Analyzing Financial Statements of Emirates Traders Ltd

VerifiedAdded on 2020/06/03

|10

|1835

|56

AI Summary

This assignment tasks students with analyzing the comprehensive income statement for Emirates Traders Ltd. The statement details revenue, cost of sales, operating income, expenses (categorized by function), and ultimately, the company's comprehensive income. Students are expected to interpret these figures, understand how different expense classifications impact financial reporting, and demonstrate knowledge of accounting standards like IFRS & IAS.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Prepare financial reports for a

corporate entity

corporate entity

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION ..........................................................................................................................1

QUESTION 1...................................................................................................................................1

Journal entries for purchase combination...............................................................................1

Journal entries for settlement..................................................................................................2

QUESTION 2...................................................................................................................................3

Statement of taxable income..................................................................................................3

Journal entries of tax expense and tax effect of temporary difference...................................3

QUESTION 3...................................................................................................................................5

Prepare cash flow from operating activities...........................................................................5

QUESTION 4 ..................................................................................................................................6

CONCLUSION ...............................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION ..........................................................................................................................1

QUESTION 1...................................................................................................................................1

Journal entries for purchase combination...............................................................................1

Journal entries for settlement..................................................................................................2

QUESTION 2...................................................................................................................................3

Statement of taxable income..................................................................................................3

Journal entries of tax expense and tax effect of temporary difference...................................3

QUESTION 3...................................................................................................................................5

Prepare cash flow from operating activities...........................................................................5

QUESTION 4 ..................................................................................................................................6

CONCLUSION ...............................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

In the business unit, it is highly required for the manager to prepare accounts and present

report about the same in a highly structured way. Moreover, reports furnish information about

the financial position and performance of firm. Consolidated financial statements may be defined

as a framework that combines assets, liabilities, equity, income, expenses and cash flows of

parent and subsidiary company into one. In IAS 27, rules are mentioned in relation to the

preparation and presentation of consolidated accounts. In this, report will describe the manner in

which consolidated statements can be prepared for presenting information more effectually.

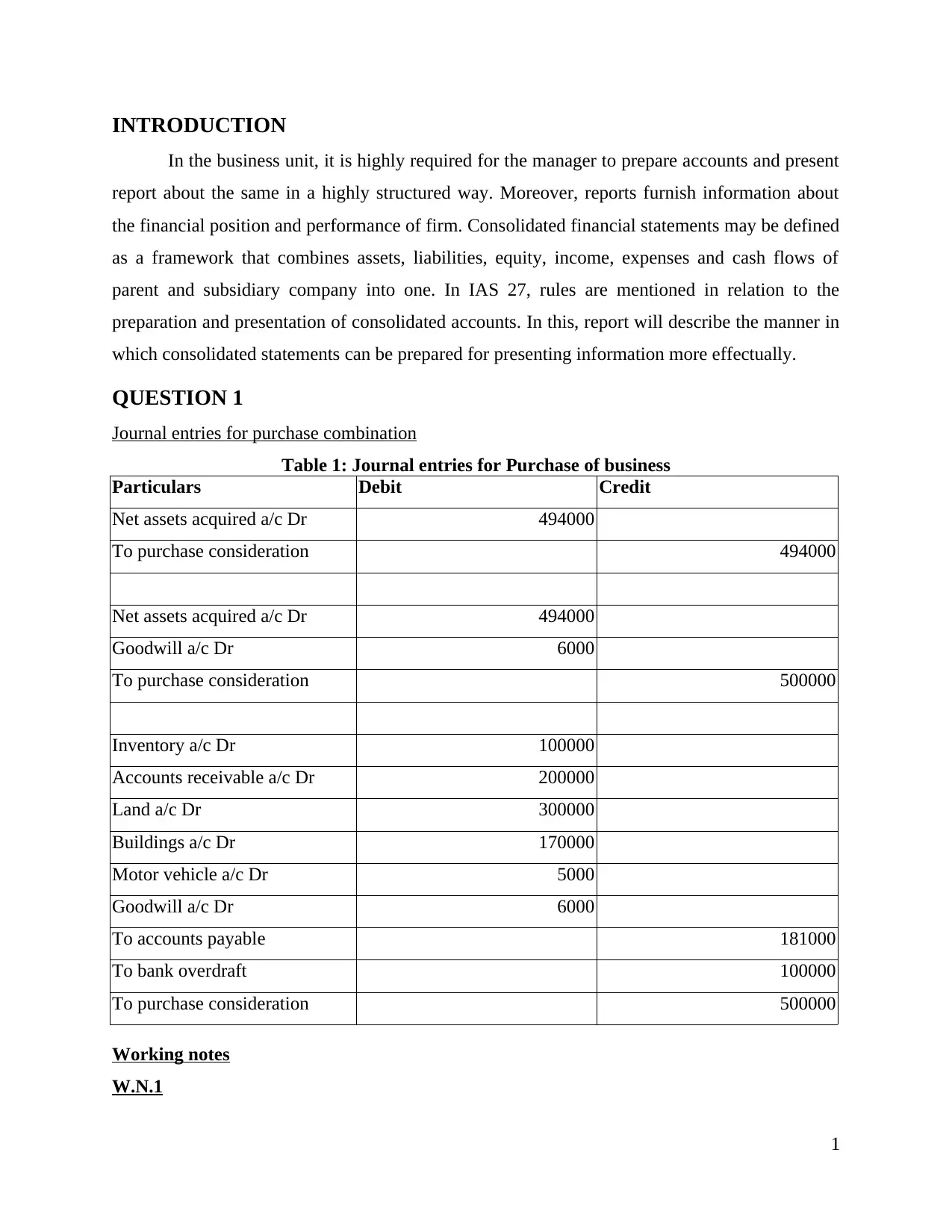

QUESTION 1

Journal entries for purchase combination

Table 1: Journal entries for Purchase of business

Particulars Debit Credit

Net assets acquired a/c Dr 494000

To purchase consideration 494000

Net assets acquired a/c Dr 494000

Goodwill a/c Dr 6000

To purchase consideration 500000

Inventory a/c Dr 100000

Accounts receivable a/c Dr 200000

Land a/c Dr 300000

Buildings a/c Dr 170000

Motor vehicle a/c Dr 5000

Goodwill a/c Dr 6000

To accounts payable 181000

To bank overdraft 100000

To purchase consideration 500000

Working notes

W.N.1

1

In the business unit, it is highly required for the manager to prepare accounts and present

report about the same in a highly structured way. Moreover, reports furnish information about

the financial position and performance of firm. Consolidated financial statements may be defined

as a framework that combines assets, liabilities, equity, income, expenses and cash flows of

parent and subsidiary company into one. In IAS 27, rules are mentioned in relation to the

preparation and presentation of consolidated accounts. In this, report will describe the manner in

which consolidated statements can be prepared for presenting information more effectually.

QUESTION 1

Journal entries for purchase combination

Table 1: Journal entries for Purchase of business

Particulars Debit Credit

Net assets acquired a/c Dr 494000

To purchase consideration 494000

Net assets acquired a/c Dr 494000

Goodwill a/c Dr 6000

To purchase consideration 500000

Inventory a/c Dr 100000

Accounts receivable a/c Dr 200000

Land a/c Dr 300000

Buildings a/c Dr 170000

Motor vehicle a/c Dr 5000

Goodwill a/c Dr 6000

To accounts payable 181000

To bank overdraft 100000

To purchase consideration 500000

Working notes

W.N.1

1

Table 2: Calculation of net asset acquired

Particulars Book Value Fair value

Assets

Inventory 145000 100000

Accounts receivable 225000 200000

Land 50000 300000

Building 80000 170000

Motor vehicle 40000

24000 16000 5000

Fittings and equipment 60000

Accumulated

depreciation 25000 35000 0

Total assets 551000 775000

Liabilities

Accounts payable 181000

Bank overdraft 100000

Total liabilities 281000

Net assets acquired 494000

Journal entries for settlement

Table 3: Purchase consideration settlement

Particulars Debit Credit

Purchase consideration

a/c Dr 500000

To Capital-Thomas

woods 125000

To Capital-John woods 125000

To cash 250000

Working notes

W.N.1

Particulars Amount

2

Particulars Book Value Fair value

Assets

Inventory 145000 100000

Accounts receivable 225000 200000

Land 50000 300000

Building 80000 170000

Motor vehicle 40000

24000 16000 5000

Fittings and equipment 60000

Accumulated

depreciation 25000 35000 0

Total assets 551000 775000

Liabilities

Accounts payable 181000

Bank overdraft 100000

Total liabilities 281000

Net assets acquired 494000

Journal entries for settlement

Table 3: Purchase consideration settlement

Particulars Debit Credit

Purchase consideration

a/c Dr 500000

To Capital-Thomas

woods 125000

To Capital-John woods 125000

To cash 250000

Working notes

W.N.1

Particulars Amount

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

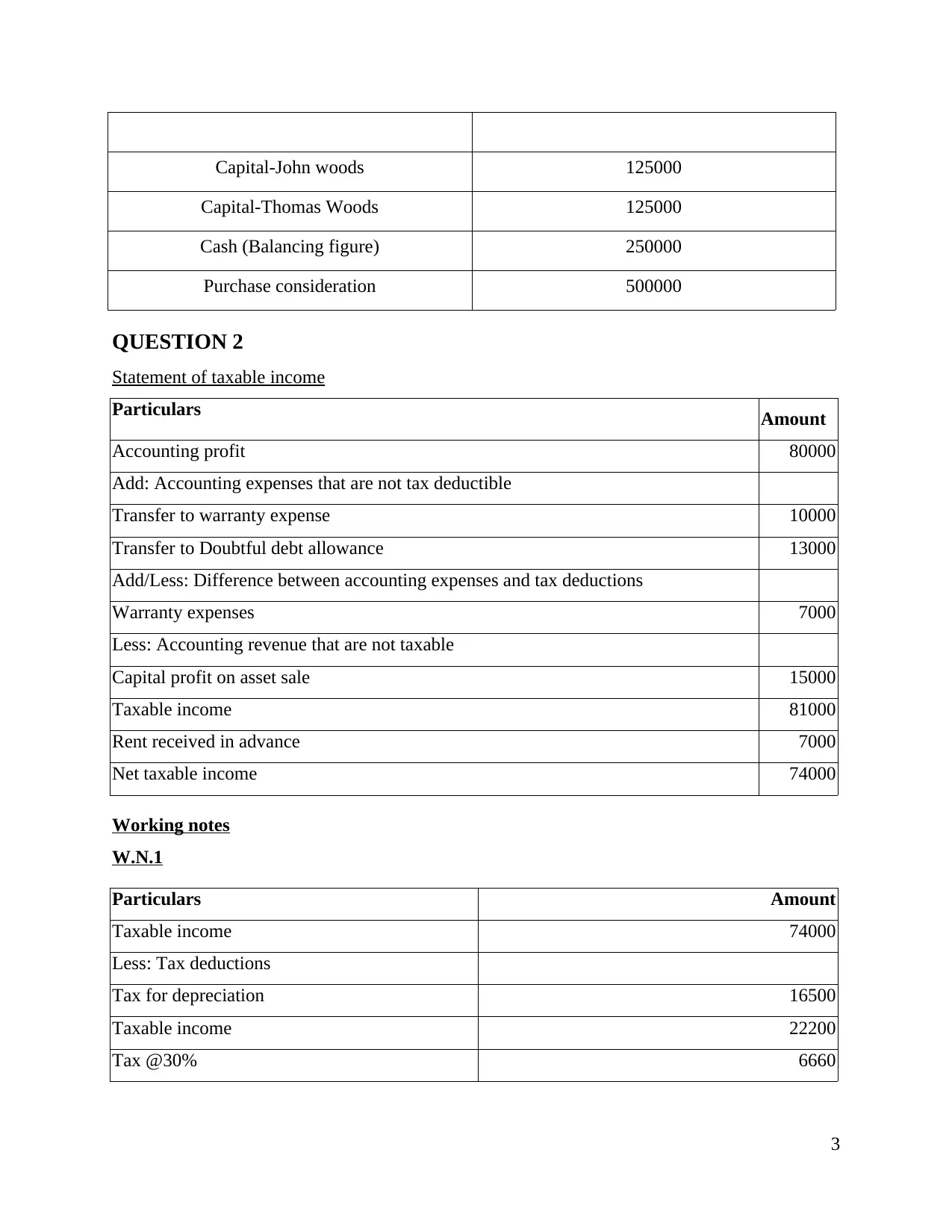

Capital-John woods 125000

Capital-Thomas Woods 125000

Cash (Balancing figure) 250000

Purchase consideration 500000

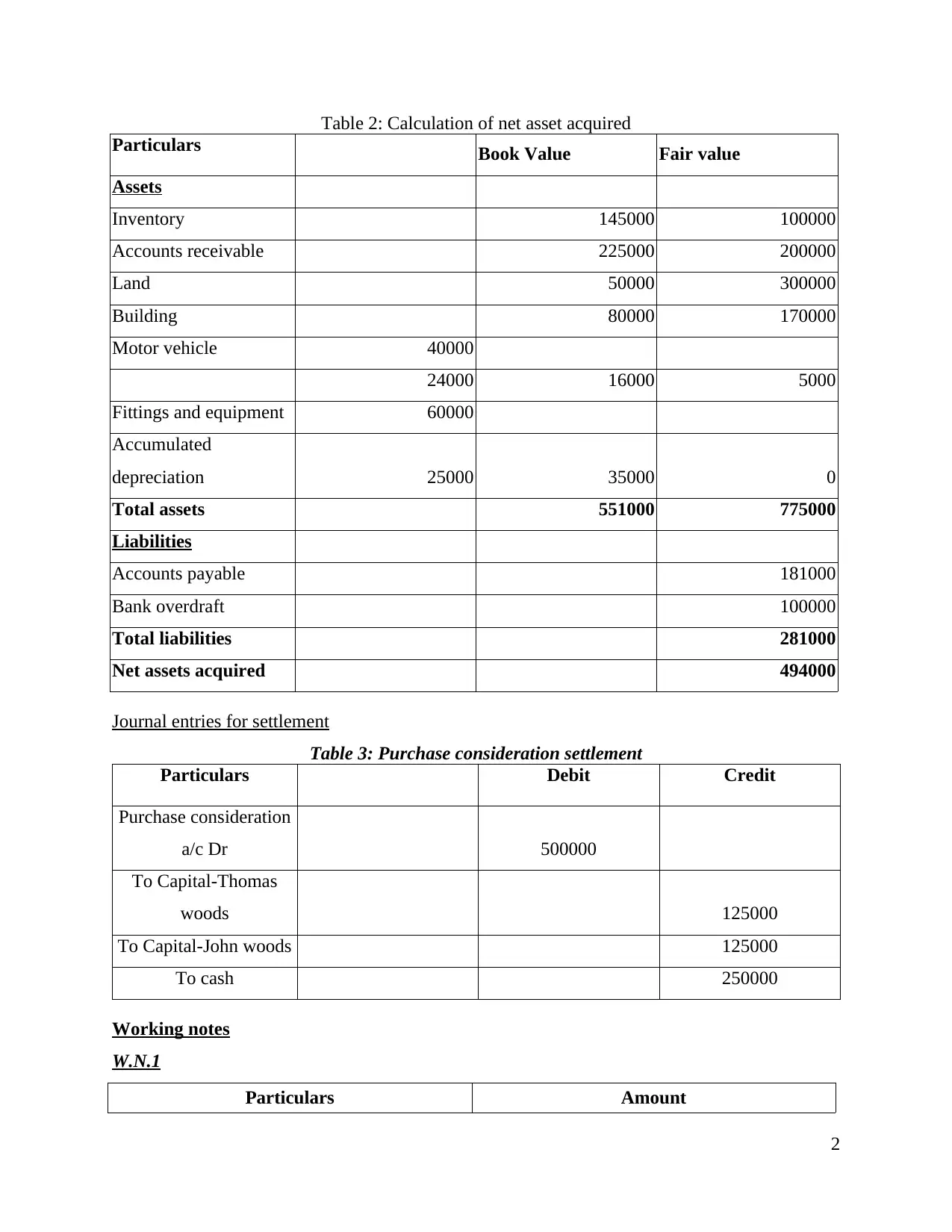

QUESTION 2

Statement of taxable income

Particulars Amount

Accounting profit 80000

Add: Accounting expenses that are not tax deductible

Transfer to warranty expense 10000

Transfer to Doubtful debt allowance 13000

Add/Less: Difference between accounting expenses and tax deductions

Warranty expenses 7000

Less: Accounting revenue that are not taxable

Capital profit on asset sale 15000

Taxable income 81000

Rent received in advance 7000

Net taxable income 74000

Working notes

W.N.1

Particulars Amount

Taxable income 74000

Less: Tax deductions

Tax for depreciation 16500

Taxable income 22200

Tax @30% 6660

3

Capital-Thomas Woods 125000

Cash (Balancing figure) 250000

Purchase consideration 500000

QUESTION 2

Statement of taxable income

Particulars Amount

Accounting profit 80000

Add: Accounting expenses that are not tax deductible

Transfer to warranty expense 10000

Transfer to Doubtful debt allowance 13000

Add/Less: Difference between accounting expenses and tax deductions

Warranty expenses 7000

Less: Accounting revenue that are not taxable

Capital profit on asset sale 15000

Taxable income 81000

Rent received in advance 7000

Net taxable income 74000

Working notes

W.N.1

Particulars Amount

Taxable income 74000

Less: Tax deductions

Tax for depreciation 16500

Taxable income 22200

Tax @30% 6660

3

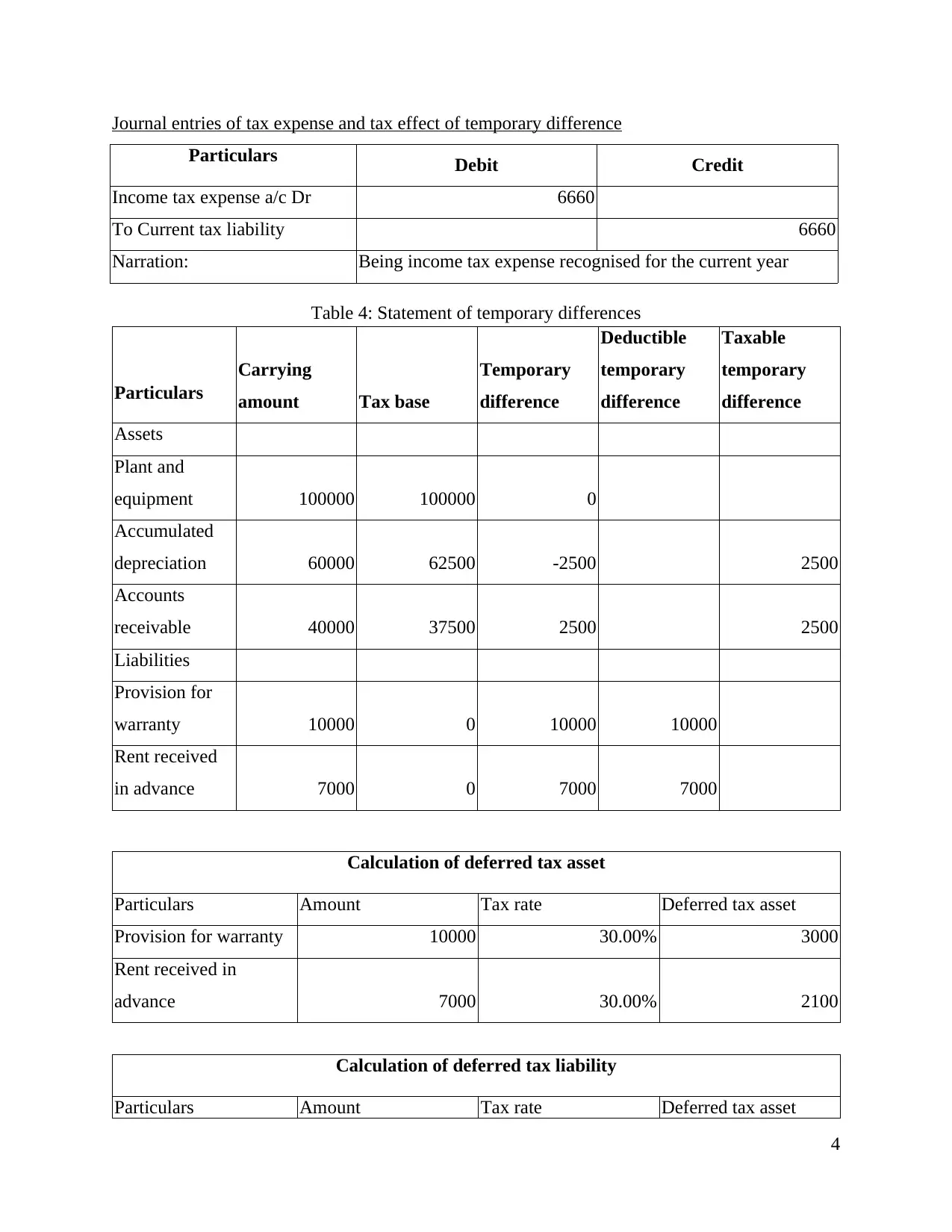

Journal entries of tax expense and tax effect of temporary difference

Particulars Debit Credit

Income tax expense a/c Dr 6660

To Current tax liability 6660

Narration: Being income tax expense recognised for the current year

Table 4: Statement of temporary differences

Particulars

Carrying

amount Tax base

Temporary

difference

Deductible

temporary

difference

Taxable

temporary

difference

Assets

Plant and

equipment 100000 100000 0

Accumulated

depreciation 60000 62500 -2500 2500

Accounts

receivable 40000 37500 2500 2500

Liabilities

Provision for

warranty 10000 0 10000 10000

Rent received

in advance 7000 0 7000 7000

Calculation of deferred tax asset

Particulars Amount Tax rate Deferred tax asset

Provision for warranty 10000 30.00% 3000

Rent received in

advance 7000 30.00% 2100

Calculation of deferred tax liability

Particulars Amount Tax rate Deferred tax asset

4

Particulars Debit Credit

Income tax expense a/c Dr 6660

To Current tax liability 6660

Narration: Being income tax expense recognised for the current year

Table 4: Statement of temporary differences

Particulars

Carrying

amount Tax base

Temporary

difference

Deductible

temporary

difference

Taxable

temporary

difference

Assets

Plant and

equipment 100000 100000 0

Accumulated

depreciation 60000 62500 -2500 2500

Accounts

receivable 40000 37500 2500 2500

Liabilities

Provision for

warranty 10000 0 10000 10000

Rent received

in advance 7000 0 7000 7000

Calculation of deferred tax asset

Particulars Amount Tax rate Deferred tax asset

Provision for warranty 10000 30.00% 3000

Rent received in

advance 7000 30.00% 2100

Calculation of deferred tax liability

Particulars Amount Tax rate Deferred tax asset

4

Accumulated

depreciation -2500 30.00% -750

Accounts receivable 2500 30.00% 750

Deferred tax assets: It may be defined as asset that is mentioned on the statement of

financial position for reducing the level of taxable income. As per IAS 12, deferred tax assets

imply for the income tax which will be recovered in future period. (IAS 12- Recognition of

deferred tax assets for unrealised losses, 2017) Such assets include deductible temporary

differences, carry forward tax losses and credits.

Deferred tax liabilities: It refers to the amount of income tax payable which will be paid

in near future in relation to temporary differences assessed (International accounting standard,

2017).

By making assessment of such aspects deferred tax assets and liabilities can be determined

in an appropriate manner. For the purpose of taxation several bases are considered by an

accountant such as temporary differences, taxable and deductible deficiencies.

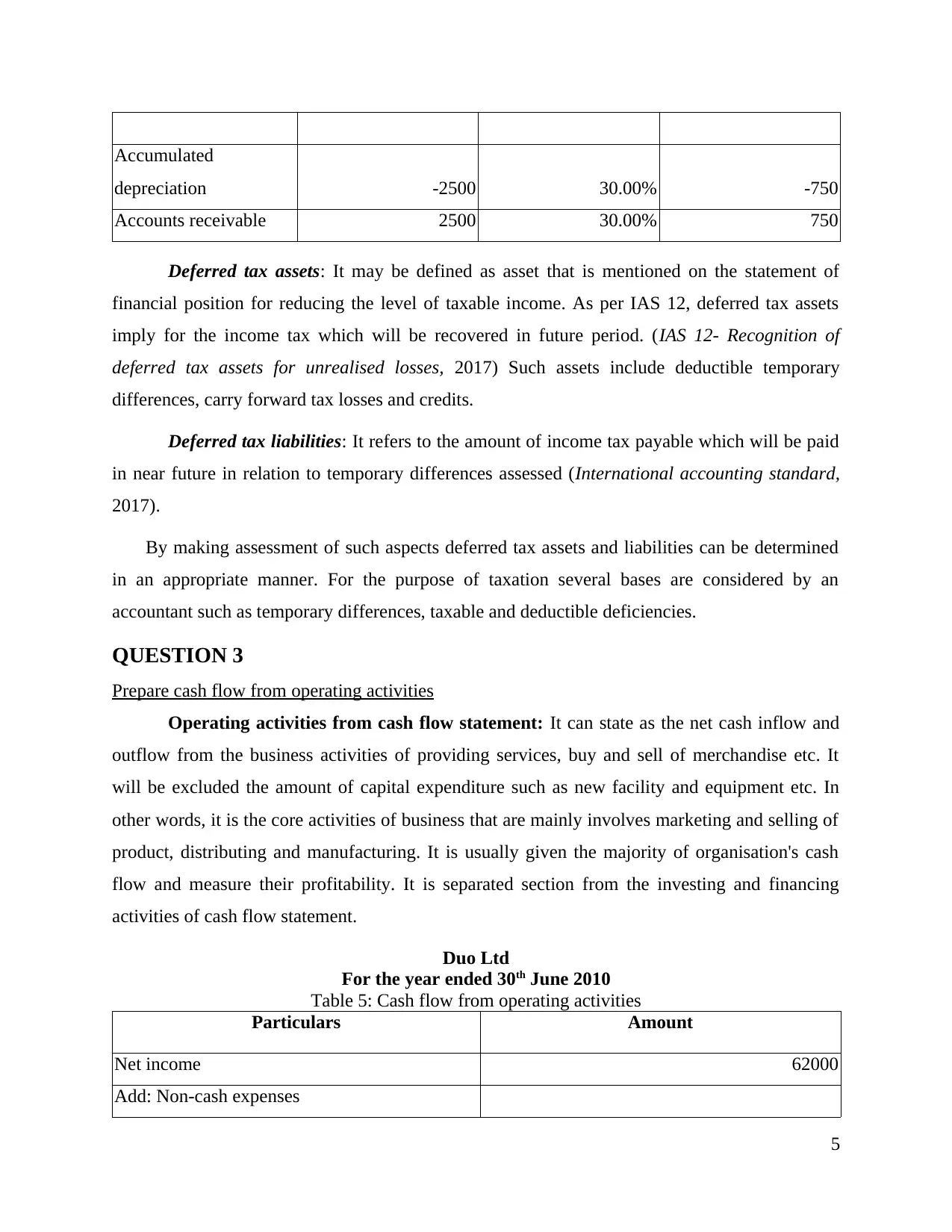

QUESTION 3

Prepare cash flow from operating activities

Operating activities from cash flow statement: It can state as the net cash inflow and

outflow from the business activities of providing services, buy and sell of merchandise etc. It

will be excluded the amount of capital expenditure such as new facility and equipment etc. In

other words, it is the core activities of business that are mainly involves marketing and selling of

product, distributing and manufacturing. It is usually given the majority of organisation's cash

flow and measure their profitability. It is separated section from the investing and financing

activities of cash flow statement.

Duo Ltd

For the year ended 30th June 2010

Table 5: Cash flow from operating activities

Particulars Amount

Net income 62000

Add: Non-cash expenses

5

depreciation -2500 30.00% -750

Accounts receivable 2500 30.00% 750

Deferred tax assets: It may be defined as asset that is mentioned on the statement of

financial position for reducing the level of taxable income. As per IAS 12, deferred tax assets

imply for the income tax which will be recovered in future period. (IAS 12- Recognition of

deferred tax assets for unrealised losses, 2017) Such assets include deductible temporary

differences, carry forward tax losses and credits.

Deferred tax liabilities: It refers to the amount of income tax payable which will be paid

in near future in relation to temporary differences assessed (International accounting standard,

2017).

By making assessment of such aspects deferred tax assets and liabilities can be determined

in an appropriate manner. For the purpose of taxation several bases are considered by an

accountant such as temporary differences, taxable and deductible deficiencies.

QUESTION 3

Prepare cash flow from operating activities

Operating activities from cash flow statement: It can state as the net cash inflow and

outflow from the business activities of providing services, buy and sell of merchandise etc. It

will be excluded the amount of capital expenditure such as new facility and equipment etc. In

other words, it is the core activities of business that are mainly involves marketing and selling of

product, distributing and manufacturing. It is usually given the majority of organisation's cash

flow and measure their profitability. It is separated section from the investing and financing

activities of cash flow statement.

Duo Ltd

For the year ended 30th June 2010

Table 5: Cash flow from operating activities

Particulars Amount

Net income 62000

Add: Non-cash expenses

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Depreciation 17000

Net income after non-cash expenses 79000

Add: Non-operating losses

Loss on sale 25000

Net eliminations in consolidation worksheet

income after no-operating losses 104000

Add: Decrease in current assets

Accounts receivable 13000

Interest receivable accrued 300

Increase in current assets

Inventory 3000

Prepayment 400

Increase in current liabilities

Dividend payable 5000

Current tax payable 1200

Rent received in advance 1400

Decrease in current liabilities

Accruals 600

Accounts payable 2000

Net cash flow from operating activities 187900

Working notes

W.N.1

Table 6: Calculation of net income

Particulars Amount

Operating profit after tax 104000

Depreciation 17000

Loss on sale 25000

Net income 62000

6

Net income after non-cash expenses 79000

Add: Non-operating losses

Loss on sale 25000

Net eliminations in consolidation worksheet

income after no-operating losses 104000

Add: Decrease in current assets

Accounts receivable 13000

Interest receivable accrued 300

Increase in current assets

Inventory 3000

Prepayment 400

Increase in current liabilities

Dividend payable 5000

Current tax payable 1200

Rent received in advance 1400

Decrease in current liabilities

Accruals 600

Accounts payable 2000

Net cash flow from operating activities 187900

Working notes

W.N.1

Table 6: Calculation of net income

Particulars Amount

Operating profit after tax 104000

Depreciation 17000

Loss on sale 25000

Net income 62000

6

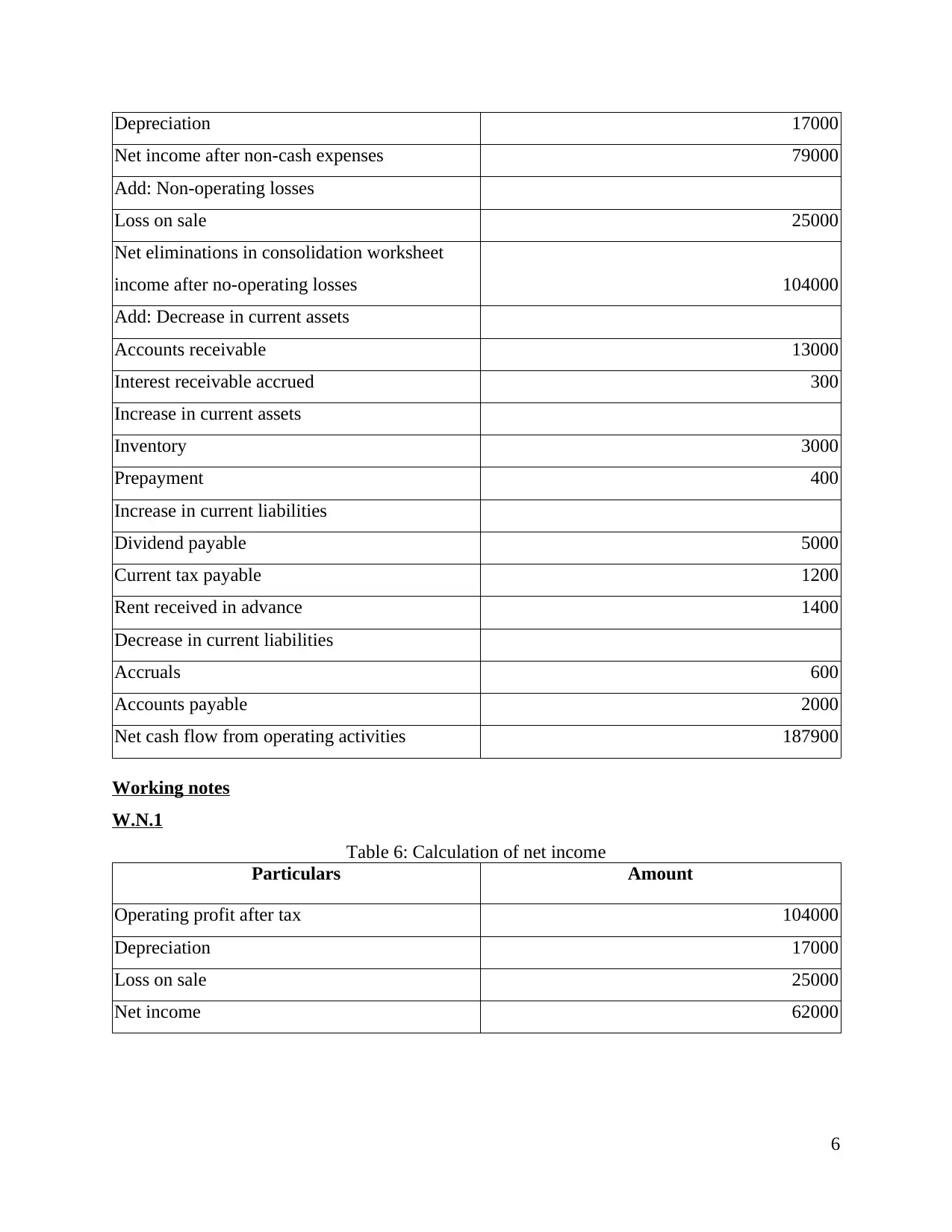

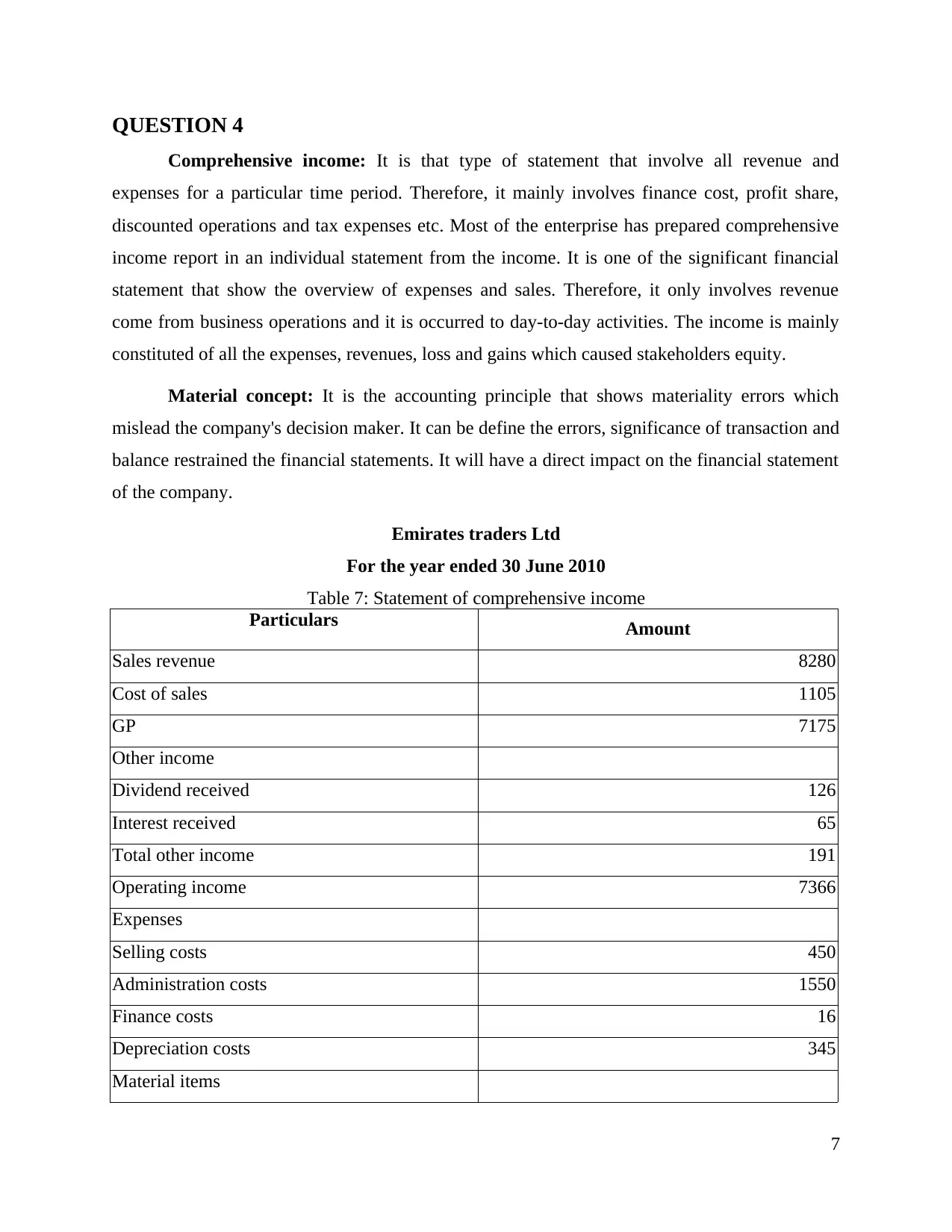

QUESTION 4

Comprehensive income: It is that type of statement that involve all revenue and

expenses for a particular time period. Therefore, it mainly involves finance cost, profit share,

discounted operations and tax expenses etc. Most of the enterprise has prepared comprehensive

income report in an individual statement from the income. It is one of the significant financial

statement that show the overview of expenses and sales. Therefore, it only involves revenue

come from business operations and it is occurred to day-to-day activities. The income is mainly

constituted of all the expenses, revenues, loss and gains which caused stakeholders equity.

Material concept: It is the accounting principle that shows materiality errors which

mislead the company's decision maker. It can be define the errors, significance of transaction and

balance restrained the financial statements. It will have a direct impact on the financial statement

of the company.

Emirates traders Ltd

For the year ended 30 June 2010

Table 7: Statement of comprehensive income

Particulars Amount

Sales revenue 8280

Cost of sales 1105

GP 7175

Other income

Dividend received 126

Interest received 65

Total other income 191

Operating income 7366

Expenses

Selling costs 450

Administration costs 1550

Finance costs 16

Depreciation costs 345

Material items

7

Comprehensive income: It is that type of statement that involve all revenue and

expenses for a particular time period. Therefore, it mainly involves finance cost, profit share,

discounted operations and tax expenses etc. Most of the enterprise has prepared comprehensive

income report in an individual statement from the income. It is one of the significant financial

statement that show the overview of expenses and sales. Therefore, it only involves revenue

come from business operations and it is occurred to day-to-day activities. The income is mainly

constituted of all the expenses, revenues, loss and gains which caused stakeholders equity.

Material concept: It is the accounting principle that shows materiality errors which

mislead the company's decision maker. It can be define the errors, significance of transaction and

balance restrained the financial statements. It will have a direct impact on the financial statement

of the company.

Emirates traders Ltd

For the year ended 30 June 2010

Table 7: Statement of comprehensive income

Particulars Amount

Sales revenue 8280

Cost of sales 1105

GP 7175

Other income

Dividend received 126

Interest received 65

Total other income 191

Operating income 7366

Expenses

Selling costs 450

Administration costs 1550

Finance costs 16

Depreciation costs 345

Material items

7

Audit of accounts 20

Information technology controls device 5

Valuation of trading accounts 250

Total expenses 2636

Income before tax 4730

income tax 1500

Comprehensive income 3230

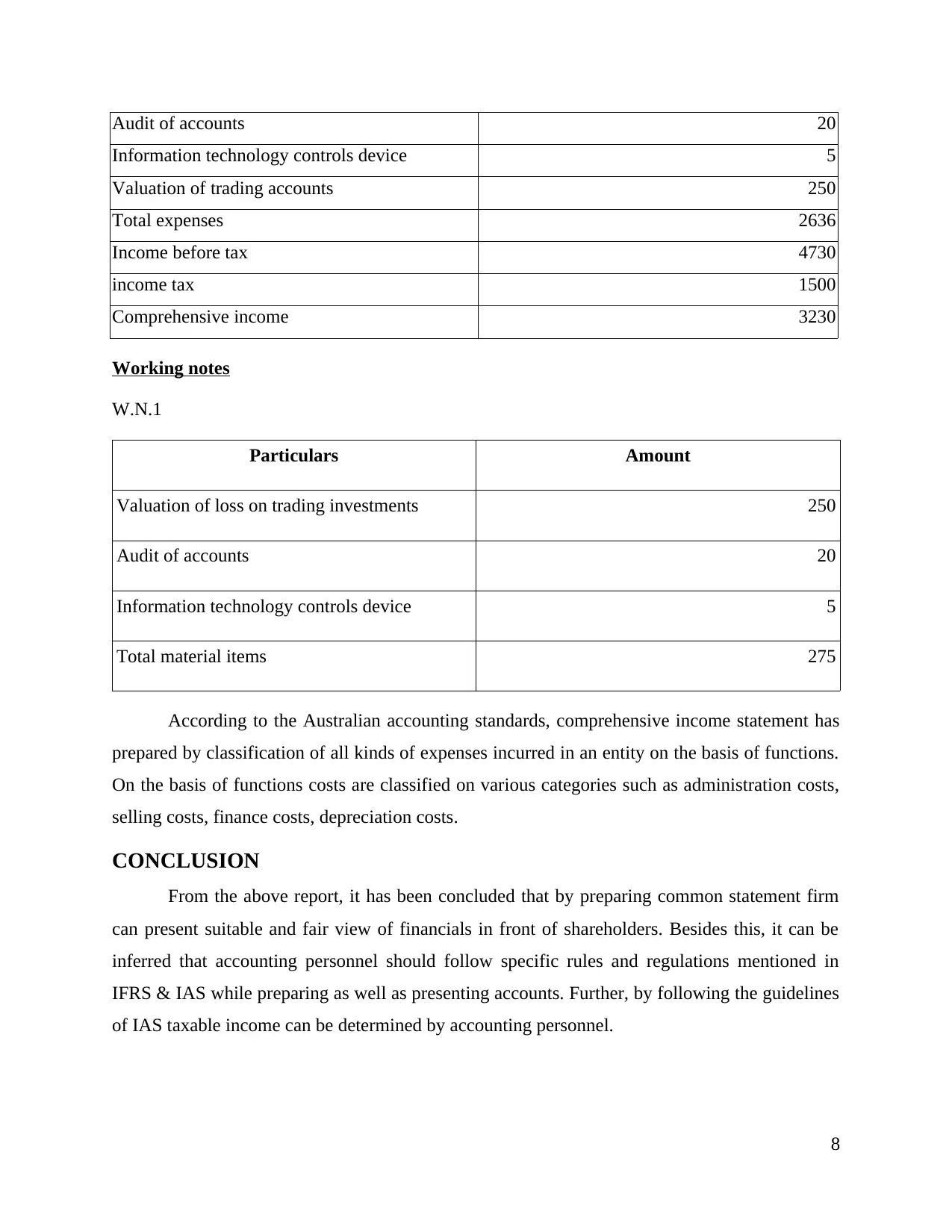

Working notes

W.N.1

Particulars Amount

Valuation of loss on trading investments 250

Audit of accounts 20

Information technology controls device 5

Total material items 275

According to the Australian accounting standards, comprehensive income statement has

prepared by classification of all kinds of expenses incurred in an entity on the basis of functions.

On the basis of functions costs are classified on various categories such as administration costs,

selling costs, finance costs, depreciation costs.

CONCLUSION

From the above report, it has been concluded that by preparing common statement firm

can present suitable and fair view of financials in front of shareholders. Besides this, it can be

inferred that accounting personnel should follow specific rules and regulations mentioned in

IFRS & IAS while preparing as well as presenting accounts. Further, by following the guidelines

of IAS taxable income can be determined by accounting personnel.

8

Information technology controls device 5

Valuation of trading accounts 250

Total expenses 2636

Income before tax 4730

income tax 1500

Comprehensive income 3230

Working notes

W.N.1

Particulars Amount

Valuation of loss on trading investments 250

Audit of accounts 20

Information technology controls device 5

Total material items 275

According to the Australian accounting standards, comprehensive income statement has

prepared by classification of all kinds of expenses incurred in an entity on the basis of functions.

On the basis of functions costs are classified on various categories such as administration costs,

selling costs, finance costs, depreciation costs.

CONCLUSION

From the above report, it has been concluded that by preparing common statement firm

can present suitable and fair view of financials in front of shareholders. Besides this, it can be

inferred that accounting personnel should follow specific rules and regulations mentioned in

IFRS & IAS while preparing as well as presenting accounts. Further, by following the guidelines

of IAS taxable income can be determined by accounting personnel.

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.