Evaluation of New Proposal by Pinto Ltd. - Financial Analysis

VerifiedAdded on 2023/06/11

|15

|3387

|89

AI Summary

The memo evaluates the new proposal by Pinto Ltd. using various capital budgeting tools. The base case analysis shows that the project will generate profits and should be accepted. Sensitivity and scenario analysis are also conducted to incorporate uncertainty. The report concludes that the project should be accepted.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Subject: Finance

University: Southern Cross University

Student Name: SYED MUZZAMMIL AHMED

Student ID: 22934738

University: Southern Cross University

Student Name: SYED MUZZAMMIL AHMED

Student ID: 22934738

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

To: CEO, Pinto Limited

From: SYED AHMED

Date: 20TH MAY, 2018

Subject : Recommendation on the new project

In our memo, we have discussed the evaluation of the new proposal put forward by Pinto ltd.

using various financial tools we have analyzed the given data and tried to comment on the

financial acceptability of the new proposal.

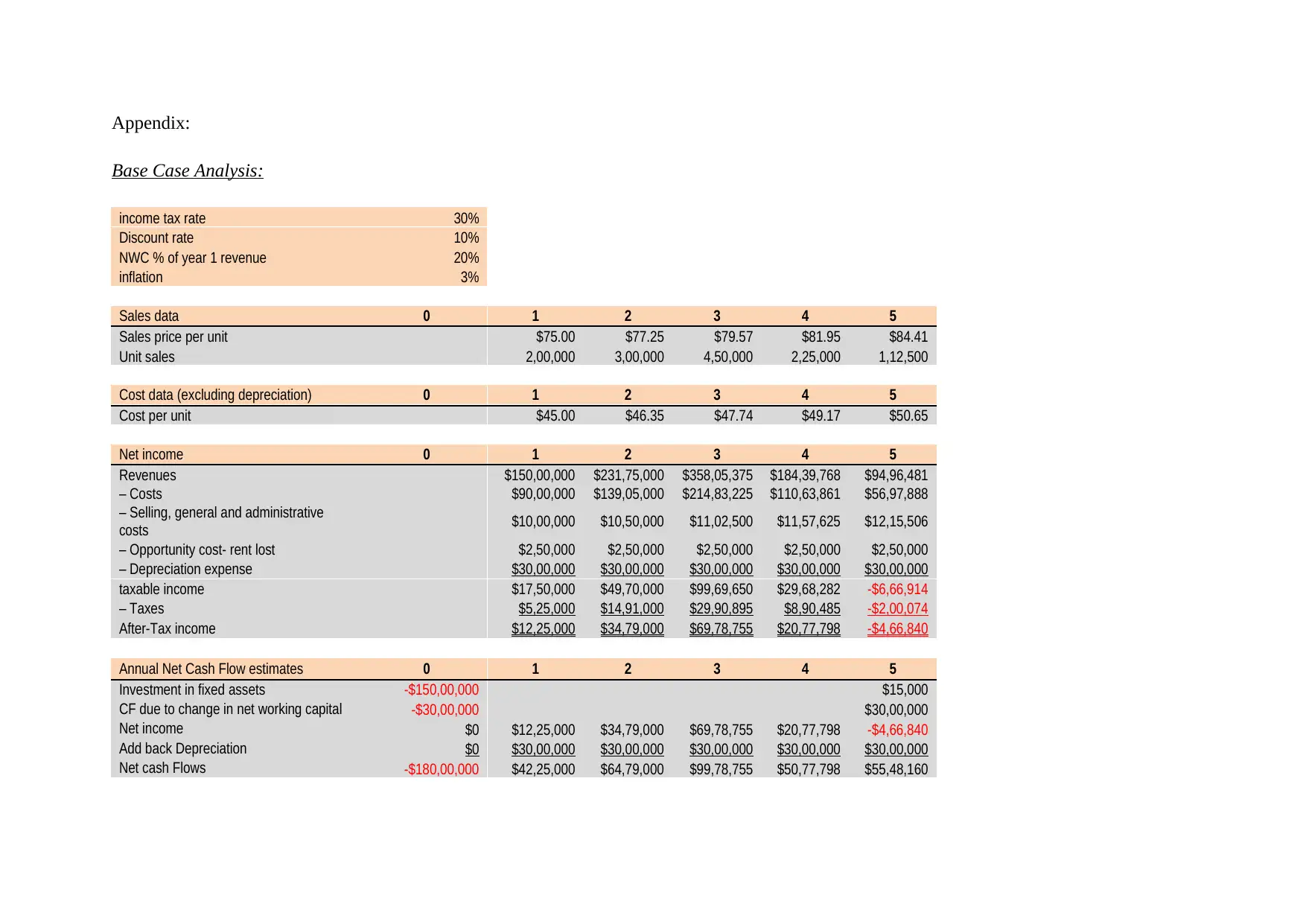

Base case analysis:

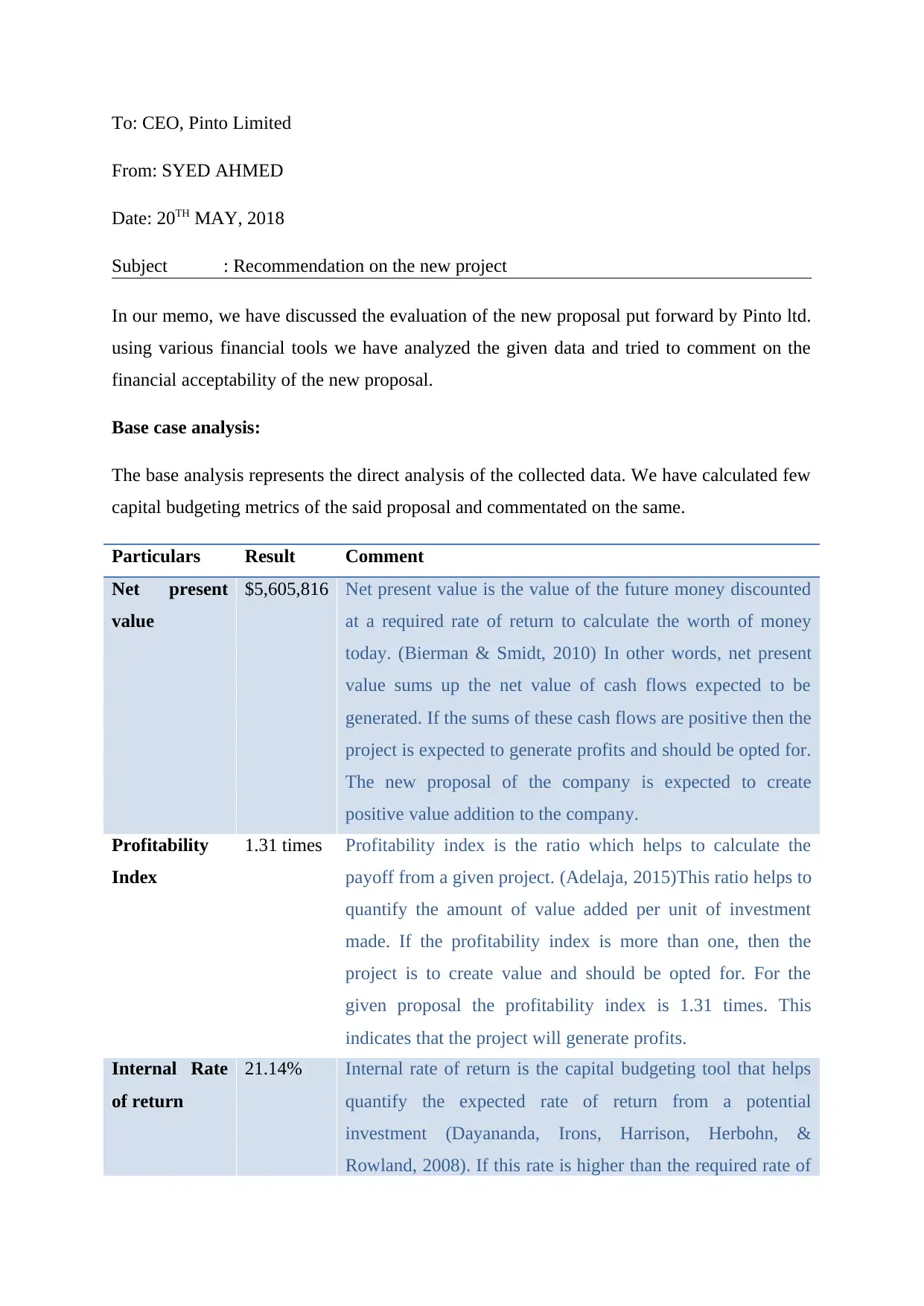

The base analysis represents the direct analysis of the collected data. We have calculated few

capital budgeting metrics of the said proposal and commentated on the same.

Particulars Result Comment

Net present

value

$5,605,816 Net present value is the value of the future money discounted

at a required rate of return to calculate the worth of money

today. (Bierman & Smidt, 2010) In other words, net present

value sums up the net value of cash flows expected to be

generated. If the sums of these cash flows are positive then the

project is expected to generate profits and should be opted for.

The new proposal of the company is expected to create

positive value addition to the company.

Profitability

Index

1.31 times Profitability index is the ratio which helps to calculate the

payoff from a given project. (Adelaja, 2015)This ratio helps to

quantify the amount of value added per unit of investment

made. If the profitability index is more than one, then the

project is to create value and should be opted for. For the

given proposal the profitability index is 1.31 times. This

indicates that the project will generate profits.

Internal Rate

of return

21.14% Internal rate of return is the capital budgeting tool that helps

quantify the expected rate of return from a potential

investment (Dayananda, Irons, Harrison, Herbohn, &

Rowland, 2008). If this rate is higher than the required rate of

From: SYED AHMED

Date: 20TH MAY, 2018

Subject : Recommendation on the new project

In our memo, we have discussed the evaluation of the new proposal put forward by Pinto ltd.

using various financial tools we have analyzed the given data and tried to comment on the

financial acceptability of the new proposal.

Base case analysis:

The base analysis represents the direct analysis of the collected data. We have calculated few

capital budgeting metrics of the said proposal and commentated on the same.

Particulars Result Comment

Net present

value

$5,605,816 Net present value is the value of the future money discounted

at a required rate of return to calculate the worth of money

today. (Bierman & Smidt, 2010) In other words, net present

value sums up the net value of cash flows expected to be

generated. If the sums of these cash flows are positive then the

project is expected to generate profits and should be opted for.

The new proposal of the company is expected to create

positive value addition to the company.

Profitability

Index

1.31 times Profitability index is the ratio which helps to calculate the

payoff from a given project. (Adelaja, 2015)This ratio helps to

quantify the amount of value added per unit of investment

made. If the profitability index is more than one, then the

project is to create value and should be opted for. For the

given proposal the profitability index is 1.31 times. This

indicates that the project will generate profits.

Internal Rate

of return

21.14% Internal rate of return is the capital budgeting tool that helps

quantify the expected rate of return from a potential

investment (Dayananda, Irons, Harrison, Herbohn, &

Rowland, 2008). If this rate is higher than the required rate of

return then the new investment should be opted for. For the

given proposal the internal rate of return is 21.14% when the

required rate is 10%. Hence the project is likely to earn more

than the cast and should be accepted.

Pay-back

period

2.73 years Pay-back period refers to the time period required by a project

to recover its initial invested amount (Peterson & Fabozzi,

2012). Lower the pay-back period, more time is viable for the

company to earn profits. For the given case the project period

is 5 years and the pay-back period is 2.73 years, this means

that any cash earned by the company after this point will be

profit. Therefore, the project is likely to earn high profits and

should be accepted.

Discounted

payback

period

3.38 years Discounted pay-back period is same as a pay-back period. It is

a litter higher than a normal pay-back period as it uses

discounted values of cash flows to determine the investment

recoverable time. (Piper, 2015) The discounted payback

period for the given proposal is 3.38 years, which seems

appropriate and hence the proposal should have opted for

execution.

Uncertainty analysis:

The capital budgeting tools are a very vital financial tool which helps the investor take

decisions regarding the acceptance or rejection of new investment opportunities. But the use

of this capital budgeting technique may lead to uncertain results (Rivenbark, Vogt, &

Marlowe, 2009). The inputs collected for the investment appraisal are based on market

research and assumptions. Change in the market structure or any of the assumptions may lead

o a different result. Taking this factor of uncertainty into account there may be possible

conclusions. Setting up the future requirements is not an easy task. Therefore, though the

capital budgeting techniques may be very useful in decision making, they will always be a

factor of uncertainty involved until the actual results are obtained.

given proposal the internal rate of return is 21.14% when the

required rate is 10%. Hence the project is likely to earn more

than the cast and should be accepted.

Pay-back

period

2.73 years Pay-back period refers to the time period required by a project

to recover its initial invested amount (Peterson & Fabozzi,

2012). Lower the pay-back period, more time is viable for the

company to earn profits. For the given case the project period

is 5 years and the pay-back period is 2.73 years, this means

that any cash earned by the company after this point will be

profit. Therefore, the project is likely to earn high profits and

should be accepted.

Discounted

payback

period

3.38 years Discounted pay-back period is same as a pay-back period. It is

a litter higher than a normal pay-back period as it uses

discounted values of cash flows to determine the investment

recoverable time. (Piper, 2015) The discounted payback

period for the given proposal is 3.38 years, which seems

appropriate and hence the proposal should have opted for

execution.

Uncertainty analysis:

The capital budgeting tools are a very vital financial tool which helps the investor take

decisions regarding the acceptance or rejection of new investment opportunities. But the use

of this capital budgeting technique may lead to uncertain results (Rivenbark, Vogt, &

Marlowe, 2009). The inputs collected for the investment appraisal are based on market

research and assumptions. Change in the market structure or any of the assumptions may lead

o a different result. Taking this factor of uncertainty into account there may be possible

conclusions. Setting up the future requirements is not an easy task. Therefore, though the

capital budgeting techniques may be very useful in decision making, they will always be a

factor of uncertainty involved until the actual results are obtained.

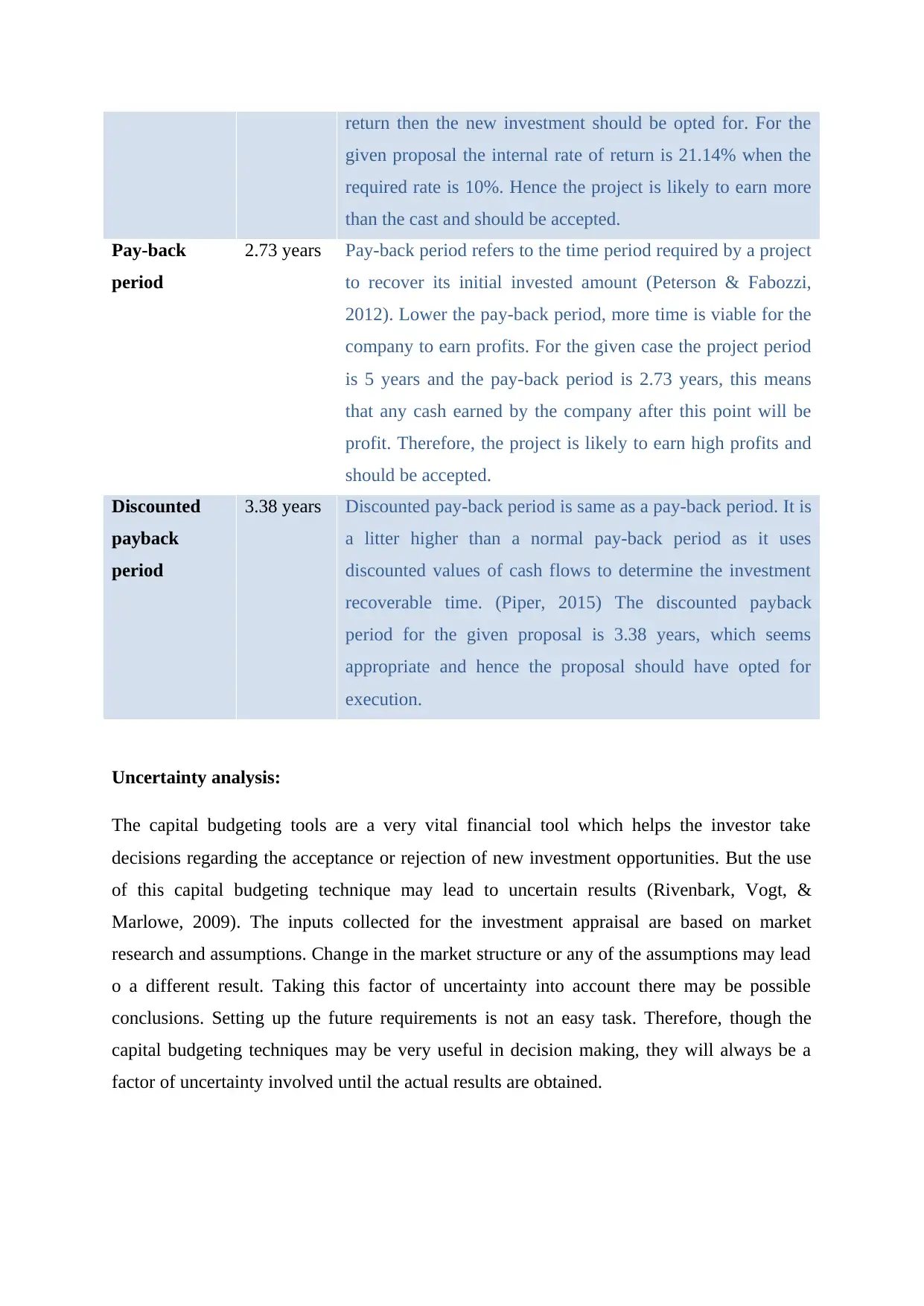

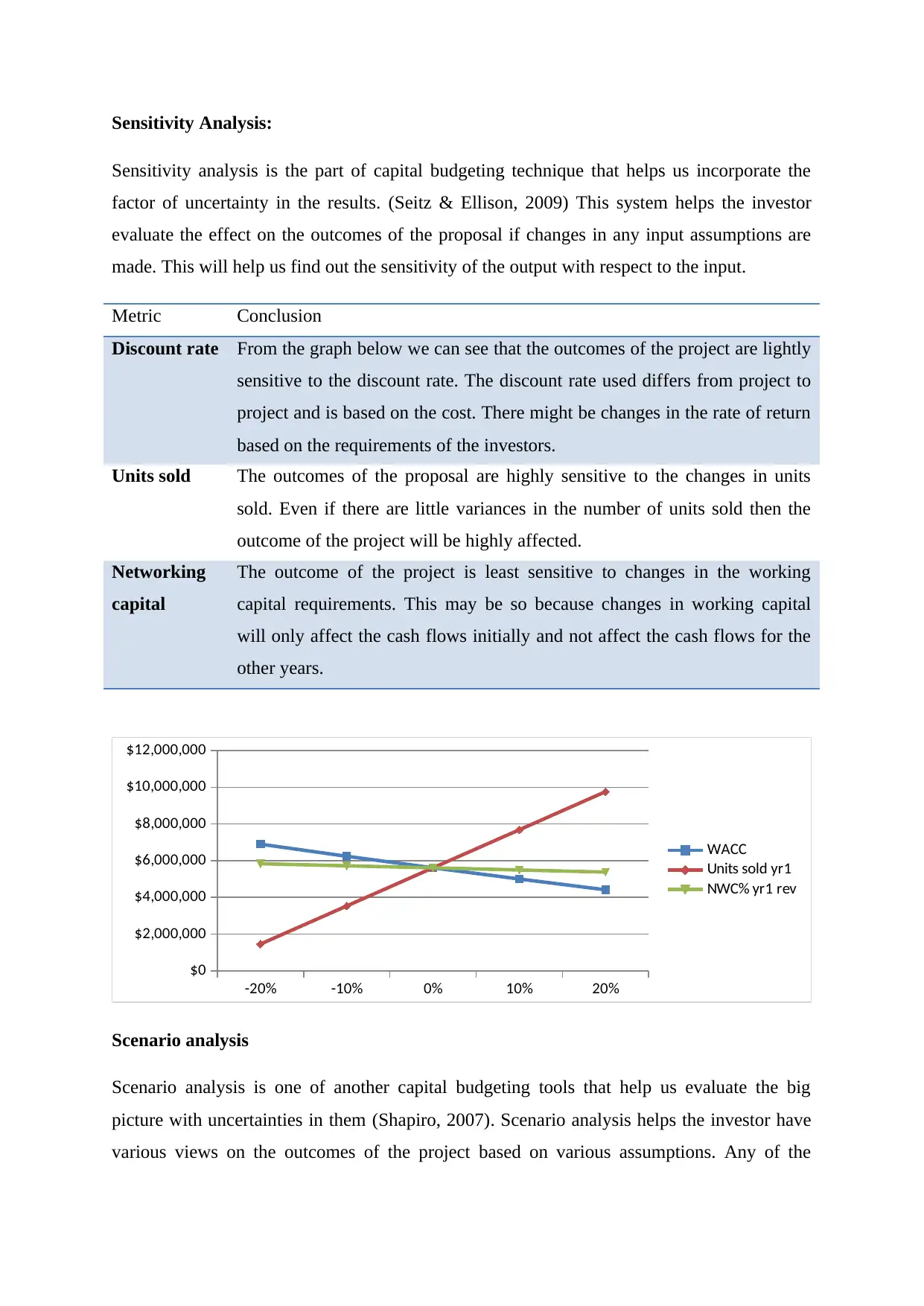

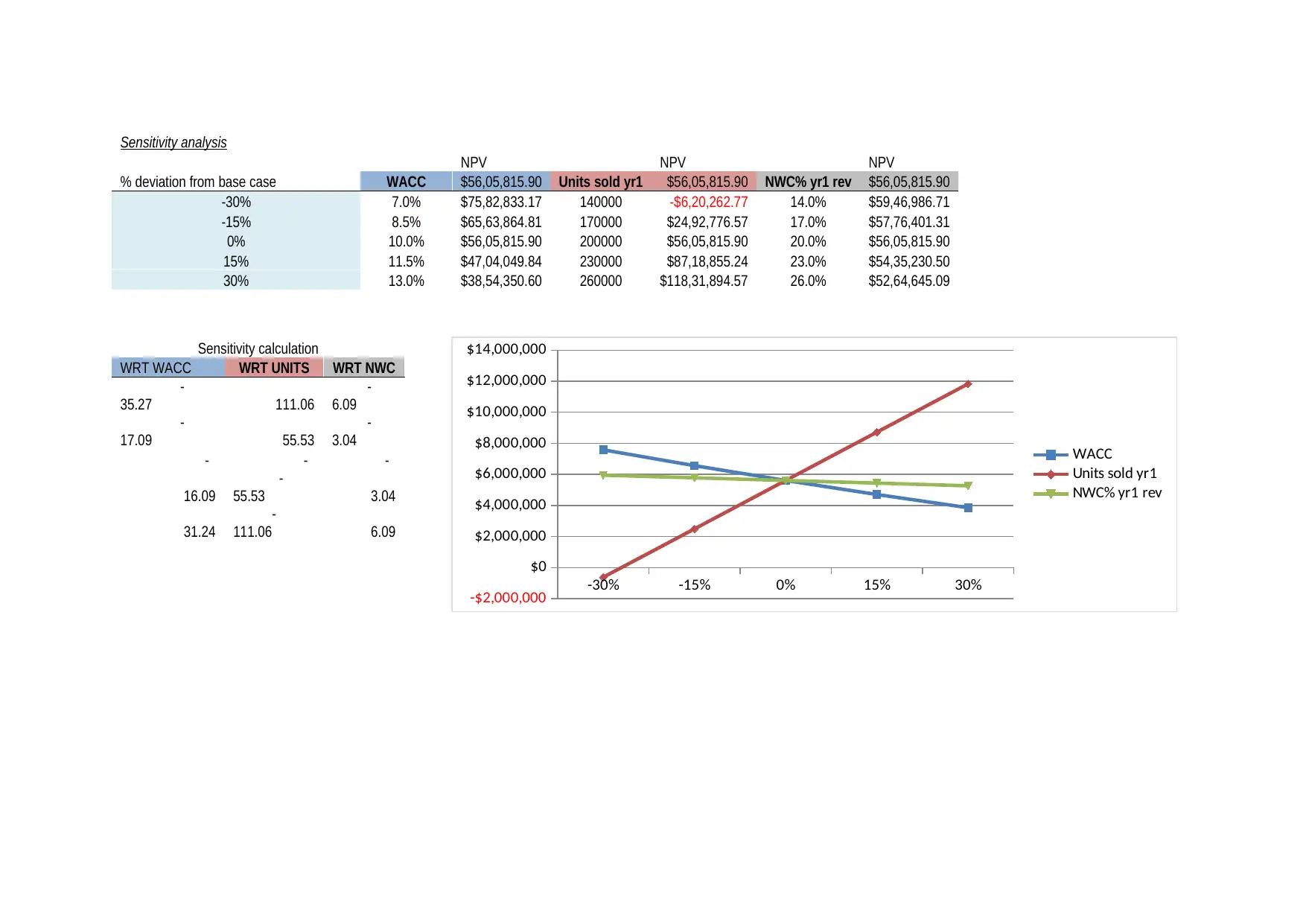

Sensitivity Analysis:

Sensitivity analysis is the part of capital budgeting technique that helps us incorporate the

factor of uncertainty in the results. (Seitz & Ellison, 2009) This system helps the investor

evaluate the effect on the outcomes of the proposal if changes in any input assumptions are

made. This will help us find out the sensitivity of the output with respect to the input.

Metric Conclusion

Discount rate From the graph below we can see that the outcomes of the project are lightly

sensitive to the discount rate. The discount rate used differs from project to

project and is based on the cost. There might be changes in the rate of return

based on the requirements of the investors.

Units sold The outcomes of the proposal are highly sensitive to the changes in units

sold. Even if there are little variances in the number of units sold then the

outcome of the project will be highly affected.

Networking

capital

The outcome of the project is least sensitive to changes in the working

capital requirements. This may be so because changes in working capital

will only affect the cash flows initially and not affect the cash flows for the

other years.

-20% -10% 0% 10% 20%

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

WACC

Units sold yr1

NWC% yr1 rev

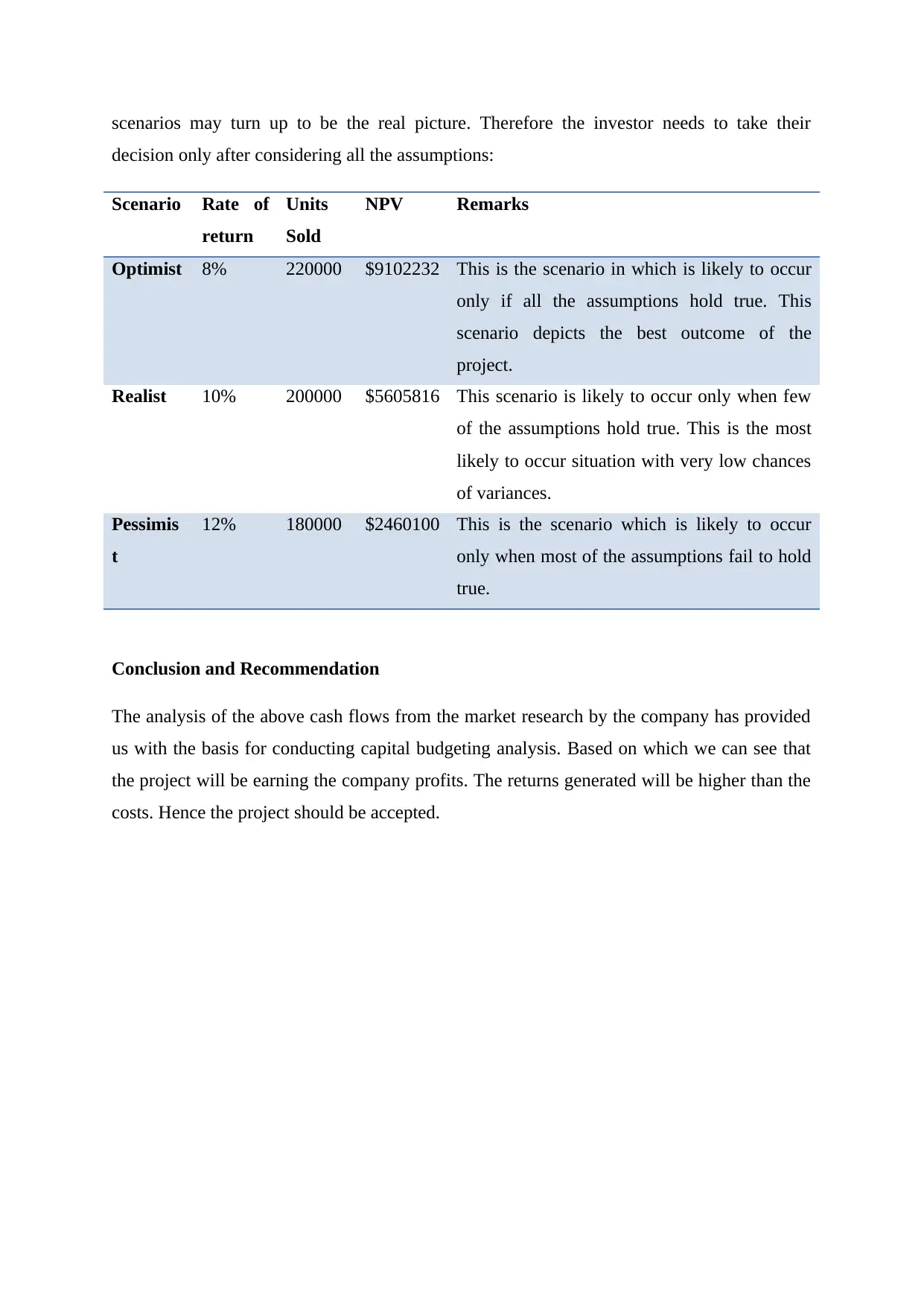

Scenario analysis

Scenario analysis is one of another capital budgeting tools that help us evaluate the big

picture with uncertainties in them (Shapiro, 2007). Scenario analysis helps the investor have

various views on the outcomes of the project based on various assumptions. Any of the

Sensitivity analysis is the part of capital budgeting technique that helps us incorporate the

factor of uncertainty in the results. (Seitz & Ellison, 2009) This system helps the investor

evaluate the effect on the outcomes of the proposal if changes in any input assumptions are

made. This will help us find out the sensitivity of the output with respect to the input.

Metric Conclusion

Discount rate From the graph below we can see that the outcomes of the project are lightly

sensitive to the discount rate. The discount rate used differs from project to

project and is based on the cost. There might be changes in the rate of return

based on the requirements of the investors.

Units sold The outcomes of the proposal are highly sensitive to the changes in units

sold. Even if there are little variances in the number of units sold then the

outcome of the project will be highly affected.

Networking

capital

The outcome of the project is least sensitive to changes in the working

capital requirements. This may be so because changes in working capital

will only affect the cash flows initially and not affect the cash flows for the

other years.

-20% -10% 0% 10% 20%

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

WACC

Units sold yr1

NWC% yr1 rev

Scenario analysis

Scenario analysis is one of another capital budgeting tools that help us evaluate the big

picture with uncertainties in them (Shapiro, 2007). Scenario analysis helps the investor have

various views on the outcomes of the project based on various assumptions. Any of the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

scenarios may turn up to be the real picture. Therefore the investor needs to take their

decision only after considering all the assumptions:

Scenario Rate of

return

Units

Sold

NPV Remarks

Optimist 8% 220000 $9102232 This is the scenario in which is likely to occur

only if all the assumptions hold true. This

scenario depicts the best outcome of the

project.

Realist 10% 200000 $5605816 This scenario is likely to occur only when few

of the assumptions hold true. This is the most

likely to occur situation with very low chances

of variances.

Pessimis

t

12% 180000 $2460100 This is the scenario which is likely to occur

only when most of the assumptions fail to hold

true.

Conclusion and Recommendation

The analysis of the above cash flows from the market research by the company has provided

us with the basis for conducting capital budgeting analysis. Based on which we can see that

the project will be earning the company profits. The returns generated will be higher than the

costs. Hence the project should be accepted.

decision only after considering all the assumptions:

Scenario Rate of

return

Units

Sold

NPV Remarks

Optimist 8% 220000 $9102232 This is the scenario in which is likely to occur

only if all the assumptions hold true. This

scenario depicts the best outcome of the

project.

Realist 10% 200000 $5605816 This scenario is likely to occur only when few

of the assumptions hold true. This is the most

likely to occur situation with very low chances

of variances.

Pessimis

t

12% 180000 $2460100 This is the scenario which is likely to occur

only when most of the assumptions fail to hold

true.

Conclusion and Recommendation

The analysis of the above cash flows from the market research by the company has provided

us with the basis for conducting capital budgeting analysis. Based on which we can see that

the project will be earning the company profits. The returns generated will be higher than the

costs. Hence the project should be accepted.

Bibliography

Adelaja, T. (2015). Capital Budgeting: Investment Appraisal Techniques Under Certainty.

Chicago: CreateSpace Independent Publishing Platform.

Bierman, H., & Smidt, S. (2010). The Capital Budgeting Decision. Boston: Routledge.

Dayananda, D., Irons, R., Harrison, S., Herbohn, J., & Rowland, P. (2008). Capital

Budgeting: Financial Appraisal of Investment Projects. Cambridge: Cambridge University

Press.

Peterson, P. P., & Fabozzi, F. J. (2012). Capital Budgeting. New York, NY: Wiley.

Piper, M. (2015). Accounting made simple. United States: CreateSpace Pub.

Rivenbark, W. C., Vogt, J., & Marlowe, J. (2009). Capital Budgeting and Finance: A Guide

for Local Governments. Washington, D.C.: ICMA Press.

Seitz, N., & Ellison, M. (2009). Capital Budgeting and Long-Term Financing Decisions.

New York: Thomson Learning.

Shapiro, A. C. (2007). Capital Budgeting and Investment Analysis. New Jersey: Wiley.

Adelaja, T. (2015). Capital Budgeting: Investment Appraisal Techniques Under Certainty.

Chicago: CreateSpace Independent Publishing Platform.

Bierman, H., & Smidt, S. (2010). The Capital Budgeting Decision. Boston: Routledge.

Dayananda, D., Irons, R., Harrison, S., Herbohn, J., & Rowland, P. (2008). Capital

Budgeting: Financial Appraisal of Investment Projects. Cambridge: Cambridge University

Press.

Peterson, P. P., & Fabozzi, F. J. (2012). Capital Budgeting. New York, NY: Wiley.

Piper, M. (2015). Accounting made simple. United States: CreateSpace Pub.

Rivenbark, W. C., Vogt, J., & Marlowe, J. (2009). Capital Budgeting and Finance: A Guide

for Local Governments. Washington, D.C.: ICMA Press.

Seitz, N., & Ellison, M. (2009). Capital Budgeting and Long-Term Financing Decisions.

New York: Thomson Learning.

Shapiro, A. C. (2007). Capital Budgeting and Investment Analysis. New Jersey: Wiley.

Appendix:

Base Case Analysis:

income tax rate 30%

Discount rate 10%

NWC % of year 1 revenue 20%

inflation 3%

Sales data 0 1 2 3 4 5

Sales price per unit $75.00 $77.25 $79.57 $81.95 $84.41

Unit sales 2,00,000 3,00,000 4,50,000 2,25,000 1,12,500

Cost data (excluding depreciation) 0 1 2 3 4 5

Cost per unit $45.00 $46.35 $47.74 $49.17 $50.65

Net income 0 1 2 3 4 5

Revenues $150,00,000 $231,75,000 $358,05,375 $184,39,768 $94,96,481

– Costs $90,00,000 $139,05,000 $214,83,225 $110,63,861 $56,97,888

– Selling, general and administrative

costs $10,00,000 $10,50,000 $11,02,500 $11,57,625 $12,15,506

– Opportunity cost- rent lost $2,50,000 $2,50,000 $2,50,000 $2,50,000 $2,50,000

– Depreciation expense $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

taxable income $17,50,000 $49,70,000 $99,69,650 $29,68,282 -$6,66,914

– Taxes $5,25,000 $14,91,000 $29,90,895 $8,90,485 -$2,00,074

After-Tax income $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Annual Net Cash Flow estimates 0 1 2 3 4 5

Investment in fixed assets -$150,00,000 $15,000

CF due to change in net working capital -$30,00,000 $30,00,000

Net income $0 $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Add back Depreciation $0 $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Net cash Flows -$180,00,000 $42,25,000 $64,79,000 $99,78,755 $50,77,798 $55,48,160

Base Case Analysis:

income tax rate 30%

Discount rate 10%

NWC % of year 1 revenue 20%

inflation 3%

Sales data 0 1 2 3 4 5

Sales price per unit $75.00 $77.25 $79.57 $81.95 $84.41

Unit sales 2,00,000 3,00,000 4,50,000 2,25,000 1,12,500

Cost data (excluding depreciation) 0 1 2 3 4 5

Cost per unit $45.00 $46.35 $47.74 $49.17 $50.65

Net income 0 1 2 3 4 5

Revenues $150,00,000 $231,75,000 $358,05,375 $184,39,768 $94,96,481

– Costs $90,00,000 $139,05,000 $214,83,225 $110,63,861 $56,97,888

– Selling, general and administrative

costs $10,00,000 $10,50,000 $11,02,500 $11,57,625 $12,15,506

– Opportunity cost- rent lost $2,50,000 $2,50,000 $2,50,000 $2,50,000 $2,50,000

– Depreciation expense $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

taxable income $17,50,000 $49,70,000 $99,69,650 $29,68,282 -$6,66,914

– Taxes $5,25,000 $14,91,000 $29,90,895 $8,90,485 -$2,00,074

After-Tax income $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Annual Net Cash Flow estimates 0 1 2 3 4 5

Investment in fixed assets -$150,00,000 $15,000

CF due to change in net working capital -$30,00,000 $30,00,000

Net income $0 $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Add back Depreciation $0 $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Net cash Flows -$180,00,000 $42,25,000 $64,79,000 $99,78,755 $50,77,798 $55,48,160

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

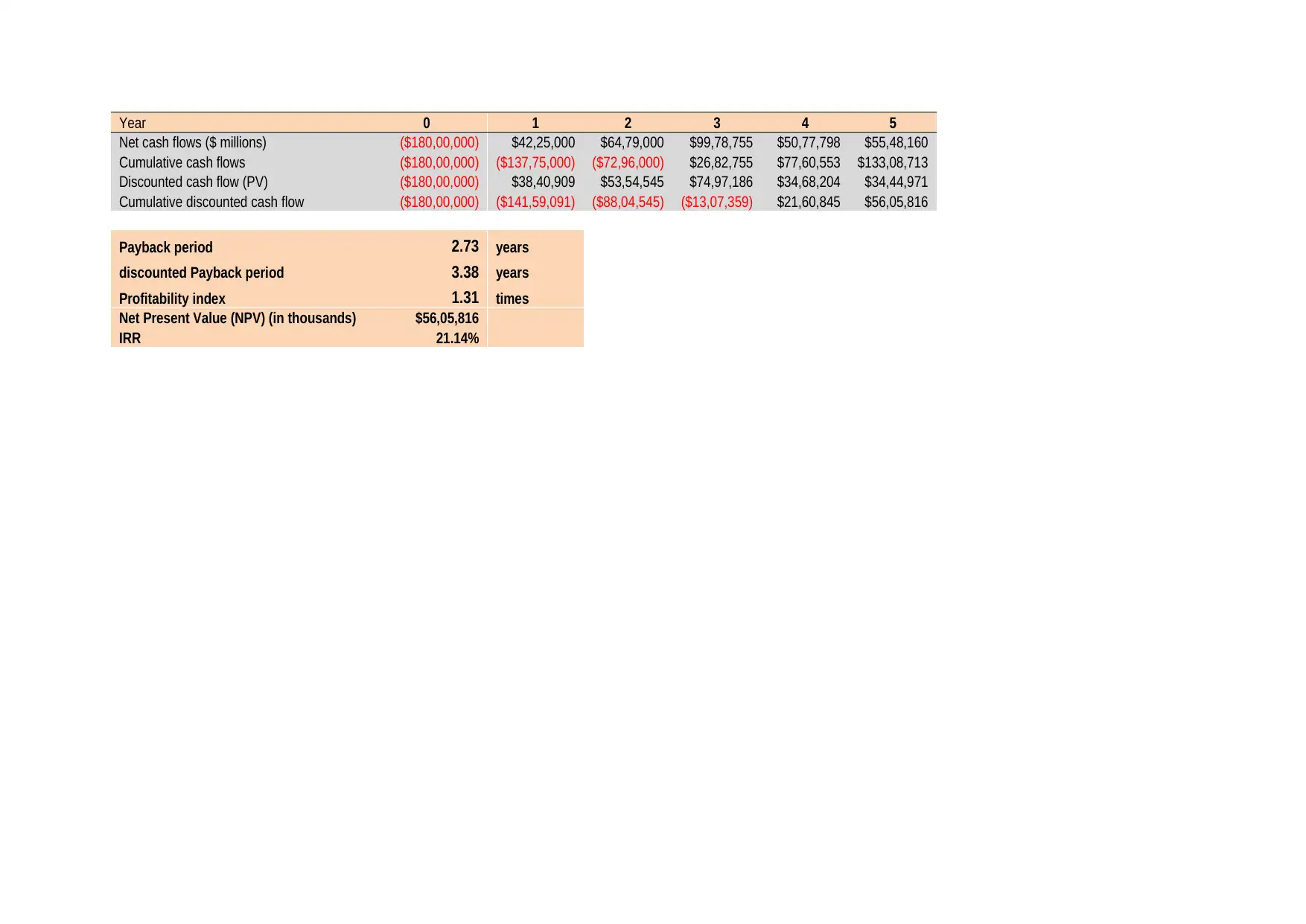

Year 0 1 2 3 4 5

Net cash flows ($ millions) ($180,00,000) $42,25,000 $64,79,000 $99,78,755 $50,77,798 $55,48,160

Cumulative cash flows ($180,00,000) ($137,75,000) ($72,96,000) $26,82,755 $77,60,553 $133,08,713

Discounted cash flow (PV) ($180,00,000) $38,40,909 $53,54,545 $74,97,186 $34,68,204 $34,44,971

Cumulative discounted cash flow ($180,00,000) ($141,59,091) ($88,04,545) ($13,07,359) $21,60,845 $56,05,816

Payback period 2.73 years

discounted Payback period 3.38 years

Profitability index 1.31 times

Net Present Value (NPV) (in thousands) $56,05,816

IRR 21.14%

Net cash flows ($ millions) ($180,00,000) $42,25,000 $64,79,000 $99,78,755 $50,77,798 $55,48,160

Cumulative cash flows ($180,00,000) ($137,75,000) ($72,96,000) $26,82,755 $77,60,553 $133,08,713

Discounted cash flow (PV) ($180,00,000) $38,40,909 $53,54,545 $74,97,186 $34,68,204 $34,44,971

Cumulative discounted cash flow ($180,00,000) ($141,59,091) ($88,04,545) ($13,07,359) $21,60,845 $56,05,816

Payback period 2.73 years

discounted Payback period 3.38 years

Profitability index 1.31 times

Net Present Value (NPV) (in thousands) $56,05,816

IRR 21.14%

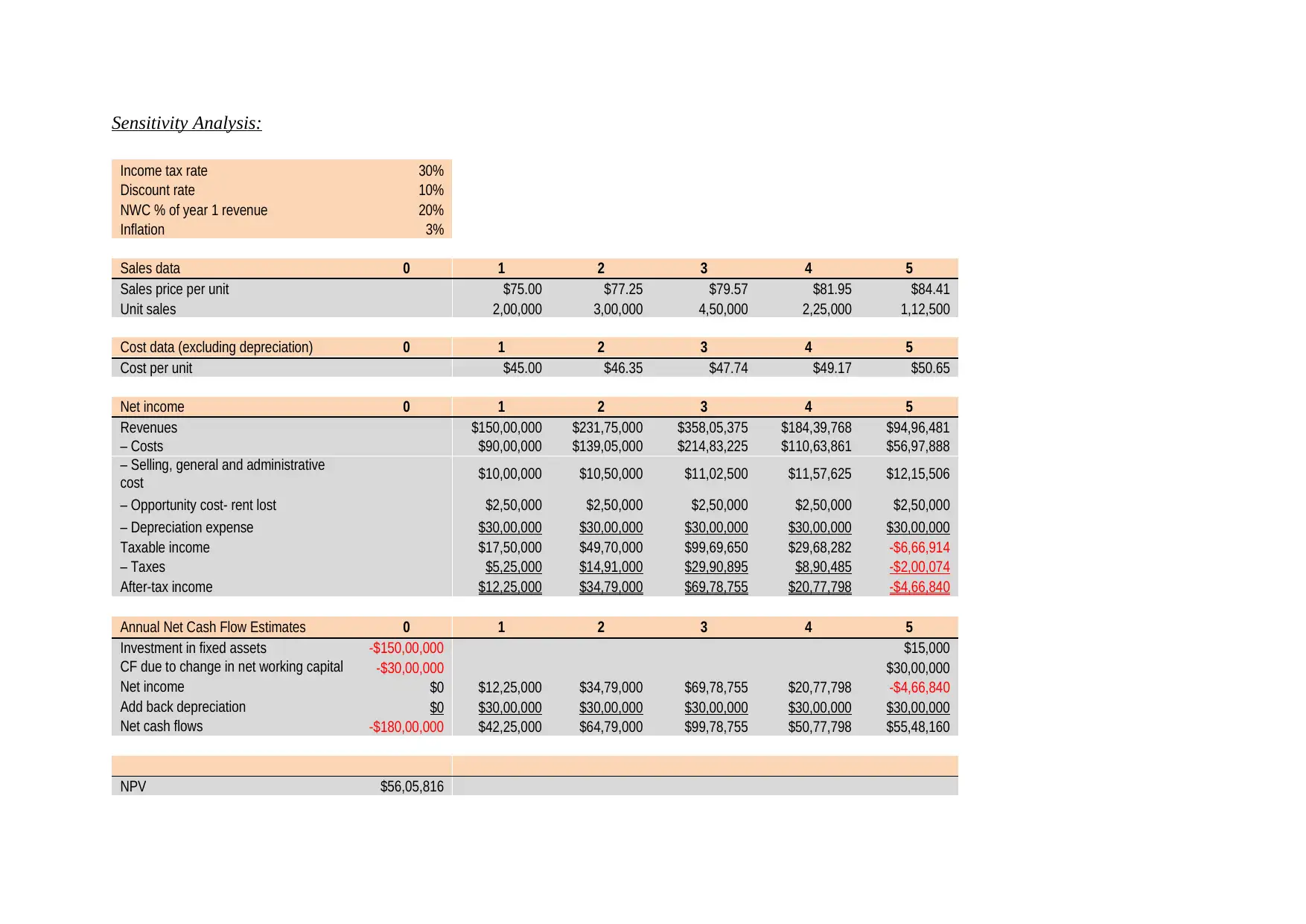

Sensitivity Analysis:

Income tax rate 30%

Discount rate 10%

NWC % of year 1 revenue 20%

Inflation 3%

Sales data 0 1 2 3 4 5

Sales price per unit $75.00 $77.25 $79.57 $81.95 $84.41

Unit sales 2,00,000 3,00,000 4,50,000 2,25,000 1,12,500

Cost data (excluding depreciation) 0 1 2 3 4 5

Cost per unit $45.00 $46.35 $47.74 $49.17 $50.65

Net income 0 1 2 3 4 5

Revenues $150,00,000 $231,75,000 $358,05,375 $184,39,768 $94,96,481

– Costs $90,00,000 $139,05,000 $214,83,225 $110,63,861 $56,97,888

– Selling, general and administrative

cost $10,00,000 $10,50,000 $11,02,500 $11,57,625 $12,15,506

– Opportunity cost- rent lost $2,50,000 $2,50,000 $2,50,000 $2,50,000 $2,50,000

– Depreciation expense $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Taxable income $17,50,000 $49,70,000 $99,69,650 $29,68,282 -$6,66,914

– Taxes $5,25,000 $14,91,000 $29,90,895 $8,90,485 -$2,00,074

After-tax income $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Annual Net Cash Flow Estimates 0 1 2 3 4 5

Investment in fixed assets -$150,00,000 $15,000

CF due to change in net working capital -$30,00,000 $30,00,000

Net income $0 $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Add back depreciation $0 $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Net cash flows -$180,00,000 $42,25,000 $64,79,000 $99,78,755 $50,77,798 $55,48,160

NPV $56,05,816

Income tax rate 30%

Discount rate 10%

NWC % of year 1 revenue 20%

Inflation 3%

Sales data 0 1 2 3 4 5

Sales price per unit $75.00 $77.25 $79.57 $81.95 $84.41

Unit sales 2,00,000 3,00,000 4,50,000 2,25,000 1,12,500

Cost data (excluding depreciation) 0 1 2 3 4 5

Cost per unit $45.00 $46.35 $47.74 $49.17 $50.65

Net income 0 1 2 3 4 5

Revenues $150,00,000 $231,75,000 $358,05,375 $184,39,768 $94,96,481

– Costs $90,00,000 $139,05,000 $214,83,225 $110,63,861 $56,97,888

– Selling, general and administrative

cost $10,00,000 $10,50,000 $11,02,500 $11,57,625 $12,15,506

– Opportunity cost- rent lost $2,50,000 $2,50,000 $2,50,000 $2,50,000 $2,50,000

– Depreciation expense $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Taxable income $17,50,000 $49,70,000 $99,69,650 $29,68,282 -$6,66,914

– Taxes $5,25,000 $14,91,000 $29,90,895 $8,90,485 -$2,00,074

After-tax income $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Annual Net Cash Flow Estimates 0 1 2 3 4 5

Investment in fixed assets -$150,00,000 $15,000

CF due to change in net working capital -$30,00,000 $30,00,000

Net income $0 $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Add back depreciation $0 $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Net cash flows -$180,00,000 $42,25,000 $64,79,000 $99,78,755 $50,77,798 $55,48,160

NPV $56,05,816

Sensitivity analysis

NPV NPV NPV

% deviation from base case WACC $56,05,815.90 Units sold yr1 $56,05,815.90 NWC% yr1 rev $56,05,815.90

-30% 7.0% $75,82,833.17 140000 -$6,20,262.77 14.0% $59,46,986.71

-15% 8.5% $65,63,864.81 170000 $24,92,776.57 17.0% $57,76,401.31

0% 10.0% $56,05,815.90 200000 $56,05,815.90 20.0% $56,05,815.90

15% 11.5% $47,04,049.84 230000 $87,18,855.24 23.0% $54,35,230.50

30% 13.0% $38,54,350.60 260000 $118,31,894.57 26.0% $52,64,645.09

Sensitivity calculation

WRT WACC WRT UNITS WRT NWC

-

35.27 111.06

-

6.09

-

17.09 55.53

-

3.04

- - -

16.09

-

55.53 3.04

31.24

-

111.06 6.09

-30% -15% 0% 15% 30%

-$2,000,000

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

WACC

Units sold yr1

NWC% yr1 rev

NPV NPV NPV

% deviation from base case WACC $56,05,815.90 Units sold yr1 $56,05,815.90 NWC% yr1 rev $56,05,815.90

-30% 7.0% $75,82,833.17 140000 -$6,20,262.77 14.0% $59,46,986.71

-15% 8.5% $65,63,864.81 170000 $24,92,776.57 17.0% $57,76,401.31

0% 10.0% $56,05,815.90 200000 $56,05,815.90 20.0% $56,05,815.90

15% 11.5% $47,04,049.84 230000 $87,18,855.24 23.0% $54,35,230.50

30% 13.0% $38,54,350.60 260000 $118,31,894.57 26.0% $52,64,645.09

Sensitivity calculation

WRT WACC WRT UNITS WRT NWC

-

35.27 111.06

-

6.09

-

17.09 55.53

-

3.04

- - -

16.09

-

55.53 3.04

31.24

-

111.06 6.09

-30% -15% 0% 15% 30%

-$2,000,000

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

WACC

Units sold yr1

NWC% yr1 rev

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

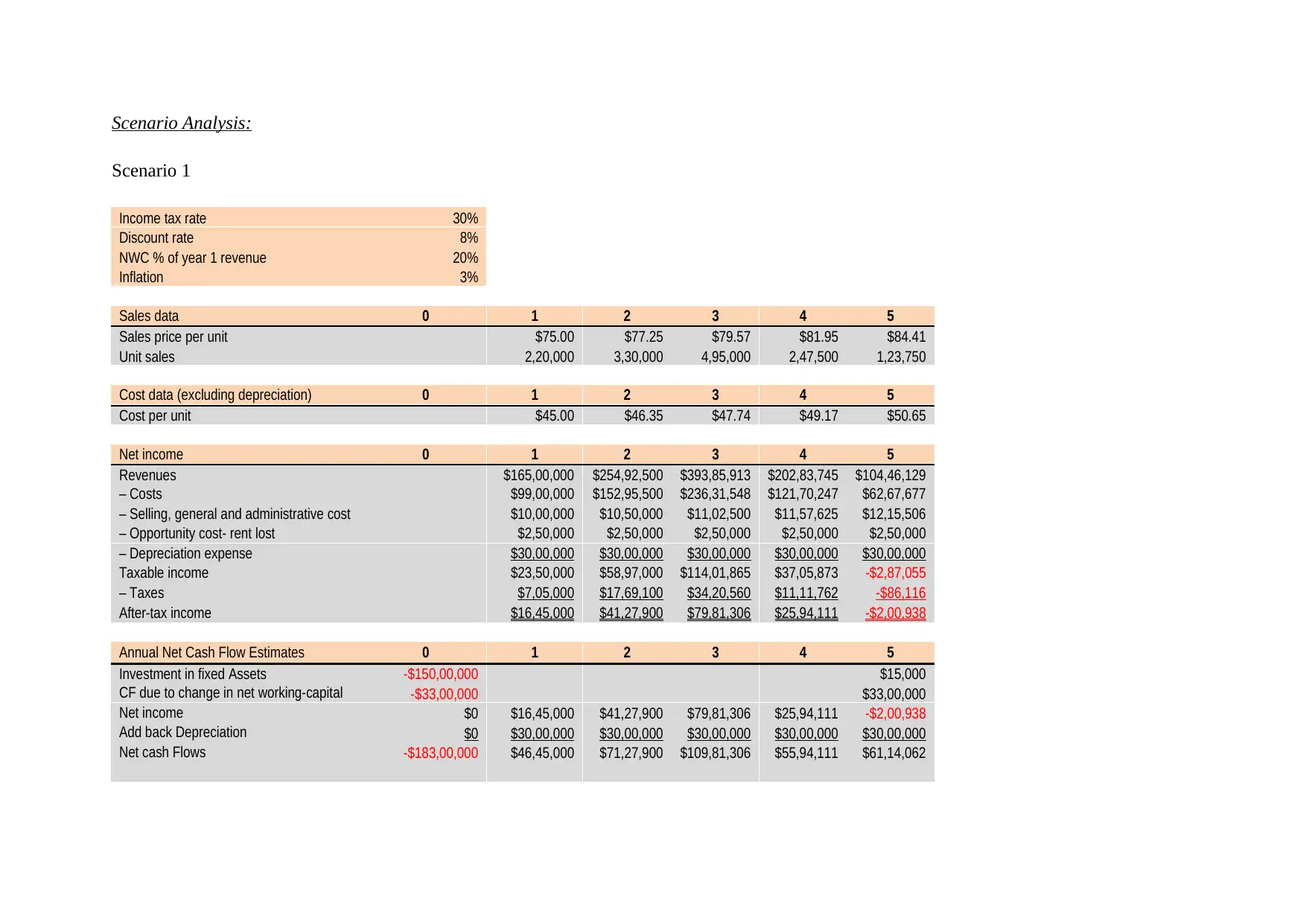

Scenario Analysis:

Scenario 1

Income tax rate 30%

Discount rate 8%

NWC % of year 1 revenue 20%

Inflation 3%

Sales data 0 1 2 3 4 5

Sales price per unit $75.00 $77.25 $79.57 $81.95 $84.41

Unit sales 2,20,000 3,30,000 4,95,000 2,47,500 1,23,750

Cost data (excluding depreciation) 0 1 2 3 4 5

Cost per unit $45.00 $46.35 $47.74 $49.17 $50.65

Net income 0 1 2 3 4 5

Revenues $165,00,000 $254,92,500 $393,85,913 $202,83,745 $104,46,129

– Costs $99,00,000 $152,95,500 $236,31,548 $121,70,247 $62,67,677

– Selling, general and administrative cost $10,00,000 $10,50,000 $11,02,500 $11,57,625 $12,15,506

– Opportunity cost- rent lost $2,50,000 $2,50,000 $2,50,000 $2,50,000 $2,50,000

– Depreciation expense $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Taxable income $23,50,000 $58,97,000 $114,01,865 $37,05,873 -$2,87,055

– Taxes $7,05,000 $17,69,100 $34,20,560 $11,11,762 -$86,116

After-tax income $16,45,000 $41,27,900 $79,81,306 $25,94,111 -$2,00,938

Annual Net Cash Flow Estimates 0 1 2 3 4 5

Investment in fixed Assets -$150,00,000 $15,000

CF due to change in net working-capital -$33,00,000 $33,00,000

Net income $0 $16,45,000 $41,27,900 $79,81,306 $25,94,111 -$2,00,938

Add back Depreciation $0 $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Net cash Flows -$183,00,000 $46,45,000 $71,27,900 $109,81,306 $55,94,111 $61,14,062

Scenario 1

Income tax rate 30%

Discount rate 8%

NWC % of year 1 revenue 20%

Inflation 3%

Sales data 0 1 2 3 4 5

Sales price per unit $75.00 $77.25 $79.57 $81.95 $84.41

Unit sales 2,20,000 3,30,000 4,95,000 2,47,500 1,23,750

Cost data (excluding depreciation) 0 1 2 3 4 5

Cost per unit $45.00 $46.35 $47.74 $49.17 $50.65

Net income 0 1 2 3 4 5

Revenues $165,00,000 $254,92,500 $393,85,913 $202,83,745 $104,46,129

– Costs $99,00,000 $152,95,500 $236,31,548 $121,70,247 $62,67,677

– Selling, general and administrative cost $10,00,000 $10,50,000 $11,02,500 $11,57,625 $12,15,506

– Opportunity cost- rent lost $2,50,000 $2,50,000 $2,50,000 $2,50,000 $2,50,000

– Depreciation expense $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Taxable income $23,50,000 $58,97,000 $114,01,865 $37,05,873 -$2,87,055

– Taxes $7,05,000 $17,69,100 $34,20,560 $11,11,762 -$86,116

After-tax income $16,45,000 $41,27,900 $79,81,306 $25,94,111 -$2,00,938

Annual Net Cash Flow Estimates 0 1 2 3 4 5

Investment in fixed Assets -$150,00,000 $15,000

CF due to change in net working-capital -$33,00,000 $33,00,000

Net income $0 $16,45,000 $41,27,900 $79,81,306 $25,94,111 -$2,00,938

Add back Depreciation $0 $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Net cash Flows -$183,00,000 $46,45,000 $71,27,900 $109,81,306 $55,94,111 $61,14,062

Year 0 1 2 3 4 5

Net Cash Flows ($ millions) ($183,00,000) $46,45,000 $71,27,900 $109,81,306 $55,94,111 $61,14,062

Cumulative Cash Flows ($183,00,000) ($136,55,000) ($65,27,100) $44,54,206 $100,48,317 $161,62,378

Discounted cash flow (PV) ($183,00,000) $43,00,926 $61,11,025 $87,17,314 $41,11,839 $41,61,128

Cumulative discounted Cash flow ($183,00,000) ($139,99,074) ($78,88,049) $8,29,266 $49,41,104 $91,02,232

Payback period 2.59 years

Discounted Payback period 2.80 years

Profitability Index 1.50 times

Net Present Value (NPV) (in

thousands) $91,02,232

IRR 24.73%

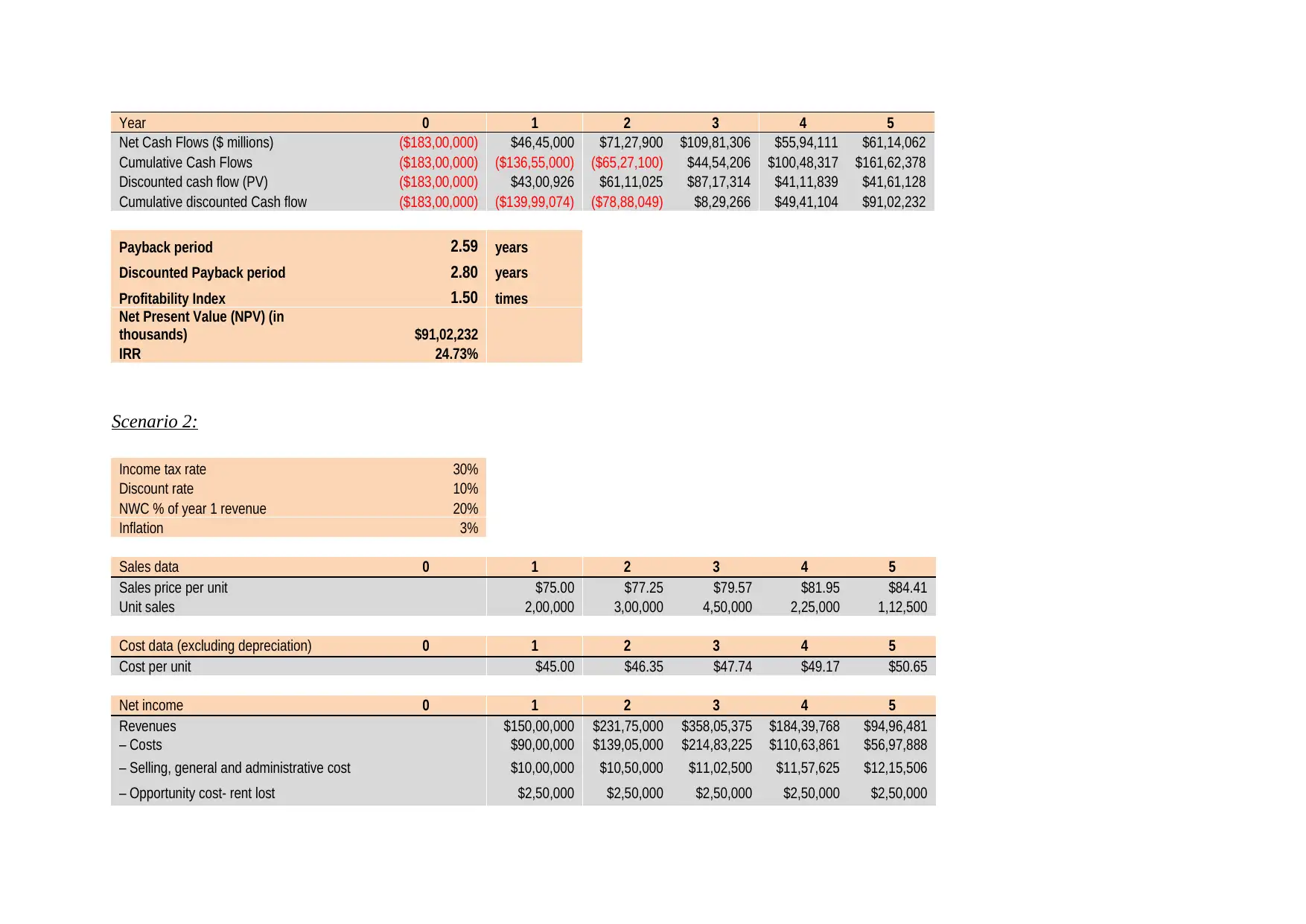

Scenario 2:

Income tax rate 30%

Discount rate 10%

NWC % of year 1 revenue 20%

Inflation 3%

Sales data 0 1 2 3 4 5

Sales price per unit $75.00 $77.25 $79.57 $81.95 $84.41

Unit sales 2,00,000 3,00,000 4,50,000 2,25,000 1,12,500

Cost data (excluding depreciation) 0 1 2 3 4 5

Cost per unit $45.00 $46.35 $47.74 $49.17 $50.65

Net income 0 1 2 3 4 5

Revenues $150,00,000 $231,75,000 $358,05,375 $184,39,768 $94,96,481

– Costs $90,00,000 $139,05,000 $214,83,225 $110,63,861 $56,97,888

– Selling, general and administrative cost $10,00,000 $10,50,000 $11,02,500 $11,57,625 $12,15,506

– Opportunity cost- rent lost $2,50,000 $2,50,000 $2,50,000 $2,50,000 $2,50,000

Net Cash Flows ($ millions) ($183,00,000) $46,45,000 $71,27,900 $109,81,306 $55,94,111 $61,14,062

Cumulative Cash Flows ($183,00,000) ($136,55,000) ($65,27,100) $44,54,206 $100,48,317 $161,62,378

Discounted cash flow (PV) ($183,00,000) $43,00,926 $61,11,025 $87,17,314 $41,11,839 $41,61,128

Cumulative discounted Cash flow ($183,00,000) ($139,99,074) ($78,88,049) $8,29,266 $49,41,104 $91,02,232

Payback period 2.59 years

Discounted Payback period 2.80 years

Profitability Index 1.50 times

Net Present Value (NPV) (in

thousands) $91,02,232

IRR 24.73%

Scenario 2:

Income tax rate 30%

Discount rate 10%

NWC % of year 1 revenue 20%

Inflation 3%

Sales data 0 1 2 3 4 5

Sales price per unit $75.00 $77.25 $79.57 $81.95 $84.41

Unit sales 2,00,000 3,00,000 4,50,000 2,25,000 1,12,500

Cost data (excluding depreciation) 0 1 2 3 4 5

Cost per unit $45.00 $46.35 $47.74 $49.17 $50.65

Net income 0 1 2 3 4 5

Revenues $150,00,000 $231,75,000 $358,05,375 $184,39,768 $94,96,481

– Costs $90,00,000 $139,05,000 $214,83,225 $110,63,861 $56,97,888

– Selling, general and administrative cost $10,00,000 $10,50,000 $11,02,500 $11,57,625 $12,15,506

– Opportunity cost- rent lost $2,50,000 $2,50,000 $2,50,000 $2,50,000 $2,50,000

– Depreciation expense $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Taxable income $17,50,000 $49,70,000 $99,69,650 $29,68,282 -$6,66,914

– Taxes $5,25,000 $14,91,000 $29,90,895 $8,90,485 -$2,00,074

After-tax income $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Annual Net Cash Flow Estimates 0 1 2 3 4 5

Investment in fixed Assets -$150,00,000 $15,000

CF due to change in net working capital -$30,00,000 $30,00,000

Net income $0 $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Add back Depreciation $0 $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Net cash flows -$180,00,000 $42,25,000 $64,79,000 $99,78,755 $50,77,798 $55,48,160

Year 0 1 2 3 4 5

Net cash flows ($ millions) ($180,00,000) $42,25,000 $64,79,000 $99,78,755 $50,77,798 $55,48,160

Cumulative cash flows ($180,00,000) ($137,75,000) ($72,96,000) $26,82,755 $77,60,553 $133,08,713

Discounted cash flow (PV) ($180,00,000) $38,40,909 $53,54,545 $74,97,186 $34,68,204 $34,44,971

Cumulative discounted cash flow ($180,00,000) ($141,59,091) ($88,04,545) ($13,07,359) $21,60,845 $56,05,816

Payback period 2.73 years

Discounted payback period 3.38 years

Profitability index 1.31 times

Net Present Value (NPV) (in thousands) $56,05,816

IRR 21.14%

Taxable income $17,50,000 $49,70,000 $99,69,650 $29,68,282 -$6,66,914

– Taxes $5,25,000 $14,91,000 $29,90,895 $8,90,485 -$2,00,074

After-tax income $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Annual Net Cash Flow Estimates 0 1 2 3 4 5

Investment in fixed Assets -$150,00,000 $15,000

CF due to change in net working capital -$30,00,000 $30,00,000

Net income $0 $12,25,000 $34,79,000 $69,78,755 $20,77,798 -$4,66,840

Add back Depreciation $0 $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Net cash flows -$180,00,000 $42,25,000 $64,79,000 $99,78,755 $50,77,798 $55,48,160

Year 0 1 2 3 4 5

Net cash flows ($ millions) ($180,00,000) $42,25,000 $64,79,000 $99,78,755 $50,77,798 $55,48,160

Cumulative cash flows ($180,00,000) ($137,75,000) ($72,96,000) $26,82,755 $77,60,553 $133,08,713

Discounted cash flow (PV) ($180,00,000) $38,40,909 $53,54,545 $74,97,186 $34,68,204 $34,44,971

Cumulative discounted cash flow ($180,00,000) ($141,59,091) ($88,04,545) ($13,07,359) $21,60,845 $56,05,816

Payback period 2.73 years

Discounted payback period 3.38 years

Profitability index 1.31 times

Net Present Value (NPV) (in thousands) $56,05,816

IRR 21.14%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

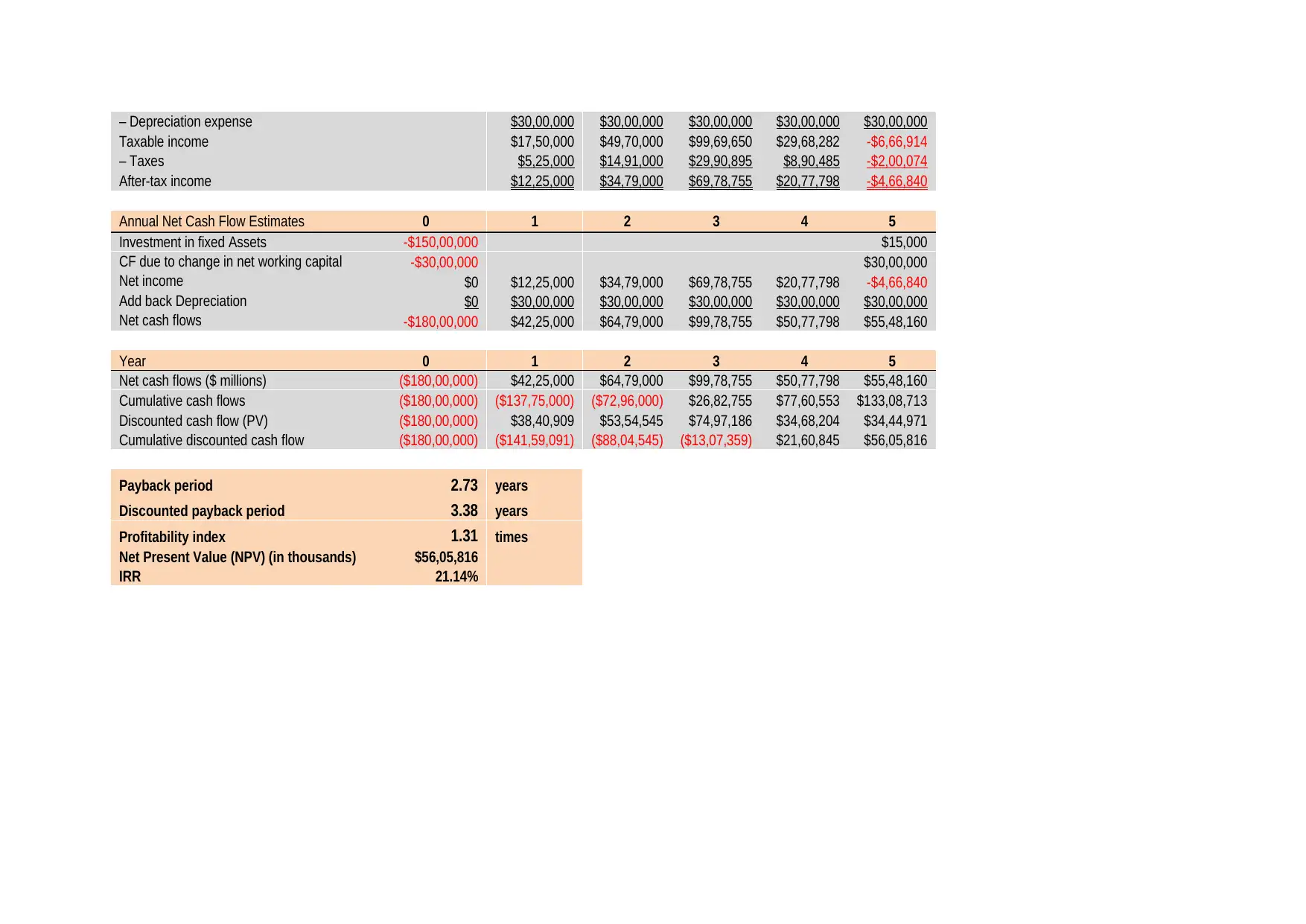

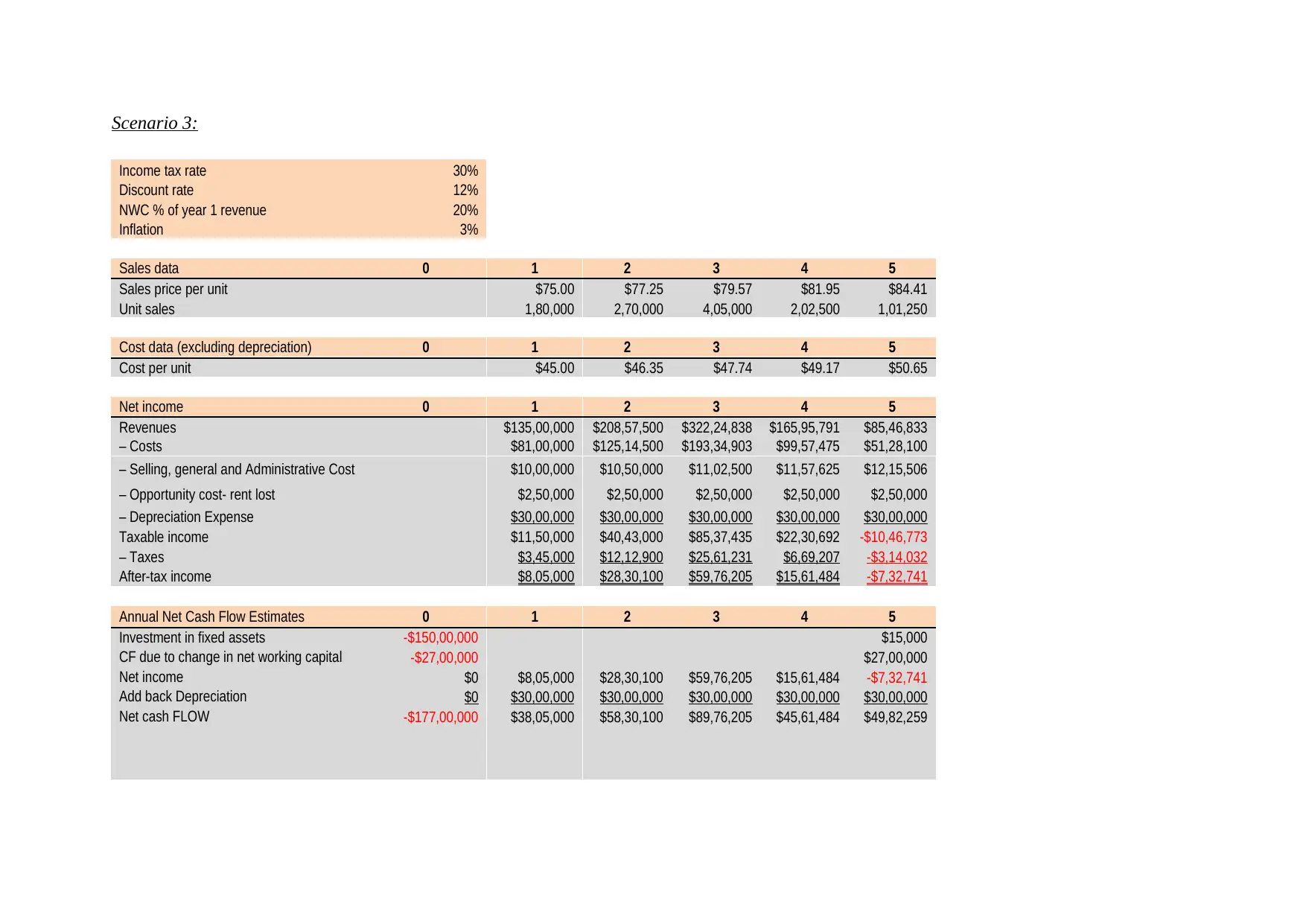

Scenario 3:

Income tax rate 30%

Discount rate 12%

NWC % of year 1 revenue 20%

Inflation 3%

Sales data 0 1 2 3 4 5

Sales price per unit $75.00 $77.25 $79.57 $81.95 $84.41

Unit sales 1,80,000 2,70,000 4,05,000 2,02,500 1,01,250

Cost data (excluding depreciation) 0 1 2 3 4 5

Cost per unit $45.00 $46.35 $47.74 $49.17 $50.65

Net income 0 1 2 3 4 5

Revenues $135,00,000 $208,57,500 $322,24,838 $165,95,791 $85,46,833

– Costs $81,00,000 $125,14,500 $193,34,903 $99,57,475 $51,28,100

– Selling, general and Administrative Cost $10,00,000 $10,50,000 $11,02,500 $11,57,625 $12,15,506

– Opportunity cost- rent lost $2,50,000 $2,50,000 $2,50,000 $2,50,000 $2,50,000

– Depreciation Expense $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Taxable income $11,50,000 $40,43,000 $85,37,435 $22,30,692 -$10,46,773

– Taxes $3,45,000 $12,12,900 $25,61,231 $6,69,207 -$3,14,032

After-tax income $8,05,000 $28,30,100 $59,76,205 $15,61,484 -$7,32,741

Annual Net Cash Flow Estimates 0 1 2 3 4 5

Investment in fixed assets -$150,00,000 $15,000

CF due to change in net working capital -$27,00,000 $27,00,000

Net income $0 $8,05,000 $28,30,100 $59,76,205 $15,61,484 -$7,32,741

Add back Depreciation $0 $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Net cash FLOW -$177,00,000 $38,05,000 $58,30,100 $89,76,205 $45,61,484 $49,82,259

Income tax rate 30%

Discount rate 12%

NWC % of year 1 revenue 20%

Inflation 3%

Sales data 0 1 2 3 4 5

Sales price per unit $75.00 $77.25 $79.57 $81.95 $84.41

Unit sales 1,80,000 2,70,000 4,05,000 2,02,500 1,01,250

Cost data (excluding depreciation) 0 1 2 3 4 5

Cost per unit $45.00 $46.35 $47.74 $49.17 $50.65

Net income 0 1 2 3 4 5

Revenues $135,00,000 $208,57,500 $322,24,838 $165,95,791 $85,46,833

– Costs $81,00,000 $125,14,500 $193,34,903 $99,57,475 $51,28,100

– Selling, general and Administrative Cost $10,00,000 $10,50,000 $11,02,500 $11,57,625 $12,15,506

– Opportunity cost- rent lost $2,50,000 $2,50,000 $2,50,000 $2,50,000 $2,50,000

– Depreciation Expense $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Taxable income $11,50,000 $40,43,000 $85,37,435 $22,30,692 -$10,46,773

– Taxes $3,45,000 $12,12,900 $25,61,231 $6,69,207 -$3,14,032

After-tax income $8,05,000 $28,30,100 $59,76,205 $15,61,484 -$7,32,741

Annual Net Cash Flow Estimates 0 1 2 3 4 5

Investment in fixed assets -$150,00,000 $15,000

CF due to change in net working capital -$27,00,000 $27,00,000

Net income $0 $8,05,000 $28,30,100 $59,76,205 $15,61,484 -$7,32,741

Add back Depreciation $0 $30,00,000 $30,00,000 $30,00,000 $30,00,000 $30,00,000

Net cash FLOW -$177,00,000 $38,05,000 $58,30,100 $89,76,205 $45,61,484 $49,82,259

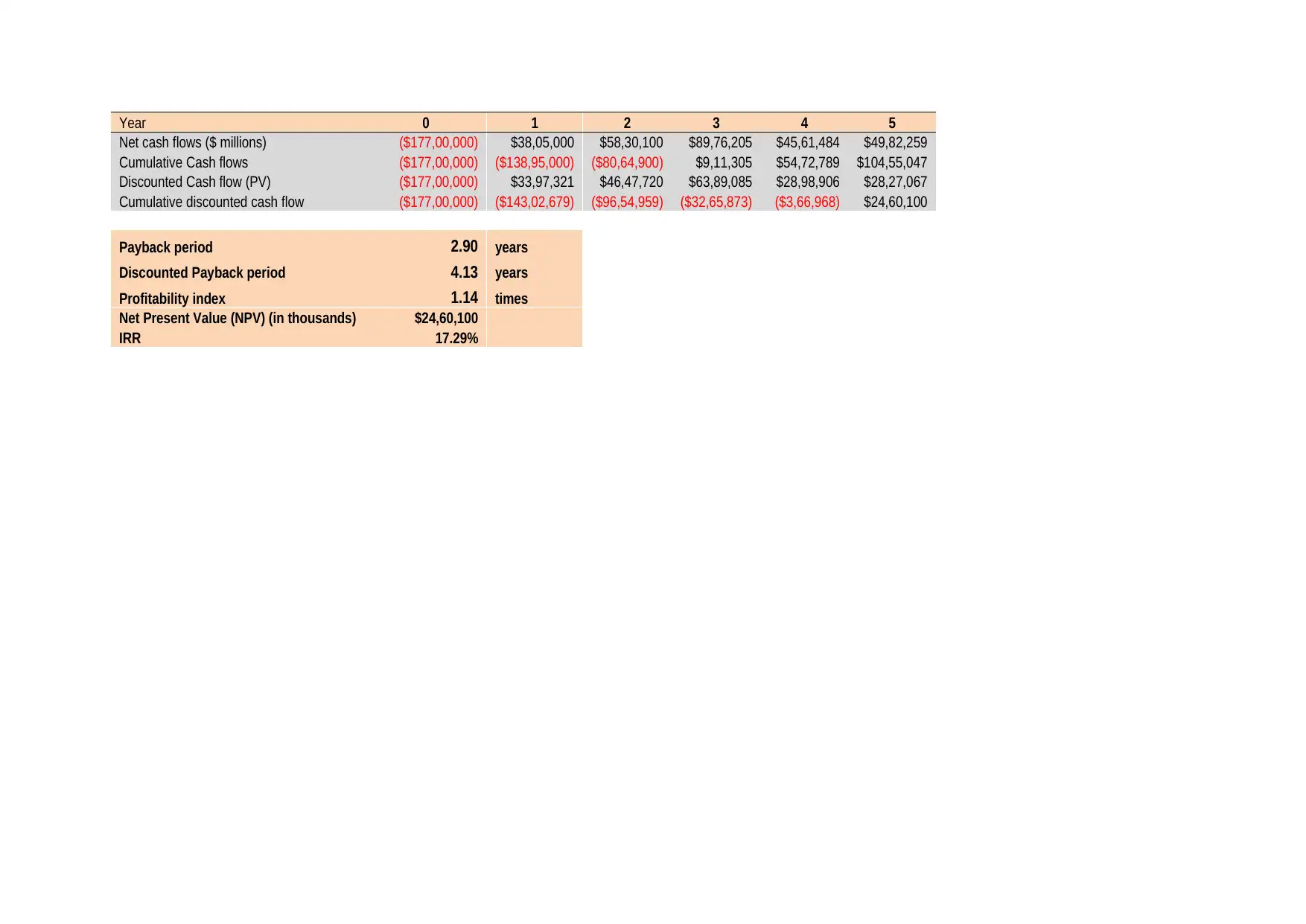

Year 0 1 2 3 4 5

Net cash flows ($ millions) ($177,00,000) $38,05,000 $58,30,100 $89,76,205 $45,61,484 $49,82,259

Cumulative Cash flows ($177,00,000) ($138,95,000) ($80,64,900) $9,11,305 $54,72,789 $104,55,047

Discounted Cash flow (PV) ($177,00,000) $33,97,321 $46,47,720 $63,89,085 $28,98,906 $28,27,067

Cumulative discounted cash flow ($177,00,000) ($143,02,679) ($96,54,959) ($32,65,873) ($3,66,968) $24,60,100

Payback period 2.90 years

Discounted Payback period 4.13 years

Profitability index 1.14 times

Net Present Value (NPV) (in thousands) $24,60,100

IRR 17.29%

Net cash flows ($ millions) ($177,00,000) $38,05,000 $58,30,100 $89,76,205 $45,61,484 $49,82,259

Cumulative Cash flows ($177,00,000) ($138,95,000) ($80,64,900) $9,11,305 $54,72,789 $104,55,047

Discounted Cash flow (PV) ($177,00,000) $33,97,321 $46,47,720 $63,89,085 $28,98,906 $28,27,067

Cumulative discounted cash flow ($177,00,000) ($143,02,679) ($96,54,959) ($32,65,873) ($3,66,968) $24,60,100

Payback period 2.90 years

Discounted Payback period 4.13 years

Profitability index 1.14 times

Net Present Value (NPV) (in thousands) $24,60,100

IRR 17.29%

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.