HA1022 Principles of Financial Management: BOQ Market Analysis

VerifiedAdded on 2023/04/04

|18

|3774

|374

Report

AI Summary

This report provides a comprehensive financial analysis of Bank of Queensland (BOQ) within the Australian financial market. It begins with an industry description, covering the size and competition level, key regulators like APRA, ASIC, and RBA, and industry groups such as the Australian Banking Association. The report details BOQ's business operations, organizational structure, and its role as a financial intermediary. A thorough analysis of financial instruments, including on and off-balance sheet items, is presented. Internal factors are assessed through key financial ratios like Net Interest Margin, Loan to Assets ratio, and Return on Average Equity, while external factors focus on competition from major banks and the impact of pricing and non-pricing strategies. The report also examines the interaction between financial players, government intervention, and past unethical practices. It concludes with recommendations for BOQ based on the analysis, emphasizing the importance of adapting to market competition and regulatory changes. Desklib provides access to this report and many other solved assignments for students.

Running Head: Principles of Financial Management

Principles of Financial Management

University Name

Student Name

Principles of Financial Management

University Name

Student Name

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Principles of Financial Management

Contents

1) Analysis of Bank of Queensland and the financial environment of the industry.................1

1.1. Industry Description................................................................................................................2

1.1.1. Size of the industry and level of competition................................................................2

1.1.2. Industry Regulators..........................................................................................................2

1.1.3. Industry groups that help regulate behaviour in the banking industry......................3

1.2. Bank of Queensland: Company Description........................................................................3

1.2.1. Bank of Queensland business........................................................................................3

1.2.2. Organisation structure of BOQ.......................................................................................3

1.2.3. Role of BOQ within a financial system..........................................................................4

1.3. Financial Instrument Analysis................................................................................................5

1.3.1. Financial Instruments that BOQ deals in:.....................................................................5

1.3.2. OFF Balance Sheet business.........................................................................................5

1.4. Analysis of Bank of Queensland...........................................................................................6

1.4.1. Analysis of Internal Factors............................................................................................6

1.4.2. Analysis of external Factors...........................................................................................7

1.5. Financial Market Analysis......................................................................................................8

1.5.1. Interaction between different financial players in the banking industry....................8

1.5.2. Government/Regulators Intervention............................................................................8

1.5.3. Unethical practices by BOQ in the past........................................................................9

2) Conclusions and Recommendations......................................................................................10

3) References.................................................................................................................................12

4) Appendices................................................................................................................................15

Contents

1) Analysis of Bank of Queensland and the financial environment of the industry.................1

1.1. Industry Description................................................................................................................2

1.1.1. Size of the industry and level of competition................................................................2

1.1.2. Industry Regulators..........................................................................................................2

1.1.3. Industry groups that help regulate behaviour in the banking industry......................3

1.2. Bank of Queensland: Company Description........................................................................3

1.2.1. Bank of Queensland business........................................................................................3

1.2.2. Organisation structure of BOQ.......................................................................................3

1.2.3. Role of BOQ within a financial system..........................................................................4

1.3. Financial Instrument Analysis................................................................................................5

1.3.1. Financial Instruments that BOQ deals in:.....................................................................5

1.3.2. OFF Balance Sheet business.........................................................................................5

1.4. Analysis of Bank of Queensland...........................................................................................6

1.4.1. Analysis of Internal Factors............................................................................................6

1.4.2. Analysis of external Factors...........................................................................................7

1.5. Financial Market Analysis......................................................................................................8

1.5.1. Interaction between different financial players in the banking industry....................8

1.5.2. Government/Regulators Intervention............................................................................8

1.5.3. Unethical practices by BOQ in the past........................................................................9

2) Conclusions and Recommendations......................................................................................10

3) References.................................................................................................................................12

4) Appendices................................................................................................................................15

Principles of Financial Management

1) Analysis of Bank of Queensland and the financial

environment of the industry

1.1. Industry Description

1.1.1. Size of the industry and level of competition.

Bank of Queensland fall under the financial sector and its industry group is banks

and its industry is also banks (ASX, n.d.).

Australia’s financial services industry is very strong and well established. The

contribution of this sector to the national GDP is significant and the financial industry

has been a major force behind the growth of the Australia’s economy (The Treasury

Australian Government, n.d.).

Banks account for the biggest part of the financial sector in Australia and it holds

approximately 50% of the financial sector’s total assets (Royal Commission, 2018).

According to the Australian Banking Association (2019), total assets held by the

banking industry are $3.9 trillion, total liabilities are $3.6 trillion and shareholder’s

equity is $267 billion.

Australia’s banking industry is very concentrated as “the big four” banks: Westpac,

Commonwealth Bank, National Australia Bank and Australia and New Zealand

Banking group completely dominate the banking sector of Australia. These large

banks have combined assets of $3.6 trillion, which accounts for more than 90% of

the total assets held by the banking industry (Janda, 2019).

1.1.2. Industry Regulators.

Leading regulators of the banking industry in Australia are (Paterson, King and

Mallesons, 2018):

Australian Prudential Regulation Authority (APRA)- It was established in 1998 and

the regulator supervises the whole industry and it is responsible for the prudential

regulation of banking sector.

Australian Securities and Investments Commission (ASIC)- It was established in

2001 and it is responsible for market conduct. ASIC regulates this sector in an

effective manner to protect all the investors from misconducts and frauds.

Reserve Bank of Australia (RBA)- The RBA oversees all the banks. It is responsible

for Australia’s monetary policy and the national financial system.

1) Analysis of Bank of Queensland and the financial

environment of the industry

1.1. Industry Description

1.1.1. Size of the industry and level of competition.

Bank of Queensland fall under the financial sector and its industry group is banks

and its industry is also banks (ASX, n.d.).

Australia’s financial services industry is very strong and well established. The

contribution of this sector to the national GDP is significant and the financial industry

has been a major force behind the growth of the Australia’s economy (The Treasury

Australian Government, n.d.).

Banks account for the biggest part of the financial sector in Australia and it holds

approximately 50% of the financial sector’s total assets (Royal Commission, 2018).

According to the Australian Banking Association (2019), total assets held by the

banking industry are $3.9 trillion, total liabilities are $3.6 trillion and shareholder’s

equity is $267 billion.

Australia’s banking industry is very concentrated as “the big four” banks: Westpac,

Commonwealth Bank, National Australia Bank and Australia and New Zealand

Banking group completely dominate the banking sector of Australia. These large

banks have combined assets of $3.6 trillion, which accounts for more than 90% of

the total assets held by the banking industry (Janda, 2019).

1.1.2. Industry Regulators.

Leading regulators of the banking industry in Australia are (Paterson, King and

Mallesons, 2018):

Australian Prudential Regulation Authority (APRA)- It was established in 1998 and

the regulator supervises the whole industry and it is responsible for the prudential

regulation of banking sector.

Australian Securities and Investments Commission (ASIC)- It was established in

2001 and it is responsible for market conduct. ASIC regulates this sector in an

effective manner to protect all the investors from misconducts and frauds.

Reserve Bank of Australia (RBA)- The RBA oversees all the banks. It is responsible

for Australia’s monetary policy and the national financial system.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Principles of Financial Management

The banking regulators have the power to ensure compliance but they were reluctant

in enforcing the regulations on the major banks. These regulators were heavily

criticised in the Royal Commission report as the regulators worked in a close manner

to the banking system and shown reluctance to act on misbehaviours of major banks

(Danckert, 2018).

1.1.3. Industry groups that help regulate behaviour in the banking industry.

Australian banking association is an industry group having the participation of 23 of

the main Australian banks. This association works with the regulators, government

and other stakeholders to help regulate the behaviour in this industry to ensure the

banking customers benefit from the stable and competitive financial system

(Australian Banking Association, n.d.).

1.2. Bank of Queensland: Company Description

1.2.1. Bank of Queensland business

BOQ is a well-established regional bank in Australia. The bank offers a variety of

financial products and services to retail and business customers. To offer these

services the bank operates under various brands (Bank of Queensland, n.d.):

Virgin Money Australia: It provides different type of easy to understand and great

value financial products to the customers.

BOQ Finance: This subsidiary of BOQ is a mid-market financier which specialises in

asset, cash flow and structured finance solutions.

BOQ Specialist: It provides customised banking solutions to specialized segments of

market like medical, veterinary, dental and accounting professionals.

St Andrew’s Insurance: It provides variety of insurance products to customers and

corporate partners.

1.2.2. Organisation structure of BOQ

Ownership structure:

According to Simply Wall St (2019):

Institutional investors own 19% of BOQ.

Insiders own 1% of BOQ.

Retail investors own 80% of BOQ.

The banking regulators have the power to ensure compliance but they were reluctant

in enforcing the regulations on the major banks. These regulators were heavily

criticised in the Royal Commission report as the regulators worked in a close manner

to the banking system and shown reluctance to act on misbehaviours of major banks

(Danckert, 2018).

1.1.3. Industry groups that help regulate behaviour in the banking industry.

Australian banking association is an industry group having the participation of 23 of

the main Australian banks. This association works with the regulators, government

and other stakeholders to help regulate the behaviour in this industry to ensure the

banking customers benefit from the stable and competitive financial system

(Australian Banking Association, n.d.).

1.2. Bank of Queensland: Company Description

1.2.1. Bank of Queensland business

BOQ is a well-established regional bank in Australia. The bank offers a variety of

financial products and services to retail and business customers. To offer these

services the bank operates under various brands (Bank of Queensland, n.d.):

Virgin Money Australia: It provides different type of easy to understand and great

value financial products to the customers.

BOQ Finance: This subsidiary of BOQ is a mid-market financier which specialises in

asset, cash flow and structured finance solutions.

BOQ Specialist: It provides customised banking solutions to specialized segments of

market like medical, veterinary, dental and accounting professionals.

St Andrew’s Insurance: It provides variety of insurance products to customers and

corporate partners.

1.2.2. Organisation structure of BOQ

Ownership structure:

According to Simply Wall St (2019):

Institutional investors own 19% of BOQ.

Insiders own 1% of BOQ.

Retail investors own 80% of BOQ.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Principles of Financial Management

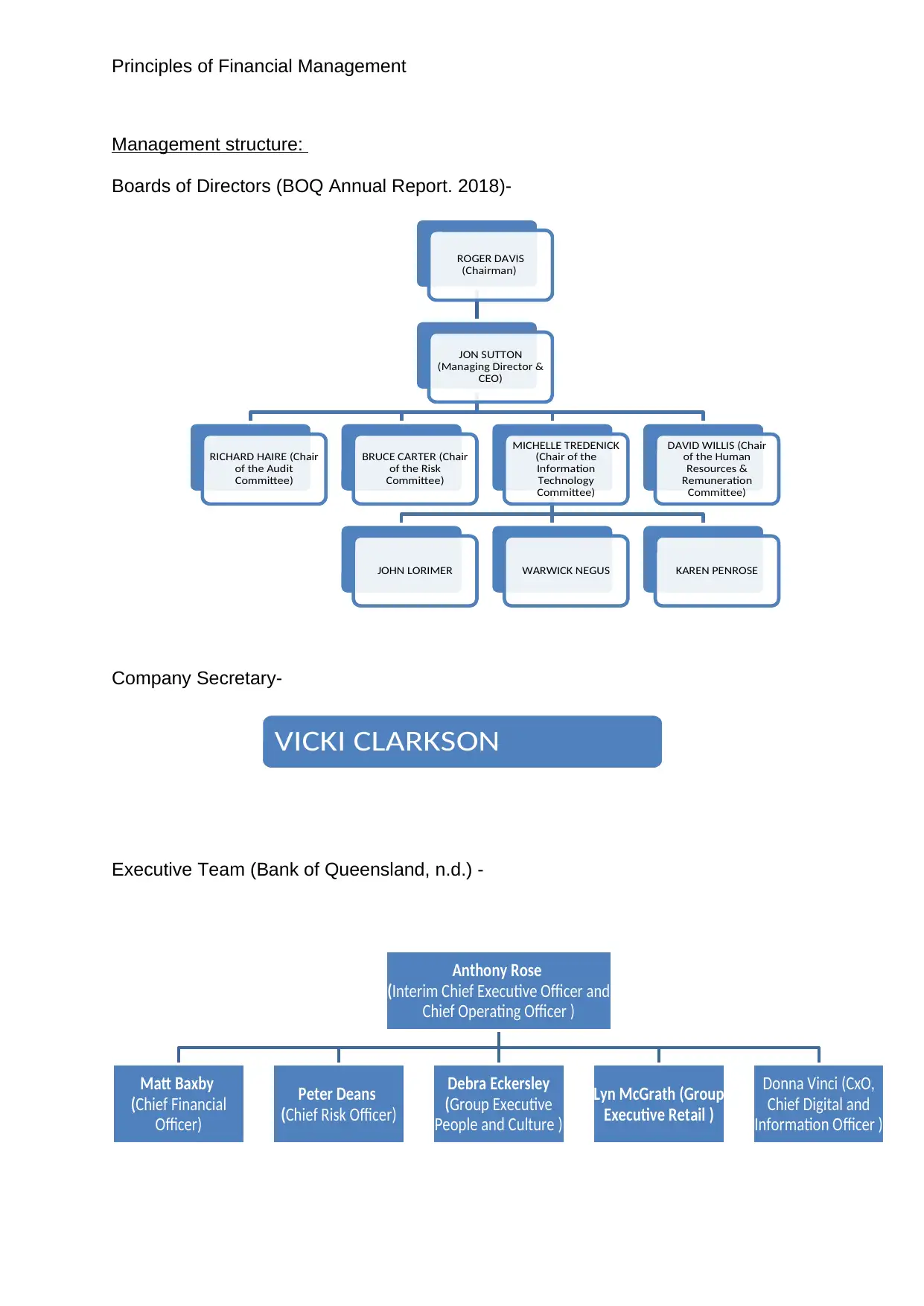

Management structure:

Boards of Directors (BOQ Annual Report. 2018)-

Company Secretary-

Executive Team (Bank of Queensland, n.d.) -

ROGER DAVIS

(Chairman)

JON SUTTON

(Managing Director &

CEO)

RICHARD HAIRE (Chair

of the Audit

Committee)

BRUCE CARTER (Chair

of the Risk

Committee)

MICHELLE TREDENICK

(Chair of the

Information

Technology

Committee)

JOHN LORIMER WARWICK NEGUS KAREN PENROSE

DAVID WILLIS (Chair

of the Human

Resources &

Remuneration

Committee)

VICKI CLARKSON

Anthony Rose

(Interim Chief Executive Officer and

Chief Operating Officer )

Matt Baxby

(Chief Financial

Officer)

Peter Deans

(Chief Risk Officer)

Debra Eckersley

(Group Executive

People and Culture )

Lyn McGrath (Group

Executive Retail )

Donna Vinci (CxO,

Chief Digital and

Information Officer )

Management structure:

Boards of Directors (BOQ Annual Report. 2018)-

Company Secretary-

Executive Team (Bank of Queensland, n.d.) -

ROGER DAVIS

(Chairman)

JON SUTTON

(Managing Director &

CEO)

RICHARD HAIRE (Chair

of the Audit

Committee)

BRUCE CARTER (Chair

of the Risk

Committee)

MICHELLE TREDENICK

(Chair of the

Information

Technology

Committee)

JOHN LORIMER WARWICK NEGUS KAREN PENROSE

DAVID WILLIS (Chair

of the Human

Resources &

Remuneration

Committee)

VICKI CLARKSON

Anthony Rose

(Interim Chief Executive Officer and

Chief Operating Officer )

Matt Baxby

(Chief Financial

Officer)

Peter Deans

(Chief Risk Officer)

Debra Eckersley

(Group Executive

People and Culture )

Lyn McGrath (Group

Executive Retail )

Donna Vinci (CxO,

Chief Digital and

Information Officer )

Principles of Financial Management

1.2.3. Role of BOQ within a financial system

Bank of Queensland acts as a financial intermediary as it allows depositors to loan

funds to firms in an effective manner without investigating or monitoring the

operations and health of those firms. So, banks allow the firms to avoid the trouble of

finding individuals that are willing to lend funds to them. Banks earn profits from the

differential between the interest they charge to the borrowers and interest they pay to

depositors.

1.3. Financial Instrument Analysis

Income statement and Balance sheet- Appendix 1 shows the financial data from

BOQ Annual Report (2018).

1.3.1. Financial Instruments that BOQ deals in:

Assets

Cash and cash equivalents: Cash, Remittance in transit and Reverse repurchase

agreements.

Available for sale securities: Debt instruments and unlisted equity instruments.

Held for trading securities: Floating rate notes and negotiable certificates of deposit.

Loans and advances: Property and personal loans, overdrafts, commercial loans,

credit cards and leasing finance.

Liabilities

Deposits: Term deposits and certificate of deposit.

Borrowings: Bonds, securitised securities and covered bonds.

Derivatives financial instruments.

Insurance policy liabilities.

1.3.2. OFF Balance Sheet business

BOQ engages in the off balance sheets liabilities via (BOQ Annual Report, 2018):

Guarantees, indemnities and letter of credit ($304m).

Customer funding commitments ($1753m).

1.2.3. Role of BOQ within a financial system

Bank of Queensland acts as a financial intermediary as it allows depositors to loan

funds to firms in an effective manner without investigating or monitoring the

operations and health of those firms. So, banks allow the firms to avoid the trouble of

finding individuals that are willing to lend funds to them. Banks earn profits from the

differential between the interest they charge to the borrowers and interest they pay to

depositors.

1.3. Financial Instrument Analysis

Income statement and Balance sheet- Appendix 1 shows the financial data from

BOQ Annual Report (2018).

1.3.1. Financial Instruments that BOQ deals in:

Assets

Cash and cash equivalents: Cash, Remittance in transit and Reverse repurchase

agreements.

Available for sale securities: Debt instruments and unlisted equity instruments.

Held for trading securities: Floating rate notes and negotiable certificates of deposit.

Loans and advances: Property and personal loans, overdrafts, commercial loans,

credit cards and leasing finance.

Liabilities

Deposits: Term deposits and certificate of deposit.

Borrowings: Bonds, securitised securities and covered bonds.

Derivatives financial instruments.

Insurance policy liabilities.

1.3.2. OFF Balance Sheet business

BOQ engages in the off balance sheets liabilities via (BOQ Annual Report, 2018):

Guarantees, indemnities and letter of credit ($304m).

Customer funding commitments ($1753m).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Principles of Financial Management

Volume of off-balance sheet operations in comparison to on-balance sheet business:

(Guarantees + funding commitments) / (Balance sheet liabilities) = (1753 +304) /

49124 = 4.18%

1.4. Analysis of Bank of Queensland

1.4.1. Analysis of Internal Factors

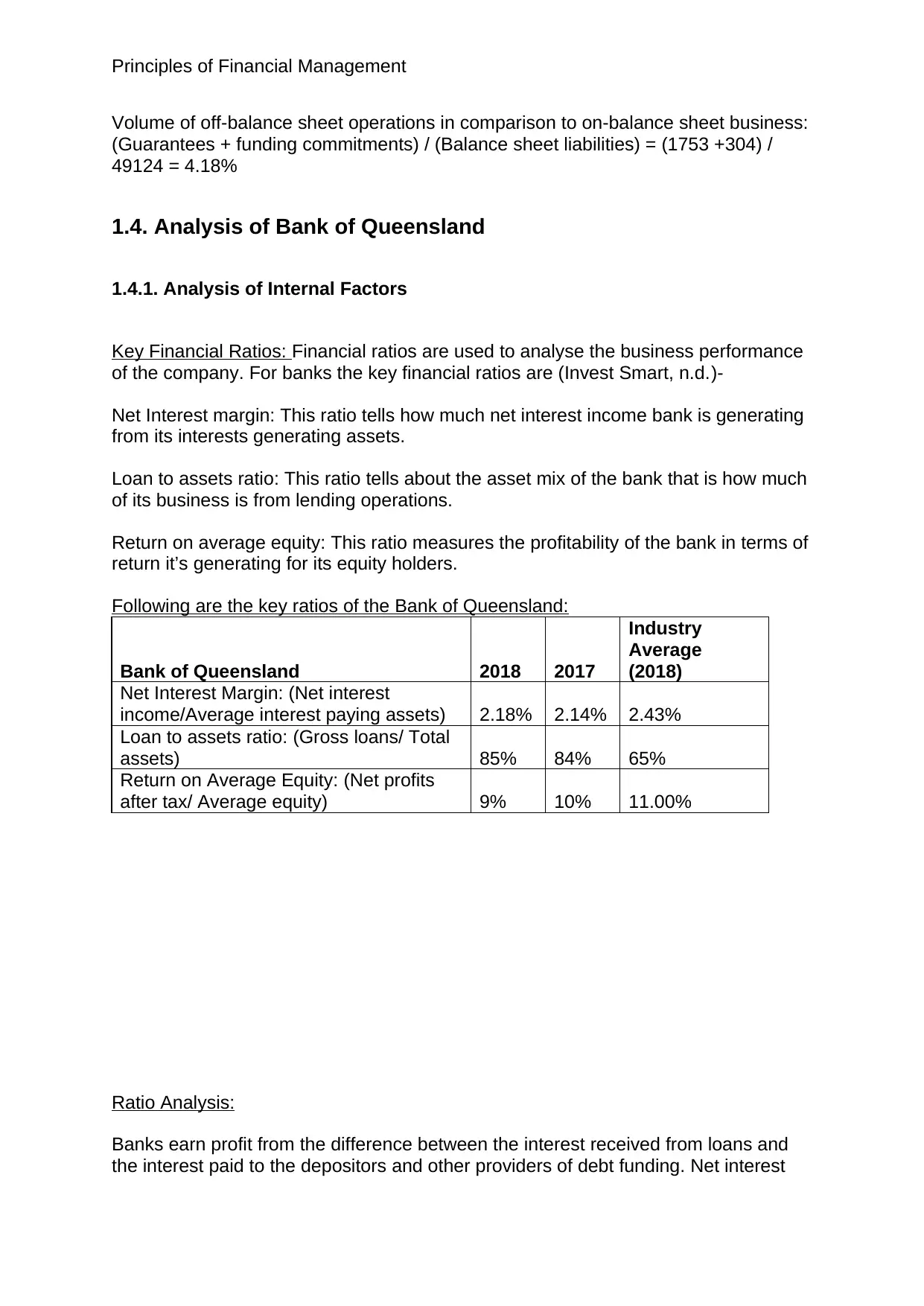

Key Financial Ratios: Financial ratios are used to analyse the business performance

of the company. For banks the key financial ratios are (Invest Smart, n.d.)-

Net Interest margin: This ratio tells how much net interest income bank is generating

from its interests generating assets.

Loan to assets ratio: This ratio tells about the asset mix of the bank that is how much

of its business is from lending operations.

Return on average equity: This ratio measures the profitability of the bank in terms of

return it’s generating for its equity holders.

Following are the key ratios of the Bank of Queensland:

Bank of Queensland 2018 2017

Industry

Average

(2018)

Net Interest Margin: (Net interest

income/Average interest paying assets) 2.18% 2.14% 2.43%

Loan to assets ratio: (Gross loans/ Total

assets) 85% 84% 65%

Return on Average Equity: (Net profits

after tax/ Average equity) 9% 10% 11.00%

Ratio Analysis:

Banks earn profit from the difference between the interest received from loans and

the interest paid to the depositors and other providers of debt funding. Net interest

Volume of off-balance sheet operations in comparison to on-balance sheet business:

(Guarantees + funding commitments) / (Balance sheet liabilities) = (1753 +304) /

49124 = 4.18%

1.4. Analysis of Bank of Queensland

1.4.1. Analysis of Internal Factors

Key Financial Ratios: Financial ratios are used to analyse the business performance

of the company. For banks the key financial ratios are (Invest Smart, n.d.)-

Net Interest margin: This ratio tells how much net interest income bank is generating

from its interests generating assets.

Loan to assets ratio: This ratio tells about the asset mix of the bank that is how much

of its business is from lending operations.

Return on average equity: This ratio measures the profitability of the bank in terms of

return it’s generating for its equity holders.

Following are the key ratios of the Bank of Queensland:

Bank of Queensland 2018 2017

Industry

Average

(2018)

Net Interest Margin: (Net interest

income/Average interest paying assets) 2.18% 2.14% 2.43%

Loan to assets ratio: (Gross loans/ Total

assets) 85% 84% 65%

Return on Average Equity: (Net profits

after tax/ Average equity) 9% 10% 11.00%

Ratio Analysis:

Banks earn profit from the difference between the interest received from loans and

the interest paid to the depositors and other providers of debt funding. Net interest

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Principles of Financial Management

margin of the Bank of Queensland has increased from 2.14% in 2017 to 2.18% in

2018 but it is less than the 2018 industry average of 2.43% (PWC, 2018). The year

on year growth is in line with the improvements in the industry net interest margins

but the relatively lower ratio is a slight weakness as the bank might not be able to

charge higher interest to its loan customers because of the increasing competition or

the might be paying higher interest rates to its capital provider’s.

Loan to assets ratio is an industry-specific ratio that provides insight about the bank

operations. A Higher loans-to-assets ratio means that the bank is earning more part

of their income from the banking operations like loans and investments. A lower

loans-to-assets ratio on the other hand means that the bank is earning a major part

of its income from other sources like asset management or trading. A higher ratio

means bank’s core business is well placed and a lower ratio means it is depending

upon variety of other businesses as it might be facing issues in the lending

operations. The bank with lower loan to assets ratio will perform better when interest

rates are low. Loan to assets ratio increased from 84% to 85% in 2018 and this is

relatively higher in comparison to the industry average of 65%. So, it acts as strength

because the bank business is dependent upon core lending activities but there is risk

from future low interest rates or from loan defaults.

ROAE is a key indicator that tells how much profits the bank is making for its

shareholders. As the banks has been increasing their capital base so the equity

portion in going up but banks revenues have stayed in almost same band. So, the

ROAE for the banking industry decreased to 11% in 2018. EOAE for the bank of

Queensland also decreased from 10% in 2017 to 9% in 2018. The lower ROAE of

9% in comparison to the industry average of 11% is a weakness for the bank as it is

generating lower returns for its equity holders maybe because of it lower interest rate

differential.

1.4.2. Analysis of external Factors

Main competitors of Bank of Queensland: Australia’s banking industry is very

concentrated and it is dominated by the big four banks: NAB, Westpac,

Commonwealth and ANB. The four banks together account for 80-85% of all home

loans. So, these four major banks provide tough competition to every other bank

including the Bank of Queensland because of their unique advantages due to their

large size. Then, the bank also faces competition from other relatively small banks

and regional banks like: Bendigo and Adelaide Bank Ltd, Suncorp Group Ltd and

Auswide Bank Ltd.

Basis of competition in the banking industry: The competition in banking industry can

be on the basis of pricing or some non-pricing factors. The banks in Australia

compete on prices for its retail business as the prices (including banking services

charges and interest rates) are closely matched among various players. It is noted

that the change in rate by one bank is swiftly responded to by other banks. This type

of competition is mostly given by the big banks as these large banks can secure

funds in a more cost effective manner because of their higher credit-ratings and their

margin of the Bank of Queensland has increased from 2.14% in 2017 to 2.18% in

2018 but it is less than the 2018 industry average of 2.43% (PWC, 2018). The year

on year growth is in line with the improvements in the industry net interest margins

but the relatively lower ratio is a slight weakness as the bank might not be able to

charge higher interest to its loan customers because of the increasing competition or

the might be paying higher interest rates to its capital provider’s.

Loan to assets ratio is an industry-specific ratio that provides insight about the bank

operations. A Higher loans-to-assets ratio means that the bank is earning more part

of their income from the banking operations like loans and investments. A lower

loans-to-assets ratio on the other hand means that the bank is earning a major part

of its income from other sources like asset management or trading. A higher ratio

means bank’s core business is well placed and a lower ratio means it is depending

upon variety of other businesses as it might be facing issues in the lending

operations. The bank with lower loan to assets ratio will perform better when interest

rates are low. Loan to assets ratio increased from 84% to 85% in 2018 and this is

relatively higher in comparison to the industry average of 65%. So, it acts as strength

because the bank business is dependent upon core lending activities but there is risk

from future low interest rates or from loan defaults.

ROAE is a key indicator that tells how much profits the bank is making for its

shareholders. As the banks has been increasing their capital base so the equity

portion in going up but banks revenues have stayed in almost same band. So, the

ROAE for the banking industry decreased to 11% in 2018. EOAE for the bank of

Queensland also decreased from 10% in 2017 to 9% in 2018. The lower ROAE of

9% in comparison to the industry average of 11% is a weakness for the bank as it is

generating lower returns for its equity holders maybe because of it lower interest rate

differential.

1.4.2. Analysis of external Factors

Main competitors of Bank of Queensland: Australia’s banking industry is very

concentrated and it is dominated by the big four banks: NAB, Westpac,

Commonwealth and ANB. The four banks together account for 80-85% of all home

loans. So, these four major banks provide tough competition to every other bank

including the Bank of Queensland because of their unique advantages due to their

large size. Then, the bank also faces competition from other relatively small banks

and regional banks like: Bendigo and Adelaide Bank Ltd, Suncorp Group Ltd and

Auswide Bank Ltd.

Basis of competition in the banking industry: The competition in banking industry can

be on the basis of pricing or some non-pricing factors. The banks in Australia

compete on prices for its retail business as the prices (including banking services

charges and interest rates) are closely matched among various players. It is noted

that the change in rate by one bank is swiftly responded to by other banks. This type

of competition is mostly given by the big banks as these large banks can secure

funds in a more cost effective manner because of their higher credit-ratings and their

Principles of Financial Management

systematically important position. The non-pricing competition on the basis of quality

and access to services and product features is given by the relatively small regional

players as these small banks can focus on particular product category and focus

more on the customer service (Deloitte, 2014).

Impact of the competition: The competition can create both threats and opportunities.

The price competition from the big four banks can put negative pressure on the

profitability of Bank of Queensland as if the bank is unable to get funds in a cost

effective manner because of its relatively smaller size then it will be not able to

provide competitive rates to its customers and there will threat to its existence. But

there are also new opportunities as the non-pricing competition can encourage the

bank to invest more in technology and product innovation to stand out from the other

regional banks.

1.5. Financial Market Analysis

1.5.1. Interaction between different financial players in the banking industry

BOQ acts as a financial intermediary and allows the investors/lenders to provide

funds to the borrowers in an efficient manner. Investors can put their money in the

bank via deposit account or term deposits to earn returns. The borrowers can apply

for loans by providing all the required details and they will need to pay interest rate

on this loan amount. Banks form the backbone of the financial market of the nation

and their failure can lead to systemic risk. So, regulators keep a close watch on

banks in order to monitor their business activities to prevent future frauds and

failures. This is done by subjecting banks to certain requirements, restrictions and

guidelines.

Relationship between the various financial players appears to be mutually beneficial.

The lenders are able to lend their money at competitive rates without doing any

research about the borrowers and they even need not to worry about the risk of

default as bank guarantees the deposit money. Similarly, borrowers need not to

waste resources to find individual investors but they can borrow directly from the

banks at low rates because of high degree of competition in banking industry. Banks

earn from this interest rate differential. The increased competition may have

decreased this interest rate margin but the growing economic activities have helped

financial intermediaries via higher transactions and volumes. This has also helped

the small investors and borrowers as they now have access to the financial markets

due to the financial inclusion programs of the banks.

1.5.2. Government/Regulators Intervention

The banking industry is responsible for the economic growth of the nation and failure

of banks can have devastating effect on the country. So, the governments need to

regulate this industry. Also, the inquiry into banking and related financial firms has

made public various misconducts by these firms. These malpractices have affected

the general public in an adverse manner. The poor conduct by the banks included

various activities like fraudulent documentation, administration errors, breaches of

systematically important position. The non-pricing competition on the basis of quality

and access to services and product features is given by the relatively small regional

players as these small banks can focus on particular product category and focus

more on the customer service (Deloitte, 2014).

Impact of the competition: The competition can create both threats and opportunities.

The price competition from the big four banks can put negative pressure on the

profitability of Bank of Queensland as if the bank is unable to get funds in a cost

effective manner because of its relatively smaller size then it will be not able to

provide competitive rates to its customers and there will threat to its existence. But

there are also new opportunities as the non-pricing competition can encourage the

bank to invest more in technology and product innovation to stand out from the other

regional banks.

1.5. Financial Market Analysis

1.5.1. Interaction between different financial players in the banking industry

BOQ acts as a financial intermediary and allows the investors/lenders to provide

funds to the borrowers in an efficient manner. Investors can put their money in the

bank via deposit account or term deposits to earn returns. The borrowers can apply

for loans by providing all the required details and they will need to pay interest rate

on this loan amount. Banks form the backbone of the financial market of the nation

and their failure can lead to systemic risk. So, regulators keep a close watch on

banks in order to monitor their business activities to prevent future frauds and

failures. This is done by subjecting banks to certain requirements, restrictions and

guidelines.

Relationship between the various financial players appears to be mutually beneficial.

The lenders are able to lend their money at competitive rates without doing any

research about the borrowers and they even need not to worry about the risk of

default as bank guarantees the deposit money. Similarly, borrowers need not to

waste resources to find individual investors but they can borrow directly from the

banks at low rates because of high degree of competition in banking industry. Banks

earn from this interest rate differential. The increased competition may have

decreased this interest rate margin but the growing economic activities have helped

financial intermediaries via higher transactions and volumes. This has also helped

the small investors and borrowers as they now have access to the financial markets

due to the financial inclusion programs of the banks.

1.5.2. Government/Regulators Intervention

The banking industry is responsible for the economic growth of the nation and failure

of banks can have devastating effect on the country. So, the governments need to

regulate this industry. Also, the inquiry into banking and related financial firms has

made public various misconducts by these firms. These malpractices have affected

the general public in an adverse manner. The poor conduct by the banks included

various activities like fraudulent documentation, administration errors, breaches of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Principles of Financial Management

responsible lending obligations and conflict of interest arising from the dual

operations of banks as they provide financial advice and sell financial products as

well (Hutchens, 2018). So, government/regulators intervention is required in the

banking industry to make it more ethical and transparent.

Actions taken by regulators to ensure ethical behaviour within the banking industry:

In May 2017, Government had announced Banking Executive Accountability Regime

(BEAR). It will apply to all the authorised deposit-taking organisations from July

2019. Many problems related to the banking industry arisen over last few years were

in some way due to the organisational complexity and diffused responsibility. The

implementation of the BEAR will enhance the governance and risk management of

banks by providing clearer understanding and agreement on executive’s

accountabilities (Australian Prudential Regulation Authority, 2018).

ASIC approved a new Banking Code of Practice in July 2018 to introduce a large

number of measures to make banking products simple and customer friendly. These

codes represent a stronger commitment to responsible lending, ethical behavior and

increased transparency (Australian Banking Association, 2019).

The Banking Royal Commission report looked into the misconduct by the financial

industry and it has given various recommendations to make this industry more

ethical. In response to some of the recommendations the government has decided to

remove all the possible conflicts of interest between brokers and consumers by

banning ill-suited lender-paid commissions like trail commissions on new loans from

1 July 2020 (Remeikis, 2019).

1.5.3. Unethical practices by BOQ in the past

Royal commission found that the Bank of Queensland has failed its customer

seriously as bank’s lending manager had broken the bank’s policy by inappropriately

offering $280,000 loan to a customer in 2012. The reasons for this can be manger’s

inexperience and failure of internal controls in checking reckless lending in order to

increase loan numbers (Hutchens, 2018).

This reduced the confidence of investors and the bank’s share price took a hit. The

royal commission has also passed various recommendations to stop such

malpractices by the banks and to financial service more customers oriented rather

than sales oriented.

In order to avoid such ethical misconducts in future, BOQ has closed its branch in

Pirie Street in Adelaide and the bank fired the branch manager. Also, the bank has

promised reforms to avoid such misconducts in the future.

responsible lending obligations and conflict of interest arising from the dual

operations of banks as they provide financial advice and sell financial products as

well (Hutchens, 2018). So, government/regulators intervention is required in the

banking industry to make it more ethical and transparent.

Actions taken by regulators to ensure ethical behaviour within the banking industry:

In May 2017, Government had announced Banking Executive Accountability Regime

(BEAR). It will apply to all the authorised deposit-taking organisations from July

2019. Many problems related to the banking industry arisen over last few years were

in some way due to the organisational complexity and diffused responsibility. The

implementation of the BEAR will enhance the governance and risk management of

banks by providing clearer understanding and agreement on executive’s

accountabilities (Australian Prudential Regulation Authority, 2018).

ASIC approved a new Banking Code of Practice in July 2018 to introduce a large

number of measures to make banking products simple and customer friendly. These

codes represent a stronger commitment to responsible lending, ethical behavior and

increased transparency (Australian Banking Association, 2019).

The Banking Royal Commission report looked into the misconduct by the financial

industry and it has given various recommendations to make this industry more

ethical. In response to some of the recommendations the government has decided to

remove all the possible conflicts of interest between brokers and consumers by

banning ill-suited lender-paid commissions like trail commissions on new loans from

1 July 2020 (Remeikis, 2019).

1.5.3. Unethical practices by BOQ in the past

Royal commission found that the Bank of Queensland has failed its customer

seriously as bank’s lending manager had broken the bank’s policy by inappropriately

offering $280,000 loan to a customer in 2012. The reasons for this can be manger’s

inexperience and failure of internal controls in checking reckless lending in order to

increase loan numbers (Hutchens, 2018).

This reduced the confidence of investors and the bank’s share price took a hit. The

royal commission has also passed various recommendations to stop such

malpractices by the banks and to financial service more customers oriented rather

than sales oriented.

In order to avoid such ethical misconducts in future, BOQ has closed its branch in

Pirie Street in Adelaide and the bank fired the branch manager. Also, the bank has

promised reforms to avoid such misconducts in the future.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Principles of Financial Management

2) Conclusions and Recommendations

Bank of Queensland belongs to the banking industry. This is a vibrant industry which

has contributed significantly to the country’s economic growth. Various regulators of

the banking industry are ASIC, RBA and APRA. The regulators have failed to

efficiently monitor this industry as there have been many cases of misconduct in

recent past.

BOQ acts as a financial intermediary by connecting investors with the borrowers and

in return earning interest differential from these transactions. Net Interest margin,

Loan to assets ratio and Return on average equity are the key ratios that can be

used to financially analyse BOQ. There has been improvement in the bank’s net

interest margin and loan to asset ratio in 2018. But its net interest margin of 2.18%

was lower than the industry average of 2.43%. BOQ’s return on equity decreased to

9% in 2018 and it was lower than the industry average of 11%. So, compared to the

industry the bank’s core lending operations make up higher proportion of its business

but are less profitable.

The competition in this industry is very high as major four banks occupy major share

of banking sector. This competition can be based on price or even product

differentiation. The intense competition put pressure on the bank profit and loss

statement but is also responsible for innovation, new product development and

business expansion.

Various financial players interact in a beneficial manner in the banking industry that

helps the overall growth of economy. The banking sector is really important for the

financial stability and its failure can cause systemic risk so it needs government

intervention. There have been various actions taken in the past by the regulators to

promote ethical behaviour in banking industry like BEAR implementation,

introduction of new banking codes and implementation of various recommendations

of the Royal commission. BOQ has acted in an unethical manner in past by issuing

wrong loans but it has promised reforms to avoid such misconducts.

The overall financial market is healthy for the banking industry because of its nice

growth in the past and its huge size but the industry needs to work in ethical manner

to avoid any misconduct as the conflict of interest and executive’s incentives can

lead to its failure.

The Royal commission has recently presented a report where it has given various

recommendations to sustain the health and development of the industry. It

recommended banks to act in the best interests of the borrowers by banning all

types of trail commissions. The report recommended that on-going fee arrangements

2) Conclusions and Recommendations

Bank of Queensland belongs to the banking industry. This is a vibrant industry which

has contributed significantly to the country’s economic growth. Various regulators of

the banking industry are ASIC, RBA and APRA. The regulators have failed to

efficiently monitor this industry as there have been many cases of misconduct in

recent past.

BOQ acts as a financial intermediary by connecting investors with the borrowers and

in return earning interest differential from these transactions. Net Interest margin,

Loan to assets ratio and Return on average equity are the key ratios that can be

used to financially analyse BOQ. There has been improvement in the bank’s net

interest margin and loan to asset ratio in 2018. But its net interest margin of 2.18%

was lower than the industry average of 2.43%. BOQ’s return on equity decreased to

9% in 2018 and it was lower than the industry average of 11%. So, compared to the

industry the bank’s core lending operations make up higher proportion of its business

but are less profitable.

The competition in this industry is very high as major four banks occupy major share

of banking sector. This competition can be based on price or even product

differentiation. The intense competition put pressure on the bank profit and loss

statement but is also responsible for innovation, new product development and

business expansion.

Various financial players interact in a beneficial manner in the banking industry that

helps the overall growth of economy. The banking sector is really important for the

financial stability and its failure can cause systemic risk so it needs government

intervention. There have been various actions taken in the past by the regulators to

promote ethical behaviour in banking industry like BEAR implementation,

introduction of new banking codes and implementation of various recommendations

of the Royal commission. BOQ has acted in an unethical manner in past by issuing

wrong loans but it has promised reforms to avoid such misconducts.

The overall financial market is healthy for the banking industry because of its nice

growth in the past and its huge size but the industry needs to work in ethical manner

to avoid any misconduct as the conflict of interest and executive’s incentives can

lead to its failure.

The Royal commission has recently presented a report where it has given various

recommendations to sustain the health and development of the industry. It

recommended banks to act in the best interests of the borrowers by banning all

types of trail commissions. The report recommended that on-going fee arrangements

Principles of Financial Management

of all the banking customers should be renewed every year to stop banks from

charging fees for no service. It further recommended that the clients should be

informed each year in detail about the annual fees structure and services they’ll be

entitled to receive for that fees. The commission criticised both the regulators, ASIC

and APRA for their failure in the detection of misconduct by the banks and taking

appropriate actions. It has recommended that the current “twin peaks” regulation

model should be maintained but with a clear distinction between the responsibilities

of ASIC and APRA. It has even recommended a new oversight entity to monitor the

effectiveness of these two regulators (Seeto, 2019).

The paper agrees with these recommendations as the conflict of interests and the

sole focus on sales can lead to misconducts in banking industry. Such, actions as

recommended by the commission will lead to a transparent and more customer

focused industry which will help to sustain the health and growth of banking industry.

Also, the recommendation regarding a new authority to oversee current regulators

will help monitor the banking industry in an effective manner and it will reduce the

systemic risk because of the frauds and failure of the financial sector.

of all the banking customers should be renewed every year to stop banks from

charging fees for no service. It further recommended that the clients should be

informed each year in detail about the annual fees structure and services they’ll be

entitled to receive for that fees. The commission criticised both the regulators, ASIC

and APRA for their failure in the detection of misconduct by the banks and taking

appropriate actions. It has recommended that the current “twin peaks” regulation

model should be maintained but with a clear distinction between the responsibilities

of ASIC and APRA. It has even recommended a new oversight entity to monitor the

effectiveness of these two regulators (Seeto, 2019).

The paper agrees with these recommendations as the conflict of interests and the

sole focus on sales can lead to misconducts in banking industry. Such, actions as

recommended by the commission will lead to a transparent and more customer

focused industry which will help to sustain the health and growth of banking industry.

Also, the recommendation regarding a new authority to oversee current regulators

will help monitor the banking industry in an effective manner and it will reduce the

systemic risk because of the frauds and failure of the financial sector.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.