Statement of Advice Project - Risk Management & Insurance Finance

VerifiedAdded on 2023/06/18

|17

|4199

|204

Project

AI Summary

This project outlines the steps to complete a Statement of Advice (SOA) related to risk management and insurance, focusing on a client's personal and financial situation. It details the required sections of the SOA, including an introduction/executive summary, current personal and financial situation, recommendations, implementation structure, disclosure of payments, ongoing services, an implementation schedule, and authority to proceed. The project emphasizes the importance of a comprehensive risk analysis and the need for clear, objective advice tailored to the client's specific objectives and circumstances. It includes sections on existing insurance, financial details, recommended insurance, and assumptions, providing a framework for assessing insurance needs and formulating a plan to address them. The document also highlights potential risks in the advice and stresses the importance of client understanding and consent before proceeding with any financial actions. Desklib provides access to past papers and solved assignments for students seeking additional resources.

Steps to complete project:

1. Review the client profile. (same clients as Assessment 1)

2. Review your application of the risk management process (5 steps) to the

Smiths' situation (Assessment 1)

3. Discuss the risks you identified from Assessment 1 with your group. (Are

they similar, any missing? Collaborate.)

4. Complete the risk analysis.

5. Review the rubric and the following for guidance on what information

needs to be included in the SOA.

6. Discuss in your group what sections of the SOA each individual will work

on.

Project due date: 17 October 2021. End of Week 10

Summary of Rubric/Structure: Below is what we need in order to get HD for each heading

Intro/executive summary: must include situation, objectives, strategies, expected outcome and next

step.

outlined briefly & objectively.

Current Personal & Financial Situation

Client’s reasons for seeking advice, personal and financial information has been detailed objectively

to be able to prepare strategy recommendations.

Recommendations

Comprehensive explanation of the advice strategies, and the justification of recommendations.

Objective details on the risks/disadvantages and estimated outcomes relevant to the client's

circumstances.

Required structure to implement strategy

Comprehensive outline of additional information that the client needs to consider in order to have

complete understanding of advice. Examples: types of insurance, the sums insured, and ownership

structure, In addition, objective justification of any structure recommended.

Disclosure of Payments for Advice

Clearly details all forms of adviser fees in the categories of initial advice fees, ongoing advice fees,

commissions, any refund of commissions and how these fees will be paid.

Ongoing services

Comprehensive detail on the offer of on-going service, costs and value of service relevant to client's

circumstances

Implementation Schedule

Comprehensively detailed schedule to implement all the strategies; priorities, tasks, timeframe

Authority to proceed

Comprehensively details key elements that requires the client's express consent relevant to client's

circumstances; eg, changes in existing products, on-going advice contract

Financial position before and after implementation of strategy, eg risk needs analysis

Comprehensively detailed personal tax, cash flow and balance sheet tables/graphs are neatly

completed for before AND after scenario relevant to client's circumstances clearly demonstrating

value of advice

1. Review the client profile. (same clients as Assessment 1)

2. Review your application of the risk management process (5 steps) to the

Smiths' situation (Assessment 1)

3. Discuss the risks you identified from Assessment 1 with your group. (Are

they similar, any missing? Collaborate.)

4. Complete the risk analysis.

5. Review the rubric and the following for guidance on what information

needs to be included in the SOA.

6. Discuss in your group what sections of the SOA each individual will work

on.

Project due date: 17 October 2021. End of Week 10

Summary of Rubric/Structure: Below is what we need in order to get HD for each heading

Intro/executive summary: must include situation, objectives, strategies, expected outcome and next

step.

outlined briefly & objectively.

Current Personal & Financial Situation

Client’s reasons for seeking advice, personal and financial information has been detailed objectively

to be able to prepare strategy recommendations.

Recommendations

Comprehensive explanation of the advice strategies, and the justification of recommendations.

Objective details on the risks/disadvantages and estimated outcomes relevant to the client's

circumstances.

Required structure to implement strategy

Comprehensive outline of additional information that the client needs to consider in order to have

complete understanding of advice. Examples: types of insurance, the sums insured, and ownership

structure, In addition, objective justification of any structure recommended.

Disclosure of Payments for Advice

Clearly details all forms of adviser fees in the categories of initial advice fees, ongoing advice fees,

commissions, any refund of commissions and how these fees will be paid.

Ongoing services

Comprehensive detail on the offer of on-going service, costs and value of service relevant to client's

circumstances

Implementation Schedule

Comprehensively detailed schedule to implement all the strategies; priorities, tasks, timeframe

Authority to proceed

Comprehensively details key elements that requires the client's express consent relevant to client's

circumstances; eg, changes in existing products, on-going advice contract

Financial position before and after implementation of strategy, eg risk needs analysis

Comprehensively detailed personal tax, cash flow and balance sheet tables/graphs are neatly

completed for before AND after scenario relevant to client's circumstances clearly demonstrating

value of advice

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assumption

Comprehensively details reasonable assumptions used to prepare tax, cash flow and balance sheet

figures and other related personal and economic assumptions, relevant to client's circumstances

Insurance Product recommendations

Types of Insurance Cover, eg personal, general, business covers

Comprehensive explanation of all types of insurance recommended, relevant to client's circumstances

Comprehensively details reasonable assumptions used to prepare tax, cash flow and balance sheet

figures and other related personal and economic assumptions, relevant to client's circumstances

Insurance Product recommendations

Types of Insurance Cover, eg personal, general, business covers

Comprehensive explanation of all types of insurance recommended, relevant to client's circumstances

Statement of Advice

Thank you for the opportunity to discuss your insurance needs. We are pleased to enclose your

personal insurance plan which outlines our recommendations.

This Statement of Advice has been prepared based on your objectives and your current financial

situation. Please take the time to carefully read and understand it, to ensure that it is consistent with

your views and reflects the information we discussed.

The recommendations in this report are based on current information and should only be considered

to be current for one month from the date of this report. After that time, or if you have had any

significant changes to your personal circumstances, you should contact us so that we can re-assess

their suitability.

Once implemented, the recommendations in this Statement of Advice should be reviewed on a

regular basis to ensure that they continue to meet your ongoing needs. Changes in legislation,

financial markets and your personal situation will occur over time, and as your financial adviser we

can work with you to update your financial plan so that you stay on track to achieve your goals and

objectives.

This Statement of Advice relates to you only and the advice contained in this document is not suitable

to anyone else. Please take time to review the fee disclosure section for an explanation of the fees

associated with the development and implementation of our recommendations.

We look forward to helping you implement the enclosed recommendations, and in the meantime we

remain available to assist you with any queries you may have in relation to this Statement of Advice.

Yours sincerely,

___________________________________

26 Swinburne

Thank you for the opportunity to discuss your insurance needs. We are pleased to enclose your

personal insurance plan which outlines our recommendations.

This Statement of Advice has been prepared based on your objectives and your current financial

situation. Please take the time to carefully read and understand it, to ensure that it is consistent with

your views and reflects the information we discussed.

The recommendations in this report are based on current information and should only be considered

to be current for one month from the date of this report. After that time, or if you have had any

significant changes to your personal circumstances, you should contact us so that we can re-assess

their suitability.

Once implemented, the recommendations in this Statement of Advice should be reviewed on a

regular basis to ensure that they continue to meet your ongoing needs. Changes in legislation,

financial markets and your personal situation will occur over time, and as your financial adviser we

can work with you to update your financial plan so that you stay on track to achieve your goals and

objectives.

This Statement of Advice relates to you only and the advice contained in this document is not suitable

to anyone else. Please take time to review the fee disclosure section for an explanation of the fees

associated with the development and implementation of our recommendations.

We look forward to helping you implement the enclosed recommendations, and in the meantime we

remain available to assist you with any queries you may have in relation to this Statement of Advice.

Yours sincerely,

___________________________________

26 Swinburne

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

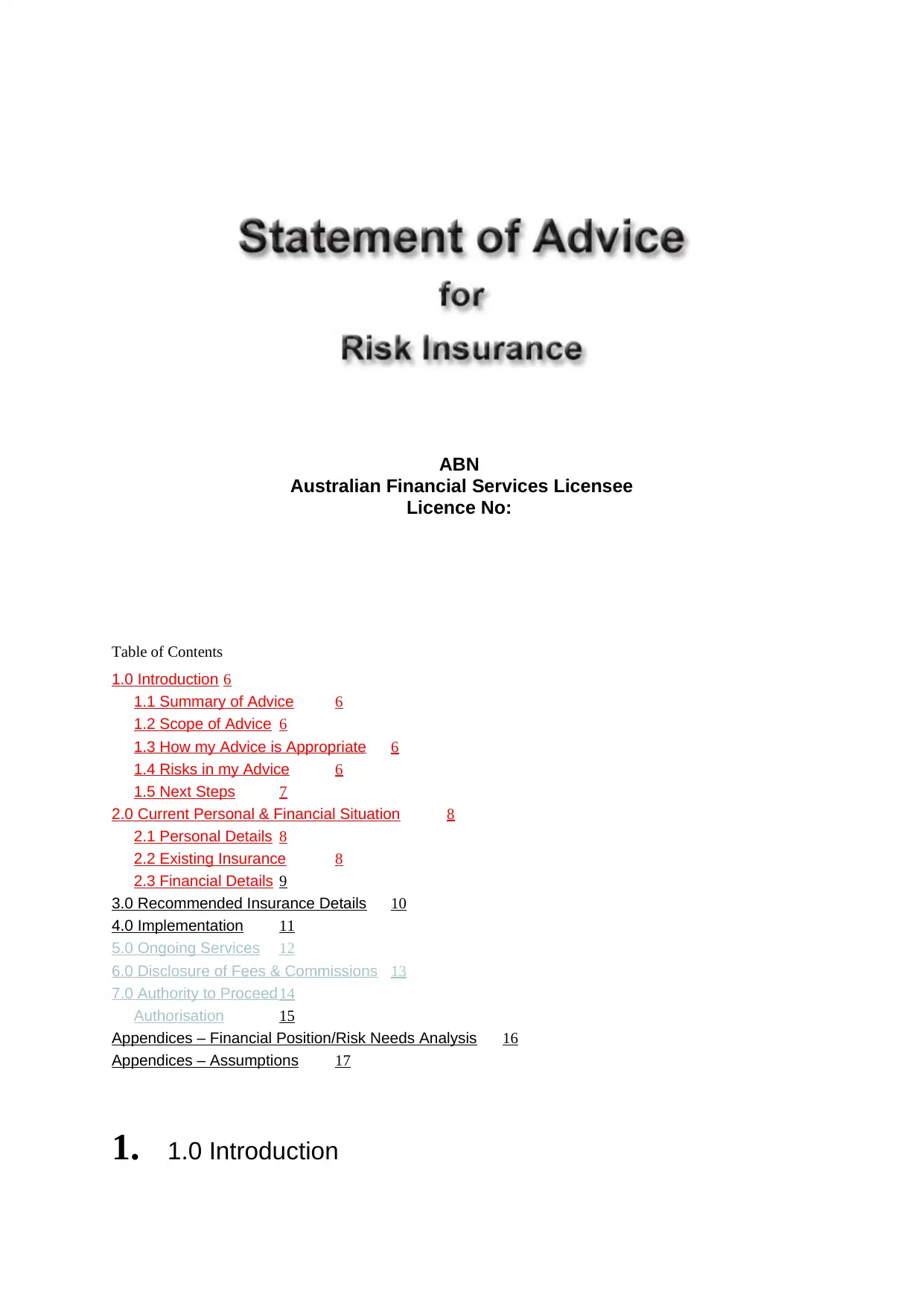

ABN

Australian Financial Services Licensee

Licence No:

Table of Contents

1.0 Introduction 6

1.1 Summary of Advice 6

1.2 Scope of Advice 6

1.3 How my Advice is Appropriate 6

1.4 Risks in my Advice 6

1.5 Next Steps 7

2.0 Current Personal & Financial Situation 8

2.1 Personal Details 8

2.2 Existing Insurance 8

2.3 Financial Details 9

3.0 Recommended Insurance Details 10

4.0 Implementation 11

5.0 Ongoing Services 12

6.0 Disclosure of Fees & Commissions 13

7.0 Authority to Proceed14

Authorisation 15

Appendices – Financial Position/Risk Needs Analysis 16

Appendices – Assumptions 17

1. 1.0 Introduction

Australian Financial Services Licensee

Licence No:

Table of Contents

1.0 Introduction 6

1.1 Summary of Advice 6

1.2 Scope of Advice 6

1.3 How my Advice is Appropriate 6

1.4 Risks in my Advice 6

1.5 Next Steps 7

2.0 Current Personal & Financial Situation 8

2.1 Personal Details 8

2.2 Existing Insurance 8

2.3 Financial Details 9

3.0 Recommended Insurance Details 10

4.0 Implementation 11

5.0 Ongoing Services 12

6.0 Disclosure of Fees & Commissions 13

7.0 Authority to Proceed14

Authorisation 15

Appendices – Financial Position/Risk Needs Analysis 16

Appendices – Assumptions 17

1. 1.0 Introduction

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1.1 Summary of Advice

Nick & Lynn, we have analysed your personal insurance needs and

formulated a plan to address these requirements. (please take note that a

Statement of Advice is addressed to the client. Do not write this Statement of

Advice like you are writing to the unit lecturer)

We recommend you take out the following:

Give a summary here of the types of insurance covers recommended, the

recommended sum insured amounts

1.2 Scope of Advice

Whilst we have detailed the different types of insurance policies that may be

related to you, this Statement of Advice does not include a number of other

recommendations.

These excluded recommendations include the following:

- Taxation

- Investment Portfolio

- Centrelink

This Statement of Advice is strictly in relation to your current risk exposures

and how to minimise or eliminate this exposure, however, other

recommendations that may be useful in the future that is also not included in

this SOA are:

- Estate Planning

- Retirement Planning

1.3 How my Advice is Appropriate

The general meaning of insurance is to reduce or eliminate financial uncertainty whilst

also making those potential losses financially feasible. From the information that we

have gathered, we have developed our recommendations around your objectives, these

objectives being:

- Having sufficient financial resources to allow your twin daughters to

attend private high school next year (costing an annual amount of $22,000

per child or $44,000 in total).

Nick & Lynn, we have analysed your personal insurance needs and

formulated a plan to address these requirements. (please take note that a

Statement of Advice is addressed to the client. Do not write this Statement of

Advice like you are writing to the unit lecturer)

We recommend you take out the following:

Give a summary here of the types of insurance covers recommended, the

recommended sum insured amounts

1.2 Scope of Advice

Whilst we have detailed the different types of insurance policies that may be

related to you, this Statement of Advice does not include a number of other

recommendations.

These excluded recommendations include the following:

- Taxation

- Investment Portfolio

- Centrelink

This Statement of Advice is strictly in relation to your current risk exposures

and how to minimise or eliminate this exposure, however, other

recommendations that may be useful in the future that is also not included in

this SOA are:

- Estate Planning

- Retirement Planning

1.3 How my Advice is Appropriate

The general meaning of insurance is to reduce or eliminate financial uncertainty whilst

also making those potential losses financially feasible. From the information that we

have gathered, we have developed our recommendations around your objectives, these

objectives being:

- Having sufficient financial resources to allow your twin daughters to

attend private high school next year (costing an annual amount of $22,000

per child or $44,000 in total).

- You would like to repay the mortgage on your primary residence within

the next 10 years (totalling $620,000).

- Being able to maintain the hiking and trail bike riding.

- Bernie, you would like to continue your rock climbing.

- You wish to sell your investment property at the time of your

retirements.

- You wish to make capital contributions into your superannuation

accounts to help fund your retirements.

- Deena, you would like your business to be safeguarded if an

unforeseen financial situation occurred.

- You both would like to have financial protection if either of you could not

work for an extended period of time or may never be able to work again.

Insert objectives here (from assessment 1)

1.4 Risks in my Advice

● If the information that you have provided us with is incorrect,

incomplete or misleading, then this may result in the insurance policy being

cancelled for breaching the terms and conditions of the contract.

● The underwriter may increase or decrease the premium cost if

they chose to exclude or include particular conditions in-relation to perceived

risk.

● If you have a Superannuation fund with insurance included, then

this will decrease the value of your fund.

1.5 Next Steps

Before either of you proceed on taking any further financial actions, you must

ensure that you carefully read our advice and that you are satisfied with it. If

you have any queries or suggestions please inform us so we can be ensured

that both of you are clear on the advice that we have recommended.

Therefore, if both of you wish to proceed then please refer to the ‘Authority to

Proceed’ section within this document and complete it.

2.0 Current Personal & Financial Situation

the next 10 years (totalling $620,000).

- Being able to maintain the hiking and trail bike riding.

- Bernie, you would like to continue your rock climbing.

- You wish to sell your investment property at the time of your

retirements.

- You wish to make capital contributions into your superannuation

accounts to help fund your retirements.

- Deena, you would like your business to be safeguarded if an

unforeseen financial situation occurred.

- You both would like to have financial protection if either of you could not

work for an extended period of time or may never be able to work again.

Insert objectives here (from assessment 1)

1.4 Risks in my Advice

● If the information that you have provided us with is incorrect,

incomplete or misleading, then this may result in the insurance policy being

cancelled for breaching the terms and conditions of the contract.

● The underwriter may increase or decrease the premium cost if

they chose to exclude or include particular conditions in-relation to perceived

risk.

● If you have a Superannuation fund with insurance included, then

this will decrease the value of your fund.

1.5 Next Steps

Before either of you proceed on taking any further financial actions, you must

ensure that you carefully read our advice and that you are satisfied with it. If

you have any queries or suggestions please inform us so we can be ensured

that both of you are clear on the advice that we have recommended.

Therefore, if both of you wish to proceed then please refer to the ‘Authority to

Proceed’ section within this document and complete it.

2.0 Current Personal & Financial Situation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In order to accurately assess what you would like to achieve it is important

that we identify your current position. Detailed below are the key facts upon

which the recommendations in your personal insurance plan are based.

Please let us know immediately if the information contains any errors or

omissions as these might affect the appropriateness of our advice to you.

2.1 Personal Details

*Assumption – State of Residence - Victoria

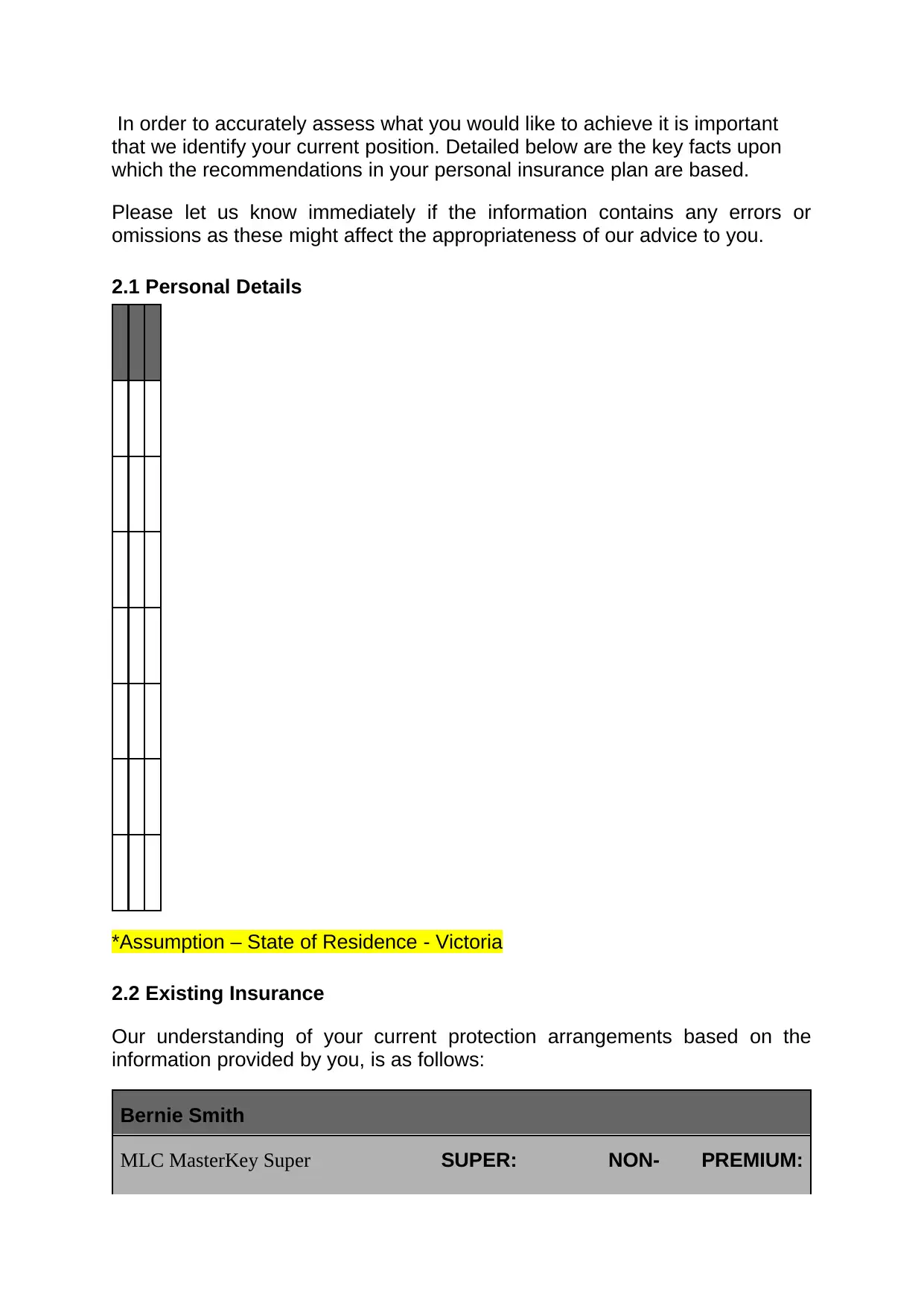

2.2 Existing Insurance

Our understanding of your current protection arrangements based on the

information provided by you, is as follows:

Bernie Smith

MLC MasterKey Super SUPER: NON- PREMIUM:

that we identify your current position. Detailed below are the key facts upon

which the recommendations in your personal insurance plan are based.

Please let us know immediately if the information contains any errors or

omissions as these might affect the appropriateness of our advice to you.

2.1 Personal Details

*Assumption – State of Residence - Victoria

2.2 Existing Insurance

Our understanding of your current protection arrangements based on the

information provided by you, is as follows:

Bernie Smith

MLC MasterKey Super SUPER: NON- PREMIUM:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Fundamentals N/A SUPER:

N/A

$810.00 /year

Superannuation

Life $100,000.00

TPD $100,000.00

Deena Smith

MLC MasterKey Super

Fundamentals

SUPER:

N/A

NON-

SUPER:

N/A

PREMIUM:

$810.00 /year

Superannuation

Life $100,000.00

TPD $100,000.00

*Assumption – They both hold an MLC MasterKey Super Fundamentals account.

*Assumption – The premium amount is the default amount

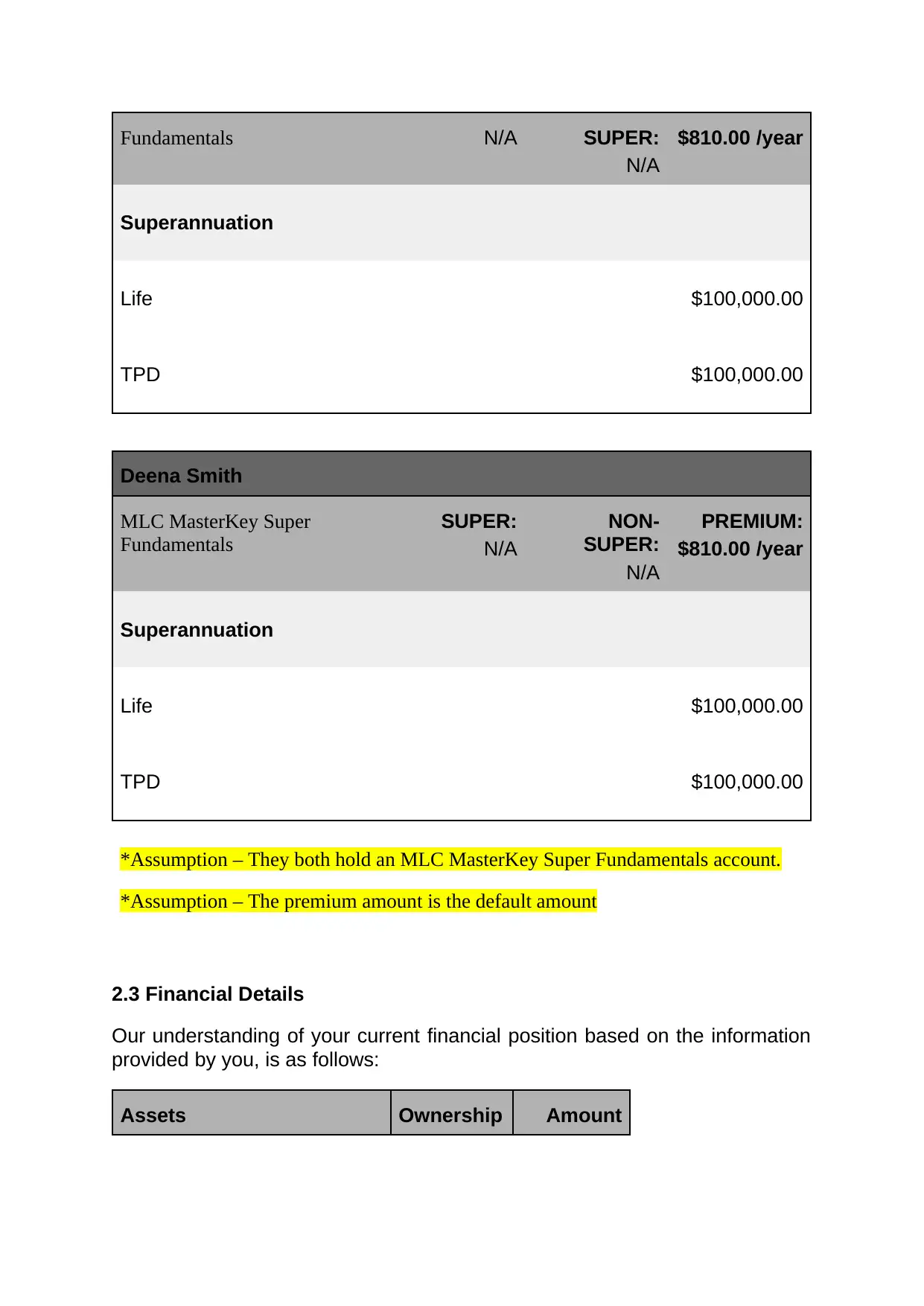

2.3 Financial Details

Our understanding of your current financial position based on the information

provided by you, is as follows:

Assets Ownership Amount

N/A

$810.00 /year

Superannuation

Life $100,000.00

TPD $100,000.00

Deena Smith

MLC MasterKey Super

Fundamentals

SUPER:

N/A

NON-

SUPER:

N/A

PREMIUM:

$810.00 /year

Superannuation

Life $100,000.00

TPD $100,000.00

*Assumption – They both hold an MLC MasterKey Super Fundamentals account.

*Assumption – The premium amount is the default amount

2.3 Financial Details

Our understanding of your current financial position based on the information

provided by you, is as follows:

Assets Ownership Amount

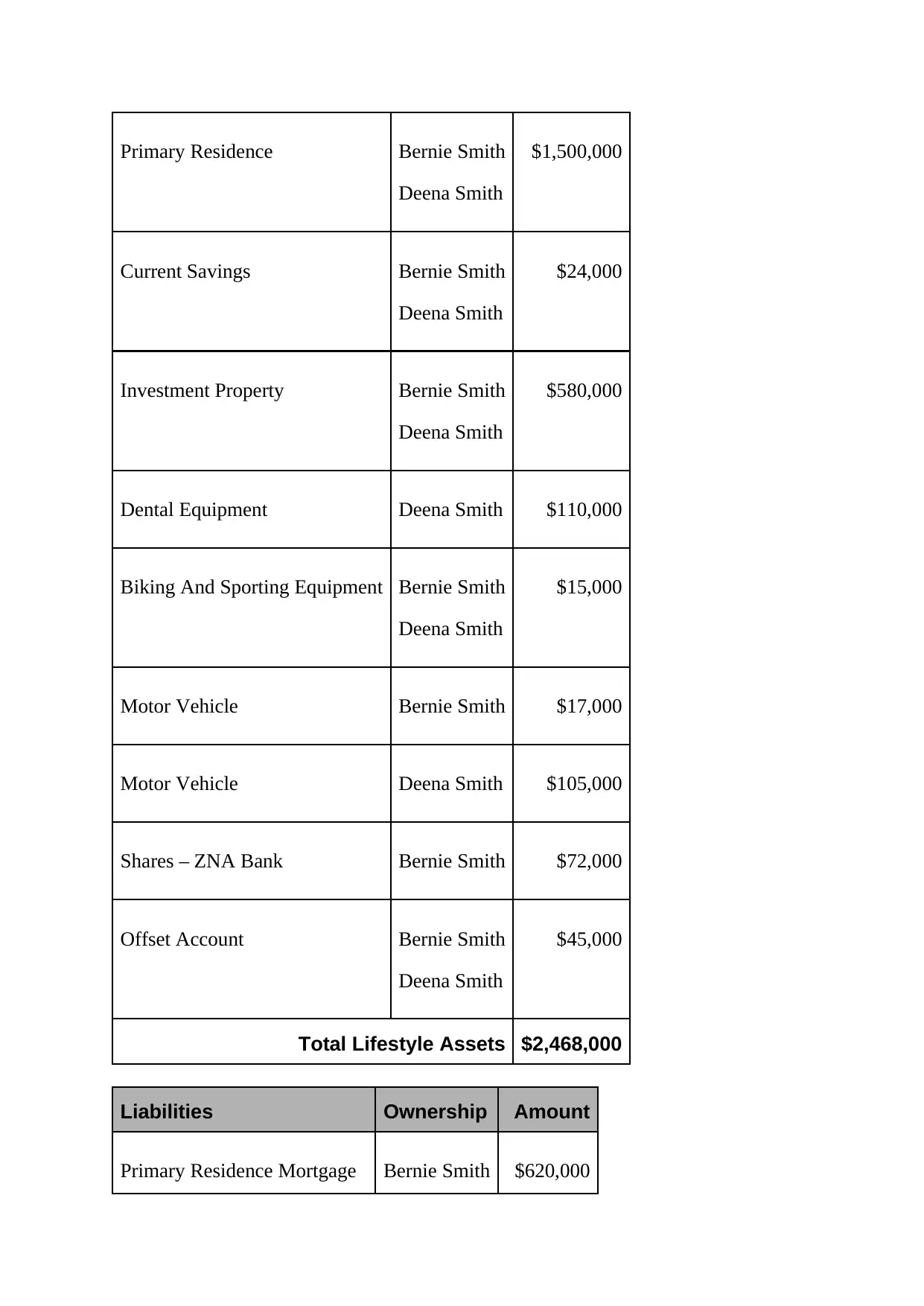

Primary Residence Bernie Smith

Deena Smith

$1,500,000

Current Savings Bernie Smith

Deena Smith

$24,000

Investment Property Bernie Smith

Deena Smith

$580,000

Dental Equipment Deena Smith $110,000

Biking And Sporting Equipment Bernie Smith

Deena Smith

$15,000

Motor Vehicle Bernie Smith $17,000

Motor Vehicle Deena Smith $105,000

Shares – ZNA Bank Bernie Smith $72,000

Offset Account Bernie Smith

Deena Smith

$45,000

Total Lifestyle Assets $2,468,000

Liabilities Ownership Amount

Primary Residence Mortgage Bernie Smith $620,000

Deena Smith

$1,500,000

Current Savings Bernie Smith

Deena Smith

$24,000

Investment Property Bernie Smith

Deena Smith

$580,000

Dental Equipment Deena Smith $110,000

Biking And Sporting Equipment Bernie Smith

Deena Smith

$15,000

Motor Vehicle Bernie Smith $17,000

Motor Vehicle Deena Smith $105,000

Shares – ZNA Bank Bernie Smith $72,000

Offset Account Bernie Smith

Deena Smith

$45,000

Total Lifestyle Assets $2,468,000

Liabilities Ownership Amount

Primary Residence Mortgage Bernie Smith $620,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Deena Smith

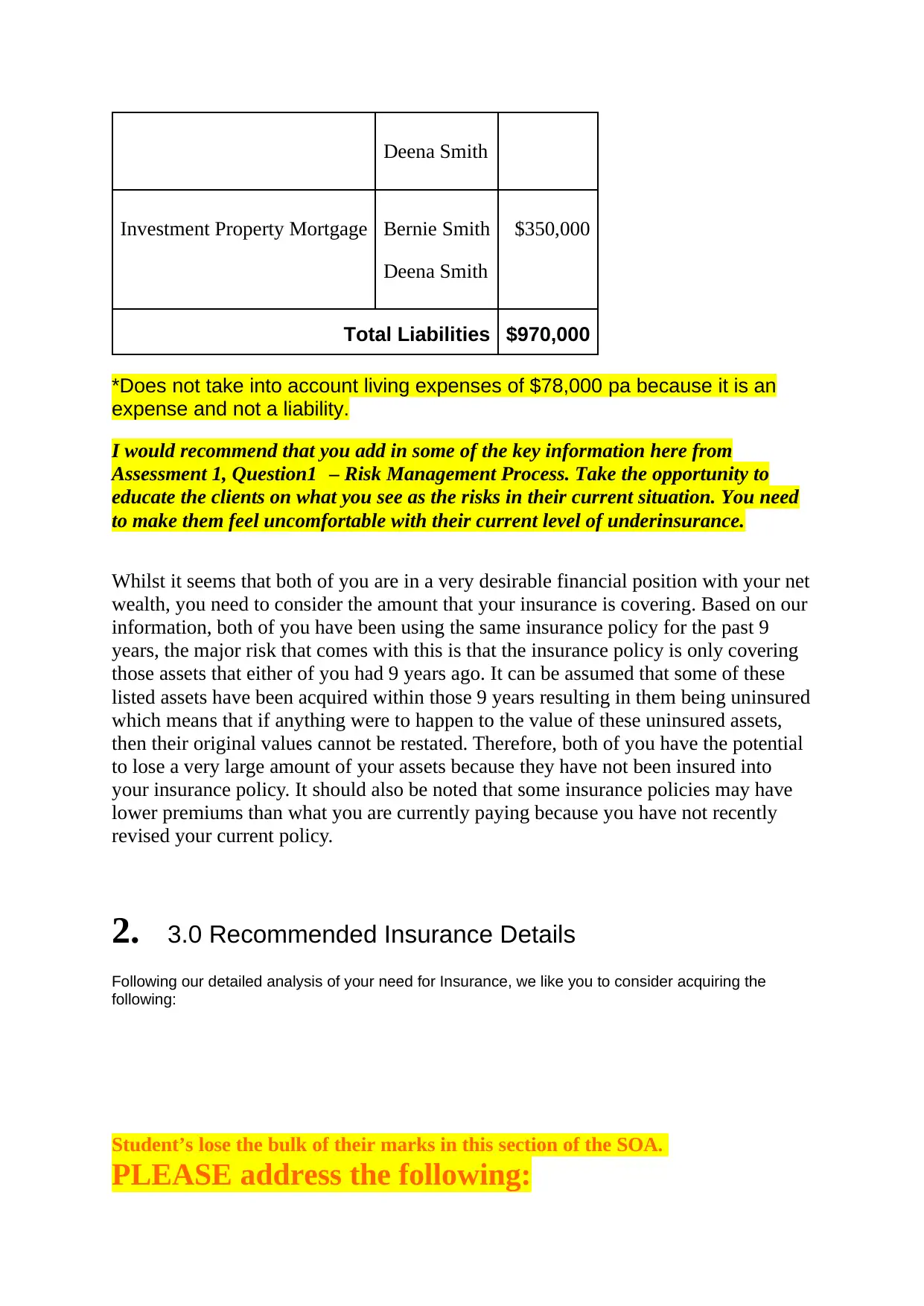

Investment Property Mortgage Bernie Smith

Deena Smith

$350,000

Total Liabilities $970,000

*Does not take into account living expenses of $78,000 pa because it is an

expense and not a liability.

I would recommend that you add in some of the key information here from

Assessment 1, Question1 – Risk Management Process. Take the opportunity to

educate the clients on what you see as the risks in their current situation. You need

to make them feel uncomfortable with their current level of underinsurance.

Whilst it seems that both of you are in a very desirable financial position with your net

wealth, you need to consider the amount that your insurance is covering. Based on our

information, both of you have been using the same insurance policy for the past 9

years, the major risk that comes with this is that the insurance policy is only covering

those assets that either of you had 9 years ago. It can be assumed that some of these

listed assets have been acquired within those 9 years resulting in them being uninsured

which means that if anything were to happen to the value of these uninsured assets,

then their original values cannot be restated. Therefore, both of you have the potential

to lose a very large amount of your assets because they have not been insured into

your insurance policy. It should also be noted that some insurance policies may have

lower premiums than what you are currently paying because you have not recently

revised your current policy.

2. 3.0 Recommended Insurance Details

Following our detailed analysis of your need for Insurance, we like you to consider acquiring the

following:

Student’s lose the bulk of their marks in this section of the SOA.

PLEASE address the following:

Investment Property Mortgage Bernie Smith

Deena Smith

$350,000

Total Liabilities $970,000

*Does not take into account living expenses of $78,000 pa because it is an

expense and not a liability.

I would recommend that you add in some of the key information here from

Assessment 1, Question1 – Risk Management Process. Take the opportunity to

educate the clients on what you see as the risks in their current situation. You need

to make them feel uncomfortable with their current level of underinsurance.

Whilst it seems that both of you are in a very desirable financial position with your net

wealth, you need to consider the amount that your insurance is covering. Based on our

information, both of you have been using the same insurance policy for the past 9

years, the major risk that comes with this is that the insurance policy is only covering

those assets that either of you had 9 years ago. It can be assumed that some of these

listed assets have been acquired within those 9 years resulting in them being uninsured

which means that if anything were to happen to the value of these uninsured assets,

then their original values cannot be restated. Therefore, both of you have the potential

to lose a very large amount of your assets because they have not been insured into

your insurance policy. It should also be noted that some insurance policies may have

lower premiums than what you are currently paying because you have not recently

revised your current policy.

2. 3.0 Recommended Insurance Details

Following our detailed analysis of your need for Insurance, we like you to consider acquiring the

following:

Student’s lose the bulk of their marks in this section of the SOA.

PLEASE address the following:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

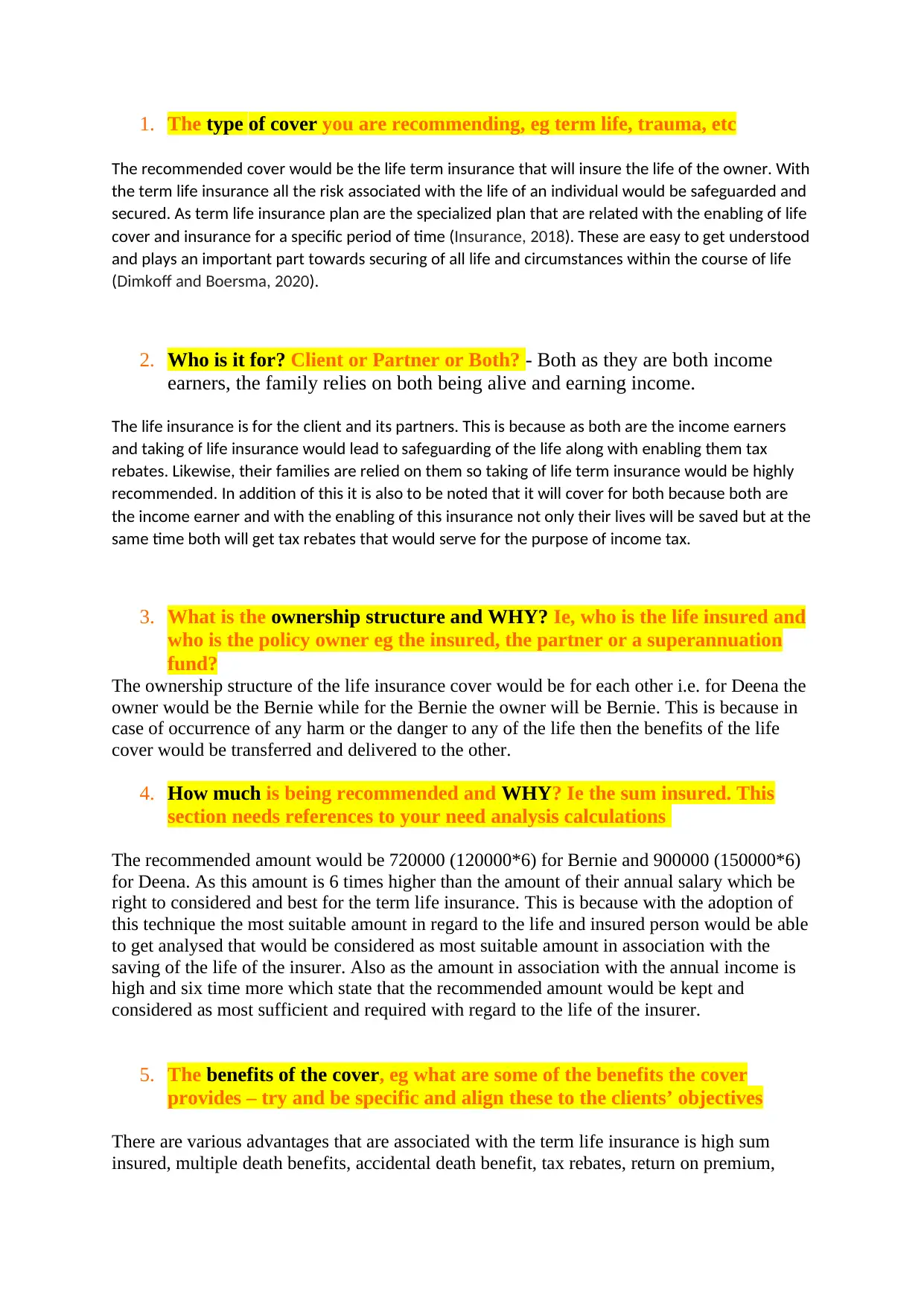

1. The type of cover you are recommending, eg term life, trauma, etc

The recommended cover would be the life term insurance that will insure the life of the owner. With

the term life insurance all the risk associated with the life of an individual would be safeguarded and

secured. As term life insurance plan are the specialized plan that are related with the enabling of life

cover and insurance for a specific period of time (Insurance, 2018). These are easy to get understood

and plays an important part towards securing of all life and circumstances within the course of life

(Dimkoff and Boersma, 2020).

2. Who is it for? Client or Partner or Both? - Both as they are both income

earners, the family relies on both being alive and earning income.

The life insurance is for the client and its partners. This is because as both are the income earners

and taking of life insurance would lead to safeguarding of the life along with enabling them tax

rebates. Likewise, their families are relied on them so taking of life term insurance would be highly

recommended. In addition of this it is also to be noted that it will cover for both because both are

the income earner and with the enabling of this insurance not only their lives will be saved but at the

same time both will get tax rebates that would serve for the purpose of income tax.

3. What is the ownership structure and WHY? Ie, who is the life insured and

who is the policy owner eg the insured, the partner or a superannuation

fund?

The ownership structure of the life insurance cover would be for each other i.e. for Deena the

owner would be the Bernie while for the Bernie the owner will be Bernie. This is because in

case of occurrence of any harm or the danger to any of the life then the benefits of the life

cover would be transferred and delivered to the other.

4. How much is being recommended and WHY? Ie the sum insured. This

section needs references to your need analysis calculations

The recommended amount would be 720000 (120000*6) for Bernie and 900000 (150000*6)

for Deena. As this amount is 6 times higher than the amount of their annual salary which be

right to considered and best for the term life insurance. This is because with the adoption of

this technique the most suitable amount in regard to the life and insured person would be able

to get analysed that would be considered as most suitable amount in association with the

saving of the life of the insurer. Also as the amount in association with the annual income is

high and six time more which state that the recommended amount would be kept and

considered as most sufficient and required with regard to the life of the insurer.

5. The benefits of the cover, eg what are some of the benefits the cover

provides – try and be specific and align these to the clients’ objectives

There are various advantages that are associated with the term life insurance is high sum

insured, multiple death benefits, accidental death benefit, tax rebates, return on premium,

The recommended cover would be the life term insurance that will insure the life of the owner. With

the term life insurance all the risk associated with the life of an individual would be safeguarded and

secured. As term life insurance plan are the specialized plan that are related with the enabling of life

cover and insurance for a specific period of time (Insurance, 2018). These are easy to get understood

and plays an important part towards securing of all life and circumstances within the course of life

(Dimkoff and Boersma, 2020).

2. Who is it for? Client or Partner or Both? - Both as they are both income

earners, the family relies on both being alive and earning income.

The life insurance is for the client and its partners. This is because as both are the income earners

and taking of life insurance would lead to safeguarding of the life along with enabling them tax

rebates. Likewise, their families are relied on them so taking of life term insurance would be highly

recommended. In addition of this it is also to be noted that it will cover for both because both are

the income earner and with the enabling of this insurance not only their lives will be saved but at the

same time both will get tax rebates that would serve for the purpose of income tax.

3. What is the ownership structure and WHY? Ie, who is the life insured and

who is the policy owner eg the insured, the partner or a superannuation

fund?

The ownership structure of the life insurance cover would be for each other i.e. for Deena the

owner would be the Bernie while for the Bernie the owner will be Bernie. This is because in

case of occurrence of any harm or the danger to any of the life then the benefits of the life

cover would be transferred and delivered to the other.

4. How much is being recommended and WHY? Ie the sum insured. This

section needs references to your need analysis calculations

The recommended amount would be 720000 (120000*6) for Bernie and 900000 (150000*6)

for Deena. As this amount is 6 times higher than the amount of their annual salary which be

right to considered and best for the term life insurance. This is because with the adoption of

this technique the most suitable amount in regard to the life and insured person would be able

to get analysed that would be considered as most suitable amount in association with the

saving of the life of the insurer. Also as the amount in association with the annual income is

high and six time more which state that the recommended amount would be kept and

considered as most sufficient and required with regard to the life of the insurer.

5. The benefits of the cover, eg what are some of the benefits the cover

provides – try and be specific and align these to the clients’ objectives

There are various advantages that are associated with the term life insurance is high sum

insured, multiple death benefits, accidental death benefit, tax rebates, return on premium,

critical illness coverage and various others (Pearson, 2021). Likewise, the rate of term life

insurance is low in comparison with the whole life insurance. It will also enable benefits in

terms of free from mental tension and pressure among the clients with regard to their life and

unforeseen circumstances.

6. The shortfalls/risks/disadvantages of the recommended cover

The biggest disadvantage of the term life insurance is the high amount of premium that would

be charged with the raising age of the individual. This means if it would be taken at the later

stage in life the the sum assured and the premium amount will be high. In the same way

another biggest risk that is associated with the term life insurance is non saving of money

(Boodhun and Jayabalan, 2018). This means that it will not enable the saving of money and

enable capital need while the living of an individual. This would be used only on the

occurrence of the accidents and death.

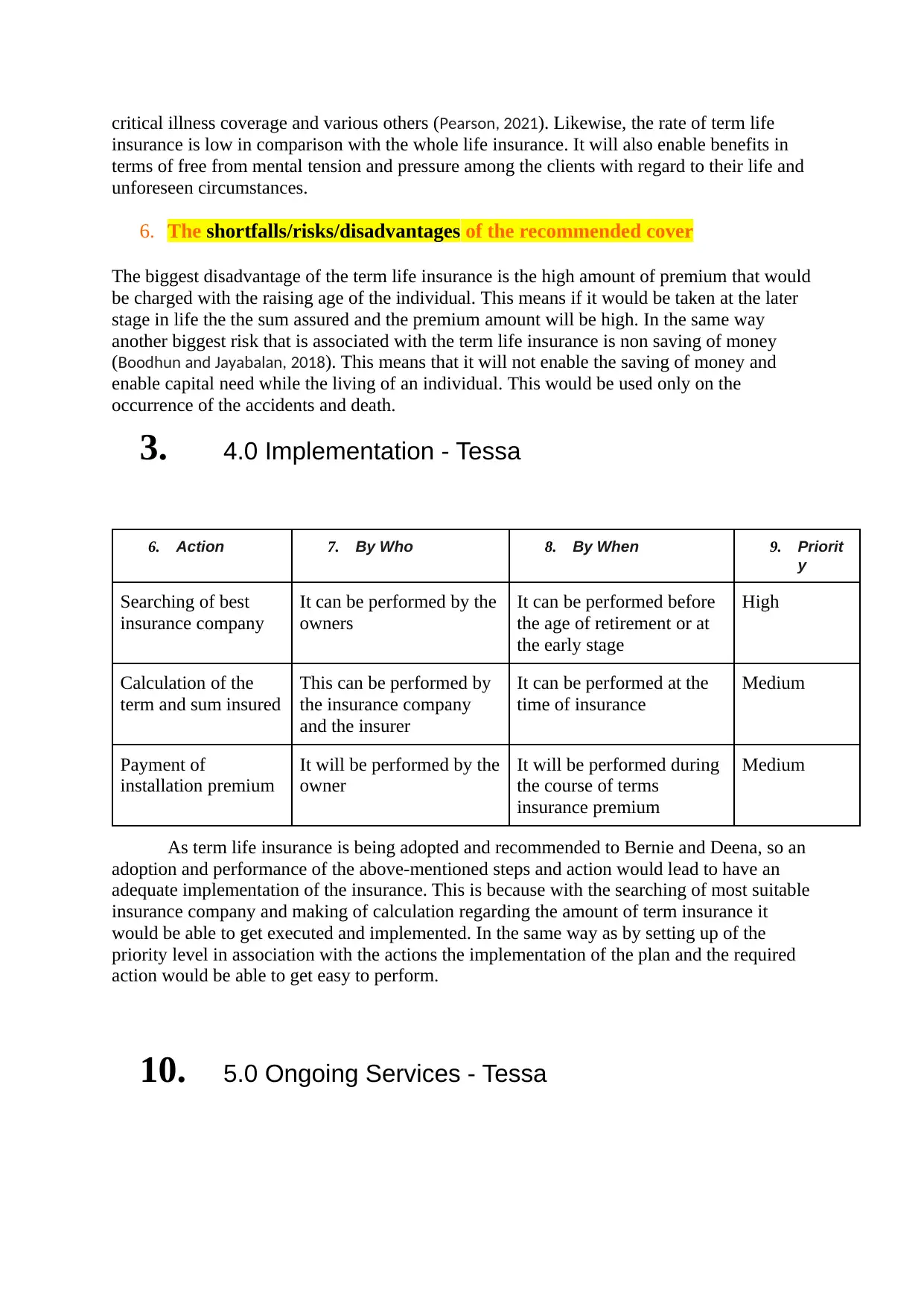

3. 4.0 Implementation - Tessa

6. Action 7. By Who 8. By When 9. Priorit

y

Searching of best

insurance company

It can be performed by the

owners

It can be performed before

the age of retirement or at

the early stage

High

Calculation of the

term and sum insured

This can be performed by

the insurance company

and the insurer

It can be performed at the

time of insurance

Medium

Payment of

installation premium

It will be performed by the

owner

It will be performed during

the course of terms

insurance premium

Medium

As term life insurance is being adopted and recommended to Bernie and Deena, so an

adoption and performance of the above-mentioned steps and action would lead to have an

adequate implementation of the insurance. This is because with the searching of most suitable

insurance company and making of calculation regarding the amount of term insurance it

would be able to get executed and implemented. In the same way as by setting up of the

priority level in association with the actions the implementation of the plan and the required

action would be able to get easy to perform.

10. 5.0 Ongoing Services - Tessa

insurance is low in comparison with the whole life insurance. It will also enable benefits in

terms of free from mental tension and pressure among the clients with regard to their life and

unforeseen circumstances.

6. The shortfalls/risks/disadvantages of the recommended cover

The biggest disadvantage of the term life insurance is the high amount of premium that would

be charged with the raising age of the individual. This means if it would be taken at the later

stage in life the the sum assured and the premium amount will be high. In the same way

another biggest risk that is associated with the term life insurance is non saving of money

(Boodhun and Jayabalan, 2018). This means that it will not enable the saving of money and

enable capital need while the living of an individual. This would be used only on the

occurrence of the accidents and death.

3. 4.0 Implementation - Tessa

6. Action 7. By Who 8. By When 9. Priorit

y

Searching of best

insurance company

It can be performed by the

owners

It can be performed before

the age of retirement or at

the early stage

High

Calculation of the

term and sum insured

This can be performed by

the insurance company

and the insurer

It can be performed at the

time of insurance

Medium

Payment of

installation premium

It will be performed by the

owner

It will be performed during

the course of terms

insurance premium

Medium

As term life insurance is being adopted and recommended to Bernie and Deena, so an

adoption and performance of the above-mentioned steps and action would lead to have an

adequate implementation of the insurance. This is because with the searching of most suitable

insurance company and making of calculation regarding the amount of term insurance it

would be able to get executed and implemented. In the same way as by setting up of the

priority level in association with the actions the implementation of the plan and the required

action would be able to get easy to perform.

10. 5.0 Ongoing Services - Tessa

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.