AAF040-6 Financial Markets and Portfolio Management: Stock Report

VerifiedAdded on 2023/06/12

|14

|3736

|484

Report

AI Summary

This portfolio management report analyzes BP Plc, BHP Billiton Plc, Holders Technology Plc, and Phoenix Group Holdings, evaluating their financial performance, daily mean returns, standard deviations, covariance, correlation, and beta. The report uses the Capital Asset Pricing Model (CAPM) to compute the mean return of each stock and compares expected returns with actual market returns to determine if the stocks are overvalued or undervalued. Ultimately, the report recommends Holders Technology Limited and Phoenix Holdings Ltd as suitable investments for a risk-averse client, explaining the rationale behind their selection based on stock price, dividend payout, beta, and risk diversification. An efficient frontier is developed to graphically represent the risk and return combinations for portfolios comprising these two stocks, highlighting the benefits of diversification for risk-averse investors. Desklib offers a platform to explore similar student assignments and study resources.

PORTFOLIO MANAGEMENT 1

Financial Market and Portfolio Management

Student’s Name

Institutional Affiliation

Financial Market and Portfolio Management

Student’s Name

Institutional Affiliation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT 2

Section 1

Background Information About the Companies and the Reason for Choosing Them

The companies that I may choose to include in my portfolio are BP Plc, BHP Billiton Plc,

Holders Technology Plc and Phoenix group holdings. First, BP Plc is a multinational oil and gas

company in London, England which was founded in 1908 as an Anglo-Persian oil company. The

company is the world's seventh-largest oil and gas producer and by market capitalization, it is

considered the sixth largest in the world. By 2017, the corporation had branches in over 70

countries worldwide and it produces 3.6 million barrels of oil daily. BP Plc is performing well

from the look of its financial statements since in 2017, the company's revenue increased to

$240.208 billion, its operating income increased to $9.474 billion, its net income rose to $3.389

billion, its total assets inclined to $276.515 billion and its total equity rose to $100.404 billion

(BP PLC, 2018, n.d.). Ultimately, the current share price of BP Plc is $575.69 and it pays a

dividend of $0.595. The primary reason for choosing this stock is because the oil and gas sector

is considered the most profitable to invest in.

Second, BHP Billiton Plc is a multinational mining, petroleum, and metals company in

Melbourne, Australia that is traded on the London Securities Exchange (LSE) with ticker symbol

BLT. The company was founded in 1885 as a result of a merger between BHP and Billiton.

Currently, it is ranked as the largest mining corporation in the world by market capitalization. Its

main products are iron ore, petroleum, coal, copper, nickel, natural gas, and uranium. Likewise,

BHP Billiton Plc has been performing well since, in 2017, the company achieved a revenue of

$38.285 billion, an operating income of $11.753 billion and a net income of $6.222 billion. Its

share price currently ranges at $1,731.50, and it paid a dividend of $55 as at 8th March 2018

(BHP Billiton PLC, 2018, n.d.). The main reason for choosing this stock is that it is a performing

Section 1

Background Information About the Companies and the Reason for Choosing Them

The companies that I may choose to include in my portfolio are BP Plc, BHP Billiton Plc,

Holders Technology Plc and Phoenix group holdings. First, BP Plc is a multinational oil and gas

company in London, England which was founded in 1908 as an Anglo-Persian oil company. The

company is the world's seventh-largest oil and gas producer and by market capitalization, it is

considered the sixth largest in the world. By 2017, the corporation had branches in over 70

countries worldwide and it produces 3.6 million barrels of oil daily. BP Plc is performing well

from the look of its financial statements since in 2017, the company's revenue increased to

$240.208 billion, its operating income increased to $9.474 billion, its net income rose to $3.389

billion, its total assets inclined to $276.515 billion and its total equity rose to $100.404 billion

(BP PLC, 2018, n.d.). Ultimately, the current share price of BP Plc is $575.69 and it pays a

dividend of $0.595. The primary reason for choosing this stock is because the oil and gas sector

is considered the most profitable to invest in.

Second, BHP Billiton Plc is a multinational mining, petroleum, and metals company in

Melbourne, Australia that is traded on the London Securities Exchange (LSE) with ticker symbol

BLT. The company was founded in 1885 as a result of a merger between BHP and Billiton.

Currently, it is ranked as the largest mining corporation in the world by market capitalization. Its

main products are iron ore, petroleum, coal, copper, nickel, natural gas, and uranium. Likewise,

BHP Billiton Plc has been performing well since, in 2017, the company achieved a revenue of

$38.285 billion, an operating income of $11.753 billion and a net income of $6.222 billion. Its

share price currently ranges at $1,731.50, and it paid a dividend of $55 as at 8th March 2018

(BHP Billiton PLC, 2018, n.d.). The main reason for choosing this stock is that it is a performing

PORTFOLIO MANAGEMENT 3

stock since its financial statements have been favorable. Besides, its stock price is still inclining

which was a factor I considered when choosing this stock.

Third, Holders Technology plc is a company that was incorporated in 1983 in the United

Kingdom to manufacture specialty laminates and materials for a printed circuit board (PCB)

manufactures and operates as a light emitting diode (LED) solutions provider to the lighting and

industrial markets. The company is traded on the LSE with ticker symbol HDT. When compared

to its competitors, it may not be the best but it has an average return. Ideally, the company is

performing well since it realized a revenue of $12.21 million and a net income of $59,000

(Holders Technology, 2018, n.d.). Ideally, its current share price is $43.50 and it pays a dividend

of $0.50. The primary reason for choosing this company is the fact that it has one of the lowest

stock prices and it has the possibility of inclining in the future. Besides, being in the technology

industry gives my portfolio an edge.

Lastly, Phoenix group holdings is a company in London, U.K. that was founded in 1857

by Henry Staunton with an aim of providing insurance services. The company is considered to be

the largest provider of insurance services in the United Kingdom which is evident by the fact that

it is grouped in FTSE 250 index. The firm has been performing well since in 2017, it achieved a

revenue of £6,089 billion and an operating income of £125 million. However, in that same year,

the company realized a net loss from its operations of -£27 million. Currently, Phoenix group

holdings have a share price of $775 and it pays a dividend of $50.60 (Phoenix Holdings Limited,

2018, n.d.). The main reason of choosing this company is that it is the leading company in the

insurance sector in the United Kingdom and despite its financials looking bad, it pays a high

dividend than many companies in the same industry.

The Daily Mean Return and Standard Deviations of Each Company

stock since its financial statements have been favorable. Besides, its stock price is still inclining

which was a factor I considered when choosing this stock.

Third, Holders Technology plc is a company that was incorporated in 1983 in the United

Kingdom to manufacture specialty laminates and materials for a printed circuit board (PCB)

manufactures and operates as a light emitting diode (LED) solutions provider to the lighting and

industrial markets. The company is traded on the LSE with ticker symbol HDT. When compared

to its competitors, it may not be the best but it has an average return. Ideally, the company is

performing well since it realized a revenue of $12.21 million and a net income of $59,000

(Holders Technology, 2018, n.d.). Ideally, its current share price is $43.50 and it pays a dividend

of $0.50. The primary reason for choosing this company is the fact that it has one of the lowest

stock prices and it has the possibility of inclining in the future. Besides, being in the technology

industry gives my portfolio an edge.

Lastly, Phoenix group holdings is a company in London, U.K. that was founded in 1857

by Henry Staunton with an aim of providing insurance services. The company is considered to be

the largest provider of insurance services in the United Kingdom which is evident by the fact that

it is grouped in FTSE 250 index. The firm has been performing well since in 2017, it achieved a

revenue of £6,089 billion and an operating income of £125 million. However, in that same year,

the company realized a net loss from its operations of -£27 million. Currently, Phoenix group

holdings have a share price of $775 and it pays a dividend of $50.60 (Phoenix Holdings Limited,

2018, n.d.). The main reason of choosing this company is that it is the leading company in the

insurance sector in the United Kingdom and despite its financials looking bad, it pays a high

dividend than many companies in the same industry.

The Daily Mean Return and Standard Deviations of Each Company

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PORTFOLIO MANAGEMENT 4

From the analysis done in Excel, BP Plc has a daily mean return of $34.86 and a standard

deviation of $4.45, BHP Billiton Plc has a daily mean return of $37.48 and a standard deviation

of $6.50, Holders Technology Plc has a daily mean return of $66.49 and a standard deviation of

$11.20 and Phoenix Holdings Ltd has a daily mean return of $1887.93 and a standard deviation

of $59.07 (Aouni, Colapinto and La Torre, 2014, p.537).

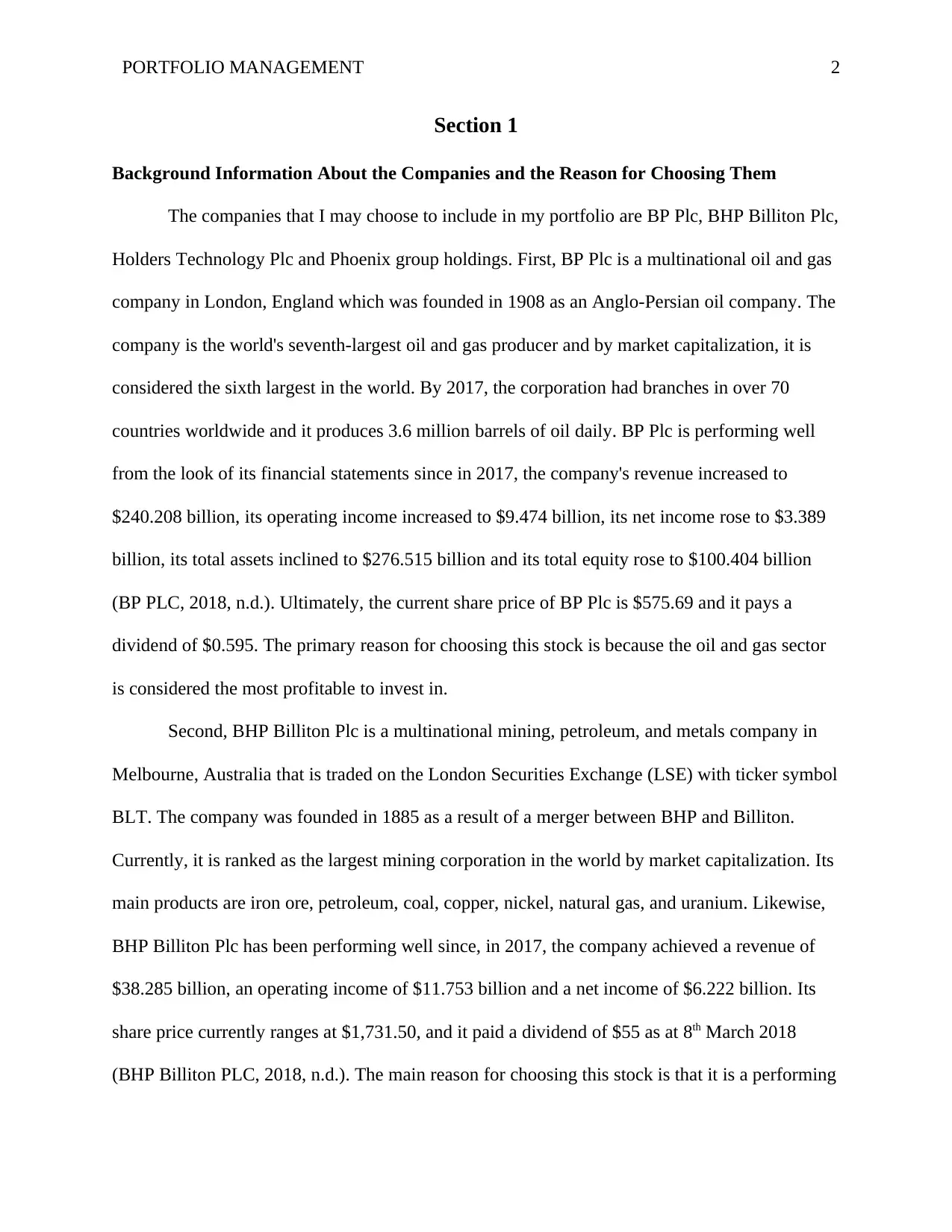

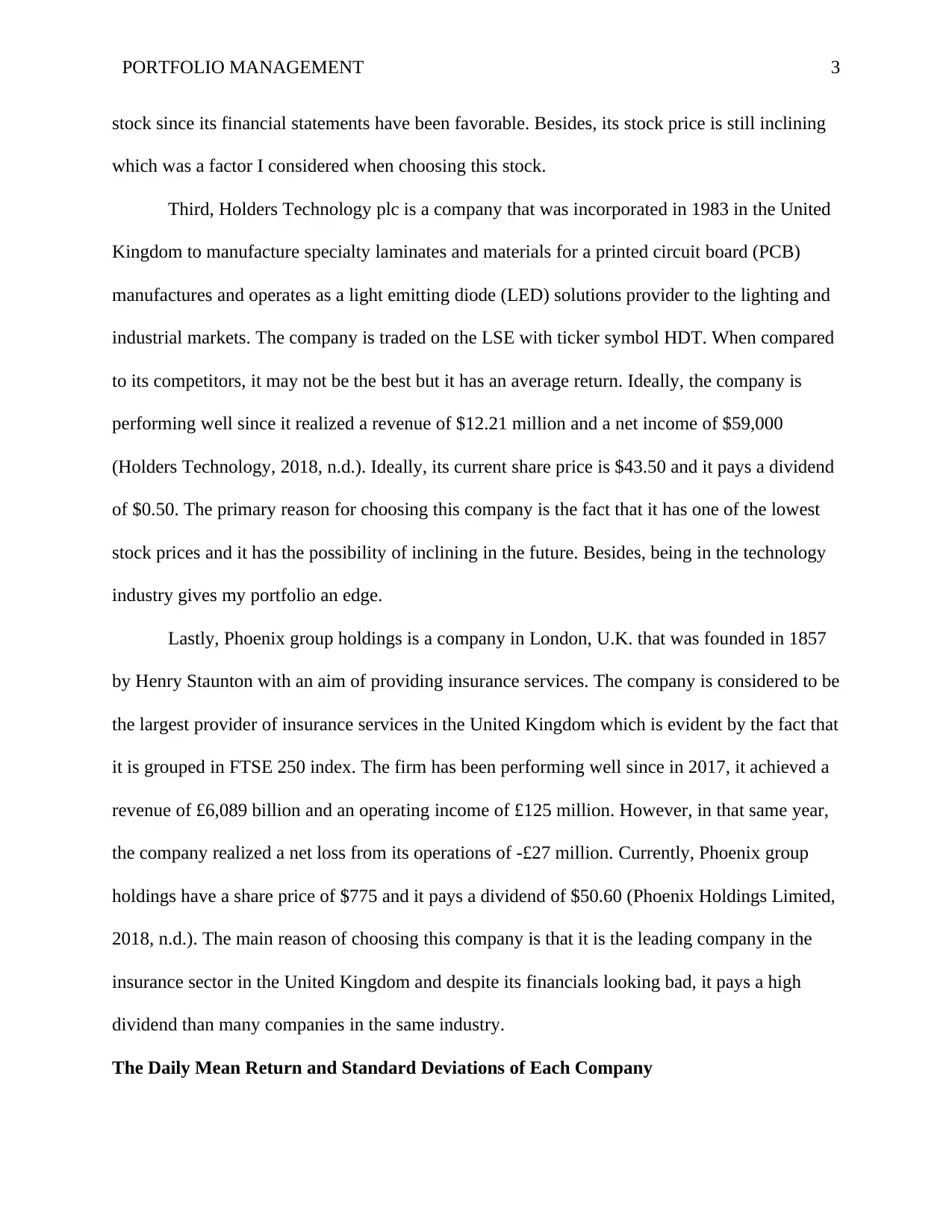

Covariance and Correlation Between the Stocks

The covariance of the four company stocks is shown below.

BP BHP HK PHOE.TA

BP 19.79894

BHP 26.15578 42.29401

HK 38.05058 63.86046 125.4347

PHOE.TA 974.3224 1379.943 2218.915 213678

The correlation of the four company stocks is depicted in the table below.

BP BHP HK PHOE.TA

BP 1

BHP 0.903873 1

HK 0.806786 0.901942 1

PHOE.TA 0.624832 0.546608 0.430406 1

Correlation and covariance measure how random variables associate or differ from each

other. From the correlation table above, there is no correlation between BP Plc and the other

companies. Furthermore, there is no correlation between Phoenix Holdings Ltd with the other

companies (Beach and Orlov, 2007, p.148). A correlation of close to 1 would mean that the

company stocks have a close association with each other like it is evident between BP and BHP,

BP and HK, and BHP and HK. However, a correlation of close to zero or none would mean that

the company stocks differ from each other like what is evident between Holders Technology

Limited and Phoenix Holdings Ltd.

From the analysis done in Excel, BP Plc has a daily mean return of $34.86 and a standard

deviation of $4.45, BHP Billiton Plc has a daily mean return of $37.48 and a standard deviation

of $6.50, Holders Technology Plc has a daily mean return of $66.49 and a standard deviation of

$11.20 and Phoenix Holdings Ltd has a daily mean return of $1887.93 and a standard deviation

of $59.07 (Aouni, Colapinto and La Torre, 2014, p.537).

Covariance and Correlation Between the Stocks

The covariance of the four company stocks is shown below.

BP BHP HK PHOE.TA

BP 19.79894

BHP 26.15578 42.29401

HK 38.05058 63.86046 125.4347

PHOE.TA 974.3224 1379.943 2218.915 213678

The correlation of the four company stocks is depicted in the table below.

BP BHP HK PHOE.TA

BP 1

BHP 0.903873 1

HK 0.806786 0.901942 1

PHOE.TA 0.624832 0.546608 0.430406 1

Correlation and covariance measure how random variables associate or differ from each

other. From the correlation table above, there is no correlation between BP Plc and the other

companies. Furthermore, there is no correlation between Phoenix Holdings Ltd with the other

companies (Beach and Orlov, 2007, p.148). A correlation of close to 1 would mean that the

company stocks have a close association with each other like it is evident between BP and BHP,

BP and HK, and BHP and HK. However, a correlation of close to zero or none would mean that

the company stocks differ from each other like what is evident between Holders Technology

Limited and Phoenix Holdings Ltd.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT 5

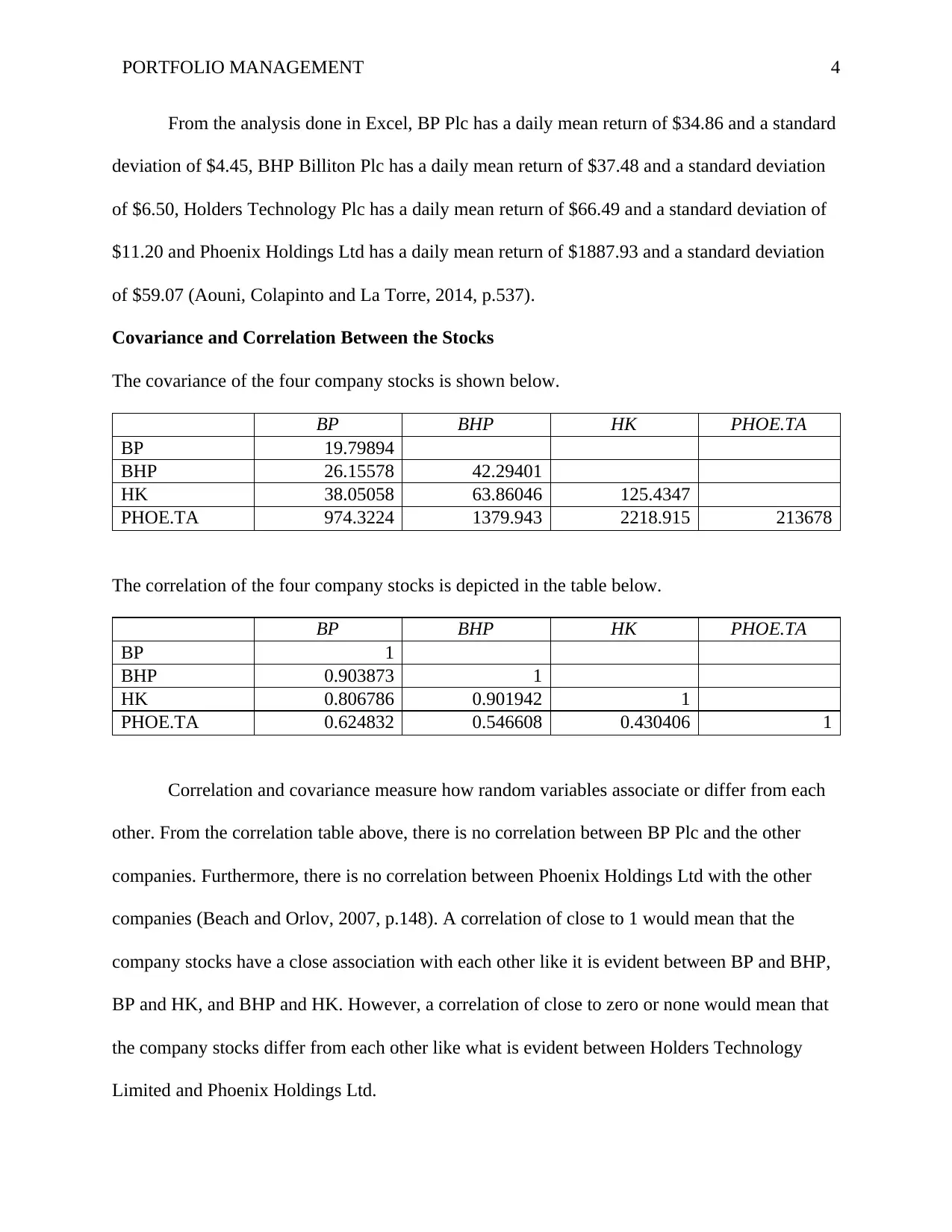

Computation of Beta

β= Covariance

Variance

BP= 0.90

( 4.45 ) 2 =0.05

BHP= 0.90

( 6.50 ) 2 =0.02

HK = 0.81

( 11.20 ) 2 =0.006

PHOE .TA= 0.43

( 59.07 ) 2 =0.0001

From the analysis above, BP Plc has a beta of 0.05, BHP Billiton Plc has a beta of 0.02,

Holders Technology Ltd has a beta of 0.006 and Phoenix Holdings Ltd has a beta of 0.0001.

Ideally, a beta of greater that one would mean that the stock is aggressive and highly risky while

a beta of less than one would mean that a stock is less volatile and less risky. From the

computation of the beta of these stock, they have a low risk, thus favorable to a risk-averse

investor (Bodnar and Gupta, 2015, p.1177). This means that the stock of BP Plc is the most

volatile when compared to the other companies while that of Phoenix Holdings Limited is the

least volatile. A risk-averse investor would be advised to invest in a company with a low risk

while a risk taker would be recommended to invest in a firm with a high risk since he or she is

expected to get greater returns from his or her investment while the risk-averse investor would

get minimal returns in the long run.

The Mean Return of Each Stock Using CAPM

When computing the mean return of a stock, the Capital Assets Pricing Model (CAPM)

formula is used as shown below.

ℜ=Rf + β ( ERm−Rf )

Computation of Beta

β= Covariance

Variance

BP= 0.90

( 4.45 ) 2 =0.05

BHP= 0.90

( 6.50 ) 2 =0.02

HK = 0.81

( 11.20 ) 2 =0.006

PHOE .TA= 0.43

( 59.07 ) 2 =0.0001

From the analysis above, BP Plc has a beta of 0.05, BHP Billiton Plc has a beta of 0.02,

Holders Technology Ltd has a beta of 0.006 and Phoenix Holdings Ltd has a beta of 0.0001.

Ideally, a beta of greater that one would mean that the stock is aggressive and highly risky while

a beta of less than one would mean that a stock is less volatile and less risky. From the

computation of the beta of these stock, they have a low risk, thus favorable to a risk-averse

investor (Bodnar and Gupta, 2015, p.1177). This means that the stock of BP Plc is the most

volatile when compared to the other companies while that of Phoenix Holdings Limited is the

least volatile. A risk-averse investor would be advised to invest in a company with a low risk

while a risk taker would be recommended to invest in a firm with a high risk since he or she is

expected to get greater returns from his or her investment while the risk-averse investor would

get minimal returns in the long run.

The Mean Return of Each Stock Using CAPM

When computing the mean return of a stock, the Capital Assets Pricing Model (CAPM)

formula is used as shown below.

ℜ=Rf + β ( ERm−Rf )

PORTFOLIO MANAGEMENT 6

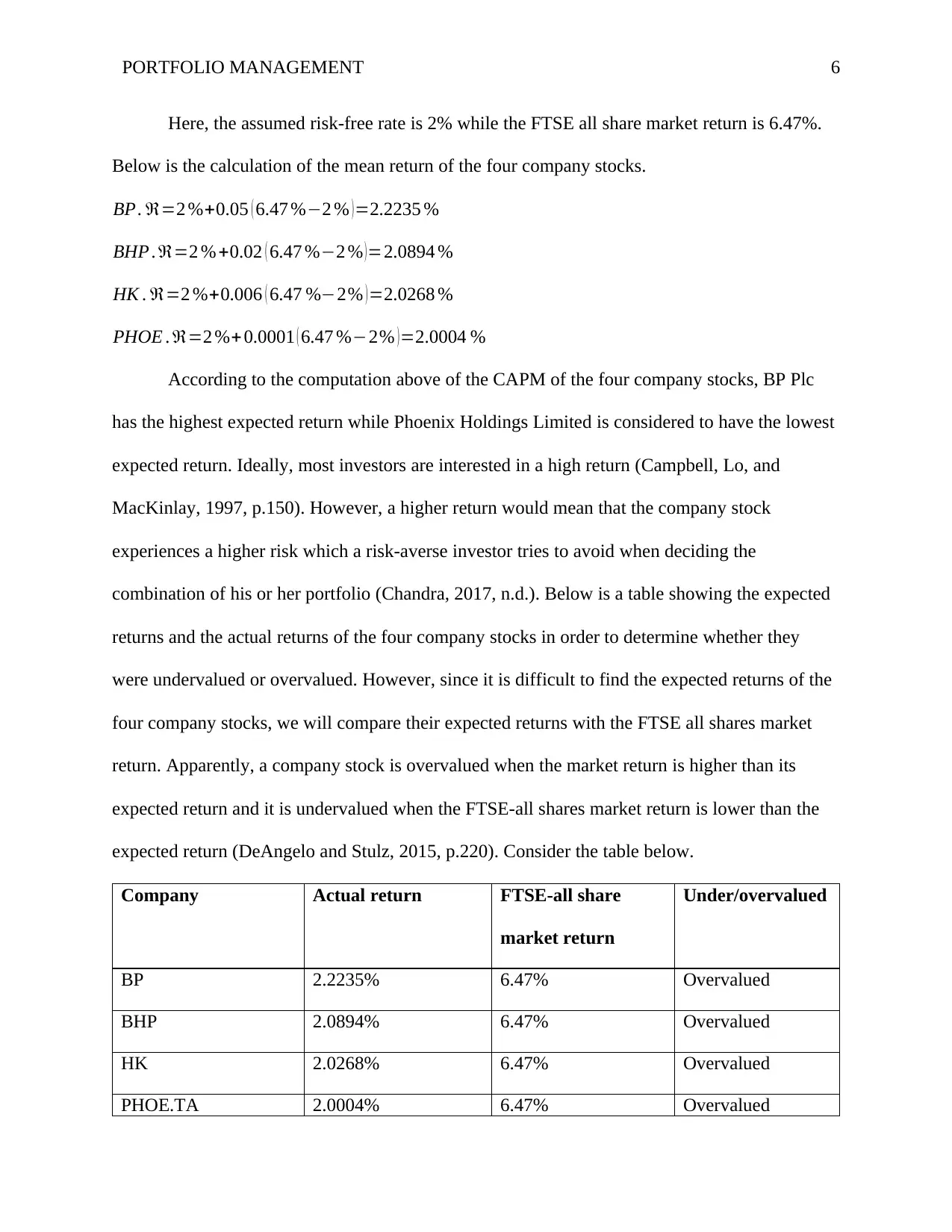

Here, the assumed risk-free rate is 2% while the FTSE all share market return is 6.47%.

Below is the calculation of the mean return of the four company stocks.

BP. ℜ=2 %+0.05 ( 6.47 %−2 % ) =2.2235 %

BHP . ℜ=2 % +0.02 ( 6.47 %−2 % )=2.0894 %

HK . ℜ=2 %+0.006 ( 6.47 %−2% )=2.0268 %

PHOE . ℜ=2 %+ 0.0001 ( 6.47 %−2% )=2.0004 %

According to the computation above of the CAPM of the four company stocks, BP Plc

has the highest expected return while Phoenix Holdings Limited is considered to have the lowest

expected return. Ideally, most investors are interested in a high return (Campbell, Lo, and

MacKinlay, 1997, p.150). However, a higher return would mean that the company stock

experiences a higher risk which a risk-averse investor tries to avoid when deciding the

combination of his or her portfolio (Chandra, 2017, n.d.). Below is a table showing the expected

returns and the actual returns of the four company stocks in order to determine whether they

were undervalued or overvalued. However, since it is difficult to find the expected returns of the

four company stocks, we will compare their expected returns with the FTSE all shares market

return. Apparently, a company stock is overvalued when the market return is higher than its

expected return and it is undervalued when the FTSE-all shares market return is lower than the

expected return (DeAngelo and Stulz, 2015, p.220). Consider the table below.

Company Actual return FTSE-all share

market return

Under/overvalued

BP 2.2235% 6.47% Overvalued

BHP 2.0894% 6.47% Overvalued

HK 2.0268% 6.47% Overvalued

PHOE.TA 2.0004% 6.47% Overvalued

Here, the assumed risk-free rate is 2% while the FTSE all share market return is 6.47%.

Below is the calculation of the mean return of the four company stocks.

BP. ℜ=2 %+0.05 ( 6.47 %−2 % ) =2.2235 %

BHP . ℜ=2 % +0.02 ( 6.47 %−2 % )=2.0894 %

HK . ℜ=2 %+0.006 ( 6.47 %−2% )=2.0268 %

PHOE . ℜ=2 %+ 0.0001 ( 6.47 %−2% )=2.0004 %

According to the computation above of the CAPM of the four company stocks, BP Plc

has the highest expected return while Phoenix Holdings Limited is considered to have the lowest

expected return. Ideally, most investors are interested in a high return (Campbell, Lo, and

MacKinlay, 1997, p.150). However, a higher return would mean that the company stock

experiences a higher risk which a risk-averse investor tries to avoid when deciding the

combination of his or her portfolio (Chandra, 2017, n.d.). Below is a table showing the expected

returns and the actual returns of the four company stocks in order to determine whether they

were undervalued or overvalued. However, since it is difficult to find the expected returns of the

four company stocks, we will compare their expected returns with the FTSE all shares market

return. Apparently, a company stock is overvalued when the market return is higher than its

expected return and it is undervalued when the FTSE-all shares market return is lower than the

expected return (DeAngelo and Stulz, 2015, p.220). Consider the table below.

Company Actual return FTSE-all share

market return

Under/overvalued

BP 2.2235% 6.47% Overvalued

BHP 2.0894% 6.47% Overvalued

HK 2.0268% 6.47% Overvalued

PHOE.TA 2.0004% 6.47% Overvalued

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PORTFOLIO MANAGEMENT 7

From the analysis, the four company stocks are overvalued since the FTSE-all share

market return is more than their actual returns. Ideally, an investor would be advised to purchase

a company when it is undervalued and sell when it is overvalued since when undervalued, the

share price is usually at its lowest and when overvalued, the stock price is usually at its highest

(Ernst, Thompson and Miao, 2017, p.318).

Section 2

An Explanation to My Client Why the Two Company Stocks are Worth Investing When

Compared to the Others

Since the investor is risk averse, the two stocks are Holders Technology Limited and

Phoenix Holdings Ltd. This is because Holders Technology has a stock price of $43.50 despite it

having a low dividend payout of $0.5. Ideally, an investor would be advised to invest in a

company that has a low stock price and that is expected to rise than a company with a very large

share price which has no chances of rising (Francs, Jorion, Rudolf, Stucki, Stulz and Yermack,

2006, n.d.). Moreover, Holders Technology Limited has one of the lowest betas when compared

to the other company stocks which means that it possesses a low risk.

The risk-averse investor should invest in Phoenix Holdings Limited since it pays a

dividend of $50.60 which is a major interest of all shareholders. Additionally, it is the largest in

the insurance industry with one of the lowest betas which means that it possesses a low risk, thus

favorable to a risk-averse investor. Despite its share price is high, it is expected that it would

continue inclining into the foreseeable future (Johannes, 2017, p.486).

From the analysis, the four company stocks are overvalued since the FTSE-all share

market return is more than their actual returns. Ideally, an investor would be advised to purchase

a company when it is undervalued and sell when it is overvalued since when undervalued, the

share price is usually at its lowest and when overvalued, the stock price is usually at its highest

(Ernst, Thompson and Miao, 2017, p.318).

Section 2

An Explanation to My Client Why the Two Company Stocks are Worth Investing When

Compared to the Others

Since the investor is risk averse, the two stocks are Holders Technology Limited and

Phoenix Holdings Ltd. This is because Holders Technology has a stock price of $43.50 despite it

having a low dividend payout of $0.5. Ideally, an investor would be advised to invest in a

company that has a low stock price and that is expected to rise than a company with a very large

share price which has no chances of rising (Francs, Jorion, Rudolf, Stucki, Stulz and Yermack,

2006, n.d.). Moreover, Holders Technology Limited has one of the lowest betas when compared

to the other company stocks which means that it possesses a low risk.

The risk-averse investor should invest in Phoenix Holdings Limited since it pays a

dividend of $50.60 which is a major interest of all shareholders. Additionally, it is the largest in

the insurance industry with one of the lowest betas which means that it possesses a low risk, thus

favorable to a risk-averse investor. Despite its share price is high, it is expected that it would

continue inclining into the foreseeable future (Johannes, 2017, p.486).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT 8

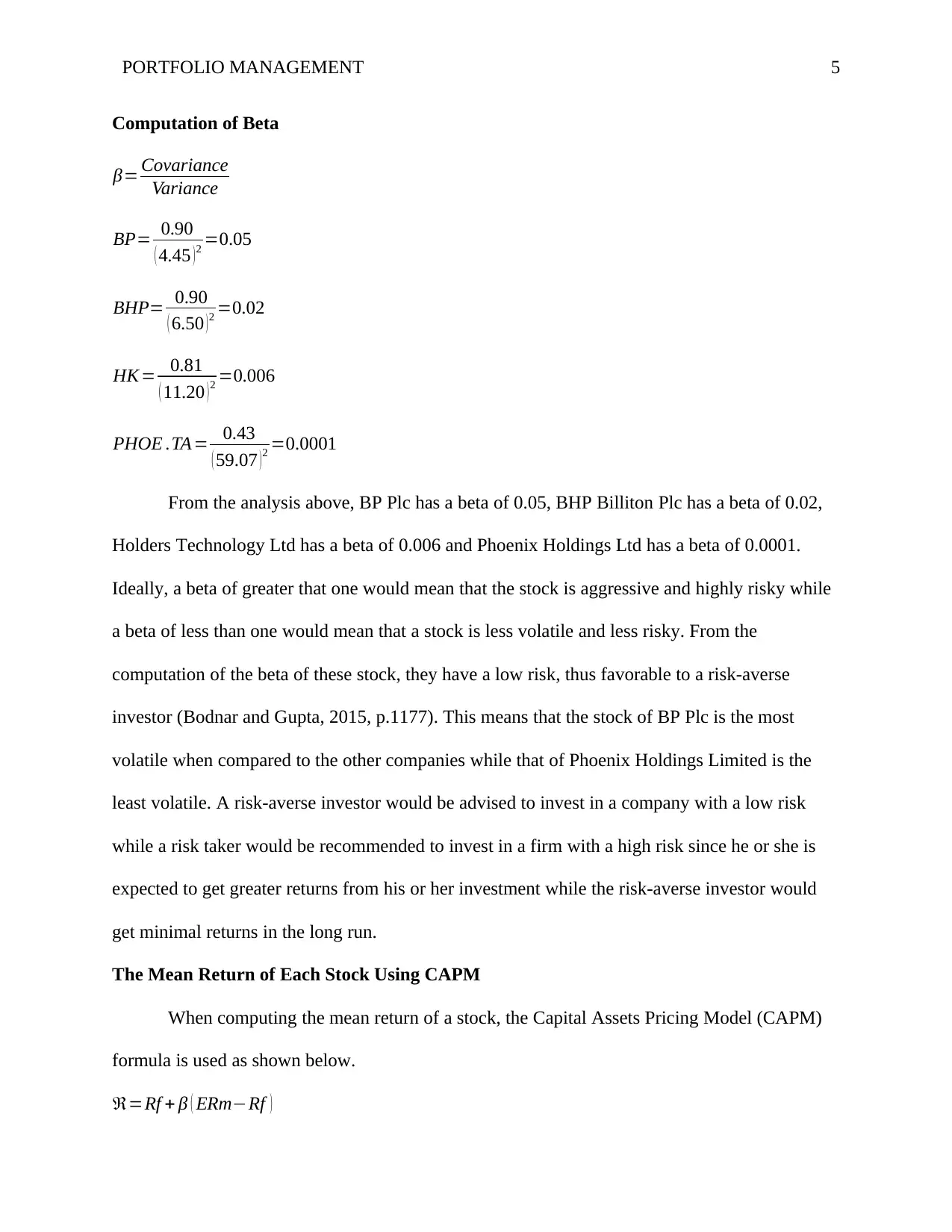

The Graphical Combinations of Risk and Return for Portfolios Comprising the Two stocks

(i.e. the Efficient Frontier)

0% 25% 50% 75% 100% 125% 150%

0%

20%

40%

60%

80%

efficient frontier assets

risk

return

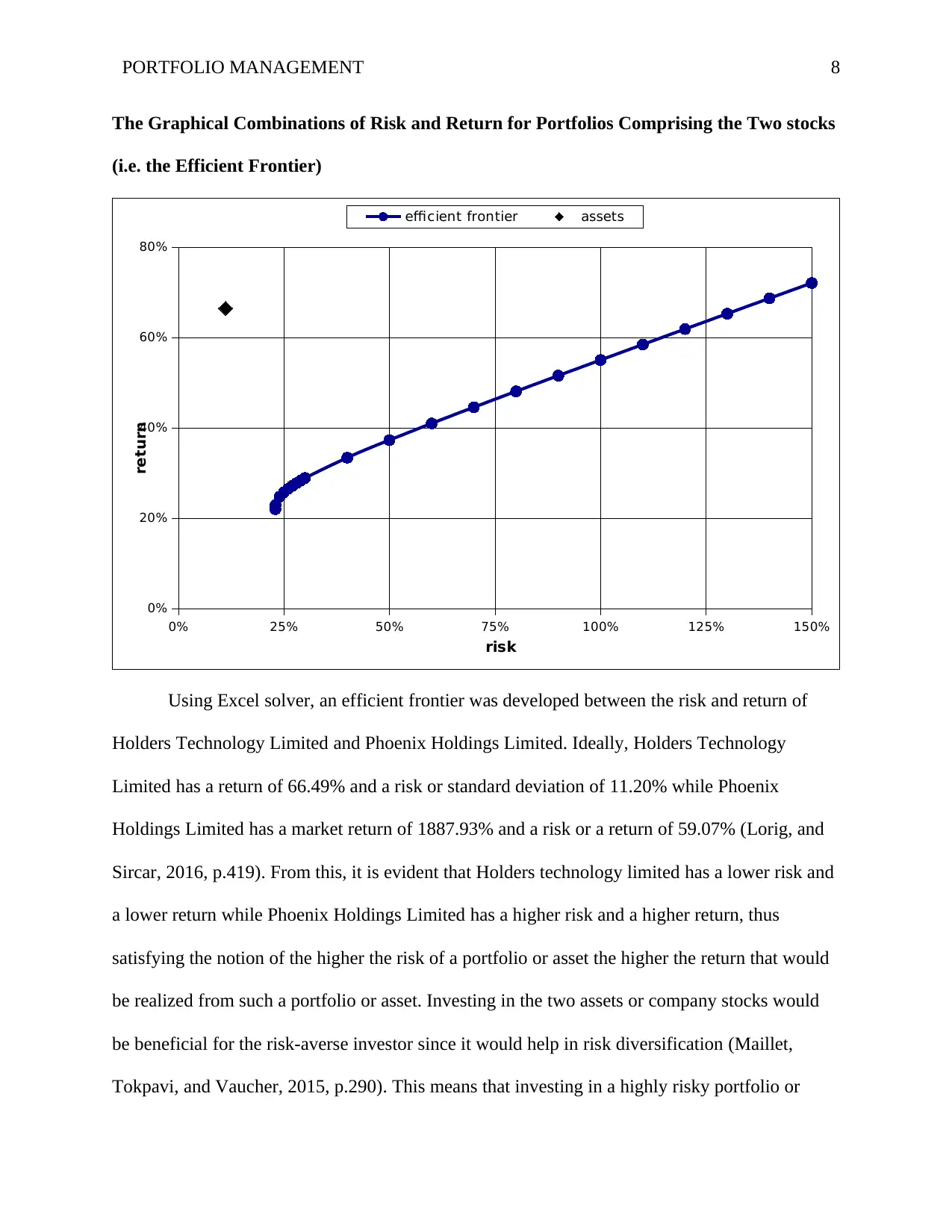

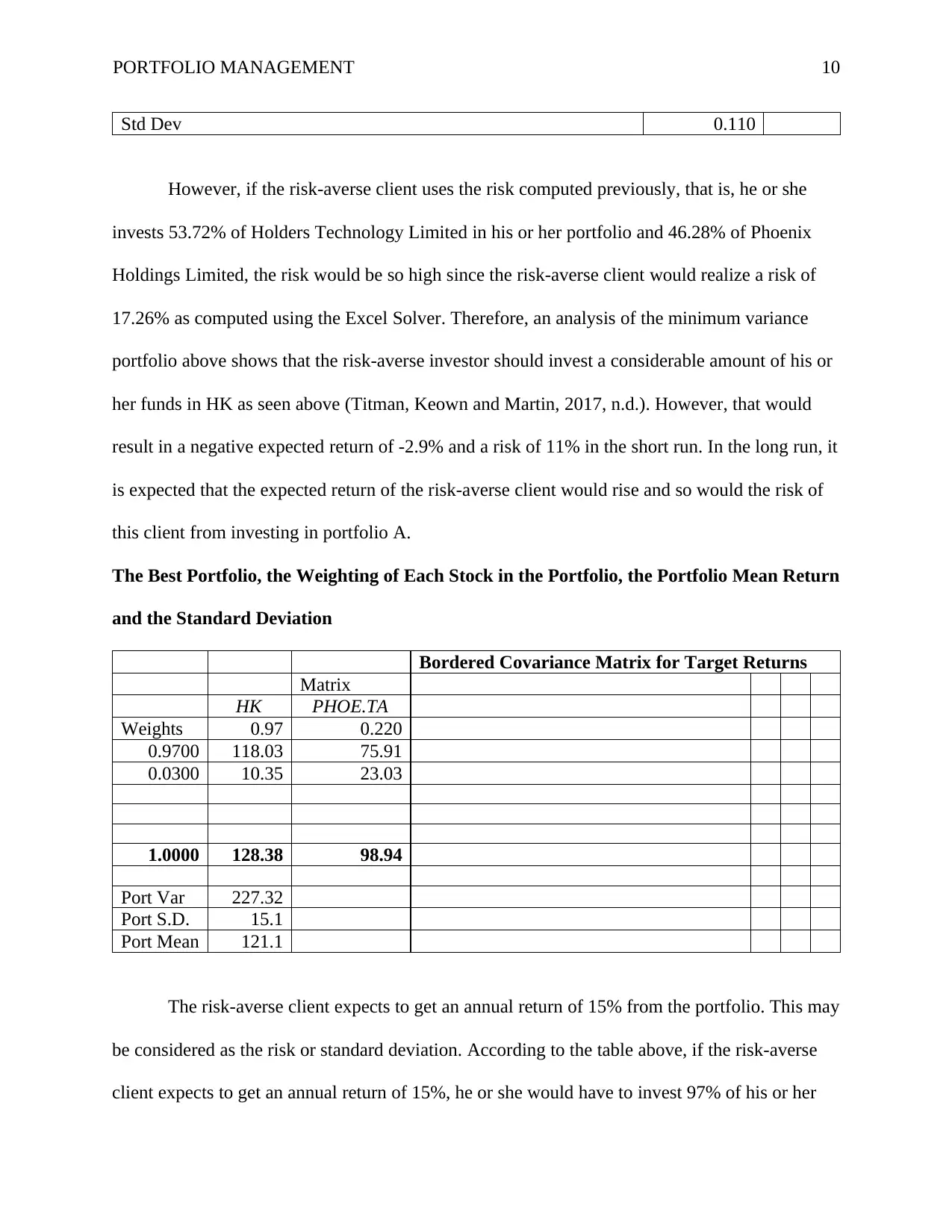

Using Excel solver, an efficient frontier was developed between the risk and return of

Holders Technology Limited and Phoenix Holdings Limited. Ideally, Holders Technology

Limited has a return of 66.49% and a risk or standard deviation of 11.20% while Phoenix

Holdings Limited has a market return of 1887.93% and a risk or a return of 59.07% (Lorig, and

Sircar, 2016, p.419). From this, it is evident that Holders technology limited has a lower risk and

a lower return while Phoenix Holdings Limited has a higher risk and a higher return, thus

satisfying the notion of the higher the risk of a portfolio or asset the higher the return that would

be realized from such a portfolio or asset. Investing in the two assets or company stocks would

be beneficial for the risk-averse investor since it would help in risk diversification (Maillet,

Tokpavi, and Vaucher, 2015, p.290). This means that investing in a highly risky portfolio or

The Graphical Combinations of Risk and Return for Portfolios Comprising the Two stocks

(i.e. the Efficient Frontier)

0% 25% 50% 75% 100% 125% 150%

0%

20%

40%

60%

80%

efficient frontier assets

risk

return

Using Excel solver, an efficient frontier was developed between the risk and return of

Holders Technology Limited and Phoenix Holdings Limited. Ideally, Holders Technology

Limited has a return of 66.49% and a risk or standard deviation of 11.20% while Phoenix

Holdings Limited has a market return of 1887.93% and a risk or a return of 59.07% (Lorig, and

Sircar, 2016, p.419). From this, it is evident that Holders technology limited has a lower risk and

a lower return while Phoenix Holdings Limited has a higher risk and a higher return, thus

satisfying the notion of the higher the risk of a portfolio or asset the higher the return that would

be realized from such a portfolio or asset. Investing in the two assets or company stocks would

be beneficial for the risk-averse investor since it would help in risk diversification (Maillet,

Tokpavi, and Vaucher, 2015, p.290). This means that investing in a highly risky portfolio or

PORTFOLIO MANAGEMENT 9

asset together with the one that has a low risk would help neutralize or reduce the risk, thus the

risk-averse investor would not lose his or her invested money. From the efficiency frontier curve,

it is evident that only the stock of Holders Technologies Limited is within the efficient frontier

line and thus it would imply that Phoenix Holdings Limited is not an efficient asset.

An Identification of the Portfolio Mix with Minimum-Variance, the Risk, and Return of

That Portfolio and Meaning of a Minimum Variance Portfolio

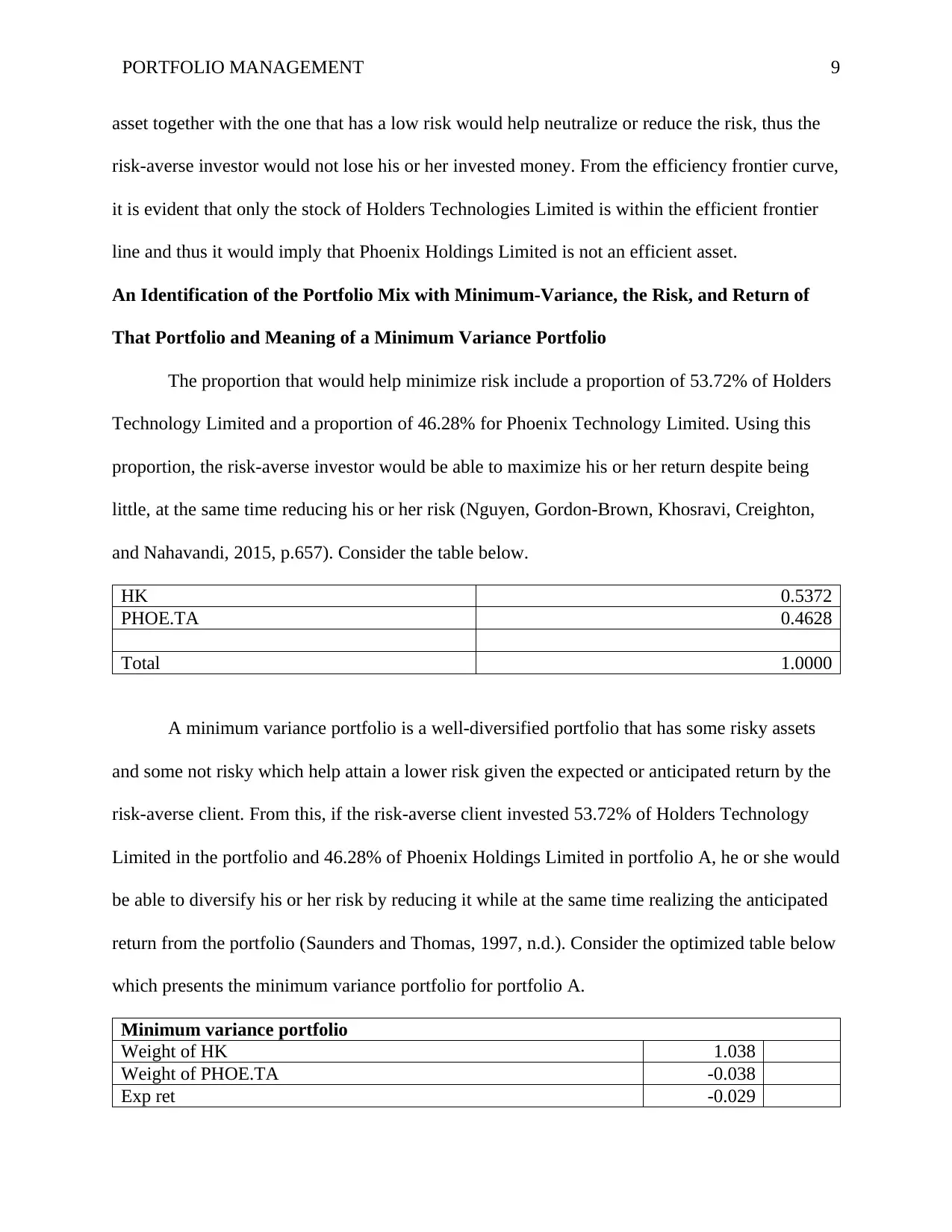

The proportion that would help minimize risk include a proportion of 53.72% of Holders

Technology Limited and a proportion of 46.28% for Phoenix Technology Limited. Using this

proportion, the risk-averse investor would be able to maximize his or her return despite being

little, at the same time reducing his or her risk (Nguyen, Gordon-Brown, Khosravi, Creighton,

and Nahavandi, 2015, p.657). Consider the table below.

HK 0.5372

PHOE.TA 0.4628

Total 1.0000

A minimum variance portfolio is a well-diversified portfolio that has some risky assets

and some not risky which help attain a lower risk given the expected or anticipated return by the

risk-averse client. From this, if the risk-averse client invested 53.72% of Holders Technology

Limited in the portfolio and 46.28% of Phoenix Holdings Limited in portfolio A, he or she would

be able to diversify his or her risk by reducing it while at the same time realizing the anticipated

return from the portfolio (Saunders and Thomas, 1997, n.d.). Consider the optimized table below

which presents the minimum variance portfolio for portfolio A.

Minimum variance portfolio

Weight of HK 1.038

Weight of PHOE.TA -0.038

Exp ret -0.029

asset together with the one that has a low risk would help neutralize or reduce the risk, thus the

risk-averse investor would not lose his or her invested money. From the efficiency frontier curve,

it is evident that only the stock of Holders Technologies Limited is within the efficient frontier

line and thus it would imply that Phoenix Holdings Limited is not an efficient asset.

An Identification of the Portfolio Mix with Minimum-Variance, the Risk, and Return of

That Portfolio and Meaning of a Minimum Variance Portfolio

The proportion that would help minimize risk include a proportion of 53.72% of Holders

Technology Limited and a proportion of 46.28% for Phoenix Technology Limited. Using this

proportion, the risk-averse investor would be able to maximize his or her return despite being

little, at the same time reducing his or her risk (Nguyen, Gordon-Brown, Khosravi, Creighton,

and Nahavandi, 2015, p.657). Consider the table below.

HK 0.5372

PHOE.TA 0.4628

Total 1.0000

A minimum variance portfolio is a well-diversified portfolio that has some risky assets

and some not risky which help attain a lower risk given the expected or anticipated return by the

risk-averse client. From this, if the risk-averse client invested 53.72% of Holders Technology

Limited in the portfolio and 46.28% of Phoenix Holdings Limited in portfolio A, he or she would

be able to diversify his or her risk by reducing it while at the same time realizing the anticipated

return from the portfolio (Saunders and Thomas, 1997, n.d.). Consider the optimized table below

which presents the minimum variance portfolio for portfolio A.

Minimum variance portfolio

Weight of HK 1.038

Weight of PHOE.TA -0.038

Exp ret -0.029

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PORTFOLIO MANAGEMENT 10

Std Dev 0.110

However, if the risk-averse client uses the risk computed previously, that is, he or she

invests 53.72% of Holders Technology Limited in his or her portfolio and 46.28% of Phoenix

Holdings Limited, the risk would be so high since the risk-averse client would realize a risk of

17.26% as computed using the Excel Solver. Therefore, an analysis of the minimum variance

portfolio above shows that the risk-averse investor should invest a considerable amount of his or

her funds in HK as seen above (Titman, Keown and Martin, 2017, n.d.). However, that would

result in a negative expected return of -2.9% and a risk of 11% in the short run. In the long run, it

is expected that the expected return of the risk-averse client would rise and so would the risk of

this client from investing in portfolio A.

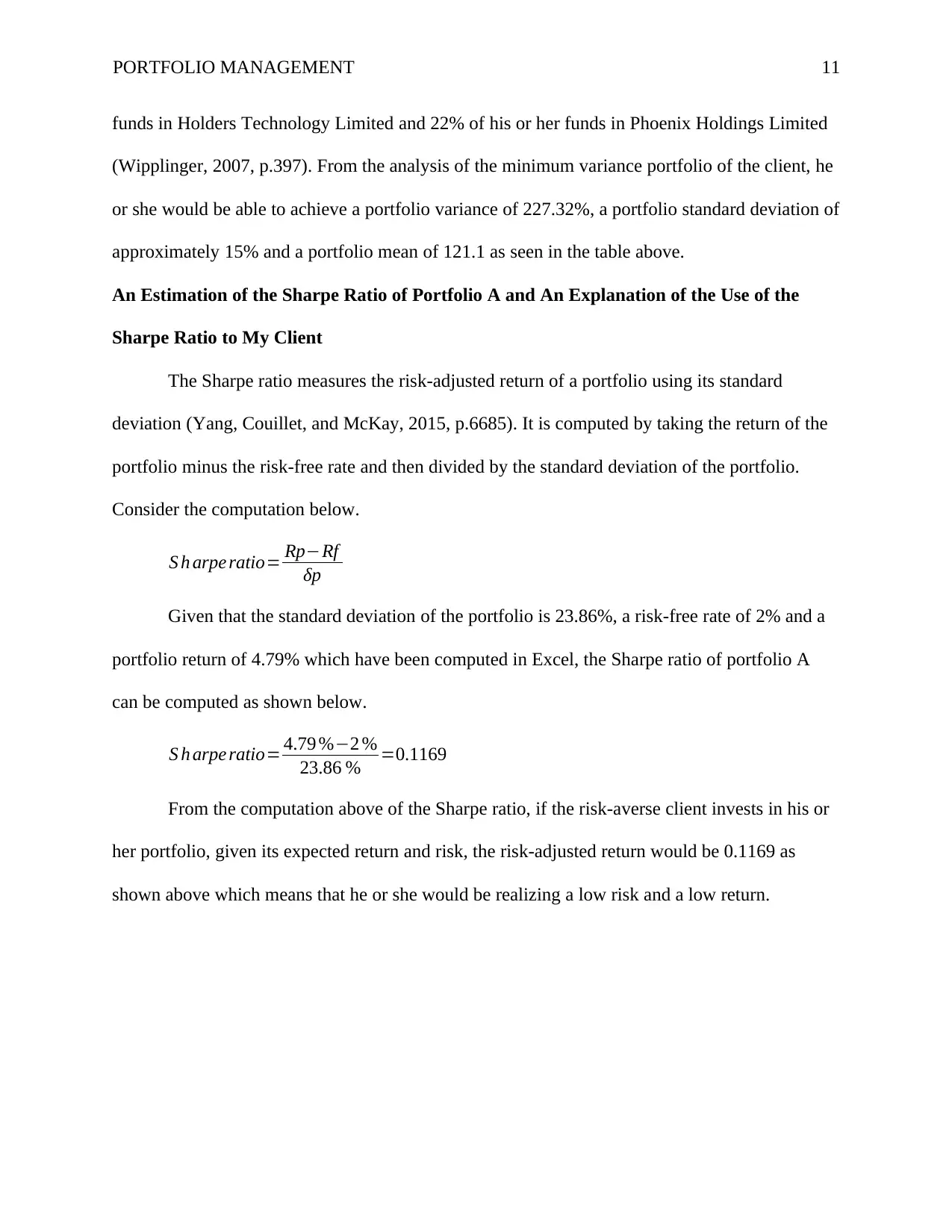

The Best Portfolio, the Weighting of Each Stock in the Portfolio, the Portfolio Mean Return

and the Standard Deviation

Bordered Covariance Matrix for Target Returns

Matrix

HK PHOE.TA

Weights 0.97 0.220

0.9700 118.03 75.91

0.0300 10.35 23.03

1.0000 128.38 98.94

Port Var 227.32

Port S.D. 15.1

Port Mean 121.1

The risk-averse client expects to get an annual return of 15% from the portfolio. This may

be considered as the risk or standard deviation. According to the table above, if the risk-averse

client expects to get an annual return of 15%, he or she would have to invest 97% of his or her

Std Dev 0.110

However, if the risk-averse client uses the risk computed previously, that is, he or she

invests 53.72% of Holders Technology Limited in his or her portfolio and 46.28% of Phoenix

Holdings Limited, the risk would be so high since the risk-averse client would realize a risk of

17.26% as computed using the Excel Solver. Therefore, an analysis of the minimum variance

portfolio above shows that the risk-averse investor should invest a considerable amount of his or

her funds in HK as seen above (Titman, Keown and Martin, 2017, n.d.). However, that would

result in a negative expected return of -2.9% and a risk of 11% in the short run. In the long run, it

is expected that the expected return of the risk-averse client would rise and so would the risk of

this client from investing in portfolio A.

The Best Portfolio, the Weighting of Each Stock in the Portfolio, the Portfolio Mean Return

and the Standard Deviation

Bordered Covariance Matrix for Target Returns

Matrix

HK PHOE.TA

Weights 0.97 0.220

0.9700 118.03 75.91

0.0300 10.35 23.03

1.0000 128.38 98.94

Port Var 227.32

Port S.D. 15.1

Port Mean 121.1

The risk-averse client expects to get an annual return of 15% from the portfolio. This may

be considered as the risk or standard deviation. According to the table above, if the risk-averse

client expects to get an annual return of 15%, he or she would have to invest 97% of his or her

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT 11

funds in Holders Technology Limited and 22% of his or her funds in Phoenix Holdings Limited

(Wipplinger, 2007, p.397). From the analysis of the minimum variance portfolio of the client, he

or she would be able to achieve a portfolio variance of 227.32%, a portfolio standard deviation of

approximately 15% and a portfolio mean of 121.1 as seen in the table above.

An Estimation of the Sharpe Ratio of Portfolio A and An Explanation of the Use of the

Sharpe Ratio to My Client

The Sharpe ratio measures the risk-adjusted return of a portfolio using its standard

deviation (Yang, Couillet, and McKay, 2015, p.6685). It is computed by taking the return of the

portfolio minus the risk-free rate and then divided by the standard deviation of the portfolio.

Consider the computation below.

S h arpe ratio= Rp−Rf

δp

Given that the standard deviation of the portfolio is 23.86%, a risk-free rate of 2% and a

portfolio return of 4.79% which have been computed in Excel, the Sharpe ratio of portfolio A

can be computed as shown below.

S h arpe ratio= 4.79 %−2 %

23.86 % =0.1169

From the computation above of the Sharpe ratio, if the risk-averse client invests in his or

her portfolio, given its expected return and risk, the risk-adjusted return would be 0.1169 as

shown above which means that he or she would be realizing a low risk and a low return.

funds in Holders Technology Limited and 22% of his or her funds in Phoenix Holdings Limited

(Wipplinger, 2007, p.397). From the analysis of the minimum variance portfolio of the client, he

or she would be able to achieve a portfolio variance of 227.32%, a portfolio standard deviation of

approximately 15% and a portfolio mean of 121.1 as seen in the table above.

An Estimation of the Sharpe Ratio of Portfolio A and An Explanation of the Use of the

Sharpe Ratio to My Client

The Sharpe ratio measures the risk-adjusted return of a portfolio using its standard

deviation (Yang, Couillet, and McKay, 2015, p.6685). It is computed by taking the return of the

portfolio minus the risk-free rate and then divided by the standard deviation of the portfolio.

Consider the computation below.

S h arpe ratio= Rp−Rf

δp

Given that the standard deviation of the portfolio is 23.86%, a risk-free rate of 2% and a

portfolio return of 4.79% which have been computed in Excel, the Sharpe ratio of portfolio A

can be computed as shown below.

S h arpe ratio= 4.79 %−2 %

23.86 % =0.1169

From the computation above of the Sharpe ratio, if the risk-averse client invests in his or

her portfolio, given its expected return and risk, the risk-adjusted return would be 0.1169 as

shown above which means that he or she would be realizing a low risk and a low return.

PORTFOLIO MANAGEMENT 12

References

Aouni, B., Colapinto, C. and La Torre, D., 2014. Financial portfolio management through the

goal programming model: Current state-of-the-art. European Journal of Operational

Research, 234(2), pp.536-545.

Beach, S.L. and Orlov, A.G., 2007. An application of the Black–Litterman model with

EGARCH-M-derived views for international portfolio management. Financial Markets

and Portfolio Management, 21(2), pp.147-166.

BHP Billiton PLC, 2018, About Us. [Online]. Available at https://www.bhp.com/

Bodnar, T. and Gupta, A.K., 2015. Robustness of the inference procedures for the global

minimum variance portfolio weights in a skew-normal model. The European Journal of

Finance, 21(13-14), pp.1176-1194.

BP PLC, 2018, About Us. [Online]. Available at http://www.bp.com/

Campbell, J.Y., Lo, A.W.C. and MacKinlay, A.C., 1997. The econometrics of financial markets

(Vol. 2, pp. 149-180). Princeton, NJ: Princeton University Press.

Chandra, P., 2017. Investment analysis and portfolio management. McGraw-Hill Education.

DeAngelo, H. and Stulz, R.M., 2015. Liquid-claim production, risk management, and bank

capital structure: Why high leverage is optimal for banks. Journal of Financial

Economics, 116(2), pp.219-236.

Ernst, P.A., Thompson, J.R. and Miao, Y., 2017. Tukey’s transformational ladder for portfolio

management. Financial Markets and Portfolio Management, 31(3), pp.317-355.

Francs, S., Jorion, F.L., Rudolf, M., Stucki, T., Stulz, R. and Yermack, D., 2006. Financial

Markets and Portfolio Management.

References

Aouni, B., Colapinto, C. and La Torre, D., 2014. Financial portfolio management through the

goal programming model: Current state-of-the-art. European Journal of Operational

Research, 234(2), pp.536-545.

Beach, S.L. and Orlov, A.G., 2007. An application of the Black–Litterman model with

EGARCH-M-derived views for international portfolio management. Financial Markets

and Portfolio Management, 21(2), pp.147-166.

BHP Billiton PLC, 2018, About Us. [Online]. Available at https://www.bhp.com/

Bodnar, T. and Gupta, A.K., 2015. Robustness of the inference procedures for the global

minimum variance portfolio weights in a skew-normal model. The European Journal of

Finance, 21(13-14), pp.1176-1194.

BP PLC, 2018, About Us. [Online]. Available at http://www.bp.com/

Campbell, J.Y., Lo, A.W.C. and MacKinlay, A.C., 1997. The econometrics of financial markets

(Vol. 2, pp. 149-180). Princeton, NJ: Princeton University Press.

Chandra, P., 2017. Investment analysis and portfolio management. McGraw-Hill Education.

DeAngelo, H. and Stulz, R.M., 2015. Liquid-claim production, risk management, and bank

capital structure: Why high leverage is optimal for banks. Journal of Financial

Economics, 116(2), pp.219-236.

Ernst, P.A., Thompson, J.R. and Miao, Y., 2017. Tukey’s transformational ladder for portfolio

management. Financial Markets and Portfolio Management, 31(3), pp.317-355.

Francs, S., Jorion, F.L., Rudolf, M., Stucki, T., Stulz, R. and Yermack, D., 2006. Financial

Markets and Portfolio Management.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.