Statistics Assignment: Analysis of Data and Problem Solutions

VerifiedAdded on 2023/06/06

|9

|1345

|115

Homework Assignment

AI Summary

This document presents solutions to a statistics assignment covering several key areas of statistical analysis. The solutions begin with the analysis of frequency distributions, including the creation of tables for frequency, cumulative frequency, relative frequency, cumulative relative frequency, and percent frequency distributions. The assignment then delves into regression analysis, exploring concepts like the degree of freedom, standard error, coefficient of determination, and coefficient of correlation. Solutions include interpretations of regression equations and predictions of supply based on unit price. Furthermore, the assignment addresses ANOVA (Analysis of Variance) with a single-factor summary, determining the significance of productivity differences across various programs. Finally, the document provides regression model outputs, including interpretations of coefficients, p-values, and t-statistics, as well as exploring the impact of competitor's price and advertising on sales, offering valuable insights into statistical modeling and its applications.

6

Problems of Statistics

Problems of Statistics

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6

ANSWER 1A

Table 1: Frequency Distribution of Scores of Students

Class Interval Lower Bound Upper Bound

Mid-

Point Frequency

50-60 50 59 54.5 3

60-70 60 69 64.5 2

70-80 70 79 74.5 5

80-90 80 89 84.5 4

90-100 90 99 94.5 6

Table 2: Cumulative Frequency Distribution of Scores of Students

Class Interval Lower Bound Upper Bound

Mid-

Point Frequency

50-60 50 59 54.5 3

60-70 60 69 64.5 5

70-80 70 79 74.5 10

80-90 80 89 84.5 14

90-100 90 99 94.5 20

Table 3: Relative Frequency Distribution of Scores of Students

Class Interval Lower Bound Upper Bound

Mid-

Point Frequency

50-60 50 59 54.5 3

60-70 60 69 64.5 2

70-80 70 79 74.5 5

80-90 80 89 84.5 4

90-100 90 99 94.5 6

Table 4: Cumulative Relative Frequency Distribution of Scores of Students

Class Interval Lower Bound Upper Bound

Mid-

Point Frequency

50-60 50 59 54.5 0.15

60-70 60 69 64.5 0.25

70-80 70 79 74.5 0.50

80-90 80 89 84.5 0.70

90-100 90 99 94.5 1.00

ANSWER 1A

Table 1: Frequency Distribution of Scores of Students

Class Interval Lower Bound Upper Bound

Mid-

Point Frequency

50-60 50 59 54.5 3

60-70 60 69 64.5 2

70-80 70 79 74.5 5

80-90 80 89 84.5 4

90-100 90 99 94.5 6

Table 2: Cumulative Frequency Distribution of Scores of Students

Class Interval Lower Bound Upper Bound

Mid-

Point Frequency

50-60 50 59 54.5 3

60-70 60 69 64.5 5

70-80 70 79 74.5 10

80-90 80 89 84.5 14

90-100 90 99 94.5 20

Table 3: Relative Frequency Distribution of Scores of Students

Class Interval Lower Bound Upper Bound

Mid-

Point Frequency

50-60 50 59 54.5 3

60-70 60 69 64.5 2

70-80 70 79 74.5 5

80-90 80 89 84.5 4

90-100 90 99 94.5 6

Table 4: Cumulative Relative Frequency Distribution of Scores of Students

Class Interval Lower Bound Upper Bound

Mid-

Point Frequency

50-60 50 59 54.5 0.15

60-70 60 69 64.5 0.25

70-80 70 79 74.5 0.50

80-90 80 89 84.5 0.70

90-100 90 99 94.5 1.00

6

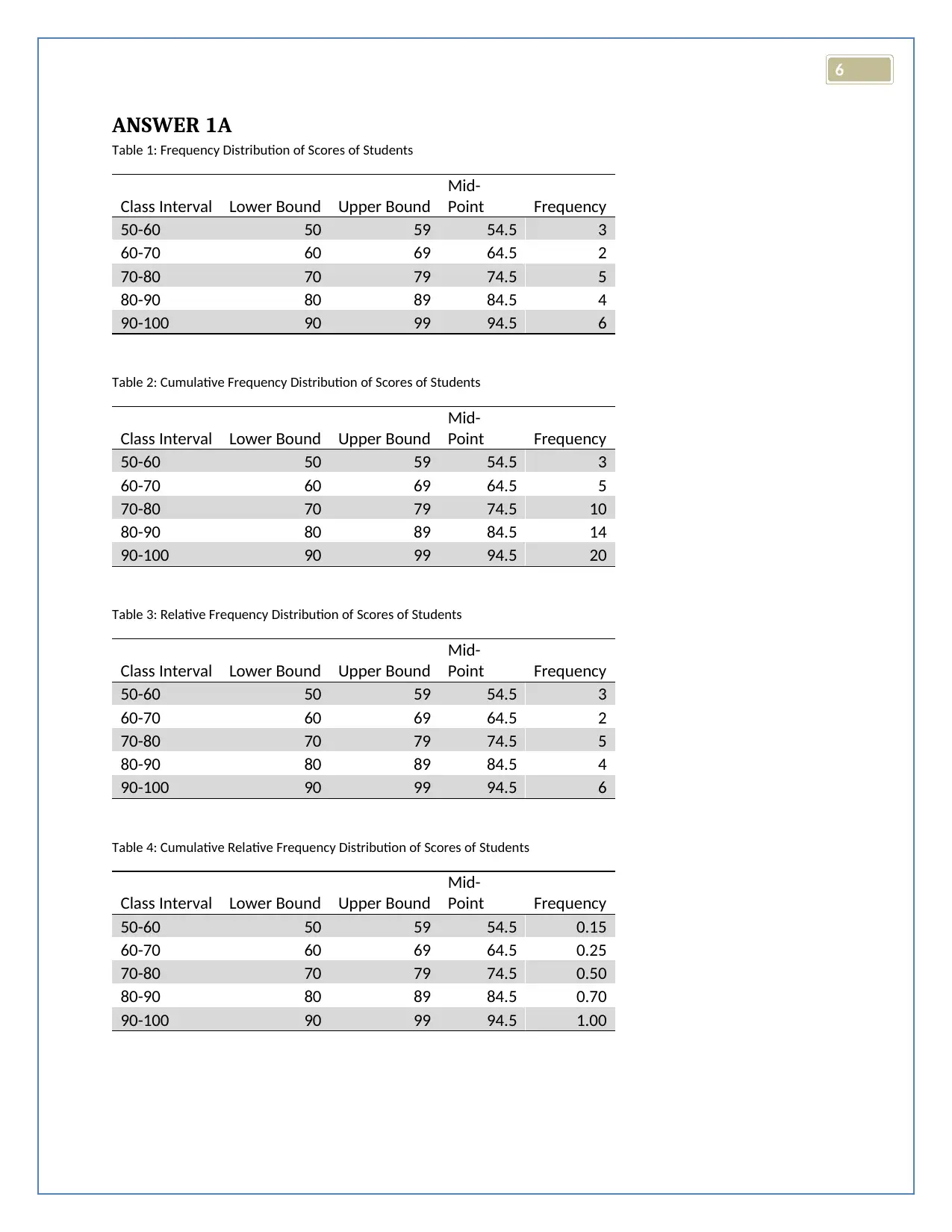

Table 5: Percent Frequency Distribution of Scores of Students

Class Interval Lower Bound Upper Bound

Mid-

Point Frequency

50-60 50 59 54.5 15.00%

60-70 60 69 64.5 10.00%

70-80 70 79 74.5 25.00%

80-90 80 89 84.5 20.00%

90-100 90 99 94.5 30.00%

ANSWER 1B

Figure 1: Distribution of Scores of the Students

The histogram shows that the distribution of scores of the students is left skewed in nature. The

conclusion may be drawn that examination scores of majority of the students are highly

satisfactory (Hinton, 2014).

Table 5: Percent Frequency Distribution of Scores of Students

Class Interval Lower Bound Upper Bound

Mid-

Point Frequency

50-60 50 59 54.5 15.00%

60-70 60 69 64.5 10.00%

70-80 70 79 74.5 25.00%

80-90 80 89 84.5 20.00%

90-100 90 99 94.5 30.00%

ANSWER 1B

Figure 1: Distribution of Scores of the Students

The histogram shows that the distribution of scores of the students is left skewed in nature. The

conclusion may be drawn that examination scores of majority of the students are highly

satisfactory (Hinton, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ANSWER 2 A

The degree of freedom for residual is always sample size minus two. Hence sample size is

(39+2) = 41 for the current problem.

ANSWER 2 B

Standard error of unit price indicated that about 95% of the data should belong within 2*standard

error (SE) of the estimate. For the current problem, it is observed that about 95% of the data falls

within 0.042% of the fitted line of regression model. Hence, supply (demand) has a strong linear

relation with unit price with low gradient.

ANSWER 2 C

From the regression model SSM (sum square model) =354.689, SSE (sum square error) =

7035.262, hence, SST (sum square total) = SSE + SSM = 354.689 +7035.262 = 7389.951.

Coefficient of determination

R2= SSM

SST =7035. 262

7389. 951 =0 . 952 implied that the model is able to

define 95.2% variation in supply. Therefore, it is possible to conclude that unit price is able to

explain the variation in supply up to 95.2%.

ANSWER 2 D

Coefficient of correlation between supply and unit price is R= √ 0 . 952=0 . 958 . The correlation

is highly positive and almost perfect in nature. For one unit increase in price the supply would

also increase (Winston, W., 2016).

ANSWER 2 A

The degree of freedom for residual is always sample size minus two. Hence sample size is

(39+2) = 41 for the current problem.

ANSWER 2 B

Standard error of unit price indicated that about 95% of the data should belong within 2*standard

error (SE) of the estimate. For the current problem, it is observed that about 95% of the data falls

within 0.042% of the fitted line of regression model. Hence, supply (demand) has a strong linear

relation with unit price with low gradient.

ANSWER 2 C

From the regression model SSM (sum square model) =354.689, SSE (sum square error) =

7035.262, hence, SST (sum square total) = SSE + SSM = 354.689 +7035.262 = 7389.951.

Coefficient of determination

R2= SSM

SST =7035. 262

7389. 951 =0 . 952 implied that the model is able to

define 95.2% variation in supply. Therefore, it is possible to conclude that unit price is able to

explain the variation in supply up to 95.2%.

ANSWER 2 D

Coefficient of correlation between supply and unit price is R= √ 0 . 952=0 . 958 . The correlation

is highly positive and almost perfect in nature. For one unit increase in price the supply would

also increase (Winston, W., 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6

ANSWER 2 E

Equation of the regression line is Y = 0 .029 X+ 54 . 076 , where supply Y is in thousands of

units, and unit price X is in thousands of dollars. Hence, for unit price of $50,000, the supply

would be calculated as, Supply ( Y ) =0 . 029∗50+54 . 076=55 .526 thousand units.

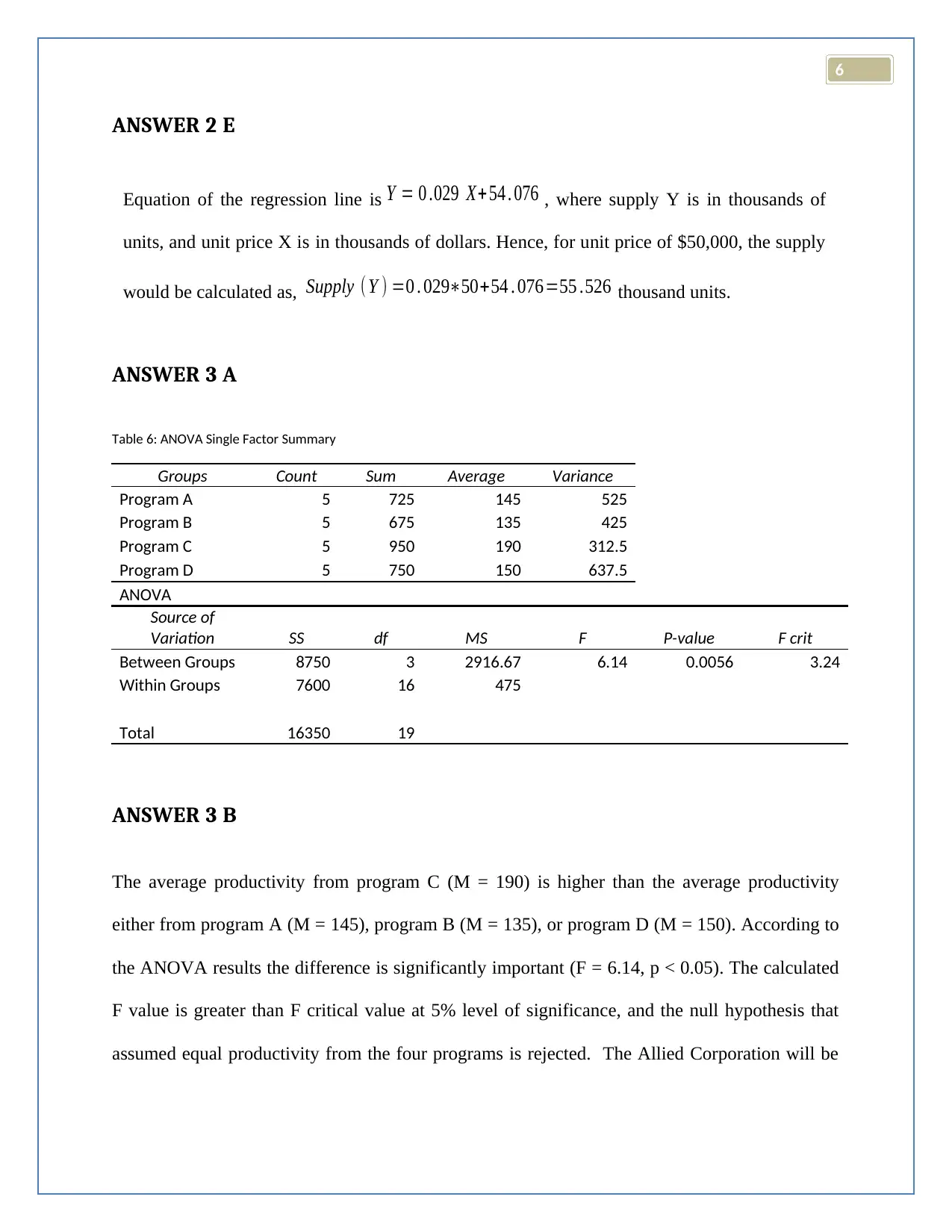

ANSWER 3 A

Table 6: ANOVA Single Factor Summary

Groups Count Sum Average Variance

Program A 5 725 145 525

Program B 5 675 135 425

Program C 5 950 190 312.5

Program D 5 750 150 637.5

ANOVA

Source of

Variation SS df MS F P-value F crit

Between Groups 8750 3 2916.67 6.14 0.0056 3.24

Within Groups 7600 16 475

Total 16350 19

ANSWER 3 B

The average productivity from program C (M = 190) is higher than the average productivity

either from program A (M = 145), program B (M = 135), or program D (M = 150). According to

the ANOVA results the difference is significantly important (F = 6.14, p < 0.05). The calculated

F value is greater than F critical value at 5% level of significance, and the null hypothesis that

assumed equal productivity from the four programs is rejected. The Allied Corporation will be

ANSWER 2 E

Equation of the regression line is Y = 0 .029 X+ 54 . 076 , where supply Y is in thousands of

units, and unit price X is in thousands of dollars. Hence, for unit price of $50,000, the supply

would be calculated as, Supply ( Y ) =0 . 029∗50+54 . 076=55 .526 thousand units.

ANSWER 3 A

Table 6: ANOVA Single Factor Summary

Groups Count Sum Average Variance

Program A 5 725 145 525

Program B 5 675 135 425

Program C 5 950 190 312.5

Program D 5 750 150 637.5

ANOVA

Source of

Variation SS df MS F P-value F crit

Between Groups 8750 3 2916.67 6.14 0.0056 3.24

Within Groups 7600 16 475

Total 16350 19

ANSWER 3 B

The average productivity from program C (M = 190) is higher than the average productivity

either from program A (M = 145), program B (M = 135), or program D (M = 150). According to

the ANOVA results the difference is significantly important (F = 6.14, p < 0.05). The calculated

F value is greater than F critical value at 5% level of significance, and the null hypothesis that

assumed equal productivity from the four programs is rejected. The Allied Corporation will be

6

able to greatly increase productivity of its employees by enrolling employees in program C,

compared to other three programs (Quirk, 2015).

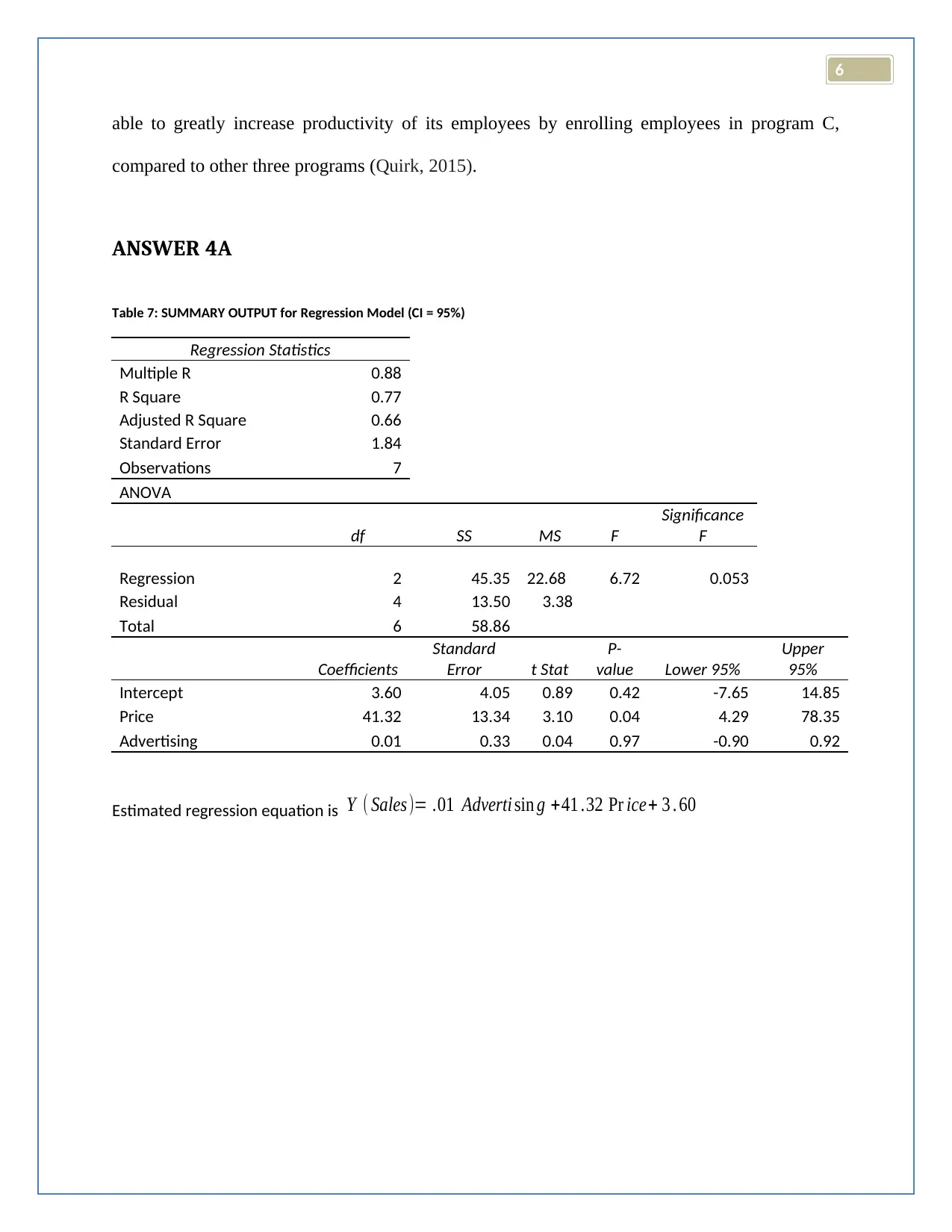

ANSWER 4A

Table 7: SUMMARY OUTPUT for Regression Model (CI = 95%)

Regression Statistics

Multiple R 0.88

R Square 0.77

Adjusted R Square 0.66

Standard Error 1.84

Observations 7

ANOVA

df SS MS F

Significance

F

Regression 2 45.35 22.68 6.72 0.053

Residual 4 13.50 3.38

Total 6 58.86

Coefficients

Standard

Error t Stat

P-

value Lower 95%

Upper

95%

Intercept 3.60 4.05 0.89 0.42 -7.65 14.85

Price 41.32 13.34 3.10 0.04 4.29 78.35

Advertising 0.01 0.33 0.04 0.97 -0.90 0.92

Estimated regression equation is Y ( Sales)= .01 Adverti sin g +41 .32 Pr ice+ 3 . 60

able to greatly increase productivity of its employees by enrolling employees in program C,

compared to other three programs (Quirk, 2015).

ANSWER 4A

Table 7: SUMMARY OUTPUT for Regression Model (CI = 95%)

Regression Statistics

Multiple R 0.88

R Square 0.77

Adjusted R Square 0.66

Standard Error 1.84

Observations 7

ANOVA

df SS MS F

Significance

F

Regression 2 45.35 22.68 6.72 0.053

Residual 4 13.50 3.38

Total 6 58.86

Coefficients

Standard

Error t Stat

P-

value Lower 95%

Upper

95%

Intercept 3.60 4.05 0.89 0.42 -7.65 14.85

Price 41.32 13.34 3.10 0.04 4.29 78.35

Advertising 0.01 0.33 0.04 0.97 -0.90 0.92

Estimated regression equation is Y ( Sales)= .01 Adverti sin g +41 .32 Pr ice+ 3 . 60

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

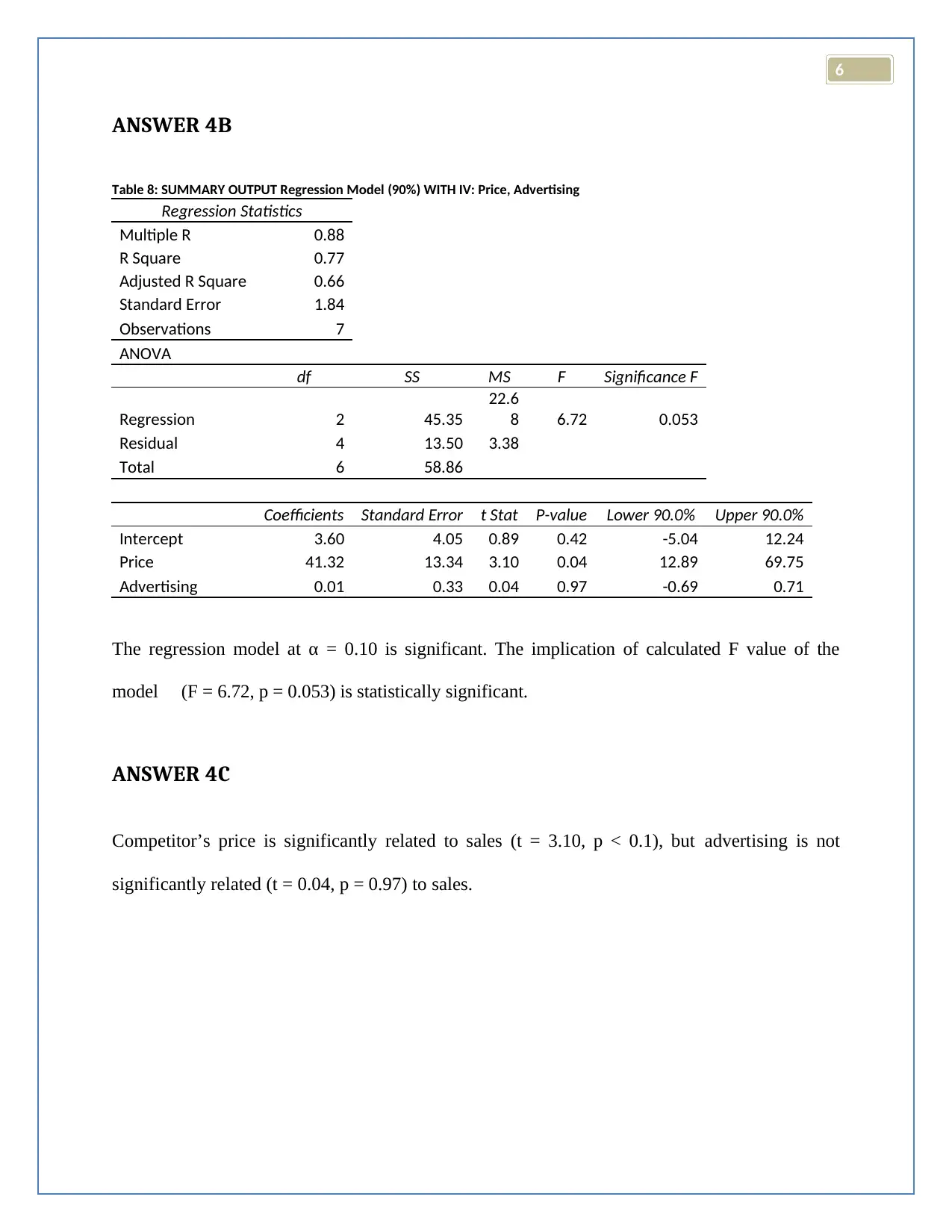

ANSWER 4B

Table 8: SUMMARY OUTPUT Regression Model (90%) WITH IV: Price, Advertising

Regression Statistics

Multiple R 0.88

R Square 0.77

Adjusted R Square 0.66

Standard Error 1.84

Observations 7

ANOVA

df SS MS F Significance F

Regression 2 45.35

22.6

8 6.72 0.053

Residual 4 13.50 3.38

Total 6 58.86

Coefficients Standard Error t Stat P-value Lower 90.0% Upper 90.0%

Intercept 3.60 4.05 0.89 0.42 -5.04 12.24

Price 41.32 13.34 3.10 0.04 12.89 69.75

Advertising 0.01 0.33 0.04 0.97 -0.69 0.71

The regression model at α = 0.10 is significant. The implication of calculated F value of the

model (F = 6.72, p = 0.053) is statistically significant.

ANSWER 4C

Competitor’s price is significantly related to sales (t = 3.10, p < 0.1), but advertising is not

significantly related (t = 0.04, p = 0.97) to sales.

ANSWER 4B

Table 8: SUMMARY OUTPUT Regression Model (90%) WITH IV: Price, Advertising

Regression Statistics

Multiple R 0.88

R Square 0.77

Adjusted R Square 0.66

Standard Error 1.84

Observations 7

ANOVA

df SS MS F Significance F

Regression 2 45.35

22.6

8 6.72 0.053

Residual 4 13.50 3.38

Total 6 58.86

Coefficients Standard Error t Stat P-value Lower 90.0% Upper 90.0%

Intercept 3.60 4.05 0.89 0.42 -5.04 12.24

Price 41.32 13.34 3.10 0.04 12.89 69.75

Advertising 0.01 0.33 0.04 0.97 -0.69 0.71

The regression model at α = 0.10 is significant. The implication of calculated F value of the

model (F = 6.72, p = 0.053) is statistically significant.

ANSWER 4C

Competitor’s price is significantly related to sales (t = 3.10, p < 0.1), but advertising is not

significantly related (t = 0.04, p = 0.97) to sales.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6

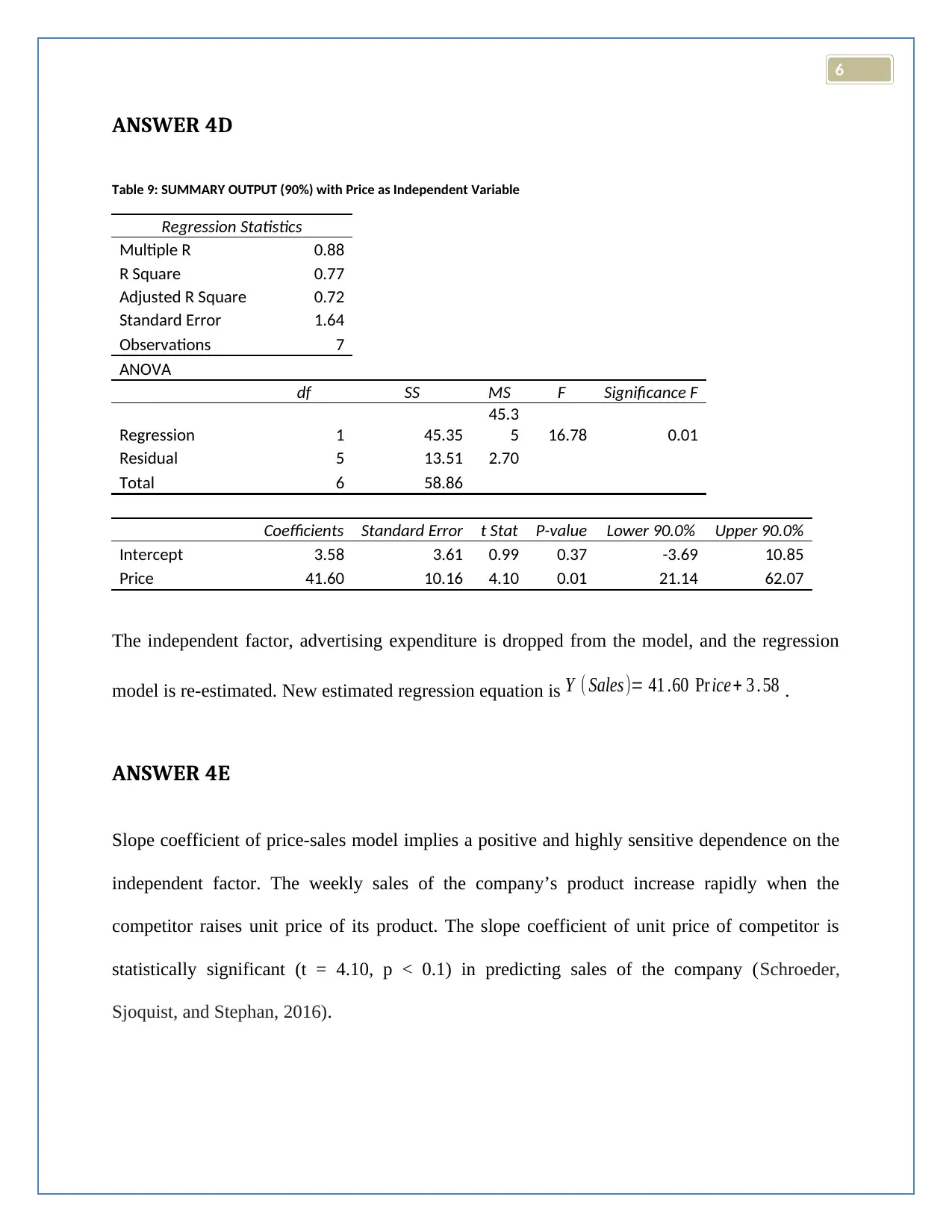

ANSWER 4D

Table 9: SUMMARY OUTPUT (90%) with Price as Independent Variable

Regression Statistics

Multiple R 0.88

R Square 0.77

Adjusted R Square 0.72

Standard Error 1.64

Observations 7

ANOVA

df SS MS F Significance F

Regression 1 45.35

45.3

5 16.78 0.01

Residual 5 13.51 2.70

Total 6 58.86

Coefficients Standard Error t Stat P-value Lower 90.0% Upper 90.0%

Intercept 3.58 3.61 0.99 0.37 -3.69 10.85

Price 41.60 10.16 4.10 0.01 21.14 62.07

The independent factor, advertising expenditure is dropped from the model, and the regression

model is re-estimated. New estimated regression equation is Y ( Sales)= 41 .60 Pr ice+ 3 . 58 .

ANSWER 4E

Slope coefficient of price-sales model implies a positive and highly sensitive dependence on the

independent factor. The weekly sales of the company’s product increase rapidly when the

competitor raises unit price of its product. The slope coefficient of unit price of competitor is

statistically significant (t = 4.10, p < 0.1) in predicting sales of the company (Schroeder,

Sjoquist, and Stephan, 2016).

ANSWER 4D

Table 9: SUMMARY OUTPUT (90%) with Price as Independent Variable

Regression Statistics

Multiple R 0.88

R Square 0.77

Adjusted R Square 0.72

Standard Error 1.64

Observations 7

ANOVA

df SS MS F Significance F

Regression 1 45.35

45.3

5 16.78 0.01

Residual 5 13.51 2.70

Total 6 58.86

Coefficients Standard Error t Stat P-value Lower 90.0% Upper 90.0%

Intercept 3.58 3.61 0.99 0.37 -3.69 10.85

Price 41.60 10.16 4.10 0.01 21.14 62.07

The independent factor, advertising expenditure is dropped from the model, and the regression

model is re-estimated. New estimated regression equation is Y ( Sales)= 41 .60 Pr ice+ 3 . 58 .

ANSWER 4E

Slope coefficient of price-sales model implies a positive and highly sensitive dependence on the

independent factor. The weekly sales of the company’s product increase rapidly when the

competitor raises unit price of its product. The slope coefficient of unit price of competitor is

statistically significant (t = 4.10, p < 0.1) in predicting sales of the company (Schroeder,

Sjoquist, and Stephan, 2016).

6

Reference

Hinton, P.R., 2014. Statistics explained. Routledge.

Quirk, T.J., 2015. One-way analysis of variance (ANOVA). In Excel 2013 for Social Sciences

Statistics(pp. 177-196). Springer, Cham.

Schroeder, L.D., Sjoquist, D.L. and Stephan, P.E., 2016. Understanding regression analysis: An

introductory guide (Vol. 57). Sage Publications.

Winston, W., 2016. Microsoft Excel data analysis and business modeling. Microsoft press.

Reference

Hinton, P.R., 2014. Statistics explained. Routledge.

Quirk, T.J., 2015. One-way analysis of variance (ANOVA). In Excel 2013 for Social Sciences

Statistics(pp. 177-196). Springer, Cham.

Schroeder, L.D., Sjoquist, D.L. and Stephan, P.E., 2016. Understanding regression analysis: An

introductory guide (Vol. 57). Sage Publications.

Winston, W., 2016. Microsoft Excel data analysis and business modeling. Microsoft press.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.