HMV Cycle: Analysis and Preparation of Operational Budget Report

VerifiedAdded on 2023/01/16

|9

|1933

|69

Report

AI Summary

This report presents an analysis of the operational budget prepared for HMV Cycle, focusing on the financial year 2011. The report begins with an introduction to budgeting principles and its significance for business operations, including forecasting and cost control. Task 1 and 3.a detail the estimated budget for 2011, comparing it with the 2010 figures, and incorporating projections for electric bike sales. The budget includes breakdowns of bike and merchandise sales, workshop revenue, and associated costs. The interpretation section highlights expected revenue increases, especially from electric bike sales, and discusses potential strategies for cost reduction and negotiation. Task 2 outlines the budget review process, timeline, and key performance indicators, emphasizing the importance of monthly reviews and considering seasonal sales patterns. The report also includes a review of the previous budget (Task 3 and 3.b), comparing budgeted figures with actual results, analyzing variances in revenue and cost items, and suggesting improvements for future budgeting. The report concludes with a summary of the key findings and recommendations for effective financial management and resource allocation within the company.

OPERATIONAL BUDGET

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1 and 3.a................................................................................................................................1

TASK 2............................................................................................................................................3

TASK 3............................................................................................................................................4

3.b.................................................................................................................................................4

CONCLUSIONS .............................................................................................................................5

REFERENCES................................................................................................................................6

INTRODUCTION...........................................................................................................................1

TASK 1 and 3.a................................................................................................................................1

TASK 2............................................................................................................................................3

TASK 3............................................................................................................................................4

3.b.................................................................................................................................................4

CONCLUSIONS .............................................................................................................................5

REFERENCES................................................................................................................................6

INTRODUCTION

Budgeting refers to process creation of plan for spending the money. The plan about the

estimated incomes and its expenditures is known as budget. The creation of budget enables the

company to determine in advance whether the operations of company will be having sufficient

funds and profits after the end. Budgeting refers to balancing income with the expenses. The

budgeting is very important for every business as it helps the business organisations to forecast

about the future activities (Chohan and Jacobs, 2018). Corporations and businesses use it for

giving the business a direction to be followed. It enables company to keep its expenditures within

the budgeted levels to avoid overs spendings. It helps the company in comparing its results with

the actual levels of expenditures and income from the budgets framed by the business. The report

is based on the HMV Cycles that has made the budgets for the financial year and wants to

prepare the budget including the electric cycle sales.

TASK 1 and 3.a

The estimated budget of HMV Cycle for 2011 taking the budgeted figures of 2010 as base.

Account 2010 2011

Bike Sales 550000 583000

Electric Bike Sales - 75000

Merchandise Sales 125000 131250

Workshop Revenue 175000 192500

Total Income 850000 981750

Cost of Sales Bikes 330000 349800

Cost of Sales of Electric

Bikes - 45000

Cost of Sales Merchandise 80000 84000

Cost of Sales Workshop 20000 22000

Total Cost of Sales 430000 500800

Gross Profit 420000 480950

Operating Expenses

Wages 240000 243600

Bookkeeper Fees 15000 15000

Commission 12000 12000

Motor Vehicle Expenses 12000 12000

Telephone 4000 4000

1

Budgeting refers to process creation of plan for spending the money. The plan about the

estimated incomes and its expenditures is known as budget. The creation of budget enables the

company to determine in advance whether the operations of company will be having sufficient

funds and profits after the end. Budgeting refers to balancing income with the expenses. The

budgeting is very important for every business as it helps the business organisations to forecast

about the future activities (Chohan and Jacobs, 2018). Corporations and businesses use it for

giving the business a direction to be followed. It enables company to keep its expenditures within

the budgeted levels to avoid overs spendings. It helps the company in comparing its results with

the actual levels of expenditures and income from the budgets framed by the business. The report

is based on the HMV Cycles that has made the budgets for the financial year and wants to

prepare the budget including the electric cycle sales.

TASK 1 and 3.a

The estimated budget of HMV Cycle for 2011 taking the budgeted figures of 2010 as base.

Account 2010 2011

Bike Sales 550000 583000

Electric Bike Sales - 75000

Merchandise Sales 125000 131250

Workshop Revenue 175000 192500

Total Income 850000 981750

Cost of Sales Bikes 330000 349800

Cost of Sales of Electric

Bikes - 45000

Cost of Sales Merchandise 80000 84000

Cost of Sales Workshop 20000 22000

Total Cost of Sales 430000 500800

Gross Profit 420000 480950

Operating Expenses

Wages 240000 243600

Bookkeeper Fees 15000 15000

Commission 12000 12000

Motor Vehicle Expenses 12000 12000

Telephone 4000 4000

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Advertising 15000 15000

Sponsorship 6000 12000

Electricity/Gas 7200 7488

Rent 20800 20800

Repairs and Maintenance 1500 1500

Office Supplies 800 800

Insurance 2500 2500

New Staff - 1520

Superannuation 22800 22944

Total Expenses 359600 371152

Net Profit or Loss 60400 109798

Interpretation

In current year business will be selling the electric bikes that were not sold in previous

year. The budget for the 2011 is prepared considering the extended business. The budget

represents that the sales of non electric will be increasing in the next year. Also the electric sales

are estimated to generate revenues of $75000 on the cost of sales of $45000. The budgets are

based on the market analysis and other factors through which sales will be generated by

company. The revenues are expected as company has received order in advance for electric

cycles. It is essential for the companies to make thorough study before the estimates are made.

Cost of sales can further be negotiated as company is contracted with wholesaler of the bikes.

Company can purchase directly from the manufacturers that will make the electric bikes

available in reduced prices (Lopez and Witt, Wells Fargo Bank NA, 2019). This will be

increasing the transportation costs for bringing the bikes to the showroom. This will also involve

other cash expenditures for carriage inward and transit insurance. Aggregating these cost also the

actual purchase price will be lower than sold by the wholesalers. Therefore the negotiation

should be made on this area.

The sales of non electric bikes will also be increasing in next year by 6% with the rising

demand of bikes. The sales of company were higher than the budgeted figures. The

advertisement expenditures have brought new customers for company rising the sales.

Merchandise sales will be rising by 5% and also the cost of sales will be rising with the same

percentage for merchandise. Workshop sales will be rising by 10% and same proportion in cost

of sales (Almazan, Chen and Titman, 2017). The cost of sales is hard to reduce below this level

2

Sponsorship 6000 12000

Electricity/Gas 7200 7488

Rent 20800 20800

Repairs and Maintenance 1500 1500

Office Supplies 800 800

Insurance 2500 2500

New Staff - 1520

Superannuation 22800 22944

Total Expenses 359600 371152

Net Profit or Loss 60400 109798

Interpretation

In current year business will be selling the electric bikes that were not sold in previous

year. The budget for the 2011 is prepared considering the extended business. The budget

represents that the sales of non electric will be increasing in the next year. Also the electric sales

are estimated to generate revenues of $75000 on the cost of sales of $45000. The budgets are

based on the market analysis and other factors through which sales will be generated by

company. The revenues are expected as company has received order in advance for electric

cycles. It is essential for the companies to make thorough study before the estimates are made.

Cost of sales can further be negotiated as company is contracted with wholesaler of the bikes.

Company can purchase directly from the manufacturers that will make the electric bikes

available in reduced prices (Lopez and Witt, Wells Fargo Bank NA, 2019). This will be

increasing the transportation costs for bringing the bikes to the showroom. This will also involve

other cash expenditures for carriage inward and transit insurance. Aggregating these cost also the

actual purchase price will be lower than sold by the wholesalers. Therefore the negotiation

should be made on this area.

The sales of non electric bikes will also be increasing in next year by 6% with the rising

demand of bikes. The sales of company were higher than the budgeted figures. The

advertisement expenditures have brought new customers for company rising the sales.

Merchandise sales will be rising by 5% and also the cost of sales will be rising with the same

percentage for merchandise. Workshop sales will be rising by 10% and same proportion in cost

of sales (Almazan, Chen and Titman, 2017). The cost of sales is hard to reduce below this level

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

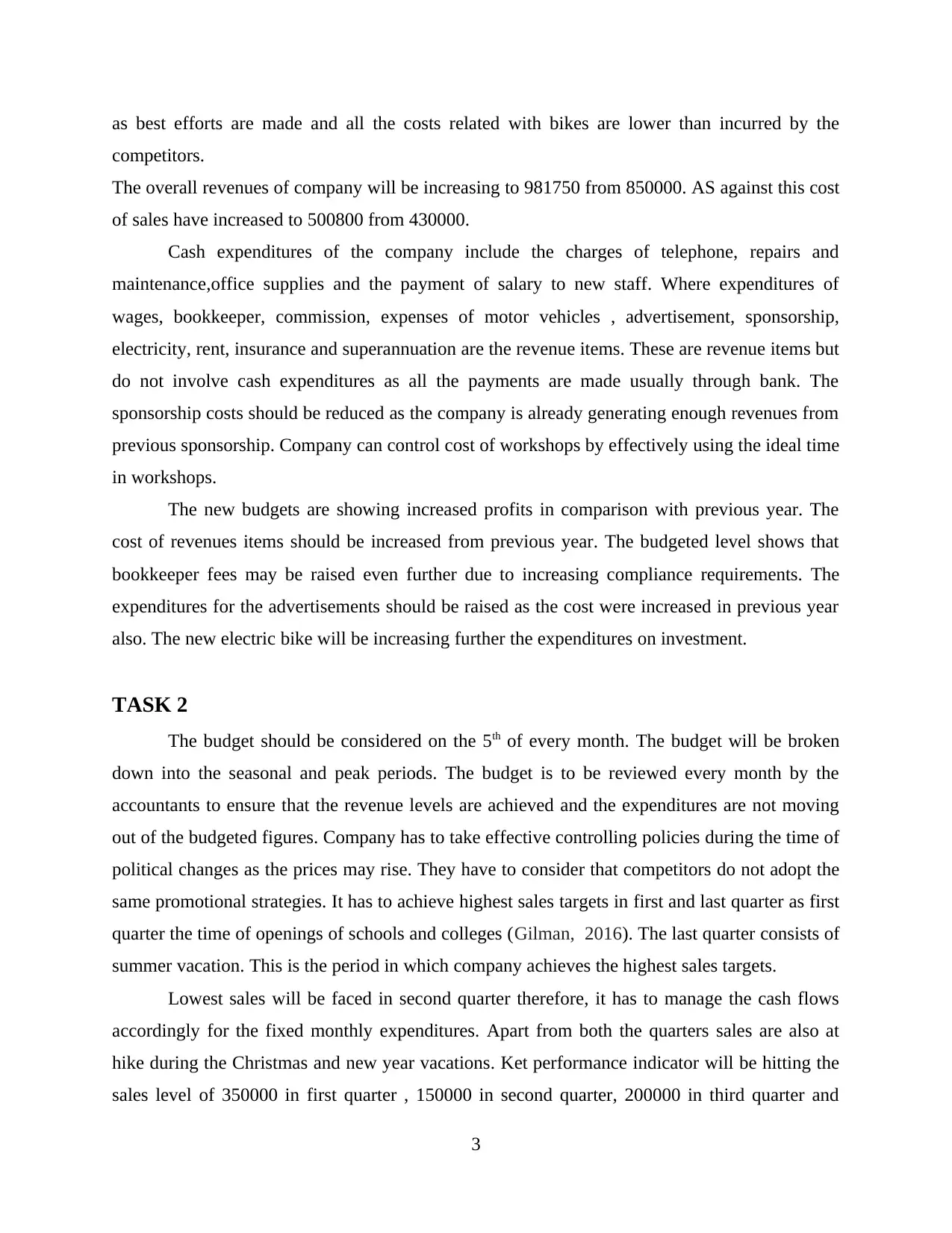

as best efforts are made and all the costs related with bikes are lower than incurred by the

competitors.

The overall revenues of company will be increasing to 981750 from 850000. AS against this cost

of sales have increased to 500800 from 430000.

Cash expenditures of the company include the charges of telephone, repairs and

maintenance,office supplies and the payment of salary to new staff. Where expenditures of

wages, bookkeeper, commission, expenses of motor vehicles , advertisement, sponsorship,

electricity, rent, insurance and superannuation are the revenue items. These are revenue items but

do not involve cash expenditures as all the payments are made usually through bank. The

sponsorship costs should be reduced as the company is already generating enough revenues from

previous sponsorship. Company can control cost of workshops by effectively using the ideal time

in workshops.

The new budgets are showing increased profits in comparison with previous year. The

cost of revenues items should be increased from previous year. The budgeted level shows that

bookkeeper fees may be raised even further due to increasing compliance requirements. The

expenditures for the advertisements should be raised as the cost were increased in previous year

also. The new electric bike will be increasing further the expenditures on investment.

TASK 2

The budget should be considered on the 5th of every month. The budget will be broken

down into the seasonal and peak periods. The budget is to be reviewed every month by the

accountants to ensure that the revenue levels are achieved and the expenditures are not moving

out of the budgeted figures. Company has to take effective controlling policies during the time of

political changes as the prices may rise. They have to consider that competitors do not adopt the

same promotional strategies. It has to achieve highest sales targets in first and last quarter as first

quarter the time of openings of schools and colleges (Gilman, 2016). The last quarter consists of

summer vacation. This is the period in which company achieves the highest sales targets.

Lowest sales will be faced in second quarter therefore, it has to manage the cash flows

accordingly for the fixed monthly expenditures. Apart from both the quarters sales are also at

hike during the Christmas and new year vacations. Ket performance indicator will be hitting the

sales level of 350000 in first quarter , 150000 in second quarter, 200000 in third quarter and

3

competitors.

The overall revenues of company will be increasing to 981750 from 850000. AS against this cost

of sales have increased to 500800 from 430000.

Cash expenditures of the company include the charges of telephone, repairs and

maintenance,office supplies and the payment of salary to new staff. Where expenditures of

wages, bookkeeper, commission, expenses of motor vehicles , advertisement, sponsorship,

electricity, rent, insurance and superannuation are the revenue items. These are revenue items but

do not involve cash expenditures as all the payments are made usually through bank. The

sponsorship costs should be reduced as the company is already generating enough revenues from

previous sponsorship. Company can control cost of workshops by effectively using the ideal time

in workshops.

The new budgets are showing increased profits in comparison with previous year. The

cost of revenues items should be increased from previous year. The budgeted level shows that

bookkeeper fees may be raised even further due to increasing compliance requirements. The

expenditures for the advertisements should be raised as the cost were increased in previous year

also. The new electric bike will be increasing further the expenditures on investment.

TASK 2

The budget should be considered on the 5th of every month. The budget will be broken

down into the seasonal and peak periods. The budget is to be reviewed every month by the

accountants to ensure that the revenue levels are achieved and the expenditures are not moving

out of the budgeted figures. Company has to take effective controlling policies during the time of

political changes as the prices may rise. They have to consider that competitors do not adopt the

same promotional strategies. It has to achieve highest sales targets in first and last quarter as first

quarter the time of openings of schools and colleges (Gilman, 2016). The last quarter consists of

summer vacation. This is the period in which company achieves the highest sales targets.

Lowest sales will be faced in second quarter therefore, it has to manage the cash flows

accordingly for the fixed monthly expenditures. Apart from both the quarters sales are also at

hike during the Christmas and new year vacations. Ket performance indicator will be hitting the

sales level of 350000 in first quarter , 150000 in second quarter, 200000 in third quarter and

3

remaining in the last quarter of year. The operating trends shows that the budgets will not show

much variances in the cost of sales. Fluctuations can be seen mainly in the cash expenditures and

other small revenue items.

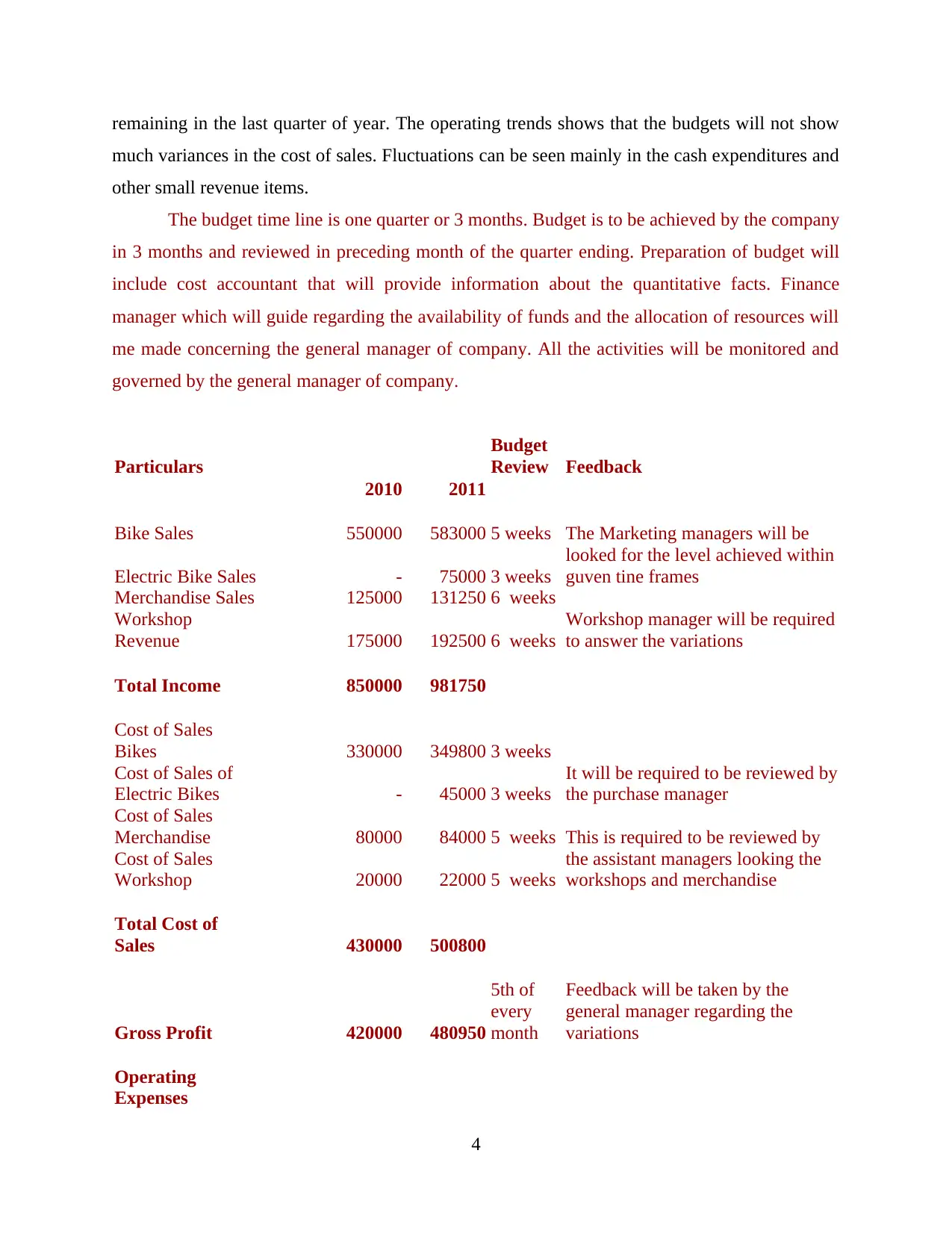

The budget time line is one quarter or 3 months. Budget is to be achieved by the company

in 3 months and reviewed in preceding month of the quarter ending. Preparation of budget will

include cost accountant that will provide information about the quantitative facts. Finance

manager which will guide regarding the availability of funds and the allocation of resources will

me made concerning the general manager of company. All the activities will be monitored and

governed by the general manager of company.

Particulars

Budget

Review Feedback

2010 2011

Bike Sales 550000 583000 5 weeks The Marketing managers will be

looked for the level achieved within

guven tine framesElectric Bike Sales - 75000 3 weeks

Merchandise Sales 125000 131250 6 weeks

Workshop manager will be required

to answer the variations

Workshop

Revenue 175000 192500 6 weeks

Total Income 850000 981750

Cost of Sales

Bikes 330000 349800 3 weeks

It will be required to be reviewed by

the purchase manager

Cost of Sales of

Electric Bikes - 45000 3 weeks

Cost of Sales

Merchandise 80000 84000 5 weeks This is required to be reviewed by

the assistant managers looking the

workshops and merchandise

Cost of Sales

Workshop 20000 22000 5 weeks

Total Cost of

Sales 430000 500800

Gross Profit 420000 480950

5th of

every

month

Feedback will be taken by the

general manager regarding the

variations

Operating

Expenses

4

much variances in the cost of sales. Fluctuations can be seen mainly in the cash expenditures and

other small revenue items.

The budget time line is one quarter or 3 months. Budget is to be achieved by the company

in 3 months and reviewed in preceding month of the quarter ending. Preparation of budget will

include cost accountant that will provide information about the quantitative facts. Finance

manager which will guide regarding the availability of funds and the allocation of resources will

me made concerning the general manager of company. All the activities will be monitored and

governed by the general manager of company.

Particulars

Budget

Review Feedback

2010 2011

Bike Sales 550000 583000 5 weeks The Marketing managers will be

looked for the level achieved within

guven tine framesElectric Bike Sales - 75000 3 weeks

Merchandise Sales 125000 131250 6 weeks

Workshop manager will be required

to answer the variations

Workshop

Revenue 175000 192500 6 weeks

Total Income 850000 981750

Cost of Sales

Bikes 330000 349800 3 weeks

It will be required to be reviewed by

the purchase manager

Cost of Sales of

Electric Bikes - 45000 3 weeks

Cost of Sales

Merchandise 80000 84000 5 weeks This is required to be reviewed by

the assistant managers looking the

workshops and merchandise

Cost of Sales

Workshop 20000 22000 5 weeks

Total Cost of

Sales 430000 500800

Gross Profit 420000 480950

5th of

every

month

Feedback will be taken by the

general manager regarding the

variations

Operating

Expenses

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

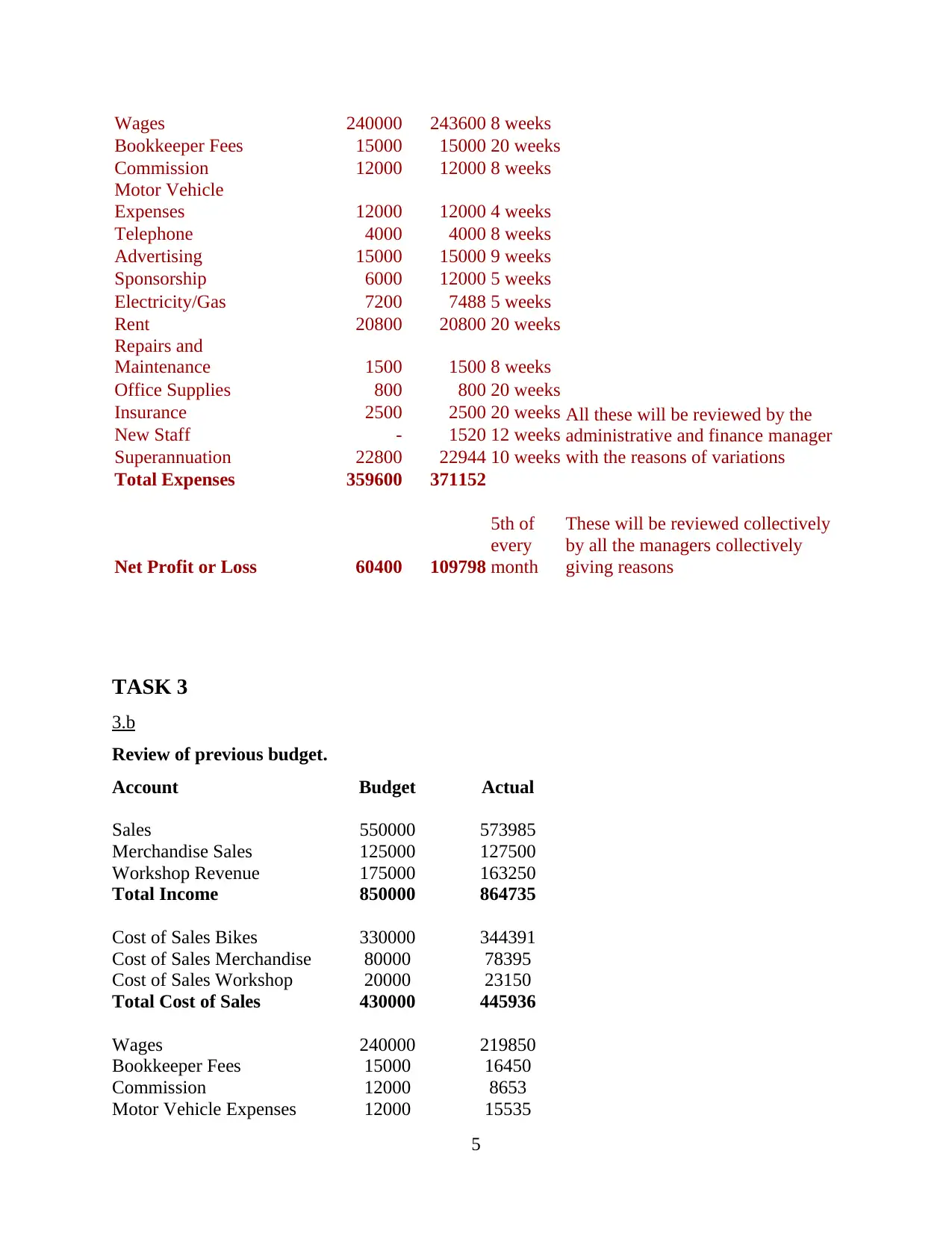

Wages 240000 243600 8 weeks

All these will be reviewed by the

administrative and finance manager

with the reasons of variations

Bookkeeper Fees 15000 15000 20 weeks

Commission 12000 12000 8 weeks

Motor Vehicle

Expenses 12000 12000 4 weeks

Telephone 4000 4000 8 weeks

Advertising 15000 15000 9 weeks

Sponsorship 6000 12000 5 weeks

Electricity/Gas 7200 7488 5 weeks

Rent 20800 20800 20 weeks

Repairs and

Maintenance 1500 1500 8 weeks

Office Supplies 800 800 20 weeks

Insurance 2500 2500 20 weeks

New Staff - 1520 12 weeks

Superannuation 22800 22944 10 weeks

Total Expenses 359600 371152

Net Profit or Loss 60400 109798

5th of

every

month

These will be reviewed collectively

by all the managers collectively

giving reasons

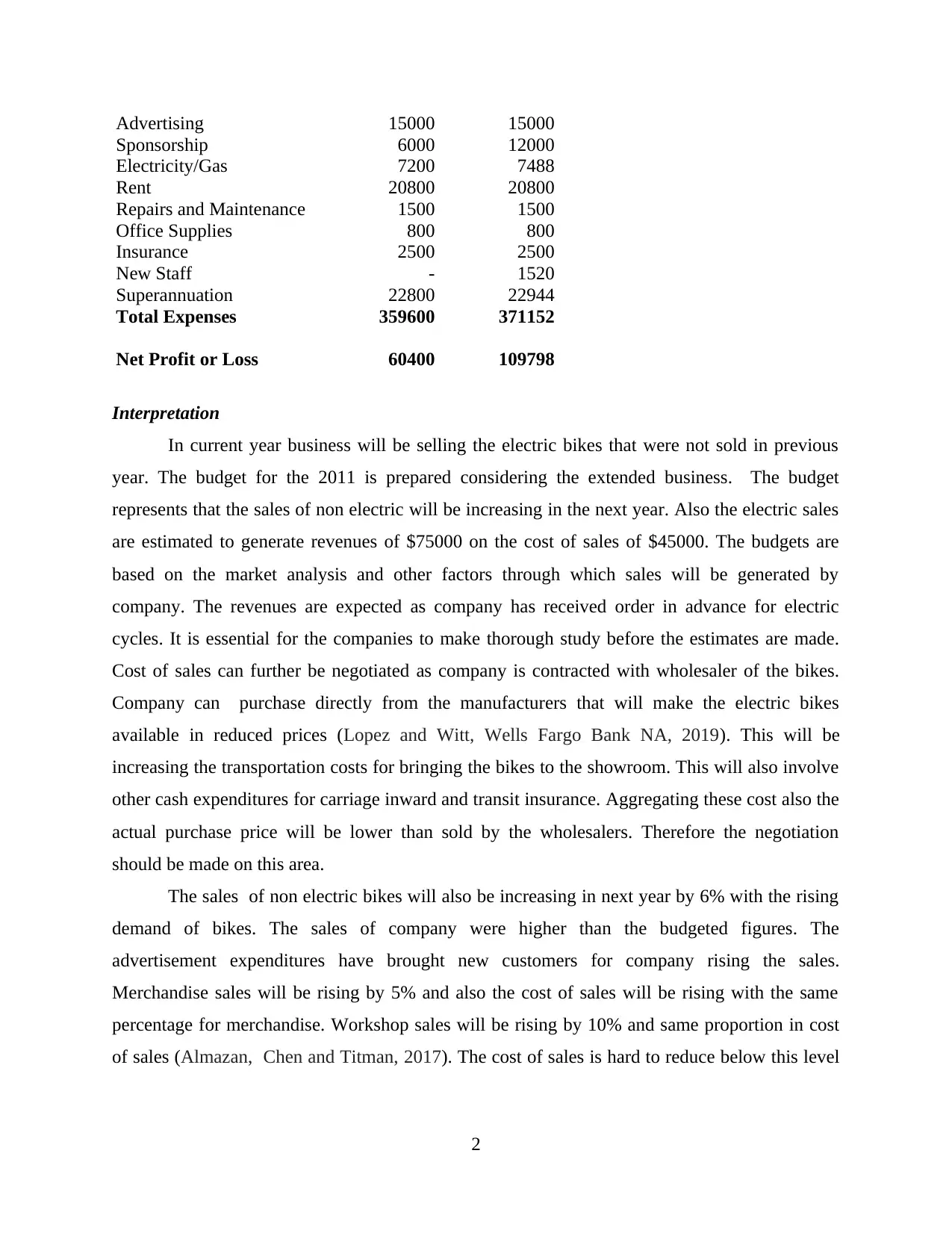

TASK 3

3.b

Review of previous budget.

Account Budget Actual

Sales 550000 573985

Merchandise Sales 125000 127500

Workshop Revenue 175000 163250

Total Income 850000 864735

Cost of Sales Bikes 330000 344391

Cost of Sales Merchandise 80000 78395

Cost of Sales Workshop 20000 23150

Total Cost of Sales 430000 445936

Wages 240000 219850

Bookkeeper Fees 15000 16450

Commission 12000 8653

Motor Vehicle Expenses 12000 15535

5

All these will be reviewed by the

administrative and finance manager

with the reasons of variations

Bookkeeper Fees 15000 15000 20 weeks

Commission 12000 12000 8 weeks

Motor Vehicle

Expenses 12000 12000 4 weeks

Telephone 4000 4000 8 weeks

Advertising 15000 15000 9 weeks

Sponsorship 6000 12000 5 weeks

Electricity/Gas 7200 7488 5 weeks

Rent 20800 20800 20 weeks

Repairs and

Maintenance 1500 1500 8 weeks

Office Supplies 800 800 20 weeks

Insurance 2500 2500 20 weeks

New Staff - 1520 12 weeks

Superannuation 22800 22944 10 weeks

Total Expenses 359600 371152

Net Profit or Loss 60400 109798

5th of

every

month

These will be reviewed collectively

by all the managers collectively

giving reasons

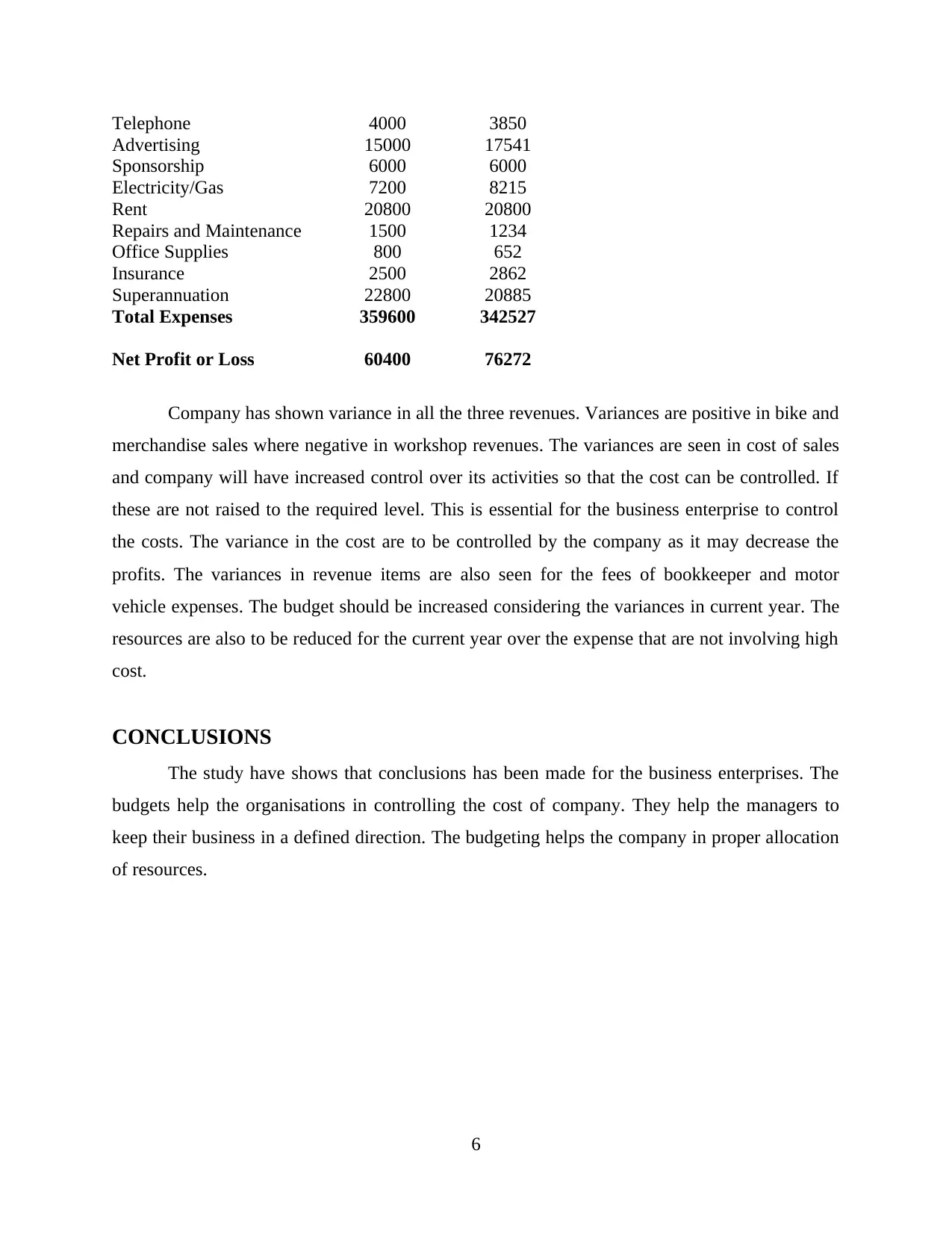

TASK 3

3.b

Review of previous budget.

Account Budget Actual

Sales 550000 573985

Merchandise Sales 125000 127500

Workshop Revenue 175000 163250

Total Income 850000 864735

Cost of Sales Bikes 330000 344391

Cost of Sales Merchandise 80000 78395

Cost of Sales Workshop 20000 23150

Total Cost of Sales 430000 445936

Wages 240000 219850

Bookkeeper Fees 15000 16450

Commission 12000 8653

Motor Vehicle Expenses 12000 15535

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Telephone 4000 3850

Advertising 15000 17541

Sponsorship 6000 6000

Electricity/Gas 7200 8215

Rent 20800 20800

Repairs and Maintenance 1500 1234

Office Supplies 800 652

Insurance 2500 2862

Superannuation 22800 20885

Total Expenses 359600 342527

Net Profit or Loss 60400 76272

Company has shown variance in all the three revenues. Variances are positive in bike and

merchandise sales where negative in workshop revenues. The variances are seen in cost of sales

and company will have increased control over its activities so that the cost can be controlled. If

these are not raised to the required level. This is essential for the business enterprise to control

the costs. The variance in the cost are to be controlled by the company as it may decrease the

profits. The variances in revenue items are also seen for the fees of bookkeeper and motor

vehicle expenses. The budget should be increased considering the variances in current year. The

resources are also to be reduced for the current year over the expense that are not involving high

cost.

CONCLUSIONS

The study have shows that conclusions has been made for the business enterprises. The

budgets help the organisations in controlling the cost of company. They help the managers to

keep their business in a defined direction. The budgeting helps the company in proper allocation

of resources.

6

Advertising 15000 17541

Sponsorship 6000 6000

Electricity/Gas 7200 8215

Rent 20800 20800

Repairs and Maintenance 1500 1234

Office Supplies 800 652

Insurance 2500 2862

Superannuation 22800 20885

Total Expenses 359600 342527

Net Profit or Loss 60400 76272

Company has shown variance in all the three revenues. Variances are positive in bike and

merchandise sales where negative in workshop revenues. The variances are seen in cost of sales

and company will have increased control over its activities so that the cost can be controlled. If

these are not raised to the required level. This is essential for the business enterprise to control

the costs. The variance in the cost are to be controlled by the company as it may decrease the

profits. The variances in revenue items are also seen for the fees of bookkeeper and motor

vehicle expenses. The budget should be increased considering the variances in current year. The

resources are also to be reduced for the current year over the expense that are not involving high

cost.

CONCLUSIONS

The study have shows that conclusions has been made for the business enterprises. The

budgets help the organisations in controlling the cost of company. They help the managers to

keep their business in a defined direction. The budgeting helps the company in proper allocation

of resources.

6

REFERENCES

Books and Journals

Chohan, U.W. and Jacobs, K., 2018. Public Value as Rhetoric: a budgeting

approach. International Journal of Public Administration. 41(15). pp.1217-1227.

Lopez, G. and Witt, L.R., Wells Fargo Bank NA, 2019. Systems and methods for interactive

financial categorization and budgeting. U.S. Patent 10,402,896.

Almazan, A., Chen, Z. and Titman, S., 2017. Firm Investment and Stakeholder Choices: A Top‐

Down Theory of Capital Budgeting. The Journal of Finance. 72(5). pp.2179-2228.

Gilman, H.R., 2016. Democracy reinvented: Participatory budgeting and civic innovation in

America. Brookings Institution Press.

7

Books and Journals

Chohan, U.W. and Jacobs, K., 2018. Public Value as Rhetoric: a budgeting

approach. International Journal of Public Administration. 41(15). pp.1217-1227.

Lopez, G. and Witt, L.R., Wells Fargo Bank NA, 2019. Systems and methods for interactive

financial categorization and budgeting. U.S. Patent 10,402,896.

Almazan, A., Chen, Z. and Titman, S., 2017. Firm Investment and Stakeholder Choices: A Top‐

Down Theory of Capital Budgeting. The Journal of Finance. 72(5). pp.2179-2228.

Gilman, H.R., 2016. Democracy reinvented: Participatory budgeting and civic innovation in

America. Brookings Institution Press.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.