Principles of Financial Management: The Bank of Queensland

VerifiedAdded on 2023/01/05

|24

|4351

|29

AI Summary

This document provides an overview of the principles of financial management applied by the Bank of Queensland. It discusses the Australian financial system, the dominance of major banks, and the role of regulators in the industry. The document also analyzes the bank's financial assets, financial structure, and key ratios important to creditors and shareholders.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

PRINCIPLES OF FINANCIAL MANAGEMENT 1

The Australian financial system: the bank of Queensland

Student’s name

Course

Instructor’s name

Institutional affiliation

City and state

Date

The Australian financial system: the bank of Queensland

Student’s name

Course

Instructor’s name

Institutional affiliation

City and state

Date

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

PRINCIPLES OF FINANCIAL MANAGEMENT 2

Industry description

Financial management can be defined as the process of undertaking strategic

planning, organizing, directing and controlling of the financial aspects within an

organization. It the process, therefore, includes the application management principles

and guidelines to financial securities and assets that are owned by an entity such as the

bank of Queensland. The financial industry within Australia is predominantly an

oligopolistic type of industry. Financial services and operations are mainly dominated by

around four major banks and insurers. The rest of the participants are simply small

financial services providers operating besides these major players. In the industry,

banks up to an e estimated 75% market share especially in the providing services such

as housing loans, small businesses, and so on (Jacobson,2018). The general insuring

firms within the industry cover-up to around 80% for creditors, reinsurance and travel

insurance among others. The small financial entities, however, have relative market

share, especially in the target markets. Therefore, this type of industry climate is an

explanation for the high levels of competition especially within the home loan markets,

consumer credits and home insurance among others. However, it is also notable that

such levels of competition are still below the desired. On the other hand, little

competition exists within the small business finance industry. These small businesses

that trade in assets such as the small business credit, lenders, pet insurance among

others have very limited completion within the industry. Regulation in the Australian

financial industry is carried out by around three bodies. These include the Australian

Securities and Investments Commission (ASIC), The Australian Prudential Regulatory

Authority (APRA) and The Reserve Bank of Australia (RBA) (Australian Government,

Industry description

Financial management can be defined as the process of undertaking strategic

planning, organizing, directing and controlling of the financial aspects within an

organization. It the process, therefore, includes the application management principles

and guidelines to financial securities and assets that are owned by an entity such as the

bank of Queensland. The financial industry within Australia is predominantly an

oligopolistic type of industry. Financial services and operations are mainly dominated by

around four major banks and insurers. The rest of the participants are simply small

financial services providers operating besides these major players. In the industry,

banks up to an e estimated 75% market share especially in the providing services such

as housing loans, small businesses, and so on (Jacobson,2018). The general insuring

firms within the industry cover-up to around 80% for creditors, reinsurance and travel

insurance among others. The small financial entities, however, have relative market

share, especially in the target markets. Therefore, this type of industry climate is an

explanation for the high levels of competition especially within the home loan markets,

consumer credits and home insurance among others. However, it is also notable that

such levels of competition are still below the desired. On the other hand, little

competition exists within the small business finance industry. These small businesses

that trade in assets such as the small business credit, lenders, pet insurance among

others have very limited completion within the industry. Regulation in the Australian

financial industry is carried out by around three bodies. These include the Australian

Securities and Investments Commission (ASIC), The Australian Prudential Regulatory

Authority (APRA) and The Reserve Bank of Australia (RBA) (Australian Government,

PRINCIPLES OF FINANCIAL MANAGEMENT 3

2018). Similarly, the Australian securities exchange has also been identified as one of

the regulators of the Australian financial industry. Besides the regulators, The Council of

Financial Regulators (CFR) also assists in monitoring the financial activities within the

Australian financial market. This body is comprised of about four members and of which

The Australian Prudential Regulation Authority (APRA) is among (Reserve Bank of

Australia,2019).

Company description

The focus for this particular paper is the bank of Queensland. The bank of

Queensland is a business to a business universal entity. The main sources of business

for this bank include offering transaction accounts, savings and investments accounts,

general insurance, credit card protection, consumer credit insurances and so many

other services. It is through such activities that the bank of Queensland derives

business. The bank of Queensland is run on a decentralized system of a structure. The

bank has an executive chief officer, the board of directors and as the top managers. The

management of the bank further has chief financial officers as well as other officers

below the CFO (Bank of Queensland limited, 2019). The chain of authority within the

bank further continues up to the retail distribution centres. The ownership of the bank is

however comprised of a total of about 20 shareholders as it is a public listed company

on the Australian stock exchange (Bank of Queensland Group,2018). The bank of

Queensland plays various roles within the industry. Among such roles, the bank of

Queensland acts as an intermediary between the lenders and borrowers. For example,

lenders deposit money on their account such as the fixed deposit accounts and then the

bank lends out this money to other users at an interest. Through services such as

2018). Similarly, the Australian securities exchange has also been identified as one of

the regulators of the Australian financial industry. Besides the regulators, The Council of

Financial Regulators (CFR) also assists in monitoring the financial activities within the

Australian financial market. This body is comprised of about four members and of which

The Australian Prudential Regulation Authority (APRA) is among (Reserve Bank of

Australia,2019).

Company description

The focus for this particular paper is the bank of Queensland. The bank of

Queensland is a business to a business universal entity. The main sources of business

for this bank include offering transaction accounts, savings and investments accounts,

general insurance, credit card protection, consumer credit insurances and so many

other services. It is through such activities that the bank of Queensland derives

business. The bank of Queensland is run on a decentralized system of a structure. The

bank has an executive chief officer, the board of directors and as the top managers. The

management of the bank further has chief financial officers as well as other officers

below the CFO (Bank of Queensland limited, 2019). The chain of authority within the

bank further continues up to the retail distribution centres. The ownership of the bank is

however comprised of a total of about 20 shareholders as it is a public listed company

on the Australian stock exchange (Bank of Queensland Group,2018). The bank of

Queensland plays various roles within the industry. Among such roles, the bank of

Queensland acts as an intermediary between the lenders and borrowers. For example,

lenders deposit money on their account such as the fixed deposit accounts and then the

bank lends out this money to other users at an interest. Through services such as

PRINCIPLES OF FINANCIAL MANAGEMENT 4

general insurance services, the bank of Queensland provides insurance cover to its

customers. Since the bank of Queensland is a public listed company, it, therefore, acts

as an investment opportunity for investors within and outside Australia. Such a role is

done through the process of issuing out shares on the stock market.

Financial instrument analysis

A financial asset or security refers to an investment that has its value derived

from a contractual agreement concerning what it holds. These financial assets are

mostly liquid since they are highly convertible to other forms such as cash in a short

period. These assets are also intangible and they include securities such as bonds,

stocks, bank deposits, and cash among others. Items such as fixed assets, land, plant

and property are not part of the financial assets of a business. This because such

assets are tangible and they are fixed in nature. It is a further noted that fixed assets

such as land are not highly convertible into cash. Therefore such assets are held by an

entity over a long period.

Bonds, for example, are those long term debt instruments that are issued out by

a company to raise capital. They normally attract very low interests and therefore

associated with very minimal risk.

From the 2018 annual report, the bank of Queensland is identified to be dealing

in financial assets such as loans and advances at amortized cost, assets that are held

for sale, shares in controlled entities, liabilities held for sale, the derivative financial

liabilities, issued capital, reserves, retained profits and so many other assets. An off-

balance sheet business is referred to as a situation through which assets and or

general insurance services, the bank of Queensland provides insurance cover to its

customers. Since the bank of Queensland is a public listed company, it, therefore, acts

as an investment opportunity for investors within and outside Australia. Such a role is

done through the process of issuing out shares on the stock market.

Financial instrument analysis

A financial asset or security refers to an investment that has its value derived

from a contractual agreement concerning what it holds. These financial assets are

mostly liquid since they are highly convertible to other forms such as cash in a short

period. These assets are also intangible and they include securities such as bonds,

stocks, bank deposits, and cash among others. Items such as fixed assets, land, plant

and property are not part of the financial assets of a business. This because such

assets are tangible and they are fixed in nature. It is a further noted that fixed assets

such as land are not highly convertible into cash. Therefore such assets are held by an

entity over a long period.

Bonds, for example, are those long term debt instruments that are issued out by

a company to raise capital. They normally attract very low interests and therefore

associated with very minimal risk.

From the 2018 annual report, the bank of Queensland is identified to be dealing

in financial assets such as loans and advances at amortized cost, assets that are held

for sale, shares in controlled entities, liabilities held for sale, the derivative financial

liabilities, issued capital, reserves, retained profits and so many other assets. An off-

balance sheet business is referred to as a situation through which assets and or

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

PRINCIPLES OF FINANCIAL MANAGEMENT 5

liabilities are not recorded on the company’s balance sheet. These assets are not

recorded in the balance sheet but they remain a company's assets. These off-balance

sheet items are usually obligations that an entity has to pay. For instance, if the bank of

Queensland obtained a loan and then decides to invest such a loan, and the debt is not

recorded anywhere among the bank liabilities. Such an example would be a clear

illustration of an off-balance sheet business. These items are vital aspects that

interested individuals need to have a clear understanding of bout. For example,

investors will use such items to come up with a representative picture of a company's

financial stability. Therefore the bank of Queensland does not deal in the off-balance

sheet business. The financial assets that are included in the off-balance sheet business

are accounts receivable, operating lease, leaseback contracts, among others. The Bank

of Queensland has had an estimated $16 million volume in an off-balance sheet volume

as compared to the estimated $250 million in the company’s asset portfolio (bank of

Queensland, 2018).

Financial structure analysis

Ratio analysis is a mathematical technique used to generate an in-depth analysis

concerning a company's state of liquidity, operational efficiency, and level of profitability

and so on. This type of analysis is conducted in comparison with similar information of

another entity in the same industry. The major aim of undertaking such a process is to

identify the most profitable company that is worth investing in. the alternative reason for

such a process is to assess the performance of the entity.

liabilities are not recorded on the company’s balance sheet. These assets are not

recorded in the balance sheet but they remain a company's assets. These off-balance

sheet items are usually obligations that an entity has to pay. For instance, if the bank of

Queensland obtained a loan and then decides to invest such a loan, and the debt is not

recorded anywhere among the bank liabilities. Such an example would be a clear

illustration of an off-balance sheet business. These items are vital aspects that

interested individuals need to have a clear understanding of bout. For example,

investors will use such items to come up with a representative picture of a company's

financial stability. Therefore the bank of Queensland does not deal in the off-balance

sheet business. The financial assets that are included in the off-balance sheet business

are accounts receivable, operating lease, leaseback contracts, among others. The Bank

of Queensland has had an estimated $16 million volume in an off-balance sheet volume

as compared to the estimated $250 million in the company’s asset portfolio (bank of

Queensland, 2018).

Financial structure analysis

Ratio analysis is a mathematical technique used to generate an in-depth analysis

concerning a company's state of liquidity, operational efficiency, and level of profitability

and so on. This type of analysis is conducted in comparison with similar information of

another entity in the same industry. The major aim of undertaking such a process is to

identify the most profitable company that is worth investing in. the alternative reason for

such a process is to assess the performance of the entity.

PRINCIPLES OF FINANCIAL MANAGEMENT 6

Therefore, several ratio analyses can be conducted under such a process. These

ratio analyses are, however, categorized into six major categories. These include the

profitability ratios such as operating profits, the return of equity, net profit, and the

earnings before deducting income and tax among others. The other categories of ratios

include the activity ratios, liquidity ratios, debt ratios and market ratios. However, each

financial participant in the financial industry has individual interests that have to be

fulfilled. The creditors, for instance, are more interested in assessing the ability of a

company's ability to pay off obligations whereas the shareholders are more interested in

receiving timely dividends from their investments in an organization. This is the reason

as to why the following ratios are provided for both the creditors and shareholders as

required.

The key ratios important to the creditors

The creditors of a business desire that a business or a debt is in a position to pay

off obligations in the shortest time possible. Therefore before they give out any credit,

they assess the creditworthiness of the debtor. The following are therefore among the

ratios effectively before they can give out credit. Creditors look at ratios such as the

liquidity ratios, solvency ratios, and the converge ratios. However, all these different

ratios are further broken down for further understanding of the aspect. For instance,

liquidity ratios include current ratios, quick ratios, and working capital ratios and so on.

The solvency ratios, on the other hand, include the dent-to equity ratio, debt-to-asset

ratio, and the interest current ratio. Coverage ratios are further subdivided into times

interest ratios. Debt –service coverage ratios among others (Management Study

Therefore, several ratio analyses can be conducted under such a process. These

ratio analyses are, however, categorized into six major categories. These include the

profitability ratios such as operating profits, the return of equity, net profit, and the

earnings before deducting income and tax among others. The other categories of ratios

include the activity ratios, liquidity ratios, debt ratios and market ratios. However, each

financial participant in the financial industry has individual interests that have to be

fulfilled. The creditors, for instance, are more interested in assessing the ability of a

company's ability to pay off obligations whereas the shareholders are more interested in

receiving timely dividends from their investments in an organization. This is the reason

as to why the following ratios are provided for both the creditors and shareholders as

required.

The key ratios important to the creditors

The creditors of a business desire that a business or a debt is in a position to pay

off obligations in the shortest time possible. Therefore before they give out any credit,

they assess the creditworthiness of the debtor. The following are therefore among the

ratios effectively before they can give out credit. Creditors look at ratios such as the

liquidity ratios, solvency ratios, and the converge ratios. However, all these different

ratios are further broken down for further understanding of the aspect. For instance,

liquidity ratios include current ratios, quick ratios, and working capital ratios and so on.

The solvency ratios, on the other hand, include the dent-to equity ratio, debt-to-asset

ratio, and the interest current ratio. Coverage ratios are further subdivided into times

interest ratios. Debt –service coverage ratios among others (Management Study

PRINCIPLES OF FINANCIAL MANAGEMENT 7

Guide,2019). For this particular paper, the focus will be put on current ratios, quick

ratios and the debt ratio.

Current ratio

The current ratio is a financial analysis ratio that reflects the degree to which a

business entity is in a position to pay off obligations. This ratio is stated as the total

assets of an entity divided by the total current liabilities (Nuhu, 2014).

Current ratio = current assets

current liabilities

Quick ratios

The quick ratio is an example of the liquidity ratios. This particular type of ratio analysis I

used to indicate the level at which current liabilities can be paid off while using the liquid

current assets. These assets include cash, marketable securities and accounts

receivables (Al- Awawdeh and Al-sakini, 2017). The major distinction that exists

between the quick ratio and current ratio is that quick ratios are used correct the

assumption held by current ratios. Current a] ratios assume that all current assets can

be converted into cash to meet short term obligations. However, in real-life situations,

such an assumption is not realistic. Therefore the quick ratio is developed based on

correcting such an assumption. This quick ratio, therefore, tries to eliminate current

Guide,2019). For this particular paper, the focus will be put on current ratios, quick

ratios and the debt ratio.

Current ratio

The current ratio is a financial analysis ratio that reflects the degree to which a

business entity is in a position to pay off obligations. This ratio is stated as the total

assets of an entity divided by the total current liabilities (Nuhu, 2014).

Current ratio = current assets

current liabilities

Quick ratios

The quick ratio is an example of the liquidity ratios. This particular type of ratio analysis I

used to indicate the level at which current liabilities can be paid off while using the liquid

current assets. These assets include cash, marketable securities and accounts

receivables (Al- Awawdeh and Al-sakini, 2017). The major distinction that exists

between the quick ratio and current ratio is that quick ratios are used correct the

assumption held by current ratios. Current a] ratios assume that all current assets can

be converted into cash to meet short term obligations. However, in real-life situations,

such an assumption is not realistic. Therefore the quick ratio is developed based on

correcting such an assumption. This quick ratio, therefore, tries to eliminate current

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PRINCIPLES OF FINANCIAL MANAGEMENT 8

assets that cannot be easily converted into cash immediately (Delkhosh and Mousavi,

2016). The quick ratio is therefore given by the following formula.

Quick ratio = current assets−inventory

current liabilities

The debt ratio

The ratio is an example of the leverage ratios. This ratio indicates the proportion of

assets that are financed through obtaining debts. It is also notable that these debts are

categorized into long and short-term debts (Collet,2019). The ratio, therefore, is

computed based on the total debt that is within the business entity. This sum of the debt

amount is obtained by adding both the short and long- term debts within the business

entity. The measurement criteria for analyzing debt ratios is called leverage ratios. The

higher the leverage ratio, the more indebted the company will be and the lower the

leverage ratio, the lower the amount of debt within the business. It is therefore advisable

for a firm to minimize the level of the leverage ratio. If the leverage ratio is high,

consequently the firm has limited capacity to pay off obligations (Beers, 2018). The

formula for calculating debt ratios is given as below:

Debt ratio = total debt

total assets

According to the above explanation, a creditor will only give out a loan to a company

that can pay off the loans (Paces and Heremans, 2011).

Key important ratios important to shareholders

assets that cannot be easily converted into cash immediately (Delkhosh and Mousavi,

2016). The quick ratio is therefore given by the following formula.

Quick ratio = current assets−inventory

current liabilities

The debt ratio

The ratio is an example of the leverage ratios. This ratio indicates the proportion of

assets that are financed through obtaining debts. It is also notable that these debts are

categorized into long and short-term debts (Collet,2019). The ratio, therefore, is

computed based on the total debt that is within the business entity. This sum of the debt

amount is obtained by adding both the short and long- term debts within the business

entity. The measurement criteria for analyzing debt ratios is called leverage ratios. The

higher the leverage ratio, the more indebted the company will be and the lower the

leverage ratio, the lower the amount of debt within the business. It is therefore advisable

for a firm to minimize the level of the leverage ratio. If the leverage ratio is high,

consequently the firm has limited capacity to pay off obligations (Beers, 2018). The

formula for calculating debt ratios is given as below:

Debt ratio = total debt

total assets

According to the above explanation, a creditor will only give out a loan to a company

that can pay off the loans (Paces and Heremans, 2011).

Key important ratios important to shareholders

PRINCIPLES OF FINANCIAL MANAGEMENT 9

The shareholders have a major interest in understanding the firm’s ability to announce

dividends. Therefore to determine this ability, the following ratios are used;

Return on equity

The return on equity is a profitability ratio that is used by an investor to measure the

return on capital or equity shareholders. Return on equity represents the percentage

average return on common stock. Net income represents that income that a firm is

capable of issuing out for distribution to the ordinary shareholders. It is normally

obtained after Lessing preferred dividends (Kenton, 2019).

ROE = net income

average common equity

Return on assets

The return on assets is a measure of the returns that are generated from

the total assets that are employed in the business (Clive, 2012). This return on

assets is the same as the return on capital employed. This ratio is important

because assets are financed through debt and equity (Corporate Finance

Institute, 2019). It is, therefore, an important aspect to measure the return

attributable to both the shareholders together with the debt holders. The ratio is

calculated by ROA = net income+expenses

averagetotal assets

The shareholders have a major interest in understanding the firm’s ability to announce

dividends. Therefore to determine this ability, the following ratios are used;

Return on equity

The return on equity is a profitability ratio that is used by an investor to measure the

return on capital or equity shareholders. Return on equity represents the percentage

average return on common stock. Net income represents that income that a firm is

capable of issuing out for distribution to the ordinary shareholders. It is normally

obtained after Lessing preferred dividends (Kenton, 2019).

ROE = net income

average common equity

Return on assets

The return on assets is a measure of the returns that are generated from

the total assets that are employed in the business (Clive, 2012). This return on

assets is the same as the return on capital employed. This ratio is important

because assets are financed through debt and equity (Corporate Finance

Institute, 2019). It is, therefore, an important aspect to measure the return

attributable to both the shareholders together with the debt holders. The ratio is

calculated by ROA = net income+expenses

averagetotal assets

PRINCIPLES OF FINANCIAL MANAGEMENT 10

Earnings per share

The EPS is a ratio that is used to how the net income present for ordinary

shareholders and it is divided by the total number of shares issued (Pushkala,

Mahamayi and Venkatesh, 2017).

EPS = market price per share

earnings per share

Calculation of the ratios

I). current ratio = current assets /current liabilities

= $52,410/ 49, 1241.0

= $1.06689

ii).quick ratio = current assets – inventory/ current liabilities

= $(52,410 -4003)/49,124

= 48,997/49,124

= 0.9970

iii) Debt ratio = total debt/ total assets

= $49,124 /52,980

= 0.9272

IV). ROE = net income/ average common equity

Earnings per share

The EPS is a ratio that is used to how the net income present for ordinary

shareholders and it is divided by the total number of shares issued (Pushkala,

Mahamayi and Venkatesh, 2017).

EPS = market price per share

earnings per share

Calculation of the ratios

I). current ratio = current assets /current liabilities

= $52,410/ 49, 1241.0

= $1.06689

ii).quick ratio = current assets – inventory/ current liabilities

= $(52,410 -4003)/49,124

= 48,997/49,124

= 0.9970

iii) Debt ratio = total debt/ total assets

= $49,124 /52,980

= 0.9272

IV). ROE = net income/ average common equity

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

PRINCIPLES OF FINANCIAL MANAGEMENT 11

= $339/ (3,856+3360)/2

= 339/ (3,608)

=0.09396 *100

= 9.4%

v). ROA = net income +expenses (average total assets)

= $339+ 1104/(52,980+51658)

= 3391104/104638

= 32.408

VI). EPS = market price per share /earnings per share

= 0.46/166.7

=0.0028

Recommendation on the financing source to use

Depending on the calculated ratios above, it would be a better option for the bank of

Queensland to borrow the ten million AUD instead of issuing out shares on the stock

market. The results generated from the calculations reflect that the bank has a high

capacity to pay off the debts (Caruana,2015). Additionally, the 9.2% leverage ratio

shows that the bank of Queensland has a low debt to equity ratio, therefore, this is an

implication that assets financed by equity outweigh those financed by debt

= $339/ (3,856+3360)/2

= 339/ (3,608)

=0.09396 *100

= 9.4%

v). ROA = net income +expenses (average total assets)

= $339+ 1104/(52,980+51658)

= 3391104/104638

= 32.408

VI). EPS = market price per share /earnings per share

= 0.46/166.7

=0.0028

Recommendation on the financing source to use

Depending on the calculated ratios above, it would be a better option for the bank of

Queensland to borrow the ten million AUD instead of issuing out shares on the stock

market. The results generated from the calculations reflect that the bank has a high

capacity to pay off the debts (Caruana,2015). Additionally, the 9.2% leverage ratio

shows that the bank of Queensland has a low debt to equity ratio, therefore, this is an

implication that assets financed by equity outweigh those financed by debt

PRINCIPLES OF FINANCIAL MANAGEMENT 12

(Chanticleer,2019). On the other hand, ratios such as the return on equity away far

below the required minimum. According to this ratio, an entity is required to have a ratio

the ranges from about 15-20%. However, the bank of Queensland does not effectively

satisfy this condition. Therefore it does not need to finance through issuing out shares.

Financial market analysis

The financial market just like any other market is comprised of several participants and

players. These may be called the buyers and sellers. However, each of the participants

has a role or two that they carry out within the market. These players range from

financial institutions such as banks, the regulatory authorities, investors, the borrowers.

All these different players operate in a mutual type of relationship (Gary, 2014). This is

because a single participant cannot be traded to oneself. Therefore within the financial

market, interact with each other to carry out successful trade. , for example, financial

intermediaries such as banks, brokers act as a link between the investors and

borrowers (Schmidt, 2019). The brokers play this intermediary role through facilitating

the trading on the stock market. They do this by obtaining funds from investors who are

interested in buying stocks of public listed companies. The inventors may, however, be

an artificial individual such as companies or natural human beings.

The regulators through their roles further facilitate the sooth and efficient flow of

operations within the financial market. They set up guiding principles that have to be,

followed when transacting within the market. This, therefore, creates an interaction as

well as ensuring that the market does not lose value or become unfavourable to the

general participants. Therefore regulators, borrowers, financial intermediaries have to

(Chanticleer,2019). On the other hand, ratios such as the return on equity away far

below the required minimum. According to this ratio, an entity is required to have a ratio

the ranges from about 15-20%. However, the bank of Queensland does not effectively

satisfy this condition. Therefore it does not need to finance through issuing out shares.

Financial market analysis

The financial market just like any other market is comprised of several participants and

players. These may be called the buyers and sellers. However, each of the participants

has a role or two that they carry out within the market. These players range from

financial institutions such as banks, the regulatory authorities, investors, the borrowers.

All these different players operate in a mutual type of relationship (Gary, 2014). This is

because a single participant cannot be traded to oneself. Therefore within the financial

market, interact with each other to carry out successful trade. , for example, financial

intermediaries such as banks, brokers act as a link between the investors and

borrowers (Schmidt, 2019). The brokers play this intermediary role through facilitating

the trading on the stock market. They do this by obtaining funds from investors who are

interested in buying stocks of public listed companies. The inventors may, however, be

an artificial individual such as companies or natural human beings.

The regulators through their roles further facilitate the sooth and efficient flow of

operations within the financial market. They set up guiding principles that have to be,

followed when transacting within the market. This, therefore, creates an interaction as

well as ensuring that the market does not lose value or become unfavourable to the

general participants. Therefore regulators, borrowers, financial intermediaries have to

PRINCIPLES OF FINANCIAL MANAGEMENT 13

work hand in hand to keep the financial market stable, viable and competitive on the

global scale (Uzialka,2018). it through such co-existence that all the parties are capable

of setting rules of the market, thereby having control measures on the would adverse

impacts of poor management of the financial market or industry. By setting up economic

regularities such as financial policies, regulates become an important part of the

financial market. Policies such as the contractionary monetary policies are used to

determine and influence the rate of borrowing (Brown and Lee, 2017). When the

regulators forecast that the rate of borrowing is high for example, the increase the

interest, to reduce the borrowing rate as well as purchasing power (Ryan, 2012). This is

the relation of controlling the rate of borrowing and lending ultimately results in a stable

and balanced economy (John, 2017).

The need for government intervention

The financial market is a very sensitive market that requires close control and

monitoring. Therefore there is a great need to have a government, intervention within

the financial market. The reasons for the need for government intervention are and very

diverse. For instance, there is a need to take control, monitor, and regulate the activities

taking place within the financial industry. This is done to prevent the occurrence of

macro-economic issues such as inflation, aggressive exchange rate fluctuations and so

on. If the government does not step in to regulate the economy such scenarios are most

likely to occur (Corporate Finance Institute, 2019). The impact that such macro-

economic problem s would result in is rather not favourable. For inflation resulting from

excessive demand would weaken the domestic currency in the long run.

work hand in hand to keep the financial market stable, viable and competitive on the

global scale (Uzialka,2018). it through such co-existence that all the parties are capable

of setting rules of the market, thereby having control measures on the would adverse

impacts of poor management of the financial market or industry. By setting up economic

regularities such as financial policies, regulates become an important part of the

financial market. Policies such as the contractionary monetary policies are used to

determine and influence the rate of borrowing (Brown and Lee, 2017). When the

regulators forecast that the rate of borrowing is high for example, the increase the

interest, to reduce the borrowing rate as well as purchasing power (Ryan, 2012). This is

the relation of controlling the rate of borrowing and lending ultimately results in a stable

and balanced economy (John, 2017).

The need for government intervention

The financial market is a very sensitive market that requires close control and

monitoring. Therefore there is a great need to have a government, intervention within

the financial market. The reasons for the need for government intervention are and very

diverse. For instance, there is a need to take control, monitor, and regulate the activities

taking place within the financial industry. This is done to prevent the occurrence of

macro-economic issues such as inflation, aggressive exchange rate fluctuations and so

on. If the government does not step in to regulate the economy such scenarios are most

likely to occur (Corporate Finance Institute, 2019). The impact that such macro-

economic problem s would result in is rather not favourable. For inflation resulting from

excessive demand would weaken the domestic currency in the long run.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PRINCIPLES OF FINANCIAL MANAGEMENT 14

Unethical research on the bank of Queensland

Yes, the bank of Queensland has been involved in unethical conduct over the recent

past periods. For example, the Guardian reported that the bank of Queensland

admitted to "failing the customer badly”. This article was written after the bank had failed

to act in the best interest of the client (Hutchens, 2018). The bank offered a loan

amounting to $280,000 to a client who was interested in purchasing two of Wendy's

outlets. Corrective action was taken, as the branch in Pirie Street in Adelaide was

closed and the manager was sacked. The regulatory body took action to review the

banks’ lending and redrafting of the lending standards (Walsh, 2019).

Findings and recommendations

. Further action to improve this situation needs to be taken into consideration if service

delivery is to be enhanced in the long run. Concerning the cases of unethical behaviour,

it would be of great importance if the regulators devise strict measure on the industry of

banking. Violation of banking rules such as issuing out illegal loans needs to be handled

with strict measures. Consultation proceedings into such cases of unethical conduct

need to be undertaken. When any participant in the industry is convicted then, operating

licenses can be suspended. Such action should, however, depend on the nature of the

illegal activity.

Unethical research on the bank of Queensland

Yes, the bank of Queensland has been involved in unethical conduct over the recent

past periods. For example, the Guardian reported that the bank of Queensland

admitted to "failing the customer badly”. This article was written after the bank had failed

to act in the best interest of the client (Hutchens, 2018). The bank offered a loan

amounting to $280,000 to a client who was interested in purchasing two of Wendy's

outlets. Corrective action was taken, as the branch in Pirie Street in Adelaide was

closed and the manager was sacked. The regulatory body took action to review the

banks’ lending and redrafting of the lending standards (Walsh, 2019).

Findings and recommendations

. Further action to improve this situation needs to be taken into consideration if service

delivery is to be enhanced in the long run. Concerning the cases of unethical behaviour,

it would be of great importance if the regulators devise strict measure on the industry of

banking. Violation of banking rules such as issuing out illegal loans needs to be handled

with strict measures. Consultation proceedings into such cases of unethical conduct

need to be undertaken. When any participant in the industry is convicted then, operating

licenses can be suspended. Such action should, however, depend on the nature of the

illegal activity.

PRINCIPLES OF FINANCIAL MANAGEMENT 15

Conclusions

Form all the researched information, the financial market in Australia is relatively stable.

However, the domination of the industry by only four major financial institutions renders

it a low competitive industry. This consequently affects the rate of growth and service

delivery. Stringent measures should, be adapted to promote an ethical way of

conducting business. Eventually, the strict procedures of operation would ensure that

the financial industry of Australia should be effectively monitored, regulated and so on.

Conclusions

Form all the researched information, the financial market in Australia is relatively stable.

However, the domination of the industry by only four major financial institutions renders

it a low competitive industry. This consequently affects the rate of growth and service

delivery. Stringent measures should, be adapted to promote an ethical way of

conducting business. Eventually, the strict procedures of operation would ensure that

the financial industry of Australia should be effectively monitored, regulated and so on.

PRINCIPLES OF FINANCIAL MANAGEMENT 16

References

Al- Awawdeh. H., Al-Sakini, S. 2017. Off-Balance Items and Their Impact on the

Financial Performance Standards of the Banks: An Empirical Study on the Commercial

Banks Of Jordan: International Business and Management. Retrieved from

http://www.cscanada.net/index.php/ibm/article/download/9993/pdf

Australian Government: Productivity Commission, 2018. Competition in the Australian

Financial System: Productivity Commission Inquiry Report, Overview and

Recommendations. Retrieved from https://www.pc.gov.au/inquiries/completed/financial-

system/report/financial-system-overview.pdf

Bank of Queensland Group, 2018. 2018 Annual Report. Retrieved from

https://www.boq.com.au/content/dam/boq/files/shareholder-centre/financial-results/

2018/FY2018_Annual_Report.pdf

Bank Of Queensland Limited, 2019. Financial Services Guide: Personal Solutions.

Retrieved from https://www.boq.com.au/content/dam/boq/files/terms-and-conditions/

boq-financial-services-guide.pdf

Bank of Queensland, 2018. BOQ Annual Reporting 2018. Retrieved from

https://www.boq.com.au/microsites/annual-reports/2018

Beers B, 2018. What Are Some Types Of off-Balance Sheet Assets? Retrieved from

https://www.investopedia.com/ask/answers/062915/what-types-assets-may-be-

considered-balance-sheet-obs.asp

References

Al- Awawdeh. H., Al-Sakini, S. 2017. Off-Balance Items and Their Impact on the

Financial Performance Standards of the Banks: An Empirical Study on the Commercial

Banks Of Jordan: International Business and Management. Retrieved from

http://www.cscanada.net/index.php/ibm/article/download/9993/pdf

Australian Government: Productivity Commission, 2018. Competition in the Australian

Financial System: Productivity Commission Inquiry Report, Overview and

Recommendations. Retrieved from https://www.pc.gov.au/inquiries/completed/financial-

system/report/financial-system-overview.pdf

Bank of Queensland Group, 2018. 2018 Annual Report. Retrieved from

https://www.boq.com.au/content/dam/boq/files/shareholder-centre/financial-results/

2018/FY2018_Annual_Report.pdf

Bank Of Queensland Limited, 2019. Financial Services Guide: Personal Solutions.

Retrieved from https://www.boq.com.au/content/dam/boq/files/terms-and-conditions/

boq-financial-services-guide.pdf

Bank of Queensland, 2018. BOQ Annual Reporting 2018. Retrieved from

https://www.boq.com.au/microsites/annual-reports/2018

Beers B, 2018. What Are Some Types Of off-Balance Sheet Assets? Retrieved from

https://www.investopedia.com/ask/answers/062915/what-types-assets-may-be-

considered-balance-sheet-obs.asp

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

PRINCIPLES OF FINANCIAL MANAGEMENT 17

Brown, R., Lee, N. 2017. The Theory And Practice Of Financial Instruments For Small

And Medium- Sized Enterprises. Retrieved from https://www.oecd.org/cfe/regional-

policy/Brown_When-to-use-financial-instruments.pdf

Caruana J, 2015. Financial Reform and the Role of Regulators: Evolving Markets,

Evolving Risks, Evolving Regulation retrieved from

https://www.bis.org/speeches/sp150225.htm

Chanticleer, 2019. Westpac And Bank Of Queensland Updates Provide Window Into

Banking Completion. Retrieved from https://www.afr.com/chanticleer/westpac-and-

bank-of-queensland-updates-provide-window-into-banking-competition-20190218-

h1bf1x

Collet J., 2019. Bank Of Queens Land Breaks Ranks With ‘Big Four' On Lending Rule

Changes: The Morning Herald. retrieved from

https://www.smh.com.au/business/banking-and-finance/bank-of-queensland-breaks-

ranks-with-big-four-on-lending-rule-changes-20190812-p52g7f.html

Corporate Finance Institute, 2019. Key Players In The Capital Markets: Bank,

Institutions, Corporation And Public Accounting. Retrieved from

https://corporatefinanceinstitute.com/resources/careers/companies/key-players-in-

capital-markets/

Corporate Finance Institute,2019. Profitability Ratios. Retrieved from

https://corporatefinanceinstitute.com/resources/knowledge/finance/profitability-ratios/

Brown, R., Lee, N. 2017. The Theory And Practice Of Financial Instruments For Small

And Medium- Sized Enterprises. Retrieved from https://www.oecd.org/cfe/regional-

policy/Brown_When-to-use-financial-instruments.pdf

Caruana J, 2015. Financial Reform and the Role of Regulators: Evolving Markets,

Evolving Risks, Evolving Regulation retrieved from

https://www.bis.org/speeches/sp150225.htm

Chanticleer, 2019. Westpac And Bank Of Queensland Updates Provide Window Into

Banking Completion. Retrieved from https://www.afr.com/chanticleer/westpac-and-

bank-of-queensland-updates-provide-window-into-banking-competition-20190218-

h1bf1x

Collet J., 2019. Bank Of Queens Land Breaks Ranks With ‘Big Four' On Lending Rule

Changes: The Morning Herald. retrieved from

https://www.smh.com.au/business/banking-and-finance/bank-of-queensland-breaks-

ranks-with-big-four-on-lending-rule-changes-20190812-p52g7f.html

Corporate Finance Institute, 2019. Key Players In The Capital Markets: Bank,

Institutions, Corporation And Public Accounting. Retrieved from

https://corporatefinanceinstitute.com/resources/careers/companies/key-players-in-

capital-markets/

Corporate Finance Institute,2019. Profitability Ratios. Retrieved from

https://corporatefinanceinstitute.com/resources/knowledge/finance/profitability-ratios/

PRINCIPLES OF FINANCIAL MANAGEMENT 18

Delkhosh M., Mousavi H., 2016. Strategic Financial Management Review On The

Financial Success Of An Organization. Retrieved from

https://www.researchgate.net/publication/303040544_Strategic_Financial_Management

_Review_on_the_Financial_Success_of_an_Organization

Hutchens G., 2018. Bank of Queensland Admits It Failed Customer Badly-Banking

Inquiry: The Guardian. Retrieved from

https://www.theguardian.com/australia-news/2018/may/24/bank-of-queensland-admits-

it-failed-customer-badly-banking-inquiry

Jacobson D.2018. Competition in The Australian Financial System Report. Retrieved

from https://www.brightlaw.com.au/competition-australian-financial-system-report/

Kenton W., 2019. Ratio Analysis. Retrieved from

https://www.investopedia.com/terms/r/ratioanalysis.asp

Management Study Guide, 2019. Financial Intermediaries- Meaning, Role And Its

Importance. Retrieved from https://www.managementstudyguide.com/financial-

intermediaries.htm

Nuhu.M., 2014. Role of Ratio Analysis In Business Decisions: A Case Study Of NBC

Maiduguri Plant. Retrieved from

http://www.mcser.org/journal/index.php/%20jesr/article/download/4399/4302

Paces A. M., Heremans D., 2011. Regulation of Banking And Financial Markets.

Retrieved from

Delkhosh M., Mousavi H., 2016. Strategic Financial Management Review On The

Financial Success Of An Organization. Retrieved from

https://www.researchgate.net/publication/303040544_Strategic_Financial_Management

_Review_on_the_Financial_Success_of_an_Organization

Hutchens G., 2018. Bank of Queensland Admits It Failed Customer Badly-Banking

Inquiry: The Guardian. Retrieved from

https://www.theguardian.com/australia-news/2018/may/24/bank-of-queensland-admits-

it-failed-customer-badly-banking-inquiry

Jacobson D.2018. Competition in The Australian Financial System Report. Retrieved

from https://www.brightlaw.com.au/competition-australian-financial-system-report/

Kenton W., 2019. Ratio Analysis. Retrieved from

https://www.investopedia.com/terms/r/ratioanalysis.asp

Management Study Guide, 2019. Financial Intermediaries- Meaning, Role And Its

Importance. Retrieved from https://www.managementstudyguide.com/financial-

intermediaries.htm

Nuhu.M., 2014. Role of Ratio Analysis In Business Decisions: A Case Study Of NBC

Maiduguri Plant. Retrieved from

http://www.mcser.org/journal/index.php/%20jesr/article/download/4399/4302

Paces A. M., Heremans D., 2011. Regulation of Banking And Financial Markets.

Retrieved from

PRINCIPLES OF FINANCIAL MANAGEMENT 19

https://www.researchgate.net/publication/228126773_Regulation_of_Banking_and_Fina

ncial_Markets

Pushkala,N., Mahamayi, J., Venkatesh, K.,A. 2017. Liquidity and Off-Balance Sheet

Items: a Comparative study of Public and Private Sector Banks in India . Retrieved from

https://www.researchgate.net/publication/317797580_Liquidity_and_Off-

Balance_Sheet_Items_A_Comparative_Study_of_Public_and_Private_Sector_Banks_i

n_India

Reserve Bank of Australia. 2019. Australia’s Financial Regulatory Framework:

Summary of Framework. Retrieved from https://www.rba.gov.au/publications/annual-

reports/cfr/2002/aus-fin-reg-frmwk.html

Ryan, S., G. 2012. Financial Reporting For Financial Instruments. Retrieved from

https://www.nowpublishers.com/article/DownloadSummary/ACC-021

Schmidt, M. 2019. Financial Regulators: Who They Are And What They Do. Retrieved

from https://www.investopedia.com/articles/economics/09/financial-regulatory-body.asp

Uzialko, A, 2018. Debt vs. Equity Financing: What’s The Best Choice For Your

Business? Retrieved from https://www.businessnewsdaily.com/6363-debt-vs-equity-

financing.html

Walsh, L. 2019. Bank of Queensland Debts to Pay-$20k To Call It Quits…? No Way..!!.

Retrieved from https://www.bankreformnow.com.au/news/banking-news/boq-exposed

Clive, M. 2012. Financial Management for Non-Financial Managers. 1st edition. Isbn:

978074946677.

https://www.researchgate.net/publication/228126773_Regulation_of_Banking_and_Fina

ncial_Markets

Pushkala,N., Mahamayi, J., Venkatesh, K.,A. 2017. Liquidity and Off-Balance Sheet

Items: a Comparative study of Public and Private Sector Banks in India . Retrieved from

https://www.researchgate.net/publication/317797580_Liquidity_and_Off-

Balance_Sheet_Items_A_Comparative_Study_of_Public_and_Private_Sector_Banks_i

n_India

Reserve Bank of Australia. 2019. Australia’s Financial Regulatory Framework:

Summary of Framework. Retrieved from https://www.rba.gov.au/publications/annual-

reports/cfr/2002/aus-fin-reg-frmwk.html

Ryan, S., G. 2012. Financial Reporting For Financial Instruments. Retrieved from

https://www.nowpublishers.com/article/DownloadSummary/ACC-021

Schmidt, M. 2019. Financial Regulators: Who They Are And What They Do. Retrieved

from https://www.investopedia.com/articles/economics/09/financial-regulatory-body.asp

Uzialko, A, 2018. Debt vs. Equity Financing: What’s The Best Choice For Your

Business? Retrieved from https://www.businessnewsdaily.com/6363-debt-vs-equity-

financing.html

Walsh, L. 2019. Bank of Queensland Debts to Pay-$20k To Call It Quits…? No Way..!!.

Retrieved from https://www.bankreformnow.com.au/news/banking-news/boq-exposed

Clive, M. 2012. Financial Management for Non-Financial Managers. 1st edition. Isbn:

978074946677.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PRINCIPLES OF FINANCIAL MANAGEMENT 20

Gary, B. 2014. Financial Management And Accounting In The Public Sector. 2nd edition,

isbn:9781138787872.

John, P., W. 2017.Financial Management FIN211 (Custom Edition), 2nd edition, isbn:

9781488618420.

Gary, B. 2014. Financial Management And Accounting In The Public Sector. 2nd edition,

isbn:9781138787872.

John, P., W. 2017.Financial Management FIN211 (Custom Edition), 2nd edition, isbn:

9781488618420.

PRINCIPLES OF FINANCIAL MANAGEMENT 21

Appendices

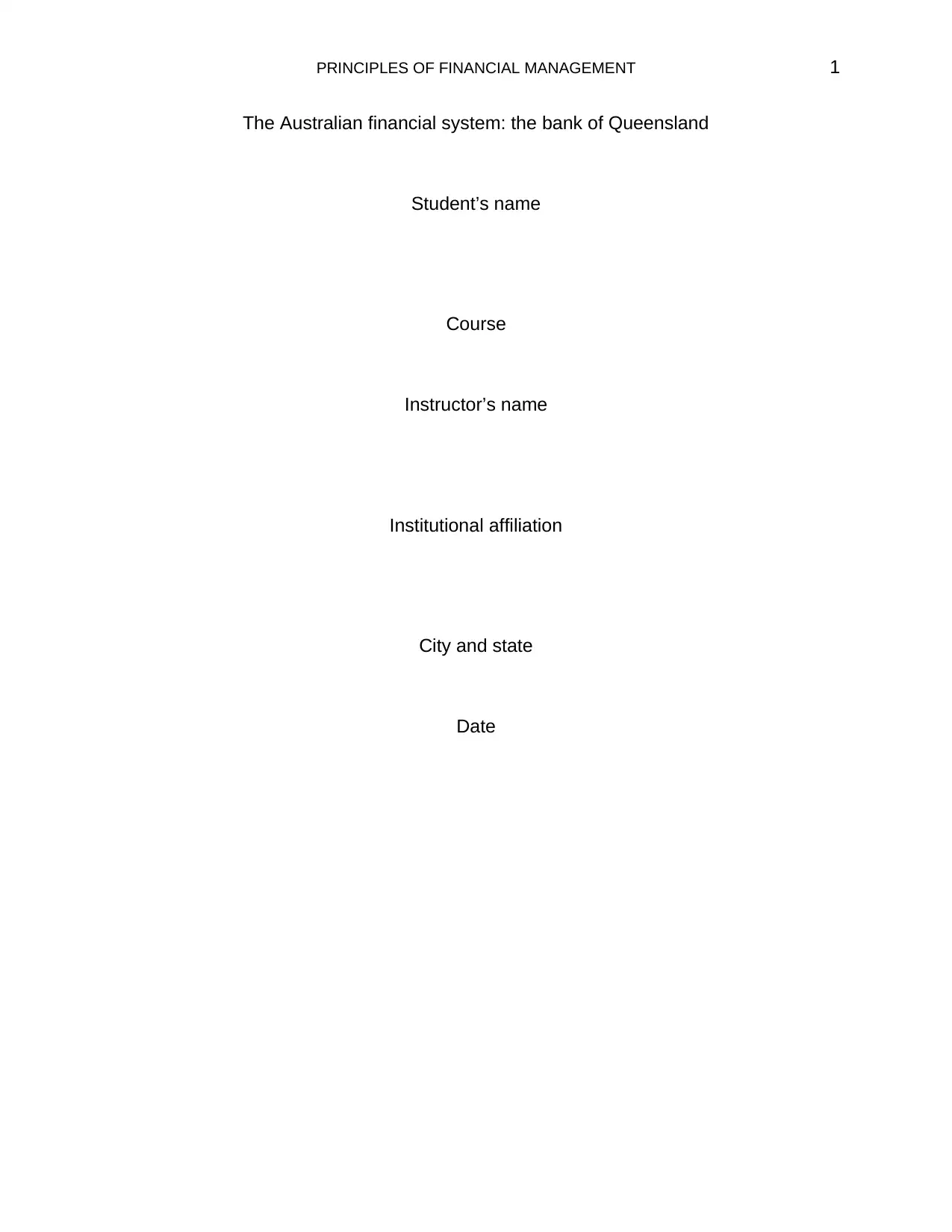

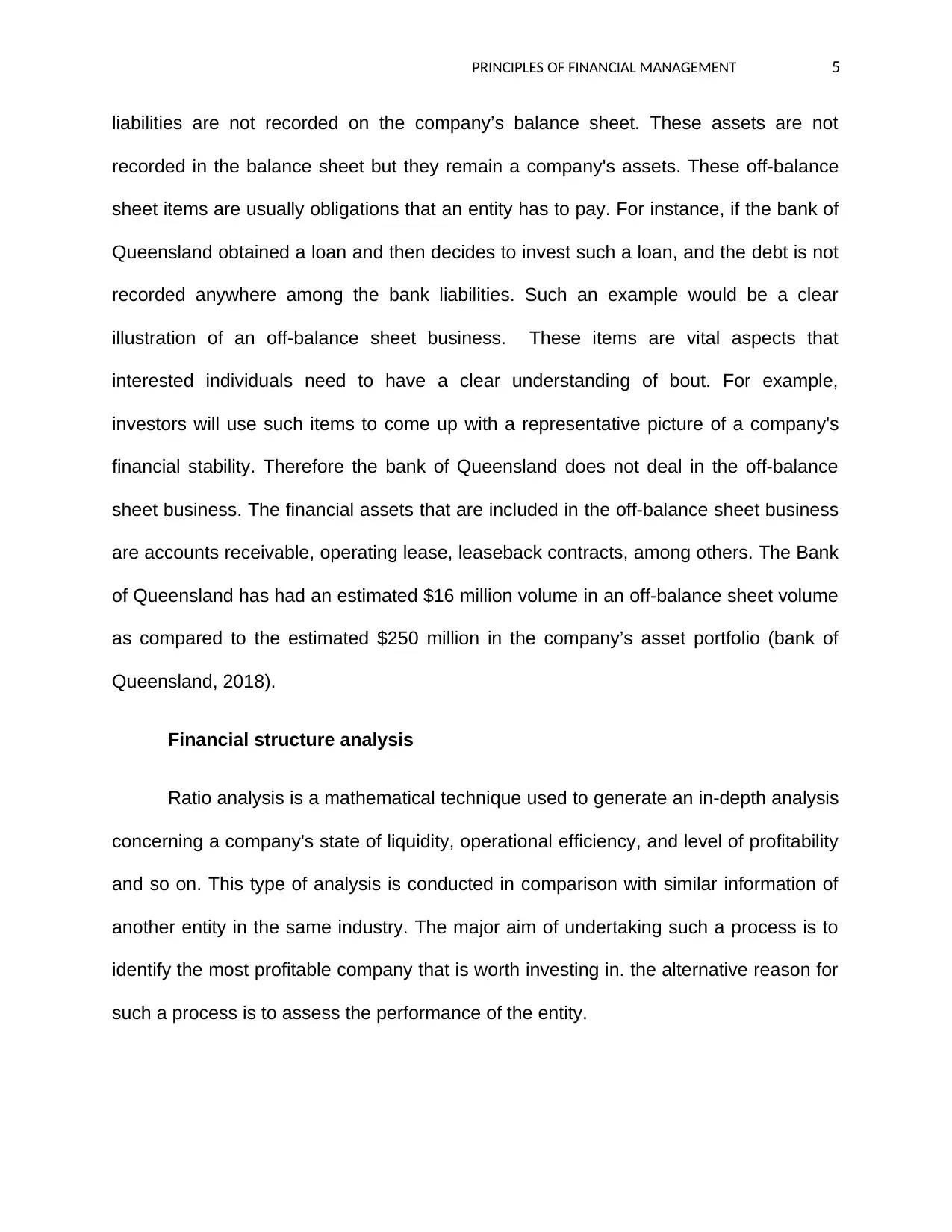

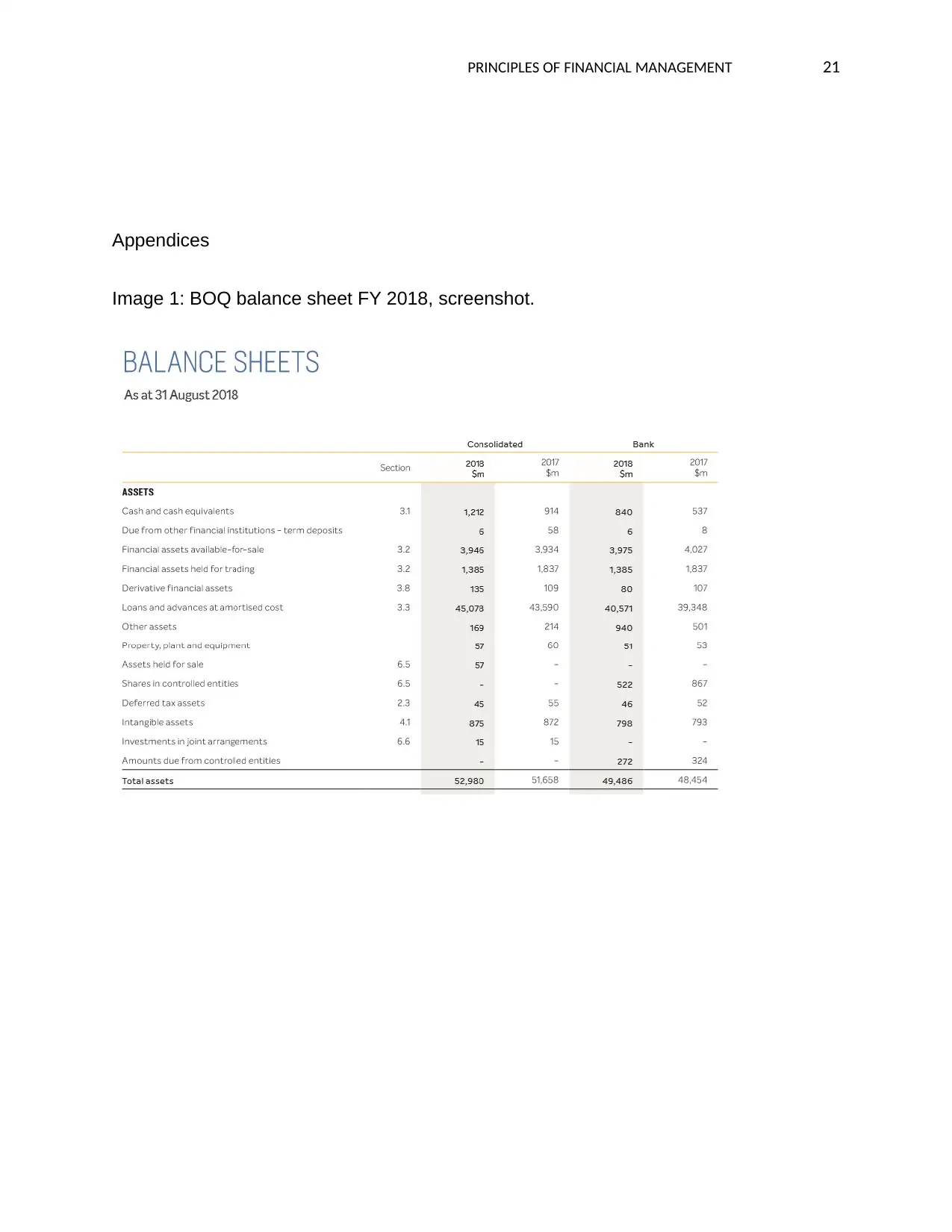

Image 1: BOQ balance sheet FY 2018, screenshot.

Appendices

Image 1: BOQ balance sheet FY 2018, screenshot.

PRINCIPLES OF FINANCIAL MANAGEMENT 22

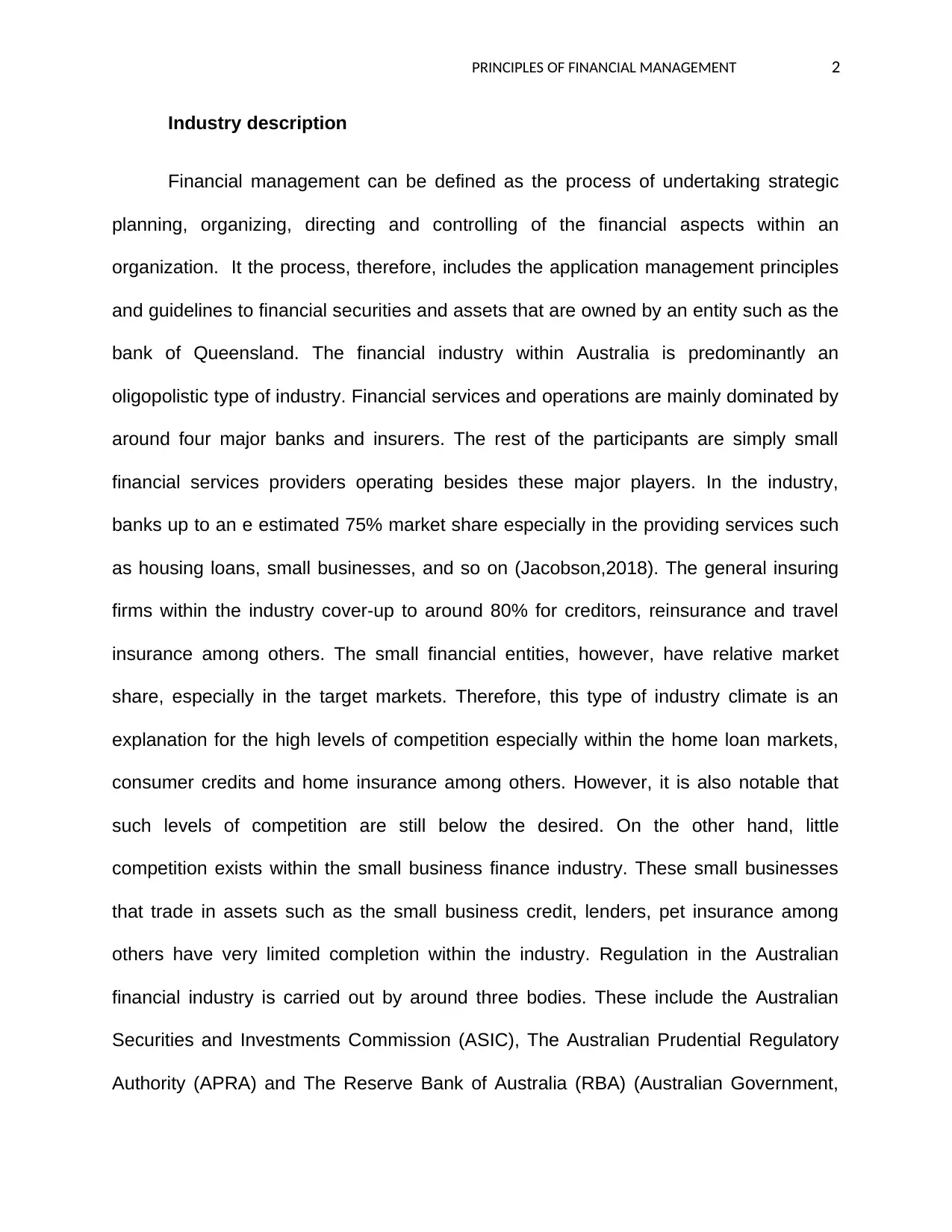

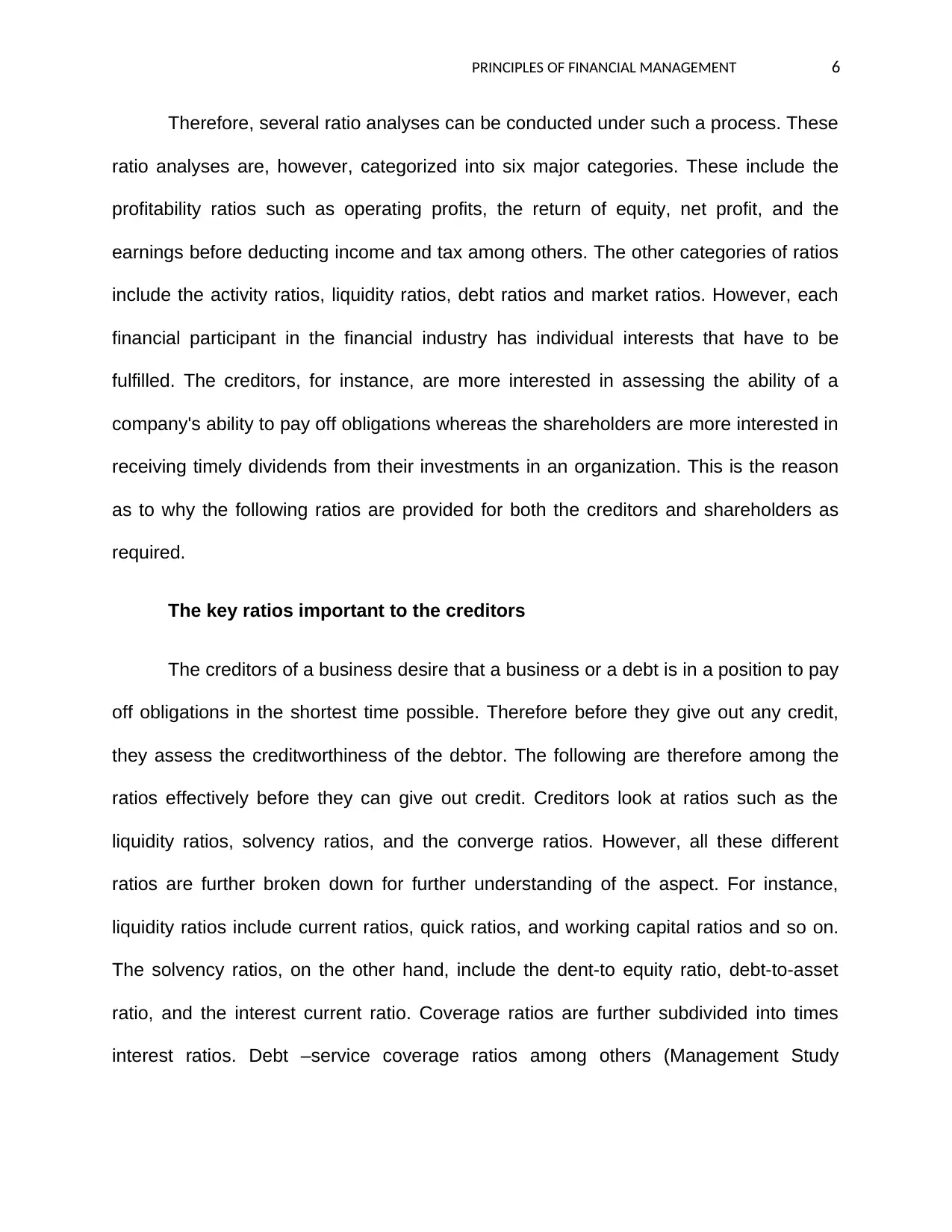

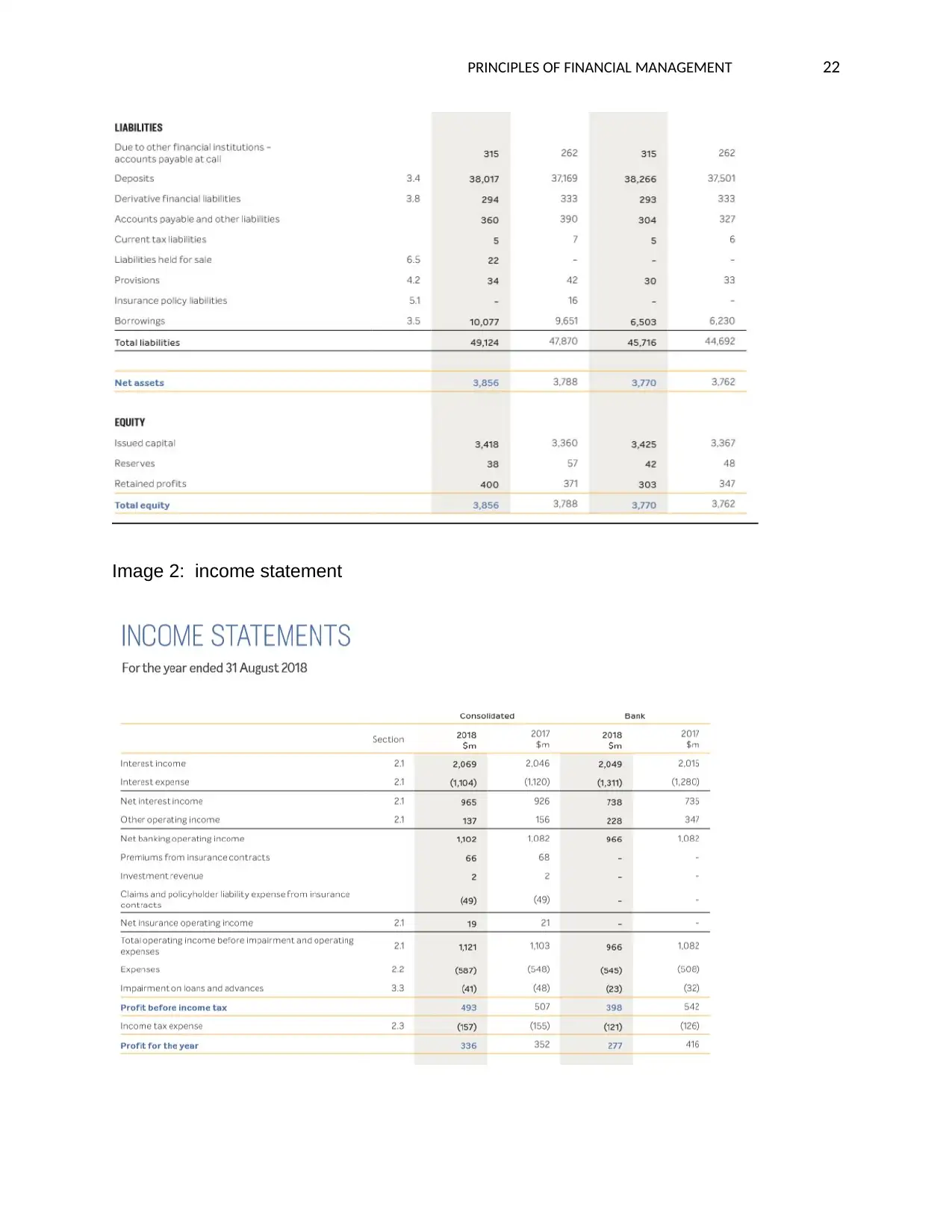

Image 2: income statement

Image 2: income statement

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

PRINCIPLES OF FINANCIAL MANAGEMENT 23

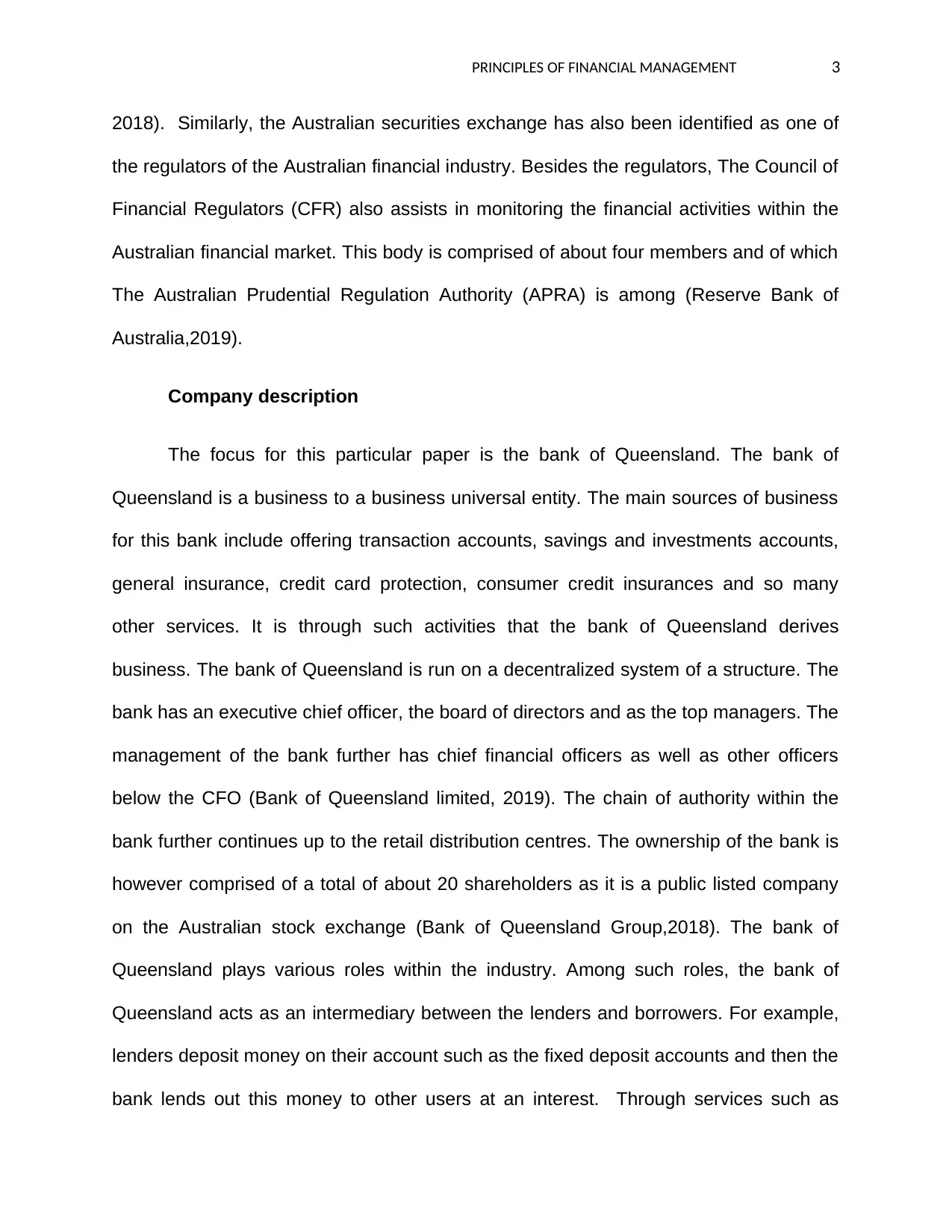

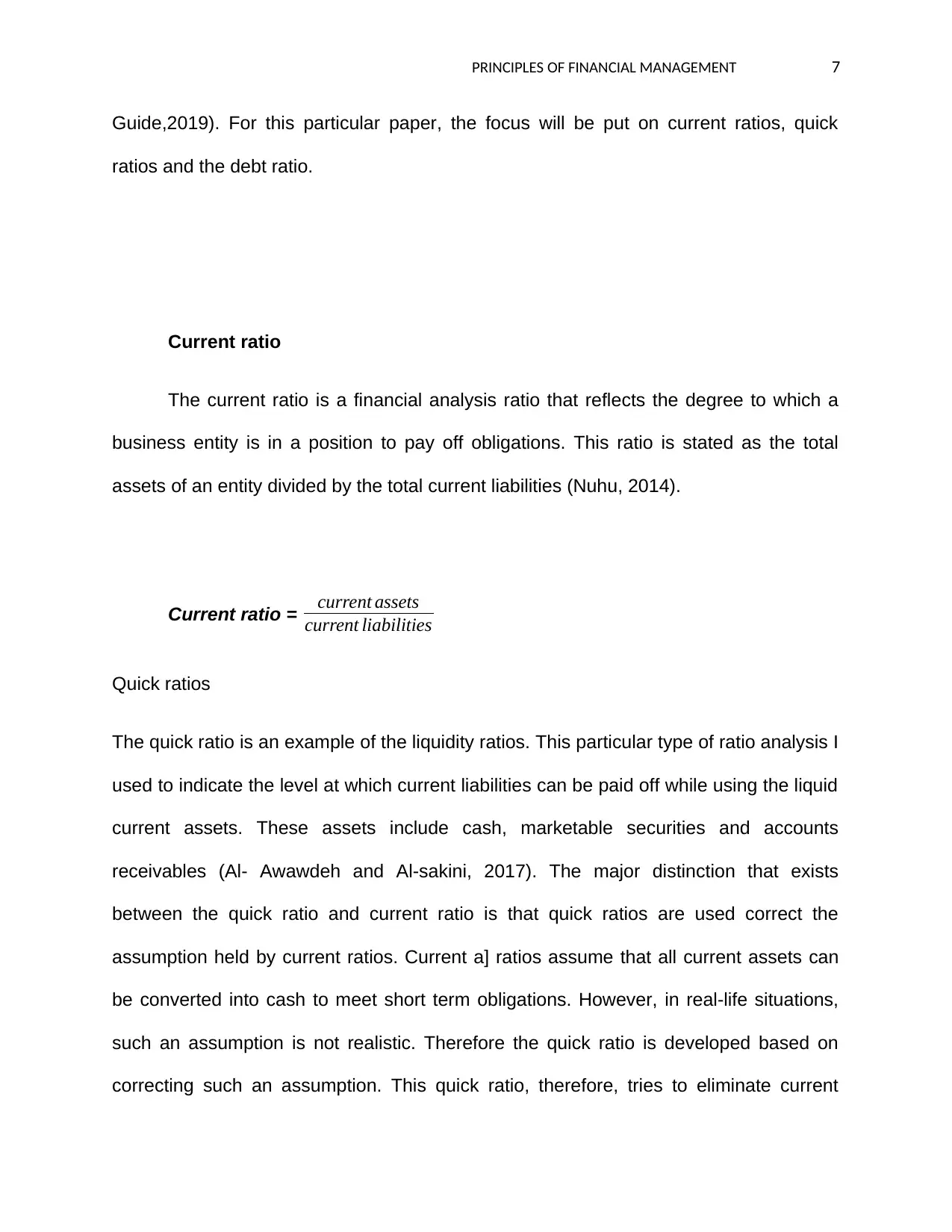

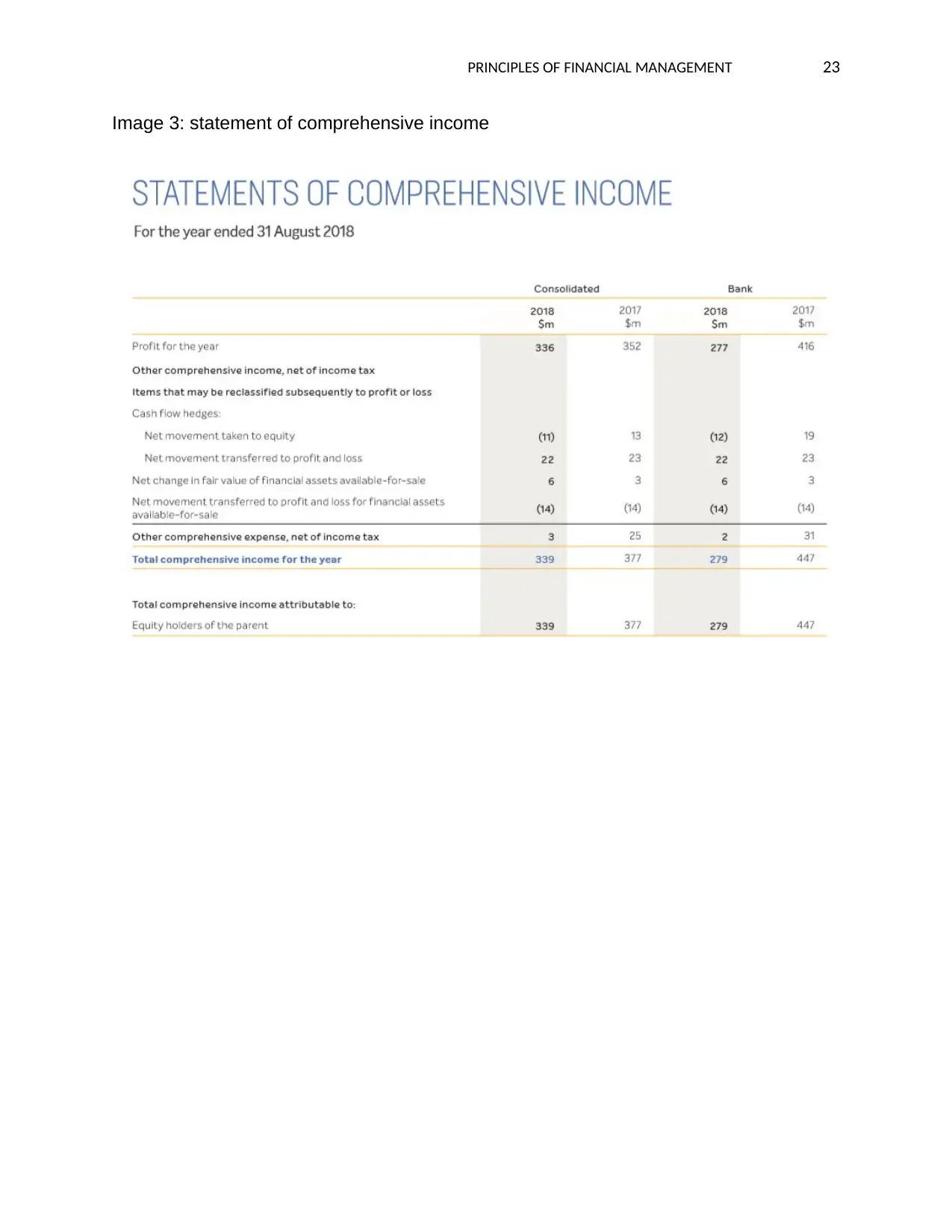

Image 3: statement of comprehensive income

Image 3: statement of comprehensive income

PRINCIPLES OF FINANCIAL MANAGEMENT 24

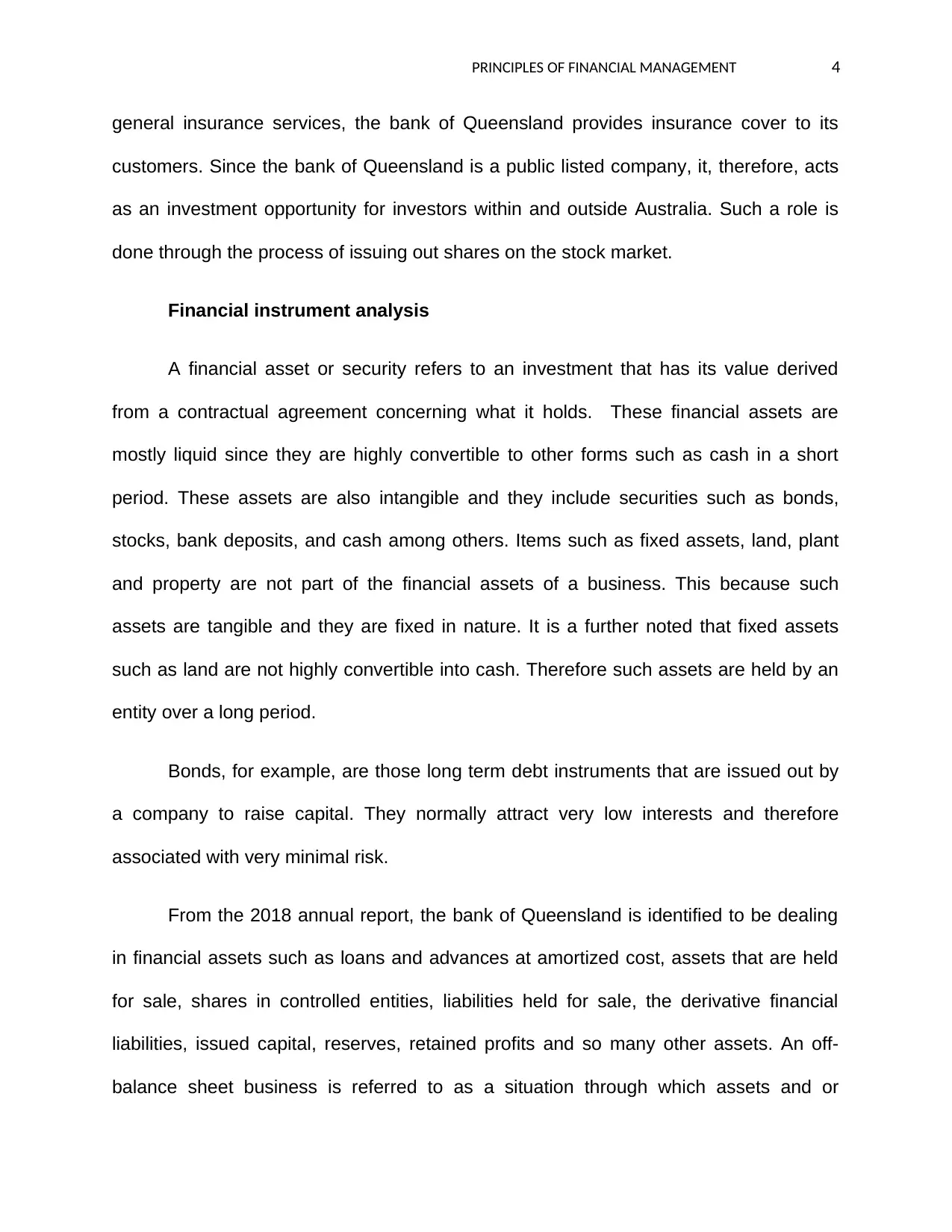

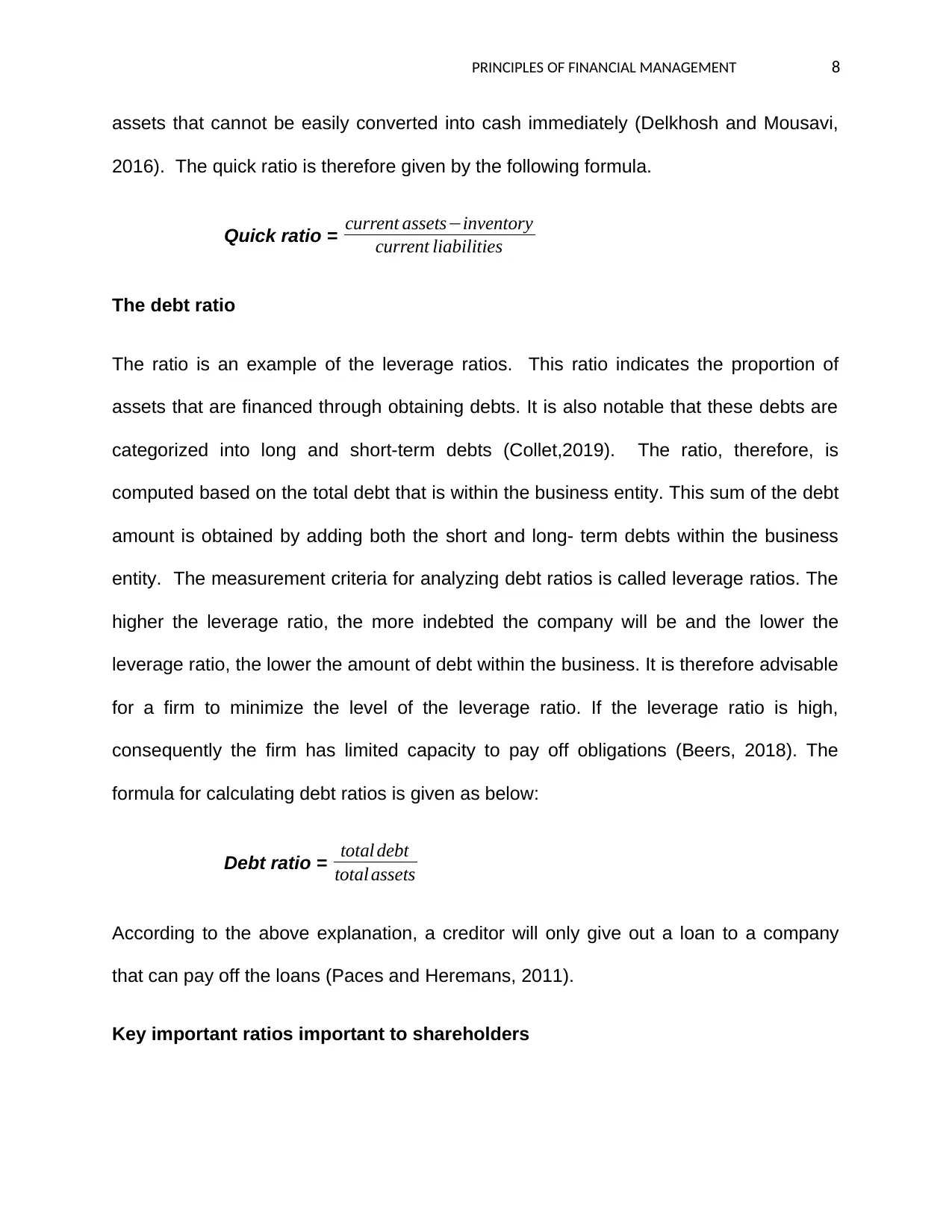

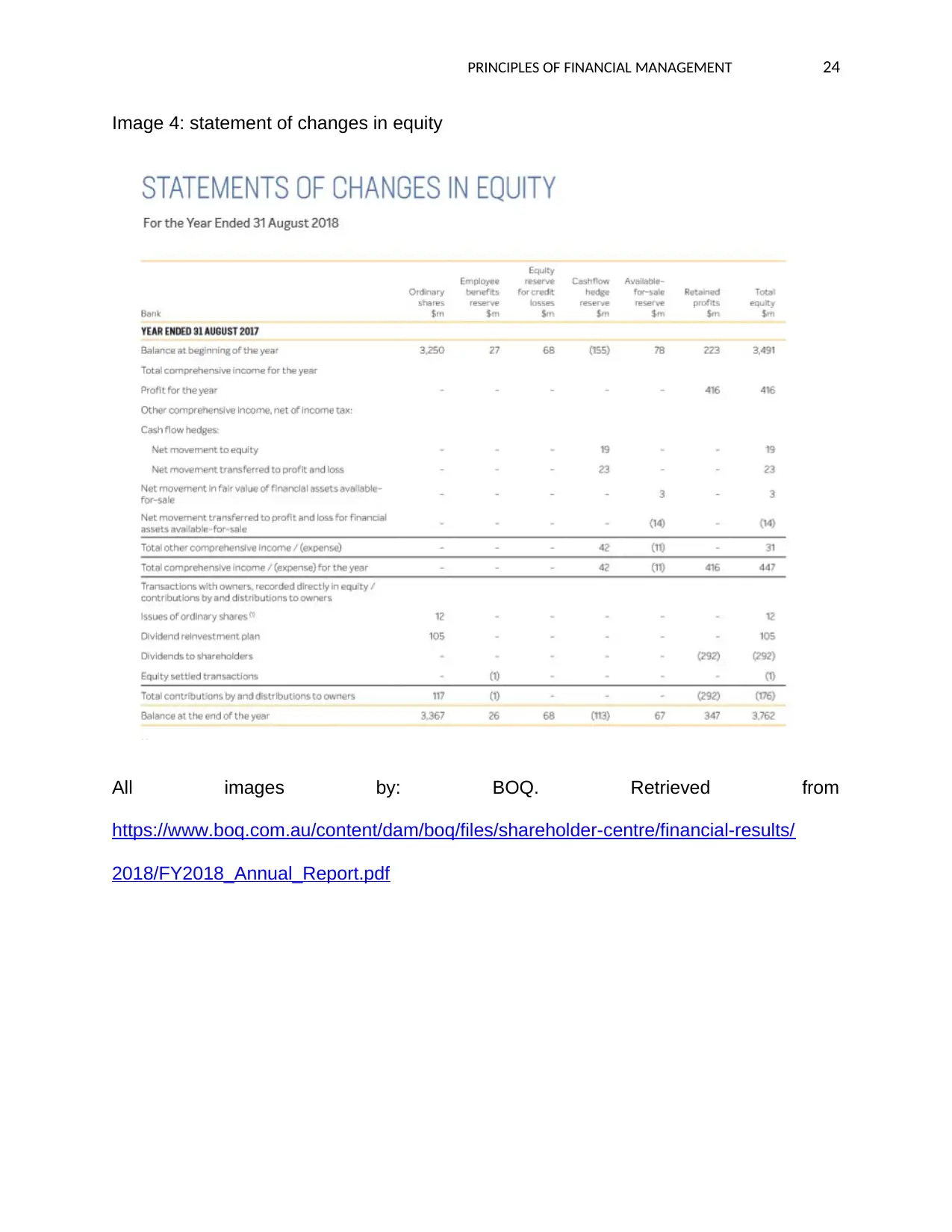

Image 4: statement of changes in equity

All images by: BOQ. Retrieved from

https://www.boq.com.au/content/dam/boq/files/shareholder-centre/financial-results/

2018/FY2018_Annual_Report.pdf

Image 4: statement of changes in equity

All images by: BOQ. Retrieved from

https://www.boq.com.au/content/dam/boq/files/shareholder-centre/financial-results/

2018/FY2018_Annual_Report.pdf

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.