Financial Reporting Standards and Compliance

VerifiedAdded on 2020/10/22

|13

|3727

|149

AI Summary

The provided document delves into the world of financial reporting standards, specifically International Financial Reporting Standards (IFRS). It examines how IFRS guides businesses in presenting accurate and transparent financial statements to external stakeholders. The document also touches on the benefits of IFRS compliance, including attracting international investors and facilitating business operations worldwide. References to various books, journals, and online resources are provided for further reading.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL

REPORTING

REPORTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1. Purpose of financial reporting.................................................................................................1

2. Conceptual Framework...........................................................................................................2

3.Main Stakeholders of Marks & Spencer.................................................................................3

4. Value of financial Reporting...................................................................................................4

5. Financial Statements As per IAS............................................................................................4

6. Two years financial statements of Marks & Spencer..............................................................6

7. Difference Between International Accounting Standards (IAS) and International financial

reporting Standards (IFRS).........................................................................................................7

8. Benefits of International Financial Reporting Standards........................................................8

CONCLUSION................................................................................................................................9

REFERENCES .............................................................................................................................11

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1. Purpose of financial reporting.................................................................................................1

2. Conceptual Framework...........................................................................................................2

3.Main Stakeholders of Marks & Spencer.................................................................................3

4. Value of financial Reporting...................................................................................................4

5. Financial Statements As per IAS............................................................................................4

6. Two years financial statements of Marks & Spencer..............................................................6

7. Difference Between International Accounting Standards (IAS) and International financial

reporting Standards (IFRS).........................................................................................................7

8. Benefits of International Financial Reporting Standards........................................................8

CONCLUSION................................................................................................................................9

REFERENCES .............................................................................................................................11

INTRODUCTION

Financial reporting mention to the communication of financial information, like creditors

and investors. Financial reporting is using by companies for issuing financial statements. In

general way financial statements sets of statements of owner's equity, income

statement,statement of cash flow and balance sheet, but financial reporting is much more broad

than just as set of financial statements. In this context chosen company is Marks & Spencer, is a

British multinational retail company founded in 1884. Apart from investment banking, Marks &

Spencer is organised into four core businesses: corporate banking, investment management,

wealth management and personal banking. This report covers context and purpose of financial

reporting and identify main stakeholders of Marks & Spencer and describe benefits of them.

Value of financial reporting for meeting of objectives and growth of Marks & Spencer and

interpretation of financial statements.

1. Purpose of financial reporting

The purpose of financial reporting is to deliver financial information to the stakeholders

and lenders for business. According to FTES financial reporting have many purposes they are as

following -

a. Give information to management of Marks & Spencer which is utilised for the purpose of

decision making, planning, analysis and benchmarking.

b. Providing content to creditors, investors, debt provider and promoters which is used to them to

male rational and prudent decisions regarding investments, credit (Nobes, 2014).

c. They are providing information to organization for how to using and procuring various

resources.

d. Providing information of economic resources of organization to claim these resources and how

to claims and those resources change according to particular time.

f. Providing information to the statutory auditors which in turn facilitates audit.

g. It helps to management to inhabit in impressive decision making concerning the Marks &

Spencer objective and whole strategies. The data revealed in this reports can help the

management recognize the strengths and weaknesses of the company.

h. Financial reporting provides essential information of financial health activities and health to its

stakeholders including government regulators, potential investors, shareholders and consumers.

1

Financial reporting mention to the communication of financial information, like creditors

and investors. Financial reporting is using by companies for issuing financial statements. In

general way financial statements sets of statements of owner's equity, income

statement,statement of cash flow and balance sheet, but financial reporting is much more broad

than just as set of financial statements. In this context chosen company is Marks & Spencer, is a

British multinational retail company founded in 1884. Apart from investment banking, Marks &

Spencer is organised into four core businesses: corporate banking, investment management,

wealth management and personal banking. This report covers context and purpose of financial

reporting and identify main stakeholders of Marks & Spencer and describe benefits of them.

Value of financial reporting for meeting of objectives and growth of Marks & Spencer and

interpretation of financial statements.

1. Purpose of financial reporting

The purpose of financial reporting is to deliver financial information to the stakeholders

and lenders for business. According to FTES financial reporting have many purposes they are as

following -

a. Give information to management of Marks & Spencer which is utilised for the purpose of

decision making, planning, analysis and benchmarking.

b. Providing content to creditors, investors, debt provider and promoters which is used to them to

male rational and prudent decisions regarding investments, credit (Nobes, 2014).

c. They are providing information to organization for how to using and procuring various

resources.

d. Providing information of economic resources of organization to claim these resources and how

to claims and those resources change according to particular time.

f. Providing information to the statutory auditors which in turn facilitates audit.

g. It helps to management to inhabit in impressive decision making concerning the Marks &

Spencer objective and whole strategies. The data revealed in this reports can help the

management recognize the strengths and weaknesses of the company.

h. Financial reporting provides essential information of financial health activities and health to its

stakeholders including government regulators, potential investors, shareholders and consumers.

1

2. Conceptual Framework

The Conceptual Framework for financial reporting describes the concepts and objectives

for general purpose of financial reporting. It is a practical tool that helps the International

Accounting Standards Board to develop requirements in IFRS standard based on consistent

concepts (Rajgopal and Venkatachalam, 2011), 2018Level of compliance with IFRS, 2016).

Consideration of these concepts, in turn, should result in the board developing IFRS standards

that require entities to provide financial information that is useful to creditors, investors and

lenders.

Purpose

To assist the preparers of financial reports to develop consistent accounting policies for

transactions or other events when no standard applies or a standard allows a choice of

accounting policies.

To assist all parties to understand and interpret standards.

To assist the board to develop IFRS standards based on consistent concepts, resulting in

financial information that is useful to lenders, creditors and investors.

Principles

The principle of all income and expenses are categorized and included in the statement of

profit and loss.

The principle of income and expenses also including other comprehensive income in the

head of Recycling to describe that one period are recycled to the statement of profit and

loss in a upcoming time period when doing so results in the statement of profit and loss

providing true representation and more faithful information.

Qualitative Characteristics

Relevance

Information is relevant if it is capable of making a difference to the decision made by

users

Financial information is capable of making a difference in decisions if is has predictive

value or confirmatory value (Ball, Jayaraman and Shivakumar, 2012).

Faithful Representation

Information must faithfully represent the substance of what it purports to represent

2

The Conceptual Framework for financial reporting describes the concepts and objectives

for general purpose of financial reporting. It is a practical tool that helps the International

Accounting Standards Board to develop requirements in IFRS standard based on consistent

concepts (Rajgopal and Venkatachalam, 2011), 2018Level of compliance with IFRS, 2016).

Consideration of these concepts, in turn, should result in the board developing IFRS standards

that require entities to provide financial information that is useful to creditors, investors and

lenders.

Purpose

To assist the preparers of financial reports to develop consistent accounting policies for

transactions or other events when no standard applies or a standard allows a choice of

accounting policies.

To assist all parties to understand and interpret standards.

To assist the board to develop IFRS standards based on consistent concepts, resulting in

financial information that is useful to lenders, creditors and investors.

Principles

The principle of all income and expenses are categorized and included in the statement of

profit and loss.

The principle of income and expenses also including other comprehensive income in the

head of Recycling to describe that one period are recycled to the statement of profit and

loss in a upcoming time period when doing so results in the statement of profit and loss

providing true representation and more faithful information.

Qualitative Characteristics

Relevance

Information is relevant if it is capable of making a difference to the decision made by

users

Financial information is capable of making a difference in decisions if is has predictive

value or confirmatory value (Ball, Jayaraman and Shivakumar, 2012).

Faithful Representation

Information must faithfully represent the substance of what it purports to represent

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

A faithful representation is, to the maximum extent possible, complete, neutral and free

from error.

A faithful representation is affected by level of measurement uncertainty

Enhancing Qualitative Characteristics

Comparability, timeliness, verifiability and understandability these four using for providing

information.

3.Main Stakeholders of Marks & Spencer

Marks & Spencer have main stake holders are clients, investors, organisations, government and

customers.

Benefits to stakeholders from financial informations

Stakeholders obtain a set of financial statements as a right, and are the only stakeholders

to do so. The stakeholders interest will be in what the bank is doing with the wealth they have

invested, and whether it is making a profit or loss. If it is bankable, they will want a return in

form of interests, so they will be afraid with the level of interests the company is paying out year

on year and the possible for future interests and profits (Brown, 2014). If profits levels and

interest pay outs decrease observably, or if no interest are paid out because the bank has made a

loss, then they will consider selling their shares and investing in something else which will give

them a higher return. Patently operating profit amount is also required to measure overall

performance.

For needful informations

Every stakeholders wants to needful informations relating to bank so they propose to

show financial information. After that it helps to evaluate their investments and analysis of

profitability ratios, debt ratios, liquidity ratios, price ratios and efficiency ratios.

Helping for taking decisions

On the basis of financial information the stakeholders taking appropriate decisions and

these financial information helping for investment purpose.

Evaluate performance

Through financial information stakeholders evaluate performance of an organisation

because it helps to further investments. Stakeholders knows that financial position of company

and suggest to other for investments.

3

from error.

A faithful representation is affected by level of measurement uncertainty

Enhancing Qualitative Characteristics

Comparability, timeliness, verifiability and understandability these four using for providing

information.

3.Main Stakeholders of Marks & Spencer

Marks & Spencer have main stake holders are clients, investors, organisations, government and

customers.

Benefits to stakeholders from financial informations

Stakeholders obtain a set of financial statements as a right, and are the only stakeholders

to do so. The stakeholders interest will be in what the bank is doing with the wealth they have

invested, and whether it is making a profit or loss. If it is bankable, they will want a return in

form of interests, so they will be afraid with the level of interests the company is paying out year

on year and the possible for future interests and profits (Brown, 2014). If profits levels and

interest pay outs decrease observably, or if no interest are paid out because the bank has made a

loss, then they will consider selling their shares and investing in something else which will give

them a higher return. Patently operating profit amount is also required to measure overall

performance.

For needful informations

Every stakeholders wants to needful informations relating to bank so they propose to

show financial information. After that it helps to evaluate their investments and analysis of

profitability ratios, debt ratios, liquidity ratios, price ratios and efficiency ratios.

Helping for taking decisions

On the basis of financial information the stakeholders taking appropriate decisions and

these financial information helping for investment purpose.

Evaluate performance

Through financial information stakeholders evaluate performance of an organisation

because it helps to further investments. Stakeholders knows that financial position of company

and suggest to other for investments.

3

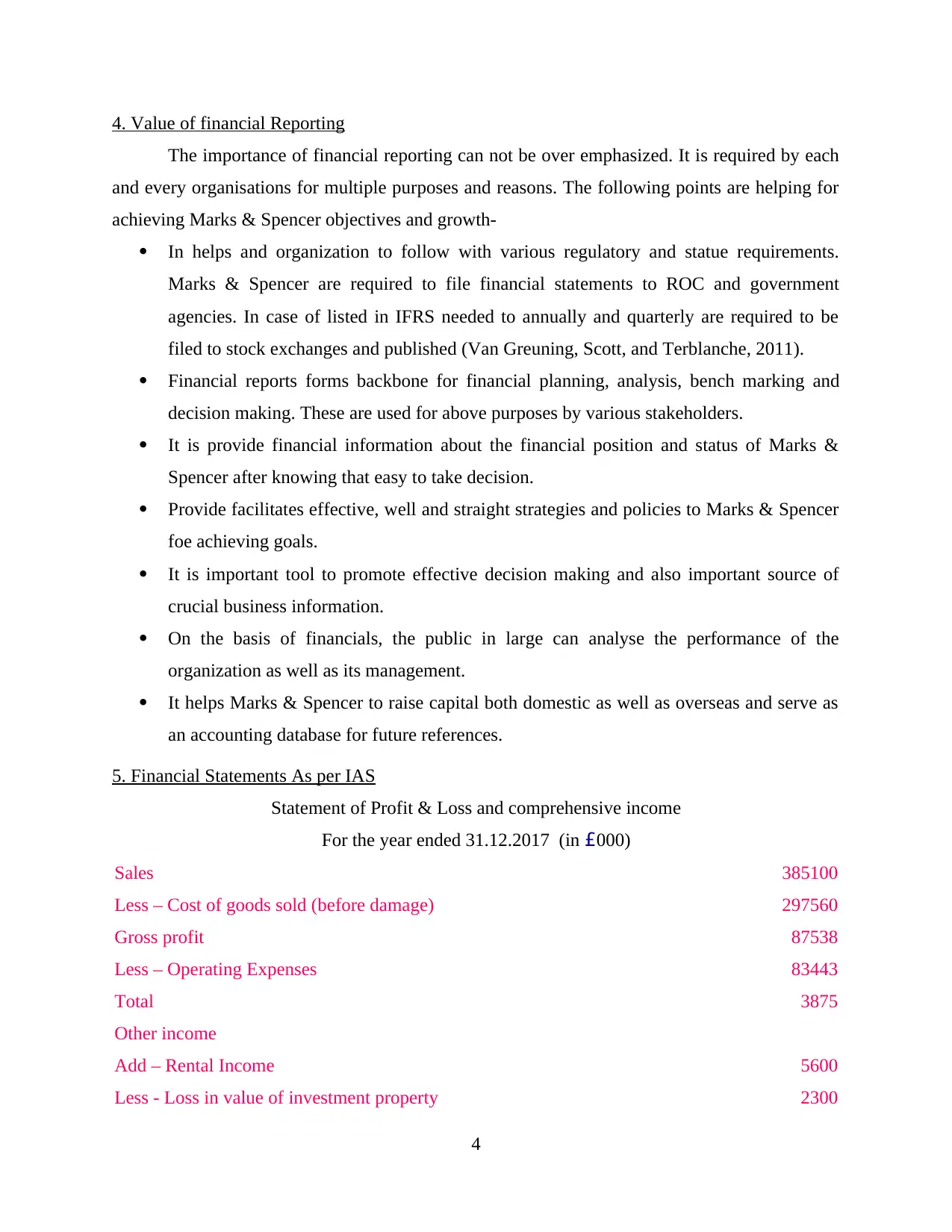

4. Value of financial Reporting

The importance of financial reporting can not be over emphasized. It is required by each

and every organisations for multiple purposes and reasons. The following points are helping for

achieving Marks & Spencer objectives and growth-

In helps and organization to follow with various regulatory and statue requirements.

Marks & Spencer are required to file financial statements to ROC and government

agencies. In case of listed in IFRS needed to annually and quarterly are required to be

filed to stock exchanges and published (Van Greuning, Scott, and Terblanche, 2011).

Financial reports forms backbone for financial planning, analysis, bench marking and

decision making. These are used for above purposes by various stakeholders.

It is provide financial information about the financial position and status of Marks &

Spencer after knowing that easy to take decision.

Provide facilitates effective, well and straight strategies and policies to Marks & Spencer

foe achieving goals.

It is important tool to promote effective decision making and also important source of

crucial business information.

On the basis of financials, the public in large can analyse the performance of the

organization as well as its management.

It helps Marks & Spencer to raise capital both domestic as well as overseas and serve as

an accounting database for future references.

5. Financial Statements As per IAS

Statement of Profit & Loss and comprehensive income

For the year ended 31.12.2017 (in £000)

Sales 385100

Less – Cost of goods sold (before damage) 297560

Gross profit 87538

Less – Operating Expenses 83443

Total 3875

Other income

Add – Rental Income 5600

Less - Loss in value of investment property 2300

4

The importance of financial reporting can not be over emphasized. It is required by each

and every organisations for multiple purposes and reasons. The following points are helping for

achieving Marks & Spencer objectives and growth-

In helps and organization to follow with various regulatory and statue requirements.

Marks & Spencer are required to file financial statements to ROC and government

agencies. In case of listed in IFRS needed to annually and quarterly are required to be

filed to stock exchanges and published (Van Greuning, Scott, and Terblanche, 2011).

Financial reports forms backbone for financial planning, analysis, bench marking and

decision making. These are used for above purposes by various stakeholders.

It is provide financial information about the financial position and status of Marks &

Spencer after knowing that easy to take decision.

Provide facilitates effective, well and straight strategies and policies to Marks & Spencer

foe achieving goals.

It is important tool to promote effective decision making and also important source of

crucial business information.

On the basis of financials, the public in large can analyse the performance of the

organization as well as its management.

It helps Marks & Spencer to raise capital both domestic as well as overseas and serve as

an accounting database for future references.

5. Financial Statements As per IAS

Statement of Profit & Loss and comprehensive income

For the year ended 31.12.2017 (in £000)

Sales 385100

Less – Cost of goods sold (before damage) 297560

Gross profit 87538

Less – Operating Expenses 83443

Total 3875

Other income

Add – Rental Income 5600

Less - Loss in value of investment property 2300

4

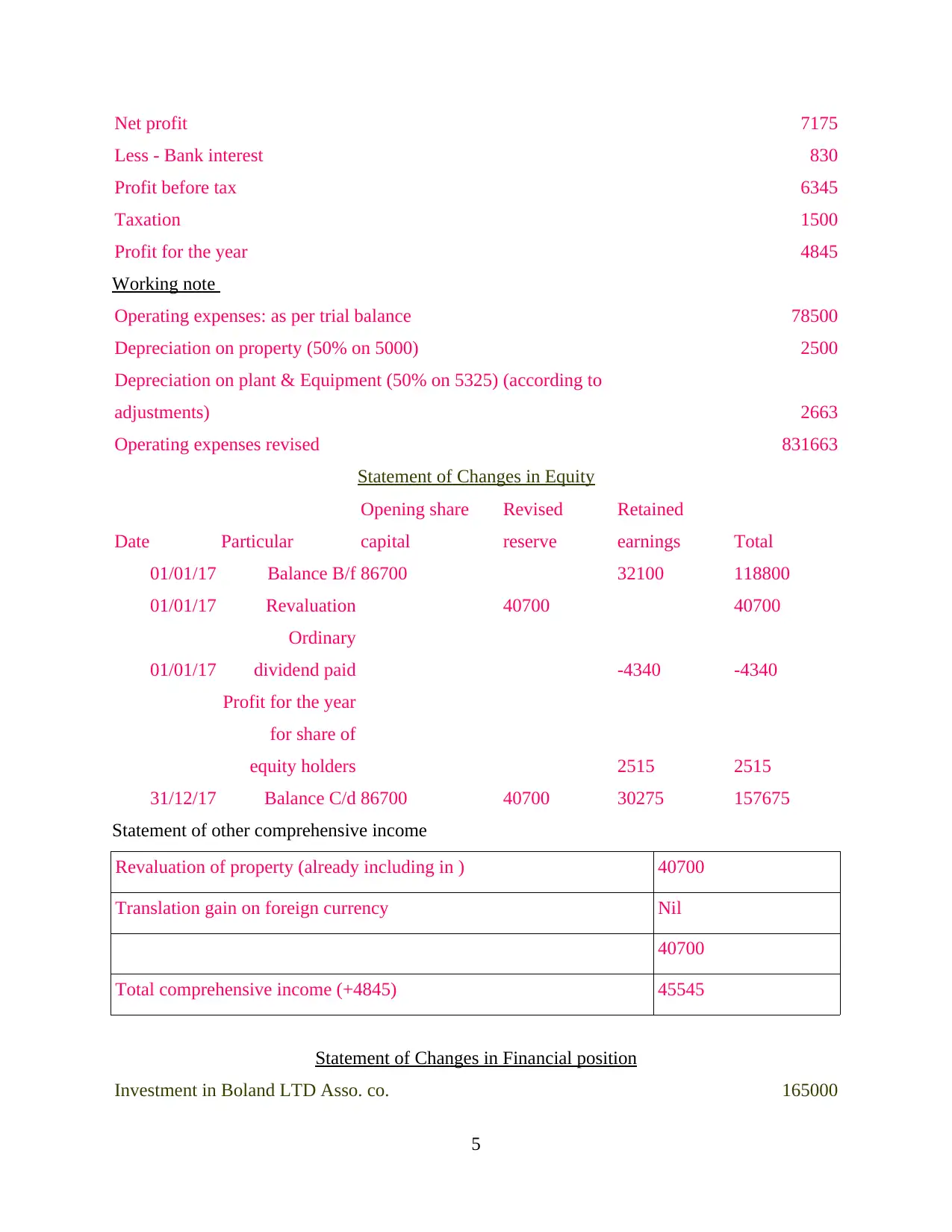

Net profit 7175

Less - Bank interest 830

Profit before tax 6345

Taxation 1500

Profit for the year 4845

Working note

Operating expenses: as per trial balance 78500

Depreciation on property (50% on 5000) 2500

Depreciation on plant & Equipment (50% on 5325) (according to

adjustments) 2663

Operating expenses revised 831663

Statement of Changes in Equity

Date Particular

Opening share

capital

Revised

reserve

Retained

earnings Total

01/01/17 Balance B/f 86700 32100 118800

01/01/17 Revaluation 40700 40700

01/01/17

Ordinary

dividend paid -4340 -4340

Profit for the year

for share of

equity holders 2515 2515

31/12/17 Balance C/d 86700 40700 30275 157675

Statement of other comprehensive income

Revaluation of property (already including in ) 40700

Translation gain on foreign currency Nil

40700

Total comprehensive income (+4845) 45545

Statement of Changes in Financial position

Investment in Boland LTD Asso. co. 165000

5

Less - Bank interest 830

Profit before tax 6345

Taxation 1500

Profit for the year 4845

Working note

Operating expenses: as per trial balance 78500

Depreciation on property (50% on 5000) 2500

Depreciation on plant & Equipment (50% on 5325) (according to

adjustments) 2663

Operating expenses revised 831663

Statement of Changes in Equity

Date Particular

Opening share

capital

Revised

reserve

Retained

earnings Total

01/01/17 Balance B/f 86700 32100 118800

01/01/17 Revaluation 40700 40700

01/01/17

Ordinary

dividend paid -4340 -4340

Profit for the year

for share of

equity holders 2515 2515

31/12/17 Balance C/d 86700 40700 30275 157675

Statement of other comprehensive income

Revaluation of property (already including in ) 40700

Translation gain on foreign currency Nil

40700

Total comprehensive income (+4845) 45545

Statement of Changes in Financial position

Investment in Boland LTD Asso. co. 165000

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

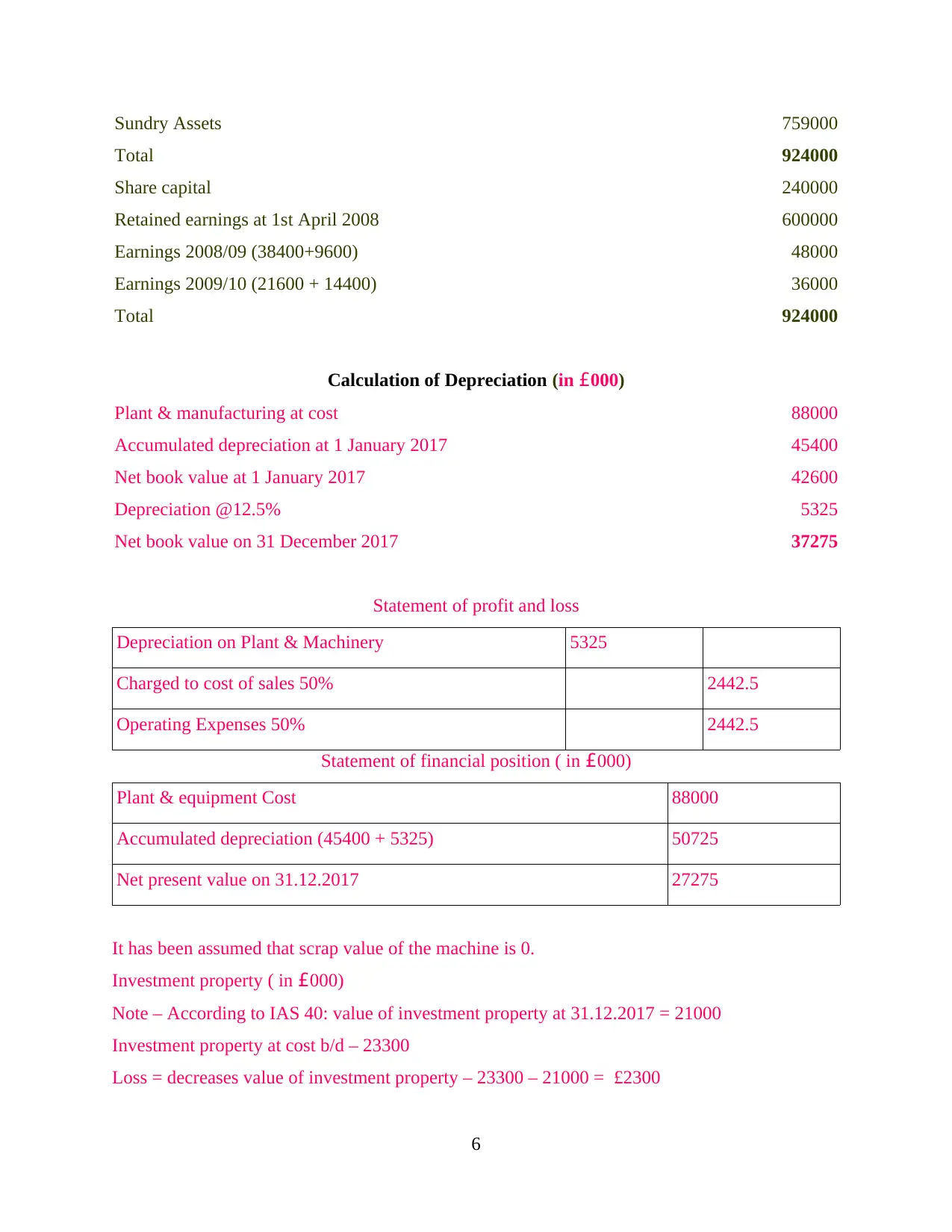

Sundry Assets 759000

Total 924000

Share capital 240000

Retained earnings at 1st April 2008 600000

Earnings 2008/09 (38400+9600) 48000

Earnings 2009/10 (21600 + 14400) 36000

Total 924000

Calculation of Depreciation (in £000)

Plant & manufacturing at cost 88000

Accumulated depreciation at 1 January 2017 45400

Net book value at 1 January 2017 42600

Depreciation @12.5% 5325

Net book value on 31 December 2017 37275

Statement of profit and loss

Depreciation on Plant & Machinery 5325

Charged to cost of sales 50% 2442.5

Operating Expenses 50% 2442.5

Statement of financial position ( in £000)

Plant & equipment Cost 88000

Accumulated depreciation (45400 + 5325) 50725

Net present value on 31.12.2017 27275

It has been assumed that scrap value of the machine is 0.

Investment property ( in £000)

Note – According to IAS 40: value of investment property at 31.12.2017 = 21000

Investment property at cost b/d – 23300

Loss = decreases value of investment property – 23300 – 21000 = £2300

6

Total 924000

Share capital 240000

Retained earnings at 1st April 2008 600000

Earnings 2008/09 (38400+9600) 48000

Earnings 2009/10 (21600 + 14400) 36000

Total 924000

Calculation of Depreciation (in £000)

Plant & manufacturing at cost 88000

Accumulated depreciation at 1 January 2017 45400

Net book value at 1 January 2017 42600

Depreciation @12.5% 5325

Net book value on 31 December 2017 37275

Statement of profit and loss

Depreciation on Plant & Machinery 5325

Charged to cost of sales 50% 2442.5

Operating Expenses 50% 2442.5

Statement of financial position ( in £000)

Plant & equipment Cost 88000

Accumulated depreciation (45400 + 5325) 50725

Net present value on 31.12.2017 27275

It has been assumed that scrap value of the machine is 0.

Investment property ( in £000)

Note – According to IAS 40: value of investment property at 31.12.2017 = 21000

Investment property at cost b/d – 23300

Loss = decreases value of investment property – 23300 – 21000 = £2300

6

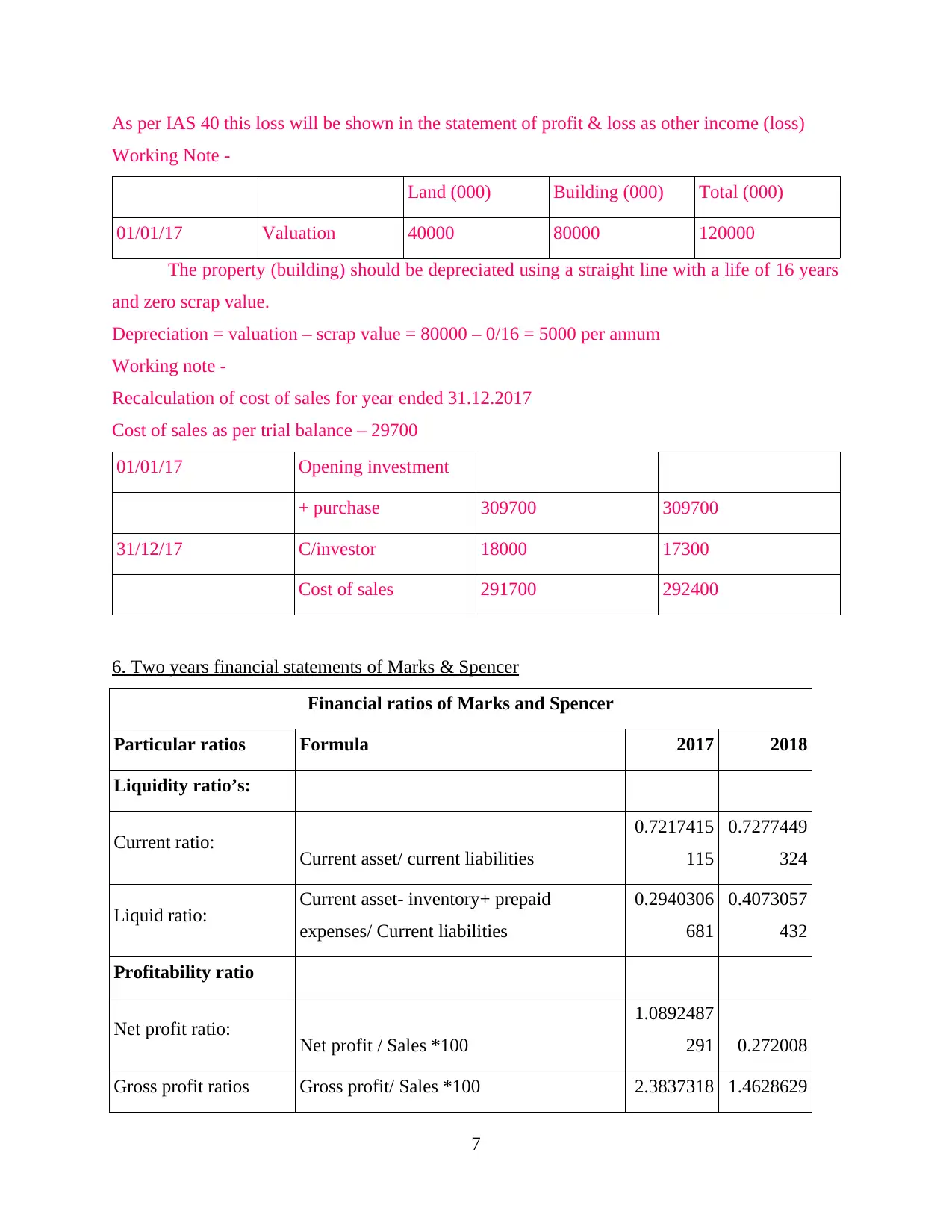

As per IAS 40 this loss will be shown in the statement of profit & loss as other income (loss)

Working Note -

Land (000) Building (000) Total (000)

01/01/17 Valuation 40000 80000 120000

The property (building) should be depreciated using a straight line with a life of 16 years

and zero scrap value.

Depreciation = valuation – scrap value = 80000 – 0/16 = 5000 per annum

Working note -

Recalculation of cost of sales for year ended 31.12.2017

Cost of sales as per trial balance – 29700

01/01/17 Opening investment

+ purchase 309700 309700

31/12/17 C/investor 18000 17300

Cost of sales 291700 292400

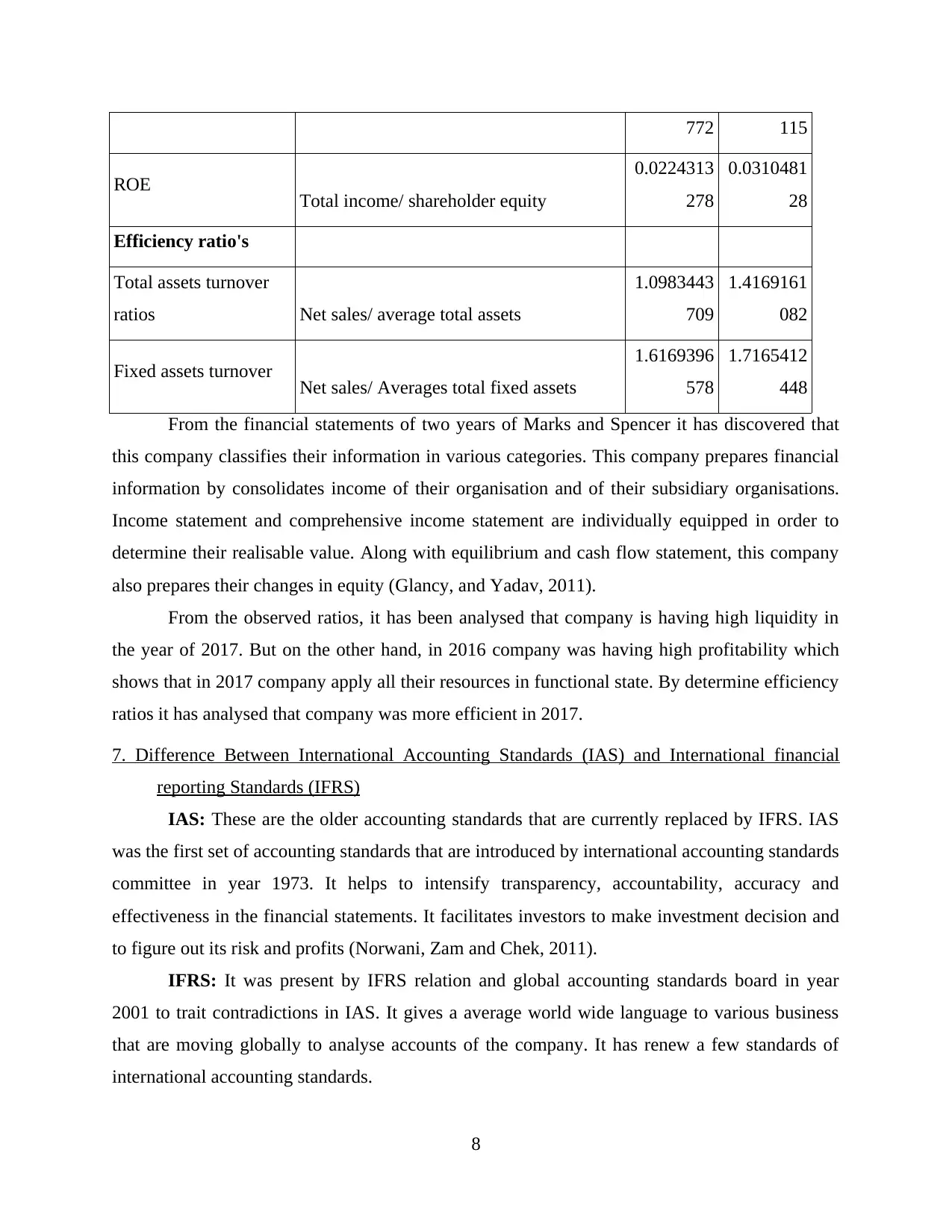

6. Two years financial statements of Marks & Spencer

Financial ratios of Marks and Spencer

Particular ratios Formula 2017 2018

Liquidity ratio’s:

Current ratio: Current asset/ current liabilities

0.7217415

115

0.7277449

324

Liquid ratio: Current asset- inventory+ prepaid

expenses/ Current liabilities

0.2940306

681

0.4073057

432

Profitability ratio

Net profit ratio: Net profit / Sales *100

1.0892487

291 0.272008

Gross profit ratios Gross profit/ Sales *100 2.3837318 1.4628629

7

Working Note -

Land (000) Building (000) Total (000)

01/01/17 Valuation 40000 80000 120000

The property (building) should be depreciated using a straight line with a life of 16 years

and zero scrap value.

Depreciation = valuation – scrap value = 80000 – 0/16 = 5000 per annum

Working note -

Recalculation of cost of sales for year ended 31.12.2017

Cost of sales as per trial balance – 29700

01/01/17 Opening investment

+ purchase 309700 309700

31/12/17 C/investor 18000 17300

Cost of sales 291700 292400

6. Two years financial statements of Marks & Spencer

Financial ratios of Marks and Spencer

Particular ratios Formula 2017 2018

Liquidity ratio’s:

Current ratio: Current asset/ current liabilities

0.7217415

115

0.7277449

324

Liquid ratio: Current asset- inventory+ prepaid

expenses/ Current liabilities

0.2940306

681

0.4073057

432

Profitability ratio

Net profit ratio: Net profit / Sales *100

1.0892487

291 0.272008

Gross profit ratios Gross profit/ Sales *100 2.3837318 1.4628629

7

772 115

ROE Total income/ shareholder equity

0.0224313

278

0.0310481

28

Efficiency ratio's

Total assets turnover

ratios Net sales/ average total assets

1.0983443

709

1.4169161

082

Fixed assets turnover Net sales/ Averages total fixed assets

1.6169396

578

1.7165412

448

From the financial statements of two years of Marks and Spencer it has discovered that

this company classifies their information in various categories. This company prepares financial

information by consolidates income of their organisation and of their subsidiary organisations.

Income statement and comprehensive income statement are individually equipped in order to

determine their realisable value. Along with equilibrium and cash flow statement, this company

also prepares their changes in equity (Glancy, and Yadav, 2011).

From the observed ratios, it has been analysed that company is having high liquidity in

the year of 2017. But on the other hand, in 2016 company was having high profitability which

shows that in 2017 company apply all their resources in functional state. By determine efficiency

ratios it has analysed that company was more efficient in 2017.

7. Difference Between International Accounting Standards (IAS) and International financial

reporting Standards (IFRS)

IAS: These are the older accounting standards that are currently replaced by IFRS. IAS

was the first set of accounting standards that are introduced by international accounting standards

committee in year 1973. It helps to intensify transparency, accountability, accuracy and

effectiveness in the financial statements. It facilitates investors to make investment decision and

to figure out its risk and profits (Norwani, Zam and Chek, 2011).

IFRS: It was present by IFRS relation and global accounting standards board in year

2001 to trait contradictions in IAS. It gives a average world wide language to various business

that are moving globally to analyse accounts of the company. It has renew a few standards of

international accounting standards.

8

ROE Total income/ shareholder equity

0.0224313

278

0.0310481

28

Efficiency ratio's

Total assets turnover

ratios Net sales/ average total assets

1.0983443

709

1.4169161

082

Fixed assets turnover Net sales/ Averages total fixed assets

1.6169396

578

1.7165412

448

From the financial statements of two years of Marks and Spencer it has discovered that

this company classifies their information in various categories. This company prepares financial

information by consolidates income of their organisation and of their subsidiary organisations.

Income statement and comprehensive income statement are individually equipped in order to

determine their realisable value. Along with equilibrium and cash flow statement, this company

also prepares their changes in equity (Glancy, and Yadav, 2011).

From the observed ratios, it has been analysed that company is having high liquidity in

the year of 2017. But on the other hand, in 2016 company was having high profitability which

shows that in 2017 company apply all their resources in functional state. By determine efficiency

ratios it has analysed that company was more efficient in 2017.

7. Difference Between International Accounting Standards (IAS) and International financial

reporting Standards (IFRS)

IAS: These are the older accounting standards that are currently replaced by IFRS. IAS

was the first set of accounting standards that are introduced by international accounting standards

committee in year 1973. It helps to intensify transparency, accountability, accuracy and

effectiveness in the financial statements. It facilitates investors to make investment decision and

to figure out its risk and profits (Norwani, Zam and Chek, 2011).

IFRS: It was present by IFRS relation and global accounting standards board in year

2001 to trait contradictions in IAS. It gives a average world wide language to various business

that are moving globally to analyse accounts of the company. It has renew a few standards of

international accounting standards.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

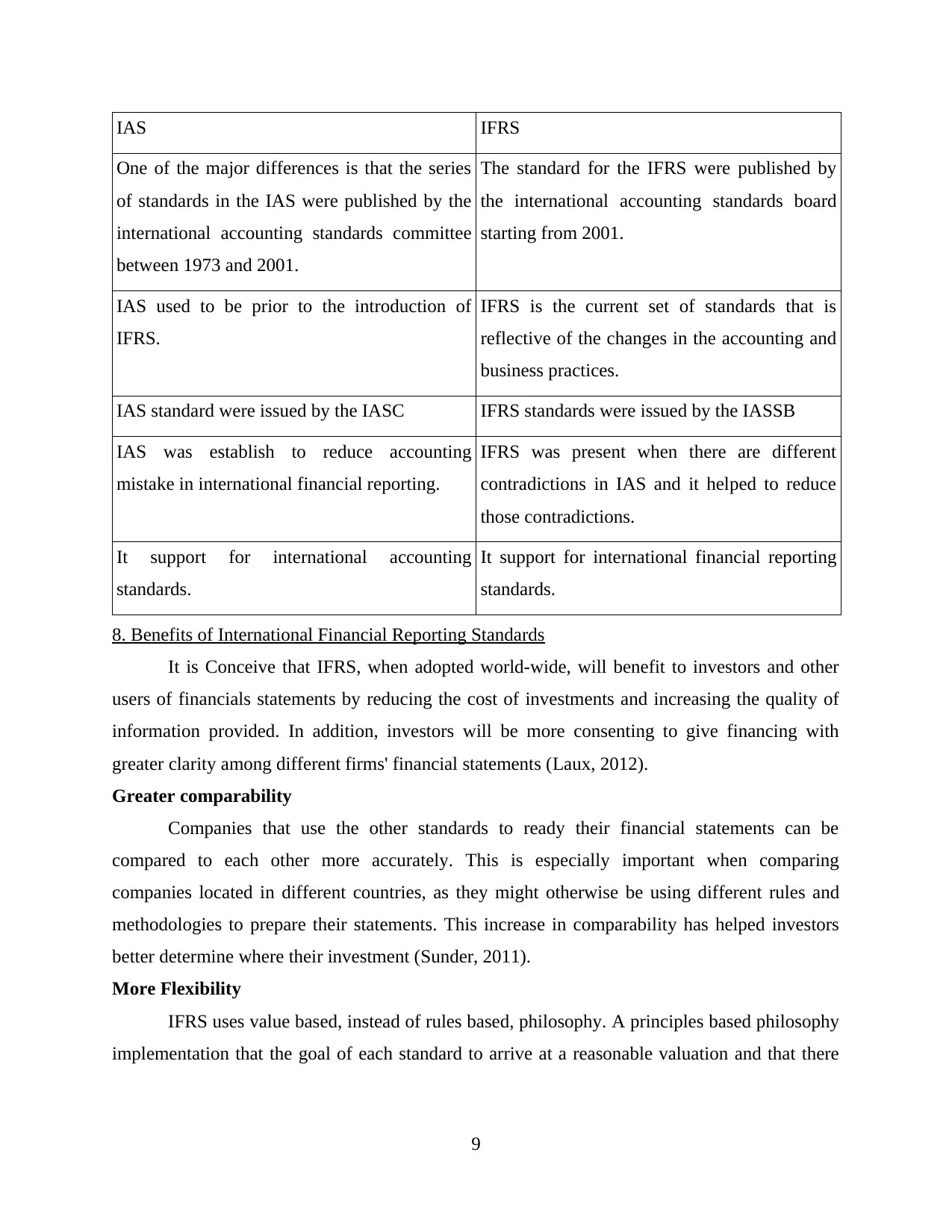

IAS IFRS

One of the major differences is that the series

of standards in the IAS were published by the

international accounting standards committee

between 1973 and 2001.

The standard for the IFRS were published by

the international accounting standards board

starting from 2001.

IAS used to be prior to the introduction of

IFRS.

IFRS is the current set of standards that is

reflective of the changes in the accounting and

business practices.

IAS standard were issued by the IASC IFRS standards were issued by the IASSB

IAS was establish to reduce accounting

mistake in international financial reporting.

IFRS was present when there are different

contradictions in IAS and it helped to reduce

those contradictions.

It support for international accounting

standards.

It support for international financial reporting

standards.

8. Benefits of International Financial Reporting Standards

It is Conceive that IFRS, when adopted world-wide, will benefit to investors and other

users of financials statements by reducing the cost of investments and increasing the quality of

information provided. In addition, investors will be more consenting to give financing with

greater clarity among different firms' financial statements (Laux, 2012).

Greater comparability

Companies that use the other standards to ready their financial statements can be

compared to each other more accurately. This is especially important when comparing

companies located in different countries, as they might otherwise be using different rules and

methodologies to prepare their statements. This increase in comparability has helped investors

better determine where their investment (Sunder, 2011).

More Flexibility

IFRS uses value based, instead of rules based, philosophy. A principles based philosophy

implementation that the goal of each standard to arrive at a reasonable valuation and that there

9

One of the major differences is that the series

of standards in the IAS were published by the

international accounting standards committee

between 1973 and 2001.

The standard for the IFRS were published by

the international accounting standards board

starting from 2001.

IAS used to be prior to the introduction of

IFRS.

IFRS is the current set of standards that is

reflective of the changes in the accounting and

business practices.

IAS standard were issued by the IASC IFRS standards were issued by the IASSB

IAS was establish to reduce accounting

mistake in international financial reporting.

IFRS was present when there are different

contradictions in IAS and it helped to reduce

those contradictions.

It support for international accounting

standards.

It support for international financial reporting

standards.

8. Benefits of International Financial Reporting Standards

It is Conceive that IFRS, when adopted world-wide, will benefit to investors and other

users of financials statements by reducing the cost of investments and increasing the quality of

information provided. In addition, investors will be more consenting to give financing with

greater clarity among different firms' financial statements (Laux, 2012).

Greater comparability

Companies that use the other standards to ready their financial statements can be

compared to each other more accurately. This is especially important when comparing

companies located in different countries, as they might otherwise be using different rules and

methodologies to prepare their statements. This increase in comparability has helped investors

better determine where their investment (Sunder, 2011).

More Flexibility

IFRS uses value based, instead of rules based, philosophy. A principles based philosophy

implementation that the goal of each standard to arrive at a reasonable valuation and that there

9

are many ways to get there. This gives companies the freedom to adapt IFRS to their specific

situation, which leads to more useful and easily read statements.

It is beneficial to new and small investors

The IFRS can help small and new investors by preparing reporting standards to become

simpler and have better quality, putting professional investors with these investors in a similar

position, which was not executable under preceding standards. When the investors trading so that

time this change helping to them, as the occupational group will not be capable to take benefit

because the quality of financial statements will just be understood and simple by all.

9 Various degrees of compliance with IFRS and factors which impact compliance within

organization

IFRS (International Financial Reporting Standards) are needed to be followed by every

organization. Compliance with IFRS give advantage to both investors and companies, for

instance, enhancement in quality of information provided to investors will ultimately lead to

higher transparency in financial reporting system (.Martínez‐Ferrero, Garcia‐Sanchez and

Cuadrado‐Ballesteros, 2015). Resultantly, investors will be more interested in funding. Degree of

compliance acts as assurance for accuracy to investors who are dependent on information

provided by organizations. Factors that influence compliance with IFRS are as follows:

Size of firm: Larger firms are assumed to have high degree of compliance as compared

with smaller firms because they pursue good reputation. Also this helps in avoiding government

intervention.

Agency theory: High agency costs are involved in larger firms due to complex

organizational structure. So, disclosure is important to insiders as well as outsiders. Agency

theory is also related to level of leverage, highly levered firms need to disclose more quality

information.

Profitability: More profitable firms wants to provide high quality of information to its

investors for showing its strengths. Also for justification about packages of employees,

disclosure is needed to be given in clear manner as compared to less profitable companies.

Age of company: Older firms have more well trained professionals who knows how to

present accounting information in full disclosure manner. Financial statements are also prepared

in effective manner to fulfil IFRS requirements. But younger firms are sometimes hesitant in

10

situation, which leads to more useful and easily read statements.

It is beneficial to new and small investors

The IFRS can help small and new investors by preparing reporting standards to become

simpler and have better quality, putting professional investors with these investors in a similar

position, which was not executable under preceding standards. When the investors trading so that

time this change helping to them, as the occupational group will not be capable to take benefit

because the quality of financial statements will just be understood and simple by all.

9 Various degrees of compliance with IFRS and factors which impact compliance within

organization

IFRS (International Financial Reporting Standards) are needed to be followed by every

organization. Compliance with IFRS give advantage to both investors and companies, for

instance, enhancement in quality of information provided to investors will ultimately lead to

higher transparency in financial reporting system (.Martínez‐Ferrero, Garcia‐Sanchez and

Cuadrado‐Ballesteros, 2015). Resultantly, investors will be more interested in funding. Degree of

compliance acts as assurance for accuracy to investors who are dependent on information

provided by organizations. Factors that influence compliance with IFRS are as follows:

Size of firm: Larger firms are assumed to have high degree of compliance as compared

with smaller firms because they pursue good reputation. Also this helps in avoiding government

intervention.

Agency theory: High agency costs are involved in larger firms due to complex

organizational structure. So, disclosure is important to insiders as well as outsiders. Agency

theory is also related to level of leverage, highly levered firms need to disclose more quality

information.

Profitability: More profitable firms wants to provide high quality of information to its

investors for showing its strengths. Also for justification about packages of employees,

disclosure is needed to be given in clear manner as compared to less profitable companies.

Age of company: Older firms have more well trained professionals who knows how to

present accounting information in full disclosure manner. Financial statements are also prepared

in effective manner to fulfil IFRS requirements. But younger firms are sometimes hesitant in

10

disclosing full information because it can be harmful for it when sensitive information is known

to competitors (IFRS (International Financial Reporting Standards).

IFRS were established initially by developed countries to support developing countries

because of lack of resources with them. They can not develop their own accounting resources.

CONCLUSION

Financial reporting important for Creditors and investors because through this know

financial position of the company. It's purpose to provide appropriate information to it's

stakeholders for showing financial situation of marks and Spencer. This company adopted IFRS

standards for formulating the financial reporting for reflecting the actual picture of the firm.

There are convinced problems that can be obviate by the firm for making their business dealing

effectual. Under this, project, financial statements are formulated and analysing the firm

financial positions by using ratios. By applying firm IFRS board, firm is able to determine

several error and trying to overcome this. These statements are presented to the external

stakeholders such as creditors, investors, government, shareholders, and customers. It can assist

the management to examine that organisation is increase profits or lining losses. IFRS stands for

international financial reporting standards that are used by those business entities who are

running their business worldwide. This guides the structure to explicate all the statements

accurately suitably in order to keep clarity in final reports. It also attracts international investors

who are willing to invest in good profit making companies.

11

to competitors (IFRS (International Financial Reporting Standards).

IFRS were established initially by developed countries to support developing countries

because of lack of resources with them. They can not develop their own accounting resources.

CONCLUSION

Financial reporting important for Creditors and investors because through this know

financial position of the company. It's purpose to provide appropriate information to it's

stakeholders for showing financial situation of marks and Spencer. This company adopted IFRS

standards for formulating the financial reporting for reflecting the actual picture of the firm.

There are convinced problems that can be obviate by the firm for making their business dealing

effectual. Under this, project, financial statements are formulated and analysing the firm

financial positions by using ratios. By applying firm IFRS board, firm is able to determine

several error and trying to overcome this. These statements are presented to the external

stakeholders such as creditors, investors, government, shareholders, and customers. It can assist

the management to examine that organisation is increase profits or lining losses. IFRS stands for

international financial reporting standards that are used by those business entities who are

running their business worldwide. This guides the structure to explicate all the statements

accurately suitably in order to keep clarity in final reports. It also attracts international investors

who are willing to invest in good profit making companies.

11

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.