Pricing Analytics and Revenue Management: Sales Data Analysis Report

VerifiedAdded on 2023/01/11

|6

|1050

|31

Report

AI Summary

This report provides an analysis of pricing analytics and revenue management, focusing on sales data analysis using regression models. The introduction highlights the importance of price analytics in improving profitability and market share. The report uses SPSS and Microsoft Excel to analyze the sales data from ssanner.csv. Task 1 involves building and interpreting a linear regression model, examining the relationship between sales volume and variables like price, promotions, coupons, and displays. The analysis includes R-squared values, significance levels, and the calculation of price elasticity. The report then explores the relationship between log volume and log price, concluding that there is no significant relationship. Finally, the report uses Microsoft Excel to develop and analyze the impact of price increases and decreases on sales volume, concluding that changes in price levels significantly affect sales volume. The report concludes that sales volume is more influenced by price changes than the absolute price level.

Pricing Analytics and

Revenue Management

Revenue Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1. Linear regression model..........................................................................................................1

2. `Log volume' and `log price'....................................................................................................2

3 (a)..............................................................................................................................................3

3 (b)..............................................................................................................................................3

CONCLUSION................................................................................................................................4

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1. Linear regression model..........................................................................................................1

2. `Log volume' and `log price'....................................................................................................2

3 (a)..............................................................................................................................................3

3 (b)..............................................................................................................................................3

CONCLUSION................................................................................................................................4

INTRODUCTION

Price analytics is a process of analysing the prices of the goods and services which are sold

by the organisation. This concept of price analytics helps in improving profitability and market

share. The main aim of this piece of work is to analyse the sales data given in ssanner.csv. For

this purpose, in this report regression model is used to analyse the relationship between various

variables. The software application of SPSS and Microsoft Excel are used in this report to

develop new log variables and then analyse them with using linear regression model.

TASK 1

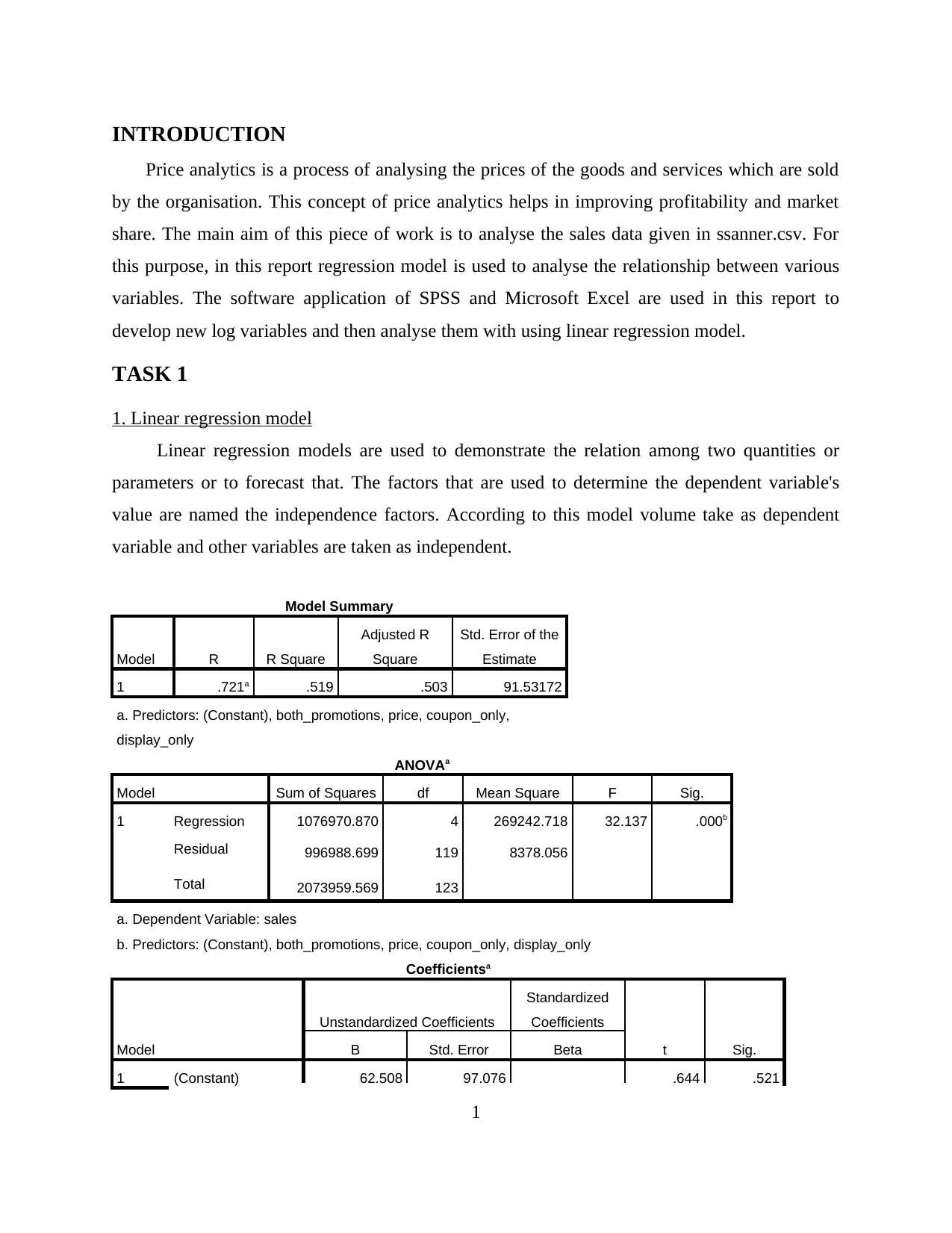

1. Linear regression model

Linear regression models are used to demonstrate the relation among two quantities or

parameters or to forecast that. The factors that are used to determine the dependent variable's

value are named the independence factors. According to this model volume take as dependent

variable and other variables are taken as independent.

Model Summary

Model R R Square

Adjusted R

Square

Std. Error of the

Estimate

1 .721a .519 .503 91.53172

a. Predictors: (Constant), both_promotions, price, coupon_only,

display_only

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1 Regression 1076970.870 4 269242.718 32.137 .000b

Residual 996988.699 119 8378.056

Total 2073959.569 123

a. Dependent Variable: sales

b. Predictors: (Constant), both_promotions, price, coupon_only, display_only

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig.B Std. Error Beta

1 (Constant) 62.508 97.076 .644 .521

1

Price analytics is a process of analysing the prices of the goods and services which are sold

by the organisation. This concept of price analytics helps in improving profitability and market

share. The main aim of this piece of work is to analyse the sales data given in ssanner.csv. For

this purpose, in this report regression model is used to analyse the relationship between various

variables. The software application of SPSS and Microsoft Excel are used in this report to

develop new log variables and then analyse them with using linear regression model.

TASK 1

1. Linear regression model

Linear regression models are used to demonstrate the relation among two quantities or

parameters or to forecast that. The factors that are used to determine the dependent variable's

value are named the independence factors. According to this model volume take as dependent

variable and other variables are taken as independent.

Model Summary

Model R R Square

Adjusted R

Square

Std. Error of the

Estimate

1 .721a .519 .503 91.53172

a. Predictors: (Constant), both_promotions, price, coupon_only,

display_only

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1 Regression 1076970.870 4 269242.718 32.137 .000b

Residual 996988.699 119 8378.056

Total 2073959.569 123

a. Dependent Variable: sales

b. Predictors: (Constant), both_promotions, price, coupon_only, display_only

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig.B Std. Error Beta

1 (Constant) 62.508 97.076 .644 .521

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

price -7.985 82.174 -.006 -.097 .923

display_only 79.575 19.641 .272 4.051 .000

coupon_only 228.965 28.563 .523 8.016 .000

both_promotions 316.477 36.419 .565 8.690 .000

a. Dependent Variable: sales

From the above results, it has been seen that variables display_only, coupon_only and

both_promotions are related to sales volume as their significance level is lower than the alpha

value of .05. The R square value observed from above results is .519 which means sales volume

is 51% determined by the all independent values. R-squared (R2), which is also the percentage of

result variance described by the parameters of the predictors. In regression analysis designs, R2

equates to the rectangular similarity between both the designer's measured result principles and

the values predicted. The stronger the R-squared, the stronger the sequence.

In order to calculate the price elasticity, it is important to develop the regression equation.

The regression equation for above regression model is y = -7.985 * price + 62.50

-7985 * 8378.056 / 269242.718

As the price elasticity is more than 1, it can be said that the price is elastic.

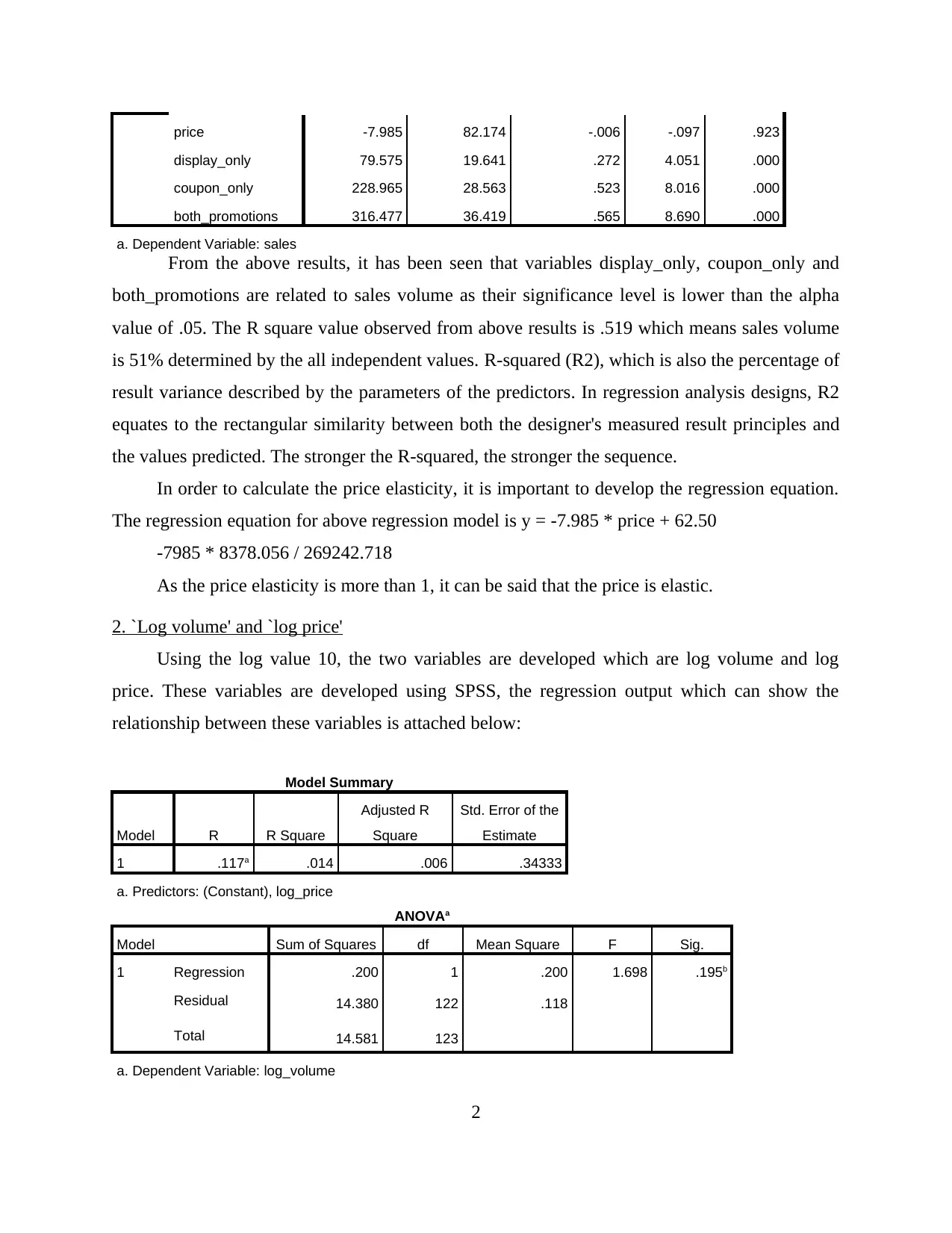

2. `Log volume' and `log price'

Using the log value 10, the two variables are developed which are log volume and log

price. These variables are developed using SPSS, the regression output which can show the

relationship between these variables is attached below:

Model Summary

Model R R Square

Adjusted R

Square

Std. Error of the

Estimate

1 .117a .014 .006 .34333

a. Predictors: (Constant), log_price

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1 Regression .200 1 .200 1.698 .195b

Residual 14.380 122 .118

Total 14.581 123

a. Dependent Variable: log_volume

2

display_only 79.575 19.641 .272 4.051 .000

coupon_only 228.965 28.563 .523 8.016 .000

both_promotions 316.477 36.419 .565 8.690 .000

a. Dependent Variable: sales

From the above results, it has been seen that variables display_only, coupon_only and

both_promotions are related to sales volume as their significance level is lower than the alpha

value of .05. The R square value observed from above results is .519 which means sales volume

is 51% determined by the all independent values. R-squared (R2), which is also the percentage of

result variance described by the parameters of the predictors. In regression analysis designs, R2

equates to the rectangular similarity between both the designer's measured result principles and

the values predicted. The stronger the R-squared, the stronger the sequence.

In order to calculate the price elasticity, it is important to develop the regression equation.

The regression equation for above regression model is y = -7.985 * price + 62.50

-7985 * 8378.056 / 269242.718

As the price elasticity is more than 1, it can be said that the price is elastic.

2. `Log volume' and `log price'

Using the log value 10, the two variables are developed which are log volume and log

price. These variables are developed using SPSS, the regression output which can show the

relationship between these variables is attached below:

Model Summary

Model R R Square

Adjusted R

Square

Std. Error of the

Estimate

1 .117a .014 .006 .34333

a. Predictors: (Constant), log_price

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1 Regression .200 1 .200 1.698 .195b

Residual 14.380 122 .118

Total 14.581 123

a. Dependent Variable: log_volume

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

b. Predictors: (Constant), log_price

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig.B Std. Error Beta

1 (Constant) 1.955 .057 34.187 .000

log_price -1.016 .780 -.117 -1.303 .195

a. Dependent Variable: log_volume

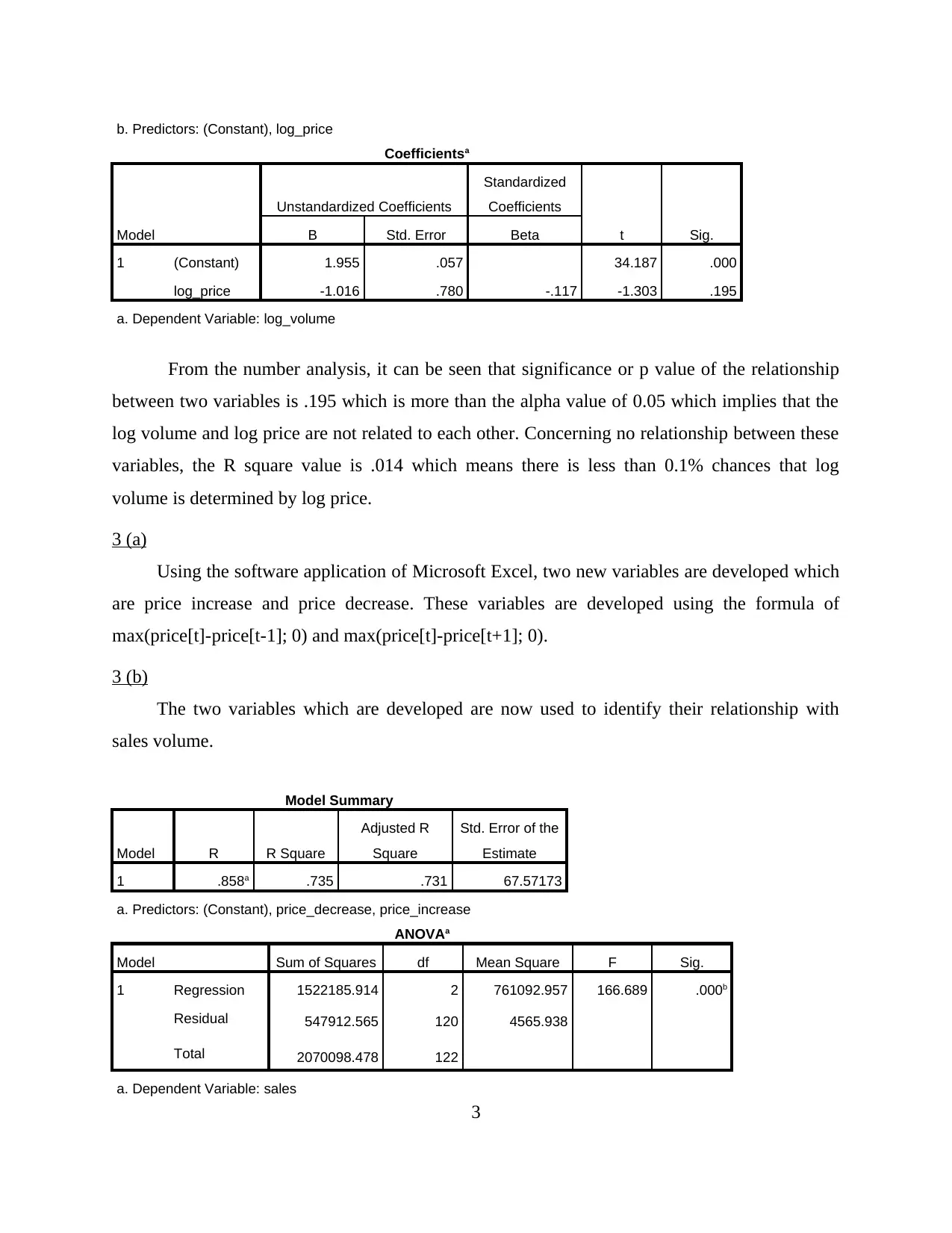

From the number analysis, it can be seen that significance or p value of the relationship

between two variables is .195 which is more than the alpha value of 0.05 which implies that the

log volume and log price are not related to each other. Concerning no relationship between these

variables, the R square value is .014 which means there is less than 0.1% chances that log

volume is determined by log price.

3 (a)

Using the software application of Microsoft Excel, two new variables are developed which

are price increase and price decrease. These variables are developed using the formula of

max(price[t]-price[t-1]; 0) and max(price[t]-price[t+1]; 0).

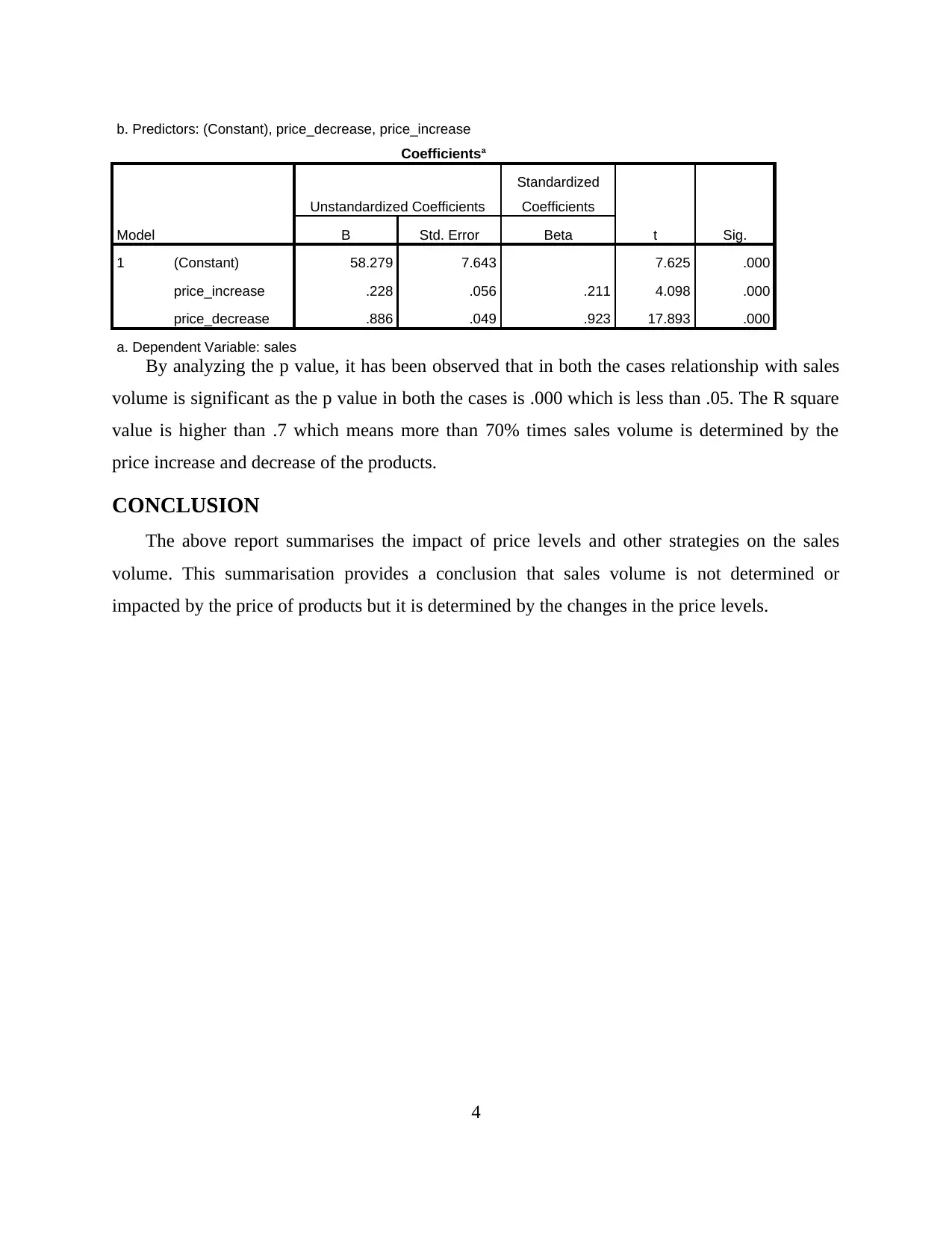

3 (b)

The two variables which are developed are now used to identify their relationship with

sales volume.

Model Summary

Model R R Square

Adjusted R

Square

Std. Error of the

Estimate

1 .858a .735 .731 67.57173

a. Predictors: (Constant), price_decrease, price_increase

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1 Regression 1522185.914 2 761092.957 166.689 .000b

Residual 547912.565 120 4565.938

Total 2070098.478 122

a. Dependent Variable: sales

3

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig.B Std. Error Beta

1 (Constant) 1.955 .057 34.187 .000

log_price -1.016 .780 -.117 -1.303 .195

a. Dependent Variable: log_volume

From the number analysis, it can be seen that significance or p value of the relationship

between two variables is .195 which is more than the alpha value of 0.05 which implies that the

log volume and log price are not related to each other. Concerning no relationship between these

variables, the R square value is .014 which means there is less than 0.1% chances that log

volume is determined by log price.

3 (a)

Using the software application of Microsoft Excel, two new variables are developed which

are price increase and price decrease. These variables are developed using the formula of

max(price[t]-price[t-1]; 0) and max(price[t]-price[t+1]; 0).

3 (b)

The two variables which are developed are now used to identify their relationship with

sales volume.

Model Summary

Model R R Square

Adjusted R

Square

Std. Error of the

Estimate

1 .858a .735 .731 67.57173

a. Predictors: (Constant), price_decrease, price_increase

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1 Regression 1522185.914 2 761092.957 166.689 .000b

Residual 547912.565 120 4565.938

Total 2070098.478 122

a. Dependent Variable: sales

3

b. Predictors: (Constant), price_decrease, price_increase

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig.B Std. Error Beta

1 (Constant) 58.279 7.643 7.625 .000

price_increase .228 .056 .211 4.098 .000

price_decrease .886 .049 .923 17.893 .000

a. Dependent Variable: sales

By analyzing the p value, it has been observed that in both the cases relationship with sales

volume is significant as the p value in both the cases is .000 which is less than .05. The R square

value is higher than .7 which means more than 70% times sales volume is determined by the

price increase and decrease of the products.

CONCLUSION

The above report summarises the impact of price levels and other strategies on the sales

volume. This summarisation provides a conclusion that sales volume is not determined or

impacted by the price of products but it is determined by the changes in the price levels.

4

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig.B Std. Error Beta

1 (Constant) 58.279 7.643 7.625 .000

price_increase .228 .056 .211 4.098 .000

price_decrease .886 .049 .923 17.893 .000

a. Dependent Variable: sales

By analyzing the p value, it has been observed that in both the cases relationship with sales

volume is significant as the p value in both the cases is .000 which is less than .05. The R square

value is higher than .7 which means more than 70% times sales volume is determined by the

price increase and decrease of the products.

CONCLUSION

The above report summarises the impact of price levels and other strategies on the sales

volume. This summarisation provides a conclusion that sales volume is not determined or

impacted by the price of products but it is determined by the changes in the price levels.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.