Financial Analysis Assignment: KPI, Budgeting, and Investment Analysis

VerifiedAdded on 2020/05/04

|8

|1197

|58

Homework Assignment

AI Summary

This finance assignment solution provides comprehensive answers to various financial analysis problems. Solution 1 focuses on Key Performance Indicators (KPIs), categorizing them as strategic drivers, operating drivers, and outcomes. Solution 2 presents sales and production budgets for two products, including detailed calculations for sales revenue, production units, purchases, labor costs, and contribution per unit. Solution 3 explores break-even analysis, profit calculations, and the impact of new equipment, considering lease rentals and variable cost changes. Finally, Solution 4 evaluates an investment project using different capital budgeting techniques, including accounting rate of return (ARR), payback period, internal rate of return (IRR), and net present value (NPV), with a comparative analysis of two forecast scenarios and a final recommendation based on the results.

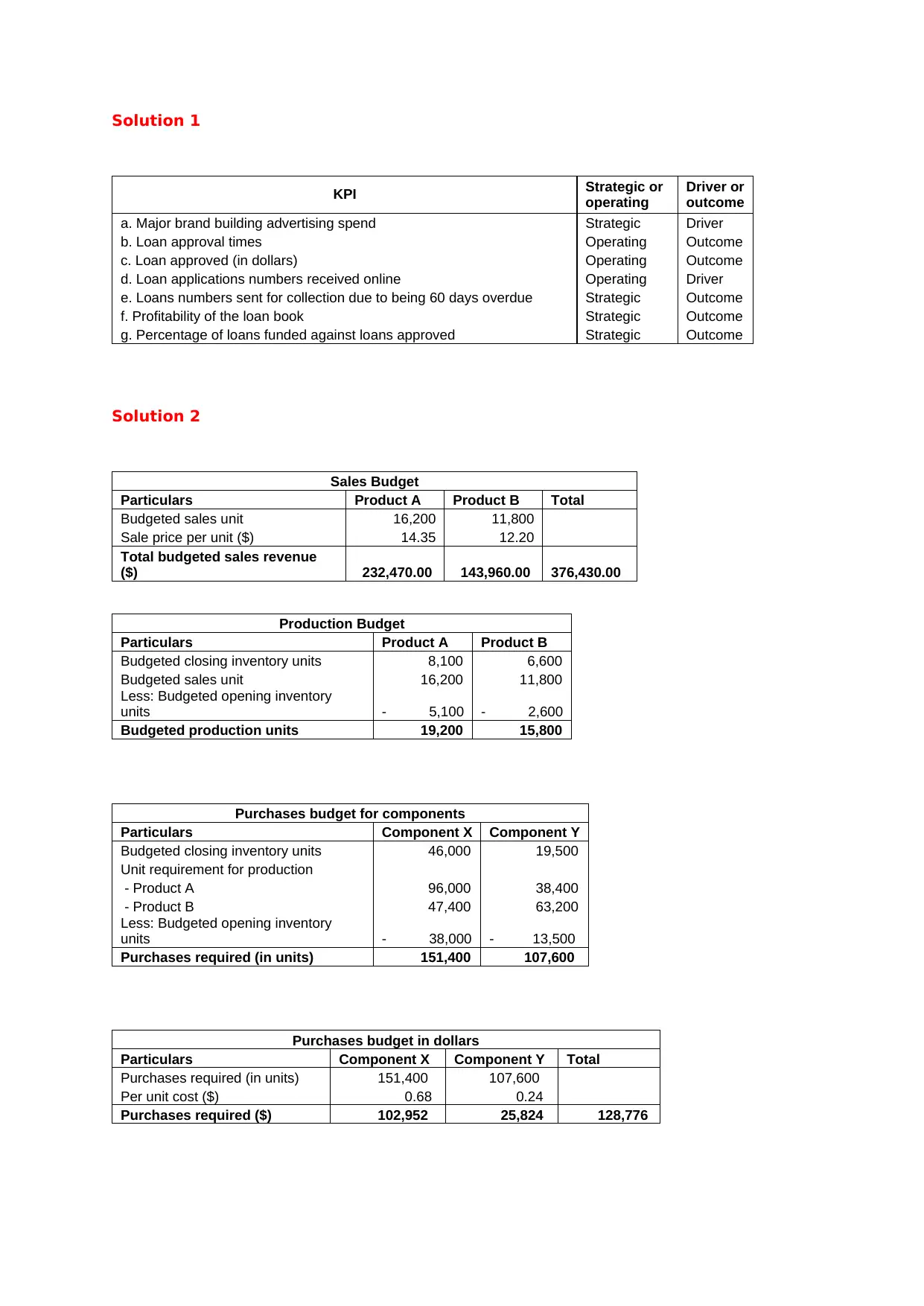

Solution 1

KPI Strategic or

operating

Driver or

outcome

a. Major brand building advertising spend Strategic Driver

b. Loan approval times Operating Outcome

c. Loan approved (in dollars) Operating Outcome

d. Loan applications numbers received online Operating Driver

e. Loans numbers sent for collection due to being 60 days overdue Strategic Outcome

f. Profitability of the loan book Strategic Outcome

g. Percentage of loans funded against loans approved Strategic Outcome

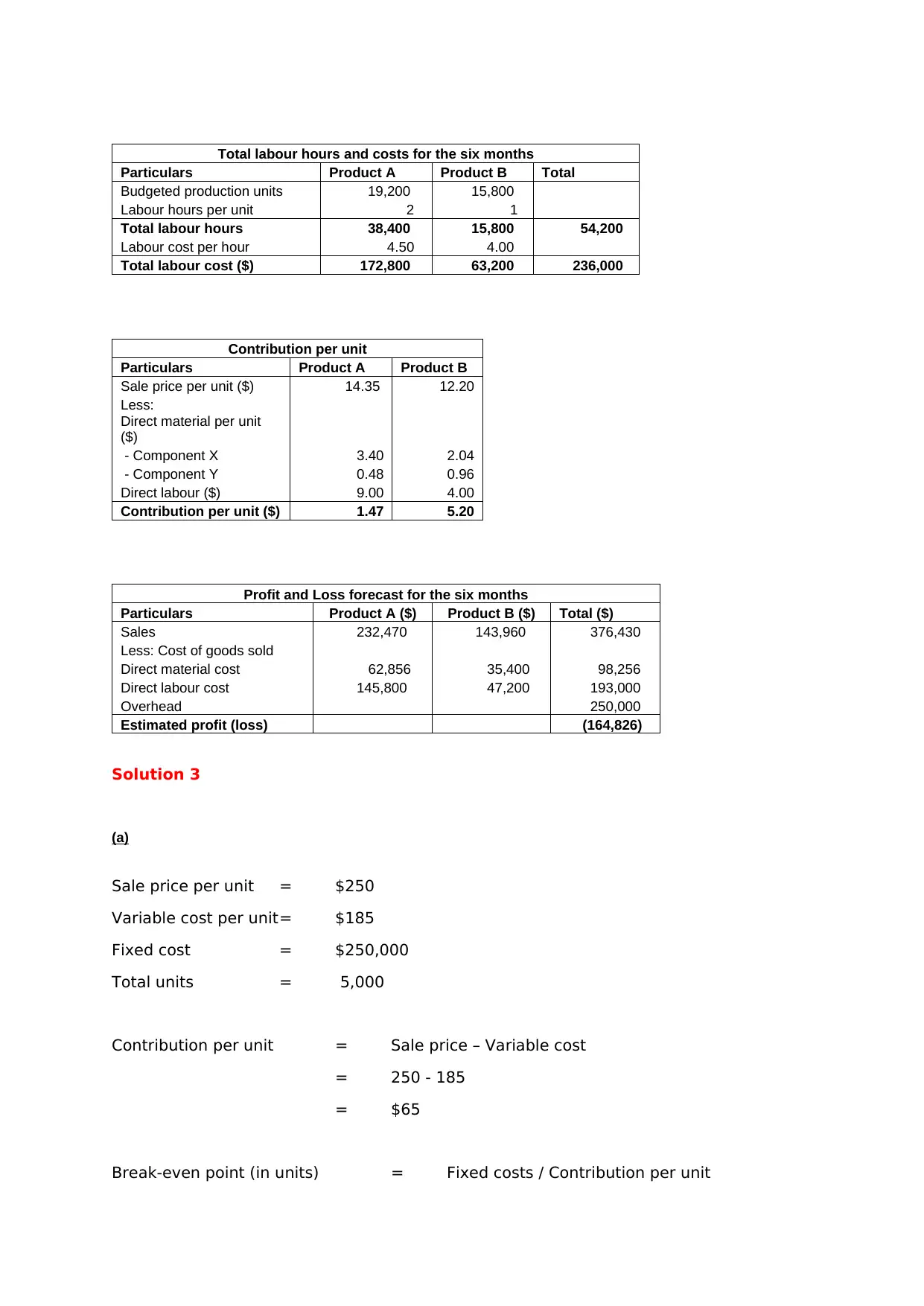

Solution 2

Sales Budget

Particulars Product A Product B Total

Budgeted sales unit 16,200 11,800

Sale price per unit ($) 14.35 12.20

Total budgeted sales revenue

($) 232,470.00 143,960.00 376,430.00

Production Budget

Particulars Product A Product B

Budgeted closing inventory units 8,100 6,600

Budgeted sales unit 16,200 11,800

Less: Budgeted opening inventory

units - 5,100 - 2,600

Budgeted production units 19,200 15,800

Purchases budget for components

Particulars Component X Component Y

Budgeted closing inventory units 46,000 19,500

Unit requirement for production

- Product A 96,000 38,400

- Product B 47,400 63,200

Less: Budgeted opening inventory

units - 38,000 - 13,500

Purchases required (in units) 151,400 107,600

Purchases budget in dollars

Particulars Component X Component Y Total

Purchases required (in units) 151,400 107,600

Per unit cost ($) 0.68 0.24

Purchases required ($) 102,952 25,824 128,776

KPI Strategic or

operating

Driver or

outcome

a. Major brand building advertising spend Strategic Driver

b. Loan approval times Operating Outcome

c. Loan approved (in dollars) Operating Outcome

d. Loan applications numbers received online Operating Driver

e. Loans numbers sent for collection due to being 60 days overdue Strategic Outcome

f. Profitability of the loan book Strategic Outcome

g. Percentage of loans funded against loans approved Strategic Outcome

Solution 2

Sales Budget

Particulars Product A Product B Total

Budgeted sales unit 16,200 11,800

Sale price per unit ($) 14.35 12.20

Total budgeted sales revenue

($) 232,470.00 143,960.00 376,430.00

Production Budget

Particulars Product A Product B

Budgeted closing inventory units 8,100 6,600

Budgeted sales unit 16,200 11,800

Less: Budgeted opening inventory

units - 5,100 - 2,600

Budgeted production units 19,200 15,800

Purchases budget for components

Particulars Component X Component Y

Budgeted closing inventory units 46,000 19,500

Unit requirement for production

- Product A 96,000 38,400

- Product B 47,400 63,200

Less: Budgeted opening inventory

units - 38,000 - 13,500

Purchases required (in units) 151,400 107,600

Purchases budget in dollars

Particulars Component X Component Y Total

Purchases required (in units) 151,400 107,600

Per unit cost ($) 0.68 0.24

Purchases required ($) 102,952 25,824 128,776

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total labour hours and costs for the six months

Particulars Product A Product B Total

Budgeted production units 19,200 15,800

Labour hours per unit 2 1

Total labour hours 38,400 15,800 54,200

Labour cost per hour 4.50 4.00

Total labour cost ($) 172,800 63,200 236,000

Contribution per unit

Particulars Product A Product B

Sale price per unit ($) 14.35 12.20

Less:

Direct material per unit

($)

- Component X 3.40 2.04

- Component Y 0.48 0.96

Direct labour ($) 9.00 4.00

Contribution per unit ($) 1.47 5.20

Profit and Loss forecast for the six months

Particulars Product A ($) Product B ($) Total ($)

Sales 232,470 143,960 376,430

Less: Cost of goods sold

Direct material cost 62,856 35,400 98,256

Direct labour cost 145,800 47,200 193,000

Overhead 250,000

Estimated profit (loss) (164,826)

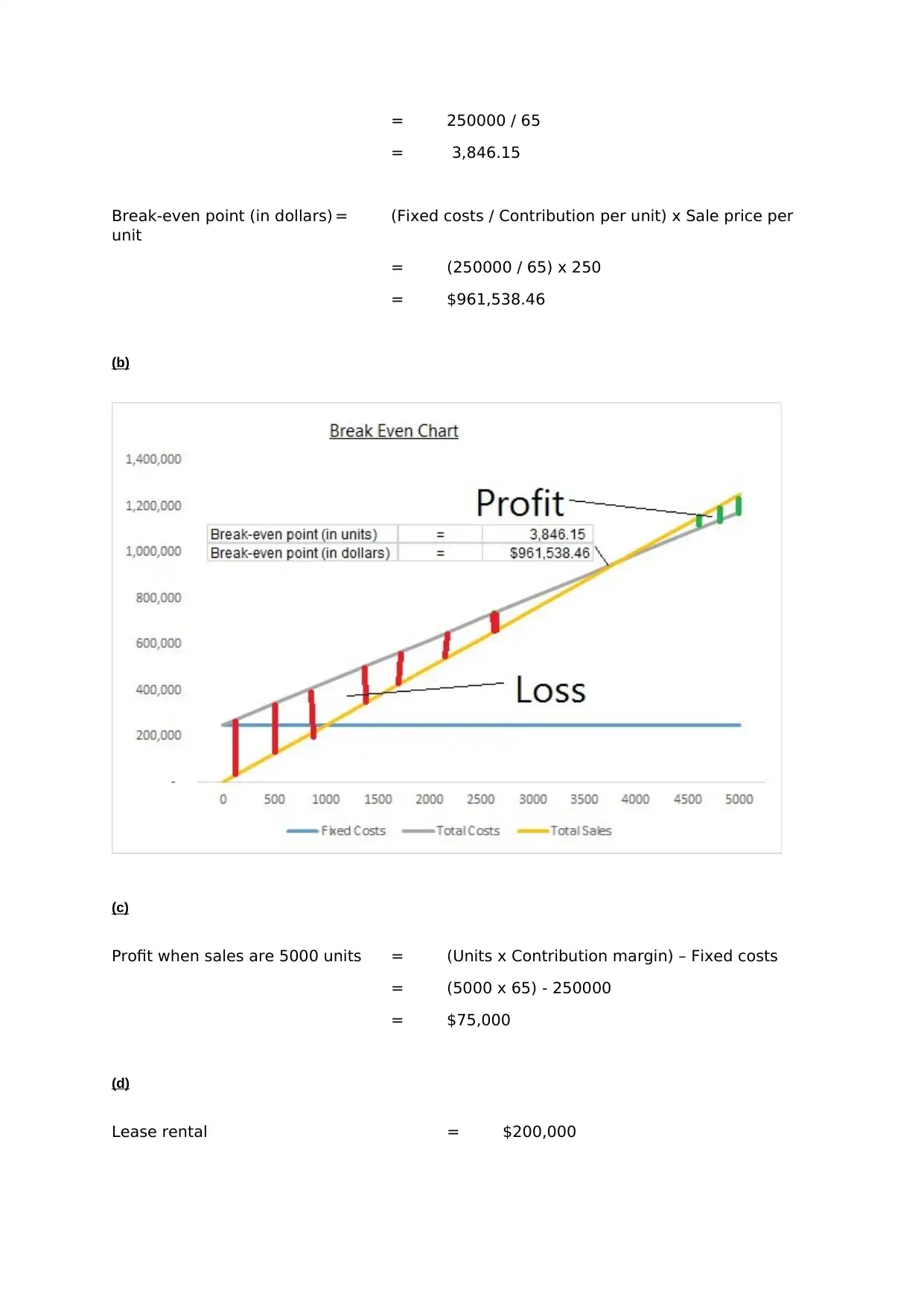

Solution 3

(a)

Sale price per unit = $250

Variable cost per unit= $185

Fixed cost = $250,000

Total units = 5,000

Contribution per unit = Sale price – Variable cost

= 250 - 185

= $65

Break-even point (in units) = Fixed costs / Contribution per unit

Particulars Product A Product B Total

Budgeted production units 19,200 15,800

Labour hours per unit 2 1

Total labour hours 38,400 15,800 54,200

Labour cost per hour 4.50 4.00

Total labour cost ($) 172,800 63,200 236,000

Contribution per unit

Particulars Product A Product B

Sale price per unit ($) 14.35 12.20

Less:

Direct material per unit

($)

- Component X 3.40 2.04

- Component Y 0.48 0.96

Direct labour ($) 9.00 4.00

Contribution per unit ($) 1.47 5.20

Profit and Loss forecast for the six months

Particulars Product A ($) Product B ($) Total ($)

Sales 232,470 143,960 376,430

Less: Cost of goods sold

Direct material cost 62,856 35,400 98,256

Direct labour cost 145,800 47,200 193,000

Overhead 250,000

Estimated profit (loss) (164,826)

Solution 3

(a)

Sale price per unit = $250

Variable cost per unit= $185

Fixed cost = $250,000

Total units = 5,000

Contribution per unit = Sale price – Variable cost

= 250 - 185

= $65

Break-even point (in units) = Fixed costs / Contribution per unit

= 250000 / 65

= 3,846.15

Break-even point (in dollars) = (Fixed costs / Contribution per unit) x Sale price per

unit

= (250000 / 65) x 250

= $961,538.46

(b)

(c)

Profit when sales are 5000 units = (Units x Contribution margin) – Fixed costs

= (5000 x 65) - 250000

= $75,000

(d)

Lease rental = $200,000

= 3,846.15

Break-even point (in dollars) = (Fixed costs / Contribution per unit) x Sale price per

unit

= (250000 / 65) x 250

= $961,538.46

(b)

(c)

Profit when sales are 5000 units = (Units x Contribution margin) – Fixed costs

= (5000 x 65) - 250000

= $75,000

(d)

Lease rental = $200,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Increase on profit on existing 5000 units = Units (Old variable cost – new variable cost)

= 5000 (185 - 175)

= $50,000

Profit due to additional 3100 units = Additional units (Sale price – new variable cost)

= 3100 (250 - 175)

= $232,500

Net increase in profit = Profit due to additional 3100 units + Increase on profit on

existing 5000 units – Lease rental

= 232500 + 50000 - 200000

= $82,500

BFC limited should lease the new equipment as there is profit after recovery of lease

rental.

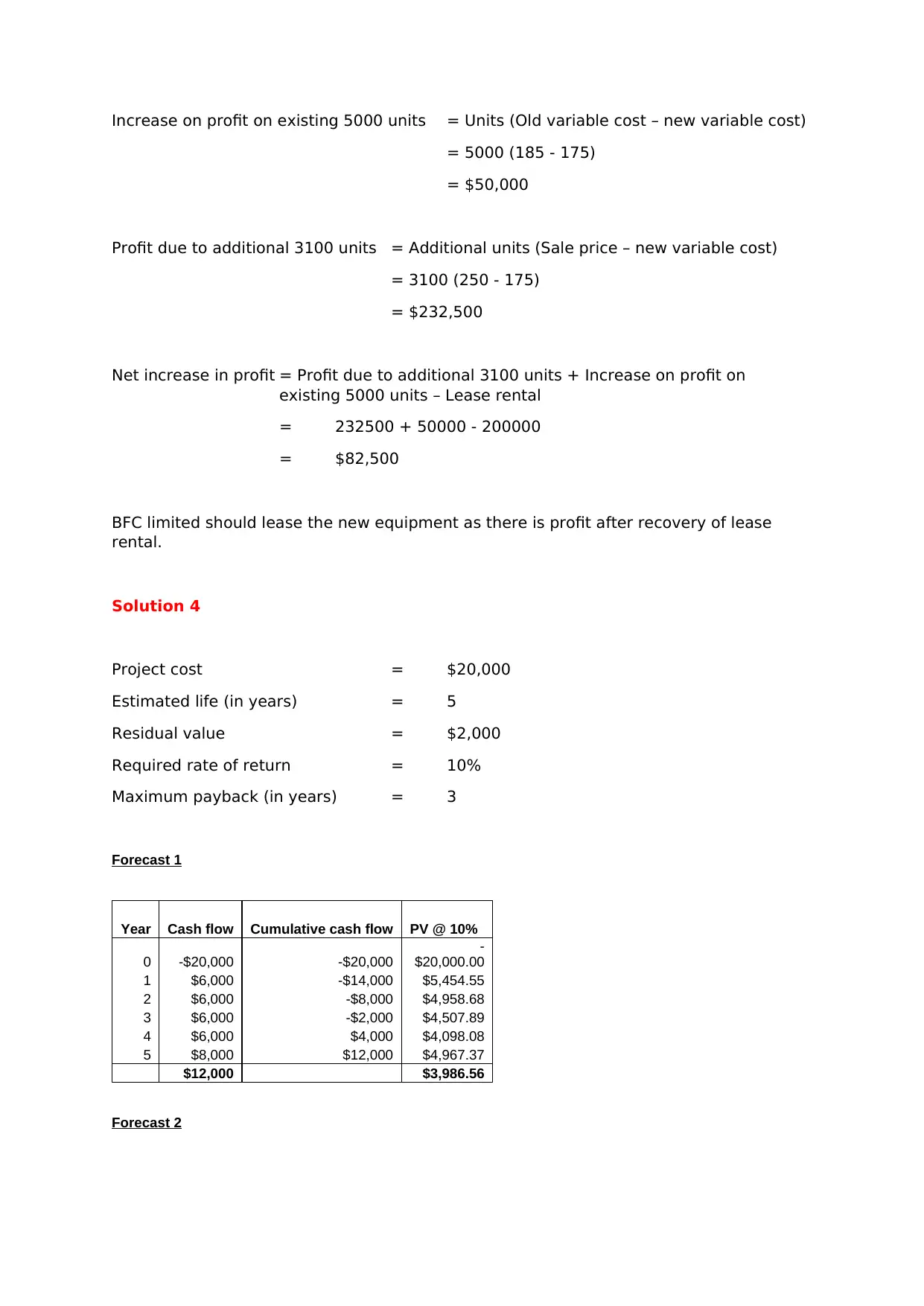

Solution 4

Project cost = $20,000

Estimated life (in years) = 5

Residual value = $2,000

Required rate of return = 10%

Maximum payback (in years) = 3

Forecast 1

Year Cash flow Cumulative cash flow PV @ 10%

0 -$20,000 -$20,000

-

$20,000.00

1 $6,000 -$14,000 $5,454.55

2 $6,000 -$8,000 $4,958.68

3 $6,000 -$2,000 $4,507.89

4 $6,000 $4,000 $4,098.08

5 $8,000 $12,000 $4,967.37

$12,000 $3,986.56

Forecast 2

= 5000 (185 - 175)

= $50,000

Profit due to additional 3100 units = Additional units (Sale price – new variable cost)

= 3100 (250 - 175)

= $232,500

Net increase in profit = Profit due to additional 3100 units + Increase on profit on

existing 5000 units – Lease rental

= 232500 + 50000 - 200000

= $82,500

BFC limited should lease the new equipment as there is profit after recovery of lease

rental.

Solution 4

Project cost = $20,000

Estimated life (in years) = 5

Residual value = $2,000

Required rate of return = 10%

Maximum payback (in years) = 3

Forecast 1

Year Cash flow Cumulative cash flow PV @ 10%

0 -$20,000 -$20,000

-

$20,000.00

1 $6,000 -$14,000 $5,454.55

2 $6,000 -$8,000 $4,958.68

3 $6,000 -$2,000 $4,507.89

4 $6,000 $4,000 $4,098.08

5 $8,000 $12,000 $4,967.37

$12,000 $3,986.56

Forecast 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

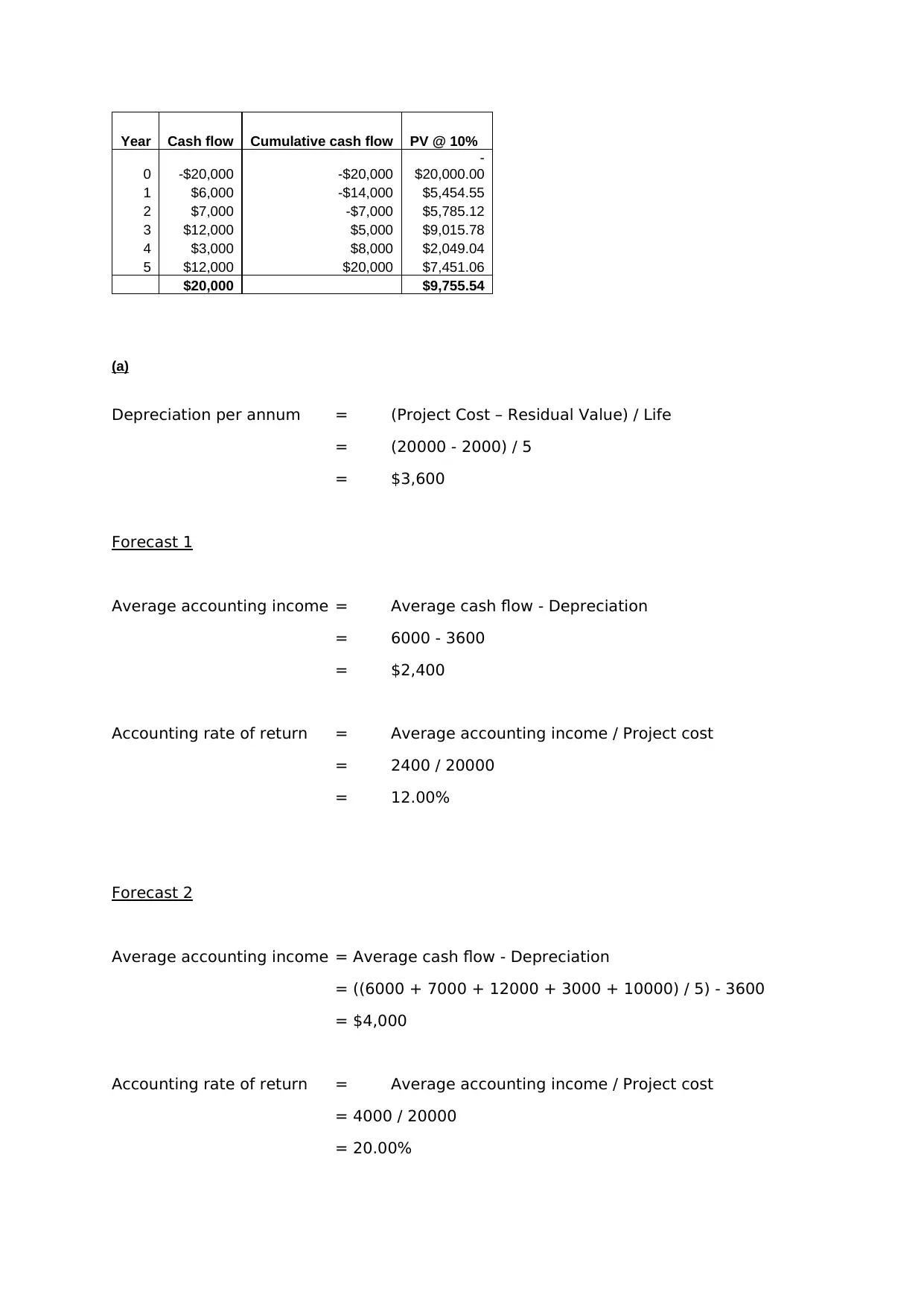

Year Cash flow Cumulative cash flow PV @ 10%

0 -$20,000 -$20,000

-

$20,000.00

1 $6,000 -$14,000 $5,454.55

2 $7,000 -$7,000 $5,785.12

3 $12,000 $5,000 $9,015.78

4 $3,000 $8,000 $2,049.04

5 $12,000 $20,000 $7,451.06

$20,000 $9,755.54

(a)

Depreciation per annum = (Project Cost – Residual Value) / Life

= (20000 - 2000) / 5

= $3,600

Forecast 1

Average accounting income = Average cash flow - Depreciation

= 6000 - 3600

= $2,400

Accounting rate of return = Average accounting income / Project cost

= 2400 / 20000

= 12.00%

Forecast 2

Average accounting income = Average cash flow - Depreciation

= ((6000 + 7000 + 12000 + 3000 + 10000) / 5) - 3600

= $4,000

Accounting rate of return = Average accounting income / Project cost

= 4000 / 20000

= 20.00%

0 -$20,000 -$20,000

-

$20,000.00

1 $6,000 -$14,000 $5,454.55

2 $7,000 -$7,000 $5,785.12

3 $12,000 $5,000 $9,015.78

4 $3,000 $8,000 $2,049.04

5 $12,000 $20,000 $7,451.06

$20,000 $9,755.54

(a)

Depreciation per annum = (Project Cost – Residual Value) / Life

= (20000 - 2000) / 5

= $3,600

Forecast 1

Average accounting income = Average cash flow - Depreciation

= 6000 - 3600

= $2,400

Accounting rate of return = Average accounting income / Project cost

= 2400 / 20000

= 12.00%

Forecast 2

Average accounting income = Average cash flow - Depreciation

= ((6000 + 7000 + 12000 + 3000 + 10000) / 5) - 3600

= $4,000

Accounting rate of return = Average accounting income / Project cost

= 4000 / 20000

= 20.00%

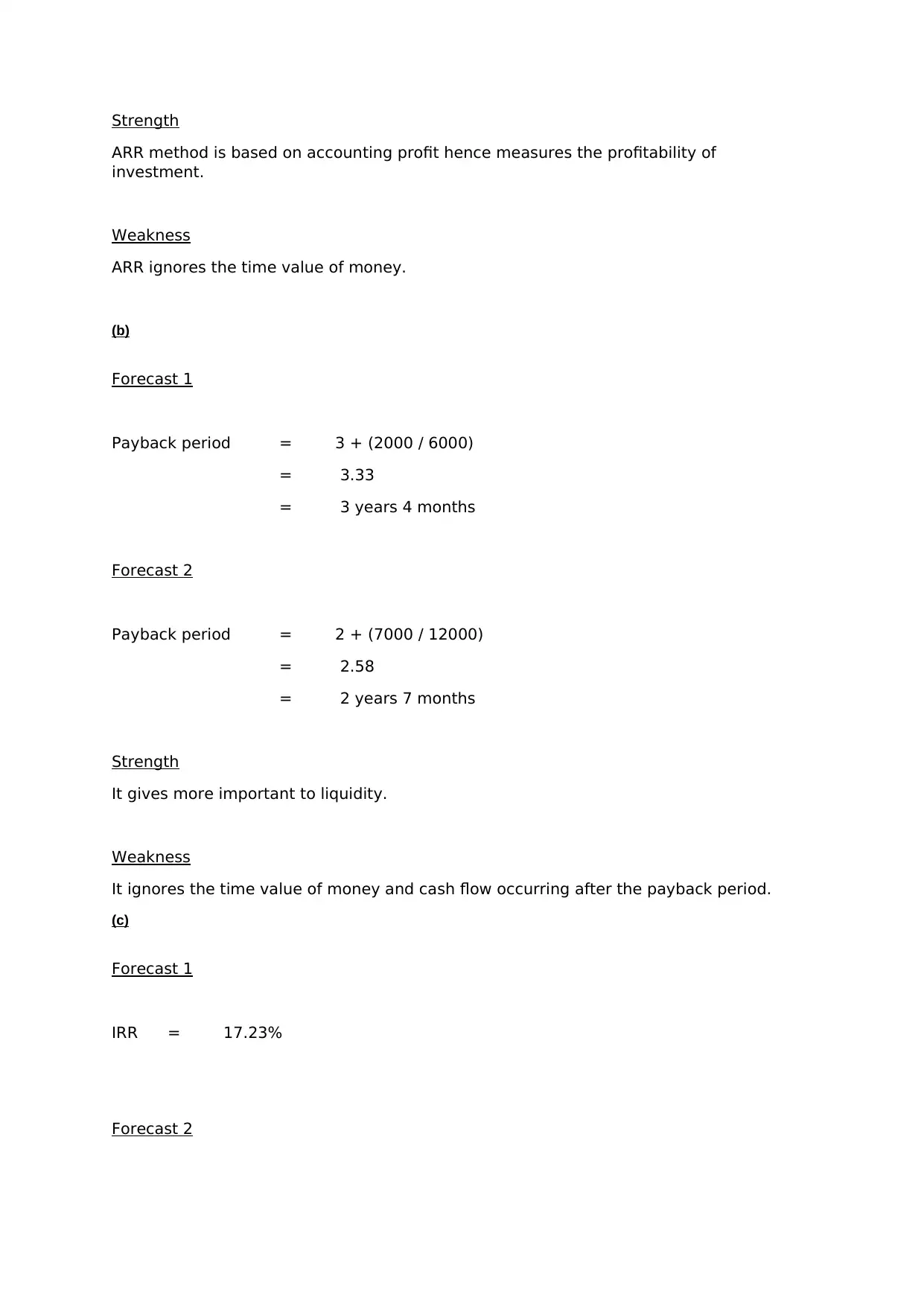

Strength

ARR method is based on accounting profit hence measures the profitability of

investment.

Weakness

ARR ignores the time value of money.

(b)

Forecast 1

Payback period = 3 + (2000 / 6000)

= 3.33

= 3 years 4 months

Forecast 2

Payback period = 2 + (7000 / 12000)

= 2.58

= 2 years 7 months

Strength

It gives more important to liquidity.

Weakness

It ignores the time value of money and cash flow occurring after the payback period.

(c)

Forecast 1

IRR = 17.23%

Forecast 2

ARR method is based on accounting profit hence measures the profitability of

investment.

Weakness

ARR ignores the time value of money.

(b)

Forecast 1

Payback period = 3 + (2000 / 6000)

= 3.33

= 3 years 4 months

Forecast 2

Payback period = 2 + (7000 / 12000)

= 2.58

= 2 years 7 months

Strength

It gives more important to liquidity.

Weakness

It ignores the time value of money and cash flow occurring after the payback period.

(c)

Forecast 1

IRR = 17.23%

Forecast 2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

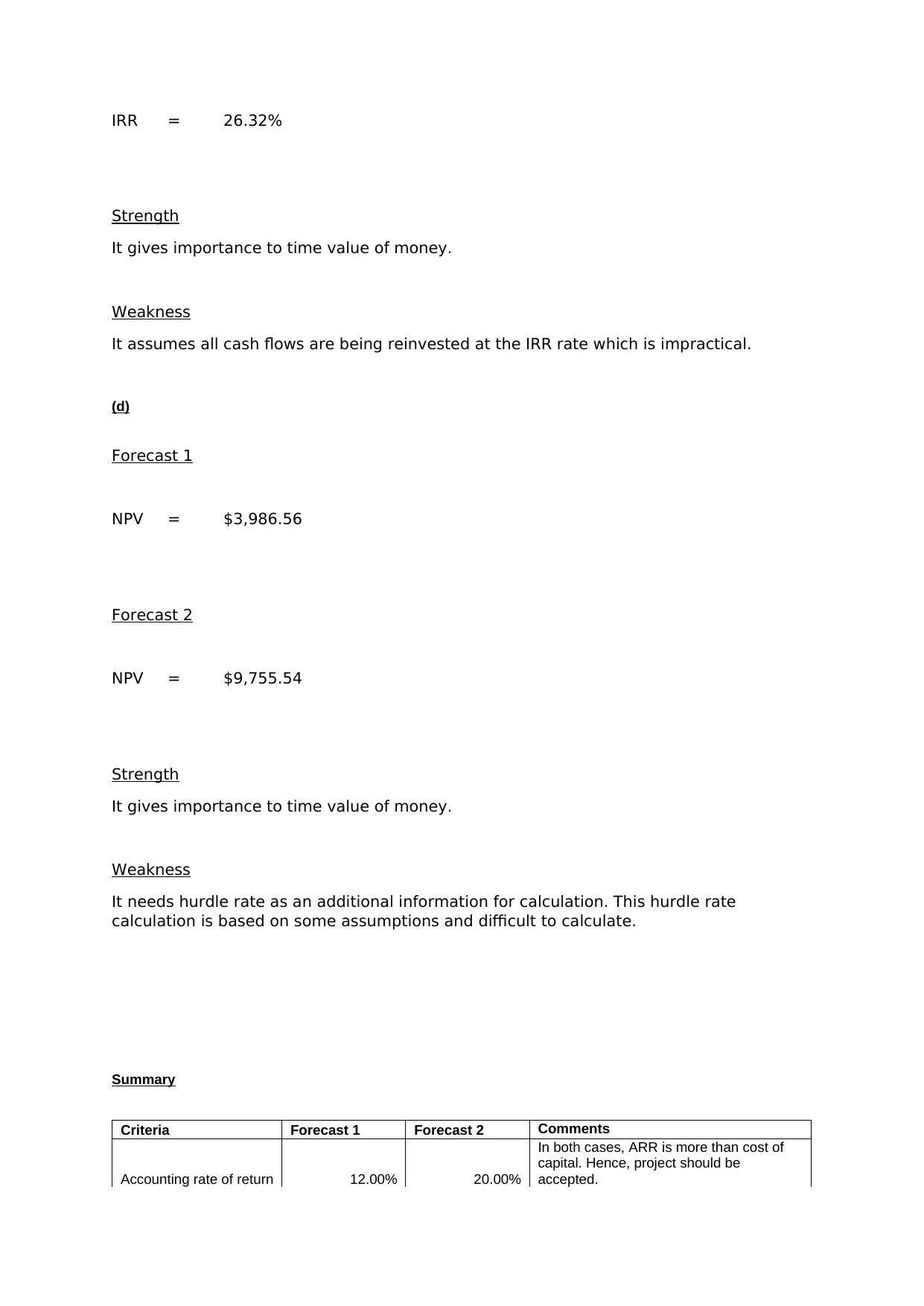

IRR = 26.32%

Strength

It gives importance to time value of money.

Weakness

It assumes all cash flows are being reinvested at the IRR rate which is impractical.

(d)

Forecast 1

NPV = $3,986.56

Forecast 2

NPV = $9,755.54

Strength

It gives importance to time value of money.

Weakness

It needs hurdle rate as an additional information for calculation. This hurdle rate

calculation is based on some assumptions and difficult to calculate.

Summary

Criteria Forecast 1 Forecast 2 Comments

Accounting rate of return 12.00% 20.00%

In both cases, ARR is more than cost of

capital. Hence, project should be

accepted.

Strength

It gives importance to time value of money.

Weakness

It assumes all cash flows are being reinvested at the IRR rate which is impractical.

(d)

Forecast 1

NPV = $3,986.56

Forecast 2

NPV = $9,755.54

Strength

It gives importance to time value of money.

Weakness

It needs hurdle rate as an additional information for calculation. This hurdle rate

calculation is based on some assumptions and difficult to calculate.

Summary

Criteria Forecast 1 Forecast 2 Comments

Accounting rate of return 12.00% 20.00%

In both cases, ARR is more than cost of

capital. Hence, project should be

accepted.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

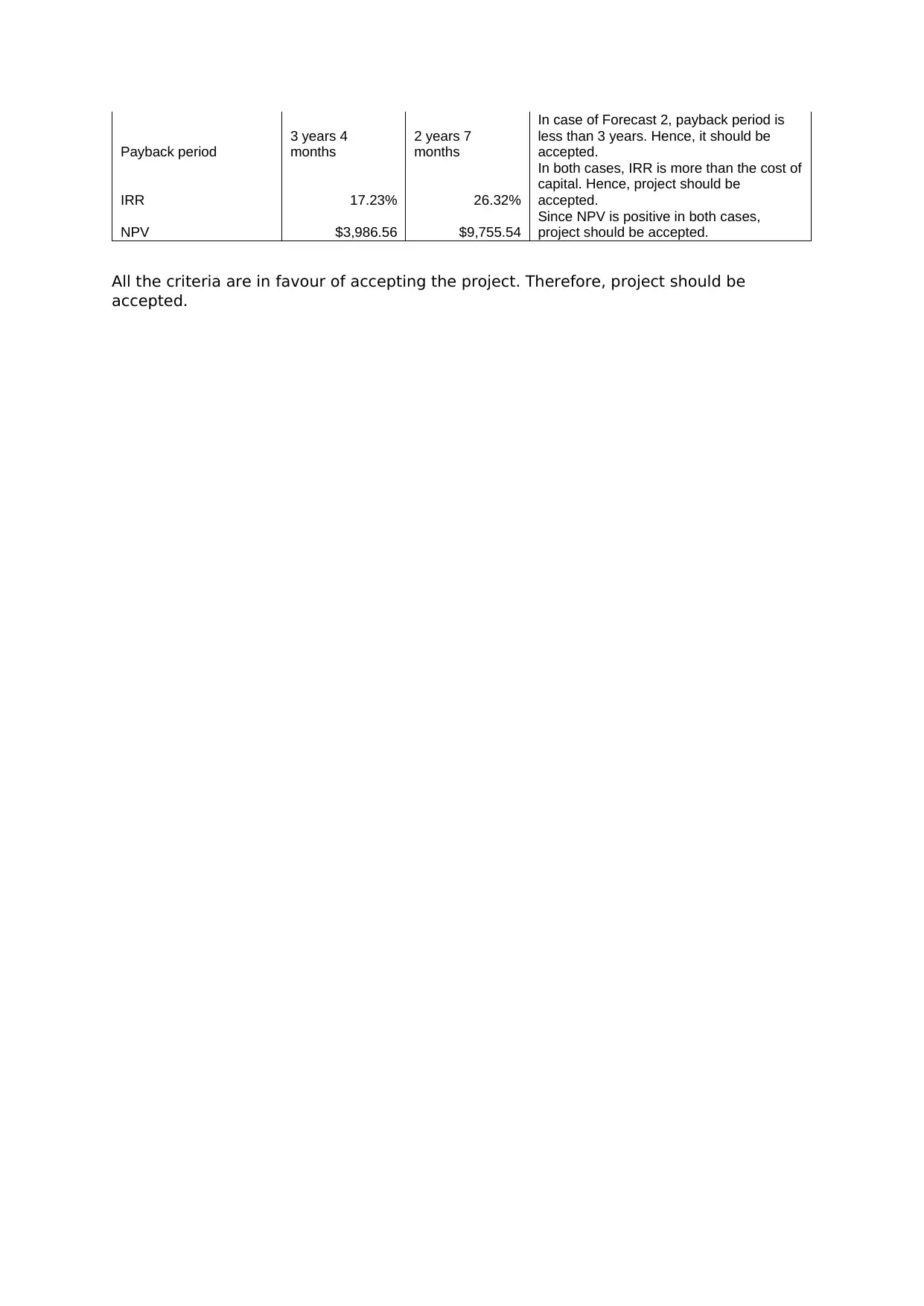

Payback period

3 years 4

months

2 years 7

months

In case of Forecast 2, payback period is

less than 3 years. Hence, it should be

accepted.

IRR 17.23% 26.32%

In both cases, IRR is more than the cost of

capital. Hence, project should be

accepted.

NPV $3,986.56 $9,755.54

Since NPV is positive in both cases,

project should be accepted.

All the criteria are in favour of accepting the project. Therefore, project should be

accepted.

3 years 4

months

2 years 7

months

In case of Forecast 2, payback period is

less than 3 years. Hence, it should be

accepted.

IRR 17.23% 26.32%

In both cases, IRR is more than the cost of

capital. Hence, project should be

accepted.

NPV $3,986.56 $9,755.54

Since NPV is positive in both cases,

project should be accepted.

All the criteria are in favour of accepting the project. Therefore, project should be

accepted.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.