Financial Analysis of Tesco and Sainsbury: A Comparative Report

VerifiedAdded on 2023/01/05

|17

|3747

|62

Report

AI Summary

This report provides a detailed financial analysis of Tesco and Sainsbury PLC, two major players in the retail industry. The analysis is divided into two portfolios. Portfolio 1 focuses on calculating and interpreting various financial ratios, including current ratio, quick ratio, net profit margin, gross profit margin, gearing ratio, price earnings ratio, earnings per share, return on capital employed, average inventories turnover ratio, and dividend payout ratio, for both companies over the years 2018 and 2019. The report compares their financial positions, performance, and investment potential, providing charts to illustrate the trends and offering recommendations for the underperforming company. Portfolio 2 delves into the application of investment appraisal techniques to advise senior management on investment decisions, along with a discussion of the limitations of these techniques in long-term decision-making. The report concludes with a summary of the key findings and insights derived from the financial analysis.

Managerial Finance

(Portfolio Tesco and

Sainsbury Plc)

(Portfolio Tesco and

Sainsbury Plc)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Table of Contents.............................................................................................................................2

INTRODUCTION...........................................................................................................................1

PORTFOLIO 1................................................................................................................................1

a. Calculation of financial ratios for Tesco and Sainsbury..........................................................1

b. Analysis of performance, financial position and investment potential of both the companies

on the basis of charts for the performance...................................................................................3

c. Recommendations for the company which is performing poorly..........................................10

d. Discussion of limitation of relying on financial ratios..........................................................10

PORTFOLIO 2..............................................................................................................................11

a. Use of appropriate investment appraisal techniques to advise the senior management to

adopt one of the two alternatives...............................................................................................11

b. Discussion of limitations of using investment appraisal techniques in long-term decision

making.......................................................................................................................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

Table of Contents.............................................................................................................................2

INTRODUCTION...........................................................................................................................1

PORTFOLIO 1................................................................................................................................1

a. Calculation of financial ratios for Tesco and Sainsbury..........................................................1

b. Analysis of performance, financial position and investment potential of both the companies

on the basis of charts for the performance...................................................................................3

c. Recommendations for the company which is performing poorly..........................................10

d. Discussion of limitation of relying on financial ratios..........................................................10

PORTFOLIO 2..............................................................................................................................11

a. Use of appropriate investment appraisal techniques to advise the senior management to

adopt one of the two alternatives...............................................................................................11

b. Discussion of limitations of using investment appraisal techniques in long-term decision

making.......................................................................................................................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION

Managerial finance could be defined as the funding which is required by managers for the

purpose of carrying out all the operational activities of business in systematic manner. If the

businesses will not be able to carry out operations properly with the help of finance, then it may

leave negative impact upon functionality of business. In order to sustain in the market, it is very

important for all the businesses to make sure that they are focused with managing finance

systematically (AlKulaib, Al-Jassar and Al-Saad, 2016). Present report is based upon analysis of

performance of Sainsbury and Tesco which are two different organisations that are operating

business under retail industry and these are competitors of each other. There are two different

portfolios are discussed in this report. First one is based upon financial ratios so that actual

performance of business could be determined. Second portfolio is focused with capital

investment appraisal which can help the entities to make right decision for making investment in

future.

PORTFOLIO 1

a. Calculation of financial ratios for Tesco and Sainsbury

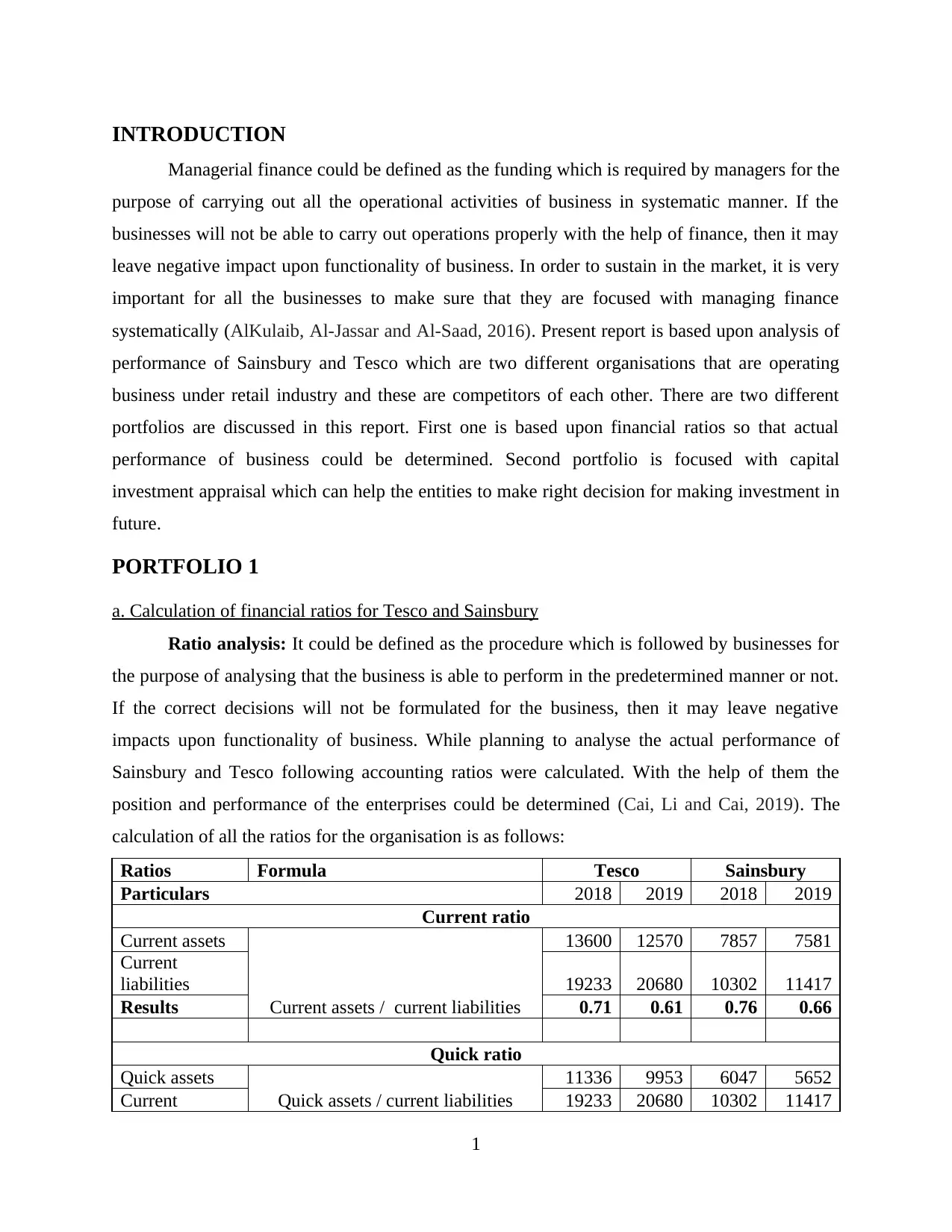

Ratio analysis: It could be defined as the procedure which is followed by businesses for

the purpose of analysing that the business is able to perform in the predetermined manner or not.

If the correct decisions will not be formulated for the business, then it may leave negative

impacts upon functionality of business. While planning to analyse the actual performance of

Sainsbury and Tesco following accounting ratios were calculated. With the help of them the

position and performance of the enterprises could be determined (Cai, Li and Cai, 2019). The

calculation of all the ratios for the organisation is as follows:

Ratios Formula Tesco Sainsbury

Particulars 2018 2019 2018 2019

Current ratio

Current assets

Current assets / current liabilities

13600 12570 7857 7581

Current

liabilities 19233 20680 10302 11417

Results 0.71 0.61 0.76 0.66

Quick ratio

Quick assets

Quick assets / current liabilities

11336 9953 6047 5652

Current 19233 20680 10302 11417

1

Managerial finance could be defined as the funding which is required by managers for the

purpose of carrying out all the operational activities of business in systematic manner. If the

businesses will not be able to carry out operations properly with the help of finance, then it may

leave negative impact upon functionality of business. In order to sustain in the market, it is very

important for all the businesses to make sure that they are focused with managing finance

systematically (AlKulaib, Al-Jassar and Al-Saad, 2016). Present report is based upon analysis of

performance of Sainsbury and Tesco which are two different organisations that are operating

business under retail industry and these are competitors of each other. There are two different

portfolios are discussed in this report. First one is based upon financial ratios so that actual

performance of business could be determined. Second portfolio is focused with capital

investment appraisal which can help the entities to make right decision for making investment in

future.

PORTFOLIO 1

a. Calculation of financial ratios for Tesco and Sainsbury

Ratio analysis: It could be defined as the procedure which is followed by businesses for

the purpose of analysing that the business is able to perform in the predetermined manner or not.

If the correct decisions will not be formulated for the business, then it may leave negative

impacts upon functionality of business. While planning to analyse the actual performance of

Sainsbury and Tesco following accounting ratios were calculated. With the help of them the

position and performance of the enterprises could be determined (Cai, Li and Cai, 2019). The

calculation of all the ratios for the organisation is as follows:

Ratios Formula Tesco Sainsbury

Particulars 2018 2019 2018 2019

Current ratio

Current assets

Current assets / current liabilities

13600 12570 7857 7581

Current

liabilities 19233 20680 10302 11417

Results 0.71 0.61 0.76 0.66

Quick ratio

Quick assets

Quick assets / current liabilities

11336 9953 6047 5652

Current 19233 20680 10302 11417

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

liabilities

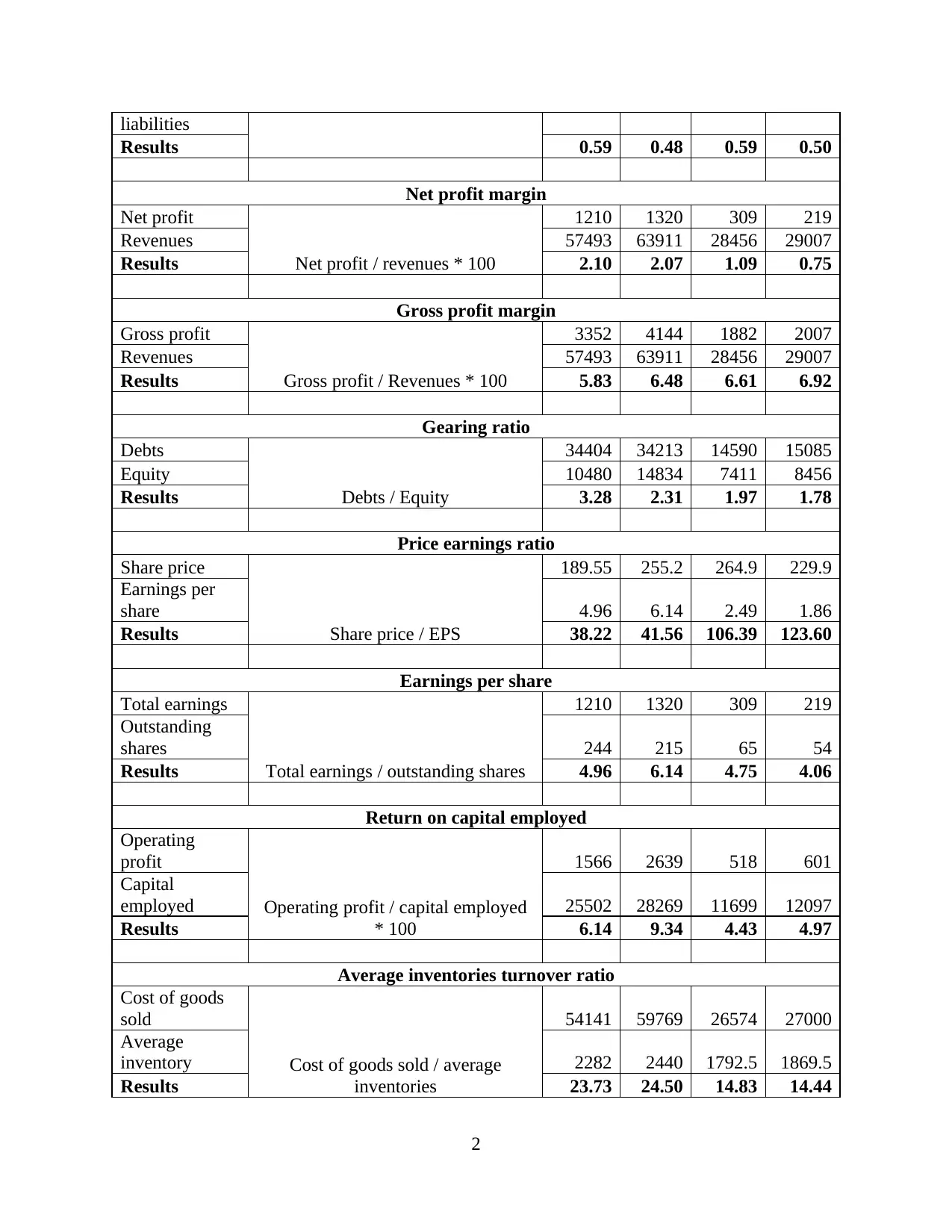

Results 0.59 0.48 0.59 0.50

Net profit margin

Net profit

Net profit / revenues * 100

1210 1320 309 219

Revenues 57493 63911 28456 29007

Results 2.10 2.07 1.09 0.75

Gross profit margin

Gross profit

Gross profit / Revenues * 100

3352 4144 1882 2007

Revenues 57493 63911 28456 29007

Results 5.83 6.48 6.61 6.92

Gearing ratio

Debts

Debts / Equity

34404 34213 14590 15085

Equity 10480 14834 7411 8456

Results 3.28 2.31 1.97 1.78

Price earnings ratio

Share price

Share price / EPS

189.55 255.2 264.9 229.9

Earnings per

share 4.96 6.14 2.49 1.86

Results 38.22 41.56 106.39 123.60

Earnings per share

Total earnings

Total earnings / outstanding shares

1210 1320 309 219

Outstanding

shares 244 215 65 54

Results 4.96 6.14 4.75 4.06

Return on capital employed

Operating

profit

Operating profit / capital employed

* 100

1566 2639 518 601

Capital

employed 25502 28269 11699 12097

Results 6.14 9.34 4.43 4.97

Average inventories turnover ratio

Cost of goods

sold

Cost of goods sold / average

inventories

54141 59769 26574 27000

Average

inventory 2282 2440 1792.5 1869.5

Results 23.73 24.50 14.83 14.44

2

Results 0.59 0.48 0.59 0.50

Net profit margin

Net profit

Net profit / revenues * 100

1210 1320 309 219

Revenues 57493 63911 28456 29007

Results 2.10 2.07 1.09 0.75

Gross profit margin

Gross profit

Gross profit / Revenues * 100

3352 4144 1882 2007

Revenues 57493 63911 28456 29007

Results 5.83 6.48 6.61 6.92

Gearing ratio

Debts

Debts / Equity

34404 34213 14590 15085

Equity 10480 14834 7411 8456

Results 3.28 2.31 1.97 1.78

Price earnings ratio

Share price

Share price / EPS

189.55 255.2 264.9 229.9

Earnings per

share 4.96 6.14 2.49 1.86

Results 38.22 41.56 106.39 123.60

Earnings per share

Total earnings

Total earnings / outstanding shares

1210 1320 309 219

Outstanding

shares 244 215 65 54

Results 4.96 6.14 4.75 4.06

Return on capital employed

Operating

profit

Operating profit / capital employed

* 100

1566 2639 518 601

Capital

employed 25502 28269 11699 12097

Results 6.14 9.34 4.43 4.97

Average inventories turnover ratio

Cost of goods

sold

Cost of goods sold / average

inventories

54141 59769 26574 27000

Average

inventory 2282 2440 1792.5 1869.5

Results 23.73 24.50 14.83 14.44

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Dividend pay-out ratio

Dividend

Dividend / Net profit * 100

82 357 235 247

Net profit 1210 1320 309 219

Results 6.78 27.05 76.05 112.79

Working notes:

Calculation of capital employed

Particulars

Tesco Sainsbury

2018 2019 2018 2019

Total assets 44735 48949 22001 23514

Less: Current

liabilities 19233 20680 10302 11417

Capital employed 25502 28269 11699 12097

b. Analysis of performance, financial position and investment potential of both the companies on

the basis of charts for the performance

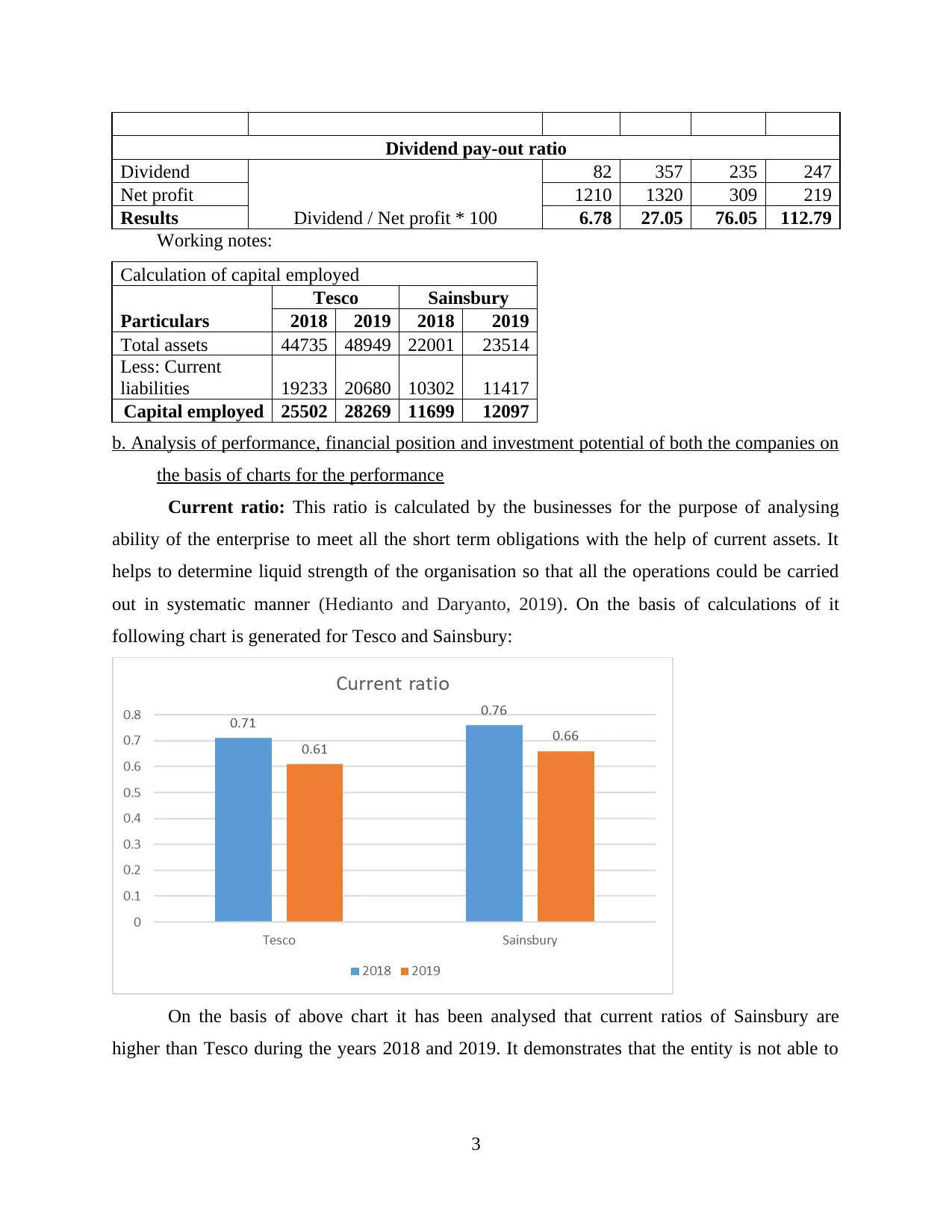

Current ratio: This ratio is calculated by the businesses for the purpose of analysing

ability of the enterprise to meet all the short term obligations with the help of current assets. It

helps to determine liquid strength of the organisation so that all the operations could be carried

out in systematic manner (Hedianto and Daryanto, 2019). On the basis of calculations of it

following chart is generated for Tesco and Sainsbury:

On the basis of above chart it has been analysed that current ratios of Sainsbury are

higher than Tesco during the years 2018 and 2019. It demonstrates that the entity is not able to

3

Dividend

Dividend / Net profit * 100

82 357 235 247

Net profit 1210 1320 309 219

Results 6.78 27.05 76.05 112.79

Working notes:

Calculation of capital employed

Particulars

Tesco Sainsbury

2018 2019 2018 2019

Total assets 44735 48949 22001 23514

Less: Current

liabilities 19233 20680 10302 11417

Capital employed 25502 28269 11699 12097

b. Analysis of performance, financial position and investment potential of both the companies on

the basis of charts for the performance

Current ratio: This ratio is calculated by the businesses for the purpose of analysing

ability of the enterprise to meet all the short term obligations with the help of current assets. It

helps to determine liquid strength of the organisation so that all the operations could be carried

out in systematic manner (Hedianto and Daryanto, 2019). On the basis of calculations of it

following chart is generated for Tesco and Sainsbury:

On the basis of above chart it has been analysed that current ratios of Sainsbury are

higher than Tesco during the years 2018 and 2019. It demonstrates that the entity is not able to

3

pay all the short term debts in less time as compared to the other organisation. It also shows that

liquidity of Tesco is lower than Sainsbury.

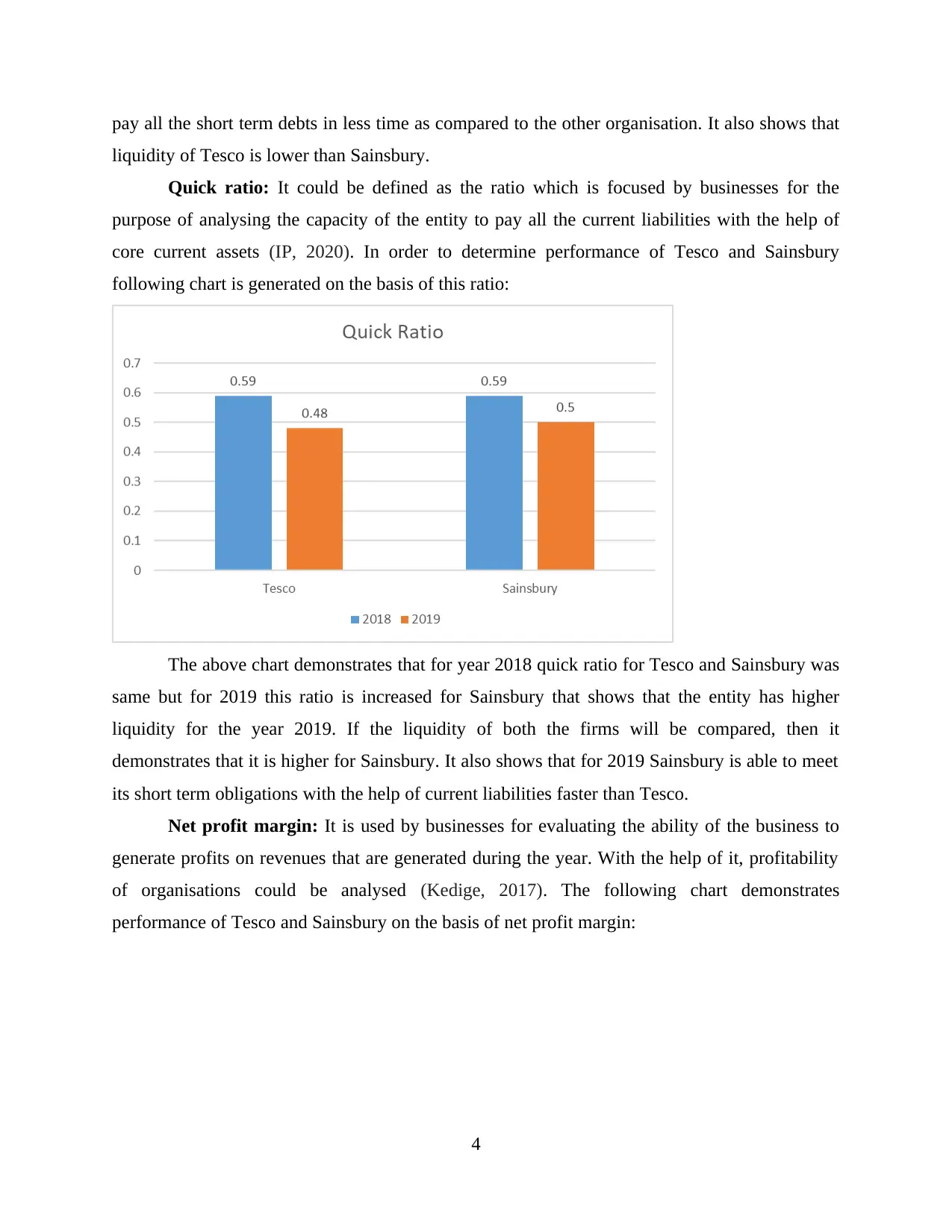

Quick ratio: It could be defined as the ratio which is focused by businesses for the

purpose of analysing the capacity of the entity to pay all the current liabilities with the help of

core current assets (IP, 2020). In order to determine performance of Tesco and Sainsbury

following chart is generated on the basis of this ratio:

The above chart demonstrates that for year 2018 quick ratio for Tesco and Sainsbury was

same but for 2019 this ratio is increased for Sainsbury that shows that the entity has higher

liquidity for the year 2019. If the liquidity of both the firms will be compared, then it

demonstrates that it is higher for Sainsbury. It also shows that for 2019 Sainsbury is able to meet

its short term obligations with the help of current liabilities faster than Tesco.

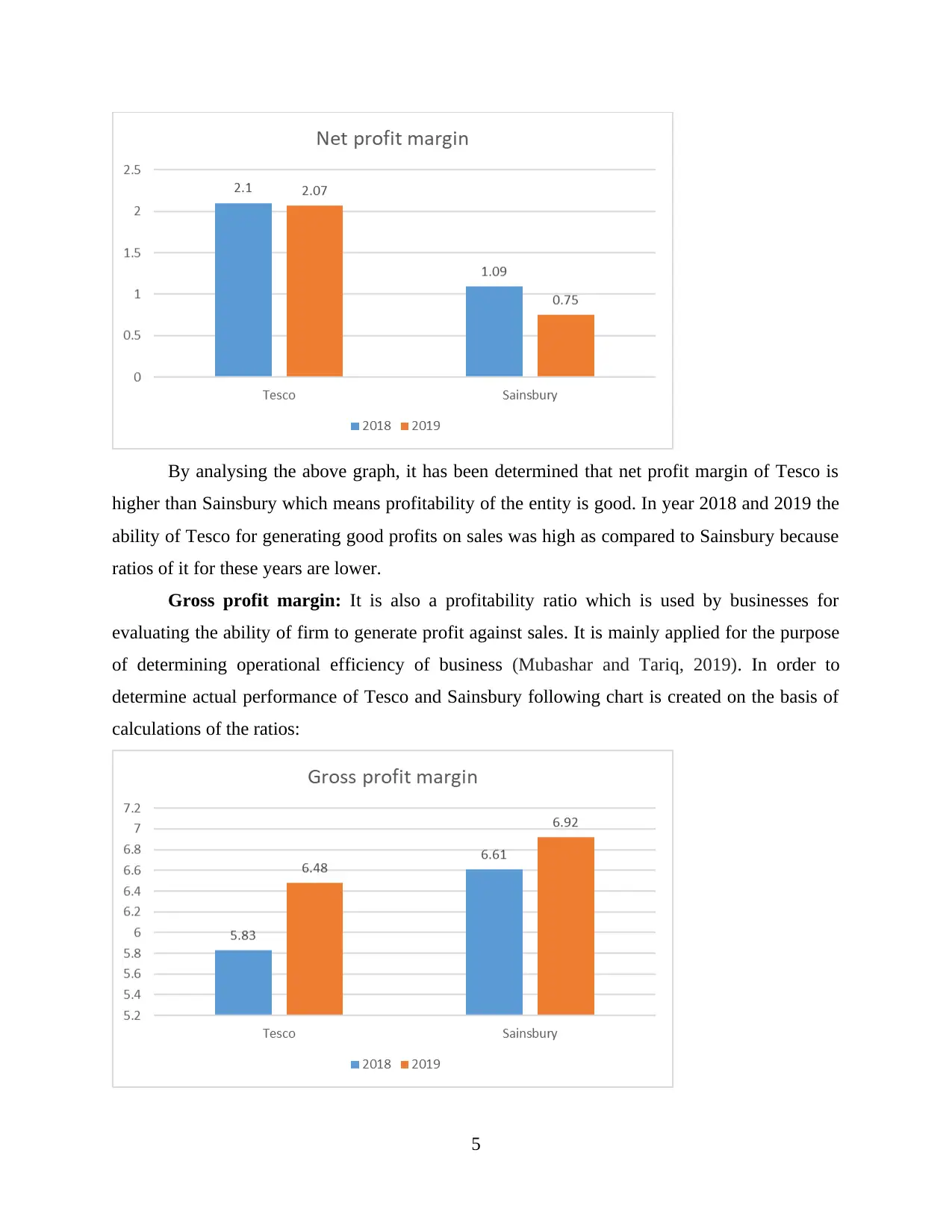

Net profit margin: It is used by businesses for evaluating the ability of the business to

generate profits on revenues that are generated during the year. With the help of it, profitability

of organisations could be analysed (Kedige, 2017). The following chart demonstrates

performance of Tesco and Sainsbury on the basis of net profit margin:

4

liquidity of Tesco is lower than Sainsbury.

Quick ratio: It could be defined as the ratio which is focused by businesses for the

purpose of analysing the capacity of the entity to pay all the current liabilities with the help of

core current assets (IP, 2020). In order to determine performance of Tesco and Sainsbury

following chart is generated on the basis of this ratio:

The above chart demonstrates that for year 2018 quick ratio for Tesco and Sainsbury was

same but for 2019 this ratio is increased for Sainsbury that shows that the entity has higher

liquidity for the year 2019. If the liquidity of both the firms will be compared, then it

demonstrates that it is higher for Sainsbury. It also shows that for 2019 Sainsbury is able to meet

its short term obligations with the help of current liabilities faster than Tesco.

Net profit margin: It is used by businesses for evaluating the ability of the business to

generate profits on revenues that are generated during the year. With the help of it, profitability

of organisations could be analysed (Kedige, 2017). The following chart demonstrates

performance of Tesco and Sainsbury on the basis of net profit margin:

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

By analysing the above graph, it has been determined that net profit margin of Tesco is

higher than Sainsbury which means profitability of the entity is good. In year 2018 and 2019 the

ability of Tesco for generating good profits on sales was high as compared to Sainsbury because

ratios of it for these years are lower.

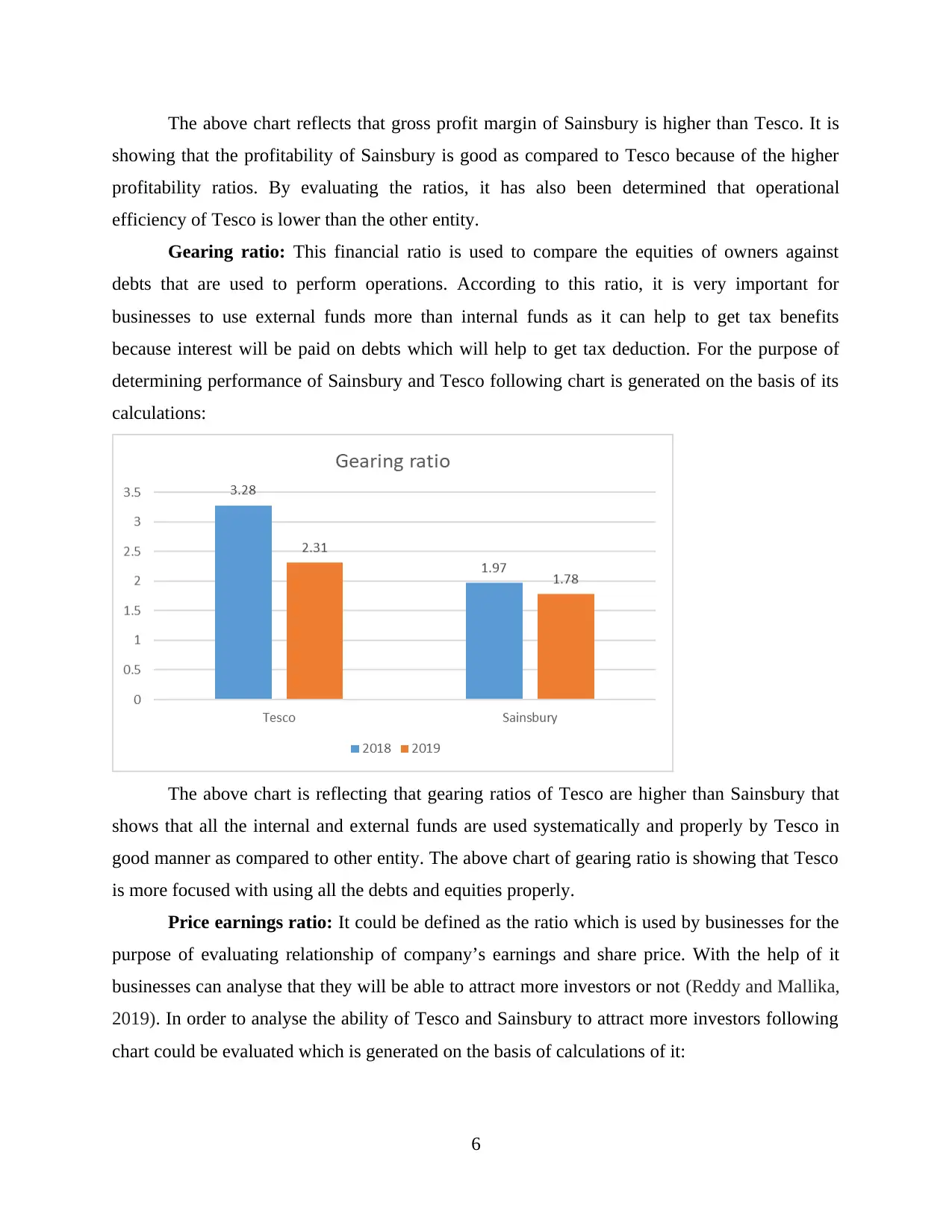

Gross profit margin: It is also a profitability ratio which is used by businesses for

evaluating the ability of firm to generate profit against sales. It is mainly applied for the purpose

of determining operational efficiency of business (Mubashar and Tariq, 2019). In order to

determine actual performance of Tesco and Sainsbury following chart is created on the basis of

calculations of the ratios:

5

higher than Sainsbury which means profitability of the entity is good. In year 2018 and 2019 the

ability of Tesco for generating good profits on sales was high as compared to Sainsbury because

ratios of it for these years are lower.

Gross profit margin: It is also a profitability ratio which is used by businesses for

evaluating the ability of firm to generate profit against sales. It is mainly applied for the purpose

of determining operational efficiency of business (Mubashar and Tariq, 2019). In order to

determine actual performance of Tesco and Sainsbury following chart is created on the basis of

calculations of the ratios:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The above chart reflects that gross profit margin of Sainsbury is higher than Tesco. It is

showing that the profitability of Sainsbury is good as compared to Tesco because of the higher

profitability ratios. By evaluating the ratios, it has also been determined that operational

efficiency of Tesco is lower than the other entity.

Gearing ratio: This financial ratio is used to compare the equities of owners against

debts that are used to perform operations. According to this ratio, it is very important for

businesses to use external funds more than internal funds as it can help to get tax benefits

because interest will be paid on debts which will help to get tax deduction. For the purpose of

determining performance of Sainsbury and Tesco following chart is generated on the basis of its

calculations:

The above chart is reflecting that gearing ratios of Tesco are higher than Sainsbury that

shows that all the internal and external funds are used systematically and properly by Tesco in

good manner as compared to other entity. The above chart of gearing ratio is showing that Tesco

is more focused with using all the debts and equities properly.

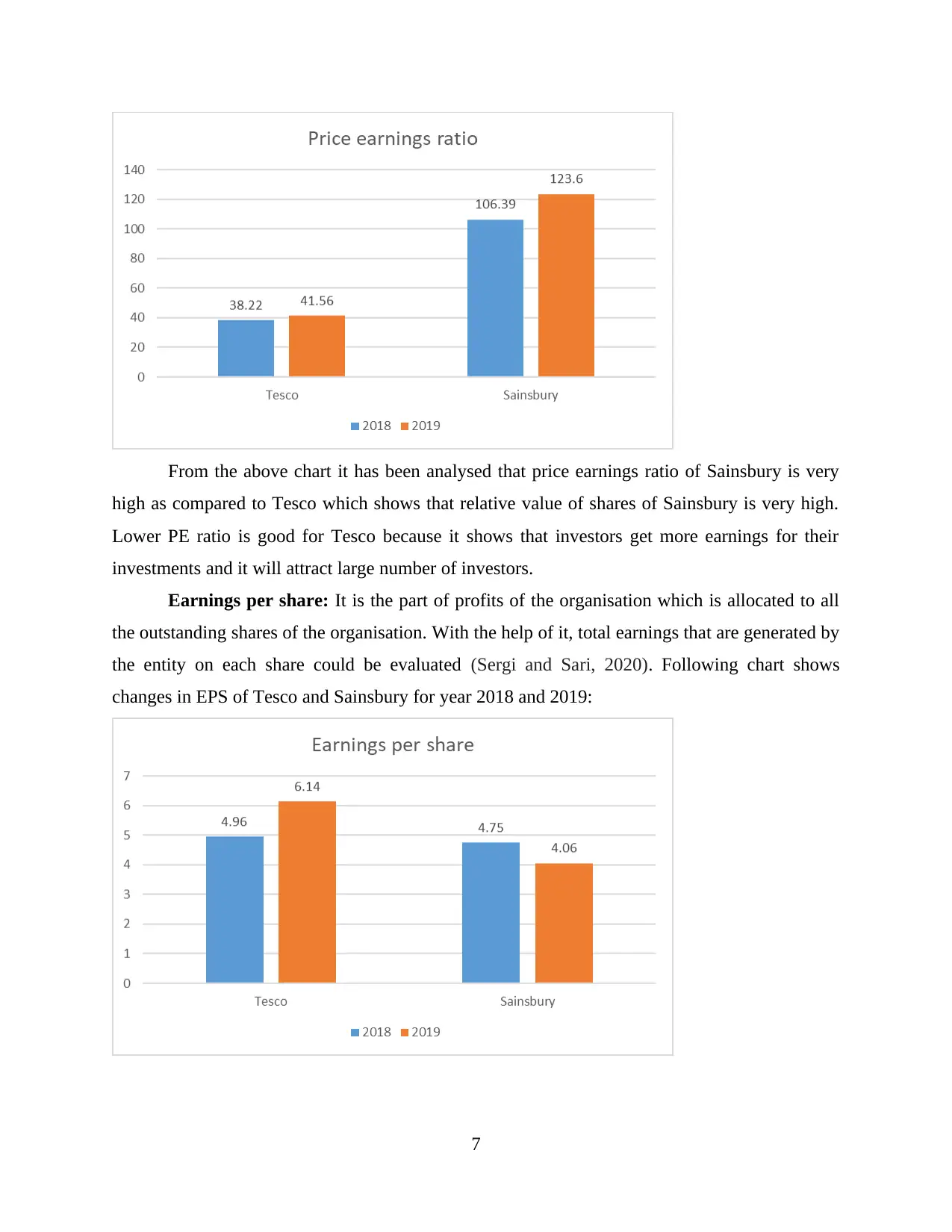

Price earnings ratio: It could be defined as the ratio which is used by businesses for the

purpose of evaluating relationship of company’s earnings and share price. With the help of it

businesses can analyse that they will be able to attract more investors or not (Reddy and Mallika,

2019). In order to analyse the ability of Tesco and Sainsbury to attract more investors following

chart could be evaluated which is generated on the basis of calculations of it:

6

showing that the profitability of Sainsbury is good as compared to Tesco because of the higher

profitability ratios. By evaluating the ratios, it has also been determined that operational

efficiency of Tesco is lower than the other entity.

Gearing ratio: This financial ratio is used to compare the equities of owners against

debts that are used to perform operations. According to this ratio, it is very important for

businesses to use external funds more than internal funds as it can help to get tax benefits

because interest will be paid on debts which will help to get tax deduction. For the purpose of

determining performance of Sainsbury and Tesco following chart is generated on the basis of its

calculations:

The above chart is reflecting that gearing ratios of Tesco are higher than Sainsbury that

shows that all the internal and external funds are used systematically and properly by Tesco in

good manner as compared to other entity. The above chart of gearing ratio is showing that Tesco

is more focused with using all the debts and equities properly.

Price earnings ratio: It could be defined as the ratio which is used by businesses for the

purpose of evaluating relationship of company’s earnings and share price. With the help of it

businesses can analyse that they will be able to attract more investors or not (Reddy and Mallika,

2019). In order to analyse the ability of Tesco and Sainsbury to attract more investors following

chart could be evaluated which is generated on the basis of calculations of it:

6

From the above chart it has been analysed that price earnings ratio of Sainsbury is very

high as compared to Tesco which shows that relative value of shares of Sainsbury is very high.

Lower PE ratio is good for Tesco because it shows that investors get more earnings for their

investments and it will attract large number of investors.

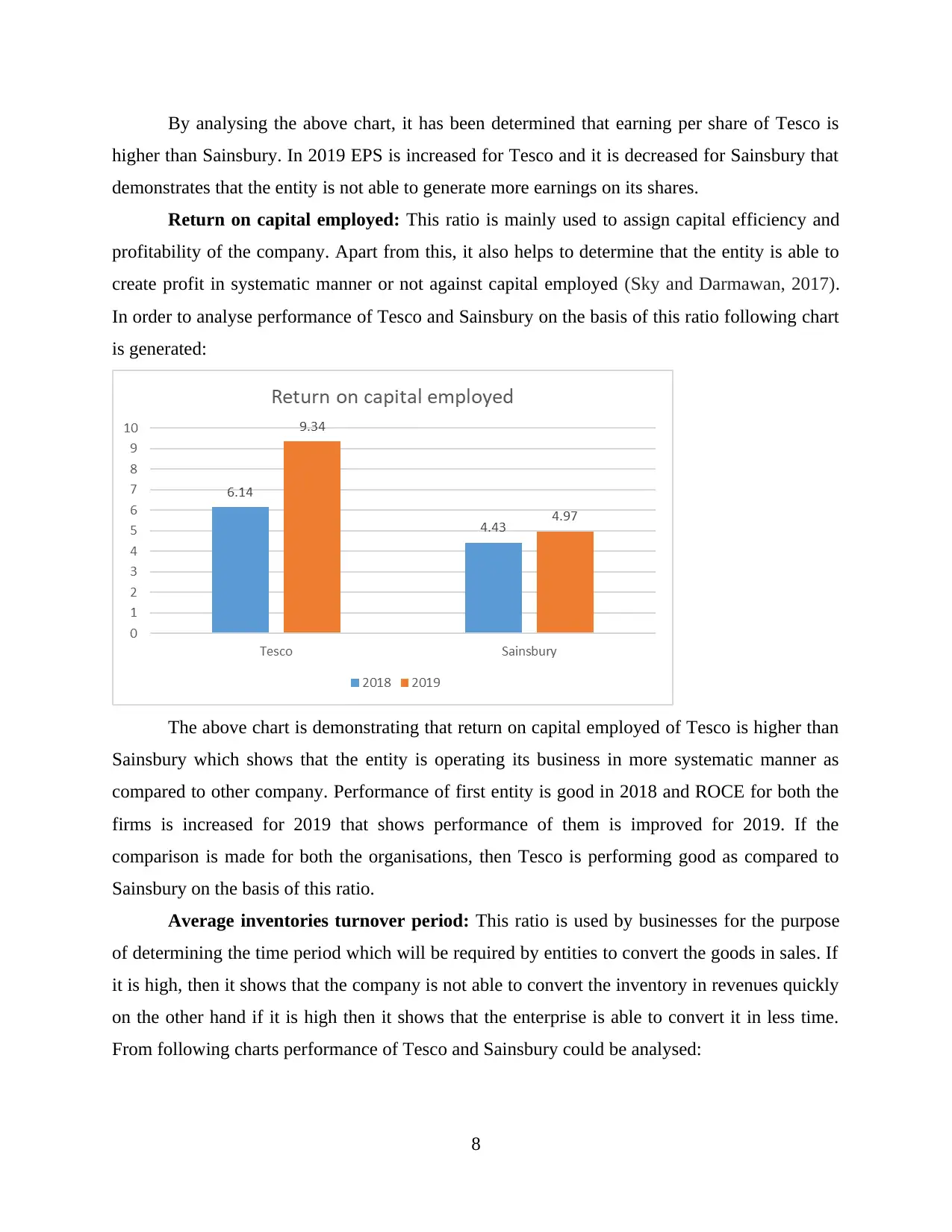

Earnings per share: It is the part of profits of the organisation which is allocated to all

the outstanding shares of the organisation. With the help of it, total earnings that are generated by

the entity on each share could be evaluated (Sergi and Sari, 2020). Following chart shows

changes in EPS of Tesco and Sainsbury for year 2018 and 2019:

7

high as compared to Tesco which shows that relative value of shares of Sainsbury is very high.

Lower PE ratio is good for Tesco because it shows that investors get more earnings for their

investments and it will attract large number of investors.

Earnings per share: It is the part of profits of the organisation which is allocated to all

the outstanding shares of the organisation. With the help of it, total earnings that are generated by

the entity on each share could be evaluated (Sergi and Sari, 2020). Following chart shows

changes in EPS of Tesco and Sainsbury for year 2018 and 2019:

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

By analysing the above chart, it has been determined that earning per share of Tesco is

higher than Sainsbury. In 2019 EPS is increased for Tesco and it is decreased for Sainsbury that

demonstrates that the entity is not able to generate more earnings on its shares.

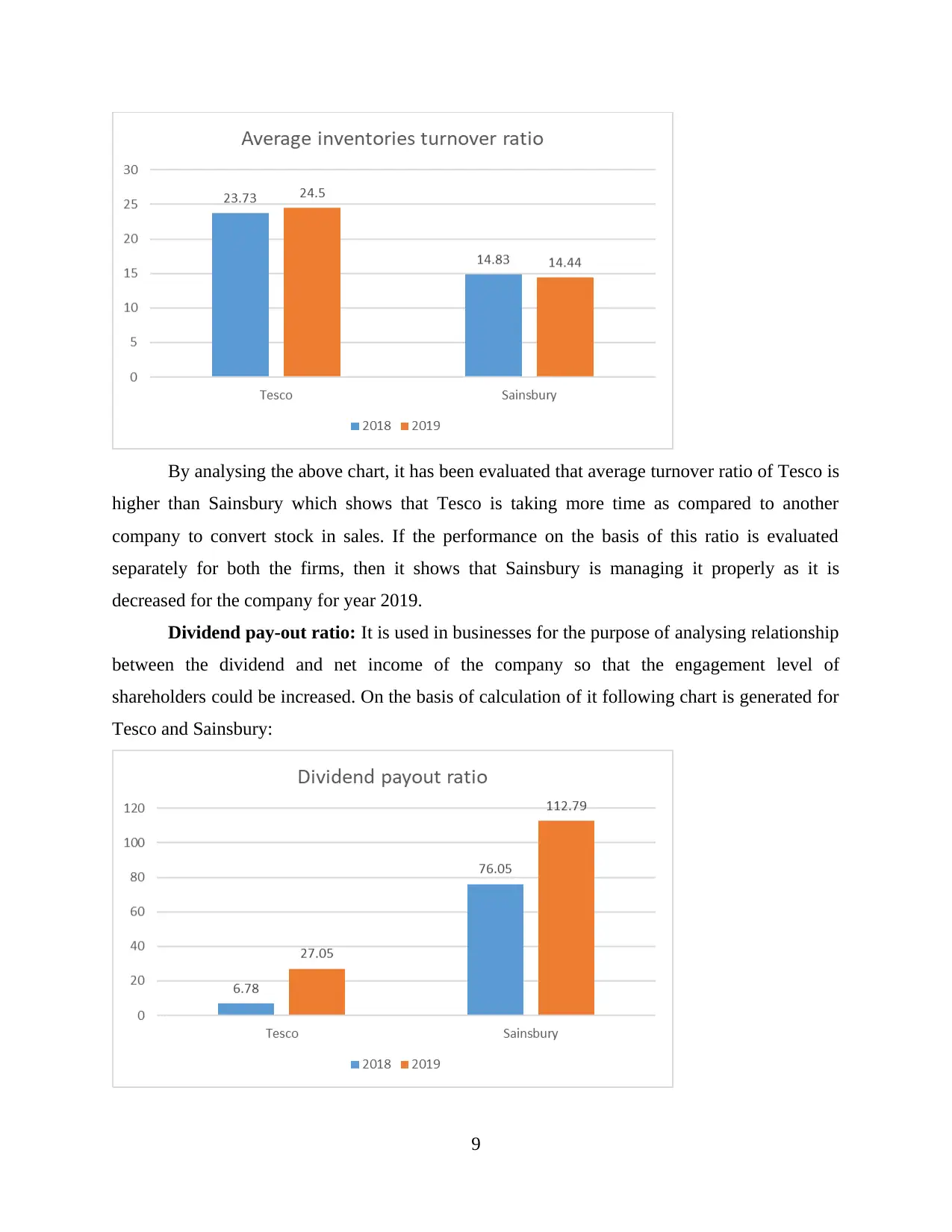

Return on capital employed: This ratio is mainly used to assign capital efficiency and

profitability of the company. Apart from this, it also helps to determine that the entity is able to

create profit in systematic manner or not against capital employed (Sky and Darmawan, 2017).

In order to analyse performance of Tesco and Sainsbury on the basis of this ratio following chart

is generated:

The above chart is demonstrating that return on capital employed of Tesco is higher than

Sainsbury which shows that the entity is operating its business in more systematic manner as

compared to other company. Performance of first entity is good in 2018 and ROCE for both the

firms is increased for 2019 that shows performance of them is improved for 2019. If the

comparison is made for both the organisations, then Tesco is performing good as compared to

Sainsbury on the basis of this ratio.

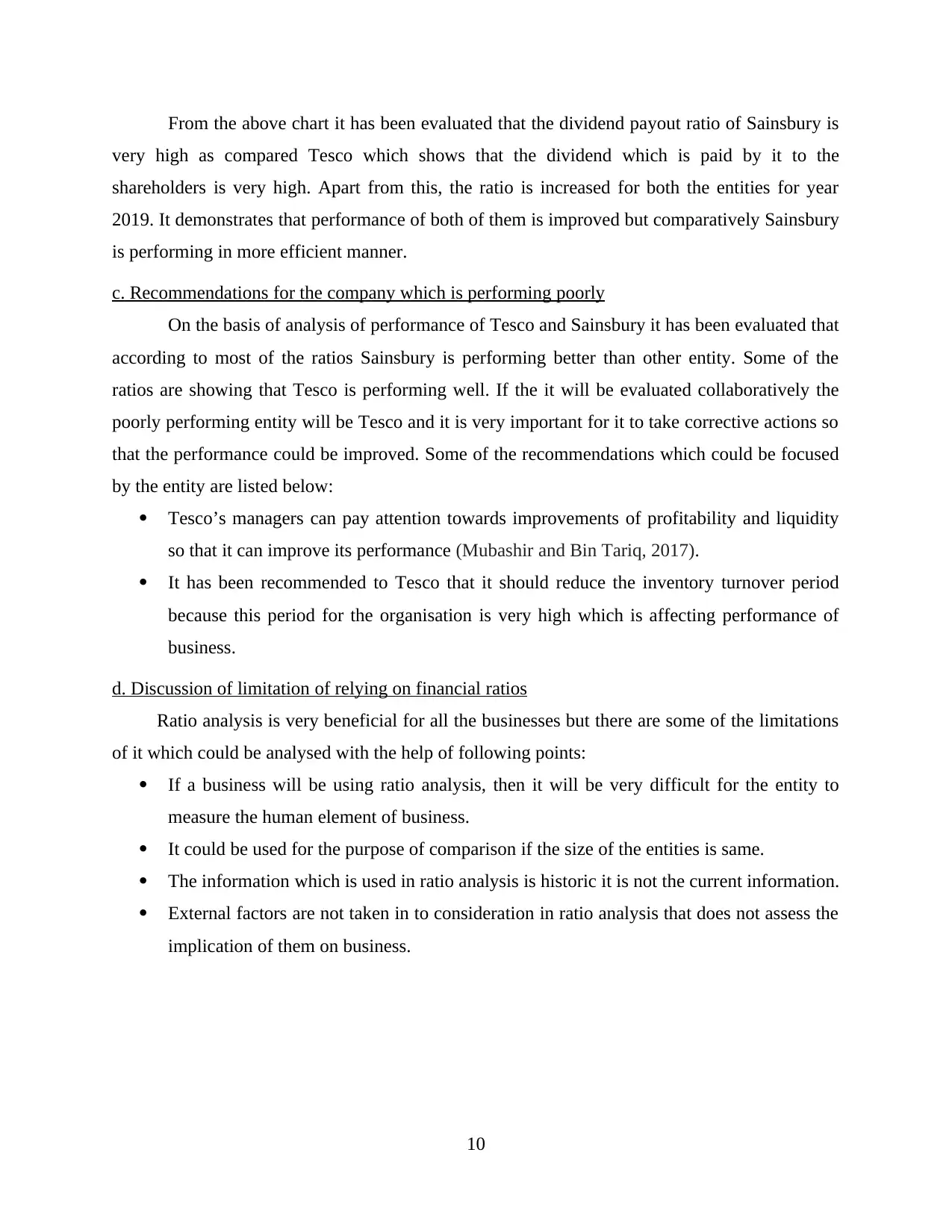

Average inventories turnover period: This ratio is used by businesses for the purpose

of determining the time period which will be required by entities to convert the goods in sales. If

it is high, then it shows that the company is not able to convert the inventory in revenues quickly

on the other hand if it is high then it shows that the enterprise is able to convert it in less time.

From following charts performance of Tesco and Sainsbury could be analysed:

8

higher than Sainsbury. In 2019 EPS is increased for Tesco and it is decreased for Sainsbury that

demonstrates that the entity is not able to generate more earnings on its shares.

Return on capital employed: This ratio is mainly used to assign capital efficiency and

profitability of the company. Apart from this, it also helps to determine that the entity is able to

create profit in systematic manner or not against capital employed (Sky and Darmawan, 2017).

In order to analyse performance of Tesco and Sainsbury on the basis of this ratio following chart

is generated:

The above chart is demonstrating that return on capital employed of Tesco is higher than

Sainsbury which shows that the entity is operating its business in more systematic manner as

compared to other company. Performance of first entity is good in 2018 and ROCE for both the

firms is increased for 2019 that shows performance of them is improved for 2019. If the

comparison is made for both the organisations, then Tesco is performing good as compared to

Sainsbury on the basis of this ratio.

Average inventories turnover period: This ratio is used by businesses for the purpose

of determining the time period which will be required by entities to convert the goods in sales. If

it is high, then it shows that the company is not able to convert the inventory in revenues quickly

on the other hand if it is high then it shows that the enterprise is able to convert it in less time.

From following charts performance of Tesco and Sainsbury could be analysed:

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

By analysing the above chart, it has been evaluated that average turnover ratio of Tesco is

higher than Sainsbury which shows that Tesco is taking more time as compared to another

company to convert stock in sales. If the performance on the basis of this ratio is evaluated

separately for both the firms, then it shows that Sainsbury is managing it properly as it is

decreased for the company for year 2019.

Dividend pay-out ratio: It is used in businesses for the purpose of analysing relationship

between the dividend and net income of the company so that the engagement level of

shareholders could be increased. On the basis of calculation of it following chart is generated for

Tesco and Sainsbury:

9

higher than Sainsbury which shows that Tesco is taking more time as compared to another

company to convert stock in sales. If the performance on the basis of this ratio is evaluated

separately for both the firms, then it shows that Sainsbury is managing it properly as it is

decreased for the company for year 2019.

Dividend pay-out ratio: It is used in businesses for the purpose of analysing relationship

between the dividend and net income of the company so that the engagement level of

shareholders could be increased. On the basis of calculation of it following chart is generated for

Tesco and Sainsbury:

9

From the above chart it has been evaluated that the dividend payout ratio of Sainsbury is

very high as compared Tesco which shows that the dividend which is paid by it to the

shareholders is very high. Apart from this, the ratio is increased for both the entities for year

2019. It demonstrates that performance of both of them is improved but comparatively Sainsbury

is performing in more efficient manner.

c. Recommendations for the company which is performing poorly

On the basis of analysis of performance of Tesco and Sainsbury it has been evaluated that

according to most of the ratios Sainsbury is performing better than other entity. Some of the

ratios are showing that Tesco is performing well. If the it will be evaluated collaboratively the

poorly performing entity will be Tesco and it is very important for it to take corrective actions so

that the performance could be improved. Some of the recommendations which could be focused

by the entity are listed below:

Tesco’s managers can pay attention towards improvements of profitability and liquidity

so that it can improve its performance (Mubashir and Bin Tariq, 2017).

It has been recommended to Tesco that it should reduce the inventory turnover period

because this period for the organisation is very high which is affecting performance of

business.

d. Discussion of limitation of relying on financial ratios

Ratio analysis is very beneficial for all the businesses but there are some of the limitations

of it which could be analysed with the help of following points:

If a business will be using ratio analysis, then it will be very difficult for the entity to

measure the human element of business.

It could be used for the purpose of comparison if the size of the entities is same.

The information which is used in ratio analysis is historic it is not the current information.

External factors are not taken in to consideration in ratio analysis that does not assess the

implication of them on business.

10

very high as compared Tesco which shows that the dividend which is paid by it to the

shareholders is very high. Apart from this, the ratio is increased for both the entities for year

2019. It demonstrates that performance of both of them is improved but comparatively Sainsbury

is performing in more efficient manner.

c. Recommendations for the company which is performing poorly

On the basis of analysis of performance of Tesco and Sainsbury it has been evaluated that

according to most of the ratios Sainsbury is performing better than other entity. Some of the

ratios are showing that Tesco is performing well. If the it will be evaluated collaboratively the

poorly performing entity will be Tesco and it is very important for it to take corrective actions so

that the performance could be improved. Some of the recommendations which could be focused

by the entity are listed below:

Tesco’s managers can pay attention towards improvements of profitability and liquidity

so that it can improve its performance (Mubashir and Bin Tariq, 2017).

It has been recommended to Tesco that it should reduce the inventory turnover period

because this period for the organisation is very high which is affecting performance of

business.

d. Discussion of limitation of relying on financial ratios

Ratio analysis is very beneficial for all the businesses but there are some of the limitations

of it which could be analysed with the help of following points:

If a business will be using ratio analysis, then it will be very difficult for the entity to

measure the human element of business.

It could be used for the purpose of comparison if the size of the entities is same.

The information which is used in ratio analysis is historic it is not the current information.

External factors are not taken in to consideration in ratio analysis that does not assess the

implication of them on business.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.