Comprehensive Financial Analysis of Stock Performance Project Report

VerifiedAdded on 2020/05/28

|17

|3852

|53

Project

AI Summary

This project report presents a comprehensive analysis of the stock performance of four companies: Telstra, Woodside Petroleum, Unilever Plc, and Capital Land plc. The report includes a list of stocks, their prices, and investment amounts. It details the week-wise performance of each stock over an eight-week period, providing percentage changes and the primary reasons behind these fluctuations. Furthermore, the report compares the stock performance of Telstra and Woodside Petroleum with the ASX 200 index, and Unilever Plc and Capital Land plc with the NYSE and STI indices, respectively. The analysis highlights the correlation between the companies' stock prices and the respective market indices, considering both internal and external factors influencing stock movements. The report uses charts to visually represent the stock trends and concludes with insights into market dependencies and the factors affecting stock prices.

Running Head: Finances

1

Project Report: Finances

1

Project Report: Finances

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finances

2

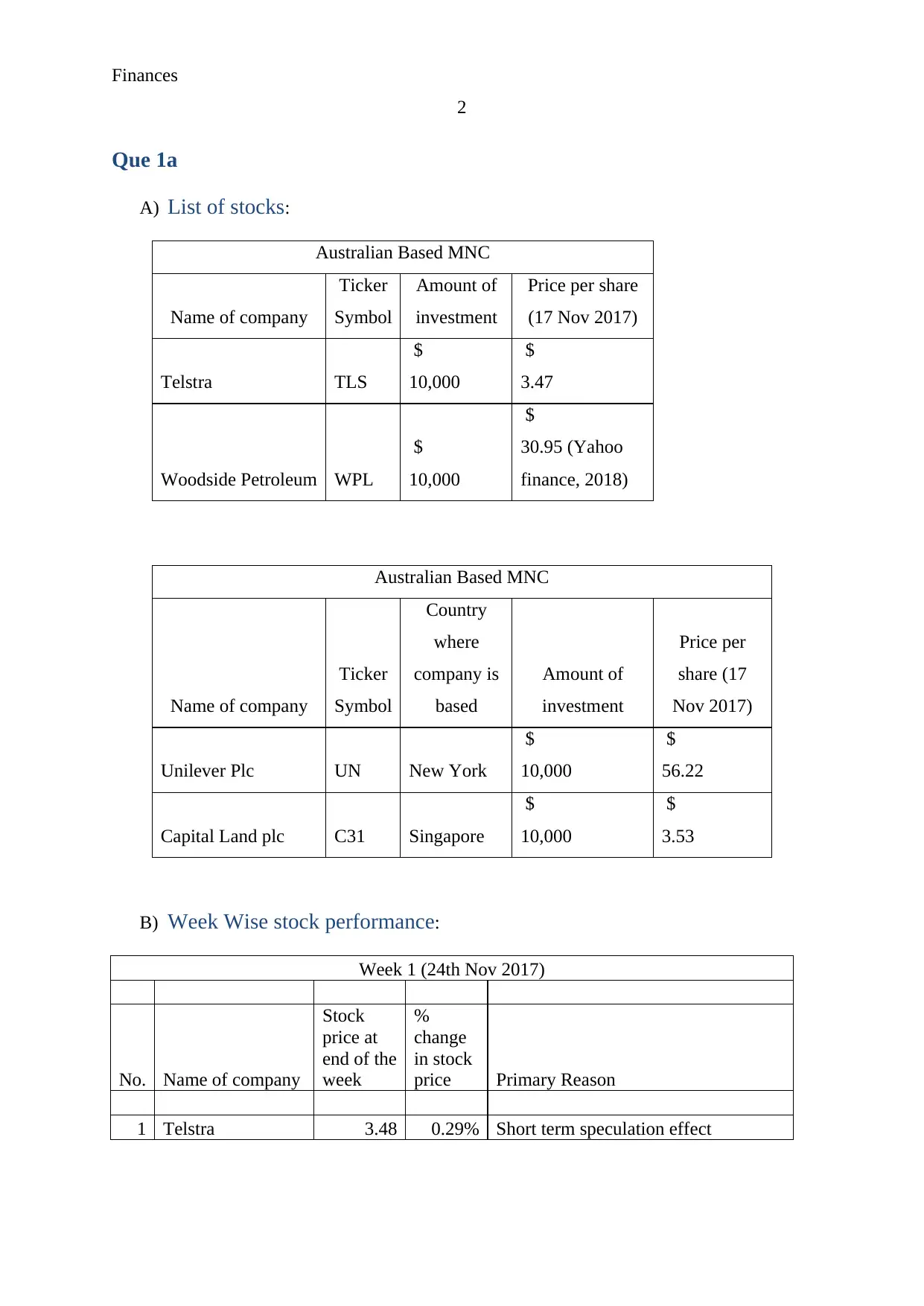

Que 1a

A) List of stocks:

Australian Based MNC

Name of company

Ticker

Symbol

Amount of

investment

Price per share

(17 Nov 2017)

Telstra TLS

$

10,000

$

3.47

Woodside Petroleum WPL

$

10,000

$

30.95 (Yahoo

finance, 2018)

Australian Based MNC

Name of company

Ticker

Symbol

Country

where

company is

based

Amount of

investment

Price per

share (17

Nov 2017)

Unilever Plc UN New York

$

10,000

$

56.22

Capital Land plc C31 Singapore

$

10,000

$

3.53

B) Week Wise stock performance:

Week 1 (24th Nov 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.48 0.29% Short term speculation effect

2

Que 1a

A) List of stocks:

Australian Based MNC

Name of company

Ticker

Symbol

Amount of

investment

Price per share

(17 Nov 2017)

Telstra TLS

$

10,000

$

3.47

Woodside Petroleum WPL

$

10,000

$

30.95 (Yahoo

finance, 2018)

Australian Based MNC

Name of company

Ticker

Symbol

Country

where

company is

based

Amount of

investment

Price per

share (17

Nov 2017)

Unilever Plc UN New York

$

10,000

$

56.22

Capital Land plc C31 Singapore

$

10,000

$

3.53

B) Week Wise stock performance:

Week 1 (24th Nov 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.48 0.29% Short term speculation effect

Finances

3

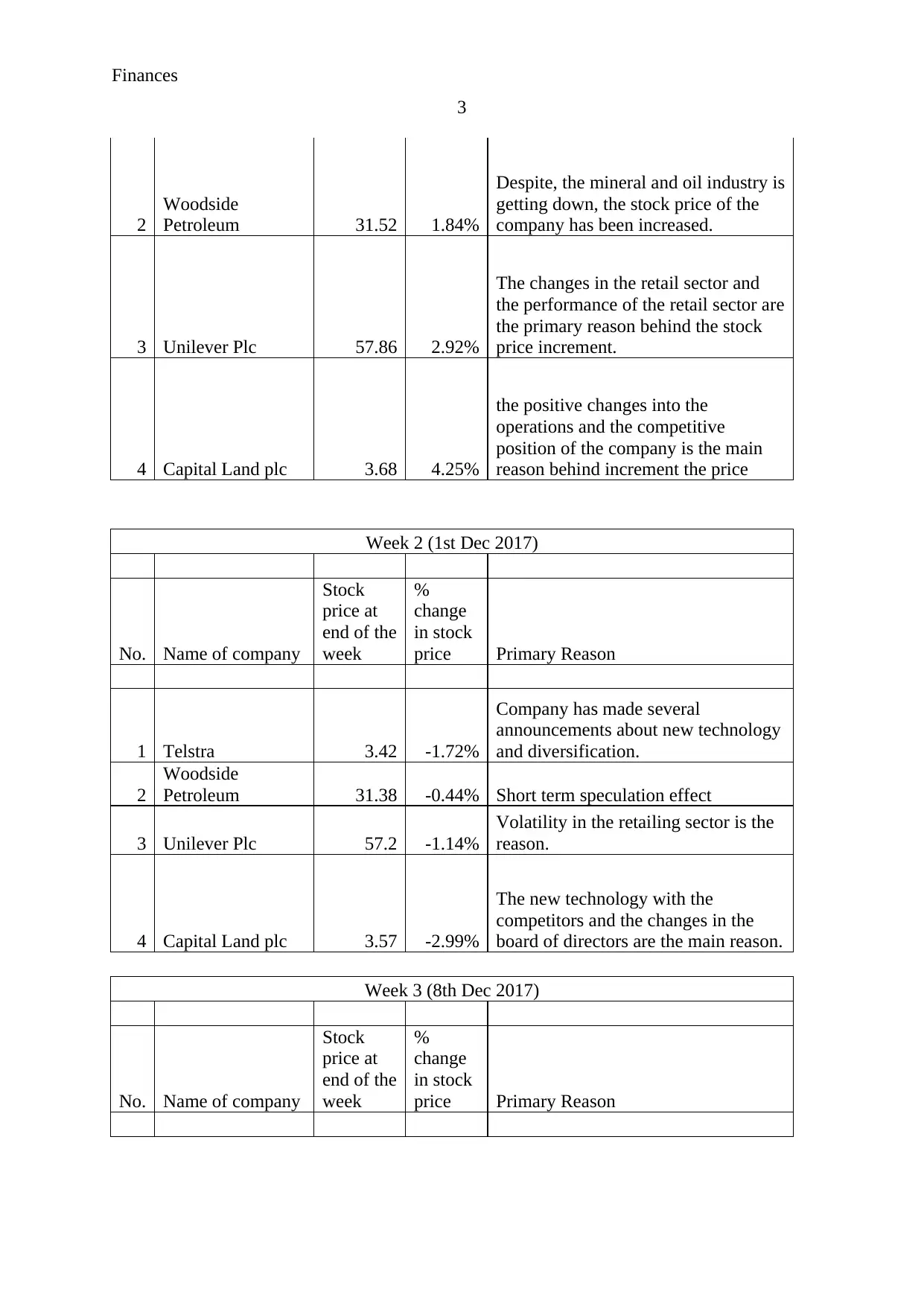

2

Woodside

Petroleum 31.52 1.84%

Despite, the mineral and oil industry is

getting down, the stock price of the

company has been increased.

3 Unilever Plc 57.86 2.92%

The changes in the retail sector and

the performance of the retail sector are

the primary reason behind the stock

price increment.

4 Capital Land plc 3.68 4.25%

the positive changes into the

operations and the competitive

position of the company is the main

reason behind increment the price

Week 2 (1st Dec 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.42 -1.72%

Company has made several

announcements about new technology

and diversification.

2

Woodside

Petroleum 31.38 -0.44% Short term speculation effect

3 Unilever Plc 57.2 -1.14%

Volatility in the retailing sector is the

reason.

4 Capital Land plc 3.57 -2.99%

The new technology with the

competitors and the changes in the

board of directors are the main reason.

Week 3 (8th Dec 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

3

2

Woodside

Petroleum 31.52 1.84%

Despite, the mineral and oil industry is

getting down, the stock price of the

company has been increased.

3 Unilever Plc 57.86 2.92%

The changes in the retail sector and

the performance of the retail sector are

the primary reason behind the stock

price increment.

4 Capital Land plc 3.68 4.25%

the positive changes into the

operations and the competitive

position of the company is the main

reason behind increment the price

Week 2 (1st Dec 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.42 -1.72%

Company has made several

announcements about new technology

and diversification.

2

Woodside

Petroleum 31.38 -0.44% Short term speculation effect

3 Unilever Plc 57.2 -1.14%

Volatility in the retailing sector is the

reason.

4 Capital Land plc 3.57 -2.99%

The new technology with the

competitors and the changes in the

board of directors are the main reason.

Week 3 (8th Dec 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finances

4

1 Telstra 3.69 7.89%

Company has just announced the

annual report and the financial

performance of the company is

positive (Yahoo finance, 2018).

2

Woodside

Petroleum 31.56 0.57% Short term speculation effect

3 Unilever Plc 57.69 0.86% Short term speculation effect

4 Capital Land plc 3.46 -3.08%

The trend of stock price decrement

has been continued in this week as

well.

Week 4 (15th Dec 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.69 0.00%

No changes have taken place into the

stock price of the company in a weak

which express that the stock price of

the company is stable

2

Woodside

Petroleum 31.87 0.98%

Short term speculation effect (Yahoo

finance, 2018).

3 Unilever Plc 57.1 -1.02%

Volatility in the retailing sector is the

reason.

4 Capital Land plc 3.5 1.16%

The changes in the operations and the

new announcement about the projects

are the reason.

Week 5 (22th Dec 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.66 -0.81% Short term speculation effect

4

1 Telstra 3.69 7.89%

Company has just announced the

annual report and the financial

performance of the company is

positive (Yahoo finance, 2018).

2

Woodside

Petroleum 31.56 0.57% Short term speculation effect

3 Unilever Plc 57.69 0.86% Short term speculation effect

4 Capital Land plc 3.46 -3.08%

The trend of stock price decrement

has been continued in this week as

well.

Week 4 (15th Dec 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.69 0.00%

No changes have taken place into the

stock price of the company in a weak

which express that the stock price of

the company is stable

2

Woodside

Petroleum 31.87 0.98%

Short term speculation effect (Yahoo

finance, 2018).

3 Unilever Plc 57.1 -1.02%

Volatility in the retailing sector is the

reason.

4 Capital Land plc 3.5 1.16%

The changes in the operations and the

new announcement about the projects

are the reason.

Week 5 (22th Dec 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.66 -0.81% Short term speculation effect

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finances

5

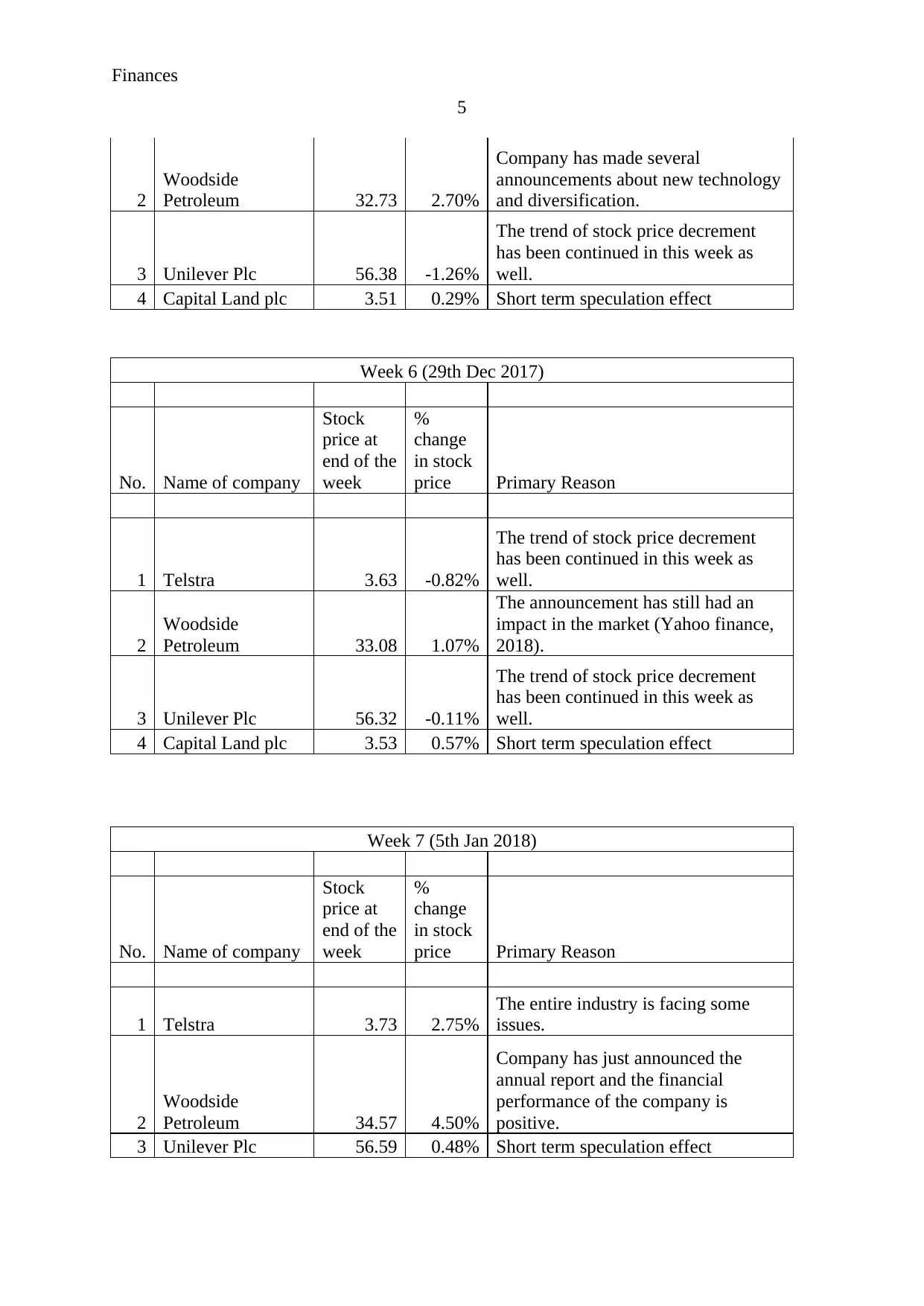

2

Woodside

Petroleum 32.73 2.70%

Company has made several

announcements about new technology

and diversification.

3 Unilever Plc 56.38 -1.26%

The trend of stock price decrement

has been continued in this week as

well.

4 Capital Land plc 3.51 0.29% Short term speculation effect

Week 6 (29th Dec 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.63 -0.82%

The trend of stock price decrement

has been continued in this week as

well.

2

Woodside

Petroleum 33.08 1.07%

The announcement has still had an

impact in the market (Yahoo finance,

2018).

3 Unilever Plc 56.32 -0.11%

The trend of stock price decrement

has been continued in this week as

well.

4 Capital Land plc 3.53 0.57% Short term speculation effect

Week 7 (5th Jan 2018)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.73 2.75%

The entire industry is facing some

issues.

2

Woodside

Petroleum 34.57 4.50%

Company has just announced the

annual report and the financial

performance of the company is

positive.

3 Unilever Plc 56.59 0.48% Short term speculation effect

5

2

Woodside

Petroleum 32.73 2.70%

Company has made several

announcements about new technology

and diversification.

3 Unilever Plc 56.38 -1.26%

The trend of stock price decrement

has been continued in this week as

well.

4 Capital Land plc 3.51 0.29% Short term speculation effect

Week 6 (29th Dec 2017)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.63 -0.82%

The trend of stock price decrement

has been continued in this week as

well.

2

Woodside

Petroleum 33.08 1.07%

The announcement has still had an

impact in the market (Yahoo finance,

2018).

3 Unilever Plc 56.32 -0.11%

The trend of stock price decrement

has been continued in this week as

well.

4 Capital Land plc 3.53 0.57% Short term speculation effect

Week 7 (5th Jan 2018)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.73 2.75%

The entire industry is facing some

issues.

2

Woodside

Petroleum 34.57 4.50%

Company has just announced the

annual report and the financial

performance of the company is

positive.

3 Unilever Plc 56.59 0.48% Short term speculation effect

Finances

6

4 Capital Land plc 3.65 3.40%

The analysts have announced that the

company is one of the best

opportunities for the investors.

Week 8 (12th Jan 2018)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.74 0.27%

Short term speculation effect (Yahoo

finance, 2018).

2

Woodside

Petroleum 34.48 -0.26%

The company has expressed lower

dividends in its annual report in

comparison with the last quarter and

thus the stock price of the company

has been affected.

3 Unilever Plc 55.49 -1.94%

Though, the company is earnings

great revenue but still the stock price

has been lower which express about

the less interest of the investors.

4 Capital Land plc 3.78 3.56%

Company has just announced the

annual report and the financial

performance of the company is

positive.

Week 9 (26th Jan 2018)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.79 1.34%

The entire industry is enjoying a great

growth

2

Woodside

Petroleum 34.24 -0.70% Short term speculation effect

6

4 Capital Land plc 3.65 3.40%

The analysts have announced that the

company is one of the best

opportunities for the investors.

Week 8 (12th Jan 2018)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.74 0.27%

Short term speculation effect (Yahoo

finance, 2018).

2

Woodside

Petroleum 34.48 -0.26%

The company has expressed lower

dividends in its annual report in

comparison with the last quarter and

thus the stock price of the company

has been affected.

3 Unilever Plc 55.49 -1.94%

Though, the company is earnings

great revenue but still the stock price

has been lower which express about

the less interest of the investors.

4 Capital Land plc 3.78 3.56%

Company has just announced the

annual report and the financial

performance of the company is

positive.

Week 9 (26th Jan 2018)

No. Name of company

Stock

price at

end of the

week

%

change

in stock

price Primary Reason

1 Telstra 3.79 1.34%

The entire industry is enjoying a great

growth

2

Woodside

Petroleum 34.24 -0.70% Short term speculation effect

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finances

7

3 Unilever Plc 57.37 3.39%

Volatility in the retailing sector is the

reason.

4 Capital Land plc 3.76 -0.53% Short term speculation effect

Que 1b

Que 2

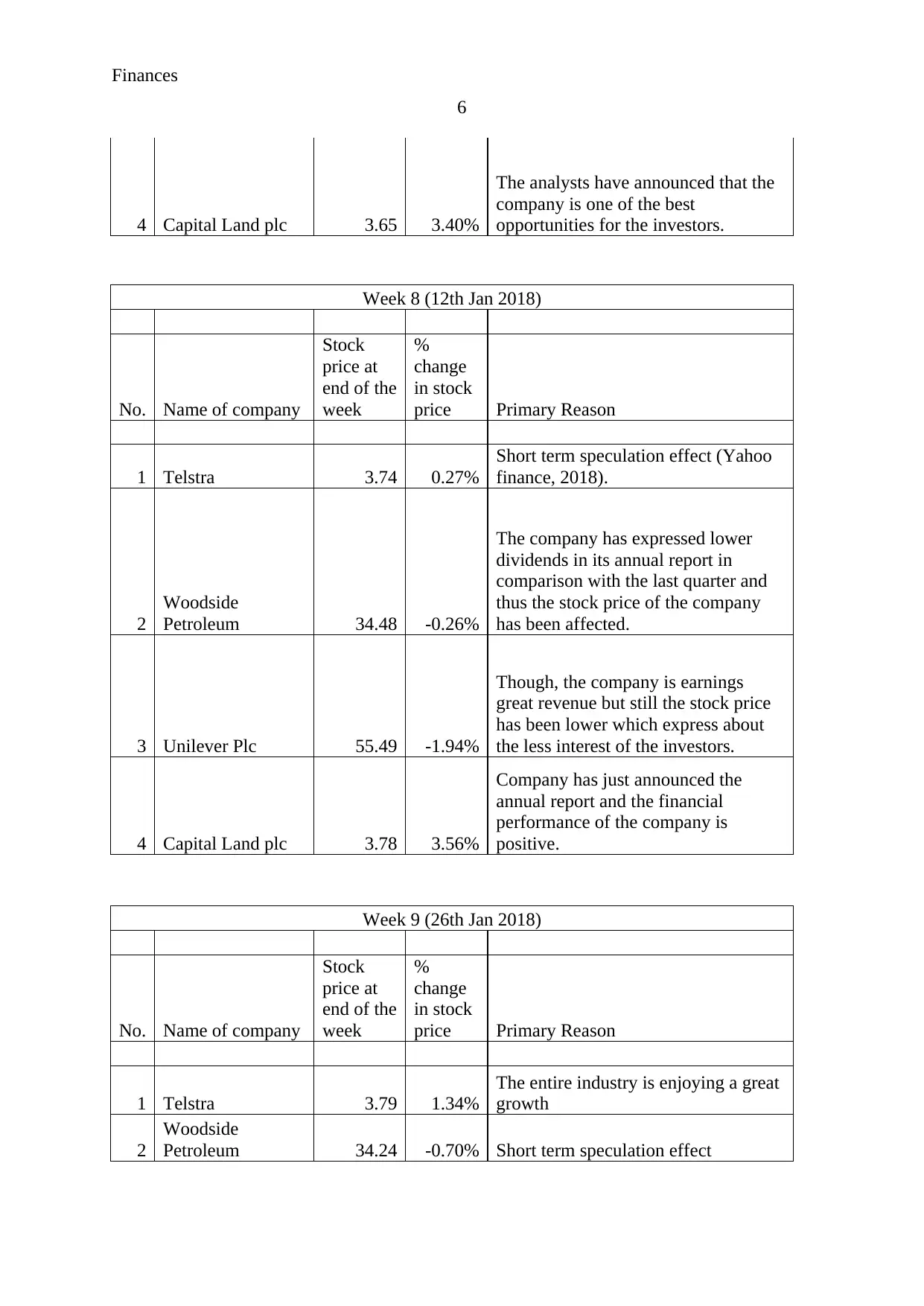

Telstra Vs ASX:

Figure 1: Telstra Vs ASX 200

The above chart explains that the prices of Telstra are moving upwards and downward

continuously and it has not a direct connection with the ASX stock price. The ASX prices are

not moving in the same trend. In august month, the stock price of the company was on

highest but with the time; the stock price of the company has been lowered. Though, it has

also been found that the stock price of the company has been affected through various

industrial factors (Yahoo finance, 2018). Further, it has been investigated that this stocks are

enough independent to manage its stock prices in the market (Shapiro, 2005).

Woodside petroleum Vs ASX:

7

3 Unilever Plc 57.37 3.39%

Volatility in the retailing sector is the

reason.

4 Capital Land plc 3.76 -0.53% Short term speculation effect

Que 1b

Que 2

Telstra Vs ASX:

Figure 1: Telstra Vs ASX 200

The above chart explains that the prices of Telstra are moving upwards and downward

continuously and it has not a direct connection with the ASX stock price. The ASX prices are

not moving in the same trend. In august month, the stock price of the company was on

highest but with the time; the stock price of the company has been lowered. Though, it has

also been found that the stock price of the company has been affected through various

industrial factors (Yahoo finance, 2018). Further, it has been investigated that this stocks are

enough independent to manage its stock prices in the market (Shapiro, 2005).

Woodside petroleum Vs ASX:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finances

8

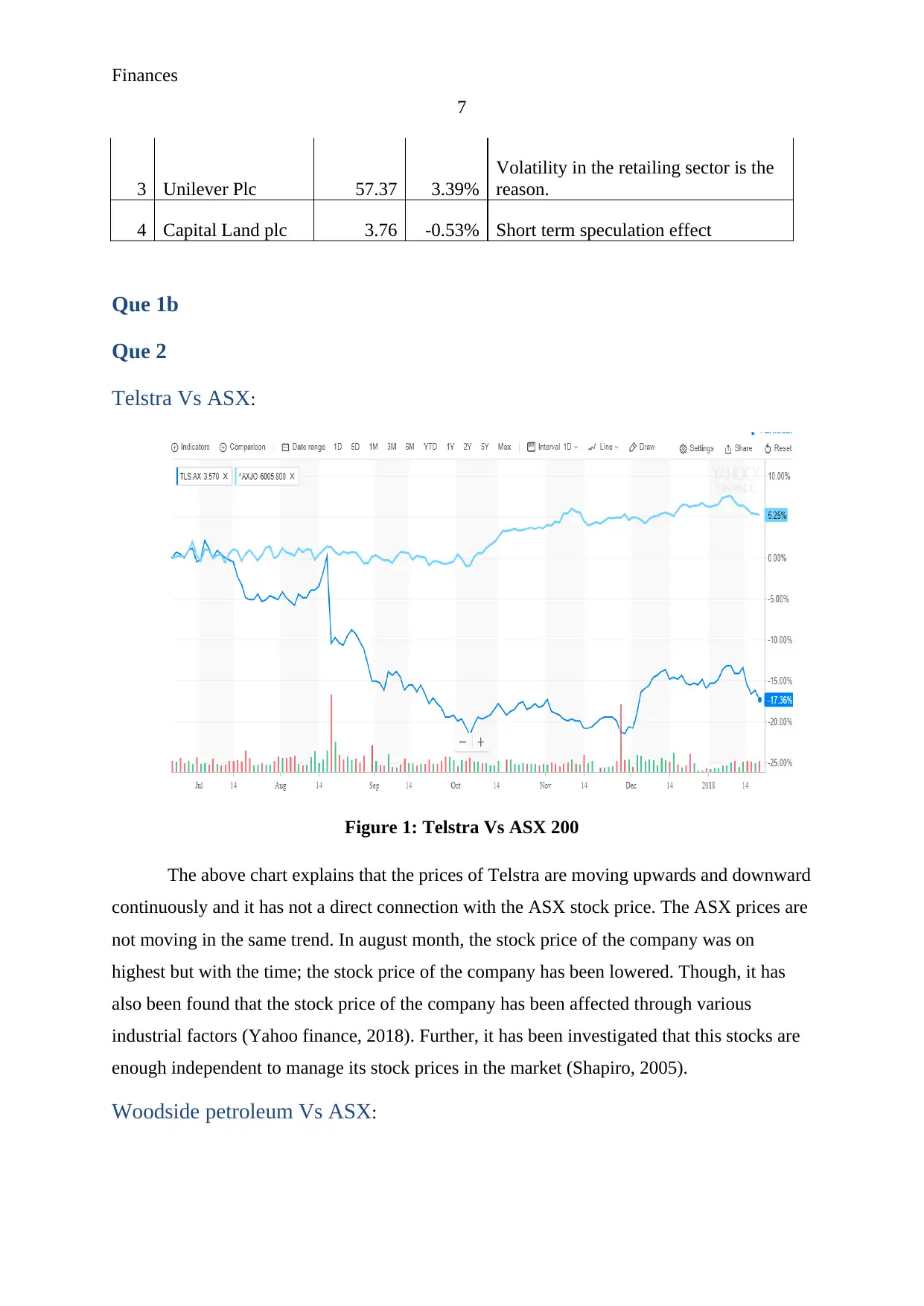

Figure 2: Woodside Vs ASX

The above chart explains that the prices of Woodside limited are somehow connected

with the price of ASX. The ASX trend directly affects over the stock price of Woodside

limited. These changes take place due to global presence of the company. Though, it has also

been found that there are various other factors also which have affected the stock price of the

company (Du & Girma, 2009). Further, it has been investigated that this stocks are enough

independent to manage its performance in the market.

Que 3a

Unilever plc Vs NYSE:

8

Figure 2: Woodside Vs ASX

The above chart explains that the prices of Woodside limited are somehow connected

with the price of ASX. The ASX trend directly affects over the stock price of Woodside

limited. These changes take place due to global presence of the company. Though, it has also

been found that there are various other factors also which have affected the stock price of the

company (Du & Girma, 2009). Further, it has been investigated that this stocks are enough

independent to manage its performance in the market.

Que 3a

Unilever plc Vs NYSE:

Finances

9

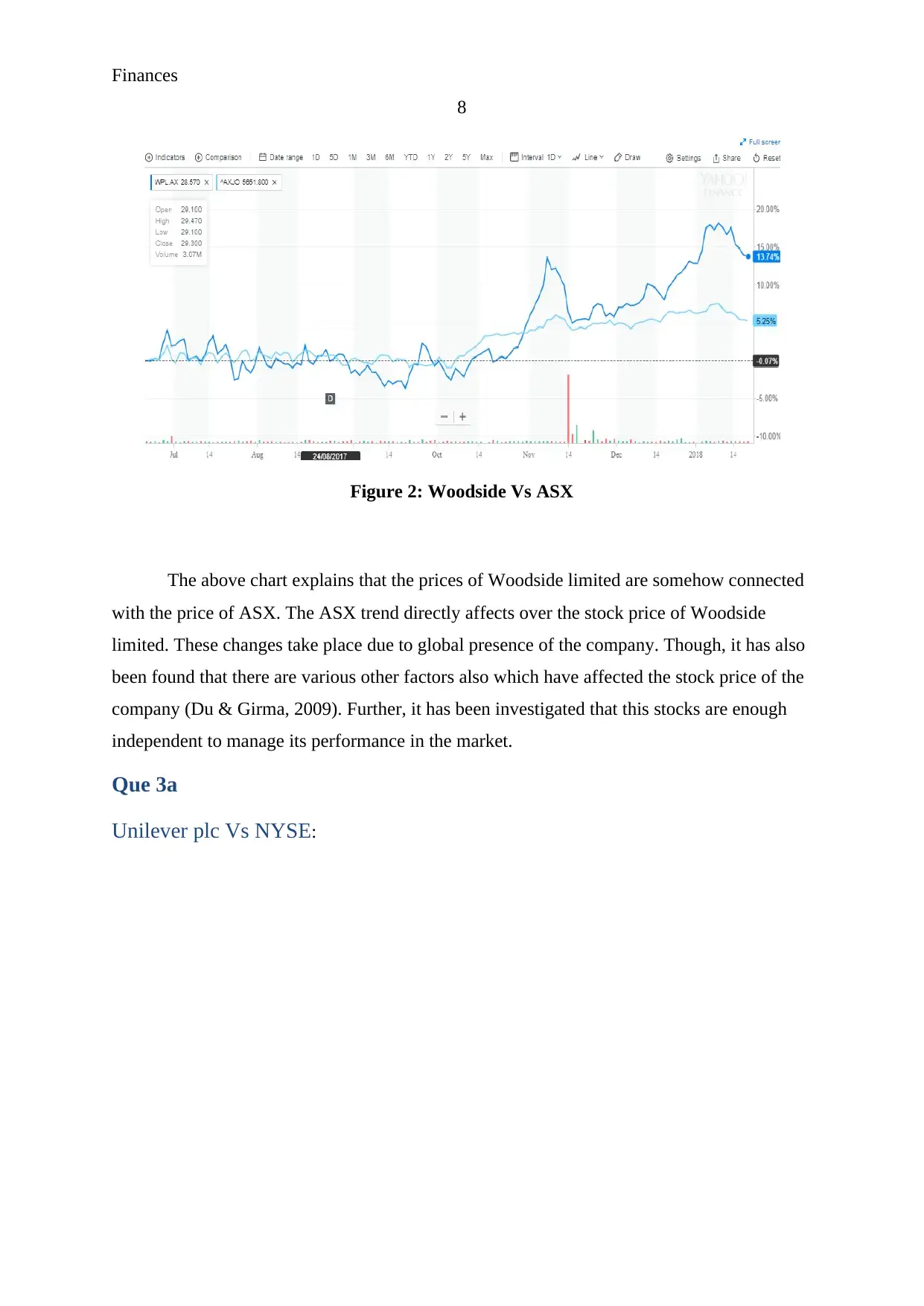

Figure 2: Unilever Plc Vs NYSE

The above chart explains that the prices of Uniliver plc are somehow connected with

the price of NYSE. The NYSE trend directly affects over the stock price of Unilever plc.

These changes take place due to global presence of the company. Though, it has also been

found that there are various other factors also which have affected the stock price of the

company (Yahoo finance, 2018). Further, it has been investigated that this stocks are only

dependent on the NYSE prices as well.

Capital land Vs STI:

9

Figure 2: Unilever Plc Vs NYSE

The above chart explains that the prices of Uniliver plc are somehow connected with

the price of NYSE. The NYSE trend directly affects over the stock price of Unilever plc.

These changes take place due to global presence of the company. Though, it has also been

found that there are various other factors also which have affected the stock price of the

company (Yahoo finance, 2018). Further, it has been investigated that this stocks are only

dependent on the NYSE prices as well.

Capital land Vs STI:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finances

10

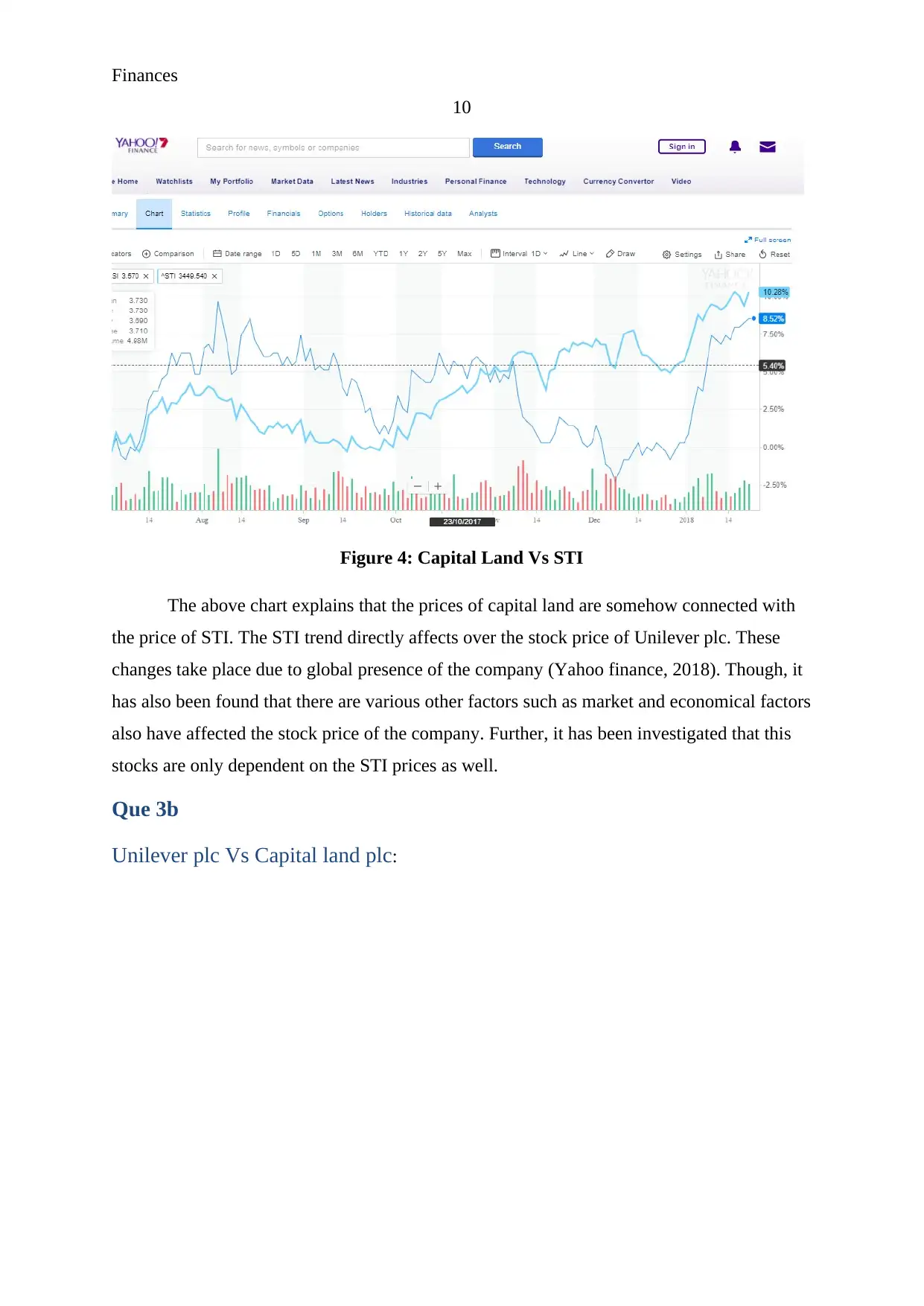

Figure 4: Capital Land Vs STI

The above chart explains that the prices of capital land are somehow connected with

the price of STI. The STI trend directly affects over the stock price of Unilever plc. These

changes take place due to global presence of the company (Yahoo finance, 2018). Though, it

has also been found that there are various other factors such as market and economical factors

also have affected the stock price of the company. Further, it has been investigated that this

stocks are only dependent on the STI prices as well.

Que 3b

Unilever plc Vs Capital land plc:

10

Figure 4: Capital Land Vs STI

The above chart explains that the prices of capital land are somehow connected with

the price of STI. The STI trend directly affects over the stock price of Unilever plc. These

changes take place due to global presence of the company (Yahoo finance, 2018). Though, it

has also been found that there are various other factors such as market and economical factors

also have affected the stock price of the company. Further, it has been investigated that this

stocks are only dependent on the STI prices as well.

Que 3b

Unilever plc Vs Capital land plc:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finances

11

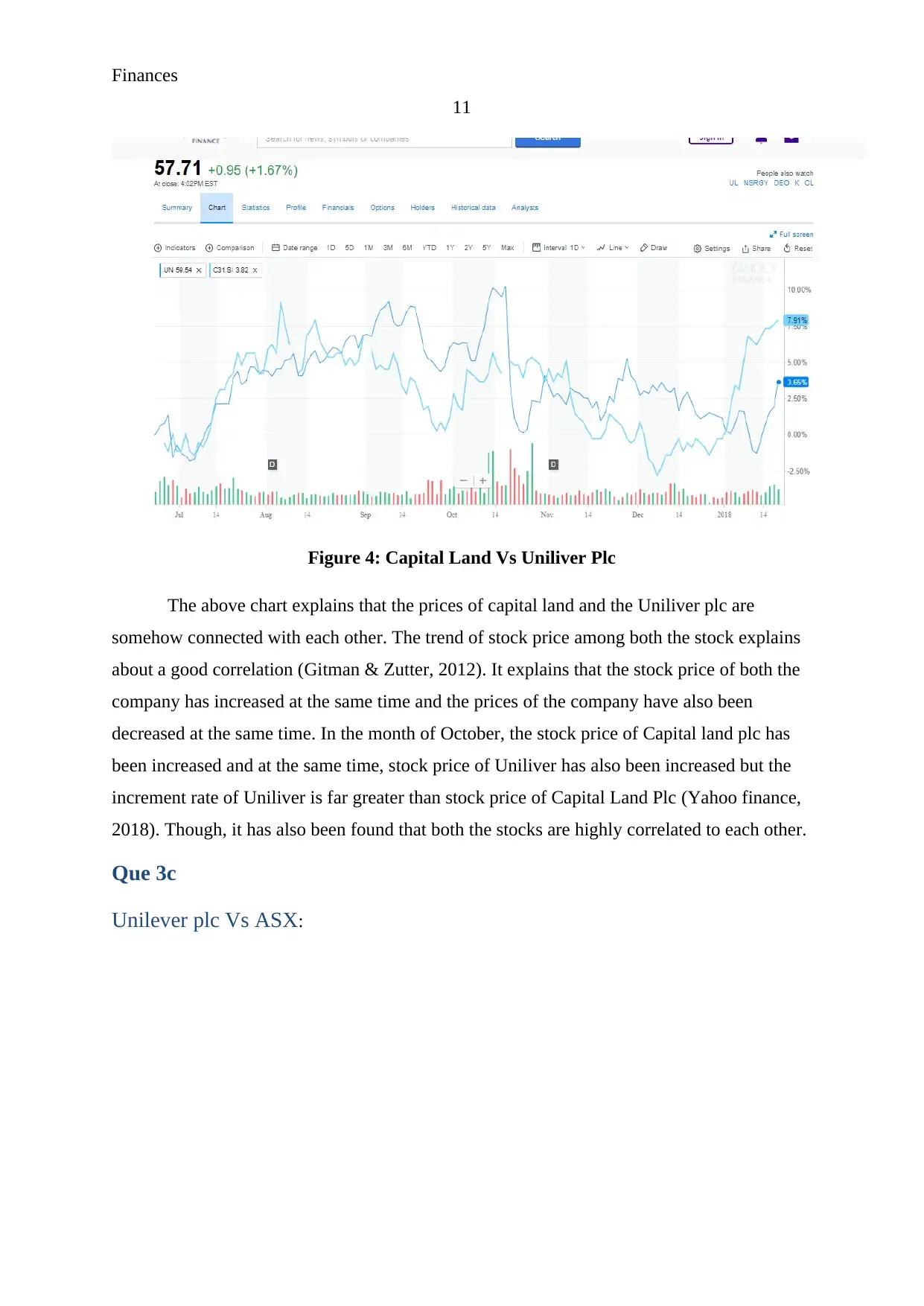

Figure 4: Capital Land Vs Uniliver Plc

The above chart explains that the prices of capital land and the Uniliver plc are

somehow connected with each other. The trend of stock price among both the stock explains

about a good correlation (Gitman & Zutter, 2012). It explains that the stock price of both the

company has increased at the same time and the prices of the company have also been

decreased at the same time. In the month of October, the stock price of Capital land plc has

been increased and at the same time, stock price of Uniliver has also been increased but the

increment rate of Uniliver is far greater than stock price of Capital Land Plc (Yahoo finance,

2018). Though, it has also been found that both the stocks are highly correlated to each other.

Que 3c

Unilever plc Vs ASX:

11

Figure 4: Capital Land Vs Uniliver Plc

The above chart explains that the prices of capital land and the Uniliver plc are

somehow connected with each other. The trend of stock price among both the stock explains

about a good correlation (Gitman & Zutter, 2012). It explains that the stock price of both the

company has increased at the same time and the prices of the company have also been

decreased at the same time. In the month of October, the stock price of Capital land plc has

been increased and at the same time, stock price of Uniliver has also been increased but the

increment rate of Uniliver is far greater than stock price of Capital Land Plc (Yahoo finance,

2018). Though, it has also been found that both the stocks are highly correlated to each other.

Que 3c

Unilever plc Vs ASX:

Finances

12

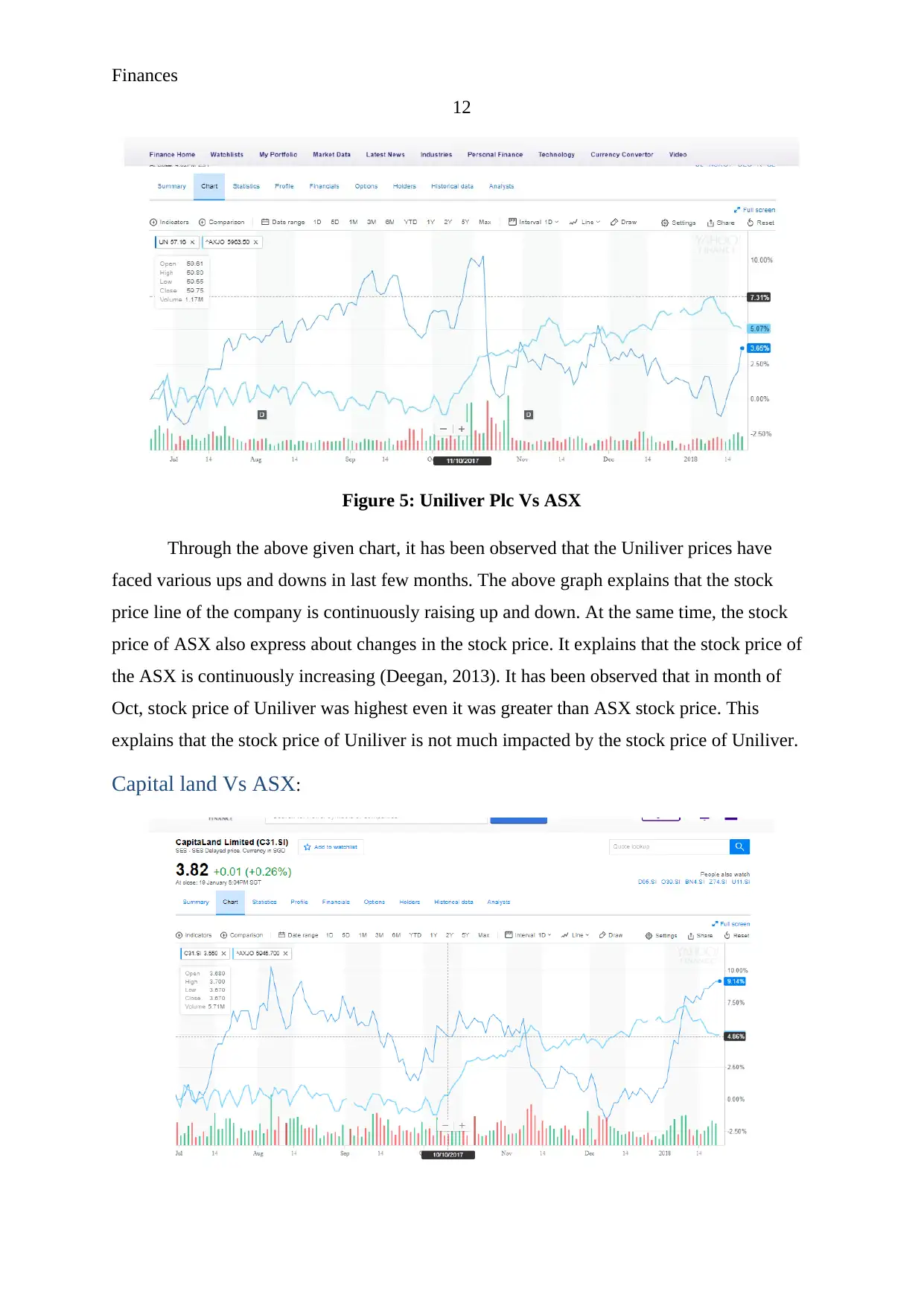

Figure 5: Uniliver Plc Vs ASX

Through the above given chart, it has been observed that the Uniliver prices have

faced various ups and downs in last few months. The above graph explains that the stock

price line of the company is continuously raising up and down. At the same time, the stock

price of ASX also express about changes in the stock price. It explains that the stock price of

the ASX is continuously increasing (Deegan, 2013). It has been observed that in month of

Oct, stock price of Uniliver was highest even it was greater than ASX stock price. This

explains that the stock price of Uniliver is not much impacted by the stock price of Uniliver.

Capital land Vs ASX:

12

Figure 5: Uniliver Plc Vs ASX

Through the above given chart, it has been observed that the Uniliver prices have

faced various ups and downs in last few months. The above graph explains that the stock

price line of the company is continuously raising up and down. At the same time, the stock

price of ASX also express about changes in the stock price. It explains that the stock price of

the ASX is continuously increasing (Deegan, 2013). It has been observed that in month of

Oct, stock price of Uniliver was highest even it was greater than ASX stock price. This

explains that the stock price of Uniliver is not much impacted by the stock price of Uniliver.

Capital land Vs ASX:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.