ECON1056 Price Theory: Pre-Mix Concrete Industry Merger Analysis

VerifiedAdded on 2023/03/23

|13

|1663

|27

Report

AI Summary

This report provides an industry analysis of the pre-mix concrete industry, evaluating the potential consequences of a merger between ConCorp and Big Industries. It examines the industry structure, which is characterized as an oligopoly with significant entry barriers, and compares the industry outcomes before and after the proposed merger. Before the merger, three firms (Aggregate Inc, Big Industries, and ConCrop) operate, each producing 2300 cubic meters of pre-mixed concrete with a profit of $64500. The market price is $255, and the consumer surplus is $1190250. After the merger, the merged firm, Big Con, increases its output to 3400 cubic meters due to lower marginal costs, while Aggregate Inc reduces its output. The aggregate industry output decreases to 6300 cubic meters, and while each firm enjoys a higher profit, the consumer surplus decreases to 992250. The analysis concludes that the industry produces a better outcome without the merger, recommending that the merger between ConCorp and Big Industries should not be approved as it negatively impacts consumer welfare.

Running head: PRICE THEORY

Price Theory

Name of the Student

Name of the University

Student ID

Price Theory

Name of the Student

Name of the University

Student ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1PRICE THEORY

Table of Contents

Brief.................................................................................................................................................2

Subject:........................................................................................................................................2

Core message...............................................................................................................................2

Recommendation.........................................................................................................................2

Key information...........................................................................................................................2

Financial implication...................................................................................................................3

Industry Analysis.............................................................................................................................4

Before merger..............................................................................................................................4

After merger.................................................................................................................................7

Bibliography..................................................................................................................................12

Table of Contents

Brief.................................................................................................................................................2

Subject:........................................................................................................................................2

Core message...............................................................................................................................2

Recommendation.........................................................................................................................2

Key information...........................................................................................................................2

Financial implication...................................................................................................................3

Industry Analysis.............................................................................................................................4

Before merger..............................................................................................................................4

After merger.................................................................................................................................7

Bibliography..................................................................................................................................12

2PRICE THEORY

Brief

Briefing for the decision of merger in the industry of pre-mix concrete

Subject: Critical evaluation for consequences of merger in the industry of pre-mix concrete.

Prepared by: Name of the Student

Core message

Executive summary

The brief analyzes industry outcome and associated welfare of involved stakeholder in

pre and post-merger scenario to understand the effect of any proposed merger in this industry.

The main objective is to give the concerned authority correct assessment of the two scenarios

before giving the permission of mergers between ConCorp and Big Industries. The analysis

rejects the claim of any favorable impact of the merger to industry and hence, indicates it is not a

viable decision to allow the proposed merger.

Recommendation

The industry analysis before and after the merger indicate that the industry produces a

better outcome in the absence of merger. The authority therefore should not consider the merger

between ConCorp and Big Industries.

Key information

In the concrete industry, pre-mixed concrete is considered as an important input. In this

market, initially are three operating firm - Aggregate lnc, Big Industries and ConCrop. The

industry structure is a kind of oligopoly market as there are only three operating firms. There

exists a significant entry barrier in the form of large scale capital requirement and legal barrier.

Brief

Briefing for the decision of merger in the industry of pre-mix concrete

Subject: Critical evaluation for consequences of merger in the industry of pre-mix concrete.

Prepared by: Name of the Student

Core message

Executive summary

The brief analyzes industry outcome and associated welfare of involved stakeholder in

pre and post-merger scenario to understand the effect of any proposed merger in this industry.

The main objective is to give the concerned authority correct assessment of the two scenarios

before giving the permission of mergers between ConCorp and Big Industries. The analysis

rejects the claim of any favorable impact of the merger to industry and hence, indicates it is not a

viable decision to allow the proposed merger.

Recommendation

The industry analysis before and after the merger indicate that the industry produces a

better outcome in the absence of merger. The authority therefore should not consider the merger

between ConCorp and Big Industries.

Key information

In the concrete industry, pre-mixed concrete is considered as an important input. In this

market, initially are three operating firm - Aggregate lnc, Big Industries and ConCrop. The

industry structure is a kind of oligopoly market as there are only three operating firms. There

exists a significant entry barrier in the form of large scale capital requirement and legal barrier.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3PRICE THEORY

Two of the firms ConCrop and Big Industries now are interested to merge as the merger

reduces marginal cost of production and therefore increases efficiency of the merged firms. The

merger reduces competition in the industry as there remain only two active firm after the merger

– one is merged firm Big Con and other is Aggregate Inc. The evaluation of merger involves

comparison of aggregate output, profit, price and resulted surpluses before and after the merger.

Industry outcome before merger

Before merger each of the three firm produces identical output of 2300 cubic metres pre-

mixed concrete and enjoys a profit of $64500. Marker price is $255, aggregate industry output is

6900 cubic meter pre-mixed concrete and surplus to consumer is 1190250.

Industry outcome after merger

After merger, because of a lower marginal cost the merged firm Big Con produces a

higher output of 3400 cubic metres pre-mixed concrete. The individual firm Aggregate Inc

produce a lower output than the merged firm. The aggregate output in the industry reduces to

6300 cubic metres pre-mixed concrete from earlier 6900 cubic metres pre-mixed concrete. Each

firm though enjoys a higher profit after merger, the surplus to consumers however decreases.

Financial implication

Prohibition of merger allows construction industry to buy the key input (pre-mixed

concrete) at a cheaper rate relative to the situation of merger. Builders can save ($285 - $255) =

$20 per cubic metre on purchase of pre-mixed concrete. This in turn helps them to maintain a

higher profit in the construction business.

Two of the firms ConCrop and Big Industries now are interested to merge as the merger

reduces marginal cost of production and therefore increases efficiency of the merged firms. The

merger reduces competition in the industry as there remain only two active firm after the merger

– one is merged firm Big Con and other is Aggregate Inc. The evaluation of merger involves

comparison of aggregate output, profit, price and resulted surpluses before and after the merger.

Industry outcome before merger

Before merger each of the three firm produces identical output of 2300 cubic metres pre-

mixed concrete and enjoys a profit of $64500. Marker price is $255, aggregate industry output is

6900 cubic meter pre-mixed concrete and surplus to consumer is 1190250.

Industry outcome after merger

After merger, because of a lower marginal cost the merged firm Big Con produces a

higher output of 3400 cubic metres pre-mixed concrete. The individual firm Aggregate Inc

produce a lower output than the merged firm. The aggregate output in the industry reduces to

6300 cubic metres pre-mixed concrete from earlier 6900 cubic metres pre-mixed concrete. Each

firm though enjoys a higher profit after merger, the surplus to consumers however decreases.

Financial implication

Prohibition of merger allows construction industry to buy the key input (pre-mixed

concrete) at a cheaper rate relative to the situation of merger. Builders can save ($285 - $255) =

$20 per cubic metre on purchase of pre-mixed concrete. This in turn helps them to maintain a

higher profit in the construction business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4PRICE THEORY

Industry Analysis

The inverse demand function in the pre-mixed concrete industry is

P=600− Q

20

P is the price per cubic meter of concrete and Q is the total cubic metre of concrete supplied in

the market.

Before merger each of the three has a fixed cost of $200,000 and a marginal cost of $140

per cubic meter.

After merger between ConCrop and Big Industries, fixed cost of the merger firm

increases to $350,000 while marginal cost reduces to $115 per cubic metre.

Industry outcome before and after merger are discussed below

Before merger

Assuming QA is quantity produced by a typical X is the combined production of rest of

the two firms, the total quantity produced in the market is (QA + X).

Total Revenue (TR¿¿ A)=P ×QA ¿

¿ (600− Q

20 )×QA

¿ 600 QA −QA ( QA +X )

20

¿ 600 QA −QA

2 +QA X

20

Industry Analysis

The inverse demand function in the pre-mixed concrete industry is

P=600− Q

20

P is the price per cubic meter of concrete and Q is the total cubic metre of concrete supplied in

the market.

Before merger each of the three has a fixed cost of $200,000 and a marginal cost of $140

per cubic meter.

After merger between ConCrop and Big Industries, fixed cost of the merger firm

increases to $350,000 while marginal cost reduces to $115 per cubic metre.

Industry outcome before and after merger are discussed below

Before merger

Assuming QA is quantity produced by a typical X is the combined production of rest of

the two firms, the total quantity produced in the market is (QA + X).

Total Revenue (TR¿¿ A)=P ×QA ¿

¿ (600− Q

20 )×QA

¿ 600 QA −QA ( QA +X )

20

¿ 600 QA −QA

2 +QA X

20

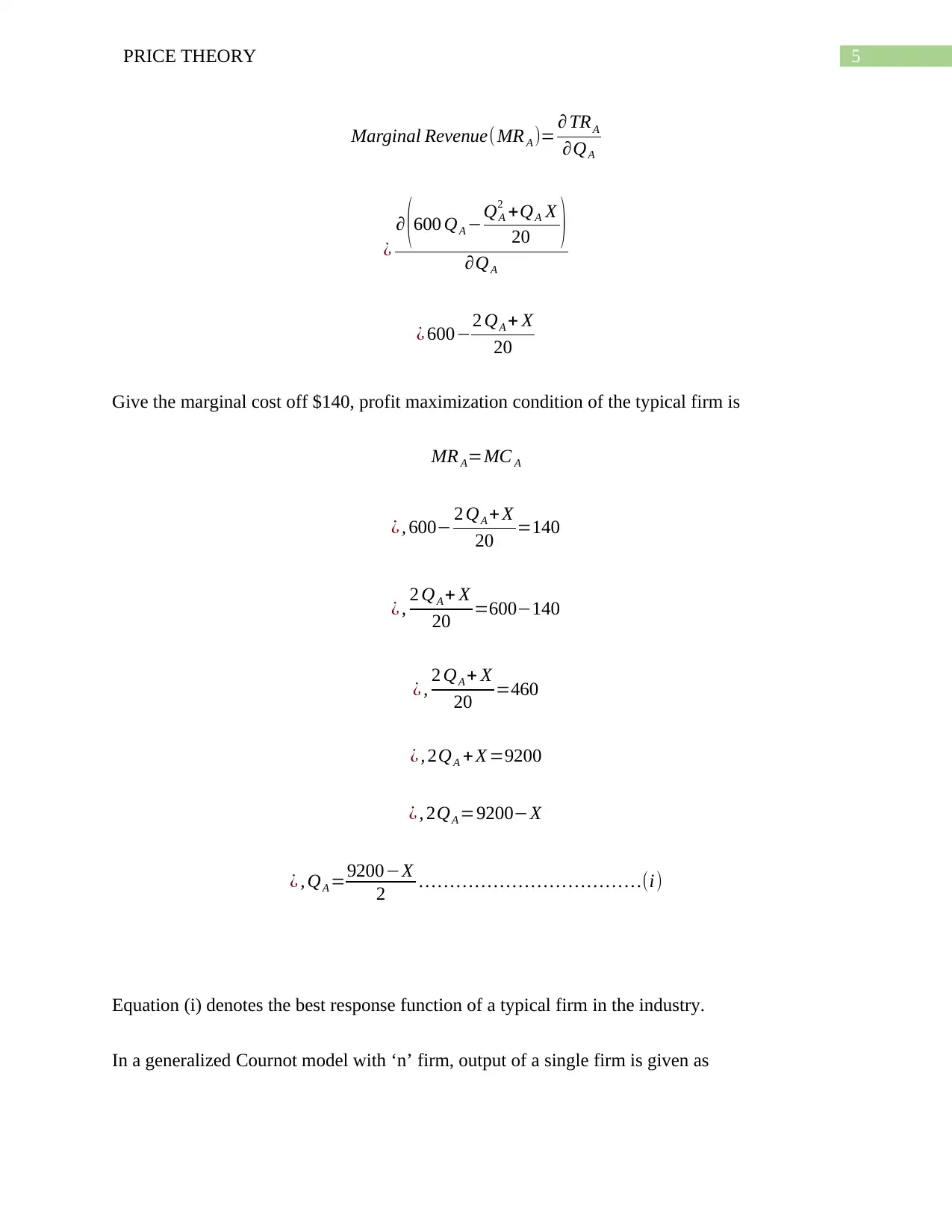

5PRICE THEORY

Marginal Revenue(MR A )= ∂ TRA

∂QA

¿

∂ ( 600 QA −QA

2 +QA X

20 )

∂QA

¿ 600−2 QA + X

20

Give the marginal cost off $140, profit maximization condition of the typical firm is

MR A=MC A

¿ , 600− 2 QA + X

20 =140

¿ , 2 QA + X

20 =600−140

¿ , 2 QA + X

20 =460

¿ , 2QA + X =9200

¿ , 2QA =9200−X

¿ , QA =9200−X

2 … … … … … … … … …… … …(i)

Equation (i) denotes the best response function of a typical firm in the industry.

In a generalized Cournot model with ‘n’ firm, output of a single firm is given as

Marginal Revenue(MR A )= ∂ TRA

∂QA

¿

∂ ( 600 QA −QA

2 +QA X

20 )

∂QA

¿ 600−2 QA + X

20

Give the marginal cost off $140, profit maximization condition of the typical firm is

MR A=MC A

¿ , 600− 2 QA + X

20 =140

¿ , 2 QA + X

20 =600−140

¿ , 2 QA + X

20 =460

¿ , 2QA + X =9200

¿ , 2QA =9200−X

¿ , QA =9200−X

2 … … … … … … … … …… … …(i)

Equation (i) denotes the best response function of a typical firm in the industry.

In a generalized Cournot model with ‘n’ firm, output of a single firm is given as

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

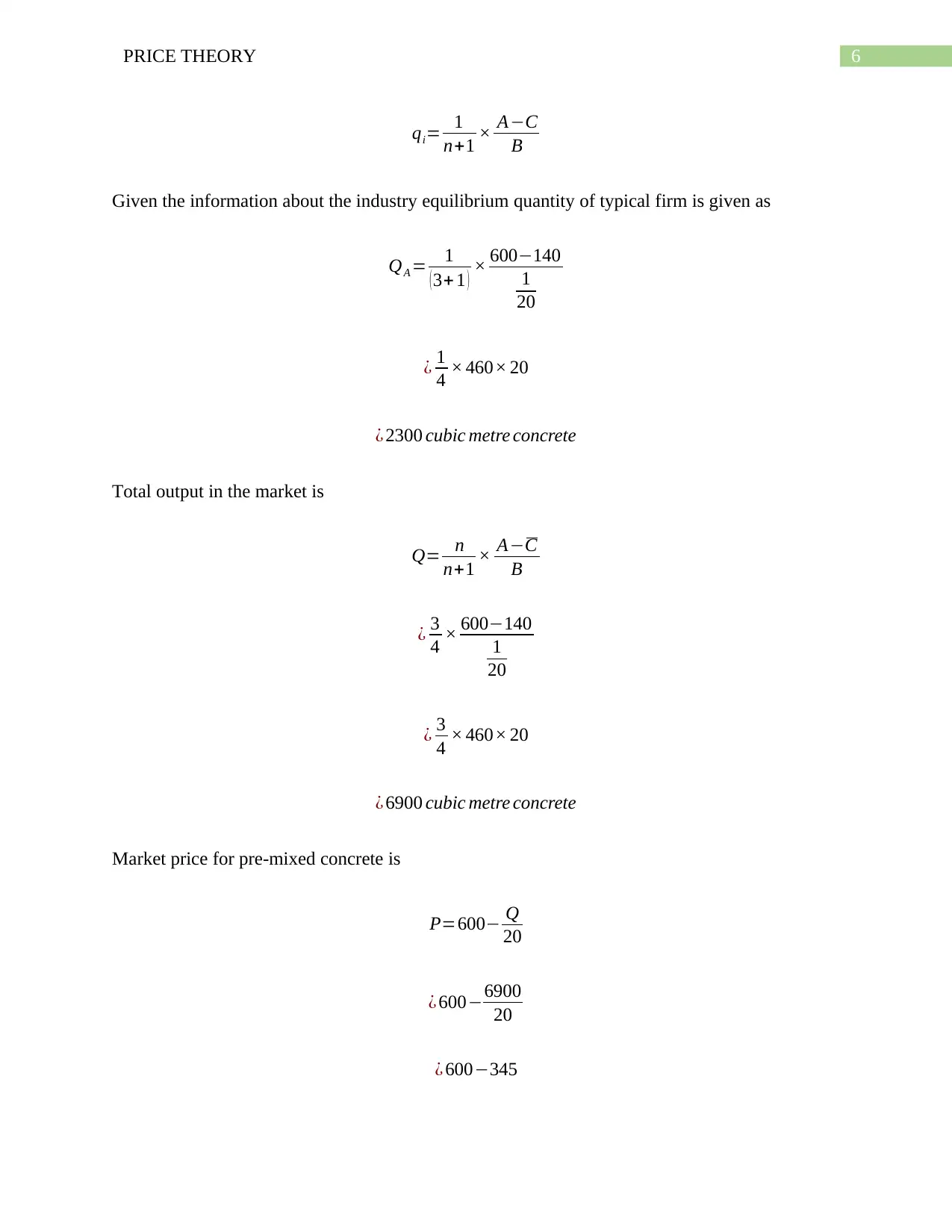

6PRICE THEORY

qi= 1

n+1 × A−C

B

Given the information about the industry equilibrium quantity of typical firm is given as

QA = 1

( 3+ 1 ) × 600−140

1

20

¿ 1

4 × 460× 20

¿ 2300 cubic metre concrete

Total output in the market is

Q= n

n+1 × A−C

B

¿ 3

4 × 600−140

1

20

¿ 3

4 × 460× 20

¿ 6900 cubic metre concrete

Market price for pre-mixed concrete is

P=600− Q

20

¿ 600−6900

20

¿ 600−345

qi= 1

n+1 × A−C

B

Given the information about the industry equilibrium quantity of typical firm is given as

QA = 1

( 3+ 1 ) × 600−140

1

20

¿ 1

4 × 460× 20

¿ 2300 cubic metre concrete

Total output in the market is

Q= n

n+1 × A−C

B

¿ 3

4 × 600−140

1

20

¿ 3

4 × 460× 20

¿ 6900 cubic metre concrete

Market price for pre-mixed concrete is

P=600− Q

20

¿ 600−6900

20

¿ 600−345

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7PRICE THEORY

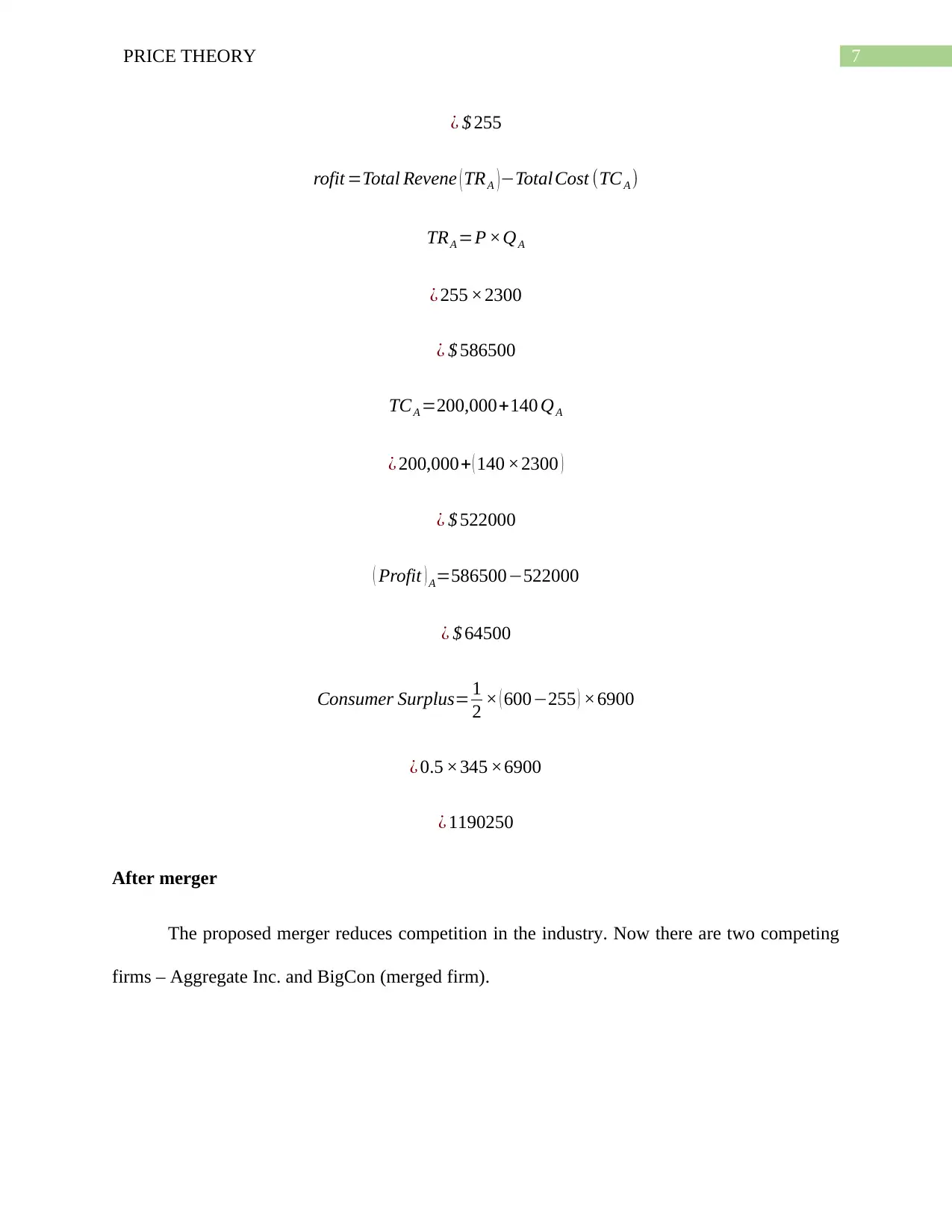

¿ $ 255

rofit =Total Revene ( TRA )−Total Cost (TCA )

TRA =P ×QA

¿ 255 ×2300

¿ $ 586500

TCA =200,000+140 QA

¿ 200,000+ ( 140 ×2300 )

¿ $ 522000

( Profit ) A=586500−522000

¿ $ 64500

Consumer Surplus= 1

2 × ( 600−255 ) ×6900

¿ 0.5 ×345 ×6900

¿ 1190250

After merger

The proposed merger reduces competition in the industry. Now there are two competing

firms – Aggregate Inc. and BigCon (merged firm).

¿ $ 255

rofit =Total Revene ( TRA )−Total Cost (TCA )

TRA =P ×QA

¿ 255 ×2300

¿ $ 586500

TCA =200,000+140 QA

¿ 200,000+ ( 140 ×2300 )

¿ $ 522000

( Profit ) A=586500−522000

¿ $ 64500

Consumer Surplus= 1

2 × ( 600−255 ) ×6900

¿ 0.5 ×345 ×6900

¿ 1190250

After merger

The proposed merger reduces competition in the industry. Now there are two competing

firms – Aggregate Inc. and BigCon (merged firm).

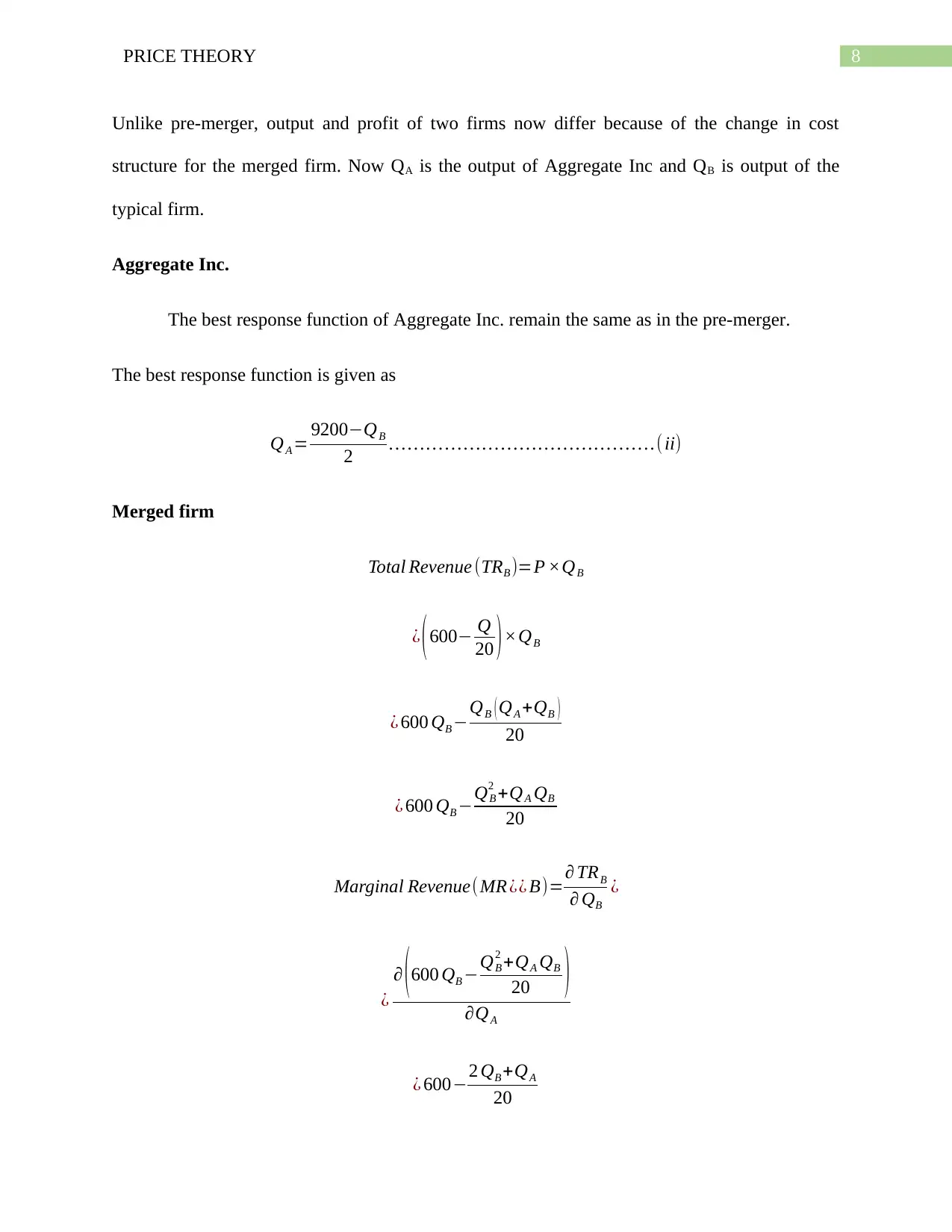

8PRICE THEORY

Unlike pre-merger, output and profit of two firms now differ because of the change in cost

structure for the merged firm. Now QA is the output of Aggregate Inc and QB is output of the

typical firm.

Aggregate Inc.

The best response function of Aggregate Inc. remain the same as in the pre-merger.

The best response function is given as

QA = 9200−QB

2 … … … … … … … … … … … … … … .(ii)

Merged firm

Total Revenue (TRB )=P ×QB

¿ (600− Q

20 )×QB

¿ 600 QB −QB ( QA +QB )

20

¿ 600 QB −QB

2 +QA QB

20

Marginal Revenue(MR ¿¿ B)=∂ TRB

∂ QB

¿

¿

∂ (600 QB −QB

2 +QA QB

20 )

∂QA

¿ 600−2 QB +QA

20

Unlike pre-merger, output and profit of two firms now differ because of the change in cost

structure for the merged firm. Now QA is the output of Aggregate Inc and QB is output of the

typical firm.

Aggregate Inc.

The best response function of Aggregate Inc. remain the same as in the pre-merger.

The best response function is given as

QA = 9200−QB

2 … … … … … … … … … … … … … … .(ii)

Merged firm

Total Revenue (TRB )=P ×QB

¿ (600− Q

20 )×QB

¿ 600 QB −QB ( QA +QB )

20

¿ 600 QB −QB

2 +QA QB

20

Marginal Revenue(MR ¿¿ B)=∂ TRB

∂ QB

¿

¿

∂ (600 QB −QB

2 +QA QB

20 )

∂QA

¿ 600−2 QB +QA

20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9PRICE THEORY

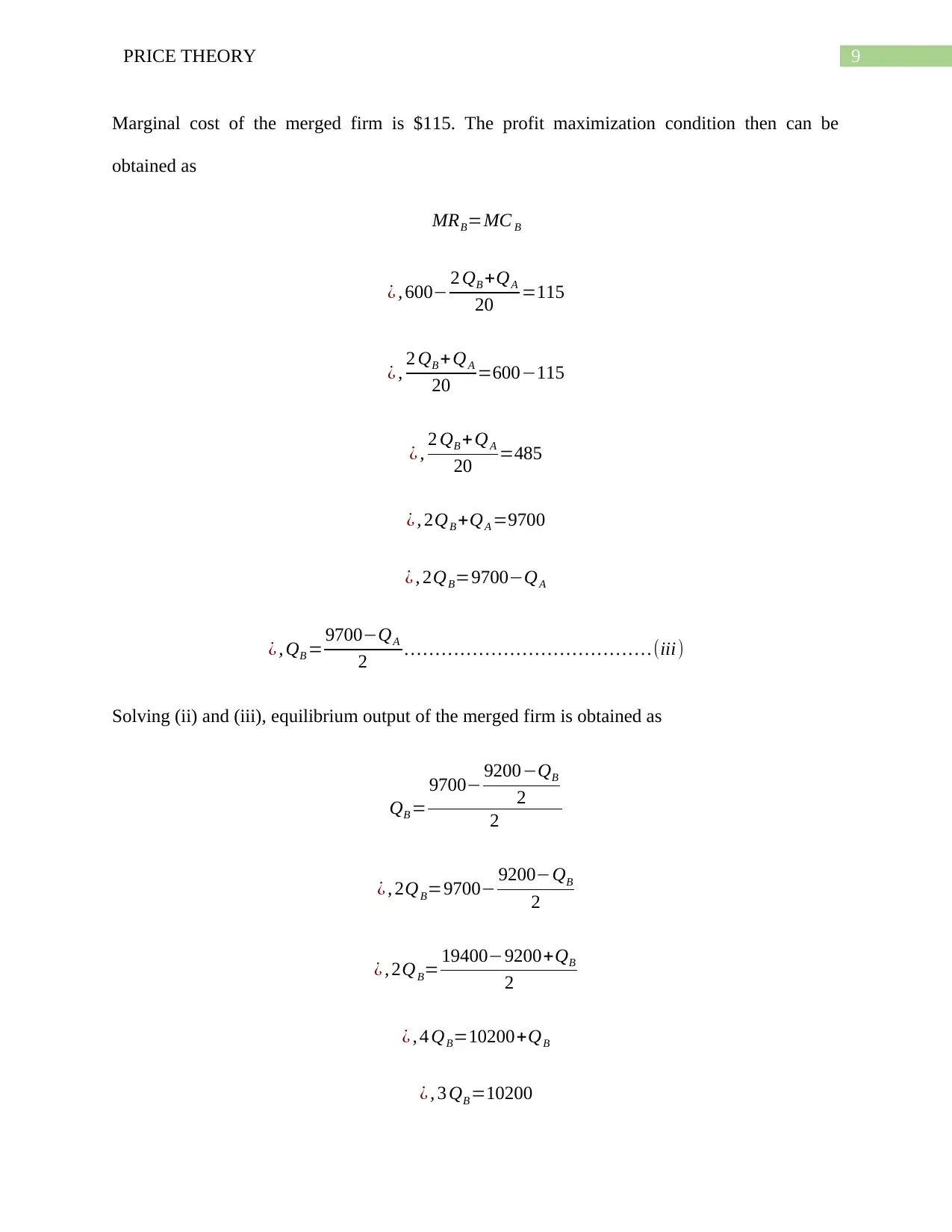

Marginal cost of the merged firm is $115. The profit maximization condition then can be

obtained as

MRB=MC B

¿ , 600− 2 QB +QA

20 =115

¿ , 2 QB +QA

20 =600−115

¿ , 2 QB +QA

20 =485

¿ , 2QB +QA =9700

¿ , 2QB=9700−QA

¿ , QB = 9700−QA

2 … … … … … … … … … … … … … .(iii )

Solving (ii) and (iii), equilibrium output of the merged firm is obtained as

QB =

9700− 9200−QB

2

2

¿ , 2QB=9700− 9200−QB

2

¿ , 2QB= 19400−9200+QB

2

¿ , 4 QB=10200+QB

¿ , 3 QB =10200

Marginal cost of the merged firm is $115. The profit maximization condition then can be

obtained as

MRB=MC B

¿ , 600− 2 QB +QA

20 =115

¿ , 2 QB +QA

20 =600−115

¿ , 2 QB +QA

20 =485

¿ , 2QB +QA =9700

¿ , 2QB=9700−QA

¿ , QB = 9700−QA

2 … … … … … … … … … … … … … .(iii )

Solving (ii) and (iii), equilibrium output of the merged firm is obtained as

QB =

9700− 9200−QB

2

2

¿ , 2QB=9700− 9200−QB

2

¿ , 2QB= 19400−9200+QB

2

¿ , 4 QB=10200+QB

¿ , 3 QB =10200

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

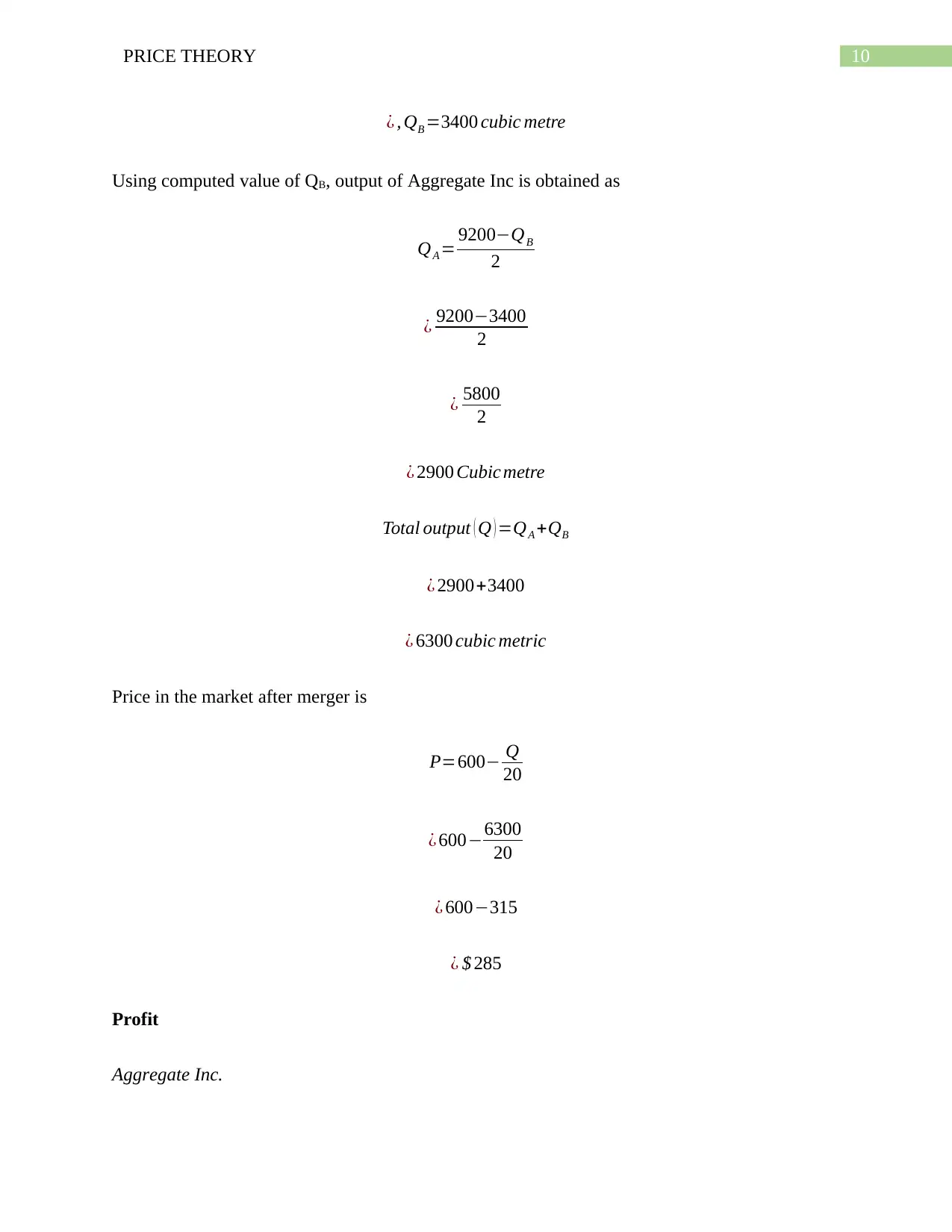

10PRICE THEORY

¿ , QB =3400 cubic metre

Using computed value of QB, output of Aggregate Inc is obtained as

QA = 9200−QB

2

¿ 9200−3400

2

¿ 5800

2

¿ 2900 Cubic metre

Total output ( Q ) =QA +QB

¿ 2900+3400

¿ 6300 cubic metric

Price in the market after merger is

P=600− Q

20

¿ 600−6300

20

¿ 600−315

¿ $ 285

Profit

Aggregate Inc.

¿ , QB =3400 cubic metre

Using computed value of QB, output of Aggregate Inc is obtained as

QA = 9200−QB

2

¿ 9200−3400

2

¿ 5800

2

¿ 2900 Cubic metre

Total output ( Q ) =QA +QB

¿ 2900+3400

¿ 6300 cubic metric

Price in the market after merger is

P=600− Q

20

¿ 600−6300

20

¿ 600−315

¿ $ 285

Profit

Aggregate Inc.

11PRICE THEORY

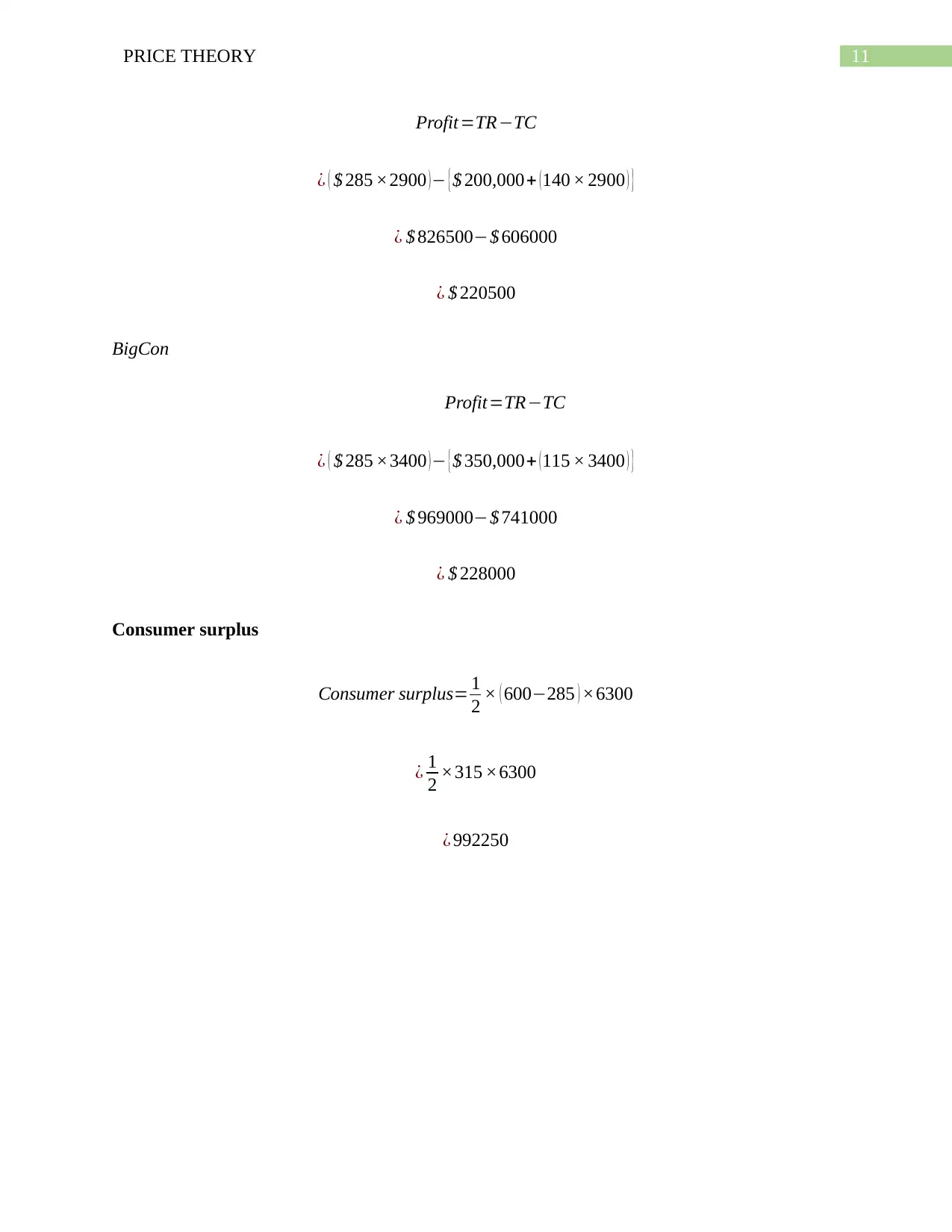

Profit=TR−TC

¿ ( $ 285 ×2900 ) − { $ 200,000+ ( 140 × 2900 ) }

¿ $ 826500−$ 606000

¿ $ 220500

BigCon

Profit=TR−TC

¿ ( $ 285 ×3400 ) − { $ 350,000+ ( 115 × 3400 ) }

¿ $ 969000−$ 741000

¿ $ 228000

Consumer surplus

Consumer surplus= 1

2 × ( 600−285 ) ×6300

¿ 1

2 ×315 ×6300

¿ 992250

Profit=TR−TC

¿ ( $ 285 ×2900 ) − { $ 200,000+ ( 140 × 2900 ) }

¿ $ 826500−$ 606000

¿ $ 220500

BigCon

Profit=TR−TC

¿ ( $ 285 ×3400 ) − { $ 350,000+ ( 115 × 3400 ) }

¿ $ 969000−$ 741000

¿ $ 228000

Consumer surplus

Consumer surplus= 1

2 × ( 600−285 ) ×6300

¿ 1

2 ×315 ×6300

¿ 992250

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.