Planning for growth - Oak cash & carry Ltd Assignment

VerifiedAdded on 2021/01/02

|17

|4992

|417

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Planning for growth

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Key consideration for evaluating growth opportunities and justify these considerations.....1

P2 Opportunities for growth by applying Ansoffs growth vector matrix ..................................4

TASK 2............................................................................................................................................5

P3 Potential sources of funding available to businesses and discuss benefits and drawbacks...5

TASK 3............................................................................................................................................7

P4 Design business plan for growth that includes financial information and strategic

objectives.....................................................................................................................................7

TASK 4..........................................................................................................................................10

P5 Assess exit or succession options for a small business explaining the benefits and

drawbacks .................................................................................................................................10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Key consideration for evaluating growth opportunities and justify these considerations.....1

P2 Opportunities for growth by applying Ansoffs growth vector matrix ..................................4

TASK 2............................................................................................................................................5

P3 Potential sources of funding available to businesses and discuss benefits and drawbacks...5

TASK 3............................................................................................................................................7

P4 Design business plan for growth that includes financial information and strategic

objectives.....................................................................................................................................7

TASK 4..........................................................................................................................................10

P5 Assess exit or succession options for a small business explaining the benefits and

drawbacks .................................................................................................................................10

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

Planning is very necessary activities in every sector of business doing and also one most

prominent to growth and development of the company. In context of business growth, doing an

effective planning is very necessary to led its suitability for longer period of time. In a current

scenario of business operation, growth building is necessary and also the prominent stage for

doing business functioning (Keyser, 2016). In a current scenario, business expansion is comes

under the category of doing planning for growth and also business generation over longer period

of time.

This report will be carry on Oak cash & carry Ltd, which provides cash and carry service.

This company offers wide range of products in bulk for retailers, caterer, offices off licensees

and newspaper agents. This business firm is headquartered in United Kingdom. Apart from this,

report will be carry on key consideration for an evaluation of growth based opportunities along

with evaluation of an opportunities by application of the Ans-off matrix. Also, report will have

major discussion over finding potential sources, structuring of the business plan and assessing of

an exit or succession options for small businesses and related drawbacks.

Planning is very necessary activities in every sector of business doing and also one most

prominent to growth and development of the company. In context of business growth, doing an

effective planning is very necessary to led its suitability for longer period of time. In a current

scenario of business operation, growth building is necessary and also the prominent stage for

doing business functioning (Keyser, 2016). In a current scenario, business expansion is comes

under the category of doing planning for growth and also business generation over longer period

of time.

This report will be carry on Oak cash & carry Ltd, which provides cash and carry service.

This company offers wide range of products in bulk for retailers, caterer, offices off licensees

and newspaper agents. This business firm is headquartered in United Kingdom. Apart from this,

report will be carry on key consideration for an evaluation of growth based opportunities along

with evaluation of an opportunities by application of the Ans-off matrix. Also, report will have

major discussion over finding potential sources, structuring of the business plan and assessing of

an exit or succession options for small businesses and related drawbacks.

TASK 1

P1 Key consideration for evaluating growth opportunities and justify these considerations

Planning play a important role in achieving the goal of the organisation. In this analysing

the current operations and consider the factor where they can improve future. Growth of business

is about reaches to the highest level of expansion and consider point to generate profit.

Competitive advantage:

This is the position from which organisation helps in becoming more profitable than the

competitors. In this there is many different resources that is required to perform business

operations which seek to attain target (Mobin, 2016). Oak Cash & Carry has various factor that is

useful in the growth of business operations. For achieving competitive advantages , there are

some elements that are explain below:

Resources: This the tool which is tangible and core basic part of the organisation. This is

the tool which differentiate their product from others. Oak Cash & Carry use new update

technology and design to achieving competitive advantage.

Capabilities: In Oak Cash & Carry they have highly skilled employee and they have

great capability. This help this organisation to achieve its goals and objectives.

Core competencies: This is the combination of of multiple resources and skill which is

different from there competitors. Oak Cash & Carry preferred highly skilled worker and

technology that help in production to save time and money.

Porter generic model :

For the growth of small scale industry organisation use different framework for gaining

competitive advantages. For this organisation need to determine its direction or strategy. Michael

porter uses 4 strategies that an organisation can select from. He believes that a company requisite

choose a clear course in order to beat the competition . The four strategies to choose from are

explain below:

Cost leadership: This leadership is define as traditional method to achieve its objective

of producing product on large scale that enables business to exploit economies of scale. This

target on a broad market and offer lowest possible price. In this organisation need to keep costs

as low as possible (Shi and et. al., 2012). Company make sure that they have larger market share

P1 Key consideration for evaluating growth opportunities and justify these considerations

Planning play a important role in achieving the goal of the organisation. In this analysing

the current operations and consider the factor where they can improve future. Growth of business

is about reaches to the highest level of expansion and consider point to generate profit.

Competitive advantage:

This is the position from which organisation helps in becoming more profitable than the

competitors. In this there is many different resources that is required to perform business

operations which seek to attain target (Mobin, 2016). Oak Cash & Carry has various factor that is

useful in the growth of business operations. For achieving competitive advantages , there are

some elements that are explain below:

Resources: This the tool which is tangible and core basic part of the organisation. This is

the tool which differentiate their product from others. Oak Cash & Carry use new update

technology and design to achieving competitive advantage.

Capabilities: In Oak Cash & Carry they have highly skilled employee and they have

great capability. This help this organisation to achieve its goals and objectives.

Core competencies: This is the combination of of multiple resources and skill which is

different from there competitors. Oak Cash & Carry preferred highly skilled worker and

technology that help in production to save time and money.

Porter generic model :

For the growth of small scale industry organisation use different framework for gaining

competitive advantages. For this organisation need to determine its direction or strategy. Michael

porter uses 4 strategies that an organisation can select from. He believes that a company requisite

choose a clear course in order to beat the competition . The four strategies to choose from are

explain below:

Cost leadership: This leadership is define as traditional method to achieve its objective

of producing product on large scale that enables business to exploit economies of scale. This

target on a broad market and offer lowest possible price. In this organisation need to keep costs

as low as possible (Shi and et. al., 2012). Company make sure that they have larger market share

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

with there average price. In this the main aim is keep company cost low as possible. If company

like Oak Cash & Carry use this then they focus on offer lowest price to its customer. This

organisation can provide discount to its customer for increasing in sales.

Differentiation leadership: In this strategy of porter, company add some unique feature

in there product which make them different from competitor. In this company target the broad

market by offering unique product in market. This help in make product unique then their

competitor. Oak Cash & Carry focus on the expansion and growth because this concentrate on

large market place and provide unique feature in their product.

Cost focus: This is focus on cost of the product .This strategy focus on niche market and

offer lowest price to its customer. In this company produce its product according to the demand

of its ultimate customer's (MacLeod, 2013). This is general when company use low cost in there

product then they can provide there product to its customer at low price. When the price is low

then the demand is high.

Differentiation focus: This strategy involves strong brand loyalty among customer. Oak

Cash & Carry make sure that there product remains unique in order to stay in possible

competition. Company sell its unique feature product in niche market.

For Oak Cash & Carry cost leadership is best strategy. In this when the cost of product is

decrease the price of product is also decreases. This cover the large are of market which incrses

the sales in the organisation.

PESTLE analysis:

This is analytical tool which help in study the external factor of the organization. this

pestle includes political , economic , social , technological , legal and environmental . this factors

are explain below:

Political: this factor include government intervention. This factor important for

maintaining political stability to operate business. This factor include government policies ,

internal political issues, tax policy and trading policy that have impact on business. Tax of rate is

levied by the government which help Oak Cash & Carry (Deakin, 2012). This factor consider tax

rate which low and give positive impact in the business.

Economic: This are define to determine for economic performance that give directly

impact and give long term effect. Economy factor include inflation rate , interest rate and

exchange rate. This are the factors which affect the purchasing power of the customer. In UK

like Oak Cash & Carry use this then they focus on offer lowest price to its customer. This

organisation can provide discount to its customer for increasing in sales.

Differentiation leadership: In this strategy of porter, company add some unique feature

in there product which make them different from competitor. In this company target the broad

market by offering unique product in market. This help in make product unique then their

competitor. Oak Cash & Carry focus on the expansion and growth because this concentrate on

large market place and provide unique feature in their product.

Cost focus: This is focus on cost of the product .This strategy focus on niche market and

offer lowest price to its customer. In this company produce its product according to the demand

of its ultimate customer's (MacLeod, 2013). This is general when company use low cost in there

product then they can provide there product to its customer at low price. When the price is low

then the demand is high.

Differentiation focus: This strategy involves strong brand loyalty among customer. Oak

Cash & Carry make sure that there product remains unique in order to stay in possible

competition. Company sell its unique feature product in niche market.

For Oak Cash & Carry cost leadership is best strategy. In this when the cost of product is

decrease the price of product is also decreases. This cover the large are of market which incrses

the sales in the organisation.

PESTLE analysis:

This is analytical tool which help in study the external factor of the organization. this

pestle includes political , economic , social , technological , legal and environmental . this factors

are explain below:

Political: this factor include government intervention. This factor important for

maintaining political stability to operate business. This factor include government policies ,

internal political issues, tax policy and trading policy that have impact on business. Tax of rate is

levied by the government which help Oak Cash & Carry (Deakin, 2012). This factor consider tax

rate which low and give positive impact in the business.

Economic: This are define to determine for economic performance that give directly

impact and give long term effect. Economy factor include inflation rate , interest rate and

exchange rate. This are the factors which affect the purchasing power of the customer. In UK

economy level level is very good which encourage the purchasing power of customer. This work

effectively for Oak Cash & Carry . This increase the sale of the organisation when the economy

level of country is high.

Social factor: this factor is define as the standard living of people. This factor includes

norm , custom and values which organisation should follow. In social factor there is also brand

and company image involved. This social factor help an organization to create postive image in

the mind of the customer. Oak Cash & Carry produce the product according to the culture, value

which help in attracting customer and in increasing sales.

Technological factor: This are the factor which is related to the technology , level of

innovation, automation. The more Oak Cash & Carry technology is emerging they more

productivity is increases (Barbour, 2018). This factor help in developing and upgrading the level

of working. In Oak Cash & Carry use different innovative technology which help increasing

sales of organisation.

Legal factor: This are the factor which is focus on employment law and consumer

protection. Oak Cash & Carry should follow all the rules regarding Protection of employee.

Environmental factor: This factor consider impact of whether and ecological that have

effect on function of the organisation. This factor include internal and external factor. They both

factor effect environment of organisation. Oak Cash & Carry is company transfer its good from

one place to another place .

P2 Opportunities for growth by applying Ansoffs growth vector matrix

It is very important in the organisation to give opportunity to grow in the market this help

in achieving the competitive advantage. when the organisation have opportunities to grow and

choose various technology that help in expanding the businesses.

Ans-off matrix is define as the marketing planning tool which help an organisation to

increase the growth of the business (Chapin, 2012). This model is effective in know the different

which help in increasing the growth of the business this ansoff matrix is explain below:

Market penetration: In this the organization focus on to achieve growth with its existing

products in there current market. The aim is to increase its market share. This strategy known as

the least risk strategy. With growing market maintaining market share will result in growth of

business. In this Oak Cash & Carry should uses its product in the existing market and aim to

increase its market share. This strategy can be done in various way. Oak Cash & Carry can

effectively for Oak Cash & Carry . This increase the sale of the organisation when the economy

level of country is high.

Social factor: this factor is define as the standard living of people. This factor includes

norm , custom and values which organisation should follow. In social factor there is also brand

and company image involved. This social factor help an organization to create postive image in

the mind of the customer. Oak Cash & Carry produce the product according to the culture, value

which help in attracting customer and in increasing sales.

Technological factor: This are the factor which is related to the technology , level of

innovation, automation. The more Oak Cash & Carry technology is emerging they more

productivity is increases (Barbour, 2018). This factor help in developing and upgrading the level

of working. In Oak Cash & Carry use different innovative technology which help increasing

sales of organisation.

Legal factor: This are the factor which is focus on employment law and consumer

protection. Oak Cash & Carry should follow all the rules regarding Protection of employee.

Environmental factor: This factor consider impact of whether and ecological that have

effect on function of the organisation. This factor include internal and external factor. They both

factor effect environment of organisation. Oak Cash & Carry is company transfer its good from

one place to another place .

P2 Opportunities for growth by applying Ansoffs growth vector matrix

It is very important in the organisation to give opportunity to grow in the market this help

in achieving the competitive advantage. when the organisation have opportunities to grow and

choose various technology that help in expanding the businesses.

Ans-off matrix is define as the marketing planning tool which help an organisation to

increase the growth of the business (Chapin, 2012). This model is effective in know the different

which help in increasing the growth of the business this ansoff matrix is explain below:

Market penetration: In this the organization focus on to achieve growth with its existing

products in there current market. The aim is to increase its market share. This strategy known as

the least risk strategy. With growing market maintaining market share will result in growth of

business. In this Oak Cash & Carry should uses its product in the existing market and aim to

increase its market share. This strategy can be done in various way. Oak Cash & Carry can

decrease the price of its product so that more customer attract toward there product. The have to

high the level of promotion and distribution efforts. Organisation should have the knowledge

about its competitor in the market that they can beat it.

Market development: It is about selling organisation existing product into a different

market to different customer. In this expanding new business in new market means into new

customer segment and region. This can be done in a different ways that is expanding in new

domestic market and entering into a foreign market. Oak Cash & Carry can use the online

channels to sell there product into new market at lower price. They can sell there existing

product to its new market segment and with various customer's.

Product development; this is define as changes in product of organization. It very

important for the organisation to do change and update its product according to taste and

preference of customer (Ziari and et. al., 2012). According to the time taste and preference of

customer is getting change organisation should consider this point. Oak Cash & Carry use the

web to add value to or extend existing products and services. Oak Cash & Carry can done this

strategy in many various way. They have to invest in research and development so that with

research they can analysis the market and taste and preferences of the customer. Organisation

should make sure that the product meet the need and preferences of existing market.

Diversification: This is about move into new market with the new product. This can be

the risk term for the organisation. Diversification has its two type that is related diversification in

this there are potential synergies between the existing and new product (Todes, 2012). Another

one is unrelated diversification in which there is no potential and synergy between exiting

business and new product .Oak Cash & Carry should move to the different which create more

customer and this help in increasing the sell of company.

TASK 2

P3 Potential sources of funding available to businesses and discuss benefits and drawbacks

Finance has become important aspects for every business firm to operate on an effective

and productive basis. This is very prominent factor, in which business firm buys raw materials,

arrange effective labour as well as provides remuneration to business workers. In order to do

manage things accordingly, it is necessary for business firms to arrange funds from different

high the level of promotion and distribution efforts. Organisation should have the knowledge

about its competitor in the market that they can beat it.

Market development: It is about selling organisation existing product into a different

market to different customer. In this expanding new business in new market means into new

customer segment and region. This can be done in a different ways that is expanding in new

domestic market and entering into a foreign market. Oak Cash & Carry can use the online

channels to sell there product into new market at lower price. They can sell there existing

product to its new market segment and with various customer's.

Product development; this is define as changes in product of organization. It very

important for the organisation to do change and update its product according to taste and

preference of customer (Ziari and et. al., 2012). According to the time taste and preference of

customer is getting change organisation should consider this point. Oak Cash & Carry use the

web to add value to or extend existing products and services. Oak Cash & Carry can done this

strategy in many various way. They have to invest in research and development so that with

research they can analysis the market and taste and preferences of the customer. Organisation

should make sure that the product meet the need and preferences of existing market.

Diversification: This is about move into new market with the new product. This can be

the risk term for the organisation. Diversification has its two type that is related diversification in

this there are potential synergies between the existing and new product (Todes, 2012). Another

one is unrelated diversification in which there is no potential and synergy between exiting

business and new product .Oak Cash & Carry should move to the different which create more

customer and this help in increasing the sell of company.

TASK 2

P3 Potential sources of funding available to businesses and discuss benefits and drawbacks

Finance has become important aspects for every business firm to operate on an effective

and productive basis. This is very prominent factor, in which business firm buys raw materials,

arrange effective labour as well as provides remuneration to business workers. In order to do

manage things accordingly, it is necessary for business firms to arrange funds from different

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

sources such as angel investor's, crowdfunding, bank loan etc. In context with given business

entity, there are two different ways of arranging funds such as internal and external sources.

Internal sources of funding: In this sources of funding, majorly priority is used to be

given inside money sources such as retained earning, capital reserve etc. These are basically kept

money with business entities. These sources of funding are basically high secured and protected

with own efforts.

External sources of funding: In this kind of funding, major focus on arranging funds

from outside structures such as banks, financial institution, money lenders, outside parties etc., as

these have major support of getting money in early point of time. In addition to this, business

entities are required to pay back these funds in an early period of time (Zolfaghari, 2012).

In context with Oak Cash & Carry, funding is very necessary to generate their massive

expansion of business operation with support of their strategic planning & directing in context of

raising funds. In context to expand business operation at an optimised level, Oak Cash & Carry is

required to go for certain level of funds access such as Angel investors, crowdfunding, bank loan

and financial institution. Oak Cash & Carry have several other sources of major funding for their

business expansion are as follows:

Bank loan: This is a convenient sources of receiving funds from the bank system in

return for future repayments with calculated interest amount. Repaying of the loan amount

depends for how much time duration loan taken and rate of interest to be levied (Jaber, 2016). In

context with Oak Cash & Carry, bank loan is a best way to generate money & funds for

conducting activities of this business firms.

Advantages:

Bank loan is a convenient option in comparison to overdraft, as it allows lower interest

rate and money will be keep for longer period of time.

Another major advantage is to get tax benefit, which says amount pays as a interest have

major beneficial on paying tax amount.

Disadvantage:

A major limitation of bank loan is undertaking borrowing on that higher level that I may

lead to reduction in cash flow of firm.

entity, there are two different ways of arranging funds such as internal and external sources.

Internal sources of funding: In this sources of funding, majorly priority is used to be

given inside money sources such as retained earning, capital reserve etc. These are basically kept

money with business entities. These sources of funding are basically high secured and protected

with own efforts.

External sources of funding: In this kind of funding, major focus on arranging funds

from outside structures such as banks, financial institution, money lenders, outside parties etc., as

these have major support of getting money in early point of time. In addition to this, business

entities are required to pay back these funds in an early period of time (Zolfaghari, 2012).

In context with Oak Cash & Carry, funding is very necessary to generate their massive

expansion of business operation with support of their strategic planning & directing in context of

raising funds. In context to expand business operation at an optimised level, Oak Cash & Carry is

required to go for certain level of funds access such as Angel investors, crowdfunding, bank loan

and financial institution. Oak Cash & Carry have several other sources of major funding for their

business expansion are as follows:

Bank loan: This is a convenient sources of receiving funds from the bank system in

return for future repayments with calculated interest amount. Repaying of the loan amount

depends for how much time duration loan taken and rate of interest to be levied (Jaber, 2016). In

context with Oak Cash & Carry, bank loan is a best way to generate money & funds for

conducting activities of this business firms.

Advantages:

Bank loan is a convenient option in comparison to overdraft, as it allows lower interest

rate and money will be keep for longer period of time.

Another major advantage is to get tax benefit, which says amount pays as a interest have

major beneficial on paying tax amount.

Disadvantage:

A major limitation of bank loan is undertaking borrowing on that higher level that I may

lead to reduction in cash flow of firm.

Angel investor: This is a kind of an equity financing, in which different investor's

supplies funds or money in exchange of giving position or share in equity holding of the Oak

Cash & Carry. In this business entity, This way of generating will be best suitable to enhance

funds raising in any period of time. This may lead to strategic planning & effective relationship

with angel investor to indulged them into effective functioning.

Advantages:

The merit of this source of funding is increased level of financial support to business

entity.

In this source of raising funds, this is highly prominent way to get access of funds in

given period of time.

Disadvantage:

Using source of angel financing as a major source of fund, it has major disadvantages that

it will also takes long time to find a suitable investor.

Peer to peer lending: This is an ease method for raising of higher funds that basically enables

an individual person to lend & borrow funds with a use of banks or financial institution. For

purpose of Oak Cash & Carry Ltd, peer to peer lending system would remove middleman in an

entire funds raising process, but this process of making funds raising is more risky and also time

consuming as compared to other sources of fund.

Advantages:

The major benefit of peer to peer money lending is that, there is an access to the major

higher returns, as this has lower interest rate.

In peer to peer lending, interest rate is fixed and also monthly payment are available with

prevention of no upfront or hidden fees.

Another advantage of this method is there is no prepayment penalty.

Disadvantage:

A major drawback of peer to peer funds money system is that money might not be lend as

and when required.

Also, other disadvantage of this funding lend method is an amount of interest, that doesn't

garmented over tax refunds.

supplies funds or money in exchange of giving position or share in equity holding of the Oak

Cash & Carry. In this business entity, This way of generating will be best suitable to enhance

funds raising in any period of time. This may lead to strategic planning & effective relationship

with angel investor to indulged them into effective functioning.

Advantages:

The merit of this source of funding is increased level of financial support to business

entity.

In this source of raising funds, this is highly prominent way to get access of funds in

given period of time.

Disadvantage:

Using source of angel financing as a major source of fund, it has major disadvantages that

it will also takes long time to find a suitable investor.

Peer to peer lending: This is an ease method for raising of higher funds that basically enables

an individual person to lend & borrow funds with a use of banks or financial institution. For

purpose of Oak Cash & Carry Ltd, peer to peer lending system would remove middleman in an

entire funds raising process, but this process of making funds raising is more risky and also time

consuming as compared to other sources of fund.

Advantages:

The major benefit of peer to peer money lending is that, there is an access to the major

higher returns, as this has lower interest rate.

In peer to peer lending, interest rate is fixed and also monthly payment are available with

prevention of no upfront or hidden fees.

Another advantage of this method is there is no prepayment penalty.

Disadvantage:

A major drawback of peer to peer funds money system is that money might not be lend as

and when required.

Also, other disadvantage of this funding lend method is an amount of interest, that doesn't

garmented over tax refunds.

TASK 3

P4 Design business plan for growth that includes financial information and strategic objectives

Business plan is an effective tool or techniques by which manager of Oak Cash & Carry

can do curriculum planning for business operations will work or how targets can be achieved

(Glock, 2017). Hence, it is prominent for Oak to have business plan which will assist in

expanding business operations and measures growth for longer period of time.

Overview of the company: Oak Cash & Carry provides cash and carry services.

Business offers a wide range of services or products in bulk for retailer's, offices, off-licences

and other local business. This business entity is engaged and working in United Kingdom.

Products & services: Oak offers offers services related to the cash and carry and also led

to provides wide range of products in bulk quantity to retailer's, caterers, offices, off-licences and

local businesses at a profit level.

Vision & Mission: The vision of Oak is to “Deliver customer till the last breath and life

time” and mission is to grow operations at a consistent level of increasing scenario of profit

build. Their core values are highly comprises of an effective use of business ethics and also

increased performance at a greater level of working.

Strategic objectives: The major strategic objectives of the Oak Cash & Carry is to build

their business operations by 2 percent annual growth, increasing higher and higher tangibility

and composition of the services. Manager of Oak has been classified objectives into SMART

goals, which they have identified it as specific, measurable, attainable, reliable and time bound.

Entrepreneurship strategies: Oak Cash & Carry in their initial period for Niche market,

means doing business operation in limited market to grab initial opportunity to raise profit basis

to run business for longer period of time. Their target market will be dealer, business entity to

want to get renders Oak services in an ease period of time. In further period, it is much

provocative for Oak to led starting of their business operations from a stage of non-functioning

to productive operations.

Financial information; In this executing level of an information, total budgeting making

and cash flow budget will be prepared to ascertain cash generation for business expansion of Oak

cash & carry. This will be majorly prepared after deciding sources of funds such as Angel

investor, retained earning and bank loans, which has led an initiatives to provide ease access of

the funds at given period of time.

P4 Design business plan for growth that includes financial information and strategic objectives

Business plan is an effective tool or techniques by which manager of Oak Cash & Carry

can do curriculum planning for business operations will work or how targets can be achieved

(Glock, 2017). Hence, it is prominent for Oak to have business plan which will assist in

expanding business operations and measures growth for longer period of time.

Overview of the company: Oak Cash & Carry provides cash and carry services.

Business offers a wide range of services or products in bulk for retailer's, offices, off-licences

and other local business. This business entity is engaged and working in United Kingdom.

Products & services: Oak offers offers services related to the cash and carry and also led

to provides wide range of products in bulk quantity to retailer's, caterers, offices, off-licences and

local businesses at a profit level.

Vision & Mission: The vision of Oak is to “Deliver customer till the last breath and life

time” and mission is to grow operations at a consistent level of increasing scenario of profit

build. Their core values are highly comprises of an effective use of business ethics and also

increased performance at a greater level of working.

Strategic objectives: The major strategic objectives of the Oak Cash & Carry is to build

their business operations by 2 percent annual growth, increasing higher and higher tangibility

and composition of the services. Manager of Oak has been classified objectives into SMART

goals, which they have identified it as specific, measurable, attainable, reliable and time bound.

Entrepreneurship strategies: Oak Cash & Carry in their initial period for Niche market,

means doing business operation in limited market to grab initial opportunity to raise profit basis

to run business for longer period of time. Their target market will be dealer, business entity to

want to get renders Oak services in an ease period of time. In further period, it is much

provocative for Oak to led starting of their business operations from a stage of non-functioning

to productive operations.

Financial information; In this executing level of an information, total budgeting making

and cash flow budget will be prepared to ascertain cash generation for business expansion of Oak

cash & carry. This will be majorly prepared after deciding sources of funds such as Angel

investor, retained earning and bank loans, which has led an initiatives to provide ease access of

the funds at given period of time.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

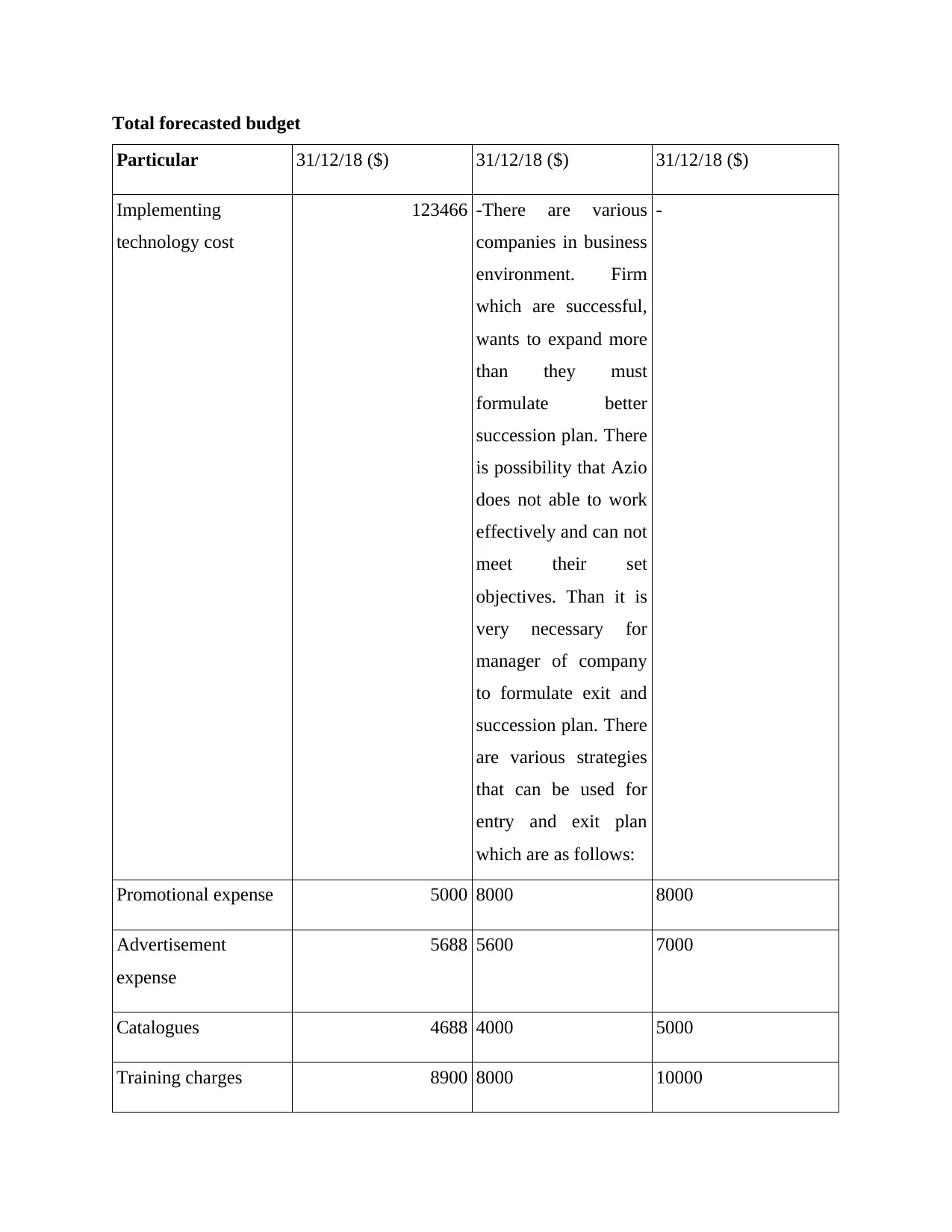

Total forecasted budget

Particular 31/12/18 ($) 31/12/18 ($) 31/12/18 ($)

Implementing

technology cost

123466 -There are various

companies in business

environment. Firm

which are successful,

wants to expand more

than they must

formulate better

succession plan. There

is possibility that Azio

does not able to work

effectively and can not

meet their set

objectives. Than it is

very necessary for

manager of company

to formulate exit and

succession plan. There

are various strategies

that can be used for

entry and exit plan

which are as follows:

-

Promotional expense 5000 8000 8000

Advertisement

expense

5688 5600 7000

Catalogues 4688 4000 5000

Training charges 8900 8000 10000

Particular 31/12/18 ($) 31/12/18 ($) 31/12/18 ($)

Implementing

technology cost

123466 -There are various

companies in business

environment. Firm

which are successful,

wants to expand more

than they must

formulate better

succession plan. There

is possibility that Azio

does not able to work

effectively and can not

meet their set

objectives. Than it is

very necessary for

manager of company

to formulate exit and

succession plan. There

are various strategies

that can be used for

entry and exit plan

which are as follows:

-

Promotional expense 5000 8000 8000

Advertisement

expense

5688 5600 7000

Catalogues 4688 4000 5000

Training charges 8900 8000 10000

Total Cost 123899 25600 30000

This given budget shows that Oak Cash & Carry are spending their large pieces of

expenses on setting up of the technology to announces business functioning at a growing stage or

time to led increase in business profitability.

TASK 4

P5 Assess exit or succession options for a small business explaining the benefits and drawbacks

Expansion of the business functioning has not declared always with positive results, there

always possibility of negative outcomes also. Along with this, negative results may led to major

failure into the business process. There are various tools or techniques, through which business

firm's can enhance their goodwill and growth of business, which are also possible. Managers of

Oak Cash & Carry Ltd., needs to be formulate a plan for establishing succession & exit for

effective business operations.

Different ways of succession and exit strategies

In business process, there are various types of operating firm's which are nutshelly

operating their business affairs to expand more than what they must do formulation of better

This given budget shows that Oak Cash & Carry are spending their large pieces of

expenses on setting up of the technology to announces business functioning at a growing stage or

time to led increase in business profitability.

TASK 4

P5 Assess exit or succession options for a small business explaining the benefits and drawbacks

Expansion of the business functioning has not declared always with positive results, there

always possibility of negative outcomes also. Along with this, negative results may led to major

failure into the business process. There are various tools or techniques, through which business

firm's can enhance their goodwill and growth of business, which are also possible. Managers of

Oak Cash & Carry Ltd., needs to be formulate a plan for establishing succession & exit for

effective business operations.

Different ways of succession and exit strategies

In business process, there are various types of operating firm's which are nutshelly

operating their business affairs to expand more than what they must do formulation of better

succession plan. There is a higher possibilities that Oak Cash & Carry Ltd does not able to work

effectively and can not meet their set objectives. It is very necessary for manager of Oaks to

formulate exit and succession plan at same point of time (Sharifi and et. al., 2014). There are

various strategies that can be used for entry an exit plan which are as follows:

Winding up: This method of exit plan means ending or dissolving a business by selling

its assets to paying off all liability and remaining assets distributes to their shareholder or

partners. It is an end the trading life business by putting company into formal liquidation

(Parolin, 2013).

Advantages: The major benefit of winding up business is it removes the responsibility from the

directors and the business owners. When company is winding up than there is no ongoing

pressure of debt repayment. So, the available fund may be used as other business opportunity.

Disadvantages: Drawback of winding up business is, it is time consuming process as there is

legal procedure for liquidation. Another limitation of this method of exit is company will loose

the productive employees and teams.

Selling in open market: In this method, exit plan is selling ongoing business in open

marketplace. The image of company is not disturbed as other company will purchased. There is

rebate in taxes to other party who buy it.

Advantages: One of the major advantage of selling business in open market is there image of

company do not get disturbed. It also helps in improvement in economy of country. Operations

of business not changed as other company purchase their ongoing business.

Disadvantage: Drawback of this method is financial status of company is comes in front of

external parties and this leads to reduce the image of company. This affects the reduction in

value as compared with other organisations. Another drawback of the exit plan is skilled

employees may leave the firm which affects the functioning of company who purchase that firm.

effectively and can not meet their set objectives. It is very necessary for manager of Oaks to

formulate exit and succession plan at same point of time (Sharifi and et. al., 2014). There are

various strategies that can be used for entry an exit plan which are as follows:

Winding up: This method of exit plan means ending or dissolving a business by selling

its assets to paying off all liability and remaining assets distributes to their shareholder or

partners. It is an end the trading life business by putting company into formal liquidation

(Parolin, 2013).

Advantages: The major benefit of winding up business is it removes the responsibility from the

directors and the business owners. When company is winding up than there is no ongoing

pressure of debt repayment. So, the available fund may be used as other business opportunity.

Disadvantages: Drawback of winding up business is, it is time consuming process as there is

legal procedure for liquidation. Another limitation of this method of exit is company will loose

the productive employees and teams.

Selling in open market: In this method, exit plan is selling ongoing business in open

marketplace. The image of company is not disturbed as other company will purchased. There is

rebate in taxes to other party who buy it.

Advantages: One of the major advantage of selling business in open market is there image of

company do not get disturbed. It also helps in improvement in economy of country. Operations

of business not changed as other company purchase their ongoing business.

Disadvantage: Drawback of this method is financial status of company is comes in front of

external parties and this leads to reduce the image of company. This affects the reduction in

value as compared with other organisations. Another drawback of the exit plan is skilled

employees may leave the firm which affects the functioning of company who purchase that firm.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Merger & Acquisition: Merger means combination of two business to form one company.

Acquisition means taking over other company (Williamson, 2015). These two are the major

factors of corporate world.

Advantages: Benefit of this is synergy that means magic power i.e. useful in increased value

efficiency of new business and it also gains the economies of scale as they share resources and

services. Another limitation of this method is it reduces the risk of using innovative techniques

and tools for managing financial risk. There is one more benefit of this is it has tax benefits.

Disadvantage: Drawback of this method is company may looses the experienced staff member.

Merging of two company leads to doing similar things and may be there is duplication of work.

Another limitation of this exit plan is it increases the cost of company that results in management

of modification and there is delay in implementation of merger and acquisition.

Acquisition means taking over other company (Williamson, 2015). These two are the major

factors of corporate world.

Advantages: Benefit of this is synergy that means magic power i.e. useful in increased value

efficiency of new business and it also gains the economies of scale as they share resources and

services. Another limitation of this method is it reduces the risk of using innovative techniques

and tools for managing financial risk. There is one more benefit of this is it has tax benefits.

Disadvantage: Drawback of this method is company may looses the experienced staff member.

Merging of two company leads to doing similar things and may be there is duplication of work.

Another limitation of this exit plan is it increases the cost of company that results in management

of modification and there is delay in implementation of merger and acquisition.

CONCLUSION

From given report, it is concluded that planning is necessary to led effective initiation of

the growth and expansion of the business performance of firm or entity. Source of funding has

become important to led an initiative to make business perfect and also suitable to raise business

performance at a bigger and optimised level to increase performance of business enterprise.

Making a business plan has been resulted into think strategically to enhances business operation

of the company at a utilised stage or level. Exit or succession planning has simply led business

entity to close their business peaceful and also without support of any kind of informal business

loss, with the purpose to generate level of profits and its suitability.

From given report, it is concluded that planning is necessary to led effective initiation of

the growth and expansion of the business performance of firm or entity. Source of funding has

become important to led an initiative to make business perfect and also suitable to raise business

performance at a bigger and optimised level to increase performance of business enterprise.

Making a business plan has been resulted into think strategically to enhances business operation

of the company at a utilised stage or level. Exit or succession planning has simply led business

entity to close their business peaceful and also without support of any kind of informal business

loss, with the purpose to generate level of profits and its suitability.

REFERENCES

Books and Journals

Todes, A., 2012. Urban growth and strategic spatial planning in Johannesburg, South Africa.

Cities. 29(3). pp.158-165.

Ziari, I., and et. al., 2012. Integrated distribution systems planning to improve reliability under

load growth. IEEE Transactions on power delivery. 27(2). pp.757-765.

Chapin, T. S., 2012. Introduction: from growth controls, to comprehensive planning, to smart

growth: planning's emerging fourth wave. Journal of the American Planning Association.

78(1). pp.5-15.

Barbour, E. and Deakin, E. A., 2012. Smart growth planning for climate protection: Evaluating

California's Senate Bill 375. Journal of the American Planning Association. 78(1). pp.70-

86.

MacLeod, G., 2013. New urbanism/smart growth in the Scottish Highlands: Mobile policies and

post-politics in local development planning. Urban Studies. 50(11). pp.2196-2221.

Schetke, S., Haase, D. and Kötter, T., 2012. Towards sustainable settlement growth: A new

multi-criteria assessment for implementing environmental targets into strategic urban

planning. Environmental Impact Assessment Review. 32(1). pp.195-210.

Shi, Y., and et. al., 2012. Characterizing growth types and analyzing growth density distribution

in response to urban growth patterns in peri-urban areas of Lianyungang City. Landscape

and urban planning .105(4). pp.425-433.

Li, Z., Mobin, M. and Keyser, T., 2016. Multi-objective and multi-stage reliability growth

planning in early product-development stage. IEEE Transactions on Reliability. 65(2).

pp.769-781.

Williamson, W. and Parolin, B., 2013. Web 2.0 and social media growth in planning practice: A

longitudinal study. Planning Practice and Research. 28(5). pp.544-562.

Glock, C. H., Jaber, M. Y. and Zolfaghari, S., 2012. Production planning for a ramp-up process

with learning in production and growth in demand. International Journal of Production

Research. 50(20). pp.5707-5718.

Sharifi, A., and et. al., 2014. Can master planning control and regulate urban growth in

Vientiane, Laos?. Landscape and Urban Planning. 131. pp.1-13.

Books and Journals

Todes, A., 2012. Urban growth and strategic spatial planning in Johannesburg, South Africa.

Cities. 29(3). pp.158-165.

Ziari, I., and et. al., 2012. Integrated distribution systems planning to improve reliability under

load growth. IEEE Transactions on power delivery. 27(2). pp.757-765.

Chapin, T. S., 2012. Introduction: from growth controls, to comprehensive planning, to smart

growth: planning's emerging fourth wave. Journal of the American Planning Association.

78(1). pp.5-15.

Barbour, E. and Deakin, E. A., 2012. Smart growth planning for climate protection: Evaluating

California's Senate Bill 375. Journal of the American Planning Association. 78(1). pp.70-

86.

MacLeod, G., 2013. New urbanism/smart growth in the Scottish Highlands: Mobile policies and

post-politics in local development planning. Urban Studies. 50(11). pp.2196-2221.

Schetke, S., Haase, D. and Kötter, T., 2012. Towards sustainable settlement growth: A new

multi-criteria assessment for implementing environmental targets into strategic urban

planning. Environmental Impact Assessment Review. 32(1). pp.195-210.

Shi, Y., and et. al., 2012. Characterizing growth types and analyzing growth density distribution

in response to urban growth patterns in peri-urban areas of Lianyungang City. Landscape

and urban planning .105(4). pp.425-433.

Li, Z., Mobin, M. and Keyser, T., 2016. Multi-objective and multi-stage reliability growth

planning in early product-development stage. IEEE Transactions on Reliability. 65(2).

pp.769-781.

Williamson, W. and Parolin, B., 2013. Web 2.0 and social media growth in planning practice: A

longitudinal study. Planning Practice and Research. 28(5). pp.544-562.

Glock, C. H., Jaber, M. Y. and Zolfaghari, S., 2012. Production planning for a ramp-up process

with learning in production and growth in demand. International Journal of Production

Research. 50(20). pp.5707-5718.

Sharifi, A., and et. al., 2014. Can master planning control and regulate urban growth in

Vientiane, Laos?. Landscape and Urban Planning. 131. pp.1-13.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Lu, C., and et. al., 2013. Driving force of urban growth and regional planning: A case study of

China's Guangdong Province. Habitat international. 40. pp.35-41.

Osiyevskyy, O., and et. al., 2013. Planning to grow? Exploring the effect of business planning on

the growth of small and medium enterprises (SMEs). Exploring the Effect of Business

Planning on the Growth of Small and Medium Enterprises (SMEs)(Winter 2013).

Entrepreneurial Practice Review. 2(4). pp.36-56.

Zhang, J., and et. al., 2013. Planning for distributed wind generation under active management

mode. International Journal of Electrical Power & Energy Systems .47,.pp.140-146.

Wey, W. M., 2015. Smart growth and transit-oriented development planning in site selection for

a new metro transit station in Taipei, Taiwan. Habitat International. 47. pp.158-168.

Huang, B. and Zhang, W., 2014. Sustainable land-use planning for a downtown lake area in

central China: multiobjective optimization approach aided by urban growth modeling.

Journal of Urban Planning and Development.140(2). p.04014002.

China's Guangdong Province. Habitat international. 40. pp.35-41.

Osiyevskyy, O., and et. al., 2013. Planning to grow? Exploring the effect of business planning on

the growth of small and medium enterprises (SMEs). Exploring the Effect of Business

Planning on the Growth of Small and Medium Enterprises (SMEs)(Winter 2013).

Entrepreneurial Practice Review. 2(4). pp.36-56.

Zhang, J., and et. al., 2013. Planning for distributed wind generation under active management

mode. International Journal of Electrical Power & Energy Systems .47,.pp.140-146.

Wey, W. M., 2015. Smart growth and transit-oriented development planning in site selection for

a new metro transit station in Taipei, Taiwan. Habitat International. 47. pp.158-168.

Huang, B. and Zhang, W., 2014. Sustainable land-use planning for a downtown lake area in

central China: multiobjective optimization approach aided by urban growth modeling.

Journal of Urban Planning and Development.140(2). p.04014002.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.