Principles of Taxation: Tax Planning, VAT, and Capital Gains Analysis

VerifiedAdded on 2023/01/09

|13

|2384

|37

Homework Assignment

AI Summary

This assignment solution delves into the core principles of taxation, providing detailed calculations and analyses. Section A focuses on individual income tax calculations, including employment income, tax liability, and tax payable/repayable, with specific examples for John Usdaw. Question 2 covers capital allowance calculations for Unison Chemicals Plc, including main and special rate pools, disposals, and the correct treatment of various income sources like dividends, interest, and rental income. It also includes tax-adjusted trading profits and taxable total profits. Section B examines capital gains tax (CGT) calculations for Tessa Tuc, including the net chargeable gain/loss on the disposal of assets, CGT liability, and rollover relief. The assignment concludes with VAT-related questions, covering registration, notification to HMRC, output VAT calculations, and the flat rate scheme. The solution provides a comprehensive understanding of tax principles and practical application.

Principles of Taxation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENT

SECTION A.....................................................................................................................................3

Question 1........................................................................................................................................3

Question 2........................................................................................................................................4

SECTION B.....................................................................................................................................8

Question 3........................................................................................................................................8

Question 4......................................................................................................................................10

REFERENCES..............................................................................................................................13

SECTION A.....................................................................................................................................3

Question 1........................................................................................................................................3

Question 2........................................................................................................................................4

SECTION B.....................................................................................................................................8

Question 3........................................................................................................................................8

Question 4......................................................................................................................................10

REFERENCES..............................................................................................................................13

SECTION A

Question 1

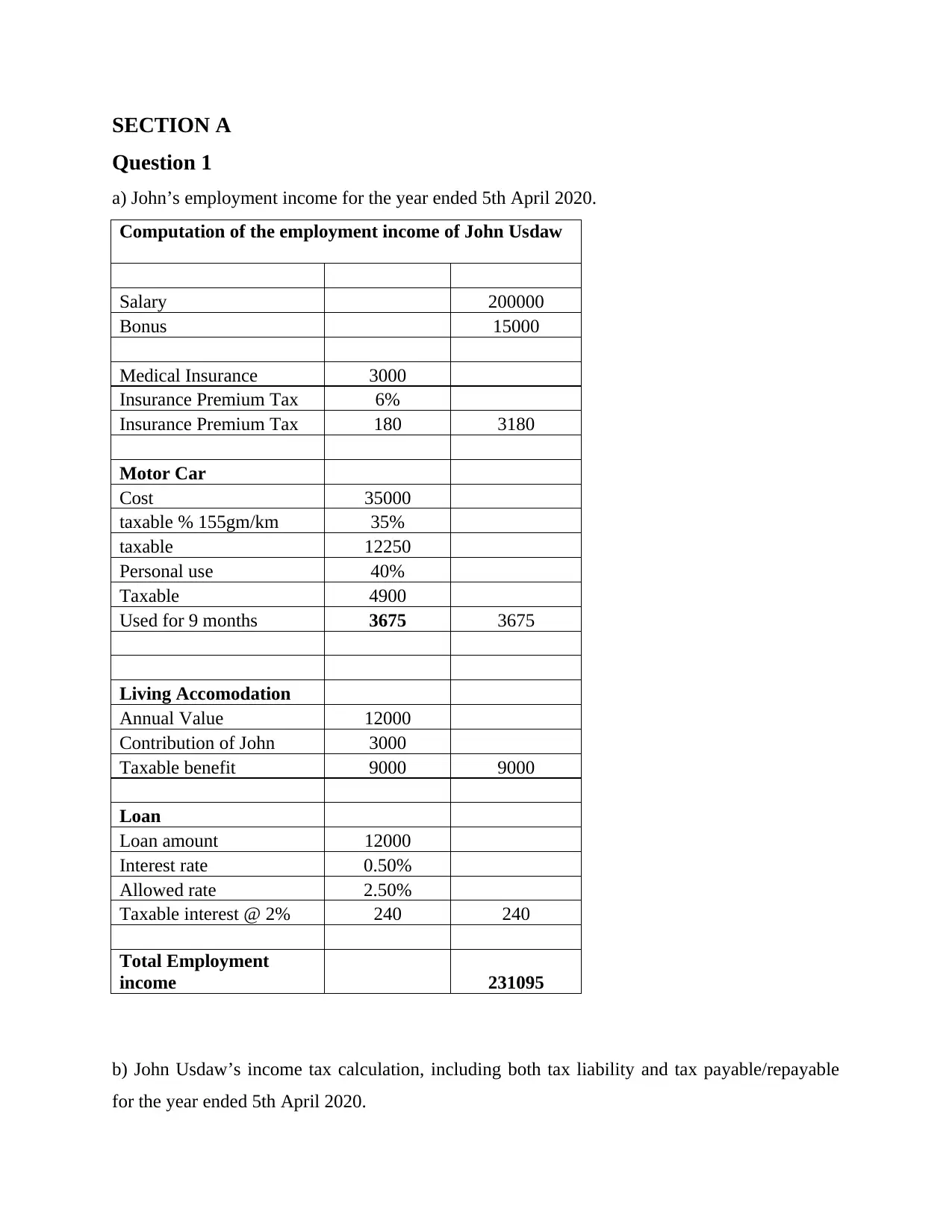

a) John’s employment income for the year ended 5th April 2020.

Computation of the employment income of John Usdaw

Salary 200000

Bonus 15000

Medical Insurance 3000

Insurance Premium Tax 6%

Insurance Premium Tax 180 3180

Motor Car

Cost 35000

taxable % 155gm/km 35%

taxable 12250

Personal use 40%

Taxable 4900

Used for 9 months 3675 3675

Living Accomodation

Annual Value 12000

Contribution of John 3000

Taxable benefit 9000 9000

Loan

Loan amount 12000

Interest rate 0.50%

Allowed rate 2.50%

Taxable interest @ 2% 240 240

Total Employment

income 231095

b) John Usdaw’s income tax calculation, including both tax liability and tax payable/repayable

for the year ended 5th April 2020.

Question 1

a) John’s employment income for the year ended 5th April 2020.

Computation of the employment income of John Usdaw

Salary 200000

Bonus 15000

Medical Insurance 3000

Insurance Premium Tax 6%

Insurance Premium Tax 180 3180

Motor Car

Cost 35000

taxable % 155gm/km 35%

taxable 12250

Personal use 40%

Taxable 4900

Used for 9 months 3675 3675

Living Accomodation

Annual Value 12000

Contribution of John 3000

Taxable benefit 9000 9000

Loan

Loan amount 12000

Interest rate 0.50%

Allowed rate 2.50%

Taxable interest @ 2% 240 240

Total Employment

income 231095

b) John Usdaw’s income tax calculation, including both tax liability and tax payable/repayable

for the year ended 5th April 2020.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

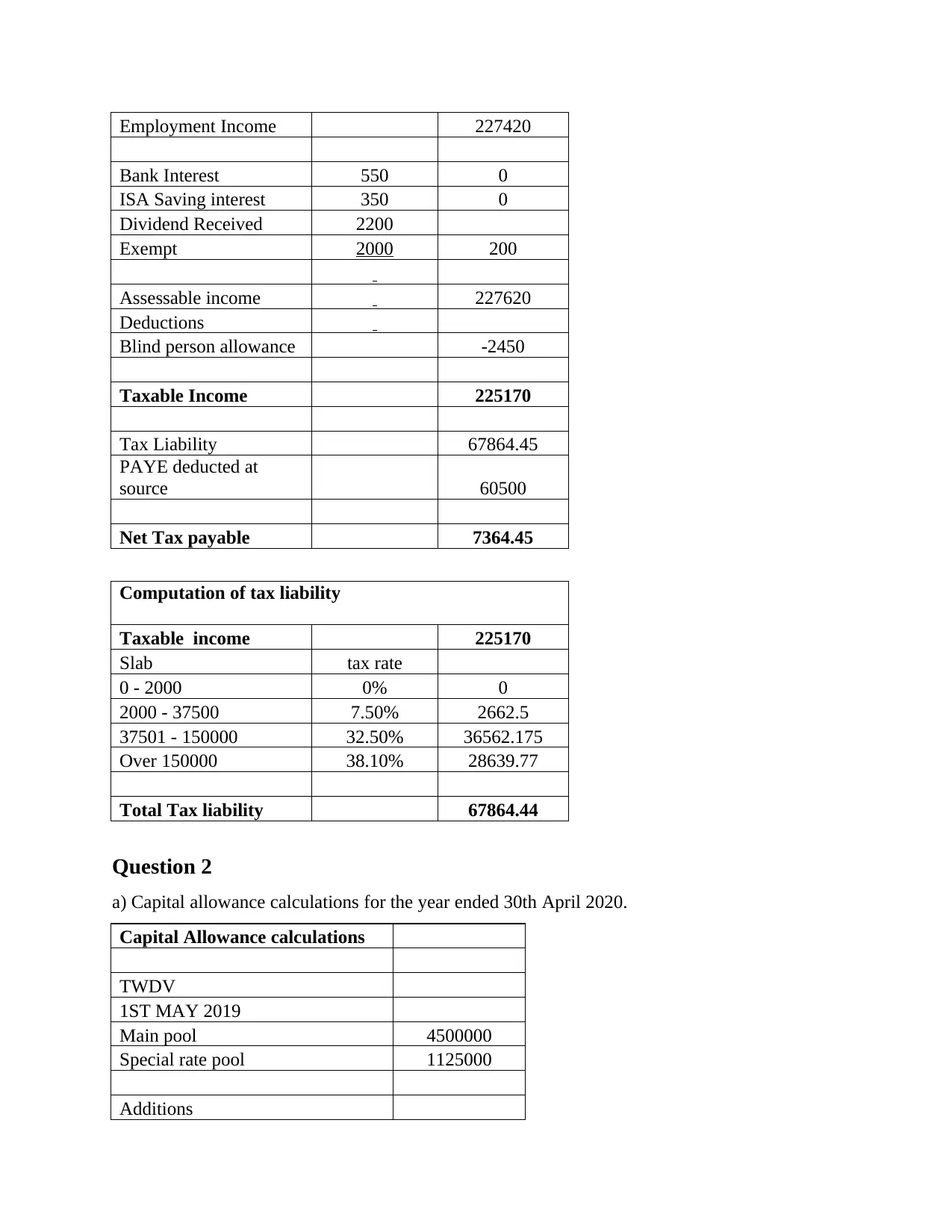

Employment Income 227420

Bank Interest 550 0

ISA Saving interest 350 0

Dividend Received 2200

Exempt 2000 200

Assessable income 227620

Deductions

Blind person allowance -2450

Taxable Income 225170

Tax Liability 67864.45

PAYE deducted at

source 60500

Net Tax payable 7364.45

Computation of tax liability

Taxable income 225170

Slab tax rate

0 - 2000 0% 0

2000 - 37500 7.50% 2662.5

37501 - 150000 32.50% 36562.175

Over 150000 38.10% 28639.77

Total Tax liability 67864.44

Question 2

a) Capital allowance calculations for the year ended 30th April 2020.

Capital Allowance calculations

TWDV

1ST MAY 2019

Main pool 4500000

Special rate pool 1125000

Additions

Bank Interest 550 0

ISA Saving interest 350 0

Dividend Received 2200

Exempt 2000 200

Assessable income 227620

Deductions

Blind person allowance -2450

Taxable Income 225170

Tax Liability 67864.45

PAYE deducted at

source 60500

Net Tax payable 7364.45

Computation of tax liability

Taxable income 225170

Slab tax rate

0 - 2000 0% 0

2000 - 37500 7.50% 2662.5

37501 - 150000 32.50% 36562.175

Over 150000 38.10% 28639.77

Total Tax liability 67864.44

Question 2

a) Capital allowance calculations for the year ended 30th April 2020.

Capital Allowance calculations

TWDV

1ST MAY 2019

Main pool 4500000

Special rate pool 1125000

Additions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

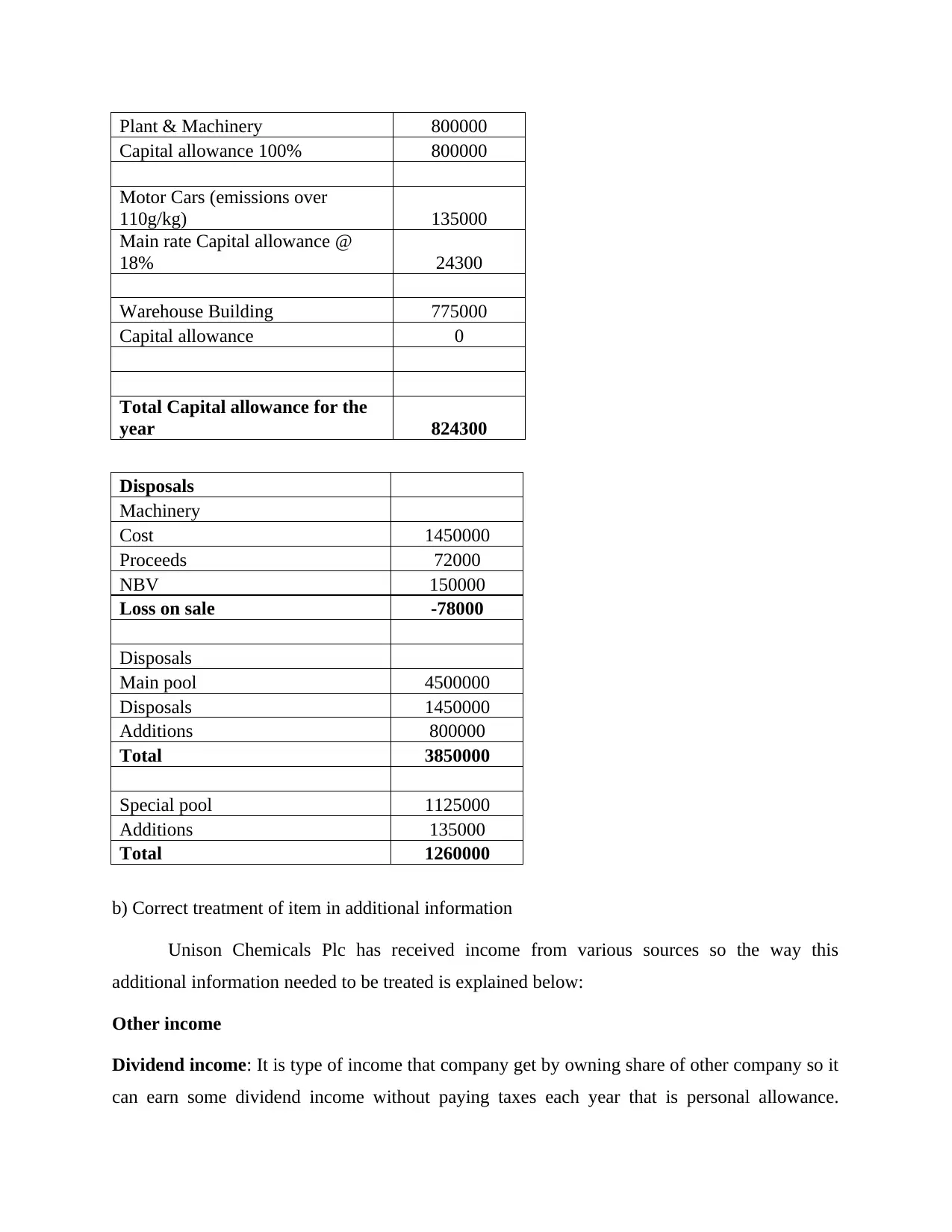

Plant & Machinery 800000

Capital allowance 100% 800000

Motor Cars (emissions over

110g/kg) 135000

Main rate Capital allowance @

18% 24300

Warehouse Building 775000

Capital allowance 0

Total Capital allowance for the

year 824300

Disposals

Machinery

Cost 1450000

Proceeds 72000

NBV 150000

Loss on sale -78000

Disposals

Main pool 4500000

Disposals 1450000

Additions 800000

Total 3850000

Special pool 1125000

Additions 135000

Total 1260000

b) Correct treatment of item in additional information

Unison Chemicals Plc has received income from various sources so the way this

additional information needed to be treated is explained below:

Other income

Dividend income: It is type of income that company get by owning share of other company so it

can earn some dividend income without paying taxes each year that is personal allowance.

Capital allowance 100% 800000

Motor Cars (emissions over

110g/kg) 135000

Main rate Capital allowance @

18% 24300

Warehouse Building 775000

Capital allowance 0

Total Capital allowance for the

year 824300

Disposals

Machinery

Cost 1450000

Proceeds 72000

NBV 150000

Loss on sale -78000

Disposals

Main pool 4500000

Disposals 1450000

Additions 800000

Total 3850000

Special pool 1125000

Additions 135000

Total 1260000

b) Correct treatment of item in additional information

Unison Chemicals Plc has received income from various sources so the way this

additional information needed to be treated is explained below:

Other income

Dividend income: It is type of income that company get by owning share of other company so it

can earn some dividend income without paying taxes each year that is personal allowance.

Company need not have to pay tax in case it receive money £2,000 as per 2020-21 as it is tax

free allowance. So the allowance in 2017-18 was cut for income £5,000 so it can be stated that

Unison chemical Plc need not have to deduct tax so it have to treat it as income (Arnold, Ault

and Cooper, 2019).

Interest received: Starting rates of saving is £5,000 at which individual need not have to pay tax

on saving amount and at the same time other incomes need not to be more than 17500.

Therefore, Unison Chemical Plc is a firm that have received interest of 2500 that is less than

5000 and its overall other income is not more than 17500 so no tax will be deducted for firm.

Rental income from property: It can be stated that less than basic rate threshold that is

£12,500, 0 % tax need to be paid by corporate business. Therefore, no tax need to be paid by

Unison chemical Plc as it have earned only £1450 that is less than is £12,500.

Legal and professional fees: Unisom chemical have to incur legal fee or charges such as it has

found guilty to pour toxic chemical in river therefore it was fined for £250000. Company needs

to pay Penalties and fines for breach of regulation that are made by government so Unisom have

not abided rules of government which have lead to legal complication or fines. It has paid fines

as punishment which is not tax deductible (Chari, Nicolini and Teles, 2019). Unisom was also

planning to raise more capital on stock exchanged so it has spent legal cost on advisors that is

treated as allowable revenue expenditure.

Entertainment and Gifts: It can be stated that expense that are made by corporate for

entertainment or gift is not allowed as deducted from profit of company. But in case the gift is

given to same individual within similar period of time that is not more than £50 that it should

have company logo, name and advertisements. Gift given by Unisom chemical includes total

cost more than £10000 and advertisement of name of firm so it is treated as allowable revenue

expenditure. Cost of staff entertainment is also allowed so Unisom chemical that have spend

money for staff entertainment are considered as allowable revenue expenditure of firm.

Loss on disposable of non-current assets: It is type of asset that is purchased to make use in

operation of business such as equipments or other intangible assets. Unisom chemical plc have

sold old machinery piece for £ 78000 and collect proceed less than actual book value of asset. At

the same time it is non cash expense because there is no actual inflow and outflow of cash

therefore it is accounted as investing cash flow (Long and Miller, 2017). It can also be termed as

free allowance. So the allowance in 2017-18 was cut for income £5,000 so it can be stated that

Unison chemical Plc need not have to deduct tax so it have to treat it as income (Arnold, Ault

and Cooper, 2019).

Interest received: Starting rates of saving is £5,000 at which individual need not have to pay tax

on saving amount and at the same time other incomes need not to be more than 17500.

Therefore, Unison Chemical Plc is a firm that have received interest of 2500 that is less than

5000 and its overall other income is not more than 17500 so no tax will be deducted for firm.

Rental income from property: It can be stated that less than basic rate threshold that is

£12,500, 0 % tax need to be paid by corporate business. Therefore, no tax need to be paid by

Unison chemical Plc as it have earned only £1450 that is less than is £12,500.

Legal and professional fees: Unisom chemical have to incur legal fee or charges such as it has

found guilty to pour toxic chemical in river therefore it was fined for £250000. Company needs

to pay Penalties and fines for breach of regulation that are made by government so Unisom have

not abided rules of government which have lead to legal complication or fines. It has paid fines

as punishment which is not tax deductible (Chari, Nicolini and Teles, 2019). Unisom was also

planning to raise more capital on stock exchanged so it has spent legal cost on advisors that is

treated as allowable revenue expenditure.

Entertainment and Gifts: It can be stated that expense that are made by corporate for

entertainment or gift is not allowed as deducted from profit of company. But in case the gift is

given to same individual within similar period of time that is not more than £50 that it should

have company logo, name and advertisements. Gift given by Unisom chemical includes total

cost more than £10000 and advertisement of name of firm so it is treated as allowable revenue

expenditure. Cost of staff entertainment is also allowed so Unisom chemical that have spend

money for staff entertainment are considered as allowable revenue expenditure of firm.

Loss on disposable of non-current assets: It is type of asset that is purchased to make use in

operation of business such as equipments or other intangible assets. Unisom chemical plc have

sold old machinery piece for £ 78000 and collect proceed less than actual book value of asset. At

the same time it is non cash expense because there is no actual inflow and outflow of cash

therefore it is accounted as investing cash flow (Long and Miller, 2017). It can also be termed as

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

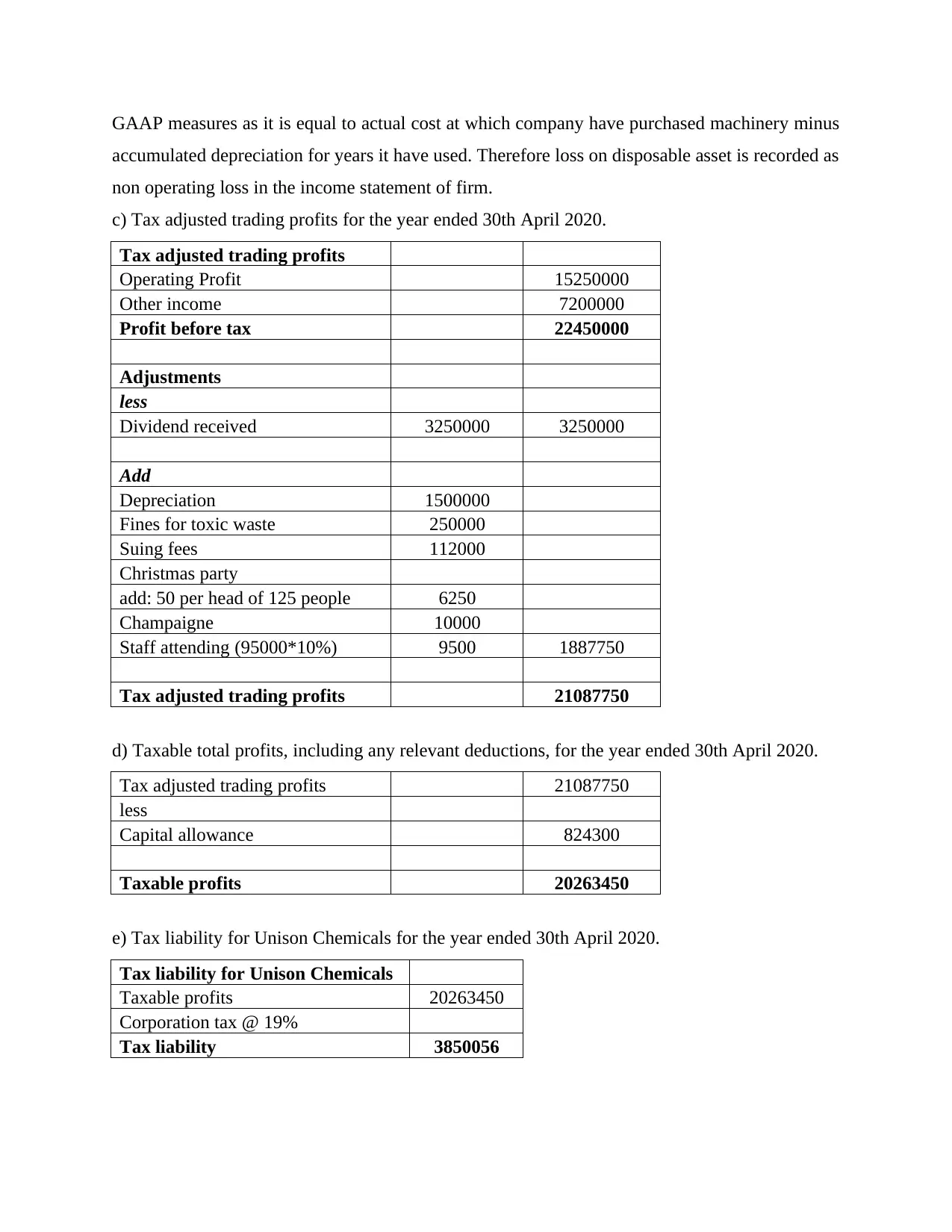

GAAP measures as it is equal to actual cost at which company have purchased machinery minus

accumulated depreciation for years it have used. Therefore loss on disposable asset is recorded as

non operating loss in the income statement of firm.

c) Tax adjusted trading profits for the year ended 30th April 2020.

Tax adjusted trading profits

Operating Profit 15250000

Other income 7200000

Profit before tax 22450000

Adjustments

less

Dividend received 3250000 3250000

Add

Depreciation 1500000

Fines for toxic waste 250000

Suing fees 112000

Christmas party

add: 50 per head of 125 people 6250

Champaigne 10000

Staff attending (95000*10%) 9500 1887750

Tax adjusted trading profits 21087750

d) Taxable total profits, including any relevant deductions, for the year ended 30th April 2020.

Tax adjusted trading profits 21087750

less

Capital allowance 824300

Taxable profits 20263450

e) Tax liability for Unison Chemicals for the year ended 30th April 2020.

Tax liability for Unison Chemicals

Taxable profits 20263450

Corporation tax @ 19%

Tax liability 3850056

accumulated depreciation for years it have used. Therefore loss on disposable asset is recorded as

non operating loss in the income statement of firm.

c) Tax adjusted trading profits for the year ended 30th April 2020.

Tax adjusted trading profits

Operating Profit 15250000

Other income 7200000

Profit before tax 22450000

Adjustments

less

Dividend received 3250000 3250000

Add

Depreciation 1500000

Fines for toxic waste 250000

Suing fees 112000

Christmas party

add: 50 per head of 125 people 6250

Champaigne 10000

Staff attending (95000*10%) 9500 1887750

Tax adjusted trading profits 21087750

d) Taxable total profits, including any relevant deductions, for the year ended 30th April 2020.

Tax adjusted trading profits 21087750

less

Capital allowance 824300

Taxable profits 20263450

e) Tax liability for Unison Chemicals for the year ended 30th April 2020.

Tax liability for Unison Chemicals

Taxable profits 20263450

Corporation tax @ 19%

Tax liability 3850056

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

SECTION B

Question 3

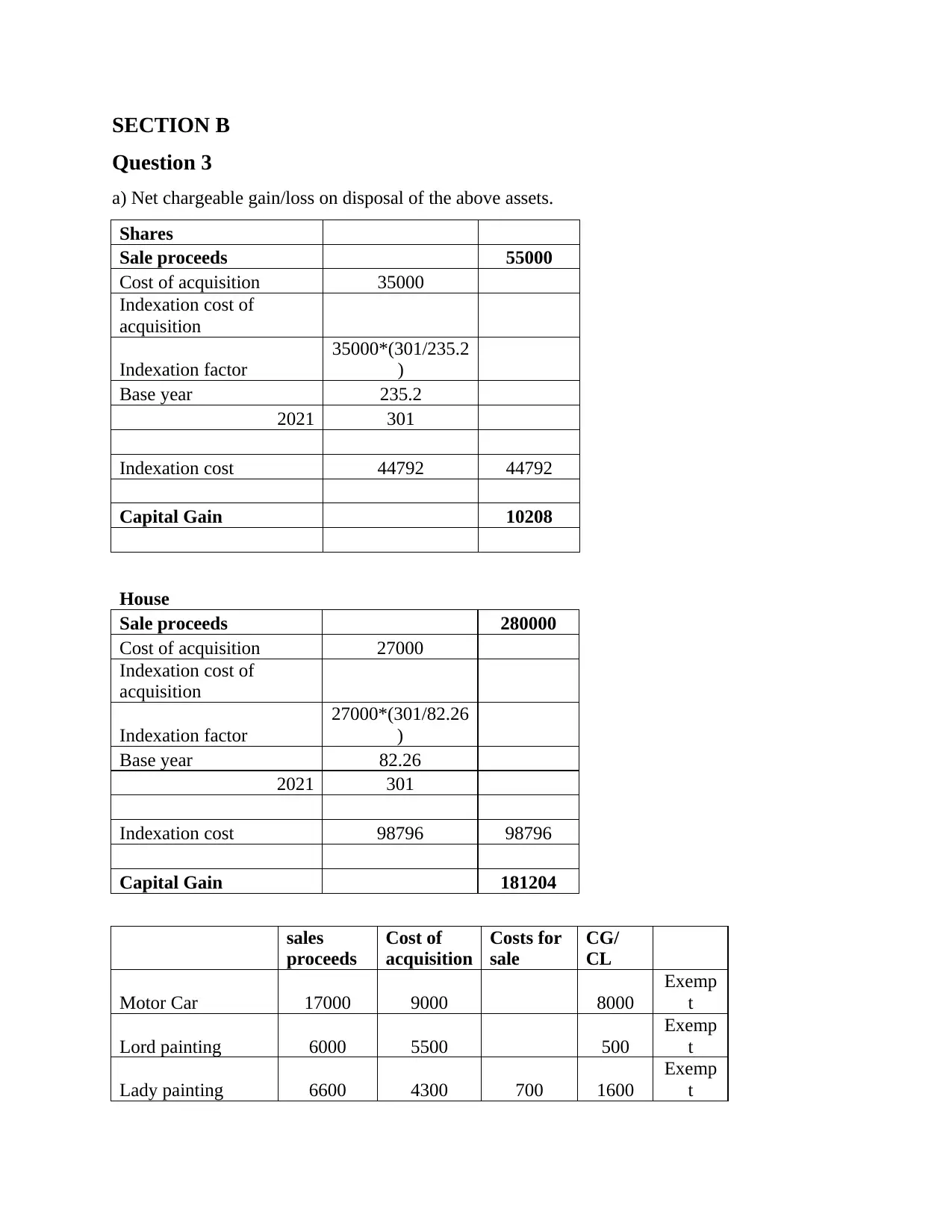

a) Net chargeable gain/loss on disposal of the above assets.

Shares

Sale proceeds 55000

Cost of acquisition 35000

Indexation cost of

acquisition

Indexation factor

35000*(301/235.2

)

Base year 235.2

2021 301

Indexation cost 44792 44792

Capital Gain 10208

House

Sale proceeds 280000

Cost of acquisition 27000

Indexation cost of

acquisition

Indexation factor

27000*(301/82.26

)

Base year 82.26

2021 301

Indexation cost 98796 98796

Capital Gain 181204

sales

proceeds

Cost of

acquisition

Costs for

sale

CG/

CL

Motor Car 17000 9000 8000

Exemp

t

Lord painting 6000 5500 500

Exemp

t

Lady painting 6600 4300 700 1600

Exemp

t

Question 3

a) Net chargeable gain/loss on disposal of the above assets.

Shares

Sale proceeds 55000

Cost of acquisition 35000

Indexation cost of

acquisition

Indexation factor

35000*(301/235.2

)

Base year 235.2

2021 301

Indexation cost 44792 44792

Capital Gain 10208

House

Sale proceeds 280000

Cost of acquisition 27000

Indexation cost of

acquisition

Indexation factor

27000*(301/82.26

)

Base year 82.26

2021 301

Indexation cost 98796 98796

Capital Gain 181204

sales

proceeds

Cost of

acquisition

Costs for

sale

CG/

CL

Motor Car 17000 9000 8000

Exemp

t

Lord painting 6000 5500 500

Exemp

t

Lady painting 6600 4300 700 1600

Exemp

t

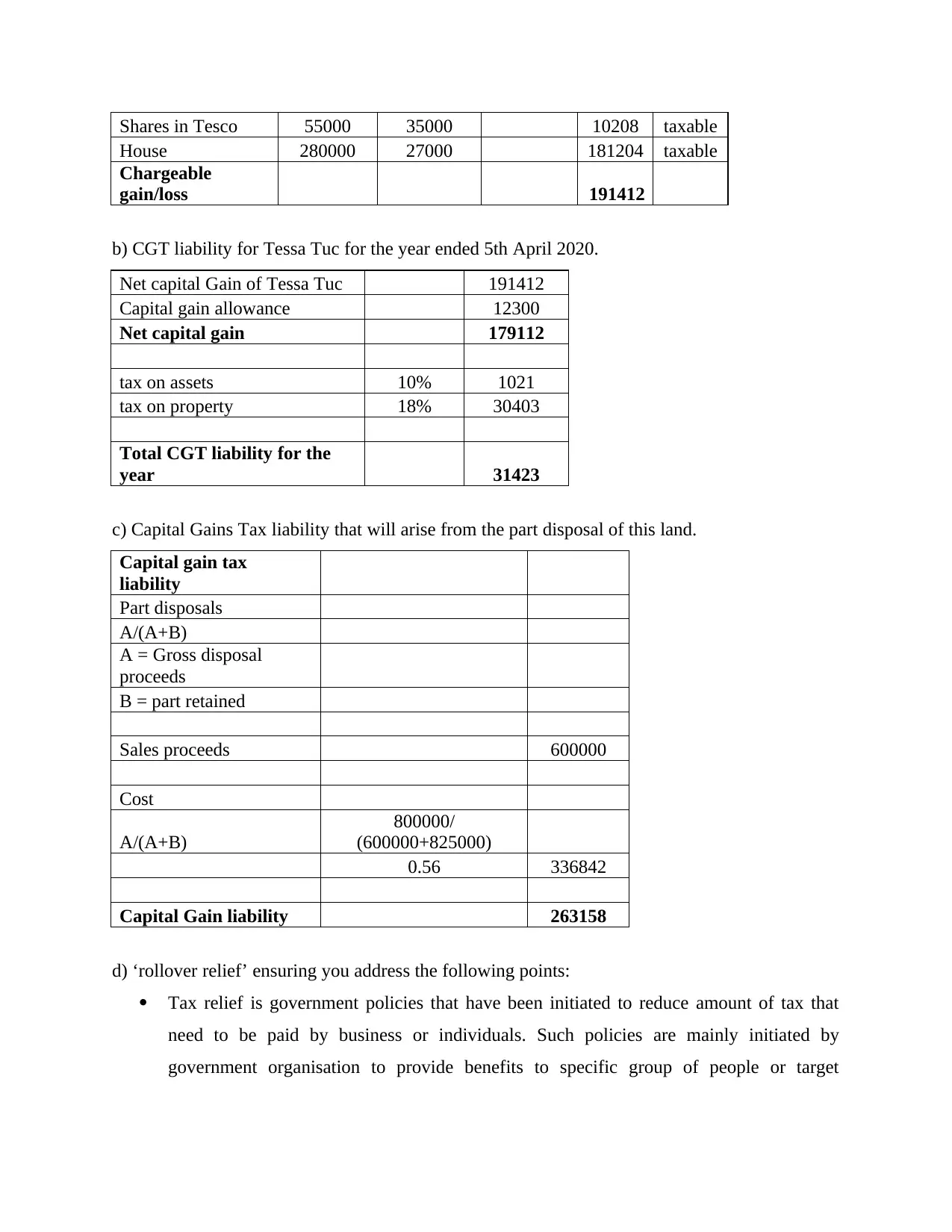

Shares in Tesco 55000 35000 10208 taxable

House 280000 27000 181204 taxable

Chargeable

gain/loss 191412

b) CGT liability for Tessa Tuc for the year ended 5th April 2020.

Net capital Gain of Tessa Tuc 191412

Capital gain allowance 12300

Net capital gain 179112

tax on assets 10% 1021

tax on property 18% 30403

Total CGT liability for the

year 31423

c) Capital Gains Tax liability that will arise from the part disposal of this land.

Capital gain tax

liability

Part disposals

A/(A+B)

A = Gross disposal

proceeds

B = part retained

Sales proceeds 600000

Cost

A/(A+B)

800000/

(600000+825000)

0.56 336842

Capital Gain liability 263158

d) ‘rollover relief’ ensuring you address the following points:

Tax relief is government policies that have been initiated to reduce amount of tax that

need to be paid by business or individuals. Such policies are mainly initiated by

government organisation to provide benefits to specific group of people or target

House 280000 27000 181204 taxable

Chargeable

gain/loss 191412

b) CGT liability for Tessa Tuc for the year ended 5th April 2020.

Net capital Gain of Tessa Tuc 191412

Capital gain allowance 12300

Net capital gain 179112

tax on assets 10% 1021

tax on property 18% 30403

Total CGT liability for the

year 31423

c) Capital Gains Tax liability that will arise from the part disposal of this land.

Capital gain tax

liability

Part disposals

A/(A+B)

A = Gross disposal

proceeds

B = part retained

Sales proceeds 600000

Cost

A/(A+B)

800000/

(600000+825000)

0.56 336842

Capital Gain liability 263158

d) ‘rollover relief’ ensuring you address the following points:

Tax relief is government policies that have been initiated to reduce amount of tax that

need to be paid by business or individuals. Such policies are mainly initiated by

government organisation to provide benefits to specific group of people or target

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

individuals. Therefore it can be stated that tax credit is type of tax relief allowed by

government for certain business so that they can grow and expand.

Business relief is provided to assets that in trading so it can be stated that relief is not

provided for assets that are non- trading in nature (Brooks and et.al., 2016). At the same

time the asset which are not used for purpose of business are disallowed relief and In case

business, assets or share ceased to qualify within 6 months than relief will be withdraw.

Company in order to get relief must have less than 100 employees and limited scale of

operation, products and services in which industry it operates. Non profit organisation are

also allowed some amount of relief as they are mainly operated to provide social services

to customers or people for their better living.

Holdover relief allow postponing any gain held over on the bases of market value of the

day gift was given to recipients. So it is market value at which asset might be reasonably

available in open market. It helps in reducing overall base cost of asset which is in hand

of recipients. Whereas in case of tax relief government provide cut tax of specific

individual or business to provide them financial support. Thus, individual needs not have

to pay capital gain tax in case of recipients of gifts.

Question 4

a) Company needs to compulsory register itself for VAT when it have turnover more than

£85,000 over period of 30 day or taxable turnover more than £85,000 during 12 months. Such

as company was started in January 2020 so as per estimation Turnover firm can get registered for

VAT in February 2022. Company have to get compulsory registered within 30 days of the end of

month after went to threshold.

b) Mcluskey and O’Grady need to notify HMRC about that they are subject to VAT by three

month period from tax accounting period. Company can notify HMRC by online registration

services and various detailed needs to be included in letter such as name of firm, registration

number and date company accounting period started or principle place of business (Mattozzi and

Snowberg, 2018). It should also include sign of directors or company secretary in order to

declare that the published information is correct as per their knowledge.

c) The effective date of registration for VAT is August 1 when it realised sales will exceed

threshold limit of 85000

government for certain business so that they can grow and expand.

Business relief is provided to assets that in trading so it can be stated that relief is not

provided for assets that are non- trading in nature (Brooks and et.al., 2016). At the same

time the asset which are not used for purpose of business are disallowed relief and In case

business, assets or share ceased to qualify within 6 months than relief will be withdraw.

Company in order to get relief must have less than 100 employees and limited scale of

operation, products and services in which industry it operates. Non profit organisation are

also allowed some amount of relief as they are mainly operated to provide social services

to customers or people for their better living.

Holdover relief allow postponing any gain held over on the bases of market value of the

day gift was given to recipients. So it is market value at which asset might be reasonably

available in open market. It helps in reducing overall base cost of asset which is in hand

of recipients. Whereas in case of tax relief government provide cut tax of specific

individual or business to provide them financial support. Thus, individual needs not have

to pay capital gain tax in case of recipients of gifts.

Question 4

a) Company needs to compulsory register itself for VAT when it have turnover more than

£85,000 over period of 30 day or taxable turnover more than £85,000 during 12 months. Such

as company was started in January 2020 so as per estimation Turnover firm can get registered for

VAT in February 2022. Company have to get compulsory registered within 30 days of the end of

month after went to threshold.

b) Mcluskey and O’Grady need to notify HMRC about that they are subject to VAT by three

month period from tax accounting period. Company can notify HMRC by online registration

services and various detailed needs to be included in letter such as name of firm, registration

number and date company accounting period started or principle place of business (Mattozzi and

Snowberg, 2018). It should also include sign of directors or company secretary in order to

declare that the published information is correct as per their knowledge.

c) The effective date of registration for VAT is August 1 when it realised sales will exceed

threshold limit of 85000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

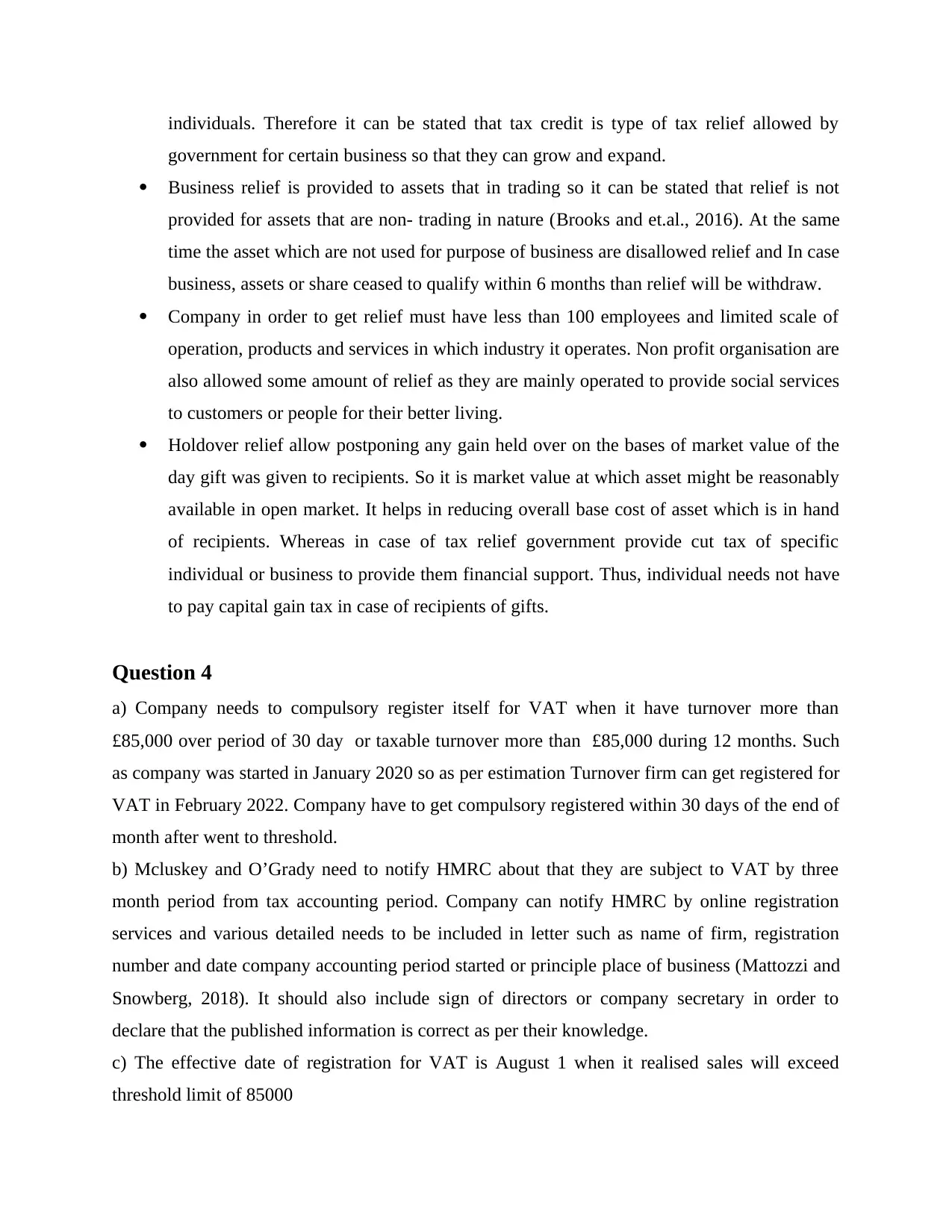

d) Output VAT payable to HMRC

Output VAT for 1st

VAT quarter

sales till june 48300

July 20000

August 20500

September 16400

Total 105200

Threshold 85000

Taxable 20200

Output VAT @20% 4040

d)

4 items in VAT invoice

1. VAT registration number

2. Unique identification

number

3. Time of supply of goods

4. Total amount of VAT

e) MOG may have wanted to register for VAT prior to date as it is vitally important for

businesses entering into new businesses to program out their requirements before they develop

their services and establish wider functional requirements within company productivity metrics.

Registration for VAT is essential for new companies within business as it profoundly establishes

efficiency levels within business world and for working with new working paradigms where

there are major factors to be taken care of. The VAT prior also enables for gaining new

functional requirements developing metrics onto what are the essential factors highly important

for business establishment.

(G) The purpose and conditions to join Flat rate scheme within business as it applies to VAT can

be understood from the fact that it enables business to pay or claim back from HM revenue and

customers where usually difference between VAT charged by business to customers and the Vat

business pays on their own have to be factorised. Under this you are able to pay fixed rate of

Output VAT for 1st

VAT quarter

sales till june 48300

July 20000

August 20500

September 16400

Total 105200

Threshold 85000

Taxable 20200

Output VAT @20% 4040

d)

4 items in VAT invoice

1. VAT registration number

2. Unique identification

number

3. Time of supply of goods

4. Total amount of VAT

e) MOG may have wanted to register for VAT prior to date as it is vitally important for

businesses entering into new businesses to program out their requirements before they develop

their services and establish wider functional requirements within company productivity metrics.

Registration for VAT is essential for new companies within business as it profoundly establishes

efficiency levels within business world and for working with new working paradigms where

there are major factors to be taken care of. The VAT prior also enables for gaining new

functional requirements developing metrics onto what are the essential factors highly important

for business establishment.

(G) The purpose and conditions to join Flat rate scheme within business as it applies to VAT can

be understood from the fact that it enables business to pay or claim back from HM revenue and

customers where usually difference between VAT charged by business to customers and the Vat

business pays on their own have to be factorised. Under this you are able to pay fixed rate of

VAT to HMRC and keep difference what you charge your customers ate pay to HRMC highly

under functional control for gaining stronger working efficiency. There is also one more factor

where person cannot reclaim VAT on purchases except for certain capital assets over 2000

pounds. The flat rate scheme also develops new working efficiency goals for operations among

business in companies for technical long term advancement and for fuelling growth with new

synergy of goals. The system also will make sure that MOG business are able to reach onto new

heights with stronger cost management fundamentals and avenues where company is

productively focusing onto all parameters of taxation, legal proceedings and also for bringing on

new relative cost benefits which wil;l potentially enhance their goals within future avenues

(Cano, 2020)

under functional control for gaining stronger working efficiency. There is also one more factor

where person cannot reclaim VAT on purchases except for certain capital assets over 2000

pounds. The flat rate scheme also develops new working efficiency goals for operations among

business in companies for technical long term advancement and for fuelling growth with new

synergy of goals. The system also will make sure that MOG business are able to reach onto new

heights with stronger cost management fundamentals and avenues where company is

productively focusing onto all parameters of taxation, legal proceedings and also for bringing on

new relative cost benefits which wil;l potentially enhance their goals within future avenues

(Cano, 2020)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.