Queensland Cotton: Report on Business Level Strategy and Analysis

VerifiedAdded on 2023/01/19

|35

|8493

|33

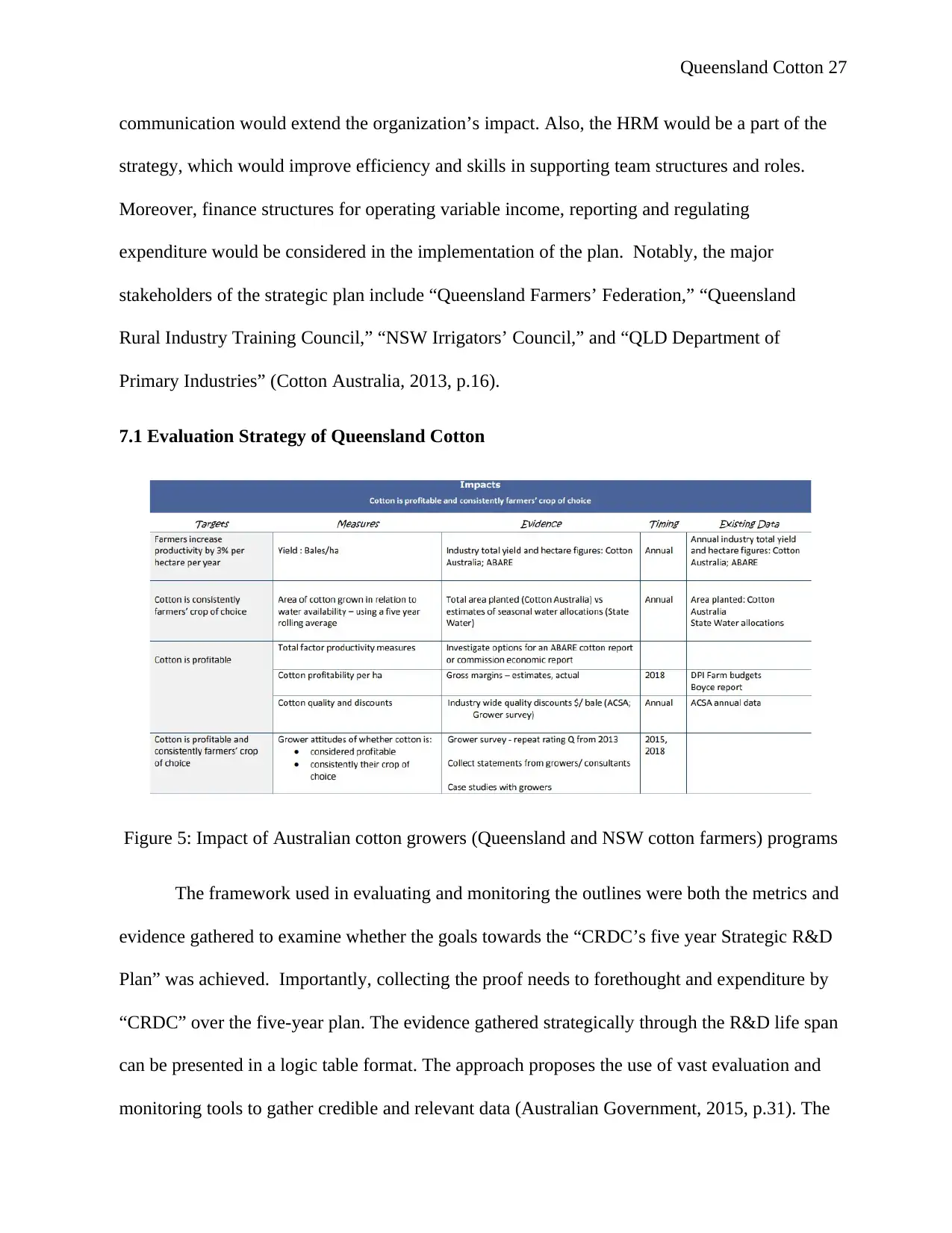

Report

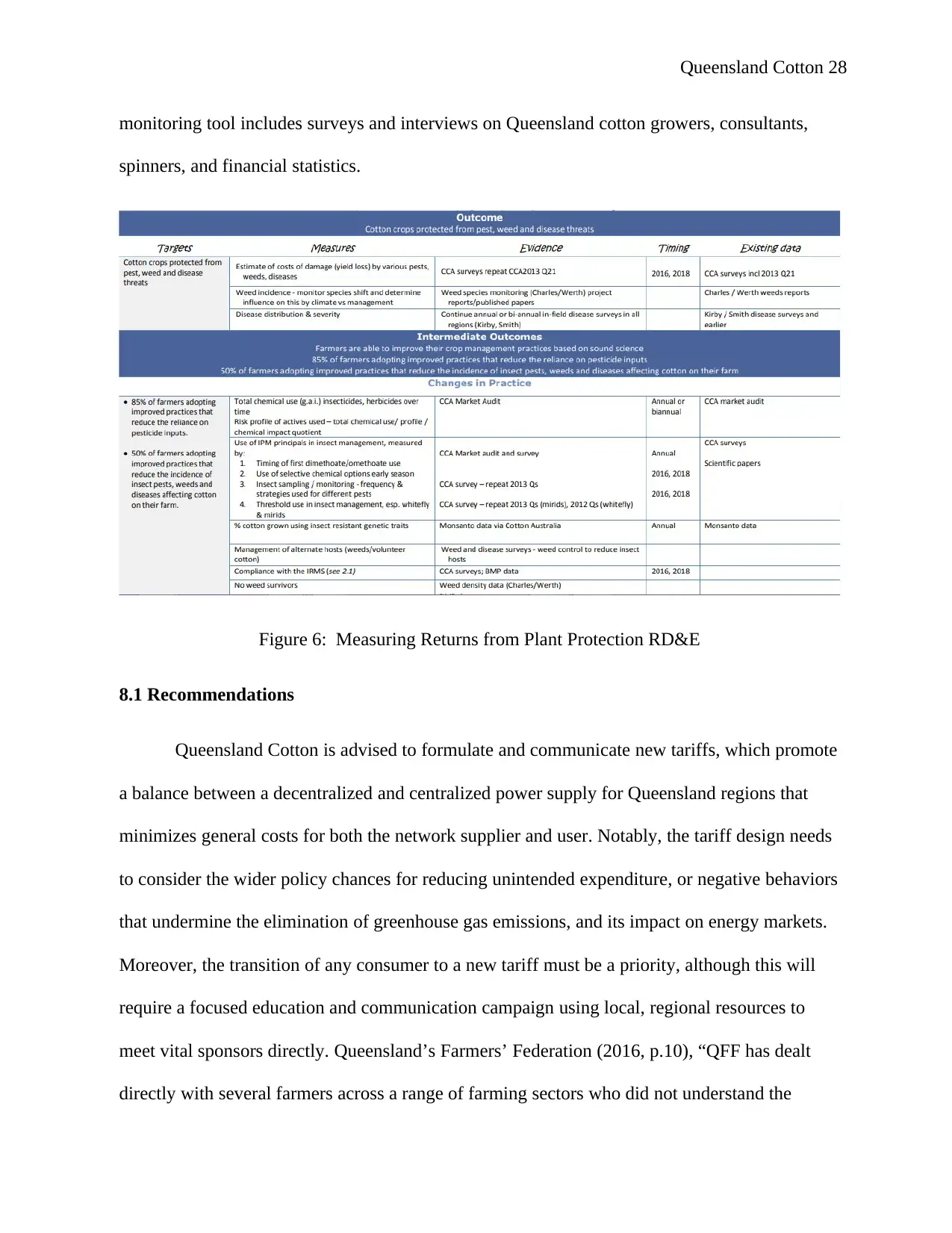

AI Summary

This report provides an in-depth analysis of Queensland Cotton, a leading Australian cotton marketing and ginning organization. It examines the company's business units, product lines, and revenue streams, highlighting the importance of its largest revenue units. The report delves into Queensland Cotton's business-level strategies, including cost leadership, differentiation, and integrated approaches, and analyzes its model of competitive reality within the Australian cotton industry. Furthermore, it outlines an implementation plan, an evaluation strategy, and offers recommendations for the future strategic direction of Queensland Cotton. The analysis covers the Australian Stock Exchange's impact, seasonal conditions, and cotton production statistics, providing a comprehensive overview of the company's operations and strategic positioning within the agribusiness sector. The report also references the Cotton Research and Development Corporation (CRDC) and its strategic plan for the cotton industry.

Queensland Cotton 1

QUEENSLAND COTTON

By (Name)

Class

Professor

College

City and State

QUEENSLAND COTTON

By (Name)

Class

Professor

College

City and State

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Queensland Cotton 2

Executive Summary

“Queensland Cotton Corporation Pty Ltd (Queensland Cotton)” was created in 1921, and is the

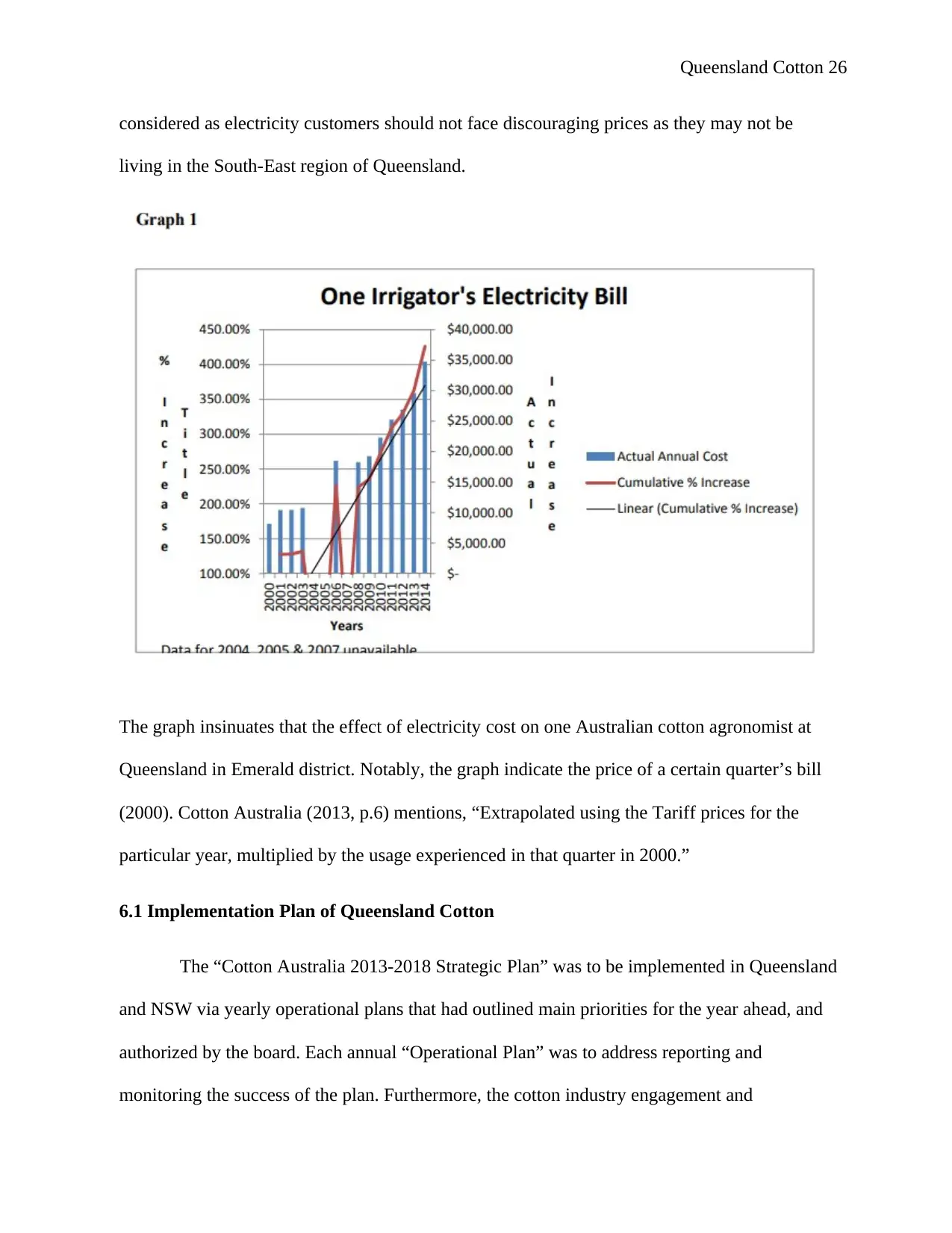

oldest Australia’s cotton marketing and ginning organization. Importantly, it is a crucial

supplier of premium cotton to the globe’s textile markets. Queensland specializes in all phases

of ginning and processing of cotton seed to the marketing process including acquisition, sales,

risk management, financing, and storage and classification of processed cotton. Queensland

Cotton’s enterprise has a vast knowledge in selling and buying of agricultural products.

Executive Summary

“Queensland Cotton Corporation Pty Ltd (Queensland Cotton)” was created in 1921, and is the

oldest Australia’s cotton marketing and ginning organization. Importantly, it is a crucial

supplier of premium cotton to the globe’s textile markets. Queensland specializes in all phases

of ginning and processing of cotton seed to the marketing process including acquisition, sales,

risk management, financing, and storage and classification of processed cotton. Queensland

Cotton’s enterprise has a vast knowledge in selling and buying of agricultural products.

Queensland Cotton 3

Table of Contents

INTRODUCTION………………………………………………………………………….4

1.1. Introduction…………………………………………………………………………….4

1.2. Objective………………………………………………………………………………..4

1.3. Scope of Report…………………………………………………………………….......5

ANALYSIS………………………………………………………………………………...5

2.1 Australian Stock Exchange…………………………………………………………..…5

2.2 Queensland Cotton……………………………………………………………………...8

2.2.1 Business Units and product and Service Lines………………………………………11

2.2.2 Business Revenue Units and the Importance of the Largest Revenue Units…………15

3.1 Business Level Strategies……………………………………………………………....17

3.1.1. Cost Leadership………………………………………………………………….…..17

3.1.2. Differentiation…………………………………………………………………….….19

3.1.3 Integrated Cost Leadership and Differentiation Strategy………………………….…20

3.1.4 Focus Technique……………………………………………………………...………22

4.1 The Business Level Approach of Queensland Cotton………………………………….25

5.1 Queensland Cotton Model of Competitive Reality in Australia……………………..…25

6.1 Implementation Plan of Queensland Cotton…………………………………...……….27

7.1 Evaluation Strategy of Queensland Cotton………………………………………..……27

8.1 Recommendation………………………………………………………………….…….28

9.1 Conclusion…………………………………………………………………………..…..29

Table of Contents

INTRODUCTION………………………………………………………………………….4

1.1. Introduction…………………………………………………………………………….4

1.2. Objective………………………………………………………………………………..4

1.3. Scope of Report…………………………………………………………………….......5

ANALYSIS………………………………………………………………………………...5

2.1 Australian Stock Exchange…………………………………………………………..…5

2.2 Queensland Cotton……………………………………………………………………...8

2.2.1 Business Units and product and Service Lines………………………………………11

2.2.2 Business Revenue Units and the Importance of the Largest Revenue Units…………15

3.1 Business Level Strategies……………………………………………………………....17

3.1.1. Cost Leadership………………………………………………………………….…..17

3.1.2. Differentiation…………………………………………………………………….….19

3.1.3 Integrated Cost Leadership and Differentiation Strategy………………………….…20

3.1.4 Focus Technique……………………………………………………………...………22

4.1 The Business Level Approach of Queensland Cotton………………………………….25

5.1 Queensland Cotton Model of Competitive Reality in Australia……………………..…25

6.1 Implementation Plan of Queensland Cotton…………………………………...……….27

7.1 Evaluation Strategy of Queensland Cotton………………………………………..……27

8.1 Recommendation………………………………………………………………….…….28

9.1 Conclusion…………………………………………………………………………..…..29

You're viewing a preview

Unlock full access by subscribing today!

Queensland Cotton 4

INTRODUCTION

1.1 Introduction

The primary production regions of cotton in Australia stretches from the Macintyre

River on the Queensland border and Macquarie and Namoi valleys. In Queensland, the cotton

grown majorly is in the south in the Macintyre, Darling Downs, and Dirranbandi Valley areas.

The Australian cotton grows seasonally for about six months starting from October, which is the

planting season to ending April, which is the picking season. Notably, irrigation water for

cotton production is limited, which is a primary issue. In addition, water utilization efficiency

has increased by about 240 percent from the 1970s. Alternatively, the best management

programs of cotton practice include “Integrated Pest Management” strategies, and

biotechnology use in minimizing pesticide use by over 85 percent from 2000 to 2010.

Furthermore, cotton production forecasts at approximately 4.8 million bales, while the harvested

region is predicted at 450,000 hectares from 2018 to 2019. The low production is as a result of

low rainfall in most growing areas, and cotton crop damage influenced by herbicide spray drift

over about 36,000 hectares. Conversely, the “Cotton Research and Development Corporation

(CRDC)” delivers outcomes in cotton “Research, Development, and Extension (RD&E)” on

behalf of all Australian cotton growers, and the Australian government. Importantly, CRDC

plays a vital role in the 2018 to 2023 Strategic Plan that aims at building a successful five-year

plan on providing a two billion dollars gross value of cotton production, which will benefit

Australian cotton growers.

1.2 Objective

INTRODUCTION

1.1 Introduction

The primary production regions of cotton in Australia stretches from the Macintyre

River on the Queensland border and Macquarie and Namoi valleys. In Queensland, the cotton

grown majorly is in the south in the Macintyre, Darling Downs, and Dirranbandi Valley areas.

The Australian cotton grows seasonally for about six months starting from October, which is the

planting season to ending April, which is the picking season. Notably, irrigation water for

cotton production is limited, which is a primary issue. In addition, water utilization efficiency

has increased by about 240 percent from the 1970s. Alternatively, the best management

programs of cotton practice include “Integrated Pest Management” strategies, and

biotechnology use in minimizing pesticide use by over 85 percent from 2000 to 2010.

Furthermore, cotton production forecasts at approximately 4.8 million bales, while the harvested

region is predicted at 450,000 hectares from 2018 to 2019. The low production is as a result of

low rainfall in most growing areas, and cotton crop damage influenced by herbicide spray drift

over about 36,000 hectares. Conversely, the “Cotton Research and Development Corporation

(CRDC)” delivers outcomes in cotton “Research, Development, and Extension (RD&E)” on

behalf of all Australian cotton growers, and the Australian government. Importantly, CRDC

plays a vital role in the 2018 to 2023 Strategic Plan that aims at building a successful five-year

plan on providing a two billion dollars gross value of cotton production, which will benefit

Australian cotton growers.

1.2 Objective

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Queensland Cotton 5

The report aims at providing an in-depth analysis of Queensland Cotton, and the business units

and product lines. Also, the report focuses on Queensland Cotton prioritizes on business

strategy, which keeps it ahead of its competition. In spite of that, the article addresses the

following;

1. Queensland Cotton business level approach.

2. Queensland Cotton model of competitive reality.

3. The implementation plan and assessment strategy of Queensland Cotton.

1.3 Scope of Report

The article focuses on Queensland Cotton and how it achieves the cost leadership and

differentiation approach. Also, the business revenue units of Queensland Cotton are provided.

ANALYSIS

2.1 Australian Stock Exchange

“Australia Bureau of Agricultural and Resource Economics (ABARE)” June 2012

estimated that the Australian cotton exports may increase by at least 11.5 percent in 2012 and

2013, which is about 1.2 million tonnes. The forecast in 2012 predicted a 26 percent decrease in

cotton planted areas at 442,000 hectares, while irrigated cotton regions decreased by seven

percent to 418,000 hectares, and the regions of dryland cotton fell by 85 percent to 23,000

hectares. Importantly, Australia is a net cotton exporter, and the prices reflect in USD terms.

The USD is a currency of international cotton trade, which Australian cotton exports denote it

by the US dollar. NSW and Queensland growers predominantly operate an Australian dollar-

denominated enterprise, and prefer to have their sales receipts in “AUD.”

The report aims at providing an in-depth analysis of Queensland Cotton, and the business units

and product lines. Also, the report focuses on Queensland Cotton prioritizes on business

strategy, which keeps it ahead of its competition. In spite of that, the article addresses the

following;

1. Queensland Cotton business level approach.

2. Queensland Cotton model of competitive reality.

3. The implementation plan and assessment strategy of Queensland Cotton.

1.3 Scope of Report

The article focuses on Queensland Cotton and how it achieves the cost leadership and

differentiation approach. Also, the business revenue units of Queensland Cotton are provided.

ANALYSIS

2.1 Australian Stock Exchange

“Australia Bureau of Agricultural and Resource Economics (ABARE)” June 2012

estimated that the Australian cotton exports may increase by at least 11.5 percent in 2012 and

2013, which is about 1.2 million tonnes. The forecast in 2012 predicted a 26 percent decrease in

cotton planted areas at 442,000 hectares, while irrigated cotton regions decreased by seven

percent to 418,000 hectares, and the regions of dryland cotton fell by 85 percent to 23,000

hectares. Importantly, Australia is a net cotton exporter, and the prices reflect in USD terms.

The USD is a currency of international cotton trade, which Australian cotton exports denote it

by the US dollar. NSW and Queensland growers predominantly operate an Australian dollar-

denominated enterprise, and prefer to have their sales receipts in “AUD.”

Queensland Cotton 6

On the other hand, the United States dollar cotton export values ought to be converted

into AUD values, which better suits Queensland cotton growers. The latter prefer their local

currency as AUD per USD rates has a significant influence on the price of AUD locally.

Importantly, local “AUD per Bale price” increases as the Australian dollar rate softens against

the U.S dollar. Most of the contracts between Queensland growers and merchants are in

Australian dollar cash price per bale, where the Australian cotton grower assumes no currency

risk (Australian Cotton Shippers Association, 2008, p.7). Unfortunately, if utilizing an on-call

agreement where the growers fix the three pricing components (basis, futures, and currency)

separately, they, as a result, maintain, and operate a currency risk. Notably, in the case where

the currency is fixed, then the USD cotton value depreciates; as a result, the grower may have

an “over-hedged” currency position, which may develop a higher loss risk.

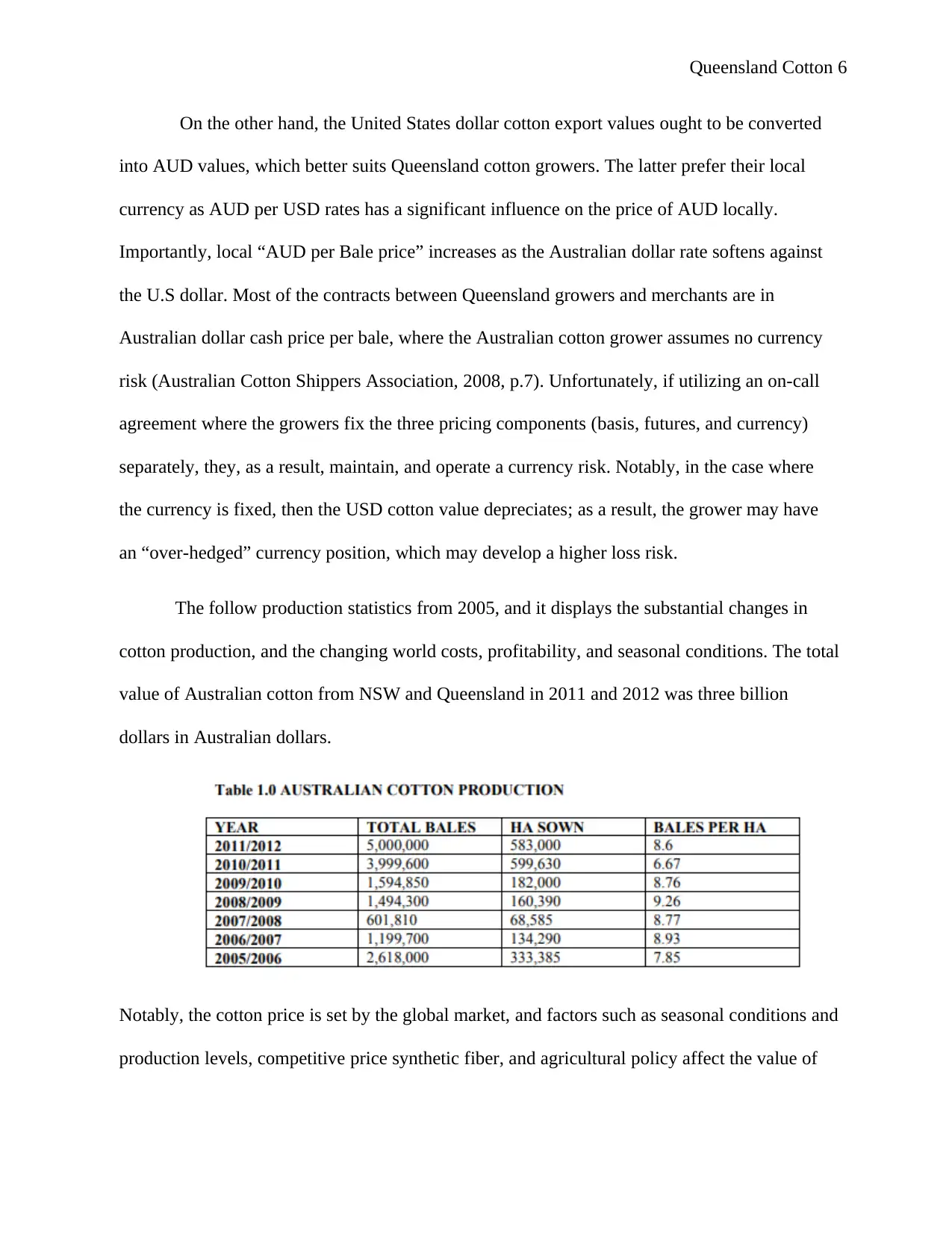

The follow production statistics from 2005, and it displays the substantial changes in

cotton production, and the changing world costs, profitability, and seasonal conditions. The total

value of Australian cotton from NSW and Queensland in 2011 and 2012 was three billion

dollars in Australian dollars.

Notably, the cotton price is set by the global market, and factors such as seasonal conditions and

production levels, competitive price synthetic fiber, and agricultural policy affect the value of

On the other hand, the United States dollar cotton export values ought to be converted

into AUD values, which better suits Queensland cotton growers. The latter prefer their local

currency as AUD per USD rates has a significant influence on the price of AUD locally.

Importantly, local “AUD per Bale price” increases as the Australian dollar rate softens against

the U.S dollar. Most of the contracts between Queensland growers and merchants are in

Australian dollar cash price per bale, where the Australian cotton grower assumes no currency

risk (Australian Cotton Shippers Association, 2008, p.7). Unfortunately, if utilizing an on-call

agreement where the growers fix the three pricing components (basis, futures, and currency)

separately, they, as a result, maintain, and operate a currency risk. Notably, in the case where

the currency is fixed, then the USD cotton value depreciates; as a result, the grower may have

an “over-hedged” currency position, which may develop a higher loss risk.

The follow production statistics from 2005, and it displays the substantial changes in

cotton production, and the changing world costs, profitability, and seasonal conditions. The total

value of Australian cotton from NSW and Queensland in 2011 and 2012 was three billion

dollars in Australian dollars.

Notably, the cotton price is set by the global market, and factors such as seasonal conditions and

production levels, competitive price synthetic fiber, and agricultural policy affect the value of

You're viewing a preview

Unlock full access by subscribing today!

Queensland Cotton 7

cotton (De Garis, 2013, p.7). Recently, the cost is about 1,000 Australian dollar per bale, and a

region of 350 dollars to 4000 dollars per Australian bale dollar.

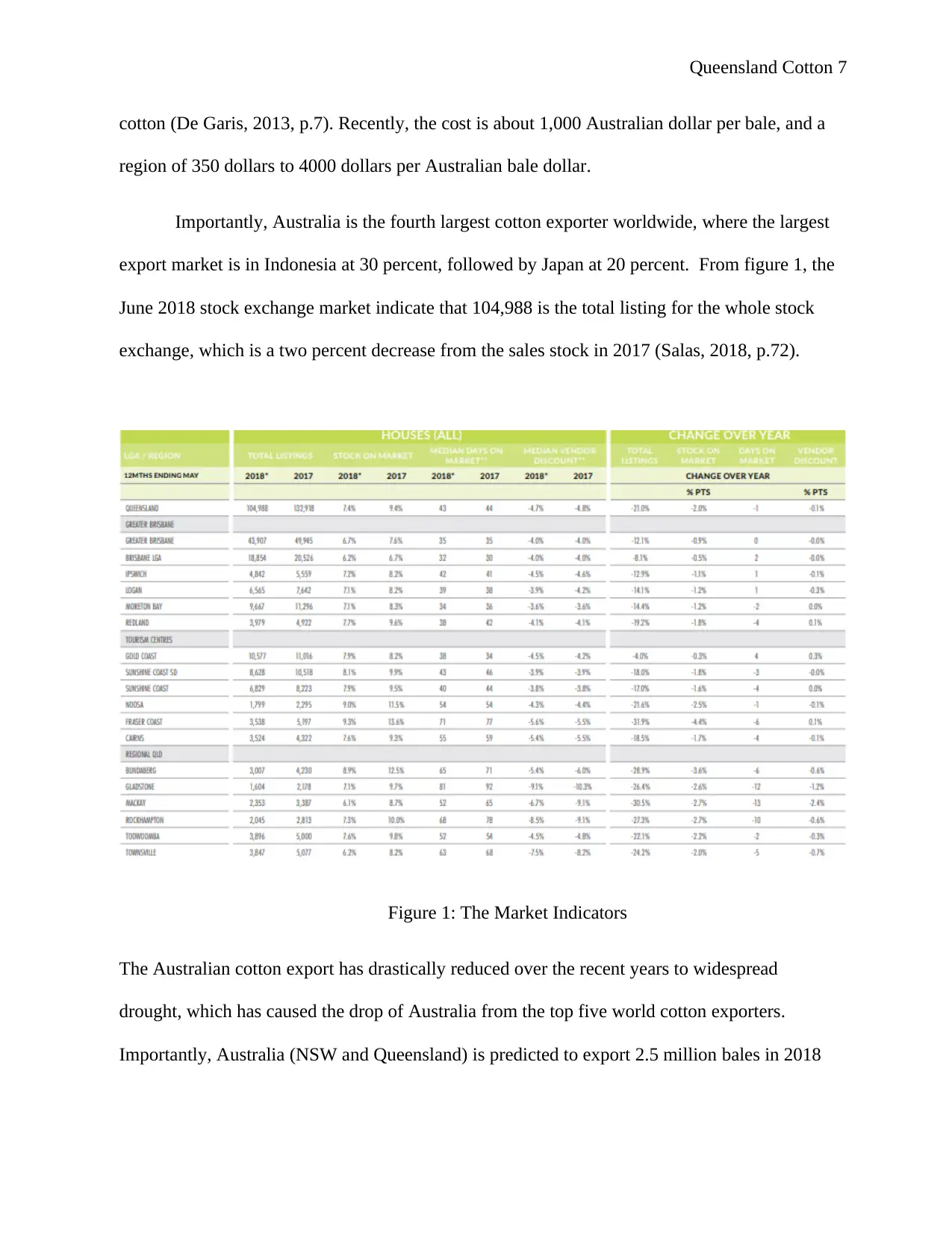

Importantly, Australia is the fourth largest cotton exporter worldwide, where the largest

export market is in Indonesia at 30 percent, followed by Japan at 20 percent. From figure 1, the

June 2018 stock exchange market indicate that 104,988 is the total listing for the whole stock

exchange, which is a two percent decrease from the sales stock in 2017 (Salas, 2018, p.72).

Figure 1: The Market Indicators

The Australian cotton export has drastically reduced over the recent years to widespread

drought, which has caused the drop of Australia from the top five world cotton exporters.

Importantly, Australia (NSW and Queensland) is predicted to export 2.5 million bales in 2018

cotton (De Garis, 2013, p.7). Recently, the cost is about 1,000 Australian dollar per bale, and a

region of 350 dollars to 4000 dollars per Australian bale dollar.

Importantly, Australia is the fourth largest cotton exporter worldwide, where the largest

export market is in Indonesia at 30 percent, followed by Japan at 20 percent. From figure 1, the

June 2018 stock exchange market indicate that 104,988 is the total listing for the whole stock

exchange, which is a two percent decrease from the sales stock in 2017 (Salas, 2018, p.72).

Figure 1: The Market Indicators

The Australian cotton export has drastically reduced over the recent years to widespread

drought, which has caused the drop of Australia from the top five world cotton exporters.

Importantly, Australia (NSW and Queensland) is predicted to export 2.5 million bales in 2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Queensland Cotton 8

and 2019 due to the relatively low recovery process (Mutuc, Hudson, Pan, and Yates, 2009,

p.21).

2.2 Queensland Cotton

The seasonal conditions from December 2018 to January 2019 were unfavorable in

cropping areas in Queensland. Moreover, the rainfall in most cropping areas was below

average, and the temperature above average. As a result, the conditions minimized soil

moisture levels to below average in most cropping areas, and region planted to dryland summer

crops; thus, the yield is predicted to be below average. In Queensland, cotton areas were

approximately 44 percent to 106,000 hectares in 2018 to 2019 (Australian Government, n.d.).

Therefore, the cotton production is forecasted to fall by 39 percent to 210,000 cotton lint tonnes,

and around 297,000 cottonseed tonnes in 2018 to 2019.

According to USDA Foreign Agricultural Service (2018, p.4), the moderate rainfall

during the first week of February 2019 assisted Southern Queensland cotton growers to ease the

drought conditions, and is expected to result in better yields. Notably, in Darling Downs areas,

an intense storm in December 2017 caused damage on cotton crops, while the dry conditions in

2018 minimized production area. Irrigation of cotton accounts for about 80 percent of the total

production in Queensland, while rain-fed cotton depends on sufficient and timely rainfall.

During 2018 and 2019, Australia’s cotton regions continue to extend into southern NSW, and

northern Queensland.

and 2019 due to the relatively low recovery process (Mutuc, Hudson, Pan, and Yates, 2009,

p.21).

2.2 Queensland Cotton

The seasonal conditions from December 2018 to January 2019 were unfavorable in

cropping areas in Queensland. Moreover, the rainfall in most cropping areas was below

average, and the temperature above average. As a result, the conditions minimized soil

moisture levels to below average in most cropping areas, and region planted to dryland summer

crops; thus, the yield is predicted to be below average. In Queensland, cotton areas were

approximately 44 percent to 106,000 hectares in 2018 to 2019 (Australian Government, n.d.).

Therefore, the cotton production is forecasted to fall by 39 percent to 210,000 cotton lint tonnes,

and around 297,000 cottonseed tonnes in 2018 to 2019.

According to USDA Foreign Agricultural Service (2018, p.4), the moderate rainfall

during the first week of February 2019 assisted Southern Queensland cotton growers to ease the

drought conditions, and is expected to result in better yields. Notably, in Darling Downs areas,

an intense storm in December 2017 caused damage on cotton crops, while the dry conditions in

2018 minimized production area. Irrigation of cotton accounts for about 80 percent of the total

production in Queensland, while rain-fed cotton depends on sufficient and timely rainfall.

During 2018 and 2019, Australia’s cotton regions continue to extend into southern NSW, and

northern Queensland.

Queensland Cotton 9

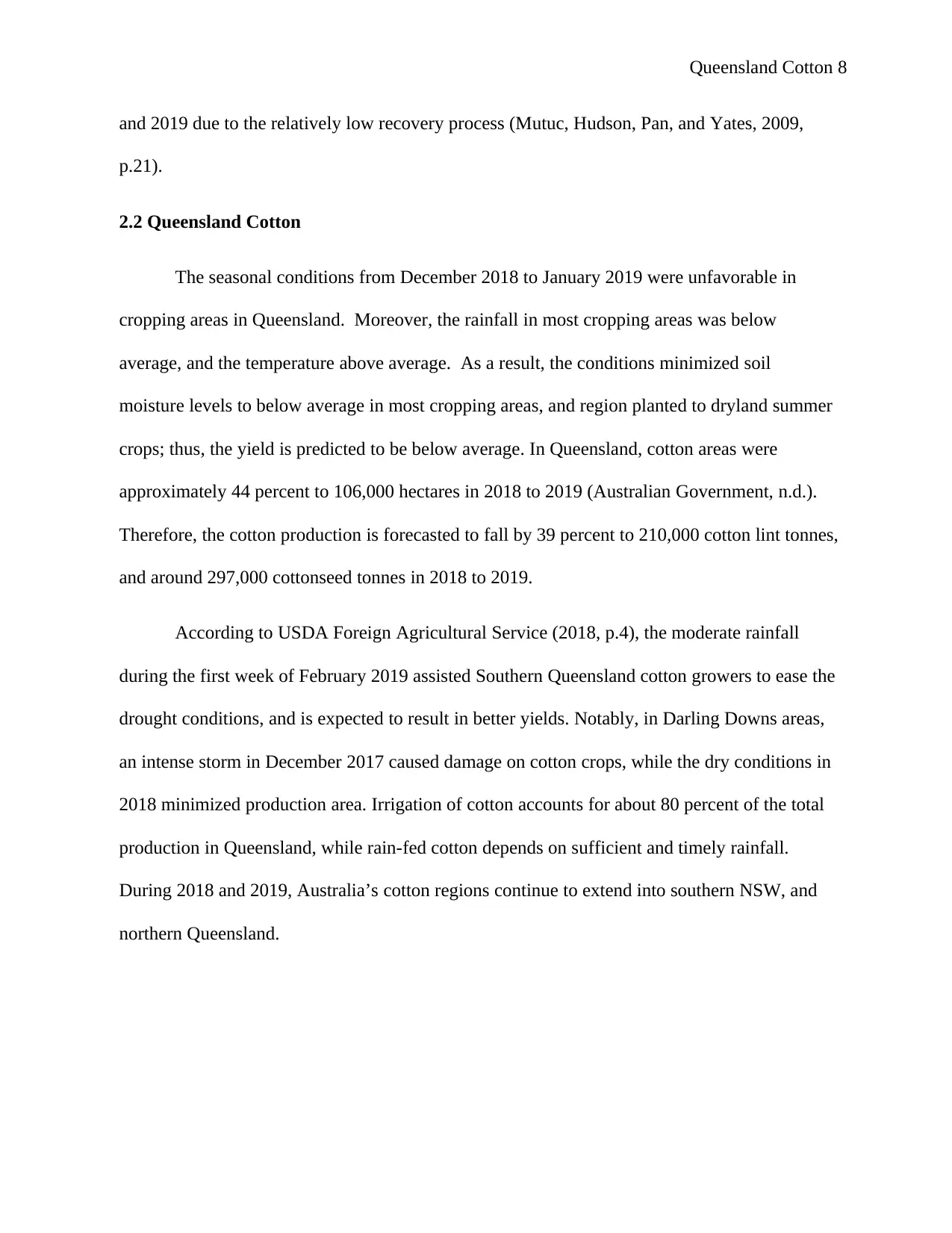

Figure 2: Australian (NSW and Queensland) Cotton Export

Figure 2: Australian (NSW and Queensland) Cotton Export

You're viewing a preview

Unlock full access by subscribing today!

Queensland Cotton 10

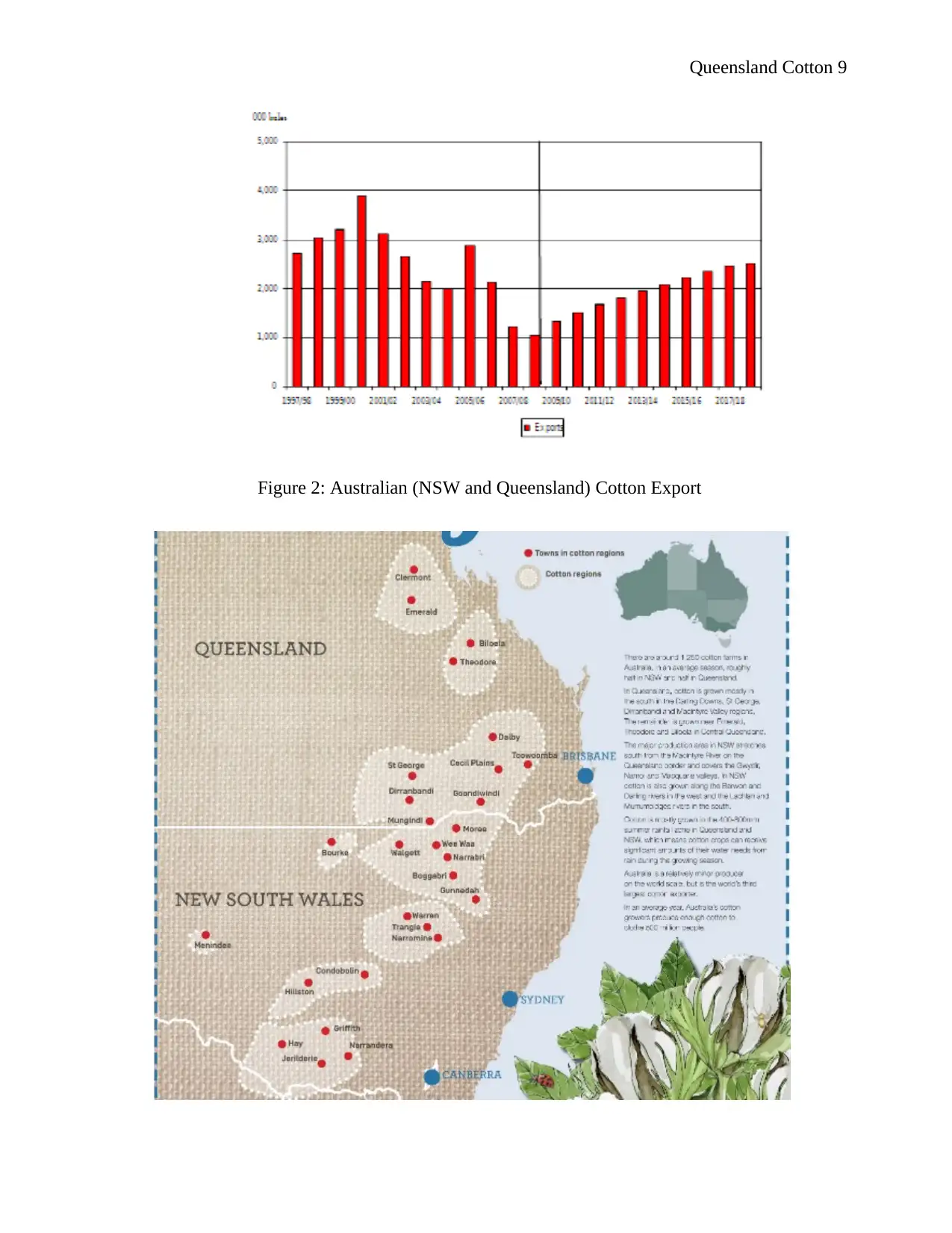

Figure 3: Queensland and NSW cotton growing areas

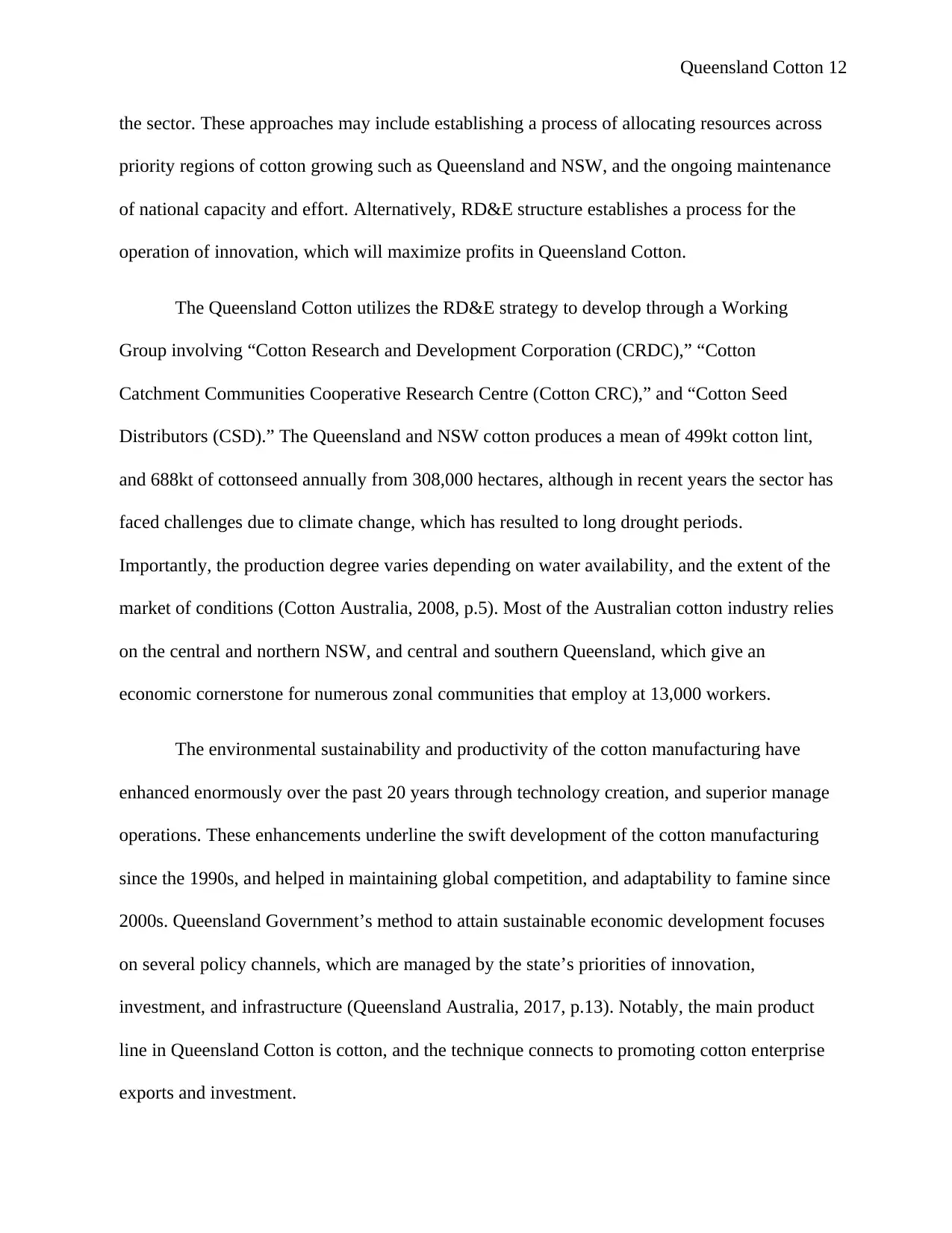

The cotton production costs in Australia is among the lowest in the world. The industry

has one of the most exceptional average cotton yields of seven bales in the world, which is

about 2.6 times the world’s average. Notably, Australia has 800 cotton growers with 72 percent

based in NSW, and 28 percent in Queensland. Therefore, the total Australian cotton growing

regions is about 537,000 hectares. NSW and Queensland cotton export about 3million bales

annually, with its major export countries being Indonesia, Japan, China, and Thailand (de Garis,

2013, p.3). Hence, the Australian cotton industry generates credible export revenue of about one

billion dollars annually, and the employment needs for rural communities in Australia.

Queensland Government (2013, p.37) suggest that the GVP for cotton from 2013 to

2014 forecasted a 648 million dollar cash sale of cotton from Queensland, which was two

percent more than the final estimate of DAFF from 2012 and 2013. Notably, this was ten

percent more than the average for the previous five years. The total plated cotton locations in

Queensland decreased in 2013 and 2014 by 500 hectares. Fortunately, the prediction made was

that there was no effect on the average yields as there was a decrease in irrigated cotton farms,

cottonseed and cotton lint mass production.

The cotton cost per bale was expected to remain constant at 400 dollars per bale, and the

price of cottonseed remained steady at 335 dollars per tonne. Alternatively, the irrigated cotton

cropping region was predicted to elevate by five percent to at least 133,000 hectares across

Queensland states. These states include Darling Downs at 35,000 hectares, Dirranbandi areas at

53,000 hectares, Border Rivers at 25,000 hectares, and 20,000 hectares at Central Queensland.

Importantly, the slight decrease in supplies of irrigation water in Macintyre, “Condamine,”

“Barwon and Moonie Rivers,” and “Border Rivers” areas have been experienced since the

Figure 3: Queensland and NSW cotton growing areas

The cotton production costs in Australia is among the lowest in the world. The industry

has one of the most exceptional average cotton yields of seven bales in the world, which is

about 2.6 times the world’s average. Notably, Australia has 800 cotton growers with 72 percent

based in NSW, and 28 percent in Queensland. Therefore, the total Australian cotton growing

regions is about 537,000 hectares. NSW and Queensland cotton export about 3million bales

annually, with its major export countries being Indonesia, Japan, China, and Thailand (de Garis,

2013, p.3). Hence, the Australian cotton industry generates credible export revenue of about one

billion dollars annually, and the employment needs for rural communities in Australia.

Queensland Government (2013, p.37) suggest that the GVP for cotton from 2013 to

2014 forecasted a 648 million dollar cash sale of cotton from Queensland, which was two

percent more than the final estimate of DAFF from 2012 and 2013. Notably, this was ten

percent more than the average for the previous five years. The total plated cotton locations in

Queensland decreased in 2013 and 2014 by 500 hectares. Fortunately, the prediction made was

that there was no effect on the average yields as there was a decrease in irrigated cotton farms,

cottonseed and cotton lint mass production.

The cotton cost per bale was expected to remain constant at 400 dollars per bale, and the

price of cottonseed remained steady at 335 dollars per tonne. Alternatively, the irrigated cotton

cropping region was predicted to elevate by five percent to at least 133,000 hectares across

Queensland states. These states include Darling Downs at 35,000 hectares, Dirranbandi areas at

53,000 hectares, Border Rivers at 25,000 hectares, and 20,000 hectares at Central Queensland.

Importantly, the slight decrease in supplies of irrigation water in Macintyre, “Condamine,”

“Barwon and Moonie Rivers,” and “Border Rivers” areas have been experienced since the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Queensland Cotton 11

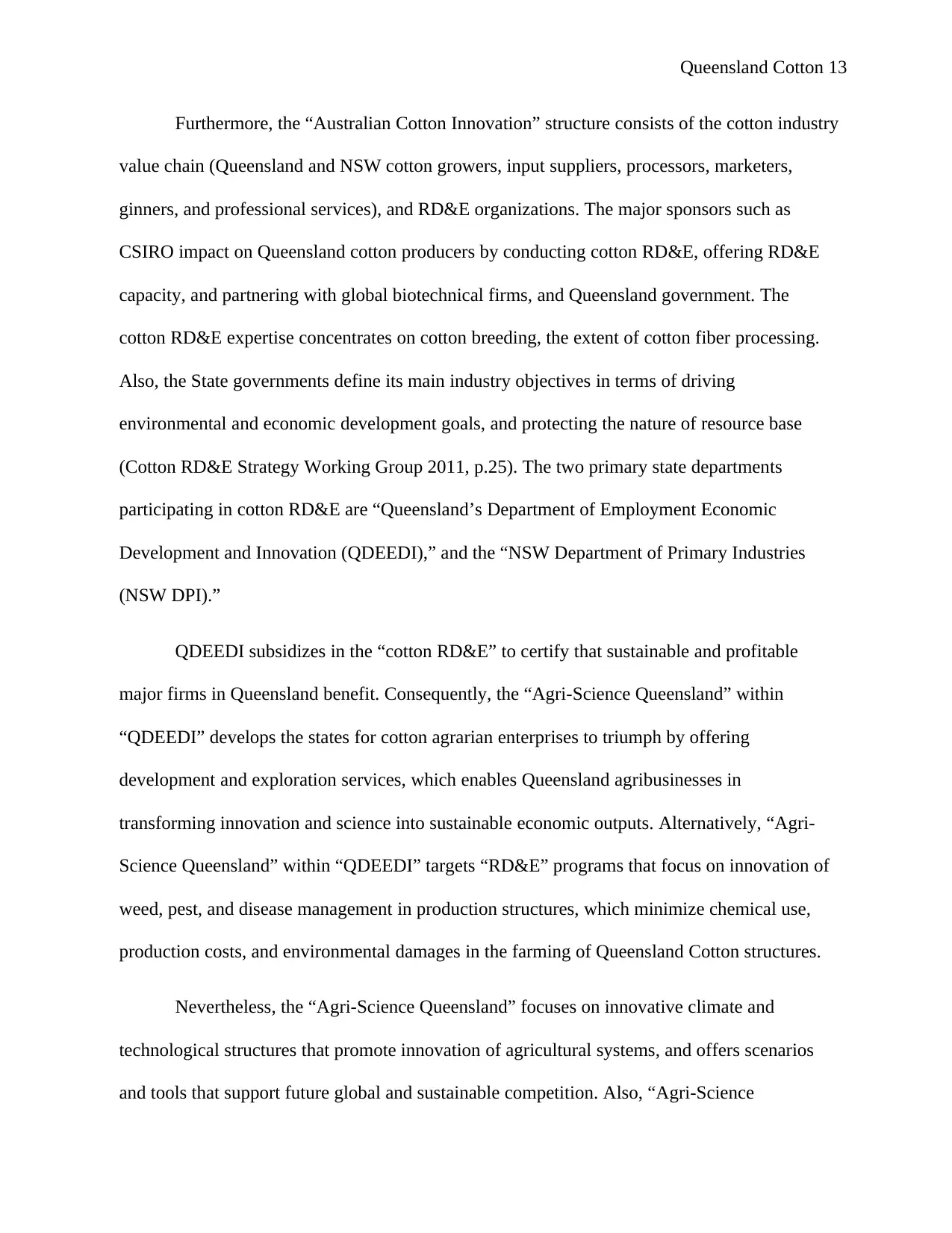

previous 2012. Fortunately, ample water remains stored for Queensland cotton growers who

prefer irrigation; figure 4 illustrates the same. Queensland Government (2013) notes;

“A forecast increase in area sown and under irrigation of 6000 hectares in 2013–14 is

expected to increase cotton lint production to 1 269 500 bales (288 177 tonnes), up

29 500 bales from the 2012–13 level. Cottonseed production is also forecast to increase

by 9710 tonnes from the 2012–13 level of 408 146 tonnes to 417 856 tonnes for 2013–

14 (p.37).”

Figure 4: Queensland irrigation dams and their volume of water in 2013

2.2.1 Business Units and Product and Service Lines

Cotton RD&E Strategy Working Group (2011, p.1) suggests that the “Australia’s rural

Research Development and Extension (RD&E)” structure aims at improving the profitability,

output, global competition, and maintainability of Queensland Cotton with benefits for grower

and exporter businesses. The cotton sector has an RD&E approach, which is set out for RD&E

organizations, which collaborate on a national level to examine the strategies needed to enhance

previous 2012. Fortunately, ample water remains stored for Queensland cotton growers who

prefer irrigation; figure 4 illustrates the same. Queensland Government (2013) notes;

“A forecast increase in area sown and under irrigation of 6000 hectares in 2013–14 is

expected to increase cotton lint production to 1 269 500 bales (288 177 tonnes), up

29 500 bales from the 2012–13 level. Cottonseed production is also forecast to increase

by 9710 tonnes from the 2012–13 level of 408 146 tonnes to 417 856 tonnes for 2013–

14 (p.37).”

Figure 4: Queensland irrigation dams and their volume of water in 2013

2.2.1 Business Units and Product and Service Lines

Cotton RD&E Strategy Working Group (2011, p.1) suggests that the “Australia’s rural

Research Development and Extension (RD&E)” structure aims at improving the profitability,

output, global competition, and maintainability of Queensland Cotton with benefits for grower

and exporter businesses. The cotton sector has an RD&E approach, which is set out for RD&E

organizations, which collaborate on a national level to examine the strategies needed to enhance

Queensland Cotton 12

the sector. These approaches may include establishing a process of allocating resources across

priority regions of cotton growing such as Queensland and NSW, and the ongoing maintenance

of national capacity and effort. Alternatively, RD&E structure establishes a process for the

operation of innovation, which will maximize profits in Queensland Cotton.

The Queensland Cotton utilizes the RD&E strategy to develop through a Working

Group involving “Cotton Research and Development Corporation (CRDC),” “Cotton

Catchment Communities Cooperative Research Centre (Cotton CRC),” and “Cotton Seed

Distributors (CSD).” The Queensland and NSW cotton produces a mean of 499kt cotton lint,

and 688kt of cottonseed annually from 308,000 hectares, although in recent years the sector has

faced challenges due to climate change, which has resulted to long drought periods.

Importantly, the production degree varies depending on water availability, and the extent of the

market of conditions (Cotton Australia, 2008, p.5). Most of the Australian cotton industry relies

on the central and northern NSW, and central and southern Queensland, which give an

economic cornerstone for numerous zonal communities that employ at 13,000 workers.

The environmental sustainability and productivity of the cotton manufacturing have

enhanced enormously over the past 20 years through technology creation, and superior manage

operations. These enhancements underline the swift development of the cotton manufacturing

since the 1990s, and helped in maintaining global competition, and adaptability to famine since

2000s. Queensland Government’s method to attain sustainable economic development focuses

on several policy channels, which are managed by the state’s priorities of innovation,

investment, and infrastructure (Queensland Australia, 2017, p.13). Notably, the main product

line in Queensland Cotton is cotton, and the technique connects to promoting cotton enterprise

exports and investment.

the sector. These approaches may include establishing a process of allocating resources across

priority regions of cotton growing such as Queensland and NSW, and the ongoing maintenance

of national capacity and effort. Alternatively, RD&E structure establishes a process for the

operation of innovation, which will maximize profits in Queensland Cotton.

The Queensland Cotton utilizes the RD&E strategy to develop through a Working

Group involving “Cotton Research and Development Corporation (CRDC),” “Cotton

Catchment Communities Cooperative Research Centre (Cotton CRC),” and “Cotton Seed

Distributors (CSD).” The Queensland and NSW cotton produces a mean of 499kt cotton lint,

and 688kt of cottonseed annually from 308,000 hectares, although in recent years the sector has

faced challenges due to climate change, which has resulted to long drought periods.

Importantly, the production degree varies depending on water availability, and the extent of the

market of conditions (Cotton Australia, 2008, p.5). Most of the Australian cotton industry relies

on the central and northern NSW, and central and southern Queensland, which give an

economic cornerstone for numerous zonal communities that employ at 13,000 workers.

The environmental sustainability and productivity of the cotton manufacturing have

enhanced enormously over the past 20 years through technology creation, and superior manage

operations. These enhancements underline the swift development of the cotton manufacturing

since the 1990s, and helped in maintaining global competition, and adaptability to famine since

2000s. Queensland Government’s method to attain sustainable economic development focuses

on several policy channels, which are managed by the state’s priorities of innovation,

investment, and infrastructure (Queensland Australia, 2017, p.13). Notably, the main product

line in Queensland Cotton is cotton, and the technique connects to promoting cotton enterprise

exports and investment.

You're viewing a preview

Unlock full access by subscribing today!

Queensland Cotton 13

Furthermore, the “Australian Cotton Innovation” structure consists of the cotton industry

value chain (Queensland and NSW cotton growers, input suppliers, processors, marketers,

ginners, and professional services), and RD&E organizations. The major sponsors such as

CSIRO impact on Queensland cotton producers by conducting cotton RD&E, offering RD&E

capacity, and partnering with global biotechnical firms, and Queensland government. The

cotton RD&E expertise concentrates on cotton breeding, the extent of cotton fiber processing.

Also, the State governments define its main industry objectives in terms of driving

environmental and economic development goals, and protecting the nature of resource base

(Cotton RD&E Strategy Working Group 2011, p.25). The two primary state departments

participating in cotton RD&E are “Queensland’s Department of Employment Economic

Development and Innovation (QDEEDI),” and the “NSW Department of Primary Industries

(NSW DPI).”

QDEEDI subsidizes in the “cotton RD&E” to certify that sustainable and profitable

major firms in Queensland benefit. Consequently, the “Agri-Science Queensland” within

“QDEEDI” develops the states for cotton agrarian enterprises to triumph by offering

development and exploration services, which enables Queensland agribusinesses in

transforming innovation and science into sustainable economic outputs. Alternatively, “Agri-

Science Queensland” within “QDEEDI” targets “RD&E” programs that focus on innovation of

weed, pest, and disease management in production structures, which minimize chemical use,

production costs, and environmental damages in the farming of Queensland Cotton structures.

Nevertheless, the “Agri-Science Queensland” focuses on innovative climate and

technological structures that promote innovation of agricultural systems, and offers scenarios

and tools that support future global and sustainable competition. Also, “Agri-Science

Furthermore, the “Australian Cotton Innovation” structure consists of the cotton industry

value chain (Queensland and NSW cotton growers, input suppliers, processors, marketers,

ginners, and professional services), and RD&E organizations. The major sponsors such as

CSIRO impact on Queensland cotton producers by conducting cotton RD&E, offering RD&E

capacity, and partnering with global biotechnical firms, and Queensland government. The

cotton RD&E expertise concentrates on cotton breeding, the extent of cotton fiber processing.

Also, the State governments define its main industry objectives in terms of driving

environmental and economic development goals, and protecting the nature of resource base

(Cotton RD&E Strategy Working Group 2011, p.25). The two primary state departments

participating in cotton RD&E are “Queensland’s Department of Employment Economic

Development and Innovation (QDEEDI),” and the “NSW Department of Primary Industries

(NSW DPI).”

QDEEDI subsidizes in the “cotton RD&E” to certify that sustainable and profitable

major firms in Queensland benefit. Consequently, the “Agri-Science Queensland” within

“QDEEDI” develops the states for cotton agrarian enterprises to triumph by offering

development and exploration services, which enables Queensland agribusinesses in

transforming innovation and science into sustainable economic outputs. Alternatively, “Agri-

Science Queensland” within “QDEEDI” targets “RD&E” programs that focus on innovation of

weed, pest, and disease management in production structures, which minimize chemical use,

production costs, and environmental damages in the farming of Queensland Cotton structures.

Nevertheless, the “Agri-Science Queensland” focuses on innovative climate and

technological structures that promote innovation of agricultural systems, and offers scenarios

and tools that support future global and sustainable competition. Also, “Agri-Science

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Queensland Cotton 14

Queensland” promotes farming structures that reduce the environmental influence on

agricultural production by utilizing advanced farming strategies, and enhanced water use

efficiency. Queensland’s biosecurity within “QDEEDI” conveys an “RD&E program,” which

buttress emerging and tropical biosecurity ultimatums (Cotton RD&E Strategy Working Group

2011, p.26). Additionally, it prioritizes on the comprehensive biosecurity continuum,

preparedness, exotic threats prevention, and surveillance.

In the past few years, the demand of Queensland Cotton has reduced in China that

marked the beginning of the “End of a World Surplus,” and a probable return to better demand

for cotton. As a result, Olam has noted a decrease in government influence in Queensland’s

cotton sector, and a less direct market, for instance, China’s cotton is sold directly by cotton

growers to ginners (Hegde, n.d.). Olam further suggests that cotton demand and supply has at

least reached a balanced position, with the present supply at almost 15 million bales, and a

demand of about 118 million bales. Notably, the global GDP growth of two percent to three

percent should be a positive indicator for Queensland’s cotton sector.

Olam cotton has a well-vast portfolio sourcing all cotton varieties from Africa, America,

and Australia, Queensland (Olam, 2017, p.1). Queensland Cotton production is quite variable,

and the State has at least 600 growers occasionally producing at least one million bales

annually. This value in output generates between 500 million dollars and 900 million dollars,

which includes cottonseed value annually. Typically, water and energy play a key input in

determine Queensland Cotton production, although cotton production is heavily reliant on the

consultation procedures connecting to power. Therefore, traffic pricing strategies that precisely

reflect the nature of consumer use would achieve a sustainable price mechanism, which

encourages the use of the available infrastructure.

Queensland” promotes farming structures that reduce the environmental influence on

agricultural production by utilizing advanced farming strategies, and enhanced water use

efficiency. Queensland’s biosecurity within “QDEEDI” conveys an “RD&E program,” which

buttress emerging and tropical biosecurity ultimatums (Cotton RD&E Strategy Working Group

2011, p.26). Additionally, it prioritizes on the comprehensive biosecurity continuum,

preparedness, exotic threats prevention, and surveillance.

In the past few years, the demand of Queensland Cotton has reduced in China that

marked the beginning of the “End of a World Surplus,” and a probable return to better demand

for cotton. As a result, Olam has noted a decrease in government influence in Queensland’s

cotton sector, and a less direct market, for instance, China’s cotton is sold directly by cotton

growers to ginners (Hegde, n.d.). Olam further suggests that cotton demand and supply has at

least reached a balanced position, with the present supply at almost 15 million bales, and a

demand of about 118 million bales. Notably, the global GDP growth of two percent to three

percent should be a positive indicator for Queensland’s cotton sector.

Olam cotton has a well-vast portfolio sourcing all cotton varieties from Africa, America,

and Australia, Queensland (Olam, 2017, p.1). Queensland Cotton production is quite variable,

and the State has at least 600 growers occasionally producing at least one million bales

annually. This value in output generates between 500 million dollars and 900 million dollars,

which includes cottonseed value annually. Typically, water and energy play a key input in

determine Queensland Cotton production, although cotton production is heavily reliant on the

consultation procedures connecting to power. Therefore, traffic pricing strategies that precisely

reflect the nature of consumer use would achieve a sustainable price mechanism, which

encourages the use of the available infrastructure.

Queensland Cotton 15

2.2.2 Business Revenue Units and the Importance of the Largest Revenue Units

Queensland Government (2018, p.10) mentions that during 2015 and 2016, there were at

least 16,200 farm enterprises in Queensland. Conversely, for cotton farming to be profitable, the

Queensland cotton growers require to maintain minimized costs and high yields. Thus, farms

need carefully monitor water use, and pest degree that affects the soil quality. Australia cotton

seems to gain strength due to numerous people who have engaged in the business, and the

increased demand for cotton (Kennedy, 2018). About 3,000 hectares of dryland cotton was

farmed at “Queensland’s Gulf County” in 2017, which mentioned that in 2018 season the

ABARES forecast expected an increase of four percent on cotton production from NSW and

Queensland.

Cotton is one of the leading platforms for Olam, which made acquisitions with

integration and purchase of Queensland cotton. Currently, Olam cotton is the second global

head in a cotton volume that exceeds one million metric tonnes per year. The cotton sector

encounters various challenges in recent years, although the ability to plan and deal with supply

stocks, cost volatility, and shifting in demand patterns have been primary competitive merit. In

2011, the cotton cot volatility changed in demand from natural fibers to synthetic fibers.

Contrary, in 2014, the pricing and demand for Queensland Cotton began to stabilize, and there

was a steady growth for natural fibers, in spite of the continuous faster growth in synthetic

demand. This indicated a minimum rate of substitution, and rising demand for both types of

fibers.

Australian cotton comply from two primary areas; NSW and Queensland. As such, the

Australian cotton is exchanged in a highly globalized merchandise, and it competes against a

hundred other cotton producing countries. Hence, the Australian cotton industry needs to earn a

2.2.2 Business Revenue Units and the Importance of the Largest Revenue Units

Queensland Government (2018, p.10) mentions that during 2015 and 2016, there were at

least 16,200 farm enterprises in Queensland. Conversely, for cotton farming to be profitable, the

Queensland cotton growers require to maintain minimized costs and high yields. Thus, farms

need carefully monitor water use, and pest degree that affects the soil quality. Australia cotton

seems to gain strength due to numerous people who have engaged in the business, and the

increased demand for cotton (Kennedy, 2018). About 3,000 hectares of dryland cotton was

farmed at “Queensland’s Gulf County” in 2017, which mentioned that in 2018 season the

ABARES forecast expected an increase of four percent on cotton production from NSW and

Queensland.

Cotton is one of the leading platforms for Olam, which made acquisitions with

integration and purchase of Queensland cotton. Currently, Olam cotton is the second global

head in a cotton volume that exceeds one million metric tonnes per year. The cotton sector

encounters various challenges in recent years, although the ability to plan and deal with supply

stocks, cost volatility, and shifting in demand patterns have been primary competitive merit. In

2011, the cotton cot volatility changed in demand from natural fibers to synthetic fibers.

Contrary, in 2014, the pricing and demand for Queensland Cotton began to stabilize, and there

was a steady growth for natural fibers, in spite of the continuous faster growth in synthetic

demand. This indicated a minimum rate of substitution, and rising demand for both types of

fibers.

Australian cotton comply from two primary areas; NSW and Queensland. As such, the

Australian cotton is exchanged in a highly globalized merchandise, and it competes against a

hundred other cotton producing countries. Hence, the Australian cotton industry needs to earn a

You're viewing a preview

Unlock full access by subscribing today!

Queensland Cotton 16

stature as a dependable supplier, with efficient conveyance channels to export terminuses, and

timely remittance (Cotton Australian, n.d.). The Australian cotton industry has a high demand

and attracts premium prices because of the high-quality features, proven accomplishment, and

reliability in tweetup of consumer and manufacturer wants. Notably, cotton from Queensland

consistently has zero contamination and is shipped from Australian ports to other Asian

markets.

Queensland Cotton exports the cotton through Brisbane, Sydney, and Melbourne. In

2013, Indonesia, Thailand, Pakistan, Bangladesh, and China were Queensland’s leading markets

for cotton, which makes Australia the third largest cotton exporter globally; behind the United

States and India. More than 1.25 billion kilograms of cotton seeds were produced in Queensland

and NSW during 2013 and 2014 season. Australia exports cottonseeds to China, Japan, Korea,

and the U.S depending on the parity cost and the Australian dollar value (Australian

Government, 2018, p.55). In 2014, seed value exports were at 255 million Australian dollars

from 2009 to 2014, the Australian cotton crop from Queensland and NSW was worth two

billion dollars.

Queensland cotton growers vend their product to one of the independent Australian

merchants, who in turn sells it to the global merchandises, which an aim of making the best

price valuable; occasionally, it is a transparent and competitive market. The amount the growers

get for each cotton bale manufactured is set by the global market that relies on various elements

such as conditions of the global economy, fashion trends, agricultural politics, price of synthetic

fiber, climate, and cotton’s demand and supply. The cost of cotton ranges between 300

Australian dollars per bale and 600 Australian dollars per bale. Cotton Australia (2014, p.23)

argues that the highest price ever recorded on the price of Australian cotton was 758 dollars per

stature as a dependable supplier, with efficient conveyance channels to export terminuses, and

timely remittance (Cotton Australian, n.d.). The Australian cotton industry has a high demand

and attracts premium prices because of the high-quality features, proven accomplishment, and

reliability in tweetup of consumer and manufacturer wants. Notably, cotton from Queensland

consistently has zero contamination and is shipped from Australian ports to other Asian

markets.

Queensland Cotton exports the cotton through Brisbane, Sydney, and Melbourne. In

2013, Indonesia, Thailand, Pakistan, Bangladesh, and China were Queensland’s leading markets

for cotton, which makes Australia the third largest cotton exporter globally; behind the United

States and India. More than 1.25 billion kilograms of cotton seeds were produced in Queensland

and NSW during 2013 and 2014 season. Australia exports cottonseeds to China, Japan, Korea,

and the U.S depending on the parity cost and the Australian dollar value (Australian

Government, 2018, p.55). In 2014, seed value exports were at 255 million Australian dollars

from 2009 to 2014, the Australian cotton crop from Queensland and NSW was worth two

billion dollars.

Queensland cotton growers vend their product to one of the independent Australian

merchants, who in turn sells it to the global merchandises, which an aim of making the best

price valuable; occasionally, it is a transparent and competitive market. The amount the growers

get for each cotton bale manufactured is set by the global market that relies on various elements

such as conditions of the global economy, fashion trends, agricultural politics, price of synthetic

fiber, climate, and cotton’s demand and supply. The cost of cotton ranges between 300

Australian dollars per bale and 600 Australian dollars per bale. Cotton Australia (2014, p.23)

argues that the highest price ever recorded on the price of Australian cotton was 758 dollars per

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Queensland Cotton 17

bale (1995), while the lost being 233 dollars per bale (1986). In 2011, prices were high due to

short-term cotton shortages in exportable regions, which made the value of Australian cotton to

be at 664 dollars per bale. During 2009 and 2014 the amount was 396 dollars per bale, while

between 2011 and 2014 the prices were 440 dollars per bale.

The cotton lint consists of 42 percent of the pricked Australian cotton from NSW and

Queensland, and bestows approximately 85 percent of the total income from the cotton plant.

The other 15 percent of income is from cottonseeds. There is a direct market for Australian

cotton where agronomists can vend their cotton produce at a fixed price up to three years

forwards. Queensland growers have a tremendous stature for good enterprise execution in the

global market because of agreement sanctities, and dependable counterparties, and abidance to

the “International Cotton Association (ICA).” Queensland cotton agronomists are acuity of the

market, and understand the components making up their cotton prices. In addition, they monitor

cost movements, and take actions depending on the price levels that are appropriate to their

enterprises (Cotton Australia, 2018, p.2).

3.1. Business Level Strategies

3.1.1. Cost Leadership

This offers the best cost for items. Currently, globalized markets determine a significant

factor in vending goods or services to a customer. The “Big box” stores utilize collective styles

for pricing, which keeps costs lower than most. The new marketplaces do not need the

significant retail overheads which “brick-and-mortar” outlets do. Alternatively, a “cost

leadership” approach considers the price to make on items, transport, and deliver them to

consumers (Thompson 2019). Importantly, the value point is influenced when distributions are

bale (1995), while the lost being 233 dollars per bale (1986). In 2011, prices were high due to

short-term cotton shortages in exportable regions, which made the value of Australian cotton to

be at 664 dollars per bale. During 2009 and 2014 the amount was 396 dollars per bale, while

between 2011 and 2014 the prices were 440 dollars per bale.

The cotton lint consists of 42 percent of the pricked Australian cotton from NSW and

Queensland, and bestows approximately 85 percent of the total income from the cotton plant.

The other 15 percent of income is from cottonseeds. There is a direct market for Australian

cotton where agronomists can vend their cotton produce at a fixed price up to three years

forwards. Queensland growers have a tremendous stature for good enterprise execution in the

global market because of agreement sanctities, and dependable counterparties, and abidance to

the “International Cotton Association (ICA).” Queensland cotton agronomists are acuity of the

market, and understand the components making up their cotton prices. In addition, they monitor

cost movements, and take actions depending on the price levels that are appropriate to their

enterprises (Cotton Australia, 2018, p.2).

3.1. Business Level Strategies

3.1.1. Cost Leadership

This offers the best cost for items. Currently, globalized markets determine a significant

factor in vending goods or services to a customer. The “Big box” stores utilize collective styles

for pricing, which keeps costs lower than most. The new marketplaces do not need the

significant retail overheads which “brick-and-mortar” outlets do. Alternatively, a “cost

leadership” approach considers the price to make on items, transport, and deliver them to

consumers (Thompson 2019). Importantly, the value point is influenced when distributions are

Queensland Cotton 18

readily available, and the price an enterprise incurs in making a switch on suppliers and vendors

if their prices become high.

A firm that follows a cost leadership approach offers services and products with

acceptable features and quality to an extensive set of consumers at a minimum price. For

instance, Walmart is one of the most famous cost leaders that used this technique to become the

largest firm globally. The company’s publicizing slogan includes “Always Low Prices” and

“Save Money Live Better” emphasizes on “Walmart’s” point on levy minimizing to potential

consumers. Importantly, “Walmart” has the most diverse customer base of any company in the

U.S. The firm has approximately 100 million Americans visiting “Walmart” in a normal week;

thus, about a third of Americans are regular “Walmart” consumers. Therefore, the vast

consumer base includes individuals from all social and demographic groups within society.

Cost leaders occasionally share some essential characteristics, which include the

capability to levy minimum costs and still make a gain, although it is barriers. Cost heads

manage this by insisting on coherence. For instance, “Waffle House,” consumers are served

inexpensive meals speedily to keep booth available for later consumers. Muasa (2014, p.174)

asserts, “As part of the effort to be efficient, most cost leaders spend little on advertising, market

research, or research and development.” Thus, “Waffle House” restricts its publicizing to many

billboards along highways, and it simplifies its menu that needs minimal studies and builds out.

Most of the cost heads depend on economies of scale in achieving coherence. The

economies of scale are developed when the prices of providing services and products decrease

as a company can sell more products. This happens because expenses get distributed across a

broader number of items. Notably, Walmart spent about two billion dollars on advertising in

2008, which is a massive number, although “Walmart” is so large that it is publicizing tolls

readily available, and the price an enterprise incurs in making a switch on suppliers and vendors

if their prices become high.

A firm that follows a cost leadership approach offers services and products with

acceptable features and quality to an extensive set of consumers at a minimum price. For

instance, Walmart is one of the most famous cost leaders that used this technique to become the

largest firm globally. The company’s publicizing slogan includes “Always Low Prices” and

“Save Money Live Better” emphasizes on “Walmart’s” point on levy minimizing to potential

consumers. Importantly, “Walmart” has the most diverse customer base of any company in the

U.S. The firm has approximately 100 million Americans visiting “Walmart” in a normal week;

thus, about a third of Americans are regular “Walmart” consumers. Therefore, the vast

consumer base includes individuals from all social and demographic groups within society.

Cost leaders occasionally share some essential characteristics, which include the

capability to levy minimum costs and still make a gain, although it is barriers. Cost heads

manage this by insisting on coherence. For instance, “Waffle House,” consumers are served

inexpensive meals speedily to keep booth available for later consumers. Muasa (2014, p.174)

asserts, “As part of the effort to be efficient, most cost leaders spend little on advertising, market

research, or research and development.” Thus, “Waffle House” restricts its publicizing to many

billboards along highways, and it simplifies its menu that needs minimal studies and builds out.

Most of the cost heads depend on economies of scale in achieving coherence. The

economies of scale are developed when the prices of providing services and products decrease

as a company can sell more products. This happens because expenses get distributed across a

broader number of items. Notably, Walmart spent about two billion dollars on advertising in

2008, which is a massive number, although “Walmart” is so large that it is publicizing tolls

You're viewing a preview

Unlock full access by subscribing today!

Queensland Cotton 19

equal just a minimal fraction of its disposals. Cost heads are commonly large firms that allow

them to demand cost compromises from their several suppliers. Importantly, “Walmart” is

notorious for forcing suppliers such as “Procter & Gamble” to vend goods to “Walmart” for a

lower price over time. The company passes some of these savings to consumers in the form of

minimized costs in its outlets.

Cost Leadership Approach of Queensland Cotton

Queensland Cotton utilize the cost leadership technique to produce cotton at an

acceptable quality, and consistently minimum production costs than its rivals. The strategy

protects Queensland Cotton from industry forces by preventing new entrants from matching low

prices. Notably, Queensland cotton utilizes three primary elements to achieve cost leadership

approach; “Cotton Innovation Network,” CRDC approach and investment, and myBMP (Cotton

Australia, 2013, p.10). The CRDC technique maximizes meeting efficiency, and use of modern

information platforms, which enables firms to utilize cost leadership in Queensland Cotton.

Alternatively, myBMP works together with RD&E organizations in Queensland, and they

improve the general performance of myBMP structure that is conducive cotton firms in

Queensland. The three strategies enable Queensland Cotton sponsors to maintain relationships

with growers, and the government, which helps in attaining a cost leadership approach in the

management of cotton firm performance.

3.1.2. Differentiation

In this approach, companies attempt to have their services and items to be perceived as

exquisite to obtain a premium price. Hence, brand-loyal consumers are occasionally a sign that

the strategy is effective. Multiple examples exist on the same such as Casino vs. Rolex watches;

equal just a minimal fraction of its disposals. Cost heads are commonly large firms that allow

them to demand cost compromises from their several suppliers. Importantly, “Walmart” is

notorious for forcing suppliers such as “Procter & Gamble” to vend goods to “Walmart” for a

lower price over time. The company passes some of these savings to consumers in the form of

minimized costs in its outlets.

Cost Leadership Approach of Queensland Cotton

Queensland Cotton utilize the cost leadership technique to produce cotton at an

acceptable quality, and consistently minimum production costs than its rivals. The strategy

protects Queensland Cotton from industry forces by preventing new entrants from matching low

prices. Notably, Queensland cotton utilizes three primary elements to achieve cost leadership

approach; “Cotton Innovation Network,” CRDC approach and investment, and myBMP (Cotton

Australia, 2013, p.10). The CRDC technique maximizes meeting efficiency, and use of modern

information platforms, which enables firms to utilize cost leadership in Queensland Cotton.

Alternatively, myBMP works together with RD&E organizations in Queensland, and they

improve the general performance of myBMP structure that is conducive cotton firms in

Queensland. The three strategies enable Queensland Cotton sponsors to maintain relationships

with growers, and the government, which helps in attaining a cost leadership approach in the

management of cotton firm performance.

3.1.2. Differentiation

In this approach, companies attempt to have their services and items to be perceived as

exquisite to obtain a premium price. Hence, brand-loyal consumers are occasionally a sign that

the strategy is effective. Multiple examples exist on the same such as Casino vs. Rolex watches;

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Queensland Cotton 20

t-shirts from Abercrombie and Fitch vs. Walmart. The underlying root for differentiation

insinuates that the service or product a consumer is willing to pay a premium for is the

foundation of the approach (Gallagher, 2008, p.3). Thus, companies seek to apply this method

should focus on innovation, quality, and consumer responsiveness. Importantly, innovation is

useful and familiar to differentiators, and companies should make an effort to not punish failure

as most innovations, particularly on new products.

Differentiation approach is based on providing customers with something different,

which makes the firm’s service or distinct product from its rivals. Furthermore, the primary

assumption behind the strategy is that the buyers are willing to pay higher prices for a product

that is unique in a meaningful way (Bordes, 2009, p.9). Hence, superior value is developed as

the product is of more prime importance.

Differentiation Approach by Queensland Cotton

The operational technique utilizes operational activities that are organized into a value

chain to achieve the differentiation method. The 1991 Porter’s framework describes these

generic operational activities. Queensland Cotton can accomplish the differentiation technique

through sales and marketing, supporting R&D, which form the “basic unit of competitive

advantage” (University of Technology Sydney, 2015, p.33).

3.1.3. Integrated Cost Leadership and Differentiation Strategy

This is a hybrid technique that has become vital due to competitive nature in the world.

Typically, companies depend on a single inclusive approach, while firms that merge the

universal techniques may position themselves to enhance their capability to modify the

environmental changes fast, and acquire new expertise and telecommunication (Baroto,

t-shirts from Abercrombie and Fitch vs. Walmart. The underlying root for differentiation

insinuates that the service or product a consumer is willing to pay a premium for is the

foundation of the approach (Gallagher, 2008, p.3). Thus, companies seek to apply this method

should focus on innovation, quality, and consumer responsiveness. Importantly, innovation is

useful and familiar to differentiators, and companies should make an effort to not punish failure

as most innovations, particularly on new products.

Differentiation approach is based on providing customers with something different,

which makes the firm’s service or distinct product from its rivals. Furthermore, the primary

assumption behind the strategy is that the buyers are willing to pay higher prices for a product

that is unique in a meaningful way (Bordes, 2009, p.9). Hence, superior value is developed as

the product is of more prime importance.

Differentiation Approach by Queensland Cotton

The operational technique utilizes operational activities that are organized into a value

chain to achieve the differentiation method. The 1991 Porter’s framework describes these

generic operational activities. Queensland Cotton can accomplish the differentiation technique

through sales and marketing, supporting R&D, which form the “basic unit of competitive

advantage” (University of Technology Sydney, 2015, p.33).

3.1.3. Integrated Cost Leadership and Differentiation Strategy

This is a hybrid technique that has become vital due to competitive nature in the world.

Typically, companies depend on a single inclusive approach, while firms that merge the

universal techniques may position themselves to enhance their capability to modify the

environmental changes fast, and acquire new expertise and telecommunication (Baroto,

Queensland Cotton 21

Abdullah and Wan, 2012, p.123). Hence, it is more effective when leveraging core proficiencies

across enterprise units and item lines, which also assist in the production of a product with

differentiated attributes that consumers’ value; these offer differentiated items at a low cost

compared to its rival items. As a result, the several addictive satisfaction of successfully

pursuing the “cost leadership and differentiation” approach work simultaneously (Open

Learning World. Not.Com, n.d.). Notably, differentiation provides the company to levy

premium tolls, while cost leadership allows the firm to levy the lowest aggressive prices.

Therefore, the firm can achieve aggressive merit by providing value to consumers based on both

low prices and item features. Several factors also contribute to firms having a competitive edge,

and earn an above-average return from an integrated cost leadership and differentiation method.

These are;

1. Flexible Manufacturing Systems

This is a computer-regulated process utilized to manufacture several items in flexible and

moderate aggregates. It allows firms to attain the pliability that is essential to simultaneously

greet to shifts in consumer preferences and needs, while maintaining the low-cost advantage of

large-scale manufacturing. Hence, it elevates a firm’s capability to engage in an amalgamated

low cost and differentiation approach.

2. Information Networks across Firms

This enables a firm to coordinate reliance between the externally and internally executed value-

developing activities, which elevate responsiveness and flexibility. For instance, real-time

connections between manufacturers and subcontractors or suppliers, and between supplier and

retailers. These connections can enhance time-to-market a new item by coordinating the

Abdullah and Wan, 2012, p.123). Hence, it is more effective when leveraging core proficiencies

across enterprise units and item lines, which also assist in the production of a product with

differentiated attributes that consumers’ value; these offer differentiated items at a low cost

compared to its rival items. As a result, the several addictive satisfaction of successfully

pursuing the “cost leadership and differentiation” approach work simultaneously (Open

Learning World. Not.Com, n.d.). Notably, differentiation provides the company to levy

premium tolls, while cost leadership allows the firm to levy the lowest aggressive prices.

Therefore, the firm can achieve aggressive merit by providing value to consumers based on both

low prices and item features. Several factors also contribute to firms having a competitive edge,

and earn an above-average return from an integrated cost leadership and differentiation method.

These are;

1. Flexible Manufacturing Systems

This is a computer-regulated process utilized to manufacture several items in flexible and

moderate aggregates. It allows firms to attain the pliability that is essential to simultaneously

greet to shifts in consumer preferences and needs, while maintaining the low-cost advantage of

large-scale manufacturing. Hence, it elevates a firm’s capability to engage in an amalgamated

low cost and differentiation approach.

2. Information Networks across Firms

This enables a firm to coordinate reliance between the externally and internally executed value-

developing activities, which elevate responsiveness and flexibility. For instance, real-time

connections between manufacturers and subcontractors or suppliers, and between supplier and

retailers. These connections can enhance time-to-market a new item by coordinating the

You're viewing a preview

Unlock full access by subscribing today!

Queensland Cotton 22

production and design activities, and minimizing “out-of-stock” cases by shortening the “order-

restock cycle.”

3. Total Quality Management Systems

These structures are created to enhance an item’s classification depending on the consumer’s

needs, and are enhanced to upgrade the work rate in the execution of the interior value-

developing activities. Enhancing item quality prioritizes on the awareness of consumers on item

utility, reliability, and performance (Open Learning World. Not.Com, n.d.). Furthermore, the

systems enable a firm to differentiate its items, and charge higher prices, while decreasing the

cost of service and manufacturing.

Integrated Cost Leadership and Differentiation Strategy of Queensland Cotton

Queensland Cotton utilize the open method to achieve the “Integrated Cost Leadership

and Differentiation Strategy of Queensland Cotton.” The open strategic activities include

establishing an overarching strategic goal, and experimenting on newly acquired ideas between

the Queensland cotton producers from various firms, and develop new strategic data that

collaborates mechanisms that carry out the “open strategy process.” For this to work,

Queensland Cotton has to possess a set of favorable conditions that provide an economic

incentive (University of Technology Sydney, 2015, p.20).

3.1.4 Focus Technique

The focus technique centralized on a tiny segment within which it tries to attain either a

cost differentiation or advantage. A company uses the focused approach to enjoy a high degree

of consumer loyalty, and entrench commitment that discourages other companies from

competing directly (QuickMBA, n.d.). Therefore, companies that utilize this strategy

production and design activities, and minimizing “out-of-stock” cases by shortening the “order-

restock cycle.”

3. Total Quality Management Systems

These structures are created to enhance an item’s classification depending on the consumer’s

needs, and are enhanced to upgrade the work rate in the execution of the interior value-

developing activities. Enhancing item quality prioritizes on the awareness of consumers on item

utility, reliability, and performance (Open Learning World. Not.Com, n.d.). Furthermore, the

systems enable a firm to differentiate its items, and charge higher prices, while decreasing the

cost of service and manufacturing.

Integrated Cost Leadership and Differentiation Strategy of Queensland Cotton

Queensland Cotton utilize the open method to achieve the “Integrated Cost Leadership

and Differentiation Strategy of Queensland Cotton.” The open strategic activities include

establishing an overarching strategic goal, and experimenting on newly acquired ideas between

the Queensland cotton producers from various firms, and develop new strategic data that

collaborates mechanisms that carry out the “open strategy process.” For this to work,

Queensland Cotton has to possess a set of favorable conditions that provide an economic

incentive (University of Technology Sydney, 2015, p.20).

3.1.4 Focus Technique

The focus technique centralized on a tiny segment within which it tries to attain either a

cost differentiation or advantage. A company uses the focused approach to enjoy a high degree

of consumer loyalty, and entrench commitment that discourages other companies from

competing directly (QuickMBA, n.d.). Therefore, companies that utilize this strategy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Queensland Cotton 23

concentrates on specific niche markets by understanding the unique needs of consumers, and

understanding the markets’ dynamics that develop a low cost and well-specified item for the

market (MindTools, n.d.). As the market grows, the company may consider whether to use cost

leadership or difference as focus approach being its primary method.

1. Focus Cost Leadership Technique

A company using this strategy competes based on price targets on a tight market, and it

does not essentially levy the lowest costs in the market. Instead, it costs a minimum price that is

connected to other companies that contest within the earmark market. For instance, “Redbox”

utilizes vending machines placed outside grocery and other outlets to rent DVDs of movies for

one dollar. Importantly, various ways exist to view movies even cheaper such as through video

streaming subscriptions provided by Netflix. Therefore, among companies that rent out actual

DVDs, “Redbox” gives unparalleled levels of great conveniences and low prices (Libraries,

n.d.). Additionally, the nature of the small target market varies depending on the companies that

utilized a focused cost leadership approach. In some scenarios, the earmark statistics can

identify market. For example, Claire strives to plead to junior lasses by vending inexpensive

retrofits, ear piercings, and jewelry; the firm uses the focused cost leadership technique, and it is

successful as it has over three thousand areas, and has outlets in 95 percent of United States

shopping centers.

In other occurrences, the earmark market is identified by the distribution channel utilized

to reach consumers. Majority of pizza outlets give delivery, a sit-down service, or both.

Contrary, “Papa Murphy’s” vends pizzas that consumers bake at home as these pizzas are

inexpensive to be at home compared to the outlet (Libraries, n.d.). This enables “Papa

concentrates on specific niche markets by understanding the unique needs of consumers, and

understanding the markets’ dynamics that develop a low cost and well-specified item for the

market (MindTools, n.d.). As the market grows, the company may consider whether to use cost

leadership or difference as focus approach being its primary method.

1. Focus Cost Leadership Technique

A company using this strategy competes based on price targets on a tight market, and it

does not essentially levy the lowest costs in the market. Instead, it costs a minimum price that is

connected to other companies that contest within the earmark market. For instance, “Redbox”

utilizes vending machines placed outside grocery and other outlets to rent DVDs of movies for

one dollar. Importantly, various ways exist to view movies even cheaper such as through video

streaming subscriptions provided by Netflix. Therefore, among companies that rent out actual

DVDs, “Redbox” gives unparalleled levels of great conveniences and low prices (Libraries,

n.d.). Additionally, the nature of the small target market varies depending on the companies that

utilized a focused cost leadership approach. In some scenarios, the earmark statistics can

identify market. For example, Claire strives to plead to junior lasses by vending inexpensive

retrofits, ear piercings, and jewelry; the firm uses the focused cost leadership technique, and it is

successful as it has over three thousand areas, and has outlets in 95 percent of United States

shopping centers.

In other occurrences, the earmark market is identified by the distribution channel utilized

to reach consumers. Majority of pizza outlets give delivery, a sit-down service, or both.

Contrary, “Papa Murphy’s” vends pizzas that consumers bake at home as these pizzas are

inexpensive to be at home compared to the outlet (Libraries, n.d.). This enables “Papa

Queensland Cotton 24

Murphy’s” to recognize food coupons as a payment, which enables the firm to attract consumers

that may not afford a prepared pizza.

2. Focus Cost Differentiation Strategy

A focused differentiation method offers unique characteristics that attain the

importunities of the tight market. Some companies use this strategy to centralize their attempts

on a specific sales channel; for instance, vending over the online only. Another target specific

demographic groups such as Breezes Resorts that cater to couples without kids (Libraries, n.d.).

The company wields seven tropical retreats where globetrotters are assured that they may not be

irritated by disruptive and loud kids. Importantly, the differentiation approach involves giving

excellent characteristics that lead to a variety of consumers, and the need to please the wants of

tight merchandise.

Focused Technique of Queensland Cotton

Queensland Cotton achieve the focused technique through the RD&E approach, which

analysis the current resources that the private cotton sector can focus on, and distribution

channels that can assist in achieving the approach. Furthermore, the competitive strategy is

occasionally utilized by Queensland Cotton in gaining a “competitive advantage” through

having a well-structured operational approach. Notably, the innovation procedure and open

R&D connects activities that provide new information that will help the company create and

fine-tune its operational technique.

4.1 The Business Level Approach of Queensland Cotton

The Queensland Cotton is primarily a premium cotton supplier to the global textile

markets. The latter’s logistics and supply chain processes play a major role in connecting cotton

Murphy’s” to recognize food coupons as a payment, which enables the firm to attract consumers

that may not afford a prepared pizza.

2. Focus Cost Differentiation Strategy

A focused differentiation method offers unique characteristics that attain the

importunities of the tight market. Some companies use this strategy to centralize their attempts

on a specific sales channel; for instance, vending over the online only. Another target specific

demographic groups such as Breezes Resorts that cater to couples without kids (Libraries, n.d.).

The company wields seven tropical retreats where globetrotters are assured that they may not be

irritated by disruptive and loud kids. Importantly, the differentiation approach involves giving