Preparing and Administering Tax Documentation for Entities Name of the Student Name of the University Authors Note Course ID Assessment 1 - Written Test 2

VerifiedAdded on 2022/10/19

|14

|2073

|133

AI Summary

PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES Prepare and Administer Tax Documentation for Entities Name of the Student Name of the University Authors Note Course ID Assessment 1 – Written Test 2 Answer to question 1: 2 Answer to question 2: 4 Answer to question 3: 4 Answer to question 4: 5 Answer to question 5: 5 Answer to question 6: 6 Answer to question 7: 6 Answer to question 8: 7 Assessment 2: 8 Case 1: 8 Requirement A

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

Prepare and Administer Tax Documentation for Entities

Name of the Student

Name of the University

Authors Note

Course ID

Prepare and Administer Tax Documentation for Entities

Name of the Student

Name of the University

Authors Note

Course ID

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

Table of Contents

Assessment 1 – Written Test......................................................................................................2

Answer to question 1:.................................................................................................................2

Answer to question 2:.................................................................................................................4

Answer to question 3:.................................................................................................................4

Answer to question 4:.................................................................................................................5

Answer to question 5:.................................................................................................................5

Answer to question 6:.................................................................................................................6

Answer to question 7:.................................................................................................................6

Answer to question 8:.................................................................................................................7

Assessment 2:.............................................................................................................................8

Case 1:....................................................................................................................................8

Requirement A:......................................................................................................................8

Requirement B:......................................................................................................................9

Case 2:..................................................................................................................................10

Assessment 3:...........................................................................................................................11

Task 1: Computation of Section 90 Partnership Net Income...............................................11

Answer A:............................................................................................................................11

Answer B:.............................................................................................................................11

Task 2: Individual Tax Return:................................................................................................11

References:...............................................................................................................................13

Table of Contents

Assessment 1 – Written Test......................................................................................................2

Answer to question 1:.................................................................................................................2

Answer to question 2:.................................................................................................................4

Answer to question 3:.................................................................................................................4

Answer to question 4:.................................................................................................................5

Answer to question 5:.................................................................................................................5

Answer to question 6:.................................................................................................................6

Answer to question 7:.................................................................................................................6

Answer to question 8:.................................................................................................................7

Assessment 2:.............................................................................................................................8

Case 1:....................................................................................................................................8

Requirement A:......................................................................................................................8

Requirement B:......................................................................................................................9

Case 2:..................................................................................................................................10

Assessment 3:...........................................................................................................................11

Task 1: Computation of Section 90 Partnership Net Income...............................................11

Answer A:............................................................................................................................11

Answer B:.............................................................................................................................11

Task 2: Individual Tax Return:................................................................................................11

References:...............................................................................................................................13

2PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

Assessment 1 – Written Test

Answer to question 1:

The four main business structures that is most commonly used by the small business

in Australia are as follows;

Sole trader – An individual that is trading on their own.

Partnership – There are number of people or entities that is running the business together

but does not include a company (Barkoczy 2016).

Company – A company includes the legal entity that is different from its owners.

Trust – An entity that holds the property or income for the others benefit.

Advantages and Disadvantages of Sole trader:

Advantages:

a. Unlike the other business structures, beginning a sole proprietorship needs less

paperwork and time to form a legal sole trader.

b. Sole trader gets the tax benefits (Freudenberg et al. 2017). The sole trader is imposed

tax based on individual tax rates instead of corporate rate which makes it simpler and

cheaper to adhere with the tax regulations.

Disadvantages:

a. Owners are completely liable for the overwhelming debts of business and this will

impact the owner’s finances. When the sole trader fails to pay the debts all the savings

and assets can be used to meet the debt obligations.

Assessment 1 – Written Test

Answer to question 1:

The four main business structures that is most commonly used by the small business

in Australia are as follows;

Sole trader – An individual that is trading on their own.

Partnership – There are number of people or entities that is running the business together

but does not include a company (Barkoczy 2016).

Company – A company includes the legal entity that is different from its owners.

Trust – An entity that holds the property or income for the others benefit.

Advantages and Disadvantages of Sole trader:

Advantages:

a. Unlike the other business structures, beginning a sole proprietorship needs less

paperwork and time to form a legal sole trader.

b. Sole trader gets the tax benefits (Freudenberg et al. 2017). The sole trader is imposed

tax based on individual tax rates instead of corporate rate which makes it simpler and

cheaper to adhere with the tax regulations.

Disadvantages:

a. Owners are completely liable for the overwhelming debts of business and this will

impact the owner’s finances. When the sole trader fails to pay the debts all the savings

and assets can be used to meet the debt obligations.

3PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

b. Raising the capital is considered difficult (Sadiq 2019). Initial business is produced by

owners and raising funds for business can be considered difficult because they do not

use stocks or other kind of investment income.

Advantages and Disadvantages of Partnership:

Advantages:

a. The business would have higher amount of capital available

b. Higher capacity to borrow

c. Easy to change legal structure of business if situation arises

Disadvantages:

a. There are possibilities of risks related to disagreement and frictions amid the partners

and management

b. If the partners leave or join, the valuing all the assets of the partnership becomes

costly.

Advantages and Disadvantage of Company:

Advantage:

a. The liability of shareholders is limited

b. The rates of taxation are very much favourable

Disadvantage:

a. The profits that are distributes to the shareholders are considered taxable

b. The requirements relating to reporting is complex

Advantages and Disadvantages of Trusts:

Advantages:

b. Raising the capital is considered difficult (Sadiq 2019). Initial business is produced by

owners and raising funds for business can be considered difficult because they do not

use stocks or other kind of investment income.

Advantages and Disadvantages of Partnership:

Advantages:

a. The business would have higher amount of capital available

b. Higher capacity to borrow

c. Easy to change legal structure of business if situation arises

Disadvantages:

a. There are possibilities of risks related to disagreement and frictions amid the partners

and management

b. If the partners leave or join, the valuing all the assets of the partnership becomes

costly.

Advantages and Disadvantage of Company:

Advantage:

a. The liability of shareholders is limited

b. The rates of taxation are very much favourable

Disadvantage:

a. The profits that are distributes to the shareholders are considered taxable

b. The requirements relating to reporting is complex

Advantages and Disadvantages of Trusts:

Advantages:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

a. The income from trust is generally taxed as the income of an individual

b. There is flexibility in the distributions among the beneficiaries

Disadvantage:

a. The structure of trust is complex

b. The trust deed imposes restriction on the trustee’s power.

Answer to question 2:

Record keeping is regarded as the necessary part of running the business. It results in

good business sense as well.

Specific record keeping requirements for Travel Expenses:

If an individual travel allowance is shown in the income statement or in the payment

summary and wants to make the claim against those expenses, then they are required to have

the written evidences for the entire amount of claim, not simply those are more than the

reasonable amount.

The records an individual taxpayer is required to keep for travel expenditure includes

fares, accommodation, food, drinks and incidental expenses depending upon the length of

your trip whether it is domestic or international (Murray et al. 2018). If an individual travel

for six or greater than six nights then the taxpayer would be required to keep the travel diary

that would contain the records for dates, place, time and duration of travel and activities.

Answer to question 3:

Records that must be kept by business includes;

a. Receipts and other evidences related to sales and purchases that is made for business

b. Tax invoices, wages and salary records

c. All the documents related to GST

a. The income from trust is generally taxed as the income of an individual

b. There is flexibility in the distributions among the beneficiaries

Disadvantage:

a. The structure of trust is complex

b. The trust deed imposes restriction on the trustee’s power.

Answer to question 2:

Record keeping is regarded as the necessary part of running the business. It results in

good business sense as well.

Specific record keeping requirements for Travel Expenses:

If an individual travel allowance is shown in the income statement or in the payment

summary and wants to make the claim against those expenses, then they are required to have

the written evidences for the entire amount of claim, not simply those are more than the

reasonable amount.

The records an individual taxpayer is required to keep for travel expenditure includes

fares, accommodation, food, drinks and incidental expenses depending upon the length of

your trip whether it is domestic or international (Murray et al. 2018). If an individual travel

for six or greater than six nights then the taxpayer would be required to keep the travel diary

that would contain the records for dates, place, time and duration of travel and activities.

Answer to question 3:

Records that must be kept by business includes;

a. Receipts and other evidences related to sales and purchases that is made for business

b. Tax invoices, wages and salary records

c. All the documents related to GST

5PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

d. Bank records including the bank statements and loan records

e. Records associated to tax returns, activity statements, fringe benefit tax and

contributions to employee superannuation contribution (Morgan et al. 2018).

Answer to question 4:

The banking records forms the necessary part of the overall business and requires to be

retained for five years. The small business is required to retain the banking records are as

follows;

a. Deposit slips, books or records

b. Cheque butts or records relating to payment

c. Records relating to bank statement

d. Statements relating to Credit card

e. Loan and lease agreements

Answer to question 5:

Checklist of documents that as a tax agent will be asked by clients are as follows;

a. Tax File Number (TFN)

b. Bank details

c. Account holder name

d. Medical expenditure

e. PayG summaries

f. Details of foreign earnings

g. Statement of dividends received or invested

h. Statements on revenues from managed funds

i. Receipts for gifts and donations

j. Receipts for the work-related expenditure including the uniforms, mileage

d. Bank records including the bank statements and loan records

e. Records associated to tax returns, activity statements, fringe benefit tax and

contributions to employee superannuation contribution (Morgan et al. 2018).

Answer to question 4:

The banking records forms the necessary part of the overall business and requires to be

retained for five years. The small business is required to retain the banking records are as

follows;

a. Deposit slips, books or records

b. Cheque butts or records relating to payment

c. Records relating to bank statement

d. Statements relating to Credit card

e. Loan and lease agreements

Answer to question 5:

Checklist of documents that as a tax agent will be asked by clients are as follows;

a. Tax File Number (TFN)

b. Bank details

c. Account holder name

d. Medical expenditure

e. PayG summaries

f. Details of foreign earnings

g. Statement of dividends received or invested

h. Statements on revenues from managed funds

i. Receipts for gifts and donations

j. Receipts for the work-related expenditure including the uniforms, mileage

6PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

k. Medical receipts greater than >$2,120

Answer to question 6:

BAS Checklist

Checking for following during the BAS Period:

Purchase or trade in vehicles

Purchase of PPE

Foreign purchase and invoices of customs

Payroll terminations

Reviewing all Data Entered and Accounts Reconciled:

All the credit card and loans reconciled

All the purchases that are entered

Cash expenditure that are entered

Outstanding debtors and creditors

Electronic payroll clearing accounts

Reconciling PayG liability and ATO Accounts

Implementing check on private reports and journals

Reconciling GST with reports:

For cash purpose reconciling GST reports with the P&L reports

Reconciling the GST reports with the balance sheet accounts

Answer to question 7:

There may be instances where the client might not identify some of the information

that is provided in the pre-fill report. For example, this might due to the unfamiliarity with the

sum of interest. This mainly happens because of

k. Medical receipts greater than >$2,120

Answer to question 6:

BAS Checklist

Checking for following during the BAS Period:

Purchase or trade in vehicles

Purchase of PPE

Foreign purchase and invoices of customs

Payroll terminations

Reviewing all Data Entered and Accounts Reconciled:

All the credit card and loans reconciled

All the purchases that are entered

Cash expenditure that are entered

Outstanding debtors and creditors

Electronic payroll clearing accounts

Reconciling PayG liability and ATO Accounts

Implementing check on private reports and journals

Reconciling GST with reports:

For cash purpose reconciling GST reports with the P&L reports

Reconciling the GST reports with the balance sheet accounts

Answer to question 7:

There may be instances where the client might not identify some of the information

that is provided in the pre-fill report. For example, this might due to the unfamiliarity with the

sum of interest. This mainly happens because of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

a. Interest bearing securities that are reported by the share registries instead of bank.

b. Bank accounts or investments that are ignored by the investor

c. Certain investment or bank accounts which is yet to be established on behalf of the

client but they are not known to them (Morgan and Castelyn 2018).

On noticing any kind of discrepancy there are steps that can be taken to eliminate the

discrepancy;

a. Checking the records of clients or statements to understand the cause of discrepancy

b. Asking the client to clear the discrepancy with the information that is earned from the

provider. The provider should rectify the information if there are any kind of error.

c. Checking the present data issues for the updates on the recognized pre-filling data

issues for the present year of income.

d. Checking the data issues that are recurrent in nature as this would help in obtaining

the details regarding the issues that are affecting the multiple years.

Answer to question 8:

Verification that can be done to assure that documents are real or original for business

purpose;

a. Operating in the GST system that includes the claims relating to GST credits

b. Confirming the business identity to others at the time of ordering and invoicing

c. Documents relating to goods and service tax

d. Pay as you go (PAYG) instalments, PAYG withholding tax and other tax obligations

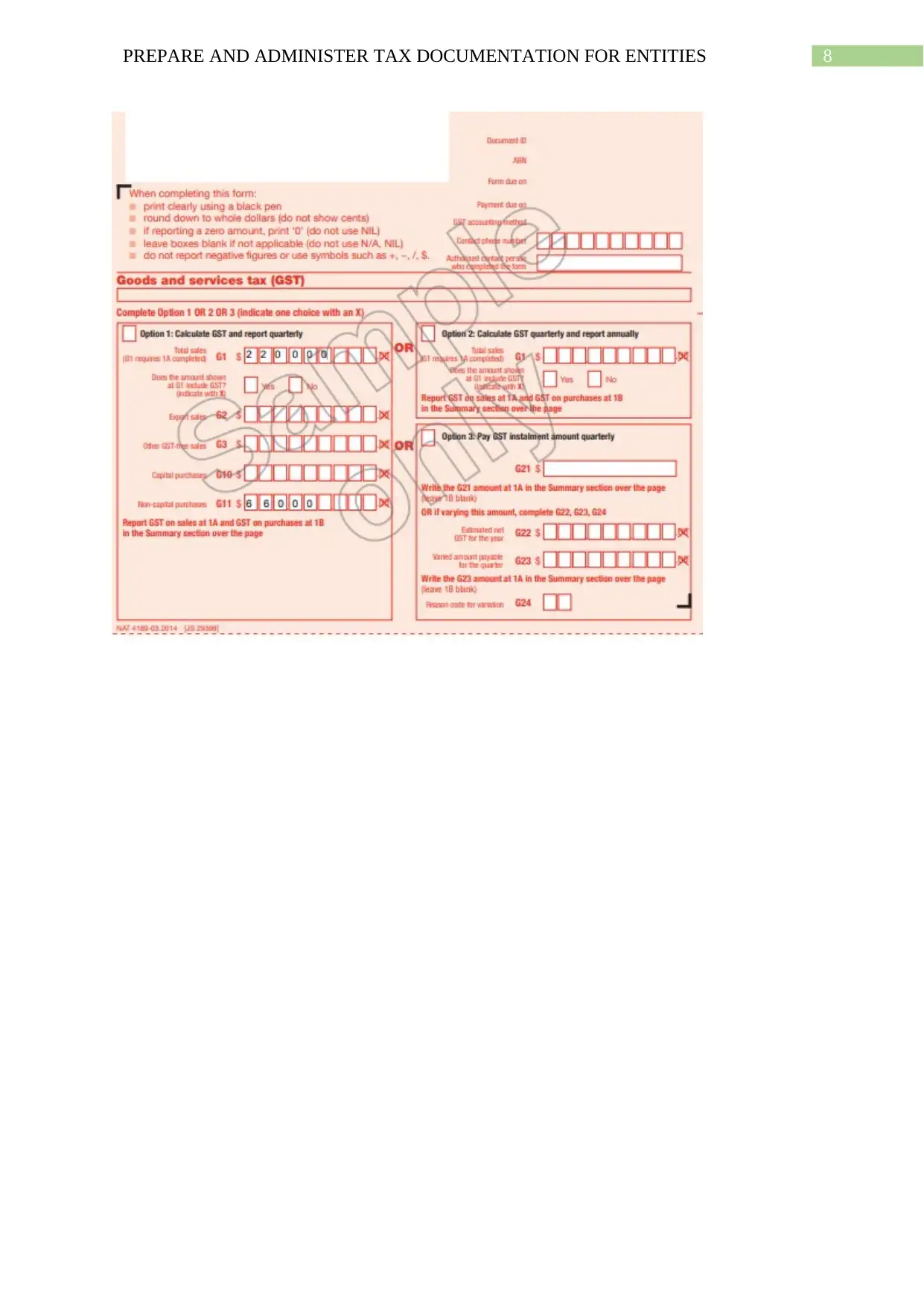

Assessment 2:

Case 1:

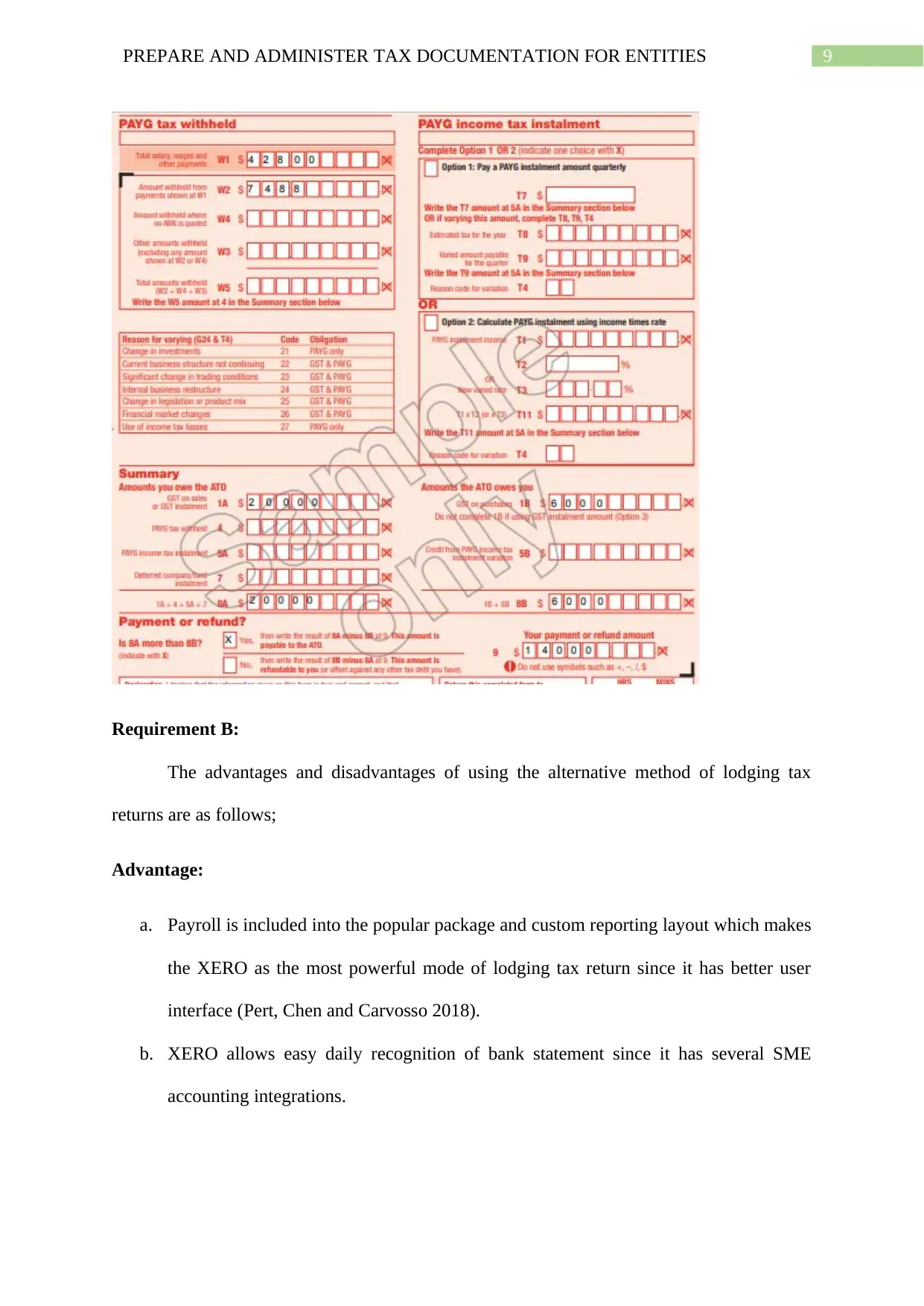

Requirement A:

a. Interest bearing securities that are reported by the share registries instead of bank.

b. Bank accounts or investments that are ignored by the investor

c. Certain investment or bank accounts which is yet to be established on behalf of the

client but they are not known to them (Morgan and Castelyn 2018).

On noticing any kind of discrepancy there are steps that can be taken to eliminate the

discrepancy;

a. Checking the records of clients or statements to understand the cause of discrepancy

b. Asking the client to clear the discrepancy with the information that is earned from the

provider. The provider should rectify the information if there are any kind of error.

c. Checking the present data issues for the updates on the recognized pre-filling data

issues for the present year of income.

d. Checking the data issues that are recurrent in nature as this would help in obtaining

the details regarding the issues that are affecting the multiple years.

Answer to question 8:

Verification that can be done to assure that documents are real or original for business

purpose;

a. Operating in the GST system that includes the claims relating to GST credits

b. Confirming the business identity to others at the time of ordering and invoicing

c. Documents relating to goods and service tax

d. Pay as you go (PAYG) instalments, PAYG withholding tax and other tax obligations

Assessment 2:

Case 1:

Requirement A:

8PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

9PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

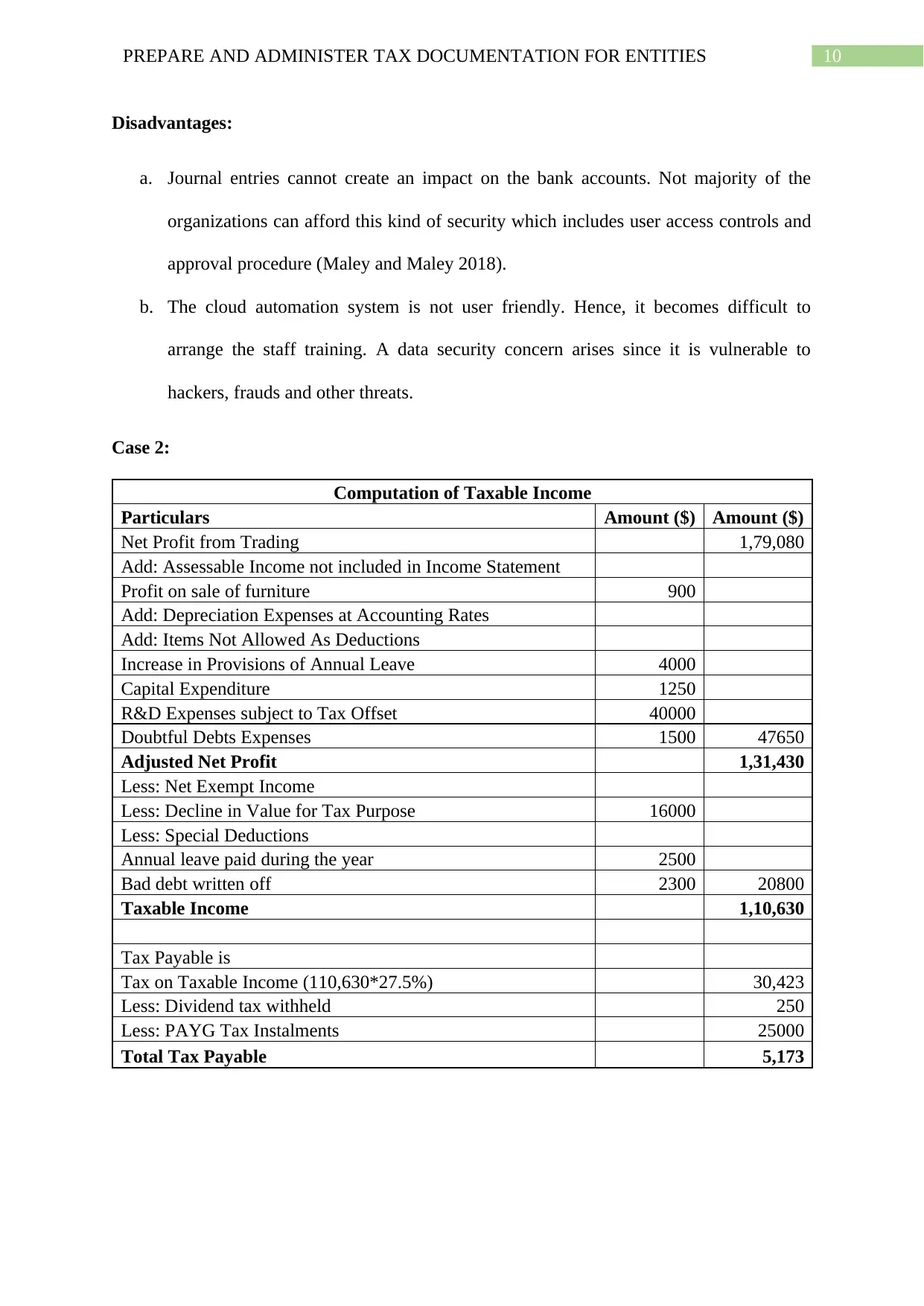

Requirement B:

The advantages and disadvantages of using the alternative method of lodging tax

returns are as follows;

Advantage:

a. Payroll is included into the popular package and custom reporting layout which makes

the XERO as the most powerful mode of lodging tax return since it has better user

interface (Pert, Chen and Carvosso 2018).

b. XERO allows easy daily recognition of bank statement since it has several SME

accounting integrations.

Requirement B:

The advantages and disadvantages of using the alternative method of lodging tax

returns are as follows;

Advantage:

a. Payroll is included into the popular package and custom reporting layout which makes

the XERO as the most powerful mode of lodging tax return since it has better user

interface (Pert, Chen and Carvosso 2018).

b. XERO allows easy daily recognition of bank statement since it has several SME

accounting integrations.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

Disadvantages:

a. Journal entries cannot create an impact on the bank accounts. Not majority of the

organizations can afford this kind of security which includes user access controls and

approval procedure (Maley and Maley 2018).

b. The cloud automation system is not user friendly. Hence, it becomes difficult to

arrange the staff training. A data security concern arises since it is vulnerable to

hackers, frauds and other threats.

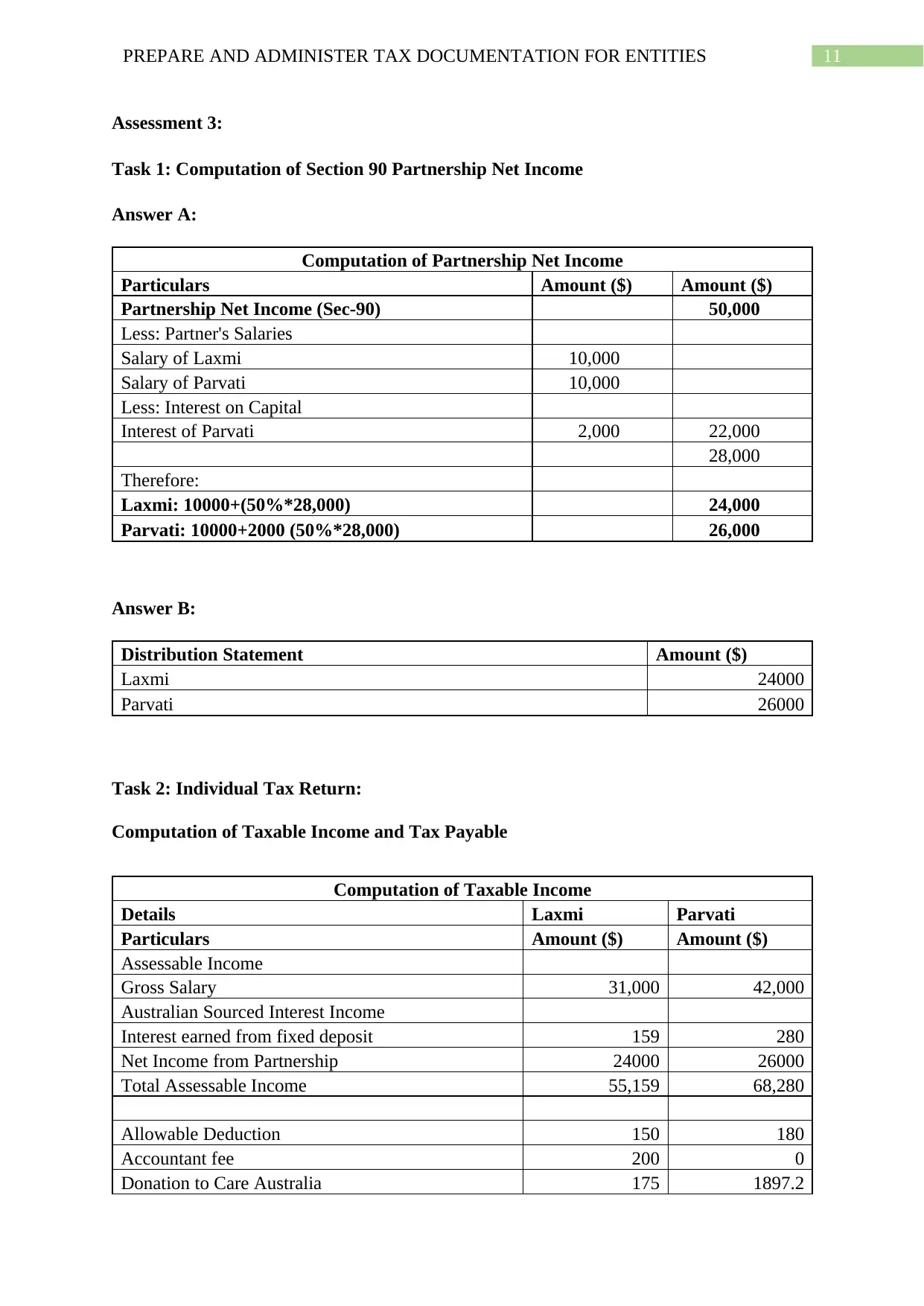

Case 2:

Computation of Taxable Income

Particulars Amount ($) Amount ($)

Net Profit from Trading 1,79,080

Add: Assessable Income not included in Income Statement

Profit on sale of furniture 900

Add: Depreciation Expenses at Accounting Rates

Add: Items Not Allowed As Deductions

Increase in Provisions of Annual Leave 4000

Capital Expenditure 1250

R&D Expenses subject to Tax Offset 40000

Doubtful Debts Expenses 1500 47650

Adjusted Net Profit 1,31,430

Less: Net Exempt Income

Less: Decline in Value for Tax Purpose 16000

Less: Special Deductions

Annual leave paid during the year 2500

Bad debt written off 2300 20800

Taxable Income 1,10,630

Tax Payable is

Tax on Taxable Income (110,630*27.5%) 30,423

Less: Dividend tax withheld 250

Less: PAYG Tax Instalments 25000

Total Tax Payable 5,173

Disadvantages:

a. Journal entries cannot create an impact on the bank accounts. Not majority of the

organizations can afford this kind of security which includes user access controls and

approval procedure (Maley and Maley 2018).

b. The cloud automation system is not user friendly. Hence, it becomes difficult to

arrange the staff training. A data security concern arises since it is vulnerable to

hackers, frauds and other threats.

Case 2:

Computation of Taxable Income

Particulars Amount ($) Amount ($)

Net Profit from Trading 1,79,080

Add: Assessable Income not included in Income Statement

Profit on sale of furniture 900

Add: Depreciation Expenses at Accounting Rates

Add: Items Not Allowed As Deductions

Increase in Provisions of Annual Leave 4000

Capital Expenditure 1250

R&D Expenses subject to Tax Offset 40000

Doubtful Debts Expenses 1500 47650

Adjusted Net Profit 1,31,430

Less: Net Exempt Income

Less: Decline in Value for Tax Purpose 16000

Less: Special Deductions

Annual leave paid during the year 2500

Bad debt written off 2300 20800

Taxable Income 1,10,630

Tax Payable is

Tax on Taxable Income (110,630*27.5%) 30,423

Less: Dividend tax withheld 250

Less: PAYG Tax Instalments 25000

Total Tax Payable 5,173

11PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

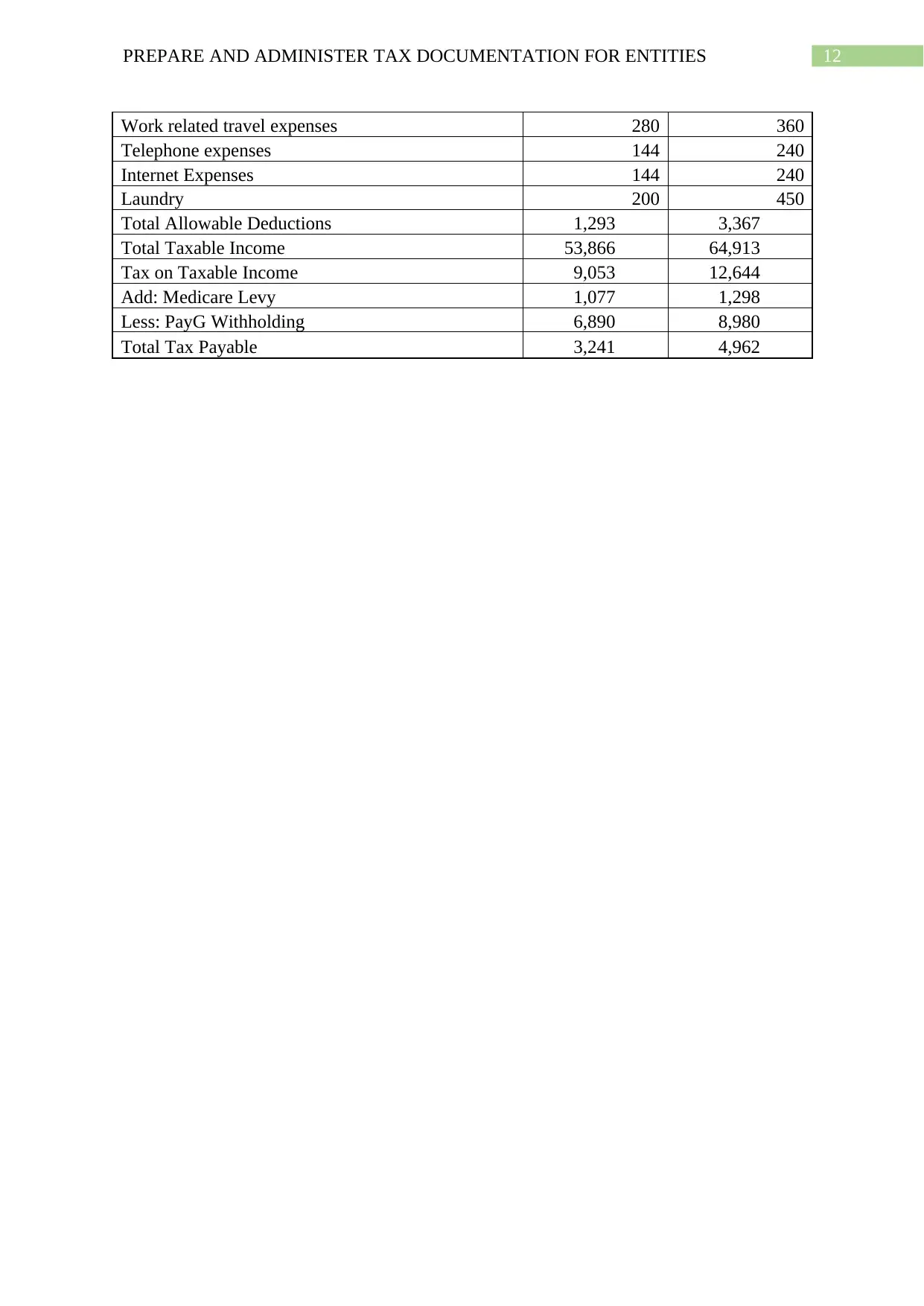

Assessment 3:

Task 1: Computation of Section 90 Partnership Net Income

Answer A:

Computation of Partnership Net Income

Particulars Amount ($) Amount ($)

Partnership Net Income (Sec-90) 50,000

Less: Partner's Salaries

Salary of Laxmi 10,000

Salary of Parvati 10,000

Less: Interest on Capital

Interest of Parvati 2,000 22,000

28,000

Therefore:

Laxmi: 10000+(50%*28,000) 24,000

Parvati: 10000+2000 (50%*28,000) 26,000

Answer B:

Distribution Statement Amount ($)

Laxmi 24000

Parvati 26000

Task 2: Individual Tax Return:

Computation of Taxable Income and Tax Payable

Computation of Taxable Income

Details Laxmi Parvati

Particulars Amount ($) Amount ($)

Assessable Income

Gross Salary 31,000 42,000

Australian Sourced Interest Income

Interest earned from fixed deposit 159 280

Net Income from Partnership 24000 26000

Total Assessable Income 55,159 68,280

Allowable Deduction 150 180

Accountant fee 200 0

Donation to Care Australia 175 1897.2

Assessment 3:

Task 1: Computation of Section 90 Partnership Net Income

Answer A:

Computation of Partnership Net Income

Particulars Amount ($) Amount ($)

Partnership Net Income (Sec-90) 50,000

Less: Partner's Salaries

Salary of Laxmi 10,000

Salary of Parvati 10,000

Less: Interest on Capital

Interest of Parvati 2,000 22,000

28,000

Therefore:

Laxmi: 10000+(50%*28,000) 24,000

Parvati: 10000+2000 (50%*28,000) 26,000

Answer B:

Distribution Statement Amount ($)

Laxmi 24000

Parvati 26000

Task 2: Individual Tax Return:

Computation of Taxable Income and Tax Payable

Computation of Taxable Income

Details Laxmi Parvati

Particulars Amount ($) Amount ($)

Assessable Income

Gross Salary 31,000 42,000

Australian Sourced Interest Income

Interest earned from fixed deposit 159 280

Net Income from Partnership 24000 26000

Total Assessable Income 55,159 68,280

Allowable Deduction 150 180

Accountant fee 200 0

Donation to Care Australia 175 1897.2

12PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

Work related travel expenses 280 360

Telephone expenses 144 240

Internet Expenses 144 240

Laundry 200 450

Total Allowable Deductions 1,293 3,367

Total Taxable Income 53,866 64,913

Tax on Taxable Income 9,053 12,644

Add: Medicare Levy 1,077 1,298

Less: PayG Withholding 6,890 8,980

Total Tax Payable 3,241 4,962

Work related travel expenses 280 360

Telephone expenses 144 240

Internet Expenses 144 240

Laundry 200 450

Total Allowable Deductions 1,293 3,367

Total Taxable Income 53,866 64,913

Tax on Taxable Income 9,053 12,644

Add: Medicare Levy 1,077 1,298

Less: PayG Withholding 6,890 8,980

Total Tax Payable 3,241 4,962

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13PREPARE AND ADMINISTER TAX DOCUMENTATION FOR ENTITIES

References:

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

Freudenberg, B., Chardon, T., Brimble, M. and Isle, M.B., 2017. Tax literacy of Australian

small businesses. J. Austl. Tax'n, 19, p.21.

Maley, M.N. and Maley, D.M., 2018. Australian Taxation Office Guidance on the Diverted

Profits Tax.

Morgan, A. and Castelyn, D., 2018. Taxation Education in Secondary Schools. J.

Australasian Tax Tchrs. Ass'n, 13, p.307.

Morgan, A., Mortimer, C. and Pinto, D., 2018. A practical introduction to Australian

taxation law 2018. Oxford University Press.

Murray, I., Taylor, J., Walpole, M., Burton, M. and Ciro, T., 2018. Understanding Taxation

Law 2019.

Pert, A., Chen, H. and Carvosso, R., 2018. 'Federal Commissioner of Taxation v

Jayasinghe'(2016) 247 FCR 40. Australian Year Book of International Law, 35, p.260.

Sadiq, K., 2019. Australian Taxation Law Cases 2019. Thomson Reuters.

References:

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

Freudenberg, B., Chardon, T., Brimble, M. and Isle, M.B., 2017. Tax literacy of Australian

small businesses. J. Austl. Tax'n, 19, p.21.

Maley, M.N. and Maley, D.M., 2018. Australian Taxation Office Guidance on the Diverted

Profits Tax.

Morgan, A. and Castelyn, D., 2018. Taxation Education in Secondary Schools. J.

Australasian Tax Tchrs. Ass'n, 13, p.307.

Morgan, A., Mortimer, C. and Pinto, D., 2018. A practical introduction to Australian

taxation law 2018. Oxford University Press.

Murray, I., Taylor, J., Walpole, M., Burton, M. and Ciro, T., 2018. Understanding Taxation

Law 2019.

Pert, A., Chen, H. and Carvosso, R., 2018. 'Federal Commissioner of Taxation v

Jayasinghe'(2016) 247 FCR 40. Australian Year Book of International Law, 35, p.260.

Sadiq, K., 2019. Australian Taxation Law Cases 2019. Thomson Reuters.

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.