Microeconomics Assignment: Production, Elasticity, and Taxation

VerifiedAdded on 2019/11/26

|11

|1665

|122

Homework Assignment

AI Summary

This economics assignment solution delves into several core microeconomic concepts. The first part analyzes a production possibility frontier (PPF), illustrating opportunity costs, efficiency, and the impact of resource changes. The second part explores price elasticity of demand, calculating revenue changes and demonstrating inelastic demand. It then proceeds to a market equilibrium analysis, determining consumer and producer surplus, and illustrating deadweight loss under price controls. The final section examines the effects of taxation on an addictive good, explaining why price-based interventions are ineffective due to inelastic demand and discussing the incidence of tax. It concludes by suggesting non-price interventions for reducing consumption.

A1

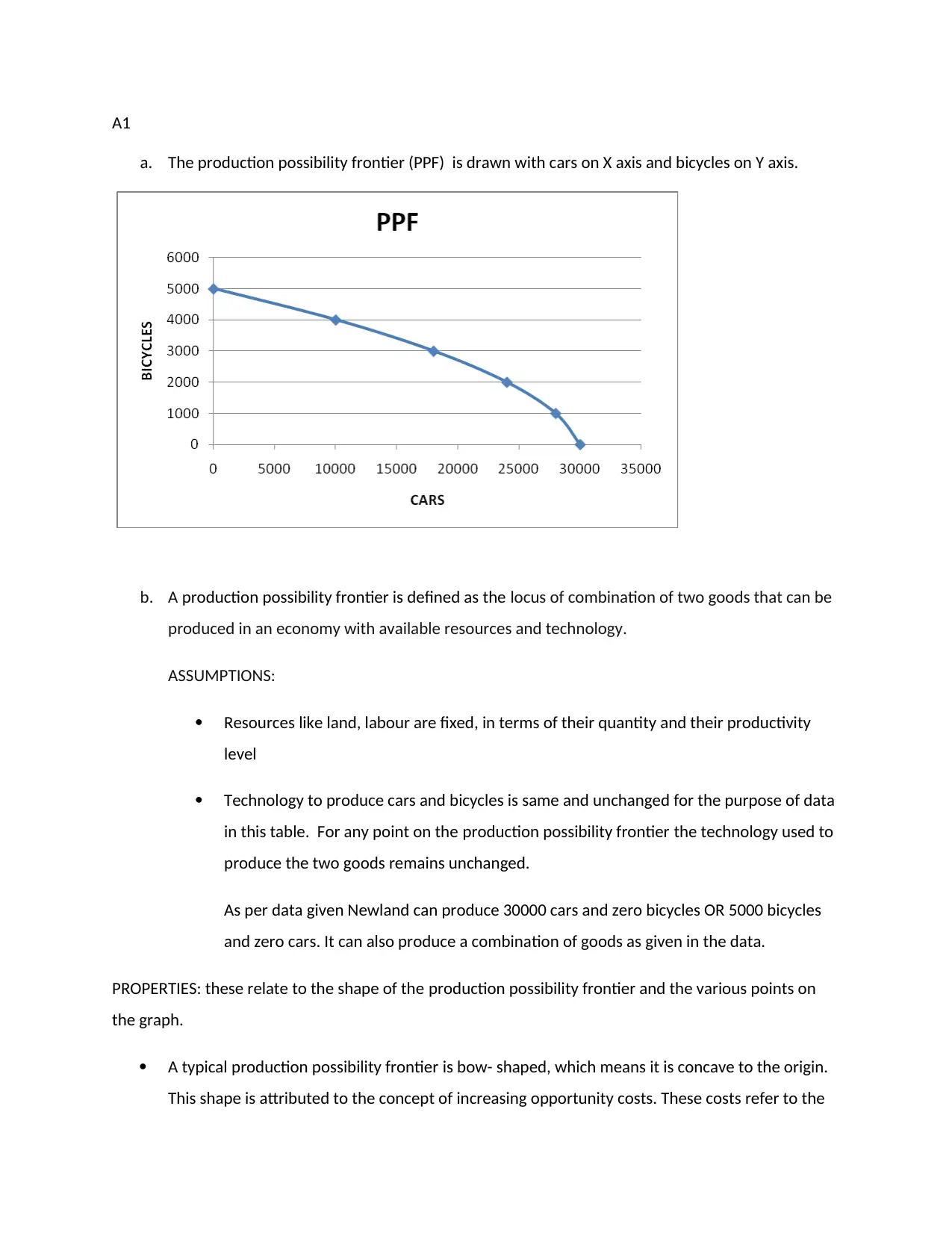

a. The production possibility frontier (PPF) is drawn with cars on X axis and bicycles on Y axis.

b. A production possibility frontier is defined as the locus of combination of two goods that can be

produced in an economy with available resources and technology.

ASSUMPTIONS:

Resources like land, labour are fixed, in terms of their quantity and their productivity

level

Technology to produce cars and bicycles is same and unchanged for the purpose of data

in this table. For any point on the production possibility frontier the technology used to

produce the two goods remains unchanged.

As per data given Newland can produce 30000 cars and zero bicycles OR 5000 bicycles

and zero cars. It can also produce a combination of goods as given in the data.

PROPERTIES: these relate to the shape of the production possibility frontier and the various points on

the graph.

A typical production possibility frontier is bow- shaped, which means it is concave to the origin.

This shape is attributed to the concept of increasing opportunity costs. These costs refer to the

a. The production possibility frontier (PPF) is drawn with cars on X axis and bicycles on Y axis.

b. A production possibility frontier is defined as the locus of combination of two goods that can be

produced in an economy with available resources and technology.

ASSUMPTIONS:

Resources like land, labour are fixed, in terms of their quantity and their productivity

level

Technology to produce cars and bicycles is same and unchanged for the purpose of data

in this table. For any point on the production possibility frontier the technology used to

produce the two goods remains unchanged.

As per data given Newland can produce 30000 cars and zero bicycles OR 5000 bicycles

and zero cars. It can also produce a combination of goods as given in the data.

PROPERTIES: these relate to the shape of the production possibility frontier and the various points on

the graph.

A typical production possibility frontier is bow- shaped, which means it is concave to the origin.

This shape is attributed to the concept of increasing opportunity costs. These costs refer to the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

amounts of a good that have to be given up for an alternative good. To produce one more car

we need resources. As all resources are used up we will have to pull out resources from bicycle

production. The amount of pulled out resources is the opportunity cost of 1 car. Increasing

opportunity costs means that to make more and more cars we need to free up an increasing

amount of resources from bicycles. This means we have to give up on more and more bicycles.

Any point inside the production possibility frontier shows that resources are unused. This is an

inefficient point as resources are idle/ UNUTILISED.

Any point outside the production possibility frontier is unachievable, though desirable. Given

the resources and technology available such a point is unattainable.

Any point on the curve is EFFCICIENT, as all resources are used.

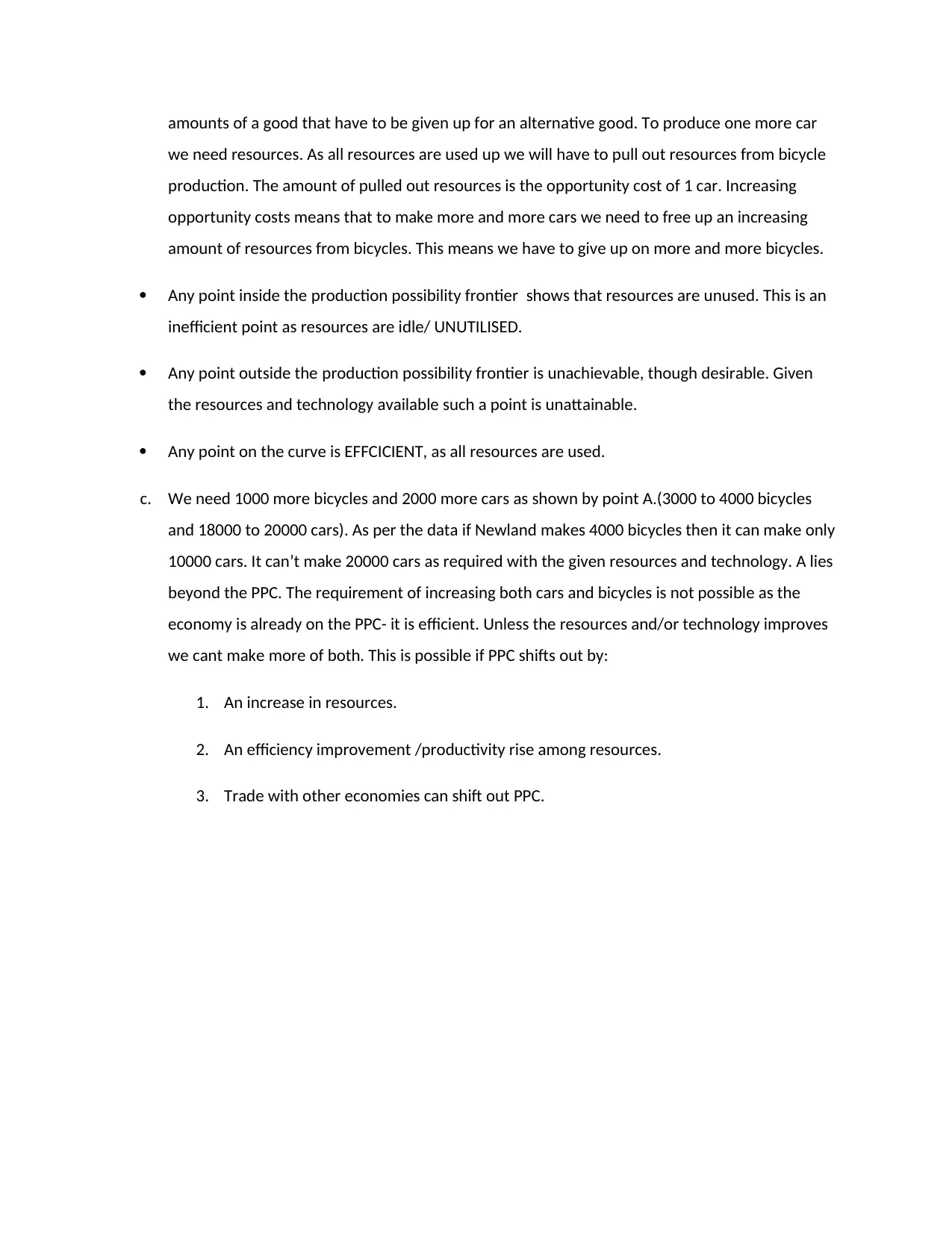

c. We need 1000 more bicycles and 2000 more cars as shown by point A.(3000 to 4000 bicycles

and 18000 to 20000 cars). As per the data if Newland makes 4000 bicycles then it can make only

10000 cars. It can’t make 20000 cars as required with the given resources and technology. A lies

beyond the PPC. The requirement of increasing both cars and bicycles is not possible as the

economy is already on the PPC- it is efficient. Unless the resources and/or technology improves

we cant make more of both. This is possible if PPC shifts out by:

1. An increase in resources.

2. An efficiency improvement /productivity rise among resources.

3. Trade with other economies can shift out PPC.

we need resources. As all resources are used up we will have to pull out resources from bicycle

production. The amount of pulled out resources is the opportunity cost of 1 car. Increasing

opportunity costs means that to make more and more cars we need to free up an increasing

amount of resources from bicycles. This means we have to give up on more and more bicycles.

Any point inside the production possibility frontier shows that resources are unused. This is an

inefficient point as resources are idle/ UNUTILISED.

Any point outside the production possibility frontier is unachievable, though desirable. Given

the resources and technology available such a point is unattainable.

Any point on the curve is EFFCICIENT, as all resources are used.

c. We need 1000 more bicycles and 2000 more cars as shown by point A.(3000 to 4000 bicycles

and 18000 to 20000 cars). As per the data if Newland makes 4000 bicycles then it can make only

10000 cars. It can’t make 20000 cars as required with the given resources and technology. A lies

beyond the PPC. The requirement of increasing both cars and bicycles is not possible as the

economy is already on the PPC- it is efficient. Unless the resources and/or technology improves

we cant make more of both. This is possible if PPC shifts out by:

1. An increase in resources.

2. An efficiency improvement /productivity rise among resources.

3. Trade with other economies can shift out PPC.

A 2:

a. Revenue is defined as the product of price and quantity. As the table tells us when price equals

$400 the quantity demanded is 30 millions. Thus revenue = 30million*400 = $12000000000 = 12

billion.

When price equal $350 the quantity demanded is 35 million. So revenue = 35million*350 =

12250000000 = 12.25 billion. Clearly revenue has risen by 0.25 billion increased.

b. As per theory, there is direct relation between effect of price changes on revenues and price

elasticity of demand. Revenues will rise when price rises if demand is inelastic, while inelastic

demand cause revenues to fall. In our case when price rose from $300 to $350 the revenues

rose by 0.25 billion. Thus, an increase in price is accompanied by rise in revenues, showing that

demand is inelastic.

We can show this with a decrease in price as well. If price were to fall to 250 then revenues =

250 million*45 = 11250000000 = 11.25 billion. Now revenue falls from 12 billion to 11.25 billion

when price falls from $300 to $250. Thus, a fall in price caused a decrease in revenues

confirming in elastic demand.

PART II

Qd= 100-5P

Qs = 5P

a. Revenue is defined as the product of price and quantity. As the table tells us when price equals

$400 the quantity demanded is 30 millions. Thus revenue = 30million*400 = $12000000000 = 12

billion.

When price equal $350 the quantity demanded is 35 million. So revenue = 35million*350 =

12250000000 = 12.25 billion. Clearly revenue has risen by 0.25 billion increased.

b. As per theory, there is direct relation between effect of price changes on revenues and price

elasticity of demand. Revenues will rise when price rises if demand is inelastic, while inelastic

demand cause revenues to fall. In our case when price rose from $300 to $350 the revenues

rose by 0.25 billion. Thus, an increase in price is accompanied by rise in revenues, showing that

demand is inelastic.

We can show this with a decrease in price as well. If price were to fall to 250 then revenues =

250 million*45 = 11250000000 = 11.25 billion. Now revenue falls from 12 billion to 11.25 billion

when price falls from $300 to $250. Thus, a fall in price caused a decrease in revenues

confirming in elastic demand.

PART II

Qd= 100-5P

Qs = 5P

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

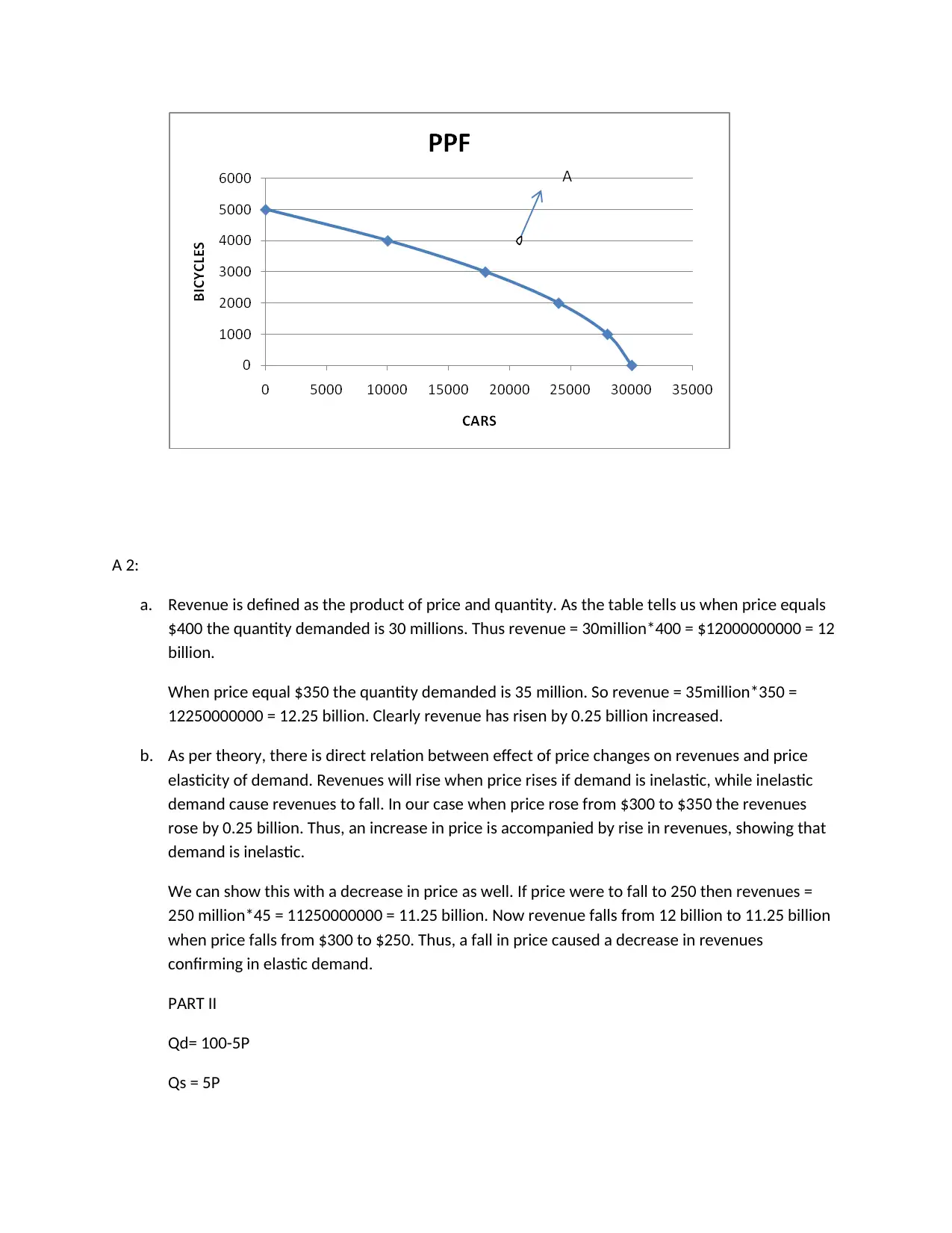

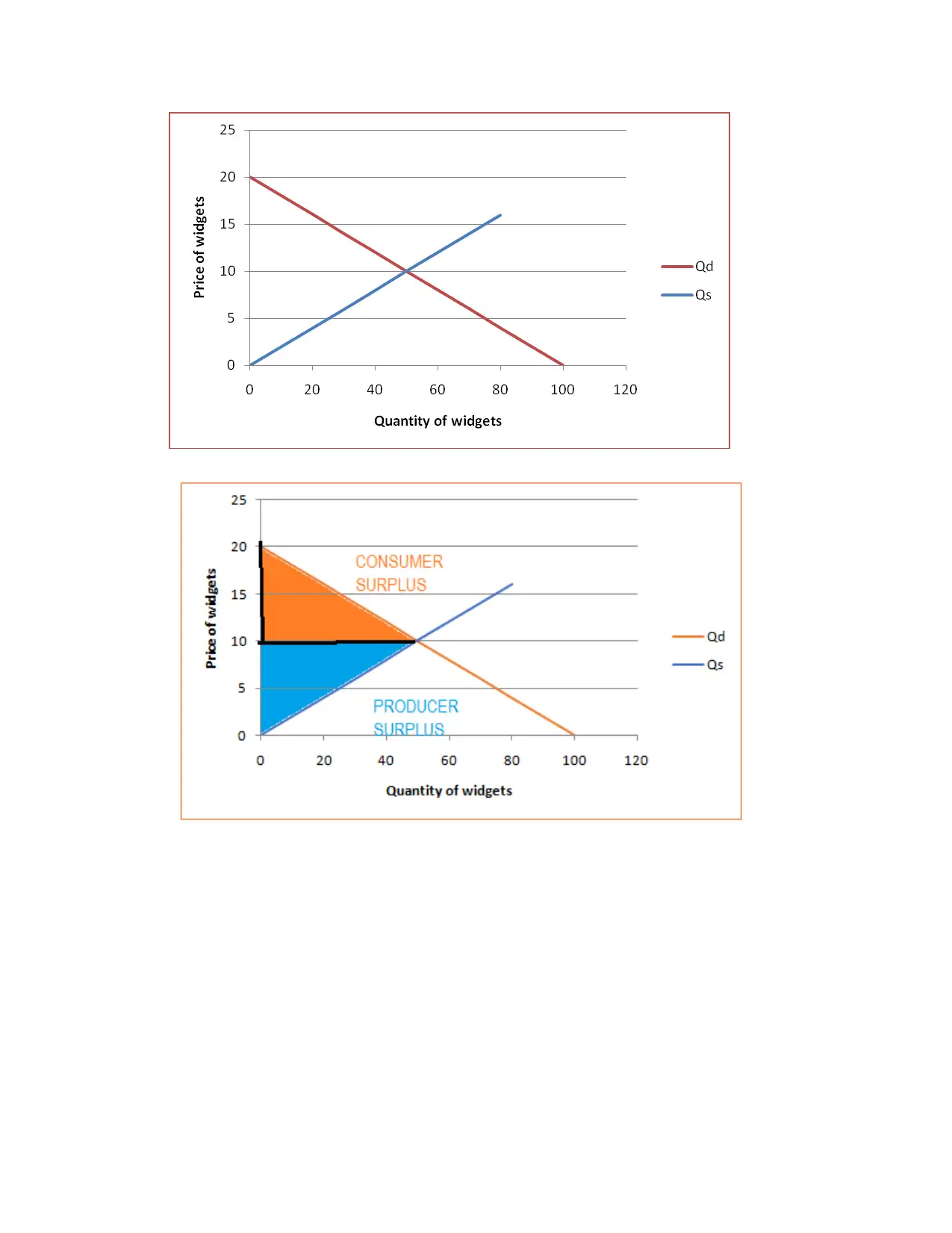

c. Equilibrium is reached at the point where demand = supply.

Qd=Qs

100 – 5P = 5P

100 =10P

P= 100/10 = 10

Put this P value in Qd or Qs

Putting in Qs: Qs= equilibrium Q= 5*10=50

d. Consumer surplus is the area under the demand curve and the equilibrium price.

To get a point of price axis we put Q= 0 in Qd to get Qd= 0 = 100 -5P

P= 100/5 =20

Consumer surplus = area of orange triangle = ½ *50*(20-10) = 250

To get a point of price axis we put Q= 0 in Qs to get Q = 0

Producer surplus = area of blue triangle = ½ *50*10 = 250

Total surplus = 250+250 = 500

Qd=Qs

100 – 5P = 5P

100 =10P

P= 100/10 = 10

Put this P value in Qd or Qs

Putting in Qs: Qs= equilibrium Q= 5*10=50

d. Consumer surplus is the area under the demand curve and the equilibrium price.

To get a point of price axis we put Q= 0 in Qd to get Qd= 0 = 100 -5P

P= 100/5 =20

Consumer surplus = area of orange triangle = ½ *50*(20-10) = 250

To get a point of price axis we put Q= 0 in Qs to get Q = 0

Producer surplus = area of blue triangle = ½ *50*10 = 250

Total surplus = 250+250 = 500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

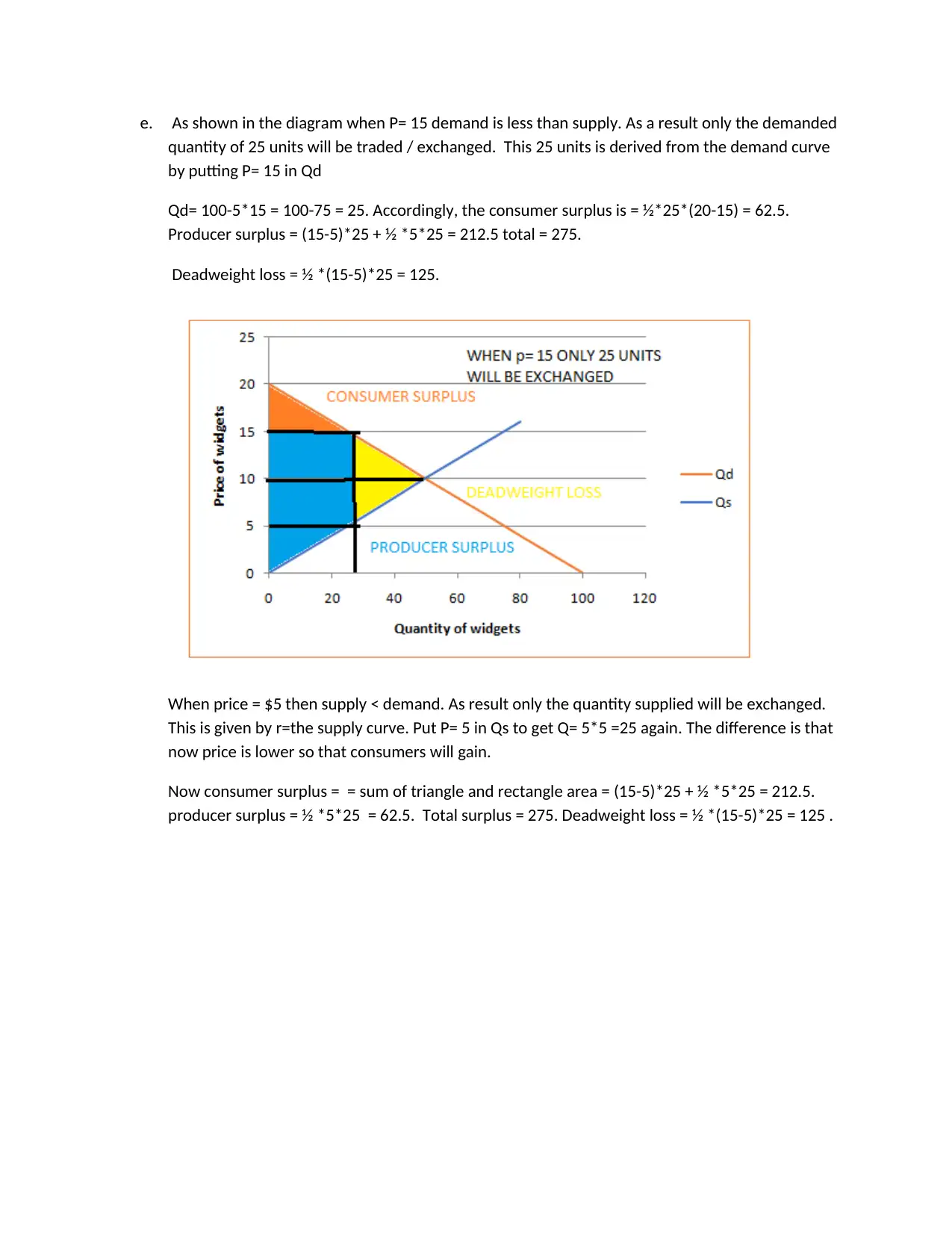

e. As shown in the diagram when P= 15 demand is less than supply. As a result only the demanded

quantity of 25 units will be traded / exchanged. This 25 units is derived from the demand curve

by putting P= 15 in Qd

Qd= 100-5*15 = 100-75 = 25. Accordingly, the consumer surplus is = ½*25*(20-15) = 62.5.

Producer surplus = (15-5)*25 + ½ *5*25 = 212.5 total = 275.

Deadweight loss = ½ *(15-5)*25 = 125.

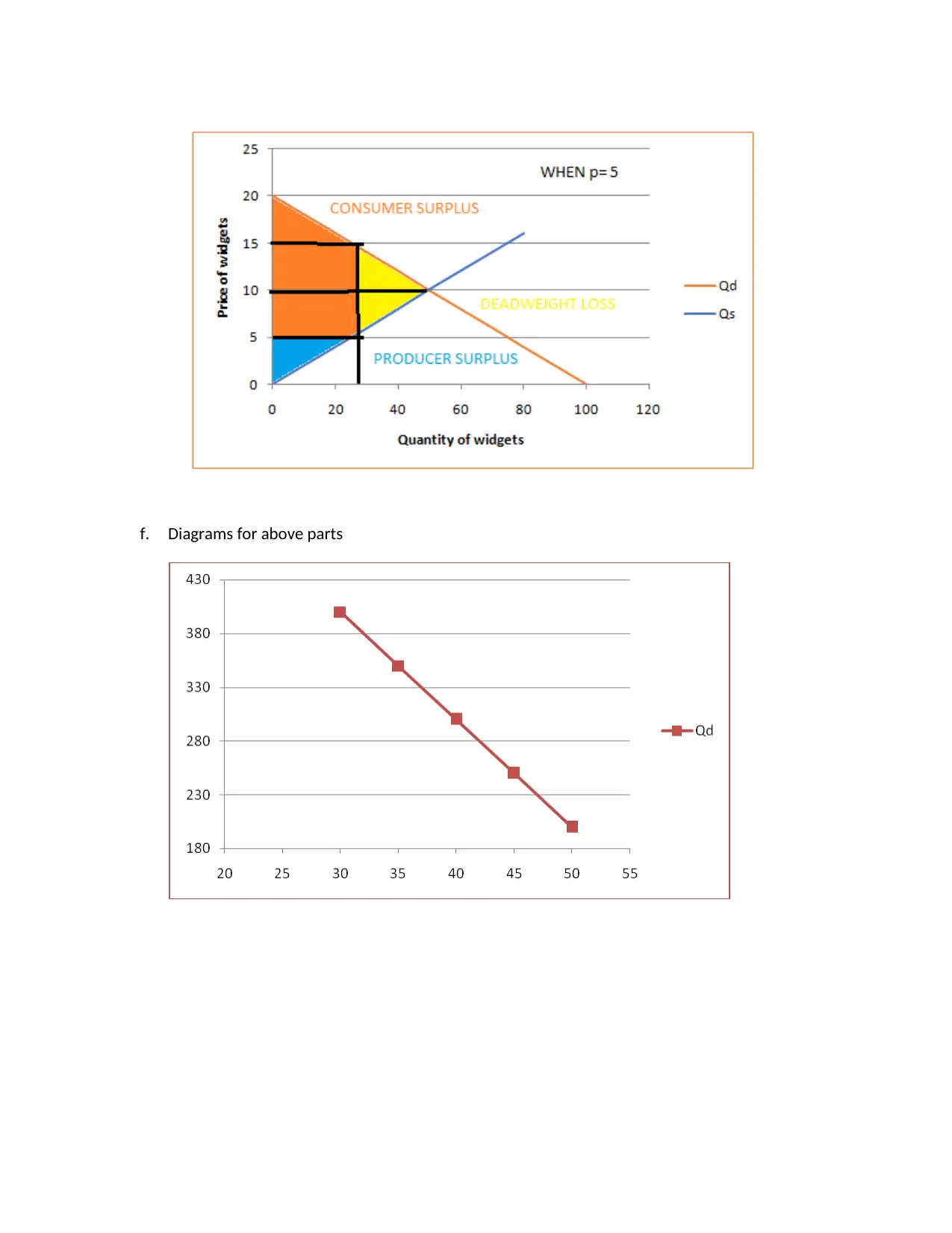

When price = $5 then supply < demand. As result only the quantity supplied will be exchanged.

This is given by r=the supply curve. Put P= 5 in Qs to get Q= 5*5 =25 again. The difference is that

now price is lower so that consumers will gain.

Now consumer surplus = = sum of triangle and rectangle area = (15-5)*25 + ½ *5*25 = 212.5.

producer surplus = ½ *5*25 = 62.5. Total surplus = 275. Deadweight loss = ½ *(15-5)*25 = 125 .

quantity of 25 units will be traded / exchanged. This 25 units is derived from the demand curve

by putting P= 15 in Qd

Qd= 100-5*15 = 100-75 = 25. Accordingly, the consumer surplus is = ½*25*(20-15) = 62.5.

Producer surplus = (15-5)*25 + ½ *5*25 = 212.5 total = 275.

Deadweight loss = ½ *(15-5)*25 = 125.

When price = $5 then supply < demand. As result only the quantity supplied will be exchanged.

This is given by r=the supply curve. Put P= 5 in Qs to get Q= 5*5 =25 again. The difference is that

now price is lower so that consumers will gain.

Now consumer surplus = = sum of triangle and rectangle area = (15-5)*25 + ½ *5*25 = 212.5.

producer surplus = ½ *5*25 = 62.5. Total surplus = 275. Deadweight loss = ½ *(15-5)*25 = 125 .

f. Diagrams for above parts

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 3:

a. NO .The finding that alcohol related deaths have not reduced is expected given the nature of

this good.

Economics tells us how demand is impacted when price changes based on the nature of a good.

Alcohol is an addictive good, which is hard to shake off. Users have little control over its

consumption. This is referred to as inelastic demand in Economics.

a. NO .The finding that alcohol related deaths have not reduced is expected given the nature of

this good.

Economics tells us how demand is impacted when price changes based on the nature of a good.

Alcohol is an addictive good, which is hard to shake off. Users have little control over its

consumption. This is referred to as inelastic demand in Economics.

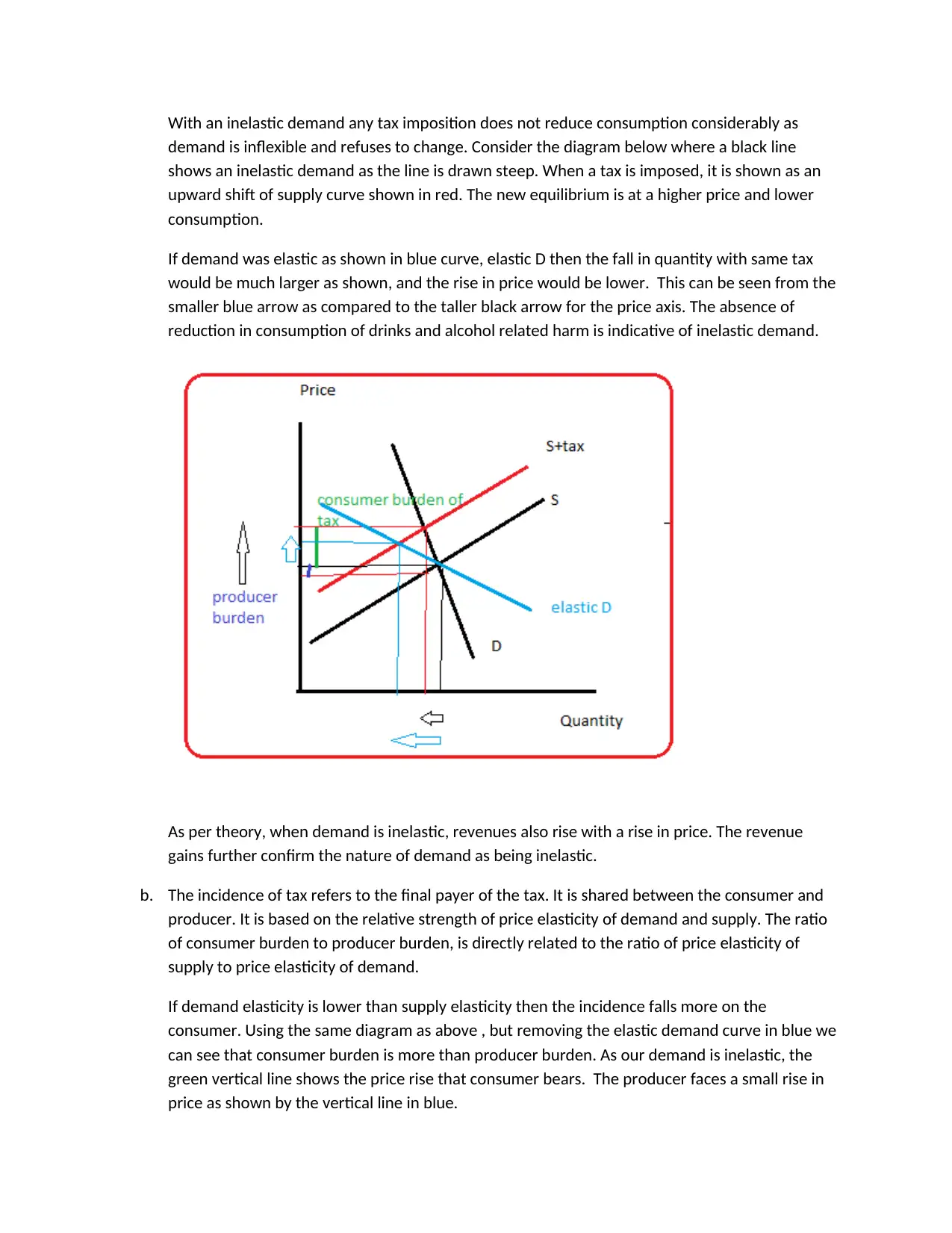

With an inelastic demand any tax imposition does not reduce consumption considerably as

demand is inflexible and refuses to change. Consider the diagram below where a black line

shows an inelastic demand as the line is drawn steep. When a tax is imposed, it is shown as an

upward shift of supply curve shown in red. The new equilibrium is at a higher price and lower

consumption.

If demand was elastic as shown in blue curve, elastic D then the fall in quantity with same tax

would be much larger as shown, and the rise in price would be lower. This can be seen from the

smaller blue arrow as compared to the taller black arrow for the price axis. The absence of

reduction in consumption of drinks and alcohol related harm is indicative of inelastic demand.

As per theory, when demand is inelastic, revenues also rise with a rise in price. The revenue

gains further confirm the nature of demand as being inelastic.

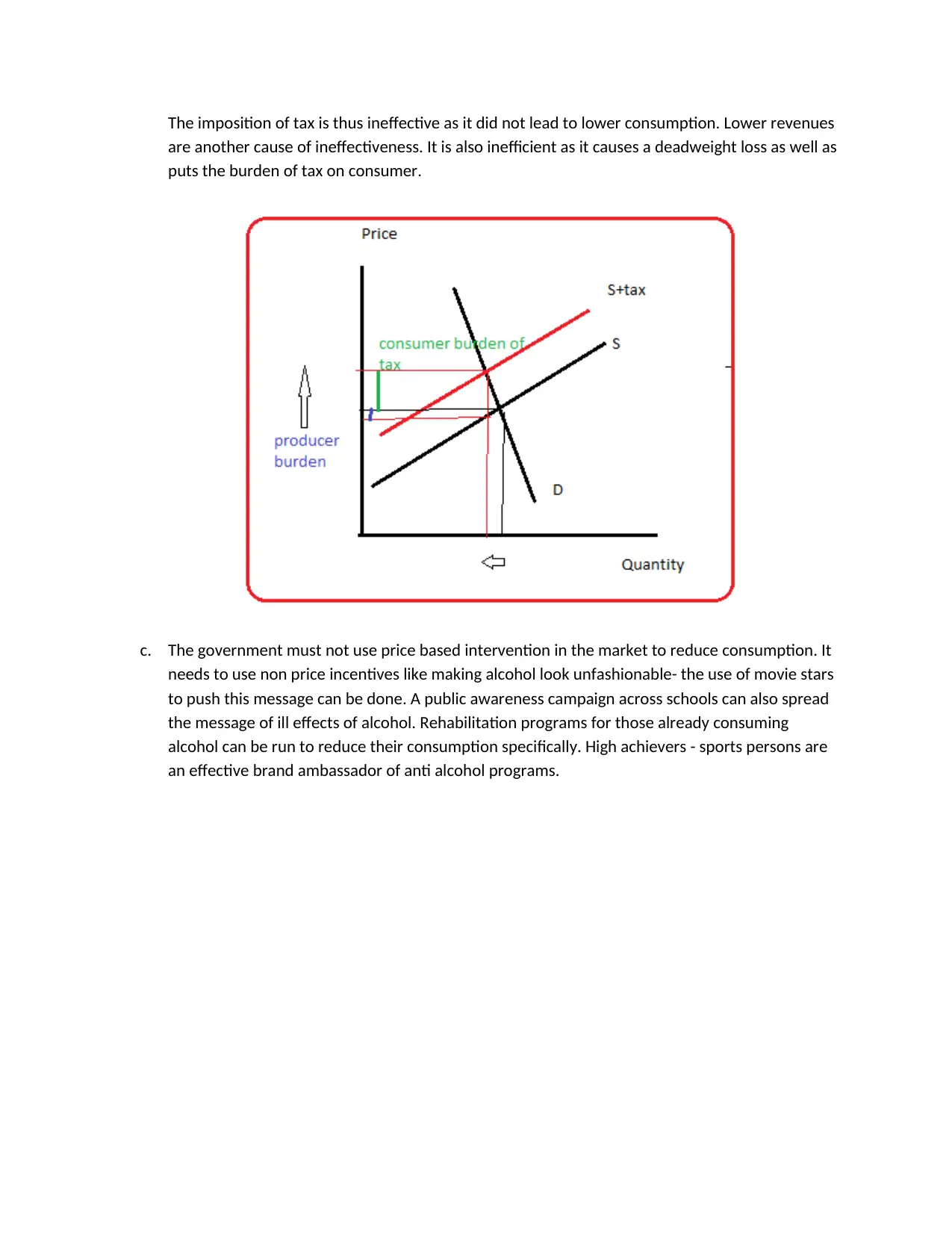

b. The incidence of tax refers to the final payer of the tax. It is shared between the consumer and

producer. It is based on the relative strength of price elasticity of demand and supply. The ratio

of consumer burden to producer burden, is directly related to the ratio of price elasticity of

supply to price elasticity of demand.

If demand elasticity is lower than supply elasticity then the incidence falls more on the

consumer. Using the same diagram as above , but removing the elastic demand curve in blue we

can see that consumer burden is more than producer burden. As our demand is inelastic, the

green vertical line shows the price rise that consumer bears. The producer faces a small rise in

price as shown by the vertical line in blue.

demand is inflexible and refuses to change. Consider the diagram below where a black line

shows an inelastic demand as the line is drawn steep. When a tax is imposed, it is shown as an

upward shift of supply curve shown in red. The new equilibrium is at a higher price and lower

consumption.

If demand was elastic as shown in blue curve, elastic D then the fall in quantity with same tax

would be much larger as shown, and the rise in price would be lower. This can be seen from the

smaller blue arrow as compared to the taller black arrow for the price axis. The absence of

reduction in consumption of drinks and alcohol related harm is indicative of inelastic demand.

As per theory, when demand is inelastic, revenues also rise with a rise in price. The revenue

gains further confirm the nature of demand as being inelastic.

b. The incidence of tax refers to the final payer of the tax. It is shared between the consumer and

producer. It is based on the relative strength of price elasticity of demand and supply. The ratio

of consumer burden to producer burden, is directly related to the ratio of price elasticity of

supply to price elasticity of demand.

If demand elasticity is lower than supply elasticity then the incidence falls more on the

consumer. Using the same diagram as above , but removing the elastic demand curve in blue we

can see that consumer burden is more than producer burden. As our demand is inelastic, the

green vertical line shows the price rise that consumer bears. The producer faces a small rise in

price as shown by the vertical line in blue.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The imposition of tax is thus ineffective as it did not lead to lower consumption. Lower revenues

are another cause of ineffectiveness. It is also inefficient as it causes a deadweight loss as well as

puts the burden of tax on consumer.

c. The government must not use price based intervention in the market to reduce consumption. It

needs to use non price incentives like making alcohol look unfashionable- the use of movie stars

to push this message can be done. A public awareness campaign across schools can also spread

the message of ill effects of alcohol. Rehabilitation programs for those already consuming

alcohol can be run to reduce their consumption specifically. High achievers - sports persons are

an effective brand ambassador of anti alcohol programs.

are another cause of ineffectiveness. It is also inefficient as it causes a deadweight loss as well as

puts the burden of tax on consumer.

c. The government must not use price based intervention in the market to reduce consumption. It

needs to use non price incentives like making alcohol look unfashionable- the use of movie stars

to push this message can be done. A public awareness campaign across schools can also spread

the message of ill effects of alcohol. Rehabilitation programs for those already consuming

alcohol can be run to reduce their consumption specifically. High achievers - sports persons are

an effective brand ambassador of anti alcohol programs.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References

Econ.ohio-state.edu, n.d. Elasticity. [Online] Available at:

http://www.econ.ohio-state.edu/jpeck/H200/EconH200L5.pdf [Accessed 30 May 2017].

Krpton.mnsu.edu, n.d. Production Possibility curves. [Online] Available at:

http://krypton.mnsu.edu/~cu7296vs/ppc.htm [Accessed 15 Auguat 2017].

Econ.ohio-state.edu, n.d. Elasticity. [Online] Available at:

http://www.econ.ohio-state.edu/jpeck/H200/EconH200L5.pdf [Accessed 30 May 2017].

Krpton.mnsu.edu, n.d. Production Possibility curves. [Online] Available at:

http://krypton.mnsu.edu/~cu7296vs/ppc.htm [Accessed 15 Auguat 2017].

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.