Managerial Finance Report: Ratio Analysis of Tesco and Sainsbury

VerifiedAdded on 2022/12/30

|19

|4170

|5

Report

AI Summary

This report presents a comparative financial analysis of Tesco and Sainsbury, two prominent UK-based retail corporations. It begins with an introduction to managerial finance, defining key concepts and their importance in business operations. The core of the report focuses on ratio analysis, examining liquidity, profitability, and efficiency ratios for both companies over a two-year period. Detailed calculations and interpretations of current ratios, quick ratios, gross profit margins, net profit margins, price-to-earnings ratios, gearing ratios, return on capital employed, inventory turnover, dividend payout ratios, and earnings per share are provided. The analysis includes charts and tables to visually represent the financial performance of each company. Furthermore, the report explores investment appraisal techniques, although the specifics are not fully detailed in the provided text. It also addresses the limitations of using ratio analysis and investment appraisal techniques for long-term decision-making. The report concludes with a summary of findings and recommendations for each company, highlighting their strengths and weaknesses based on the financial data analyzed.

Managerial Financial

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

PORTFOLIO 1................................................................................................................................3

Ratio analysis:..............................................................................................................................3

Interpretation:..............................................................................................................................5

Recommendations:....................................................................................................................13

Limitations for using ratio analysis for knowing firms financial position:...............................13

PORTFOLIO 2..............................................................................................................................14

Investment appraisal techniques for project A and project B:...................................................14

a. Investment appraisal techniques:...........................................................................................14

Limitations of using investment appraisal techniques for long term decision-making:............16

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION...........................................................................................................................3

PORTFOLIO 1................................................................................................................................3

Ratio analysis:..............................................................................................................................3

Interpretation:..............................................................................................................................5

Recommendations:....................................................................................................................13

Limitations for using ratio analysis for knowing firms financial position:...............................13

PORTFOLIO 2..............................................................................................................................14

Investment appraisal techniques for project A and project B:...................................................14

a. Investment appraisal techniques:...........................................................................................14

Limitations of using investment appraisal techniques for long term decision-making:............16

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION

In managerial finance, word Finance relates to managing funds, borrowing, credits,

liability, capital, investing and other financial operations. Finance aspect is mostly about

managing monies and the procurement of funding. Finance is core base of every corporation, as

it allows insights and money management for organisational operations within the entity.

Management finance is mainly relating to determining how the organisation uses accounting

strategies at different stages. That is the management finance inside a business how much the

company makes use of the existing capital through its operations. Every enterprise sought for

capital, finance operations help in the acquisition and disposal of resources of businesses (Ameer

and Othman, 2017). The businesses chosen for this study-assessment are Tesco Company

and Sainsbury Plc. Tesco is UK's international supermarket chain, incorporated in year-1919

while Sainsbury is a retail-based corporation incorporated in year-1869 and headquartered in

UK. This study-assessment covers issues such as the study of the ratios of these firms, the

shortcomings of the ratios including charts for the contrast of the two companies. In addition to

this, report also includes problems like the investments appraisal capital, the limitation/restraint

of ratios in relation to long-term decision-makings.

PORTFOLIO 1

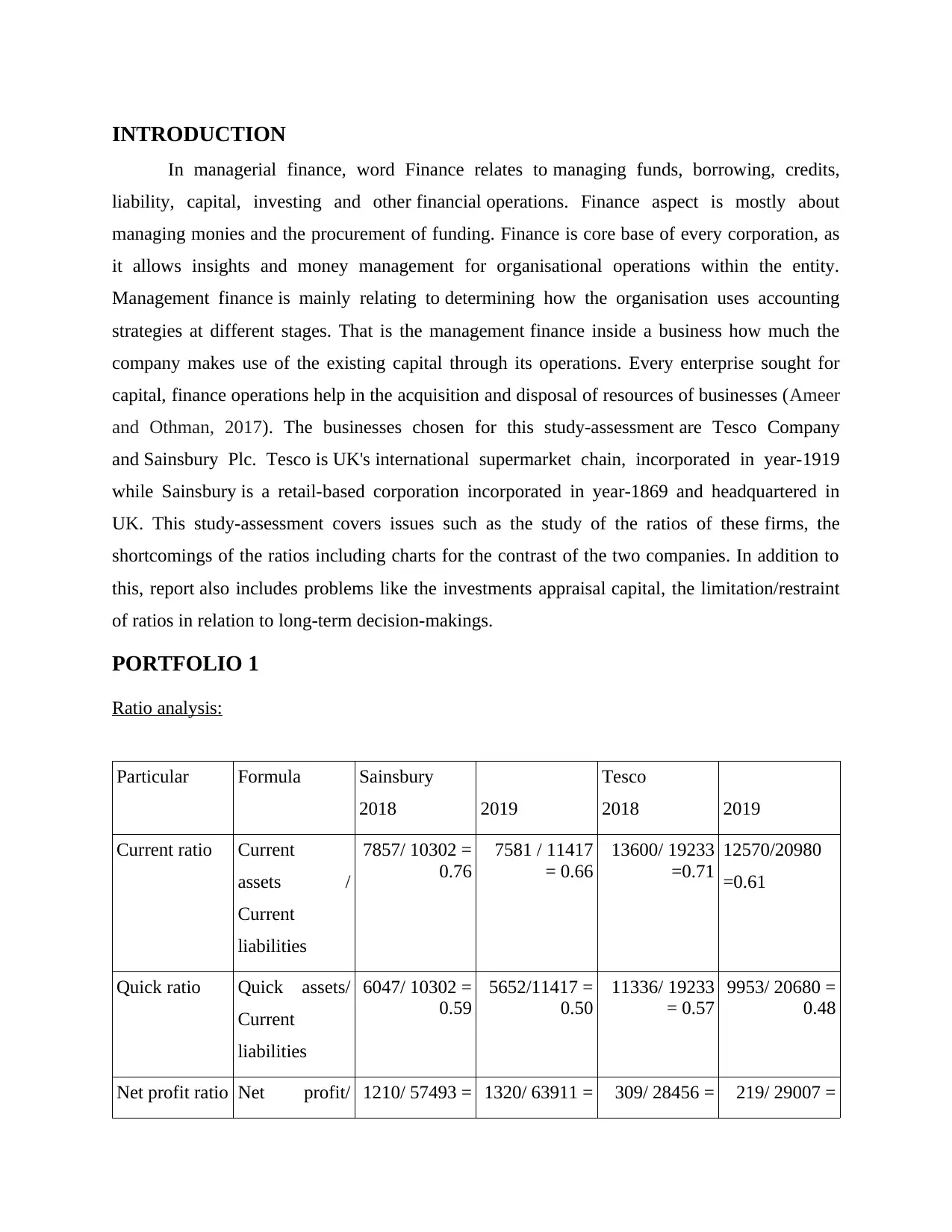

Ratio analysis:

Particular Formula Sainsbury

2018 2019

Tesco

2018 2019

Current ratio Current

assets /

Current

liabilities

7857/ 10302 =

0.76

7581 / 11417

= 0.66

13600/ 19233

=0.71

12570/20980

=0.61

Quick ratio Quick assets/

Current

liabilities

6047/ 10302 =

0.59

5652/11417 =

0.50

11336/ 19233

= 0.57

9953/ 20680 =

0.48

Net profit ratio Net profit/ 1210/ 57493 = 1320/ 63911 = 309/ 28456 = 219/ 29007 =

In managerial finance, word Finance relates to managing funds, borrowing, credits,

liability, capital, investing and other financial operations. Finance aspect is mostly about

managing monies and the procurement of funding. Finance is core base of every corporation, as

it allows insights and money management for organisational operations within the entity.

Management finance is mainly relating to determining how the organisation uses accounting

strategies at different stages. That is the management finance inside a business how much the

company makes use of the existing capital through its operations. Every enterprise sought for

capital, finance operations help in the acquisition and disposal of resources of businesses (Ameer

and Othman, 2017). The businesses chosen for this study-assessment are Tesco Company

and Sainsbury Plc. Tesco is UK's international supermarket chain, incorporated in year-1919

while Sainsbury is a retail-based corporation incorporated in year-1869 and headquartered in

UK. This study-assessment covers issues such as the study of the ratios of these firms, the

shortcomings of the ratios including charts for the contrast of the two companies. In addition to

this, report also includes problems like the investments appraisal capital, the limitation/restraint

of ratios in relation to long-term decision-makings.

PORTFOLIO 1

Ratio analysis:

Particular Formula Sainsbury

2018 2019

Tesco

2018 2019

Current ratio Current

assets /

Current

liabilities

7857/ 10302 =

0.76

7581 / 11417

= 0.66

13600/ 19233

=0.71

12570/20980

=0.61

Quick ratio Quick assets/

Current

liabilities

6047/ 10302 =

0.59

5652/11417 =

0.50

11336/ 19233

= 0.57

9953/ 20680 =

0.48

Net profit ratio Net profit/ 1210/ 57493 = 1320/ 63911 = 309/ 28456 = 219/ 29007 =

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

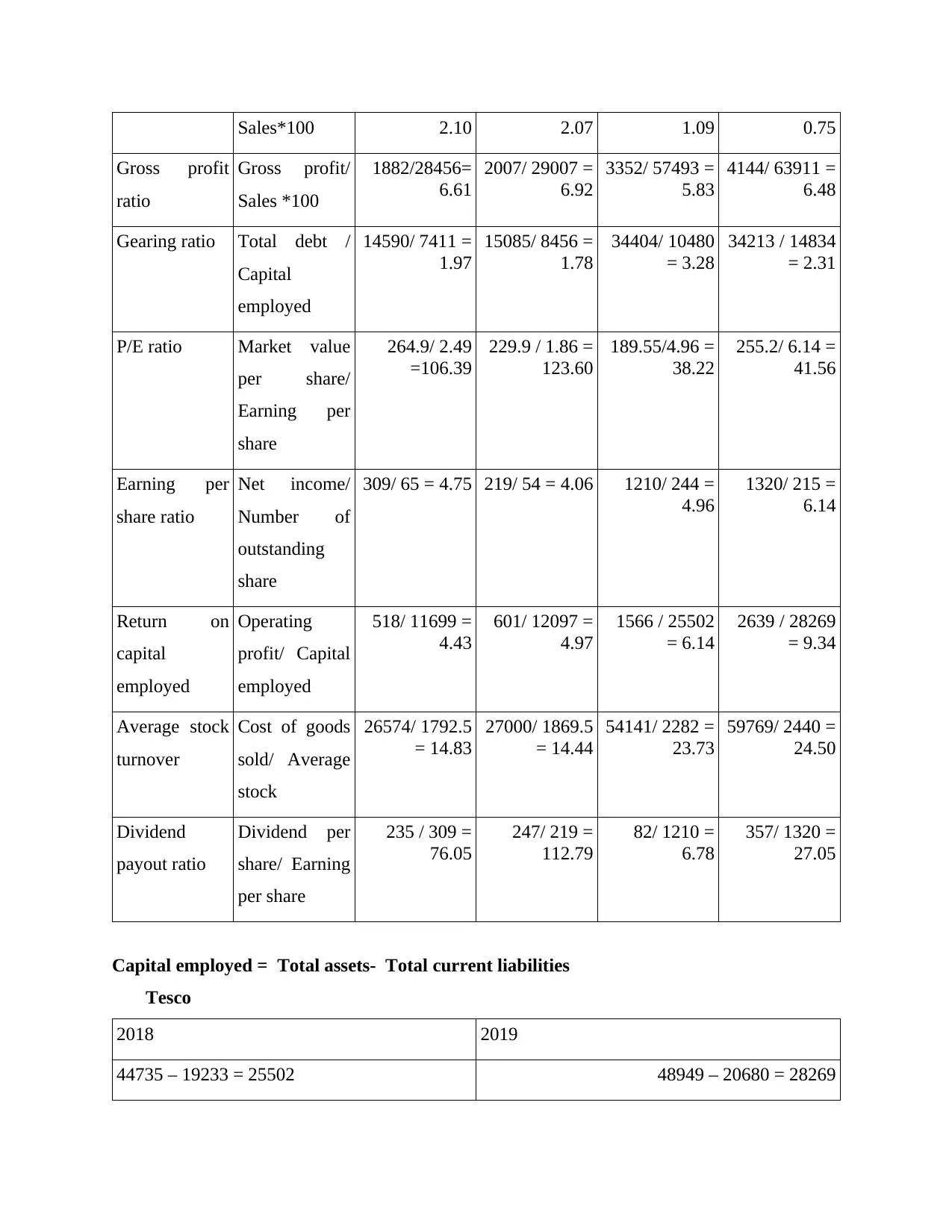

Sales*100 2.10 2.07 1.09 0.75

Gross profit

ratio

Gross profit/

Sales *100

1882/28456=

6.61

2007/ 29007 =

6.92

3352/ 57493 =

5.83

4144/ 63911 =

6.48

Gearing ratio Total debt /

Capital

employed

14590/ 7411 =

1.97

15085/ 8456 =

1.78

34404/ 10480

= 3.28

34213 / 14834

= 2.31

P/E ratio Market value

per share/

Earning per

share

264.9/ 2.49

=106.39

229.9 / 1.86 =

123.60

189.55/4.96 =

38.22

255.2/ 6.14 =

41.56

Earning per

share ratio

Net income/

Number of

outstanding

share

309/ 65 = 4.75 219/ 54 = 4.06 1210/ 244 =

4.96

1320/ 215 =

6.14

Return on

capital

employed

Operating

profit/ Capital

employed

518/ 11699 =

4.43

601/ 12097 =

4.97

1566 / 25502

= 6.14

2639 / 28269

= 9.34

Average stock

turnover

Cost of goods

sold/ Average

stock

26574/ 1792.5

= 14.83

27000/ 1869.5

= 14.44

54141/ 2282 =

23.73

59769/ 2440 =

24.50

Dividend

payout ratio

Dividend per

share/ Earning

per share

235 / 309 =

76.05

247/ 219 =

112.79

82/ 1210 =

6.78

357/ 1320 =

27.05

Capital employed = Total assets- Total current liabilities

Tesco

2018 2019

44735 – 19233 = 25502 48949 – 20680 = 28269

Gross profit

ratio

Gross profit/

Sales *100

1882/28456=

6.61

2007/ 29007 =

6.92

3352/ 57493 =

5.83

4144/ 63911 =

6.48

Gearing ratio Total debt /

Capital

employed

14590/ 7411 =

1.97

15085/ 8456 =

1.78

34404/ 10480

= 3.28

34213 / 14834

= 2.31

P/E ratio Market value

per share/

Earning per

share

264.9/ 2.49

=106.39

229.9 / 1.86 =

123.60

189.55/4.96 =

38.22

255.2/ 6.14 =

41.56

Earning per

share ratio

Net income/

Number of

outstanding

share

309/ 65 = 4.75 219/ 54 = 4.06 1210/ 244 =

4.96

1320/ 215 =

6.14

Return on

capital

employed

Operating

profit/ Capital

employed

518/ 11699 =

4.43

601/ 12097 =

4.97

1566 / 25502

= 6.14

2639 / 28269

= 9.34

Average stock

turnover

Cost of goods

sold/ Average

stock

26574/ 1792.5

= 14.83

27000/ 1869.5

= 14.44

54141/ 2282 =

23.73

59769/ 2440 =

24.50

Dividend

payout ratio

Dividend per

share/ Earning

per share

235 / 309 =

76.05

247/ 219 =

112.79

82/ 1210 =

6.78

357/ 1320 =

27.05

Capital employed = Total assets- Total current liabilities

Tesco

2018 2019

44735 – 19233 = 25502 48949 – 20680 = 28269

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sainsbury

2018 2019

22001 – 10302 = 11699 23514 – 11417 = 12097

Interpretation:

Ratio analysis can help to demonstrates the liquidity-state, financial stability, efficiency

of Tesco and Sainsbury corporations for understanding their financial status. The aforementioned

table shows ratios for year 2018 and year-2019 for the year that will help hep to identify

companies' financial position for said period. In this regard following is comprehensive and

thorough evaluation of different ratios, as follows:

Current ratio:

Tesco

Sainsbury

00.20.40.60.8 0.71 0.76

0.61 0.66

Current ratio

2018 2019

2018 2019

22001 – 10302 = 11699 23514 – 11417 = 12097

Interpretation:

Ratio analysis can help to demonstrates the liquidity-state, financial stability, efficiency

of Tesco and Sainsbury corporations for understanding their financial status. The aforementioned

table shows ratios for year 2018 and year-2019 for the year that will help hep to identify

companies' financial position for said period. In this regard following is comprehensive and

thorough evaluation of different ratios, as follows:

Current ratio:

Tesco

Sainsbury

00.20.40.60.8 0.71 0.76

0.61 0.66

Current ratio

2018 2019

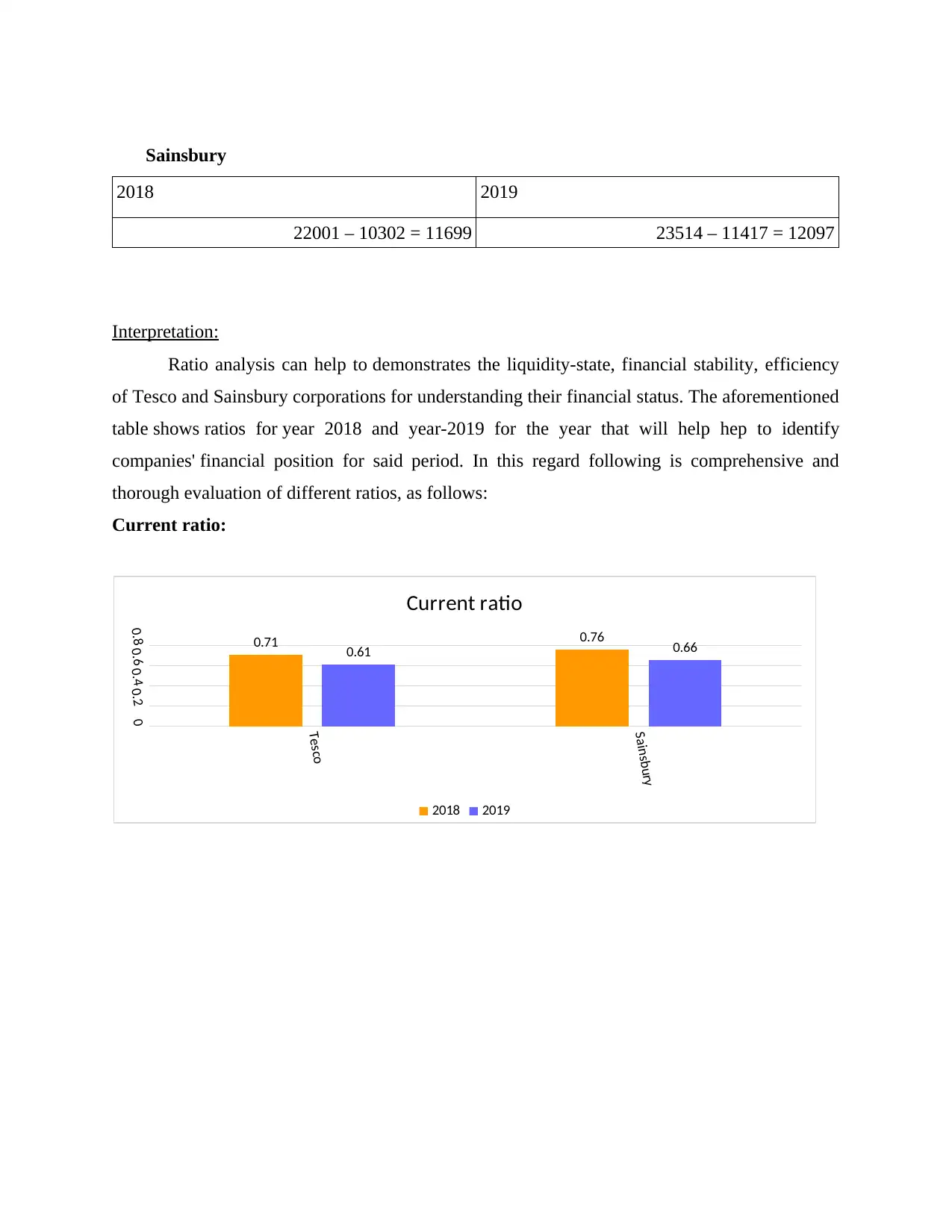

The current ratios of Tesco corporation are around 0.71 and 0.61, accordingly, throughout

the 2018 and 2019, reflecting an improved performance during the two years, whereas current

ratios of Sainsbury reaches 0.76 and 0.64, across the said periods. Both businesses showed an

uptick in the ratio, although Sainsbury's efficiency, with greater current proportions in respect of

shorter liquidity status, is quite excellent comparable to Tesco corporation (Blanco-Oliver, A.

and Irimia-Diéguez, 2019).

Quick Ratio:

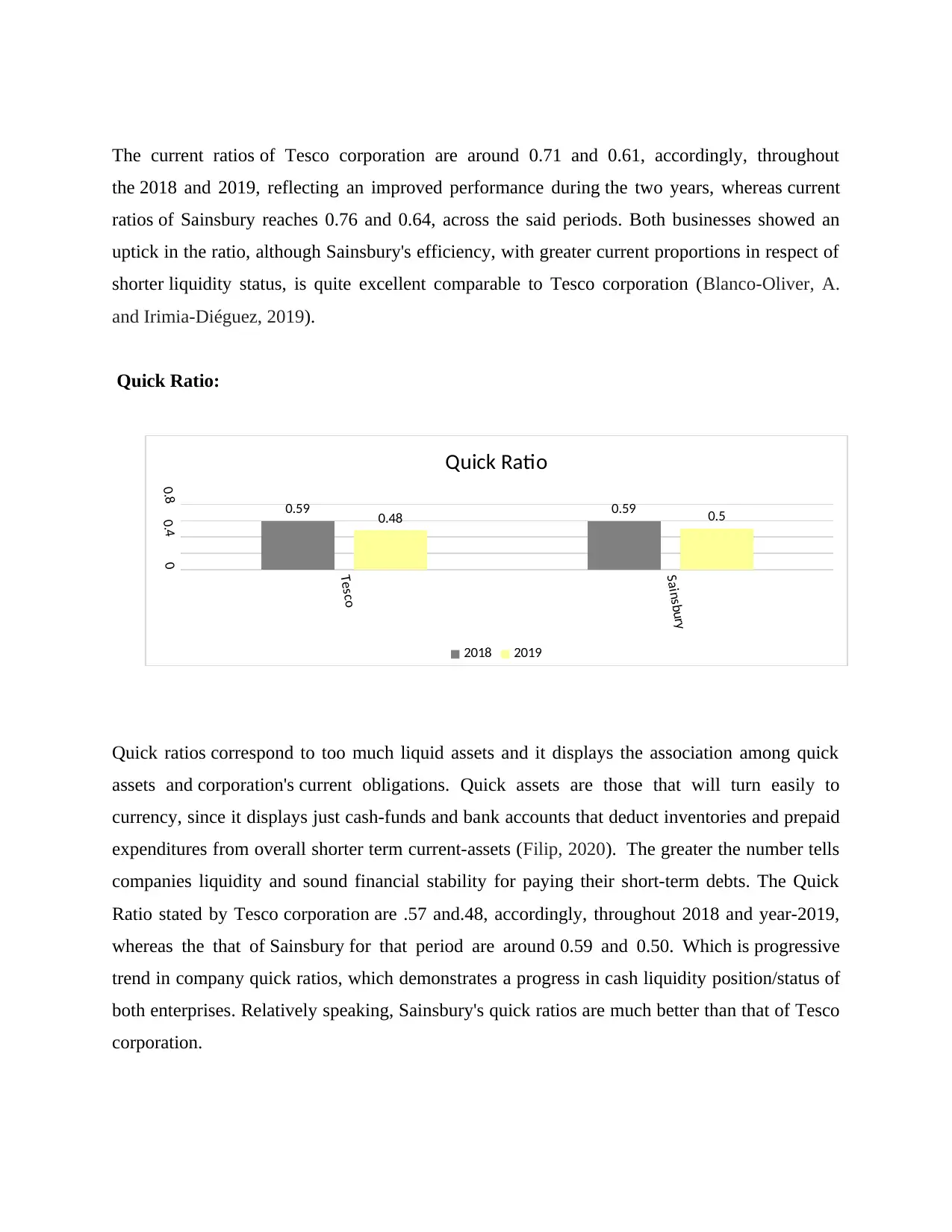

Quick ratios correspond to too much liquid assets and it displays the association among quick

assets and corporation's current obligations. Quick assets are those that will turn easily to

currency, since it displays just cash-funds and bank accounts that deduct inventories and prepaid

expenditures from overall shorter term current-assets (Filip, 2020). The greater the number tells

companies liquidity and sound financial stability for paying their short-term debts. The Quick

Ratio stated by Tesco corporation are .57 and.48, accordingly, throughout 2018 and year-2019,

whereas the that of Sainsbury for that period are around 0.59 and 0.50. Which is progressive

trend in company quick ratios, which demonstrates a progress in cash liquidity position/status of

both enterprises. Relatively speaking, Sainsbury's quick ratios are much better than that of Tesco

corporation.

Tesco

Sainsbury

00.40.8 0.59 0.59

0.48 0.5

Quick Ratio

2018 2019

the 2018 and 2019, reflecting an improved performance during the two years, whereas current

ratios of Sainsbury reaches 0.76 and 0.64, across the said periods. Both businesses showed an

uptick in the ratio, although Sainsbury's efficiency, with greater current proportions in respect of

shorter liquidity status, is quite excellent comparable to Tesco corporation (Blanco-Oliver, A.

and Irimia-Diéguez, 2019).

Quick Ratio:

Quick ratios correspond to too much liquid assets and it displays the association among quick

assets and corporation's current obligations. Quick assets are those that will turn easily to

currency, since it displays just cash-funds and bank accounts that deduct inventories and prepaid

expenditures from overall shorter term current-assets (Filip, 2020). The greater the number tells

companies liquidity and sound financial stability for paying their short-term debts. The Quick

Ratio stated by Tesco corporation are .57 and.48, accordingly, throughout 2018 and year-2019,

whereas the that of Sainsbury for that period are around 0.59 and 0.50. Which is progressive

trend in company quick ratios, which demonstrates a progress in cash liquidity position/status of

both enterprises. Relatively speaking, Sainsbury's quick ratios are much better than that of Tesco

corporation.

Tesco

Sainsbury

00.40.8 0.59 0.59

0.48 0.5

Quick Ratio

2018 2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Gross profit ratio:

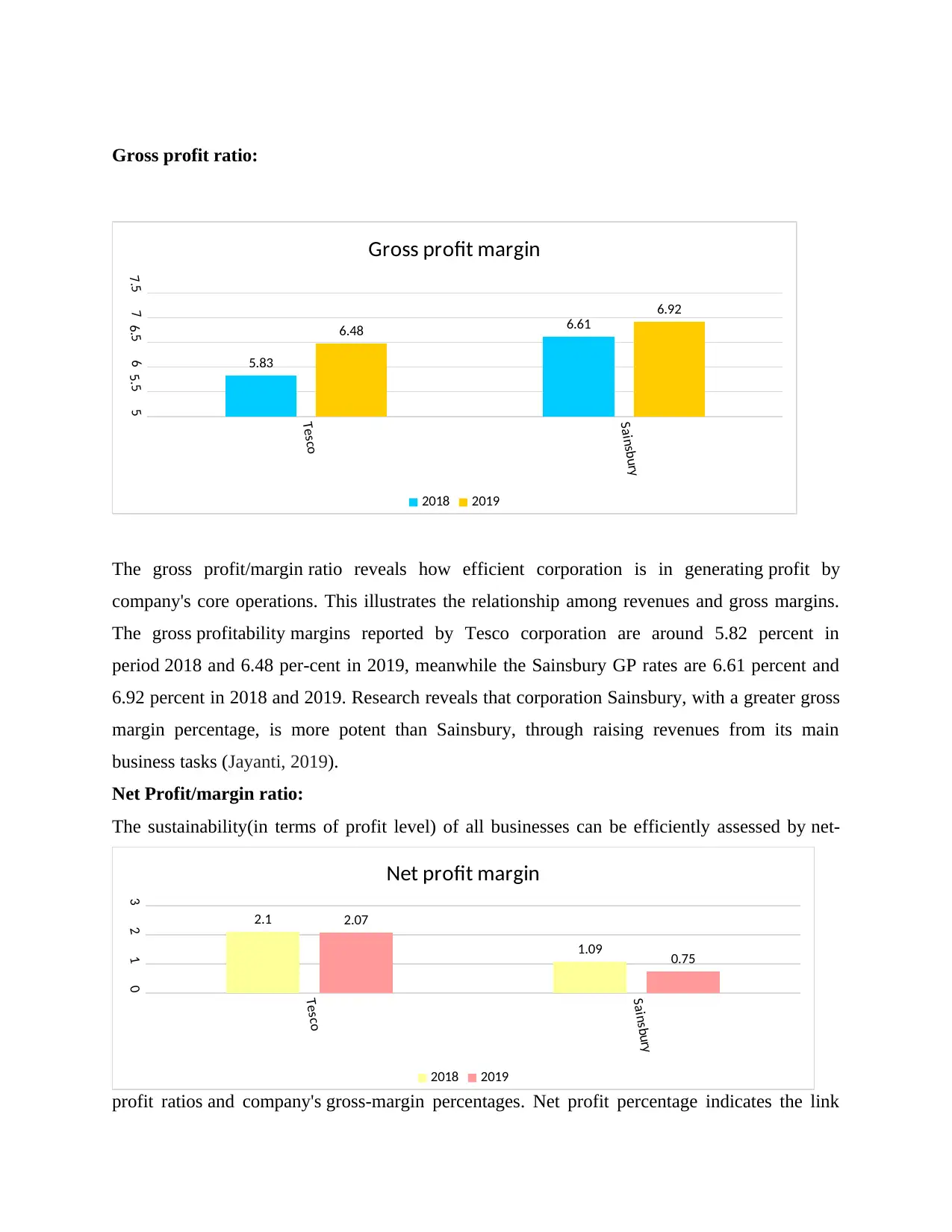

The gross profit/margin ratio reveals how efficient corporation is in generating profit by

company's core operations. This illustrates the relationship among revenues and gross margins.

The gross profitability margins reported by Tesco corporation are around 5.82 percent in

period 2018 and 6.48 per-cent in 2019, meanwhile the Sainsbury GP rates are 6.61 percent and

6.92 percent in 2018 and 2019. Research reveals that corporation Sainsbury, with a greater gross

margin percentage, is more potent than Sainsbury, through raising revenues from its main

business tasks (Jayanti, 2019).

Net Profit/margin ratio:

The sustainability(in terms of profit level) of all businesses can be efficiently assessed by net-

profit ratios and company's gross-margin percentages. Net profit percentage indicates the link

Tesco

Sainsbury

55.566.577.5

5.83

6.616.48

6.92

Gross profit margin

2018 2019

Tesco

Sainsbury

0123

2.1

1.09

2.07

0.75

Net profit margin

2018 2019

The gross profit/margin ratio reveals how efficient corporation is in generating profit by

company's core operations. This illustrates the relationship among revenues and gross margins.

The gross profitability margins reported by Tesco corporation are around 5.82 percent in

period 2018 and 6.48 per-cent in 2019, meanwhile the Sainsbury GP rates are 6.61 percent and

6.92 percent in 2018 and 2019. Research reveals that corporation Sainsbury, with a greater gross

margin percentage, is more potent than Sainsbury, through raising revenues from its main

business tasks (Jayanti, 2019).

Net Profit/margin ratio:

The sustainability(in terms of profit level) of all businesses can be efficiently assessed by net-

profit ratios and company's gross-margin percentages. Net profit percentage indicates the link

Tesco

Sainsbury

55.566.577.5

5.83

6.616.48

6.92

Gross profit margin

2018 2019

Tesco

Sainsbury

0123

2.1

1.09

2.07

0.75

Net profit margin

2018 2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

among the corporation's earnings/sales and net-income. Net profit is sum represent profit remain

after reduction of all expenditures, depreciation sum and income tax (Sibaroni, Ekaputra and

Prasetiyowati, 2020). Sainsbury corporation's net profit proportions are around 1.09 per cent and

around 0.75 per cent in period-2018 and 2019, exhibits a gradual rise, although the net profit

proportions are 2.10 percent and 2.07 per-cent in period2018 and 2019. Both corporations have

enhanced net profit-generating efficiency, but Tesco corporation has achieved greater profit

margins opposed to Sainsbury, which means that the profitability performance is much stronger

than Sainsbury corporation.

P/E ratio:

Tesco

Sainsbury

0

40

80

120

38.22

106.39

41.56

123.6

Price earnings ratio

2018 2019

after reduction of all expenditures, depreciation sum and income tax (Sibaroni, Ekaputra and

Prasetiyowati, 2020). Sainsbury corporation's net profit proportions are around 1.09 per cent and

around 0.75 per cent in period-2018 and 2019, exhibits a gradual rise, although the net profit

proportions are 2.10 percent and 2.07 per-cent in period2018 and 2019. Both corporations have

enhanced net profit-generating efficiency, but Tesco corporation has achieved greater profit

margins opposed to Sainsbury, which means that the profitability performance is much stronger

than Sainsbury corporation.

P/E ratio:

Tesco

Sainsbury

0

40

80

120

38.22

106.39

41.56

123.6

Price earnings ratio

2018 2019

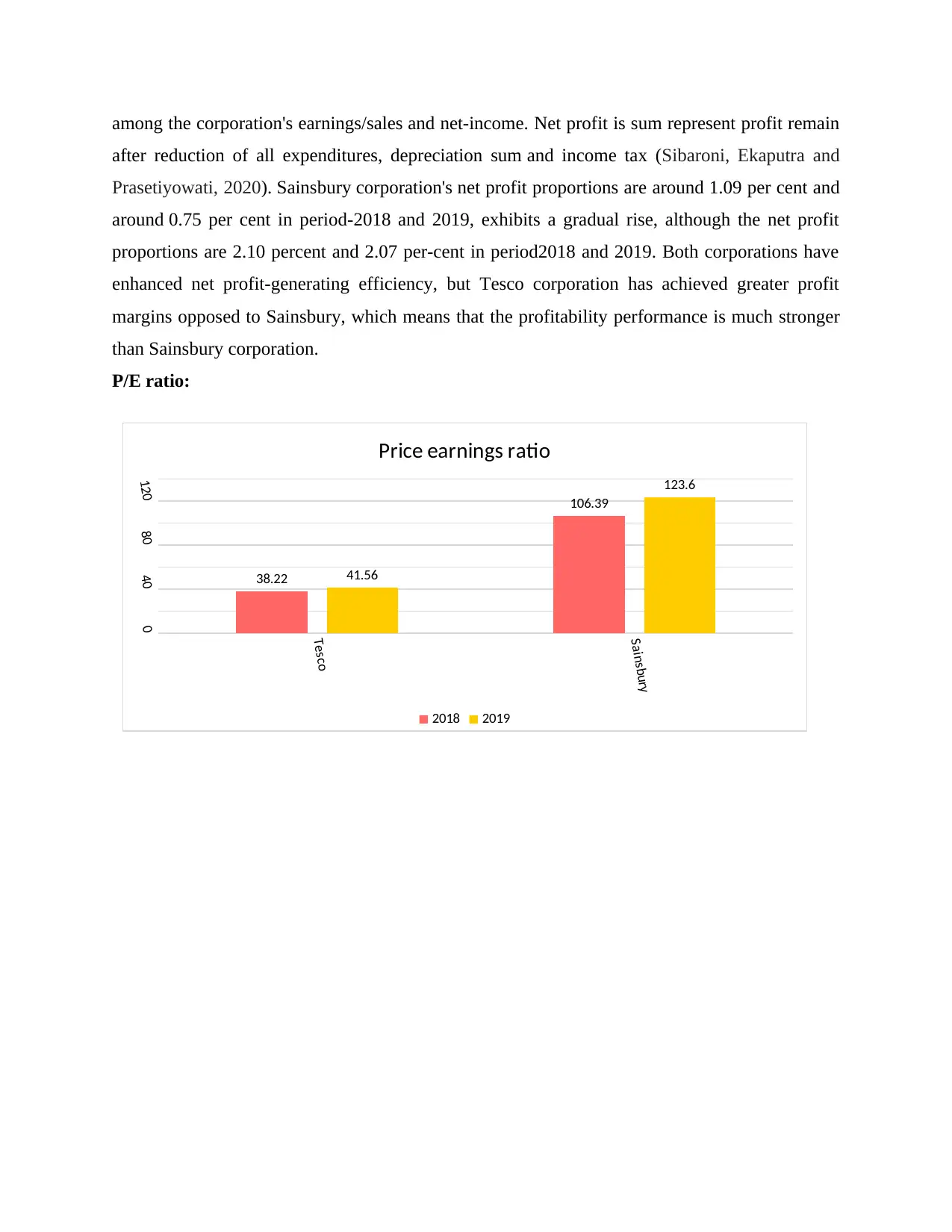

Price earnings (PE) ratio suggests what investors are able to pay for company's securities/shares.

Increasing earnings imply that stock prices being overvalued and lower earnings suggest that

the share prices are lesser compared to earnings-per share. Upon this basis of the data from

Tesco-plc and Sainsbury corporation, the firm's eagerness to attain more profits relate to its share

prices. Tesco's PE ranges are approx. 38.22 as well as 41.56, accordingly, throughout 2018 as

well as in 2019, indicating a reducing pattern, although Sainsbury's PE proportions are

around 106.39 and 123.9 in respectively 2018 and 2019 demonstrating a declining trend in the

PE level. This reveals that Sainsbury corporation is relatively more effective in supplying its

owners with a gain per each equity they buy and also a greater fair value with Sainsbury's stock.

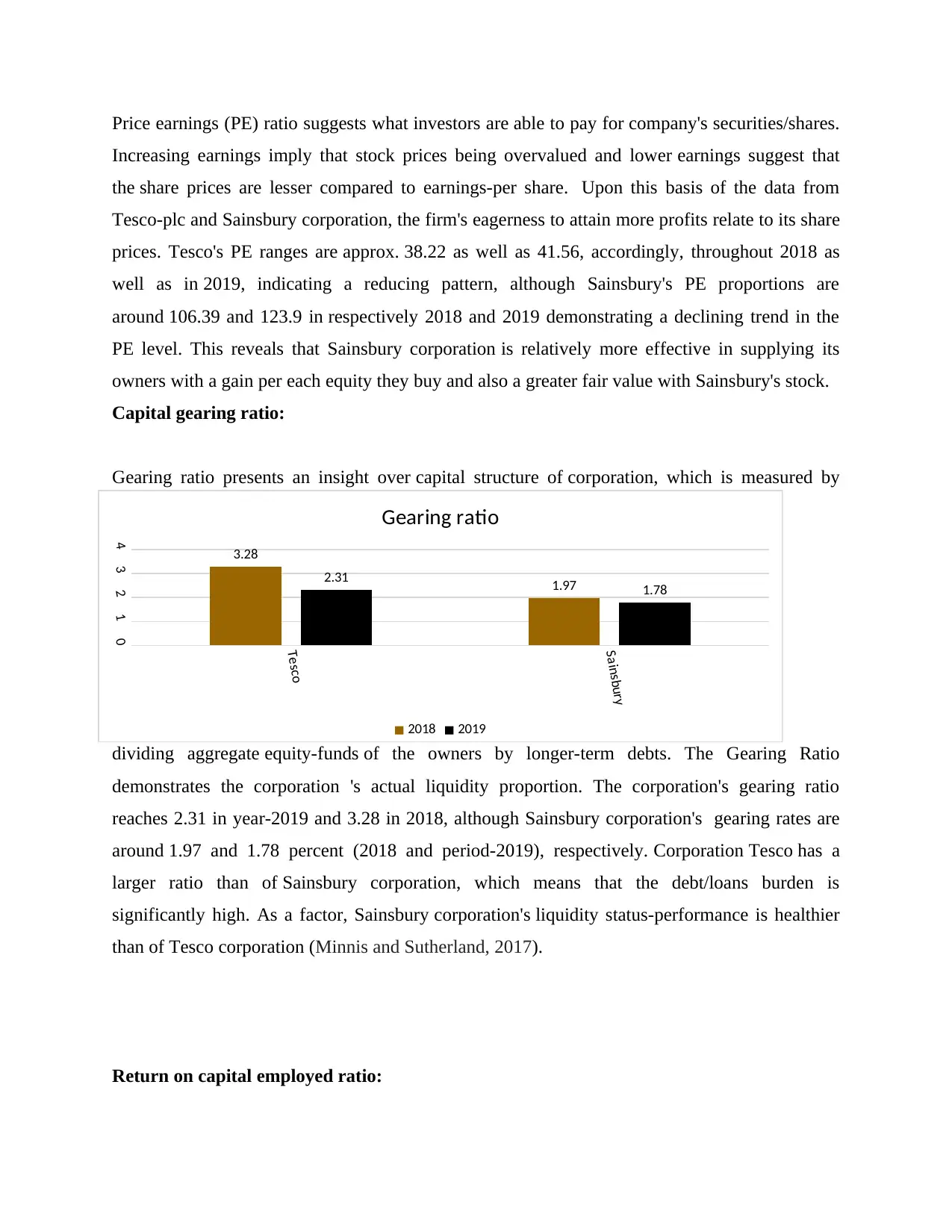

Capital gearing ratio:

Gearing ratio presents an insight over capital structure of corporation, which is measured by

dividing aggregate equity-funds of the owners by longer-term debts. The Gearing Ratio

demonstrates the corporation 's actual liquidity proportion. The corporation's gearing ratio

reaches 2.31 in year-2019 and 3.28 in 2018, although Sainsbury corporation's gearing rates are

around 1.97 and 1.78 percent (2018 and period-2019), respectively. Corporation Tesco has a

larger ratio than of Sainsbury corporation, which means that the debt/loans burden is

significantly high. As a factor, Sainsbury corporation's liquidity status-performance is healthier

than of Tesco corporation (Minnis and Sutherland, 2017).

Return on capital employed ratio:

Tesco

Sainsbury

01234 3.28

1.97

2.31 1.78

Gearing ratio

2018 2019

Increasing earnings imply that stock prices being overvalued and lower earnings suggest that

the share prices are lesser compared to earnings-per share. Upon this basis of the data from

Tesco-plc and Sainsbury corporation, the firm's eagerness to attain more profits relate to its share

prices. Tesco's PE ranges are approx. 38.22 as well as 41.56, accordingly, throughout 2018 as

well as in 2019, indicating a reducing pattern, although Sainsbury's PE proportions are

around 106.39 and 123.9 in respectively 2018 and 2019 demonstrating a declining trend in the

PE level. This reveals that Sainsbury corporation is relatively more effective in supplying its

owners with a gain per each equity they buy and also a greater fair value with Sainsbury's stock.

Capital gearing ratio:

Gearing ratio presents an insight over capital structure of corporation, which is measured by

dividing aggregate equity-funds of the owners by longer-term debts. The Gearing Ratio

demonstrates the corporation 's actual liquidity proportion. The corporation's gearing ratio

reaches 2.31 in year-2019 and 3.28 in 2018, although Sainsbury corporation's gearing rates are

around 1.97 and 1.78 percent (2018 and period-2019), respectively. Corporation Tesco has a

larger ratio than of Sainsbury corporation, which means that the debt/loans burden is

significantly high. As a factor, Sainsbury corporation's liquidity status-performance is healthier

than of Tesco corporation (Minnis and Sutherland, 2017).

Return on capital employed ratio:

Tesco

Sainsbury

01234 3.28

1.97

2.31 1.78

Gearing ratio

2018 2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

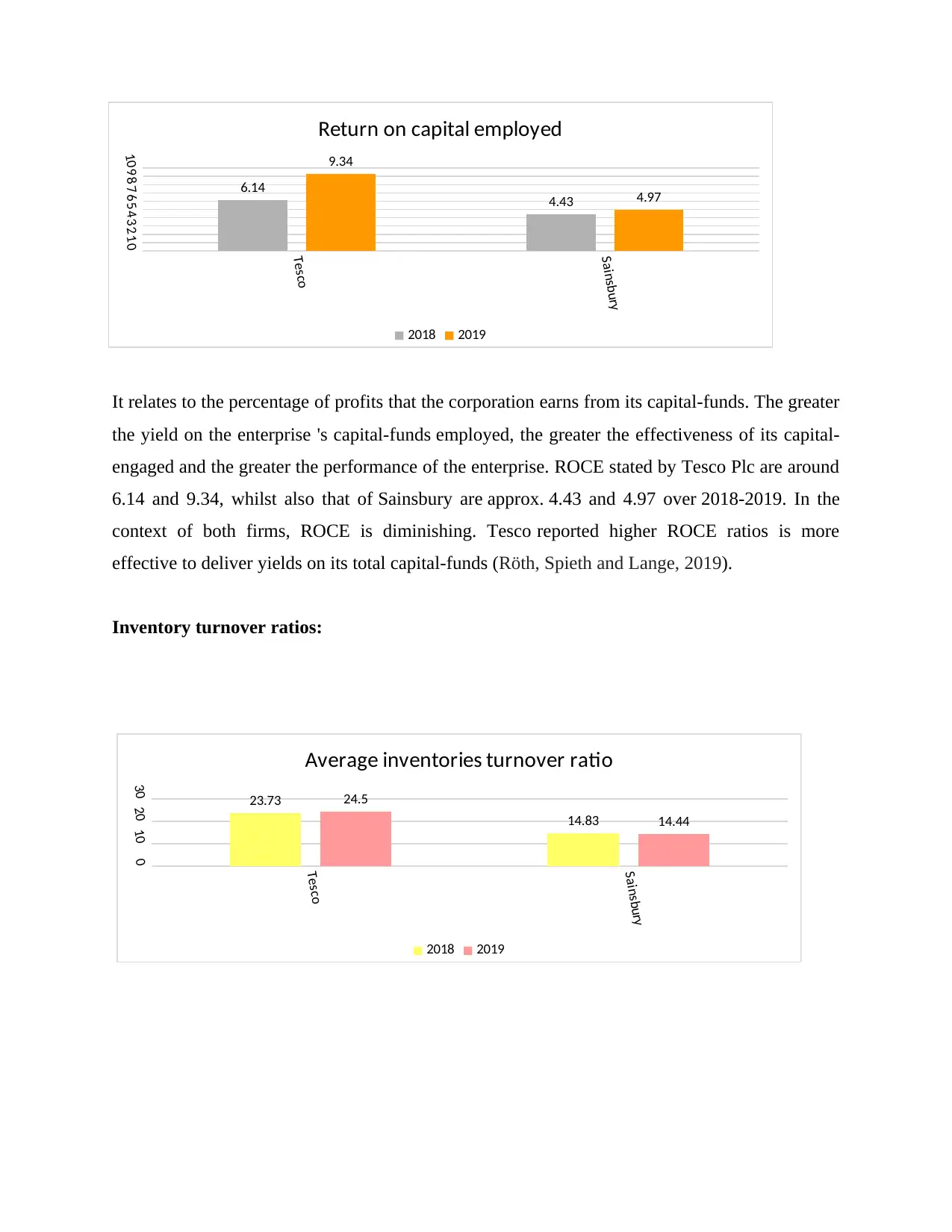

It relates to the percentage of profits that the corporation earns from its capital-funds. The greater

the yield on the enterprise 's capital-funds employed, the greater the effectiveness of its capital-

engaged and the greater the performance of the enterprise. ROCE stated by Tesco Plc are around

6.14 and 9.34, whilst also that of Sainsbury are approx. 4.43 and 4.97 over 2018-2019. In the

context of both firms, ROCE is diminishing. Tesco reported higher ROCE ratios is more

effective to deliver yields on its total capital-funds (Röth, Spieth and Lange, 2019).

Inventory turnover ratios:

Tesco

Sainsbury

012345678910

6.14

4.43

9.34

4.97

Return on capital employed

2018 2019

Tesco

Sainsbury

0102030 23.73

14.83

24.5

14.44

Average inventories turnover ratio

2018 2019

the yield on the enterprise 's capital-funds employed, the greater the effectiveness of its capital-

engaged and the greater the performance of the enterprise. ROCE stated by Tesco Plc are around

6.14 and 9.34, whilst also that of Sainsbury are approx. 4.43 and 4.97 over 2018-2019. In the

context of both firms, ROCE is diminishing. Tesco reported higher ROCE ratios is more

effective to deliver yields on its total capital-funds (Röth, Spieth and Lange, 2019).

Inventory turnover ratios:

Tesco

Sainsbury

012345678910

6.14

4.43

9.34

4.97

Return on capital employed

2018 2019

Tesco

Sainsbury

0102030 23.73

14.83

24.5

14.44

Average inventories turnover ratio

2018 2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

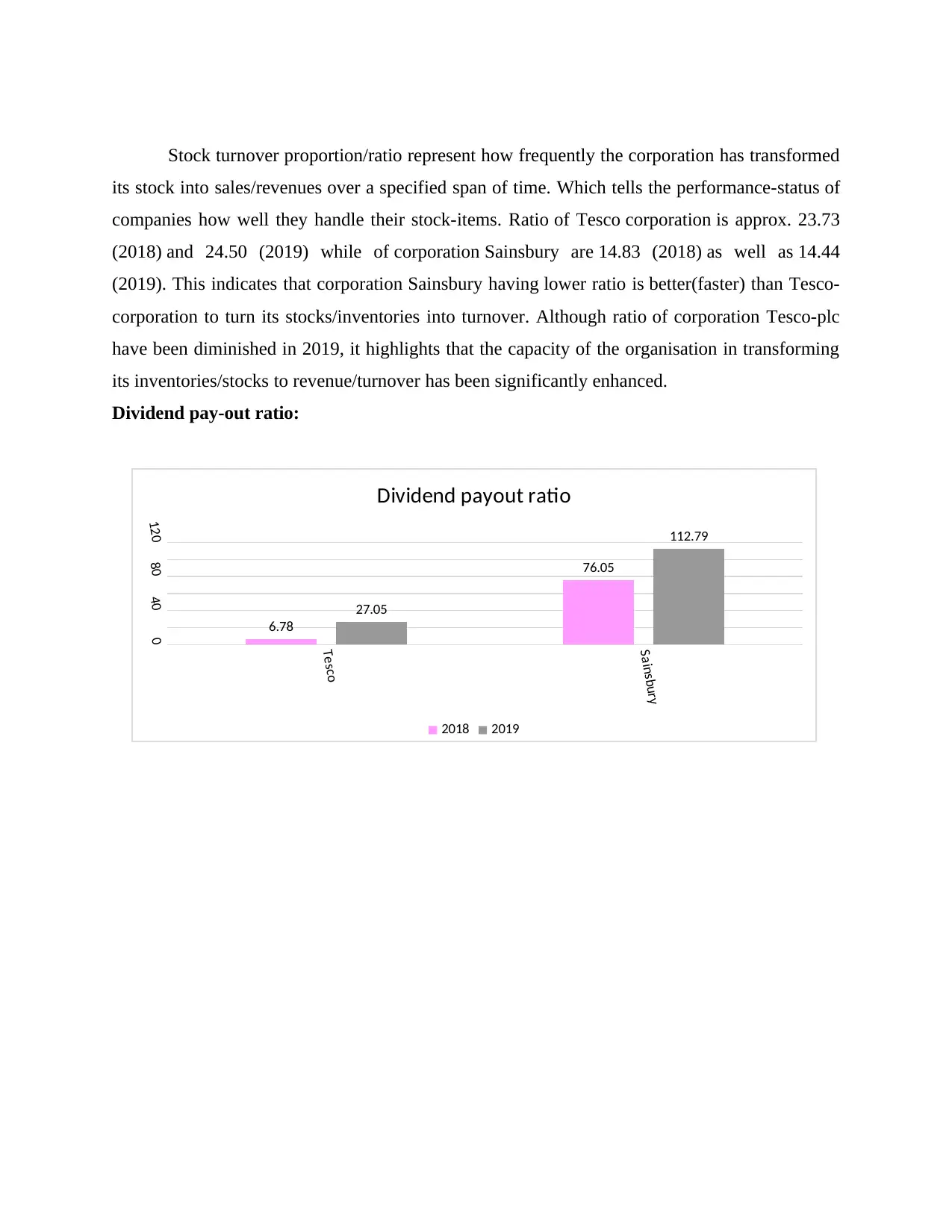

Stock turnover proportion/ratio represent how frequently the corporation has transformed

its stock into sales/revenues over a specified span of time. Which tells the performance-status of

companies how well they handle their stock-items. Ratio of Tesco corporation is approx. 23.73

(2018) and 24.50 (2019) while of corporation Sainsbury are 14.83 (2018) as well as 14.44

(2019). This indicates that corporation Sainsbury having lower ratio is better(faster) than Tesco-

corporation to turn its stocks/inventories into turnover. Although ratio of corporation Tesco-plc

have been diminished in 2019, it highlights that the capacity of the organisation in transforming

its inventories/stocks to revenue/turnover has been significantly enhanced.

Dividend pay-out ratio:

Tesco

Sainsbury

04080120

6.78

76.05

27.05

112.79

Dividend payout ratio

2018 2019

its stock into sales/revenues over a specified span of time. Which tells the performance-status of

companies how well they handle their stock-items. Ratio of Tesco corporation is approx. 23.73

(2018) and 24.50 (2019) while of corporation Sainsbury are 14.83 (2018) as well as 14.44

(2019). This indicates that corporation Sainsbury having lower ratio is better(faster) than Tesco-

corporation to turn its stocks/inventories into turnover. Although ratio of corporation Tesco-plc

have been diminished in 2019, it highlights that the capacity of the organisation in transforming

its inventories/stocks to revenue/turnover has been significantly enhanced.

Dividend pay-out ratio:

Tesco

Sainsbury

04080120

6.78

76.05

27.05

112.79

Dividend payout ratio

2018 2019

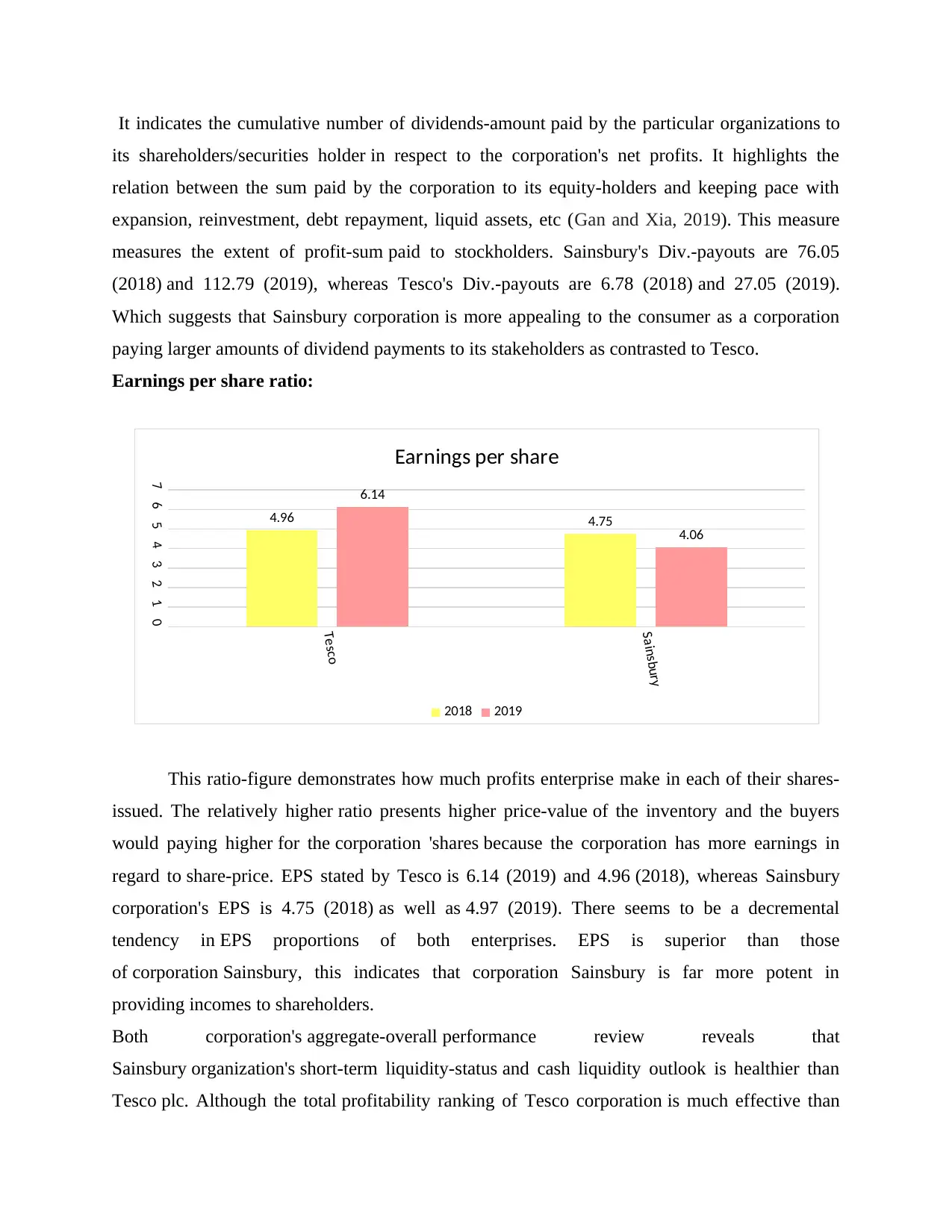

It indicates the cumulative number of dividends-amount paid by the particular organizations to

its shareholders/securities holder in respect to the corporation's net profits. It highlights the

relation between the sum paid by the corporation to its equity-holders and keeping pace with

expansion, reinvestment, debt repayment, liquid assets, etc (Gan and Xia, 2019). This measure

measures the extent of profit-sum paid to stockholders. Sainsbury's Div.-payouts are 76.05

(2018) and 112.79 (2019), whereas Tesco's Div.-payouts are 6.78 (2018) and 27.05 (2019).

Which suggests that Sainsbury corporation is more appealing to the consumer as a corporation

paying larger amounts of dividend payments to its stakeholders as contrasted to Tesco.

Earnings per share ratio:

This ratio-figure demonstrates how much profits enterprise make in each of their shares-

issued. The relatively higher ratio presents higher price-value of the inventory and the buyers

would paying higher for the corporation 'shares because the corporation has more earnings in

regard to share-price. EPS stated by Tesco is 6.14 (2019) and 4.96 (2018), whereas Sainsbury

corporation's EPS is 4.75 (2018) as well as 4.97 (2019). There seems to be a decremental

tendency in EPS proportions of both enterprises. EPS is superior than those

of corporation Sainsbury, this indicates that corporation Sainsbury is far more potent in

providing incomes to shareholders.

Both corporation's aggregate-overall performance review reveals that

Sainsbury organization's short-term liquidity-status and cash liquidity outlook is healthier than

Tesco plc. Although the total profitability ranking of Tesco corporation is much effective than

Tesco

Sainsbury

01234567

4.96 4.75

6.14

4.06

Earnings per share

2018 2019

its shareholders/securities holder in respect to the corporation's net profits. It highlights the

relation between the sum paid by the corporation to its equity-holders and keeping pace with

expansion, reinvestment, debt repayment, liquid assets, etc (Gan and Xia, 2019). This measure

measures the extent of profit-sum paid to stockholders. Sainsbury's Div.-payouts are 76.05

(2018) and 112.79 (2019), whereas Tesco's Div.-payouts are 6.78 (2018) and 27.05 (2019).

Which suggests that Sainsbury corporation is more appealing to the consumer as a corporation

paying larger amounts of dividend payments to its stakeholders as contrasted to Tesco.

Earnings per share ratio:

This ratio-figure demonstrates how much profits enterprise make in each of their shares-

issued. The relatively higher ratio presents higher price-value of the inventory and the buyers

would paying higher for the corporation 'shares because the corporation has more earnings in

regard to share-price. EPS stated by Tesco is 6.14 (2019) and 4.96 (2018), whereas Sainsbury

corporation's EPS is 4.75 (2018) as well as 4.97 (2019). There seems to be a decremental

tendency in EPS proportions of both enterprises. EPS is superior than those

of corporation Sainsbury, this indicates that corporation Sainsbury is far more potent in

providing incomes to shareholders.

Both corporation's aggregate-overall performance review reveals that

Sainsbury organization's short-term liquidity-status and cash liquidity outlook is healthier than

Tesco plc. Although the total profitability ranking of Tesco corporation is much effective than

Tesco

Sainsbury

01234567

4.96 4.75

6.14

4.06

Earnings per share

2018 2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.