Principles of Accounting: Preparation of Financial Statements and Closing Entries

VerifiedAdded on 2023/03/23

|17

|3154

|90

AI Summary

This document discusses the principles of accounting, specifically focusing on the preparation of financial statements, closing entries, and the use of a worksheet. It also explores the importance of source documents in a manual accounting system and how computerized accounting packages can assist in making better business decisions. The case study of Samantha Kennedy, owner of Magic Thread, is used as an example throughout the document.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Principles of Accounting

5/16/2019

5/16/2019

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting 1

Contents

Case 1...............................................................................................................................................2

Preparation of worksheet, financial statements, and closing entries...........................................2

HNM Medical Service Income Statement...................................................................................4

Statement of changes in equity....................................................................................................5

Balance Sheet...............................................................................................................................5

Case 2...............................................................................................................................................8

Background of the case................................................................................................................8

Source documents would be required in a manual accounting system.......................................9

Computerised accounting package help Samantha make better decisions and manage her

business better............................................................................................................................11

Case 3.............................................................................................................................................12

Stakeholders...............................................................................................................................12

Derek appear to be doing anything wrong.................................................................................13

Ethical issues involved in the case.............................................................................................14

References......................................................................................................................................15

Contents

Case 1...............................................................................................................................................2

Preparation of worksheet, financial statements, and closing entries...........................................2

HNM Medical Service Income Statement...................................................................................4

Statement of changes in equity....................................................................................................5

Balance Sheet...............................................................................................................................5

Case 2...............................................................................................................................................8

Background of the case................................................................................................................8

Source documents would be required in a manual accounting system.......................................9

Computerised accounting package help Samantha make better decisions and manage her

business better............................................................................................................................11

Case 3.............................................................................................................................................12

Stakeholders...............................................................................................................................12

Derek appear to be doing anything wrong.................................................................................13

Ethical issues involved in the case.............................................................................................14

References......................................................................................................................................15

Accounting 2

Case 1

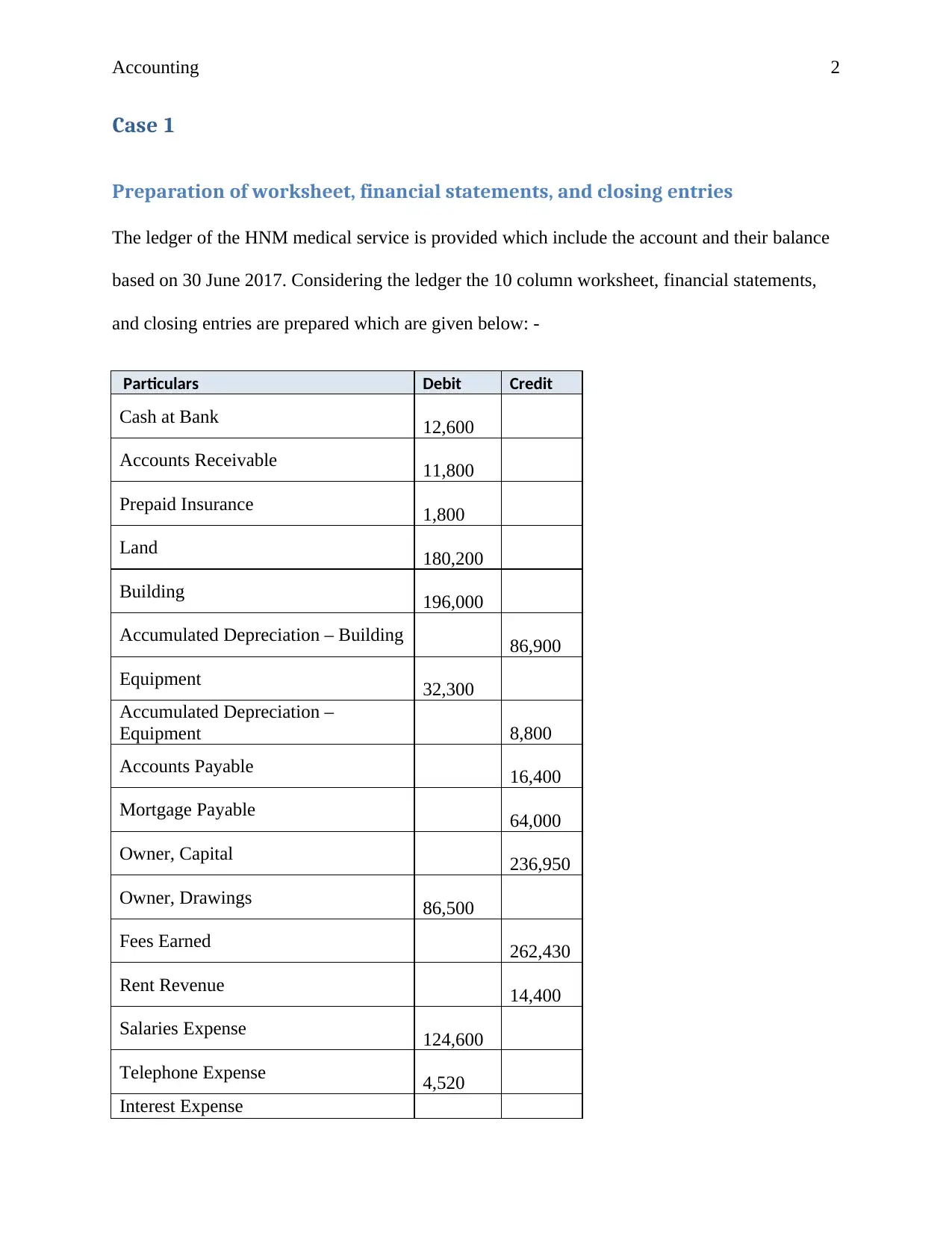

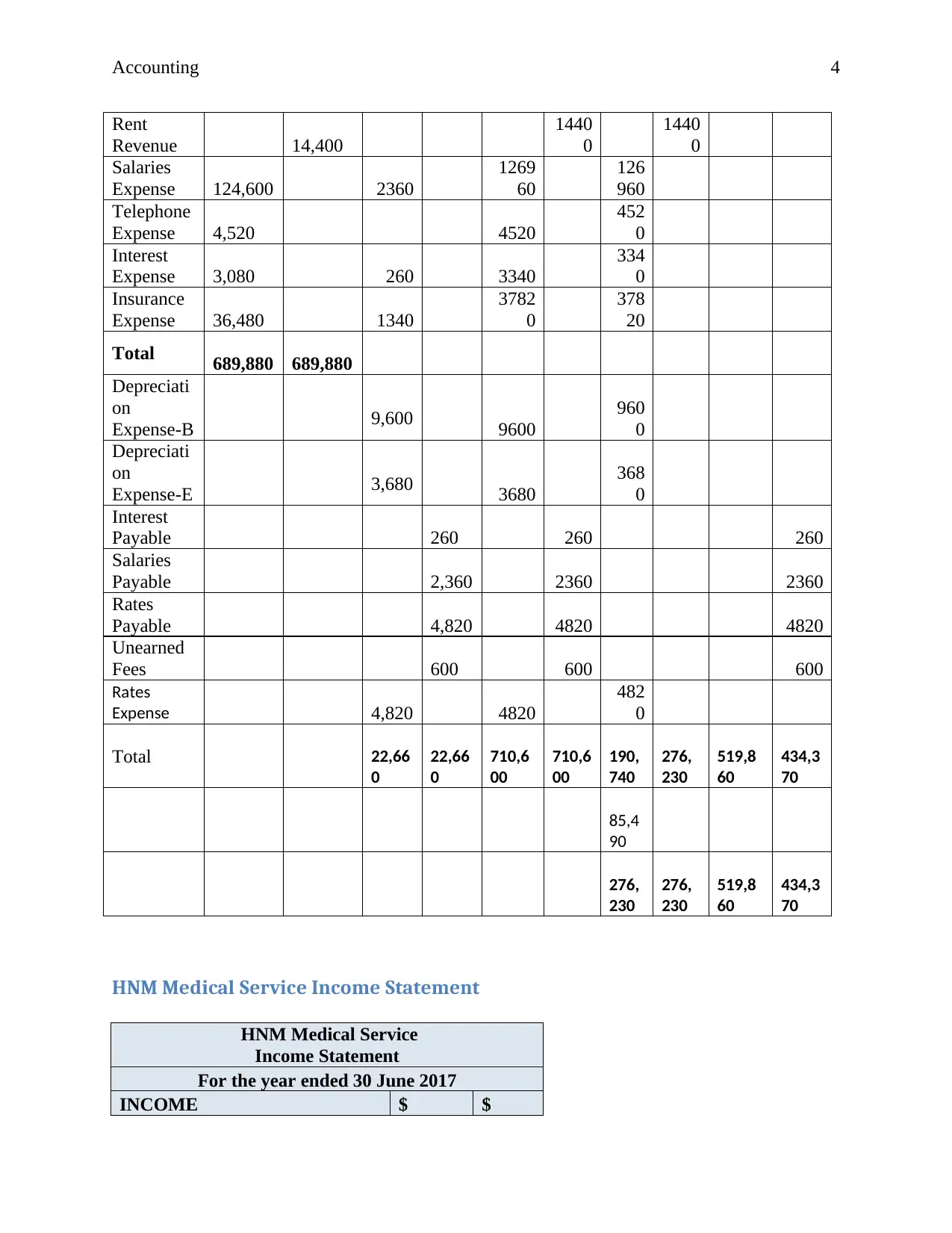

Preparation of worksheet, financial statements, and closing entries

The ledger of the HNM medical service is provided which include the account and their balance

based on 30 June 2017. Considering the ledger the 10 column worksheet, financial statements,

and closing entries are prepared which are given below: -

Particulars Debit Credit

Cash at Bank 12,600

Accounts Receivable 11,800

Prepaid Insurance 1,800

Land 180,200

Building 196,000

Accumulated Depreciation – Building 86,900

Equipment 32,300

Accumulated Depreciation –

Equipment 8,800

Accounts Payable 16,400

Mortgage Payable 64,000

Owner, Capital 236,950

Owner, Drawings 86,500

Fees Earned 262,430

Rent Revenue 14,400

Salaries Expense 124,600

Telephone Expense 4,520

Interest Expense

Case 1

Preparation of worksheet, financial statements, and closing entries

The ledger of the HNM medical service is provided which include the account and their balance

based on 30 June 2017. Considering the ledger the 10 column worksheet, financial statements,

and closing entries are prepared which are given below: -

Particulars Debit Credit

Cash at Bank 12,600

Accounts Receivable 11,800

Prepaid Insurance 1,800

Land 180,200

Building 196,000

Accumulated Depreciation – Building 86,900

Equipment 32,300

Accumulated Depreciation –

Equipment 8,800

Accounts Payable 16,400

Mortgage Payable 64,000

Owner, Capital 236,950

Owner, Drawings 86,500

Fees Earned 262,430

Rent Revenue 14,400

Salaries Expense 124,600

Telephone Expense 4,520

Interest Expense

Accounting 3

3,080

Insurance Expense 36,480

Total 689,880 689,880

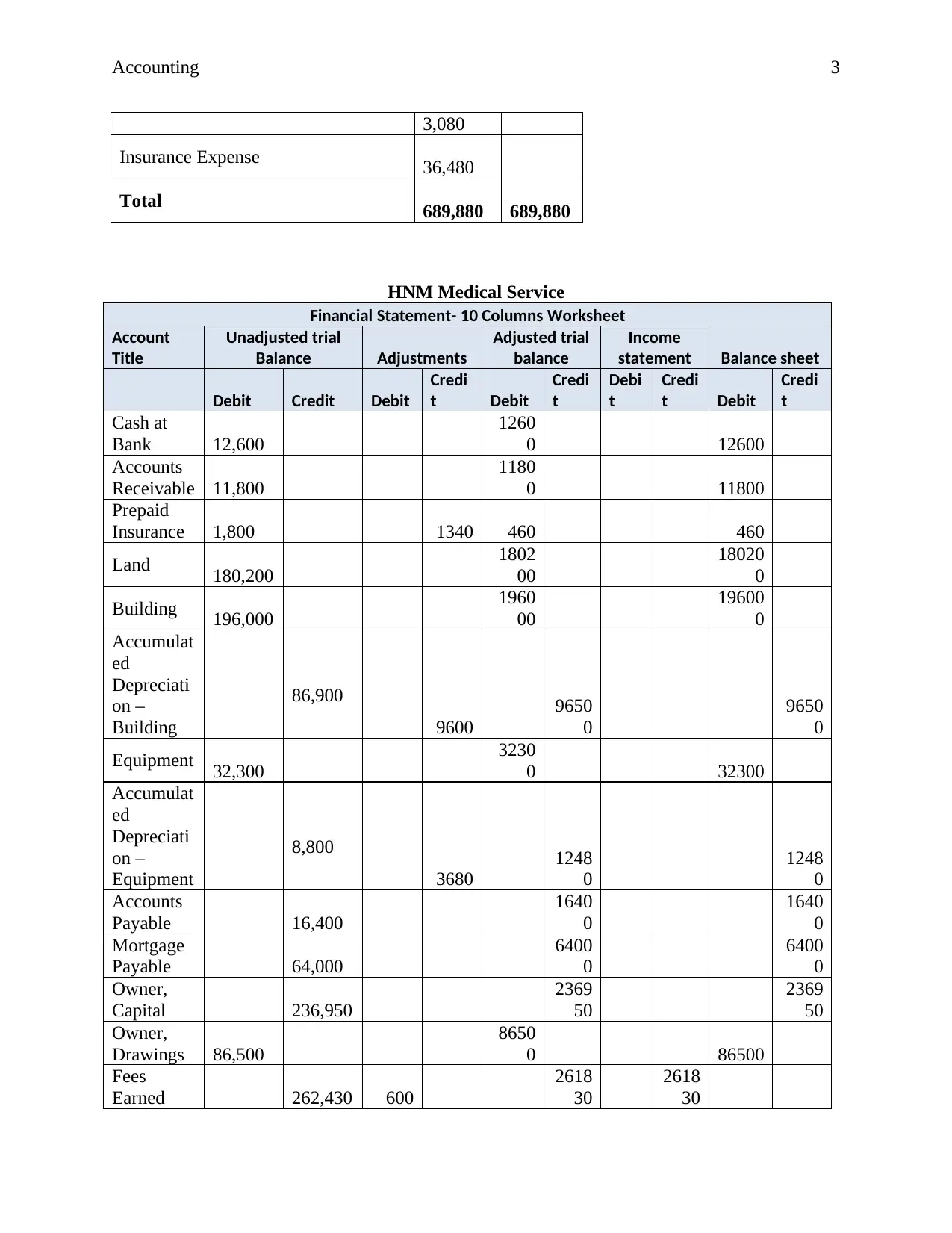

HNM Medical Service

Financial Statement- 10 Columns Worksheet

Account

Title

Unadjusted trial

Balance Adjustments

Adjusted trial

balance

Income

statement Balance sheet

Debit Credit Debit

Credi

t Debit

Credi

t

Debi

t

Credi

t Debit

Credi

t

Cash at

Bank 12,600

1260

0 12600

Accounts

Receivable 11,800

1180

0 11800

Prepaid

Insurance 1,800 1340 460 460

Land 180,200

1802

00

18020

0

Building 196,000

1960

00

19600

0

Accumulat

ed

Depreciati

on –

Building

86,900

9600

9650

0

9650

0

Equipment 32,300

3230

0 32300

Accumulat

ed

Depreciati

on –

Equipment

8,800

3680

1248

0

1248

0

Accounts

Payable 16,400

1640

0

1640

0

Mortgage

Payable 64,000

6400

0

6400

0

Owner,

Capital 236,950

2369

50

2369

50

Owner,

Drawings 86,500

8650

0 86500

Fees

Earned 262,430 600

2618

30

2618

30

3,080

Insurance Expense 36,480

Total 689,880 689,880

HNM Medical Service

Financial Statement- 10 Columns Worksheet

Account

Title

Unadjusted trial

Balance Adjustments

Adjusted trial

balance

Income

statement Balance sheet

Debit Credit Debit

Credi

t Debit

Credi

t

Debi

t

Credi

t Debit

Credi

t

Cash at

Bank 12,600

1260

0 12600

Accounts

Receivable 11,800

1180

0 11800

Prepaid

Insurance 1,800 1340 460 460

Land 180,200

1802

00

18020

0

Building 196,000

1960

00

19600

0

Accumulat

ed

Depreciati

on –

Building

86,900

9600

9650

0

9650

0

Equipment 32,300

3230

0 32300

Accumulat

ed

Depreciati

on –

Equipment

8,800

3680

1248

0

1248

0

Accounts

Payable 16,400

1640

0

1640

0

Mortgage

Payable 64,000

6400

0

6400

0

Owner,

Capital 236,950

2369

50

2369

50

Owner,

Drawings 86,500

8650

0 86500

Fees

Earned 262,430 600

2618

30

2618

30

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting 4

Rent

Revenue 14,400

1440

0

1440

0

Salaries

Expense 124,600 2360

1269

60

126

960

Telephone

Expense 4,520 4520

452

0

Interest

Expense 3,080 260 3340

334

0

Insurance

Expense 36,480 1340

3782

0

378

20

Total 689,880 689,880

Depreciati

on

Expense-B 9,600 9600

960

0

Depreciati

on

Expense-E 3,680 3680

368

0

Interest

Payable 260 260 260

Salaries

Payable 2,360 2360 2360

Rates

Payable 4,820 4820 4820

Unearned

Fees 600 600 600

Rates

Expense 4,820 4820

482

0

Total 22,66

0

22,66

0

710,6

00

710,6

00

190,

740

276,

230

519,8

60

434,3

70

85,4

90

276,

230

276,

230

519,8

60

434,3

70

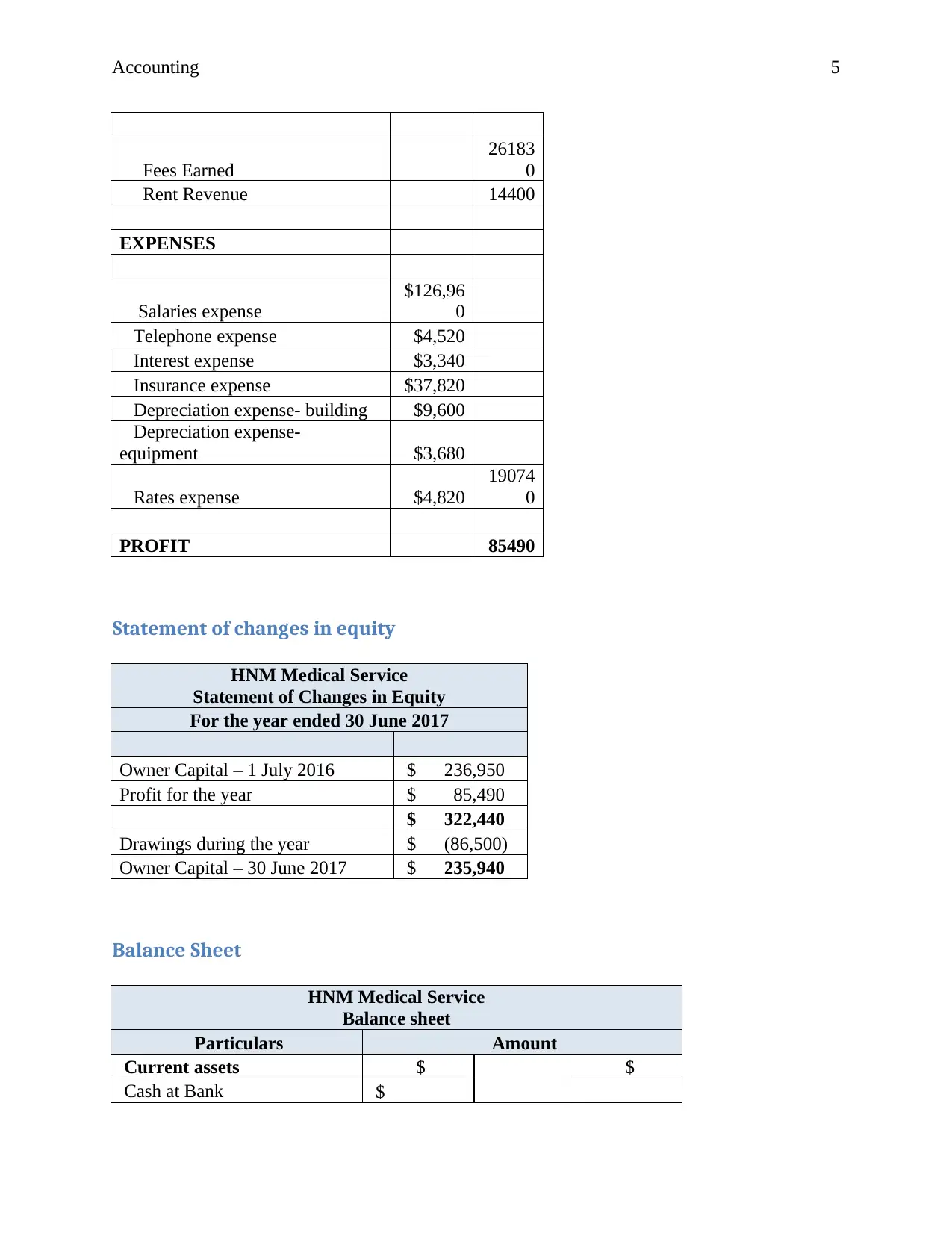

HNM Medical Service Income Statement

HNM Medical Service

Income Statement

For the year ended 30 June 2017

INCOME $ $

Rent

Revenue 14,400

1440

0

1440

0

Salaries

Expense 124,600 2360

1269

60

126

960

Telephone

Expense 4,520 4520

452

0

Interest

Expense 3,080 260 3340

334

0

Insurance

Expense 36,480 1340

3782

0

378

20

Total 689,880 689,880

Depreciati

on

Expense-B 9,600 9600

960

0

Depreciati

on

Expense-E 3,680 3680

368

0

Interest

Payable 260 260 260

Salaries

Payable 2,360 2360 2360

Rates

Payable 4,820 4820 4820

Unearned

Fees 600 600 600

Rates

Expense 4,820 4820

482

0

Total 22,66

0

22,66

0

710,6

00

710,6

00

190,

740

276,

230

519,8

60

434,3

70

85,4

90

276,

230

276,

230

519,8

60

434,3

70

HNM Medical Service Income Statement

HNM Medical Service

Income Statement

For the year ended 30 June 2017

INCOME $ $

Accounting 5

Fees Earned

26183

0

Rent Revenue 14400

EXPENSES

Salaries expense

$126,96

0

Telephone expense $4,520

Interest expense $3,340

Insurance expense $37,820

Depreciation expense- building $9,600

Depreciation expense-

equipment $3,680

Rates expense $4,820

19074

0

PROFIT 85490

Statement of changes in equity

HNM Medical Service

Statement of Changes in Equity

For the year ended 30 June 2017

Owner Capital – 1 July 2016 $ 236,950

Profit for the year $ 85,490

$ 322,440

Drawings during the year $ (86,500)

Owner Capital – 30 June 2017 $ 235,940

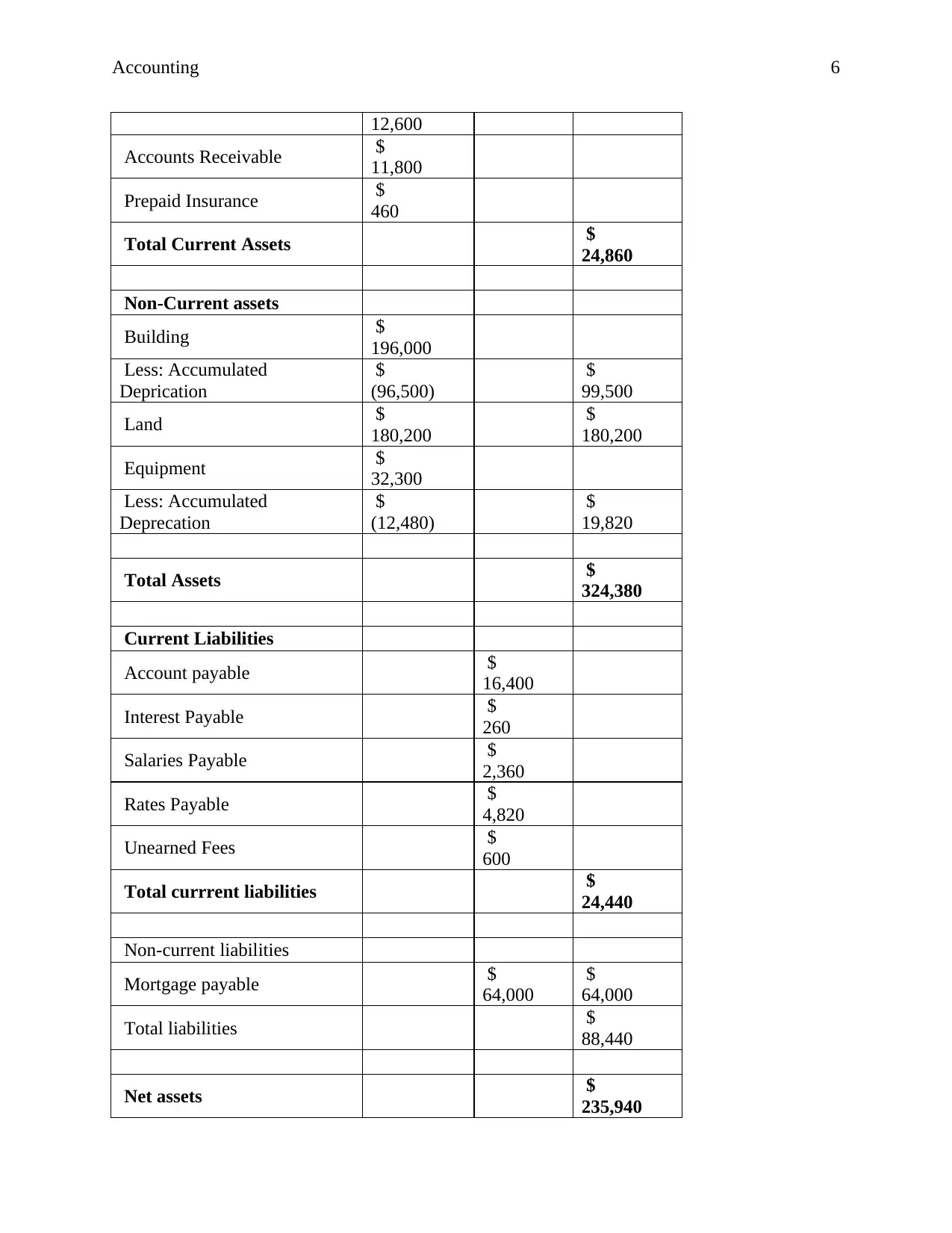

Balance Sheet

HNM Medical Service

Balance sheet

Particulars Amount

Current assets $ $

Cash at Bank $

Fees Earned

26183

0

Rent Revenue 14400

EXPENSES

Salaries expense

$126,96

0

Telephone expense $4,520

Interest expense $3,340

Insurance expense $37,820

Depreciation expense- building $9,600

Depreciation expense-

equipment $3,680

Rates expense $4,820

19074

0

PROFIT 85490

Statement of changes in equity

HNM Medical Service

Statement of Changes in Equity

For the year ended 30 June 2017

Owner Capital – 1 July 2016 $ 236,950

Profit for the year $ 85,490

$ 322,440

Drawings during the year $ (86,500)

Owner Capital – 30 June 2017 $ 235,940

Balance Sheet

HNM Medical Service

Balance sheet

Particulars Amount

Current assets $ $

Cash at Bank $

Accounting 6

12,600

Accounts Receivable $

11,800

Prepaid Insurance $

460

Total Current Assets $

24,860

Non-Current assets

Building $

196,000

Less: Accumulated

Deprication

$

(96,500)

$

99,500

Land $

180,200

$

180,200

Equipment $

32,300

Less: Accumulated

Deprecation

$

(12,480)

$

19,820

Total Assets $

324,380

Current Liabilities

Account payable $

16,400

Interest Payable $

260

Salaries Payable $

2,360

Rates Payable $

4,820

Unearned Fees $

600

Total currrent liabilities $

24,440

Non-current liabilities

Mortgage payable $

64,000

$

64,000

Total liabilities $

88,440

Net assets $

235,940

12,600

Accounts Receivable $

11,800

Prepaid Insurance $

460

Total Current Assets $

24,860

Non-Current assets

Building $

196,000

Less: Accumulated

Deprication

$

(96,500)

$

99,500

Land $

180,200

$

180,200

Equipment $

32,300

Less: Accumulated

Deprecation

$

(12,480)

$

19,820

Total Assets $

324,380

Current Liabilities

Account payable $

16,400

Interest Payable $

260

Salaries Payable $

2,360

Rates Payable $

4,820

Unearned Fees $

600

Total currrent liabilities $

24,440

Non-current liabilities

Mortgage payable $

64,000

$

64,000

Total liabilities $

88,440

Net assets $

235,940

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting 7

Equity

Owner capital 235940

Total equity 235940

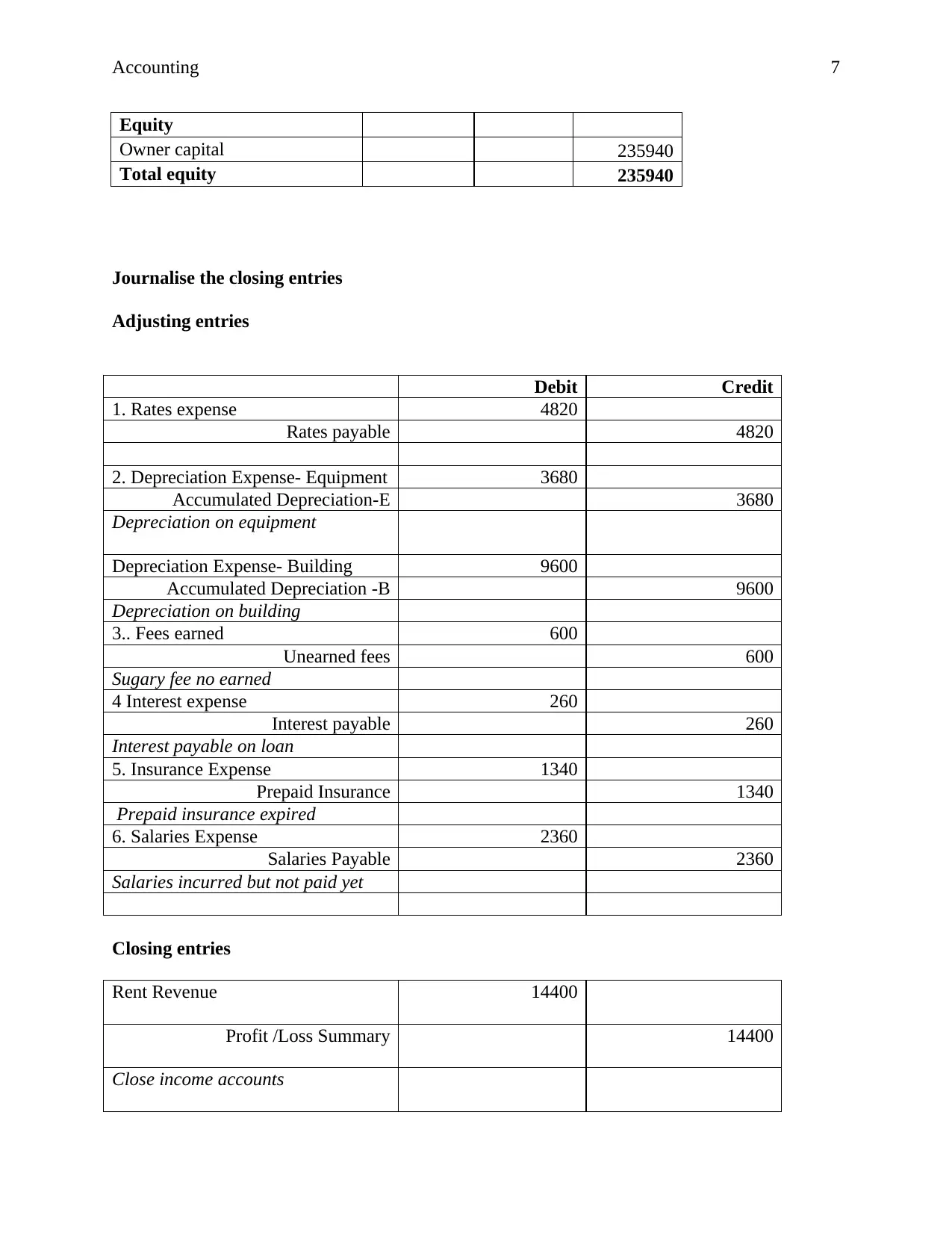

Journalise the closing entries

Adjusting entries

Debit Credit

1. Rates expense 4820

Rates payable 4820

2. Depreciation Expense- Equipment 3680

Accumulated Depreciation-E 3680

Depreciation on equipment

Depreciation Expense- Building 9600

Accumulated Depreciation -B 9600

Depreciation on building

3.. Fees earned 600

Unearned fees 600

Sugary fee no earned

4 Interest expense 260

Interest payable 260

Interest payable on loan

5. Insurance Expense 1340

Prepaid Insurance 1340

Prepaid insurance expired

6. Salaries Expense 2360

Salaries Payable 2360

Salaries incurred but not paid yet

Closing entries

Rent Revenue 14400

Profit /Loss Summary 14400

Close income accounts

Equity

Owner capital 235940

Total equity 235940

Journalise the closing entries

Adjusting entries

Debit Credit

1. Rates expense 4820

Rates payable 4820

2. Depreciation Expense- Equipment 3680

Accumulated Depreciation-E 3680

Depreciation on equipment

Depreciation Expense- Building 9600

Accumulated Depreciation -B 9600

Depreciation on building

3.. Fees earned 600

Unearned fees 600

Sugary fee no earned

4 Interest expense 260

Interest payable 260

Interest payable on loan

5. Insurance Expense 1340

Prepaid Insurance 1340

Prepaid insurance expired

6. Salaries Expense 2360

Salaries Payable 2360

Salaries incurred but not paid yet

Closing entries

Rent Revenue 14400

Profit /Loss Summary 14400

Close income accounts

Accounting 8

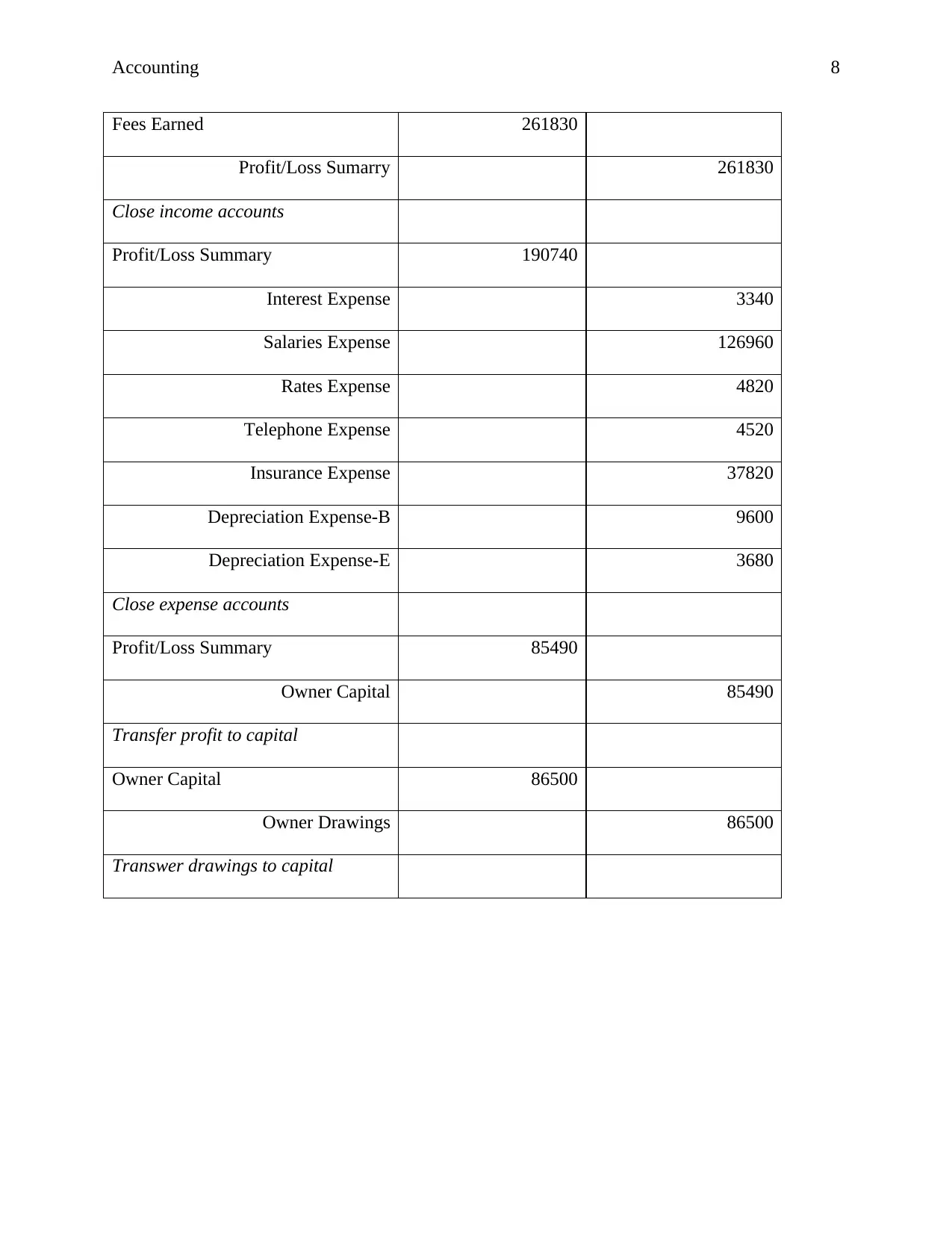

Fees Earned 261830

Profit/Loss Sumarry 261830

Close income accounts

Profit/Loss Summary 190740

Interest Expense 3340

Salaries Expense 126960

Rates Expense 4820

Telephone Expense 4520

Insurance Expense 37820

Depreciation Expense-B 9600

Depreciation Expense-E 3680

Close expense accounts

Profit/Loss Summary 85490

Owner Capital 85490

Transfer profit to capital

Owner Capital 86500

Owner Drawings 86500

Transwer drawings to capital

Fees Earned 261830

Profit/Loss Sumarry 261830

Close income accounts

Profit/Loss Summary 190740

Interest Expense 3340

Salaries Expense 126960

Rates Expense 4820

Telephone Expense 4520

Insurance Expense 37820

Depreciation Expense-B 9600

Depreciation Expense-E 3680

Close expense accounts

Profit/Loss Summary 85490

Owner Capital 85490

Transfer profit to capital

Owner Capital 86500

Owner Drawings 86500

Transwer drawings to capital

Accounting 9

Case 2

Background of case

The case talks about the Samantha Kennedy who owns as well as manages the craft as well as

the material shop that is known with the name of Magic Thread. The shop of Samantha majorly

remain dependent on the huge number of dealers with the minor sums of various craft resources

due to this they are unable to keep the track of all of her account payables (Libby, 2017). The

owner is not well organised due to which she fights to send out the outcomes to her consumers to

gather currency from them. She is allowing for applying the computerised bookkeeping system

so that they can manage the business effectively.

Source documents would be required in a manual accounting system

Every company who makes the financial transaction generate the record of the transaction done

by them with the help of paper trail. The paper trails in which the accountants record their

transaction are treated as the source of document (Peavler, 2018). Source document is considered

as vital part of bookkeeping as well as bookkeeping process as it offers the indication that a

monetary deal has happened. Considering the case of Samantha, it is essential to keep the source

documents to record the sales clients and receiving of money, and to safeguard accurate expense

of currency to dealers. The types of documents that are required include -

Cash receipt tape: - Cash receipt tape can be used as a source document for recording

the cash sales that assist recording of sales deal of the business. This source document

can be used by the company in order to check the cash sales done by them.

Sales invoices: - The sales invoice works as the source documents that offer a record for

every sale made by the company. For the control purposes, the sales invoice are required

Case 2

Background of case

The case talks about the Samantha Kennedy who owns as well as manages the craft as well as

the material shop that is known with the name of Magic Thread. The shop of Samantha majorly

remain dependent on the huge number of dealers with the minor sums of various craft resources

due to this they are unable to keep the track of all of her account payables (Libby, 2017). The

owner is not well organised due to which she fights to send out the outcomes to her consumers to

gather currency from them. She is allowing for applying the computerised bookkeeping system

so that they can manage the business effectively.

Source documents would be required in a manual accounting system

Every company who makes the financial transaction generate the record of the transaction done

by them with the help of paper trail. The paper trails in which the accountants record their

transaction are treated as the source of document (Peavler, 2018). Source document is considered

as vital part of bookkeeping as well as bookkeeping process as it offers the indication that a

monetary deal has happened. Considering the case of Samantha, it is essential to keep the source

documents to record the sales clients and receiving of money, and to safeguard accurate expense

of currency to dealers. The types of documents that are required include -

Cash receipt tape: - Cash receipt tape can be used as a source document for recording

the cash sales that assist recording of sales deal of the business. This source document

can be used by the company in order to check the cash sales done by them.

Sales invoices: - The sales invoice works as the source documents that offer a record for

every sale made by the company. For the control purposes, the sales invoice are required

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting 10

to be sequentially prenumbered to provide the assistance in order to help the business

owner with the amount (Accounting tools, 2017).

Lockbox check images: - These images assist recording of the money receipts that are

attained by the company from the customers.

Packing slip: - This packing slip is considered as the source of the documents as it shows

the items shipped to the customers and due to which it provide the assistance to the

recording of the sale transaction done by the company.

Supplier invoice: - The supplier invoice is documents that provide the assistance to the

issuance of the cash, check, and other mode of payment to the suppliers. This invoice also

provides the support to the business in order to record the expenses, inventory item, and

many other amounts (Cliff Notes, 2019). This invoice can be used by the business at the

time of making the payment to the suppliers as through this they can check the amount

that they are paying to their suppliers.

Cash receipts: - The cash receipts are one of the sources of document journal that is

specialized accounting journal. It is related to major entry book that is majorly used in the

physical accounting system to keep track of sales of items when the amount is received

by crediting the sum of sales as well as debiting cash and some other transactions that are

link to the receipts of cash.

Bank statement: - The bank statement is considered as one of source document that is

required in manual account ting for recording the transaction. It contains the adjustment

to the business’s book balance of cash on hand that corporation should locate to get the

records align with the bank amount.

to be sequentially prenumbered to provide the assistance in order to help the business

owner with the amount (Accounting tools, 2017).

Lockbox check images: - These images assist recording of the money receipts that are

attained by the company from the customers.

Packing slip: - This packing slip is considered as the source of the documents as it shows

the items shipped to the customers and due to which it provide the assistance to the

recording of the sale transaction done by the company.

Supplier invoice: - The supplier invoice is documents that provide the assistance to the

issuance of the cash, check, and other mode of payment to the suppliers. This invoice also

provides the support to the business in order to record the expenses, inventory item, and

many other amounts (Cliff Notes, 2019). This invoice can be used by the business at the

time of making the payment to the suppliers as through this they can check the amount

that they are paying to their suppliers.

Cash receipts: - The cash receipts are one of the sources of document journal that is

specialized accounting journal. It is related to major entry book that is majorly used in the

physical accounting system to keep track of sales of items when the amount is received

by crediting the sum of sales as well as debiting cash and some other transactions that are

link to the receipts of cash.

Bank statement: - The bank statement is considered as one of source document that is

required in manual account ting for recording the transaction. It contains the adjustment

to the business’s book balance of cash on hand that corporation should locate to get the

records align with the bank amount.

Accounting 11

The above given are the few source documents which are considered as vital document to record

the transactions to clients and receiving of cash, and to ensure right payment of cash to dealers.

Computerised accounting package help for better decisions

In the case, this has been found that Samantha is not able to manage the business operations

effectively because she is not well organised due to which she send out the outcomes to her

customers with the motive to collect the money majorly from them. Thus, this is the reason due

to which she took the step to apply the computerised accounting. In the computer course, she

gains the knowledge that focus in accounting should not be only on the bookkeeping but it

should also include use of information present inside computer.

Computerised accounting package supports her to make the better decisions that can contribute

in improving its business operations (Atar & Birman, 2017). The system of the computerised

accounting is software that provides the support to the businesses in order to manage the big

financial transactions that include reports, data, and statement with the presence of high

efficiency, speed as well as the better accuracy (Lin, Yang & Wang, 2018). Below are some of

the advantages of the computerized accounting that help the Samantha to make the better

decisions for their company.

Automation: - The computerized accounting do all the calculation with the use of

software computerized that majorly eliminate the time that is consumed generally in the

manual accounting. This will help the Samantha in making the quick decision for this

business that is possible because of the computerized accounting as it saves the time in

accounting (Amanamah, Morrison, & Asiedu, 2016).

The above given are the few source documents which are considered as vital document to record

the transactions to clients and receiving of cash, and to ensure right payment of cash to dealers.

Computerised accounting package help for better decisions

In the case, this has been found that Samantha is not able to manage the business operations

effectively because she is not well organised due to which she send out the outcomes to her

customers with the motive to collect the money majorly from them. Thus, this is the reason due

to which she took the step to apply the computerised accounting. In the computer course, she

gains the knowledge that focus in accounting should not be only on the bookkeeping but it

should also include use of information present inside computer.

Computerised accounting package supports her to make the better decisions that can contribute

in improving its business operations (Atar & Birman, 2017). The system of the computerised

accounting is software that provides the support to the businesses in order to manage the big

financial transactions that include reports, data, and statement with the presence of high

efficiency, speed as well as the better accuracy (Lin, Yang & Wang, 2018). Below are some of

the advantages of the computerized accounting that help the Samantha to make the better

decisions for their company.

Automation: - The computerized accounting do all the calculation with the use of

software computerized that majorly eliminate the time that is consumed generally in the

manual accounting. This will help the Samantha in making the quick decision for this

business that is possible because of the computerized accounting as it saves the time in

accounting (Amanamah, Morrison, & Asiedu, 2016).

Accounting 12

Improve efficiency: - The computerized accounting brings improvement in efficiency

that helps business of Samantha to take efficient decision for business.

Accuracy: - The computerised accounting system is intended to be correct as it removes

all the errors from the calculation that supports the decision of the Samantha, as they will

not get fail in their decisions (Al Bataineh & Bataineh, 2018). In addition to this, this is

clear that there are large numbers of suppliers to whom Samantha make the payment that

will be effectively possible with the presence of the accuracy.

Facilitates better control: - Considering it from the opinion of the management, the

computerized accounting provide the better control as well as organised record with the

use of the computer in accounting. This ensures the efficient performance in the records

of accounting which further helps in making the better and improved decision, which is

the reason behind the success of the business.

Simple and integrated: - Computerized accounting is considered as one of the simple as

well as integrated system that helps the business by automating as well as integrating all

the business activities. These activities might include the sales, finance, inventory, and

many other. The use of the method will lead to the arrangement of accurate as well as up-

to-date information that is used by Samantha for the effective decision related to business

suppliers and the customers.

Case 3

This section of the report includes the issue of partnership. This section will provide the answers

to actions of co-workers that are satisfactory while performing business activities.

Improve efficiency: - The computerized accounting brings improvement in efficiency

that helps business of Samantha to take efficient decision for business.

Accuracy: - The computerised accounting system is intended to be correct as it removes

all the errors from the calculation that supports the decision of the Samantha, as they will

not get fail in their decisions (Al Bataineh & Bataineh, 2018). In addition to this, this is

clear that there are large numbers of suppliers to whom Samantha make the payment that

will be effectively possible with the presence of the accuracy.

Facilitates better control: - Considering it from the opinion of the management, the

computerized accounting provide the better control as well as organised record with the

use of the computer in accounting. This ensures the efficient performance in the records

of accounting which further helps in making the better and improved decision, which is

the reason behind the success of the business.

Simple and integrated: - Computerized accounting is considered as one of the simple as

well as integrated system that helps the business by automating as well as integrating all

the business activities. These activities might include the sales, finance, inventory, and

many other. The use of the method will lead to the arrangement of accurate as well as up-

to-date information that is used by Samantha for the effective decision related to business

suppliers and the customers.

Case 3

This section of the report includes the issue of partnership. This section will provide the answers

to actions of co-workers that are satisfactory while performing business activities.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting 13

Stakeholders

The stakeholders are those who affect or affected by the organisation objectives, policies and

other plans. Some of the stakeholders include creditors, directors, employees and many other

people who are considered as major role player in the business. These people remain involved in

the implementation as well as the formation of the project. These people can take the direct

interest and can occur with the situation in order to affect the implementation. They can

influence a company in the positive as well as in the negative manner (Burns, 2016).

In the case study, Derek Brown and Kate Wilson are the two stakeholders who are owners of the

business. Both are the owners of the company as they work in the partnership in order to run the

small business. In addition to this, Derek brown has contributed approximately $60,000 and on

the other hand, Kate contribution was approx. $50,000. Derek brown is more self-assured with

the numbers as well as with the accounting terms. On the other hand, Kate prefers to deal with

the individuals and to avoid anything that is linked to the accounting or with the numbers. Thus,

the major stakeholders of the company are its owners only.

Derek appear to be doing anything wrong

In the case study, this has been found that Derek is the one who is good with the financial part

due to which he is responsible for all the kind of profit sharing and other financial data. In the

partnerships, the partners of the company are permitted to make the extractions so long as the

withdrawal is not exceeding the capital that is contributed by the partner (Collis, Holt & Hussey,

2017). This has been found that Derek is not doing anything wrong as he is just making the

drawings that are from his capital account. In this case, Derek contribution was $60,000 and out

of this capital he has withdrawn an amount of $40,000 due to which this is simple that he is not

doing anything wrong within the operations.

Stakeholders

The stakeholders are those who affect or affected by the organisation objectives, policies and

other plans. Some of the stakeholders include creditors, directors, employees and many other

people who are considered as major role player in the business. These people remain involved in

the implementation as well as the formation of the project. These people can take the direct

interest and can occur with the situation in order to affect the implementation. They can

influence a company in the positive as well as in the negative manner (Burns, 2016).

In the case study, Derek Brown and Kate Wilson are the two stakeholders who are owners of the

business. Both are the owners of the company as they work in the partnership in order to run the

small business. In addition to this, Derek brown has contributed approximately $60,000 and on

the other hand, Kate contribution was approx. $50,000. Derek brown is more self-assured with

the numbers as well as with the accounting terms. On the other hand, Kate prefers to deal with

the individuals and to avoid anything that is linked to the accounting or with the numbers. Thus,

the major stakeholders of the company are its owners only.

Derek appear to be doing anything wrong

In the case study, this has been found that Derek is the one who is good with the financial part

due to which he is responsible for all the kind of profit sharing and other financial data. In the

partnerships, the partners of the company are permitted to make the extractions so long as the

withdrawal is not exceeding the capital that is contributed by the partner (Collis, Holt & Hussey,

2017). This has been found that Derek is not doing anything wrong as he is just making the

drawings that are from his capital account. In this case, Derek contribution was $60,000 and out

of this capital he has withdrawn an amount of $40,000 due to which this is simple that he is not

doing anything wrong within the operations.

Accounting 14

Ethical issues involved in the case

Considering partnership act, any spouse of company is allowable to make the drawing from

partnership until time when the amount of the drawings is not more than the amount of the

capital contributed by the partners (Zona, 2015).

Derek as a partner is therefore permitted to conduct drawing that he has made that the amount to

$40,000 due to this quantity is comparatively less than his own capital when it comes to

partnership.

In the case, there is particular ethical problem that is presented in the time. From the initial

information, it has been found that Derek has identifies that distribution of profit will hang on

majorly on initially or starting influence. During business, the contribution of Derek reduced by

over 60% and at the same time there was no withdraw from Kate from the business in which

Kate made the investment. As per the case review, I believe that distribution of the profit is not

done by Derek in the fair manner, as there is need to divide the profit as per the principles of the

partnership that was set by them in the initial stage according to which they will share the profit

contributed by both the partner. The amount, which is withdrawn by the Derek, is withdrawn

from the capital of the company due to which the contribution in terms of capital declined

according to which the distribution is required to done by Derek. Presently, Kate has the higher

own contribution than Derek does so for distributing the profit there should be presence of the

new established division method for distributing the profit (Weygandt, Kieso, Kimmel & Aly,

2018).

Ethical issues involved in the case

Considering partnership act, any spouse of company is allowable to make the drawing from

partnership until time when the amount of the drawings is not more than the amount of the

capital contributed by the partners (Zona, 2015).

Derek as a partner is therefore permitted to conduct drawing that he has made that the amount to

$40,000 due to this quantity is comparatively less than his own capital when it comes to

partnership.

In the case, there is particular ethical problem that is presented in the time. From the initial

information, it has been found that Derek has identifies that distribution of profit will hang on

majorly on initially or starting influence. During business, the contribution of Derek reduced by

over 60% and at the same time there was no withdraw from Kate from the business in which

Kate made the investment. As per the case review, I believe that distribution of the profit is not

done by Derek in the fair manner, as there is need to divide the profit as per the principles of the

partnership that was set by them in the initial stage according to which they will share the profit

contributed by both the partner. The amount, which is withdrawn by the Derek, is withdrawn

from the capital of the company due to which the contribution in terms of capital declined

according to which the distribution is required to done by Derek. Presently, Kate has the higher

own contribution than Derek does so for distributing the profit there should be presence of the

new established division method for distributing the profit (Weygandt, Kieso, Kimmel & Aly,

2018).

Accounting 15

References

Accounting tools. (2017). Source documents. Retrieved from:

https://www.accountingtools.com/articles/what-are-source-documents-in-accounting.html

Al Bataineh, I., & Bataineh, A. (2018). The Relationship Between Computerized Accounting

Information Systems and Rationalizing the Government Expenditures at the General

Budget of Jordan. Research Journal of Finance and Accounting, 9(8), 171-178.

Amanamah, R. B., Morrison, A., & Asiedu, K. (2016). Computerized accounting systems usage

by small and medium scale enterprises in Kumasi Metropolis, Ghana. Research Journal

of Finance and Accounting, 7(16), 16-29.

Atar, N., & Birman, S. (2017). U.S. Patent No. 9,600,536. Washington, DC: U.S. Patent and

Trademark Office.

Burns, P. (2016). Entrepreneurship and small business. Palgrave Macmillan Limited.

Cliff Notes. (2019). Recording Sales. Retrieved from: https://www.cliffsnotes.com/study-

guides/accounting/accounting-principles-i/accounting-for-a-merchandising-company/

recording-sales

Collis, J., Holt, A., & Hussey, R. (2017). Business accounting. Palgrave.

Libby, R. (2017). Accounting and human information processing. In The Routledge Companion

to Behavioural Accounting Research (pp. 42-54). Routledge.

Lin, Z. J., Yang, D. C., & Wang, L. (2018). Accounting and auditing in China. Routledge.

References

Accounting tools. (2017). Source documents. Retrieved from:

https://www.accountingtools.com/articles/what-are-source-documents-in-accounting.html

Al Bataineh, I., & Bataineh, A. (2018). The Relationship Between Computerized Accounting

Information Systems and Rationalizing the Government Expenditures at the General

Budget of Jordan. Research Journal of Finance and Accounting, 9(8), 171-178.

Amanamah, R. B., Morrison, A., & Asiedu, K. (2016). Computerized accounting systems usage

by small and medium scale enterprises in Kumasi Metropolis, Ghana. Research Journal

of Finance and Accounting, 7(16), 16-29.

Atar, N., & Birman, S. (2017). U.S. Patent No. 9,600,536. Washington, DC: U.S. Patent and

Trademark Office.

Burns, P. (2016). Entrepreneurship and small business. Palgrave Macmillan Limited.

Cliff Notes. (2019). Recording Sales. Retrieved from: https://www.cliffsnotes.com/study-

guides/accounting/accounting-principles-i/accounting-for-a-merchandising-company/

recording-sales

Collis, J., Holt, A., & Hussey, R. (2017). Business accounting. Palgrave.

Libby, R. (2017). Accounting and human information processing. In The Routledge Companion

to Behavioural Accounting Research (pp. 42-54). Routledge.

Lin, Z. J., Yang, D. C., & Wang, L. (2018). Accounting and auditing in China. Routledge.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting 16

Peavler, R. (2018). Source Document Role in an Accounting Transaction. Retrieved from:

https://www.thebalancesmb.com/the-source-document-in-an-accounting-transaction-

393005

Weygandt, J. J., Kieso, D. E., Kimmel, P. D., & Aly, I. M. (2018). Managerial Accounting:

Tools for Business Decision-making. John Wiley & Sons Canada, Limited.

Zona, F. (2015). Board ownership and processes in family firms. Small Business

Economics, 44(1), 105-122.

Peavler, R. (2018). Source Document Role in an Accounting Transaction. Retrieved from:

https://www.thebalancesmb.com/the-source-document-in-an-accounting-transaction-

393005

Weygandt, J. J., Kieso, D. E., Kimmel, P. D., & Aly, I. M. (2018). Managerial Accounting:

Tools for Business Decision-making. John Wiley & Sons Canada, Limited.

Zona, F. (2015). Board ownership and processes in family firms. Small Business

Economics, 44(1), 105-122.

1 out of 17

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.