Principles of Financial Literacy: A Comprehensive Analysis

VerifiedAdded on 2019/09/19

|16

|3682

|361

Report

AI Summary

This report provides a comprehensive overview of the principles of financial literacy. It begins by defining financial literacy and its importance, then delves into key concepts such as budgeting and financial planning, emphasizing the significance of understanding income management and investment strategies. The report explores risk management, including the role of insurance, and highlights the importance of considering superannuation and legal aspects like power of attorney and valid wills. It discusses the differences between various investment strategies, such as direct investing versus mutual funds, and government versus corporate bonds. The report also examines the role of financial literacy initiatives and their impact. Finally, it concludes by summarizing the main points and emphasizing the need for continuous financial education to make informed financial decisions and achieve long-term financial well-being.

Principles of Financial Literacy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction......................................................................................................................................2

Principles of financial literacy.........................................................................................................2

1. Budgeting & financial planning...............................................................................................6

2. Key Differences........................................................................................................................8

3. Risk management.....................................................................................................................9

4. Importance of considering superannuation............................................................................10

5. Importance of power if attorney and valid will......................................................................11

Financial literacy initiatives & its impact......................................................................................12

Conclusion.....................................................................................................................................13

References......................................................................................................................................15

Introduction......................................................................................................................................2

Principles of financial literacy.........................................................................................................2

1. Budgeting & financial planning...............................................................................................6

2. Key Differences........................................................................................................................8

3. Risk management.....................................................................................................................9

4. Importance of considering superannuation............................................................................10

5. Importance of power if attorney and valid will......................................................................11

Financial literacy initiatives & its impact......................................................................................12

Conclusion.....................................................................................................................................13

References......................................................................................................................................15

Introduction

In this present paper, we will discuss the principles of financial literacy. The financial literacy is

defined as the ability to understand the working of money in the world. It includes the managing

of income of an individual in order to generate higher returns within the particular period of

time. It also comprised the skills and knowledge of an individual who helps to take an effective

decision regarding the utilization of financial resources. The short-term programs are focusing on

raising interest in personal finance in various countries such as Japan, United States, Australia

and the United Kingdom.

In the United Kingdom, it is recognized as the financial capability and the government has

started national strategy on financial capability in the year 2003 (Fernandes et al., 2014). The

government of the United States had also taken the initiative by established financial literacy and

education commission in the year 2003. According to the analysis of financial literacy by the

international OECD study, it is found that there were only 67% of respondents have an

understanding of compounded interest, but out of them, only 28 people are having a good

understanding of compound interest (Jappelli et al., 2013). In the Canadian survey, it is

considered by the respondents that the right investment prediction is more difficult than selecting

the dentist. In the survey of United States, it is found that the four out of ten people are not

saving for their retirement.

Principles of financial literacy

In the recent years, the concerned regarding the financial literacy have been improved across the

worldwide in order to enhance the financial knowledge of people. It has stemmed in the specific

In this present paper, we will discuss the principles of financial literacy. The financial literacy is

defined as the ability to understand the working of money in the world. It includes the managing

of income of an individual in order to generate higher returns within the particular period of

time. It also comprised the skills and knowledge of an individual who helps to take an effective

decision regarding the utilization of financial resources. The short-term programs are focusing on

raising interest in personal finance in various countries such as Japan, United States, Australia

and the United Kingdom.

In the United Kingdom, it is recognized as the financial capability and the government has

started national strategy on financial capability in the year 2003 (Fernandes et al., 2014). The

government of the United States had also taken the initiative by established financial literacy and

education commission in the year 2003. According to the analysis of financial literacy by the

international OECD study, it is found that there were only 67% of respondents have an

understanding of compounded interest, but out of them, only 28 people are having a good

understanding of compound interest (Jappelli et al., 2013). In the Canadian survey, it is

considered by the respondents that the right investment prediction is more difficult than selecting

the dentist. In the survey of United States, it is found that the four out of ten people are not

saving for their retirement.

Principles of financial literacy

In the recent years, the concerned regarding the financial literacy have been improved across the

worldwide in order to enhance the financial knowledge of people. It has stemmed in the specific

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

from public to private support system through shifting the demographic files which comprise of

aging of population and development in the wide range in the financial market. The concern was

highlighted mainly due to the financial and economic challenges which recognize the lack of

financial literacy and it contributes towards the ill financial decision making of people (Lusardi

et al., 2014).

Following are the seven principles of financial literacy which are developed by the organization

for economic cooperation and development in order to improve the financial literacy across the

worldwide:

1. Financial education

The aim of the financial education principle is to improve the knowledge related to the

financial products, risk, concept, information and objective advice in order to improve the

decision making of an individual which enables to enhance the financial wellbeing of

people. The financial education is beyond the provision of financial advice and

information which should be regulated in order to improve the decision making of an

individual and protect the financials of clients.

2. Financial capacity building

Another principle of financial literacy is to build the financial capacity through the

financial information and instruction which should be promoted in order to achieve the

objective of principles. The financial education should be providing in an unbiased

manner and fair in order to improve the knowledge of people. The various programs

should be coordinated in order to develop the efficiency among the people.

3. Financial education program

aging of population and development in the wide range in the financial market. The concern was

highlighted mainly due to the financial and economic challenges which recognize the lack of

financial literacy and it contributes towards the ill financial decision making of people (Lusardi

et al., 2014).

Following are the seven principles of financial literacy which are developed by the organization

for economic cooperation and development in order to improve the financial literacy across the

worldwide:

1. Financial education

The aim of the financial education principle is to improve the knowledge related to the

financial products, risk, concept, information and objective advice in order to improve the

decision making of an individual which enables to enhance the financial wellbeing of

people. The financial education is beyond the provision of financial advice and

information which should be regulated in order to improve the decision making of an

individual and protect the financials of clients.

2. Financial capacity building

Another principle of financial literacy is to build the financial capacity through the

financial information and instruction which should be promoted in order to achieve the

objective of principles. The financial education should be providing in an unbiased

manner and fair in order to improve the knowledge of people. The various programs

should be coordinated in order to develop the efficiency among the people.

3. Financial education program

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The focus of financial education program is to improve the high priority issues which

depend on the national circumstances it includes the importance of financial life

planning, for example, private debt management, savings, insurance, financial awareness

for example elementary financial mathematics and economics. The awareness among the

future retirees must be developed regarding the assessment of retirement saving scheme

in order to provide financial stability for the life of an individual (Taft et al., 2013).

4. Regulatory and administrative framework

The account of regulatory and administrative should include the financial education

which acts as a promoter tool to improve the economic growth of the nation. The

togetherness of financial regulation helps to improve the consumer protection. The

financial education should be promoted in order to develop the awareness among the

consumers

5. Measures

The corrective measures must be taken when the deficiencies are predicted in the

financial capacity. There are various policies tools which should be used to protect the

consumers and the regulations of financial institutions. The default mechanism should b e

into account the financial education without limiting the freedom of contract.

6. Role of financial institutions

The role of financial institutions should be promoted in order to improve the financial

education of people and to become the part of good governance for the financial clients.

The accountability and responsibility of financial institutions should be encouraged in

order to provide the information as well as the advice related to the financial issues and

the financial awareness among the clients must be promoted in order to improve the

depend on the national circumstances it includes the importance of financial life

planning, for example, private debt management, savings, insurance, financial awareness

for example elementary financial mathematics and economics. The awareness among the

future retirees must be developed regarding the assessment of retirement saving scheme

in order to provide financial stability for the life of an individual (Taft et al., 2013).

4. Regulatory and administrative framework

The account of regulatory and administrative should include the financial education

which acts as a promoter tool to improve the economic growth of the nation. The

togetherness of financial regulation helps to improve the consumer protection. The

financial education should be promoted in order to develop the awareness among the

consumers

5. Measures

The corrective measures must be taken when the deficiencies are predicted in the

financial capacity. There are various policies tools which should be used to protect the

consumers and the regulations of financial institutions. The default mechanism should b e

into account the financial education without limiting the freedom of contract.

6. Role of financial institutions

The role of financial institutions should be promoted in order to improve the financial

education of people and to become the part of good governance for the financial clients.

The accountability and responsibility of financial institutions should be encouraged in

order to provide the information as well as the advice related to the financial issues and

the financial awareness among the clients must be promoted in order to improve the

effective decision making related to the long-term commitment of funds which represents

the future income of an individual (Xiao et al., 2014).

7. Designing of financial education program

The financial education program should be designed to develop the financial awareness

among the people and improve the financial literacy of target audience. The financial

education should be regarded as continues process in order to enhance the financial

knowledge related to the complex market.

The United States Securities and Exchange Commission has developed the

principles for personal financing in order to improve the financial literacy among

the natives:

1. Make a plan

It is the key to financial security in order to achieve the financial goals of an

individual. The financial plan acts as a roadmap to get comfortable retirement and the

financially secure life.

2. Save and invest for the long period

The savings must be done by an individual in order to secure the future. The period of

investment should be long in order to maximize the return, but it also includes

financial risk which can be reducing through financial literacy.

3. Scrutinize before the investment

The investigation must be properly done regarding the investment plan in order to

minimize the risk related to the investment.

4. Avoid the cost of delay

the future income of an individual (Xiao et al., 2014).

7. Designing of financial education program

The financial education program should be designed to develop the financial awareness

among the people and improve the financial literacy of target audience. The financial

education should be regarded as continues process in order to enhance the financial

knowledge related to the complex market.

The United States Securities and Exchange Commission has developed the

principles for personal financing in order to improve the financial literacy among

the natives:

1. Make a plan

It is the key to financial security in order to achieve the financial goals of an

individual. The financial plan acts as a roadmap to get comfortable retirement and the

financially secure life.

2. Save and invest for the long period

The savings must be done by an individual in order to secure the future. The period of

investment should be long in order to maximize the return, but it also includes

financial risk which can be reducing through financial literacy.

3. Scrutinize before the investment

The investigation must be properly done regarding the investment plan in order to

minimize the risk related to the investment.

4. Avoid the cost of delay

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Time is considered as one of the most important factors which need to be considering

at the time of making the investment. For example, if the investment saves $5 at

eight percent in the age of 18 years than at the age of 65 then total amount will be

$134,000. So the investment should not be delays in order to maximize the returns

(Markham et al., 2015).

1. Budgeting & financial planning

Following are the factors which show that the financial planning and budgeting

helps to achieve the goals and objectives:

1. Know the total home pay

The home pay includes the total expenses which must be deducted in order to

determine the available money for the investment purpose.

2. Pay yourself first

There should be some amount which must be saved for long-term financial

obligations and unexpected emergencies before paying monthly expenses so that

the future must be saved.

3. Start saving young

The investment should be started at the early age in order to secure the future and

retirement would be secure. So the total savings must be determined then some

proportionate amount must be saved at the certain period of time.

4. Compare interest rates

at the time of making the investment. For example, if the investment saves $5 at

eight percent in the age of 18 years than at the age of 65 then total amount will be

$134,000. So the investment should not be delays in order to maximize the returns

(Markham et al., 2015).

1. Budgeting & financial planning

Following are the factors which show that the financial planning and budgeting

helps to achieve the goals and objectives:

1. Know the total home pay

The home pay includes the total expenses which must be deducted in order to

determine the available money for the investment purpose.

2. Pay yourself first

There should be some amount which must be saved for long-term financial

obligations and unexpected emergencies before paying monthly expenses so that

the future must be saved.

3. Start saving young

The investment should be started at the early age in order to secure the future and

retirement would be secure. So the total savings must be determined then some

proportionate amount must be saved at the certain period of time.

4. Compare interest rates

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The information related to the interest must be obtained from multiple financial

services in order to get the best value for money within the particular period of

time.

5. Don’t borrow what can’t be repaid

The responsible borrower must borrow the amount which can be paid in the future

and the worth of getting credit must be shown in order to get money. The

comparison must be made between the income and present financial obligations in

order to check the availability of paying the debts (Hill et al., 2016).

6. Budget the money

The annual budget must be developing in order to determine the expected income

and expenses within the particular year which enables to expense within the

limitations of income budget.

7. “The rule of 72” can be used to double the money

The duration of doubling the money can be determined by dividing the rate of

interest by 72 which enables to check the duration in achieving the particular

amount.

8. High rates are equal to high risks

It is the principle of investment which states that the higher rates come with, the

higher risk which shows that the investor must consider the risk factor at the time

of making an investment in the particular plan for the specific period of time.

9. Do not expect something for nothing

The investor must not rely on the fake advertisement and financial offers which

promise the pay free offers and guaranteed investment returns.

services in order to get the best value for money within the particular period of

time.

5. Don’t borrow what can’t be repaid

The responsible borrower must borrow the amount which can be paid in the future

and the worth of getting credit must be shown in order to get money. The

comparison must be made between the income and present financial obligations in

order to check the availability of paying the debts (Hill et al., 2016).

6. Budget the money

The annual budget must be developing in order to determine the expected income

and expenses within the particular year which enables to expense within the

limitations of income budget.

7. “The rule of 72” can be used to double the money

The duration of doubling the money can be determined by dividing the rate of

interest by 72 which enables to check the duration in achieving the particular

amount.

8. High rates are equal to high risks

It is the principle of investment which states that the higher rates come with, the

higher risk which shows that the investor must consider the risk factor at the time

of making an investment in the particular plan for the specific period of time.

9. Do not expect something for nothing

The investor must not rely on the fake advertisement and financial offers which

promise the pay free offers and guaranteed investment returns.

10. Financial Future should be map

The investor must plan for the financial future by creating a roadmap in order to

achieve the financial goals within the particular time framework. The roadmap

must be realistic to achieve the objective of financial planning.

11. The credit past will be credit future

The credit report is maintained by the credit bureau in which the history of

repaying loans of the borrower is included. The negative information in the credit

report impacts on the ability of borrowing of an individual in the future (Pang et

al., 2016).

12. Insurance must be purchased

The insurance must be purchased by the investor in order to secure the future through

avoiding the financial losses such as accident, illness, and others. The insurance plan is

the part of the financial plan.

Couple 1:

The budgeting and financial planning help to forecast and save money for the future in

order to achieve the goals and objective within the specific time framework.

Couple 2:

The pre-retirement plans require financial planning and budgeting in order to secure

the future. The planning helps to forecast and allocating the resources in order to

achieve the goals and objectives.

Couple 3:

In the retirement stage, the financial planning helps to predict the total budget of

expenditure in order to secure the future financially.

The investor must plan for the financial future by creating a roadmap in order to

achieve the financial goals within the particular time framework. The roadmap

must be realistic to achieve the objective of financial planning.

11. The credit past will be credit future

The credit report is maintained by the credit bureau in which the history of

repaying loans of the borrower is included. The negative information in the credit

report impacts on the ability of borrowing of an individual in the future (Pang et

al., 2016).

12. Insurance must be purchased

The insurance must be purchased by the investor in order to secure the future through

avoiding the financial losses such as accident, illness, and others. The insurance plan is

the part of the financial plan.

Couple 1:

The budgeting and financial planning help to forecast and save money for the future in

order to achieve the goals and objective within the specific time framework.

Couple 2:

The pre-retirement plans require financial planning and budgeting in order to secure

the future. The planning helps to forecast and allocating the resources in order to

achieve the goals and objectives.

Couple 3:

In the retirement stage, the financial planning helps to predict the total budget of

expenditure in order to secure the future financially.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

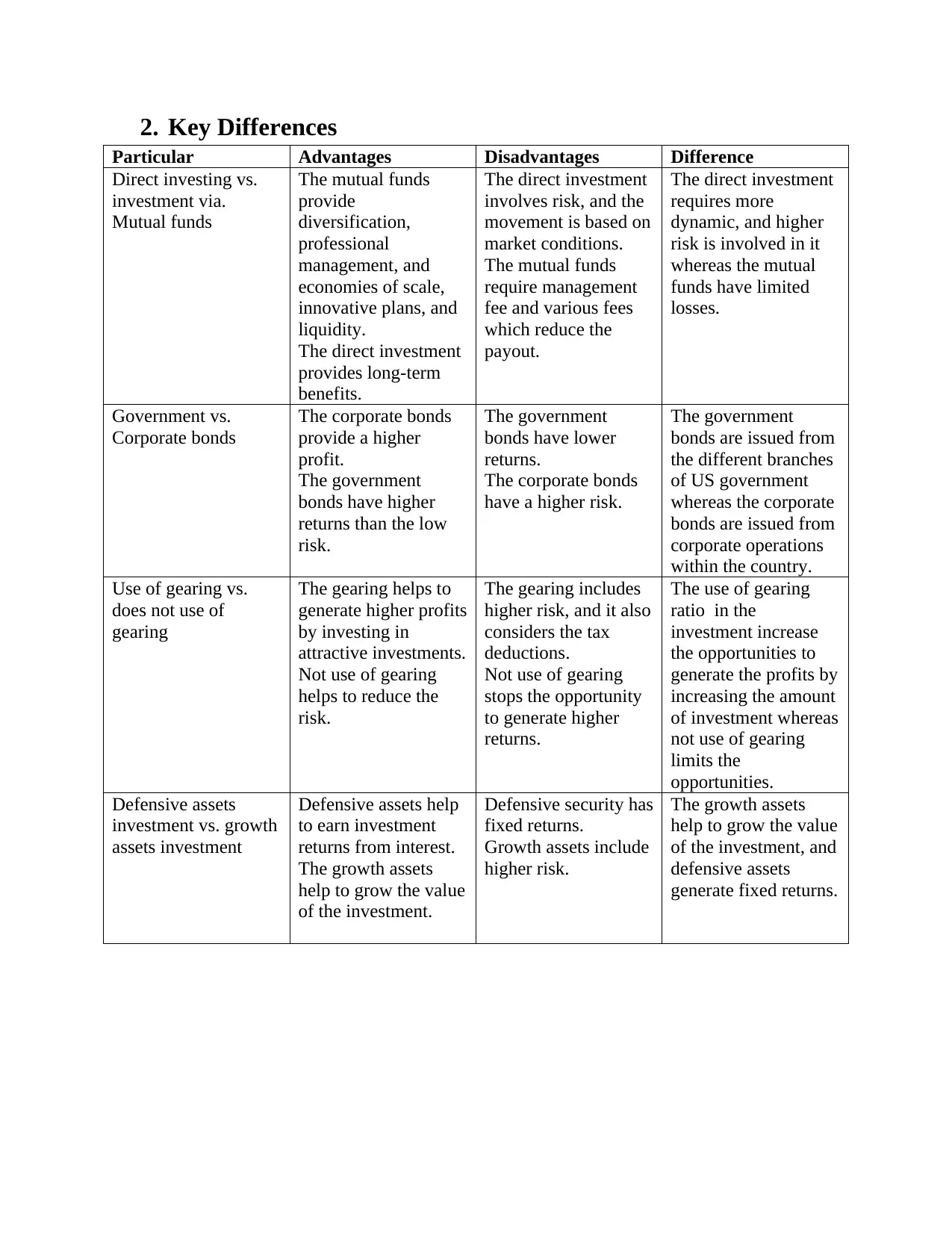

2. Key Differences

Particular Advantages Disadvantages Difference

Direct investing vs.

investment via.

Mutual funds

The mutual funds

provide

diversification,

professional

management, and

economies of scale,

innovative plans, and

liquidity.

The direct investment

provides long-term

benefits.

The direct investment

involves risk, and the

movement is based on

market conditions.

The mutual funds

require management

fee and various fees

which reduce the

payout.

The direct investment

requires more

dynamic, and higher

risk is involved in it

whereas the mutual

funds have limited

losses.

Government vs.

Corporate bonds

The corporate bonds

provide a higher

profit.

The government

bonds have higher

returns than the low

risk.

The government

bonds have lower

returns.

The corporate bonds

have a higher risk.

The government

bonds are issued from

the different branches

of US government

whereas the corporate

bonds are issued from

corporate operations

within the country.

Use of gearing vs.

does not use of

gearing

The gearing helps to

generate higher profits

by investing in

attractive investments.

Not use of gearing

helps to reduce the

risk.

The gearing includes

higher risk, and it also

considers the tax

deductions.

Not use of gearing

stops the opportunity

to generate higher

returns.

The use of gearing

ratio in the

investment increase

the opportunities to

generate the profits by

increasing the amount

of investment whereas

not use of gearing

limits the

opportunities.

Defensive assets

investment vs. growth

assets investment

Defensive assets help

to earn investment

returns from interest.

The growth assets

help to grow the value

of the investment.

Defensive security has

fixed returns.

Growth assets include

higher risk.

The growth assets

help to grow the value

of the investment, and

defensive assets

generate fixed returns.

Particular Advantages Disadvantages Difference

Direct investing vs.

investment via.

Mutual funds

The mutual funds

provide

diversification,

professional

management, and

economies of scale,

innovative plans, and

liquidity.

The direct investment

provides long-term

benefits.

The direct investment

involves risk, and the

movement is based on

market conditions.

The mutual funds

require management

fee and various fees

which reduce the

payout.

The direct investment

requires more

dynamic, and higher

risk is involved in it

whereas the mutual

funds have limited

losses.

Government vs.

Corporate bonds

The corporate bonds

provide a higher

profit.

The government

bonds have higher

returns than the low

risk.

The government

bonds have lower

returns.

The corporate bonds

have a higher risk.

The government

bonds are issued from

the different branches

of US government

whereas the corporate

bonds are issued from

corporate operations

within the country.

Use of gearing vs.

does not use of

gearing

The gearing helps to

generate higher profits

by investing in

attractive investments.

Not use of gearing

helps to reduce the

risk.

The gearing includes

higher risk, and it also

considers the tax

deductions.

Not use of gearing

stops the opportunity

to generate higher

returns.

The use of gearing

ratio in the

investment increase

the opportunities to

generate the profits by

increasing the amount

of investment whereas

not use of gearing

limits the

opportunities.

Defensive assets

investment vs. growth

assets investment

Defensive assets help

to earn investment

returns from interest.

The growth assets

help to grow the value

of the investment.

Defensive security has

fixed returns.

Growth assets include

higher risk.

The growth assets

help to grow the value

of the investment, and

defensive assets

generate fixed returns.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

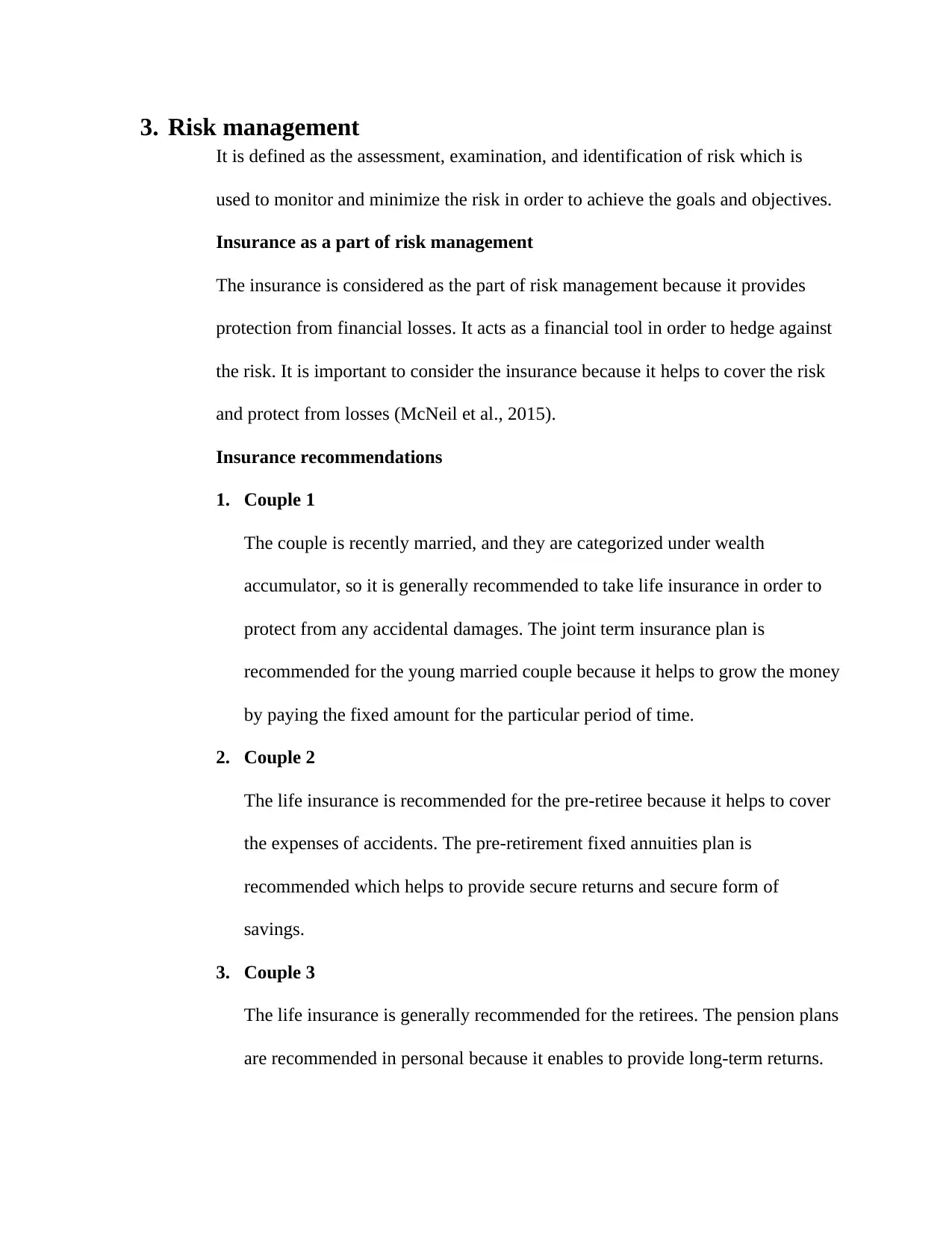

3. Risk management

It is defined as the assessment, examination, and identification of risk which is

used to monitor and minimize the risk in order to achieve the goals and objectives.

Insurance as a part of risk management

The insurance is considered as the part of risk management because it provides

protection from financial losses. It acts as a financial tool in order to hedge against

the risk. It is important to consider the insurance because it helps to cover the risk

and protect from losses (McNeil et al., 2015).

Insurance recommendations

1. Couple 1

The couple is recently married, and they are categorized under wealth

accumulator, so it is generally recommended to take life insurance in order to

protect from any accidental damages. The joint term insurance plan is

recommended for the young married couple because it helps to grow the money

by paying the fixed amount for the particular period of time.

2. Couple 2

The life insurance is recommended for the pre-retiree because it helps to cover

the expenses of accidents. The pre-retirement fixed annuities plan is

recommended which helps to provide secure returns and secure form of

savings.

3. Couple 3

The life insurance is generally recommended for the retirees. The pension plans

are recommended in personal because it enables to provide long-term returns.

It is defined as the assessment, examination, and identification of risk which is

used to monitor and minimize the risk in order to achieve the goals and objectives.

Insurance as a part of risk management

The insurance is considered as the part of risk management because it provides

protection from financial losses. It acts as a financial tool in order to hedge against

the risk. It is important to consider the insurance because it helps to cover the risk

and protect from losses (McNeil et al., 2015).

Insurance recommendations

1. Couple 1

The couple is recently married, and they are categorized under wealth

accumulator, so it is generally recommended to take life insurance in order to

protect from any accidental damages. The joint term insurance plan is

recommended for the young married couple because it helps to grow the money

by paying the fixed amount for the particular period of time.

2. Couple 2

The life insurance is recommended for the pre-retiree because it helps to cover

the expenses of accidents. The pre-retirement fixed annuities plan is

recommended which helps to provide secure returns and secure form of

savings.

3. Couple 3

The life insurance is generally recommended for the retirees. The pension plans

are recommended in personal because it enables to provide long-term returns.

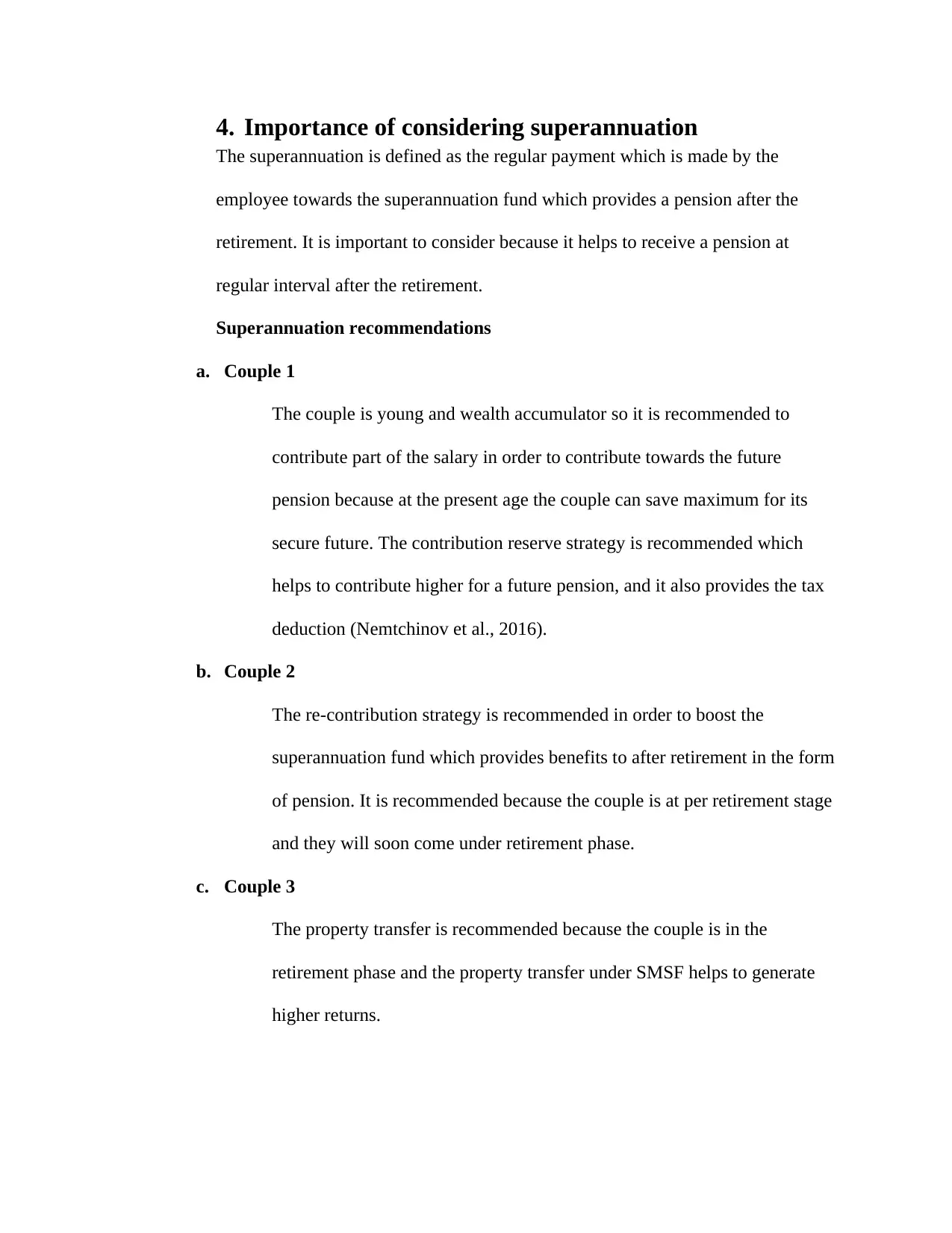

4. Importance of considering superannuation

The superannuation is defined as the regular payment which is made by the

employee towards the superannuation fund which provides a pension after the

retirement. It is important to consider because it helps to receive a pension at

regular interval after the retirement.

Superannuation recommendations

a. Couple 1

The couple is young and wealth accumulator so it is recommended to

contribute part of the salary in order to contribute towards the future

pension because at the present age the couple can save maximum for its

secure future. The contribution reserve strategy is recommended which

helps to contribute higher for a future pension, and it also provides the tax

deduction (Nemtchinov et al., 2016).

b. Couple 2

The re-contribution strategy is recommended in order to boost the

superannuation fund which provides benefits to after retirement in the form

of pension. It is recommended because the couple is at per retirement stage

and they will soon come under retirement phase.

c. Couple 3

The property transfer is recommended because the couple is in the

retirement phase and the property transfer under SMSF helps to generate

higher returns.

The superannuation is defined as the regular payment which is made by the

employee towards the superannuation fund which provides a pension after the

retirement. It is important to consider because it helps to receive a pension at

regular interval after the retirement.

Superannuation recommendations

a. Couple 1

The couple is young and wealth accumulator so it is recommended to

contribute part of the salary in order to contribute towards the future

pension because at the present age the couple can save maximum for its

secure future. The contribution reserve strategy is recommended which

helps to contribute higher for a future pension, and it also provides the tax

deduction (Nemtchinov et al., 2016).

b. Couple 2

The re-contribution strategy is recommended in order to boost the

superannuation fund which provides benefits to after retirement in the form

of pension. It is recommended because the couple is at per retirement stage

and they will soon come under retirement phase.

c. Couple 3

The property transfer is recommended because the couple is in the

retirement phase and the property transfer under SMSF helps to generate

higher returns.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.