Investment Appraisal and Procurement Strategies: A Business Report

VerifiedAdded on 2023/06/14

|14

|3347

|126

Report

AI Summary

This business report provides a comprehensive analysis of various aspects of K plc's operations, including investment appraisal, funding methods, variance analysis, and procurement strategies. Part A focuses on evaluating different projects using payback period and net present value (NPV) methods, ranking them accordingly, and discussing the strengths and weaknesses of each method, alongside qualitative factors influencing final investment decisions. Part B explores alternative funding methods for K plc's acquisition plans and the link between financing and investment decisions. Part C involves a detailed variance analysis of variable cost elements, identifying potential explanations for the variances. Finally, Part D compares centralized and decentralized procurement approaches, highlighting their respective advantages and disadvantages. The report concludes with recommendations for K plc based on the analysis presented.

Business Report

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION.......................................................................................................................................3

PART A.......................................................................................................................................................3

a) Payback period calculation..................................................................................................................3

b) NPV for all projects.............................................................................................................................4

c) Rank the projects on the basis of Pay back as well as NPV.................................................................5

d) Selecting the project............................................................................................................................6

e) Strength and weaknesses of payback period and net present value method.........................................6

f) Qualitative factors which help the directors in making a final payment...............................................7

PART B.......................................................................................................................................................8

a) Alternative methods of funding...........................................................................................................8

b) Link between the financing and investment decision in relation to acquisition...................................8

PART C.......................................................................................................................................................9

a) Prepare a full variance analysis statement of variable cost elements...................................................9

b) Possible explanations for variances identified...................................................................................11

PART D.....................................................................................................................................................11

Centralised and decentralised procurement............................................................................................11

CONCLUSION.........................................................................................................................................13

REFERENCES..........................................................................................................................................14

INTRODUCTION.......................................................................................................................................3

PART A.......................................................................................................................................................3

a) Payback period calculation..................................................................................................................3

b) NPV for all projects.............................................................................................................................4

c) Rank the projects on the basis of Pay back as well as NPV.................................................................5

d) Selecting the project............................................................................................................................6

e) Strength and weaknesses of payback period and net present value method.........................................6

f) Qualitative factors which help the directors in making a final payment...............................................7

PART B.......................................................................................................................................................8

a) Alternative methods of funding...........................................................................................................8

b) Link between the financing and investment decision in relation to acquisition...................................8

PART C.......................................................................................................................................................9

a) Prepare a full variance analysis statement of variable cost elements...................................................9

b) Possible explanations for variances identified...................................................................................11

PART D.....................................................................................................................................................11

Centralised and decentralised procurement............................................................................................11

CONCLUSION.........................................................................................................................................13

REFERENCES..........................................................................................................................................14

INTRODUCTION

A business report is a collection of information on a company's activities. This report is

being written with the intention of determining appropriate plans for the company. It includes a

comparison of numerous projects and expenditures, as well as a study of the real outcomes. K plc

is the company chosen for this research. It is a publicly listed company. The research is broken

down into four sections (Drobetz and Johns, 2018). Its first portion examines the different refers

to a process and makes a suggestion for the highest achievement. The second portion informs the

company about the different financial applications accessible to it and the optimum one to use

for purchase purposes. The third compares the firm's projected figures to the original results in

order to assess its effectiveness. The fourth part compares and contrasts decentralized versus

centralized buying, as well as their benefits.

PART A

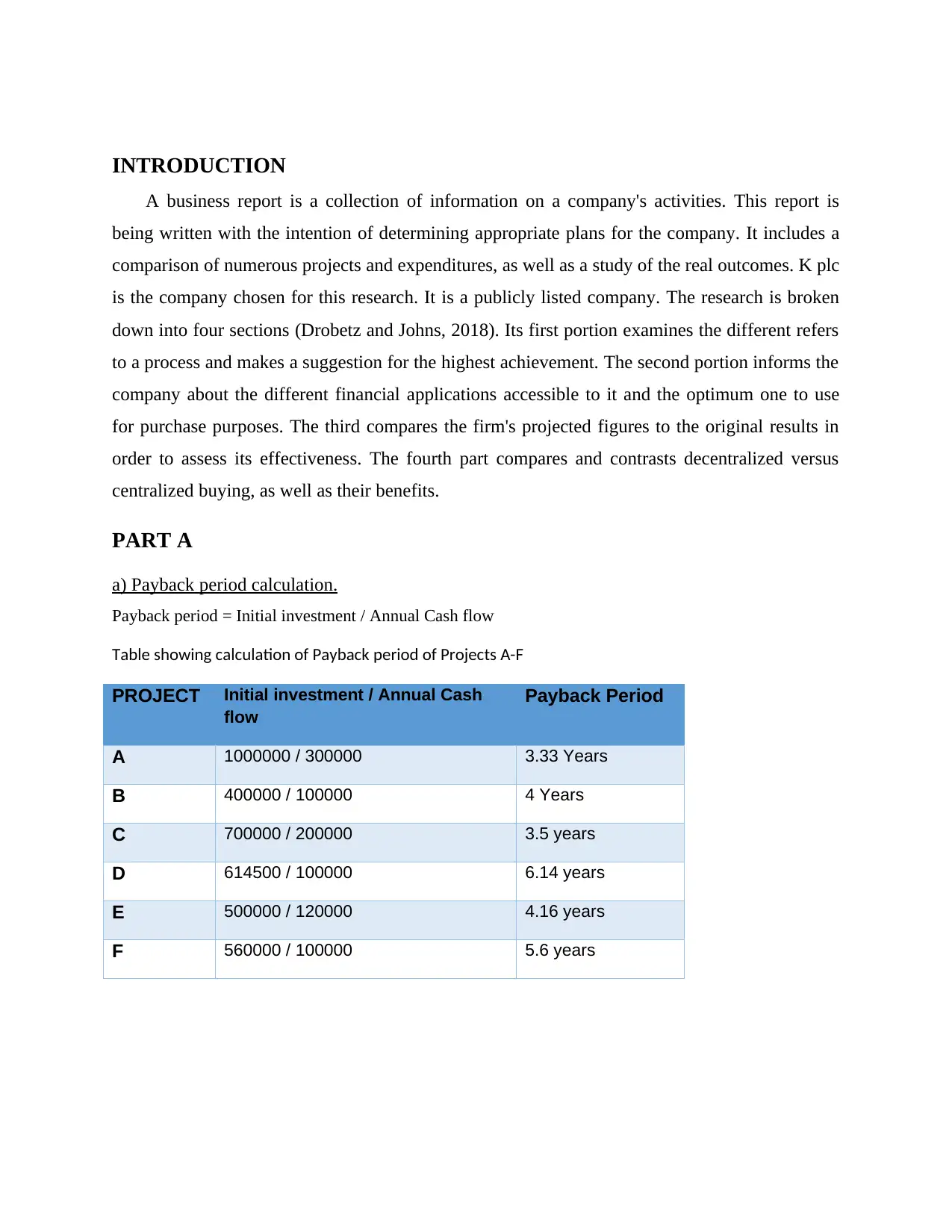

a) Payback period calculation.

Payback period = Initial investment / Annual Cash flow

Table showing calculation of Payback period of Projects A-F

PROJECT Initial investment / Annual Cash

flow

Payback Period

A 1000000 / 300000 3.33 Years

B 400000 / 100000 4 Years

C 700000 / 200000 3.5 years

D 614500 / 100000 6.14 years

E 500000 / 120000 4.16 years

F 560000 / 100000 5.6 years

A business report is a collection of information on a company's activities. This report is

being written with the intention of determining appropriate plans for the company. It includes a

comparison of numerous projects and expenditures, as well as a study of the real outcomes. K plc

is the company chosen for this research. It is a publicly listed company. The research is broken

down into four sections (Drobetz and Johns, 2018). Its first portion examines the different refers

to a process and makes a suggestion for the highest achievement. The second portion informs the

company about the different financial applications accessible to it and the optimum one to use

for purchase purposes. The third compares the firm's projected figures to the original results in

order to assess its effectiveness. The fourth part compares and contrasts decentralized versus

centralized buying, as well as their benefits.

PART A

a) Payback period calculation.

Payback period = Initial investment / Annual Cash flow

Table showing calculation of Payback period of Projects A-F

PROJECT Initial investment / Annual Cash

flow

Payback Period

A 1000000 / 300000 3.33 Years

B 400000 / 100000 4 Years

C 700000 / 200000 3.5 years

D 614500 / 100000 6.14 years

E 500000 / 120000 4.16 years

F 560000 / 100000 5.6 years

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

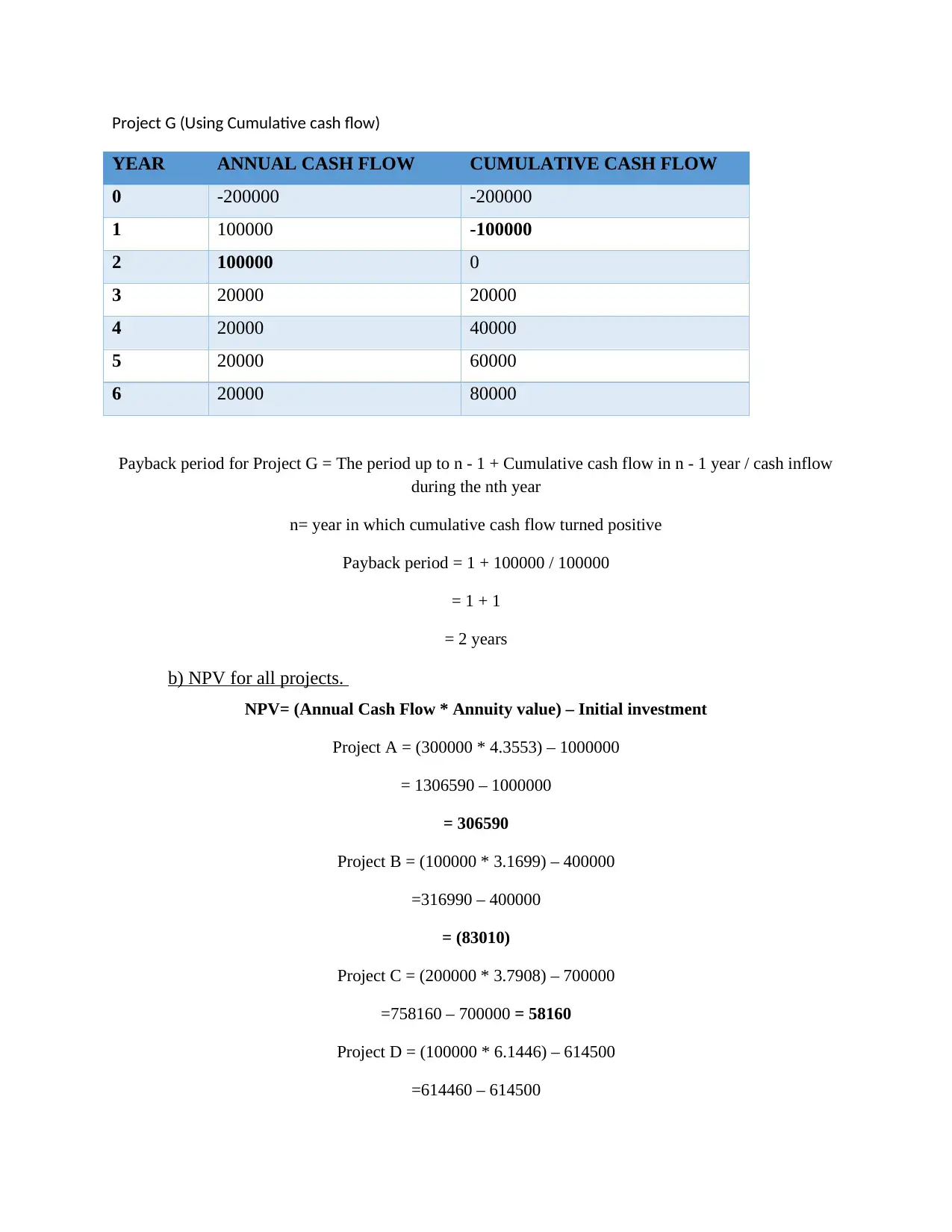

Project G (Using Cumulative cash flow)

YEAR ANNUAL CASH FLOW CUMULATIVE CASH FLOW

0 -200000 -200000

1 100000 -100000

2 100000 0

3 20000 20000

4 20000 40000

5 20000 60000

6 20000 80000

Payback period for Project G = The period up to n - 1 + Cumulative cash flow in n - 1 year / cash inflow

during the nth year

n= year in which cumulative cash flow turned positive

Payback period = 1 + 100000 / 100000

= 1 + 1

= 2 years

b) NPV for all projects.

NPV= (Annual Cash Flow * Annuity value) – Initial investment

Project A = (300000 * 4.3553) – 1000000

= 1306590 – 1000000

= 306590

Project B = (100000 * 3.1699) – 400000

=316990 – 400000

= (83010)

Project C = (200000 * 3.7908) – 700000

=758160 – 700000 = 58160

Project D = (100000 * 6.1446) – 614500

=614460 – 614500

YEAR ANNUAL CASH FLOW CUMULATIVE CASH FLOW

0 -200000 -200000

1 100000 -100000

2 100000 0

3 20000 20000

4 20000 40000

5 20000 60000

6 20000 80000

Payback period for Project G = The period up to n - 1 + Cumulative cash flow in n - 1 year / cash inflow

during the nth year

n= year in which cumulative cash flow turned positive

Payback period = 1 + 100000 / 100000

= 1 + 1

= 2 years

b) NPV for all projects.

NPV= (Annual Cash Flow * Annuity value) – Initial investment

Project A = (300000 * 4.3553) – 1000000

= 1306590 – 1000000

= 306590

Project B = (100000 * 3.1699) – 400000

=316990 – 400000

= (83010)

Project C = (200000 * 3.7908) – 700000

=758160 – 700000 = 58160

Project D = (100000 * 6.1446) – 614500

=614460 – 614500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

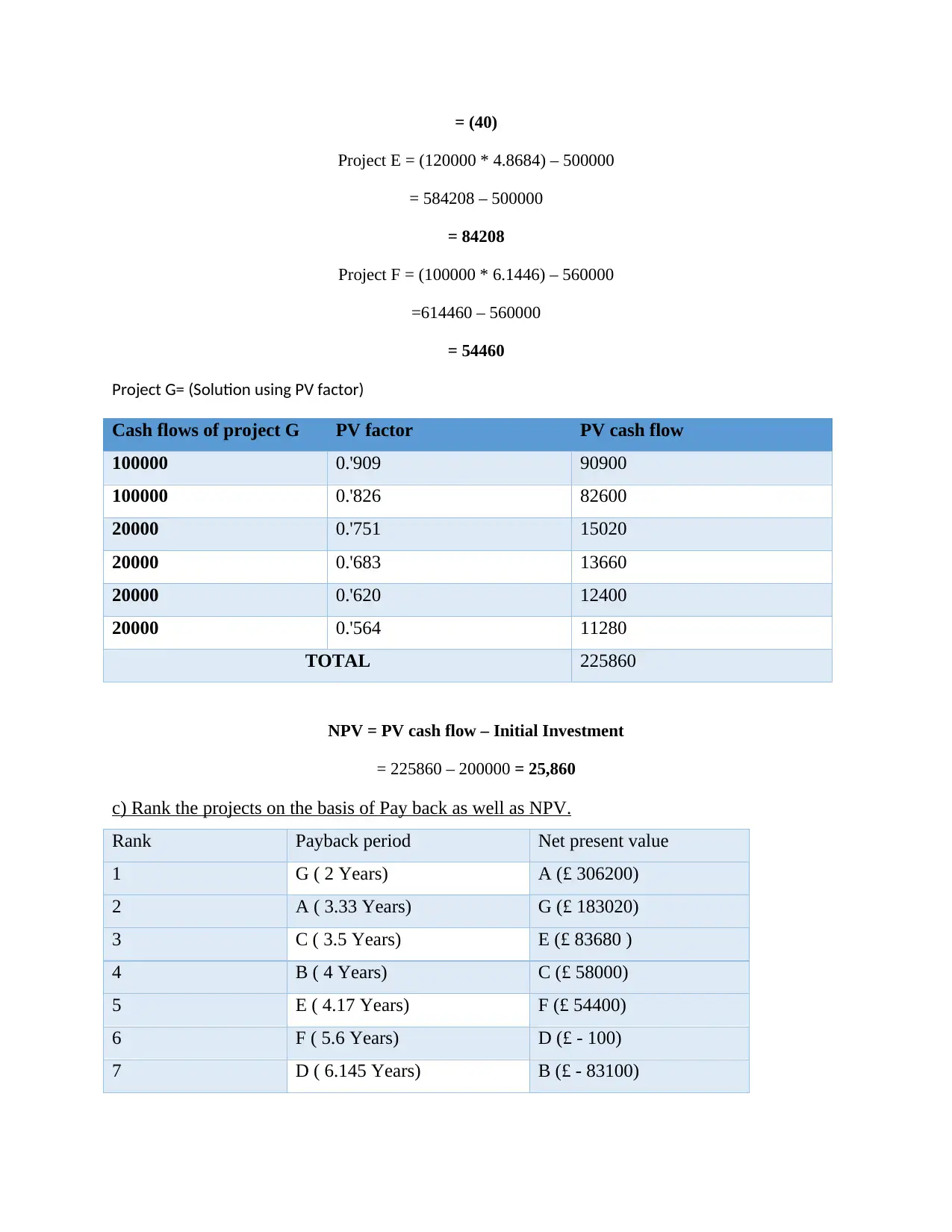

= (40)

Project E = (120000 * 4.8684) – 500000

= 584208 – 500000

= 84208

Project F = (100000 * 6.1446) – 560000

=614460 – 560000

= 54460

Project G= (Solution using PV factor)

Cash flows of project G PV factor PV cash flow

100000 0.'909 90900

100000 0.'826 82600

20000 0.'751 15020

20000 0.'683 13660

20000 0.'620 12400

20000 0.'564 11280

TOTAL 225860

NPV = PV cash flow – Initial Investment

= 225860 – 200000 = 25,860

c) Rank the projects on the basis of Pay back as well as NPV.

Rank Payback period Net present value

1 G ( 2 Years) A (£ 306200)

2 A ( 3.33 Years) G (£ 183020)

3 C ( 3.5 Years) E (£ 83680 )

4 B ( 4 Years) C (£ 58000)

5 E ( 4.17 Years) F (£ 54400)

6 F ( 5.6 Years) D (£ - 100)

7 D ( 6.145 Years) B (£ - 83100)

Project E = (120000 * 4.8684) – 500000

= 584208 – 500000

= 84208

Project F = (100000 * 6.1446) – 560000

=614460 – 560000

= 54460

Project G= (Solution using PV factor)

Cash flows of project G PV factor PV cash flow

100000 0.'909 90900

100000 0.'826 82600

20000 0.'751 15020

20000 0.'683 13660

20000 0.'620 12400

20000 0.'564 11280

TOTAL 225860

NPV = PV cash flow – Initial Investment

= 225860 – 200000 = 25,860

c) Rank the projects on the basis of Pay back as well as NPV.

Rank Payback period Net present value

1 G ( 2 Years) A (£ 306200)

2 A ( 3.33 Years) G (£ 183020)

3 C ( 3.5 Years) E (£ 83680 )

4 B ( 4 Years) C (£ 58000)

5 E ( 4.17 Years) F (£ 54400)

6 F ( 5.6 Years) D (£ - 100)

7 D ( 6.145 Years) B (£ - 83100)

d) Selecting the project.

From the above-mentioned format prescribed, it is evident that K plc will not be able to

pursue Projects E, F, or D because they all required a finishing time of more than 4 years. As per

K plc's goal, the money must be returned in no more than four years. Furthermore, these

initiatives do not yield high profits, with F and D yielding negative returns upon completion. Out

of another four remaining deals—A, B, C, and G—it is suggested that project G be pursued since

it appears to be more valuable to the firm. Each of these offerings will take 6 years to complete.

There is a lot more money invested in Project A than in Project G. Despite the fact that the profit

from this sale is higher. Furthermore, a will reappear in 3 years and a few days, but G will only

arrive in 2 years (Enyi, 2019).

e) Strength and weaknesses of payback period and net present value method.

Strength of Pay back Weakness of Pay back

It's the most basic method of stock

valuation.

When computing the timeframe, it

eliminates the influence of the payback

period.

It simplifies the effort of comparing items

depends on the quantity reimbursed.

It should not take into account the amount

obtained after repayment.

The tool's main advantage is its

simplicity. Because it focuses on cost

returns, companies can use this technique

as an early screening tool to split projects

based on their rate of repaying initial

expenses. This tool also aids the strategic

management of the company in

identifying which sources of funding are

available and how long they will take to

pay off if they are used.

When determining the repayment period,

the time value of money is not taken into

account. After the payback period, the

cash flows received have less weight than

those obtained at the start. Despite the fact

that two initiatives have the same payback

period, one may be a better investment for

the organisation. It also neglects to

consider the project's return on

investment.

From the above-mentioned format prescribed, it is evident that K plc will not be able to

pursue Projects E, F, or D because they all required a finishing time of more than 4 years. As per

K plc's goal, the money must be returned in no more than four years. Furthermore, these

initiatives do not yield high profits, with F and D yielding negative returns upon completion. Out

of another four remaining deals—A, B, C, and G—it is suggested that project G be pursued since

it appears to be more valuable to the firm. Each of these offerings will take 6 years to complete.

There is a lot more money invested in Project A than in Project G. Despite the fact that the profit

from this sale is higher. Furthermore, a will reappear in 3 years and a few days, but G will only

arrive in 2 years (Enyi, 2019).

e) Strength and weaknesses of payback period and net present value method.

Strength of Pay back Weakness of Pay back

It's the most basic method of stock

valuation.

When computing the timeframe, it

eliminates the influence of the payback

period.

It simplifies the effort of comparing items

depends on the quantity reimbursed.

It should not take into account the amount

obtained after repayment.

The tool's main advantage is its

simplicity. Because it focuses on cost

returns, companies can use this technique

as an early screening tool to split projects

based on their rate of repaying initial

expenses. This tool also aids the strategic

management of the company in

identifying which sources of funding are

available and how long they will take to

pay off if they are used.

When determining the repayment period,

the time value of money is not taken into

account. After the payback period, the

cash flows received have less weight than

those obtained at the start. Despite the fact

that two initiatives have the same payback

period, one may be a better investment for

the organisation. It also neglects to

consider the project's return on

investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

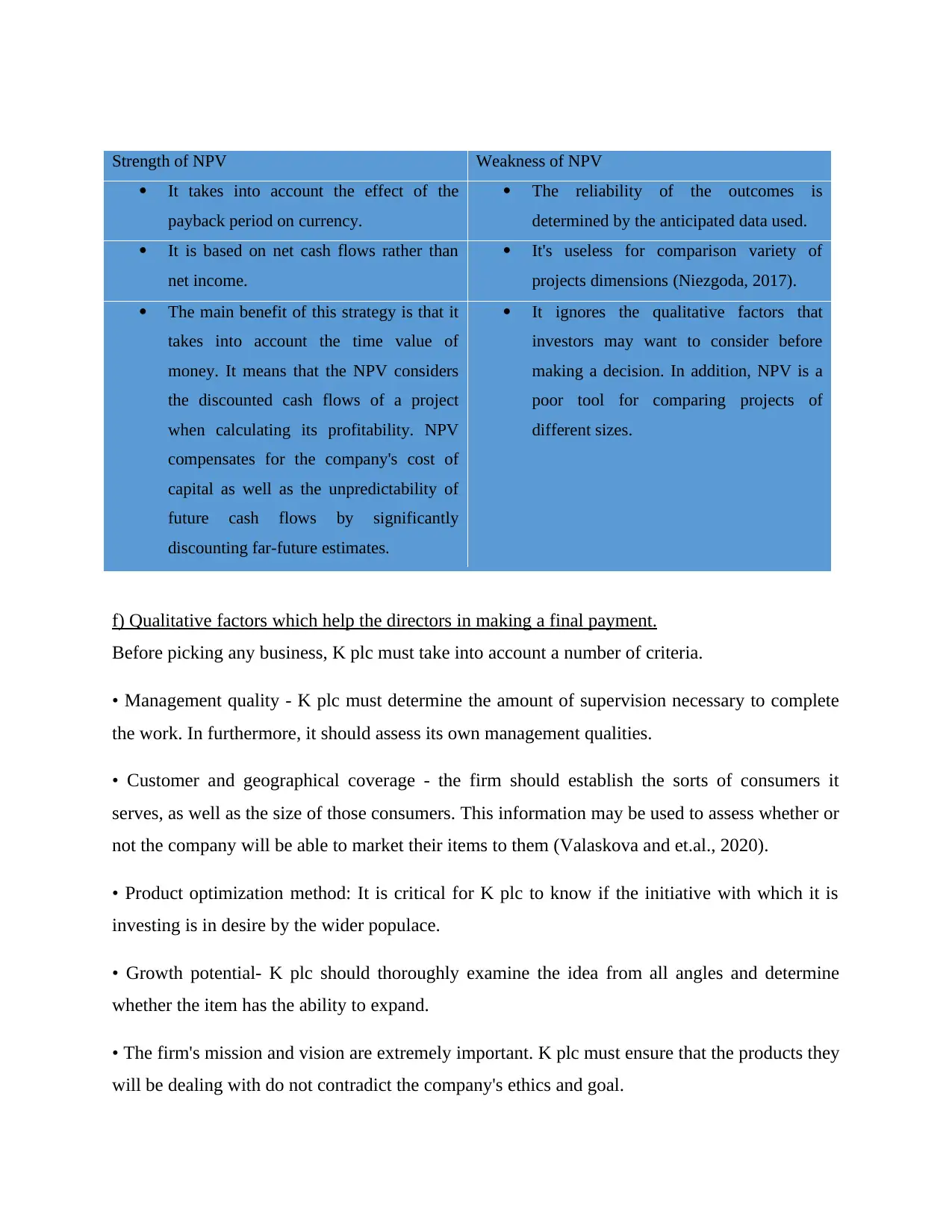

Strength of NPV Weakness of NPV

It takes into account the effect of the

payback period on currency.

The reliability of the outcomes is

determined by the anticipated data used.

It is based on net cash flows rather than

net income.

It's useless for comparison variety of

projects dimensions (Niezgoda, 2017).

The main benefit of this strategy is that it

takes into account the time value of

money. It means that the NPV considers

the discounted cash flows of a project

when calculating its profitability. NPV

compensates for the company's cost of

capital as well as the unpredictability of

future cash flows by significantly

discounting far-future estimates.

It ignores the qualitative factors that

investors may want to consider before

making a decision. In addition, NPV is a

poor tool for comparing projects of

different sizes.

f) Qualitative factors which help the directors in making a final payment.

Before picking any business, K plc must take into account a number of criteria.

• Management quality - K plc must determine the amount of supervision necessary to complete

the work. In furthermore, it should assess its own management qualities.

• Customer and geographical coverage - the firm should establish the sorts of consumers it

serves, as well as the size of those consumers. This information may be used to assess whether or

not the company will be able to market their items to them (Valaskova and et.al., 2020).

• Product optimization method: It is critical for K plc to know if the initiative with which it is

investing is in desire by the wider populace.

• Growth potential- K plc should thoroughly examine the idea from all angles and determine

whether the item has the ability to expand.

• The firm's mission and vision are extremely important. K plc must ensure that the products they

will be dealing with do not contradict the company's ethics and goal.

It takes into account the effect of the

payback period on currency.

The reliability of the outcomes is

determined by the anticipated data used.

It is based on net cash flows rather than

net income.

It's useless for comparison variety of

projects dimensions (Niezgoda, 2017).

The main benefit of this strategy is that it

takes into account the time value of

money. It means that the NPV considers

the discounted cash flows of a project

when calculating its profitability. NPV

compensates for the company's cost of

capital as well as the unpredictability of

future cash flows by significantly

discounting far-future estimates.

It ignores the qualitative factors that

investors may want to consider before

making a decision. In addition, NPV is a

poor tool for comparing projects of

different sizes.

f) Qualitative factors which help the directors in making a final payment.

Before picking any business, K plc must take into account a number of criteria.

• Management quality - K plc must determine the amount of supervision necessary to complete

the work. In furthermore, it should assess its own management qualities.

• Customer and geographical coverage - the firm should establish the sorts of consumers it

serves, as well as the size of those consumers. This information may be used to assess whether or

not the company will be able to market their items to them (Valaskova and et.al., 2020).

• Product optimization method: It is critical for K plc to know if the initiative with which it is

investing is in desire by the wider populace.

• Growth potential- K plc should thoroughly examine the idea from all angles and determine

whether the item has the ability to expand.

• The firm's mission and vision are extremely important. K plc must ensure that the products they

will be dealing with do not contradict the company's ethics and goal.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

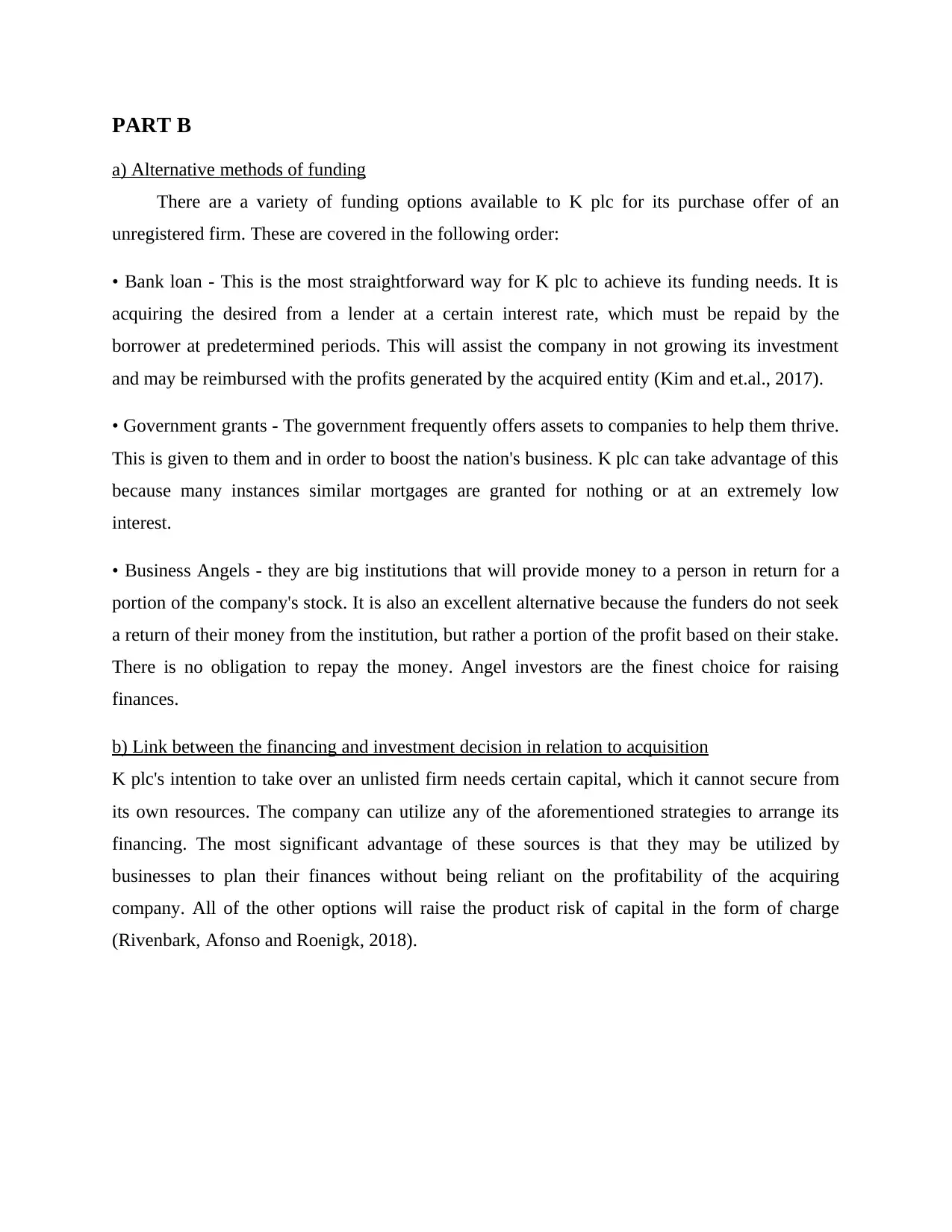

PART B

a) Alternative methods of funding

There are a variety of funding options available to K plc for its purchase offer of an

unregistered firm. These are covered in the following order:

• Bank loan - This is the most straightforward way for K plc to achieve its funding needs. It is

acquiring the desired from a lender at a certain interest rate, which must be repaid by the

borrower at predetermined periods. This will assist the company in not growing its investment

and may be reimbursed with the profits generated by the acquired entity (Kim and et.al., 2017).

• Government grants - The government frequently offers assets to companies to help them thrive.

This is given to them and in order to boost the nation's business. K plc can take advantage of this

because many instances similar mortgages are granted for nothing or at an extremely low

interest.

• Business Angels - they are big institutions that will provide money to a person in return for a

portion of the company's stock. It is also an excellent alternative because the funders do not seek

a return of their money from the institution, but rather a portion of the profit based on their stake.

There is no obligation to repay the money. Angel investors are the finest choice for raising

finances.

b) Link between the financing and investment decision in relation to acquisition

K plc's intention to take over an unlisted firm needs certain capital, which it cannot secure from

its own resources. The company can utilize any of the aforementioned strategies to arrange its

financing. The most significant advantage of these sources is that they may be utilized by

businesses to plan their finances without being reliant on the profitability of the acquiring

company. All of the other options will raise the product risk of capital in the form of charge

(Rivenbark, Afonso and Roenigk, 2018).

a) Alternative methods of funding

There are a variety of funding options available to K plc for its purchase offer of an

unregistered firm. These are covered in the following order:

• Bank loan - This is the most straightforward way for K plc to achieve its funding needs. It is

acquiring the desired from a lender at a certain interest rate, which must be repaid by the

borrower at predetermined periods. This will assist the company in not growing its investment

and may be reimbursed with the profits generated by the acquired entity (Kim and et.al., 2017).

• Government grants - The government frequently offers assets to companies to help them thrive.

This is given to them and in order to boost the nation's business. K plc can take advantage of this

because many instances similar mortgages are granted for nothing or at an extremely low

interest.

• Business Angels - they are big institutions that will provide money to a person in return for a

portion of the company's stock. It is also an excellent alternative because the funders do not seek

a return of their money from the institution, but rather a portion of the profit based on their stake.

There is no obligation to repay the money. Angel investors are the finest choice for raising

finances.

b) Link between the financing and investment decision in relation to acquisition

K plc's intention to take over an unlisted firm needs certain capital, which it cannot secure from

its own resources. The company can utilize any of the aforementioned strategies to arrange its

financing. The most significant advantage of these sources is that they may be utilized by

businesses to plan their finances without being reliant on the profitability of the acquiring

company. All of the other options will raise the product risk of capital in the form of charge

(Rivenbark, Afonso and Roenigk, 2018).

PART C

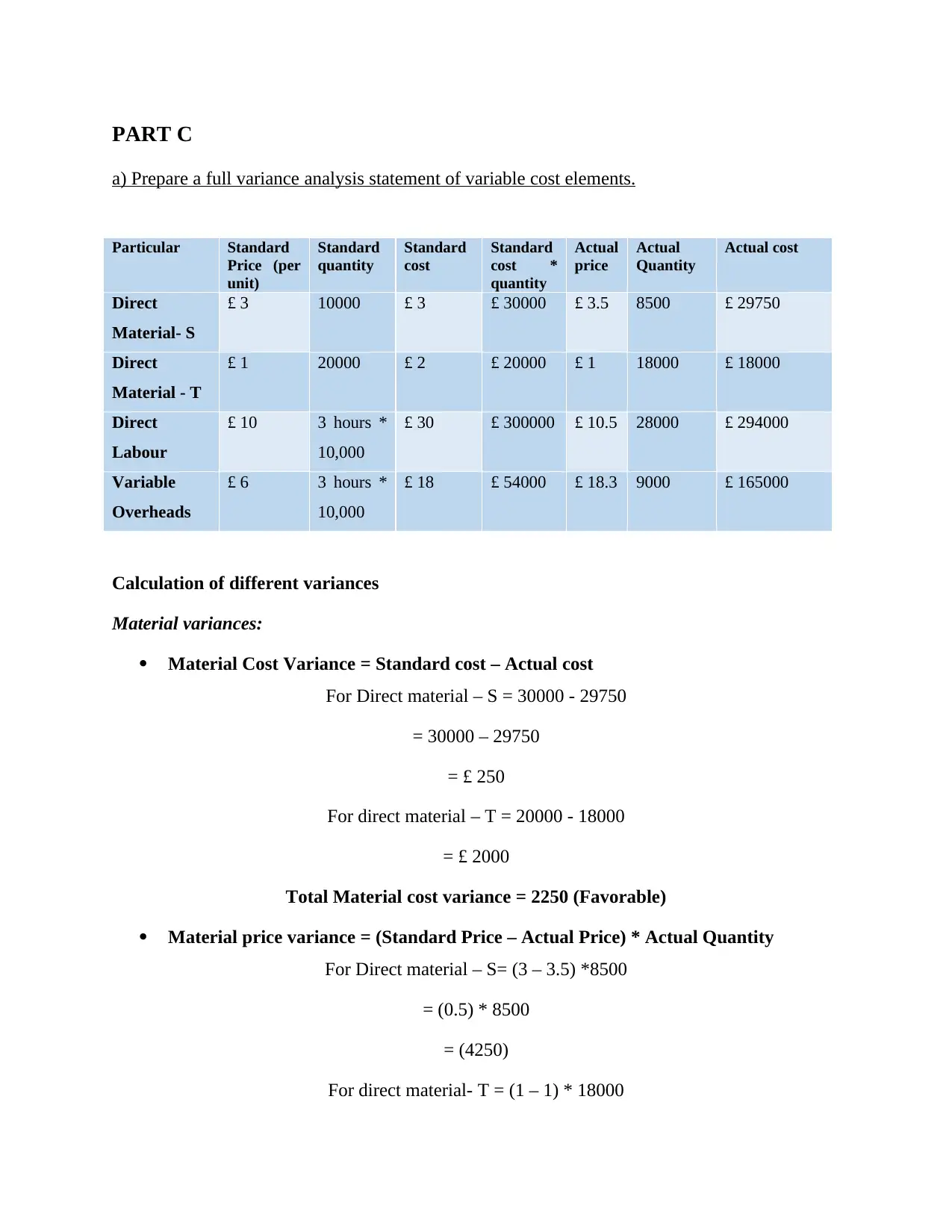

a) Prepare a full variance analysis statement of variable cost elements.

Particular Standard

Price (per

unit)

Standard

quantity

Standard

cost

Standard

cost *

quantity

Actual

price

Actual

Quantity

Actual cost

Direct

Material- S

£ 3 10000 £ 3 £ 30000 £ 3.5 8500 £ 29750

Direct

Material - T

£ 1 20000 £ 2 £ 20000 £ 1 18000 £ 18000

Direct

Labour

£ 10 3 hours *

10,000

£ 30 £ 300000 £ 10.5 28000 £ 294000

Variable

Overheads

£ 6 3 hours *

10,000

£ 18 £ 54000 £ 18.3 9000 £ 165000

Calculation of different variances

Material variances:

Material Cost Variance = Standard cost – Actual cost

For Direct material – S = 30000 - 29750

= 30000 – 29750

= £ 250

For direct material – T = 20000 - 18000

= £ 2000

Total Material cost variance = 2250 (Favorable)

Material price variance = (Standard Price – Actual Price) * Actual Quantity

For Direct material – S= (3 – 3.5) *8500

= (0.5) * 8500

= (4250)

For direct material- T = (1 – 1) * 18000

a) Prepare a full variance analysis statement of variable cost elements.

Particular Standard

Price (per

unit)

Standard

quantity

Standard

cost

Standard

cost *

quantity

Actual

price

Actual

Quantity

Actual cost

Direct

Material- S

£ 3 10000 £ 3 £ 30000 £ 3.5 8500 £ 29750

Direct

Material - T

£ 1 20000 £ 2 £ 20000 £ 1 18000 £ 18000

Direct

Labour

£ 10 3 hours *

10,000

£ 30 £ 300000 £ 10.5 28000 £ 294000

Variable

Overheads

£ 6 3 hours *

10,000

£ 18 £ 54000 £ 18.3 9000 £ 165000

Calculation of different variances

Material variances:

Material Cost Variance = Standard cost – Actual cost

For Direct material – S = 30000 - 29750

= 30000 – 29750

= £ 250

For direct material – T = 20000 - 18000

= £ 2000

Total Material cost variance = 2250 (Favorable)

Material price variance = (Standard Price – Actual Price) * Actual Quantity

For Direct material – S= (3 – 3.5) *8500

= (0.5) * 8500

= (4250)

For direct material- T = (1 – 1) * 18000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

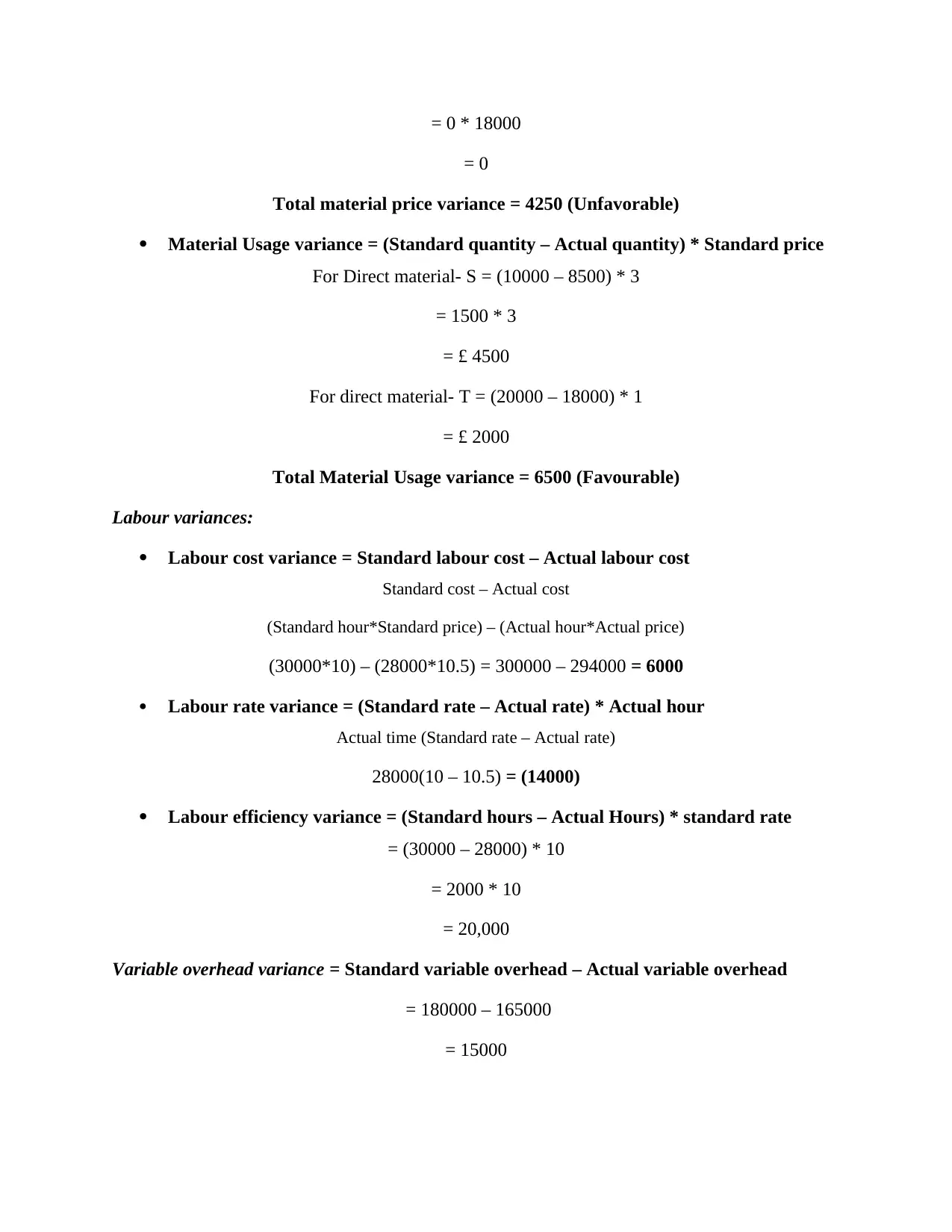

= 0 * 18000

= 0

Total material price variance = 4250 (Unfavorable)

Material Usage variance = (Standard quantity – Actual quantity) * Standard price

For Direct material- S = (10000 – 8500) * 3

= 1500 * 3

= £ 4500

For direct material- T = (20000 – 18000) * 1

= £ 2000

Total Material Usage variance = 6500 (Favourable)

Labour variances:

Labour cost variance = Standard labour cost – Actual labour cost

Standard cost – Actual cost

(Standard hour*Standard price) – (Actual hour*Actual price)

(30000*10) – (28000*10.5) = 300000 – 294000 = 6000

Labour rate variance = (Standard rate – Actual rate) * Actual hour

Actual time (Standard rate – Actual rate)

28000(10 – 10.5) = (14000)

Labour efficiency variance = (Standard hours – Actual Hours) * standard rate

= (30000 – 28000) * 10

= 2000 * 10

= 20,000

Variable overhead variance = Standard variable overhead – Actual variable overhead

= 180000 – 165000

= 15000

= 0

Total material price variance = 4250 (Unfavorable)

Material Usage variance = (Standard quantity – Actual quantity) * Standard price

For Direct material- S = (10000 – 8500) * 3

= 1500 * 3

= £ 4500

For direct material- T = (20000 – 18000) * 1

= £ 2000

Total Material Usage variance = 6500 (Favourable)

Labour variances:

Labour cost variance = Standard labour cost – Actual labour cost

Standard cost – Actual cost

(Standard hour*Standard price) – (Actual hour*Actual price)

(30000*10) – (28000*10.5) = 300000 – 294000 = 6000

Labour rate variance = (Standard rate – Actual rate) * Actual hour

Actual time (Standard rate – Actual rate)

28000(10 – 10.5) = (14000)

Labour efficiency variance = (Standard hours – Actual Hours) * standard rate

= (30000 – 28000) * 10

= 2000 * 10

= 20,000

Variable overhead variance = Standard variable overhead – Actual variable overhead

= 180000 – 165000

= 15000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

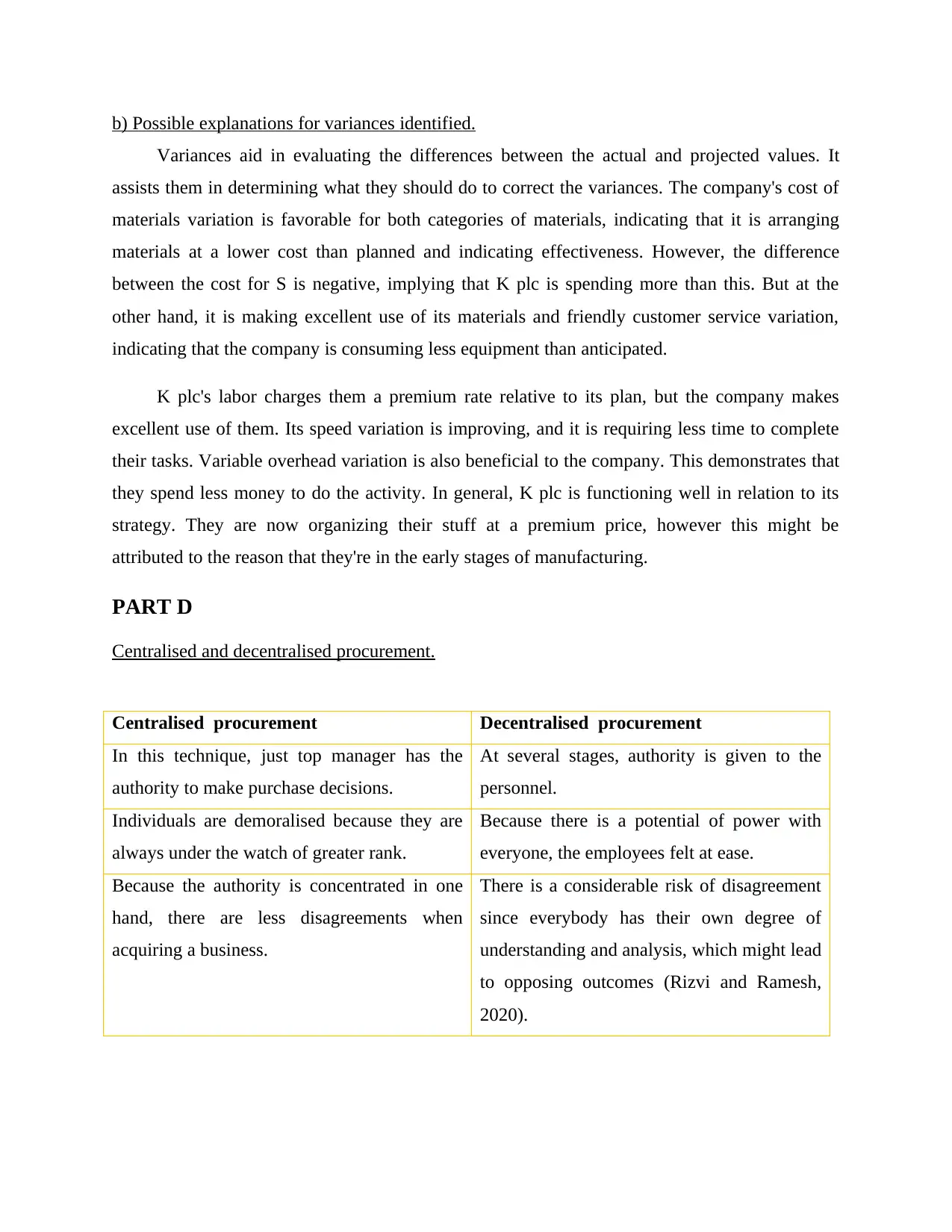

b) Possible explanations for variances identified.

Variances aid in evaluating the differences between the actual and projected values. It

assists them in determining what they should do to correct the variances. The company's cost of

materials variation is favorable for both categories of materials, indicating that it is arranging

materials at a lower cost than planned and indicating effectiveness. However, the difference

between the cost for S is negative, implying that K plc is spending more than this. But at the

other hand, it is making excellent use of its materials and friendly customer service variation,

indicating that the company is consuming less equipment than anticipated.

K plc's labor charges them a premium rate relative to its plan, but the company makes

excellent use of them. Its speed variation is improving, and it is requiring less time to complete

their tasks. Variable overhead variation is also beneficial to the company. This demonstrates that

they spend less money to do the activity. In general, K plc is functioning well in relation to its

strategy. They are now organizing their stuff at a premium price, however this might be

attributed to the reason that they're in the early stages of manufacturing.

PART D

Centralised and decentralised procurement.

Centralised procurement Decentralised procurement

In this technique, just top manager has the

authority to make purchase decisions.

At several stages, authority is given to the

personnel.

Individuals are demoralised because they are

always under the watch of greater rank.

Because there is a potential of power with

everyone, the employees felt at ease.

Because the authority is concentrated in one

hand, there are less disagreements when

acquiring a business.

There is a considerable risk of disagreement

since everybody has their own degree of

understanding and analysis, which might lead

to opposing outcomes (Rizvi and Ramesh,

2020).

Variances aid in evaluating the differences between the actual and projected values. It

assists them in determining what they should do to correct the variances. The company's cost of

materials variation is favorable for both categories of materials, indicating that it is arranging

materials at a lower cost than planned and indicating effectiveness. However, the difference

between the cost for S is negative, implying that K plc is spending more than this. But at the

other hand, it is making excellent use of its materials and friendly customer service variation,

indicating that the company is consuming less equipment than anticipated.

K plc's labor charges them a premium rate relative to its plan, but the company makes

excellent use of them. Its speed variation is improving, and it is requiring less time to complete

their tasks. Variable overhead variation is also beneficial to the company. This demonstrates that

they spend less money to do the activity. In general, K plc is functioning well in relation to its

strategy. They are now organizing their stuff at a premium price, however this might be

attributed to the reason that they're in the early stages of manufacturing.

PART D

Centralised and decentralised procurement.

Centralised procurement Decentralised procurement

In this technique, just top manager has the

authority to make purchase decisions.

At several stages, authority is given to the

personnel.

Individuals are demoralised because they are

always under the watch of greater rank.

Because there is a potential of power with

everyone, the employees felt at ease.

Because the authority is concentrated in one

hand, there are less disagreements when

acquiring a business.

There is a considerable risk of disagreement

since everybody has their own degree of

understanding and analysis, which might lead

to opposing outcomes (Rizvi and Ramesh,

2020).

Advantages of centralised and decentralised procurement

Companies who apply some of these strategies, based on their efficacy, sell their product

more accurately. It will assist them in organizing superior items since democratizing method will

allow them to evaluate offerings in a more thorough manner. The centralized option, on the other

hand, will assist in picking the optimal technique without causing any controversy. They may

choose the most cost-effective item this way.

Centralized purchase

Staff with specialised knowledge and experience in purchasing might focus on a single

area.

Improved internal storage arrangement.

High-tech talents are put to use.

A firm policy should be implemented, which may result in more advantageous buying

conditions, such as a bigger trade markdown, easier monthly payments, and so on.

The standardisation of quality control makes things easier (Lamperti and et.al., 2019).

A minimal amount of money is necessary.

Better control over the use of resources, as well as.

Furthermore, because risky purchase by diverse persons is avoided, total management

over buying is feasible. Having all buy transaction history in one location also aids

management.

Decentralized purchase

Every division can acquire materials as needed on a local level.

Resource accessibility in a reasonable timeframe.

Supplies are simply purchased in the proper quantity and variety for each function.

There is no need for a large original investment.

Companies who apply some of these strategies, based on their efficacy, sell their product

more accurately. It will assist them in organizing superior items since democratizing method will

allow them to evaluate offerings in a more thorough manner. The centralized option, on the other

hand, will assist in picking the optimal technique without causing any controversy. They may

choose the most cost-effective item this way.

Centralized purchase

Staff with specialised knowledge and experience in purchasing might focus on a single

area.

Improved internal storage arrangement.

High-tech talents are put to use.

A firm policy should be implemented, which may result in more advantageous buying

conditions, such as a bigger trade markdown, easier monthly payments, and so on.

The standardisation of quality control makes things easier (Lamperti and et.al., 2019).

A minimal amount of money is necessary.

Better control over the use of resources, as well as.

Furthermore, because risky purchase by diverse persons is avoided, total management

over buying is feasible. Having all buy transaction history in one location also aids

management.

Decentralized purchase

Every division can acquire materials as needed on a local level.

Resource accessibility in a reasonable timeframe.

Supplies are simply purchased in the proper quantity and variety for each function.

There is no need for a large original investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Internal transportation is less expensive.

Incompatibility is less likely.

Order forms may be placed swiftly and efficiently.

It takes just a few minutes to repair old components (Kahn and Baum, 2020).

CONCLUSION

From the foregoing report, it can be stated that firms must generate reports in order to

analyses the current state of their various avenues. Organizations employ a variety of ways to

assess the viability of projects and active market. It informs its customers about the measures

how well a company does its responsibilities. Firms produce feedback on the effectiveness of

operations in relation to the strategy they created by evaluating multiple variances. This may also

be utilized to determine the cause of the discrepancies and what can be done to address them.

Incompatibility is less likely.

Order forms may be placed swiftly and efficiently.

It takes just a few minutes to repair old components (Kahn and Baum, 2020).

CONCLUSION

From the foregoing report, it can be stated that firms must generate reports in order to

analyses the current state of their various avenues. Organizations employ a variety of ways to

assess the viability of projects and active market. It informs its customers about the measures

how well a company does its responsibilities. Firms produce feedback on the effectiveness of

operations in relation to the strategy they created by evaluating multiple variances. This may also

be utilized to determine the cause of the discrepancies and what can be done to address them.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journal

Drobetz, W. and Johns, M., 2018. The evolution of modern ship finance. In Finance and risk

management for international logistics and the supply chain (pp. 85-108). Elsevier.

Enyi, E. P., 2019. Relational Trend Analysis: A Simple and Effective Way To Detect Financial

Statements Fraud. Enyi, E. P,(2019). Relational Trend Analysis: A simple and

effective way to detect financial statements fraud, International Journal of Scientific

and Research Publications. 9(2). pp.538-546.

Niezgoda, J., 2017. The use of statistical process control tools for analysing financial

statements. Folia Oeconomica Stetinensia. 17(1). pp.129-137.

Valaskova, K., and et.al.,2020. Financial compass for Slovak enterprises: modeling economic

stability of agricultural entities. Journal of Risk and Financial management. 13(5).

p.92.

Kim, M. S.,and et.al.,2017. A study on the analysis of stability indicators in financial statements

using fuzzy c-means clustering. International Journal of Applied Engineering

Research. 12(20). pp.9863-9865.

Rivenbark, W. C., Afonso, W. and Roenigk, D. J., 2018. Capital spending in local government:

Providing context through the lens of government-wide financial statements. Journal of

Public Budgeting, Accounting & Financial Management.

Rizvi, N. and Ramesh, D., 2020. Fair budget constrained workflow scheduling approach for

heterogeneous clouds. Cluster Computing. 23(4). pp.3185-3201.

Lamperti, F., and et.al., 2019. The Green Transition: Public Policy, Finance, and the Role of the

State. Vierteljahrshefte zur Wirtschaftsforschung. 88(2). pp.73-88.

Kahn, M. J. and Baum, N., 2020. Basic accounting and interpretation of financial statements.

In The Business Basics of Building and Managing a Healthcare Practice (pp. 13-18).

Springer, Cham.

Books and Journal

Drobetz, W. and Johns, M., 2018. The evolution of modern ship finance. In Finance and risk

management for international logistics and the supply chain (pp. 85-108). Elsevier.

Enyi, E. P., 2019. Relational Trend Analysis: A Simple and Effective Way To Detect Financial

Statements Fraud. Enyi, E. P,(2019). Relational Trend Analysis: A simple and

effective way to detect financial statements fraud, International Journal of Scientific

and Research Publications. 9(2). pp.538-546.

Niezgoda, J., 2017. The use of statistical process control tools for analysing financial

statements. Folia Oeconomica Stetinensia. 17(1). pp.129-137.

Valaskova, K., and et.al.,2020. Financial compass for Slovak enterprises: modeling economic

stability of agricultural entities. Journal of Risk and Financial management. 13(5).

p.92.

Kim, M. S.,and et.al.,2017. A study on the analysis of stability indicators in financial statements

using fuzzy c-means clustering. International Journal of Applied Engineering

Research. 12(20). pp.9863-9865.

Rivenbark, W. C., Afonso, W. and Roenigk, D. J., 2018. Capital spending in local government:

Providing context through the lens of government-wide financial statements. Journal of

Public Budgeting, Accounting & Financial Management.

Rizvi, N. and Ramesh, D., 2020. Fair budget constrained workflow scheduling approach for

heterogeneous clouds. Cluster Computing. 23(4). pp.3185-3201.

Lamperti, F., and et.al., 2019. The Green Transition: Public Policy, Finance, and the Role of the

State. Vierteljahrshefte zur Wirtschaftsforschung. 88(2). pp.73-88.

Kahn, M. J. and Baum, N., 2020. Basic accounting and interpretation of financial statements.

In The Business Basics of Building and Managing a Healthcare Practice (pp. 13-18).

Springer, Cham.

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.