HI5002 Finance for Business: Qantas Airways Financial Analysis

VerifiedAdded on 2023/06/12

|20

|4178

|212

Report

AI Summary

This report provides a comprehensive financial analysis of Qantas Airways Ltd., utilizing ratio analysis, the Capital Asset Pricing Model (CAPM), and an examination of the company's dividend policy. It assesses the airline's liquidity, solvency, profitability, and market position. The report calculates the weighted average cost of capital to evaluate the effectiveness of the company's capital structure and uses the beta factor to determine the impact of market volatility on the price of Qantas securities. A correlation analysis is performed comparing Qantas's share price movement with the All Ordinaries index. The analysis culminates in a recommendation letter, advising investors to carefully monitor Qantas's future performance in light of its growth initiatives before making investment decisions. Desklib offers a range of resources for students, including past papers and solved assignments.

1

HI5002

Finance for Business

HI5002

Finance for Business

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Executive Summary

The report has carried out analysis of the financial performance of Qantas Airways Ltd.

The financial performance is carried out with the use of ratio analysis, CAPM model and

calculation of cost of debt and cost of equity. The report has also discussed the dividend policy

of the airline as well to demonstrate its ability to provide return to shareholders. Lastly, the letter

of recommendations has suggested the investors to wait and analyze the future performance of

the airline. The airline has made strong announcements in relation to its future growth and

therefore investors need to wait and analyze the impact of potential growth opportunities son its

financial outcomes.

Executive Summary

The report has carried out analysis of the financial performance of Qantas Airways Ltd.

The financial performance is carried out with the use of ratio analysis, CAPM model and

calculation of cost of debt and cost of equity. The report has also discussed the dividend policy

of the airline as well to demonstrate its ability to provide return to shareholders. Lastly, the letter

of recommendations has suggested the investors to wait and analyze the future performance of

the airline. The airline has made strong announcements in relation to its future growth and

therefore investors need to wait and analyze the impact of potential growth opportunities son its

financial outcomes.

3

Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

1. Description of the Company........................................................................................................4

2. Ownership-Governance Structure of Qantas Airlines.................................................................5

3: Calculation of fundamental ratio of Qantas Airlines...................................................................6

4: Share Price Movement OF Qantas Airways and All Ordinaries in last two years (1 Jan, 2016

to 31 Dec, 2017)..............................................................................................................................9

5. Research carries out in context of Financial or Business Publications.....................................13

6: Use of Capital assets pricing model to find out the required rate of return of Qantas Airways14

7: Application of Weighted Average cost of capital.....................................................................15

8: Discussion on the capital structure of the company..................................................................16

9: Dividend Policy of Qantas Airways..........................................................................................17

10: Recommendation Letter..........................................................................................................17

References......................................................................................................................................19

Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

1. Description of the Company........................................................................................................4

2. Ownership-Governance Structure of Qantas Airlines.................................................................5

3: Calculation of fundamental ratio of Qantas Airlines...................................................................6

4: Share Price Movement OF Qantas Airways and All Ordinaries in last two years (1 Jan, 2016

to 31 Dec, 2017)..............................................................................................................................9

5. Research carries out in context of Financial or Business Publications.....................................13

6: Use of Capital assets pricing model to find out the required rate of return of Qantas Airways14

7: Application of Weighted Average cost of capital.....................................................................15

8: Discussion on the capital structure of the company..................................................................16

9: Dividend Policy of Qantas Airways..........................................................................................17

10: Recommendation Letter..........................................................................................................17

References......................................................................................................................................19

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

Introduction

The report is developed for the purpose of facilitating the decision-making process of

investors seeking to invest in a company listed on ASX. The company selected in this regards is

Qantas Airways Ltd. The financial analysis is carried out for proving an insight into the present

and future growth prospects of the company. This will help in developing a solid base to the

investors for guiding their decision-making process related to investment. The financial

performance is carried out with the help of performance ratios that assesses the liquidity,

solvency, and profitability and market conditions of the company. Also, the report has calculated

the weighted verge cost of capital for analyzing the capital structure effectiveness of the

company. The debt ratios will provide an analysis relating to the use of debt by the company for

financing its business operations. The impact of market volatility on the price of its securities is

determined by the use of beta factor with the use of CAPM model. Also, the dividend policy of

the company is described to gain an analysis of its capability to create value for the shareholders.

At last, the letter of recommendations is developed for client to facilitate the investment related

decisions in support of the overall analysis carried out.

1. Description of the Company

Qantas Airways, a flag carrier and largest airline of Australia established in the year 1920

and operates both domestic and international airline. It is involved in carrying out both the

operations including domestic and international air transportation services. The airline after its

establishment has grown into one of the major long distance airline and recognized brands within

Australia. The airline has developed its reputation by gaining excellence in safety, operational

reliability, engineering, and maintenance and customer service. The main business operations of

the airline includes providing world class transportation services with its two brands, that are,

Qantas and Jetstar. It also carries out subsidiary businesses that include operations in specialist

markets such as Q Catering. The airline provides employment to about 30,000 people and the

majority of them constitute the local workforce. The company aims to achieve the position of

best airline in the world by carrying out its operations in a sustainable manner. The business

strategy of the company is to accomplish its aims and objectives by placing emphasis on safety,

Introduction

The report is developed for the purpose of facilitating the decision-making process of

investors seeking to invest in a company listed on ASX. The company selected in this regards is

Qantas Airways Ltd. The financial analysis is carried out for proving an insight into the present

and future growth prospects of the company. This will help in developing a solid base to the

investors for guiding their decision-making process related to investment. The financial

performance is carried out with the help of performance ratios that assesses the liquidity,

solvency, and profitability and market conditions of the company. Also, the report has calculated

the weighted verge cost of capital for analyzing the capital structure effectiveness of the

company. The debt ratios will provide an analysis relating to the use of debt by the company for

financing its business operations. The impact of market volatility on the price of its securities is

determined by the use of beta factor with the use of CAPM model. Also, the dividend policy of

the company is described to gain an analysis of its capability to create value for the shareholders.

At last, the letter of recommendations is developed for client to facilitate the investment related

decisions in support of the overall analysis carried out.

1. Description of the Company

Qantas Airways, a flag carrier and largest airline of Australia established in the year 1920

and operates both domestic and international airline. It is involved in carrying out both the

operations including domestic and international air transportation services. The airline after its

establishment has grown into one of the major long distance airline and recognized brands within

Australia. The airline has developed its reputation by gaining excellence in safety, operational

reliability, engineering, and maintenance and customer service. The main business operations of

the airline includes providing world class transportation services with its two brands, that are,

Qantas and Jetstar. It also carries out subsidiary businesses that include operations in specialist

markets such as Q Catering. The airline provides employment to about 30,000 people and the

majority of them constitute the local workforce. The company aims to achieve the position of

best airline in the world by carrying out its operations in a sustainable manner. The business

strategy of the company is to accomplish its aims and objectives by placing emphasis on safety,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

sustainable operations, strong reputation and environmental responsibility (Qantas Airways Ltd,

2018).

2. Ownership-Governance Structure of Qantas Airlines

i. Major Shareholders

The major shareholders of the airline having more than 5% and 20% of the shareholdings

are HSBC Custody Nominees Ltd (40.21%), JP Morgan Nominees Australia Limited (17.93%)

and Citicorp Nominees Pty Ltd (9.19%). The airline is classified as a non-family company as its

shareholders does not have any role in its ownership and governance structure.

ii. Major People Involved in Firm Governance

The Chairman

Leigh Clifford is the chairman of the company appointed in the year 2007 and is

responsible for over-viewing the roles and responsibilities of the Board.

The Board Members

sustainable operations, strong reputation and environmental responsibility (Qantas Airways Ltd,

2018).

2. Ownership-Governance Structure of Qantas Airlines

i. Major Shareholders

The major shareholders of the airline having more than 5% and 20% of the shareholdings

are HSBC Custody Nominees Ltd (40.21%), JP Morgan Nominees Australia Limited (17.93%)

and Citicorp Nominees Pty Ltd (9.19%). The airline is classified as a non-family company as its

shareholders does not have any role in its ownership and governance structure.

ii. Major People Involved in Firm Governance

The Chairman

Leigh Clifford is the chairman of the company appointed in the year 2007 and is

responsible for over-viewing the roles and responsibilities of the Board.

The Board Members

6

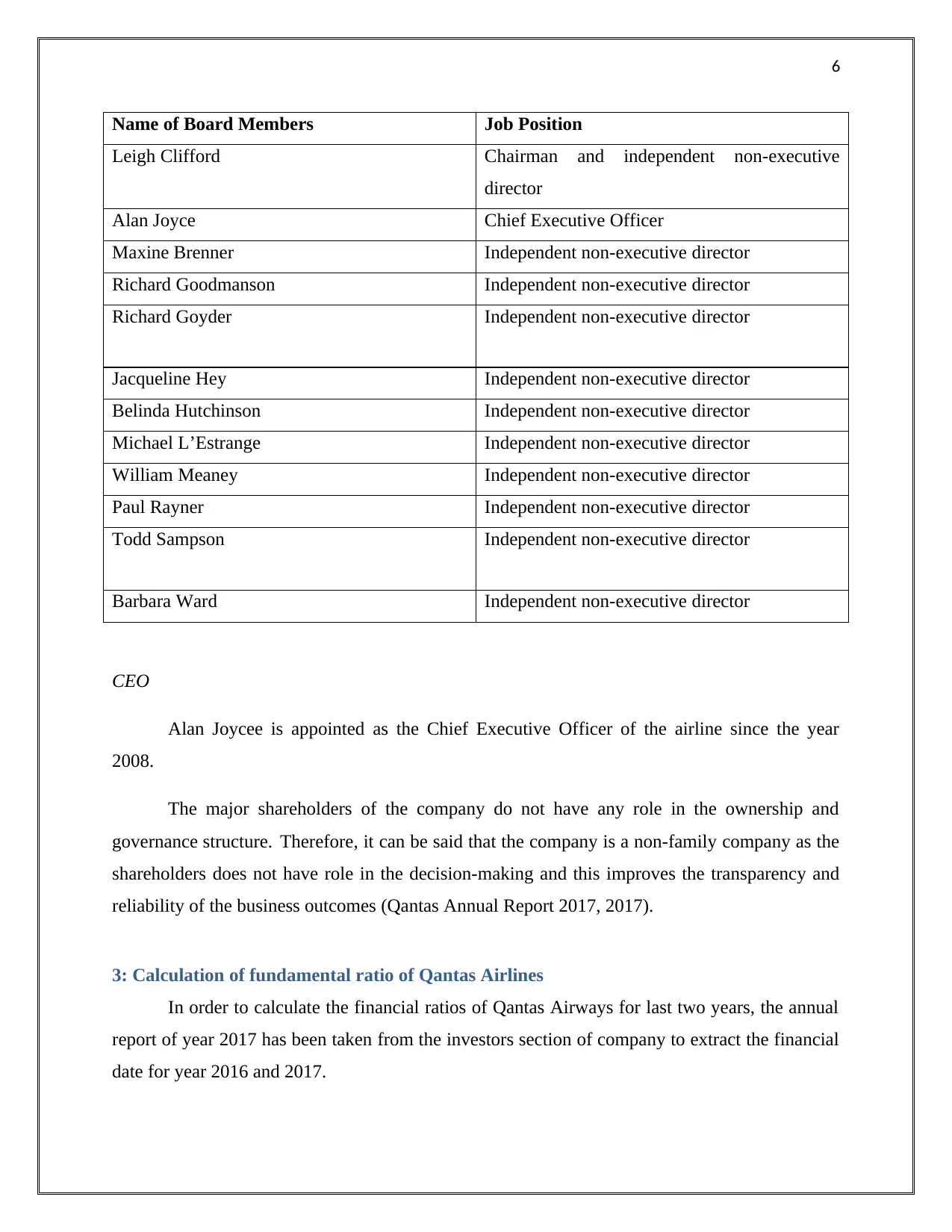

Name of Board Members Job Position

Leigh Clifford Chairman and independent non-executive

director

Alan Joyce Chief Executive Officer

Maxine Brenner Independent non-executive director

Richard Goodmanson Independent non-executive director

Richard Goyder Independent non-executive director

Jacqueline Hey Independent non-executive director

Belinda Hutchinson Independent non-executive director

Michael L’Estrange Independent non-executive director

William Meaney Independent non-executive director

Paul Rayner Independent non-executive director

Todd Sampson Independent non-executive director

Barbara Ward Independent non-executive director

CEO

Alan Joycee is appointed as the Chief Executive Officer of the airline since the year

2008.

The major shareholders of the company do not have any role in the ownership and

governance structure. Therefore, it can be said that the company is a non-family company as the

shareholders does not have role in the decision-making and this improves the transparency and

reliability of the business outcomes (Qantas Annual Report 2017, 2017).

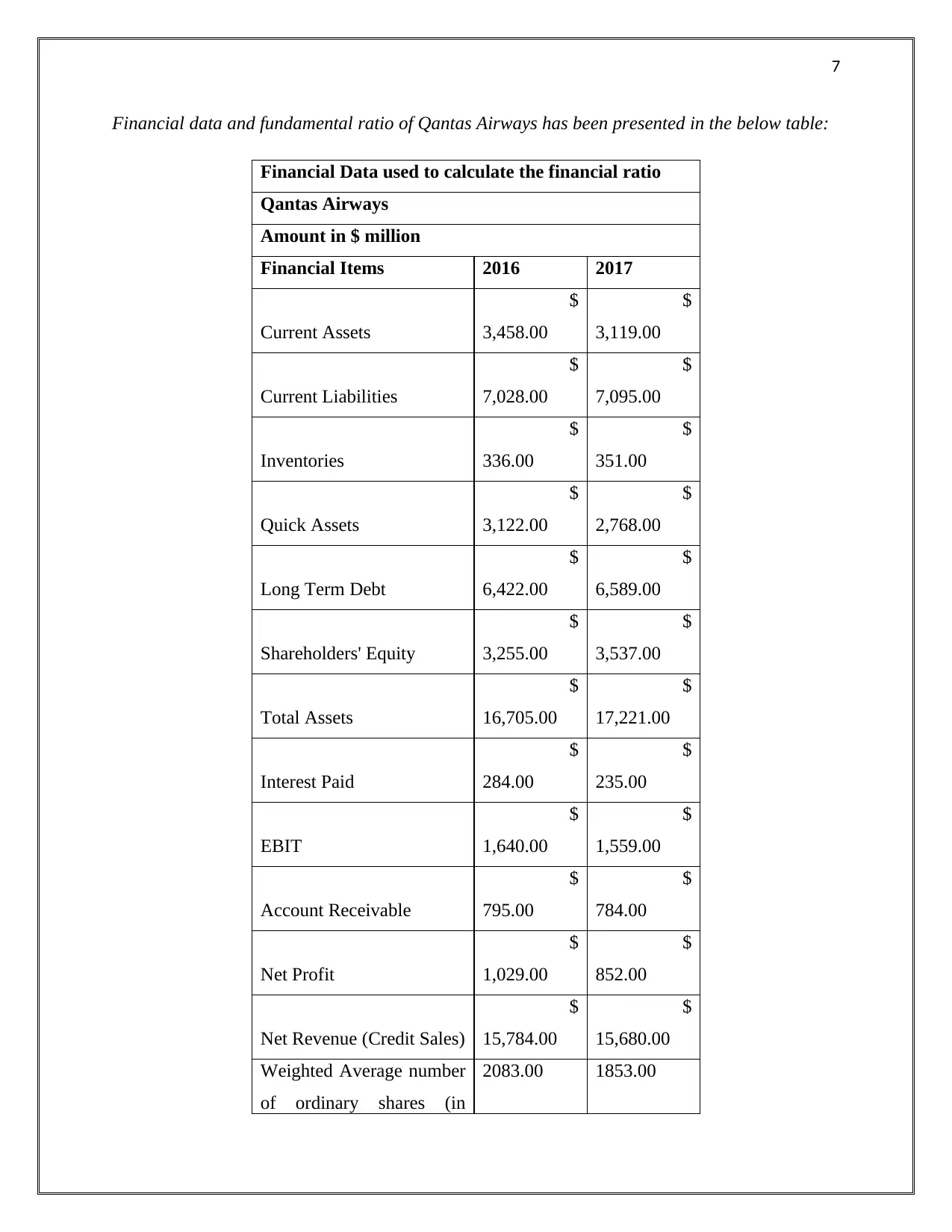

3: Calculation of fundamental ratio of Qantas Airlines

In order to calculate the financial ratios of Qantas Airways for last two years, the annual

report of year 2017 has been taken from the investors section of company to extract the financial

date for year 2016 and 2017.

Name of Board Members Job Position

Leigh Clifford Chairman and independent non-executive

director

Alan Joyce Chief Executive Officer

Maxine Brenner Independent non-executive director

Richard Goodmanson Independent non-executive director

Richard Goyder Independent non-executive director

Jacqueline Hey Independent non-executive director

Belinda Hutchinson Independent non-executive director

Michael L’Estrange Independent non-executive director

William Meaney Independent non-executive director

Paul Rayner Independent non-executive director

Todd Sampson Independent non-executive director

Barbara Ward Independent non-executive director

CEO

Alan Joycee is appointed as the Chief Executive Officer of the airline since the year

2008.

The major shareholders of the company do not have any role in the ownership and

governance structure. Therefore, it can be said that the company is a non-family company as the

shareholders does not have role in the decision-making and this improves the transparency and

reliability of the business outcomes (Qantas Annual Report 2017, 2017).

3: Calculation of fundamental ratio of Qantas Airlines

In order to calculate the financial ratios of Qantas Airways for last two years, the annual

report of year 2017 has been taken from the investors section of company to extract the financial

date for year 2016 and 2017.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

Financial data and fundamental ratio of Qantas Airways has been presented in the below table:

Financial Data used to calculate the financial ratio

Qantas Airways

Amount in $ million

Financial Items 2016 2017

Current Assets

$

3,458.00

$

3,119.00

Current Liabilities

$

7,028.00

$

7,095.00

Inventories

$

336.00

$

351.00

Quick Assets

$

3,122.00

$

2,768.00

Long Term Debt

$

6,422.00

$

6,589.00

Shareholders' Equity

$

3,255.00

$

3,537.00

Total Assets

$

16,705.00

$

17,221.00

Interest Paid

$

284.00

$

235.00

EBIT

$

1,640.00

$

1,559.00

Account Receivable

$

795.00

$

784.00

Net Profit

$

1,029.00

$

852.00

Net Revenue (Credit Sales)

$

15,784.00

$

15,680.00

Weighted Average number

of ordinary shares (in

2083.00 1853.00

Financial data and fundamental ratio of Qantas Airways has been presented in the below table:

Financial Data used to calculate the financial ratio

Qantas Airways

Amount in $ million

Financial Items 2016 2017

Current Assets

$

3,458.00

$

3,119.00

Current Liabilities

$

7,028.00

$

7,095.00

Inventories

$

336.00

$

351.00

Quick Assets

$

3,122.00

$

2,768.00

Long Term Debt

$

6,422.00

$

6,589.00

Shareholders' Equity

$

3,255.00

$

3,537.00

Total Assets

$

16,705.00

$

17,221.00

Interest Paid

$

284.00

$

235.00

EBIT

$

1,640.00

$

1,559.00

Account Receivable

$

795.00

$

784.00

Net Profit

$

1,029.00

$

852.00

Net Revenue (Credit Sales)

$

15,784.00

$

15,680.00

Weighted Average number

of ordinary shares (in

2083.00 1853.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

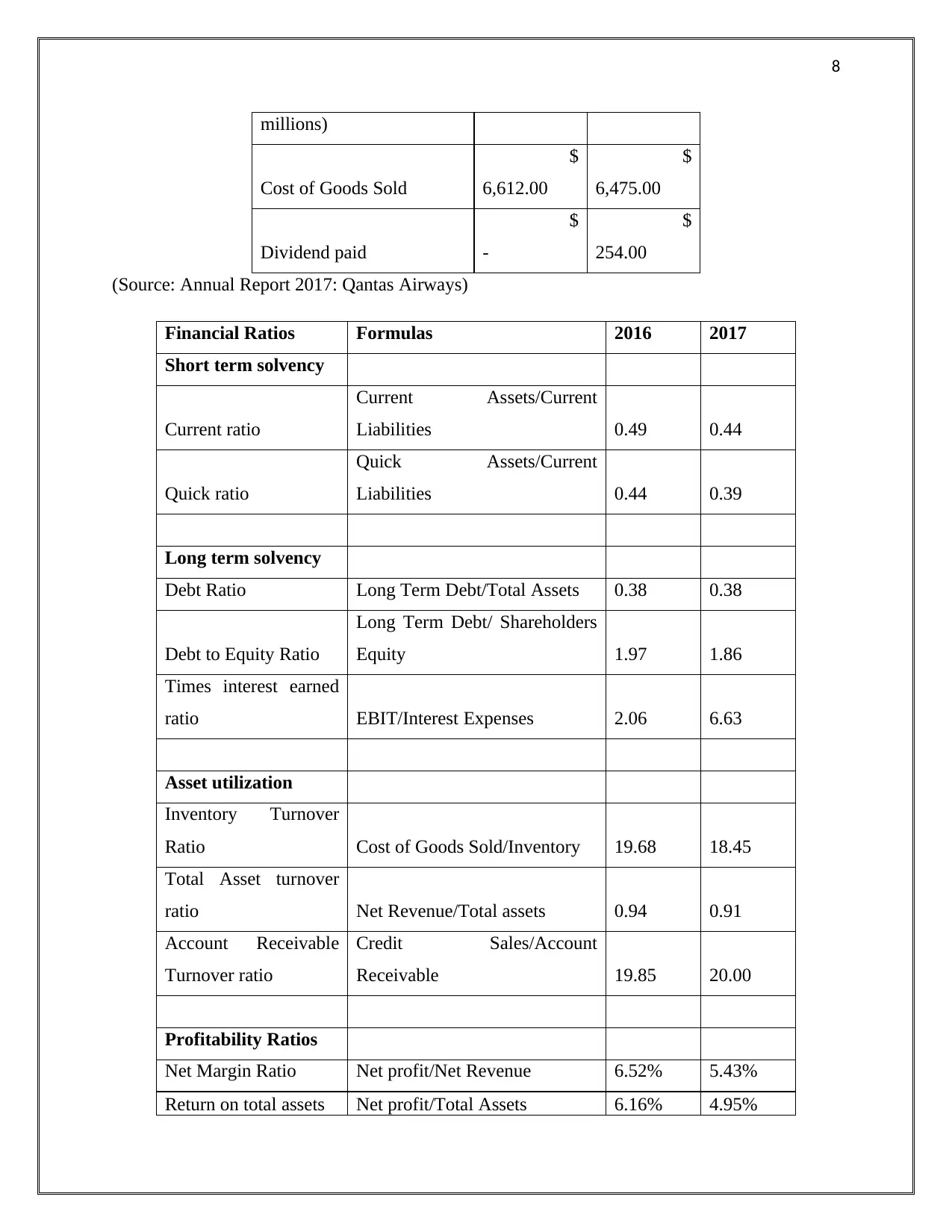

millions)

Cost of Goods Sold

$

6,612.00

$

6,475.00

Dividend paid

$

-

$

254.00

(Source: Annual Report 2017: Qantas Airways)

Financial Ratios Formulas 2016 2017

Short term solvency

Current ratio

Current Assets/Current

Liabilities 0.49 0.44

Quick ratio

Quick Assets/Current

Liabilities 0.44 0.39

Long term solvency

Debt Ratio Long Term Debt/Total Assets 0.38 0.38

Debt to Equity Ratio

Long Term Debt/ Shareholders

Equity 1.97 1.86

Times interest earned

ratio EBIT/Interest Expenses 2.06 6.63

Asset utilization

Inventory Turnover

Ratio Cost of Goods Sold/Inventory 19.68 18.45

Total Asset turnover

ratio Net Revenue/Total assets 0.94 0.91

Account Receivable

Turnover ratio

Credit Sales/Account

Receivable 19.85 20.00

Profitability Ratios

Net Margin Ratio Net profit/Net Revenue 6.52% 5.43%

Return on total assets Net profit/Total Assets 6.16% 4.95%

millions)

Cost of Goods Sold

$

6,612.00

$

6,475.00

Dividend paid

$

-

$

254.00

(Source: Annual Report 2017: Qantas Airways)

Financial Ratios Formulas 2016 2017

Short term solvency

Current ratio

Current Assets/Current

Liabilities 0.49 0.44

Quick ratio

Quick Assets/Current

Liabilities 0.44 0.39

Long term solvency

Debt Ratio Long Term Debt/Total Assets 0.38 0.38

Debt to Equity Ratio

Long Term Debt/ Shareholders

Equity 1.97 1.86

Times interest earned

ratio EBIT/Interest Expenses 2.06 6.63

Asset utilization

Inventory Turnover

Ratio Cost of Goods Sold/Inventory 19.68 18.45

Total Asset turnover

ratio Net Revenue/Total assets 0.94 0.91

Account Receivable

Turnover ratio

Credit Sales/Account

Receivable 19.85 20.00

Profitability Ratios

Net Margin Ratio Net profit/Net Revenue 6.52% 5.43%

Return on total assets Net profit/Total Assets 6.16% 4.95%

9

Return on ordinary

shareholders’ equity Net profit/Shareholder's Equity 31.61% 24.09%

Market Value Ratios

Earnings Per Share

Net profit/weighted average

number of shares

$

0.49

$

0.46

Dividend Per Share

Dividend/weighted average

number of shares (Lumby and

Jones, 2007)

$

-

$

0.14

(Sources: Annual Report 2017: Qantas Airways and Morning Star 2017: Qantas Airways)

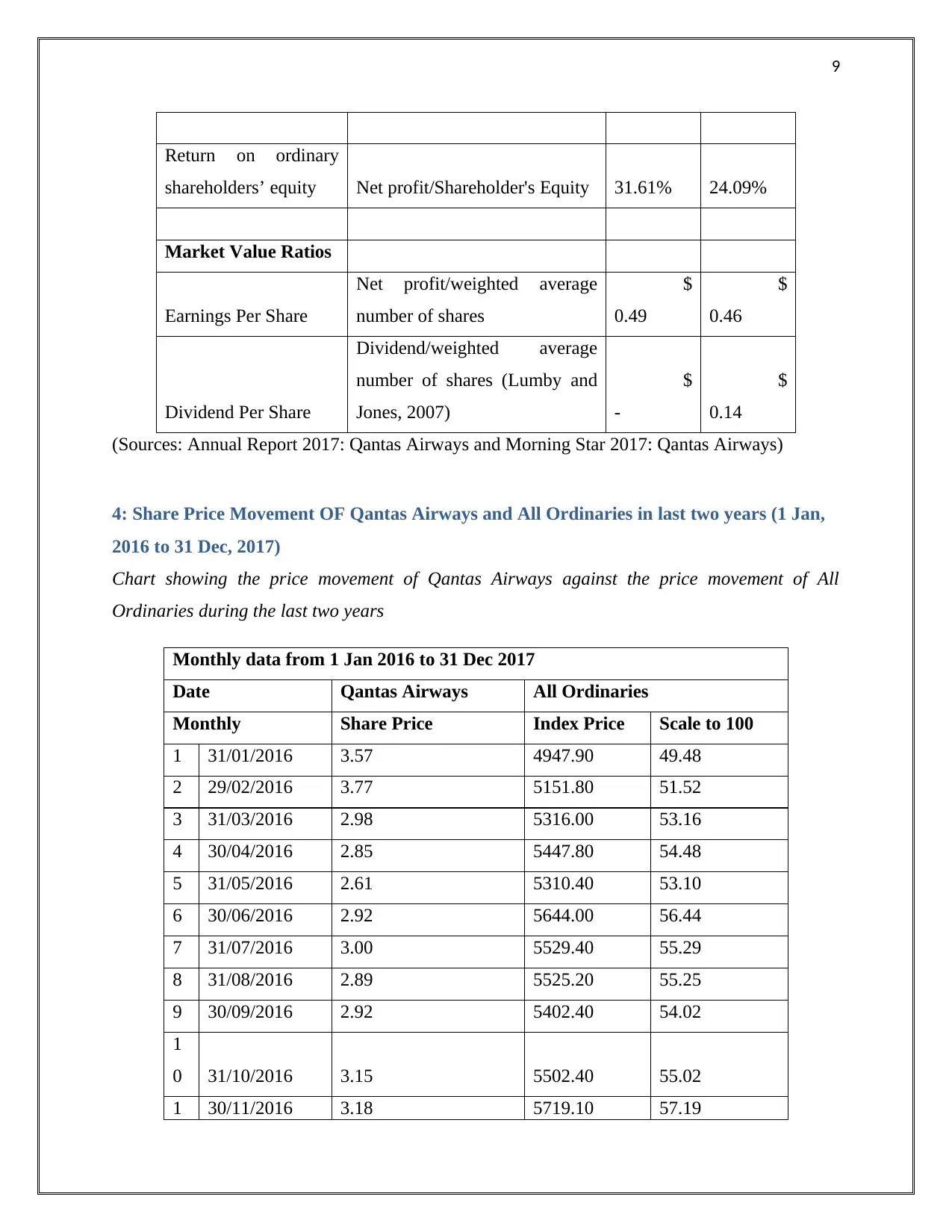

4: Share Price Movement OF Qantas Airways and All Ordinaries in last two years (1 Jan,

2016 to 31 Dec, 2017)

Chart showing the price movement of Qantas Airways against the price movement of All

Ordinaries during the last two years

Monthly data from 1 Jan 2016 to 31 Dec 2017

Date Qantas Airways All Ordinaries

Monthly Share Price Index Price Scale to 100

1 31/01/2016 3.57 4947.90 49.48

2 29/02/2016 3.77 5151.80 51.52

3 31/03/2016 2.98 5316.00 53.16

4 30/04/2016 2.85 5447.80 54.48

5 31/05/2016 2.61 5310.40 53.10

6 30/06/2016 2.92 5644.00 56.44

7 31/07/2016 3.00 5529.40 55.29

8 31/08/2016 2.89 5525.20 55.25

9 30/09/2016 2.92 5402.40 54.02

1

0 31/10/2016 3.15 5502.40 55.02

1 30/11/2016 3.18 5719.10 57.19

Return on ordinary

shareholders’ equity Net profit/Shareholder's Equity 31.61% 24.09%

Market Value Ratios

Earnings Per Share

Net profit/weighted average

number of shares

$

0.49

$

0.46

Dividend Per Share

Dividend/weighted average

number of shares (Lumby and

Jones, 2007)

$

-

$

0.14

(Sources: Annual Report 2017: Qantas Airways and Morning Star 2017: Qantas Airways)

4: Share Price Movement OF Qantas Airways and All Ordinaries in last two years (1 Jan,

2016 to 31 Dec, 2017)

Chart showing the price movement of Qantas Airways against the price movement of All

Ordinaries during the last two years

Monthly data from 1 Jan 2016 to 31 Dec 2017

Date Qantas Airways All Ordinaries

Monthly Share Price Index Price Scale to 100

1 31/01/2016 3.57 4947.90 49.48

2 29/02/2016 3.77 5151.80 51.52

3 31/03/2016 2.98 5316.00 53.16

4 30/04/2016 2.85 5447.80 54.48

5 31/05/2016 2.61 5310.40 53.10

6 30/06/2016 2.92 5644.00 56.44

7 31/07/2016 3.00 5529.40 55.29

8 31/08/2016 2.89 5525.20 55.25

9 30/09/2016 2.92 5402.40 54.02

1

0 31/10/2016 3.15 5502.40 55.02

1 30/11/2016 3.18 5719.10 57.19

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

1

1

2 31/12/2016 3.25 5675.00 56.75

1

3 31/01/2017 3.58 5761.00 57.61

1

4 28/02/2017 3.71 5903.80 59.04

1

5 31/03/2017 4.14 5947.60 59.48

1

6 30/04/2017 4.89 5761.30 57.61

1

7 31/05/2017 5.58 5764.00 57.64

1

8 30/06/2017 5.19 5773.90 57.74

1

9 31/07/2017 5.58 5776.30 57.76

2

0 31/08/2017 5.69 5744.90 57.45

2

1 30/09/2017 6.08 5976.40 59.76

2

2 31/10/2017 5.60 6057.20 60.57

2

3 30/11/2017 4.98 6167.30 61.67

2

4 31/12/2017 5.21 6146.50 61.47

(Source: Yahoo Finance, 2018: Qantas Airways and Yahoo Finance, 2018: All Ordinaries)

1

1

2 31/12/2016 3.25 5675.00 56.75

1

3 31/01/2017 3.58 5761.00 57.61

1

4 28/02/2017 3.71 5903.80 59.04

1

5 31/03/2017 4.14 5947.60 59.48

1

6 30/04/2017 4.89 5761.30 57.61

1

7 31/05/2017 5.58 5764.00 57.64

1

8 30/06/2017 5.19 5773.90 57.74

1

9 31/07/2017 5.58 5776.30 57.76

2

0 31/08/2017 5.69 5744.90 57.45

2

1 30/09/2017 6.08 5976.40 59.76

2

2 31/10/2017 5.60 6057.20 60.57

2

3 30/11/2017 4.98 6167.30 61.67

2

4 31/12/2017 5.21 6146.50 61.47

(Source: Yahoo Finance, 2018: Qantas Airways and Yahoo Finance, 2018: All Ordinaries)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

01/01/2016

01/02/2016

01/03/2016

01/04/2016

01/05/2016

01/06/2016

01/07/2016

01/08/2016

01/09/2016

01/10/2016

01/11/2016

01/12/2016

01/01/2017

01/02/2017

01/03/2017

01/04/2017

01/05/2017

01/06/2017

01/07/2017

01/08/2017

01/09/2017

01/10/2017

01/11/2017

01/12/2017

0.00

5.00

10.00

15.00

20.00

25.00

30.00

35.00

40.00

45.00

50.00

55.00

60.00

65.00

Price Movement of Quantas Airways and All

Ordinaries

All Ordinaries

Quantas Airways

Date (Monthly)

Share Price

(Madura, 2014)

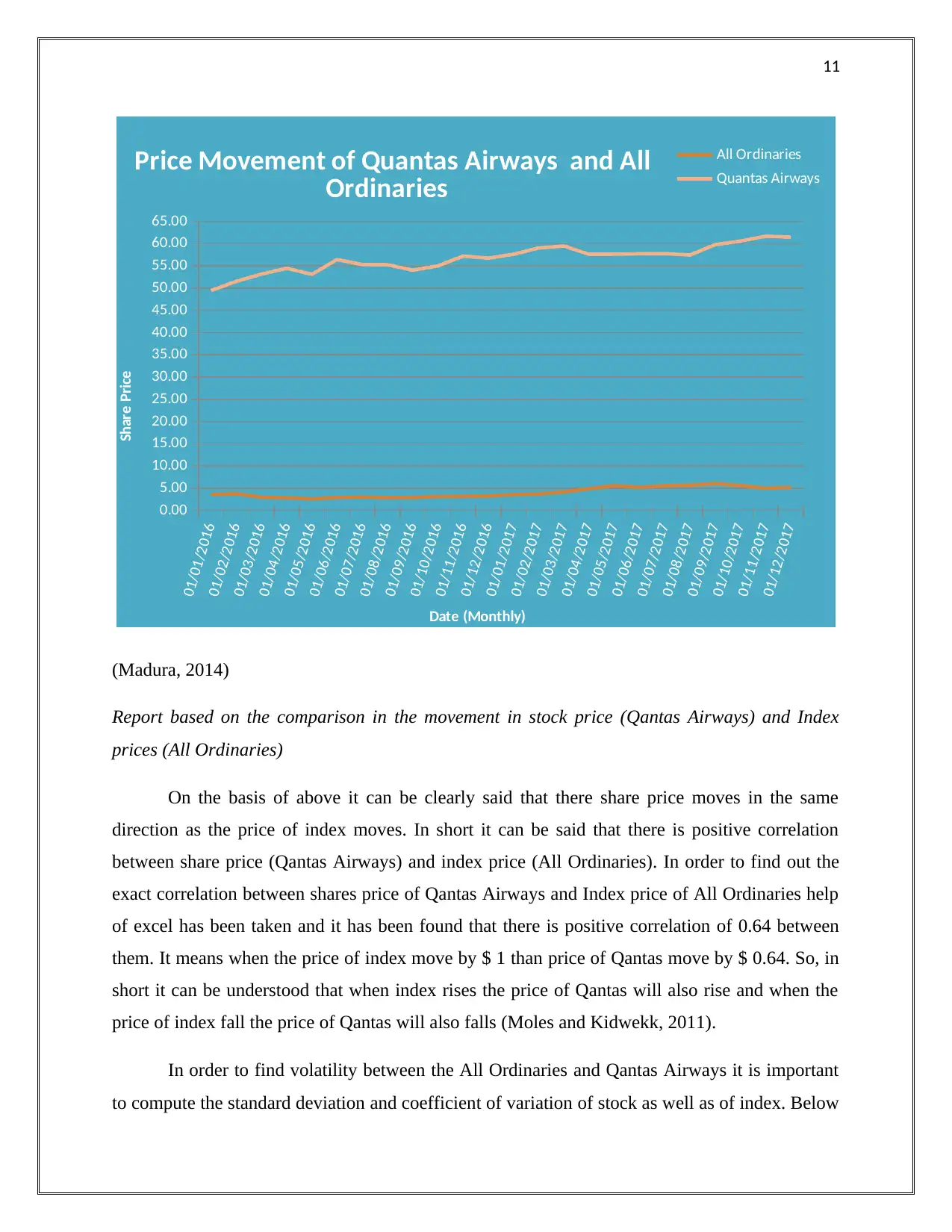

Report based on the comparison in the movement in stock price (Qantas Airways) and Index

prices (All Ordinaries)

On the basis of above it can be clearly said that there share price moves in the same

direction as the price of index moves. In short it can be said that there is positive correlation

between share price (Qantas Airways) and index price (All Ordinaries). In order to find out the

exact correlation between shares price of Qantas Airways and Index price of All Ordinaries help

of excel has been taken and it has been found that there is positive correlation of 0.64 between

them. It means when the price of index move by $ 1 than price of Qantas move by $ 0.64. So, in

short it can be understood that when index rises the price of Qantas will also rise and when the

price of index fall the price of Qantas will also falls (Moles and Kidwekk, 2011).

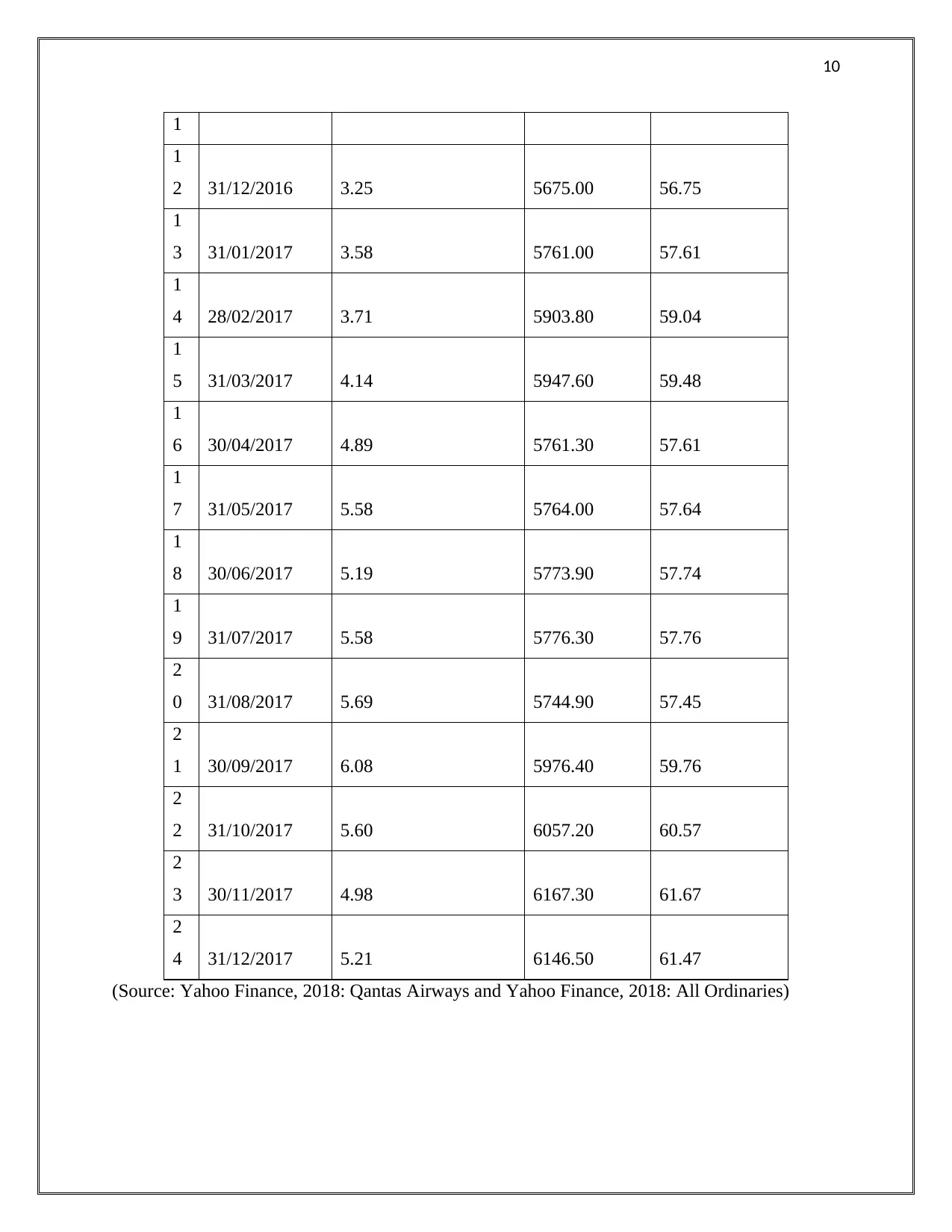

In order to find volatility between the All Ordinaries and Qantas Airways it is important

to compute the standard deviation and coefficient of variation of stock as well as of index. Below

01/01/2016

01/02/2016

01/03/2016

01/04/2016

01/05/2016

01/06/2016

01/07/2016

01/08/2016

01/09/2016

01/10/2016

01/11/2016

01/12/2016

01/01/2017

01/02/2017

01/03/2017

01/04/2017

01/05/2017

01/06/2017

01/07/2017

01/08/2017

01/09/2017

01/10/2017

01/11/2017

01/12/2017

0.00

5.00

10.00

15.00

20.00

25.00

30.00

35.00

40.00

45.00

50.00

55.00

60.00

65.00

Price Movement of Quantas Airways and All

Ordinaries

All Ordinaries

Quantas Airways

Date (Monthly)

Share Price

(Madura, 2014)

Report based on the comparison in the movement in stock price (Qantas Airways) and Index

prices (All Ordinaries)

On the basis of above it can be clearly said that there share price moves in the same

direction as the price of index moves. In short it can be said that there is positive correlation

between share price (Qantas Airways) and index price (All Ordinaries). In order to find out the

exact correlation between shares price of Qantas Airways and Index price of All Ordinaries help

of excel has been taken and it has been found that there is positive correlation of 0.64 between

them. It means when the price of index move by $ 1 than price of Qantas move by $ 0.64. So, in

short it can be understood that when index rises the price of Qantas will also rise and when the

price of index fall the price of Qantas will also falls (Moles and Kidwekk, 2011).

In order to find volatility between the All Ordinaries and Qantas Airways it is important

to compute the standard deviation and coefficient of variation of stock as well as of index. Below

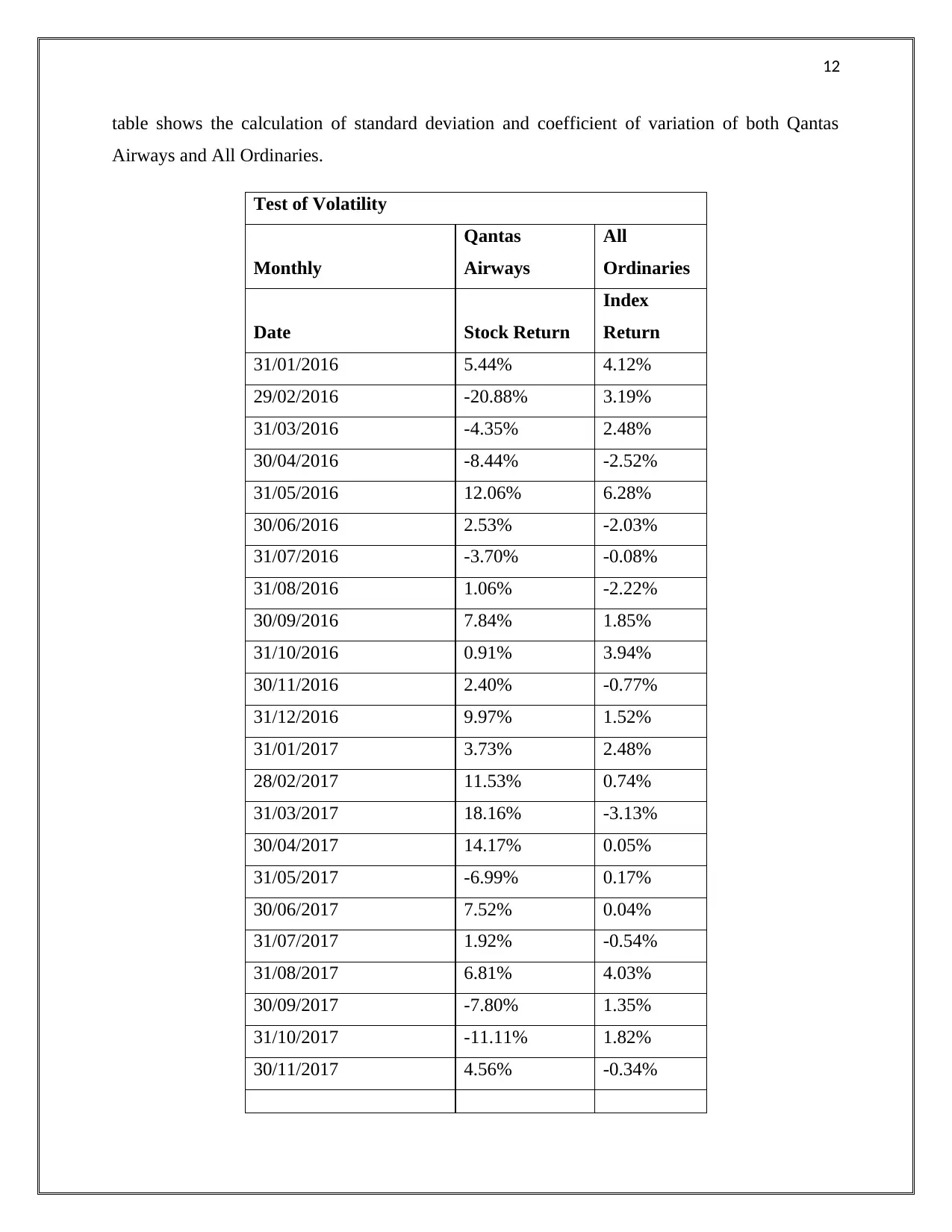

12

table shows the calculation of standard deviation and coefficient of variation of both Qantas

Airways and All Ordinaries.

Test of Volatility

Monthly

Qantas

Airways

All

Ordinaries

Date Stock Return

Index

Return

31/01/2016 5.44% 4.12%

29/02/2016 -20.88% 3.19%

31/03/2016 -4.35% 2.48%

30/04/2016 -8.44% -2.52%

31/05/2016 12.06% 6.28%

30/06/2016 2.53% -2.03%

31/07/2016 -3.70% -0.08%

31/08/2016 1.06% -2.22%

30/09/2016 7.84% 1.85%

31/10/2016 0.91% 3.94%

30/11/2016 2.40% -0.77%

31/12/2016 9.97% 1.52%

31/01/2017 3.73% 2.48%

28/02/2017 11.53% 0.74%

31/03/2017 18.16% -3.13%

30/04/2017 14.17% 0.05%

31/05/2017 -6.99% 0.17%

30/06/2017 7.52% 0.04%

31/07/2017 1.92% -0.54%

31/08/2017 6.81% 4.03%

30/09/2017 -7.80% 1.35%

31/10/2017 -11.11% 1.82%

30/11/2017 4.56% -0.34%

table shows the calculation of standard deviation and coefficient of variation of both Qantas

Airways and All Ordinaries.

Test of Volatility

Monthly

Qantas

Airways

All

Ordinaries

Date Stock Return

Index

Return

31/01/2016 5.44% 4.12%

29/02/2016 -20.88% 3.19%

31/03/2016 -4.35% 2.48%

30/04/2016 -8.44% -2.52%

31/05/2016 12.06% 6.28%

30/06/2016 2.53% -2.03%

31/07/2016 -3.70% -0.08%

31/08/2016 1.06% -2.22%

30/09/2016 7.84% 1.85%

31/10/2016 0.91% 3.94%

30/11/2016 2.40% -0.77%

31/12/2016 9.97% 1.52%

31/01/2017 3.73% 2.48%

28/02/2017 11.53% 0.74%

31/03/2017 18.16% -3.13%

30/04/2017 14.17% 0.05%

31/05/2017 -6.99% 0.17%

30/06/2017 7.52% 0.04%

31/07/2017 1.92% -0.54%

31/08/2017 6.81% 4.03%

30/09/2017 -7.80% 1.35%

31/10/2017 -11.11% 1.82%

30/11/2017 4.56% -0.34%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.