HA1022 Principals of Financial Markets: Group Assignment Report

VerifiedAdded on 2023/03/29

|17

|979

|76

Report

AI Summary

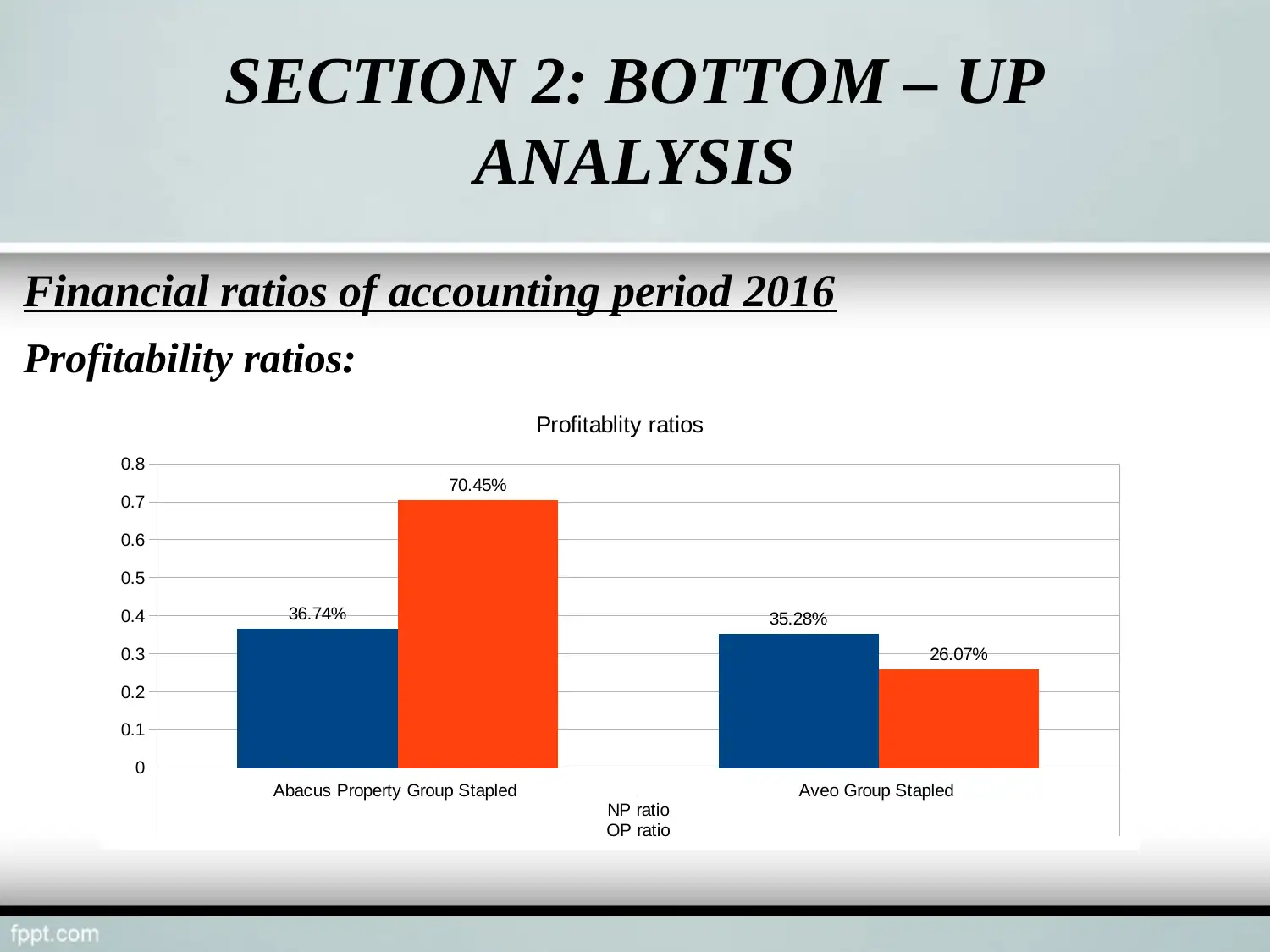

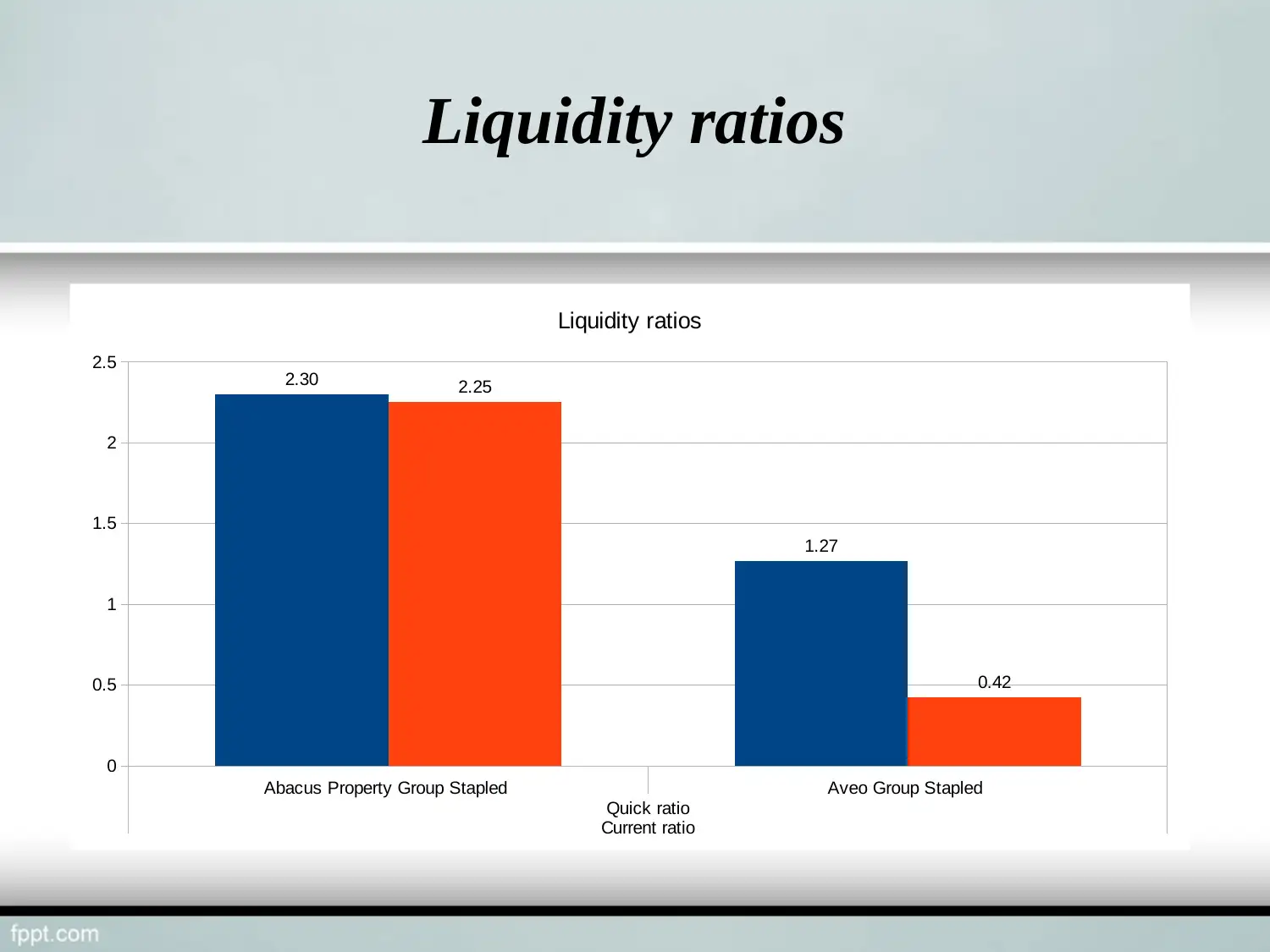

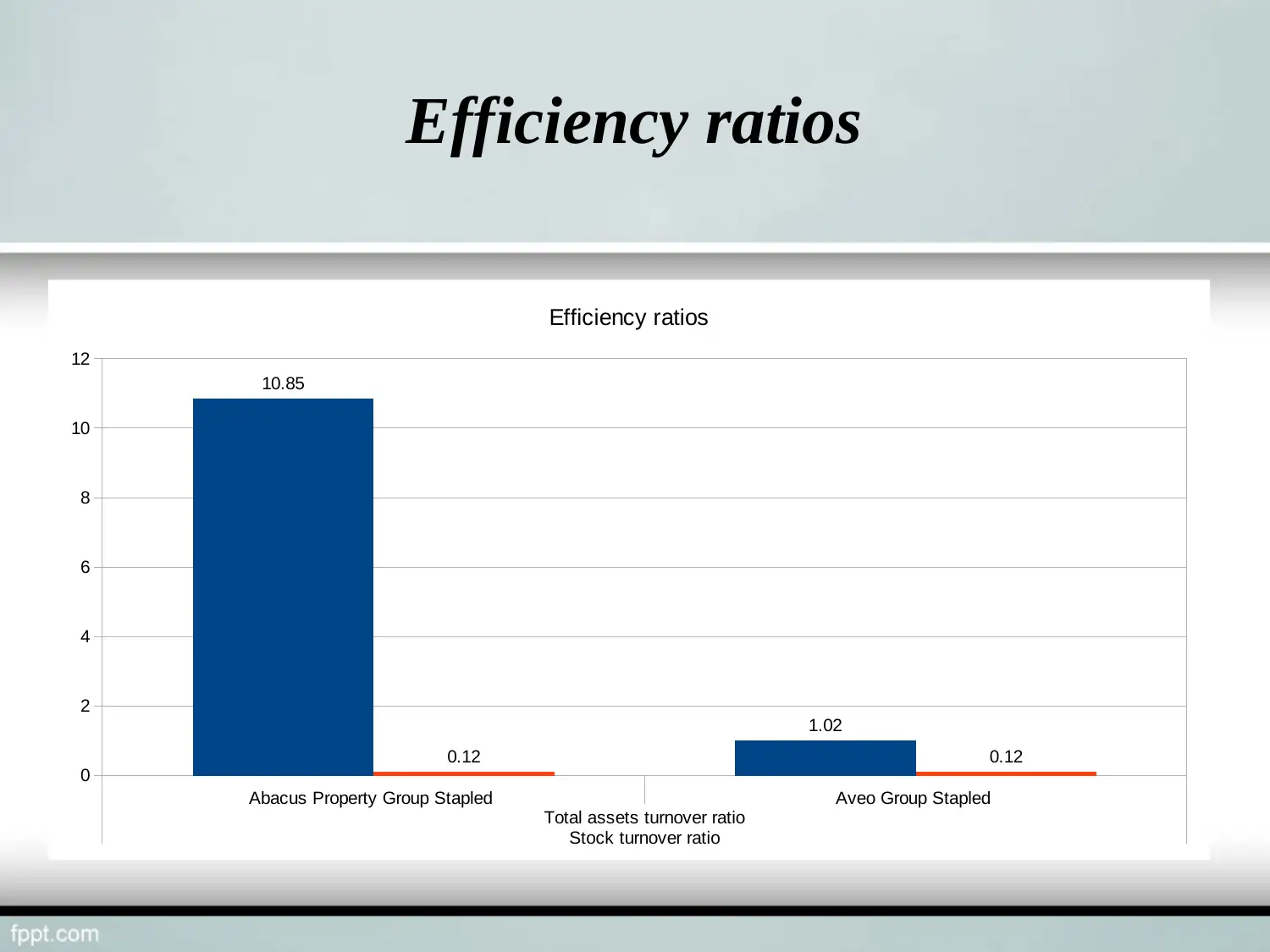

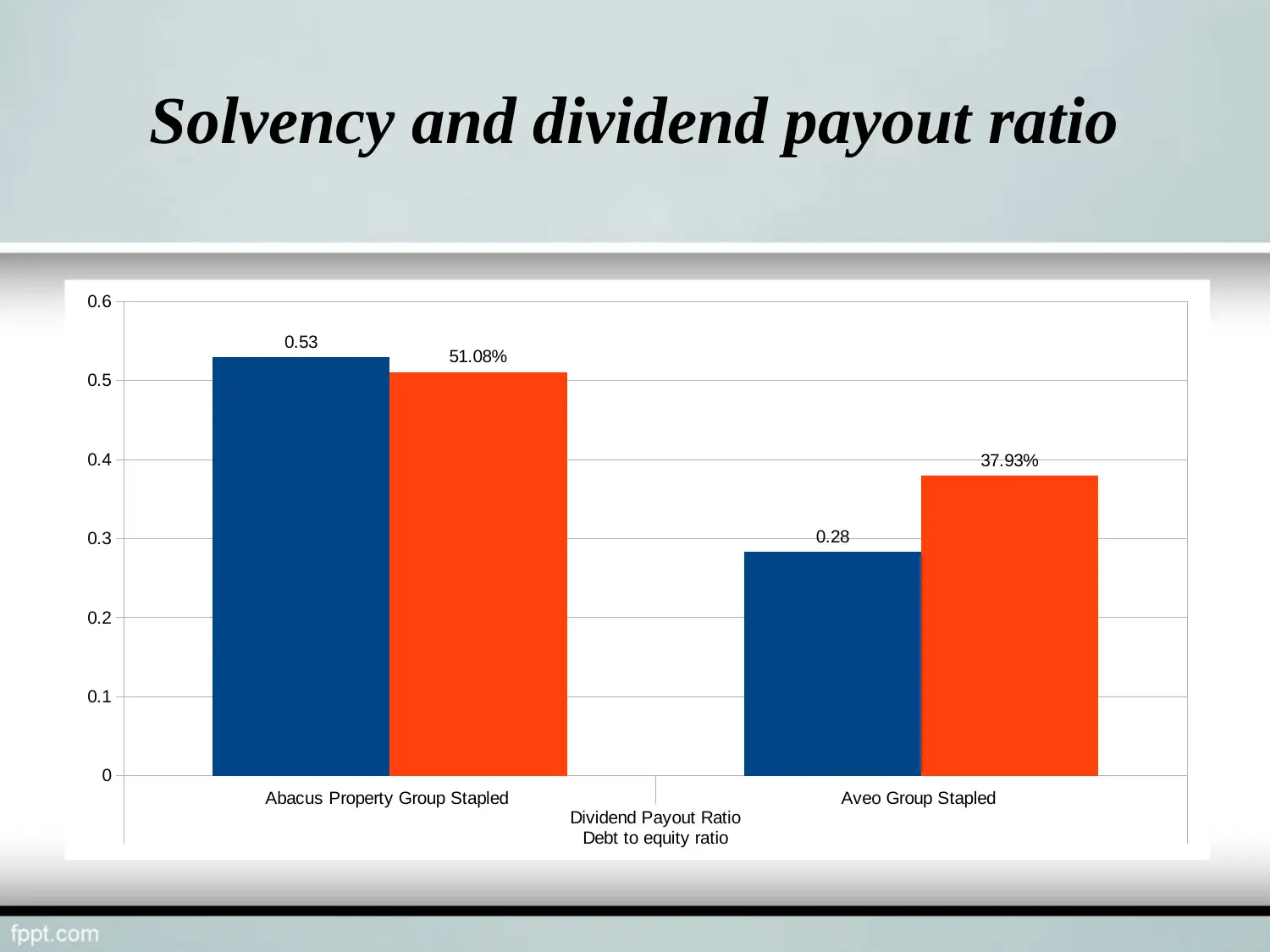

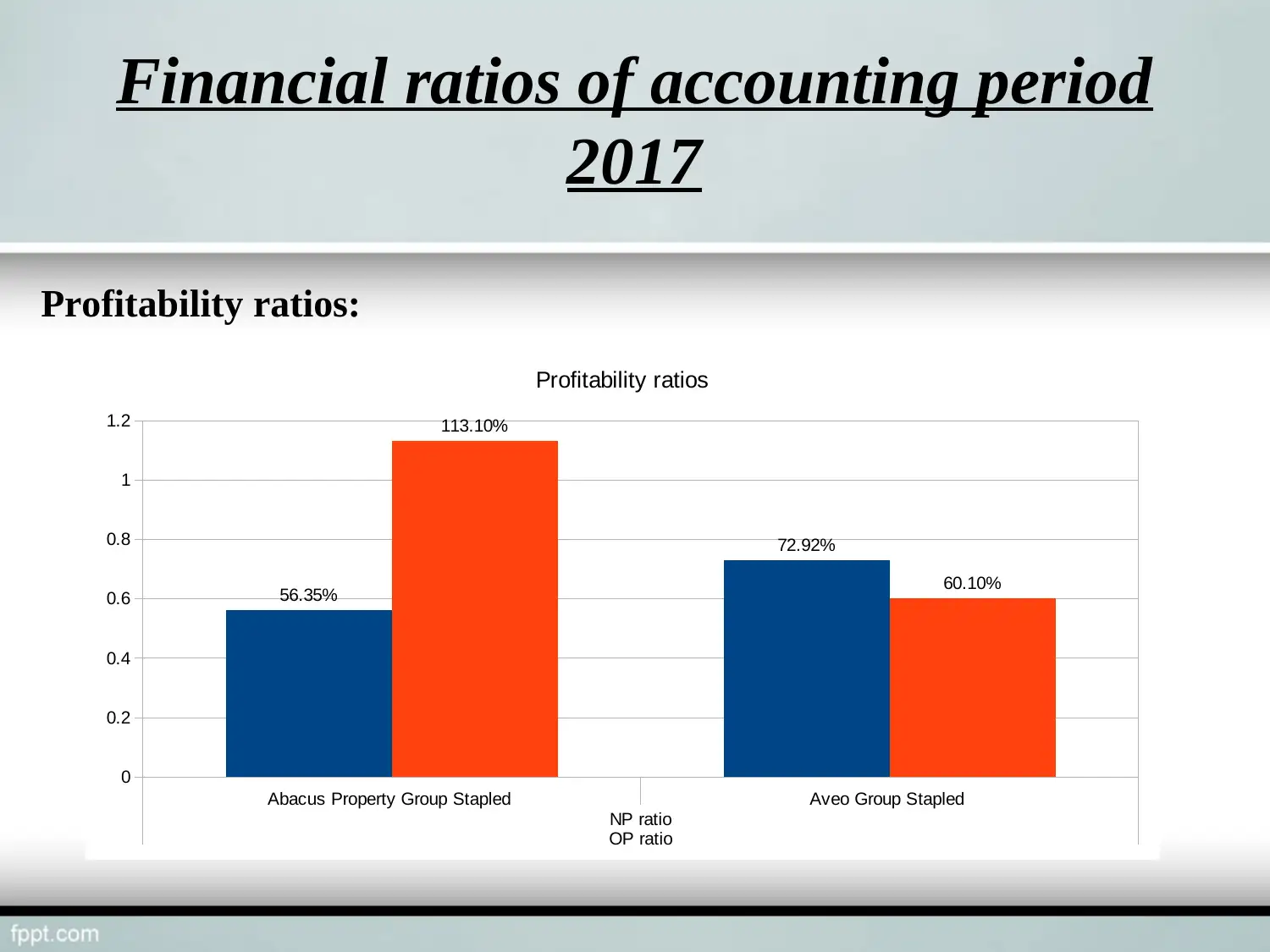

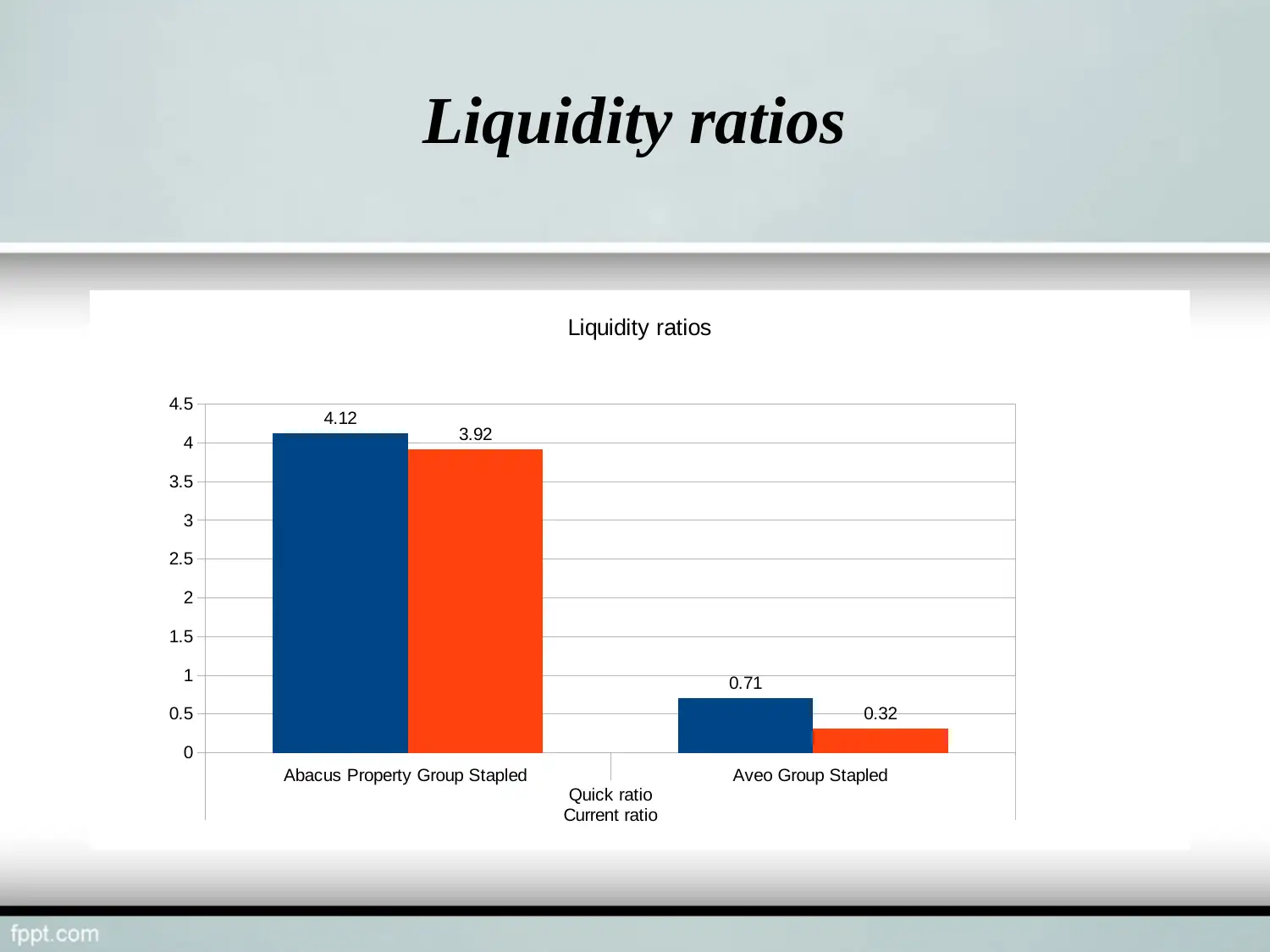

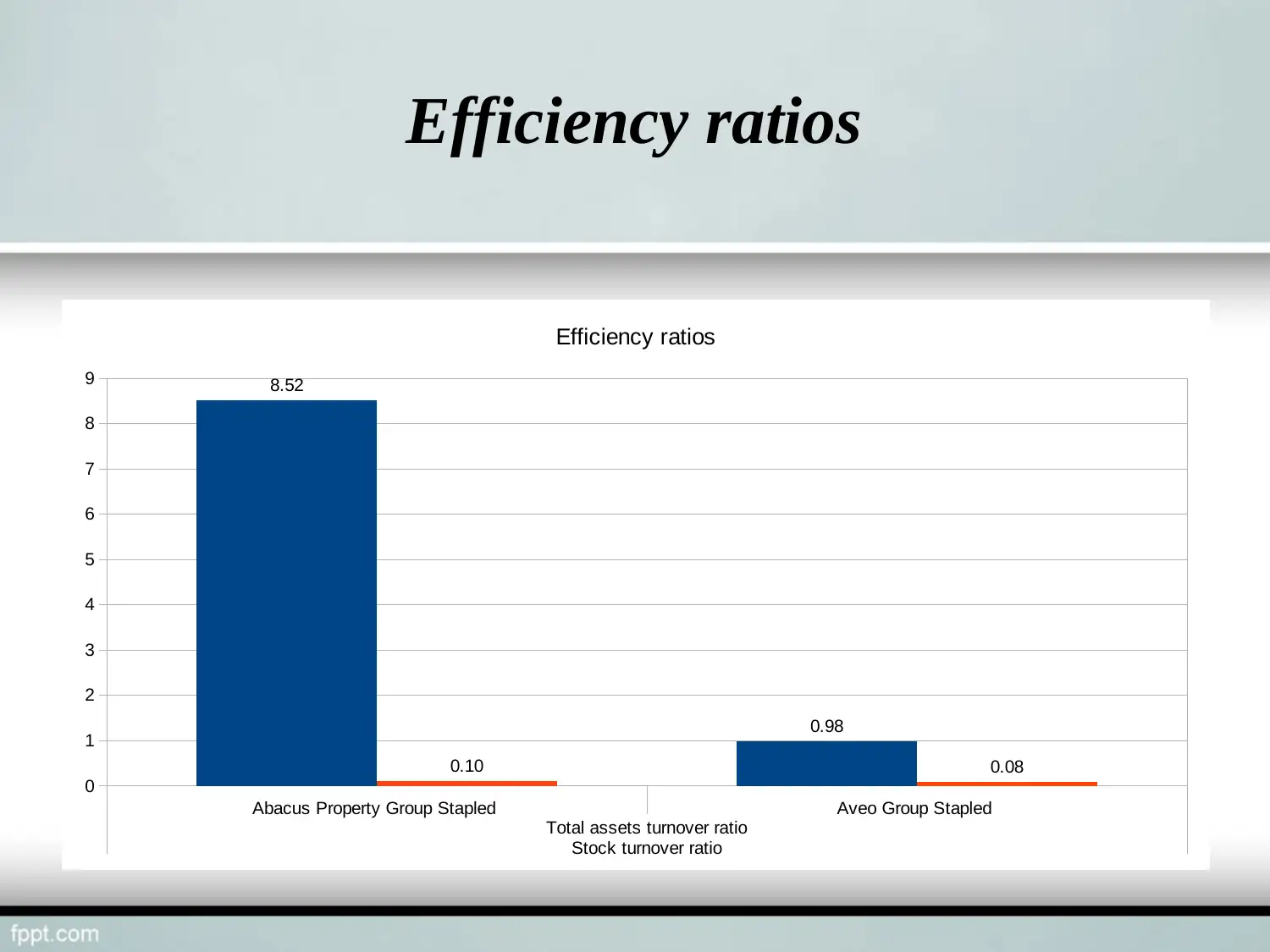

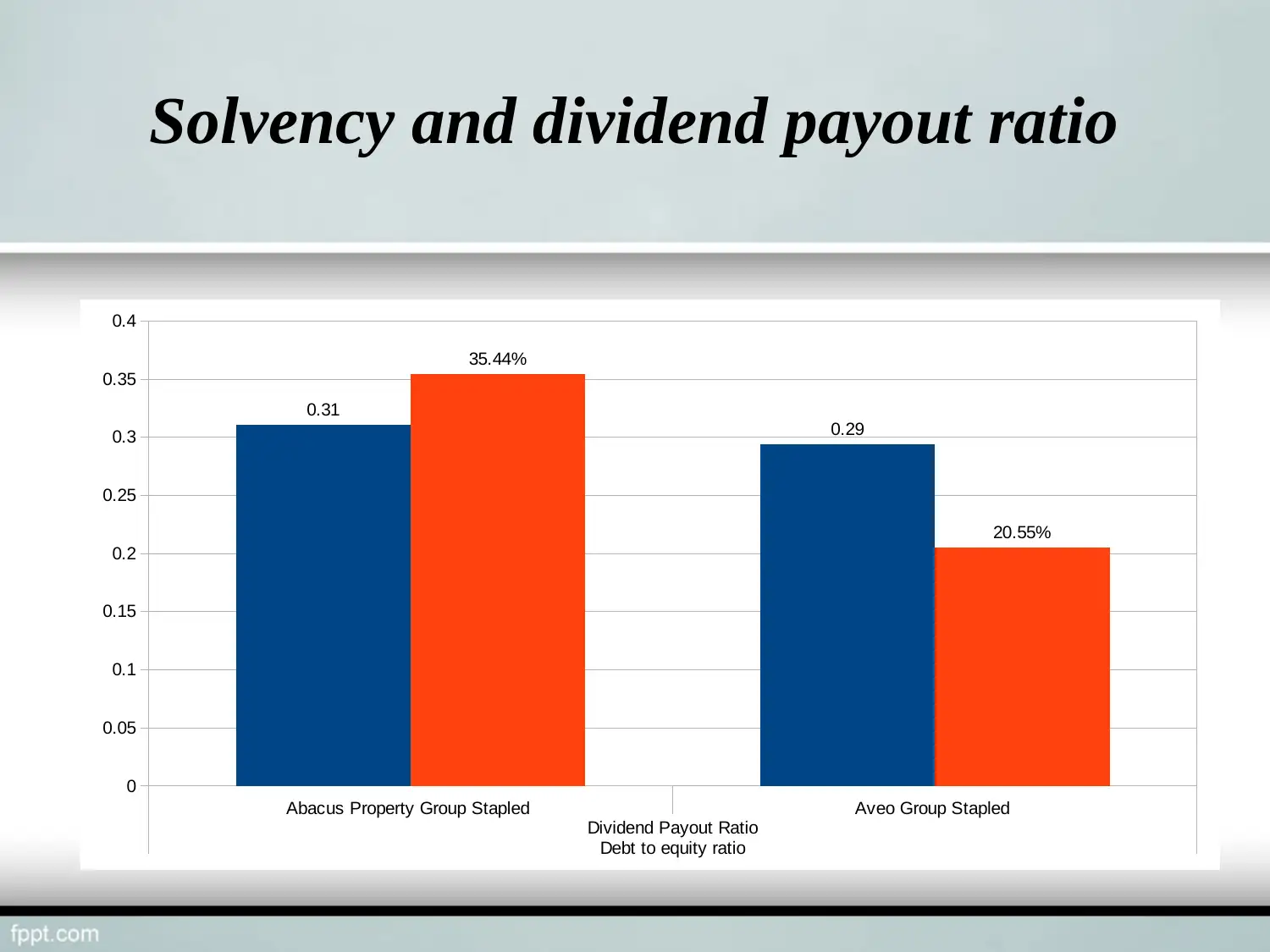

This report presents a financial analysis of Abacus Property Group Stapled (ABP) and Aveo Group Stapled (AOG), both listed on the ASX, within the real estate industry. It examines the impact of economic fundamentals, including interest rates, currency value, GDP, inflation, and exchange rates, on company performance and share prices through a top-down analysis. A bottom-up analysis delves into financial ratios for 2016 and 2017, comparing profitability, liquidity, efficiency, and solvency ratios against industry standards. The report concludes that economic factors significantly influence share prices and that Abacus generally outperforms Aveo. It provides recommendations for both companies, such as cost management for Aveo and equity over debentures for Abacus, as well as investment advice for investors. The analysis utilizes data from various financial periods and industry benchmarks to provide a comprehensive view of the companies' financial health and market performance.

1 out of 17

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)