for ADS are also clearly outlined in

the paper. Projected financial statement for the company for two years is then

prepared. The statements are then analyzed in detail to help advice Mr.MacDonald

and his company on whether or not he should take the loan and the conditions

provided by the bank. The banks position in regard to the state of the company’s

projected financial statements and whether or not it would be prudent to extend the

loan to ADS.

References

Ahuja, Narender L. Corporate Finance. Place of publication not identified: Prentice-

Hall Of India, 2016. Print.

Bilgin, Mehmet H, Hakan Danis, Ender Demir, and Ugur Can. Financial Environment

and Business Development: Proceedings of the 16th Eurasia Business and Economics

Society Conference. , 2016. Internet resource.

Kim, Joon Ho. "Debt Financing Frictions And Access To Public Debt."SSRN

Electronic Journal, 2012, Elsevier BV, doi:10.2139/ssrn.2024084.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Mullins, John W. The Customer-Funded Business: Start, Finance, or Grow Your

Company with Your Customers' Cash. , 2014. Internet resource.

Panzarino, Helene. Business Funding for Dummies. , 2016. Print

Qfinance. London, Bloomsbury, 2009,

Rose, Nathan. Equity Crowdfunding: The Complete Guide for Startups and Growning

Companies. , 2016. Print.

Subhash, . Business Accounting and Financial Management. Place of publication not

identified: Prentice-Hall Of India Pv, 2013. Print.

Strauss, Steven D. Get Your Business Funded: Creative Methods for Getting the

Money You Need. Hoboken, N.J: Wiley, 2011. Print.

Zhang, Shage. "Institutions And Debt Financing."SSRN Electronic Journal, 2012,

Elsevier BV, doi:10.2139/ssrn.2150398.

Company with Your Customers' Cash. , 2014. Internet resource.

Panzarino, Helene. Business Funding for Dummies. , 2016. Print

Qfinance. London, Bloomsbury, 2009,

Rose, Nathan. Equity Crowdfunding: The Complete Guide for Startups and Growning

Companies. , 2016. Print.

Subhash, . Business Accounting and Financial Management. Place of publication not

identified: Prentice-Hall Of India Pv, 2013. Print.

Strauss, Steven D. Get Your Business Funded: Creative Methods for Getting the

Money You Need. Hoboken, N.J: Wiley, 2011. Print.

Zhang, Shage. "Institutions And Debt Financing."SSRN Electronic Journal, 2012,

Elsevier BV, doi:10.2139/ssrn.2150398.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.