Report on Crude Oil Price Fluctuations, Market Outcomes, and Welfare

VerifiedAdded on 2021/01/02

|6

|1295

|74

Report

AI Summary

This report provides a comprehensive analysis of crude oil price fluctuations, examining the various factors that influence these changes. It delves into the relationship between oil prices and the global economy, highlighting the impact of demand, supply, and the role of organizations like OPEC. The report explores the welfare implications of these fluctuations, considering both the benefits and drawbacks for consumers, producers, and governments. It examines the effects of fiscal and monetary policies, natural disasters, and political events on oil prices. The report also discusses the correlation between oil prices and interest rates, as well as the impact of weather events and supply disruptions. Finally, the report concludes by emphasizing the need for economic reforms and strategies to mitigate the negative consequences of oil price volatility.

Prices and Markets

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

Reasons for price fluctuations................................................................................................1

Welfare Implications..............................................................................................................3

CONCLUSION................................................................................................................................3

REFERENCES................................................................................................................................4

INTRODUCTION...........................................................................................................................1

Reasons for price fluctuations................................................................................................1

Welfare Implications..............................................................................................................3

CONCLUSION................................................................................................................................3

REFERENCES................................................................................................................................4

INTRODUCTION

Crude oil is a non-renewable resource which occurs naturally. It is known as unrefined

petroleum product i.e. composed of hydrocarbon deposits and all other organic materials.

Basically, it is located underground and after refining, it is used to produce some usable products

such as gasoline. Oil prices usually rise in summer during vacation driving times. In the present

scenario, crude oil prices are fluctuating day by day. There is a huge impact on the cost of

gasoline, home heating oil, manufacturing and electric power generation during high crude oil

prices. Transportation requires 96% oil, 43% of industrial product and 21% of commercial and

residential as well as only 3% of electric power. Higher oil price is increasing the inflation like

cost of everything is getting expensive especially food. This report includes various aspects of

exchange process, factors that can affect government for crude oil price fluctuations market

outcomes and the welfare implications of exchange outcome and to find if there is any scope for

government intervention.

Reasons for price fluctuations

Crude oil has an important link to the global growth of world’s economy. There is a huge

demand and growth in energy intensive industries. If there is demand of oil then it will raise the

growth in electricity, transportation, manufacturing and shipping. If there is high growth then it

will lead to directly high demand. The oil prices were decreasing because they were largely

passed on to consumers in developed countries, there has been less pass through rest of the

World (What’s behind the drop in oil prices, 2018). So, because of this; government have taken

advantage of reduced subsidies on consumption of fuel and it strengthened their fuel

consumption. In 1985- 1986, there was fall in oil prices was due to supply driven and in 2008-

2009 the fall of oil prices was because of collapse in demand. Their was slow growth in

emerging market. Especially because of China, it led to fall in prices of commodity. There was

fall in oil prices which was majorly slower than food and metals.

Fiscal policies and monetary policy: The policies of many countries like European Union,

US, Japan and China causes the flow of capital, demand for oil and investment. There is direct

influence on the price of crude oil in global market.

Organisation of Petroleum Exporting Countries (OPEC) is the main reason behind the oil

price fluctuations. 40% supply of oil of world is in the control of OPEC. The production level is

1

Crude oil is a non-renewable resource which occurs naturally. It is known as unrefined

petroleum product i.e. composed of hydrocarbon deposits and all other organic materials.

Basically, it is located underground and after refining, it is used to produce some usable products

such as gasoline. Oil prices usually rise in summer during vacation driving times. In the present

scenario, crude oil prices are fluctuating day by day. There is a huge impact on the cost of

gasoline, home heating oil, manufacturing and electric power generation during high crude oil

prices. Transportation requires 96% oil, 43% of industrial product and 21% of commercial and

residential as well as only 3% of electric power. Higher oil price is increasing the inflation like

cost of everything is getting expensive especially food. This report includes various aspects of

exchange process, factors that can affect government for crude oil price fluctuations market

outcomes and the welfare implications of exchange outcome and to find if there is any scope for

government intervention.

Reasons for price fluctuations

Crude oil has an important link to the global growth of world’s economy. There is a huge

demand and growth in energy intensive industries. If there is demand of oil then it will raise the

growth in electricity, transportation, manufacturing and shipping. If there is high growth then it

will lead to directly high demand. The oil prices were decreasing because they were largely

passed on to consumers in developed countries, there has been less pass through rest of the

World (What’s behind the drop in oil prices, 2018). So, because of this; government have taken

advantage of reduced subsidies on consumption of fuel and it strengthened their fuel

consumption. In 1985- 1986, there was fall in oil prices was due to supply driven and in 2008-

2009 the fall of oil prices was because of collapse in demand. Their was slow growth in

emerging market. Especially because of China, it led to fall in prices of commodity. There was

fall in oil prices which was majorly slower than food and metals.

Fiscal policies and monetary policy: The policies of many countries like European Union,

US, Japan and China causes the flow of capital, demand for oil and investment. There is direct

influence on the price of crude oil in global market.

Organisation of Petroleum Exporting Countries (OPEC) is the main reason behind the oil

price fluctuations. 40% supply of oil of world is in the control of OPEC. The production level is

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

set by OPEC to meet global demand and it can influence the price by increasing and decreasing

production. In 2012, the OPEC market share was 44.5% and in 2014, it was 41.8% because of

more supply of oil which leads to oil prices fall. This cause a boom and boost in the the US

shale oil Industry. Mostly contract of oil in the world is traded in dollars. But at that time there

was decline in dollar prices, which increases the cost. To maintain profit or margins, OPEC

raised the price of oil and made the cost of imported goods constant.

Natural disasters and politics also given a huge impact on oil prices like when Hurricane

Katrina came in US 2005 which affected 19% of the US oil supply and it also cause rise in price

per barrel by $3 and in May 2011, Mississippi River flood also cause a decline in the oil price.

The storage and production cost also gives an impact on oil prices and in middle east, extraction

of oil is very cheap as compared to others and in Canada Alberta's oil sand is very costly (Crude

oil prices, climate change, and global welfare, 2018). If supply of oil get exhausted, the price

could rose in the remaining poll is in tar sands. Interest rate and changes in oil prices are

correlated to each other. Not always but sometimes this is the reason in the price fluctuation.

Weather events also plays major role in rise and fall of prices, interruptions like worker

strikes or spills also give an impact on supply, and supply is directly linked to raise any crisis

impact on crude oil prices in oil prices.

2

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0

20

40

60

80

100

120

production. In 2012, the OPEC market share was 44.5% and in 2014, it was 41.8% because of

more supply of oil which leads to oil prices fall. This cause a boom and boost in the the US

shale oil Industry. Mostly contract of oil in the world is traded in dollars. But at that time there

was decline in dollar prices, which increases the cost. To maintain profit or margins, OPEC

raised the price of oil and made the cost of imported goods constant.

Natural disasters and politics also given a huge impact on oil prices like when Hurricane

Katrina came in US 2005 which affected 19% of the US oil supply and it also cause rise in price

per barrel by $3 and in May 2011, Mississippi River flood also cause a decline in the oil price.

The storage and production cost also gives an impact on oil prices and in middle east, extraction

of oil is very cheap as compared to others and in Canada Alberta's oil sand is very costly (Crude

oil prices, climate change, and global welfare, 2018). If supply of oil get exhausted, the price

could rose in the remaining poll is in tar sands. Interest rate and changes in oil prices are

correlated to each other. Not always but sometimes this is the reason in the price fluctuation.

Weather events also plays major role in rise and fall of prices, interruptions like worker

strikes or spills also give an impact on supply, and supply is directly linked to raise any crisis

impact on crude oil prices in oil prices.

2

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

0

20

40

60

80

100

120

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

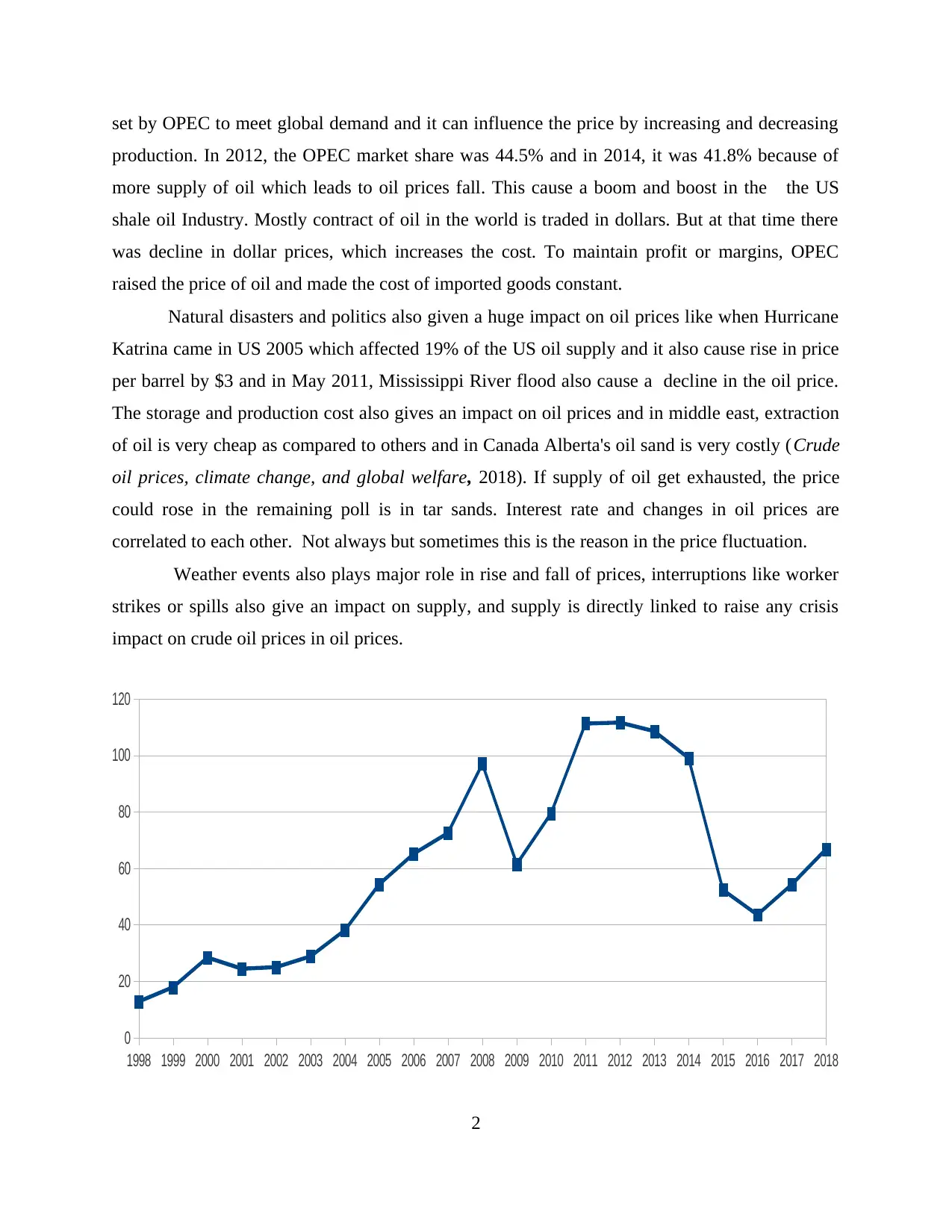

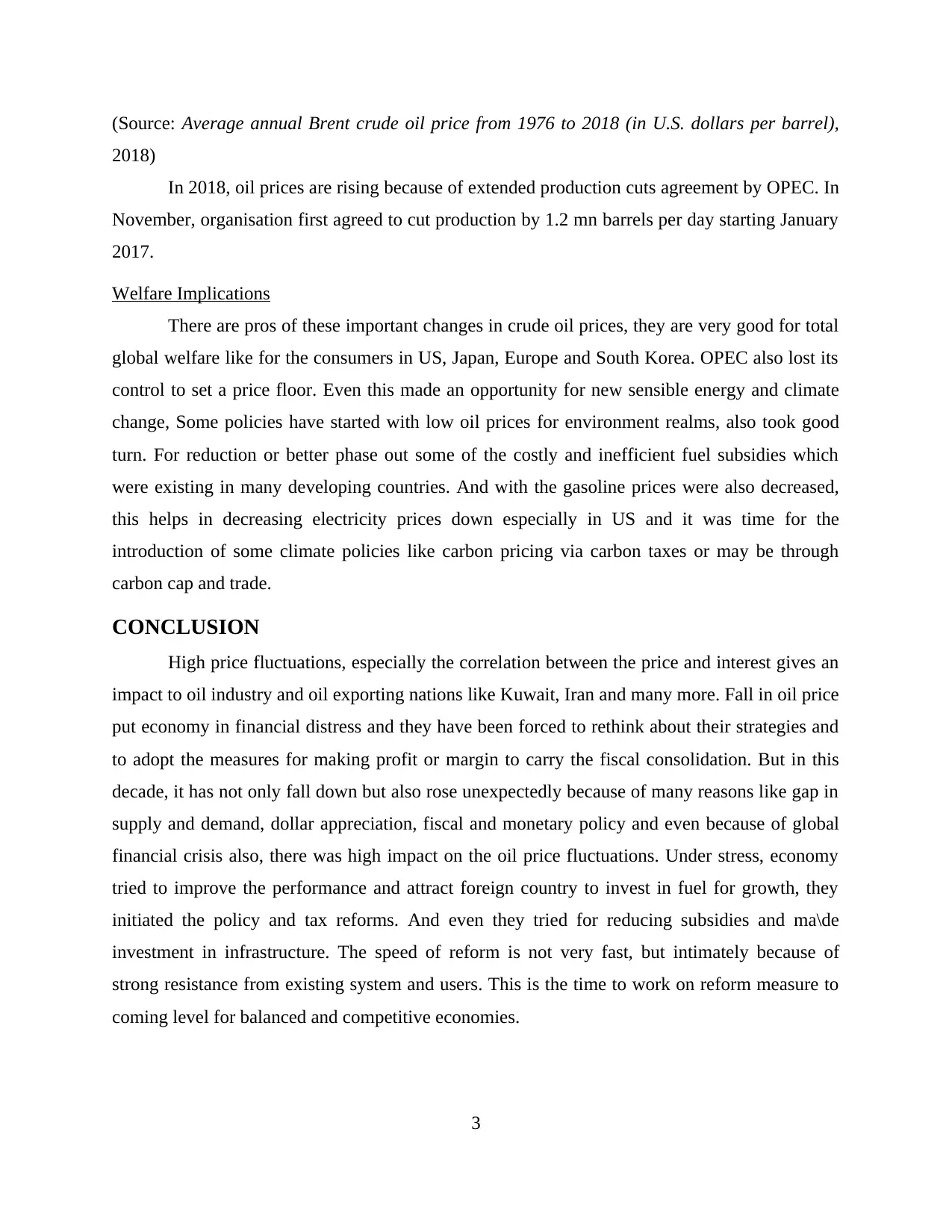

(Source: Average annual Brent crude oil price from 1976 to 2018 (in U.S. dollars per barrel),

2018)

In 2018, oil prices are rising because of extended production cuts agreement by OPEC. In

November, organisation first agreed to cut production by 1.2 mn barrels per day starting January

2017.

Welfare Implications

There are pros of these important changes in crude oil prices, they are very good for total

global welfare like for the consumers in US, Japan, Europe and South Korea. OPEC also lost its

control to set a price floor. Even this made an opportunity for new sensible energy and climate

change, Some policies have started with low oil prices for environment realms, also took good

turn. For reduction or better phase out some of the costly and inefficient fuel subsidies which

were existing in many developing countries. And with the gasoline prices were also decreased,

this helps in decreasing electricity prices down especially in US and it was time for the

introduction of some climate policies like carbon pricing via carbon taxes or may be through

carbon cap and trade.

CONCLUSION

High price fluctuations, especially the correlation between the price and interest gives an

impact to oil industry and oil exporting nations like Kuwait, Iran and many more. Fall in oil price

put economy in financial distress and they have been forced to rethink about their strategies and

to adopt the measures for making profit or margin to carry the fiscal consolidation. But in this

decade, it has not only fall down but also rose unexpectedly because of many reasons like gap in

supply and demand, dollar appreciation, fiscal and monetary policy and even because of global

financial crisis also, there was high impact on the oil price fluctuations. Under stress, economy

tried to improve the performance and attract foreign country to invest in fuel for growth, they

initiated the policy and tax reforms. And even they tried for reducing subsidies and ma\de

investment in infrastructure. The speed of reform is not very fast, but intimately because of

strong resistance from existing system and users. This is the time to work on reform measure to

coming level for balanced and competitive economies.

3

2018)

In 2018, oil prices are rising because of extended production cuts agreement by OPEC. In

November, organisation first agreed to cut production by 1.2 mn barrels per day starting January

2017.

Welfare Implications

There are pros of these important changes in crude oil prices, they are very good for total

global welfare like for the consumers in US, Japan, Europe and South Korea. OPEC also lost its

control to set a price floor. Even this made an opportunity for new sensible energy and climate

change, Some policies have started with low oil prices for environment realms, also took good

turn. For reduction or better phase out some of the costly and inefficient fuel subsidies which

were existing in many developing countries. And with the gasoline prices were also decreased,

this helps in decreasing electricity prices down especially in US and it was time for the

introduction of some climate policies like carbon pricing via carbon taxes or may be through

carbon cap and trade.

CONCLUSION

High price fluctuations, especially the correlation between the price and interest gives an

impact to oil industry and oil exporting nations like Kuwait, Iran and many more. Fall in oil price

put economy in financial distress and they have been forced to rethink about their strategies and

to adopt the measures for making profit or margin to carry the fiscal consolidation. But in this

decade, it has not only fall down but also rose unexpectedly because of many reasons like gap in

supply and demand, dollar appreciation, fiscal and monetary policy and even because of global

financial crisis also, there was high impact on the oil price fluctuations. Under stress, economy

tried to improve the performance and attract foreign country to invest in fuel for growth, they

initiated the policy and tax reforms. And even they tried for reducing subsidies and ma\de

investment in infrastructure. The speed of reform is not very fast, but intimately because of

strong resistance from existing system and users. This is the time to work on reform measure to

coming level for balanced and competitive economies.

3

REFERENCES

Online

Average annual Brent crude oil price from 1976 to 2018 (in U.S. dollars per barrel). 2018.

[Online]. Available through: <https://www.statista.com/statistics/262860/uk-brent-crude-

oil-price-changes-since-1976/#0>.

Crude oil prices, climate change, and global welfare. 2018. [Online]. Available through:

<https://www.huffingtonpost.com/robert-stavins/crude-oil-prices-

climate_b_7505934.html>.

What’s behind the drop in oil prices. 2018. [Online]. Available through:

<https://www.weforum.org/agenda/2016/03/what-s-behind-the-drop-in-oil-prices/>.

4

Online

Average annual Brent crude oil price from 1976 to 2018 (in U.S. dollars per barrel). 2018.

[Online]. Available through: <https://www.statista.com/statistics/262860/uk-brent-crude-

oil-price-changes-since-1976/#0>.

Crude oil prices, climate change, and global welfare. 2018. [Online]. Available through:

<https://www.huffingtonpost.com/robert-stavins/crude-oil-prices-

climate_b_7505934.html>.

What’s behind the drop in oil prices. 2018. [Online]. Available through:

<https://www.weforum.org/agenda/2016/03/what-s-behind-the-drop-in-oil-prices/>.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.