Practical Set 1,2,3: Comprehensive Analysis of Costing and Budgeting

VerifiedAdded on 2022/12/28

|9

|1367

|65

Practical Assignment

AI Summary

This document presents a comprehensive analysis of costing and budgeting techniques, along with variance analysis. The assignment begins with a detailed examination of different costing methods, including absorption costing and activity-based costing (ABC), calculating cost per unit and profit/loss. It then delves into material variance analysis, calculating material usage, mix, and yield variances. Furthermore, the assignment explores budgeting methods, comparing zero-based budgeting (ZBB) and incremental budgeting (IB), highlighting their advantages and disadvantages. Sensitivity analysis is also discussed. The document provides detailed calculations, explanations, and references to support the analysis, offering valuable insights into financial management and control.

PRACTICAL SET 1,2,3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

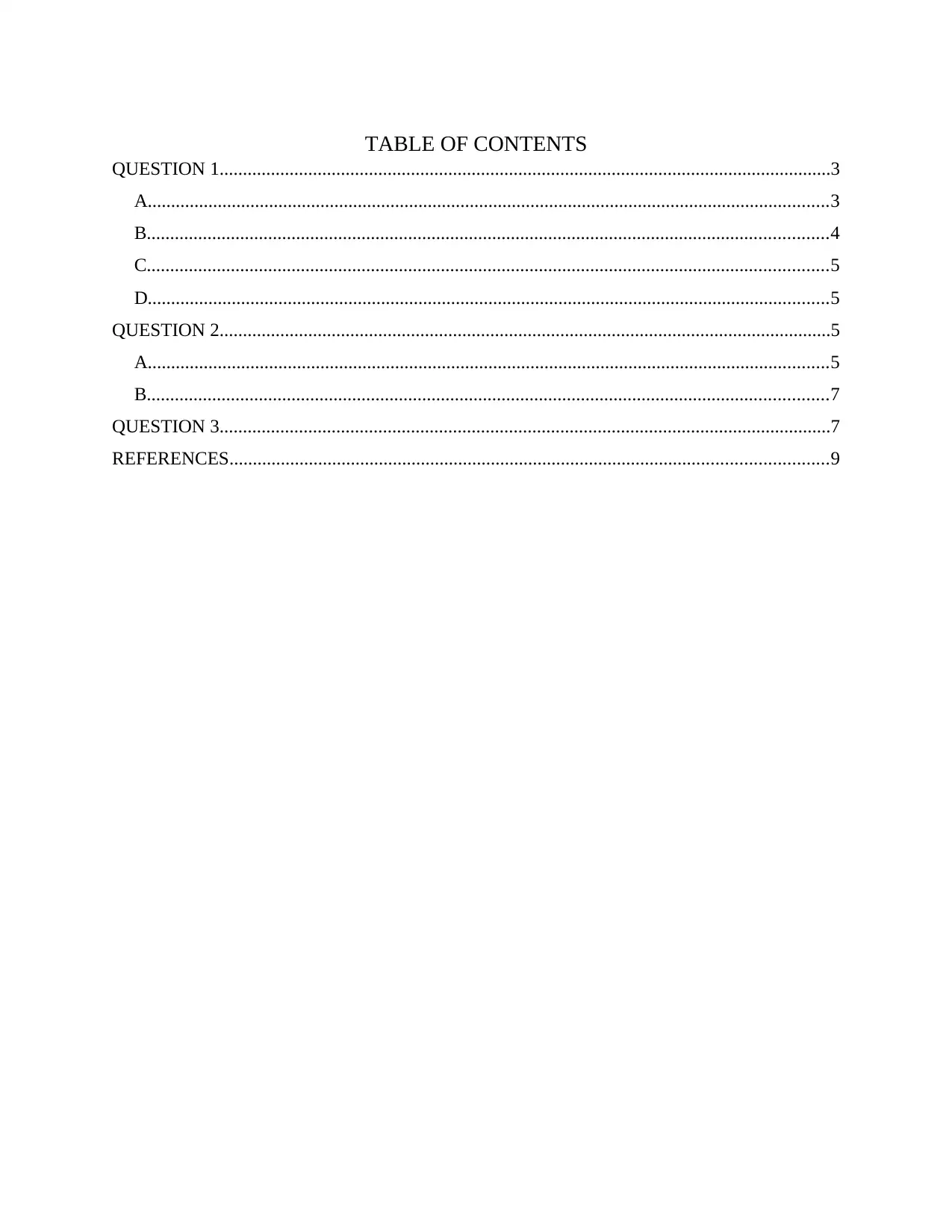

TABLE OF CONTENTS

QUESTION 1...................................................................................................................................3

A..................................................................................................................................................3

B..................................................................................................................................................4

C..................................................................................................................................................5

D..................................................................................................................................................5

QUESTION 2...................................................................................................................................5

A..................................................................................................................................................5

B..................................................................................................................................................7

QUESTION 3...................................................................................................................................7

REFERENCES................................................................................................................................9

QUESTION 1...................................................................................................................................3

A..................................................................................................................................................3

B..................................................................................................................................................4

C..................................................................................................................................................5

D..................................................................................................................................................5

QUESTION 2...................................................................................................................................5

A..................................................................................................................................................5

B..................................................................................................................................................7

QUESTION 3...................................................................................................................................7

REFERENCES................................................................................................................................9

QUESTION 1

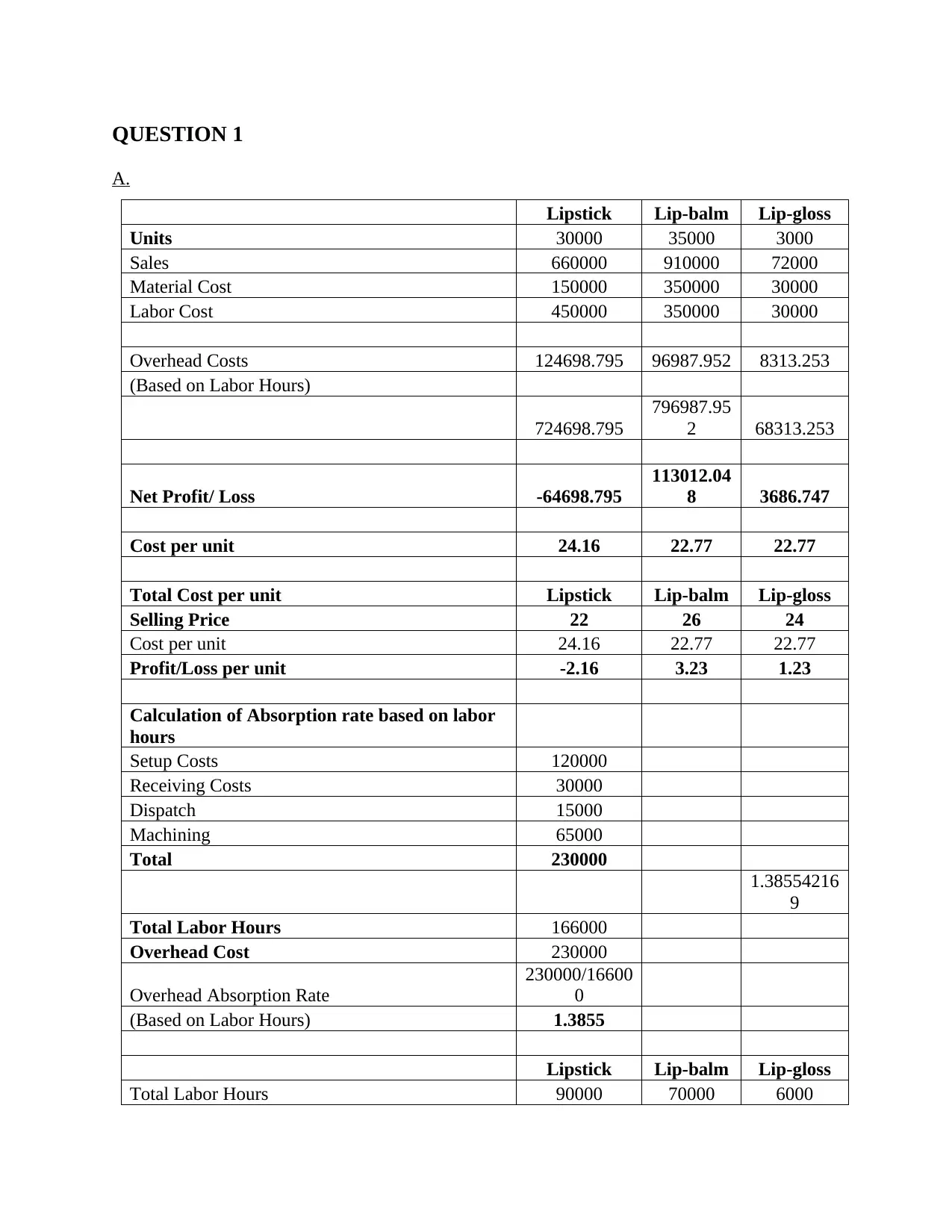

A.

Lipstick Lip-balm Lip-gloss

Units 30000 35000 3000

Sales 660000 910000 72000

Material Cost 150000 350000 30000

Labor Cost 450000 350000 30000

Overhead Costs 124698.795 96987.952 8313.253

(Based on Labor Hours)

724698.795

796987.95

2 68313.253

Net Profit/ Loss -64698.795

113012.04

8 3686.747

Cost per unit 24.16 22.77 22.77

Total Cost per unit Lipstick Lip-balm Lip-gloss

Selling Price 22 26 24

Cost per unit 24.16 22.77 22.77

Profit/Loss per unit -2.16 3.23 1.23

Calculation of Absorption rate based on labor

hours

Setup Costs 120000

Receiving Costs 30000

Dispatch 15000

Machining 65000

Total 230000

1.38554216

9

Total Labor Hours 166000

Overhead Cost 230000

Overhead Absorption Rate

230000/16600

0

(Based on Labor Hours) 1.3855

Lipstick Lip-balm Lip-gloss

Total Labor Hours 90000 70000 6000

A.

Lipstick Lip-balm Lip-gloss

Units 30000 35000 3000

Sales 660000 910000 72000

Material Cost 150000 350000 30000

Labor Cost 450000 350000 30000

Overhead Costs 124698.795 96987.952 8313.253

(Based on Labor Hours)

724698.795

796987.95

2 68313.253

Net Profit/ Loss -64698.795

113012.04

8 3686.747

Cost per unit 24.16 22.77 22.77

Total Cost per unit Lipstick Lip-balm Lip-gloss

Selling Price 22 26 24

Cost per unit 24.16 22.77 22.77

Profit/Loss per unit -2.16 3.23 1.23

Calculation of Absorption rate based on labor

hours

Setup Costs 120000

Receiving Costs 30000

Dispatch 15000

Machining 65000

Total 230000

1.38554216

9

Total Labor Hours 166000

Overhead Cost 230000

Overhead Absorption Rate

230000/16600

0

(Based on Labor Hours) 1.3855

Lipstick Lip-balm Lip-gloss

Total Labor Hours 90000 70000 6000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

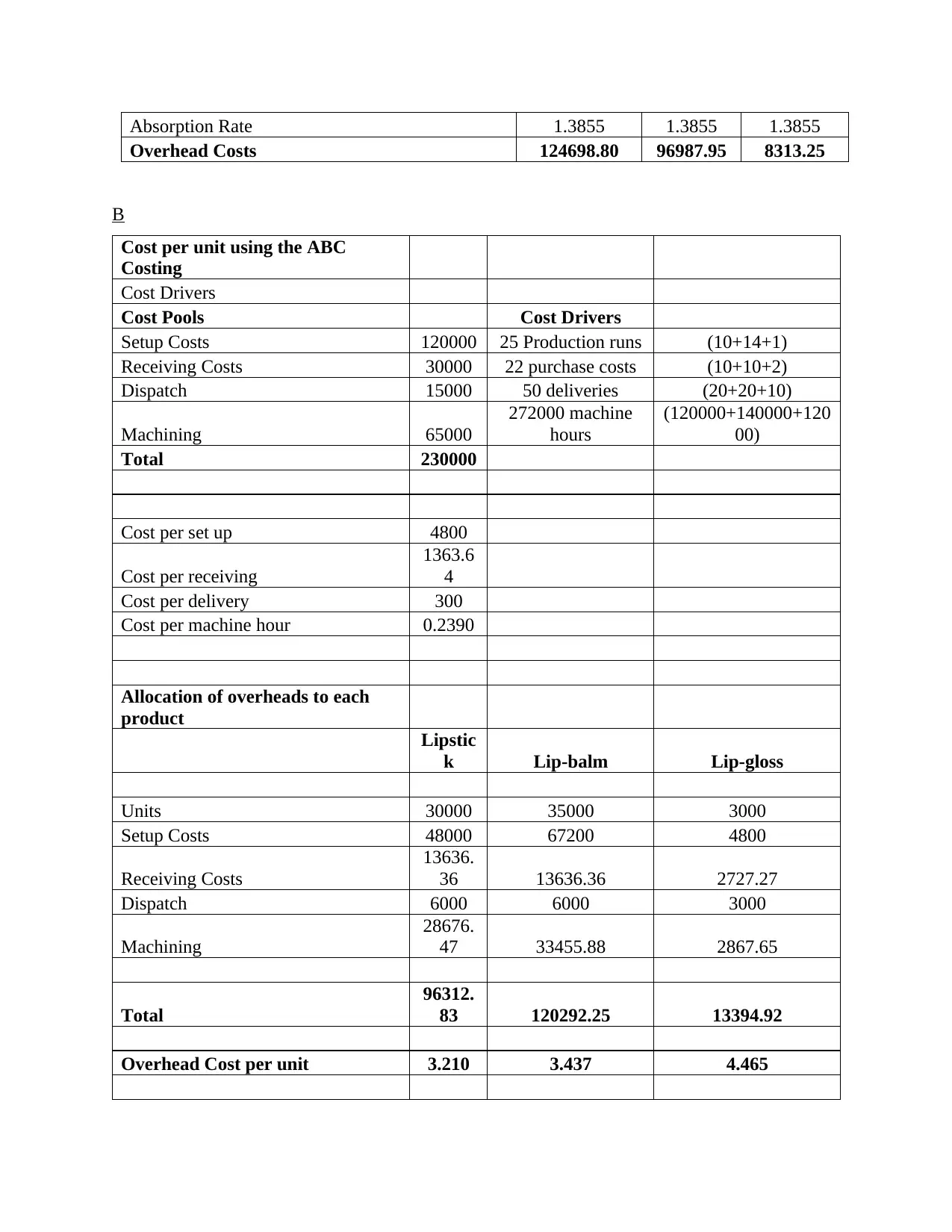

Absorption Rate 1.3855 1.3855 1.3855

Overhead Costs 124698.80 96987.95 8313.25

B

Cost per unit using the ABC

Costing

Cost Drivers

Cost Pools Cost Drivers

Setup Costs 120000 25 Production runs (10+14+1)

Receiving Costs 30000 22 purchase costs (10+10+2)

Dispatch 15000 50 deliveries (20+20+10)

Machining 65000

272000 machine

hours

(120000+140000+120

00)

Total 230000

Cost per set up 4800

Cost per receiving

1363.6

4

Cost per delivery 300

Cost per machine hour 0.2390

Allocation of overheads to each

product

Lipstic

k Lip-balm Lip-gloss

Units 30000 35000 3000

Setup Costs 48000 67200 4800

Receiving Costs

13636.

36 13636.36 2727.27

Dispatch 6000 6000 3000

Machining

28676.

47 33455.88 2867.65

Total

96312.

83 120292.25 13394.92

Overhead Cost per unit 3.210 3.437 4.465

Overhead Costs 124698.80 96987.95 8313.25

B

Cost per unit using the ABC

Costing

Cost Drivers

Cost Pools Cost Drivers

Setup Costs 120000 25 Production runs (10+14+1)

Receiving Costs 30000 22 purchase costs (10+10+2)

Dispatch 15000 50 deliveries (20+20+10)

Machining 65000

272000 machine

hours

(120000+140000+120

00)

Total 230000

Cost per set up 4800

Cost per receiving

1363.6

4

Cost per delivery 300

Cost per machine hour 0.2390

Allocation of overheads to each

product

Lipstic

k Lip-balm Lip-gloss

Units 30000 35000 3000

Setup Costs 48000 67200 4800

Receiving Costs

13636.

36 13636.36 2727.27

Dispatch 6000 6000 3000

Machining

28676.

47 33455.88 2867.65

Total

96312.

83 120292.25 13394.92

Overhead Cost per unit 3.210 3.437 4.465

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

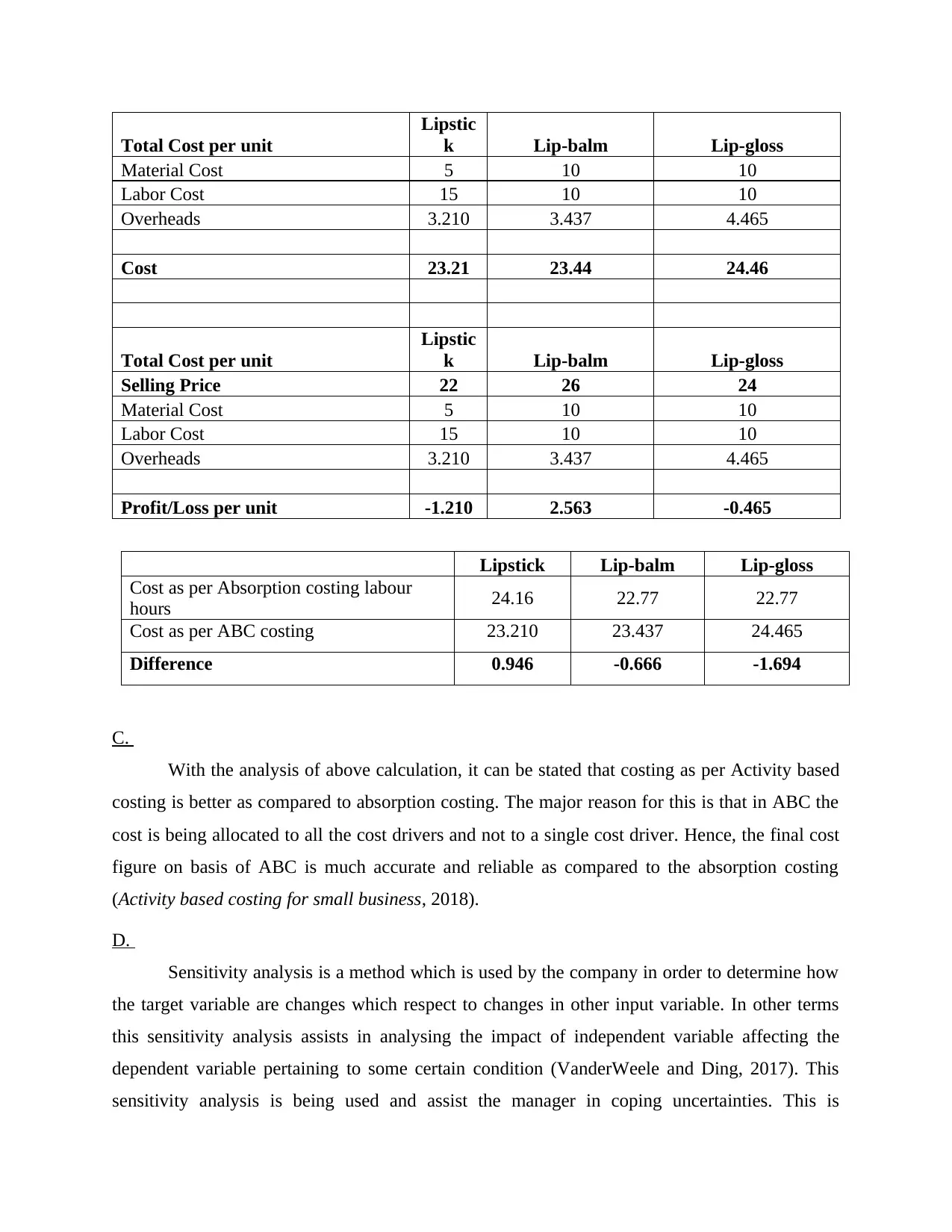

Total Cost per unit

Lipstic

k Lip-balm Lip-gloss

Material Cost 5 10 10

Labor Cost 15 10 10

Overheads 3.210 3.437 4.465

Cost 23.21 23.44 24.46

Total Cost per unit

Lipstic

k Lip-balm Lip-gloss

Selling Price 22 26 24

Material Cost 5 10 10

Labor Cost 15 10 10

Overheads 3.210 3.437 4.465

Profit/Loss per unit -1.210 2.563 -0.465

Lipstick Lip-balm Lip-gloss

Cost as per Absorption costing labour

hours 24.16 22.77 22.77

Cost as per ABC costing 23.210 23.437 24.465

Difference 0.946 -0.666 -1.694

C.

With the analysis of above calculation, it can be stated that costing as per Activity based

costing is better as compared to absorption costing. The major reason for this is that in ABC the

cost is being allocated to all the cost drivers and not to a single cost driver. Hence, the final cost

figure on basis of ABC is much accurate and reliable as compared to the absorption costing

(Activity based costing for small business, 2018).

D.

Sensitivity analysis is a method which is used by the company in order to determine how

the target variable are changes which respect to changes in other input variable. In other terms

this sensitivity analysis assists in analysing the impact of independent variable affecting the

dependent variable pertaining to some certain condition (VanderWeele and Ding, 2017). This

sensitivity analysis is being used and assist the manager in coping uncertainties. This is

Lipstic

k Lip-balm Lip-gloss

Material Cost 5 10 10

Labor Cost 15 10 10

Overheads 3.210 3.437 4.465

Cost 23.21 23.44 24.46

Total Cost per unit

Lipstic

k Lip-balm Lip-gloss

Selling Price 22 26 24

Material Cost 5 10 10

Labor Cost 15 10 10

Overheads 3.210 3.437 4.465

Profit/Loss per unit -1.210 2.563 -0.465

Lipstick Lip-balm Lip-gloss

Cost as per Absorption costing labour

hours 24.16 22.77 22.77

Cost as per ABC costing 23.210 23.437 24.465

Difference 0.946 -0.666 -1.694

C.

With the analysis of above calculation, it can be stated that costing as per Activity based

costing is better as compared to absorption costing. The major reason for this is that in ABC the

cost is being allocated to all the cost drivers and not to a single cost driver. Hence, the final cost

figure on basis of ABC is much accurate and reliable as compared to the absorption costing

(Activity based costing for small business, 2018).

D.

Sensitivity analysis is a method which is used by the company in order to determine how

the target variable are changes which respect to changes in other input variable. In other terms

this sensitivity analysis assists in analysing the impact of independent variable affecting the

dependent variable pertaining to some certain condition (VanderWeele and Ding, 2017). This

sensitivity analysis is being used and assist the manager in coping uncertainties. This is

particularly because of the reason that when sensitivity analysis the manager is in condition to

manage the impact of changes in independent factors over the dependent factor.

QUESTION 2

A.

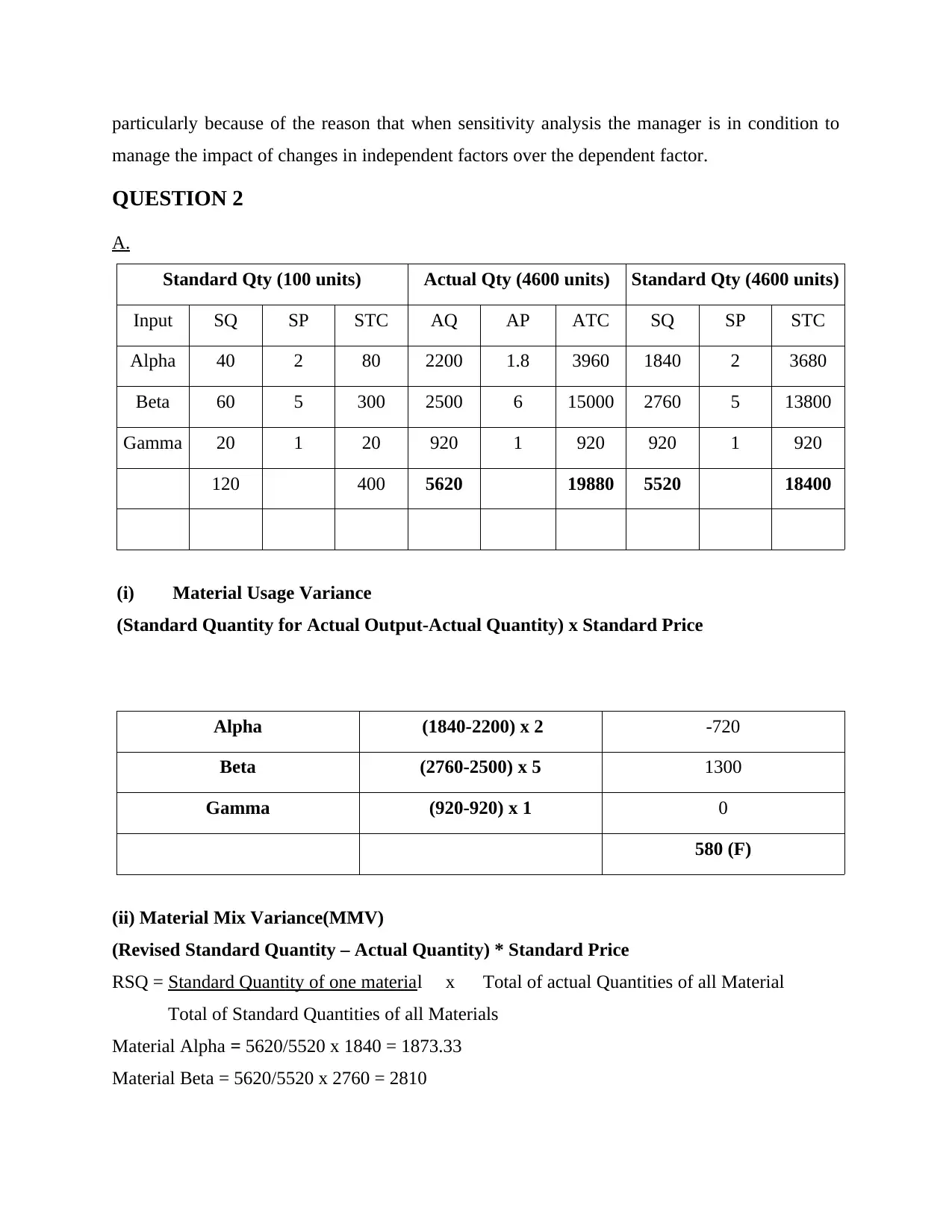

Standard Qty (100 units) Actual Qty (4600 units) Standard Qty (4600 units)

Input SQ SP STC AQ AP ATC SQ SP STC

Alpha 40 2 80 2200 1.8 3960 1840 2 3680

Beta 60 5 300 2500 6 15000 2760 5 13800

Gamma 20 1 20 920 1 920 920 1 920

120 400 5620 19880 5520 18400

(i) Material Usage Variance

(Standard Quantity for Actual Output-Actual Quantity) x Standard Price

Alpha (1840-2200) x 2 -720

Beta (2760-2500) x 5 1300

Gamma (920-920) x 1 0

580 (F)

(ii) Material Mix Variance(MMV)

(Revised Standard Quantity – Actual Quantity) * Standard Price

RSQ = Standard Quantity of one material x Total of actual Quantities of all Material

Total of Standard Quantities of all Materials

Material Alpha = 5620/5520 x 1840 = 1873.33

Material Beta = 5620/5520 x 2760 = 2810

manage the impact of changes in independent factors over the dependent factor.

QUESTION 2

A.

Standard Qty (100 units) Actual Qty (4600 units) Standard Qty (4600 units)

Input SQ SP STC AQ AP ATC SQ SP STC

Alpha 40 2 80 2200 1.8 3960 1840 2 3680

Beta 60 5 300 2500 6 15000 2760 5 13800

Gamma 20 1 20 920 1 920 920 1 920

120 400 5620 19880 5520 18400

(i) Material Usage Variance

(Standard Quantity for Actual Output-Actual Quantity) x Standard Price

Alpha (1840-2200) x 2 -720

Beta (2760-2500) x 5 1300

Gamma (920-920) x 1 0

580 (F)

(ii) Material Mix Variance(MMV)

(Revised Standard Quantity – Actual Quantity) * Standard Price

RSQ = Standard Quantity of one material x Total of actual Quantities of all Material

Total of Standard Quantities of all Materials

Material Alpha = 5620/5520 x 1840 = 1873.33

Material Beta = 5620/5520 x 2760 = 2810

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

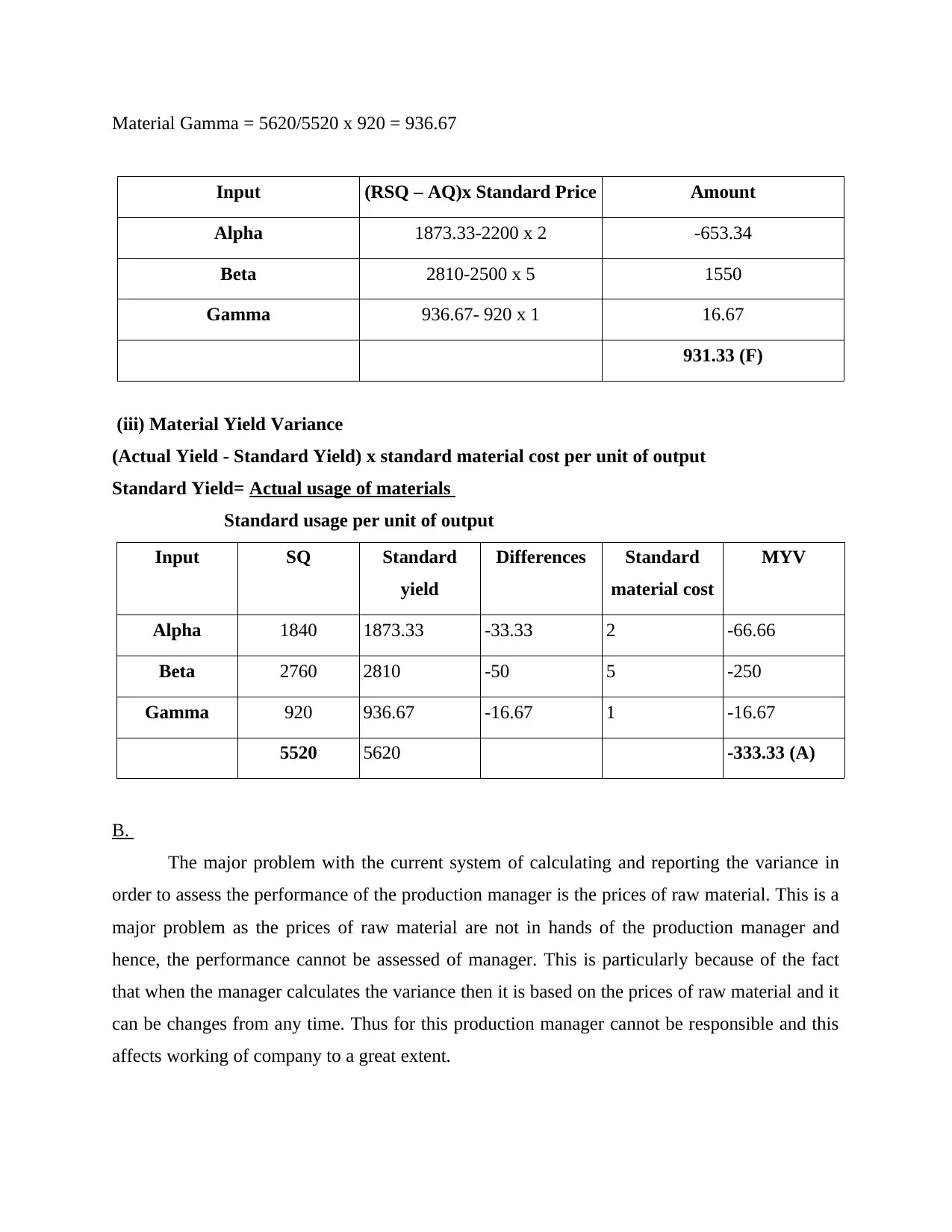

Material Gamma = 5620/5520 x 920 = 936.67

Input (RSQ – AQ)x Standard Price Amount

Alpha 1873.33-2200 x 2 -653.34

Beta 2810-2500 x 5 1550

Gamma 936.67- 920 x 1 16.67

931.33 (F)

(iii) Material Yield Variance

(Actual Yield - Standard Yield) x standard material cost per unit of output

Standard Yield= Actual usage of materials

Standard usage per unit of output

Input SQ Standard

yield

Differences Standard

material cost

MYV

Alpha 1840 1873.33 -33.33 2 -66.66

Beta 2760 2810 -50 5 -250

Gamma 920 936.67 -16.67 1 -16.67

5520 5620 -333.33 (A)

B.

The major problem with the current system of calculating and reporting the variance in

order to assess the performance of the production manager is the prices of raw material. This is a

major problem as the prices of raw material are not in hands of the production manager and

hence, the performance cannot be assessed of manager. This is particularly because of the fact

that when the manager calculates the variance then it is based on the prices of raw material and it

can be changes from any time. Thus for this production manager cannot be responsible and this

affects working of company to a great extent.

Input (RSQ – AQ)x Standard Price Amount

Alpha 1873.33-2200 x 2 -653.34

Beta 2810-2500 x 5 1550

Gamma 936.67- 920 x 1 16.67

931.33 (F)

(iii) Material Yield Variance

(Actual Yield - Standard Yield) x standard material cost per unit of output

Standard Yield= Actual usage of materials

Standard usage per unit of output

Input SQ Standard

yield

Differences Standard

material cost

MYV

Alpha 1840 1873.33 -33.33 2 -66.66

Beta 2760 2810 -50 5 -250

Gamma 920 936.67 -16.67 1 -16.67

5520 5620 -333.33 (A)

B.

The major problem with the current system of calculating and reporting the variance in

order to assess the performance of the production manager is the prices of raw material. This is a

major problem as the prices of raw material are not in hands of the production manager and

hence, the performance cannot be assessed of manager. This is particularly because of the fact

that when the manager calculates the variance then it is based on the prices of raw material and it

can be changes from any time. Thus for this production manager cannot be responsible and this

affects working of company to a great extent.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

QUESTION 3

The zero based budgeting is a tool which assist in making the budget without the use of

any past data or records (Hijal-Moghrabi, 2019). In contrast to this the incremental budgeting is a

tool which keeps some base the record of past year. Both the methods of budgeting are different

from one another as one technique involves the use of the past year performance and budget and

the other one does not makes the use of this.

As per the views of Hughes (2020) the ZBB does not provide a toll for planning and

proper coordination as this does not make the use of past records and old budget for making a

new budget. On the other side Kenno and et.al., (2020) argues that the IB is the method which

keeps the previous budget as a base for making of new budget. This is particularly because of the

reason that it might not be possible that the past information and figures are same in the future as

well. Hence, both these method of budgeting does not provide a toll for planning and

coordination and this affects the making of budget to a great extent. In addition to this both these

methods do not provide the actual or perfect budget as the future cannot be predicted in both the

methods of budgeting. Hence, this is the major drawback of both the methods with which the use

of budgeting is not proper and appropriate.

The zero based budgeting is a tool which assist in making the budget without the use of

any past data or records (Hijal-Moghrabi, 2019). In contrast to this the incremental budgeting is a

tool which keeps some base the record of past year. Both the methods of budgeting are different

from one another as one technique involves the use of the past year performance and budget and

the other one does not makes the use of this.

As per the views of Hughes (2020) the ZBB does not provide a toll for planning and

proper coordination as this does not make the use of past records and old budget for making a

new budget. On the other side Kenno and et.al., (2020) argues that the IB is the method which

keeps the previous budget as a base for making of new budget. This is particularly because of the

reason that it might not be possible that the past information and figures are same in the future as

well. Hence, both these method of budgeting does not provide a toll for planning and

coordination and this affects the making of budget to a great extent. In addition to this both these

methods do not provide the actual or perfect budget as the future cannot be predicted in both the

methods of budgeting. Hence, this is the major drawback of both the methods with which the use

of budgeting is not proper and appropriate.

REFERENCES

Books and Journals

Hijal-Moghrabi, I., 2019. Why Is it So Hard to Rationalize the Budgetary Process? A Behavioral

Analysis of Performance-Based Budgeting. Public Organization Review, 19(3), pp.387-

406.

Hughes, P., 2020. Discover the power of zero-based budgeting. Farmer’s Weekly, 2020(20032),

pp.30-30.

Kenno, S., and et.al., 2020. Budgeting, strategic planning and institutional diversity in higher

education. Studies in Higher Education, pp. 1-15.

VanderWeele, T.J. and Ding, P., 2017. Sensitivity analysis in observational research: introducing

the E-value. Annals of internal medicine. 167(4). pp. 268-274.

Online

Activity based costing for small business. 2018. [Online]. Available through:

<https://www.patriotsoftware.com/blog/accounting/activity-based-costing-small-business/

>

Books and Journals

Hijal-Moghrabi, I., 2019. Why Is it So Hard to Rationalize the Budgetary Process? A Behavioral

Analysis of Performance-Based Budgeting. Public Organization Review, 19(3), pp.387-

406.

Hughes, P., 2020. Discover the power of zero-based budgeting. Farmer’s Weekly, 2020(20032),

pp.30-30.

Kenno, S., and et.al., 2020. Budgeting, strategic planning and institutional diversity in higher

education. Studies in Higher Education, pp. 1-15.

VanderWeele, T.J. and Ding, P., 2017. Sensitivity analysis in observational research: introducing

the E-value. Annals of internal medicine. 167(4). pp. 268-274.

Online

Activity based costing for small business. 2018. [Online]. Available through:

<https://www.patriotsoftware.com/blog/accounting/activity-based-costing-small-business/

>

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.