University Project: Hawaiian Electric Share Price Prediction Analysis

VerifiedAdded on 2020/02/19

|11

|1944

|34

Project

AI Summary

This project analyzes Hawaiian Electric share price data to predict future changes. It employs multiple regression analysis on 382 trading days of data, considering factors like share prices, interest rates, currency exchange rates, and oil prices. The analysis includes Variance Inflation Factor (VIF) to assess multicollinearity, residual analysis to check for outliers, and Analysis of Variance (ANOVA) to determine variable relationships. The Coefficient of Determination (R2) reveals the model's explanatory power, while hypothesis testing identifies significant variables. Regression coefficients are examined to understand the impact of each variable on share price changes. The project concludes that while the model identifies some relationships, the low R-squared value limits the accuracy of predictions. The analysis highlights the challenges of forecasting share prices and the need for more comprehensive models, despite the positive identification of some relationships between variables and the dependent variable.

Running Head: HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

Hawaiian Electric Share Price Prediction

Name of the Student

Name of the University

Author Note

Hawaiian Electric Share Price Prediction

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

Table of Contents

1.0 Introduction................................................................................................................................3

2.0 Data Description........................................................................................................................3

3.0 Variance Inflation Factor (VIF).................................................................................................4

4.0 Residual Analysis......................................................................................................................5

5.0 Analysis of Variance (ANOVA)...............................................................................................6

6.0 Coefficient of Determination (R2).............................................................................................6

7.0 Hypothesis Testing....................................................................................................................7

8.0 Regression Coefficients.............................................................................................................8

9.0 Prediction of Share Price...........................................................................................................8

10.0 Conclusion...............................................................................................................................9

References......................................................................................................................................10

Appendix A: VIF Values...............................................................................................................11

Table of Contents

1.0 Introduction................................................................................................................................3

2.0 Data Description........................................................................................................................3

3.0 Variance Inflation Factor (VIF).................................................................................................4

4.0 Residual Analysis......................................................................................................................5

5.0 Analysis of Variance (ANOVA)...............................................................................................6

6.0 Coefficient of Determination (R2).............................................................................................6

7.0 Hypothesis Testing....................................................................................................................7

8.0 Regression Coefficients.............................................................................................................8

9.0 Prediction of Share Price...........................................................................................................8

10.0 Conclusion...............................................................................................................................9

References......................................................................................................................................10

Appendix A: VIF Values...............................................................................................................11

2HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

1.0 Introduction

The main aim of this project is to perform the analysis on the data received from

Hawaiian Electric Corporation and identify whether this is suitable enough to predict future

changes in the corporation prices. The corporation conducts various businesses. These selling the

electricity or providing the facility to various places.

Daily data will be used to run this analysis. The correlation between the daily price

changes will be measured using multiple regression analysis. The variance Inflation factor (VIF),

adjusted R2, Analysis of Variance (ANOVA) and residual analysis will be discussed.

2.0 Data Description

The data set consists of 382 data points, which include 382 trading days. 6 input

measurements are considered for each day. Out of them, 5 are input measurements and one of

them is the output measurement. The last column indicates the future changes in the share prices

of the companies that is the changes from the close of trading today to the opening of trading

tomorrow morning. The other columns include information of the changes in price of various

financial instruments. These include

The price of the same company’s shares

Interest rates

Currency exchange rates

Price of oil

The changes in price have been ranked and sorted. The number ranges from 0 to 1 where

“1” indicates the highest value

1.0 Introduction

The main aim of this project is to perform the analysis on the data received from

Hawaiian Electric Corporation and identify whether this is suitable enough to predict future

changes in the corporation prices. The corporation conducts various businesses. These selling the

electricity or providing the facility to various places.

Daily data will be used to run this analysis. The correlation between the daily price

changes will be measured using multiple regression analysis. The variance Inflation factor (VIF),

adjusted R2, Analysis of Variance (ANOVA) and residual analysis will be discussed.

2.0 Data Description

The data set consists of 382 data points, which include 382 trading days. 6 input

measurements are considered for each day. Out of them, 5 are input measurements and one of

them is the output measurement. The last column indicates the future changes in the share prices

of the companies that is the changes from the close of trading today to the opening of trading

tomorrow morning. The other columns include information of the changes in price of various

financial instruments. These include

The price of the same company’s shares

Interest rates

Currency exchange rates

Price of oil

The changes in price have been ranked and sorted. The number ranges from 0 to 1 where

“1” indicates the highest value

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

“0.5” indicates the median value

“0” indicates the least value.

Hawaiian Electric Industries, Inc., through its subsidiaries, engages in the electric utility

and banking businesses primarily in the state of Hawaii. The segment of electric utility of the

company generates purchases, transmits, distributes and sells electric energy. It generates

renewable energy sources and potential energy sources with the help of wind, solar, photovoltaic,

geothermal, hydroelectric, wave, municipal waste, sugarcane wastes and bio fuels. This electric

segment of the company distributes and sells electricity on different islands of Hawaii, Oahu,

Lanai, Molokai and Maui. It also serves the suburban communities, resorts, installation of the

armed forces of the United States, agricultural operations. There is also a bank segment of the

organization, which operates various accounts such as a savings account, money market,

checking and certificates of deposit. It also deals with the loans of residential and commercial

real estate, mortgages, constructions, developments, multifamily (both residential and

commercial real estates) and businesses. The Hawaiian Electric Industries has its headquarter in

Honolulu, Hawaii and was founded in the year 1891.

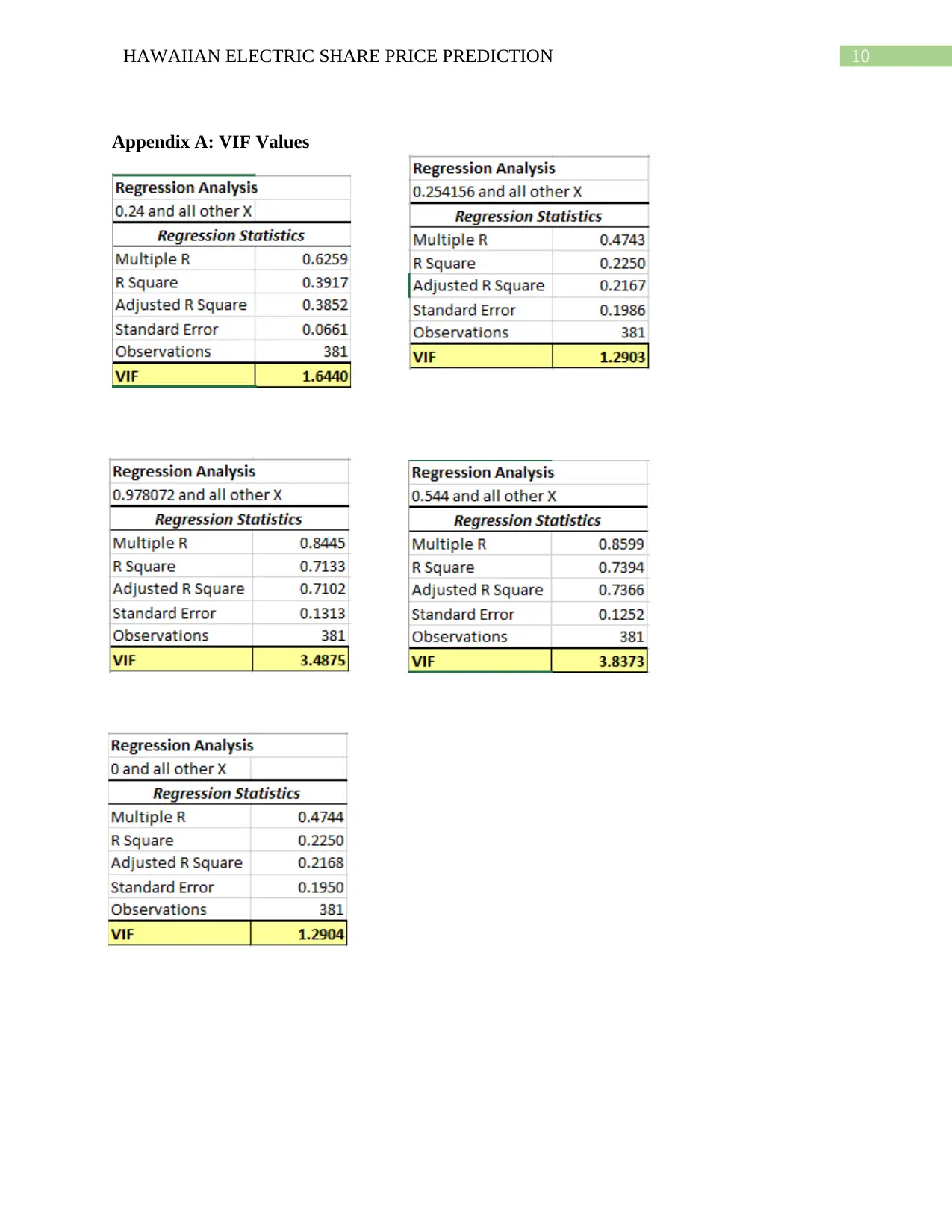

3.0 Variance Inflation Factor (VIF)

The variance inflation Factor (VIF) test is used to test the multicollinearity between the

variables. When two or more dependent variables are found to be highly correlated, then the

problem of multicollinearity arises (García et al., 2015). In the presence of multicollinearity in a

data, model fitting becomes difficult.

PHStat function was used in Excel to find the VIF for all the input variables. The variable

will be termed as highly correlated if the VIF > 5 and will be less correlated if VIF < 5. In this

“0.5” indicates the median value

“0” indicates the least value.

Hawaiian Electric Industries, Inc., through its subsidiaries, engages in the electric utility

and banking businesses primarily in the state of Hawaii. The segment of electric utility of the

company generates purchases, transmits, distributes and sells electric energy. It generates

renewable energy sources and potential energy sources with the help of wind, solar, photovoltaic,

geothermal, hydroelectric, wave, municipal waste, sugarcane wastes and bio fuels. This electric

segment of the company distributes and sells electricity on different islands of Hawaii, Oahu,

Lanai, Molokai and Maui. It also serves the suburban communities, resorts, installation of the

armed forces of the United States, agricultural operations. There is also a bank segment of the

organization, which operates various accounts such as a savings account, money market,

checking and certificates of deposit. It also deals with the loans of residential and commercial

real estate, mortgages, constructions, developments, multifamily (both residential and

commercial real estates) and businesses. The Hawaiian Electric Industries has its headquarter in

Honolulu, Hawaii and was founded in the year 1891.

3.0 Variance Inflation Factor (VIF)

The variance inflation Factor (VIF) test is used to test the multicollinearity between the

variables. When two or more dependent variables are found to be highly correlated, then the

problem of multicollinearity arises (García et al., 2015). In the presence of multicollinearity in a

data, model fitting becomes difficult.

PHStat function was used in Excel to find the VIF for all the input variables. The variable

will be termed as highly correlated if the VIF > 5 and will be less correlated if VIF < 5. In this

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

analysis, the VIF of all the variables were found to be less than 5. Thus, it can be said that there

is very less correlation or no correlation between the dependent variables.

Thus, all the input variables are independent and are required for the analysis. None of

the columns can be removed from the dataset.

4.0 Residual Analysis

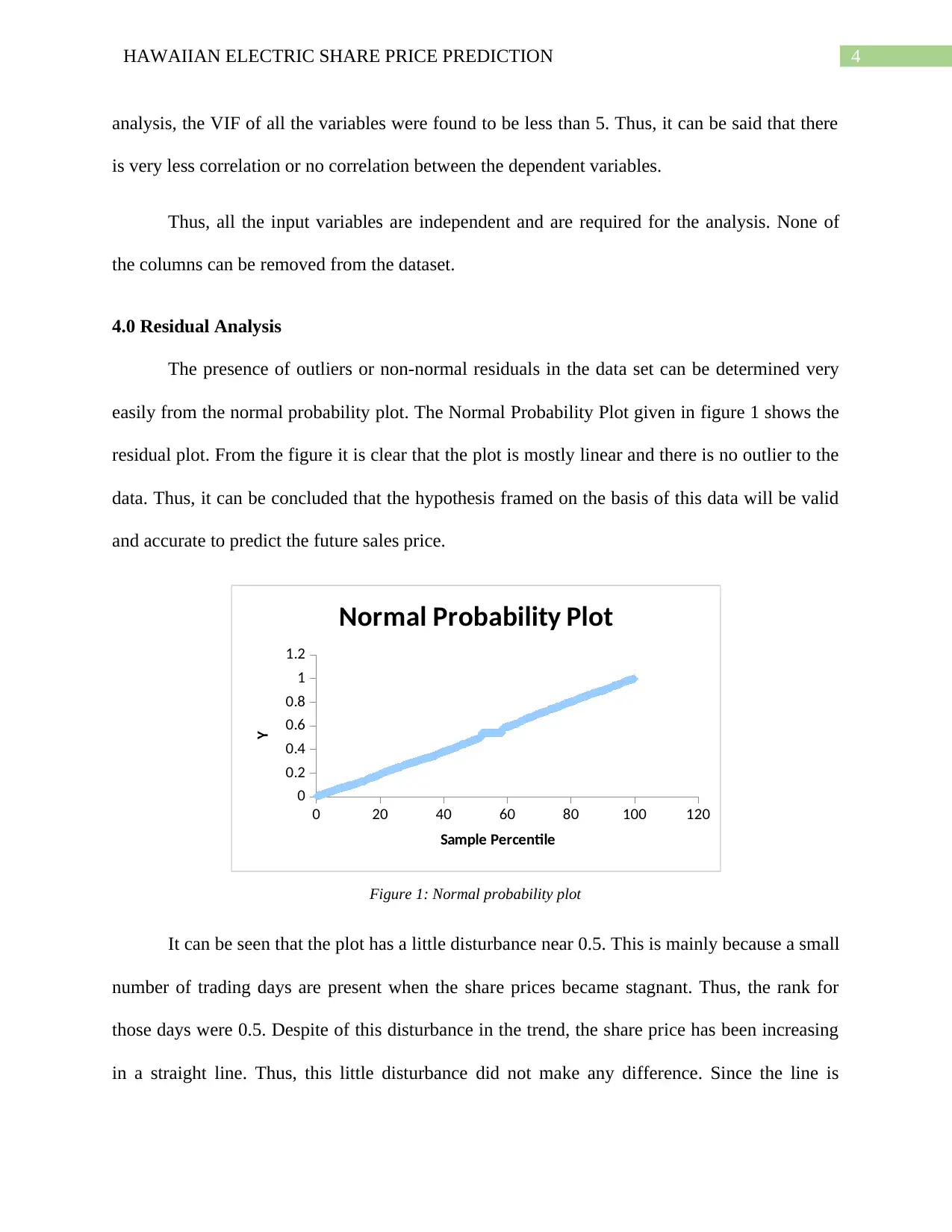

The presence of outliers or non-normal residuals in the data set can be determined very

easily from the normal probability plot. The Normal Probability Plot given in figure 1 shows the

residual plot. From the figure it is clear that the plot is mostly linear and there is no outlier to the

data. Thus, it can be concluded that the hypothesis framed on the basis of this data will be valid

and accurate to predict the future sales price.

0 20 40 60 80 100 120

0

0.2

0.4

0.6

0.8

1

1.2

Normal Probability Plot

Sample Percentile

Y

Figure 1: Normal probability plot

It can be seen that the plot has a little disturbance near 0.5. This is mainly because a small

number of trading days are present when the share prices became stagnant. Thus, the rank for

those days were 0.5. Despite of this disturbance in the trend, the share price has been increasing

in a straight line. Thus, this little disturbance did not make any difference. Since the line is

analysis, the VIF of all the variables were found to be less than 5. Thus, it can be said that there

is very less correlation or no correlation between the dependent variables.

Thus, all the input variables are independent and are required for the analysis. None of

the columns can be removed from the dataset.

4.0 Residual Analysis

The presence of outliers or non-normal residuals in the data set can be determined very

easily from the normal probability plot. The Normal Probability Plot given in figure 1 shows the

residual plot. From the figure it is clear that the plot is mostly linear and there is no outlier to the

data. Thus, it can be concluded that the hypothesis framed on the basis of this data will be valid

and accurate to predict the future sales price.

0 20 40 60 80 100 120

0

0.2

0.4

0.6

0.8

1

1.2

Normal Probability Plot

Sample Percentile

Y

Figure 1: Normal probability plot

It can be seen that the plot has a little disturbance near 0.5. This is mainly because a small

number of trading days are present when the share prices became stagnant. Thus, the rank for

those days were 0.5. Despite of this disturbance in the trend, the share price has been increasing

in a straight line. Thus, this little disturbance did not make any difference. Since the line is

5HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

almost linear, it can be said the residuals are normally distributed and the hypothesis and

predictions can be carried out safely.

5.0 Analysis of Variance (ANOVA)

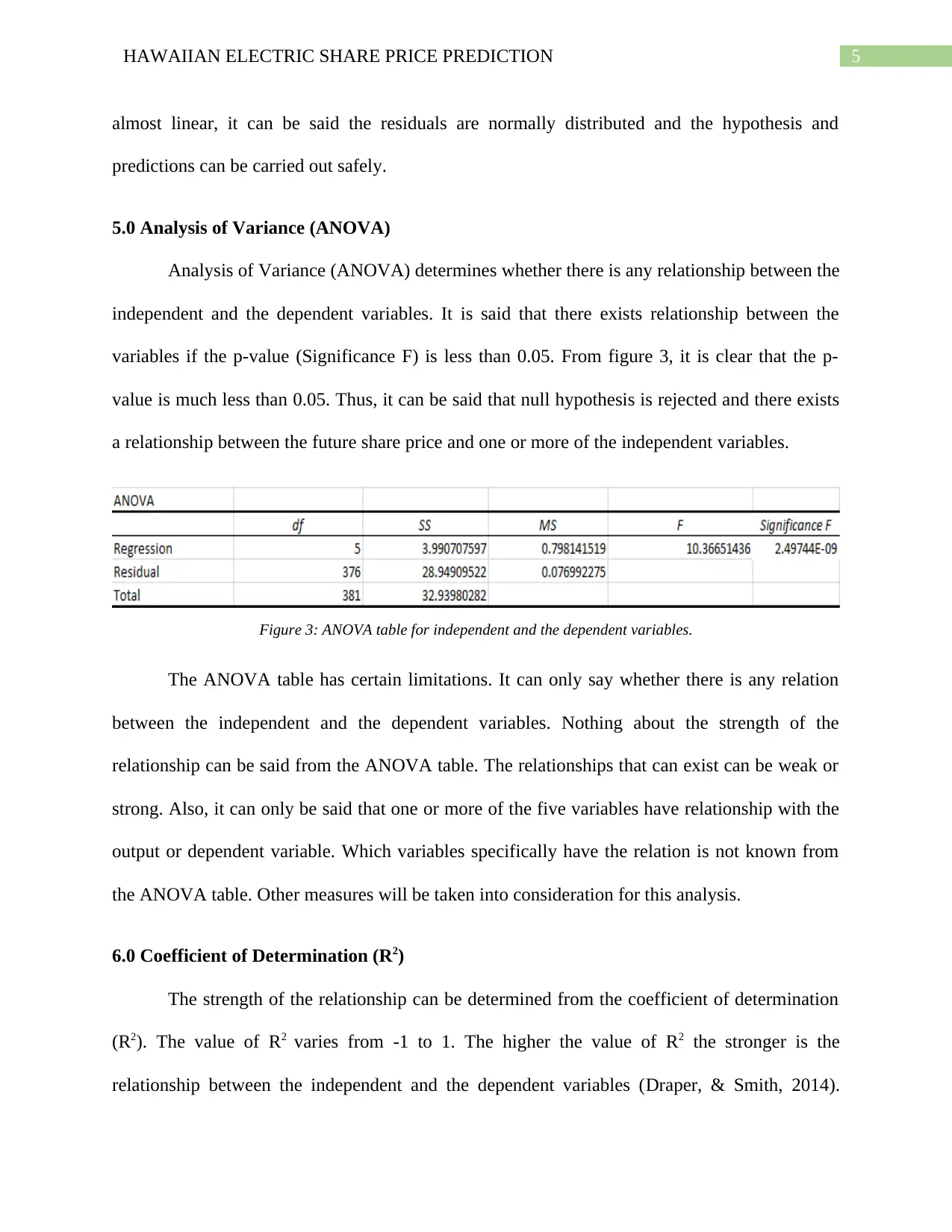

Analysis of Variance (ANOVA) determines whether there is any relationship between the

independent and the dependent variables. It is said that there exists relationship between the

variables if the p-value (Significance F) is less than 0.05. From figure 3, it is clear that the p-

value is much less than 0.05. Thus, it can be said that null hypothesis is rejected and there exists

a relationship between the future share price and one or more of the independent variables.

Figure 3: ANOVA table for independent and the dependent variables.

The ANOVA table has certain limitations. It can only say whether there is any relation

between the independent and the dependent variables. Nothing about the strength of the

relationship can be said from the ANOVA table. The relationships that can exist can be weak or

strong. Also, it can only be said that one or more of the five variables have relationship with the

output or dependent variable. Which variables specifically have the relation is not known from

the ANOVA table. Other measures will be taken into consideration for this analysis.

6.0 Coefficient of Determination (R2)

The strength of the relationship can be determined from the coefficient of determination

(R2). The value of R2 varies from -1 to 1. The higher the value of R2 the stronger is the

relationship between the independent and the dependent variables (Draper, & Smith, 2014).

almost linear, it can be said the residuals are normally distributed and the hypothesis and

predictions can be carried out safely.

5.0 Analysis of Variance (ANOVA)

Analysis of Variance (ANOVA) determines whether there is any relationship between the

independent and the dependent variables. It is said that there exists relationship between the

variables if the p-value (Significance F) is less than 0.05. From figure 3, it is clear that the p-

value is much less than 0.05. Thus, it can be said that null hypothesis is rejected and there exists

a relationship between the future share price and one or more of the independent variables.

Figure 3: ANOVA table for independent and the dependent variables.

The ANOVA table has certain limitations. It can only say whether there is any relation

between the independent and the dependent variables. Nothing about the strength of the

relationship can be said from the ANOVA table. The relationships that can exist can be weak or

strong. Also, it can only be said that one or more of the five variables have relationship with the

output or dependent variable. Which variables specifically have the relation is not known from

the ANOVA table. Other measures will be taken into consideration for this analysis.

6.0 Coefficient of Determination (R2)

The strength of the relationship can be determined from the coefficient of determination

(R2). The value of R2 varies from -1 to 1. The higher the value of R2 the stronger is the

relationship between the independent and the dependent variables (Draper, & Smith, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

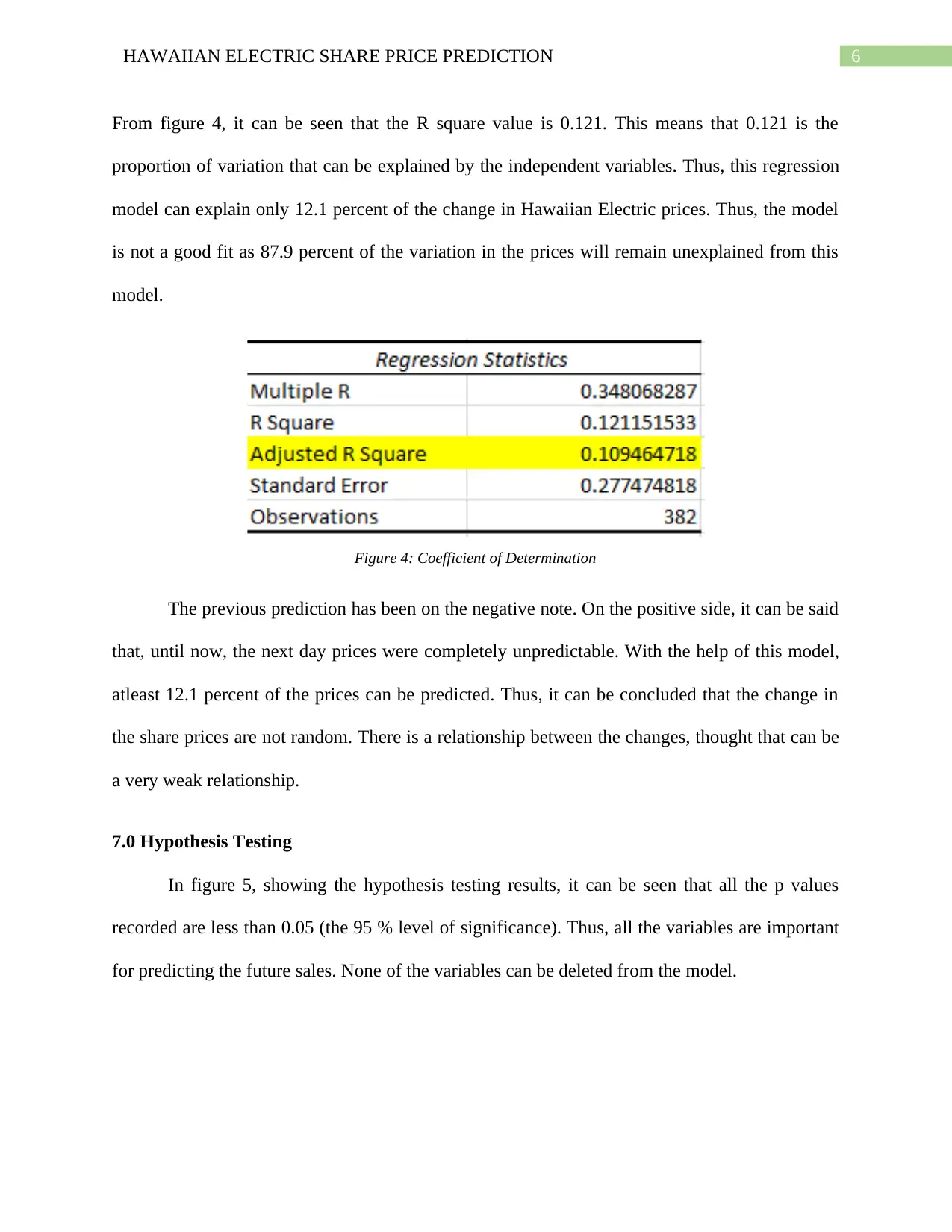

From figure 4, it can be seen that the R square value is 0.121. This means that 0.121 is the

proportion of variation that can be explained by the independent variables. Thus, this regression

model can explain only 12.1 percent of the change in Hawaiian Electric prices. Thus, the model

is not a good fit as 87.9 percent of the variation in the prices will remain unexplained from this

model.

Figure 4: Coefficient of Determination

The previous prediction has been on the negative note. On the positive side, it can be said

that, until now, the next day prices were completely unpredictable. With the help of this model,

atleast 12.1 percent of the prices can be predicted. Thus, it can be concluded that the change in

the share prices are not random. There is a relationship between the changes, thought that can be

a very weak relationship.

7.0 Hypothesis Testing

In figure 5, showing the hypothesis testing results, it can be seen that all the p values

recorded are less than 0.05 (the 95 % level of significance). Thus, all the variables are important

for predicting the future sales. None of the variables can be deleted from the model.

From figure 4, it can be seen that the R square value is 0.121. This means that 0.121 is the

proportion of variation that can be explained by the independent variables. Thus, this regression

model can explain only 12.1 percent of the change in Hawaiian Electric prices. Thus, the model

is not a good fit as 87.9 percent of the variation in the prices will remain unexplained from this

model.

Figure 4: Coefficient of Determination

The previous prediction has been on the negative note. On the positive side, it can be said

that, until now, the next day prices were completely unpredictable. With the help of this model,

atleast 12.1 percent of the prices can be predicted. Thus, it can be concluded that the change in

the share prices are not random. There is a relationship between the changes, thought that can be

a very weak relationship.

7.0 Hypothesis Testing

In figure 5, showing the hypothesis testing results, it can be seen that all the p values

recorded are less than 0.05 (the 95 % level of significance). Thus, all the variables are important

for predicting the future sales. None of the variables can be deleted from the model.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

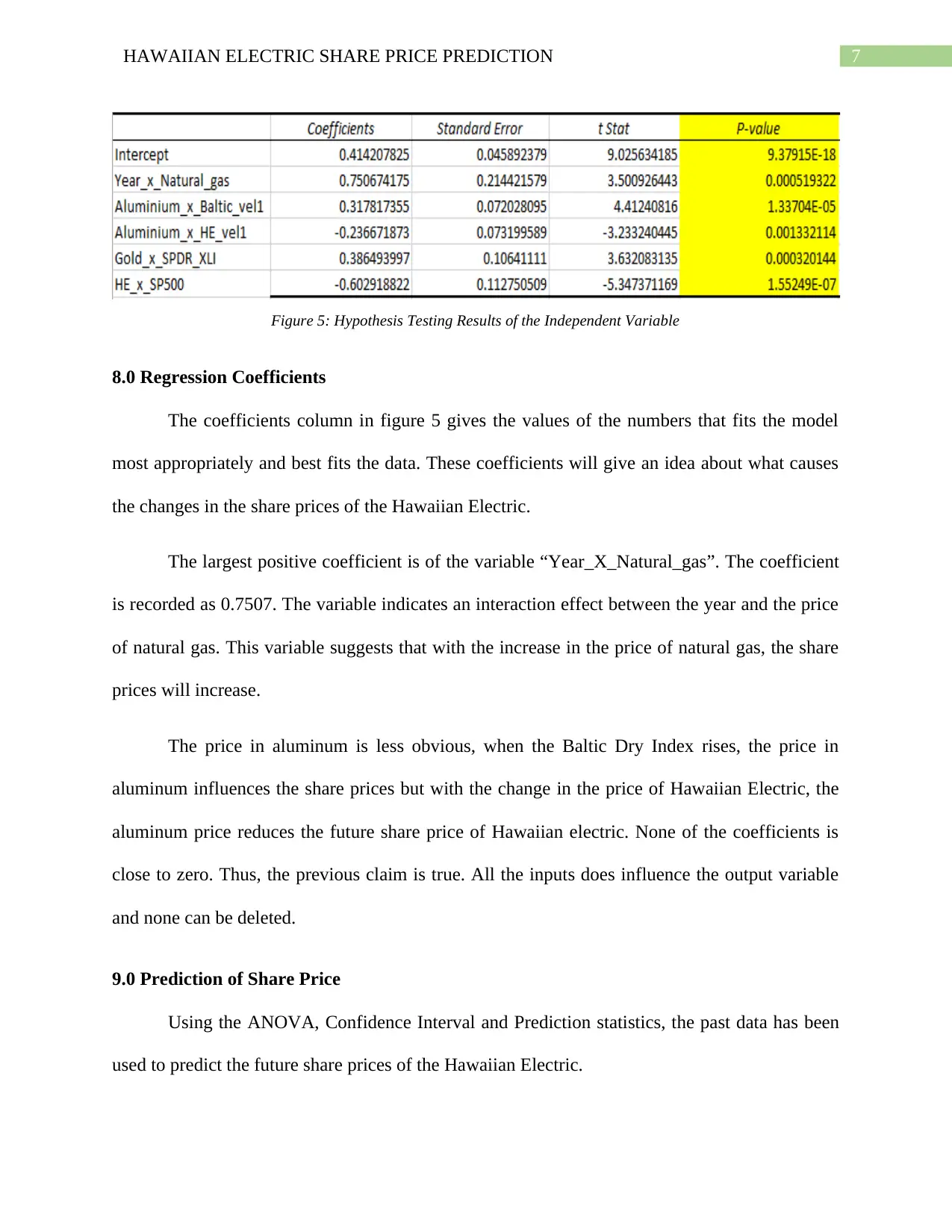

Figure 5: Hypothesis Testing Results of the Independent Variable

8.0 Regression Coefficients

The coefficients column in figure 5 gives the values of the numbers that fits the model

most appropriately and best fits the data. These coefficients will give an idea about what causes

the changes in the share prices of the Hawaiian Electric.

The largest positive coefficient is of the variable “Year_X_Natural_gas”. The coefficient

is recorded as 0.7507. The variable indicates an interaction effect between the year and the price

of natural gas. This variable suggests that with the increase in the price of natural gas, the share

prices will increase.

The price in aluminum is less obvious, when the Baltic Dry Index rises, the price in

aluminum influences the share prices but with the change in the price of Hawaiian Electric, the

aluminum price reduces the future share price of Hawaiian electric. None of the coefficients is

close to zero. Thus, the previous claim is true. All the inputs does influence the output variable

and none can be deleted.

9.0 Prediction of Share Price

Using the ANOVA, Confidence Interval and Prediction statistics, the past data has been

used to predict the future share prices of the Hawaiian Electric.

Figure 5: Hypothesis Testing Results of the Independent Variable

8.0 Regression Coefficients

The coefficients column in figure 5 gives the values of the numbers that fits the model

most appropriately and best fits the data. These coefficients will give an idea about what causes

the changes in the share prices of the Hawaiian Electric.

The largest positive coefficient is of the variable “Year_X_Natural_gas”. The coefficient

is recorded as 0.7507. The variable indicates an interaction effect between the year and the price

of natural gas. This variable suggests that with the increase in the price of natural gas, the share

prices will increase.

The price in aluminum is less obvious, when the Baltic Dry Index rises, the price in

aluminum influences the share prices but with the change in the price of Hawaiian Electric, the

aluminum price reduces the future share price of Hawaiian electric. None of the coefficients is

close to zero. Thus, the previous claim is true. All the inputs does influence the output variable

and none can be deleted.

9.0 Prediction of Share Price

Using the ANOVA, Confidence Interval and Prediction statistics, the past data has been

used to predict the future share prices of the Hawaiian Electric.

8HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

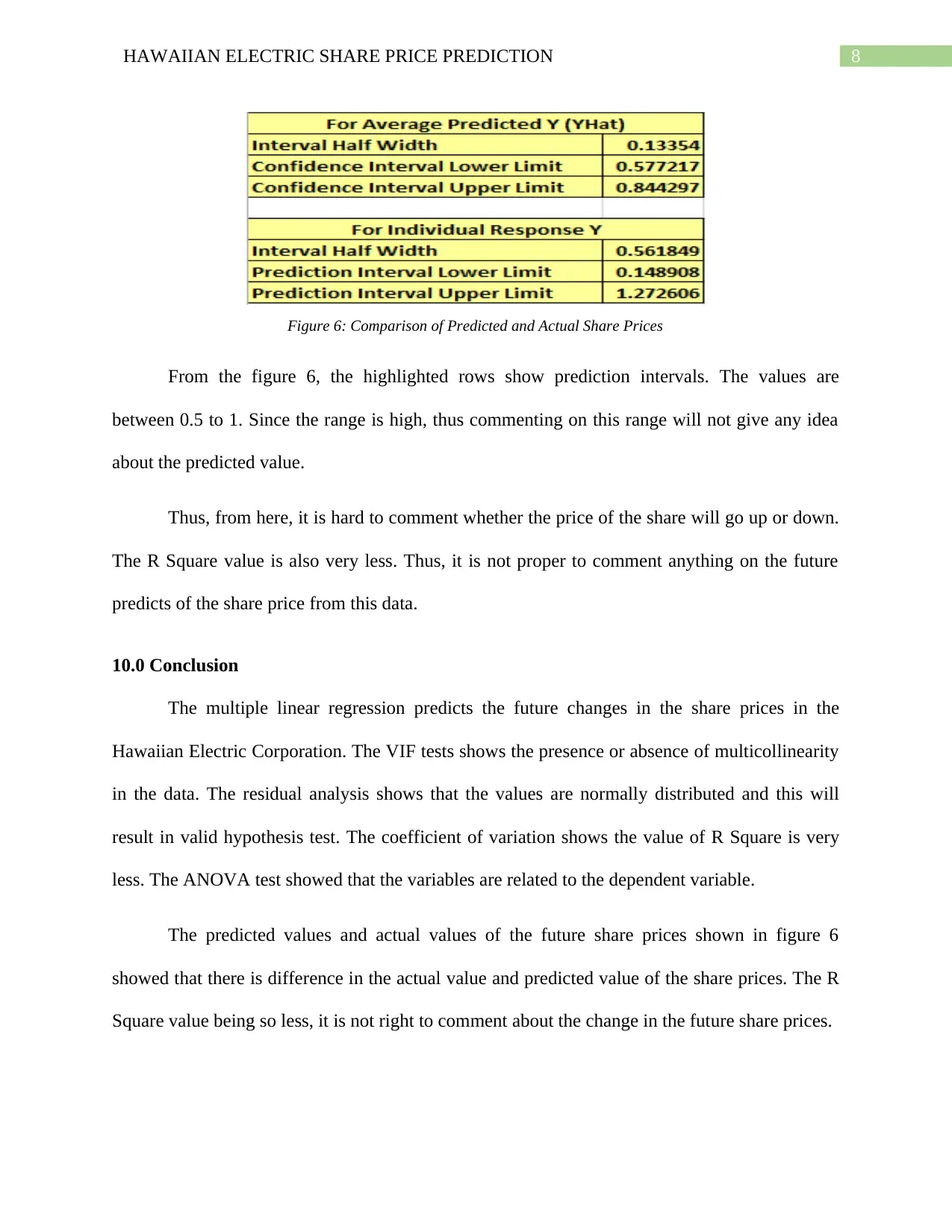

Figure 6: Comparison of Predicted and Actual Share Prices

From the figure 6, the highlighted rows show prediction intervals. The values are

between 0.5 to 1. Since the range is high, thus commenting on this range will not give any idea

about the predicted value.

Thus, from here, it is hard to comment whether the price of the share will go up or down.

The R Square value is also very less. Thus, it is not proper to comment anything on the future

predicts of the share price from this data.

10.0 Conclusion

The multiple linear regression predicts the future changes in the share prices in the

Hawaiian Electric Corporation. The VIF tests shows the presence or absence of multicollinearity

in the data. The residual analysis shows that the values are normally distributed and this will

result in valid hypothesis test. The coefficient of variation shows the value of R Square is very

less. The ANOVA test showed that the variables are related to the dependent variable.

The predicted values and actual values of the future share prices shown in figure 6

showed that there is difference in the actual value and predicted value of the share prices. The R

Square value being so less, it is not right to comment about the change in the future share prices.

Figure 6: Comparison of Predicted and Actual Share Prices

From the figure 6, the highlighted rows show prediction intervals. The values are

between 0.5 to 1. Since the range is high, thus commenting on this range will not give any idea

about the predicted value.

Thus, from here, it is hard to comment whether the price of the share will go up or down.

The R Square value is also very less. Thus, it is not proper to comment anything on the future

predicts of the share price from this data.

10.0 Conclusion

The multiple linear regression predicts the future changes in the share prices in the

Hawaiian Electric Corporation. The VIF tests shows the presence or absence of multicollinearity

in the data. The residual analysis shows that the values are normally distributed and this will

result in valid hypothesis test. The coefficient of variation shows the value of R Square is very

less. The ANOVA test showed that the variables are related to the dependent variable.

The predicted values and actual values of the future share prices shown in figure 6

showed that there is difference in the actual value and predicted value of the share prices. The R

Square value being so less, it is not right to comment about the change in the future share prices.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

References

Draper, N. R., & Smith, H. (2014). Applied regression analysis. John Wiley & Sons.

García, C. B., García, J., López Martín, M. M., & Salmerón, R. (2015). Collinearity: Revisiting

the variance inflation factor in ridge regression. Journal of Applied Statistics, 42(3), 648-661.

References

Draper, N. R., & Smith, H. (2014). Applied regression analysis. John Wiley & Sons.

García, C. B., García, J., López Martín, M. M., & Salmerón, R. (2015). Collinearity: Revisiting

the variance inflation factor in ridge regression. Journal of Applied Statistics, 42(3), 648-661.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10HAWAIIAN ELECTRIC SHARE PRICE PREDICTION

Appendix A: VIF Values

Appendix A: VIF Values

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.