Corporate Accounting and Reporting: Finance Lease and Impairment

VerifiedAdded on 2023/04/24

|8

|1518

|240

Report

AI Summary

This report delves into the specifics of corporate accounting and financial reporting, focusing on the critical aspects of finance lease disclosures as outlined in AASB 16. It examines how lessors and lessees should present relevant information to accurately reflect lease-related transactions, impacting c...

Running head: CORPORATE ACCOUNTING AND REPORTING

Corporate accounting and reporting

Name of the student

Name of the university

Student ID

Author note

Corporate accounting and reporting

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE ACCOUNTING AND REPORTING

Part A

Disclosures for the finance leases

AASB 16 sets out principles for measurement, recognition, presentation and

the disclosures for leases. This objective assures that lessor and lessees provide the

relevant information in a way that represents the lease related transactions faithfully.

The information provides the basis that can be used by the users of financial reports

for assessing the impact that the lease has on cash flow, financial position and

financial performance of the company (Aasb.gov.au 2019).

The lessor must classify each of the leases as finance lease or operating

lease. Finance lease is the lease where substantially all the rewards and risks

connected with the ownership of underlying asset are transferred (Aasb.gov.au

2019). Situation that leads the lease to be classified as the finance lease are – (i)

ownership of underlying lease asset is transferred to lessee by closing of the lease

term (ii) terms of lease is for maximum proportion of the asset’s economic life even if

title of the asset is not transferred (iii) lessee has option of buying the underlying

asset at the price that is likely to be significantly lower as compared to the fair value

on the date when the option is exercisable to make it reasonably certain (iv) at

inception date, present value of lease payment amount shall match substantially with

the entire fair value of underlying asset (v) underlying asset is of special nature and

the lessee can only use it without any major modifications. Indication of situation

that led to classification of a lease as financial lease are – (i) if lessee has the option

to cancel the lease, loss of the lessor related to cancellation of lease will be paid by

lessee (ii) lessee has ability for continuing the lease term for secondary period with

the rent that is considerable less as compared to the market value (iii) losses or

Part A

Disclosures for the finance leases

AASB 16 sets out principles for measurement, recognition, presentation and

the disclosures for leases. This objective assures that lessor and lessees provide the

relevant information in a way that represents the lease related transactions faithfully.

The information provides the basis that can be used by the users of financial reports

for assessing the impact that the lease has on cash flow, financial position and

financial performance of the company (Aasb.gov.au 2019).

The lessor must classify each of the leases as finance lease or operating

lease. Finance lease is the lease where substantially all the rewards and risks

connected with the ownership of underlying asset are transferred (Aasb.gov.au

2019). Situation that leads the lease to be classified as the finance lease are – (i)

ownership of underlying lease asset is transferred to lessee by closing of the lease

term (ii) terms of lease is for maximum proportion of the asset’s economic life even if

title of the asset is not transferred (iii) lessee has option of buying the underlying

asset at the price that is likely to be significantly lower as compared to the fair value

on the date when the option is exercisable to make it reasonably certain (iv) at

inception date, present value of lease payment amount shall match substantially with

the entire fair value of underlying asset (v) underlying asset is of special nature and

the lessee can only use it without any major modifications. Indication of situation

that led to classification of a lease as financial lease are – (i) if lessee has the option

to cancel the lease, loss of the lessor related to cancellation of lease will be paid by

lessee (ii) lessee has ability for continuing the lease term for secondary period with

the rent that is considerable less as compared to the market value (iii) losses or

2CORPORATE ACCOUNTING AND REPORTING

gains from fluctuation in fair value of residual accrue to lessee (Caster, Scheraga

and Olynick 2018).

At commencement date, lessor must recognise the asset held under the

finance lease in financial position statement and record them as receivable at the

amount that is same to net investment in lease. Lessor must use implicit interest rate

for measuring net investment in lease. However, for sublease, if implicit interest rate

cannot be determined readily, intermediate lessor may utilise discount rate utilised

for head lease for measuring net in investment in sublease. Direct cost except the

cost expensed by the dealer or manufacturer lessor, is considered while measuring

the net investment of lease initially and shall reduce the income value recognised

over lease term. Implicit interest rate in lease is defined for including the direct initial

cost automatically in net lease investment and it is not required to add them

separately (Lowe and Campbell 2017).

At commencement date, lease payments included under measurement of net

lease investment comprise various payments attributable to right to use the

subjected asset during the term of lease that are not received on commencement

date. The payments are – (i) fixed payments reduced by lease incentives, if any (ii)

variable lease payments depended on index or rate and measured initially using the

rate or index at commencement date. (iii) Residual guarantee value, if any provided

by the lessee by the lessor, party associated with the lessee or 3rd party not

associated with the lessor that is capable financially to discharge the guarantee

obligations (iv) penalty payment due to lease termination, if lease term represents

lease exercising the option of terminating lease (v) exercise price of purchase option,

if lessee is certain regarding exercising of the option (Aasb.gov.au 2019). Lessor

must record the financial income over the term of lease on the basis of pattern that

gains from fluctuation in fair value of residual accrue to lessee (Caster, Scheraga

and Olynick 2018).

At commencement date, lessor must recognise the asset held under the

finance lease in financial position statement and record them as receivable at the

amount that is same to net investment in lease. Lessor must use implicit interest rate

for measuring net investment in lease. However, for sublease, if implicit interest rate

cannot be determined readily, intermediate lessor may utilise discount rate utilised

for head lease for measuring net in investment in sublease. Direct cost except the

cost expensed by the dealer or manufacturer lessor, is considered while measuring

the net investment of lease initially and shall reduce the income value recognised

over lease term. Implicit interest rate in lease is defined for including the direct initial

cost automatically in net lease investment and it is not required to add them

separately (Lowe and Campbell 2017).

At commencement date, lease payments included under measurement of net

lease investment comprise various payments attributable to right to use the

subjected asset during the term of lease that are not received on commencement

date. The payments are – (i) fixed payments reduced by lease incentives, if any (ii)

variable lease payments depended on index or rate and measured initially using the

rate or index at commencement date. (iii) Residual guarantee value, if any provided

by the lessee by the lessor, party associated with the lessee or 3rd party not

associated with the lessor that is capable financially to discharge the guarantee

obligations (iv) penalty payment due to lease termination, if lease term represents

lease exercising the option of terminating lease (v) exercise price of purchase option,

if lessee is certain regarding exercising of the option (Aasb.gov.au 2019). Lessor

must record the financial income over the term of lease on the basis of pattern that

You're viewing a preview

Unlock full access by subscribing today!

3CORPORATE ACCOUNTING AND REPORTING

reflects the constant periodic return rate on lessor’s net lease investment. Lessor

shall aim to assign the finance income over the term of lease on rational and

systematic basis (Dakis 2016).

When the lease amount is measured subsequently the lessor shall record the

finance income over term of lease on the basis of the pattern that is reflecting

constant periodic return rate on lessor’s net lease investment. Lessor’s main aim is

distributing the finance income over term of lease on rational as well as systematic

basis. Further, the lessor must apply lease payments connected with the period

against gross lease investment for deducting principal as well as unearned finance

income (Aasb.gov.au 2019). Lessor must use the impairment and de-recognition

requirement, mentioned in AASB 9 to net lease investment. Further, the

unguaranteed estimated residual value used for computing the gross lease

investment shall be reviewed on regular basis. If any reduction is there for projected

unguaranteed residual value, lessor must revise the allocated income over the term

of lease and recognise it immediately for any reduction for the accrued amount.

Further, the assets under financial lease shall be classified using the AASB 5 on

non-current assets held for purpose of sale and discontinued operations and must be

accounted for as per the standard (Xu, Davidson and Cheong 2017).

Main objective of disclosing the lease for the lessor are to disclose the

information through notes in addition to information delivered in statement of the

financial position, profit and loss statement, cash flows statement that may provide

the basis to the users of financial reports for analysing the impact of lease that have

on cash flow, financial performance and financial position of the lessor. As per Para

90 of the standards Lessor must disclose some of the amounts in reporting period

(Joubert, Garvie and Parle 2017). The amounts are – (i) selling loss or selling profit

reflects the constant periodic return rate on lessor’s net lease investment. Lessor

shall aim to assign the finance income over the term of lease on rational and

systematic basis (Dakis 2016).

When the lease amount is measured subsequently the lessor shall record the

finance income over term of lease on the basis of the pattern that is reflecting

constant periodic return rate on lessor’s net lease investment. Lessor’s main aim is

distributing the finance income over term of lease on rational as well as systematic

basis. Further, the lessor must apply lease payments connected with the period

against gross lease investment for deducting principal as well as unearned finance

income (Aasb.gov.au 2019). Lessor must use the impairment and de-recognition

requirement, mentioned in AASB 9 to net lease investment. Further, the

unguaranteed estimated residual value used for computing the gross lease

investment shall be reviewed on regular basis. If any reduction is there for projected

unguaranteed residual value, lessor must revise the allocated income over the term

of lease and recognise it immediately for any reduction for the accrued amount.

Further, the assets under financial lease shall be classified using the AASB 5 on

non-current assets held for purpose of sale and discontinued operations and must be

accounted for as per the standard (Xu, Davidson and Cheong 2017).

Main objective of disclosing the lease for the lessor are to disclose the

information through notes in addition to information delivered in statement of the

financial position, profit and loss statement, cash flows statement that may provide

the basis to the users of financial reports for analysing the impact of lease that have

on cash flow, financial performance and financial position of the lessor. As per Para

90 of the standards Lessor must disclose some of the amounts in reporting period

(Joubert, Garvie and Parle 2017). The amounts are – (i) selling loss or selling profit

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE ACCOUNTING AND REPORTING

(ii) finance income on net lease investment and (iii) income associated with variable

lease payment that is not included in measurement of net lease investment. Further,

the lessor is required to disclose any additional quantitative as well as qualitative

information with regard to lease activities required for meeting the disclosure

objectives. This additional information may include and not limited to the information

that will assist the users of financial reports for assessing – (i) nature of lessor’s

leasing activities and (ii) how the risk associated by the lessor with rights retains in

the underlying asset. Particularly, the lessor is required to disclose the strategy

applied for risk management associated with the rights retained for the subjected

assets including the means through which lessor reduces the risk (Helalt and

Shogairat 2016).

(ii) finance income on net lease investment and (iii) income associated with variable

lease payment that is not included in measurement of net lease investment. Further,

the lessor is required to disclose any additional quantitative as well as qualitative

information with regard to lease activities required for meeting the disclosure

objectives. This additional information may include and not limited to the information

that will assist the users of financial reports for assessing – (i) nature of lessor’s

leasing activities and (ii) how the risk associated by the lessor with rights retains in

the underlying asset. Particularly, the lessor is required to disclose the strategy

applied for risk management associated with the rights retained for the subjected

assets including the means through which lessor reduces the risk (Helalt and

Shogairat 2016).

5CORPORATE ACCOUNTING AND REPORTING

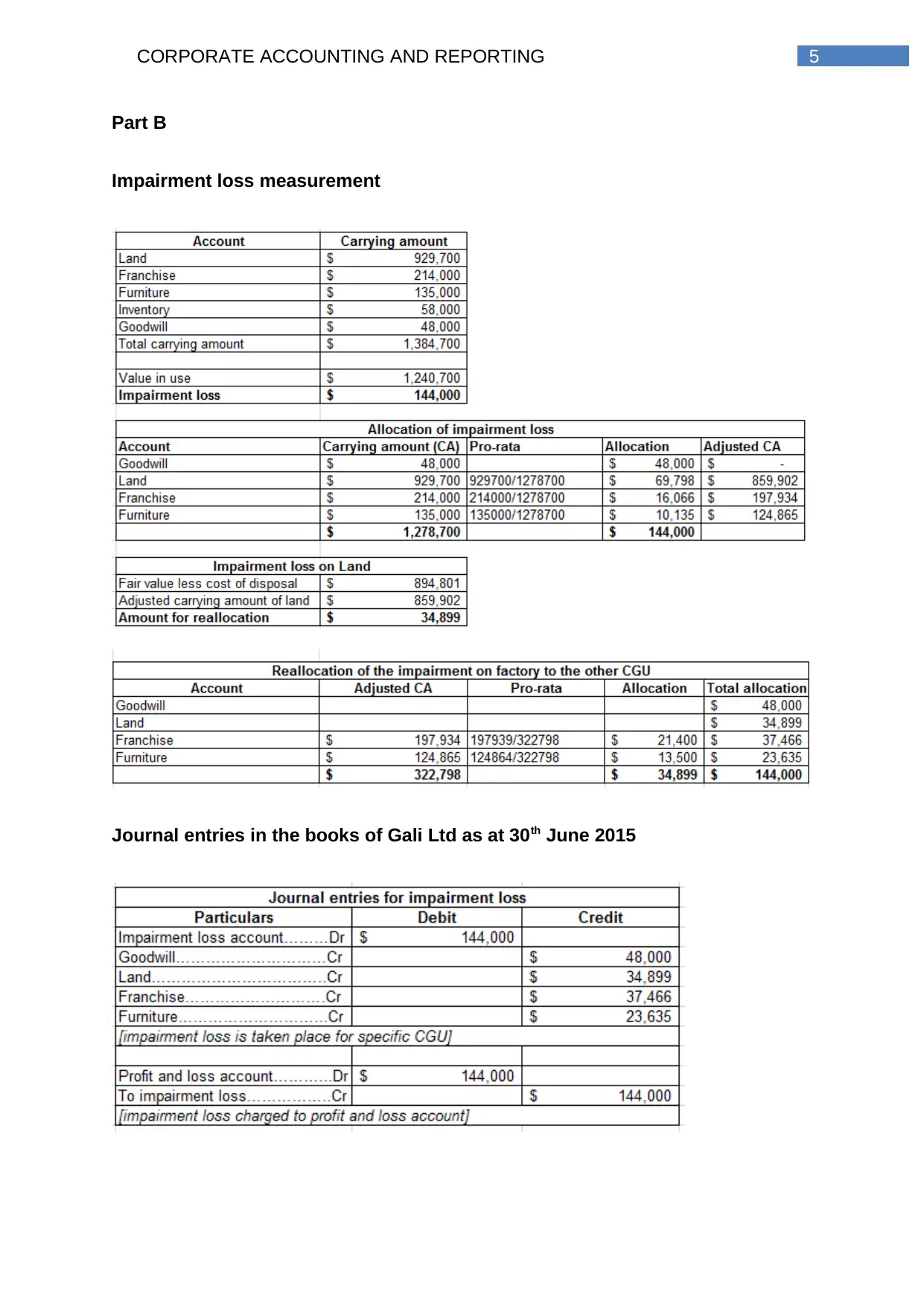

Part B

Impairment loss measurement

Journal entries in the books of Gali Ltd as at 30th June 2015

Part B

Impairment loss measurement

Journal entries in the books of Gali Ltd as at 30th June 2015

You're viewing a preview

Unlock full access by subscribing today!

6CORPORATE ACCOUNTING AND REPORTING

Note – inventories are not accounted for while allocating the impairment loss as the

inventories are valued at lower of cost and market value.

Note – inventories are not accounted for while allocating the impairment loss as the

inventories are valued at lower of cost and market value.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE ACCOUNTING AND REPORTING

Reference

Aasb.gov.au., 2019. [online] Available at:

https://www.aasb.gov.au/admin/file/content105/c9/AASB16_02-16.pdf [Accessed 23

Jan. 2019].

Caster, P., Scheraga, C.A. and Olynick, M.J., 2018. The impact of lease accounting

standards on airlines with operating leases: Implications for benchmarking and

financial analysis. Journal of Transportation Management, 28(1), p.4.

Dakis, G.S., 2016. Upcoming changes to contributions and leasing

standards. Governance Directions, 68(2), p.99.

Helalt, M.A. and Shogairat, F.M., 2016. The Expiration of the Financial Lease

Contract: A Comparative Study between Jordanian Legislation and Egyptian

Legislation. J. Pol. & L., 9, p.103.

Joubert, M., Garvie, L. and Parle, G., 2017. Implications of the New Accounting

Standard for Leases AASB 16 (IFRS 16) with the Inclusion of Operating Leases in

the Balance Sheet. Journal of New Business Ideas & Trends, 15(2).

Lowe, P. and Campbell, F., 2017. Financial Statements.

Xu, W., Davidson, R.A. and Cheong, C.S., 2017. Converting financial statements:

operating to capitalised leases. Pacific Accounting Review, 29(1), pp.34-54.

Reference

Aasb.gov.au., 2019. [online] Available at:

https://www.aasb.gov.au/admin/file/content105/c9/AASB16_02-16.pdf [Accessed 23

Jan. 2019].

Caster, P., Scheraga, C.A. and Olynick, M.J., 2018. The impact of lease accounting

standards on airlines with operating leases: Implications for benchmarking and

financial analysis. Journal of Transportation Management, 28(1), p.4.

Dakis, G.S., 2016. Upcoming changes to contributions and leasing

standards. Governance Directions, 68(2), p.99.

Helalt, M.A. and Shogairat, F.M., 2016. The Expiration of the Financial Lease

Contract: A Comparative Study between Jordanian Legislation and Egyptian

Legislation. J. Pol. & L., 9, p.103.

Joubert, M., Garvie, L. and Parle, G., 2017. Implications of the New Accounting

Standard for Leases AASB 16 (IFRS 16) with the Inclusion of Operating Leases in

the Balance Sheet. Journal of New Business Ideas & Trends, 15(2).

Lowe, P. and Campbell, F., 2017. Financial Statements.

Xu, W., Davidson, R.A. and Cheong, C.S., 2017. Converting financial statements:

operating to capitalised leases. Pacific Accounting Review, 29(1), pp.34-54.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.