Managing Financial Resources Decisions

VerifiedAdded on 2020/02/05

|20

|6727

|96

Report

AI Summary

This report provides a comprehensive analysis of financial resource management and decision-making within the context of Sweet Menu Restaurant Ltd. and Blue Island Restaurant. It explores various sources of finance (internal and external), their implications, and associated costs. The report emphasizes the importance of financial planning and examines the information needs of different stakeholders. A detailed analysis of budgets, unit cost calculations, and investment appraisal techniques (Payback and NPV methods) are presented. Furthermore, the report includes a comparison of financial statement formats for different business structures and interprets financial statements using ratio analysis (profitability, liquidity, efficiency, gearing, and investment ratios). The analysis of Sweet Menu Restaurant Ltd. and Blue Island Restaurant highlights their financial strengths and weaknesses, offering insights into effective financial management strategies.

Managing

Financial

Resources

and

Decisions

Financial

Resources

and

Decisions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction......................................................................................................................................3

Task 1...............................................................................................................................................3

Sources of Finance.......................................................................................................................3

Implications of Sources of Finance .............................................................................................4

Appropriate Source of Finance....................................................................................................5

Task 2...............................................................................................................................................5

Cost of Sources of Finance..........................................................................................................5

Importance of financial planning.................................................................................................6

Information Needs of different decision makers.........................................................................7

Impact of sources of finance on financial statements..................................................................7

Task 3...............................................................................................................................................8

Analysis of Budget.......................................................................................................................8

Calculation of Unit Cost..............................................................................................................8

Investment Appraisal Techniques................................................................................................9

Task 4.............................................................................................................................................11

Financial Statements..................................................................................................................11

Comparison of formats of financial statements for different business......................................12

Interpretation of Financial Statements using ratio analysis.......................................................12

Conclusion.....................................................................................................................................16

References......................................................................................................................................17

2

Introduction......................................................................................................................................3

Task 1...............................................................................................................................................3

Sources of Finance.......................................................................................................................3

Implications of Sources of Finance .............................................................................................4

Appropriate Source of Finance....................................................................................................5

Task 2...............................................................................................................................................5

Cost of Sources of Finance..........................................................................................................5

Importance of financial planning.................................................................................................6

Information Needs of different decision makers.........................................................................7

Impact of sources of finance on financial statements..................................................................7

Task 3...............................................................................................................................................8

Analysis of Budget.......................................................................................................................8

Calculation of Unit Cost..............................................................................................................8

Investment Appraisal Techniques................................................................................................9

Task 4.............................................................................................................................................11

Financial Statements..................................................................................................................11

Comparison of formats of financial statements for different business......................................12

Interpretation of Financial Statements using ratio analysis.......................................................12

Conclusion.....................................................................................................................................16

References......................................................................................................................................17

2

INTRODUCTION

Finance is the basic need of an organisation to run a business. An organisation needs

sufficient funds to achieve their organisational goals. Besides this, the important function of the

organization is to manage funds because proper fund management will lead the company

towards success and improper management will have negative impact on the working and

efficiency of the company (Rigby, 2011). Thus, company must take proper measures for

managing financial resources and it should exercise due care while taking decisions so that it will

help the company to grow. Sweet Menu Restaurant Ltd. is a reputable restaurant in East London.

Partners of the organisation are planning for expansion of business and for the same, they require

funds. The Current project gives description about various sources available for fund raising,

their implications, cost associated with them, what factors are required to be considered while

taking decisions in selecting sources of finance. In addition to this, it also evaluates the financial

statements including ratio analysis and takes the decision on the basis of study done above.

TASK 1

1.1 Sources of Finance

Sweet Menu Restaurant Ltd. needs to raise funds for the purpose of expanding business.

For the same, following sources are available from where funds can be raised. These are divided

into two parts such as internal and external-

Internal sources of finance

Working Capital Adjustment

Working capital refers to current assets and current liabilities of the company which help

in meeting short term requirements (Dlabay and Burrow, 2007). Thus, management can raise

funds by making adjustments in its working capital by either delaying payments to its suppliers

or receiving amount from its debtors before due date of their payment or by reducing the stock

level.

Sale of Assets

Funds can be raised by the company by selling its assets which are of less use or no use

for the company or instead of selling the same, company has an option to give the asset on lease

for receiving lease rentals against it (Komissarov, 2014).

3

Finance is the basic need of an organisation to run a business. An organisation needs

sufficient funds to achieve their organisational goals. Besides this, the important function of the

organization is to manage funds because proper fund management will lead the company

towards success and improper management will have negative impact on the working and

efficiency of the company (Rigby, 2011). Thus, company must take proper measures for

managing financial resources and it should exercise due care while taking decisions so that it will

help the company to grow. Sweet Menu Restaurant Ltd. is a reputable restaurant in East London.

Partners of the organisation are planning for expansion of business and for the same, they require

funds. The Current project gives description about various sources available for fund raising,

their implications, cost associated with them, what factors are required to be considered while

taking decisions in selecting sources of finance. In addition to this, it also evaluates the financial

statements including ratio analysis and takes the decision on the basis of study done above.

TASK 1

1.1 Sources of Finance

Sweet Menu Restaurant Ltd. needs to raise funds for the purpose of expanding business.

For the same, following sources are available from where funds can be raised. These are divided

into two parts such as internal and external-

Internal sources of finance

Working Capital Adjustment

Working capital refers to current assets and current liabilities of the company which help

in meeting short term requirements (Dlabay and Burrow, 2007). Thus, management can raise

funds by making adjustments in its working capital by either delaying payments to its suppliers

or receiving amount from its debtors before due date of their payment or by reducing the stock

level.

Sale of Assets

Funds can be raised by the company by selling its assets which are of less use or no use

for the company or instead of selling the same, company has an option to give the asset on lease

for receiving lease rentals against it (Komissarov, 2014).

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Retained Earning

Profits re-invested by the company in the business instead of distributing it to various

stakeholders is termed as retained earnings (Booker, 2006). Sweet Menu Restaurant Ltd. can

raise funds by using retained earnings as it is profits which are not used by business.

External sources of finance

Equity

Equity refers to capital of owners. Sweet manu can raise funds either through fresh issue

of shares or by increasing existing share capital receiving amount from shareholders. Issuing

shares in return entitling them a share in the earnings of the company or by entitling them the

rights over payment of dividend before ordinary shareholders (Fridson and Alvarez, 2011).

Debt

Funds can be raised from financial institution or any third party by paying them certain

financial cost for a definite period in the form of interest. These can be in the form of loans,

debentures, bonds, borrowing from friends, etc., thus Sweet Menu Restaurant Ltd. use debt

sources for raising funds (Magner and et. al., 2006).

Bank Overdraft

Bank overdraft is when banks give facility to its customers to withdraw amount more

than available balance from their current accounts. A limit is fixed by the banker upto which the

customer can overdraw from its account (Gudov, 2013).

1.2 Implications of Sources of Finance

Sweet Menu Restaurant Ltd. has various sources available to raise funds, but each source

will have its different implication on working and growth of the company and further it has its

advantages and disadvantages (Gotze, Northcott and Schuster, 2015). Like, equity capital when

increased will increase wealth of the company but it may make reduction in the per share

earning., dividend to be distributed will be increased and Control of theSweet Menu Restaurant

Ltd. may be in many new hands with increase in shareholders.

On the other hand, debt funds if used to raise funds will increase long term obligations of

the company with increase in finance cost and will affect the profitability of the company. There

4

Profits re-invested by the company in the business instead of distributing it to various

stakeholders is termed as retained earnings (Booker, 2006). Sweet Menu Restaurant Ltd. can

raise funds by using retained earnings as it is profits which are not used by business.

External sources of finance

Equity

Equity refers to capital of owners. Sweet manu can raise funds either through fresh issue

of shares or by increasing existing share capital receiving amount from shareholders. Issuing

shares in return entitling them a share in the earnings of the company or by entitling them the

rights over payment of dividend before ordinary shareholders (Fridson and Alvarez, 2011).

Debt

Funds can be raised from financial institution or any third party by paying them certain

financial cost for a definite period in the form of interest. These can be in the form of loans,

debentures, bonds, borrowing from friends, etc., thus Sweet Menu Restaurant Ltd. use debt

sources for raising funds (Magner and et. al., 2006).

Bank Overdraft

Bank overdraft is when banks give facility to its customers to withdraw amount more

than available balance from their current accounts. A limit is fixed by the banker upto which the

customer can overdraw from its account (Gudov, 2013).

1.2 Implications of Sources of Finance

Sweet Menu Restaurant Ltd. has various sources available to raise funds, but each source

will have its different implication on working and growth of the company and further it has its

advantages and disadvantages (Gotze, Northcott and Schuster, 2015). Like, equity capital when

increased will increase wealth of the company but it may make reduction in the per share

earning., dividend to be distributed will be increased and Control of theSweet Menu Restaurant

Ltd. may be in many new hands with increase in shareholders.

On the other hand, debt funds if used to raise funds will increase long term obligations of

the company with increase in finance cost and will affect the profitability of the company. There

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

is an obligation on the company to regular pay the finance cost otherwise additional cost may

also incur.

While availing bank overdraft facility, customer can withdraw amount only up to the

limit given by banker and it is a short term obligation which imposes interest on the company at

a rate higher than the term loan interest rates.

Working Capital adjustments has its own implications as to make agree the creditors and

debtors for delay/early payment is another difficult task as why will someone agree to delay its

payment or make early payment (Vandyck, 2006). It will also have a negative effect on

companies' relation with its debtors or creditors, also when stock level is reduced, storage cost

will be reduced but company must also be very careful so that demand of the customers does not

get affected.

Use of retained earnings is another issue because shareholders have to give up their

dividends to retain the same in business, as it is not easy for an individual give up their share of

earnings. Sale of assets on the other hand might reduce productivity of the company although

other cost are reduced like depreciation on such assets (Ilter, 2014).

1.3 Appropriate Source of Finance

Sweet Menu Restaurant Ltd. while selecting sources through which it can raise funds has

to consider advantages and disadvantages of it and it should also consider the impact which it

will have on the business. As per the sources available to Sweet Menu Restaurant Ltd. and

considering their implications mentioned in the above section, company should raise funds by

taking secured loan from financial institution. It is because, Sweet Menu Restaurant Ltd. has

been in existence for years and has maintained a good name, also asset position of the company

is good and this will help the company in easily availing the loan from the financial institution

(Bondt and et. al., 2010).

Company along with long term loans should avail the facility of bank overdraft from its

bank by withdrawing more than the available balance. Although, interest is chargeable at much

higher rate but there is no need to provide any security for availing services of bank overdraft

and also company can adjust the overdraft amount at the end of every month.

Furthermore share capital as external source of finance is also appropriate source. It is

because it helps management to arrange necessary ling term capital in order to expands business

5

also incur.

While availing bank overdraft facility, customer can withdraw amount only up to the

limit given by banker and it is a short term obligation which imposes interest on the company at

a rate higher than the term loan interest rates.

Working Capital adjustments has its own implications as to make agree the creditors and

debtors for delay/early payment is another difficult task as why will someone agree to delay its

payment or make early payment (Vandyck, 2006). It will also have a negative effect on

companies' relation with its debtors or creditors, also when stock level is reduced, storage cost

will be reduced but company must also be very careful so that demand of the customers does not

get affected.

Use of retained earnings is another issue because shareholders have to give up their

dividends to retain the same in business, as it is not easy for an individual give up their share of

earnings. Sale of assets on the other hand might reduce productivity of the company although

other cost are reduced like depreciation on such assets (Ilter, 2014).

1.3 Appropriate Source of Finance

Sweet Menu Restaurant Ltd. while selecting sources through which it can raise funds has

to consider advantages and disadvantages of it and it should also consider the impact which it

will have on the business. As per the sources available to Sweet Menu Restaurant Ltd. and

considering their implications mentioned in the above section, company should raise funds by

taking secured loan from financial institution. It is because, Sweet Menu Restaurant Ltd. has

been in existence for years and has maintained a good name, also asset position of the company

is good and this will help the company in easily availing the loan from the financial institution

(Bondt and et. al., 2010).

Company along with long term loans should avail the facility of bank overdraft from its

bank by withdrawing more than the available balance. Although, interest is chargeable at much

higher rate but there is no need to provide any security for availing services of bank overdraft

and also company can adjust the overdraft amount at the end of every month.

Furthermore share capital as external source of finance is also appropriate source. It is

because it helps management to arrange necessary ling term capital in order to expands business

5

in the marketplace. It helps to increase capital of the firm so as to increase overall rate of return

and meet organizational objectives in right manner on right time. On the other hand retained

profit is also appropriate source as it does not generate any cost. However, opportunity cost is

paid by corporation after investment of retained profit in other business activities company

cannot have enough money for existing business activities.

TASK 2

2.1 Cost of Sources of Finance

Funds can be raised through various sources available to a company and each source

carry a cost along with it whether it is cost of equity or any opportunity cost. At the time of

issuing the equity share, the company is required company to pay dividend to its shareholders.

BY considering this aspect, cost while raising funds through issue of equity will be the dividends

required to be paid on such issue. When a company raises fund through debt sources available,

whether through term loans or issue of debentures, it obliges a company to pay interest on the

debt fund at a pre determined rate by the lender or by the debenture holder (Assibey, Bokpin and

Twerefou, 2012). Retained earnings if used by the company to raise funds will also involve

opportunity cost to the shareholders because profit will not be distributed to them as dividend.

Stock Level reduction involves cost equivalent to loss to the company if demand of the

customers are not met. In the given scenario, company chooses term loan and bank overdraft

facility as the sources from which it can raise fund. When funds are raised by taking term loan

from financial institutions, it poses an obligation on the company to pay finance cost in the form

of interest to be paid over the loan period and related processing charges (Baker and Mukherjee,

2007). Same goes with Bank overdraft, company has to pay interest cost and high banking

charges while availing the facility of the overdraft.

In addition to this, management of Sweet Menu Restaurant Ltd. Need to pay dividend on

issue of ordinary share or right share. On the other hand, retained profit will also create

opportunity cost. It is because cost incur in one alternative lost the chances for the use of the

same in another alternative. Owing to this, cost of financial resources need to be assessed in

advance so as to determine growth ans success of Sweet Menu Restaurant Ltd. In the

marketplace.

6

and meet organizational objectives in right manner on right time. On the other hand retained

profit is also appropriate source as it does not generate any cost. However, opportunity cost is

paid by corporation after investment of retained profit in other business activities company

cannot have enough money for existing business activities.

TASK 2

2.1 Cost of Sources of Finance

Funds can be raised through various sources available to a company and each source

carry a cost along with it whether it is cost of equity or any opportunity cost. At the time of

issuing the equity share, the company is required company to pay dividend to its shareholders.

BY considering this aspect, cost while raising funds through issue of equity will be the dividends

required to be paid on such issue. When a company raises fund through debt sources available,

whether through term loans or issue of debentures, it obliges a company to pay interest on the

debt fund at a pre determined rate by the lender or by the debenture holder (Assibey, Bokpin and

Twerefou, 2012). Retained earnings if used by the company to raise funds will also involve

opportunity cost to the shareholders because profit will not be distributed to them as dividend.

Stock Level reduction involves cost equivalent to loss to the company if demand of the

customers are not met. In the given scenario, company chooses term loan and bank overdraft

facility as the sources from which it can raise fund. When funds are raised by taking term loan

from financial institutions, it poses an obligation on the company to pay finance cost in the form

of interest to be paid over the loan period and related processing charges (Baker and Mukherjee,

2007). Same goes with Bank overdraft, company has to pay interest cost and high banking

charges while availing the facility of the overdraft.

In addition to this, management of Sweet Menu Restaurant Ltd. Need to pay dividend on

issue of ordinary share or right share. On the other hand, retained profit will also create

opportunity cost. It is because cost incur in one alternative lost the chances for the use of the

same in another alternative. Owing to this, cost of financial resources need to be assessed in

advance so as to determine growth ans success of Sweet Menu Restaurant Ltd. In the

marketplace.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.2 Importance of financial planning

Financial planning involves formation of different strategies so that financial assets of the

company are used in the correct manner so as to meet the organisational goals. In addition to this

it makes changes in the spending pattern, if company feels the need of the same to function in a

better manner. Financial planning is nothing but pre planning as how and in what manner

company will spend its funds to reach goals of the organisation (Flamholtz and Kurland, 2006).

Financial planning is very important to every organisation because pre planning forms a

correct basis for decision taking and company can easily monitor results of such planning that

either plan which is made is appropriate or modifications are required to be made in it.

Financial planning will help Sweet Menu Restaurant Ltd. to establish their organisational

goals whether short term or long term. It will also help the company to monitor elements and

areas which involve more cash flows and help the company to take proper actions so that cash

outflows can be reduced. As company is thinking to start new business project, planning will

help them to decide the amount of expenditure required to be incurred by the company so as to

target large public by using the media advertisements, etc (Assibey, Bokpin and Twerefou,

2012).

Financial planning helps the firm to form a proper capital structure. It also assist the

company to decide suitable investment policy to invest in which it will generate more income as

compared to other by involving less cost and will help companies to grow.

Financial planning helps a company to carry out its functions smoothly. On the basis of

the financial planning done, all other financial activities can be checked for further modifications

(Notes to the Financial Statements, 2014).Financial planning assist the company to utilize their

funds in a proper manner by forming different policies so as to gain advantage over their

competitors, even planning also aids the organization to manage their income so as proper tax

planning can be done by the company to reduce the tax payment liability.

2.3 Information Needs of different decision makers

Financial Information of an organisation is required by various decision makers, besides

owners and employees, there are many other individuals present like suppliers or Account

receivables who are affected by working and decisions undertaken by the company. They need

information related to company because in some or the other way, they are related to the

7

Financial planning involves formation of different strategies so that financial assets of the

company are used in the correct manner so as to meet the organisational goals. In addition to this

it makes changes in the spending pattern, if company feels the need of the same to function in a

better manner. Financial planning is nothing but pre planning as how and in what manner

company will spend its funds to reach goals of the organisation (Flamholtz and Kurland, 2006).

Financial planning is very important to every organisation because pre planning forms a

correct basis for decision taking and company can easily monitor results of such planning that

either plan which is made is appropriate or modifications are required to be made in it.

Financial planning will help Sweet Menu Restaurant Ltd. to establish their organisational

goals whether short term or long term. It will also help the company to monitor elements and

areas which involve more cash flows and help the company to take proper actions so that cash

outflows can be reduced. As company is thinking to start new business project, planning will

help them to decide the amount of expenditure required to be incurred by the company so as to

target large public by using the media advertisements, etc (Assibey, Bokpin and Twerefou,

2012).

Financial planning helps the firm to form a proper capital structure. It also assist the

company to decide suitable investment policy to invest in which it will generate more income as

compared to other by involving less cost and will help companies to grow.

Financial planning helps a company to carry out its functions smoothly. On the basis of

the financial planning done, all other financial activities can be checked for further modifications

(Notes to the Financial Statements, 2014).Financial planning assist the company to utilize their

funds in a proper manner by forming different policies so as to gain advantage over their

competitors, even planning also aids the organization to manage their income so as proper tax

planning can be done by the company to reduce the tax payment liability.

2.3 Information Needs of different decision makers

Financial Information of an organisation is required by various decision makers, besides

owners and employees, there are many other individuals present like suppliers or Account

receivables who are affected by working and decisions undertaken by the company. They need

information related to company because in some or the other way, they are related to the

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

organisation i.e. companies growth or survival will have an impact on them also (Lindholm and

Suomala, 2007).

Owners are the ultimate decision makers of the organisation. They need information

related to the company because they had invested their amount in the company and are entitled to

the share in the earnings of the organization. With increase or decrease in growth and

profitability of the company, their share will also vary due to this aspect they need information

of the company to know that whether is company is growing or not (Flamholtz and Kurland,

2006).

Employees are the individual who work within the organisation and for the organisation.

Employees need information so as to know that how the organisation is growing for which they

are working because their growth is aligned with companies growth.

Suppliers are the persons who supply goods or any asset or anything to the company on

credit terms i.e. payment is due to them (Baker and Mukherjee, 2007). They require information

of the company to know that whether the company will be able to pay amount due to them.

Financial institutions include banks and other institutions who had lend certain amount to

the company and in return, the firm needs to pay interest on the same (Cook and Ali, 2010).

Thus, information is needed by these financial institutions so as to know that whether the

company has sufficient liquidity and profitability to pay its interest obligations.

2.4 Impact of sources of finance on financial statements

Sweet Menu Restaurant Ltd. had decided to raise funds by taking term loan from

financial statements and by availing bank overdraft facility. These sources carry elements which

will have an impact on financial statements of the company i.e. profit and loss account and

balance sheet of the company which is explained below.

Impact on Profit and Loss a/c

Term Loan and Bank overdraft both requires company to pay interest on them and

processing charges (if any), which will be shown as operating expenses in P & L A/c.With

increase in such expense, profit of the company will reduce which will further decrease the

amount of dividends declared and retained earnings will also get reduced (Murphy and Yetmar,

2010)

Impact on Balance Sheet

8

Suomala, 2007).

Owners are the ultimate decision makers of the organisation. They need information

related to the company because they had invested their amount in the company and are entitled to

the share in the earnings of the organization. With increase or decrease in growth and

profitability of the company, their share will also vary due to this aspect they need information

of the company to know that whether is company is growing or not (Flamholtz and Kurland,

2006).

Employees are the individual who work within the organisation and for the organisation.

Employees need information so as to know that how the organisation is growing for which they

are working because their growth is aligned with companies growth.

Suppliers are the persons who supply goods or any asset or anything to the company on

credit terms i.e. payment is due to them (Baker and Mukherjee, 2007). They require information

of the company to know that whether the company will be able to pay amount due to them.

Financial institutions include banks and other institutions who had lend certain amount to

the company and in return, the firm needs to pay interest on the same (Cook and Ali, 2010).

Thus, information is needed by these financial institutions so as to know that whether the

company has sufficient liquidity and profitability to pay its interest obligations.

2.4 Impact of sources of finance on financial statements

Sweet Menu Restaurant Ltd. had decided to raise funds by taking term loan from

financial statements and by availing bank overdraft facility. These sources carry elements which

will have an impact on financial statements of the company i.e. profit and loss account and

balance sheet of the company which is explained below.

Impact on Profit and Loss a/c

Term Loan and Bank overdraft both requires company to pay interest on them and

processing charges (if any), which will be shown as operating expenses in P & L A/c.With

increase in such expense, profit of the company will reduce which will further decrease the

amount of dividends declared and retained earnings will also get reduced (Murphy and Yetmar,

2010)

Impact on Balance Sheet

8

Long term and short term obligations of the company has increased due to raising funds

through term loan and overdraft and the same will be shown in its balance sheet, term loan under

long term debt (Assibey, Bokpin and Twerefou, 2012). Bank overdraft as current liabilities of the

company and on the assets side, bank balance will be increased by the amount of loan received

and when the instalments made due, cash and bank balance will get reduced.

TASK 3

3.1 Analysis of Budget

Cost Accountant of Blue Island Restaurant has prepared budget of 4 months, in

accordance with the budget prepared by him, it can be noticed that company had huge negative

balance in the month of September because two fixed assets were purchased by the company

involving higher amount as against sales made during that month. Although, net balance turns

positive for next month’s there is an increase in sales along with little increase in expenses but no

heavy expenditure was incurred. In the next month, further fixed assets were purchased and

amount involved in purchase is more than the increase in sales revenue so balance goes negative

(Ilter, 2014). According to the mentioned cash budget company has different additional expenses

which lower down overall rate of return. Owing to this, in the first month of September net

deficit is 25850. However, in the month of October it was 3870 which increased in the month of

November by 4770. The budget is showing that in first month large investment was made on

purchasing furniture, sales as well as wages. On the other hand, expenses on lighting and energy

are also kept on increasing. It was 500 in the month of October which increased to 650 till

December. Owing to this, corporation is having deficit in all months except October and

November. On the other hand, deficit of Blue Island started to decrease in December from

November.

According to the above results it is showing that sales turnover of corporation is

continuously decreasing. It affect overall performance of restaurant and also management need

to put efforts to reduce additional cost. Similarly, training should be provided to workforce so

that they can effectively contribute towards increasing flow of production. Also, cost effective

sources of finance should be accessed in order to save cost and increase profitability in the

marketplace.

9

through term loan and overdraft and the same will be shown in its balance sheet, term loan under

long term debt (Assibey, Bokpin and Twerefou, 2012). Bank overdraft as current liabilities of the

company and on the assets side, bank balance will be increased by the amount of loan received

and when the instalments made due, cash and bank balance will get reduced.

TASK 3

3.1 Analysis of Budget

Cost Accountant of Blue Island Restaurant has prepared budget of 4 months, in

accordance with the budget prepared by him, it can be noticed that company had huge negative

balance in the month of September because two fixed assets were purchased by the company

involving higher amount as against sales made during that month. Although, net balance turns

positive for next month’s there is an increase in sales along with little increase in expenses but no

heavy expenditure was incurred. In the next month, further fixed assets were purchased and

amount involved in purchase is more than the increase in sales revenue so balance goes negative

(Ilter, 2014). According to the mentioned cash budget company has different additional expenses

which lower down overall rate of return. Owing to this, in the first month of September net

deficit is 25850. However, in the month of October it was 3870 which increased in the month of

November by 4770. The budget is showing that in first month large investment was made on

purchasing furniture, sales as well as wages. On the other hand, expenses on lighting and energy

are also kept on increasing. It was 500 in the month of October which increased to 650 till

December. Owing to this, corporation is having deficit in all months except October and

November. On the other hand, deficit of Blue Island started to decrease in December from

November.

According to the above results it is showing that sales turnover of corporation is

continuously decreasing. It affect overall performance of restaurant and also management need

to put efforts to reduce additional cost. Similarly, training should be provided to workforce so

that they can effectively contribute towards increasing flow of production. Also, cost effective

sources of finance should be accessed in order to save cost and increase profitability in the

marketplace.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3.2 Calculation of Unit Cost

Unit costing refers to all the cost incurred whether fixed or variable in relation to a single

unit beginning from raw material cost till the product is finally sold. Unit cost is formulated as :

Unit Cost =Total Cost / sale price.

Unit cost of Blue Island Restaurant can be calculated with the help of above formula

which will be :

Items Costs £

Steak 3

Vegetables and other ingredients 1.5

labour 3.5

Overheads 2

Total Costs 10

Mark Up (40%) 4

VAT 2

Selling Price 16

Food cost (%)=Total Costs of Ingredients/ Selling Price * 100

=10/16*100

Food cost=62.50%

On the basis of above calculation, unit cost comes to £16 that means total cost of £10 will

be incurred in the production of one single unit, so company should set the sales price by adding

mark-up value on the unit cost in a way that cost incurred on the production of the unit will be

recovered.

3.3 Investment Appraisal Techniques

Companies needs to evaluate all the investments proposals available to them by

considering risks and returns associated with each proposal as these involves huge capital to be

invested in by the company. Company after evaluation should select the most suitable proposal

10

Unit costing refers to all the cost incurred whether fixed or variable in relation to a single

unit beginning from raw material cost till the product is finally sold. Unit cost is formulated as :

Unit Cost =Total Cost / sale price.

Unit cost of Blue Island Restaurant can be calculated with the help of above formula

which will be :

Items Costs £

Steak 3

Vegetables and other ingredients 1.5

labour 3.5

Overheads 2

Total Costs 10

Mark Up (40%) 4

VAT 2

Selling Price 16

Food cost (%)=Total Costs of Ingredients/ Selling Price * 100

=10/16*100

Food cost=62.50%

On the basis of above calculation, unit cost comes to £16 that means total cost of £10 will

be incurred in the production of one single unit, so company should set the sales price by adding

mark-up value on the unit cost in a way that cost incurred on the production of the unit will be

recovered.

3.3 Investment Appraisal Techniques

Companies needs to evaluate all the investments proposals available to them by

considering risks and returns associated with each proposal as these involves huge capital to be

invested in by the company. Company after evaluation should select the most suitable proposal

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to invest, following techniques are available for evaluation of investment appraisal which will

help company to decide the bet proposal.

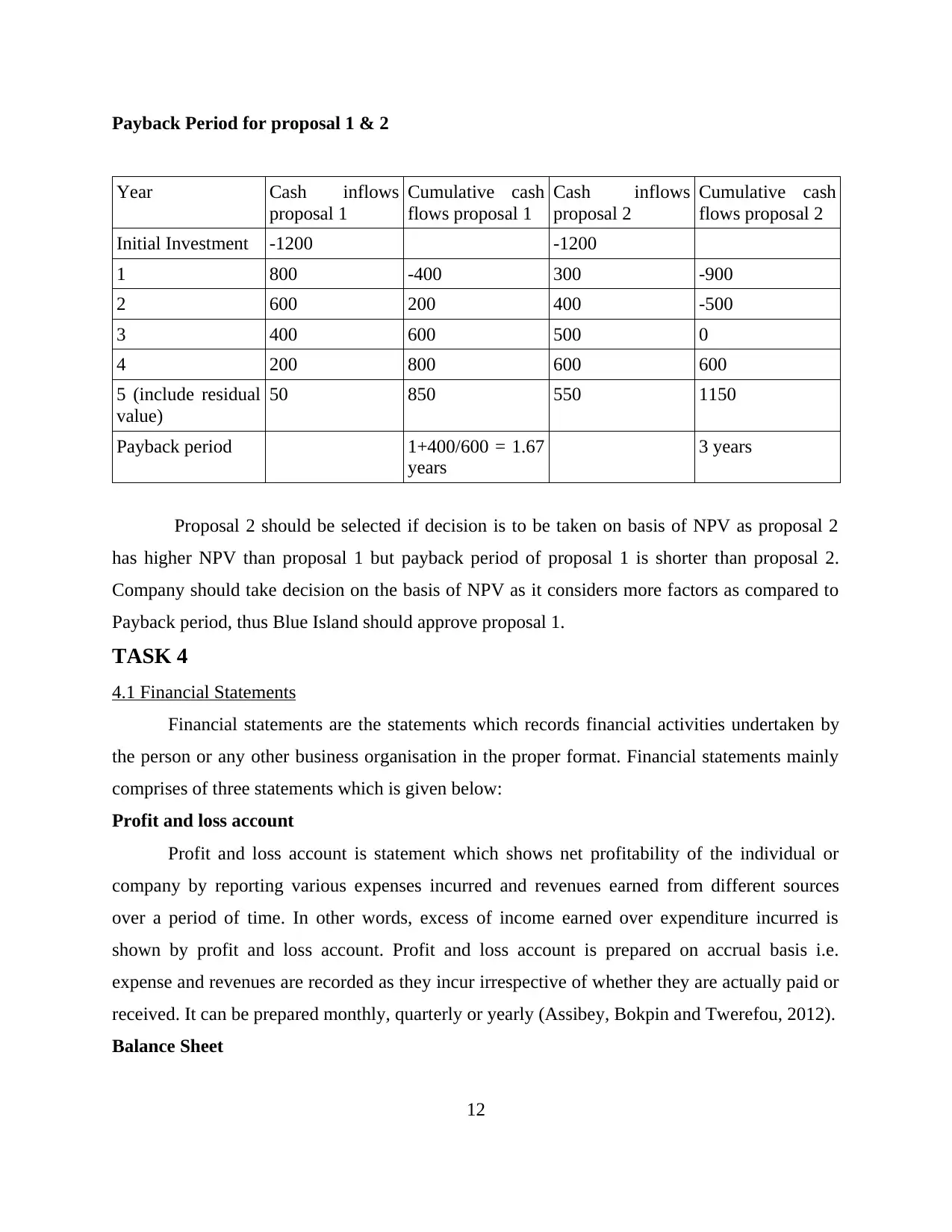

Payback Method

Payback period refers to the time in which investment initially made can be recovered

(Cook and Ali, 2010). Generally proposals having short payback period are selected as compared

to long payback period so that our invested amount would be recovered earlier.

Net Present Value Method (NPV)

Net Present value method calculates net profit or loss to the company after deducting the

initial investment made from present value of future cash inflows which are arrived by

discounting them at rate 'r' (Afonso and Cunha, 2009). In general practice, project with negative

NPV are not accepted by the companies, NPV thus can be formulated as:

NPV= Present value of all the cash inflows at rate 'r' - Initial Investment

Calculation of NPV and Payback Period of given proposals for Blue Island Restaurant is

calculated as follows:

NPV for proposal 1 & 2

Year cash Inflows

of proposal 1

(£)

(i)

cash Inflows

of proposal 2

(£)

(ii)

Present value

factor @ 10%

(iii)

P.V of inflows

proposal 1

(i*iii)

P.V of inflows

proposal 2

(ii*iii)

1 800 300 0.909 727 272

2 600 400 0.826 496 330

3 400 500 0.751 300 375

4 200 600 0.683 137 410

5 50 500 0.621 31 311

Residual

Value

0 50 0.621 0 31

Total (a) 1691 1729

Initial

investment

(b)

1200 1200

NPV [a-b] 491 529

11

help company to decide the bet proposal.

Payback Method

Payback period refers to the time in which investment initially made can be recovered

(Cook and Ali, 2010). Generally proposals having short payback period are selected as compared

to long payback period so that our invested amount would be recovered earlier.

Net Present Value Method (NPV)

Net Present value method calculates net profit or loss to the company after deducting the

initial investment made from present value of future cash inflows which are arrived by

discounting them at rate 'r' (Afonso and Cunha, 2009). In general practice, project with negative

NPV are not accepted by the companies, NPV thus can be formulated as:

NPV= Present value of all the cash inflows at rate 'r' - Initial Investment

Calculation of NPV and Payback Period of given proposals for Blue Island Restaurant is

calculated as follows:

NPV for proposal 1 & 2

Year cash Inflows

of proposal 1

(£)

(i)

cash Inflows

of proposal 2

(£)

(ii)

Present value

factor @ 10%

(iii)

P.V of inflows

proposal 1

(i*iii)

P.V of inflows

proposal 2

(ii*iii)

1 800 300 0.909 727 272

2 600 400 0.826 496 330

3 400 500 0.751 300 375

4 200 600 0.683 137 410

5 50 500 0.621 31 311

Residual

Value

0 50 0.621 0 31

Total (a) 1691 1729

Initial

investment

(b)

1200 1200

NPV [a-b] 491 529

11

Payback Period for proposal 1 & 2

Year Cash inflows

proposal 1

Cumulative cash

flows proposal 1

Cash inflows

proposal 2

Cumulative cash

flows proposal 2

Initial Investment -1200 -1200

1 800 -400 300 -900

2 600 200 400 -500

3 400 600 500 0

4 200 800 600 600

5 (include residual

value)

50 850 550 1150

Payback period 1+400/600 = 1.67

years

3 years

Proposal 2 should be selected if decision is to be taken on basis of NPV as proposal 2

has higher NPV than proposal 1 but payback period of proposal 1 is shorter than proposal 2.

Company should take decision on the basis of NPV as it considers more factors as compared to

Payback period, thus Blue Island should approve proposal 1.

TASK 4

4.1 Financial Statements

Financial statements are the statements which records financial activities undertaken by

the person or any other business organisation in the proper format. Financial statements mainly

comprises of three statements which is given below:

Profit and loss account

Profit and loss account is statement which shows net profitability of the individual or

company by reporting various expenses incurred and revenues earned from different sources

over a period of time. In other words, excess of income earned over expenditure incurred is

shown by profit and loss account. Profit and loss account is prepared on accrual basis i.e.

expense and revenues are recorded as they incur irrespective of whether they are actually paid or

received. It can be prepared monthly, quarterly or yearly (Assibey, Bokpin and Twerefou, 2012).

Balance Sheet

12

Year Cash inflows

proposal 1

Cumulative cash

flows proposal 1

Cash inflows

proposal 2

Cumulative cash

flows proposal 2

Initial Investment -1200 -1200

1 800 -400 300 -900

2 600 200 400 -500

3 400 600 500 0

4 200 800 600 600

5 (include residual

value)

50 850 550 1150

Payback period 1+400/600 = 1.67

years

3 years

Proposal 2 should be selected if decision is to be taken on basis of NPV as proposal 2

has higher NPV than proposal 1 but payback period of proposal 1 is shorter than proposal 2.

Company should take decision on the basis of NPV as it considers more factors as compared to

Payback period, thus Blue Island should approve proposal 1.

TASK 4

4.1 Financial Statements

Financial statements are the statements which records financial activities undertaken by

the person or any other business organisation in the proper format. Financial statements mainly

comprises of three statements which is given below:

Profit and loss account

Profit and loss account is statement which shows net profitability of the individual or

company by reporting various expenses incurred and revenues earned from different sources

over a period of time. In other words, excess of income earned over expenditure incurred is

shown by profit and loss account. Profit and loss account is prepared on accrual basis i.e.

expense and revenues are recorded as they incur irrespective of whether they are actually paid or

received. It can be prepared monthly, quarterly or yearly (Assibey, Bokpin and Twerefou, 2012).

Balance Sheet

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.