Portfolio Construction Report 2022

VerifiedAdded on 2022/08/26

|15

|3294

|13

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: PORTFOLIO CONSTRUCTION

Portfolio Construction

Name of the Student:

Name of the University:

Author Note:

Portfolio Construction

Name of the Student:

Name of the University:

Author Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2PORTFOLIO CONSTRUCTION

Table of Contents

Introduction:...............................................................................................................................3

Discussion:.................................................................................................................................4

Investment Policy Statement:.................................................................................................4

Risk Constraints:................................................................................................................4

Return requirements:..........................................................................................................5

Portfolio Monitoring and Feedback:..................................................................................5

Client Overview Summary:................................................................................................5

Portfolio Construction and shareholding of the portfolio 10 years:.......................................6

Individual Share Performance:...............................................................................................9

Reason for rise in portfolio:.................................................................................................11

Recommendation:....................................................................................................................12

Conclusion:..............................................................................................................................13

References and Bibliographies:................................................................................................14

Table of Contents

Introduction:...............................................................................................................................3

Discussion:.................................................................................................................................4

Investment Policy Statement:.................................................................................................4

Risk Constraints:................................................................................................................4

Return requirements:..........................................................................................................5

Portfolio Monitoring and Feedback:..................................................................................5

Client Overview Summary:................................................................................................5

Portfolio Construction and shareholding of the portfolio 10 years:.......................................6

Individual Share Performance:...............................................................................................9

Reason for rise in portfolio:.................................................................................................11

Recommendation:....................................................................................................................12

Conclusion:..............................................................................................................................13

References and Bibliographies:................................................................................................14

3PORTFOLIO CONSTRUCTION

Introduction:

Portfolio management is a process which involves the creation of a portfolio using all

the available asset class which is present to generate return for the investor. The asset class

ranges from equities being the most risky to bonds which are considered a rather safe

investment when compared to equities. The portfolio constructed should take into

consideration the risk return characteristics of an investor when selecting the investment to be

included in the portfolio. This is covered in the Investment Policy statement of the client

which accounts for all the decision which should be taken in regards to the portfolio. The

Investment Policy statement of the client also includes the constraints and objectives which

the client might have in regards to the portfolio (Bauder, Bodnar and Schmid 2018).

The portfolio which is constructed in this report is in regards to a client with an

Investment Policy Statement provided at the initiation of the report. The stocks which seem

suitable for the client are considered when constructing the portfolio which define the risk

and return objective of the client.

Thus within this report a portfolio consisting of the stocks which is listed in the

Australian stock exchange are taken for the purpose of the investment. The performance of

the portfolio is calculated on an annual basis and is compared with the performance of the

benchmark index. The various measures of relation between the stocks and the index is

calculated highlighting the performance of the portfolio in the past decade. Also a theoretical

analysis is conducted about the benefits of diversification which is provided by the portfolio

(Bessler, Opfer and Wolff 2017).

Introduction:

Portfolio management is a process which involves the creation of a portfolio using all

the available asset class which is present to generate return for the investor. The asset class

ranges from equities being the most risky to bonds which are considered a rather safe

investment when compared to equities. The portfolio constructed should take into

consideration the risk return characteristics of an investor when selecting the investment to be

included in the portfolio. This is covered in the Investment Policy statement of the client

which accounts for all the decision which should be taken in regards to the portfolio. The

Investment Policy statement of the client also includes the constraints and objectives which

the client might have in regards to the portfolio (Bauder, Bodnar and Schmid 2018).

The portfolio which is constructed in this report is in regards to a client with an

Investment Policy Statement provided at the initiation of the report. The stocks which seem

suitable for the client are considered when constructing the portfolio which define the risk

and return objective of the client.

Thus within this report a portfolio consisting of the stocks which is listed in the

Australian stock exchange are taken for the purpose of the investment. The performance of

the portfolio is calculated on an annual basis and is compared with the performance of the

benchmark index. The various measures of relation between the stocks and the index is

calculated highlighting the performance of the portfolio in the past decade. Also a theoretical

analysis is conducted about the benefits of diversification which is provided by the portfolio

(Bessler, Opfer and Wolff 2017).

4PORTFOLIO CONSTRUCTION

Discussion:

Investment Policy Statement:

One of the most important part of the construction of a portfolio is the formulation of

the Investment Policy Statement. The investment policy statement outlines the measures and

steps which is to be taken by the portfolio manager while managing the portfolio. Thus the

Investment Policy Statement with regards to the portfolio to be undertaken is provided in

detail below. (The information about the client is ignored which depends from client to client

and the major inputs in the investment policy statement is discussed).

Risk Constraints:

As per the client is willing to take risk to any extent without any limits. This has been

expressed by the client itself and thus the willingness of the client to take risk is high.

However, the client needs to be able to bear the high level of risk which is highlighted the

high amount of stable income of the client along with a huge inheritance. Thus the client has

both the ability and the willingness to take risk. This is also supported by the clients no need

of liquidity in the immediate and the near future providing a long time horizon for

investment. Thus the client has a long time horizon thus risky assets can be used for the

purpose for the investment. The client has an efficient tax planning hence has no constraints

in regards to the tax effect from the return from the investment (Guerard Jr, 2016).

Thus the client has a long time horizon and with no liquidity requirement increasing

the ability of the portfolio manager to invest in risky asset class. The client has no legal

sanctions, hence it is free from the legal constraints. However, the client has some unique

conditions which has to be undertaken while managing the portfolio of the client. The client

wants the investment to be made only in the equity asset class. The equity asset class should

consist of the stock which is traded in the Australian markets and are listed on the ASX 200

Discussion:

Investment Policy Statement:

One of the most important part of the construction of a portfolio is the formulation of

the Investment Policy Statement. The investment policy statement outlines the measures and

steps which is to be taken by the portfolio manager while managing the portfolio. Thus the

Investment Policy Statement with regards to the portfolio to be undertaken is provided in

detail below. (The information about the client is ignored which depends from client to client

and the major inputs in the investment policy statement is discussed).

Risk Constraints:

As per the client is willing to take risk to any extent without any limits. This has been

expressed by the client itself and thus the willingness of the client to take risk is high.

However, the client needs to be able to bear the high level of risk which is highlighted the

high amount of stable income of the client along with a huge inheritance. Thus the client has

both the ability and the willingness to take risk. This is also supported by the clients no need

of liquidity in the immediate and the near future providing a long time horizon for

investment. Thus the client has a long time horizon thus risky assets can be used for the

purpose for the investment. The client has an efficient tax planning hence has no constraints

in regards to the tax effect from the return from the investment (Guerard Jr, 2016).

Thus the client has a long time horizon and with no liquidity requirement increasing

the ability of the portfolio manager to invest in risky asset class. The client has no legal

sanctions, hence it is free from the legal constraints. However, the client has some unique

conditions which has to be undertaken while managing the portfolio of the client. The client

wants the investment to be made only in the equity asset class. The equity asset class should

consist of the stock which is traded in the Australian markets and are listed on the ASX 200

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5PORTFOLIO CONSTRUCTION

index which will be taken as the benchmark. The client is not wanting to make investment in

the derivatives of any kind which can be options and futures but the client is unwilling to

make investment. Also the client has expressed to avoid investment in alternate investments

which seem to provide a higher return in the long run. Also the client has expressed the

investments which are made in the portfolio should not be more than three stocks. Also the

portfolio should be equally weighted to start with but can be of different weights at the end of

the first year of investment (Han, 2018).

Return requirements:

The client has expressed that the portfolio should generate the highest possible return

which should maximize the portfolio’s value. However, volatile losses are also seems to be

comfortable for the client and if the portfolio incurs loss the client is willing to bear the same.

However, the client wants the portfolio to beat the benchmark to be considered as a

successful investment (Mamanis, 2017).

Portfolio Monitoring and Feedback:

The portfolio of the client will be monitored periodically each quarter and the

investment policy statement will be viewed annually. Tactical asset allocation has been

prohibited by the client hence short term exploiting opportunity by the portfolio manager is

not possible (McLean and Pontiff 2016).

Client Overview Summary:

Thus the summary of the investment policy statement is provided in the following

points,

The risk taking ability and willingness of the client is high.

Thus upon analysing the risk return profile the client seems to be risk seeking

investor.

index which will be taken as the benchmark. The client is not wanting to make investment in

the derivatives of any kind which can be options and futures but the client is unwilling to

make investment. Also the client has expressed to avoid investment in alternate investments

which seem to provide a higher return in the long run. Also the client has expressed the

investments which are made in the portfolio should not be more than three stocks. Also the

portfolio should be equally weighted to start with but can be of different weights at the end of

the first year of investment (Han, 2018).

Return requirements:

The client has expressed that the portfolio should generate the highest possible return

which should maximize the portfolio’s value. However, volatile losses are also seems to be

comfortable for the client and if the portfolio incurs loss the client is willing to bear the same.

However, the client wants the portfolio to beat the benchmark to be considered as a

successful investment (Mamanis, 2017).

Portfolio Monitoring and Feedback:

The portfolio of the client will be monitored periodically each quarter and the

investment policy statement will be viewed annually. Tactical asset allocation has been

prohibited by the client hence short term exploiting opportunity by the portfolio manager is

not possible (McLean and Pontiff 2016).

Client Overview Summary:

Thus the summary of the investment policy statement is provided in the following

points,

The risk taking ability and willingness of the client is high.

Thus upon analysing the risk return profile the client seems to be risk seeking

investor.

6PORTFOLIO CONSTRUCTION

The client seems to understand the equity markets and want all his investment to be

made in the equity asset class and all other asset classes to be ignored by the portfolio

manager.

The client has a home country bias and thus wants investment to be made only in

home country equities.

The client wants the investment to be made only in three stocks which are equally

weighted in the 1st year of investment. The weights can change post the initiation of

the portfolio.

The client has no liquidity constraint or time constraint, however the client is willing

that its portfolio outperform the benchmark.

Portfolio Construction and shareholding of the portfolio 10 years:

Thus as the client has agreed to the investment policy statement and the portfolio for

the client which is constructed consist of the following penny stocks. Thus penny stocks are

considered to be risky but have a huge potential for return in the long run if the investment

bet made in regards to the stock turns out to be correct (Narayan and Sharma 2016). Thus the

stocks which are selected for the client’s portfolio are,

Ramsay HealthCare Limited

Northern Star Resources Limited.

Web-jet Limited.

Information about the companies:

Ramsay Health Care was formed in the year 1964 and provides health care services to

patients in almost all the major continents. The company has operations all over

Australia with its head office located in Sydney. The company apart from providing

health care benefits also provides education at its University in Australia.

The client seems to understand the equity markets and want all his investment to be

made in the equity asset class and all other asset classes to be ignored by the portfolio

manager.

The client has a home country bias and thus wants investment to be made only in

home country equities.

The client wants the investment to be made only in three stocks which are equally

weighted in the 1st year of investment. The weights can change post the initiation of

the portfolio.

The client has no liquidity constraint or time constraint, however the client is willing

that its portfolio outperform the benchmark.

Portfolio Construction and shareholding of the portfolio 10 years:

Thus as the client has agreed to the investment policy statement and the portfolio for

the client which is constructed consist of the following penny stocks. Thus penny stocks are

considered to be risky but have a huge potential for return in the long run if the investment

bet made in regards to the stock turns out to be correct (Narayan and Sharma 2016). Thus the

stocks which are selected for the client’s portfolio are,

Ramsay HealthCare Limited

Northern Star Resources Limited.

Web-jet Limited.

Information about the companies:

Ramsay Health Care was formed in the year 1964 and provides health care services to

patients in almost all the major continents. The company has operations all over

Australia with its head office located in Sydney. The company apart from providing

health care benefits also provides education at its University in Australia.

7PORTFOLIO CONSTRUCTION

Northern Star Resources limited is a mining company which is located in Australia.

The company is one of the main mining companies in Australia which came into

limelight when it purchase a gold mine known as the Paulsen mine from one of its

competitors. Thus the company is a gold mining company which has operations at

mines which provide high quality gold at the lowest cost.

Web-jet Limited was formed in the year 1998 and was involved in providing travel

solutions to consumers. It later expanded its operations by including packages for

consumers like holidays and some discounts on flight options. To expand the business

the company went on acquiring companies and entering new markets which seem to

be feasible option for the company.

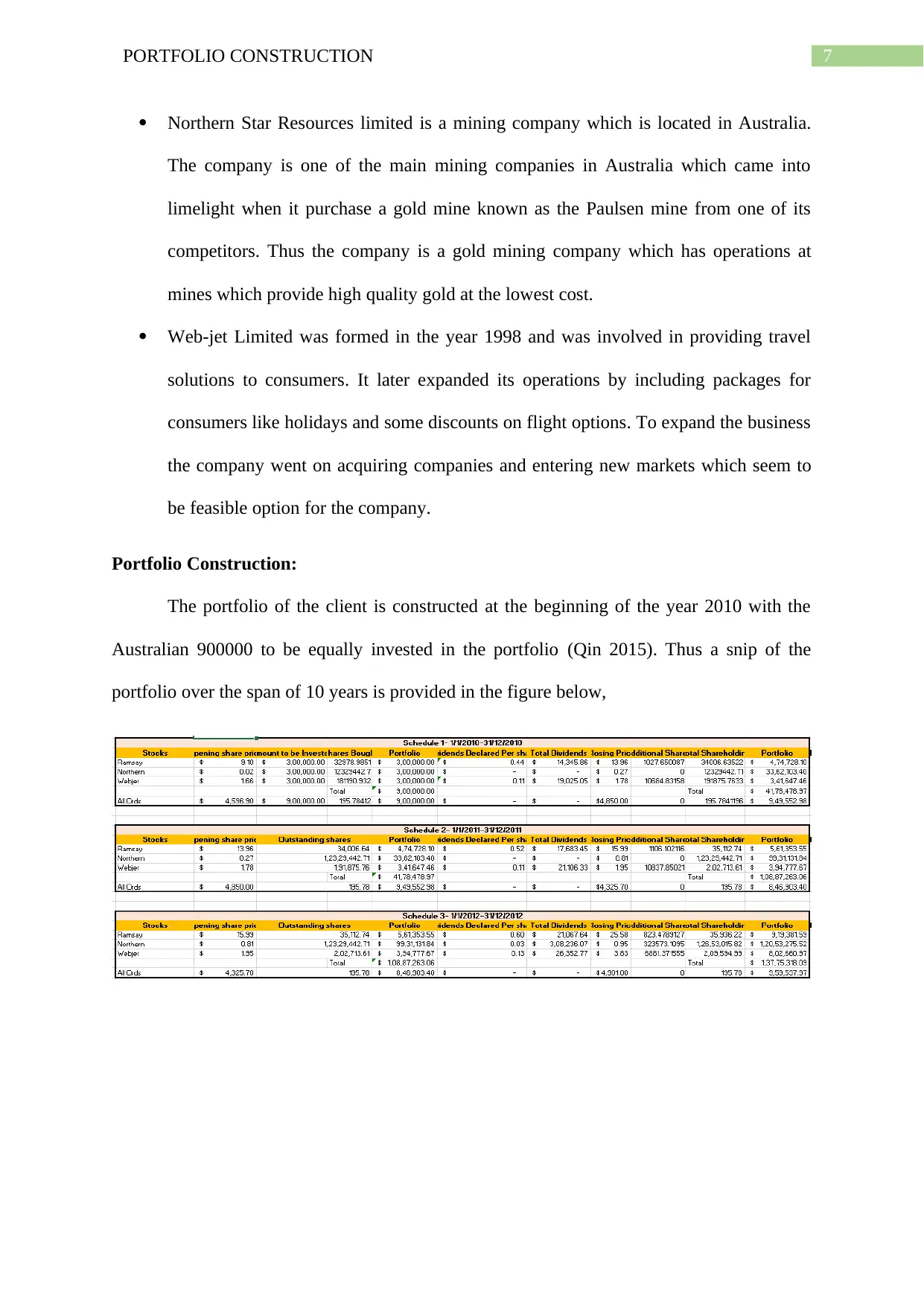

Portfolio Construction:

The portfolio of the client is constructed at the beginning of the year 2010 with the

Australian 900000 to be equally invested in the portfolio (Qin 2015). Thus a snip of the

portfolio over the span of 10 years is provided in the figure below,

Northern Star Resources limited is a mining company which is located in Australia.

The company is one of the main mining companies in Australia which came into

limelight when it purchase a gold mine known as the Paulsen mine from one of its

competitors. Thus the company is a gold mining company which has operations at

mines which provide high quality gold at the lowest cost.

Web-jet Limited was formed in the year 1998 and was involved in providing travel

solutions to consumers. It later expanded its operations by including packages for

consumers like holidays and some discounts on flight options. To expand the business

the company went on acquiring companies and entering new markets which seem to

be feasible option for the company.

Portfolio Construction:

The portfolio of the client is constructed at the beginning of the year 2010 with the

Australian 900000 to be equally invested in the portfolio (Qin 2015). Thus a snip of the

portfolio over the span of 10 years is provided in the figure below,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8PORTFOLIO CONSTRUCTION

Figure 1: Portfolio Construction and Share-Holding over the decade

Source: By the Author

Thus the portfolio was constructed using the $900000 investment in all the portfolio

equally and the shares were purchased on the opening day of 2010. Thus the shares were hold

for a period of one years and the dividend which was received by the investor was used to

repurchase the shares. Thus the investor had 32978 shares of Ramsay, 12329442.7 shares of

Northern and 181190 shares of web-jet at the initiation of the portfolio. Thus at the end of the

10 year in 2019, the investor had a total of 41232 shares of Ramsay, 14554683 shares of

Northern and 256091 shares of Web- Jet. The shares were purchased at a very low price in

the year 2010 and hence were considered to be penny stocks. The price of the stock in 2010

were $9.1 for Ramsay, $0.02 for Northern Shares and $ 1.66 for the shares of Web-Jet. The

Figure 1: Portfolio Construction and Share-Holding over the decade

Source: By the Author

Thus the portfolio was constructed using the $900000 investment in all the portfolio

equally and the shares were purchased on the opening day of 2010. Thus the shares were hold

for a period of one years and the dividend which was received by the investor was used to

repurchase the shares. Thus the investor had 32978 shares of Ramsay, 12329442.7 shares of

Northern and 181190 shares of web-jet at the initiation of the portfolio. Thus at the end of the

10 year in 2019, the investor had a total of 41232 shares of Ramsay, 14554683 shares of

Northern and 256091 shares of Web- Jet. The shares were purchased at a very low price in

the year 2010 and hence were considered to be penny stocks. The price of the stock in 2010

were $9.1 for Ramsay, $0.02 for Northern Shares and $ 1.66 for the shares of Web-Jet. The

9PORTFOLIO CONSTRUCTION

price of the stock of the company at the end of 2019 is as follows, $72.53 for the stock of

Ramsay, $ 11.31 for the stock of Northern shares and $ 13.02 for the shares of Web Jet.

The number of shares is calculated by dividing the amount which is available for

investment with the price of the share on the purchase date. Thus the initial number of shares

is calculated, while the dividends which are received are used to purchase the share at the end

of the year. Thus the price which is taken for the purchase of the share is the year end price of

the share.

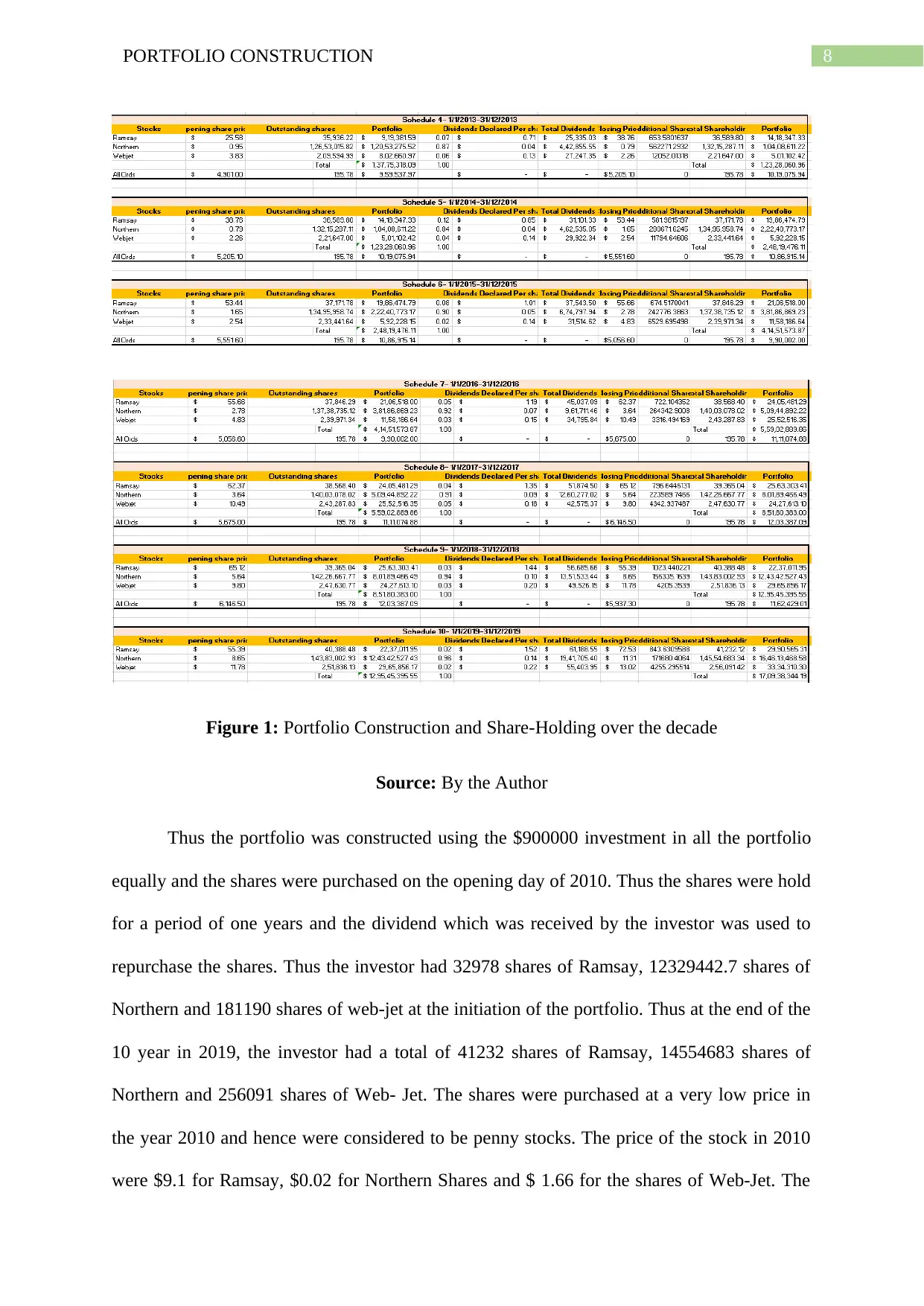

Individual Share Performance:

The average annual performance of the shares is calculated using the historical

monthly price of the shares for the past 10 years. The price of the shares are used to calculate

the monthly percentage change in the share price of the company. The average of each

investment year is calculated as the arithmetic return for the share. The geometric mean of the

share is also calculated using the percentage change in return of the share price. The standard

deviation of the shares is calculated using the monthly return which is then converted to the

annual standard deviation of the shares. The coefficient of variation of the shares is calculated

by dividing the standard deviation of the shares with the average return of the shares. Thus

the average is calculated by using the average function in excel, while geometric mean is

calculated using the geo mean function in excel and the standard deviation is calculated using

the Stdev.s function in excel.

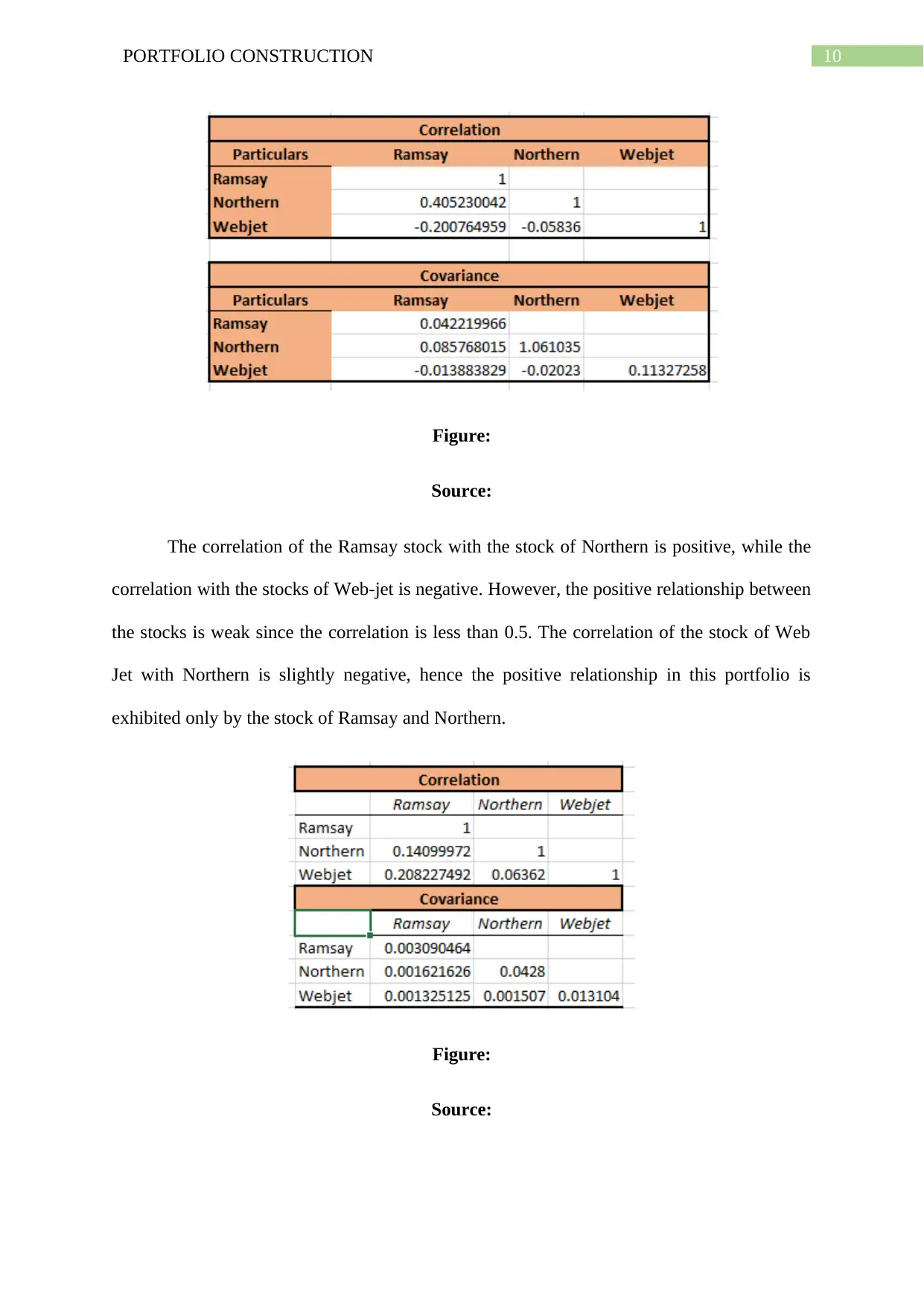

The covariance and the correlation of the stocks among themselves is provided in the

figure below,

price of the stock of the company at the end of 2019 is as follows, $72.53 for the stock of

Ramsay, $ 11.31 for the stock of Northern shares and $ 13.02 for the shares of Web Jet.

The number of shares is calculated by dividing the amount which is available for

investment with the price of the share on the purchase date. Thus the initial number of shares

is calculated, while the dividends which are received are used to purchase the share at the end

of the year. Thus the price which is taken for the purchase of the share is the year end price of

the share.

Individual Share Performance:

The average annual performance of the shares is calculated using the historical

monthly price of the shares for the past 10 years. The price of the shares are used to calculate

the monthly percentage change in the share price of the company. The average of each

investment year is calculated as the arithmetic return for the share. The geometric mean of the

share is also calculated using the percentage change in return of the share price. The standard

deviation of the shares is calculated using the monthly return which is then converted to the

annual standard deviation of the shares. The coefficient of variation of the shares is calculated

by dividing the standard deviation of the shares with the average return of the shares. Thus

the average is calculated by using the average function in excel, while geometric mean is

calculated using the geo mean function in excel and the standard deviation is calculated using

the Stdev.s function in excel.

The covariance and the correlation of the stocks among themselves is provided in the

figure below,

10PORTFOLIO CONSTRUCTION

Figure:

Source:

The correlation of the Ramsay stock with the stock of Northern is positive, while the

correlation with the stocks of Web-jet is negative. However, the positive relationship between

the stocks is weak since the correlation is less than 0.5. The correlation of the stock of Web

Jet with Northern is slightly negative, hence the positive relationship in this portfolio is

exhibited only by the stock of Ramsay and Northern.

Figure:

Source:

Figure:

Source:

The correlation of the Ramsay stock with the stock of Northern is positive, while the

correlation with the stocks of Web-jet is negative. However, the positive relationship between

the stocks is weak since the correlation is less than 0.5. The correlation of the stock of Web

Jet with Northern is slightly negative, hence the positive relationship in this portfolio is

exhibited only by the stock of Ramsay and Northern.

Figure:

Source:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11PORTFOLIO CONSTRUCTION

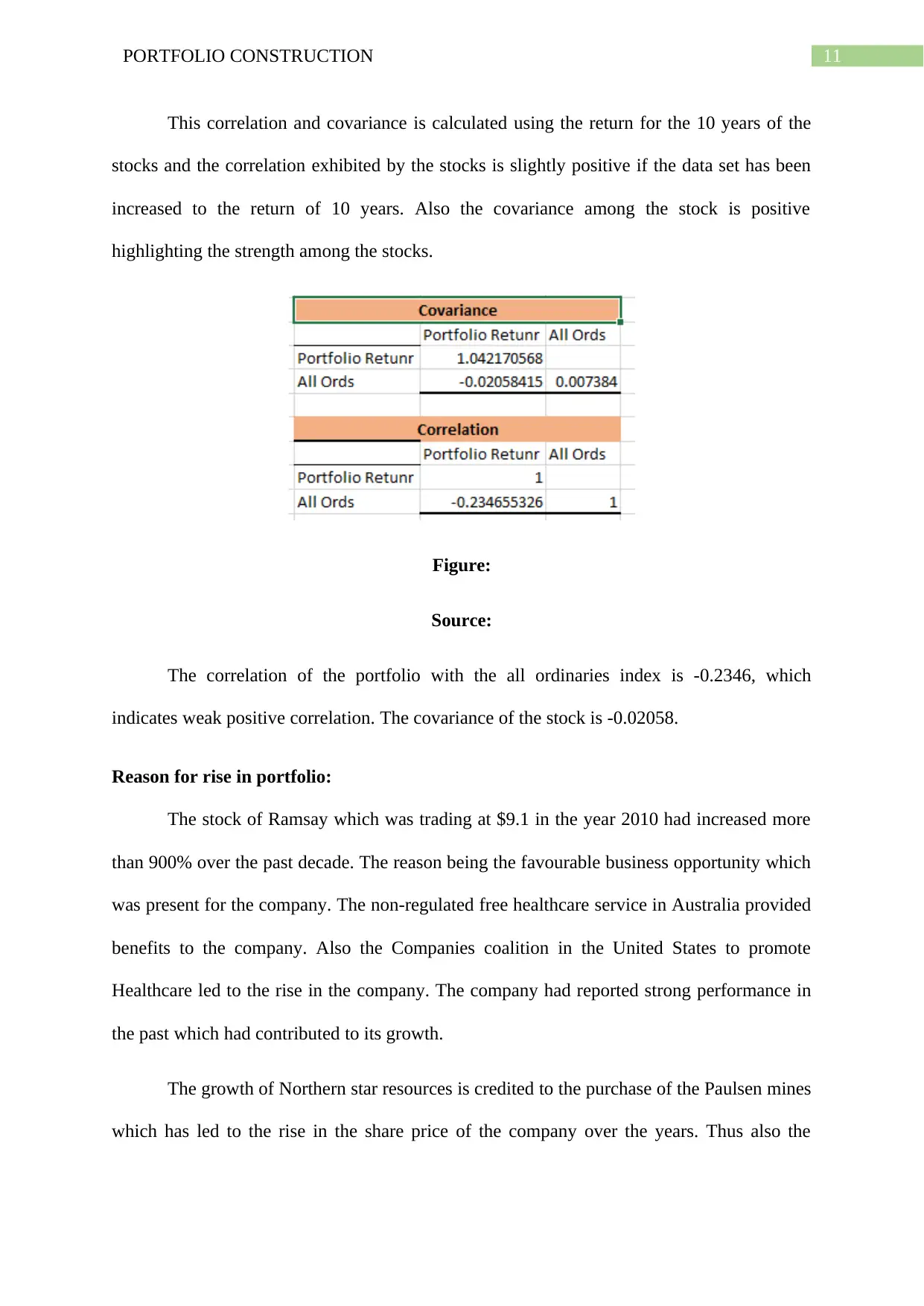

This correlation and covariance is calculated using the return for the 10 years of the

stocks and the correlation exhibited by the stocks is slightly positive if the data set has been

increased to the return of 10 years. Also the covariance among the stock is positive

highlighting the strength among the stocks.

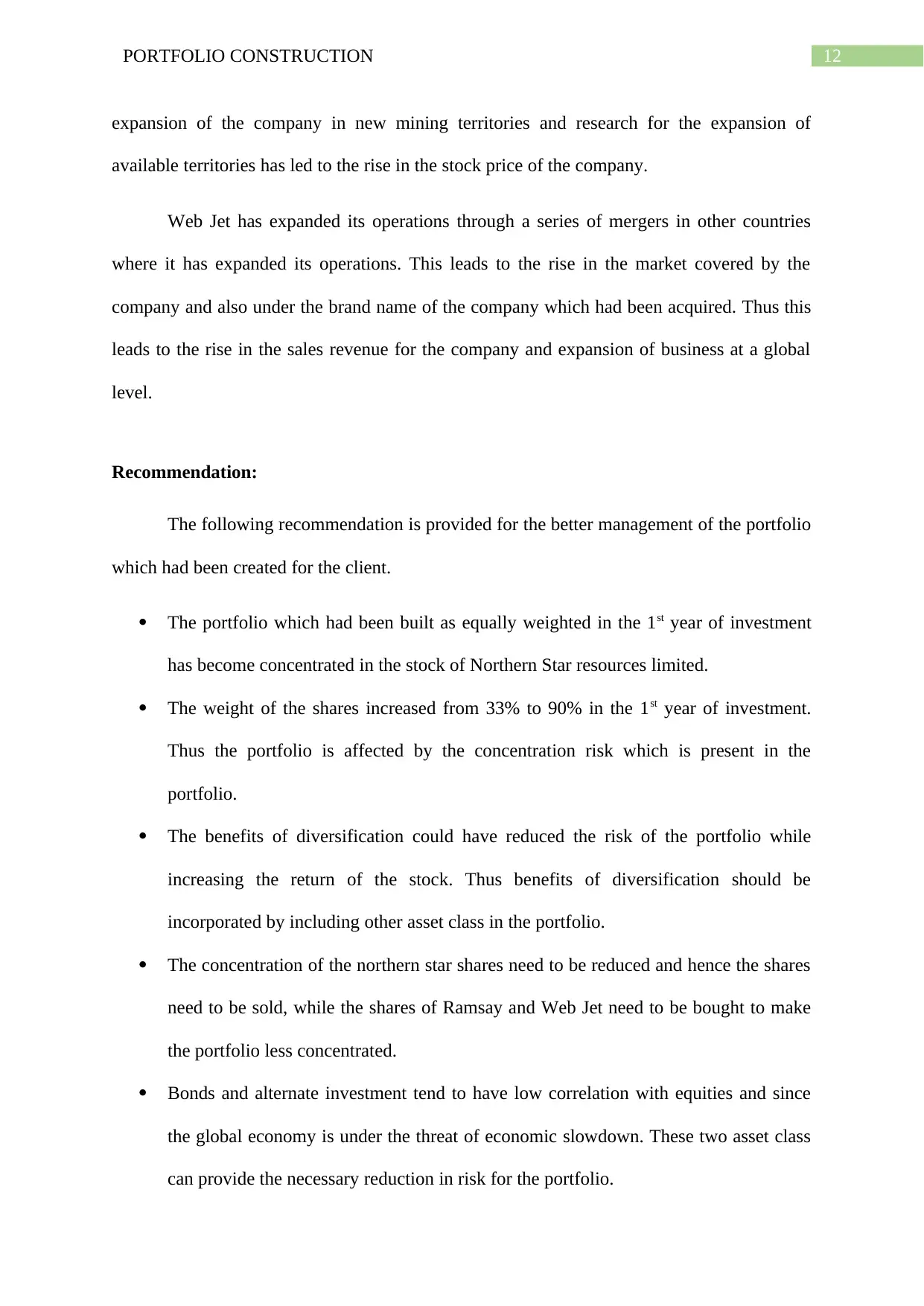

Figure:

Source:

The correlation of the portfolio with the all ordinaries index is -0.2346, which

indicates weak positive correlation. The covariance of the stock is -0.02058.

Reason for rise in portfolio:

The stock of Ramsay which was trading at $9.1 in the year 2010 had increased more

than 900% over the past decade. The reason being the favourable business opportunity which

was present for the company. The non-regulated free healthcare service in Australia provided

benefits to the company. Also the Companies coalition in the United States to promote

Healthcare led to the rise in the company. The company had reported strong performance in

the past which had contributed to its growth.

The growth of Northern star resources is credited to the purchase of the Paulsen mines

which has led to the rise in the share price of the company over the years. Thus also the

This correlation and covariance is calculated using the return for the 10 years of the

stocks and the correlation exhibited by the stocks is slightly positive if the data set has been

increased to the return of 10 years. Also the covariance among the stock is positive

highlighting the strength among the stocks.

Figure:

Source:

The correlation of the portfolio with the all ordinaries index is -0.2346, which

indicates weak positive correlation. The covariance of the stock is -0.02058.

Reason for rise in portfolio:

The stock of Ramsay which was trading at $9.1 in the year 2010 had increased more

than 900% over the past decade. The reason being the favourable business opportunity which

was present for the company. The non-regulated free healthcare service in Australia provided

benefits to the company. Also the Companies coalition in the United States to promote

Healthcare led to the rise in the company. The company had reported strong performance in

the past which had contributed to its growth.

The growth of Northern star resources is credited to the purchase of the Paulsen mines

which has led to the rise in the share price of the company over the years. Thus also the

12PORTFOLIO CONSTRUCTION

expansion of the company in new mining territories and research for the expansion of

available territories has led to the rise in the stock price of the company.

Web Jet has expanded its operations through a series of mergers in other countries

where it has expanded its operations. This leads to the rise in the market covered by the

company and also under the brand name of the company which had been acquired. Thus this

leads to the rise in the sales revenue for the company and expansion of business at a global

level.

Recommendation:

The following recommendation is provided for the better management of the portfolio

which had been created for the client.

The portfolio which had been built as equally weighted in the 1st year of investment

has become concentrated in the stock of Northern Star resources limited.

The weight of the shares increased from 33% to 90% in the 1st year of investment.

Thus the portfolio is affected by the concentration risk which is present in the

portfolio.

The benefits of diversification could have reduced the risk of the portfolio while

increasing the return of the stock. Thus benefits of diversification should be

incorporated by including other asset class in the portfolio.

The concentration of the northern star shares need to be reduced and hence the shares

need to be sold, while the shares of Ramsay and Web Jet need to be bought to make

the portfolio less concentrated.

Bonds and alternate investment tend to have low correlation with equities and since

the global economy is under the threat of economic slowdown. These two asset class

can provide the necessary reduction in risk for the portfolio.

expansion of the company in new mining territories and research for the expansion of

available territories has led to the rise in the stock price of the company.

Web Jet has expanded its operations through a series of mergers in other countries

where it has expanded its operations. This leads to the rise in the market covered by the

company and also under the brand name of the company which had been acquired. Thus this

leads to the rise in the sales revenue for the company and expansion of business at a global

level.

Recommendation:

The following recommendation is provided for the better management of the portfolio

which had been created for the client.

The portfolio which had been built as equally weighted in the 1st year of investment

has become concentrated in the stock of Northern Star resources limited.

The weight of the shares increased from 33% to 90% in the 1st year of investment.

Thus the portfolio is affected by the concentration risk which is present in the

portfolio.

The benefits of diversification could have reduced the risk of the portfolio while

increasing the return of the stock. Thus benefits of diversification should be

incorporated by including other asset class in the portfolio.

The concentration of the northern star shares need to be reduced and hence the shares

need to be sold, while the shares of Ramsay and Web Jet need to be bought to make

the portfolio less concentrated.

Bonds and alternate investment tend to have low correlation with equities and since

the global economy is under the threat of economic slowdown. These two asset class

can provide the necessary reduction in risk for the portfolio.

13PORTFOLIO CONSTRUCTION

Conclusion:

Thus in this report the basic important factors of an Investment policy statement are

discussed, highlighting the importance of the statement while constructing a portfolio. The

portfolio which had been constructed for the client consists of highly risky penny stocks

which had a huge potential to become one of the most profitable companies which had been

highlighted in this report. The stocks have provided exceptional high return over the years

and have outperformed the market index. The portfolio grew from $900000 to $17093844 in

a decade. If the portfolio would had been invested in the index it would had grown to

$1331801. Thus this indicates the potential of a right investment at the right time. The stocks

correlation among themselves and the covariance is calculated and the difference between the

results using two data sets is analysed. The relationship between the portfolio and the index is

also analysed which highlights the difference in performance between them. Thus

recommendation is provided at the end of the report in regards to a better portfolio

construction and management.

Conclusion:

Thus in this report the basic important factors of an Investment policy statement are

discussed, highlighting the importance of the statement while constructing a portfolio. The

portfolio which had been constructed for the client consists of highly risky penny stocks

which had a huge potential to become one of the most profitable companies which had been

highlighted in this report. The stocks have provided exceptional high return over the years

and have outperformed the market index. The portfolio grew from $900000 to $17093844 in

a decade. If the portfolio would had been invested in the index it would had grown to

$1331801. Thus this indicates the potential of a right investment at the right time. The stocks

correlation among themselves and the covariance is calculated and the difference between the

results using two data sets is analysed. The relationship between the portfolio and the index is

also analysed which highlights the difference in performance between them. Thus

recommendation is provided at the end of the report in regards to a better portfolio

construction and management.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14PORTFOLIO CONSTRUCTION

References and Bibliographies:

Baker, H. Kent, and Vesa Puttonen. Investment Traps Exposed: Navigating Investor Mistakes

and Behavioral Biases. Emerald Publishing Limited, 2017.

Bauder, D., Bodnar, T., Parolya, N. and Schmid, W., 2018. Bayesian mean-variance analysis:

Optimal portfolio selection under parameter uncertainty. arXiv preprint arXiv:1803.03573.

Bessler, W., Opfer, H. and Wolff, D., 2017. Multi-asset portfolio optimization and out-of-

sample performance: an evaluation of Black–Litterman, mean-variance, and naïve

diversification approaches. The European Journal of Finance, 23(1), pp.1-30.

Bloomberg - Are you a robot?. (2019). Bloomberg.com. Retrieved 14 November 2019, from

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Geller, Sheldon M. "Investment Policy Statements: Legal and Practical Considerations." The

CPA Journal 86.1 (2016): 70.

Guerard Jr, J.B. ed., 2016. Portfolio construction, measurement, and efficiency: Essays in

honor of Jack Treynor. Springer.

Han, R., 2018. The Impact of Exchange Rate Volatility on Portfolio Investment.

Hatemi-J, A., Hajji, M.A. and El-Khatib, Y., 2019. Exact Solution for the Portfolio

Diversification Problem Based on Maximizing the Risk Adjusted Return. arXiv preprint

arXiv:1903.01082.

Kess, Sidney, and Edward Mendlowitz. "Helping Individuals Determine Their Investment

Goals: Drafting an Investment Policy Statement." The CPA Journal 86.1 (2016): 68.

Mamanis, G., 2017. Portfolio Optimization with Metaheuristics. Finance and Market, 2(2).

References and Bibliographies:

Baker, H. Kent, and Vesa Puttonen. Investment Traps Exposed: Navigating Investor Mistakes

and Behavioral Biases. Emerald Publishing Limited, 2017.

Bauder, D., Bodnar, T., Parolya, N. and Schmid, W., 2018. Bayesian mean-variance analysis:

Optimal portfolio selection under parameter uncertainty. arXiv preprint arXiv:1803.03573.

Bessler, W., Opfer, H. and Wolff, D., 2017. Multi-asset portfolio optimization and out-of-

sample performance: an evaluation of Black–Litterman, mean-variance, and naïve

diversification approaches. The European Journal of Finance, 23(1), pp.1-30.

Bloomberg - Are you a robot?. (2019). Bloomberg.com. Retrieved 14 November 2019, from

https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Geller, Sheldon M. "Investment Policy Statements: Legal and Practical Considerations." The

CPA Journal 86.1 (2016): 70.

Guerard Jr, J.B. ed., 2016. Portfolio construction, measurement, and efficiency: Essays in

honor of Jack Treynor. Springer.

Han, R., 2018. The Impact of Exchange Rate Volatility on Portfolio Investment.

Hatemi-J, A., Hajji, M.A. and El-Khatib, Y., 2019. Exact Solution for the Portfolio

Diversification Problem Based on Maximizing the Risk Adjusted Return. arXiv preprint

arXiv:1903.01082.

Kess, Sidney, and Edward Mendlowitz. "Helping Individuals Determine Their Investment

Goals: Drafting an Investment Policy Statement." The CPA Journal 86.1 (2016): 68.

Mamanis, G., 2017. Portfolio Optimization with Metaheuristics. Finance and Market, 2(2).

15PORTFOLIO CONSTRUCTION

McLean, R.D. and Pontiff, J., 2016. Does academic research destroy stock return

predictability?. The Journal of Finance, 71(1), pp.5-32.

Narayan, P.K. and Sharma, S.S., 2016. Intraday return predictability, portfolio maximisation,

and hedging. Emerging Markets Review, 28, pp.105-116.

Qin, Z., 2015. Mean-variance model for portfolio optimization problem in the simultaneous

presence of random and uncertain returns. European Journal of Operational

Research, 245(2), pp.480-488.

Rutterford, Janette. "Asset Allocation in Investment." (2016).

Satchell, S. ed., 2016. Asset Management: Portfolio Construction, Performance and Returns.

Springer.

Statman, M., 2018. Rebalancing According to Behavioral Portfolio Theory. Statman, Meir,"

Rebalancing According to Behavioral Portfolio Theory," Journal of Financial Planning,

pp.29-31.

Thayer, P.K., Betro, M.F. and Emsbo-Mattingly, L.J., FMR LLC, 2019. Seasonal portfolio

construction platform apparatuses, methods and systems. U.S. Patent 10,217,167.

Ţiţan, A. G. (2015). The efficient market hypothesis: Review of specialized literature and

empirical research. Procedia Economics and Finance, 32, 442-449.

Yahoo is now a part of Verizon Media. (2019). In.finance.yahoo.com. Retrieved 14

November 2019, from https://in.finance.yahoo.com/quote/GOOGL?ltr=1

McLean, R.D. and Pontiff, J., 2016. Does academic research destroy stock return

predictability?. The Journal of Finance, 71(1), pp.5-32.

Narayan, P.K. and Sharma, S.S., 2016. Intraday return predictability, portfolio maximisation,

and hedging. Emerging Markets Review, 28, pp.105-116.

Qin, Z., 2015. Mean-variance model for portfolio optimization problem in the simultaneous

presence of random and uncertain returns. European Journal of Operational

Research, 245(2), pp.480-488.

Rutterford, Janette. "Asset Allocation in Investment." (2016).

Satchell, S. ed., 2016. Asset Management: Portfolio Construction, Performance and Returns.

Springer.

Statman, M., 2018. Rebalancing According to Behavioral Portfolio Theory. Statman, Meir,"

Rebalancing According to Behavioral Portfolio Theory," Journal of Financial Planning,

pp.29-31.

Thayer, P.K., Betro, M.F. and Emsbo-Mattingly, L.J., FMR LLC, 2019. Seasonal portfolio

construction platform apparatuses, methods and systems. U.S. Patent 10,217,167.

Ţiţan, A. G. (2015). The efficient market hypothesis: Review of specialized literature and

empirical research. Procedia Economics and Finance, 32, 442-449.

Yahoo is now a part of Verizon Media. (2019). In.finance.yahoo.com. Retrieved 14

November 2019, from https://in.finance.yahoo.com/quote/GOOGL?ltr=1

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.