MBA643 - Project Risk, Finance, and Monitoring Report: Apple Inc.

VerifiedAdded on 2023/03/20

|10

|1868

|85

Report

AI Summary

This report examines project risk, finance, and monitoring for Apple Inc., as part of an MBA assignment. Part A analyzes project selection using investment appraisal techniques like NPV, payback period, and IRR, cost management strategies, funding options (equity vs. debt), and project implementation. Part B conducts a capital budgeting analysis, calculating NPV to evaluate project viability. The report highlights the importance of cost management, funding strategies, and accurate data for project success, with a focus on Apple Inc.'s financial performance and risk mitigation. The analysis includes calculations for cash flows, NPV, and a discussion of the cost of capital, with recommendations on the best funding options. The report emphasizes the importance of financial viability and risk assessment in project management.

Running head: PROJECT RISK, FINANCE, AND MONITORING

Project risk, finance, and monitoring

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Project risk, finance, and monitoring

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

PROJECT RISK, FINANCE, AND MONITORING

Table of Contents

Executive Summary:........................................................................................................................2

Part A:..............................................................................................................................................2

i) Project Selection:..........................................................................................................................2

ii) Cost management:.......................................................................................................................3

iii) Funding:.....................................................................................................................................3

iv) Implementation and winding up:................................................................................................4

Conclusion and recommendations:..................................................................................................5

Part B:..............................................................................................................................................5

Answer to a:.....................................................................................................................................5

Answer to bi:....................................................................................................................................7

Answer to bii:..................................................................................................................................7

Answer to biii:.................................................................................................................................8

Answer to biv:..................................................................................................................................8

References and Bibliography:..........................................................................................................9

PROJECT RISK, FINANCE, AND MONITORING

Table of Contents

Executive Summary:........................................................................................................................2

Part A:..............................................................................................................................................2

i) Project Selection:..........................................................................................................................2

ii) Cost management:.......................................................................................................................3

iii) Funding:.....................................................................................................................................3

iv) Implementation and winding up:................................................................................................4

Conclusion and recommendations:..................................................................................................5

Part B:..............................................................................................................................................5

Answer to a:.....................................................................................................................................5

Answer to bi:....................................................................................................................................7

Answer to bii:..................................................................................................................................7

Answer to biii:.................................................................................................................................8

Answer to biv:..................................................................................................................................8

References and Bibliography:..........................................................................................................9

2

PROJECT RISK, FINANCE, AND MONITORING

Executive Summary:

The study helps Apple Inc. to understand the different levels of measures that could be

adopted for improving their project selection, cost management, funding, implementation and

winding up situations.

Part A:

i) Project Selection:

There are specific methods in which organizations are able to select adequate investment

options, which can improve their revenues in the long-term. The major methods that are used by

companies present in technological sector are from investment appraisal techniques such as net

present value, payback period, and internal rate of return. These identified techniques are

relatively used by organizations for identifying the most valuable investment option, which can

minimize the level of risk involved in investment and maximize total returns. Investment

appraisal techniques and adequate measure, which is used by analyst for detecting the time, value

of money, as it adequately evaluates the future cash flows on present date (Sadgrove 2016).

Apple Inc. being in the technological sector can adequately utilize the above investment

appraisal techniques for effectively securing the projects that yield higher returns in the long run.

The companies in technological industry directly rely on futuristic products, whose overall

analysis needs to be conducted for identifying its financial viability to support future revenues of

the organization. Thus, investment appraisal techniques allow the companies to identify the

PROJECT RISK, FINANCE, AND MONITORING

Executive Summary:

The study helps Apple Inc. to understand the different levels of measures that could be

adopted for improving their project selection, cost management, funding, implementation and

winding up situations.

Part A:

i) Project Selection:

There are specific methods in which organizations are able to select adequate investment

options, which can improve their revenues in the long-term. The major methods that are used by

companies present in technological sector are from investment appraisal techniques such as net

present value, payback period, and internal rate of return. These identified techniques are

relatively used by organizations for identifying the most valuable investment option, which can

minimize the level of risk involved in investment and maximize total returns. Investment

appraisal techniques and adequate measure, which is used by analyst for detecting the time, value

of money, as it adequately evaluates the future cash flows on present date (Sadgrove 2016).

Apple Inc. being in the technological sector can adequately utilize the above investment

appraisal techniques for effectively securing the projects that yield higher returns in the long run.

The companies in technological industry directly rely on futuristic products, whose overall

analysis needs to be conducted for identifying its financial viability to support future revenues of

the organization. Thus, investment appraisal techniques allow the companies to identify the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

PROJECT RISK, FINANCE, AND MONITORING

financial viability of the future product by comparing the revenues and expenses that can be

generated over the period of time.

ii) Cost management:

One of the effective measures used by organizations in the technological sector is the first

management techniques, which adequately helps in reducing the level of expenses that could be

associated with a particular project. The cost management technique such as budget planning,

time management and time tracking directly allows organization to understand the level of

expenses and its nature. This analysis literally allows the organization to detect ways in which

the cost could be minimized, which eventually support the financial viability of an organization.

Thus, after detecting the relevant cost for technological sector companies can adequately select

the most appropriate investment option that can manage the revenue generation capability of the

organization (Hall, Mikes and Millo 2015).

With the help of Cost Management techniques, Apple Inc. could adequately improve the

cost management conditions of project and reduce the level of expenses that could be hampering

their profit level. The measures such as budgeting would eventually allow Apple Inc. to allocate

resources and minimize wastage. Hence, the adoption of cost management techniques would

eventually benefit the financial performance of Apple Inc., while minimizing any kind of risk.

Therefore, Apple Inc. could adequately minimize the risk from investment, by adopting the

different levels of cost management techniques.

PROJECT RISK, FINANCE, AND MONITORING

financial viability of the future product by comparing the revenues and expenses that can be

generated over the period of time.

ii) Cost management:

One of the effective measures used by organizations in the technological sector is the first

management techniques, which adequately helps in reducing the level of expenses that could be

associated with a particular project. The cost management technique such as budget planning,

time management and time tracking directly allows organization to understand the level of

expenses and its nature. This analysis literally allows the organization to detect ways in which

the cost could be minimized, which eventually support the financial viability of an organization.

Thus, after detecting the relevant cost for technological sector companies can adequately select

the most appropriate investment option that can manage the revenue generation capability of the

organization (Hall, Mikes and Millo 2015).

With the help of Cost Management techniques, Apple Inc. could adequately improve the

cost management conditions of project and reduce the level of expenses that could be hampering

their profit level. The measures such as budgeting would eventually allow Apple Inc. to allocate

resources and minimize wastage. Hence, the adoption of cost management techniques would

eventually benefit the financial performance of Apple Inc., while minimizing any kind of risk.

Therefore, Apple Inc. could adequately minimize the risk from investment, by adopting the

different levels of cost management techniques.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

PROJECT RISK, FINANCE, AND MONITORING

iii) Funding:

The major source of funding that is available to organizations are equity financing and

debt financing, as it is more reliable and available to companies. One of the best ways of getting

the required level of funding is from equity financing, as it reduces the level of insolvency

conditions that is faced by an organization. With the help of equity financing, the organization is

not liable to pay fixed finance cost on yearly basis, whereas debt financing of fixed amount of

Finance cost needs to be paid regardless of the income generated by the organization (Minnis

and Sutherland 2017).

There are two possible sources of finance that is available to Apple Inc. one is equity

financing another is debt financing. Therefore, it is the management’s decision to identify the

best possible sources of finance that could be used by the organization to support the future

projects. However, the analysis directly indicated that using equity financing would be much

beneficial for Apple Inc. as it will maintain the level of solvency condition and reduce any

chances of increment in finance cost. Therefore, using the debt financing would increase the

finance cost and reduce the level of profits, which could be generated from operations.

iv) Implementation and winding up:

The analysis directly indicated that assumption made for the initial project is considered

to be a major issue if adequate Research and not conducted by organization before implementing

the project. the overall cash flows that has been evaluated as per the research needs to be

accurate and appropriate in nature as the results from investment appraisal techniques are

dependent on the cash inflows and outflows. Hence, the financial viability of the project is

directly based on the overall assumptions and data that have been created by the manager for the

PROJECT RISK, FINANCE, AND MONITORING

iii) Funding:

The major source of funding that is available to organizations are equity financing and

debt financing, as it is more reliable and available to companies. One of the best ways of getting

the required level of funding is from equity financing, as it reduces the level of insolvency

conditions that is faced by an organization. With the help of equity financing, the organization is

not liable to pay fixed finance cost on yearly basis, whereas debt financing of fixed amount of

Finance cost needs to be paid regardless of the income generated by the organization (Minnis

and Sutherland 2017).

There are two possible sources of finance that is available to Apple Inc. one is equity

financing another is debt financing. Therefore, it is the management’s decision to identify the

best possible sources of finance that could be used by the organization to support the future

projects. However, the analysis directly indicated that using equity financing would be much

beneficial for Apple Inc. as it will maintain the level of solvency condition and reduce any

chances of increment in finance cost. Therefore, using the debt financing would increase the

finance cost and reduce the level of profits, which could be generated from operations.

iv) Implementation and winding up:

The analysis directly indicated that assumption made for the initial project is considered

to be a major issue if adequate Research and not conducted by organization before implementing

the project. the overall cash flows that has been evaluated as per the research needs to be

accurate and appropriate in nature as the results from investment appraisal techniques are

dependent on the cash inflows and outflows. Hence, the financial viability of the project is

directly based on the overall assumptions and data that have been created by the manager for the

5

PROJECT RISK, FINANCE, AND MONITORING

particular project. Thus, Apple Inc. could directly utilize the relevant measure for ensuring high

level of anticipation of the project, as it is viable for generating feasible stats from the investment

appraisal techniques. Hence, Apple Inc. management could make relevant decisions on the

financial viability of the project and secure the investment capital. After completion of the

project, the relevant winding up process directly starts where the organization sells all the

relevant assets and requires a required Salvage value to support the cash inflows at the end of the

project life. Adequate environmental damages are conducted after the project is completed, as

the company starts a new project, where relevant restructuring of the landscape is steered

(Hopkin 2018).

Conclusion and recommendations:

Apple Inc. could directly utilize the above information regarding the selection process,

and adequate costing management process to detect the most viable investment option, which

could generate higher revenue for the organization.

Part B:

Answer to a:

The case study does not point out that Apple Inc. could be raising equity capital any time

soon, whereas the company is facing problems with its forecasted revenues, as relevant discounts

are being imposed to generate sales.

In addition, the companies use equity financing on the occasions, where they intend to

acquire capital for further improving their current operational capability. In addition, equity

PROJECT RISK, FINANCE, AND MONITORING

particular project. Thus, Apple Inc. could directly utilize the relevant measure for ensuring high

level of anticipation of the project, as it is viable for generating feasible stats from the investment

appraisal techniques. Hence, Apple Inc. management could make relevant decisions on the

financial viability of the project and secure the investment capital. After completion of the

project, the relevant winding up process directly starts where the organization sells all the

relevant assets and requires a required Salvage value to support the cash inflows at the end of the

project life. Adequate environmental damages are conducted after the project is completed, as

the company starts a new project, where relevant restructuring of the landscape is steered

(Hopkin 2018).

Conclusion and recommendations:

Apple Inc. could directly utilize the above information regarding the selection process,

and adequate costing management process to detect the most viable investment option, which

could generate higher revenue for the organization.

Part B:

Answer to a:

The case study does not point out that Apple Inc. could be raising equity capital any time

soon, whereas the company is facing problems with its forecasted revenues, as relevant discounts

are being imposed to generate sales.

In addition, the companies use equity financing on the occasions, where they intend to

acquire capital for further improving their current operational capability. In addition, equity

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

PROJECT RISK, FINANCE, AND MONITORING

financing is the best way to fund the financial requirement of organizations, as it does not

increase insolvency positions, which is conducted by debt.

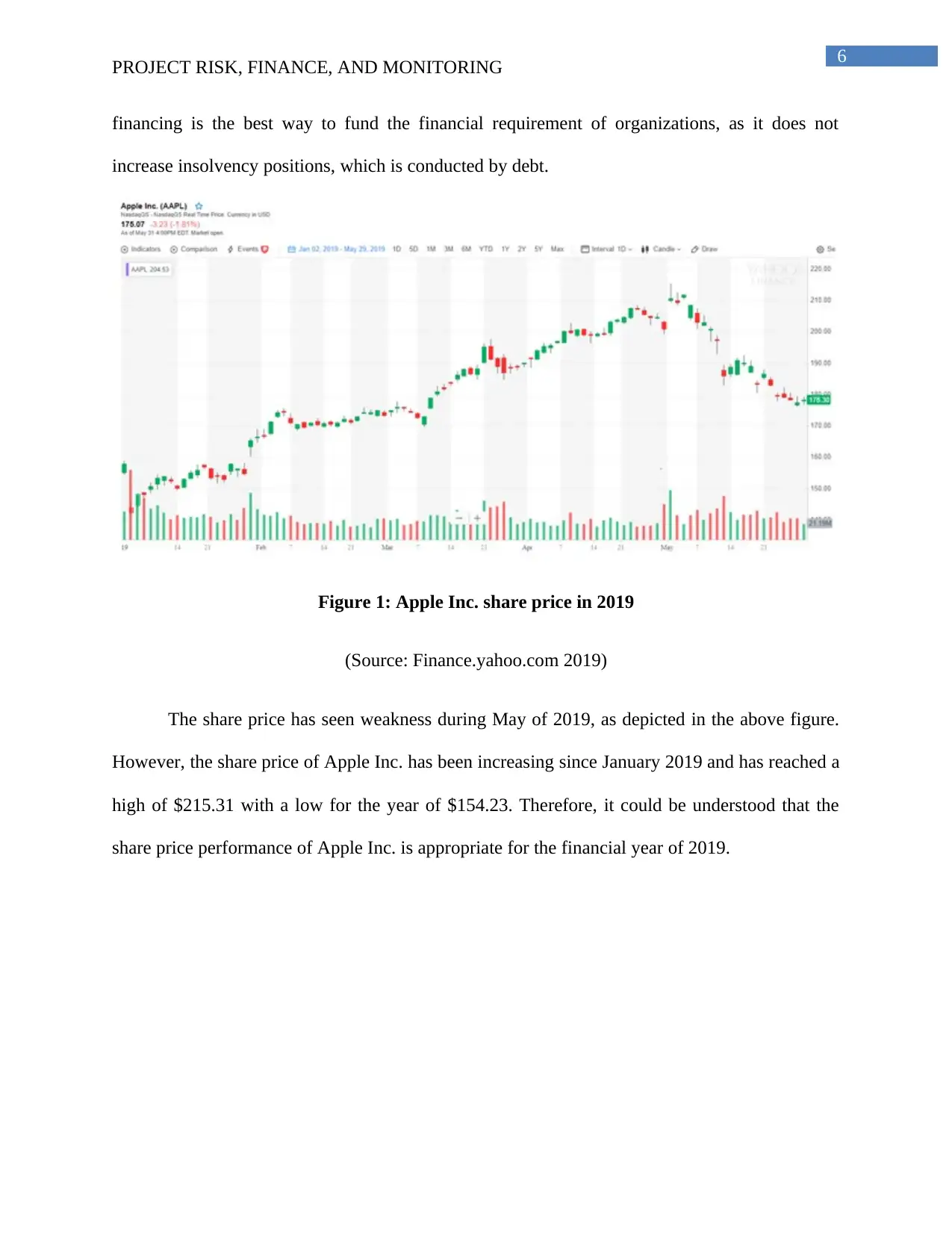

Figure 1: Apple Inc. share price in 2019

(Source: Finance.yahoo.com 2019)

The share price has seen weakness during May of 2019, as depicted in the above figure.

However, the share price of Apple Inc. has been increasing since January 2019 and has reached a

high of $215.31 with a low for the year of $154.23. Therefore, it could be understood that the

share price performance of Apple Inc. is appropriate for the financial year of 2019.

PROJECT RISK, FINANCE, AND MONITORING

financing is the best way to fund the financial requirement of organizations, as it does not

increase insolvency positions, which is conducted by debt.

Figure 1: Apple Inc. share price in 2019

(Source: Finance.yahoo.com 2019)

The share price has seen weakness during May of 2019, as depicted in the above figure.

However, the share price of Apple Inc. has been increasing since January 2019 and has reached a

high of $215.31 with a low for the year of $154.23. Therefore, it could be understood that the

share price performance of Apple Inc. is appropriate for the financial year of 2019.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

PROJECT RISK, FINANCE, AND MONITORING

Answer to bi:

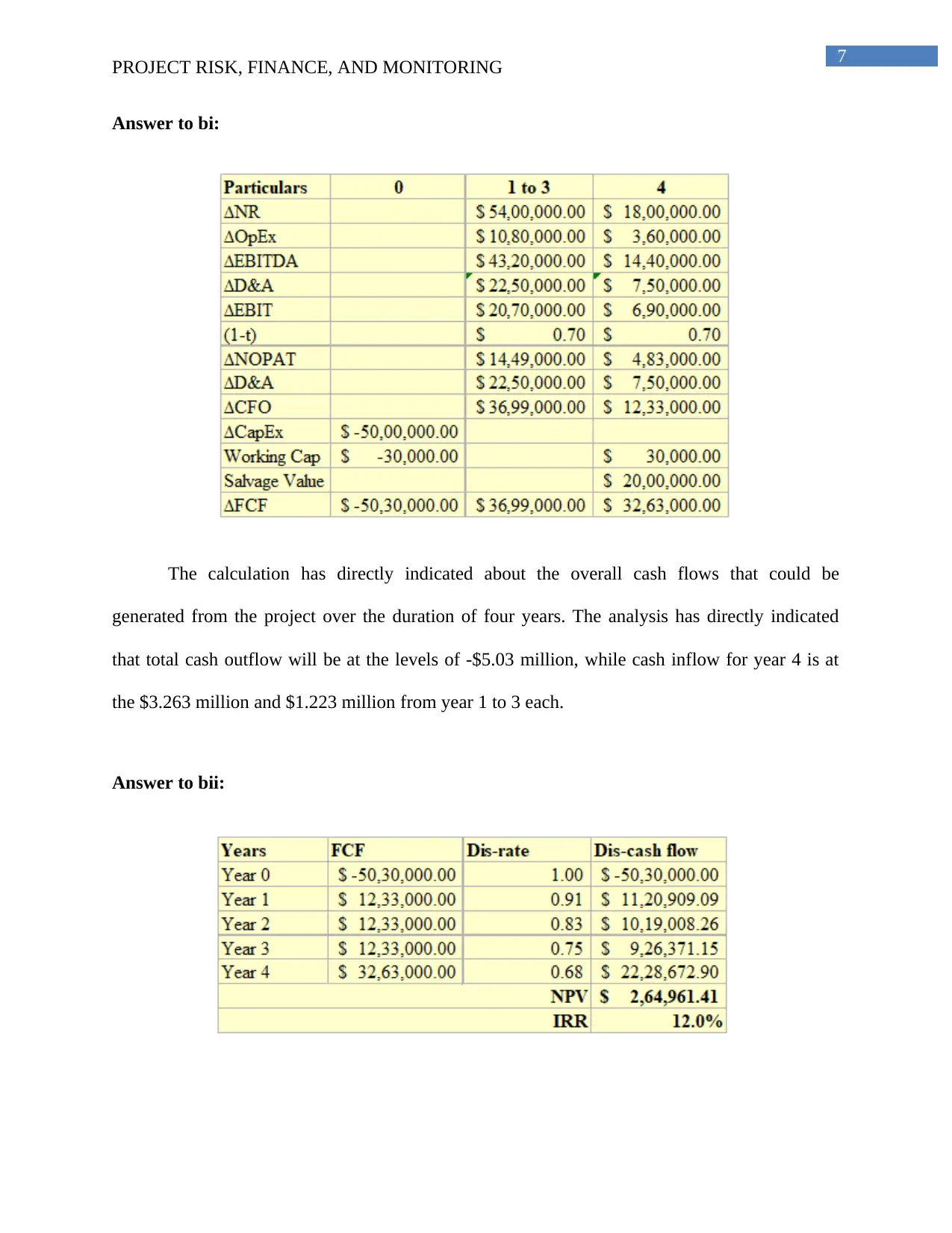

The calculation has directly indicated about the overall cash flows that could be

generated from the project over the duration of four years. The analysis has directly indicated

that total cash outflow will be at the levels of -$5.03 million, while cash inflow for year 4 is at

the $3.263 million and $1.223 million from year 1 to 3 each.

Answer to bii:

PROJECT RISK, FINANCE, AND MONITORING

Answer to bi:

The calculation has directly indicated about the overall cash flows that could be

generated from the project over the duration of four years. The analysis has directly indicated

that total cash outflow will be at the levels of -$5.03 million, while cash inflow for year 4 is at

the $3.263 million and $1.223 million from year 1 to 3 each.

Answer to bii:

8

PROJECT RISK, FINANCE, AND MONITORING

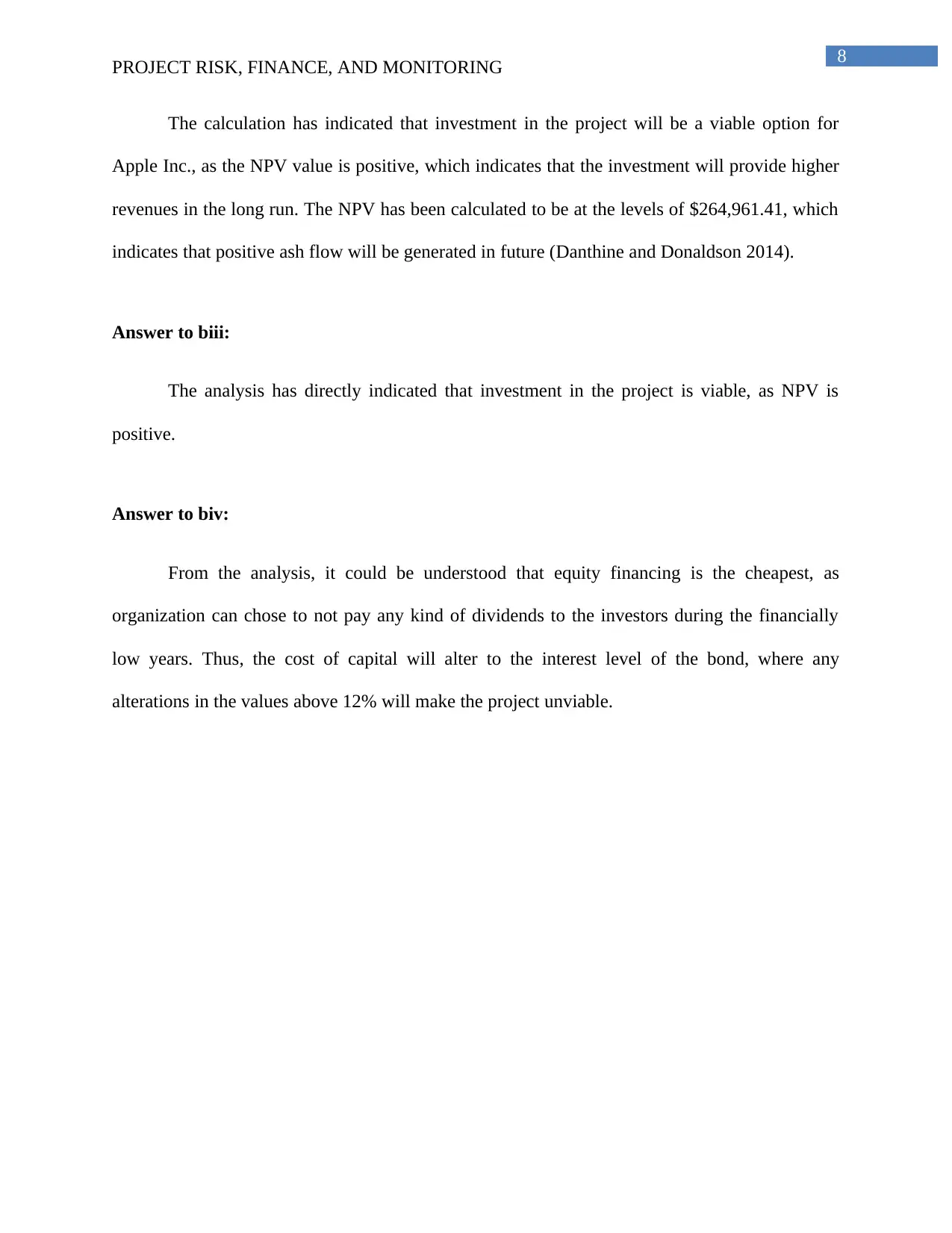

The calculation has indicated that investment in the project will be a viable option for

Apple Inc., as the NPV value is positive, which indicates that the investment will provide higher

revenues in the long run. The NPV has been calculated to be at the levels of $264,961.41, which

indicates that positive ash flow will be generated in future (Danthine and Donaldson 2014).

Answer to biii:

The analysis has directly indicated that investment in the project is viable, as NPV is

positive.

Answer to biv:

From the analysis, it could be understood that equity financing is the cheapest, as

organization can chose to not pay any kind of dividends to the investors during the financially

low years. Thus, the cost of capital will alter to the interest level of the bond, where any

alterations in the values above 12% will make the project unviable.

PROJECT RISK, FINANCE, AND MONITORING

The calculation has indicated that investment in the project will be a viable option for

Apple Inc., as the NPV value is positive, which indicates that the investment will provide higher

revenues in the long run. The NPV has been calculated to be at the levels of $264,961.41, which

indicates that positive ash flow will be generated in future (Danthine and Donaldson 2014).

Answer to biii:

The analysis has directly indicated that investment in the project is viable, as NPV is

positive.

Answer to biv:

From the analysis, it could be understood that equity financing is the cheapest, as

organization can chose to not pay any kind of dividends to the investors during the financially

low years. Thus, the cost of capital will alter to the interest level of the bond, where any

alterations in the values above 12% will make the project unviable.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

PROJECT RISK, FINANCE, AND MONITORING

References and Bibliography:

Angeloni, I., Faia, E. and Duca, M.L., 2015. Monetary policy and risk taking. Journal of

Economic Dynamics and Control, 52, pp.285-307.

Bowers, J. and Khorakian, A., 2014. Integrating risk management in the innovation

project. European Journal of innovation management, 17(1), pp.25-40.

Danthine, J.P. and Donaldson, J.B., 2014. Intermediate financial theory. academic press.

Diebold, F.X. and Yılmaz, K., 2015. Financial and macroeconomic connectedness: A network

approach to measurement and monitoring. Oxford University Press, USA.

Finance.yahoo.com. 2019. Yahoo is now part of Oath. [online] Available at:

https://finance.yahoo.com/quote/AAPL?p=AAPL [Accessed 3 Jun. 2019].

Hall, M., Mikes, A. and Millo, Y., 2015. How do risk managers become influential? A field

study of toolmaking in two financial institutions. Management Accounting Research, 26, pp.3-

22.

Hopkin, P., 2018. Fundamentals of risk management: understanding, evaluating and

implementing effective risk management. Kogan Page Publishers.

Minnis, M. and Sutherland, A., 2017. Financial statements as monitoring mechanisms: Evidence

from small commercial loans. Journal of Accounting Research, 55(1), pp.197-233.

Sadgrove, K., 2016. The complete guide to business risk management. Routledge.

PROJECT RISK, FINANCE, AND MONITORING

References and Bibliography:

Angeloni, I., Faia, E. and Duca, M.L., 2015. Monetary policy and risk taking. Journal of

Economic Dynamics and Control, 52, pp.285-307.

Bowers, J. and Khorakian, A., 2014. Integrating risk management in the innovation

project. European Journal of innovation management, 17(1), pp.25-40.

Danthine, J.P. and Donaldson, J.B., 2014. Intermediate financial theory. academic press.

Diebold, F.X. and Yılmaz, K., 2015. Financial and macroeconomic connectedness: A network

approach to measurement and monitoring. Oxford University Press, USA.

Finance.yahoo.com. 2019. Yahoo is now part of Oath. [online] Available at:

https://finance.yahoo.com/quote/AAPL?p=AAPL [Accessed 3 Jun. 2019].

Hall, M., Mikes, A. and Millo, Y., 2015. How do risk managers become influential? A field

study of toolmaking in two financial institutions. Management Accounting Research, 26, pp.3-

22.

Hopkin, P., 2018. Fundamentals of risk management: understanding, evaluating and

implementing effective risk management. Kogan Page Publishers.

Minnis, M. and Sutherland, A., 2017. Financial statements as monitoring mechanisms: Evidence

from small commercial loans. Journal of Accounting Research, 55(1), pp.197-233.

Sadgrove, K., 2016. The complete guide to business risk management. Routledge.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.