Impact of Financial Resources on Business Performance

VerifiedAdded on 2020/02/03

|21

|4660

|89

Report

AI Summary

This assignment analyzes the significance of financial resources in a business context. It examines how liquidity, measured by the current ratio, and gearing, reflected in the debt-to-equity ratio, impact an entity's ability to compete and perform effectively. The analysis considers real-world examples and demonstrates the importance of financial management for success.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGING FINANCIAL

RESOURCES

1

RESOURCES

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

INTRODUCTION

Finance plays an integral role in the business in uplifting the current business condition of an

entity. This project is al about selecting various sources of finance and then assess all the sources of

finance to be considered it for the future purpose. The cost of all the sources of finance will be

assessed by an individual. Budget will be prepared to analyse all the resources in the business along

with capital budgeting technique will be used to assess all the projects.

TASK 1

1.1 Identify the sources of finance available to a business

Internal source of finance

Retained earning- It is regarded as the internal source of finance in which surplus generated by an

entity will be retained by the owner of the business after paying off all kinds of dividends and

further expenses out of the generated profit (Coronel and Morris, 2016). The profit after paying

dividend will be held by an entity to be invested in their own business as source of investment.

Equity- This is another important source of finance in which finance will be remain in an entity on

which dividend will be paid by entity to all the shareholders who have given share in the business in

form of finance as their capital will be locked in with the firm.

External source

Bank loan- It is kind of finance in which an entity will raise large amount of finance from the

banks by depositing collateral security and this approach also requires interest to b paid on the

amount of loan.

Debentures- Coupon rate of interest will be charged by the lender from the borrower as the lender

will get debentures in exchange of the money given to the business.

1.2 Assess the implications of the different sources of finance identified

Basis Retained earning Equity Bank loan Debentures

Financial It increases

investment in the

business without

spending extra

cost

It raises fund for

the business in

order to

accomplish all the

tasks.

Fund will be

raised but it

required to pay

additional cost in

form of interest on

the amount taken

Coupon interest

rate will be paid

on the amount of

loan taken.

Legal It is personal Requires Legal agreement Debenture trustee

3

Finance plays an integral role in the business in uplifting the current business condition of an

entity. This project is al about selecting various sources of finance and then assess all the sources of

finance to be considered it for the future purpose. The cost of all the sources of finance will be

assessed by an individual. Budget will be prepared to analyse all the resources in the business along

with capital budgeting technique will be used to assess all the projects.

TASK 1

1.1 Identify the sources of finance available to a business

Internal source of finance

Retained earning- It is regarded as the internal source of finance in which surplus generated by an

entity will be retained by the owner of the business after paying off all kinds of dividends and

further expenses out of the generated profit (Coronel and Morris, 2016). The profit after paying

dividend will be held by an entity to be invested in their own business as source of investment.

Equity- This is another important source of finance in which finance will be remain in an entity on

which dividend will be paid by entity to all the shareholders who have given share in the business in

form of finance as their capital will be locked in with the firm.

External source

Bank loan- It is kind of finance in which an entity will raise large amount of finance from the

banks by depositing collateral security and this approach also requires interest to b paid on the

amount of loan.

Debentures- Coupon rate of interest will be charged by the lender from the borrower as the lender

will get debentures in exchange of the money given to the business.

1.2 Assess the implications of the different sources of finance identified

Basis Retained earning Equity Bank loan Debentures

Financial It increases

investment in the

business without

spending extra

cost

It raises fund for

the business in

order to

accomplish all the

tasks.

Fund will be

raised but it

required to pay

additional cost in

form of interest on

the amount taken

Coupon interest

rate will be paid

on the amount of

loan taken.

Legal It is personal Requires Legal agreement Debenture trustee

3

property of an

individual

permissions of

central

government and

registrar of

companies

will be appointed

Control Full possession of

owner

Shareholders rule Bank have

authority

Ownership lies

with the business

1.3 Evaluate appropriate sources of finance for your business project

Internal sources- Retained earning and equity as sources of finance will be highly used by an

entity owner as these posses lots of opportunities for an entity with less amount of costs incurred in

a enterprise.

External sources- Bank loan and debentures are regarded as external debt imposed on an entity in

which interest will be paid by an entity owner to the external environment which decreases the

overall sales and the revenue of an entity in particular year.

Internal source of finance is regarded as the best suitable source of finance for the small

scale entity chosen for the given project who intends to open their business by taking help of

government relief. Internal source is regarded as the est as it incur fewer costs such as only in form

of dividend to all the shareholders.

TASK 2

2.1 Analyse the costs of each of sources of finance you have identified

Internal source- There is less imposition of cost incurred on the business which includes paying of

dividend to all the shareholders as retained earning is the personal property of an individual. Cost of

equity will be determined by an entity using CAPM approach.

Equity-Dividend is the basic costs incurred in an entity while using equity as source of finance.

External source-This kind of approach will include paying of interest in both the approach that in

bank loan and in debenture interest which is monthly obligation imposed on an entity (DaDalt and

Coughlin, 2016). The external obligation imposed on an entity will need to be decreases by

choosing another option.

Bank loan- Interest charged by the financial institutions on the amount lend by them to the

borrowers.

Debentures- Coupon rate of interest charged on the amount lend by the debenture holders to the

4

individual

permissions of

central

government and

registrar of

companies

will be appointed

Control Full possession of

owner

Shareholders rule Bank have

authority

Ownership lies

with the business

1.3 Evaluate appropriate sources of finance for your business project

Internal sources- Retained earning and equity as sources of finance will be highly used by an

entity owner as these posses lots of opportunities for an entity with less amount of costs incurred in

a enterprise.

External sources- Bank loan and debentures are regarded as external debt imposed on an entity in

which interest will be paid by an entity owner to the external environment which decreases the

overall sales and the revenue of an entity in particular year.

Internal source of finance is regarded as the best suitable source of finance for the small

scale entity chosen for the given project who intends to open their business by taking help of

government relief. Internal source is regarded as the est as it incur fewer costs such as only in form

of dividend to all the shareholders.

TASK 2

2.1 Analyse the costs of each of sources of finance you have identified

Internal source- There is less imposition of cost incurred on the business which includes paying of

dividend to all the shareholders as retained earning is the personal property of an individual. Cost of

equity will be determined by an entity using CAPM approach.

Equity-Dividend is the basic costs incurred in an entity while using equity as source of finance.

External source-This kind of approach will include paying of interest in both the approach that in

bank loan and in debenture interest which is monthly obligation imposed on an entity (DaDalt and

Coughlin, 2016). The external obligation imposed on an entity will need to be decreases by

choosing another option.

Bank loan- Interest charged by the financial institutions on the amount lend by them to the

borrowers.

Debentures- Coupon rate of interest charged on the amount lend by the debenture holders to the

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

business for specific time.

Hence, after evaluating the above sources of finance on the basis of all the costs incurred in all these

projects it can be said that an entity would take Internal sources of finance that is equity as source of

finance.

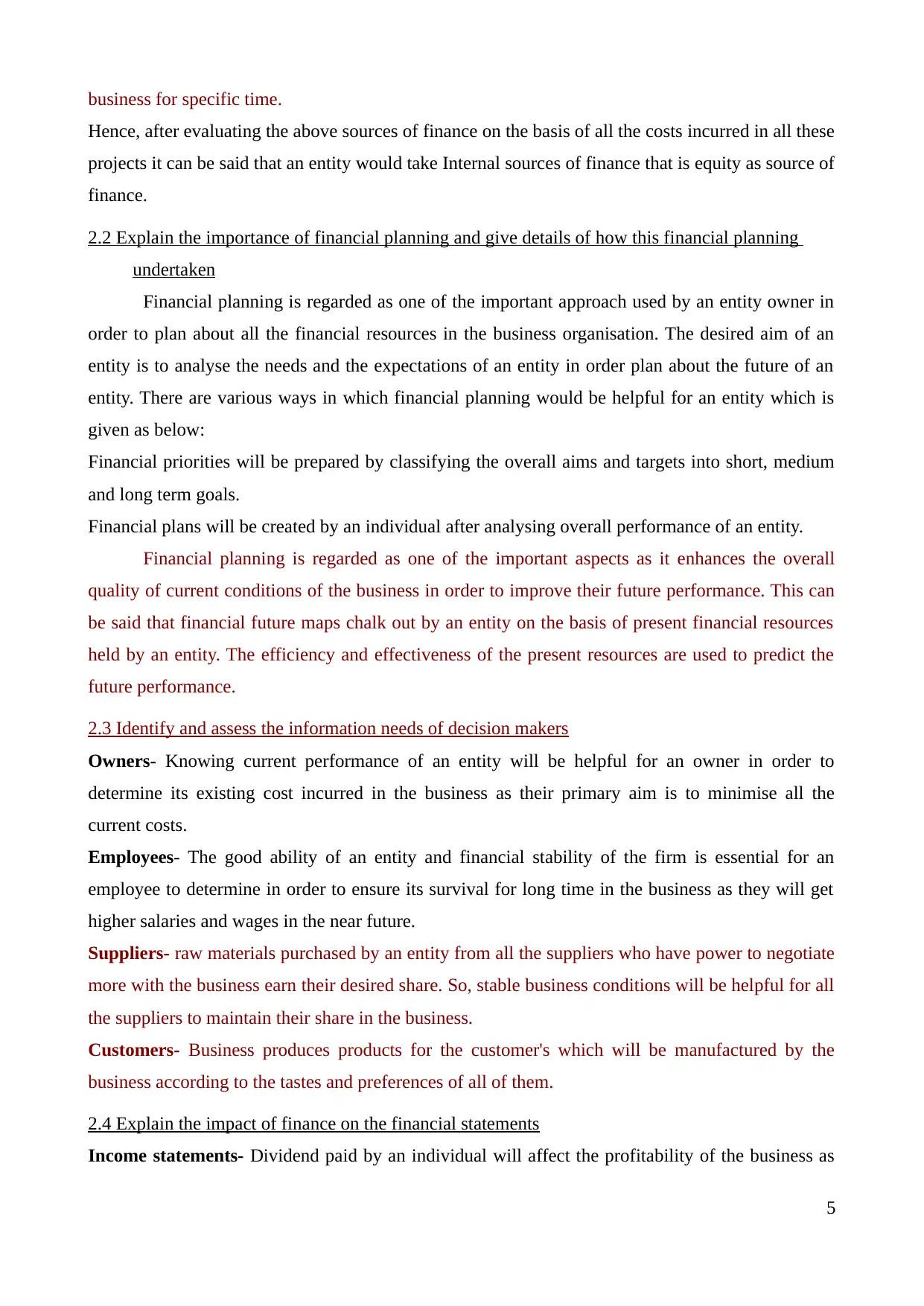

2.2 Explain the importance of financial planning and give details of how this financial planning

undertaken

Financial planning is regarded as one of the important approach used by an entity owner in

order to plan about all the financial resources in the business organisation. The desired aim of an

entity is to analyse the needs and the expectations of an entity in order plan about the future of an

entity. There are various ways in which financial planning would be helpful for an entity which is

given as below:

Financial priorities will be prepared by classifying the overall aims and targets into short, medium

and long term goals.

Financial plans will be created by an individual after analysing overall performance of an entity.

Financial planning is regarded as one of the important aspects as it enhances the overall

quality of current conditions of the business in order to improve their future performance. This can

be said that financial future maps chalk out by an entity on the basis of present financial resources

held by an entity. The efficiency and effectiveness of the present resources are used to predict the

future performance.

2.3 Identify and assess the information needs of decision makers

Owners- Knowing current performance of an entity will be helpful for an owner in order to

determine its existing cost incurred in the business as their primary aim is to minimise all the

current costs.

Employees- The good ability of an entity and financial stability of the firm is essential for an

employee to determine in order to ensure its survival for long time in the business as they will get

higher salaries and wages in the near future.

Suppliers- raw materials purchased by an entity from all the suppliers who have power to negotiate

more with the business earn their desired share. So, stable business conditions will be helpful for all

the suppliers to maintain their share in the business.

Customers- Business produces products for the customer's which will be manufactured by the

business according to the tastes and preferences of all of them.

2.4 Explain the impact of finance on the financial statements

Income statements- Dividend paid by an individual will affect the profitability of the business as

5

Hence, after evaluating the above sources of finance on the basis of all the costs incurred in all these

projects it can be said that an entity would take Internal sources of finance that is equity as source of

finance.

2.2 Explain the importance of financial planning and give details of how this financial planning

undertaken

Financial planning is regarded as one of the important approach used by an entity owner in

order to plan about all the financial resources in the business organisation. The desired aim of an

entity is to analyse the needs and the expectations of an entity in order plan about the future of an

entity. There are various ways in which financial planning would be helpful for an entity which is

given as below:

Financial priorities will be prepared by classifying the overall aims and targets into short, medium

and long term goals.

Financial plans will be created by an individual after analysing overall performance of an entity.

Financial planning is regarded as one of the important aspects as it enhances the overall

quality of current conditions of the business in order to improve their future performance. This can

be said that financial future maps chalk out by an entity on the basis of present financial resources

held by an entity. The efficiency and effectiveness of the present resources are used to predict the

future performance.

2.3 Identify and assess the information needs of decision makers

Owners- Knowing current performance of an entity will be helpful for an owner in order to

determine its existing cost incurred in the business as their primary aim is to minimise all the

current costs.

Employees- The good ability of an entity and financial stability of the firm is essential for an

employee to determine in order to ensure its survival for long time in the business as they will get

higher salaries and wages in the near future.

Suppliers- raw materials purchased by an entity from all the suppliers who have power to negotiate

more with the business earn their desired share. So, stable business conditions will be helpful for all

the suppliers to maintain their share in the business.

Customers- Business produces products for the customer's which will be manufactured by the

business according to the tastes and preferences of all of them.

2.4 Explain the impact of finance on the financial statements

Income statements- Dividend paid by an individual will affect the profitability of the business as

5

this is regarded as the essential expenses (Davies and Drexler, 2010). This kind of expenses is

excluded from the sales incurred in the business. Retained earning used by an entity will not affect

the profitability of an entity in a particular year.

Balance sheet- Equity sources of finance used by an entity will be recorded in the balance sheet

under the head equity. The retained earning used by an entity will be recorded in the reserves and

surplus.

TASK 3

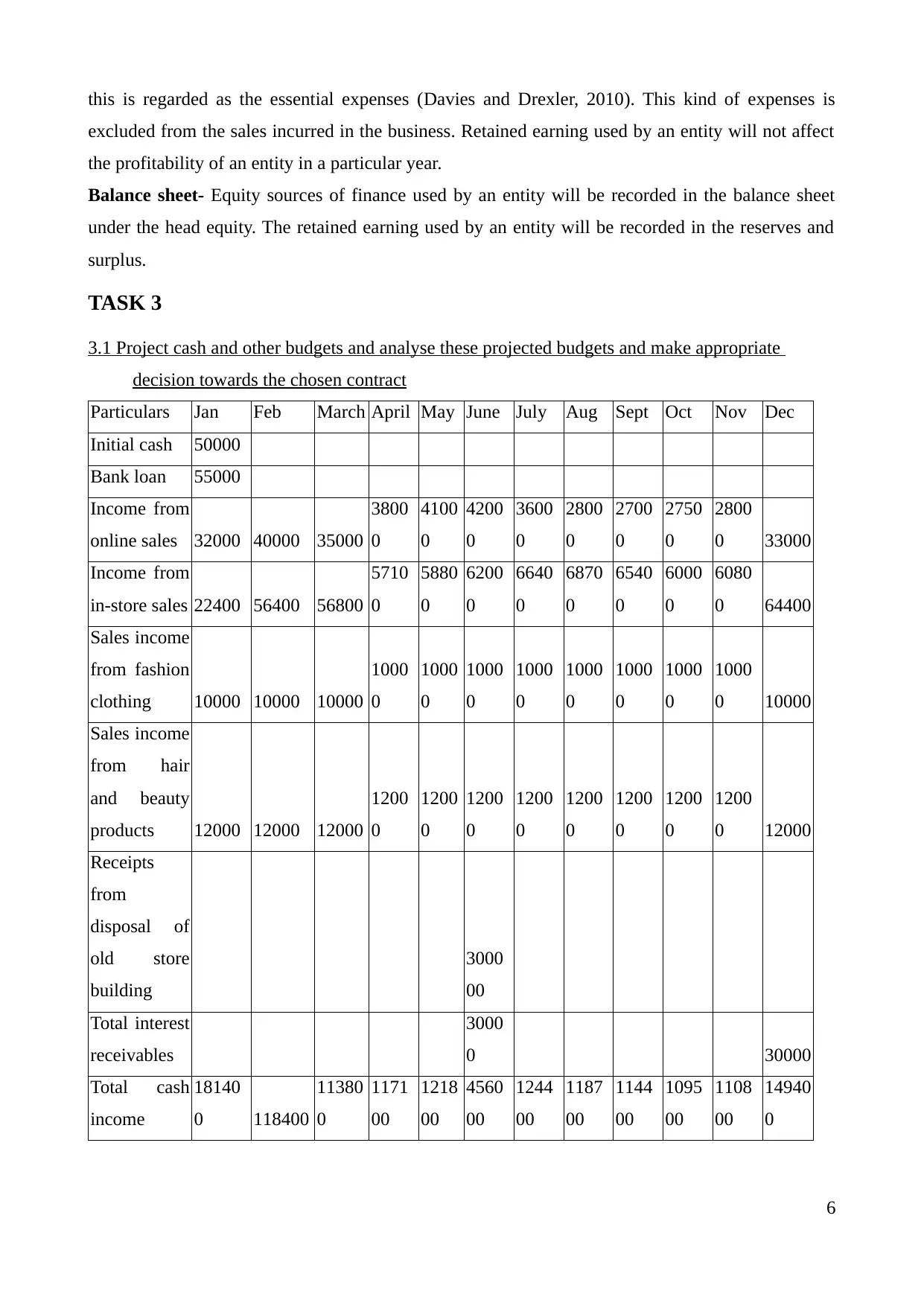

3.1 Project cash and other budgets and analyse these projected budgets and make appropriate

decision towards the chosen contract

Particulars Jan Feb March April May June July Aug Sept Oct Nov Dec

Initial cash 50000

Bank loan 55000

Income from

online sales 32000 40000 35000

3800

0

4100

0

4200

0

3600

0

2800

0

2700

0

2750

0

2800

0 33000

Income from

in-store sales 22400 56400 56800

5710

0

5880

0

6200

0

6640

0

6870

0

6540

0

6000

0

6080

0 64400

Sales income

from fashion

clothing 10000 10000 10000

1000

0

1000

0

1000

0

1000

0

1000

0

1000

0

1000

0

1000

0 10000

Sales income

from hair

and beauty

products 12000 12000 12000

1200

0

1200

0

1200

0

1200

0

1200

0

1200

0

1200

0

1200

0 12000

Receipts

from

disposal of

old store

building

3000

00

Total interest

receivables

3000

0 30000

Total cash

income

18140

0 118400

11380

0

1171

00

1218

00

4560

00

1244

00

1187

00

1144

00

1095

00

1108

00

14940

0

6

excluded from the sales incurred in the business. Retained earning used by an entity will not affect

the profitability of an entity in a particular year.

Balance sheet- Equity sources of finance used by an entity will be recorded in the balance sheet

under the head equity. The retained earning used by an entity will be recorded in the reserves and

surplus.

TASK 3

3.1 Project cash and other budgets and analyse these projected budgets and make appropriate

decision towards the chosen contract

Particulars Jan Feb March April May June July Aug Sept Oct Nov Dec

Initial cash 50000

Bank loan 55000

Income from

online sales 32000 40000 35000

3800

0

4100

0

4200

0

3600

0

2800

0

2700

0

2750

0

2800

0 33000

Income from

in-store sales 22400 56400 56800

5710

0

5880

0

6200

0

6640

0

6870

0

6540

0

6000

0

6080

0 64400

Sales income

from fashion

clothing 10000 10000 10000

1000

0

1000

0

1000

0

1000

0

1000

0

1000

0

1000

0

1000

0 10000

Sales income

from hair

and beauty

products 12000 12000 12000

1200

0

1200

0

1200

0

1200

0

1200

0

1200

0

1200

0

1200

0 12000

Receipts

from

disposal of

old store

building

3000

00

Total interest

receivables

3000

0 30000

Total cash

income

18140

0 118400

11380

0

1171

00

1218

00

4560

00

1244

00

1187

00

1144

00

1095

00

1108

00

14940

0

6

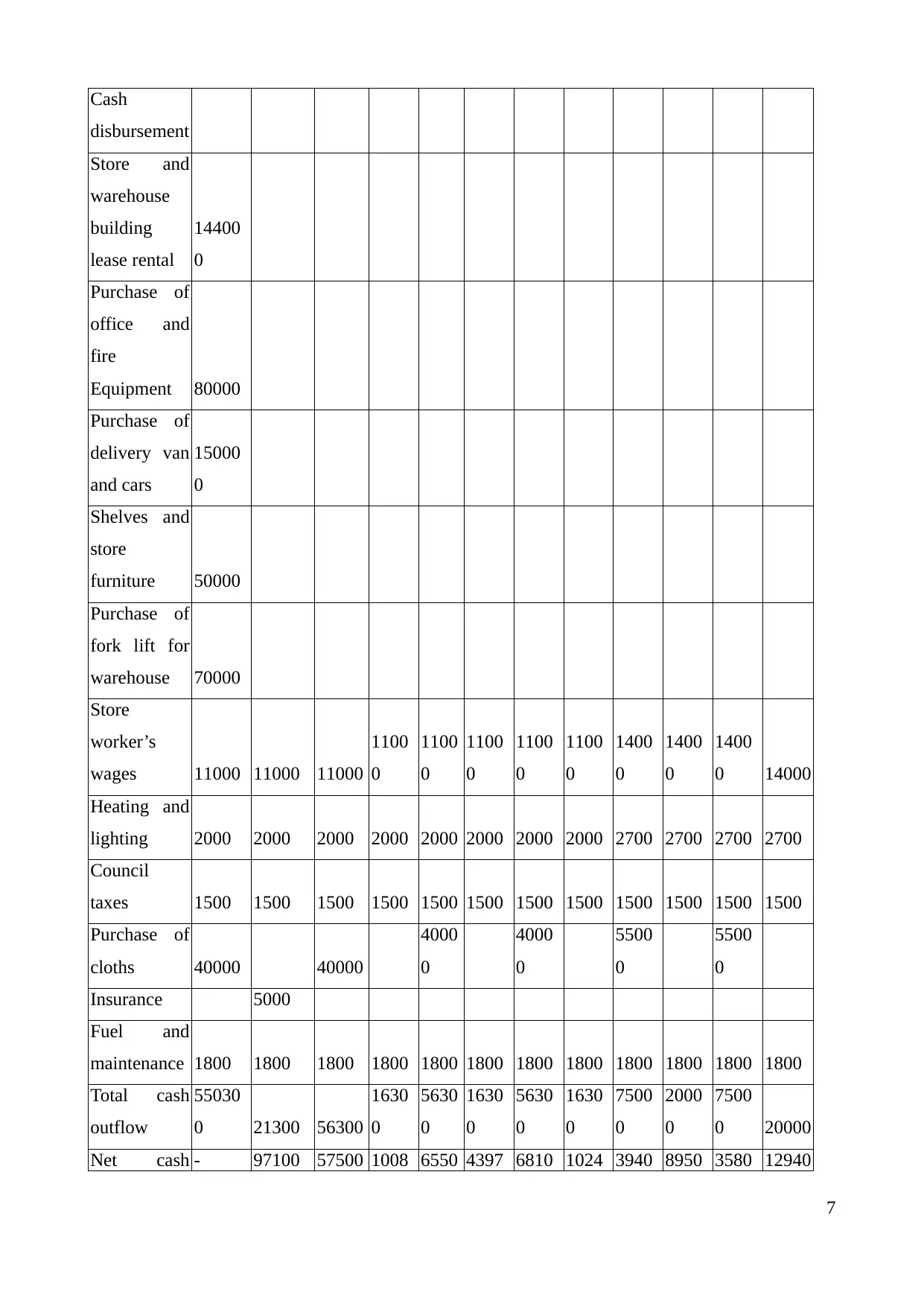

Cash

disbursement

Store and

warehouse

building

lease rental

14400

0

Purchase of

office and

fire

Equipment 80000

Purchase of

delivery van

and cars

15000

0

Shelves and

store

furniture 50000

Purchase of

fork lift for

warehouse 70000

Store

worker’s

wages 11000 11000 11000

1100

0

1100

0

1100

0

1100

0

1100

0

1400

0

1400

0

1400

0 14000

Heating and

lighting 2000 2000 2000 2000 2000 2000 2000 2000 2700 2700 2700 2700

Council

taxes 1500 1500 1500 1500 1500 1500 1500 1500 1500 1500 1500 1500

Purchase of

cloths 40000 40000

4000

0

4000

0

5500

0

5500

0

Insurance 5000

Fuel and

maintenance 1800 1800 1800 1800 1800 1800 1800 1800 1800 1800 1800 1800

Total cash

outflow

55030

0 21300 56300

1630

0

5630

0

1630

0

5630

0

1630

0

7500

0

2000

0

7500

0 20000

Net cash - 97100 57500 1008 6550 4397 6810 1024 3940 8950 3580 12940

7

disbursement

Store and

warehouse

building

lease rental

14400

0

Purchase of

office and

fire

Equipment 80000

Purchase of

delivery van

and cars

15000

0

Shelves and

store

furniture 50000

Purchase of

fork lift for

warehouse 70000

Store

worker’s

wages 11000 11000 11000

1100

0

1100

0

1100

0

1100

0

1100

0

1400

0

1400

0

1400

0 14000

Heating and

lighting 2000 2000 2000 2000 2000 2000 2000 2000 2700 2700 2700 2700

Council

taxes 1500 1500 1500 1500 1500 1500 1500 1500 1500 1500 1500 1500

Purchase of

cloths 40000 40000

4000

0

4000

0

5500

0

5500

0

Insurance 5000

Fuel and

maintenance 1800 1800 1800 1800 1800 1800 1800 1800 1800 1800 1800 1800

Total cash

outflow

55030

0 21300 56300

1630

0

5630

0

1630

0

5630

0

1630

0

7500

0

2000

0

7500

0 20000

Net cash - 97100 57500 1008 6550 4397 6810 1024 3940 8950 3580 12940

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

balance

36890

0 00 0 00 0 00 0 0 0 0

Opening

cash balance 0

-

368900

-

27180

0

-

2143

00

-

1135

00

-

4800

0

3917

00

4598

00

5622

00

6016

00

6911

00

72690

0

Closing cash

balance

-

36890

0

-

271800

-

21430

0

-

1135

00

-

4800

0

3917

00

4598

00

5622

00

6016

00

6911

00

7269

00

85630

0

Cash budget is regarded as one of the important budget prepared by an individual in order to

ascertain true position of cash in the organisation. The movement of cash flow in the business will

be determined by an entity in order to grab higher market advantage in the near future. The desired

aim of the business is to increase all the cash incurred in the business as they held responsible for

enhancing the current cash available in an entity which will be increases with the passage of time as

the basic objective of an entity (Ehrhardt and Brigham, 2016). Cash budgets prepared by an entity

to determine all the deficits or surplus generated by an entity in cash in order to help an entity in

order to grab higher competitive advantage over variety of customers who depends on the actual

business performance as all the business results will reflect true performance of an entity in the

external business environment. The above mentioned cash budget reflect the actual performance of

an entity that first five months of the organisation an entity is suffering with cash deficits that needs

to be removed with the passage of time by decreasing cash outflows and increasing the overall cash

inflow in the business. On the other hand, the rectification made by an entity in the later years that

an entity has earned higher cash flows by generating higher amount of cash inflow from the month

of June to December is reflecting good ability of an entity (Fletcher, 2016). Higher cash surplus is

god but at the same it is not suitable for an entity as it creates higher market risks which will be

balanced by investing all the higher amount of cash surplus by taking investments in bonds or

another business in order to generate higher returns in the near future.

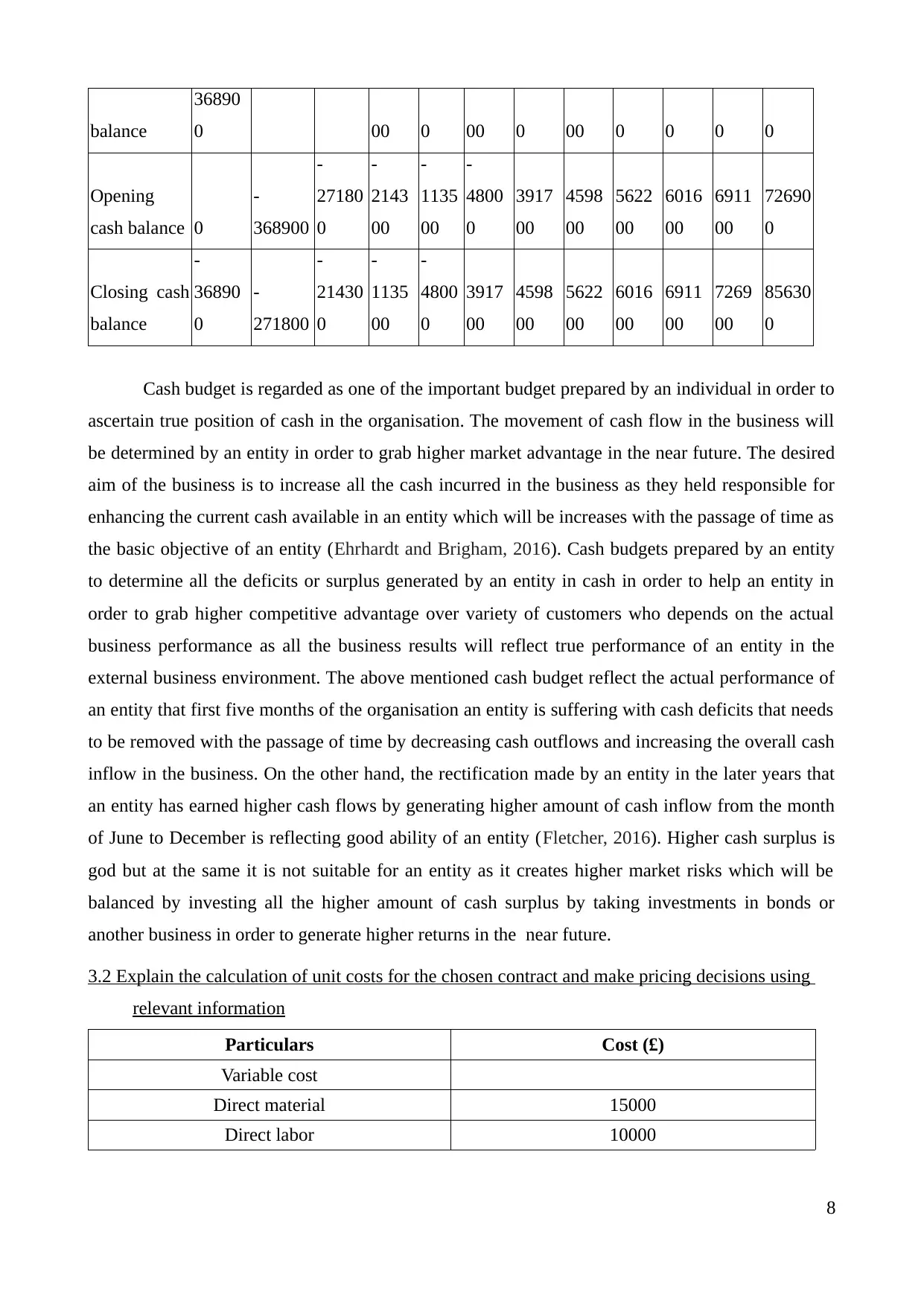

3.2 Explain the calculation of unit costs for the chosen contract and make pricing decisions using

relevant information

Particulars Cost (£)

Variable cost

Direct material 15000

Direct labor 10000

8

36890

0 00 0 00 0 00 0 0 0 0

Opening

cash balance 0

-

368900

-

27180

0

-

2143

00

-

1135

00

-

4800

0

3917

00

4598

00

5622

00

6016

00

6911

00

72690

0

Closing cash

balance

-

36890

0

-

271800

-

21430

0

-

1135

00

-

4800

0

3917

00

4598

00

5622

00

6016

00

6911

00

7269

00

85630

0

Cash budget is regarded as one of the important budget prepared by an individual in order to

ascertain true position of cash in the organisation. The movement of cash flow in the business will

be determined by an entity in order to grab higher market advantage in the near future. The desired

aim of the business is to increase all the cash incurred in the business as they held responsible for

enhancing the current cash available in an entity which will be increases with the passage of time as

the basic objective of an entity (Ehrhardt and Brigham, 2016). Cash budgets prepared by an entity

to determine all the deficits or surplus generated by an entity in cash in order to help an entity in

order to grab higher competitive advantage over variety of customers who depends on the actual

business performance as all the business results will reflect true performance of an entity in the

external business environment. The above mentioned cash budget reflect the actual performance of

an entity that first five months of the organisation an entity is suffering with cash deficits that needs

to be removed with the passage of time by decreasing cash outflows and increasing the overall cash

inflow in the business. On the other hand, the rectification made by an entity in the later years that

an entity has earned higher cash flows by generating higher amount of cash inflow from the month

of June to December is reflecting good ability of an entity (Fletcher, 2016). Higher cash surplus is

god but at the same it is not suitable for an entity as it creates higher market risks which will be

balanced by investing all the higher amount of cash surplus by taking investments in bonds or

another business in order to generate higher returns in the near future.

3.2 Explain the calculation of unit costs for the chosen contract and make pricing decisions using

relevant information

Particulars Cost (£)

Variable cost

Direct material 15000

Direct labor 10000

8

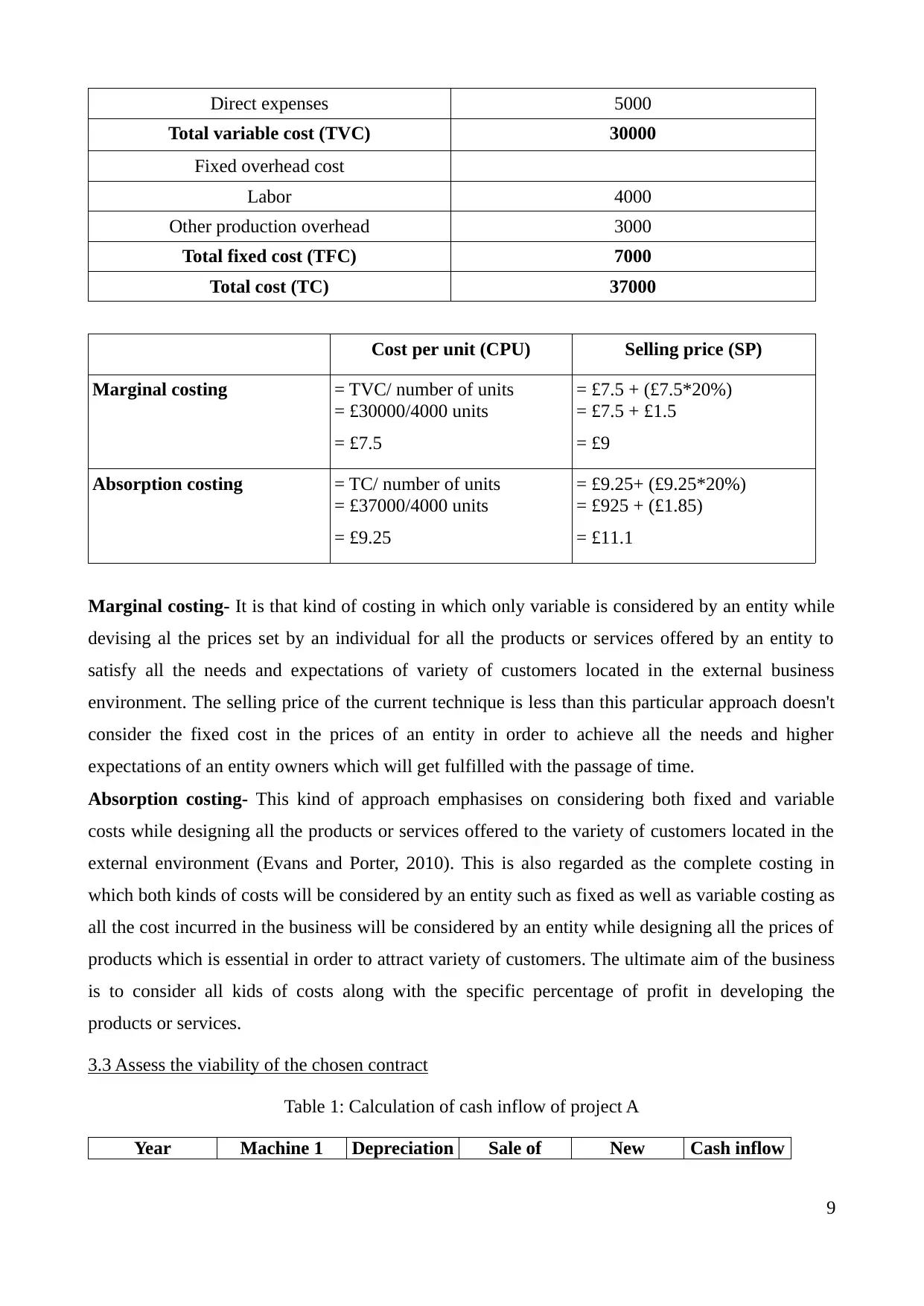

Direct expenses 5000

Total variable cost (TVC) 30000

Fixed overhead cost

Labor 4000

Other production overhead 3000

Total fixed cost (TFC) 7000

Total cost (TC) 37000

Cost per unit (CPU) Selling price (SP)

Marginal costing = TVC/ number of units

= £30000/4000 units

= £7.5

= £7.5 + (£7.5*20%)

= £7.5 + £1.5

= £9

Absorption costing = TC/ number of units

= £37000/4000 units

= £9.25

= £9.25+ (£9.25*20%)

= £925 + (£1.85)

= £11.1

Marginal costing- It is that kind of costing in which only variable is considered by an entity while

devising al the prices set by an individual for all the products or services offered by an entity to

satisfy all the needs and expectations of variety of customers located in the external business

environment. The selling price of the current technique is less than this particular approach doesn't

consider the fixed cost in the prices of an entity in order to achieve all the needs and higher

expectations of an entity owners which will get fulfilled with the passage of time.

Absorption costing- This kind of approach emphasises on considering both fixed and variable

costs while designing all the products or services offered to the variety of customers located in the

external environment (Evans and Porter, 2010). This is also regarded as the complete costing in

which both kinds of costs will be considered by an entity such as fixed as well as variable costing as

all the cost incurred in the business will be considered by an entity while designing all the prices of

products which is essential in order to attract variety of customers. The ultimate aim of the business

is to consider all kids of costs along with the specific percentage of profit in developing the

products or services.

3.3 Assess the viability of the chosen contract

Table 1: Calculation of cash inflow of project A

Year Machine 1 Depreciation Sale of New Cash inflow

9

Total variable cost (TVC) 30000

Fixed overhead cost

Labor 4000

Other production overhead 3000

Total fixed cost (TFC) 7000

Total cost (TC) 37000

Cost per unit (CPU) Selling price (SP)

Marginal costing = TVC/ number of units

= £30000/4000 units

= £7.5

= £7.5 + (£7.5*20%)

= £7.5 + £1.5

= £9

Absorption costing = TC/ number of units

= £37000/4000 units

= £9.25

= £9.25+ (£9.25*20%)

= £925 + (£1.85)

= £11.1

Marginal costing- It is that kind of costing in which only variable is considered by an entity while

devising al the prices set by an individual for all the products or services offered by an entity to

satisfy all the needs and expectations of variety of customers located in the external business

environment. The selling price of the current technique is less than this particular approach doesn't

consider the fixed cost in the prices of an entity in order to achieve all the needs and higher

expectations of an entity owners which will get fulfilled with the passage of time.

Absorption costing- This kind of approach emphasises on considering both fixed and variable

costs while designing all the products or services offered to the variety of customers located in the

external environment (Evans and Porter, 2010). This is also regarded as the complete costing in

which both kinds of costs will be considered by an entity such as fixed as well as variable costing as

all the cost incurred in the business will be considered by an entity while designing all the prices of

products which is essential in order to attract variety of customers. The ultimate aim of the business

is to consider all kids of costs along with the specific percentage of profit in developing the

products or services.

3.3 Assess the viability of the chosen contract

Table 1: Calculation of cash inflow of project A

Year Machine 1 Depreciation Sale of New Cash inflow

9

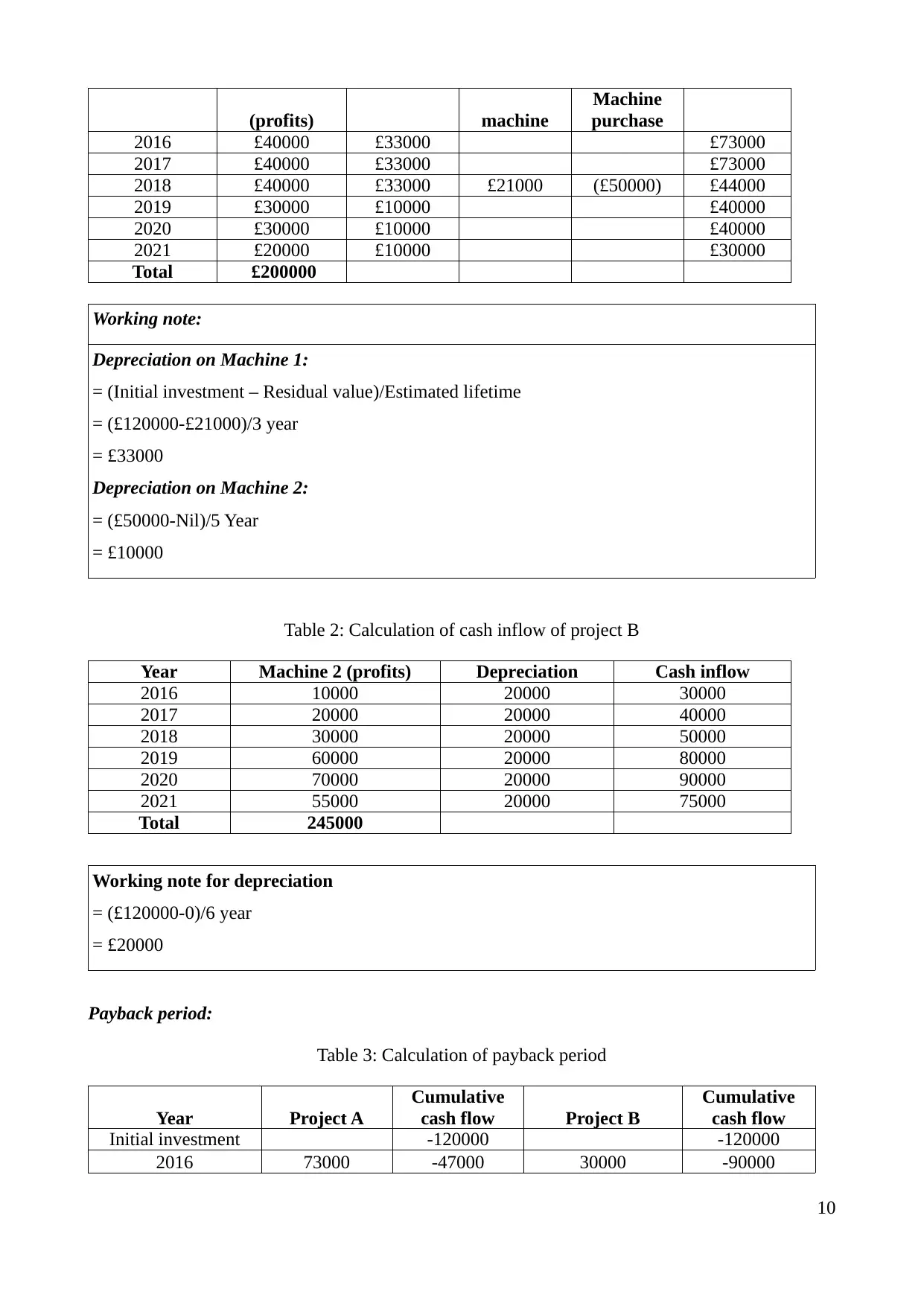

(profits) machine

Machine

purchase

2016 £40000 £33000 £73000

2017 £40000 £33000 £73000

2018 £40000 £33000 £21000 (£50000) £44000

2019 £30000 £10000 £40000

2020 £30000 £10000 £40000

2021 £20000 £10000 £30000

Total £200000

Working note:

Depreciation on Machine 1:

= (Initial investment – Residual value)/Estimated lifetime

= (£120000-£21000)/3 year

= £33000

Depreciation on Machine 2:

= (£50000-Nil)/5 Year

= £10000

Table 2: Calculation of cash inflow of project B

Year Machine 2 (profits) Depreciation Cash inflow

2016 10000 20000 30000

2017 20000 20000 40000

2018 30000 20000 50000

2019 60000 20000 80000

2020 70000 20000 90000

2021 55000 20000 75000

Total 245000

Working note for depreciation

= (£120000-0)/6 year

= £20000

Payback period:

Table 3: Calculation of payback period

Year Project A

Cumulative

cash flow Project B

Cumulative

cash flow

Initial investment -120000 -120000

2016 73000 -47000 30000 -90000

10

Machine

purchase

2016 £40000 £33000 £73000

2017 £40000 £33000 £73000

2018 £40000 £33000 £21000 (£50000) £44000

2019 £30000 £10000 £40000

2020 £30000 £10000 £40000

2021 £20000 £10000 £30000

Total £200000

Working note:

Depreciation on Machine 1:

= (Initial investment – Residual value)/Estimated lifetime

= (£120000-£21000)/3 year

= £33000

Depreciation on Machine 2:

= (£50000-Nil)/5 Year

= £10000

Table 2: Calculation of cash inflow of project B

Year Machine 2 (profits) Depreciation Cash inflow

2016 10000 20000 30000

2017 20000 20000 40000

2018 30000 20000 50000

2019 60000 20000 80000

2020 70000 20000 90000

2021 55000 20000 75000

Total 245000

Working note for depreciation

= (£120000-0)/6 year

= £20000

Payback period:

Table 3: Calculation of payback period

Year Project A

Cumulative

cash flow Project B

Cumulative

cash flow

Initial investment -120000 -120000

2016 73000 -47000 30000 -90000

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2017 73000 26000 40000 -50000

2018 44000 70000 50000 0

2019 40000 110000 80000 80000

2020 40000 150000 90000 170000

2021 30000 180000 75000 245000

Project A: 1 year + (£47000/£73000)

= 1.64 year

Project B: 3 year

Interpretation

Payback is traditional form of capital budgeting which is used to determine the time period

in which future returns will be generated by an entity in order to select or reject a particular project

in the particular financial year (Hosain, 2016). Desired aim of the business is to select the best

suitable project according to the desired aims and the objectives of the business as initial investment

applied by an entity owner in relation to all the returns they get in exchange of the returns in less

period. Hence, project A will be selected by an entity owner as this generates higher amount of

returns in the near future in less period as compared to the other project analysed by an entity by

applying this particular techniques.

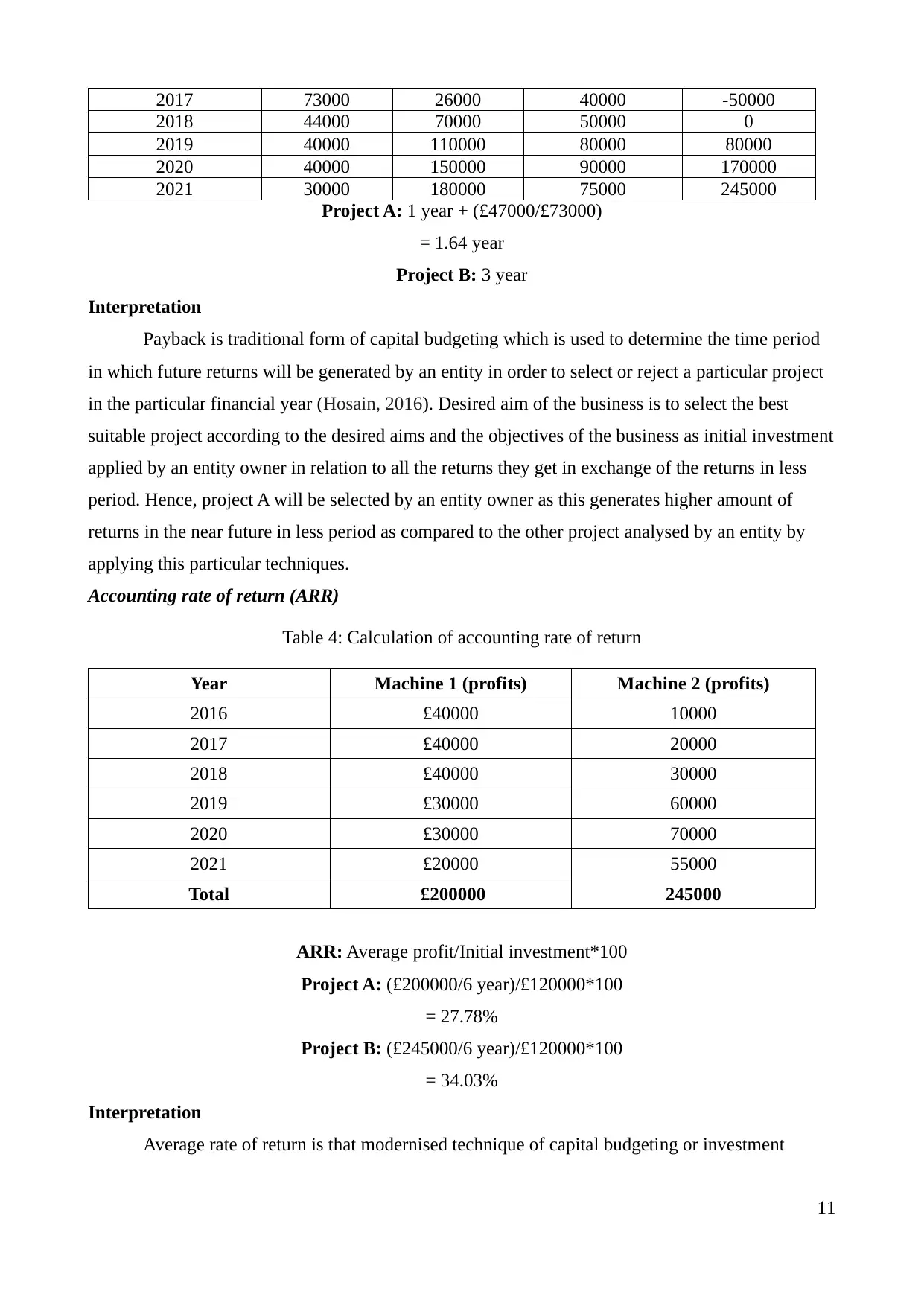

Accounting rate of return (ARR)

Table 4: Calculation of accounting rate of return

Year Machine 1 (profits) Machine 2 (profits)

2016 £40000 10000

2017 £40000 20000

2018 £40000 30000

2019 £30000 60000

2020 £30000 70000

2021 £20000 55000

Total £200000 245000

ARR: Average profit/Initial investment*100

Project A: (£200000/6 year)/£120000*100

= 27.78%

Project B: (£245000/6 year)/£120000*100

= 34.03%

Interpretation

Average rate of return is that modernised technique of capital budgeting or investment

11

2018 44000 70000 50000 0

2019 40000 110000 80000 80000

2020 40000 150000 90000 170000

2021 30000 180000 75000 245000

Project A: 1 year + (£47000/£73000)

= 1.64 year

Project B: 3 year

Interpretation

Payback is traditional form of capital budgeting which is used to determine the time period

in which future returns will be generated by an entity in order to select or reject a particular project

in the particular financial year (Hosain, 2016). Desired aim of the business is to select the best

suitable project according to the desired aims and the objectives of the business as initial investment

applied by an entity owner in relation to all the returns they get in exchange of the returns in less

period. Hence, project A will be selected by an entity owner as this generates higher amount of

returns in the near future in less period as compared to the other project analysed by an entity by

applying this particular techniques.

Accounting rate of return (ARR)

Table 4: Calculation of accounting rate of return

Year Machine 1 (profits) Machine 2 (profits)

2016 £40000 10000

2017 £40000 20000

2018 £40000 30000

2019 £30000 60000

2020 £30000 70000

2021 £20000 55000

Total £200000 245000

ARR: Average profit/Initial investment*100

Project A: (£200000/6 year)/£120000*100

= 27.78%

Project B: (£245000/6 year)/£120000*100

= 34.03%

Interpretation

Average rate of return is that modernised technique of capital budgeting or investment

11

appraisal technique whose major aim is to test the ability of a particular project by evaluating its

overall profitability. The higher profitability generated by a business project will be taken into

consideration for the future purpose as this is the desired aim of an entity. Projects are categorised y

this particular approach in order to consider the best suitable project which generate higher returns

in the near future (Jorgensen and Rotter, 2016). According to the results of the above evaluation

table, it can be said that project B will be considered for the future purpose as the ARR rate is

higher as compared to the above result generated by Project B as compared to the results produces

by the project A. This particular rate is higher as compared to the internal cost of capital of an entity.

Net present value (NPV)

Table 5: Calculation of Net present value

Year

Project A (In

£)

Discounted

value of £1

@20% DCF (In £)

Project B

(In £) DCF (In £)

2016 73000 0.833 60809 30000 24990

2017 73000 0.694 50662 40000 27760

2018 44000 0.579 25476 50000 28950

2019 40000 0.482 19280 80000 38560

2020 40000 0.402 16080 90000 36180

2021 30000 0.335 10050 75000 25125

Total future value 182357 181565

Less: Initial

investment (120000) (120000)

NPV 62357 61565

Interpretation

Net present value is the modern approach of the capital appraisal technique whose major

aim is to determine the future profitability generated by a particular project in the near future. The

basic aim of the business is to select the best suitable project for the future purpose as this kind of

technique uses the time value of concept by applying the best appropriate discounting rate in order

to test the viability of the business project. Projects will be evaluated on this particular technique in

order to provide ultimate advantage to an entity. Project A will be selected by an entity on the basis

of higher results generated by this particular project (Kostova and Nell, 2016). So, This project will

be considered by an entity for the future in order to accomplish desired aims and the objectives

within a given period.

12

overall profitability. The higher profitability generated by a business project will be taken into

consideration for the future purpose as this is the desired aim of an entity. Projects are categorised y

this particular approach in order to consider the best suitable project which generate higher returns

in the near future (Jorgensen and Rotter, 2016). According to the results of the above evaluation

table, it can be said that project B will be considered for the future purpose as the ARR rate is

higher as compared to the above result generated by Project B as compared to the results produces

by the project A. This particular rate is higher as compared to the internal cost of capital of an entity.

Net present value (NPV)

Table 5: Calculation of Net present value

Year

Project A (In

£)

Discounted

value of £1

@20% DCF (In £)

Project B

(In £) DCF (In £)

2016 73000 0.833 60809 30000 24990

2017 73000 0.694 50662 40000 27760

2018 44000 0.579 25476 50000 28950

2019 40000 0.482 19280 80000 38560

2020 40000 0.402 16080 90000 36180

2021 30000 0.335 10050 75000 25125

Total future value 182357 181565

Less: Initial

investment (120000) (120000)

NPV 62357 61565

Interpretation

Net present value is the modern approach of the capital appraisal technique whose major

aim is to determine the future profitability generated by a particular project in the near future. The

basic aim of the business is to select the best suitable project for the future purpose as this kind of

technique uses the time value of concept by applying the best appropriate discounting rate in order

to test the viability of the business project. Projects will be evaluated on this particular technique in

order to provide ultimate advantage to an entity. Project A will be selected by an entity on the basis

of higher results generated by this particular project (Kostova and Nell, 2016). So, This project will

be considered by an entity for the future in order to accomplish desired aims and the objectives

within a given period.

12

TASK 4

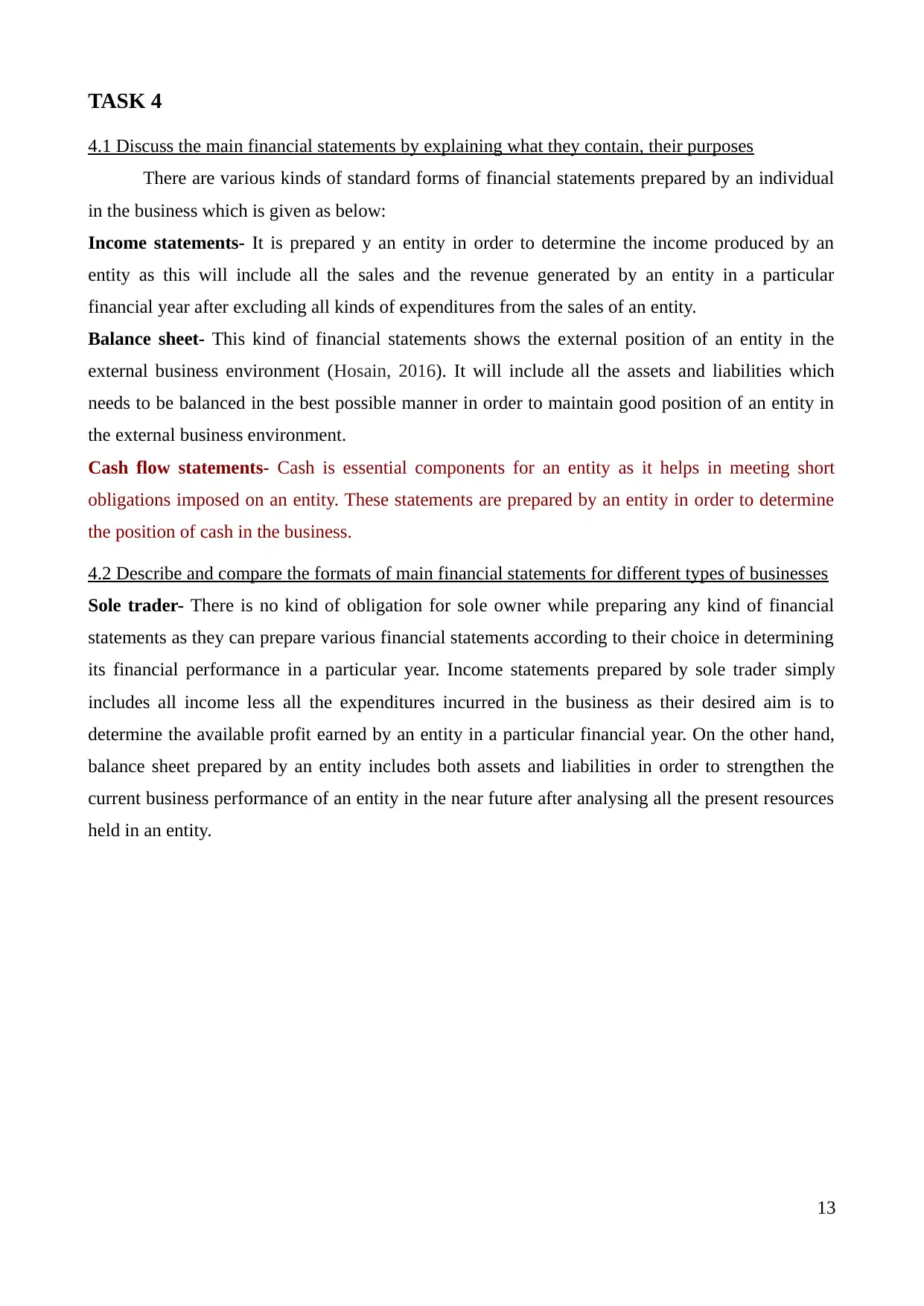

4.1 Discuss the main financial statements by explaining what they contain, their purposes

There are various kinds of standard forms of financial statements prepared by an individual

in the business which is given as below:

Income statements- It is prepared y an entity in order to determine the income produced by an

entity as this will include all the sales and the revenue generated by an entity in a particular

financial year after excluding all kinds of expenditures from the sales of an entity.

Balance sheet- This kind of financial statements shows the external position of an entity in the

external business environment (Hosain, 2016). It will include all the assets and liabilities which

needs to be balanced in the best possible manner in order to maintain good position of an entity in

the external business environment.

Cash flow statements- Cash is essential components for an entity as it helps in meeting short

obligations imposed on an entity. These statements are prepared by an entity in order to determine

the position of cash in the business.

4.2 Describe and compare the formats of main financial statements for different types of businesses

Sole trader- There is no kind of obligation for sole owner while preparing any kind of financial

statements as they can prepare various financial statements according to their choice in determining

its financial performance in a particular year. Income statements prepared by sole trader simply

includes all income less all the expenditures incurred in the business as their desired aim is to

determine the available profit earned by an entity in a particular financial year. On the other hand,

balance sheet prepared by an entity includes both assets and liabilities in order to strengthen the

current business performance of an entity in the near future after analysing all the present resources

held in an entity.

13

4.1 Discuss the main financial statements by explaining what they contain, their purposes

There are various kinds of standard forms of financial statements prepared by an individual

in the business which is given as below:

Income statements- It is prepared y an entity in order to determine the income produced by an

entity as this will include all the sales and the revenue generated by an entity in a particular

financial year after excluding all kinds of expenditures from the sales of an entity.

Balance sheet- This kind of financial statements shows the external position of an entity in the

external business environment (Hosain, 2016). It will include all the assets and liabilities which

needs to be balanced in the best possible manner in order to maintain good position of an entity in

the external business environment.

Cash flow statements- Cash is essential components for an entity as it helps in meeting short

obligations imposed on an entity. These statements are prepared by an entity in order to determine

the position of cash in the business.

4.2 Describe and compare the formats of main financial statements for different types of businesses

Sole trader- There is no kind of obligation for sole owner while preparing any kind of financial

statements as they can prepare various financial statements according to their choice in determining

its financial performance in a particular year. Income statements prepared by sole trader simply

includes all income less all the expenditures incurred in the business as their desired aim is to

determine the available profit earned by an entity in a particular financial year. On the other hand,

balance sheet prepared by an entity includes both assets and liabilities in order to strengthen the

current business performance of an entity in the near future after analysing all the present resources

held in an entity.

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

XYZ Enterprises

Income Statement for the year Ended 31 December 2015

£ £

Sales/Revenue XXXX

Cost of goods sold

Opening inventory xx

Add: Purchases xxx

Cost of goods xxx

Less: closing inventory xx

Cost of goods sold XXX

Gross Profit XXXX

Operating Expenses xxx

Rent and rates xxx

Loan interest xxx

xxx

Operating Profit xxxx

XYZ Enterprises: Balance Sheet as at 31 December 2015

£ £ £

Non-Current Assets Cost Depreciation Net Book Value

Plant & Equipment xxx xxx xxx

Current Assets

Cash & Bank xxx

xxx

Total Assets xxx

Equity and Total Liabilities

Share Capital plus retained xxxc

14

Income Statement for the year Ended 31 December 2015

£ £

Sales/Revenue XXXX

Cost of goods sold

Opening inventory xx

Add: Purchases xxx

Cost of goods xxx

Less: closing inventory xx

Cost of goods sold XXX

Gross Profit XXXX

Operating Expenses xxx

Rent and rates xxx

Loan interest xxx

xxx

Operating Profit xxxx

XYZ Enterprises: Balance Sheet as at 31 December 2015

£ £ £

Non-Current Assets Cost Depreciation Net Book Value

Plant & Equipment xxx xxx xxx

Current Assets

Cash & Bank xxx

xxx

Total Assets xxx

Equity and Total Liabilities

Share Capital plus retained xxxc

14

profit

Less: Drawings xxx

xxxx

Non-Current Liabilities

Long term Loan xxx

Current Liabilities

Trade Payables xxx

Total Liabilities and Capital xxxx

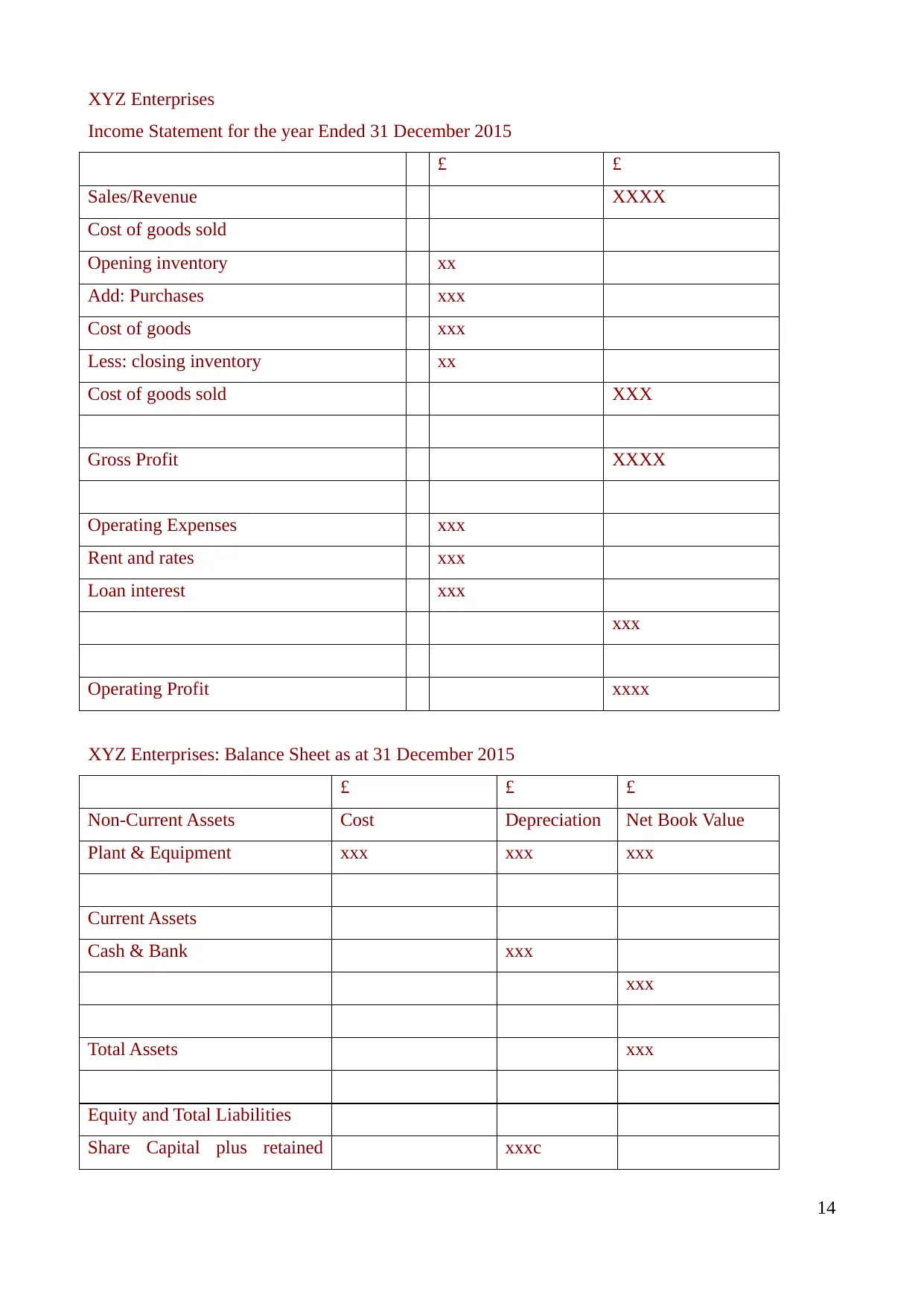

Partnership-Income statements prepared by the partnership will distribute all the profit equally

among all the partners in their specific ratio of their particular investment (Tsai, 2016). The balance

sheet will be prepared on the name of the whole partnership firm in which capital brought by all the

partners will be included in the balance sheet.

ABC & XYZ Partnership: Balance Sheet as at 31 December 2015

£ £ £

Non-Current Assets Cost Depreciation Net Book Value

Plant & Equipment xxx xxx xxxx

Current Assets

Inventories xxx

Receivables xxx

Cash & Bank xxx

xxx

Total Assets xxxx

Equity and Total Liabilities

Capital Accounts

ABC xxx

15

Less: Drawings xxx

xxxx

Non-Current Liabilities

Long term Loan xxx

Current Liabilities

Trade Payables xxx

Total Liabilities and Capital xxxx

Partnership-Income statements prepared by the partnership will distribute all the profit equally

among all the partners in their specific ratio of their particular investment (Tsai, 2016). The balance

sheet will be prepared on the name of the whole partnership firm in which capital brought by all the

partners will be included in the balance sheet.

ABC & XYZ Partnership: Balance Sheet as at 31 December 2015

£ £ £

Non-Current Assets Cost Depreciation Net Book Value

Plant & Equipment xxx xxx xxxx

Current Assets

Inventories xxx

Receivables xxx

Cash & Bank xxx

xxx

Total Assets xxxx

Equity and Total Liabilities

Capital Accounts

ABC xxx

15

XYZ xxx

Current Accounts:

ABC xxx

XYZ xxx

xxxx

Non-Current Liabilities

Loan xxx

Current Liabilities

Trade Payables xxx

xxxx

Equity and Total Liabilities xxxx

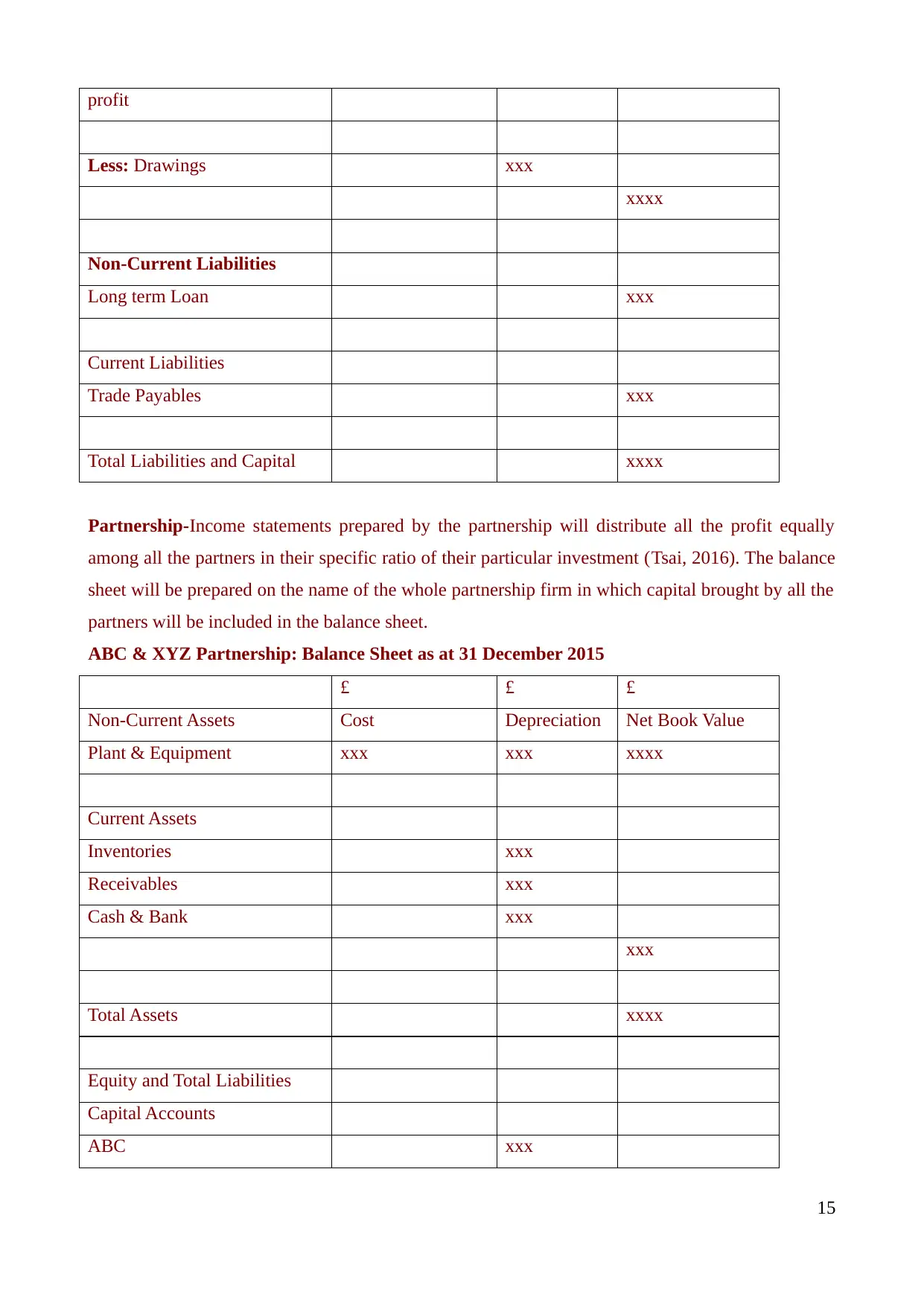

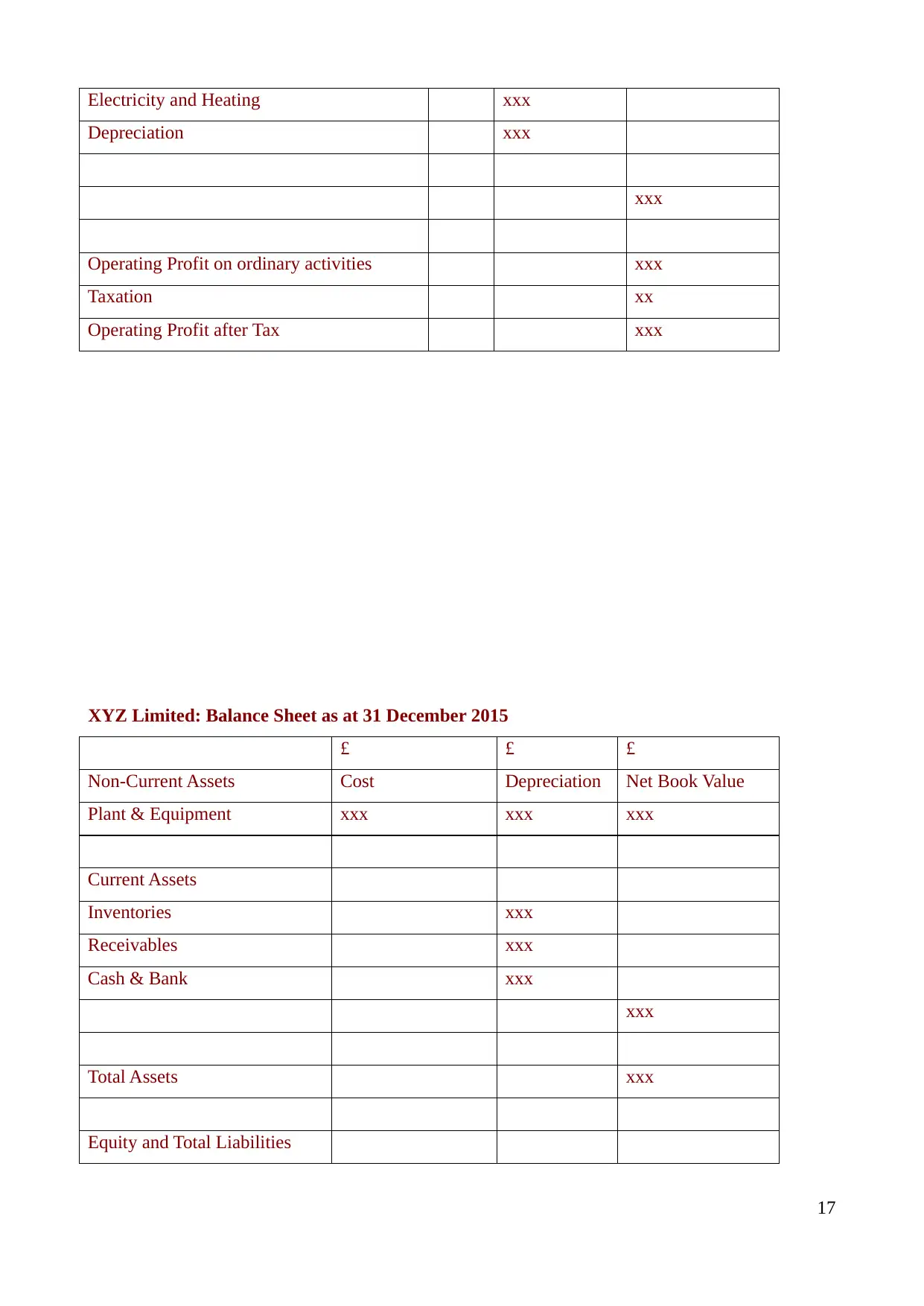

XYZ Limited: Income Statement for the year Ended 31 December 2015

£ £

Sales/Revenue XXX

Cost of goods sold

Opening inventory xx

Add: Purchases xxx

Cost of goods xxx

Less: closing inventory xx

Cost of goods sold XXX

Gross Profit XXXX

Operating Expenses

Rent and rates xxx

Wages and salaries xxx

Printing and stationery xxx

16

Current Accounts:

ABC xxx

XYZ xxx

xxxx

Non-Current Liabilities

Loan xxx

Current Liabilities

Trade Payables xxx

xxxx

Equity and Total Liabilities xxxx

XYZ Limited: Income Statement for the year Ended 31 December 2015

£ £

Sales/Revenue XXX

Cost of goods sold

Opening inventory xx

Add: Purchases xxx

Cost of goods xxx

Less: closing inventory xx

Cost of goods sold XXX

Gross Profit XXXX

Operating Expenses

Rent and rates xxx

Wages and salaries xxx

Printing and stationery xxx

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Electricity and Heating xxx

Depreciation xxx

xxx

Operating Profit on ordinary activities xxx

Taxation xx

Operating Profit after Tax xxx

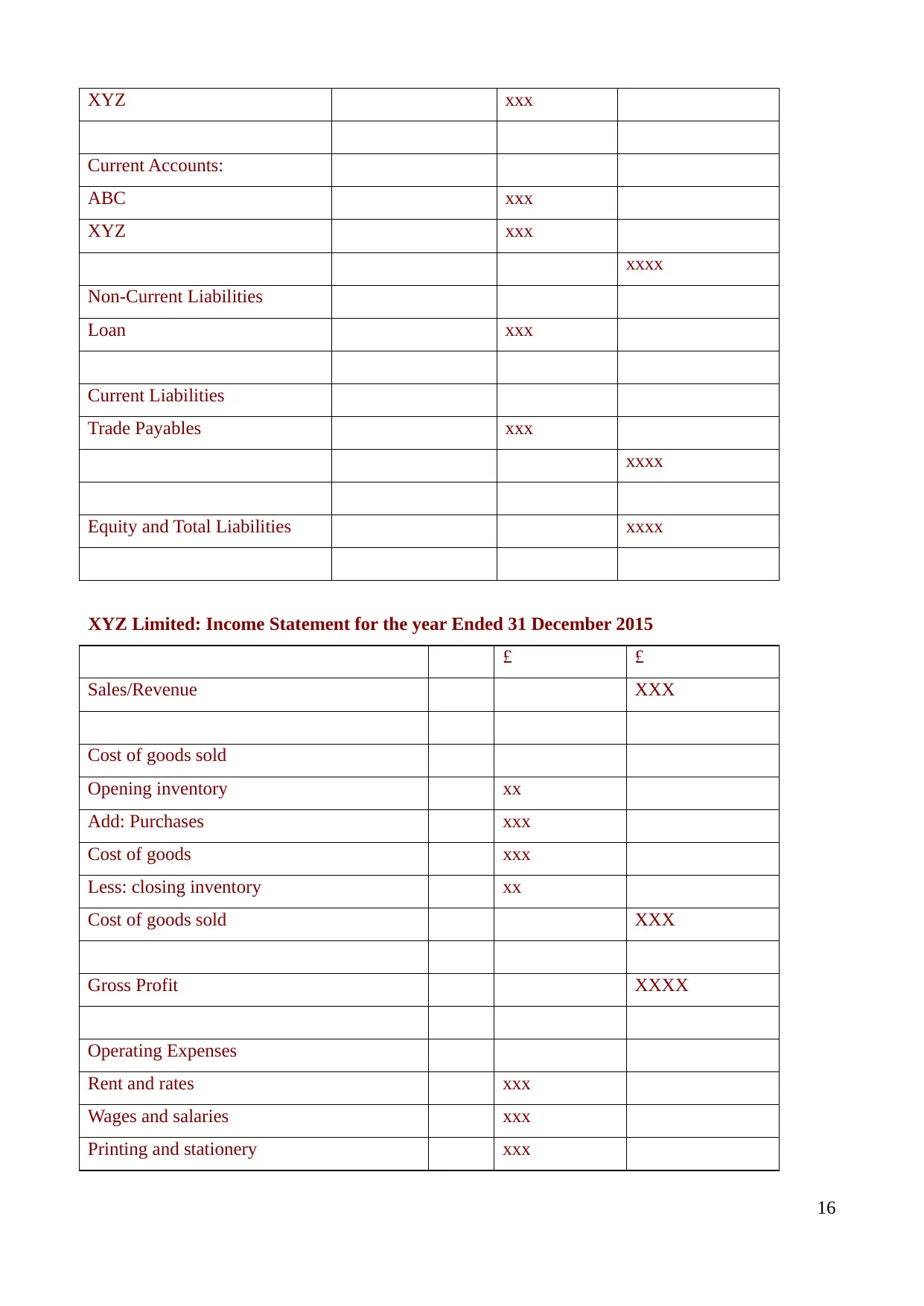

XYZ Limited: Balance Sheet as at 31 December 2015

£ £ £

Non-Current Assets Cost Depreciation Net Book Value

Plant & Equipment xxx xxx xxx

Current Assets

Inventories xxx

Receivables xxx

Cash & Bank xxx

xxx

Total Assets xxx

Equity and Total Liabilities

17

Depreciation xxx

xxx

Operating Profit on ordinary activities xxx

Taxation xx

Operating Profit after Tax xxx

XYZ Limited: Balance Sheet as at 31 December 2015

£ £ £

Non-Current Assets Cost Depreciation Net Book Value

Plant & Equipment xxx xxx xxx

Current Assets

Inventories xxx

Receivables xxx

Cash & Bank xxx

xxx

Total Assets xxx

Equity and Total Liabilities

17

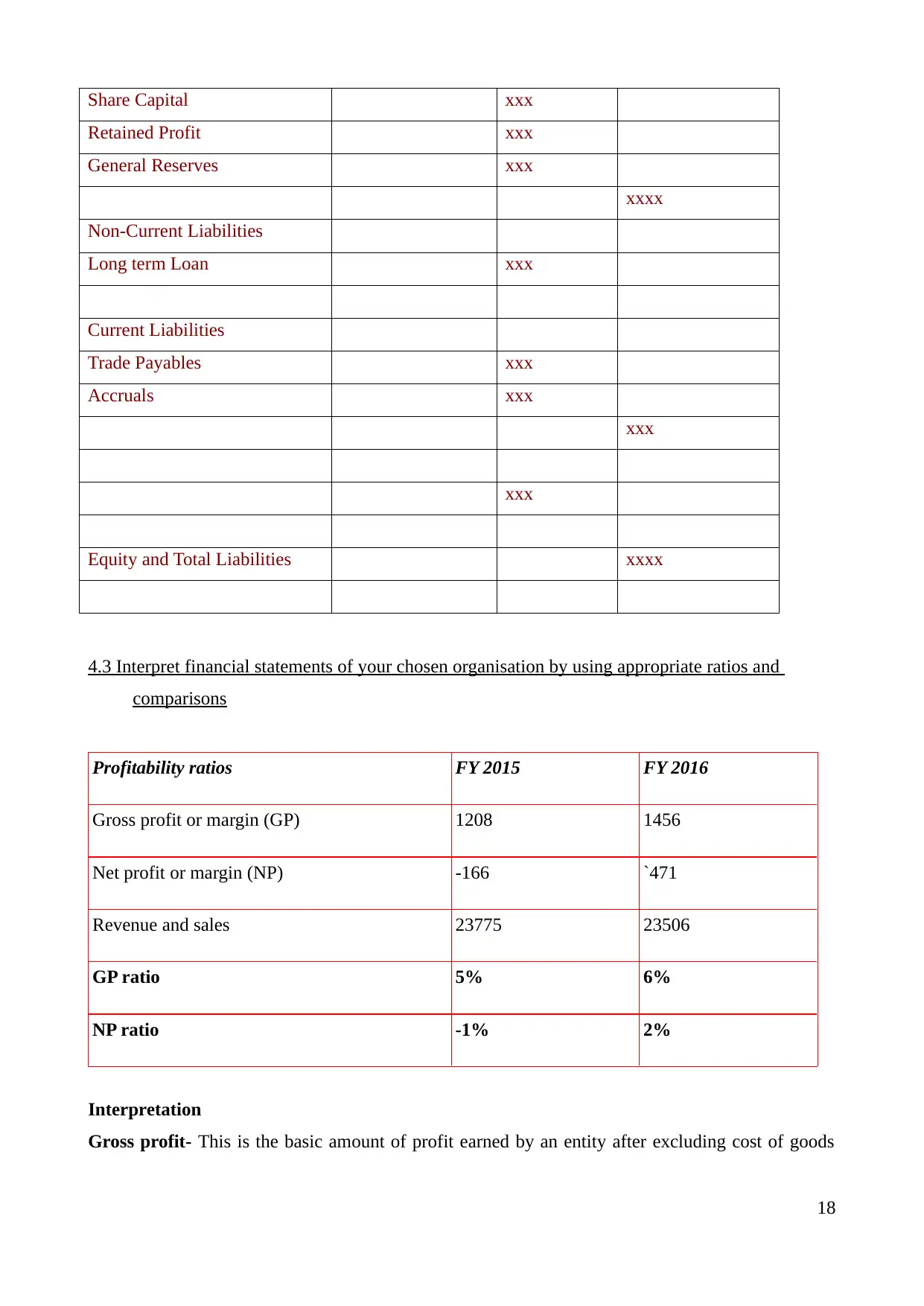

Share Capital xxx

Retained Profit xxx

General Reserves xxx

xxxx

Non-Current Liabilities

Long term Loan xxx

Current Liabilities

Trade Payables xxx

Accruals xxx

xxx

xxx

Equity and Total Liabilities xxxx

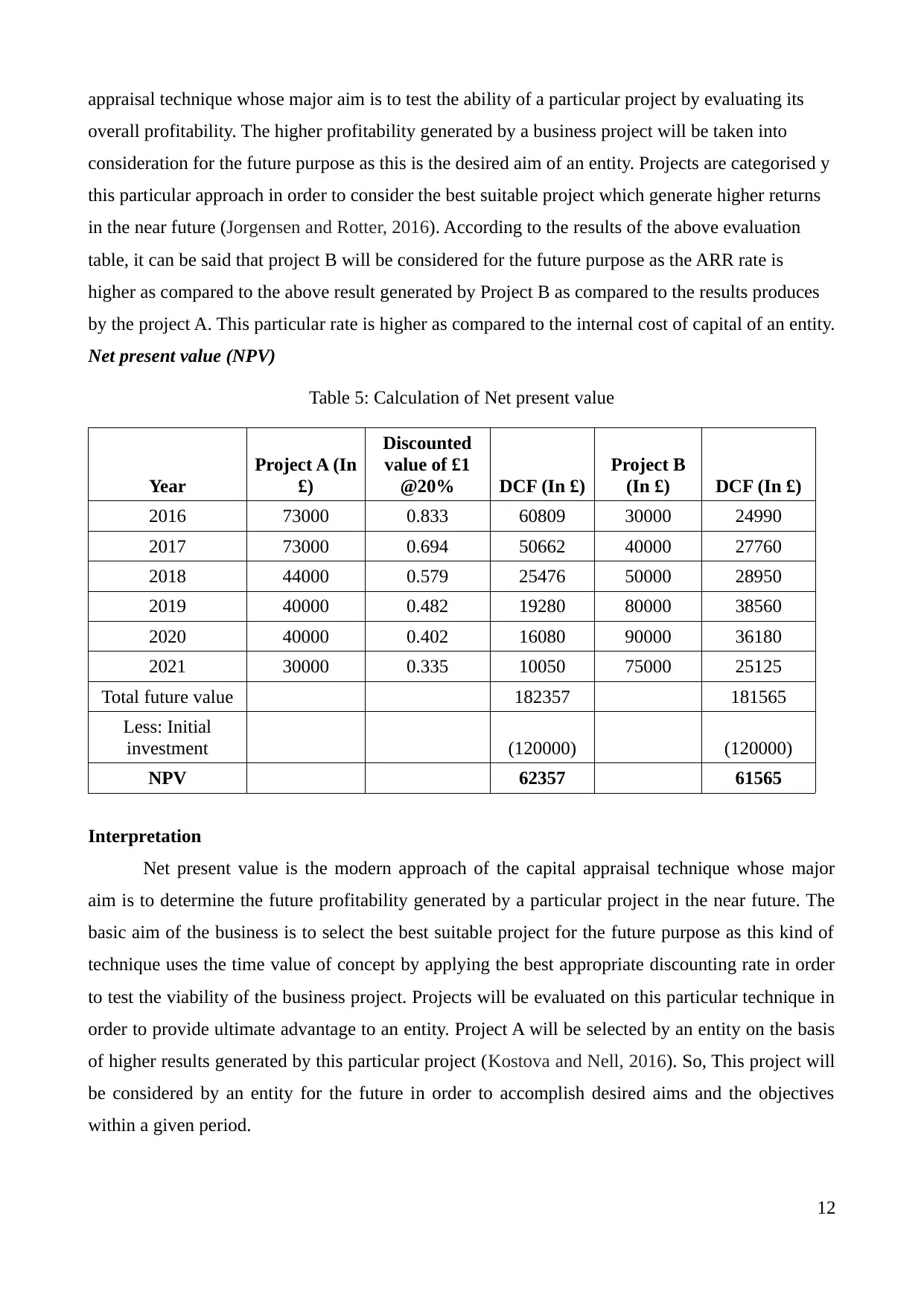

4.3 Interpret financial statements of your chosen organisation by using appropriate ratios and

comparisons

Profitability ratios FY 2015 FY 2016

Gross profit or margin (GP) 1208 1456

Net profit or margin (NP) -166 `471

Revenue and sales 23775 23506

GP ratio 5% 6%

NP ratio -1% 2%

Interpretation

Gross profit- This is the basic amount of profit earned by an entity after excluding cost of goods

18

Retained Profit xxx

General Reserves xxx

xxxx

Non-Current Liabilities

Long term Loan xxx

Current Liabilities

Trade Payables xxx

Accruals xxx

xxx

xxx

Equity and Total Liabilities xxxx

4.3 Interpret financial statements of your chosen organisation by using appropriate ratios and

comparisons

Profitability ratios FY 2015 FY 2016

Gross profit or margin (GP) 1208 1456

Net profit or margin (NP) -166 `471

Revenue and sales 23775 23506

GP ratio 5% 6%

NP ratio -1% 2%

Interpretation

Gross profit- This is the basic amount of profit earned by an entity after excluding cost of goods

18

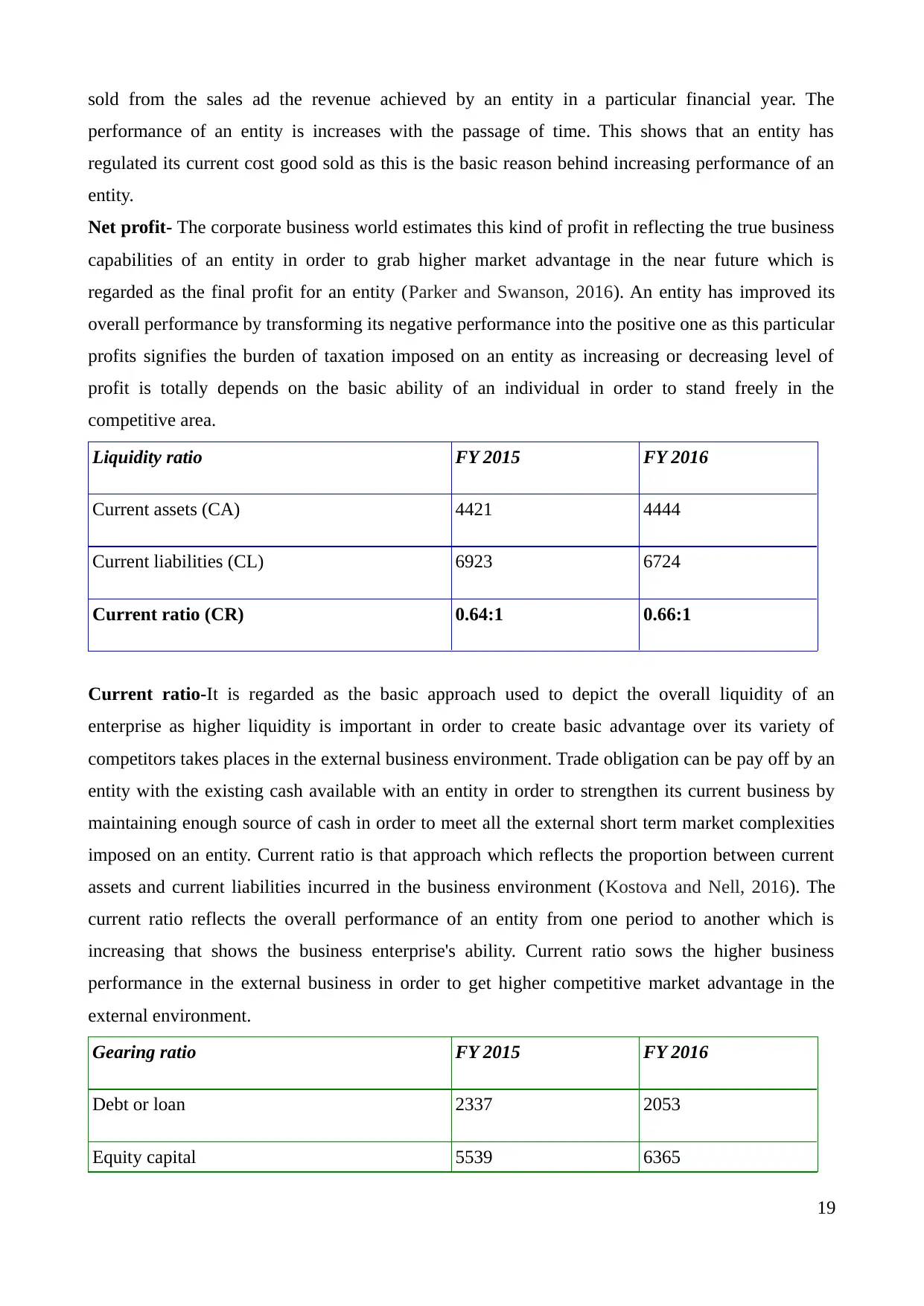

sold from the sales ad the revenue achieved by an entity in a particular financial year. The

performance of an entity is increases with the passage of time. This shows that an entity has

regulated its current cost good sold as this is the basic reason behind increasing performance of an

entity.

Net profit- The corporate business world estimates this kind of profit in reflecting the true business

capabilities of an entity in order to grab higher market advantage in the near future which is

regarded as the final profit for an entity (Parker and Swanson, 2016). An entity has improved its

overall performance by transforming its negative performance into the positive one as this particular

profits signifies the burden of taxation imposed on an entity as increasing or decreasing level of

profit is totally depends on the basic ability of an individual in order to stand freely in the

competitive area.

Liquidity ratio FY 2015 FY 2016

Current assets (CA) 4421 4444

Current liabilities (CL) 6923 6724

Current ratio (CR) 0.64:1 0.66:1

Current ratio-It is regarded as the basic approach used to depict the overall liquidity of an

enterprise as higher liquidity is important in order to create basic advantage over its variety of

competitors takes places in the external business environment. Trade obligation can be pay off by an

entity with the existing cash available with an entity in order to strengthen its current business by

maintaining enough source of cash in order to meet all the external short term market complexities

imposed on an entity. Current ratio is that approach which reflects the proportion between current

assets and current liabilities incurred in the business environment (Kostova and Nell, 2016). The

current ratio reflects the overall performance of an entity from one period to another which is

increasing that shows the business enterprise's ability. Current ratio sows the higher business

performance in the external business in order to get higher competitive market advantage in the

external environment.

Gearing ratio FY 2015 FY 2016

Debt or loan 2337 2053

Equity capital 5539 6365

19

performance of an entity is increases with the passage of time. This shows that an entity has

regulated its current cost good sold as this is the basic reason behind increasing performance of an

entity.

Net profit- The corporate business world estimates this kind of profit in reflecting the true business

capabilities of an entity in order to grab higher market advantage in the near future which is

regarded as the final profit for an entity (Parker and Swanson, 2016). An entity has improved its

overall performance by transforming its negative performance into the positive one as this particular

profits signifies the burden of taxation imposed on an entity as increasing or decreasing level of

profit is totally depends on the basic ability of an individual in order to stand freely in the

competitive area.

Liquidity ratio FY 2015 FY 2016

Current assets (CA) 4421 4444

Current liabilities (CL) 6923 6724

Current ratio (CR) 0.64:1 0.66:1

Current ratio-It is regarded as the basic approach used to depict the overall liquidity of an

enterprise as higher liquidity is important in order to create basic advantage over its variety of

competitors takes places in the external business environment. Trade obligation can be pay off by an

entity with the existing cash available with an entity in order to strengthen its current business by

maintaining enough source of cash in order to meet all the external short term market complexities

imposed on an entity. Current ratio is that approach which reflects the proportion between current

assets and current liabilities incurred in the business environment (Kostova and Nell, 2016). The

current ratio reflects the overall performance of an entity from one period to another which is

increasing that shows the business enterprise's ability. Current ratio sows the higher business

performance in the external business in order to get higher competitive market advantage in the

external environment.

Gearing ratio FY 2015 FY 2016

Debt or loan 2337 2053

Equity capital 5539 6365

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

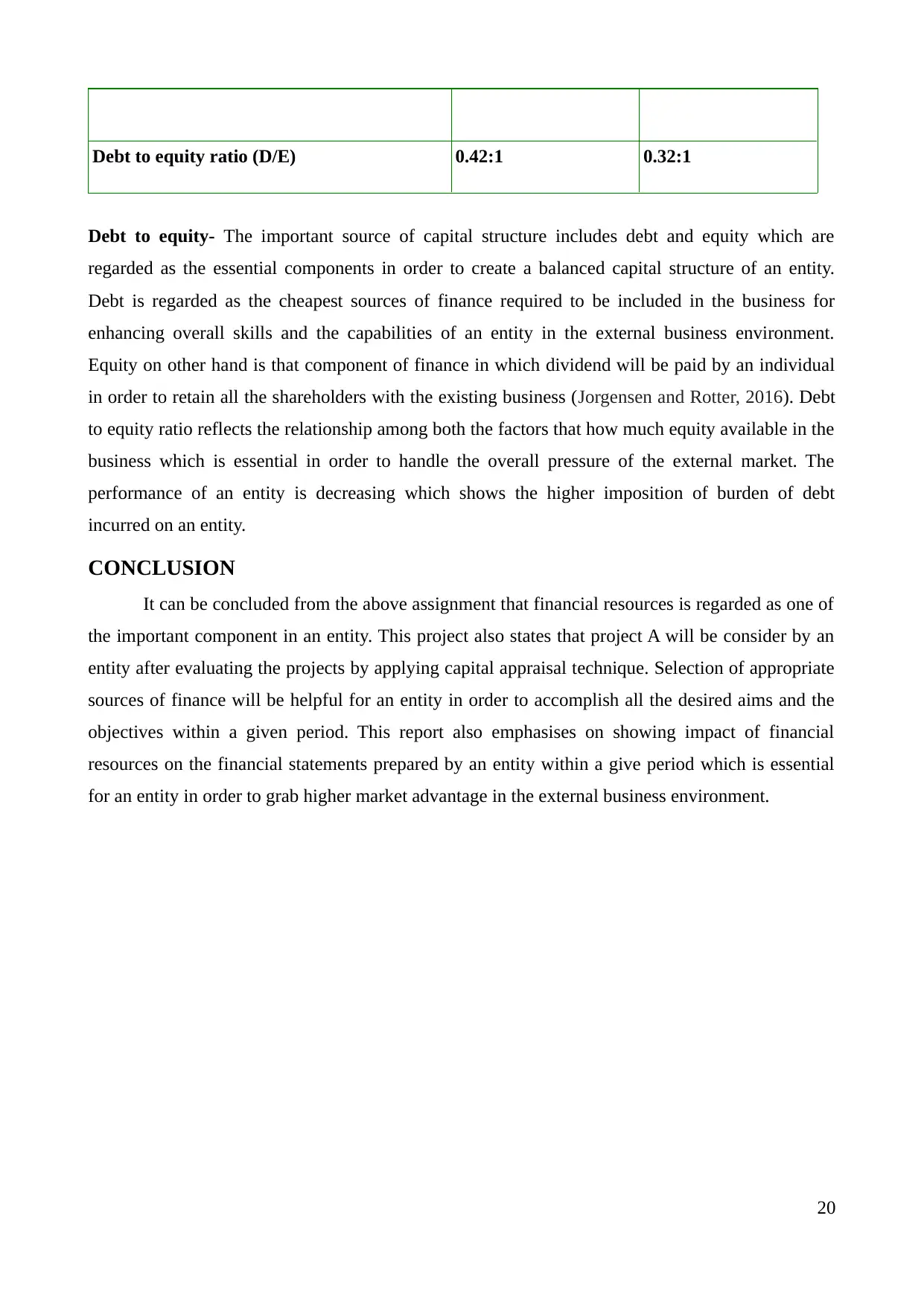

Debt to equity ratio (D/E) 0.42:1 0.32:1

Debt to equity- The important source of capital structure includes debt and equity which are

regarded as the essential components in order to create a balanced capital structure of an entity.

Debt is regarded as the cheapest sources of finance required to be included in the business for

enhancing overall skills and the capabilities of an entity in the external business environment.

Equity on other hand is that component of finance in which dividend will be paid by an individual

in order to retain all the shareholders with the existing business (Jorgensen and Rotter, 2016). Debt

to equity ratio reflects the relationship among both the factors that how much equity available in the

business which is essential in order to handle the overall pressure of the external market. The

performance of an entity is decreasing which shows the higher imposition of burden of debt

incurred on an entity.

CONCLUSION

It can be concluded from the above assignment that financial resources is regarded as one of

the important component in an entity. This project also states that project A will be consider by an

entity after evaluating the projects by applying capital appraisal technique. Selection of appropriate

sources of finance will be helpful for an entity in order to accomplish all the desired aims and the

objectives within a given period. This report also emphasises on showing impact of financial

resources on the financial statements prepared by an entity within a give period which is essential

for an entity in order to grab higher market advantage in the external business environment.

20

Debt to equity- The important source of capital structure includes debt and equity which are

regarded as the essential components in order to create a balanced capital structure of an entity.

Debt is regarded as the cheapest sources of finance required to be included in the business for

enhancing overall skills and the capabilities of an entity in the external business environment.

Equity on other hand is that component of finance in which dividend will be paid by an individual

in order to retain all the shareholders with the existing business (Jorgensen and Rotter, 2016). Debt

to equity ratio reflects the relationship among both the factors that how much equity available in the

business which is essential in order to handle the overall pressure of the external market. The

performance of an entity is decreasing which shows the higher imposition of burden of debt

incurred on an entity.

CONCLUSION

It can be concluded from the above assignment that financial resources is regarded as one of

the important component in an entity. This project also states that project A will be consider by an

entity after evaluating the projects by applying capital appraisal technique. Selection of appropriate

sources of finance will be helpful for an entity in order to accomplish all the desired aims and the

objectives within a given period. This report also emphasises on showing impact of financial

resources on the financial statements prepared by an entity within a give period which is essential

for an entity in order to grab higher market advantage in the external business environment.

20

21

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.