Impact of PASI Pension Rate and Other Factors on SMEs in Oman

VerifiedAdded on 2023/06/03

|29

|8409

|337

AI Summary

This study analyzes the impact of Public Authority for Social Insurances’ (PASI) Pension Rate and other factors on the overall success and growth of SMEs in the Sultanate of Oman. It also evaluates the role of Social Insurance law on the SMEs growth and the challenges faced by SMEs to fulfill the pension rate set by PASI.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 1

Sultan Qaboos University

College of Economics and Political Science

Finance Department

Independent Study in Finance (FINA6371)

Fall 2018

A Study into the Impact of Public Authority for Social

Insurances’ (PASI) Pension Rate and other Factors on the

Overall Success and Growth of SMEs in the Sultanate of

Oman

DRAFT

Submitted by:

Mahfoodha Saleh Al Farqani

SQU ID#: 114156

Sultan Qaboos University

College of Economics and Political Science

Finance Department

Independent Study in Finance (FINA6371)

Fall 2018

A Study into the Impact of Public Authority for Social

Insurances’ (PASI) Pension Rate and other Factors on the

Overall Success and Growth of SMEs in the Sultanate of

Oman

DRAFT

Submitted by:

Mahfoodha Saleh Al Farqani

SQU ID#: 114156

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 2

Table of Contents

Chapter 1.....................................................................................................................................................3

INTRODUCTION.......................................................................................................................................3

Research Question...................................................................................................................................4

Objectives................................................................................................................................................4

Literature Review....................................................................................................................................5

Importance of Project..............................................................................................................................6

Scope of Study.........................................................................................................................................7

Data and Methodology Used...................................................................................................................7

Main Results............................................................................................................................................7

Chapter 2.....................................................................................................................................................8

BACKGROUND OR THEORETICAL FRAMEWORK............................................................................8

Chapter 3.....................................................................................................................................................9

DATA AND METHODOLOGY.................................................................................................................9

Data.......................................................................................................................................................10

Methodology.........................................................................................................................................11

Sampling............................................................................................................................................11

Ethical Considerations.......................................................................................................................12

Questionnaire....................................................................................................................................12

Gantt chart.........................................................................................................................................13

Chapter 4...................................................................................................................................................14

MAIN RESULTS......................................................................................................................................14

Chapter 5...................................................................................................................................................22

ANALYSIS AND CONCLUSION...........................................................................................................22

Analysis..................................................................................................................................................23

PASI Strengths.......................................................................................................................................24

Contributing to the pension scheme of employees.......................................................................24

Empowering employees................................................................................................................24

PASI Weaknesses...................................................................................................................................24

PASI Opportunities................................................................................................................................24

PASI Threats...........................................................................................................................................24

Conclusion.............................................................................................................................................24

Table of Contents

Chapter 1.....................................................................................................................................................3

INTRODUCTION.......................................................................................................................................3

Research Question...................................................................................................................................4

Objectives................................................................................................................................................4

Literature Review....................................................................................................................................5

Importance of Project..............................................................................................................................6

Scope of Study.........................................................................................................................................7

Data and Methodology Used...................................................................................................................7

Main Results............................................................................................................................................7

Chapter 2.....................................................................................................................................................8

BACKGROUND OR THEORETICAL FRAMEWORK............................................................................8

Chapter 3.....................................................................................................................................................9

DATA AND METHODOLOGY.................................................................................................................9

Data.......................................................................................................................................................10

Methodology.........................................................................................................................................11

Sampling............................................................................................................................................11

Ethical Considerations.......................................................................................................................12

Questionnaire....................................................................................................................................12

Gantt chart.........................................................................................................................................13

Chapter 4...................................................................................................................................................14

MAIN RESULTS......................................................................................................................................14

Chapter 5...................................................................................................................................................22

ANALYSIS AND CONCLUSION...........................................................................................................22

Analysis..................................................................................................................................................23

PASI Strengths.......................................................................................................................................24

Contributing to the pension scheme of employees.......................................................................24

Empowering employees................................................................................................................24

PASI Weaknesses...................................................................................................................................24

PASI Opportunities................................................................................................................................24

PASI Threats...........................................................................................................................................24

Conclusion.............................................................................................................................................24

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 3

REFERENCES..........................................................................................................................................25

APPENDIX..................................................................................................................................................27

Consent Form....................................................................................................................................27

Chapter 1.....................................................................................................................................................3

INTRODUCTION.......................................................................................................................................3

Research Question...................................................................................................................................4

Objectives................................................................................................................................................4

Literature Review....................................................................................................................................5

Importance of Project..............................................................................................................................6

Scope of Study.........................................................................................................................................6

Data and Methodology Used...................................................................................................................7

Main Results............................................................................................................................................7

Chapter 2.....................................................................................................................................................7

BACKGROUND OR THEORETICAL FRAMEWORK............................................................................7

Chapter 3.....................................................................................................................................................9

DATA AND METHODOLOGY.................................................................................................................9

Data.........................................................................................................................................................9

Methodology.........................................................................................................................................11

Sampling............................................................................................................................................11

Ethical Considerations.......................................................................................................................12

Consent Form....................................................................................................................................12

Questionnaire....................................................................................................................................13

Gantt chart.........................................................................................................................................14

Project Budget...................................................................................................................................15

Chapter 4...................................................................................................................................................15

MAIN RESULTS......................................................................................................................................15

Chapter 5...................................................................................................................................................23

ANALYSIS AND CONCLUSION...........................................................................................................23

Analysis..................................................................................................................................................23

Conclusion.............................................................................................................................................24

REFERENCES..........................................................................................................................................25

REFERENCES..........................................................................................................................................25

APPENDIX..................................................................................................................................................27

Consent Form....................................................................................................................................27

Chapter 1.....................................................................................................................................................3

INTRODUCTION.......................................................................................................................................3

Research Question...................................................................................................................................4

Objectives................................................................................................................................................4

Literature Review....................................................................................................................................5

Importance of Project..............................................................................................................................6

Scope of Study.........................................................................................................................................6

Data and Methodology Used...................................................................................................................7

Main Results............................................................................................................................................7

Chapter 2.....................................................................................................................................................7

BACKGROUND OR THEORETICAL FRAMEWORK............................................................................7

Chapter 3.....................................................................................................................................................9

DATA AND METHODOLOGY.................................................................................................................9

Data.........................................................................................................................................................9

Methodology.........................................................................................................................................11

Sampling............................................................................................................................................11

Ethical Considerations.......................................................................................................................12

Consent Form....................................................................................................................................12

Questionnaire....................................................................................................................................13

Gantt chart.........................................................................................................................................14

Project Budget...................................................................................................................................15

Chapter 4...................................................................................................................................................15

MAIN RESULTS......................................................................................................................................15

Chapter 5...................................................................................................................................................23

ANALYSIS AND CONCLUSION...........................................................................................................23

Analysis..................................................................................................................................................23

Conclusion.............................................................................................................................................24

REFERENCES..........................................................................................................................................25

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 4

Chapter 1

INTRODUCTION

SMEs (small and medium enterprises) contribute significantly to the general growth of a

country’s economy. Every country must be actively involved in monitoring the factors affecting

its SMEs in order to achieve economic growth. Some of the advantages of SMEs are, provision

of employment, contribution to the country’s GDP through payment of taxes, aiding in proper

flow of money in the country among others (Almuharrami, 2015).There are many challenges that

face SMEs such as access to finance, high taxes, high pension rates and skill shortage which

must be addressed by the government and other relevant authorities. SMEs face a risk of failing

in a volatile economy thus they need a flourishing economy to flourish so that their importance is

realized (Oman, 2011). Many businesses in the globe have resulted to laying off workers or

freezing employment due to the increased cost of operations resulting from high taxes, increased

minimum wage, increase in pension rates and an upsurge of other operational costs (Pauceanu,

2016).

The economy of Oman also enjoys the benefits of SMEs as much as other global economies.

Over the years they have contributed significant percentage of money to the country’s treasuries

in terms of taxes and offered employment to thousands of citizens. Thus the government of

Oman has taken various steps to protect its SMEs by creating a conducive business environment.

In Oman a pension rate has been set on SMEs by the Public Authority for Social Insurances’

(PASI) , this pension rate has various effects on them . Besides, businesses should be prepared to

address these challenges and device new methods of adapting (Muscat, 2013).

This project focusses on finding out the effects of Public Authority for Social Insurances’

(PASI) Pension Rate due to an increase in pension rate contribution percentage by the

government and other factors on the overall Success and Growth of SMEs in the Sultanate of

Oman. In Oman the PASI has set up pension rules and regulations. The pension given at old age

pension has to be paid on a monthly basis by the employer and the employee to the insured

employee’s pension scheme. The insured employees are covered under the social insurance law

(Muscat, 2013). When the employees reach the legal age and have completed the contribution

period they are given this pension. With a service period of 10 years the legal age is 55 years and

with a service period of 15 years the legal period is 15 years. The pension rules have employed a

pension rate calculation formula which has to be adhered to by every enterprise (Al-Farsi, 2011).

Chapter 1

INTRODUCTION

SMEs (small and medium enterprises) contribute significantly to the general growth of a

country’s economy. Every country must be actively involved in monitoring the factors affecting

its SMEs in order to achieve economic growth. Some of the advantages of SMEs are, provision

of employment, contribution to the country’s GDP through payment of taxes, aiding in proper

flow of money in the country among others (Almuharrami, 2015).There are many challenges that

face SMEs such as access to finance, high taxes, high pension rates and skill shortage which

must be addressed by the government and other relevant authorities. SMEs face a risk of failing

in a volatile economy thus they need a flourishing economy to flourish so that their importance is

realized (Oman, 2011). Many businesses in the globe have resulted to laying off workers or

freezing employment due to the increased cost of operations resulting from high taxes, increased

minimum wage, increase in pension rates and an upsurge of other operational costs (Pauceanu,

2016).

The economy of Oman also enjoys the benefits of SMEs as much as other global economies.

Over the years they have contributed significant percentage of money to the country’s treasuries

in terms of taxes and offered employment to thousands of citizens. Thus the government of

Oman has taken various steps to protect its SMEs by creating a conducive business environment.

In Oman a pension rate has been set on SMEs by the Public Authority for Social Insurances’

(PASI) , this pension rate has various effects on them . Besides, businesses should be prepared to

address these challenges and device new methods of adapting (Muscat, 2013).

This project focusses on finding out the effects of Public Authority for Social Insurances’

(PASI) Pension Rate due to an increase in pension rate contribution percentage by the

government and other factors on the overall Success and Growth of SMEs in the Sultanate of

Oman. In Oman the PASI has set up pension rules and regulations. The pension given at old age

pension has to be paid on a monthly basis by the employer and the employee to the insured

employee’s pension scheme. The insured employees are covered under the social insurance law

(Muscat, 2013). When the employees reach the legal age and have completed the contribution

period they are given this pension. With a service period of 10 years the legal age is 55 years and

with a service period of 15 years the legal period is 15 years. The pension rules have employed a

pension rate calculation formula which has to be adhered to by every enterprise (Al-Farsi, 2011).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 5

Research Question

This project is aimed at answering the following research questions:

What is the role of Social Insurance law on the SMEs growth?

What is the pension rate set by PASI, its characteristics and effects on SMEs?

What is the pension rate set by the government, its characteristics and effects on SMEs?

What are the challenges faced by SMEs during the fulfillment of the pension rate set by

PASI?

What are the other factors affecting the growth of SMEs in Oman?

What is the role of the government as far as pension rate is concerned in Oman? (Albadi,

2009)

The project will seek to get answers from employers and employees on the following questions:

Employer Questionnaire

If they support the PASI set pension rates?

If they think the increased pension rates have affected employment?

If they think there is a shortage of skills in Oman?

If they think the government set taxes on goods and services are high and affect the growth of

SMEs?

If it is difficult for SMEs to access credit in Oman?

If they think the set minimum wage is high?

Employee Questionnaire

If they think you are receiving enough contribution from your employer to your pension

scheme?

Their take on the PASI set pension rates?

If they think the increased pension rates have affected employment in SMEs?

If they think there is skill shortage in Oman?

If they think the minimum wage is Oman is a strain on SMEs?

If they think government taxes in Oman have a notable effect on the success of SMEs?

Objectives

The project has various objectives which it is addressing such as:

Research Question

This project is aimed at answering the following research questions:

What is the role of Social Insurance law on the SMEs growth?

What is the pension rate set by PASI, its characteristics and effects on SMEs?

What is the pension rate set by the government, its characteristics and effects on SMEs?

What are the challenges faced by SMEs during the fulfillment of the pension rate set by

PASI?

What are the other factors affecting the growth of SMEs in Oman?

What is the role of the government as far as pension rate is concerned in Oman? (Albadi,

2009)

The project will seek to get answers from employers and employees on the following questions:

Employer Questionnaire

If they support the PASI set pension rates?

If they think the increased pension rates have affected employment?

If they think there is a shortage of skills in Oman?

If they think the government set taxes on goods and services are high and affect the growth of

SMEs?

If it is difficult for SMEs to access credit in Oman?

If they think the set minimum wage is high?

Employee Questionnaire

If they think you are receiving enough contribution from your employer to your pension

scheme?

Their take on the PASI set pension rates?

If they think the increased pension rates have affected employment in SMEs?

If they think there is skill shortage in Oman?

If they think the minimum wage is Oman is a strain on SMEs?

If they think government taxes in Oman have a notable effect on the success of SMEs?

Objectives

The project has various objectives which it is addressing such as:

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 6

To determine the role of the Social Insurance law on the SMEs growth

To evaluate the pension rate set by PASI

To evaluate how the set pension rate affects SMEs

To highlight the challenges faced met by SMEs to fulfill this rate

The other factors influencing the growth of SMEs in Oman

How the government influences the growth of SMEs in Oman (Gonzalez, 2008)

Literature Review

Many scholars have done research on the effects of pension rate on the growth and success of

SMEs (Falls, 2013) indicates that SMEs face many challenges in their operation. For instance

when it comes to the rate of pension schemes they require government intervention to cope with

an upsurge in pension contributions for their employees in order to avoid financial difficulties.

Employers are hard hit by increased pension rates thus high labor cost since they have to

contribute more to their employees’ pension schemes thus an increase in operational costs which

reduce profits and make it hard for the SMEs to grow. The government and relevant authorities

have to monitor the pension rates and ensure they are fair to both the employer and the

employees. In order to boost the growth of SMEs the pension rate percentage contribution of the

employer should be reasonably low thus ensuring low operating expenditure (Falls, 2013).

Bradac (2013) talks about the pension rate in the United Kingdom. The government has doubled

the pension rate contribution by employers from 1% to 2%. Besides the minimum wage which

can be given to employees over the age of 25 years increased by almost 5% from 1st April 2018.

The minimum wages of workers under the age of 25 years are also on the rise. Evidently this

exercise will be costly in both the money used to make the contributions and payments and

filling out the paper work involved. Further increase in the pension rate is expected in the United

Kingdom where it will increase to 3%. This will have a huge impact on small and medium

enterprises. Some small businesses feel like some employees are unaffordable due to these

increased contributions. A survey done by Forbes shows that many SMEs in the UK are

expecting 2018 to be weaker than the previous year in terms of business due to the higher

operational costs. The United Kingdom government has employed an automatic enrolment

system whereby employers have to automatically enroll their employees who meet certain

criteria into a workplace pension. This system makes it simple for people to save for their

retirement. Thousands of SMEs are working towards the implementation or have already

implemented this system, however majority of businesses have not yet implemented it. Many

small businesses say that this system will impact bonuses and pay rise with some indicating that

it may put them out of business. Employees also are concerned that the automatic enrollment

system puts their pay rise at risk with the unemployed expressing their worry that the system will

make many businesses not able to take more staff thus render them unemployed for long period

(Bradac, 2013).

Ghazanfar (2007) indicates that SMEs have become important in Oman and the world because of

their high capacity to promote entrepreneurial skills and entrepreneurship. They are highly

flexible and quick to adapt to the changing market demands. SMEs are responsible for

To determine the role of the Social Insurance law on the SMEs growth

To evaluate the pension rate set by PASI

To evaluate how the set pension rate affects SMEs

To highlight the challenges faced met by SMEs to fulfill this rate

The other factors influencing the growth of SMEs in Oman

How the government influences the growth of SMEs in Oman (Gonzalez, 2008)

Literature Review

Many scholars have done research on the effects of pension rate on the growth and success of

SMEs (Falls, 2013) indicates that SMEs face many challenges in their operation. For instance

when it comes to the rate of pension schemes they require government intervention to cope with

an upsurge in pension contributions for their employees in order to avoid financial difficulties.

Employers are hard hit by increased pension rates thus high labor cost since they have to

contribute more to their employees’ pension schemes thus an increase in operational costs which

reduce profits and make it hard for the SMEs to grow. The government and relevant authorities

have to monitor the pension rates and ensure they are fair to both the employer and the

employees. In order to boost the growth of SMEs the pension rate percentage contribution of the

employer should be reasonably low thus ensuring low operating expenditure (Falls, 2013).

Bradac (2013) talks about the pension rate in the United Kingdom. The government has doubled

the pension rate contribution by employers from 1% to 2%. Besides the minimum wage which

can be given to employees over the age of 25 years increased by almost 5% from 1st April 2018.

The minimum wages of workers under the age of 25 years are also on the rise. Evidently this

exercise will be costly in both the money used to make the contributions and payments and

filling out the paper work involved. Further increase in the pension rate is expected in the United

Kingdom where it will increase to 3%. This will have a huge impact on small and medium

enterprises. Some small businesses feel like some employees are unaffordable due to these

increased contributions. A survey done by Forbes shows that many SMEs in the UK are

expecting 2018 to be weaker than the previous year in terms of business due to the higher

operational costs. The United Kingdom government has employed an automatic enrolment

system whereby employers have to automatically enroll their employees who meet certain

criteria into a workplace pension. This system makes it simple for people to save for their

retirement. Thousands of SMEs are working towards the implementation or have already

implemented this system, however majority of businesses have not yet implemented it. Many

small businesses say that this system will impact bonuses and pay rise with some indicating that

it may put them out of business. Employees also are concerned that the automatic enrollment

system puts their pay rise at risk with the unemployed expressing their worry that the system will

make many businesses not able to take more staff thus render them unemployed for long period

(Bradac, 2013).

Ghazanfar (2007) indicates that SMEs have become important in Oman and the world because of

their high capacity to promote entrepreneurial skills and entrepreneurship. They are highly

flexible and quick to adapt to the changing market demands. SMEs are responsible for

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 7

generating many jobs in both Oman and other parts of the globe. Due to these contributions by

SMEs it is essential to identify the factors affecting them with the aim of taking the necessary

actions to remove or reduce any difficulties and build up new opportunities for these SMEs. The

problems facing these enterprises range from access to finance, competition from other

established businesses, corruption especially in the government and policies made by the

government. Ghanzanfar (2007) points out the Sultanate of Oman’s policies such as the increase

in the minimum wage and the pension rates. An increase in the minimum wage strains the

finances of the SMEs since it increases the cost of labor. On the other hand an increase in the

enterprise’s pension contribution to the accounts of its employees leads to an increase in the

company’s operational expenses this as well limits the development of the SMEs. Ghanzanfar

recommends that in order for the development of SMEs to be achieved in the globe given their

contribution to economic growth and employment the following remedies must be embrace, the

government in the world economies should control corruption in order to support SMEs

efficiently, credit access should be made easier to these enterprises in order for them to develop

easily and have the capacity to take in more labor, government policies on sensitive issues such

as the minimum wage should be made in consultation with the SMEs organizations so that the

most fair percentage payments and contributions are arrived at. The world economies should take

a step in supporting SMEs so that they can be able to thrive in stiff competition (Ghazanfar,

2007).

Al-Lamki (2009) States that customers in Oman have become sophisticated over the years

leading to an intensified competition in business. Thus SMEs require a lot of intangible and

tangible resources to compete in this ever changing environment in order to realize profitability.

SMEs face substantial resource constraints in their day to day operation but exhibit excellent

entrepreneurial characteristics which lead them to success. The interaction between various

resources types in these SMEs ensure they gain competitive advantage. According to Al-Lamki

the main challenges facing SMEs in Oman are insufficiency of operational funds to cater for

costs such as remuneration and pension contributions, insufficient resources and technology,

poor market research and selling techniques among others. Laws and regulations have a

significant effect on the small and medium enterprises in the sense that there are some set rules

that make operation difficult for these businesses. Al-Lamki gives an example of the

remuneration and pension rate laws by the Oman government. The percentage of remuneration

and required pension contribution is high for some companies to afford thus they result in laying

off workers, employment freezing and in extreme situations they may get out of business (Al-

Lamki, 2009).

A recent study conducted in Muscat on the skills in the market entitled ‘The Middle East Skills

Report’ found that majority of the people in Oman believe that the country has skills shortage.

These respondents include employers, employees and job seekers. Most job seekers cited the

reason for not securing jobs as lack of knowledge on the skills that are in high demand. Lack of

enough skills in the market affects the implementation of ideas by SMEs and makes work

difficult thus reducing profitability (Rao & Syed, 2007).

generating many jobs in both Oman and other parts of the globe. Due to these contributions by

SMEs it is essential to identify the factors affecting them with the aim of taking the necessary

actions to remove or reduce any difficulties and build up new opportunities for these SMEs. The

problems facing these enterprises range from access to finance, competition from other

established businesses, corruption especially in the government and policies made by the

government. Ghanzanfar (2007) points out the Sultanate of Oman’s policies such as the increase

in the minimum wage and the pension rates. An increase in the minimum wage strains the

finances of the SMEs since it increases the cost of labor. On the other hand an increase in the

enterprise’s pension contribution to the accounts of its employees leads to an increase in the

company’s operational expenses this as well limits the development of the SMEs. Ghanzanfar

recommends that in order for the development of SMEs to be achieved in the globe given their

contribution to economic growth and employment the following remedies must be embrace, the

government in the world economies should control corruption in order to support SMEs

efficiently, credit access should be made easier to these enterprises in order for them to develop

easily and have the capacity to take in more labor, government policies on sensitive issues such

as the minimum wage should be made in consultation with the SMEs organizations so that the

most fair percentage payments and contributions are arrived at. The world economies should take

a step in supporting SMEs so that they can be able to thrive in stiff competition (Ghazanfar,

2007).

Al-Lamki (2009) States that customers in Oman have become sophisticated over the years

leading to an intensified competition in business. Thus SMEs require a lot of intangible and

tangible resources to compete in this ever changing environment in order to realize profitability.

SMEs face substantial resource constraints in their day to day operation but exhibit excellent

entrepreneurial characteristics which lead them to success. The interaction between various

resources types in these SMEs ensure they gain competitive advantage. According to Al-Lamki

the main challenges facing SMEs in Oman are insufficiency of operational funds to cater for

costs such as remuneration and pension contributions, insufficient resources and technology,

poor market research and selling techniques among others. Laws and regulations have a

significant effect on the small and medium enterprises in the sense that there are some set rules

that make operation difficult for these businesses. Al-Lamki gives an example of the

remuneration and pension rate laws by the Oman government. The percentage of remuneration

and required pension contribution is high for some companies to afford thus they result in laying

off workers, employment freezing and in extreme situations they may get out of business (Al-

Lamki, 2009).

A recent study conducted in Muscat on the skills in the market entitled ‘The Middle East Skills

Report’ found that majority of the people in Oman believe that the country has skills shortage.

These respondents include employers, employees and job seekers. Most job seekers cited the

reason for not securing jobs as lack of knowledge on the skills that are in high demand. Lack of

enough skills in the market affects the implementation of ideas by SMEs and makes work

difficult thus reducing profitability (Rao & Syed, 2007).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 8

Importance of Project

This project is essential since it highlights the benefits of SMEs to an economy’s growth in this

case the Oman economy. The project focusses on the effects of the PASI pension rate and other

factors on the general growth and success of SMEs. The findings from the project can be used in

decision making with the aim of boosting the growth of SMEs in the Sultanate of Oman

(Thompson & Toledo, 2010). The project will enhance the existing research on the factors

affecting the growth of SMEs in Oman and the globe with a particular focus on the effects on

increase in pension rate on them. Most of the prior studies do not give focus on pension rate and

its effects.

Scope of Study

This project is based on finding out the effects of Public Authority for Social Insurances’ (PASI

) p Pension Rate and other factors on the overall Success and Growth of SMEs in the Sultanate

of Oman. The project focusses on the SMEs based in the Sultanate of Oman and seeks to

research on the factors affecting their growth with the main focus on the pension rates set by the

PASI. The project deals with aspects affecting SME growth comprising high government taxes,

limited skills in the market, high set minimum wage, high pension rates and difficulties in credit

access (Bohle & Greskovits, 2016). The research consults a large amount of materials by using

both secondary and primary data. It gathers data from the employers and employees in the SMEs

as well as gathering data from the Riyada Public Authority of Small and Medium Enterprise

Development and PACI funds records.

Data and Methodology Used

The Data used in this project has been gathered from both primary and secondary sources. Six

SMEs have been involved in this study and a thorough analysis done on the data gathered from

them. The SMEs were selected by a selection criteria of non-probability sampling. The

information gathered from these SMEs has been analyzed using Microsoft excel in order to

discover trends and make conclusions. Charts have been developed to show the percentages from

the responses given by the employers and employees from the SMEs. Besides, secondary data

from these SMEs has been consulted in order to paint a clearer picture on the factors affecting

SMEs growth (Wasmer, 2016). Besides there is data gathered from the Riyada Public Authority

of Small and Medium Enterprise Development and PACI funds records which is used alongside

the primary data to determine the factors affecting the growth of SMEs in the Sultanate of Oman.

Main Results

The project results based on the reactions from employers, employees and existing records have

s proofed that the pension rates set by the PASI are quite high and affect the operation of the

small and medium enterprises. Due to the high contributions made by the SMEs to the pension

schemes of their employees the labor cost is increased thus leading to high operational costs.

This leads to low profits which result to problems such as low employment rates with some

Importance of Project

This project is essential since it highlights the benefits of SMEs to an economy’s growth in this

case the Oman economy. The project focusses on the effects of the PASI pension rate and other

factors on the general growth and success of SMEs. The findings from the project can be used in

decision making with the aim of boosting the growth of SMEs in the Sultanate of Oman

(Thompson & Toledo, 2010). The project will enhance the existing research on the factors

affecting the growth of SMEs in Oman and the globe with a particular focus on the effects on

increase in pension rate on them. Most of the prior studies do not give focus on pension rate and

its effects.

Scope of Study

This project is based on finding out the effects of Public Authority for Social Insurances’ (PASI

) p Pension Rate and other factors on the overall Success and Growth of SMEs in the Sultanate

of Oman. The project focusses on the SMEs based in the Sultanate of Oman and seeks to

research on the factors affecting their growth with the main focus on the pension rates set by the

PASI. The project deals with aspects affecting SME growth comprising high government taxes,

limited skills in the market, high set minimum wage, high pension rates and difficulties in credit

access (Bohle & Greskovits, 2016). The research consults a large amount of materials by using

both secondary and primary data. It gathers data from the employers and employees in the SMEs

as well as gathering data from the Riyada Public Authority of Small and Medium Enterprise

Development and PACI funds records.

Data and Methodology Used

The Data used in this project has been gathered from both primary and secondary sources. Six

SMEs have been involved in this study and a thorough analysis done on the data gathered from

them. The SMEs were selected by a selection criteria of non-probability sampling. The

information gathered from these SMEs has been analyzed using Microsoft excel in order to

discover trends and make conclusions. Charts have been developed to show the percentages from

the responses given by the employers and employees from the SMEs. Besides, secondary data

from these SMEs has been consulted in order to paint a clearer picture on the factors affecting

SMEs growth (Wasmer, 2016). Besides there is data gathered from the Riyada Public Authority

of Small and Medium Enterprise Development and PACI funds records which is used alongside

the primary data to determine the factors affecting the growth of SMEs in the Sultanate of Oman.

Main Results

The project results based on the reactions from employers, employees and existing records have

s proofed that the pension rates set by the PASI are quite high and affect the operation of the

small and medium enterprises. Due to the high contributions made by the SMEs to the pension

schemes of their employees the labor cost is increased thus leading to high operational costs.

This leads to low profits which result to problems such as low employment rates with some

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 9

SMEs freezing employment since they cannot be able to afford the labor cost. Increase in

operational costs in Oman has made it difficult for many SMEs to thrive forcing others out of

business. There are also other factors affecting the operation of SMEs such as high government

taxes, limited skills in the market, high set minimum wage and difficulties in credit access (Al-

Yahyae, 2016).

Chapter 2

BACKGROUND OR THEORETICAL FRAMEWORK

There are many factors affecting the growth of SMEs in the Sultanate of Oman amongst which

are the pension rates set by the PASI, government taxes, minimum wage, and shortage of skills

among others. This project analyses these factors with the main focus on the pension effects of

the set pension rates on the SMEs. Most of these factors affecting the growth of SMEs are

influenced by the government policies, rules and regulations (Al Yahyae & Walter, 2010).

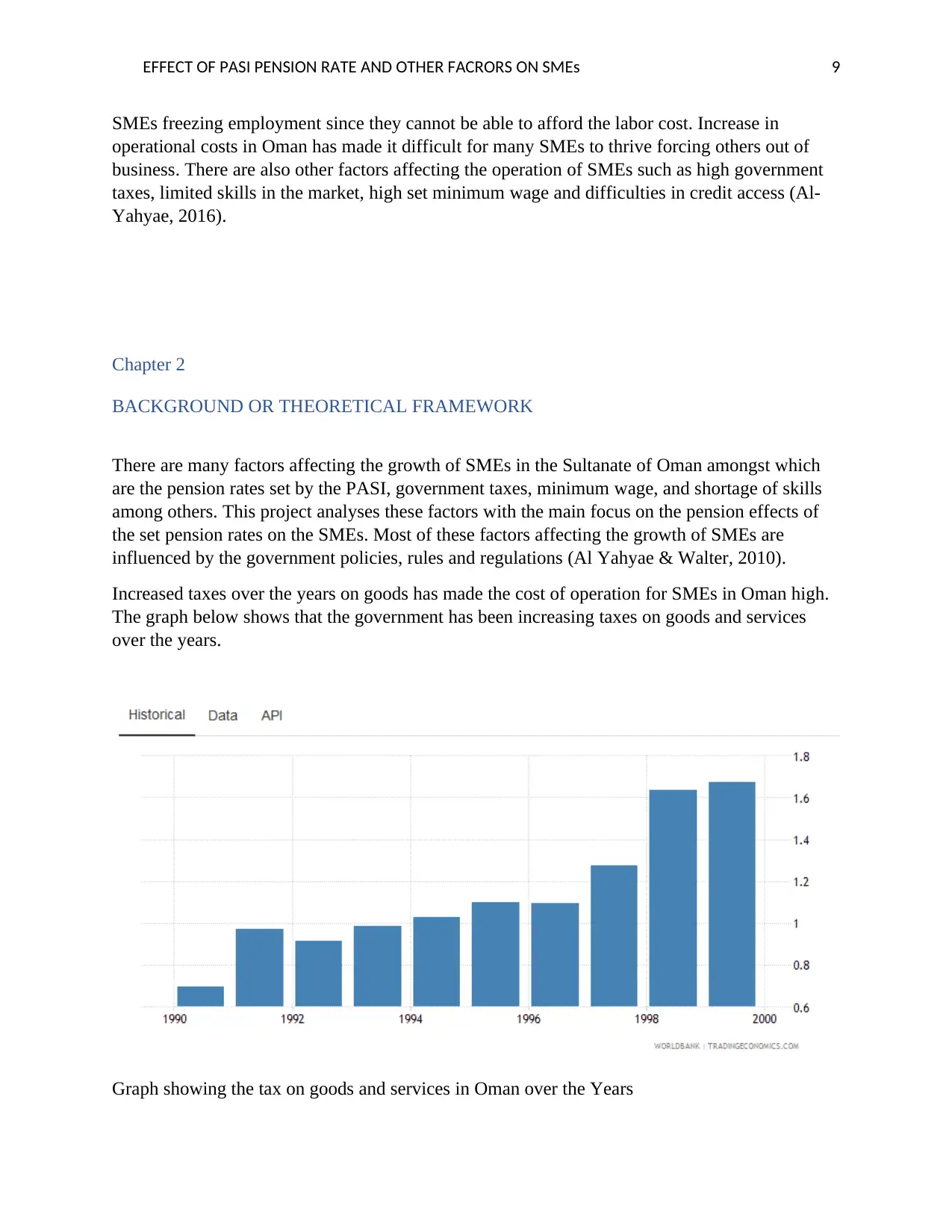

Increased taxes over the years on goods has made the cost of operation for SMEs in Oman high.

The graph below shows that the government has been increasing taxes on goods and services

over the years.

Graph showing the tax on goods and services in Oman over the Years

SMEs freezing employment since they cannot be able to afford the labor cost. Increase in

operational costs in Oman has made it difficult for many SMEs to thrive forcing others out of

business. There are also other factors affecting the operation of SMEs such as high government

taxes, limited skills in the market, high set minimum wage and difficulties in credit access (Al-

Yahyae, 2016).

Chapter 2

BACKGROUND OR THEORETICAL FRAMEWORK

There are many factors affecting the growth of SMEs in the Sultanate of Oman amongst which

are the pension rates set by the PASI, government taxes, minimum wage, and shortage of skills

among others. This project analyses these factors with the main focus on the pension effects of

the set pension rates on the SMEs. Most of these factors affecting the growth of SMEs are

influenced by the government policies, rules and regulations (Al Yahyae & Walter, 2010).

Increased taxes over the years on goods has made the cost of operation for SMEs in Oman high.

The graph below shows that the government has been increasing taxes on goods and services

over the years.

Graph showing the tax on goods and services in Oman over the Years

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 10

The graphs shows a steep tax increase thus increased SMEs operational costs. An increase in

operational costs affects factors such as increase in wages, pension, allowances, employment and

other factors due to reduced profits (Schwarz, Karolyl & Salem, 2008).

Increased operational costs due to increase in the price of commodities such as electricity is a

major factor affecting SMEs in Oman. For example the new introduced taxes and fees for

businesses and individuals based in the Oman. The Municipality introduced a 2% increase in

electricity prices based on the business and individual usage. This study will also seek to proof if

there is an increase in the operational costs of SMEs in Oman (Al-Balushi, 2011).

There is a skill shortage in the local market which makes implementation of many ideas by

SMEs difficult. Majority of the job seekers in the country have not been educated well on the

skills that they require to secure jobs thus they do not find jobs easily. Many SMEs find it

difficult to operate due to this fact of limited skills. The skills comprise communication skills,

negotiation skills, leadership skills, ability to work under pressure creativity, technical skills, and

efficiency among others. In most cases you find workers possess just some of them thus they are

not skilled enough for the potential jobs. This study will furthermore seek to proof if indeed there

is skill shortage in Oman (Schamidt, 2008).

There is increased market competition in Oman leaving SMEs at a disadvantage. Large

organizations compete with the same market with small and medium sized enterprises, since the

large organizations have the financial advantage it becomes difficult for the SMEs to thrive thus

most of them get out of business (Ghazanfar, 2007).

The Sultanate of Oman under the PASI which is the body mandated with setting up the pension

rate has set up a formula for the calculation of pension rate contributions. The formula is:

3%x Av. gross salary of the last five years x Number of full contributions years under the insurance

scheme (Rajasekar, 2014).

This formula is used by all businesses in the pension rate calculation. Many SMEs find the contributions

made to the employee’s pension scheme to be quite high thus increasing the general operational costs. On

the contrary many employees feel that the contributions made by their employers are less and should be

even more. The PASI on its side feels that the set pension rate is fair to both the employers and the

employees. This study is pursuing to gather primary information and secondary information proof

on the pension rate effects on the SMEs. The study will also gather information from SMEs to

from factual conclusions.

The graphs shows a steep tax increase thus increased SMEs operational costs. An increase in

operational costs affects factors such as increase in wages, pension, allowances, employment and

other factors due to reduced profits (Schwarz, Karolyl & Salem, 2008).

Increased operational costs due to increase in the price of commodities such as electricity is a

major factor affecting SMEs in Oman. For example the new introduced taxes and fees for

businesses and individuals based in the Oman. The Municipality introduced a 2% increase in

electricity prices based on the business and individual usage. This study will also seek to proof if

there is an increase in the operational costs of SMEs in Oman (Al-Balushi, 2011).

There is a skill shortage in the local market which makes implementation of many ideas by

SMEs difficult. Majority of the job seekers in the country have not been educated well on the

skills that they require to secure jobs thus they do not find jobs easily. Many SMEs find it

difficult to operate due to this fact of limited skills. The skills comprise communication skills,

negotiation skills, leadership skills, ability to work under pressure creativity, technical skills, and

efficiency among others. In most cases you find workers possess just some of them thus they are

not skilled enough for the potential jobs. This study will furthermore seek to proof if indeed there

is skill shortage in Oman (Schamidt, 2008).

There is increased market competition in Oman leaving SMEs at a disadvantage. Large

organizations compete with the same market with small and medium sized enterprises, since the

large organizations have the financial advantage it becomes difficult for the SMEs to thrive thus

most of them get out of business (Ghazanfar, 2007).

The Sultanate of Oman under the PASI which is the body mandated with setting up the pension

rate has set up a formula for the calculation of pension rate contributions. The formula is:

3%x Av. gross salary of the last five years x Number of full contributions years under the insurance

scheme (Rajasekar, 2014).

This formula is used by all businesses in the pension rate calculation. Many SMEs find the contributions

made to the employee’s pension scheme to be quite high thus increasing the general operational costs. On

the contrary many employees feel that the contributions made by their employers are less and should be

even more. The PASI on its side feels that the set pension rate is fair to both the employers and the

employees. This study is pursuing to gather primary information and secondary information proof

on the pension rate effects on the SMEs. The study will also gather information from SMEs to

from factual conclusions.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 11

Chapter 3

DATA AND METHODOLOGY

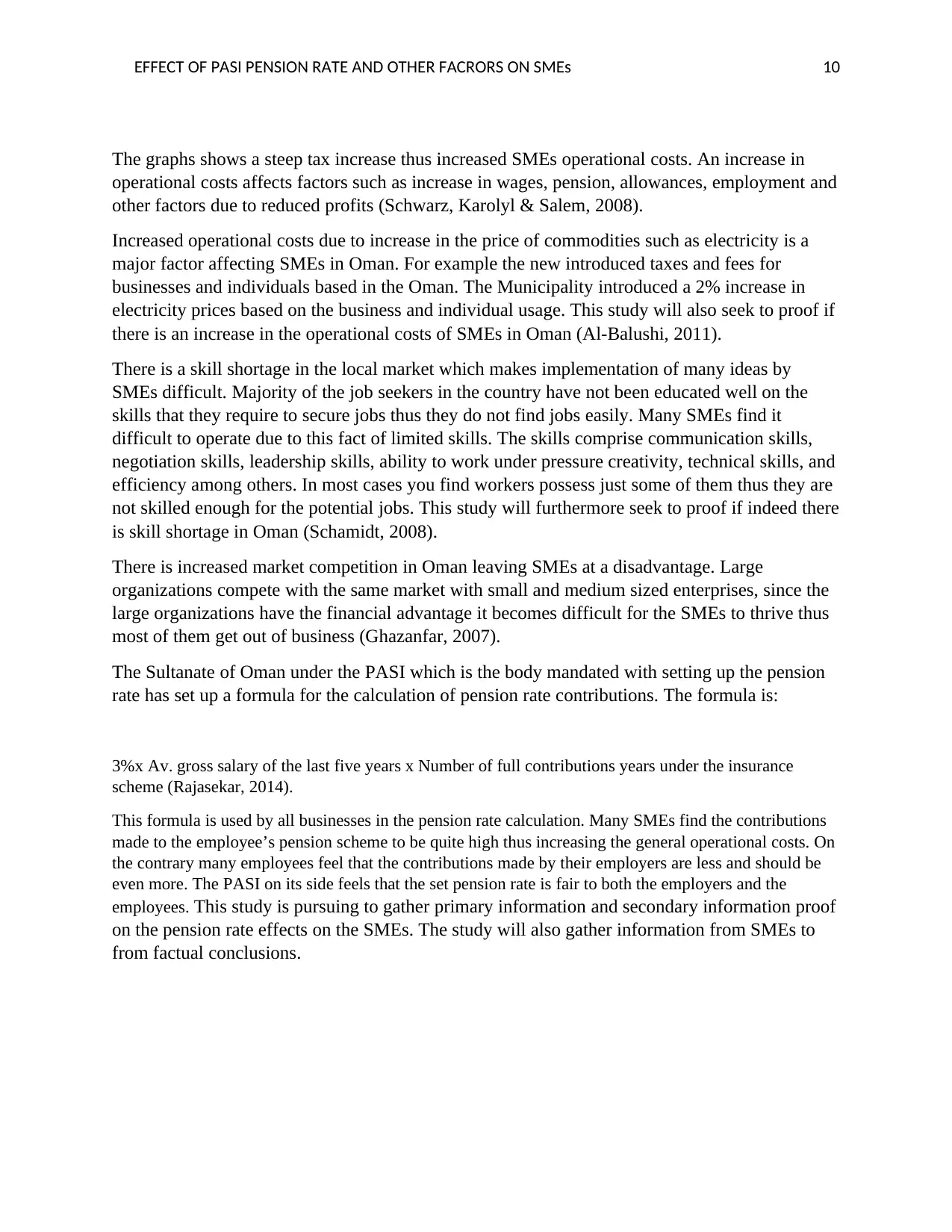

Data

The study has gathered data from six different SMEs (small and medium enterprises) with the

aim of determining the effect of PASI and government pension rates on these businesses. The

data has been gathered through questionnaires given to the employers and the employees and the

secondary data available in these SMEs. The data has been analyzed and a comparison made on

the findings from the various SMEs (Eme, Uche & Uche, 2014)

The Data used in this project is given below:

Employers

Employer

ID

a. Do you

support the

PASI set

pension

rates?

b. Do you

think the

increased

pension rates

have affected

employment

?

c. Do you

think there

is a

shortage of

skills in

Oman?

d. Do you

think the

government

set taxes on

goods and

services are

high?

e. Is it

difficult for

SMEs to

access

credit in

Oman?

f. Do you

think the

set

minimum

wage is

high?

1st No Yes Yes Yes No Yes

2nd Yes Yes Yes Yes Yes No

3rd Yes No Yes Yes No No

4th No Yes Yes Yes Yes Yes

5th No Yes Yes Yes Yes Yes

6th No Yes Yes Yes yes No

Yes 2 5 6 6 4 3

No 4 1 0 0 2 3

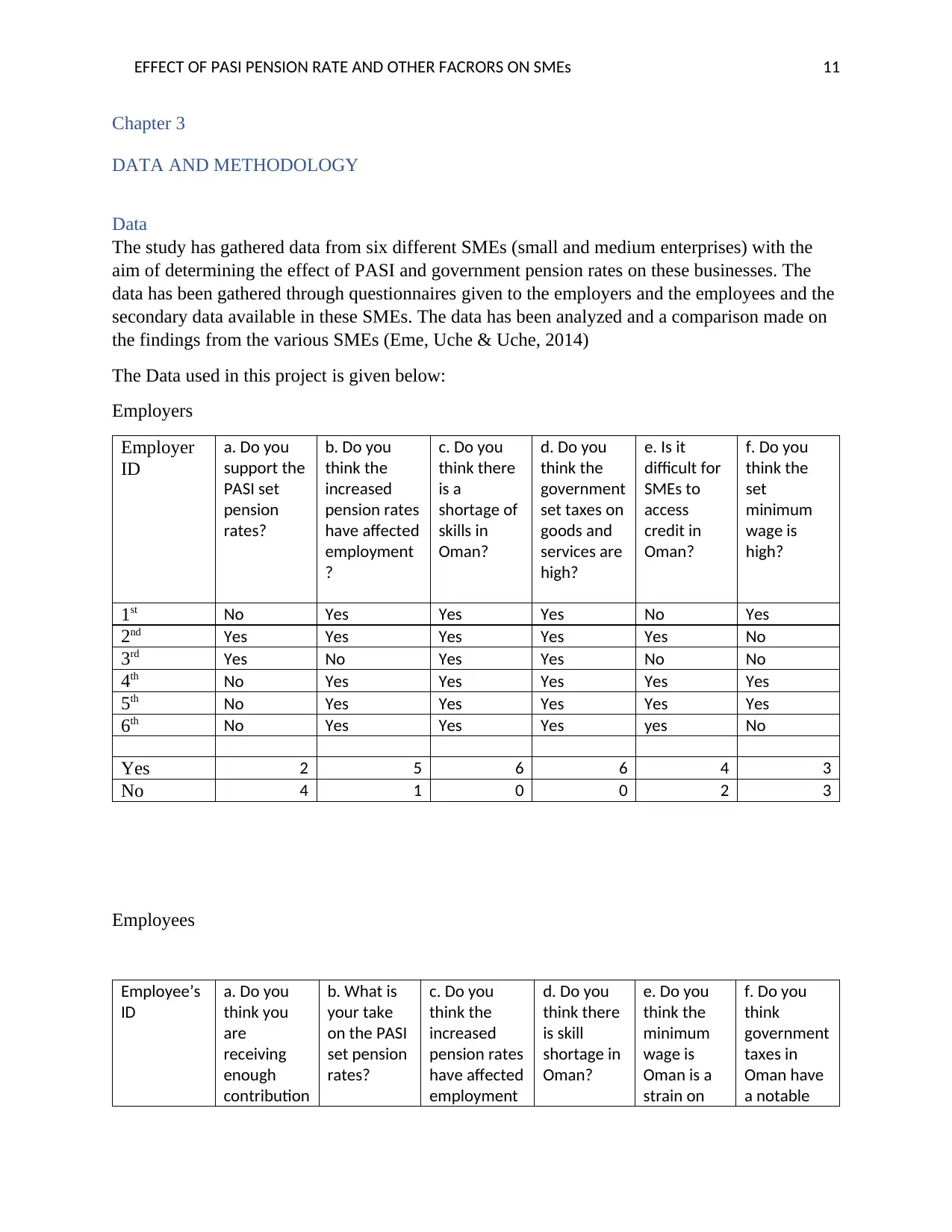

Employees

Employee’s

ID

a. Do you

think you

are

receiving

enough

contribution

b. What is

your take

on the PASI

set pension

rates?

c. Do you

think the

increased

pension rates

have affected

employment

d. Do you

think there

is skill

shortage in

Oman?

e. Do you

think the

minimum

wage is

Oman is a

strain on

f. Do you

think

government

taxes in

Oman have

a notable

Chapter 3

DATA AND METHODOLOGY

Data

The study has gathered data from six different SMEs (small and medium enterprises) with the

aim of determining the effect of PASI and government pension rates on these businesses. The

data has been gathered through questionnaires given to the employers and the employees and the

secondary data available in these SMEs. The data has been analyzed and a comparison made on

the findings from the various SMEs (Eme, Uche & Uche, 2014)

The Data used in this project is given below:

Employers

Employer

ID

a. Do you

support the

PASI set

pension

rates?

b. Do you

think the

increased

pension rates

have affected

employment

?

c. Do you

think there

is a

shortage of

skills in

Oman?

d. Do you

think the

government

set taxes on

goods and

services are

high?

e. Is it

difficult for

SMEs to

access

credit in

Oman?

f. Do you

think the

set

minimum

wage is

high?

1st No Yes Yes Yes No Yes

2nd Yes Yes Yes Yes Yes No

3rd Yes No Yes Yes No No

4th No Yes Yes Yes Yes Yes

5th No Yes Yes Yes Yes Yes

6th No Yes Yes Yes yes No

Yes 2 5 6 6 4 3

No 4 1 0 0 2 3

Employees

Employee’s

ID

a. Do you

think you

are

receiving

enough

contribution

b. What is

your take

on the PASI

set pension

rates?

c. Do you

think the

increased

pension rates

have affected

employment

d. Do you

think there

is skill

shortage in

Oman?

e. Do you

think the

minimum

wage is

Oman is a

strain on

f. Do you

think

government

taxes in

Oman have

a notable

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 12

from your

employer to

your

pension

scheme? ? SMEs?

effect on

the success

of SMEs?

1st Yes Increase Yes No Yes Yes

2nd No Increase No No No Yes

3rd Yes Contented No Yes No Yes

4th Yes Increase No No Yes No

5th Yes Decrease Yes Yes No Yes

6th No Contented No Yes Yes Yes

7th Yes Increase Yes No Yes Yes

8th No Contented No No Yes Yes

9th No Increase No No No Yes

10th Yes Increase No Yes Yes Yes

11th Yes Increase No No Yes Yes

12th Yes Increase Yes Yes No Yes

Yes 8 4 5 7 11

No 4 8 7 5 1

Increase 8

Contented 3

Decrease 1

Methodology

For the success of the study various methods were employed from the data collection step to the

data analysis and result presentation stage. The data used in this project has been collected from

both secondary and primary sources using a structured approach (Albadi, 2009). A semi

structured questionnaire and in depth interviews have been used on the SMEs personnel. Data

has been collected from the six SMEs financial reports with focus on annual pension amount and

pension contribution. Data has been gathered from The Public Authority for Small & Medium

Enterprises Development (Riyada) and PACI funds as well (Ghanzanfar, 2007).

Sampling

There are ten SMEs which have been involved in this project. The process of non-probability sampling

was used to select these SMEs in order to ensure a more practical and accurate representation of the

study objectives.

from your

employer to

your

pension

scheme? ? SMEs?

effect on

the success

of SMEs?

1st Yes Increase Yes No Yes Yes

2nd No Increase No No No Yes

3rd Yes Contented No Yes No Yes

4th Yes Increase No No Yes No

5th Yes Decrease Yes Yes No Yes

6th No Contented No Yes Yes Yes

7th Yes Increase Yes No Yes Yes

8th No Contented No No Yes Yes

9th No Increase No No No Yes

10th Yes Increase No Yes Yes Yes

11th Yes Increase No No Yes Yes

12th Yes Increase Yes Yes No Yes

Yes 8 4 5 7 11

No 4 8 7 5 1

Increase 8

Contented 3

Decrease 1

Methodology

For the success of the study various methods were employed from the data collection step to the

data analysis and result presentation stage. The data used in this project has been collected from

both secondary and primary sources using a structured approach (Albadi, 2009). A semi

structured questionnaire and in depth interviews have been used on the SMEs personnel. Data

has been collected from the six SMEs financial reports with focus on annual pension amount and

pension contribution. Data has been gathered from The Public Authority for Small & Medium

Enterprises Development (Riyada) and PACI funds as well (Ghanzanfar, 2007).

Sampling

There are ten SMEs which have been involved in this project. The process of non-probability sampling

was used to select these SMEs in order to ensure a more practical and accurate representation of the

study objectives.

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 13

Non- probability sampling

Since the research involved SMEs the researchers had to select the types of businesses which fall under

the description of SMEs thus the method of judgement non-probability sampling was employed. In this

method the researchers used their judgement to select the businesses to participate. The project

required that the samples must include both small and medium sized enterprises thus this had to be put

into consideration. The businesses with the project sample characteristics were approached and consent

sought from them to participate in the research.

Advantages of judgement non-probability sampling

The sampling method was cost effective

The sampling method was time effective

The method resulted in a range of responses

Disadvantages of judgement non-probability sampling

There was a likelihood of volunteer bias

There was probability of errors of judgement from researchers

There was a likelihood of the method not being representative

Curbing the sampling method problems

The problems faced during the use of the judgement non-probability sampling method were curbed by

ensuring that the researcher worked during the process of choosing the SMEs to participate in the

research. The researcher has to make decisions based on the characteristic requirements of the SMEs to

participate. The SMEs were chosen from a wide range of areas in Oman to ensure large representation

thus more accurate results.

SMEs Participation Requirements

The researcher has to put various factors into consideration when choosing the enterprises to

participate in the research as follows:

The enterprises had to be small or medium

The enterprises had to have less than 250 employees

The management of the enterprises must be willing to take part in the research

Ethical Considerations

Every study which involves research has to uphold certain set ethics and codes of conduct. This study

considered all the required ethics and put them into action. The SMEs and individuals from these SMEs

who participated in the research process were all consulted and consent sought from them. They were

only involved in the process if they expressed willingness. A consent form with all the research details

was given to all participants to sign before the process commenced. All participants were assured of the

privacy of the information they were giving and that it could be used for educational purposes. They

were further assured that the final report will not contain the names of the enterprises or all the

individuals who participated (Muscat, 2015).

Non- probability sampling

Since the research involved SMEs the researchers had to select the types of businesses which fall under

the description of SMEs thus the method of judgement non-probability sampling was employed. In this

method the researchers used their judgement to select the businesses to participate. The project

required that the samples must include both small and medium sized enterprises thus this had to be put

into consideration. The businesses with the project sample characteristics were approached and consent

sought from them to participate in the research.

Advantages of judgement non-probability sampling

The sampling method was cost effective

The sampling method was time effective

The method resulted in a range of responses

Disadvantages of judgement non-probability sampling

There was a likelihood of volunteer bias

There was probability of errors of judgement from researchers

There was a likelihood of the method not being representative

Curbing the sampling method problems

The problems faced during the use of the judgement non-probability sampling method were curbed by

ensuring that the researcher worked during the process of choosing the SMEs to participate in the

research. The researcher has to make decisions based on the characteristic requirements of the SMEs to

participate. The SMEs were chosen from a wide range of areas in Oman to ensure large representation

thus more accurate results.

SMEs Participation Requirements

The researcher has to put various factors into consideration when choosing the enterprises to

participate in the research as follows:

The enterprises had to be small or medium

The enterprises had to have less than 250 employees

The management of the enterprises must be willing to take part in the research

Ethical Considerations

Every study which involves research has to uphold certain set ethics and codes of conduct. This study

considered all the required ethics and put them into action. The SMEs and individuals from these SMEs

who participated in the research process were all consulted and consent sought from them. They were

only involved in the process if they expressed willingness. A consent form with all the research details

was given to all participants to sign before the process commenced. All participants were assured of the

privacy of the information they were giving and that it could be used for educational purposes. They

were further assured that the final report will not contain the names of the enterprises or all the

individuals who participated (Muscat, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 14

Questionnaire

Questionnaires were presented to both the employers and the employees of the SMEs with the aim of

sourcing information from them on the factors affecting the growth of SMEs in Oman. The questions in

the questionnaires were as follows:

Employer Questionnaire

a. Do you support the PASI set pension rates?

b. Do you think the increased pension rates have affected employment?

c. Do you think there is a shortage of skills in Oman?

d. Do you think the government set taxes on goods and services are high?

e. Is it difficult for SMEs to access credit in Oman?

f. Do you think the set minimum wage is high?

Employee Questionnaire

a. Do you think you are receiving enough contribution from your employer to your pension

scheme?

b. What is your take on the PASI set pension rates?

c. Do you think the increased pension rates have affected employment?

d. Do you think there is skill shortage in Oman?

e. Do you think the minimum wage is Oman is a strain on SMEs?

f. Do you think government taxes in Oman have a notable effect on the success of SMEs?

Gantt chart

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Project

Proposa

l

Obtaini

ng Data

From

Seconda

ry

Questionnaire

Questionnaires were presented to both the employers and the employees of the SMEs with the aim of

sourcing information from them on the factors affecting the growth of SMEs in Oman. The questions in

the questionnaires were as follows:

Employer Questionnaire

a. Do you support the PASI set pension rates?

b. Do you think the increased pension rates have affected employment?

c. Do you think there is a shortage of skills in Oman?

d. Do you think the government set taxes on goods and services are high?

e. Is it difficult for SMEs to access credit in Oman?

f. Do you think the set minimum wage is high?

Employee Questionnaire

a. Do you think you are receiving enough contribution from your employer to your pension

scheme?

b. What is your take on the PASI set pension rates?

c. Do you think the increased pension rates have affected employment?

d. Do you think there is skill shortage in Oman?

e. Do you think the minimum wage is Oman is a strain on SMEs?

f. Do you think government taxes in Oman have a notable effect on the success of SMEs?

Gantt chart

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Da

te

Project

Proposa

l

Obtaini

ng Data

From

Seconda

ry

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 15

Sources

Data

Analysis

to

Discover

Trends

Forecast

ing

Prepari

ng

Power

Point

Slides

Presenta

tion

Chapter 4

MAIN RESULTS

Employers

a. Do you support the PASI set pension rates?

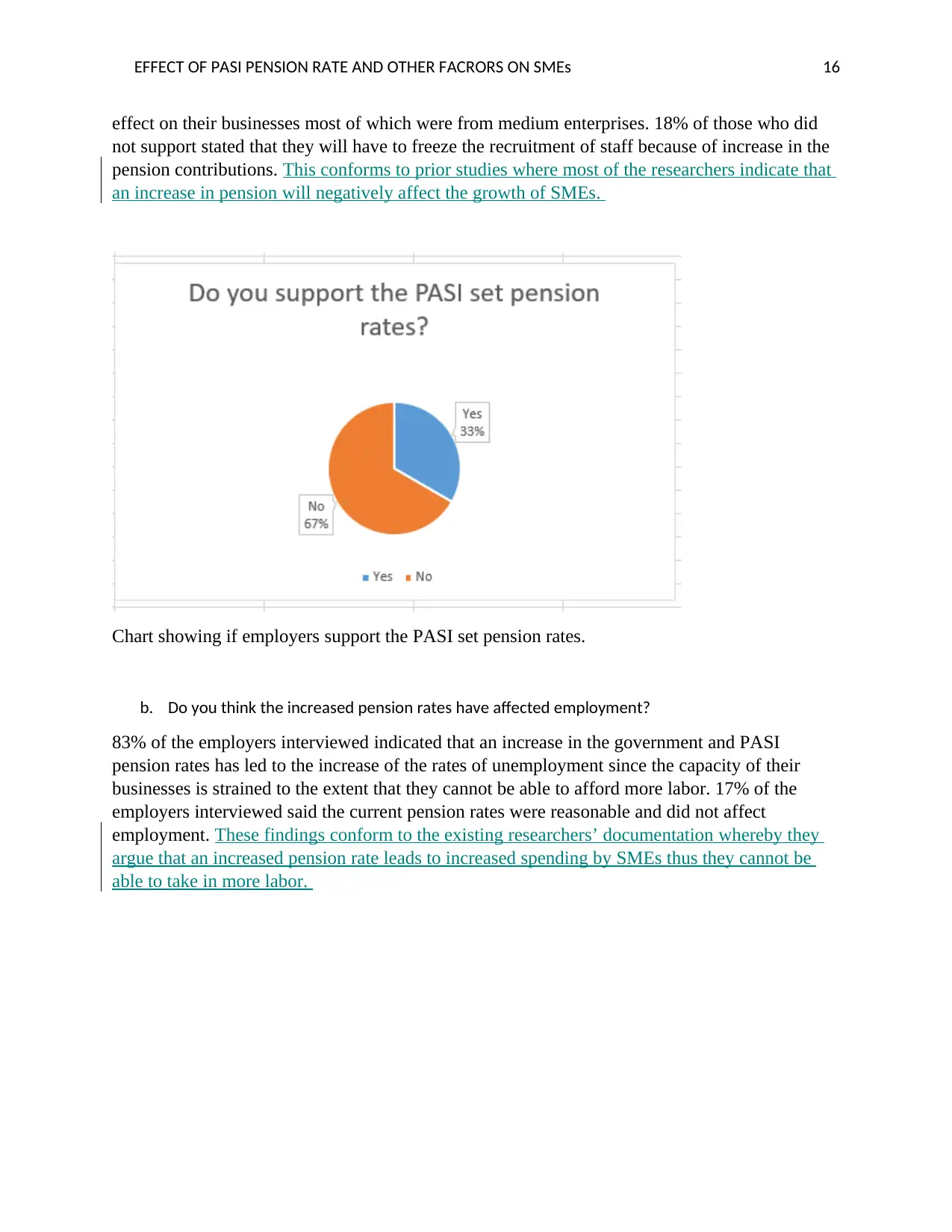

67% of the employees interviewed do not support the PASI pension rate and believe that an

increase in the government and PASI pension contributions would put a strain on their

enterprises with majority being from small enterprises. 33% indicated that it would have no

Sources

Data

Analysis

to

Discover

Trends

Forecast

ing

Prepari

ng

Power

Point

Slides

Presenta

tion

Chapter 4

MAIN RESULTS

Employers

a. Do you support the PASI set pension rates?

67% of the employees interviewed do not support the PASI pension rate and believe that an

increase in the government and PASI pension contributions would put a strain on their

enterprises with majority being from small enterprises. 33% indicated that it would have no

EFFECT OF PASI PENSION RATE AND OTHER FACRORS ON SMEs 16

effect on their businesses most of which were from medium enterprises. 18% of those who did

not support stated that they will have to freeze the recruitment of staff because of increase in the

pension contributions. This conforms to prior studies where most of the researchers indicate that

an increase in pension will negatively affect the growth of SMEs.

Chart showing if employers support the PASI set pension rates.

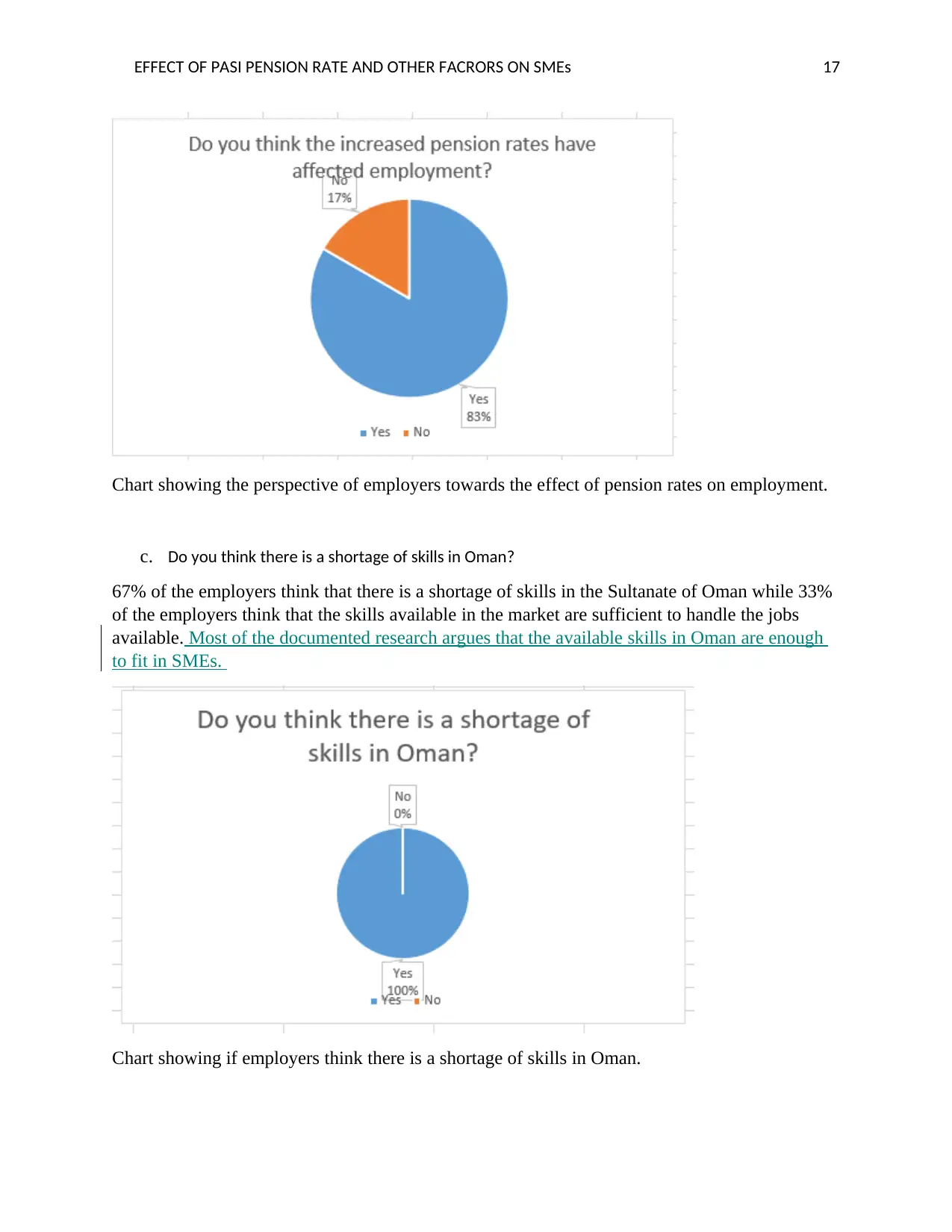

b. Do you think the increased pension rates have affected employment?

83% of the employers interviewed indicated that an increase in the government and PASI

pension rates has led to the increase of the rates of unemployment since the capacity of their

businesses is strained to the extent that they cannot be able to afford more labor. 17% of the

employers interviewed said the current pension rates were reasonable and did not affect

employment. These findings conform to the existing researchers’ documentation whereby they

argue that an increased pension rate leads to increased spending by SMEs thus they cannot be

able to take in more labor.

effect on their businesses most of which were from medium enterprises. 18% of those who did

not support stated that they will have to freeze the recruitment of staff because of increase in the

pension contributions. This conforms to prior studies where most of the researchers indicate that

an increase in pension will negatively affect the growth of SMEs.

Chart showing if employers support the PASI set pension rates.

b. Do you think the increased pension rates have affected employment?

83% of the employers interviewed indicated that an increase in the government and PASI

pension rates has led to the increase of the rates of unemployment since the capacity of their

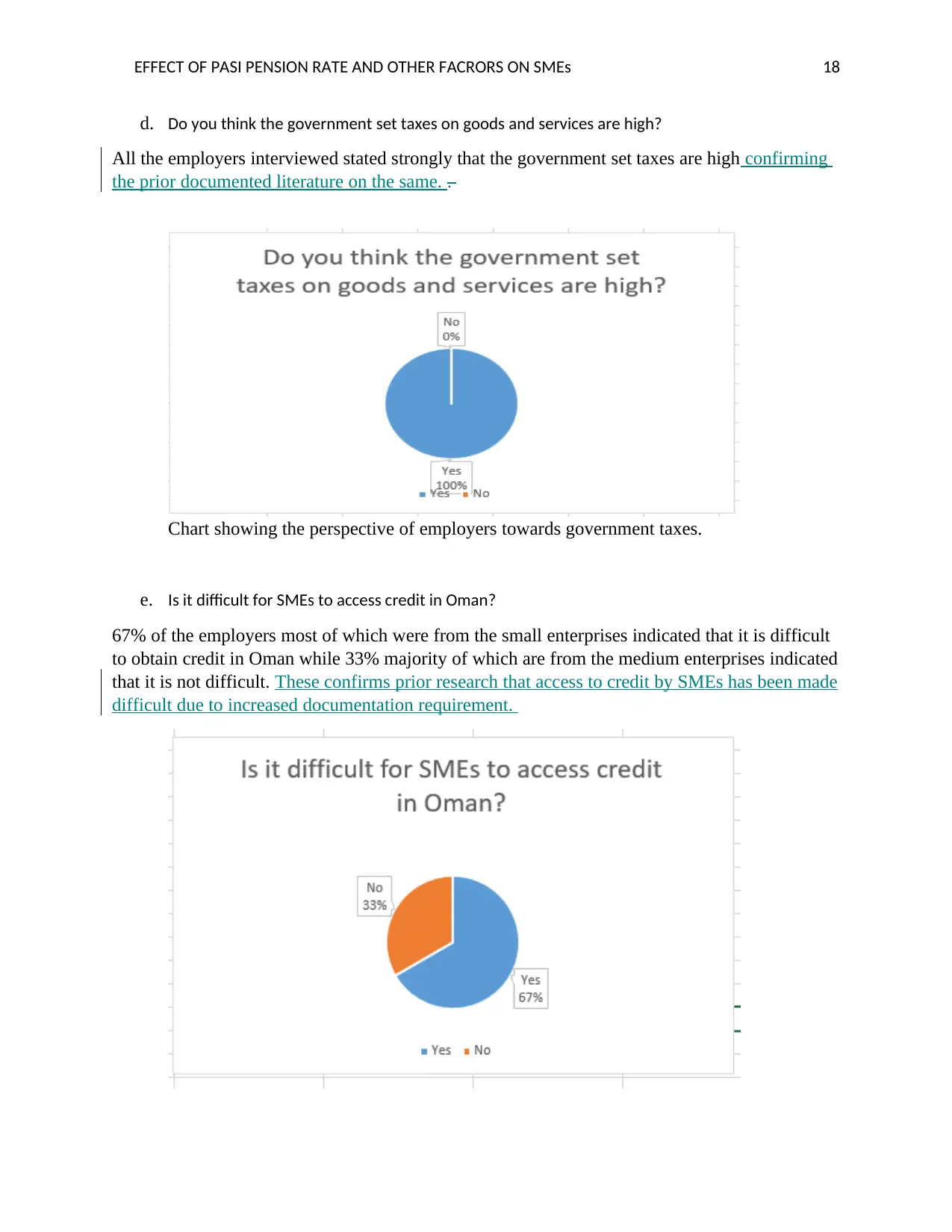

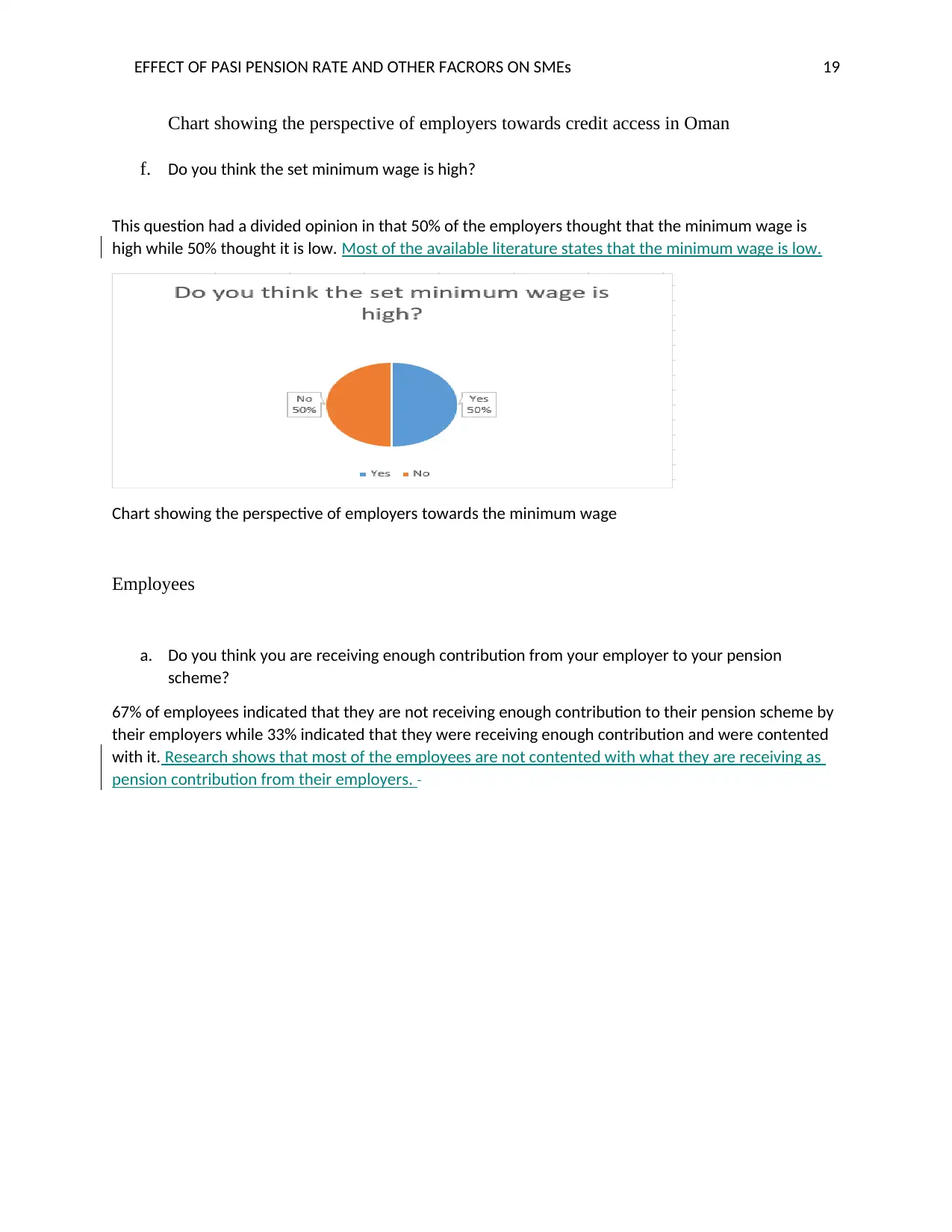

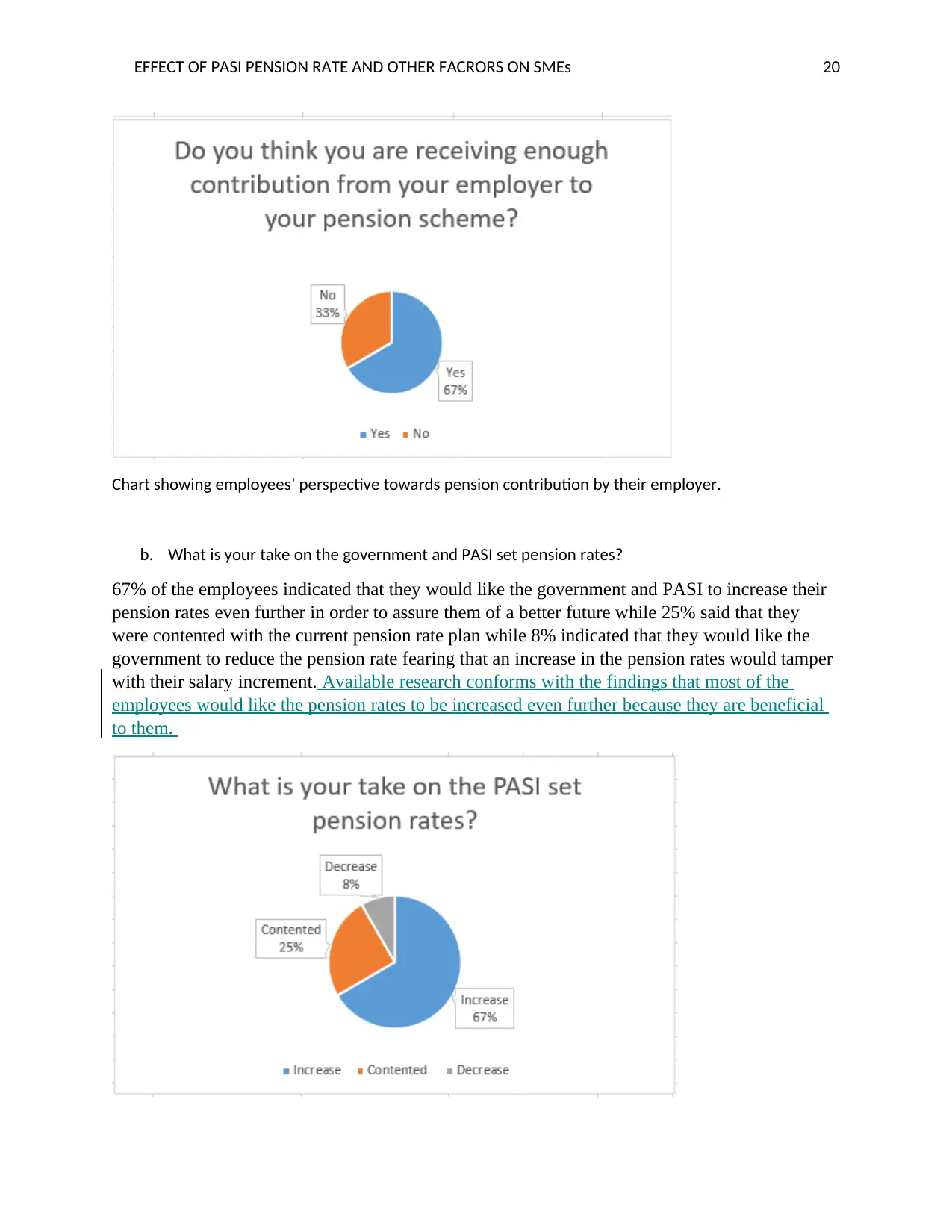

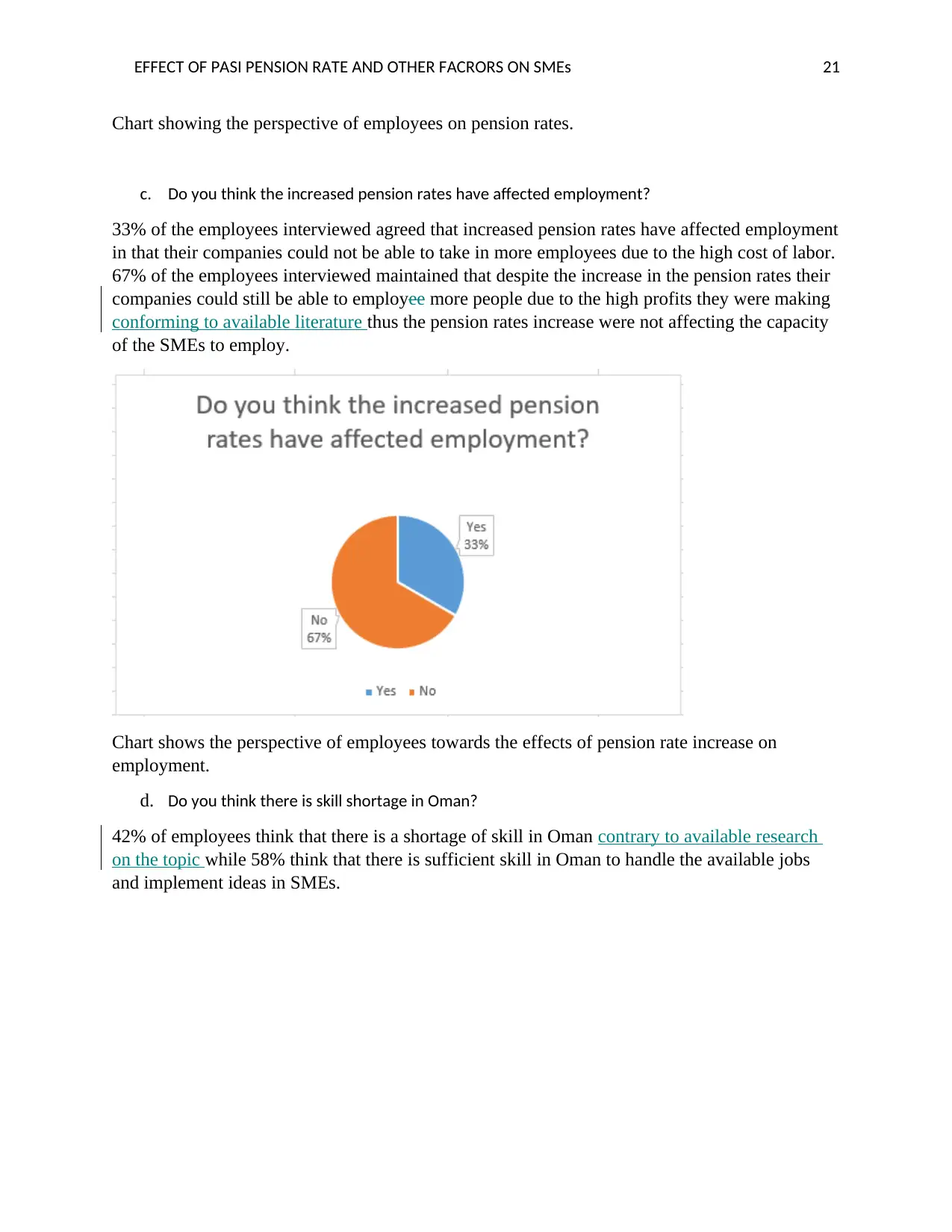

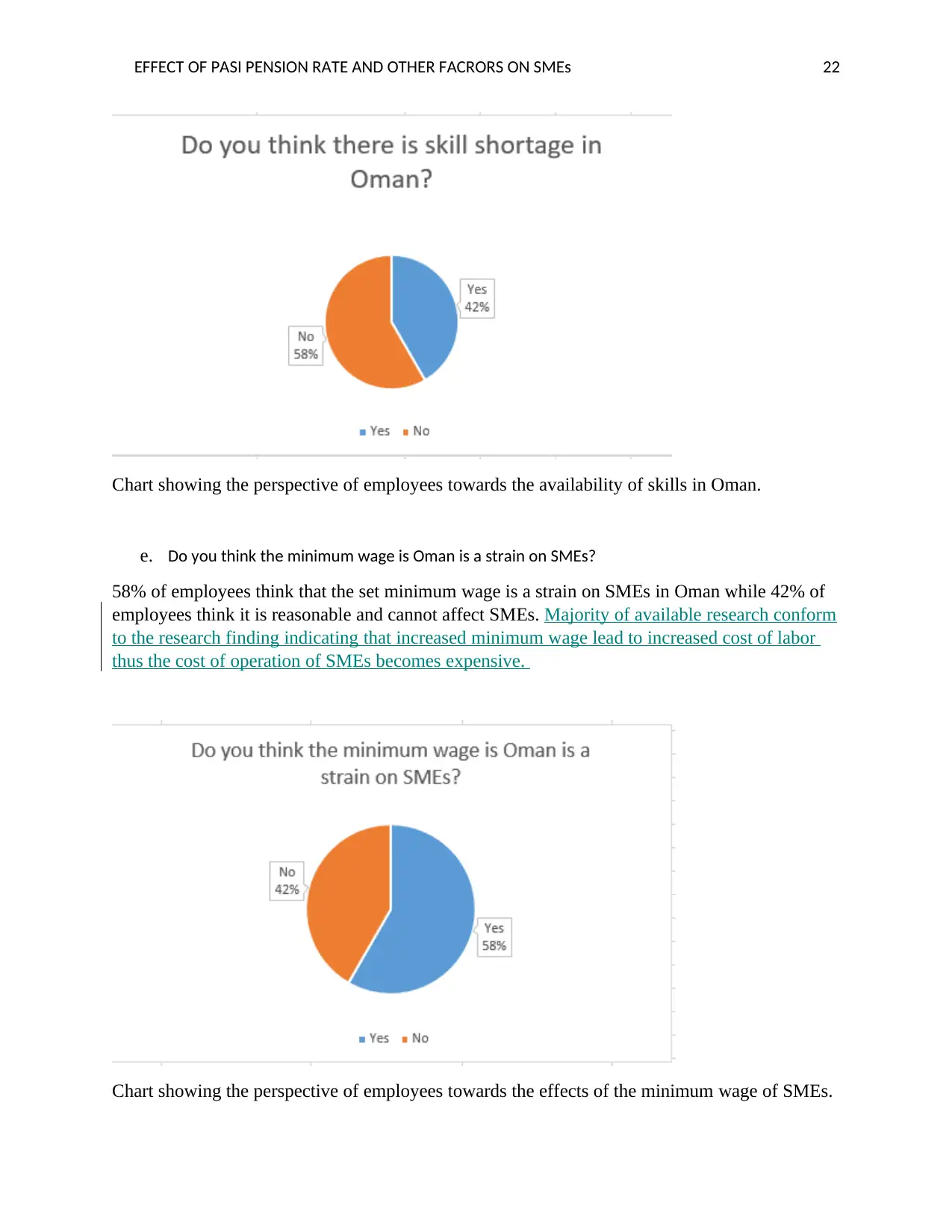

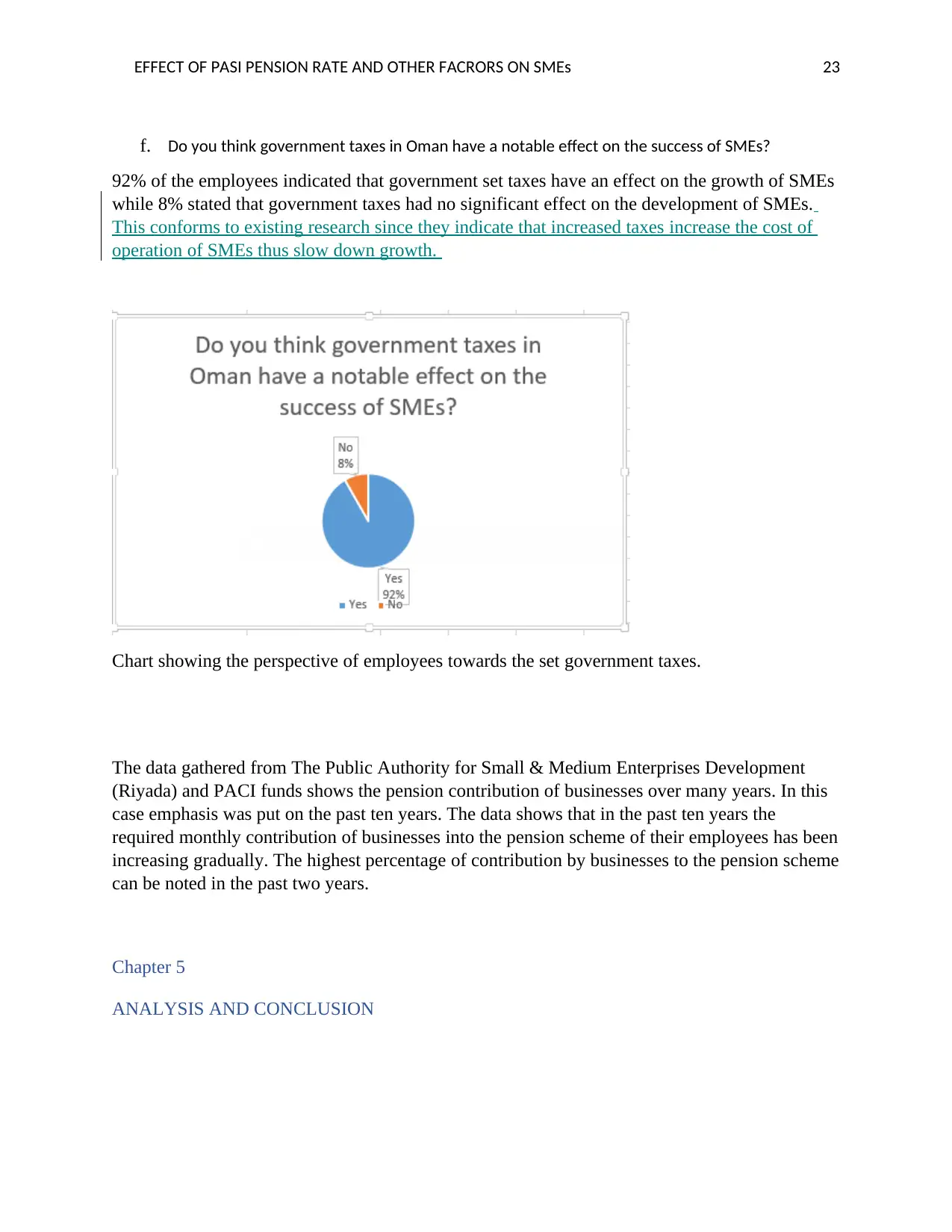

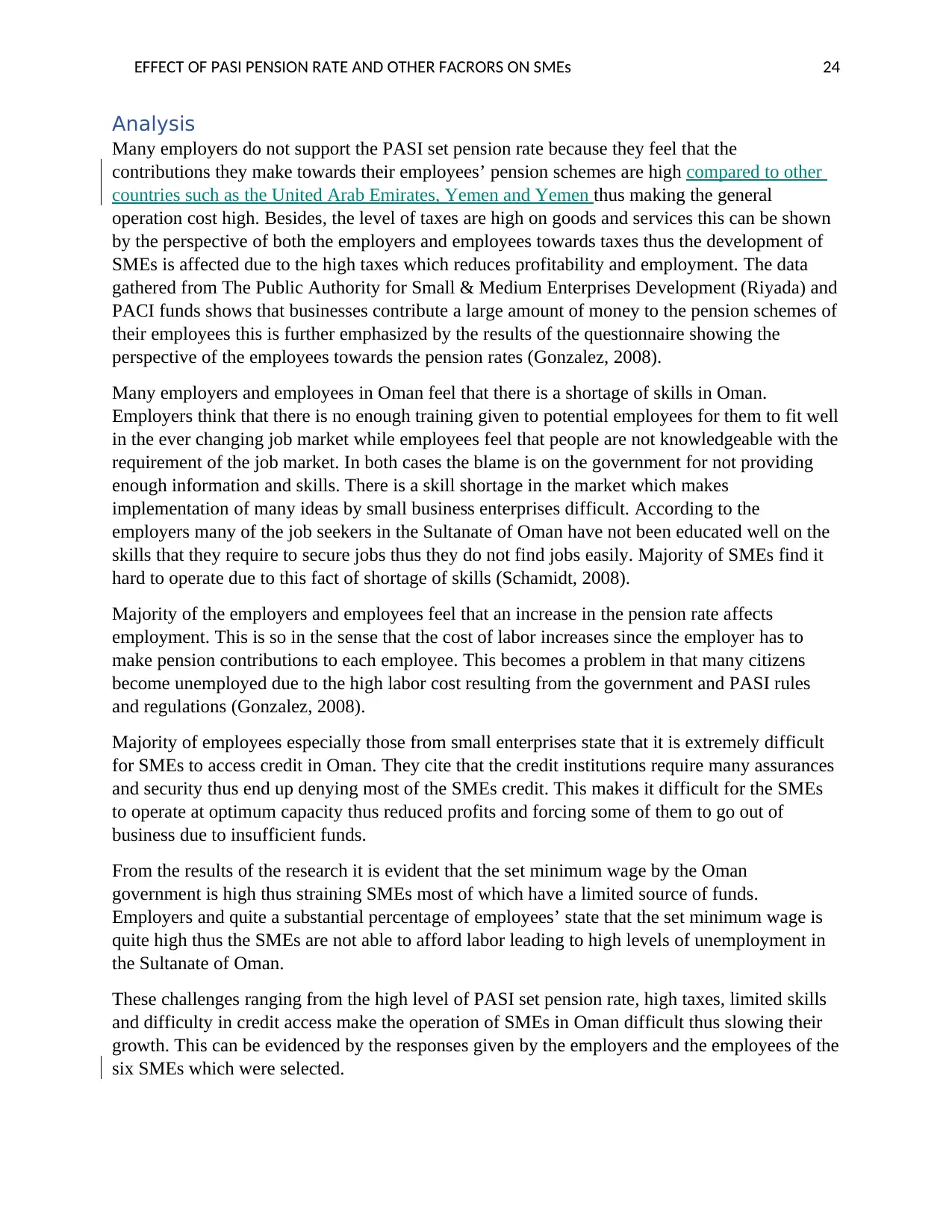

businesses is strained to the extent that they cannot be able to afford more labor. 17% of the