Bank Branch Waiting Time Analysis

VerifiedAdded on 2020/03/16

|15

|2195

|46

AI Summary

This assignment analyzes the waiting time at two different bank branches: Perth CBD and Suburban. It requires performing a hypothesis test to determine if there is a significant difference in their variances and mean waiting times. The analysis uses t-tests with PhStat software, presenting hypothesis testing steps, tables of results, and a conclusion summarizing the findings.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Quantitative skills for business

Name

University

9th October 2017

Name

University

9th October 2017

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Part A

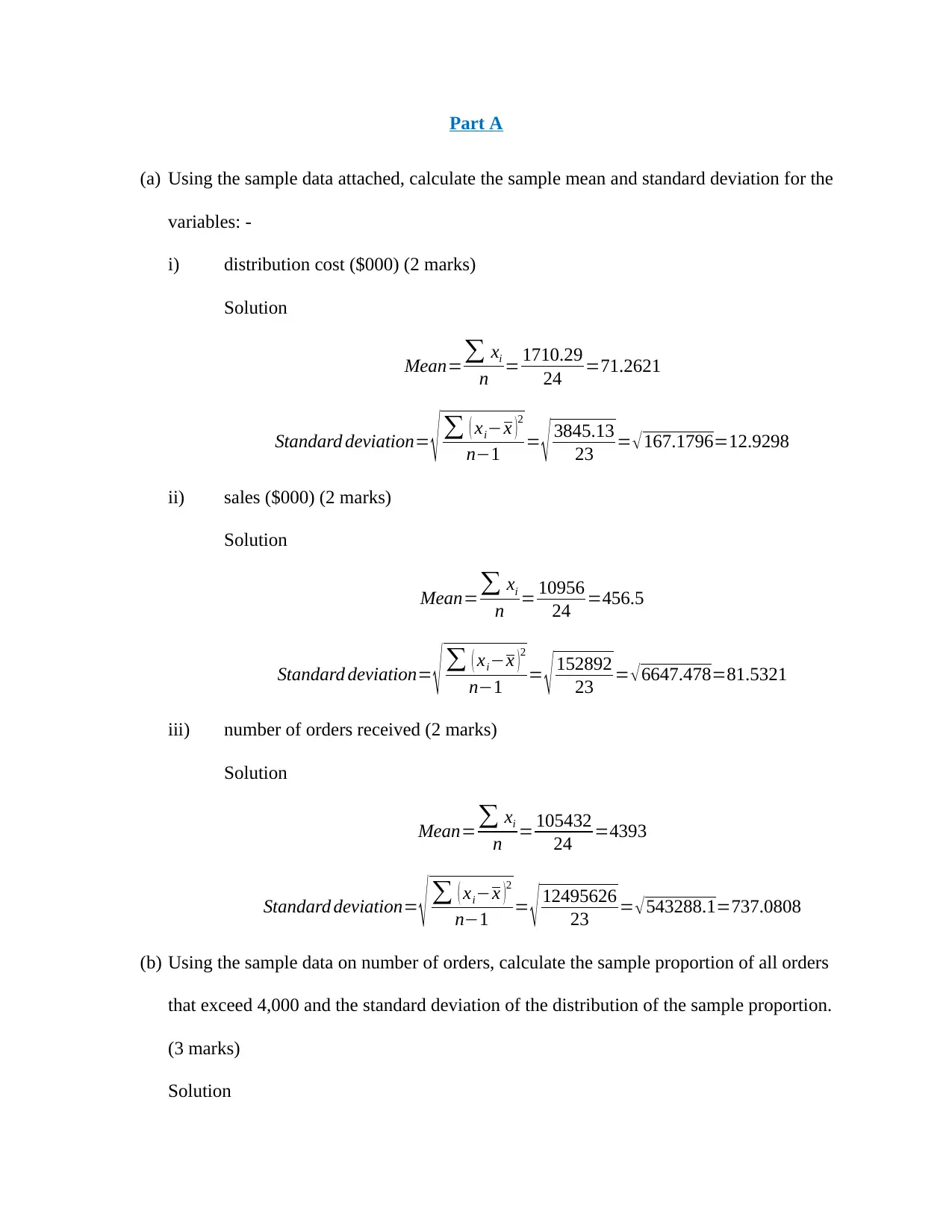

(a) Using the sample data attached, calculate the sample mean and standard deviation for the

variables: -

i) distribution cost ($000) (2 marks)

Solution

Mean=∑ xi

n = 1710.29

24 =71.2621

Standard deviation= √ ∑ ( xi−x )2

n−1 = √ 3845.13

23 = √167.1796=12.9298

ii) sales ($000) (2 marks)

Solution

Mean=∑ xi

n = 10956

24 =456.5

Standard deviation= √ ∑ ( xi−x )2

n−1 = √ 152892

23 = √6647.478=81.5321

iii) number of orders received (2 marks)

Solution

Mean=∑ xi

n = 105432

24 =4393

Standard deviation= √ ∑ ( xi−x )2

n−1 = √ 12495626

23 = √543288.1=737.0808

(b) Using the sample data on number of orders, calculate the sample proportion of all orders

that exceed 4,000 and the standard deviation of the distribution of the sample proportion.

(3 marks)

Solution

(a) Using the sample data attached, calculate the sample mean and standard deviation for the

variables: -

i) distribution cost ($000) (2 marks)

Solution

Mean=∑ xi

n = 1710.29

24 =71.2621

Standard deviation= √ ∑ ( xi−x )2

n−1 = √ 3845.13

23 = √167.1796=12.9298

ii) sales ($000) (2 marks)

Solution

Mean=∑ xi

n = 10956

24 =456.5

Standard deviation= √ ∑ ( xi−x )2

n−1 = √ 152892

23 = √6647.478=81.5321

iii) number of orders received (2 marks)

Solution

Mean=∑ xi

n = 105432

24 =4393

Standard deviation= √ ∑ ( xi−x )2

n−1 = √ 12495626

23 = √543288.1=737.0808

(b) Using the sample data on number of orders, calculate the sample proportion of all orders

that exceed 4,000 and the standard deviation of the distribution of the sample proportion.

(3 marks)

Solution

^p= 17

24 =0.7083

standard deviation= √ ^p ¿ ¿ ¿

(c) Set up and interpret the following confidence intervals –

i) A 95% confidence interval for the true population distribution cost in ($000) (5

marks)

Solution

C . I : x ± M . E

M . E= zα /2 σ

√n = 1.96∗12.9298

√24 =5.1730

Lower limit: 71,262.1−5,173.0=66,089.1

Upper limit: 71,262.1+5,173.0=76,435.1

C.I: [66,089.1, 76,435.1]

ii) A 99% confidence interval for the true population sales figures in ($000). (5

marks)

Solution

C . I : x ± M . E

M . E= zα /2 σ

√ n = 2.576∗81.5321

√ 24 =42.8715

Lower limit: 456,500−42,871.5=413,628.5

Upper limit: 456,500+ 42,871.5=499,371.5

C.I: [413,628.5, 499,371.5]

iii) A 90% confidence interval for the true population proportion of all orders that

exceed 4,000. (5 marks)

Solution

24 =0.7083

standard deviation= √ ^p ¿ ¿ ¿

(c) Set up and interpret the following confidence intervals –

i) A 95% confidence interval for the true population distribution cost in ($000) (5

marks)

Solution

C . I : x ± M . E

M . E= zα /2 σ

√n = 1.96∗12.9298

√24 =5.1730

Lower limit: 71,262.1−5,173.0=66,089.1

Upper limit: 71,262.1+5,173.0=76,435.1

C.I: [66,089.1, 76,435.1]

ii) A 99% confidence interval for the true population sales figures in ($000). (5

marks)

Solution

C . I : x ± M . E

M . E= zα /2 σ

√ n = 2.576∗81.5321

√ 24 =42.8715

Lower limit: 456,500−42,871.5=413,628.5

Upper limit: 456,500+ 42,871.5=499,371.5

C.I: [413,628.5, 499,371.5]

iii) A 90% confidence interval for the true population proportion of all orders that

exceed 4,000. (5 marks)

Solution

C . I : x ± M . E

M . E=zα / 2∗√ ^p ¿¿ ¿

Lower limit: 0.7083−0.1526=0.5557

Upper limit: 0.7083+0.1526=0.8609

(d) A follow-up study will provide a point estimate of the population proportion of orders

that exceed 4,000. The study must provide 90% confidence that the point estimate is

within 0.10 of the population proportion. If no previous proportion estimate is available

(not even that calculated in (d) above), how large a sample would you recommend for

this study?

Solution

n= z2 p (1− p)

e2 =1.6452∗0.5∗0.5

0.12 =67.65

n ≈ 68

(e) It is claimed that the average monthly warehouse distribution cost is more than $65,000.

Do the data provide significant support for this claim? Use a 5% significance level and

the critical value approach (classical approach) to test this claim.

Solution

Hypothesis tested:

H0 : μ=65,000

H A : μ>65,000

Tested at α = 0.05

z= x−μ

σ

√ n

= 71262.1−65000

12929.8

√ 24

=2.3727

M . E=zα / 2∗√ ^p ¿¿ ¿

Lower limit: 0.7083−0.1526=0.5557

Upper limit: 0.7083+0.1526=0.8609

(d) A follow-up study will provide a point estimate of the population proportion of orders

that exceed 4,000. The study must provide 90% confidence that the point estimate is

within 0.10 of the population proportion. If no previous proportion estimate is available

(not even that calculated in (d) above), how large a sample would you recommend for

this study?

Solution

n= z2 p (1− p)

e2 =1.6452∗0.5∗0.5

0.12 =67.65

n ≈ 68

(e) It is claimed that the average monthly warehouse distribution cost is more than $65,000.

Do the data provide significant support for this claim? Use a 5% significance level and

the critical value approach (classical approach) to test this claim.

Solution

Hypothesis tested:

H0 : μ=65,000

H A : μ>65,000

Tested at α = 0.05

z= x−μ

σ

√ n

= 71262.1−65000

12929.8

√ 24

=2.3727

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The critical z value at 5% significance level is 1.645

Comparing the z-computed and the z-critical values we observe that the z-computed

value is greater than the z-critical value thus we reject the null hypothesis and conclude

that indeed the average monthly warehouse distribution cost is more than $65,000.

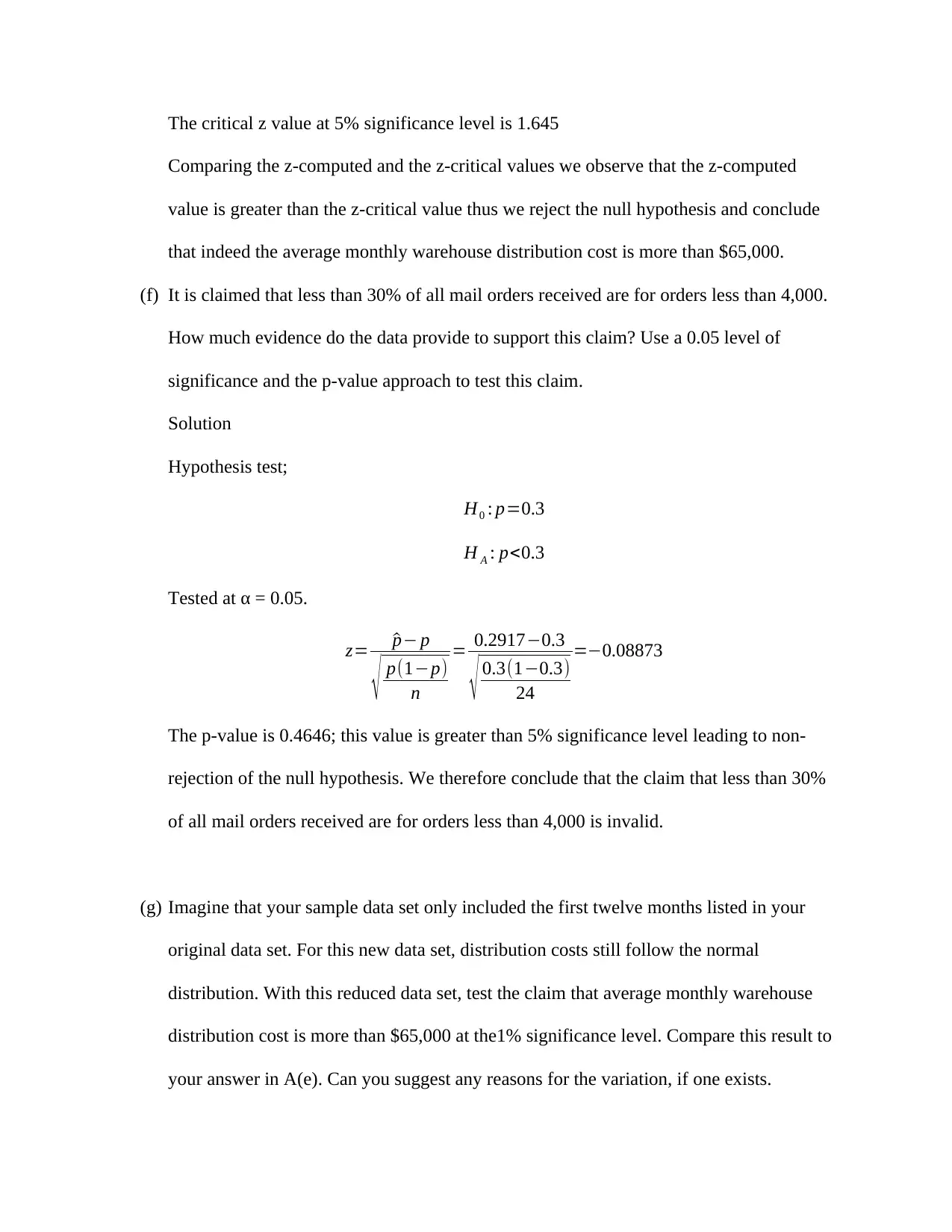

(f) It is claimed that less than 30% of all mail orders received are for orders less than 4,000.

How much evidence do the data provide to support this claim? Use a 0.05 level of

significance and the p-value approach to test this claim.

Solution

Hypothesis test;

H0 : p=0.3

H A : p<0.3

Tested at α = 0.05.

z= ^p− p

√ p(1−p)

n

= 0.2917−0.3

√ 0.3(1−0.3)

24

=−0.08873

The p-value is 0.4646; this value is greater than 5% significance level leading to non-

rejection of the null hypothesis. We therefore conclude that the claim that less than 30%

of all mail orders received are for orders less than 4,000 is invalid.

(g) Imagine that your sample data set only included the first twelve months listed in your

original data set. For this new data set, distribution costs still follow the normal

distribution. With this reduced data set, test the claim that average monthly warehouse

distribution cost is more than $65,000 at the1% significance level. Compare this result to

your answer in A(e). Can you suggest any reasons for the variation, if one exists.

Comparing the z-computed and the z-critical values we observe that the z-computed

value is greater than the z-critical value thus we reject the null hypothesis and conclude

that indeed the average monthly warehouse distribution cost is more than $65,000.

(f) It is claimed that less than 30% of all mail orders received are for orders less than 4,000.

How much evidence do the data provide to support this claim? Use a 0.05 level of

significance and the p-value approach to test this claim.

Solution

Hypothesis test;

H0 : p=0.3

H A : p<0.3

Tested at α = 0.05.

z= ^p− p

√ p(1−p)

n

= 0.2917−0.3

√ 0.3(1−0.3)

24

=−0.08873

The p-value is 0.4646; this value is greater than 5% significance level leading to non-

rejection of the null hypothesis. We therefore conclude that the claim that less than 30%

of all mail orders received are for orders less than 4,000 is invalid.

(g) Imagine that your sample data set only included the first twelve months listed in your

original data set. For this new data set, distribution costs still follow the normal

distribution. With this reduced data set, test the claim that average monthly warehouse

distribution cost is more than $65,000 at the1% significance level. Compare this result to

your answer in A(e). Can you suggest any reasons for the variation, if one exists.

Solution

Hypothesis tested:

H0 : μ=65,000

H A : μ>65,000

Tested at α = 0.05

z= x−μ

σ

√ n

= 68308.33−65000

10780.41

√ 24

=1.5034

The critical z value at 1% significance level is 2.33

Comparing the z-computed and the z-critical values we observe that the z-computed

value is less than the z-critical value thus we fail to reject the null hypothesis and

conclude that the average monthly warehouse distribution cost is not more than $65,000.

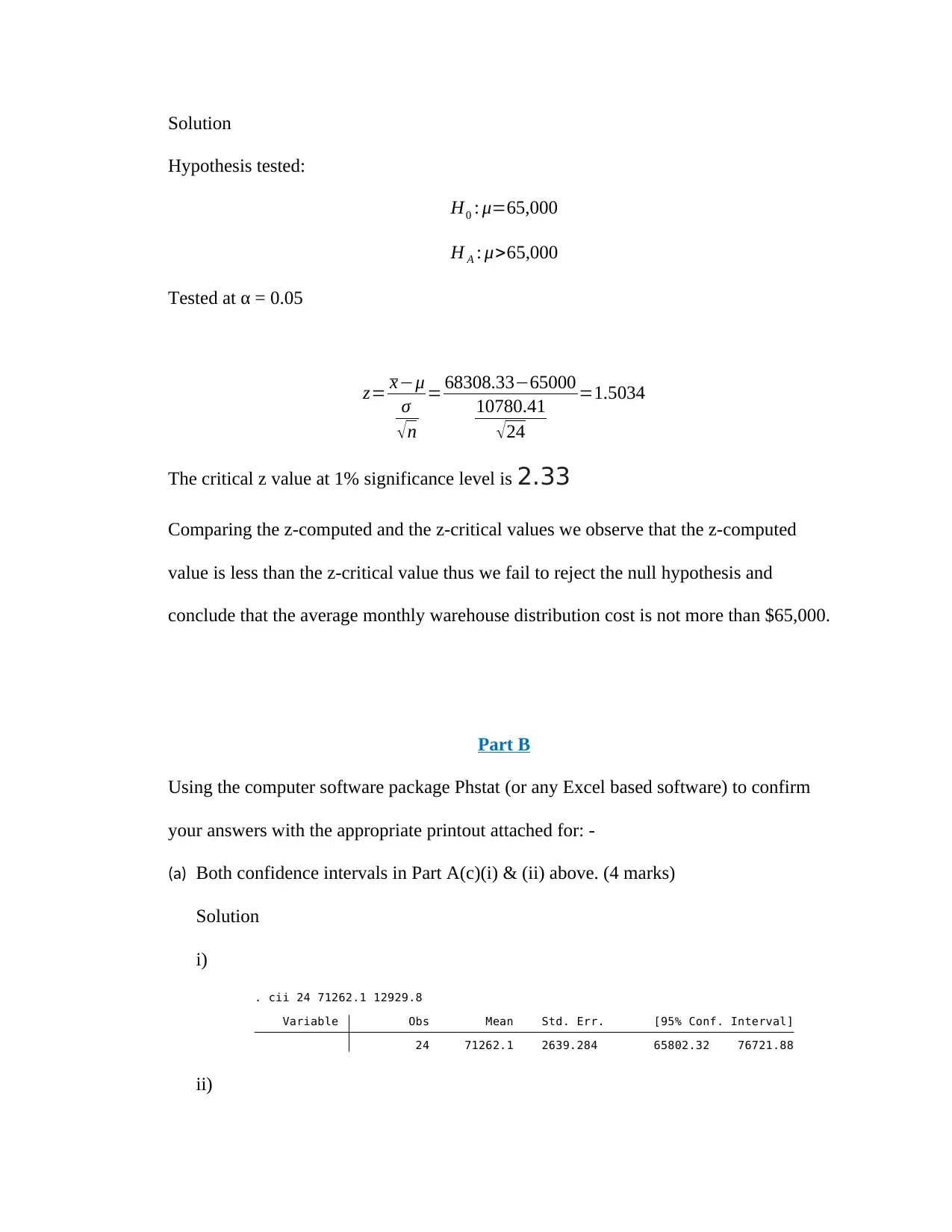

Part B

Using the computer software package Phstat (or any Excel based software) to confirm

your answers with the appropriate printout attached for: -

(a) Both confidence intervals in Part A(c)(i) & (ii) above. (4 marks)

Solution

i)

24 71262.1 2639.284 65802.32 76721.88

Variable Obs Mean Std. Err. [95% Conf. Interval]

. cii 24 71262.1 12929.8

ii)

Hypothesis tested:

H0 : μ=65,000

H A : μ>65,000

Tested at α = 0.05

z= x−μ

σ

√ n

= 68308.33−65000

10780.41

√ 24

=1.5034

The critical z value at 1% significance level is 2.33

Comparing the z-computed and the z-critical values we observe that the z-computed

value is less than the z-critical value thus we fail to reject the null hypothesis and

conclude that the average monthly warehouse distribution cost is not more than $65,000.

Part B

Using the computer software package Phstat (or any Excel based software) to confirm

your answers with the appropriate printout attached for: -

(a) Both confidence intervals in Part A(c)(i) & (ii) above. (4 marks)

Solution

i)

24 71262.1 2639.284 65802.32 76721.88

Variable Obs Mean Std. Err. [95% Conf. Interval]

. cii 24 71262.1 12929.8

ii)

sales 24 456500 16642.66 409778.5 503221.5

Variable Obs Mean Std. Err. [99% Conf. Interval]

. ci sales, level(99)

(b) The 90% confidence interval for the proportion in Part A(c)(iii) above. (4 marks)

Solution

24 .7083333 .0927805 .5212721 .8543135

Variable Obs Mean Std. Err. [90% Conf. Interval]

Binomial Exact

. cii 24 17, level(90)

(c) The sample size calculation in Part A(d) above (4 marks)

Solution

n = 68

Estimated required sample size:

alternative p = 0.4000

power = 0.5000

alpha = 0.1000 (two-sided)

Assumptions:

Test Ho: p = 0.5000, where p is the proportion in the population

to hypothesized value

Estimated sample size for one-sample comparison of proportion

. sampsi 0.5 0.4, alpha(0.1) power(.50) onesample

(d) The hypothesis test of the mean in Part A(e) (4 marks)

Solution

Hypothesis tested:

H0 : μ=65,000

H A : μ>65,000

Tested at α = 0.05

t-Test: Two-Sample Assuming Equal Variances

Cost

Sampl

e

Mean 71262.08 65000

Variable Obs Mean Std. Err. [99% Conf. Interval]

. ci sales, level(99)

(b) The 90% confidence interval for the proportion in Part A(c)(iii) above. (4 marks)

Solution

24 .7083333 .0927805 .5212721 .8543135

Variable Obs Mean Std. Err. [90% Conf. Interval]

Binomial Exact

. cii 24 17, level(90)

(c) The sample size calculation in Part A(d) above (4 marks)

Solution

n = 68

Estimated required sample size:

alternative p = 0.4000

power = 0.5000

alpha = 0.1000 (two-sided)

Assumptions:

Test Ho: p = 0.5000, where p is the proportion in the population

to hypothesized value

Estimated sample size for one-sample comparison of proportion

. sampsi 0.5 0.4, alpha(0.1) power(.50) onesample

(d) The hypothesis test of the mean in Part A(e) (4 marks)

Solution

Hypothesis tested:

H0 : μ=65,000

H A : μ>65,000

Tested at α = 0.05

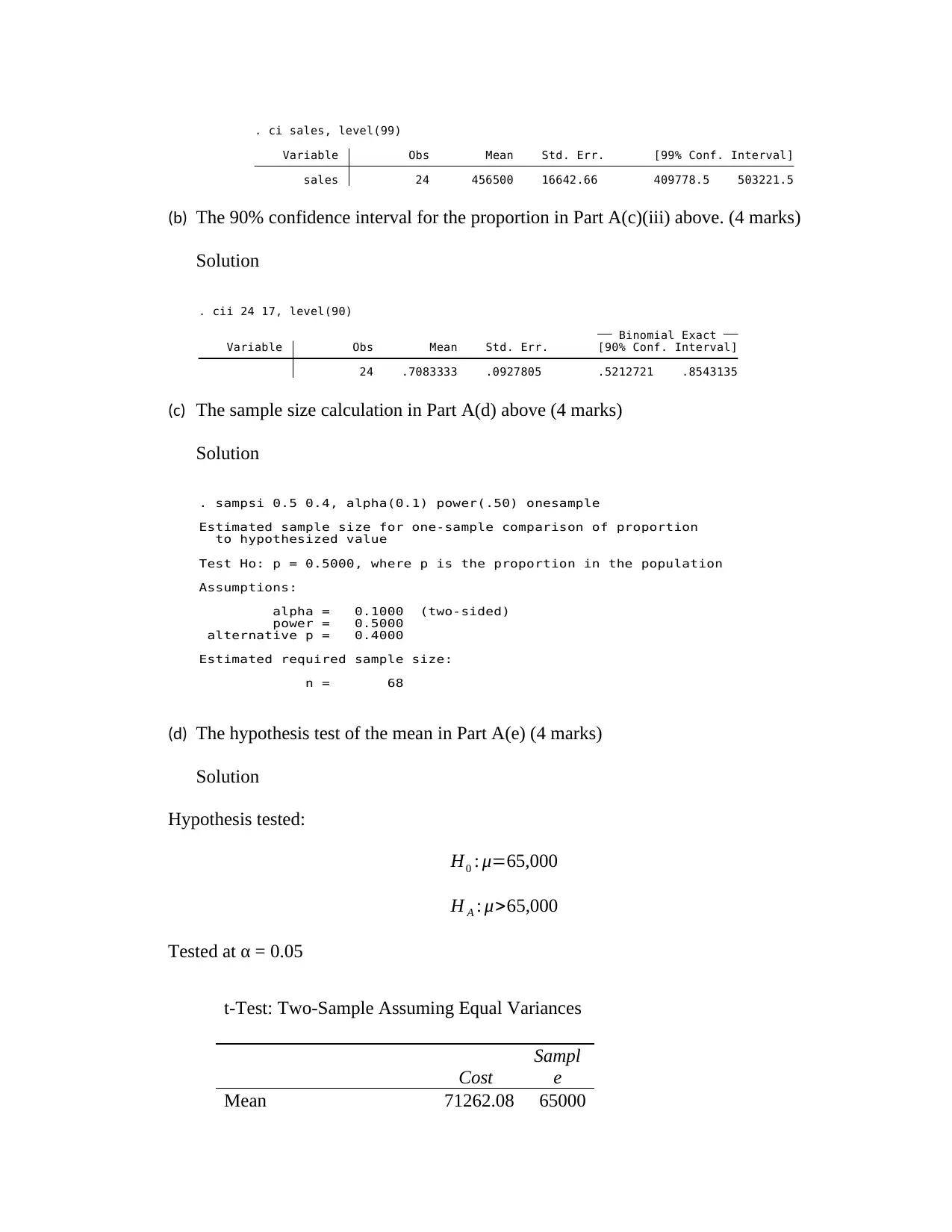

t-Test: Two-Sample Assuming Equal Variances

Cost

Sampl

e

Mean 71262.08 65000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

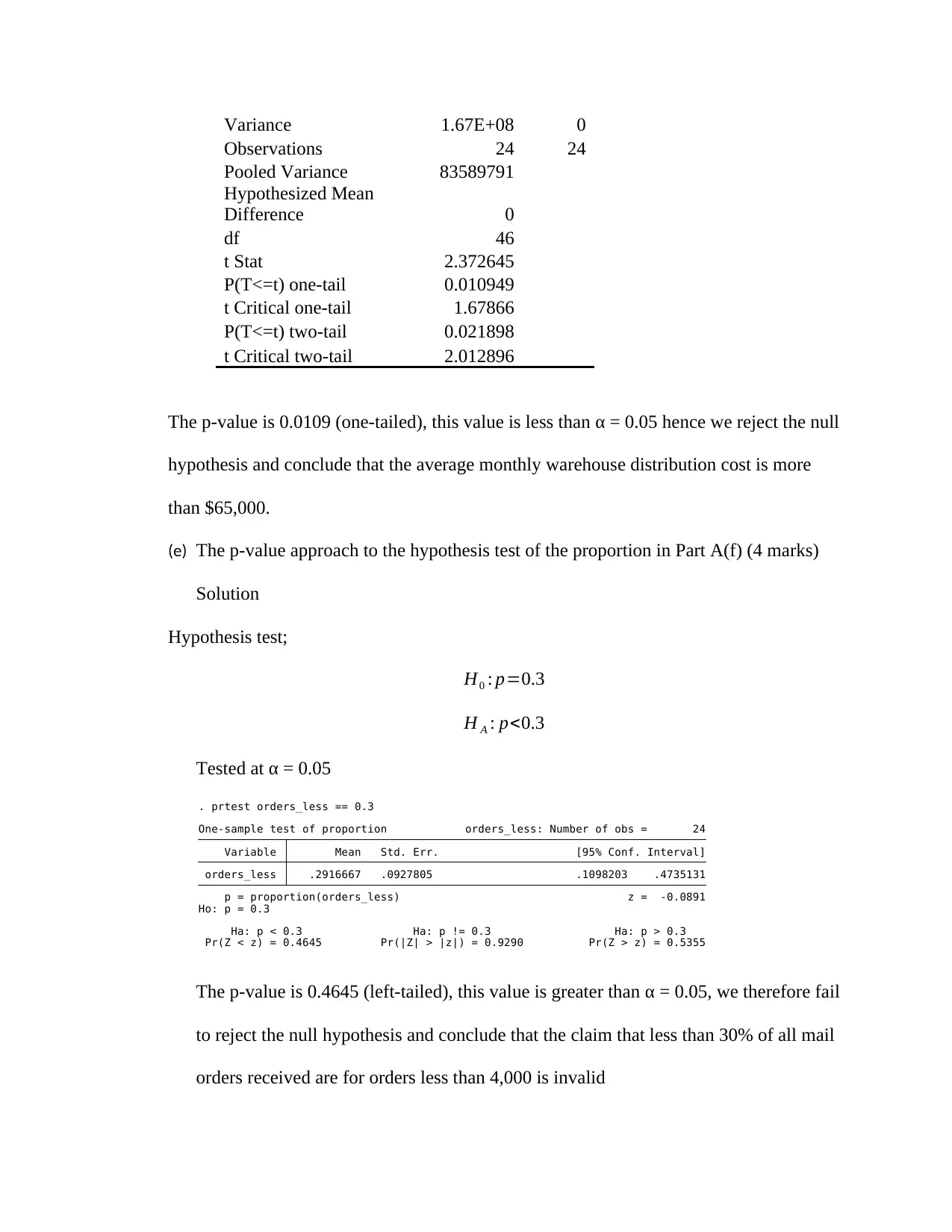

Variance 1.67E+08 0

Observations 24 24

Pooled Variance 83589791

Hypothesized Mean

Difference 0

df 46

t Stat 2.372645

P(T<=t) one-tail 0.010949

t Critical one-tail 1.67866

P(T<=t) two-tail 0.021898

t Critical two-tail 2.012896

The p-value is 0.0109 (one-tailed), this value is less than α = 0.05 hence we reject the null

hypothesis and conclude that the average monthly warehouse distribution cost is more

than $65,000.

(e) The p-value approach to the hypothesis test of the proportion in Part A(f) (4 marks)

Solution

Hypothesis test;

H0 : p=0.3

H A : p<0.3

Tested at α = 0.05

Pr(Z < z) = 0.4645 Pr(|Z| > |z|) = 0.9290 Pr(Z > z) = 0.5355

Ha: p < 0.3 Ha: p != 0.3 Ha: p > 0.3

Ho: p = 0.3

p = proportion(orders_less) z = -0.0891

orders_less .2916667 .0927805 .1098203 .4735131

Variable Mean Std. Err. [95% Conf. Interval]

One-sample test of proportion orders_less: Number of obs = 24

. prtest orders_less == 0.3

The p-value is 0.4645 (left-tailed), this value is greater than α = 0.05, we therefore fail

to reject the null hypothesis and conclude that the claim that less than 30% of all mail

orders received are for orders less than 4,000 is invalid

Observations 24 24

Pooled Variance 83589791

Hypothesized Mean

Difference 0

df 46

t Stat 2.372645

P(T<=t) one-tail 0.010949

t Critical one-tail 1.67866

P(T<=t) two-tail 0.021898

t Critical two-tail 2.012896

The p-value is 0.0109 (one-tailed), this value is less than α = 0.05 hence we reject the null

hypothesis and conclude that the average monthly warehouse distribution cost is more

than $65,000.

(e) The p-value approach to the hypothesis test of the proportion in Part A(f) (4 marks)

Solution

Hypothesis test;

H0 : p=0.3

H A : p<0.3

Tested at α = 0.05

Pr(Z < z) = 0.4645 Pr(|Z| > |z|) = 0.9290 Pr(Z > z) = 0.5355

Ha: p < 0.3 Ha: p != 0.3 Ha: p > 0.3

Ho: p = 0.3

p = proportion(orders_less) z = -0.0891

orders_less .2916667 .0927805 .1098203 .4735131

Variable Mean Std. Err. [95% Conf. Interval]

One-sample test of proportion orders_less: Number of obs = 24

. prtest orders_less == 0.3

The p-value is 0.4645 (left-tailed), this value is greater than α = 0.05, we therefore fail

to reject the null hypothesis and conclude that the claim that less than 30% of all mail

orders received are for orders less than 4,000 is invalid

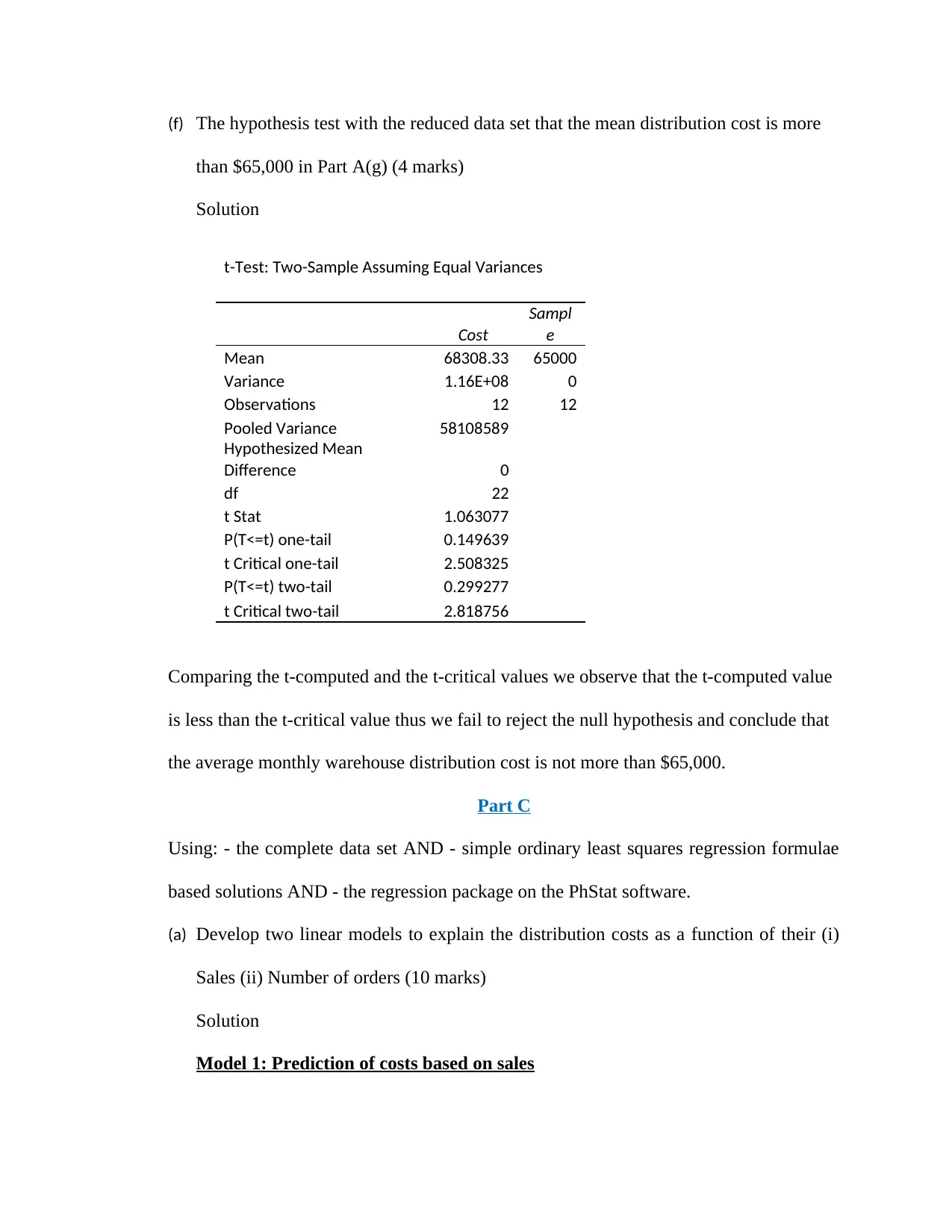

(f) The hypothesis test with the reduced data set that the mean distribution cost is more

than $65,000 in Part A(g) (4 marks)

Solution

t-Test: Two-Sample Assuming Equal Variances

Cost

Sampl

e

Mean 68308.33 65000

Variance 1.16E+08 0

Observations 12 12

Pooled Variance 58108589

Hypothesized Mean

Difference 0

df 22

t Stat 1.063077

P(T<=t) one-tail 0.149639

t Critical one-tail 2.508325

P(T<=t) two-tail 0.299277

t Critical two-tail 2.818756

Comparing the t-computed and the t-critical values we observe that the t-computed value

is less than the t-critical value thus we fail to reject the null hypothesis and conclude that

the average monthly warehouse distribution cost is not more than $65,000.

Part C

Using: - the complete data set AND - simple ordinary least squares regression formulae

based solutions AND - the regression package on the PhStat software.

(a) Develop two linear models to explain the distribution costs as a function of their (i)

Sales (ii) Number of orders (10 marks)

Solution

Model 1: Prediction of costs based on sales

than $65,000 in Part A(g) (4 marks)

Solution

t-Test: Two-Sample Assuming Equal Variances

Cost

Sampl

e

Mean 68308.33 65000

Variance 1.16E+08 0

Observations 12 12

Pooled Variance 58108589

Hypothesized Mean

Difference 0

df 22

t Stat 1.063077

P(T<=t) one-tail 0.149639

t Critical one-tail 2.508325

P(T<=t) two-tail 0.299277

t Critical two-tail 2.818756

Comparing the t-computed and the t-critical values we observe that the t-computed value

is less than the t-critical value thus we fail to reject the null hypothesis and conclude that

the average monthly warehouse distribution cost is not more than $65,000.

Part C

Using: - the complete data set AND - simple ordinary least squares regression formulae

based solutions AND - the regression package on the PhStat software.

(a) Develop two linear models to explain the distribution costs as a function of their (i)

Sales (ii) Number of orders (10 marks)

Solution

Model 1: Prediction of costs based on sales

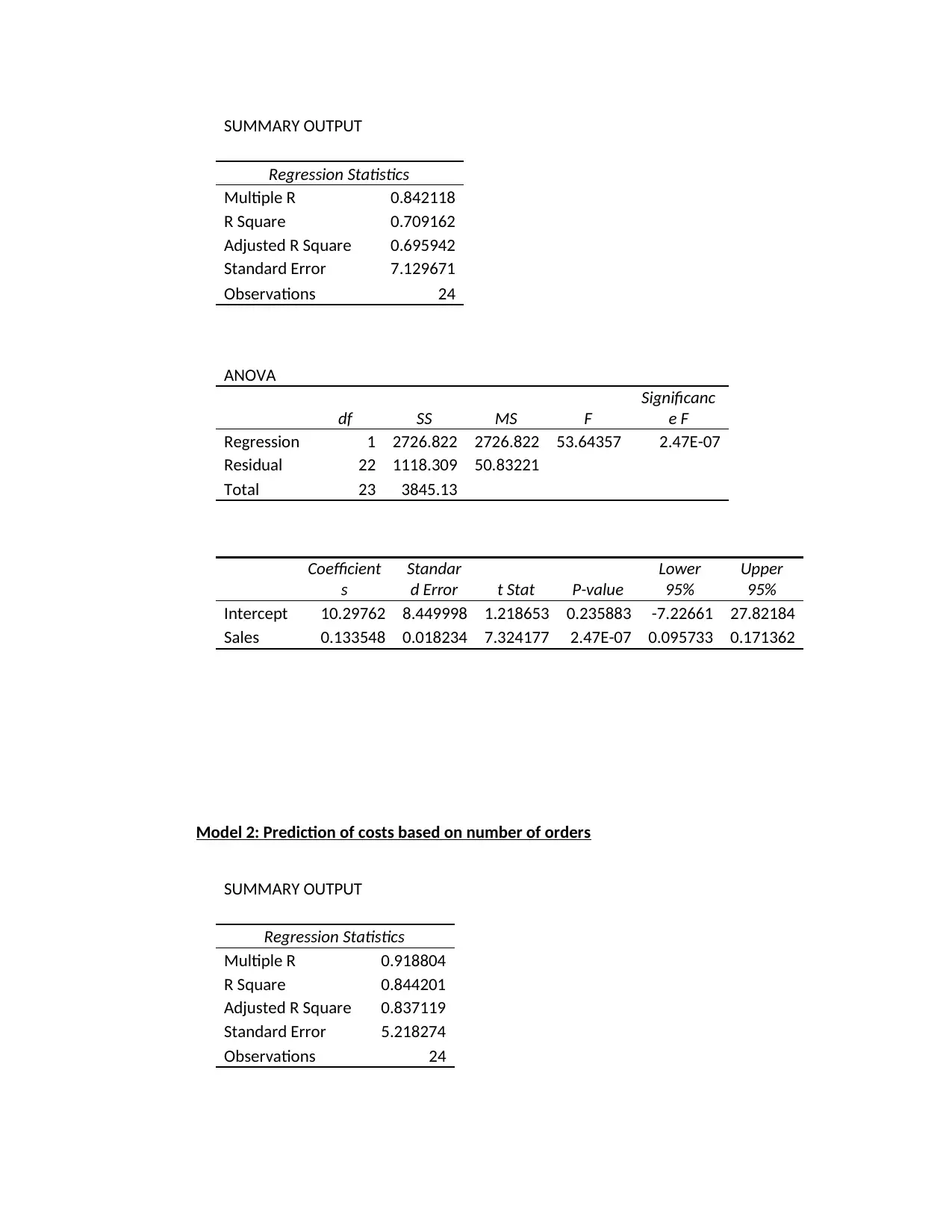

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.842118

R Square 0.709162

Adjusted R Square 0.695942

Standard Error 7.129671

Observations 24

ANOVA

df SS MS F

Significanc

e F

Regression 1 2726.822 2726.822 53.64357 2.47E-07

Residual 22 1118.309 50.83221

Total 23 3845.13

Coefficient

s

Standar

d Error t Stat P-value

Lower

95%

Upper

95%

Intercept 10.29762 8.449998 1.218653 0.235883 -7.22661 27.82184

Sales 0.133548 0.018234 7.324177 2.47E-07 0.095733 0.171362

Model 2: Prediction of costs based on number of orders

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.918804

R Square 0.844201

Adjusted R Square 0.837119

Standard Error 5.218274

Observations 24

Regression Statistics

Multiple R 0.842118

R Square 0.709162

Adjusted R Square 0.695942

Standard Error 7.129671

Observations 24

ANOVA

df SS MS F

Significanc

e F

Regression 1 2726.822 2726.822 53.64357 2.47E-07

Residual 22 1118.309 50.83221

Total 23 3845.13

Coefficient

s

Standar

d Error t Stat P-value

Lower

95%

Upper

95%

Intercept 10.29762 8.449998 1.218653 0.235883 -7.22661 27.82184

Sales 0.133548 0.018234 7.324177 2.47E-07 0.095733 0.171362

Model 2: Prediction of costs based on number of orders

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.918804

R Square 0.844201

Adjusted R Square 0.837119

Standard Error 5.218274

Observations 24

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

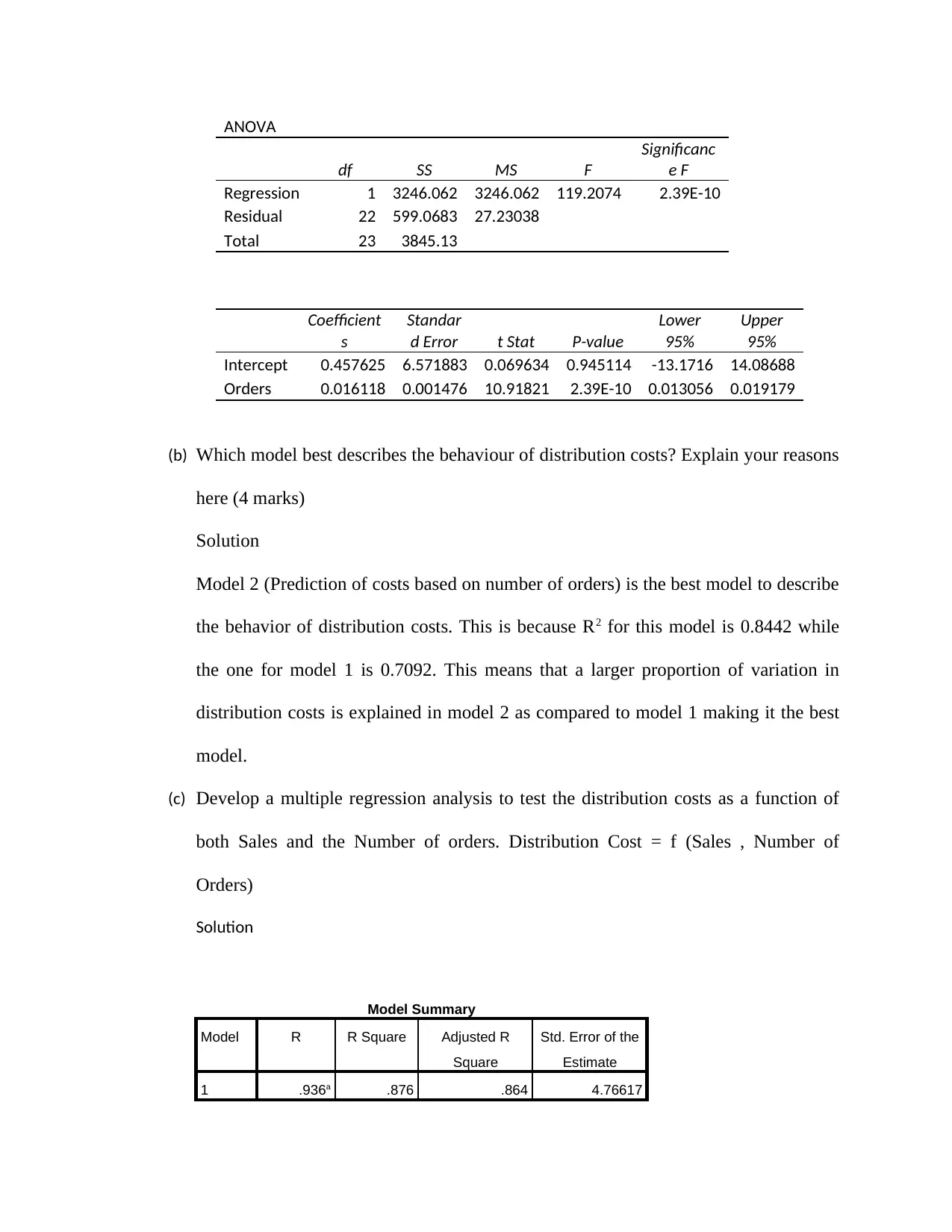

ANOVA

df SS MS F

Significanc

e F

Regression 1 3246.062 3246.062 119.2074 2.39E-10

Residual 22 599.0683 27.23038

Total 23 3845.13

Coefficient

s

Standar

d Error t Stat P-value

Lower

95%

Upper

95%

Intercept 0.457625 6.571883 0.069634 0.945114 -13.1716 14.08688

Orders 0.016118 0.001476 10.91821 2.39E-10 0.013056 0.019179

(b) Which model best describes the behaviour of distribution costs? Explain your reasons

here (4 marks)

Solution

Model 2 (Prediction of costs based on number of orders) is the best model to describe

the behavior of distribution costs. This is because R2 for this model is 0.8442 while

the one for model 1 is 0.7092. This means that a larger proportion of variation in

distribution costs is explained in model 2 as compared to model 1 making it the best

model.

(c) Develop a multiple regression analysis to test the distribution costs as a function of

both Sales and the Number of orders. Distribution Cost = f (Sales , Number of

Orders)

Solution

Model Summary

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

1 .936a .876 .864 4.76617

df SS MS F

Significanc

e F

Regression 1 3246.062 3246.062 119.2074 2.39E-10

Residual 22 599.0683 27.23038

Total 23 3845.13

Coefficient

s

Standar

d Error t Stat P-value

Lower

95%

Upper

95%

Intercept 0.457625 6.571883 0.069634 0.945114 -13.1716 14.08688

Orders 0.016118 0.001476 10.91821 2.39E-10 0.013056 0.019179

(b) Which model best describes the behaviour of distribution costs? Explain your reasons

here (4 marks)

Solution

Model 2 (Prediction of costs based on number of orders) is the best model to describe

the behavior of distribution costs. This is because R2 for this model is 0.8442 while

the one for model 1 is 0.7092. This means that a larger proportion of variation in

distribution costs is explained in model 2 as compared to model 1 making it the best

model.

(c) Develop a multiple regression analysis to test the distribution costs as a function of

both Sales and the Number of orders. Distribution Cost = f (Sales , Number of

Orders)

Solution

Model Summary

Model R R Square Adjusted R

Square

Std. Error of the

Estimate

1 .936a .876 .864 4.76617

a. Predictors: (Constant), Orders, Sales

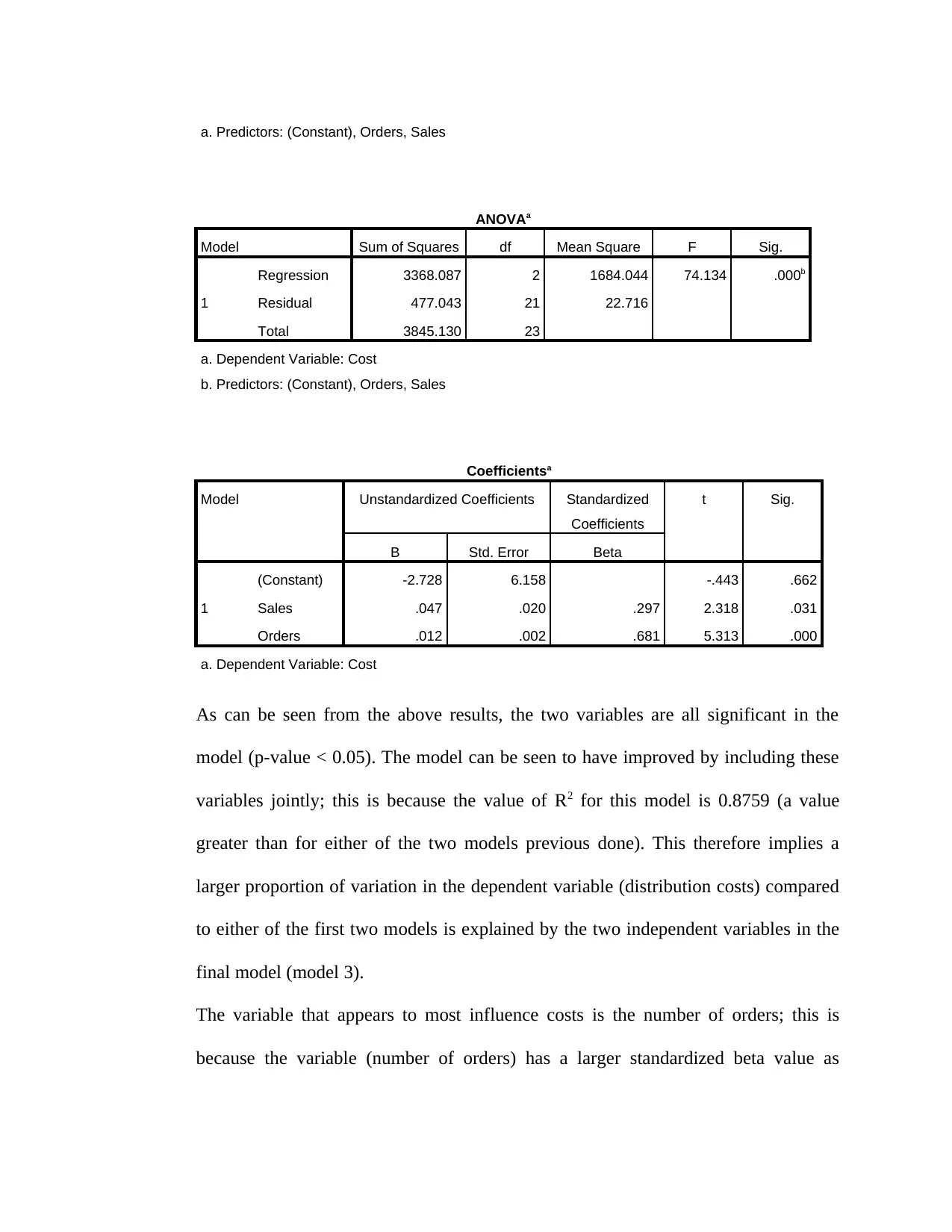

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1

Regression 3368.087 2 1684.044 74.134 .000b

Residual 477.043 21 22.716

Total 3845.130 23

a. Dependent Variable: Cost

b. Predictors: (Constant), Orders, Sales

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) -2.728 6.158 -.443 .662

Sales .047 .020 .297 2.318 .031

Orders .012 .002 .681 5.313 .000

a. Dependent Variable: Cost

As can be seen from the above results, the two variables are all significant in the

model (p-value < 0.05). The model can be seen to have improved by including these

variables jointly; this is because the value of R2 for this model is 0.8759 (a value

greater than for either of the two models previous done). This therefore implies a

larger proportion of variation in the dependent variable (distribution costs) compared

to either of the first two models is explained by the two independent variables in the

final model (model 3).

The variable that appears to most influence costs is the number of orders; this is

because the variable (number of orders) has a larger standardized beta value as

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1

Regression 3368.087 2 1684.044 74.134 .000b

Residual 477.043 21 22.716

Total 3845.130 23

a. Dependent Variable: Cost

b. Predictors: (Constant), Orders, Sales

Coefficientsa

Model Unstandardized Coefficients Standardized

Coefficients

t Sig.

B Std. Error Beta

1

(Constant) -2.728 6.158 -.443 .662

Sales .047 .020 .297 2.318 .031

Orders .012 .002 .681 5.313 .000

a. Dependent Variable: Cost

As can be seen from the above results, the two variables are all significant in the

model (p-value < 0.05). The model can be seen to have improved by including these

variables jointly; this is because the value of R2 for this model is 0.8759 (a value

greater than for either of the two models previous done). This therefore implies a

larger proportion of variation in the dependent variable (distribution costs) compared

to either of the first two models is explained by the two independent variables in the

final model (model 3).

The variable that appears to most influence costs is the number of orders; this is

because the variable (number of orders) has a larger standardized beta value as

compared to the other variable (sales). This implies that it (orders) has more influence

on the dependent variable (distribution costs) as compared to the sales.

The final regression equation model is given as follows

Distribution Cost=−2.7283+0.0471 ( Sales ) +0.0119(Orders)

Part D

a) At the 0.05 level of significance, is there a difference in the variance of the

waiting time between the two branches? Use the PhStat software to analyse the

problem but give the full hypothesis testing steps in your final presentation. (10

marks)

Solution

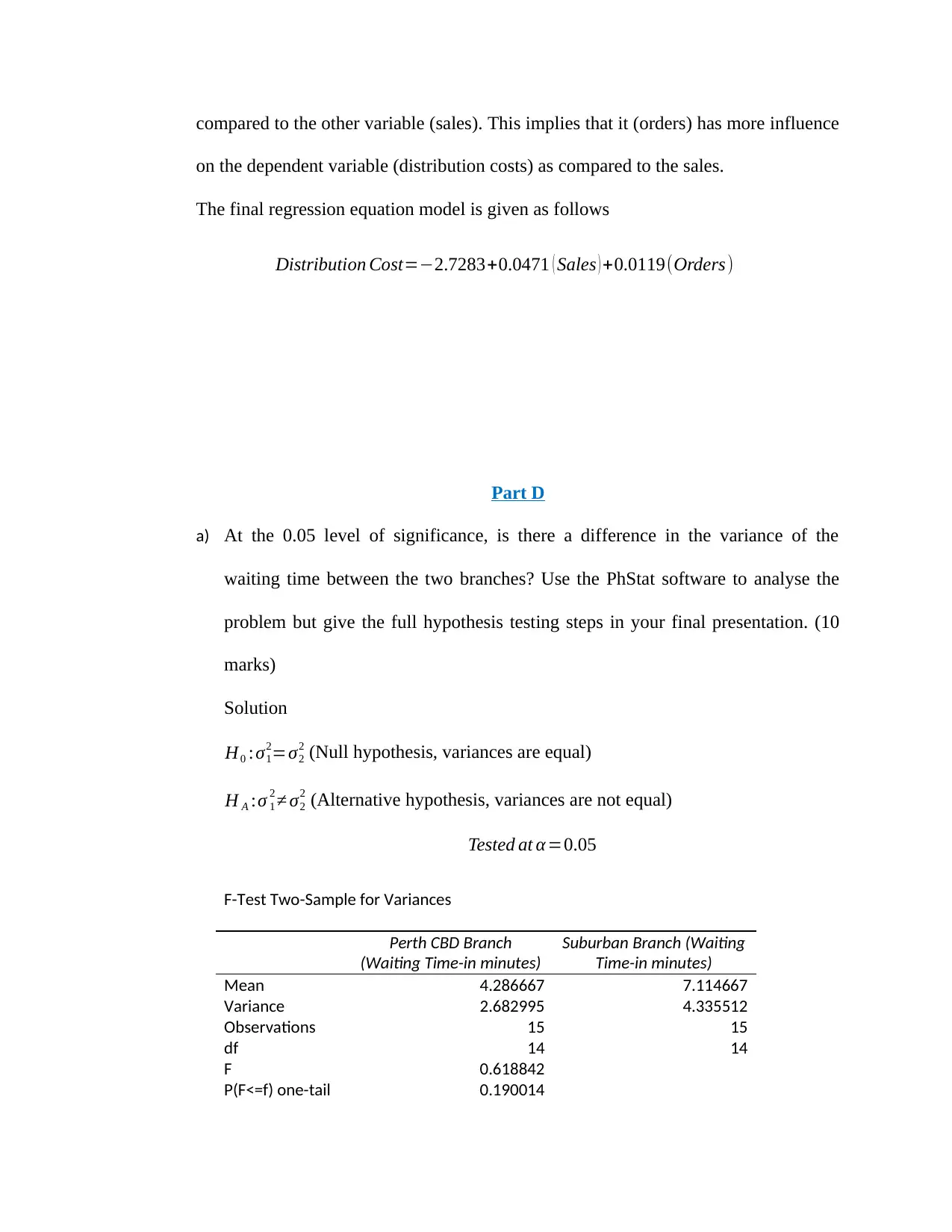

H0 :σ1

2=σ2

2 (Null hypothesis, variances are equal)

H A :σ 1

2 ≠ σ2

2 (Alternative hypothesis, variances are not equal)

Tested at α =0.05

F-Test Two-Sample for Variances

Perth CBD Branch

(Waiting Time-in minutes)

Suburban Branch (Waiting

Time-in minutes)

Mean 4.286667 7.114667

Variance 2.682995 4.335512

Observations 15 15

df 14 14

F 0.618842

P(F<=f) one-tail 0.190014

on the dependent variable (distribution costs) as compared to the sales.

The final regression equation model is given as follows

Distribution Cost=−2.7283+0.0471 ( Sales ) +0.0119(Orders)

Part D

a) At the 0.05 level of significance, is there a difference in the variance of the

waiting time between the two branches? Use the PhStat software to analyse the

problem but give the full hypothesis testing steps in your final presentation. (10

marks)

Solution

H0 :σ1

2=σ2

2 (Null hypothesis, variances are equal)

H A :σ 1

2 ≠ σ2

2 (Alternative hypothesis, variances are not equal)

Tested at α =0.05

F-Test Two-Sample for Variances

Perth CBD Branch

(Waiting Time-in minutes)

Suburban Branch (Waiting

Time-in minutes)

Mean 4.286667 7.114667

Variance 2.682995 4.335512

Observations 15 15

df 14 14

F 0.618842

P(F<=f) one-tail 0.190014

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

F Critical one-tail 0.402621

From the above table, we can see that the p-value is 0.1900 (a value greater than α

= 0.05). We therefore fail to reject the null hypothesis and conclude that the

variance of the waiting time between the two branches is equal.

b) Using the results of (a), which t - test is appropriate for comparing the mean

waiting time between the two branches? (4 marks)

Solution

Two-Sample Assuming Equal Variances would be appropriate t-test to be used to

compare the mean waiting time between the two branches. This is because from

(a) above, the variance of the waiting time between the two branches were found

to be equal.

c) At the 0.05 level of significance, test whether there is evidence of a difference in

the mean waiting time between the two branches using the test selected in (b).

Use the PhStat software to analyse the problem but give the full hypothesis testing

steps in your final presentation. (10 marks)

Solution

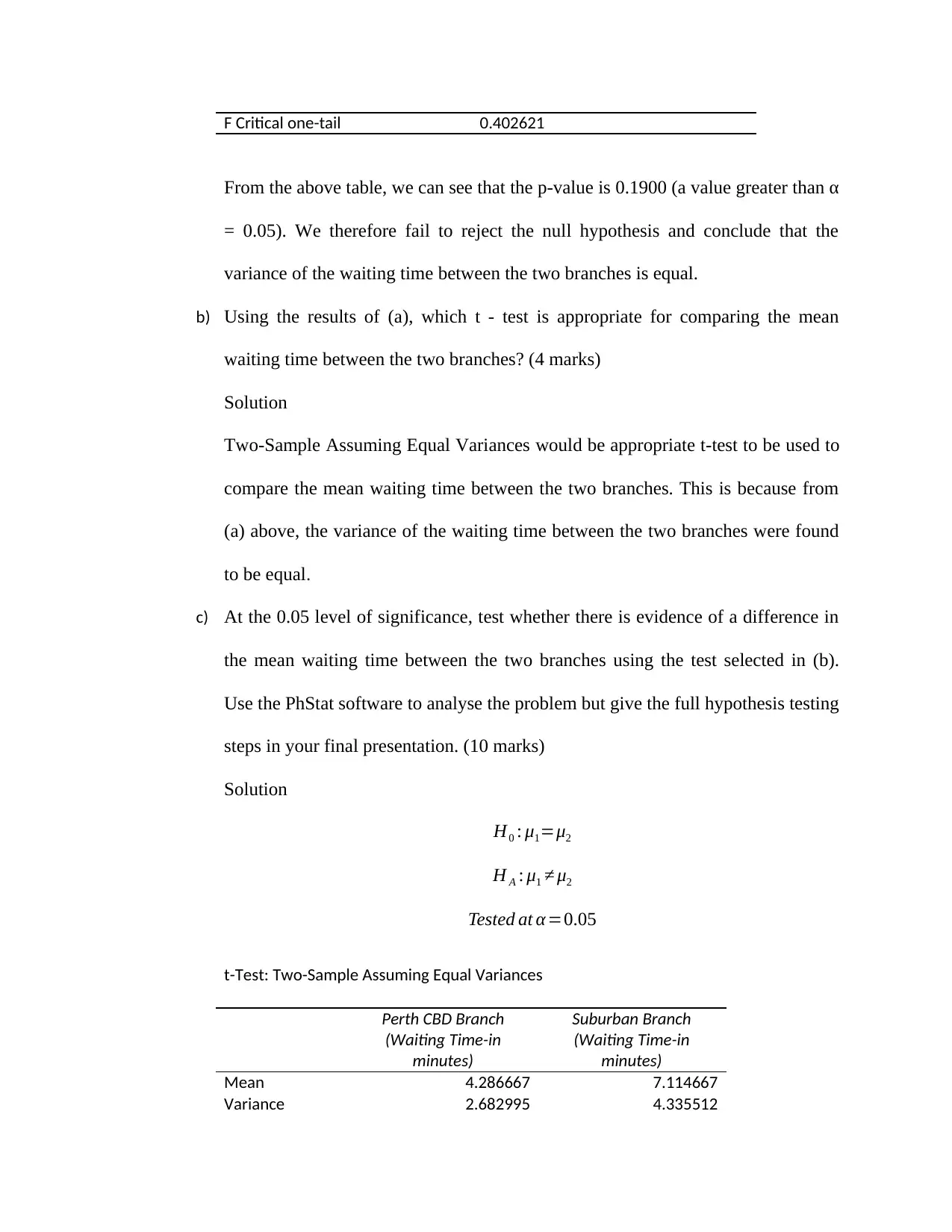

H0 : μ1=μ2

H A : μ1 ≠ μ2

Tested at α =0.05

t-Test: Two-Sample Assuming Equal Variances

Perth CBD Branch

(Waiting Time-in

minutes)

Suburban Branch

(Waiting Time-in

minutes)

Mean 4.286667 7.114667

Variance 2.682995 4.335512

From the above table, we can see that the p-value is 0.1900 (a value greater than α

= 0.05). We therefore fail to reject the null hypothesis and conclude that the

variance of the waiting time between the two branches is equal.

b) Using the results of (a), which t - test is appropriate for comparing the mean

waiting time between the two branches? (4 marks)

Solution

Two-Sample Assuming Equal Variances would be appropriate t-test to be used to

compare the mean waiting time between the two branches. This is because from

(a) above, the variance of the waiting time between the two branches were found

to be equal.

c) At the 0.05 level of significance, test whether there is evidence of a difference in

the mean waiting time between the two branches using the test selected in (b).

Use the PhStat software to analyse the problem but give the full hypothesis testing

steps in your final presentation. (10 marks)

Solution

H0 : μ1=μ2

H A : μ1 ≠ μ2

Tested at α =0.05

t-Test: Two-Sample Assuming Equal Variances

Perth CBD Branch

(Waiting Time-in

minutes)

Suburban Branch

(Waiting Time-in

minutes)

Mean 4.286667 7.114667

Variance 2.682995 4.335512

Observations 15 15

Pooled Variance 3.509254

Hypothesized

Mean Difference 0

df 28

t Stat -4.13431

P(T<=t) one-tail 0.000146

t Critical one-tail 1.701131

P(T<=t) two-tail 0.000293

t Critical two-tail 2.048407

From the above table, we can see that the p-value is 0.000 (a value less than α =

0.05). We therefore reject the null hypothesis and conclude that the mean waiting

time between the two branches is significantly different.

d) Write a short summary of your findings. (8 marks)

Solution

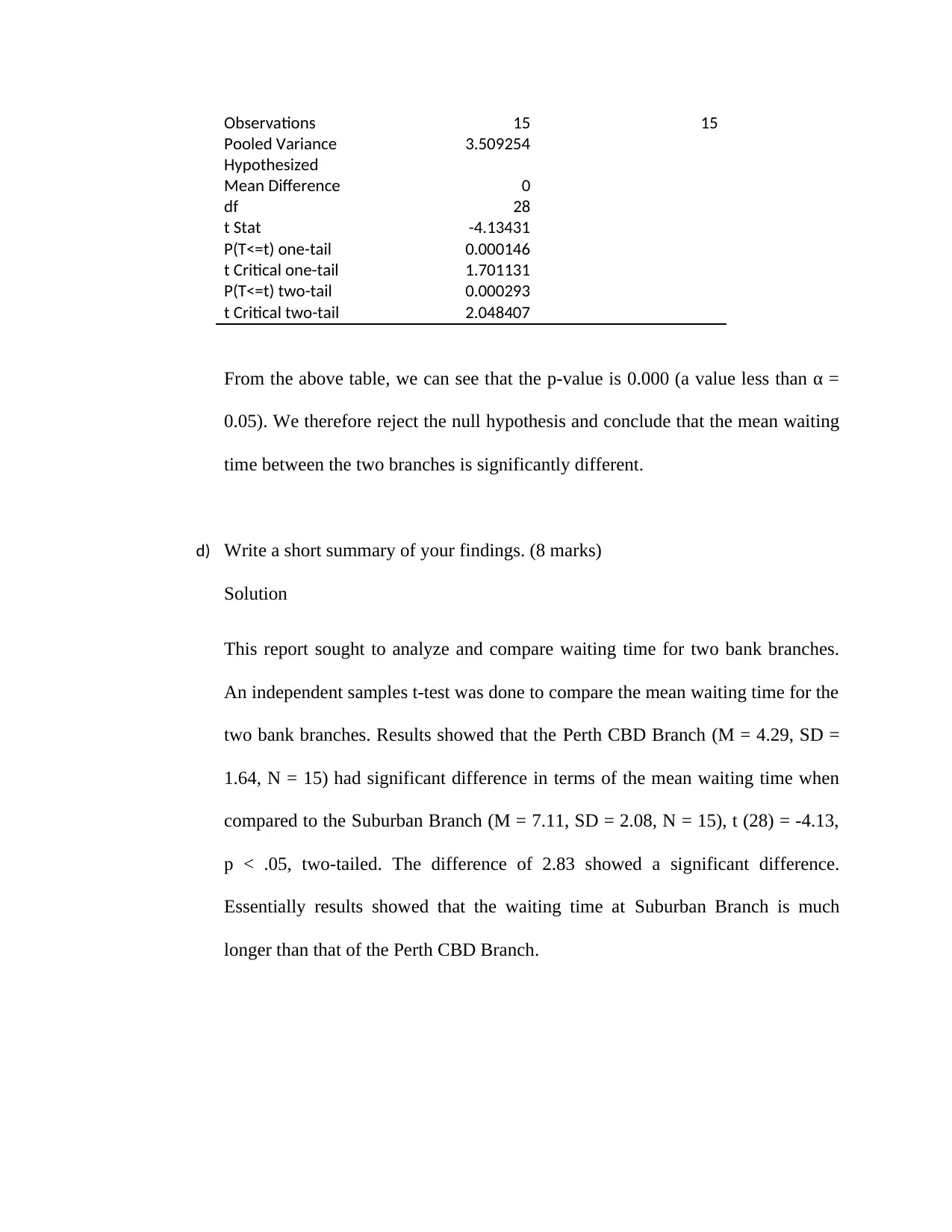

This report sought to analyze and compare waiting time for two bank branches.

An independent samples t-test was done to compare the mean waiting time for the

two bank branches. Results showed that the Perth CBD Branch (M = 4.29, SD =

1.64, N = 15) had significant difference in terms of the mean waiting time when

compared to the Suburban Branch (M = 7.11, SD = 2.08, N = 15), t (28) = -4.13,

p < .05, two-tailed. The difference of 2.83 showed a significant difference.

Essentially results showed that the waiting time at Suburban Branch is much

longer than that of the Perth CBD Branch.

Pooled Variance 3.509254

Hypothesized

Mean Difference 0

df 28

t Stat -4.13431

P(T<=t) one-tail 0.000146

t Critical one-tail 1.701131

P(T<=t) two-tail 0.000293

t Critical two-tail 2.048407

From the above table, we can see that the p-value is 0.000 (a value less than α =

0.05). We therefore reject the null hypothesis and conclude that the mean waiting

time between the two branches is significantly different.

d) Write a short summary of your findings. (8 marks)

Solution

This report sought to analyze and compare waiting time for two bank branches.

An independent samples t-test was done to compare the mean waiting time for the

two bank branches. Results showed that the Perth CBD Branch (M = 4.29, SD =

1.64, N = 15) had significant difference in terms of the mean waiting time when

compared to the Suburban Branch (M = 7.11, SD = 2.08, N = 15), t (28) = -4.13,

p < .05, two-tailed. The difference of 2.83 showed a significant difference.

Essentially results showed that the waiting time at Suburban Branch is much

longer than that of the Perth CBD Branch.

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.