Financial Analysis Report: Principles of Financial Markets

VerifiedAdded on 2020/03/28

|21

|4225

|455

Report

AI Summary

This report conducts a comprehensive financial analysis of Origin Energy Limited and Caltex Australia Limited, key players in the Australian energy sector. It begins with an executive summary and introduction, followed by a top-down analysis of macroeconomic factors such as GDP, interest rates, currency value, inflation, and unemployment, assessing their impact on the energy industry. A bottom-up analysis then evaluates the companies' financial performance through liquidity, profitability, efficiency, capital structure, and market performance ratios. The report provides detailed descriptions of each ratio category and concludes with recommendations based on the findings. The analysis incorporates data from 2017 to compare the financial health and operational efficiency of the two companies, offering insights into their strategic positions within the dynamic energy market.

Financial Analysis 1

Principles of Financial Markets

Principles of Financial Markets

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis 2

Table of Contents

Executive Summary.........................................................................................................................3

Introduction......................................................................................................................................4

Origin Energy Limited.................................................................................................................4

Caltex Australia Limited..............................................................................................................5

Top-down analysis...........................................................................................................................7

Existing Gross Domestic Product (GDP).....................................................................................7

Existing interest rate.....................................................................................................................8

Existing value of currency of Australia.......................................................................................8

Existing inflation rate...................................................................................................................9

Existing rate of unemployment....................................................................................................9

Bottom up Analysis.......................................................................................................................10

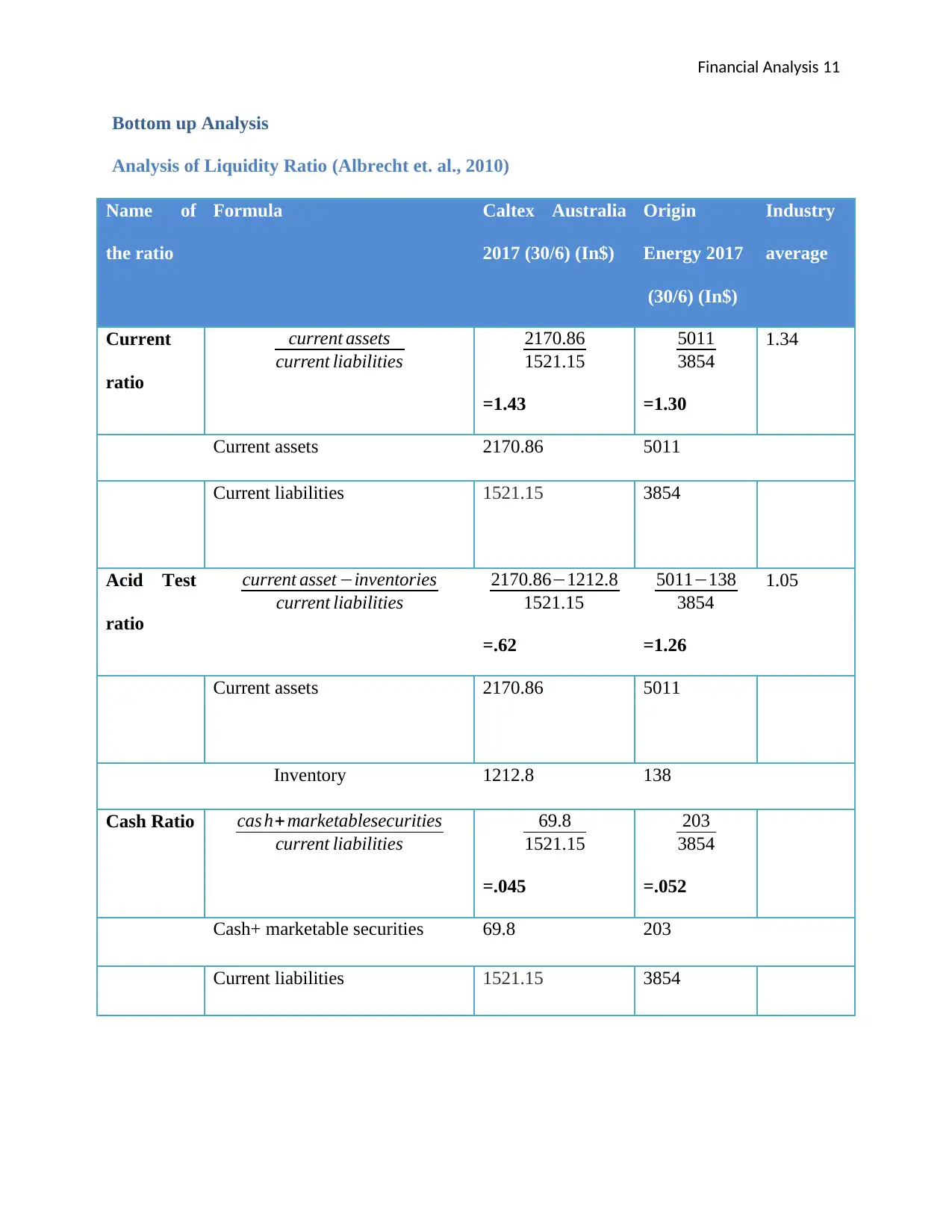

Analysis of Liquidity Ratio (Albrecht et. al., 2010)..................................................................10

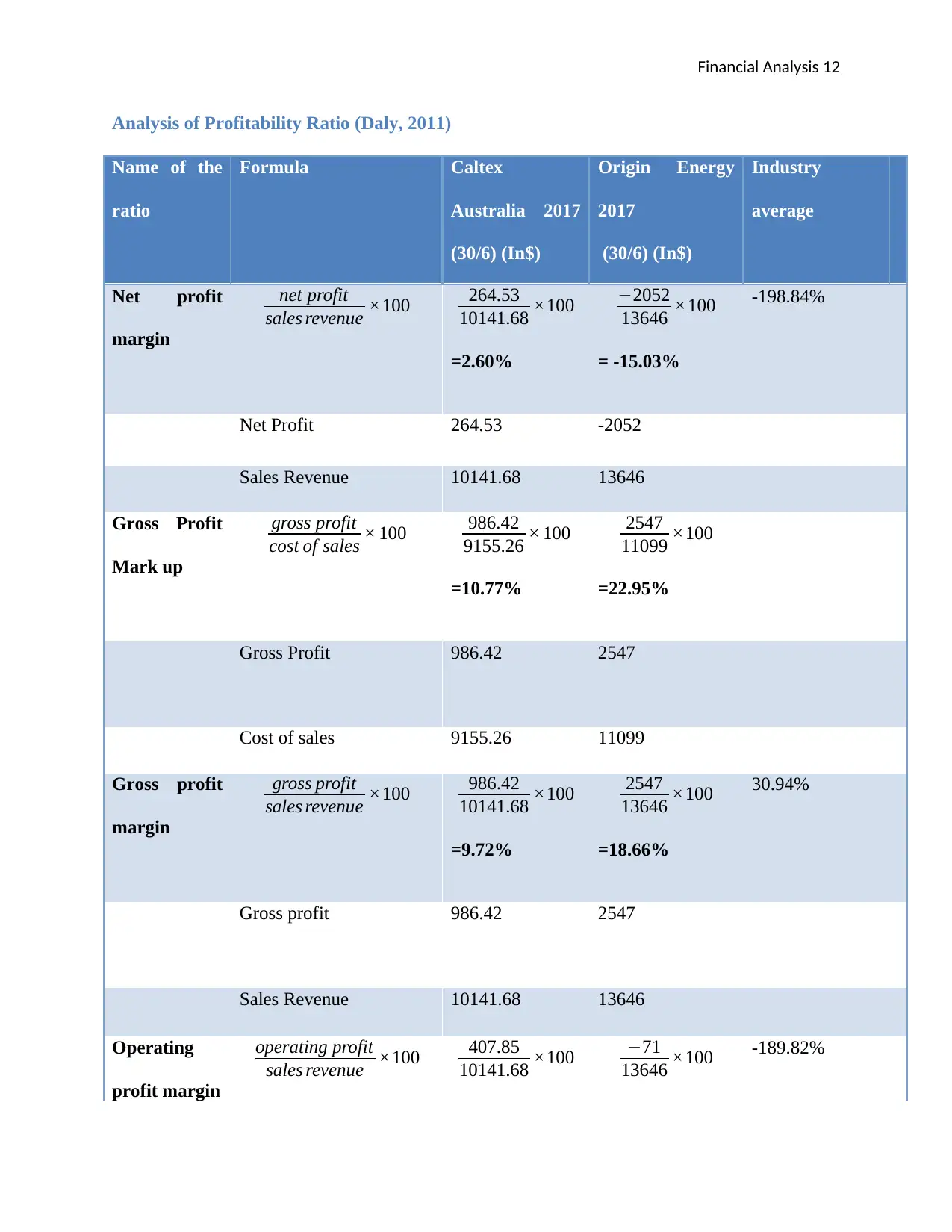

Analysis of Profitability Ratio (Daly, 2011)..............................................................................11

Analysis of Efficiency Ratio (Coe, 2011)..................................................................................12

Analysis of Capital Structure ratio.............................................................................................13

Analysis of Market Performance ratio.......................................................................................14

Ratio Analysis................................................................................................................................15

Description of Liquidity Ratio...................................................................................................15

Table of Contents

Executive Summary.........................................................................................................................3

Introduction......................................................................................................................................4

Origin Energy Limited.................................................................................................................4

Caltex Australia Limited..............................................................................................................5

Top-down analysis...........................................................................................................................7

Existing Gross Domestic Product (GDP).....................................................................................7

Existing interest rate.....................................................................................................................8

Existing value of currency of Australia.......................................................................................8

Existing inflation rate...................................................................................................................9

Existing rate of unemployment....................................................................................................9

Bottom up Analysis.......................................................................................................................10

Analysis of Liquidity Ratio (Albrecht et. al., 2010)..................................................................10

Analysis of Profitability Ratio (Daly, 2011)..............................................................................11

Analysis of Efficiency Ratio (Coe, 2011)..................................................................................12

Analysis of Capital Structure ratio.............................................................................................13

Analysis of Market Performance ratio.......................................................................................14

Ratio Analysis................................................................................................................................15

Description of Liquidity Ratio...................................................................................................15

Financial Analysis 3

Description of Profitability Ratio...............................................................................................16

Description of Efficiency Ratio.................................................................................................17

Description of capital structure Ratio........................................................................................17

Description of Market Performance ratio..................................................................................17

Conclusion.....................................................................................................................................18

Recommendations..........................................................................................................................18

References......................................................................................................................................19

Description of Profitability Ratio...............................................................................................16

Description of Efficiency Ratio.................................................................................................17

Description of capital structure Ratio........................................................................................17

Description of Market Performance ratio..................................................................................17

Conclusion.....................................................................................................................................18

Recommendations..........................................................................................................................18

References......................................................................................................................................19

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Analysis 4

Executive Summary

Economic analysis and financial analysis are very important components to identify the factors

which influence the financial performance of any company and decision of investors for the

purpose of investment. The overall report determined the current situation of companies Origin

Energy Limited and Caltex Australia Limited in the energy sector in Australia.

Top down analysis and bottom up analysis have been conducted for the purpose of finding

impact of economic environment of country on the performance of both the companies in energy

sector and to analyze and compare the financial performance of companies in terms of industry.

Various factors are considered in top down analysis such as current growth rate of GDP, inflation

rate, unemployment rate and interest rate which have direct and indirect impact on the energy

sector in Australia. Financial performances of both the companies are compared with the help of

different ratios such as operating ratio, profitability, liquidity, efficiency and ratios which shows

capital structure of the companies.

Executive Summary

Economic analysis and financial analysis are very important components to identify the factors

which influence the financial performance of any company and decision of investors for the

purpose of investment. The overall report determined the current situation of companies Origin

Energy Limited and Caltex Australia Limited in the energy sector in Australia.

Top down analysis and bottom up analysis have been conducted for the purpose of finding

impact of economic environment of country on the performance of both the companies in energy

sector and to analyze and compare the financial performance of companies in terms of industry.

Various factors are considered in top down analysis such as current growth rate of GDP, inflation

rate, unemployment rate and interest rate which have direct and indirect impact on the energy

sector in Australia. Financial performances of both the companies are compared with the help of

different ratios such as operating ratio, profitability, liquidity, efficiency and ratios which shows

capital structure of the companies.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis 5

Introduction

In this report micro and macro economic analysis and financial analysis of the companies Origin

Energy Limited and Caltex Australia Limited in the energy and gas industry in Australia will be

conducted. The companies under the energy sector of Australia which are listed in the Australian

Stock Exchange mainly involved in the growth and development and exploration of oil, coal,

gas, uranium and renewable energy resources. There is largest contribution of the energy sector

in generating revenue and in enhancing the rate of Gross Domestic Product and the growth and

development of economy of Australia (Bahadori, et al., 2013). Natural resources and energy

generating resources are available in large quantity in Australia. Australia is largest provider of

uranium and LNG and one of the biggest exporters of coal in the whole world and particularly in

the regions of Asia. Energy sector also provides largest contribution in boosting capital market of

the country and known by largest developed and growing market in the economy.

Origin Energy Limited

Origin Energy is one of the biggest and leading companies in the Oil and Energy Industry of

Australia headquartered in Australian Square, Sydney. The company mainly involves in the

buying, generating, selling, exploration and delivery of natural gas and energy in Australia and

worldwide (Origin, 2017). Origin Energy Company was found in 2000 because of the separation

from another company Boral Ltd. for the purpose of forming a new and single company in

energy sector. From the year 2002 to 2015 Origin Company was involved in merger and

acquisition and conducted deals with various companies in energy sector worldwide such as

Victorian electricity, Kupe Gas Field, Contact Energy of New Zealand, Sun Retail Private

Limited and Eraring Energy. The major products and services of the Origin Energy Company are

natural gas, electric vehicle charging services, electricity, solar panels, cooling and heating, LPG,

Introduction

In this report micro and macro economic analysis and financial analysis of the companies Origin

Energy Limited and Caltex Australia Limited in the energy and gas industry in Australia will be

conducted. The companies under the energy sector of Australia which are listed in the Australian

Stock Exchange mainly involved in the growth and development and exploration of oil, coal,

gas, uranium and renewable energy resources. There is largest contribution of the energy sector

in generating revenue and in enhancing the rate of Gross Domestic Product and the growth and

development of economy of Australia (Bahadori, et al., 2013). Natural resources and energy

generating resources are available in large quantity in Australia. Australia is largest provider of

uranium and LNG and one of the biggest exporters of coal in the whole world and particularly in

the regions of Asia. Energy sector also provides largest contribution in boosting capital market of

the country and known by largest developed and growing market in the economy.

Origin Energy Limited

Origin Energy is one of the biggest and leading companies in the Oil and Energy Industry of

Australia headquartered in Australian Square, Sydney. The company mainly involves in the

buying, generating, selling, exploration and delivery of natural gas and energy in Australia and

worldwide (Origin, 2017). Origin Energy Company was found in 2000 because of the separation

from another company Boral Ltd. for the purpose of forming a new and single company in

energy sector. From the year 2002 to 2015 Origin Company was involved in merger and

acquisition and conducted deals with various companies in energy sector worldwide such as

Victorian electricity, Kupe Gas Field, Contact Energy of New Zealand, Sun Retail Private

Limited and Eraring Energy. The major products and services of the Origin Energy Company are

natural gas, electric vehicle charging services, electricity, solar panels, cooling and heating, LPG,

Financial Analysis 6

and hot water (Origin, 2017). It is also one of the largest suppliers of products of less carbon

which includes Green Gas and electricity of Green Power for the purpose of reducing pollution

in the environment.

Origin is the biggest retailer in energy sector in Australia having 4500 million consumers

worldwide which includes residential customers and small and big market customers with 9000

employees working currently (Origin, 2017). Origin is also provider of renewable energy with

the use of upgraded technology like solar cell technology, wind and geothermal power plant.

Natural gas and coal are considered as natural sources of energy which are utilized by company

for generating the electricity. Mission statement of the company is to offer reliable, secure and

affordable energy services to customers and communities and provide better opportunities for

shareholders, communities, customers and business partners.

Caltex Australia Limited

Caltex was found in 1936 known as California Texas Oil Company as a result of merger between

the Standard Oil in California and Texas Company headquartered in Sydney. In the year 1968, it

was received the name Caltex Petroleum Corporations. Caltex is the biggest retail company in

the sector of oil and fuel industry having approximately 1850 service outlets in Australia (Caltex,

2017). Major products offered by the company are Petrol, Autogas, Motor oil, Diesel, Lubricants

and different retail stores such as Star Mart, Woolworths and Star Shop. This company is

providing its products and services in Australia as well as worldwide such as New Zealand,

China, Malaysia, Hong Kong, Philippines, South Africa, India, Taiwan and South Korea.

As the leading company in Australia in the oil, gas and fuel sector it is fulfilling the needs of one

third customers in Australia of fuel requirement for transport. With the help of exclusive supply

chain management it is supplying reliable, affordable, safe and best quality of fuel for different

and hot water (Origin, 2017). It is also one of the largest suppliers of products of less carbon

which includes Green Gas and electricity of Green Power for the purpose of reducing pollution

in the environment.

Origin is the biggest retailer in energy sector in Australia having 4500 million consumers

worldwide which includes residential customers and small and big market customers with 9000

employees working currently (Origin, 2017). Origin is also provider of renewable energy with

the use of upgraded technology like solar cell technology, wind and geothermal power plant.

Natural gas and coal are considered as natural sources of energy which are utilized by company

for generating the electricity. Mission statement of the company is to offer reliable, secure and

affordable energy services to customers and communities and provide better opportunities for

shareholders, communities, customers and business partners.

Caltex Australia Limited

Caltex was found in 1936 known as California Texas Oil Company as a result of merger between

the Standard Oil in California and Texas Company headquartered in Sydney. In the year 1968, it

was received the name Caltex Petroleum Corporations. Caltex is the biggest retail company in

the sector of oil and fuel industry having approximately 1850 service outlets in Australia (Caltex,

2017). Major products offered by the company are Petrol, Autogas, Motor oil, Diesel, Lubricants

and different retail stores such as Star Mart, Woolworths and Star Shop. This company is

providing its products and services in Australia as well as worldwide such as New Zealand,

China, Malaysia, Hong Kong, Philippines, South Africa, India, Taiwan and South Korea.

As the leading company in Australia in the oil, gas and fuel sector it is fulfilling the needs of one

third customers in Australia of fuel requirement for transport. With the help of exclusive supply

chain management it is supplying reliable, affordable, safe and best quality of fuel for different

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Analysis 7

categories of customers such as small enterprises, retailers, aviation, marine, agriculture,

transport, automobile industries, big enterprises, mining and to the government institutions

(Caltex, 2017). Mission statement of the company is to offer best quality of fuel with reliable

supply and to generate job opportunities and help in growth and development of economy by

increasing productivity of country in the sector of oil and fuel. It is also known as biggest

franchisor and exclusive retailer as more than 80% of the outlets controlled by franchisees.

categories of customers such as small enterprises, retailers, aviation, marine, agriculture,

transport, automobile industries, big enterprises, mining and to the government institutions

(Caltex, 2017). Mission statement of the company is to offer best quality of fuel with reliable

supply and to generate job opportunities and help in growth and development of economy by

increasing productivity of country in the sector of oil and fuel. It is also known as biggest

franchisor and exclusive retailer as more than 80% of the outlets controlled by franchisees.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis 8

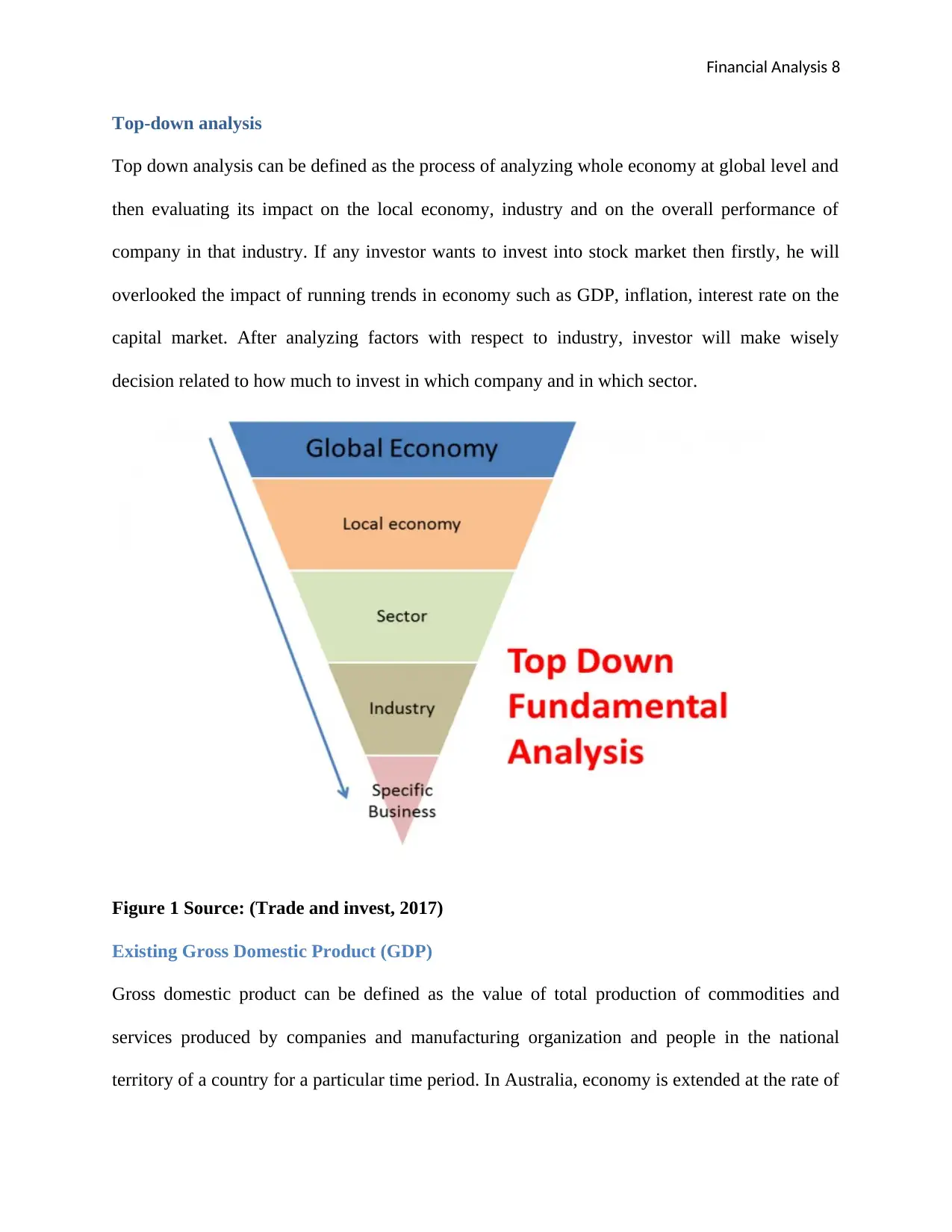

Top-down analysis

Top down analysis can be defined as the process of analyzing whole economy at global level and

then evaluating its impact on the local economy, industry and on the overall performance of

company in that industry. If any investor wants to invest into stock market then firstly, he will

overlooked the impact of running trends in economy such as GDP, inflation, interest rate on the

capital market. After analyzing factors with respect to industry, investor will make wisely

decision related to how much to invest in which company and in which sector.

Figure 1 Source: (Trade and invest, 2017)

Existing Gross Domestic Product (GDP)

Gross domestic product can be defined as the value of total production of commodities and

services produced by companies and manufacturing organization and people in the national

territory of a country for a particular time period. In Australia, economy is extended at the rate of

Top-down analysis

Top down analysis can be defined as the process of analyzing whole economy at global level and

then evaluating its impact on the local economy, industry and on the overall performance of

company in that industry. If any investor wants to invest into stock market then firstly, he will

overlooked the impact of running trends in economy such as GDP, inflation, interest rate on the

capital market. After analyzing factors with respect to industry, investor will make wisely

decision related to how much to invest in which company and in which sector.

Figure 1 Source: (Trade and invest, 2017)

Existing Gross Domestic Product (GDP)

Gross domestic product can be defined as the value of total production of commodities and

services produced by companies and manufacturing organization and people in the national

territory of a country for a particular time period. In Australia, economy is extended at the rate of

Financial Analysis 9

0.8 percent in the II quarter of June with comparison to the very slow growth rate in March

which was 0.3 percent in the financial year 2017. In 2016, the rate of GDP on annual basis was

1.8 percent. The main reasons behind the increasing growth rate in June month are increase in

the rate of consumption of government and domestic and positive expansion in the total exports

of country (Global Finance, 2017). If GDP is increasing in Australia, it will bring positive impact

on the industry of energy, oil and gas as overall economy will boost up then performances of

both the companies Origin Energy Limited and Caltex Australia Limited will also be favorable.

Existing interest rate

Interest rate can be defined as the rate which is charged by the lender of money against the

amount borrowed by the borrower of that money (Salgado, 2017). It is normally decided by the

Reserve Bank of Australia. In 2017, interest rate is 1.5 percent with compared to same interest

rate 1.5 percent in the year 2016 in Australia which is seen unchanged. In 2015 the rate of

interest was 2 percent, it can be analyzed that rate is decreasing in the year 2016 and 2017.

Origin Energy Limited and Caltex Australia Limited both the companies have favorable situation

in economy from the decreasing interest rate as companies can easily take finance from different

financial institutions at low rate.

Existing value of currency of Australia

Value of currency is also known as exchange rate which can be defined as the rate at which

currency of one country can be converted in the currency of another country (OECD, 2017). The

present exchange rate of one AUD is equal to 0.8034 US $ in 2017. Energy sector in Australia

mainly deals in the export of oil, electricity and gas worldwide. If the value of one AUD will

increase in future in comparison to other countries it will bring favorable outcome for the

performances of both the companies in Energy sector and help in generating more revenue.

0.8 percent in the II quarter of June with comparison to the very slow growth rate in March

which was 0.3 percent in the financial year 2017. In 2016, the rate of GDP on annual basis was

1.8 percent. The main reasons behind the increasing growth rate in June month are increase in

the rate of consumption of government and domestic and positive expansion in the total exports

of country (Global Finance, 2017). If GDP is increasing in Australia, it will bring positive impact

on the industry of energy, oil and gas as overall economy will boost up then performances of

both the companies Origin Energy Limited and Caltex Australia Limited will also be favorable.

Existing interest rate

Interest rate can be defined as the rate which is charged by the lender of money against the

amount borrowed by the borrower of that money (Salgado, 2017). It is normally decided by the

Reserve Bank of Australia. In 2017, interest rate is 1.5 percent with compared to same interest

rate 1.5 percent in the year 2016 in Australia which is seen unchanged. In 2015 the rate of

interest was 2 percent, it can be analyzed that rate is decreasing in the year 2016 and 2017.

Origin Energy Limited and Caltex Australia Limited both the companies have favorable situation

in economy from the decreasing interest rate as companies can easily take finance from different

financial institutions at low rate.

Existing value of currency of Australia

Value of currency is also known as exchange rate which can be defined as the rate at which

currency of one country can be converted in the currency of another country (OECD, 2017). The

present exchange rate of one AUD is equal to 0.8034 US $ in 2017. Energy sector in Australia

mainly deals in the export of oil, electricity and gas worldwide. If the value of one AUD will

increase in future in comparison to other countries it will bring favorable outcome for the

performances of both the companies in Energy sector and help in generating more revenue.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Analysis 10

Existing inflation rate

Inflation is the situation in a country when all the prices of commodities will be rising and

demand of goods and services will be increased (Baker, et al., 2016). As a result of increase in

per capita income, demand will rise and supply of products will reduces which leads to growing

in the prices of products and services. Inflation rate in Australia in the year 2017 is 1.5 percent

which is more in comparison to 1.3 percent in 2016 (OECD, 2017). As increase in inflation rate

is beneficial for the companies Origin Energy Limited and Caltex Australia Limited because

increase in demand and prices will help in generating more revenue and but will be less

favorable for country because supply will reduce.

Existing rate of unemployment

Unemployment rate is the rate which shows how many persons are not having any source of

earning and looking for the employment opportunities for earning money. Australian government

conducts various programmes which aware people about different employment opportunities and

help in incorporation of new companies which can create new job opportunities for local people.

Current rate of unemployment is decreasing in Australia as 5.61% in the month of August from

5.699 % in the month of June in 2017 as approximately 26000 more jobs was created in the

month of July (Fieger, et al., 2017). As more persons get employment the per capita income will

increase which tends to increase in consumption level of people which is favorable situation for

energy sector in Australia.

Existing inflation rate

Inflation is the situation in a country when all the prices of commodities will be rising and

demand of goods and services will be increased (Baker, et al., 2016). As a result of increase in

per capita income, demand will rise and supply of products will reduces which leads to growing

in the prices of products and services. Inflation rate in Australia in the year 2017 is 1.5 percent

which is more in comparison to 1.3 percent in 2016 (OECD, 2017). As increase in inflation rate

is beneficial for the companies Origin Energy Limited and Caltex Australia Limited because

increase in demand and prices will help in generating more revenue and but will be less

favorable for country because supply will reduce.

Existing rate of unemployment

Unemployment rate is the rate which shows how many persons are not having any source of

earning and looking for the employment opportunities for earning money. Australian government

conducts various programmes which aware people about different employment opportunities and

help in incorporation of new companies which can create new job opportunities for local people.

Current rate of unemployment is decreasing in Australia as 5.61% in the month of August from

5.699 % in the month of June in 2017 as approximately 26000 more jobs was created in the

month of July (Fieger, et al., 2017). As more persons get employment the per capita income will

increase which tends to increase in consumption level of people which is favorable situation for

energy sector in Australia.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis 11

Bottom up Analysis

Analysis of Liquidity Ratio (Albrecht et. al., 2010)

Name of

the ratio

Formula Caltex Australia

2017 (30/6) (In$)

Origin

Energy 2017

(30/6) (In$)

Industry

average

Current

ratio

current assets

current liabilities

2170.86

1521.15

=1.43

5011

3854

=1.30

1.34

Current assets 2170.86 5011

Current liabilities 1521.15 3854

Acid Test

ratio

current asset −inventories

current liabilities

2170.86−1212.8

1521.15

=.62

5011−138

3854

=1.26

1.05

Current assets 2170.86 5011

Inventory 1212.8 138

Cash Ratio cas h+ marketablesecurities

current liabilities

69.8

1521.15

=.045

203

3854

=.052

Cash+ marketable securities 69.8 203

Current liabilities 1521.15 3854

Bottom up Analysis

Analysis of Liquidity Ratio (Albrecht et. al., 2010)

Name of

the ratio

Formula Caltex Australia

2017 (30/6) (In$)

Origin

Energy 2017

(30/6) (In$)

Industry

average

Current

ratio

current assets

current liabilities

2170.86

1521.15

=1.43

5011

3854

=1.30

1.34

Current assets 2170.86 5011

Current liabilities 1521.15 3854

Acid Test

ratio

current asset −inventories

current liabilities

2170.86−1212.8

1521.15

=.62

5011−138

3854

=1.26

1.05

Current assets 2170.86 5011

Inventory 1212.8 138

Cash Ratio cas h+ marketablesecurities

current liabilities

69.8

1521.15

=.045

203

3854

=.052

Cash+ marketable securities 69.8 203

Current liabilities 1521.15 3854

Financial Analysis 12

Analysis of Profitability Ratio (Daly, 2011)

Name of the

ratio

Formula Caltex

Australia 2017

(30/6) (In$)

Origin Energy

2017

(30/6) (In$)

Industry

average

Net profit

margin

net profit

sales revenue ×100 264.53

10141.68 ×100

=2.60%

−2052

13646 ×100

= -15.03%

-198.84%

Net Profit 264.53 -2052

Sales Revenue 10141.68 13646

Gross Profit

Mark up

gross profit

cost of sales × 100 986.42

9155.26 × 100

=10.77%

2547

11099 ×100

=22.95%

Gross Profit 986.42 2547

Cost of sales 9155.26 11099

Gross profit

margin

gross profit

sales revenue ×100 986.42

10141.68 ×100

=9.72%

2547

13646 ×100

=18.66%

30.94%

Gross profit 986.42 2547

Sales Revenue 10141.68 13646

Operating

profit margin

operating profit

sales revenue ×100 407.85

10141.68 ×100 −71

13646 ×100 -189.82%

Analysis of Profitability Ratio (Daly, 2011)

Name of the

ratio

Formula Caltex

Australia 2017

(30/6) (In$)

Origin Energy

2017

(30/6) (In$)

Industry

average

Net profit

margin

net profit

sales revenue ×100 264.53

10141.68 ×100

=2.60%

−2052

13646 ×100

= -15.03%

-198.84%

Net Profit 264.53 -2052

Sales Revenue 10141.68 13646

Gross Profit

Mark up

gross profit

cost of sales × 100 986.42

9155.26 × 100

=10.77%

2547

11099 ×100

=22.95%

Gross Profit 986.42 2547

Cost of sales 9155.26 11099

Gross profit

margin

gross profit

sales revenue ×100 986.42

10141.68 ×100

=9.72%

2547

13646 ×100

=18.66%

30.94%

Gross profit 986.42 2547

Sales Revenue 10141.68 13646

Operating

profit margin

operating profit

sales revenue ×100 407.85

10141.68 ×100 −71

13646 ×100 -189.82%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.