Project Management Techniques: Payback, NPV, IRR, Crashing, Restructuring, and Respecifying

VerifiedAdded on 2023/06/18

|10

|1772

|333

AI Summary

This article discusses various project management techniques such as Payback, NPV, IRR, Crashing, Restructuring, and Respecifying. It explains their advantages and disadvantages and provides insights into how to apply them in real-life scenarios. The article also includes an illustration of how to calculate payback period, NPV, and IRR.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

PROJECT

MANAGEMENT

MANAGEMENT

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

QUESTION 3...................................................................................................................................1

a) Payback..............................................................................................................................1

b) Net present value (NPV)....................................................................................................1

c) Internal rate of return (IRR)...............................................................................................1

QUESTION 4...................................................................................................................................4

a) Crashing the network..........................................................................................................4

b) Restructuring the network..................................................................................................5

c) Respecifying the project.....................................................................................................6

REFERENCES................................................................................................................................8

QUESTION 3...................................................................................................................................1

a) Payback..............................................................................................................................1

b) Net present value (NPV)....................................................................................................1

c) Internal rate of return (IRR)...............................................................................................1

QUESTION 4...................................................................................................................................4

a) Crashing the network..........................................................................................................4

b) Restructuring the network..................................................................................................5

c) Respecifying the project.....................................................................................................6

REFERENCES................................................................................................................................8

QUESTION 3

a) Payback

Payback period is the time (number of years/months/days) required to recover invested

amount. It is the simple method which can be used easily in order to analyze the reliability of a

project (Heydt, 2017). However, on the critically note, the method completely ignore time value

of money.

b) Net present value (NPV)

NPV is the difference between present value of cash inflow and outflow for the chosen

project. With the help of this method, company can make investment planning in order to

determine the profitability of a project investment (Batra and Verma, 2017). NPV comply with

time value of money concept and also assist management of company in better decision-making.

On contrary side, it can be challenging while undertaking the discount rate because it might

represent the investment's true risk.

c) Internal rate of return (IRR)

IRR is used to estimate the probability of potential investment where NPV of all the cash

flows is equal to zero during the discounted cash flow analysis. The method assist to make the

decision of a company easier but it is somewhat limited and only be used to compare the project

who are similar size and scope only.

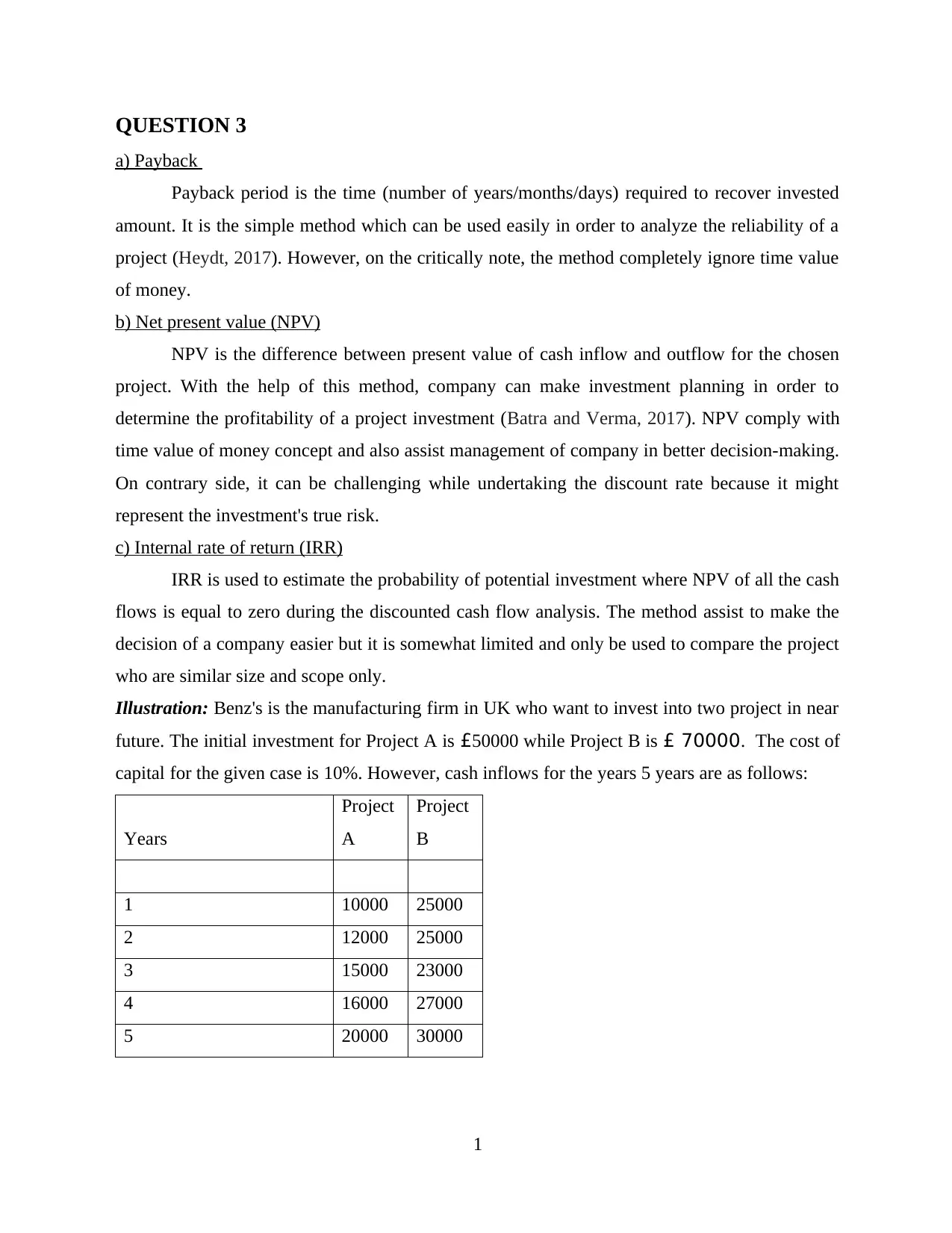

Illustration: Benz's is the manufacturing firm in UK who want to invest into two project in near

future. The initial investment for Project A is £50000 while Project B is £ 70000. The cost of

capital for the given case is 10%. However, cash inflows for the years 5 years are as follows:

Years

Project

A

Project

B

1 10000 25000

2 12000 25000

3 15000 23000

4 16000 27000

5 20000 30000

1

a) Payback

Payback period is the time (number of years/months/days) required to recover invested

amount. It is the simple method which can be used easily in order to analyze the reliability of a

project (Heydt, 2017). However, on the critically note, the method completely ignore time value

of money.

b) Net present value (NPV)

NPV is the difference between present value of cash inflow and outflow for the chosen

project. With the help of this method, company can make investment planning in order to

determine the profitability of a project investment (Batra and Verma, 2017). NPV comply with

time value of money concept and also assist management of company in better decision-making.

On contrary side, it can be challenging while undertaking the discount rate because it might

represent the investment's true risk.

c) Internal rate of return (IRR)

IRR is used to estimate the probability of potential investment where NPV of all the cash

flows is equal to zero during the discounted cash flow analysis. The method assist to make the

decision of a company easier but it is somewhat limited and only be used to compare the project

who are similar size and scope only.

Illustration: Benz's is the manufacturing firm in UK who want to invest into two project in near

future. The initial investment for Project A is £50000 while Project B is £ 70000. The cost of

capital for the given case is 10%. However, cash inflows for the years 5 years are as follows:

Years

Project

A

Project

B

1 10000 25000

2 12000 25000

3 15000 23000

4 16000 27000

5 20000 30000

1

Payback Period

Years

Project

A

Cumulative

cash inflows

Project

B

Cumulative

cash inflows

1 10000 10000 25000 25000

2 12000 22000 25000 50000

3 15000 37000 23000 73000

4 16000 53000 27000 100000

5 20000 73000 30000 130000

Payback Period (years)

3 years

+(50000-

37000)/16000

3 years +

(80000-

73000)/27000

3 years +

0.8125

3 years +

0.25

3.81 3.25

From the evaluation it can be interpreted that payback period of project A and B are

distinct from each other. Project A has 3.81 whereas B has 3.25 years of duration for recovering

initial investment. On the basis of this, it can be articulated that lower recovering time is more

useful for Benz's as it will be able to recover its initial investment sooner (Aretouyap, Kana and

Ghomsi, 2021). This objective can be accomplished by project B as its outcome is lower as

compared to other task.

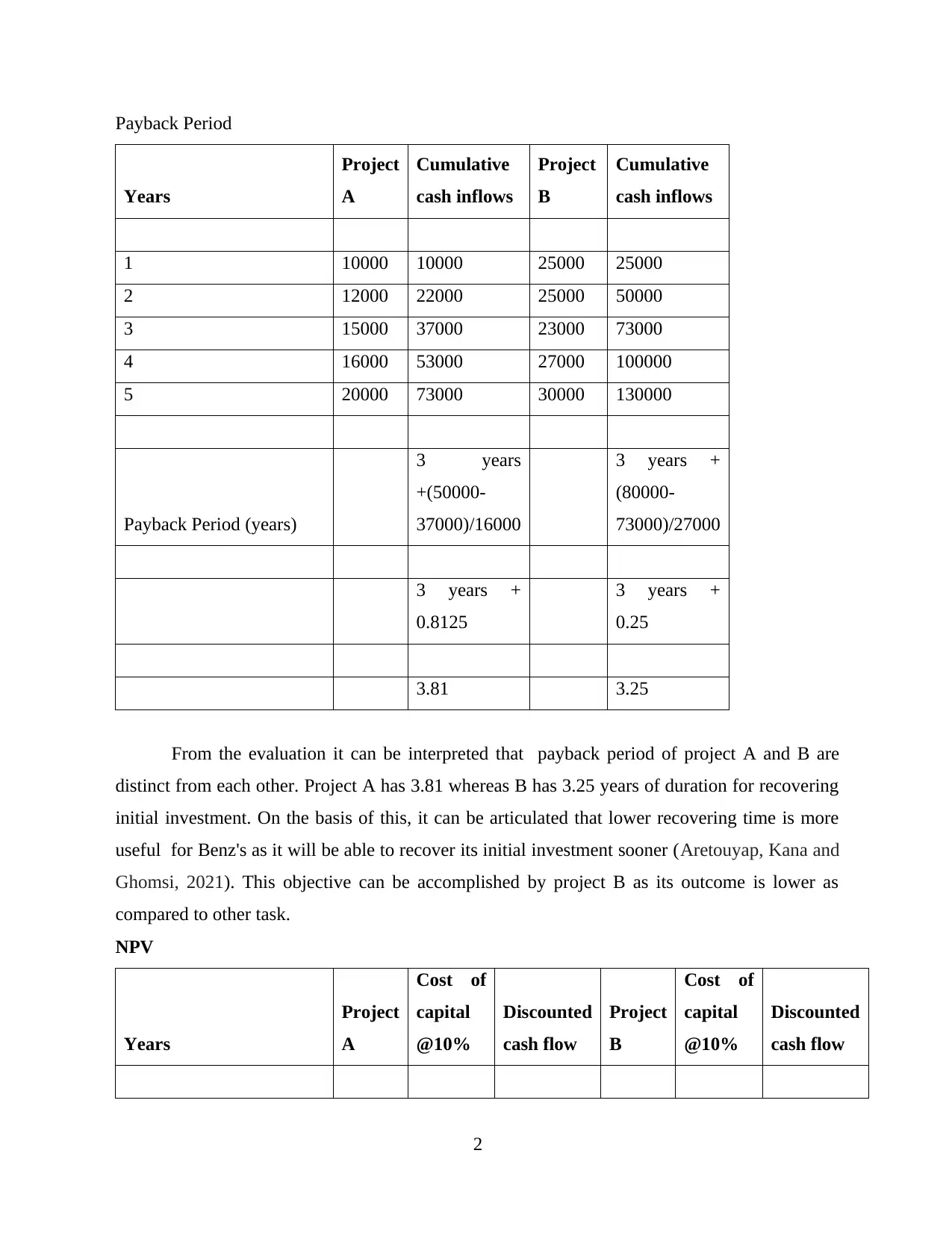

NPV

Years

Project

A

Cost of

capital

@10%

Discounted

cash flow

Project

B

Cost of

capital

@10%

Discounted

cash flow

2

Years

Project

A

Cumulative

cash inflows

Project

B

Cumulative

cash inflows

1 10000 10000 25000 25000

2 12000 22000 25000 50000

3 15000 37000 23000 73000

4 16000 53000 27000 100000

5 20000 73000 30000 130000

Payback Period (years)

3 years

+(50000-

37000)/16000

3 years +

(80000-

73000)/27000

3 years +

0.8125

3 years +

0.25

3.81 3.25

From the evaluation it can be interpreted that payback period of project A and B are

distinct from each other. Project A has 3.81 whereas B has 3.25 years of duration for recovering

initial investment. On the basis of this, it can be articulated that lower recovering time is more

useful for Benz's as it will be able to recover its initial investment sooner (Aretouyap, Kana and

Ghomsi, 2021). This objective can be accomplished by project B as its outcome is lower as

compared to other task.

NPV

Years

Project

A

Cost of

capital

@10%

Discounted

cash flow

Project

B

Cost of

capital

@10%

Discounted

cash flow

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1 10000 0.909091 9091 25000 0.909091 22727

2 12000 0.826446 9917 25000 0.826446 20661

3 15000 0.751315 11270 23000 0.751315 17280

4 16000 0.683013 10928 27000 0.683013 18441

5 20000 0.620921 12418 30000 0.620921 18628

Total discounted cash

inflow 53625 97738

Initial investment 50000 80000

NPV (Total discounted

cash inflows - initial

investment) 3625 17738

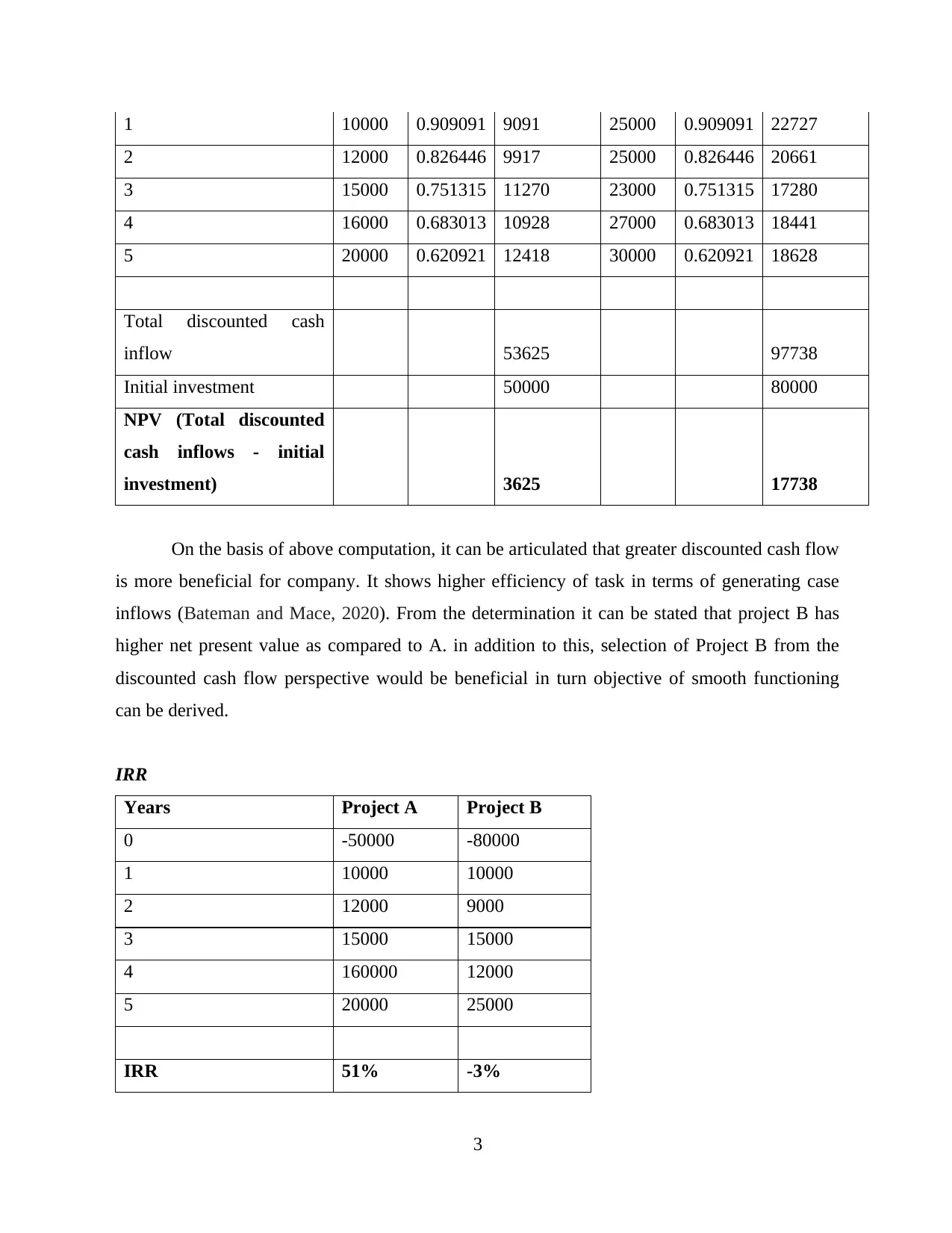

On the basis of above computation, it can be articulated that greater discounted cash flow

is more beneficial for company. It shows higher efficiency of task in terms of generating case

inflows (Bateman and Mace, 2020). From the determination it can be stated that project B has

higher net present value as compared to A. in addition to this, selection of Project B from the

discounted cash flow perspective would be beneficial in turn objective of smooth functioning

can be derived.

IRR

Years Project A Project B

0 -50000 -80000

1 10000 10000

2 12000 9000

3 15000 15000

4 160000 12000

5 20000 25000

IRR 51% -3%

3

2 12000 0.826446 9917 25000 0.826446 20661

3 15000 0.751315 11270 23000 0.751315 17280

4 16000 0.683013 10928 27000 0.683013 18441

5 20000 0.620921 12418 30000 0.620921 18628

Total discounted cash

inflow 53625 97738

Initial investment 50000 80000

NPV (Total discounted

cash inflows - initial

investment) 3625 17738

On the basis of above computation, it can be articulated that greater discounted cash flow

is more beneficial for company. It shows higher efficiency of task in terms of generating case

inflows (Bateman and Mace, 2020). From the determination it can be stated that project B has

higher net present value as compared to A. in addition to this, selection of Project B from the

discounted cash flow perspective would be beneficial in turn objective of smooth functioning

can be derived.

IRR

Years Project A Project B

0 -50000 -80000

1 10000 10000

2 12000 9000

3 15000 15000

4 160000 12000

5 20000 25000

IRR 51% -3%

3

From the evaluation it can be interpreted that internal rate of return is one of the

important technique for making decision regarding investment it can be interpreted that project

B has negative IRR whereas A has good return so opting higher providing outcome is more

advantageous for specified manufacturing firm.

On the basis of this, it can be identified that project B should be selected as it payback & net

present vale are good as per the requirement.

QUESTION 4

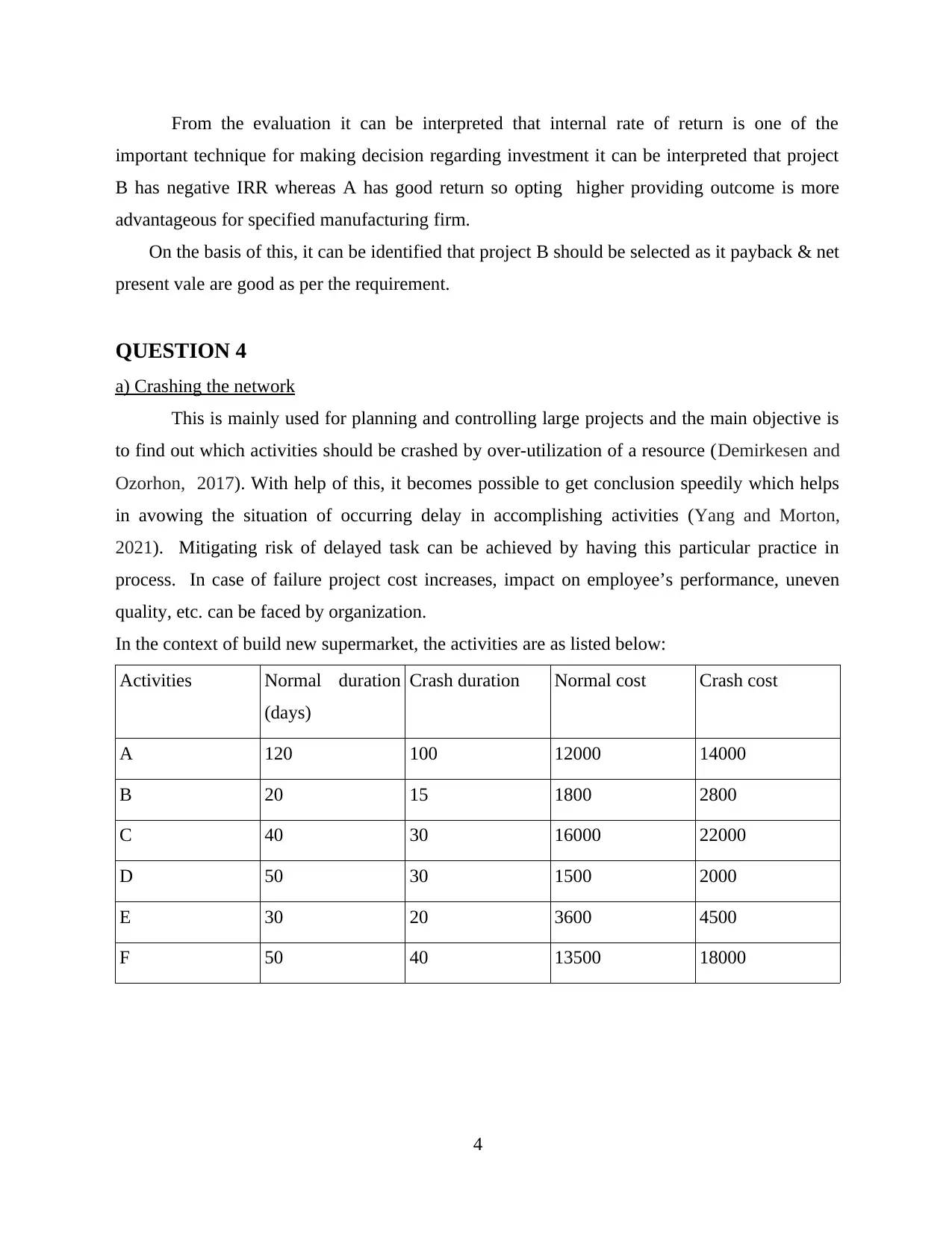

a) Crashing the network

This is mainly used for planning and controlling large projects and the main objective is

to find out which activities should be crashed by over-utilization of a resource (Demirkesen and

Ozorhon, 2017). With help of this, it becomes possible to get conclusion speedily which helps

in avowing the situation of occurring delay in accomplishing activities (Yang and Morton,

2021). Mitigating risk of delayed task can be achieved by having this particular practice in

process. In case of failure project cost increases, impact on employee’s performance, uneven

quality, etc. can be faced by organization.

In the context of build new supermarket, the activities are as listed below:

Activities Normal duration

(days)

Crash duration Normal cost Crash cost

A 120 100 12000 14000

B 20 15 1800 2800

C 40 30 16000 22000

D 50 30 1500 2000

E 30 20 3600 4500

F 50 40 13500 18000

4

important technique for making decision regarding investment it can be interpreted that project

B has negative IRR whereas A has good return so opting higher providing outcome is more

advantageous for specified manufacturing firm.

On the basis of this, it can be identified that project B should be selected as it payback & net

present vale are good as per the requirement.

QUESTION 4

a) Crashing the network

This is mainly used for planning and controlling large projects and the main objective is

to find out which activities should be crashed by over-utilization of a resource (Demirkesen and

Ozorhon, 2017). With help of this, it becomes possible to get conclusion speedily which helps

in avowing the situation of occurring delay in accomplishing activities (Yang and Morton,

2021). Mitigating risk of delayed task can be achieved by having this particular practice in

process. In case of failure project cost increases, impact on employee’s performance, uneven

quality, etc. can be faced by organization.

In the context of build new supermarket, the activities are as listed below:

Activities Normal duration

(days)

Crash duration Normal cost Crash cost

A 120 100 12000 14000

B 20 15 1800 2800

C 40 30 16000 22000

D 50 30 1500 2000

E 30 20 3600 4500

F 50 40 13500 18000

4

The crash cost slope for each activity can be determined by using the formula:

S = Crash cost – Normal Cost / Normal duration – crash duration

S(A) = 14000 – 12000 / 120 – 100

= 100/day

S(B)= 2800 – 1800 / 20 – 15

= 200/day

S(C)= 22000 – 16000 / 40 – 30

= 600/day

S(D) = 2000 – 1500 / 50 – 30

= 25/day

S(E) = 4500 - 3600 / 50 – 30

= 45/day

S(F) = 18000 – 13500 / 50 – 40

= 450/day

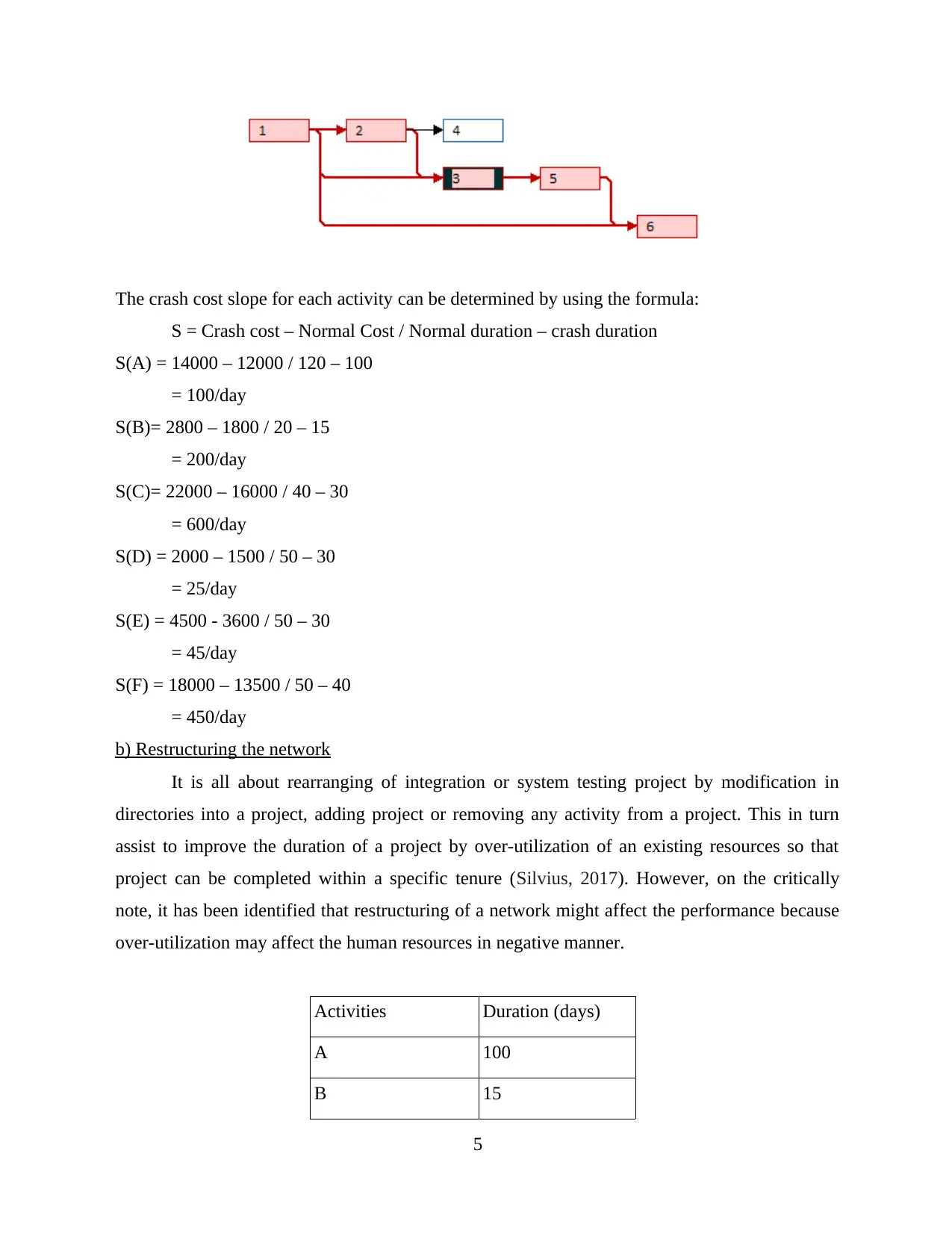

b) Restructuring the network

It is all about rearranging of integration or system testing project by modification in

directories into a project, adding project or removing any activity from a project. This in turn

assist to improve the duration of a project by over-utilization of an existing resources so that

project can be completed within a specific tenure (Silvius, 2017). However, on the critically

note, it has been identified that restructuring of a network might affect the performance because

over-utilization may affect the human resources in negative manner.

Activities Duration (days)

A 100

B 15

5

S = Crash cost – Normal Cost / Normal duration – crash duration

S(A) = 14000 – 12000 / 120 – 100

= 100/day

S(B)= 2800 – 1800 / 20 – 15

= 200/day

S(C)= 22000 – 16000 / 40 – 30

= 600/day

S(D) = 2000 – 1500 / 50 – 30

= 25/day

S(E) = 4500 - 3600 / 50 – 30

= 45/day

S(F) = 18000 – 13500 / 50 – 40

= 450/day

b) Restructuring the network

It is all about rearranging of integration or system testing project by modification in

directories into a project, adding project or removing any activity from a project. This in turn

assist to improve the duration of a project by over-utilization of an existing resources so that

project can be completed within a specific tenure (Silvius, 2017). However, on the critically

note, it has been identified that restructuring of a network might affect the performance because

over-utilization may affect the human resources in negative manner.

Activities Duration (days)

A 100

B 15

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

C 30

D 30

E 20

F 40

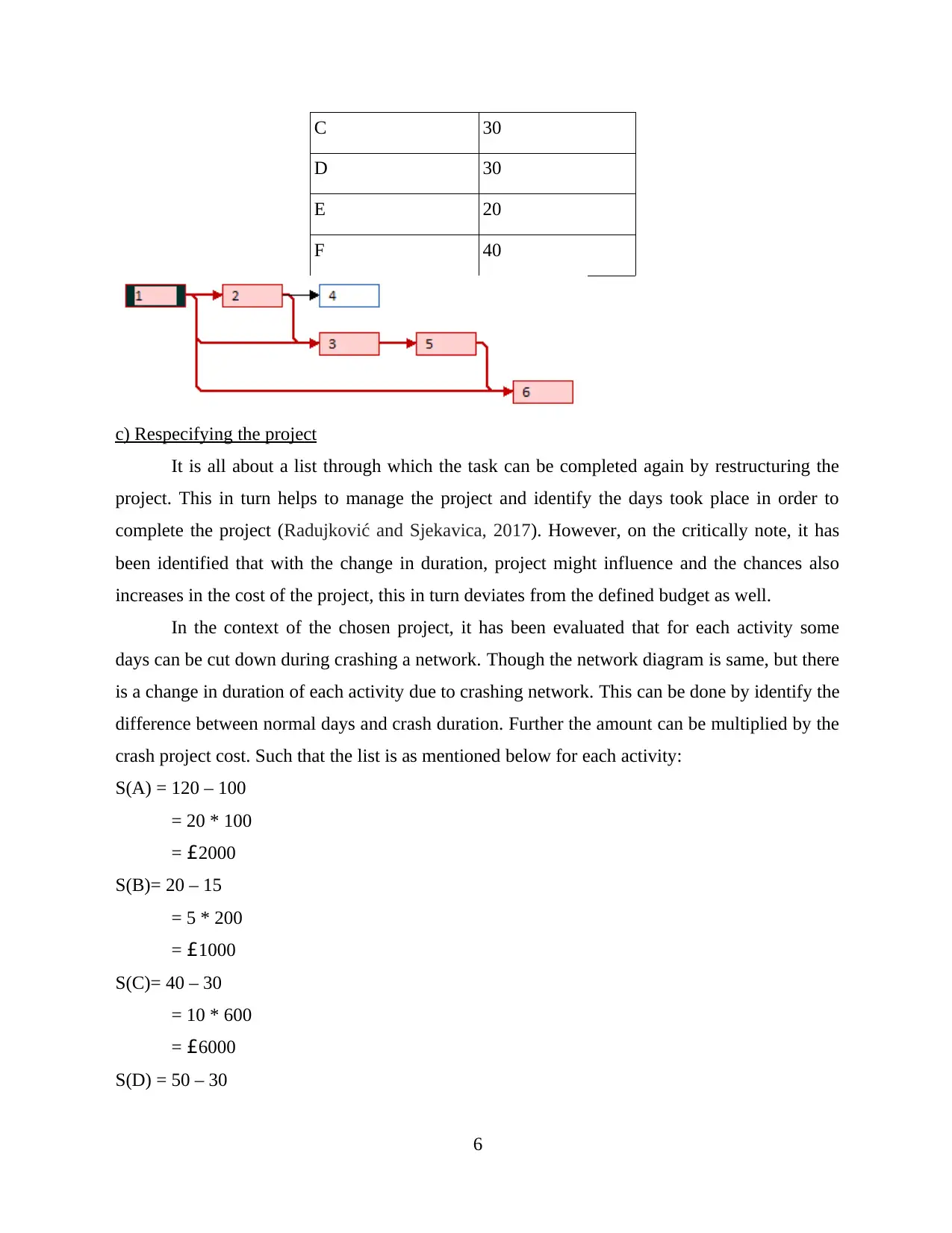

c) Respecifying the project

It is all about a list through which the task can be completed again by restructuring the

project. This in turn helps to manage the project and identify the days took place in order to

complete the project (Radujković and Sjekavica, 2017). However, on the critically note, it has

been identified that with the change in duration, project might influence and the chances also

increases in the cost of the project, this in turn deviates from the defined budget as well.

In the context of the chosen project, it has been evaluated that for each activity some

days can be cut down during crashing a network. Though the network diagram is same, but there

is a change in duration of each activity due to crashing network. This can be done by identify the

difference between normal days and crash duration. Further the amount can be multiplied by the

crash project cost. Such that the list is as mentioned below for each activity:

S(A) = 120 – 100

= 20 * 100

= £2000

S(B)= 20 – 15

= 5 * 200

= £1000

S(C)= 40 – 30

= 10 * 600

= £6000

S(D) = 50 – 30

6

D 30

E 20

F 40

c) Respecifying the project

It is all about a list through which the task can be completed again by restructuring the

project. This in turn helps to manage the project and identify the days took place in order to

complete the project (Radujković and Sjekavica, 2017). However, on the critically note, it has

been identified that with the change in duration, project might influence and the chances also

increases in the cost of the project, this in turn deviates from the defined budget as well.

In the context of the chosen project, it has been evaluated that for each activity some

days can be cut down during crashing a network. Though the network diagram is same, but there

is a change in duration of each activity due to crashing network. This can be done by identify the

difference between normal days and crash duration. Further the amount can be multiplied by the

crash project cost. Such that the list is as mentioned below for each activity:

S(A) = 120 – 100

= 20 * 100

= £2000

S(B)= 20 – 15

= 5 * 200

= £1000

S(C)= 40 – 30

= 10 * 600

= £6000

S(D) = 50 – 30

6

= 20 * 25

= £500

S(E) = 30 – 20

= 10 * 45

= £450

S(F) = 50 – 40

= 10 * 450

= £4500

Through the above it has been identified that with the help of crashing, restructuring and

re-specifying the project, project manager able to deliver the project on time.

7

= £500

S(E) = 30 – 20

= 10 * 45

= £450

S(F) = 50 – 40

= 10 * 450

= £4500

Through the above it has been identified that with the help of crashing, restructuring and

re-specifying the project, project manager able to deliver the project on time.

7

REFERENCES

Books and Journals

Aretouyap, Z., Kana, J. D. and Ghomsi, F. E. K., 2021. Appraisal of environment quality in the

capital district of Cameroon using Landsat-8 images. Sustainable Cities and Society. 67.

p.102734.

Bateman, I. J. and Mace, G. M., 2020. The natural capital framework for sustainably efficient

and equitable decision making. Nature Sustainability. 3(10), pp.776-783.

Batra, R. and Verma, S., 2017. Capital budgeting practices in Indian companies. IIMB

Management Review. 29(1). pp.29-44.

Demirkesen, S. and Ozorhon, B., 2017. Impact of integration management on construction

project management performance. International Journal of Project Management. 35(8).

pp.1639-1654.

Heydt, G. T., 2017. The probabilistic evaluation of Net Present value of electric power

distribution systems based on the Kaldor–Hicks compensation principle. IEEE

Transactions on Power Systems. 33(4). pp.4488-4495.

Radujković, M. and Sjekavica, M., 2017. Project management success factors. Procedia

engineering. 196. pp.607-615.

Silvius, G., 2017. Sustainability as a new school of thought in project management. Journal of

cleaner production. 166. pp.1479-1493.

Yang, H. and Morton, D. P., 2021. Optimal crashing of an activity network with

disruptions. Mathematical Programming. pp.1-50.

8

Books and Journals

Aretouyap, Z., Kana, J. D. and Ghomsi, F. E. K., 2021. Appraisal of environment quality in the

capital district of Cameroon using Landsat-8 images. Sustainable Cities and Society. 67.

p.102734.

Bateman, I. J. and Mace, G. M., 2020. The natural capital framework for sustainably efficient

and equitable decision making. Nature Sustainability. 3(10), pp.776-783.

Batra, R. and Verma, S., 2017. Capital budgeting practices in Indian companies. IIMB

Management Review. 29(1). pp.29-44.

Demirkesen, S. and Ozorhon, B., 2017. Impact of integration management on construction

project management performance. International Journal of Project Management. 35(8).

pp.1639-1654.

Heydt, G. T., 2017. The probabilistic evaluation of Net Present value of electric power

distribution systems based on the Kaldor–Hicks compensation principle. IEEE

Transactions on Power Systems. 33(4). pp.4488-4495.

Radujković, M. and Sjekavica, M., 2017. Project management success factors. Procedia

engineering. 196. pp.607-615.

Silvius, G., 2017. Sustainability as a new school of thought in project management. Journal of

cleaner production. 166. pp.1479-1493.

Yang, H. and Morton, D. P., 2021. Optimal crashing of an activity network with

disruptions. Mathematical Programming. pp.1-50.

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.